Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MRC GLOBAL INC. | d400274d8k.htm |

Andrew

Lane Chairman, President & CEO

MRC Global Inc. // Bank of

America Merrill Lynch Fall Bus Tour August 21, 2012

Exhibit 99.1 |

Investor

Presentation August 21, 2012

2

Forward Looking Statements and GAAP Disclaimer

This presentation contains forward-looking statements, including, for example, statements about

the Company’s business strategy, its industry, its future profitability, growth in the

Company’s various markets, the strength of future activity levels, and the Company’s

expectations, beliefs, plans, strategies, objectives, prospects and assumptions. These forward-looking

statements are not guarantees of future performance. These statements involve known and unknown

risks, uncertainties and other factors that may cause the Company’s actual results and

performance to be materially different from any future results or performance expressed or

implied by these forward-looking statements. For a discussion of key risk factors, please see the risk

factors disclosed in the Company’s registration statement on Form S-1 effective April 11,

2012, related to our common stock, and our Quarterly Statement on Form 10-Q for the quarter

ended June 30, 2012, both of which are available on the SEC’s website at www.sec.gov.

Undue reliance should not be placed on the Company’s forward-looking statements.

Although forward-looking statements reflect the Company’s good faith beliefs, reliance

should not be placed on forward-looking statements because they involve known and unknown

risks, uncertainties and other factors, which may cause our actual results, performance or achievements

to differ materially from anticipated future results, performance or achievements expressed or implied

by such forward-looking statements. The Company undertakes no obligation to publicly

update or revise any forward-looking statement, whether as a result of new information,

future events, changed circumstances or otherwise, except to the extent required by law.

Statement Regarding use of Non-GAAP Measures: The Non-GAAP

financial measures contained in this presentation (including, without limitation, EBITDA, Adjusted EBITDA,

Adjusted EBITDA Margin, Adjusted Gross Profit, Return on Net Assets (RONA) and variations thereof) are

not measures of financial performance calculated in accordance with GAAP and should not be

considered as alternatives to net income (loss) or any other performance measure derived in

accordance with GAAP or as alternatives to cash flows from operating activities as a measure of

our liquidity. They should be viewed in addition to, and not as a substitute for, analysis of our results reported in

accordance with GAAP, or as alternative measures of liquidity. Management believes that certain

non-GAAP financial measures provide a view to measures similar to those used in evaluating

our compliance with certain financial covenants under our credit facilities and provide

financial statement users meaningful comparisons between current and prior year period

results. They are also used as a metric to determine certain components of performance-based

compensation. The adjustments and Adjusted EBITDA are based on currently available

information and certain adjustments that we believe are reasonable and are presented as an aid

in understanding our operating results. They are not necessarily indicative of future results

of operations that may be obtained by the Company.

