Attached files

| file | filename |

|---|---|

| EX-3.1 - Vampt America, Inc. | ex3-1.htm |

| EX-3.3 - Vampt America, Inc. | ex3-3.htm |

| EX-31.1 - Vampt America, Inc. | ex31-1.htm |

| EX-31.2 - Vampt America, Inc. | ex31-2.htm |

| EX-32.1 - Vampt America, Inc. | ex32-1.htm |

| EX-32.2 - Vampt America, Inc. | ex32-2.htm |

| 10-Q - QUARTERLY REPORT - Vampt America, Inc. | form10q.htm |

|

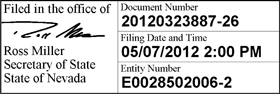

ROSS

MILLER Secretary of State 204 North Carson Street, Suite 1 Carson City, Nevada 89701-4299 (775) 684 5708 Website: www.nvsos.gov |

Certificate of Designation (PURSUANT TO NRS 78.1955) |

| USE BLACK INK ONLY - DO NOT HIGHLIGHT | ABOVE SPACE IS FOR OFFICE USE ONLY |

Certificate of Designation For

Nevada Profit Corporations

(Pursuant to NRS 78.1955)

1. Name of corporation:

CORONADO CORP.

2. By resolution of the board of directors pursuant to a provision in the articles of incorporation this certificate establishes the following regarding the voting powers, designations, preferences, limitations, restrictions and relative rights of the following class or series of stock.

Preferred Stock

Preferred Stock of the Company, to be named “Series A Preferred Stock,” consisting of 100 shares, which series shall have the following designations, powers, preferences and relative and other special rights and the following qualifications, limitations and restrictions:

see attached

3. Effective date of filing: (optional)

(must not be later than 90 days after the certificate is filed)

4. Signature: (required)

| /s/ Donald Sharpe | |

| Signature of Officer |

Filing Fee: $175.00

IMPORTANT: Failure to include any of the above information and submit with the proper fees may cause this filing to be rejected

| Nevada Secretary of State Stock Designation | |

| This form must be accompanied by appropriate fees. | Revised: 3609 |

Certificate of Designation for Series A Preferred Stock

1. Designation and Rank. The designation of such series of the Preferred Stock shall be the Series A Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”). The maximum number of shares of Series A Preferred Stock shall be 100. The Series A Preferred Stock shall rank senior to the Company’s common stock, par value $0.00001 per share (the “Common Stock”), and to all other classes and series of equity securities of the Company which by their terms do not rank senior to the Series A Preferred Stock (“Junior Stock”). The Series A Preferred Stock shall be subordinate to and rank junior to all indebtedness of the Company now or hereafter outstanding.

2. Dividends. Holders of the Series A Preferred Stock shall share ratably, with the holder of Common Stock, in any dividends that may, from time to time be declared by the Board of Directors.

3. Voting Rights. The Series A Preferred Stock shall have no voting rights except that the holders of the Series A Preferred Stock shall have the power to appoint two (2) members of the Company’s board of directors until May 7, 2105.

4. Acquisition Preference. The holders of the Series A Preferred Stock shall have the following rights in the following circumstances:

| (1) | In the event of a sale by the Company of all or substantially all of the Company’s assets whether by cash sale, stock sale or spin-off, the Series “A” holder(s) shall have the right to receive an aggregate 10% of the consideration thereof pro rata upon any decision of the board to wind up dividend or otherwise distribute proceeds thereof, in whole or in part (if in part then 10% of that part), to shareholders. In the event that the board has not determined to distribute consideration within one year of the disposition then the Series A holder(s) may elect at any time to convert their Series A shares to an aggregate 10% of the issued and outstanding common shares of the Company; | |

| (2) | In the event of a purchase, take-over bid or other acquisition resulting in a take-over or change of control of the Company by an offer to shareholders then, immediately prior to closing, the Series A holder(s), pro rata, shall be converted to common shares such that the Series A holder(s) shall receive 10% of the common shares of the Company immediately prior to closing. |

5. No Preemptive Rights. No holder of the Series A Preferred Stock shall be entitled to rights to subscribe for, purchase or receive any part of any new or additional shares of any class, whether now or hereinafter authorized, or of bonds or debentures, or other evidences of indebtedness convertible into or exchangeable for shares of any class, but all such new or additional shares of any class, or any bond, debentures or other evidences of indebtedness convertible into or exchangeable for shares, may be issued and disposed of by the Board of Directors on such terms and for such consideration (to the extent permitted by law), and to such person or persons as the Board of Directors in their absolute discretion may deem advisable.

6. Lost or Stolen Certificates, Upon receipt by the Company of evidence satisfactory to the Company of the loss, theft, destruction or mutilation of any Preferred Stock Certificates representing the shares of Series A Preferred Stock, and, in the case of loss, theft or destruction, of any indemnification undertaking by the holder to the Company and, in the case of mutilation, upon surrender and cancellation of the Preferred Stock Certificate(s), the Company shall execute and deliver new preferred stock certificate(s) of like tenor and date; provided, however, the Company shall not be obligated to re-issue Preferred Stock Certificates if the holder contemporaneously requests the Company to convert such shares of Series A Preferred Stock into Common Stock.

7. Remedies. Characterizations. Other Obligations, Breaches and Injunctive Relief. The remedies provided in this Certificate of Designation shall be cumulative and in addition to all other remedies available under this Certificate of Designation, at law or in equity (including a decree of specific performance and/or other injunctive relief), no remedy contained herein shall be deemed a waiver of compliance with the provisions giving rise to such remedy and nothing herein shall limit a holder’s right to pursue actual damages for any failure by the Company to comply with the terms of this Certificate of Designation. Amounts set forth or provided for herein with respect to payments, conversion and the like (and the computation thereof) shall be the amounts to be received by the holder thereof and shall not, except as expressly provided herein, be subject to any other obligation of the Company (or the performance thereof). The Company acknowledges that a breach by it of its obligations hereunder will cause irreparable harm to the holders of the Series A Preferred Stock and that the remedy at law for any such breach may be inadequate. The Company therefore agrees that, in the event of any such breach or threatened breach, the holders of the Series A Preferred Stock shall be entitled, in addition to all other available remedies, to an injunction restraining any breach, without the necessity of showing economic loss and without any bond or other security being required.

8. Specific Shall Not Limit General; Construction. No specific provision contained in this Certificate of Designation shall limit or modify any more general provision contained herein. This Certificate of Designation shall be deemed to be jointly drafted by the Company and all initial purchasers of the Series A Preferred Stock and shall not be construed against any person as the drafter hereof.

9. Failure or Indulgence Not Waiver. No failure or delay on the part of a holder of Series A Preferred Stock in the exercise of any power, right or privilege hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any such power, right or privilege preclude other or further exercise thereof or of any other right, power or privilege.

IN WITNESS WHEREOF, the undersigned has executed and subscribed this Certificate and does affirm the foregoing as true this 7th day of May, 2012.

| CORONADO CORP. | ||

| By: | /s/ Donald Sharpe | |

| Name: Donald Sharpe | ||

| Title: President | ||