Attached files

| file | filename |

|---|---|

| EX-31 - MINT LEASING INC | ex31.htm |

| EX-32 - MINT LEASING INC | ex32.htm |

| EX-10.19 - MINT LEASING INC | ex10-19.htm |

| EX-10.17 - MINT LEASING INC | ex10-17.htm |

| EX-10.15 - MINT LEASING INC | ex10-15.htm |

| EX-10.18 - MINT LEASING INC | ex10-18.htm |

| EX-10.16 - MINT LEASING INC | ex10-16.htm |

| 10-Q - MINT LEASING INC | mint10q063012.htm |

Exhibit 10.14

PROMISSORY NOTE

|

$100,000.00

|

Houston, Texas December 6, 2011

|

Promise to Pay: For value received, Mint Leasing North, Inc., ("Borrower") a Texas Corporation domiciled at 323 North Loop West, Houston, Harris County, Texas 77008, promises to pay to the order of Pamela Kimmel, an individual ("Lender") at XXXXXXXXXXXXXX, or at other such address as Lender may from time to time specify in writing, in lawful money of the United States of America, the sum of One Hundred Thousand and no/100 Dollars ($100,000.00), together with accrued interest on the unpaid principal balance thereof, from December 6,2011, until maturity on or about December 6, 2012.

Interest Rate: The unpaid balance of this Note shall bear interest prior to maturity at a fixed rate of twelve percent (12%) per annum. All interest due hereunder shall be computed on the basis of a year of three hundred and sixty-five (365) days and charged for the actual number of days elapsed.

Payment: Borrower shall pay Lender monthly interest payments in the amount of $1,000.00 commencing no later than January 6, 2012 during the twelve-month term of the Note. Upon completion of the interest-only payments, ending with the final credited month on December 6, 2012, Borrower shall pay Lender the Note in full in the amount of $100,000.00.

The following is a recapitulation of the Borrower's payment obligations to Lender:

| 1 | ) |

January 6, 2012

|

$ | 1,000.00 | |||

| 2 | ) |

February 6, 2012

|

$ | 1,000.00 | |||

| 3 | ) |

March 6, 2012

|

$ | 1,000.00 | |||

| 4 | ) |

April 6, 2012

|

$ | 1,000.00 | |||

| 5 | ) |

May 6, 2012

|

$ | 1,000.00 | |||

| 6 | ) |

June 6, 2012

|

$ | 1,000.00 | |||

| 7 | ) |

July 6, 2012

|

$ | 1,000.00 | |||

| 8 | ) |

August 6, 2012

|

$ | 1,000.00 | |||

| 9 | ) |

September 6, 2012

|

$ | 1,000.00 | |||

| 10 | ) | October 6, 2012 | $ | 1,000.00 | |||

| 11 | ) | November 6, 2012 | $ | 1,000.00 | |||

| 12 | ) | December 6, 2012 | $ | 101,000.00 |

Default:This Note shall become immediately due and payable upon the occurrence of one or more of the following events ("Events of Default") provided such event(s) continues after seven (7) business days of written notice thereof has been given to Borrower with respect to any monetary default and after twenty days of written notice with respect to any non-monetary default:

(1) If default shall be made in the payment of any installment of principal or interest under the Note when due and payable;

(2) If default shall be made in the performance or observance of any covenant, agreement or condition set forth in this Note;

(3) If a decree or order by a court of competent jurisdiction shall have been entered:

(a) Adjudging the Borrower a bankrupt; or

(b) Approving a petition seeking reorganization or rearrangement of Borrower under the Bankruptcy Act, or any other similar applicable Federal or State laws; or

(c) Appointing a receiver, liquidator or trustee or similar functionary to take charge of all, or substantially all, of the assets of Borrower; or

(d) Directing the winding up or liquidation of Borrower's affairs.

(4) If the Borrower shall:

(a) Institute voluntary proceedings to be adjudged a bankrupt; or

(b) Consent to the filing of bankruptcy petition against it or file a petition or answer or consent seeking reorganization or rearrangement under the Bankruptcy Act, or any other similar applicable Federal or State laws, or consent to the filing of such petition: or

(c) Consent to the appointment of a receiver, liquidator or trustee or similar functionary to take charge of all, or substantially all,of the assets of Borrower; or

(d) Make a general assignment for the benefit of its creditors; or

(e) Admit in writing its inability to pay its debts generally as they become due;

(5) Upon Failure of Borrower to:

(a) Maintain its books, accounts and records in accordance with generally accepted accounting principles; or

(b) Duly comply with all the laws applicable to Borrower and its business, the violation of which would have a material and adverse effect on the Borrower; or

(c) Timely file all Federal and State tax returns and pay all taxes as due when due; or

(6) If Borrower defaults under any of its agreements with third parties for money borrowed; or

(7) If there shall be dissolution or liquidation of Borrower; or

(8) If Borrower assigns, or attempts to assign, this Note without the prior, express, written consent of Lender. Lender, at his sole discretion, may withhold such consent.