|

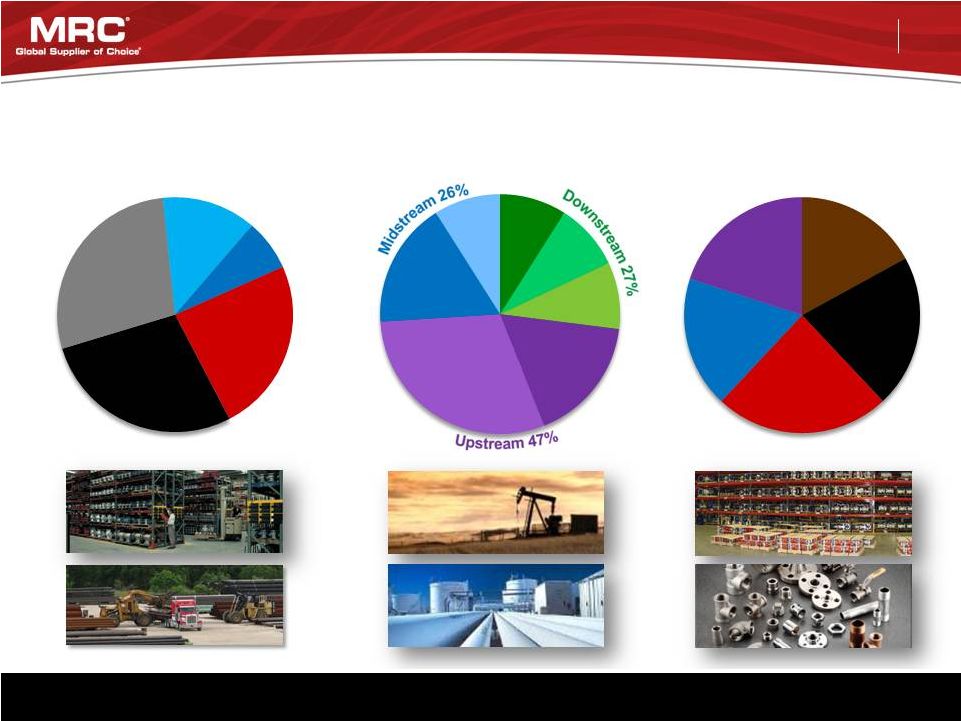

MRC

is the largest global distributor of pipe, valves and fittings (PVF) to the energy industry.

MRC is the largest global distributor of pipe, valves and fittings (PVF) to the

energy industry. Company Snapshot

International

7%

Canada

13%

MRO

66%

Projects

34%

U.S.

80%

Investor Presentation

August 21, 2012

3

By the Numbers

Industry Sectors

Product Categories

Business Model

2011 Sales

$4.83 B

Upstream

Line Pipe / OCTG

Locations

410+

Countries

18

Midstream

Valves

Customers

12,000+

Suppliers

12,000+

Downstream/

Industrial

Fittings / Flanges

SKU’s

150,000+

Employees

4,500+ |

Investor

Presentation August 21, 2012

4

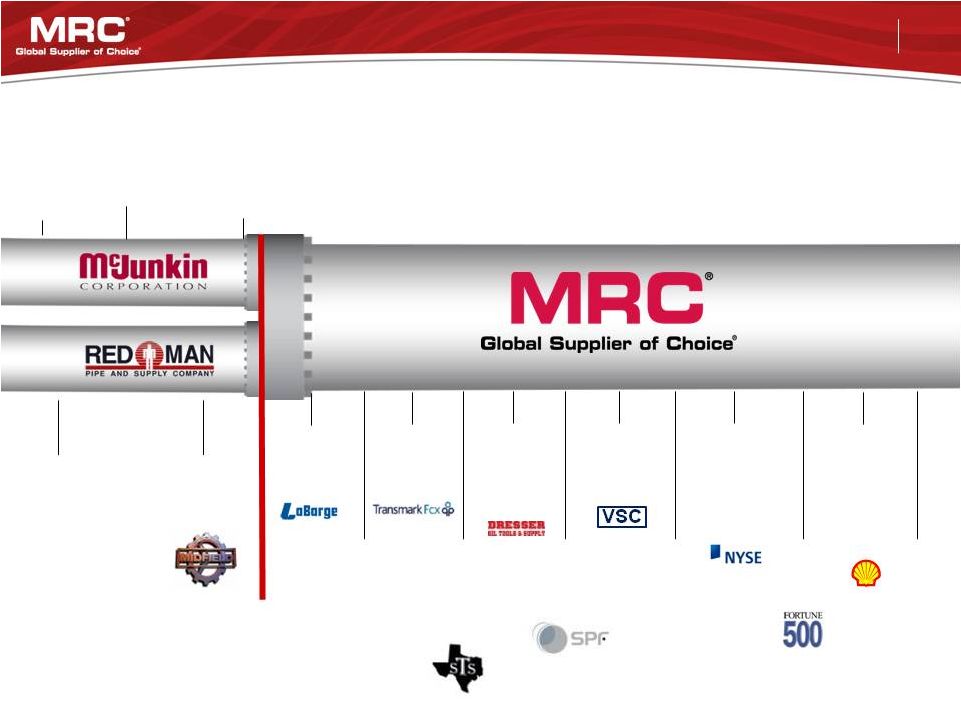

Founded

1921

1989

Acquires

Appalachian

Pipe & Supply

2007

Goldman Sachs

Capital Partners

Strategic

Investment

1977

Founded

2005

Acquires

Midfield

Supply

2008

MRC

acquires

LaBarge

2007

Merger of

McJunkin

and Red Man

to form

MRC

2009

MRC opens

Houston HQ

2009

MRC

acquires

Transmark

2010

MRC

acquires

South

Texas

Supply

2010

MRC

acquires

Dresser

Oil Tools

2011

MRC

acquires

SPF

2011

MRC

acquires

VSC

2012

MRC

acquires

OneSteel

Piping

Systems

2012

MRC

Global

IPO;

begins

trading

on NYSE

MRC’s 91 Year History // The Road to the Fortune 500

2012

MRC

signs the

industry’s

first global

valve

contract with

Shell

2012

MRC

listed on

Fortune 500

2012

MRC

acquires

Chaparral

Supply |

Investor

Presentation August 21, 2012

5

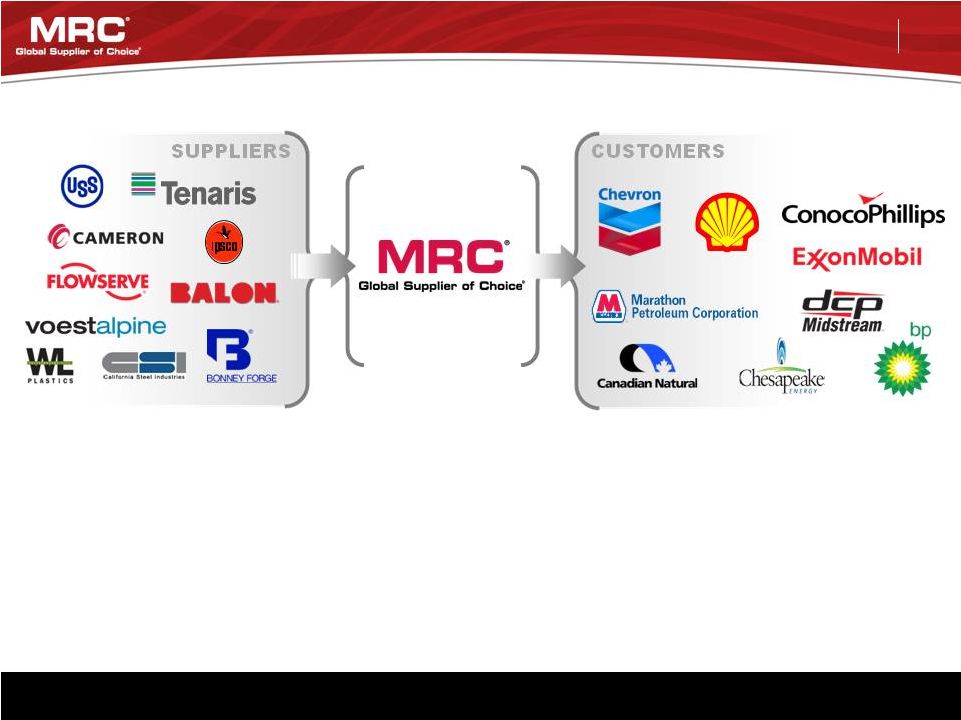

Supplier Benefits

•

•

•

Customer Benefits

•

•

•

•

MRC plays a critical role in the complex, technical, global energy supply

chain. Business Model

Mutual Benefits

•

•

•

Access to over 12,000+

customers

Manufacturing and scale

efficiencies

Leverage MRC’s technical

sales force

Trusted long-term partnerships

Financial stability

MRC Approved Supplier List /

Quality Program

Access to over 12,000+ suppliers

worldwide

Efficiencies and inventory

management

Access to a broad product offering

($1B+ inventory)

Access to global sourcing from 35

countries |

Investor

Presentation August 21, 2012

6

By Geography

Note: Business mix based on 2011 sales

By Product Line

MRC is diversified by geography, industry sector, and product line.