If an Event of Default occurs in the payment of this Note, then, at the option of Lender, exercised by written notice to Borrower as set forth herein, the unpaid principal balance of this Note, together with any interest accrued hereon, shall forthwith be and become due and payable and the Lender may, without limitation, prejudice or waiver, proceed to protect and enforce his rights by action at law, suit in equity, or foreclosure under any instrument securing the Note or Lender may resort to any two or more of such remedies, such remedies being cumulative and not exclusive.

If default is made in the payment of this Note at maturity, regardless of how its maturity is or might be brought about and this Note is placed in the hands of an attorney for collection or suit is filed hereon, or proceedings in bankruptcy or probate or other legal proceedings are initiated for collection hereof, the Borrower promises and agrees to pay all reasonable costs, fees and expenses, including, without limitation, attorneys fees and collection fees incurred by Lender in any such case.

Default Rate of Interest: If an Event of Default occurs and Borrower is given notice of such Event of Default as herein provided, the rate of interest applicable to the unpaid principal balance of the Note, from the day notice is given to Borrower until the unpaid principal balance of the Note is paid in full shall be the maximum interest rate allowed under the governing law now or hereafter in effect in the State of Texas. The foregoing notwithstanding, it is expressly stipulated and agreed to be the intent of the Lender and the Borrower or any other holder of this Note, at all times, to comply with the usury laws and all other laws relating to this Note and any instrument executed by the Borrower in connection herewith now or hereafter in effect in the State of Texas. Accordingly, it is agreed that, notwithstanding any provision to the contrary in this Note or any other document related hereto, in no event shall this Note or any such other document require the payment or permit the collection of interest in excess of the maximum amount permitted by such laws. If the laws of the State of Texas are ever revised, repealed or judicially interpreted as to render usurious any amount called for herein or under any other such document or if the terms and provisions of this Note or any such other document shall appear to call for the payment of usurious interest or if any excess or usurious interest is contracted for, charged or received under this Note or under the terms of any other document related hereto (which terms and provisions, in such case, are hereby stipulated and agreed to be a mistake in calculation or wording) or in the event the maturity of the indebtedness evidenced by this Note is accelerated in whole or in part, or in the event that all or part of the principal and interest of this Note shall be prepaid so that, under any such circumstances, the amount of interest contracted for, charged or received under this Note or under any other document related hereto or relating to the amount of principal actually outstanding under this Note shall exceed the maximum amount of interest permitted by the usury laws of the State of Texas, then, in any such event, it is the express intent of lender and Borrower or any other holder hereof that the provisions of this paragraph shall govern and control and all excess amounts theretofore collected by the lender or any other holder shall either be applied as credit against the unpaid principal amount hereof or refunded to Borrower and the provisions hereof and thereof shall be immediately deemed reformed and the amounts thereafter collectible hereunder and there under reduced, without the necessity of the execution of any new documents, so as to comply with the laws applicable hereto and thereto and to permit the recovery of the fullest amount otherwise called for hereunder and there under.

Notice: Except as otherwise provided herein, Borrower expressly waives notice of nonpayment, presentment for payment, protest, notice of protest, bringing of suit or diligence in taking any action to collect any sum owing hereon and consent that the holder hereof may release security, extend the time of payment hereof, or of any installments of principal, or interest, or both hereunder, from time to time, one or more times and release one or more parties liable hereon, all without notice and without releasing the liability of any party liable hereon, with the exception of any such party so specifically released.

Any and all designations, demands, notices and other communications required, provided or permitted to be given pursuant to this Note shall be deemed sufficiently given if written and personally delivered or sent by registered or certified mail, return receipt requested, with postage thereon prepaid and addressed as follows:

To lender: Pamela Kimmel

XXXXXXXXXX

XXXXXXXXXX

To Borrower: Jerry Parish

Mint leasing North, Inc.

323 North loop West

Houston, TX 77008

or to another address as the lender, any holder, Borrower or Guarantors hereof may from time to time designate by written notice to the other parties, personally delivered or sent by registered or certified mail, return receipt requested, with postage thereon prepaid and addressed in accordance to the above or at the duly designated address at such time as notice is given.

Successors and Assigns: This Note is for the benefit of lender and the lender's heirs, personal representatives and assigns. In the event of an assignment of the indebtedness represented by this Note or any part thereof, the rights and benefits hereunder, to the extent applicable to the indebtedness so assigned, may be transferred with such indebtedness. The covenants, term and conditions of this Note are binding on the Borrower, its successors and assigns who may have been consented to in writing by lender and on all Guarantors hereof and such Guarantors heirs and personal representatives.

|

|

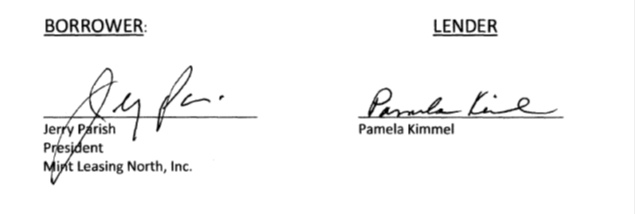

In witness thereof the parties, wishing to be bound by the terms of this Note, affix their signatures below on this 6th day of December, 2011

|