Transmission

17%

MRC Diversification

Drilling &

Completion

Tubulars

17%

Production

Infrastructure,

Materials &

Supplies

30%

International

7%

Western

US

24%

Gulf

Coast

28%

Eastern

US

28%

Canada

13%

Chemical

9%

Refining

9%

Other/

Industrial

9%

Gas Utility

9%

OCTG

17%

Line

Pipe

21%

Valves

24%

Fittings

&

Flanges

18%

Other

20%

By Industry Sector |

Investor

Presentation August 21, 2012

7

Horn River

Montney

Duvernay

Bakken

Niobrara

Monterey

Mississippian

Lime

Granite Washington

Woodford

Fayetteville

Barnett

Haynesville

Permian

Basin

Eagle Ford

Utica

Marcellus

North America Shales

North America Core Business Model

Well positioned to capitalize on shale, heavy oil and oil sands activity.

North America E&P spending to grow 6% in 2012*.

* Barclays Equity Research

•

•

•

•

175+ Branches

160+ Pipe Yards

7 Regional Distribution Centers

14 Valve Automation Centers

North American Infrastructure |

Investor

Presentation August 21, 2012

8

International E&P spending forecast to grow 12% in 2012*.

International Growth Model

* Barclays Equity Research

MRC Branches / Locations

Regional Distribution Centers

Valve Automation Centers

Expanding International Presence

•

•

•

•

40+ Branches

2 Pipe Yards

Regional Distribution Centers in

UK, Singapore and Australia

10 Valve Automation Centers |

Investor

Presentation August 21, 2012

9

Strong Growth in Global E&P Spending

Source: Barclays 2012 E&P Spending Outlook Mid Year Update.

U.S. Refining Turnaround Activity

Positive Trends

U.S. Additions to Natural Gas Pipelines

U.S. Aging Infrastructure / New Legislation to

Drive Pipeline Replacement

Source: Industrial Info Resource, Inc. Based on quarterly average planned

unit outages. Source: Pipeline Safety and Hazardous Materials Administration,

Wall Street Journal, for Top 10 states by pipeline mileage Outside

North

America

U.S.

Investor Presentation

August 21, 2012

9

444

548

688

1,193

1,126

2009A

2010A

2011E

2012E

2013E

Actual Estimates

Outside

North

America

Canada

U.S.

0

100

200

300

400

500

600

900

700

800

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Source: ICF International, North American Midstream Infrastructure Through 2035 – A Secure Energy

Future, Prepared for the INGAA Foundation, June 28, 2011

|

Investor

Presentation August 21, 2012

10

Global

Procurement

Today

10 –

15 Years Ago

Next 1 to 5 Years

Consolidating energy industry benefits global players.

Changing PVF Energy Distribution Landscape

Purchasing more

consolidated

Contracts by end

segment:

Contracts cover PVF

Customers align with

suppliers with size/scale

Centralized

Procurement

Upstream

Midstream

Downstream

Global upstream /

midstream /

downstream PVF

contracts

Pipe

Valves

Fittings

Flanges

Supplies

Decentralized

Procurement

PVF purchasing

handled locally

Facility-by-facility

basis

Separate contracts

by product class: |

MRC &

Shell // Global Valve Contract for MRO & Projects

Industry’s first global valve and combined North American PFF contract.

Deepwater

GOM

NA Tight Gas

& Liquids

Brazil

Offshore

BC-10

West

Africa

Future

Middle

East

RDC

FLNG

/ LNG

Oceania

Sakhalin

Shell

Offshore

Shell has one of the top 5 global CAPEX budgets

Coal Bed

Methane

Cracker Unit

Pittsburgh, PA

China

Tight Gas

Tar Sands

Kashagan

Ph1

Alaska

Offshore

LNG /

GTL

LNG

Salym

Development

Investor Presentation

August 21, 2012

11

North America

Includes PFF |

Investor

Presentation August 21, 2012

12

Increasing MRC Shareholder Value

Growth

Efficiency / Profitability

Organic Growth

Increase Returns on

Working Capital Investment

Optimize Cost of Capital

•

North American shale activity

•

Midstream infrastructure

•

Downstream

–

refining

turnaround

activity and resurgence in

petrochemical activity

•

Australia

–

new

PVF

leadership

position

•

Optimize inventory mix

•

Global sourcing

•

Focus on higher margin

products

•

Target leverage at

2.0x

–

3.0x

•

Reduce overall cost

of debt

Acquisitions

•

International geographic extensions

•

Valve & actuation

•

North American region / shale bolt-ons

Revenue Growth:

Target 10% to 12% per year

Organic:

8% to 9%

Acquisitions:

2% to 3%

Adjusted EBITDA Margin Improvement

in near term

in mid term

in 5 years

8.0 to 8.5%

9.0 to 9.5%

10+% |

Investor

Presentation August 21, 2012

13

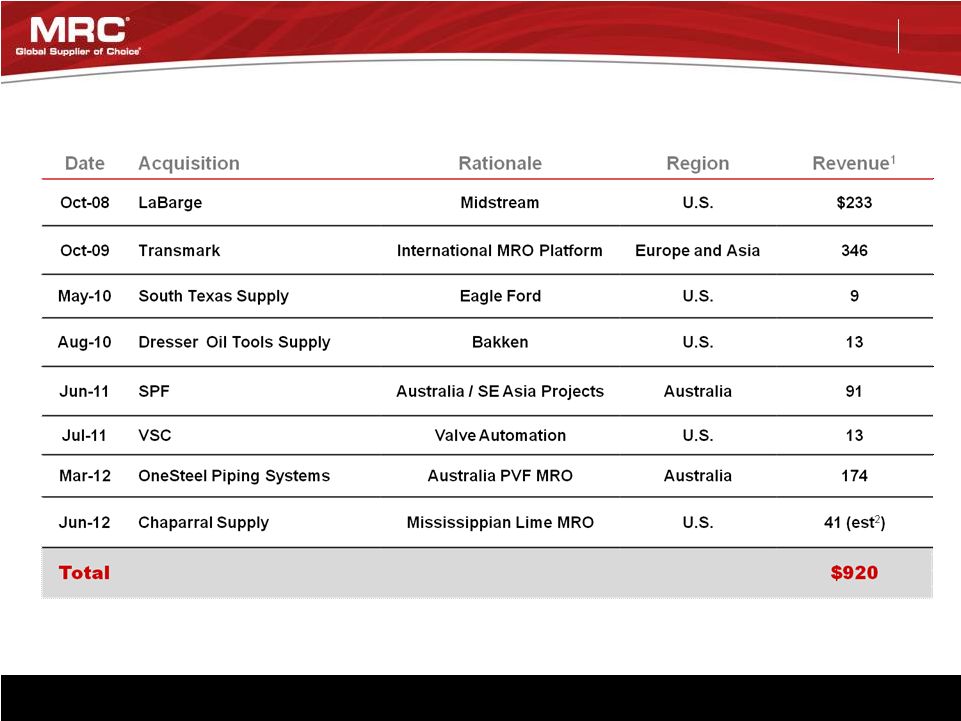

MRC has completed and successfully acquired $920 million of revenues since mid

2008. 1

Reflects reported revenues for the year of acquisition

2

Estimate based on supply agreement with SandRidge Energy

(US$ in millions)

Track Record of Successful M&A |

Investor

Presentation August 21, 2012

14

Historic Margins

OCTG

5-7%

All Other

17-19%

Multi-Year Strategy to Shift Away from OCTG Towards

Higher Margin, Less Volatile Products

Key Components to Strategy

Remain committed to one-stop PVF focused customers

Focus on energy infrastructure E&P spend

Increase earnings stability

Improve overall margins

Reduce inventory risk

Reduce volatility and exposure to North America rig count

Shift to

Higher Margin Products

Short term loss of revenue offset by long term benefits

2013

(Target)

2008

(Actual)

All other

75%

OCTG

25%

OCTG

10%

All other

90% |

Investor

Presentation August 21, 2012

15

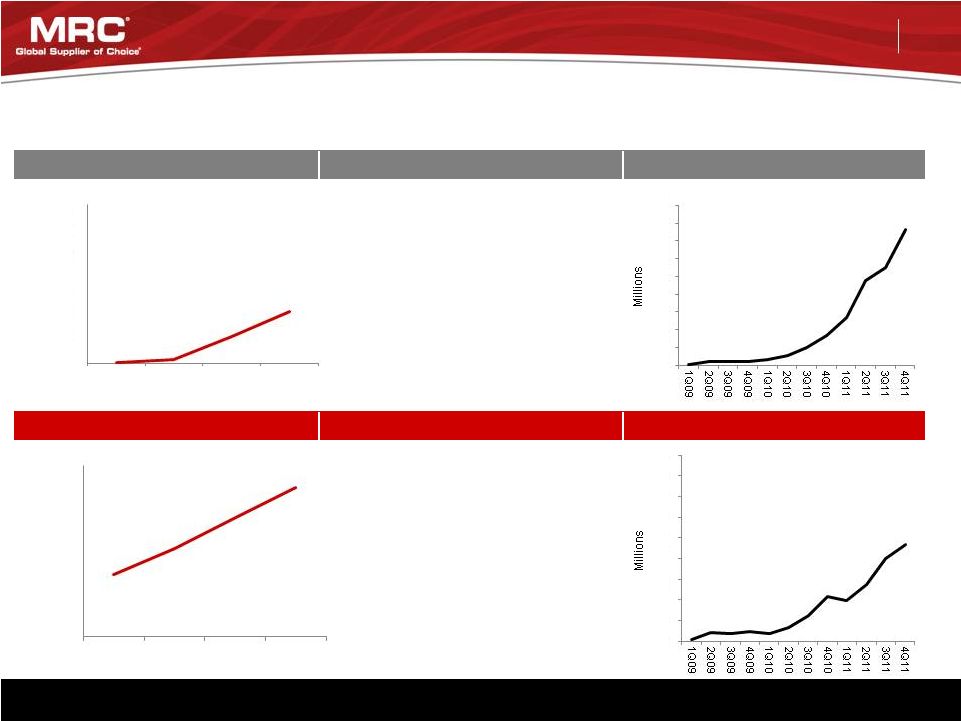

Strategic investments in shale plays driving North America Growth.

Strategic Investments to Capitalize on Shale Growth

Eagle Ford Production

MRC Investment in the Eagle Ford

MRC Sales in the Eagle Ford

May 2010

Acquisition

–

South

Texas

Supply

March 2011

Opened Regional Distribution

Center in San Antonio, TX

Bakken

Production

MRC Investment in the Bakken

MRC Sales in the Bakken

August 2010

Acquisition –

Dresser Oil Tools &

Supply

January 2012

Opened Regional Distribution

Center in Cheyenne, WY

-

100,000

200,000

300,000

400,000

500,000

600,000

2009

2010

2011

2012A

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

-

100,000

200,000

300,000

400,000

500,000

600,000

2009

2010

2011

2012A

Eagle Ford Rig: Stephens

Eagle Ford Sales: MRC

data

Eagle Ford Production: www.rrc.state.tx.us; 2012

Annualized

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

Bakken Rig: Stephens

Bakken Sales: MRC data

Bakken Production: MidstreamBusiness.com, "Bakken's

Rapid Ascent” 2012 Annualized

|

Investor

Presentation August 21, 2012

16

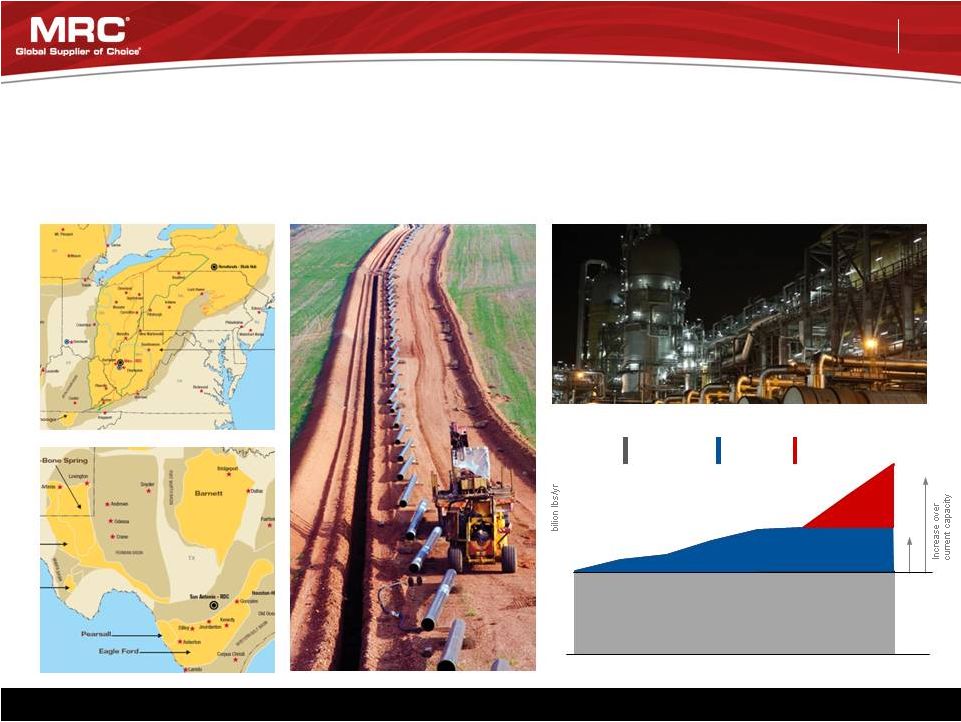

Increased Access to and Supply of NGL’s Have Created

Opportunities for MRC Over the Next 5 to 7 Years

Upstream

Production

Midstream

Infrastructure

Growth Forecast

MRC is well positioned to capitalize on this trend across the upstream, midstream,

& downstream market segments. Downstream

Processing Expansion & New Builds

New Build

Crackers

billion lbs/yr

15%

38%

Production

Expansion

billion lbs/yr

Current Ethylene

Production

billion lbs/yr

*Source: Tudor Pickering Holt & Co

80

60

40

72

79

57

59

60

63

65

66

2011

2012

2013

2014

2015

2016

2017

2018 |

Investor

Presentation August 21, 2012

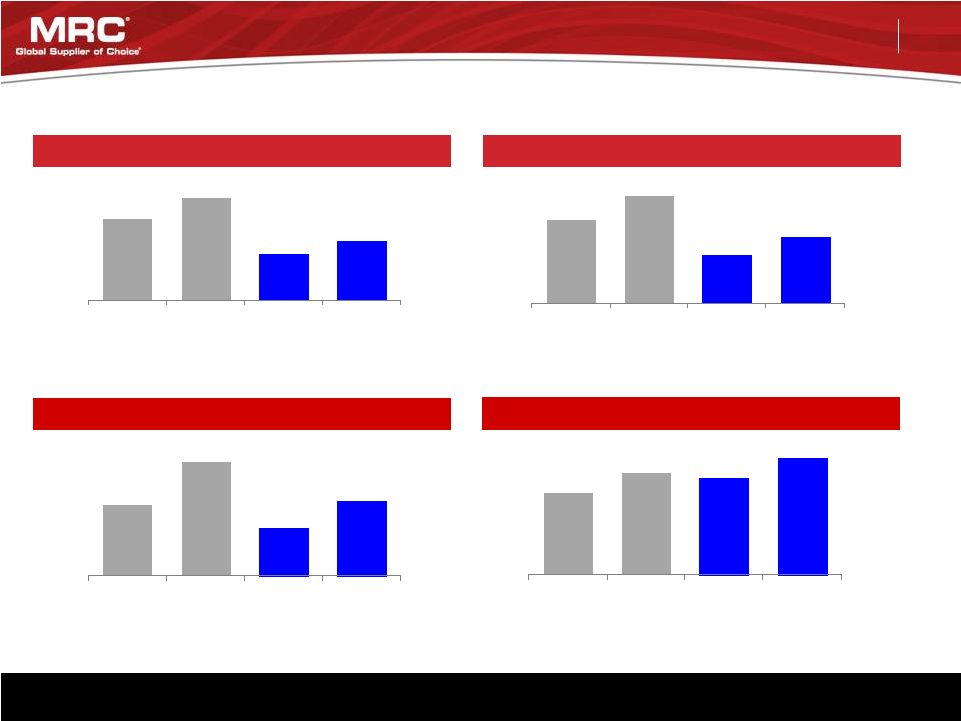

17

$224

$361

$151

$239

2010

2011

1st Half

2011

1st Half

2012

Sales

Adjusted Gross Profit and % Margin

Source: Company management

RONA calculation = Adjusted EBITDA divided by the sum of accounts receivable,

inventory (plus the LIFO reserve), and PP&E less accounts payable. Adjusted

EBITDA and % Margin Return on Net Assets (RONA)

Strong growth and improving profitability.

Y-o-Y Growth

26%

30%

Y-o-Y Growth

28%

39%

Y-o-Y Growth

61%

59%

17.2%

17.6%

17.6%

18.8%

5.8%

7.5%

7.0%

8.5%

(US$ in millions)

Financial Trends

$3,846

$4,832

$2,160

$2,813

2010

2011

1st Half

2011

1st Half

2012

$663

$850

$381

$530

2010

2011

1st Half

2011

1st Half

2012

19.6%

24.1%

23.1%

27.8%

2010

2011

1st Half

2011

1st Half

2012 |

Investor

Presentation August 21, 2012

18

First Half Update

Year Over Year Results

In Millions, except per share data

1 Half

2012

1 Half

2011

Sales

$ 2,813

$ 2,160

30%

Cost of sales

2,335

1,840

Gross profit

478

320

SG&A

297

242

Operating income

181

78

Net income

$ 69

$ 4

EPS

$ 0.75

$ 0.04

Adjusted EBITDA

$ 239

$ 151

59%

Adjusted EBITDA%

8.5%

7.0%

Full Year 2012 Outlook

Sales

$5.5 to $5.65 billion

Adjusted EBITDA

8.2% to 8.6% of sales

Adjusted Gross Profit

18.3% to 19.0% of sales

Effective Tax Rate

35.0% to 36.0%

Capital Expenditures

$26 to $27 million

Cash from Operations

$125

-

$150

million

Capital Structure

April 2012 IPO with net proceeds of $333 million

Total Net Debt $1.315 billion

Net Debt / Adjusted EBITDA 2.9X

Net Debt / Adjusted EBITDA 2012 EOY Target 2.5X

st

st |