Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - EFLO ENERGY, INC. | eflo_8k.htm |

EXHIBIT 99.1

U. S. INSTITUTIONAL INVESTOR PRESENTATION UPDATED AUGUST 16, 2012B

Certain statements in this presentation constitute forward-looking statements or forward-looking information within the meaning of applicable securities laws (“forward-looking statements”). Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of EFL Overseas Inc. (“EFLO” or “the Company”), or developments in EFLO’s business or in its industry, to differ materially from the anticipated results, performance, achievements or developments expressed or implied by such forward-looking statements. Forward-looking statements include all disclosure regarding possible events, conditions or results of operations that is based on assumptions about future economic conditions and courses of action. Forward-looking statements may also include any statement relating to future events, conditions or circumstances. EFL Overseas Inc. cautions you not to place undue reliance upon any such forward-looking statements, which speak only as of the date they are made. Forward-looking statements relate to, among other things, changes in the resource market; the market focus of EFLO’s revenue mix and margin targets; operations priorities; and strategy for its products and solutions. The risks and uncertainties that may affect forward-looking statements include, among others, the completion and integration of acquisitions, the possibility of technical, logistical or planning issues in connection with deployments, the continuous commitment of EFLO's customers, demand for EFLO 's assets and other risks detailed from time to time in EFLO's filings with the Securities and Exchange Commission and Canadian provincial securities regulators. Forward-looking statements are based on management’s current plans, reserve estimates, production and economic projections, beliefs and opinions, and the Company does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change. The primary risk of oil and gas exploration lies in the drilling of dry holes or drilling and completing well which, though productive, do not produce gas and/or oil in sufficient amounts to return the amounts expended and produce a profit. Exploratory drilling involves substantially greater economic risks than development drilling since the percentage of wells completed as producing wells is usually less than in development drilling. While exploration adjacent to or near existing reservoirs may be more likely to result in the discovery of oil and gas than in completely unproven area, exploratory efforts are nevertheless high risk activities. Although the completion of oil and gas wells is, to a certain extent, less risky than drilling for oil and gas, the process of completing an oil or gas well is nevertheless associated with considerable risk. I addition, even if a well is completed as a producer, the well for a variety of reasons may not produce sufficient oil or gas in order to repay the investment in the well. Since its inception EFLO has only drilled one well that was not productive of oil in commercial quantities. EFLO has never generated any revenue and may never be profitable. There can be no assurance EFLO can implement its business plan, or that EFLO’s securities which may be sold will have any value. Disclaimer Forward Looking Statements *

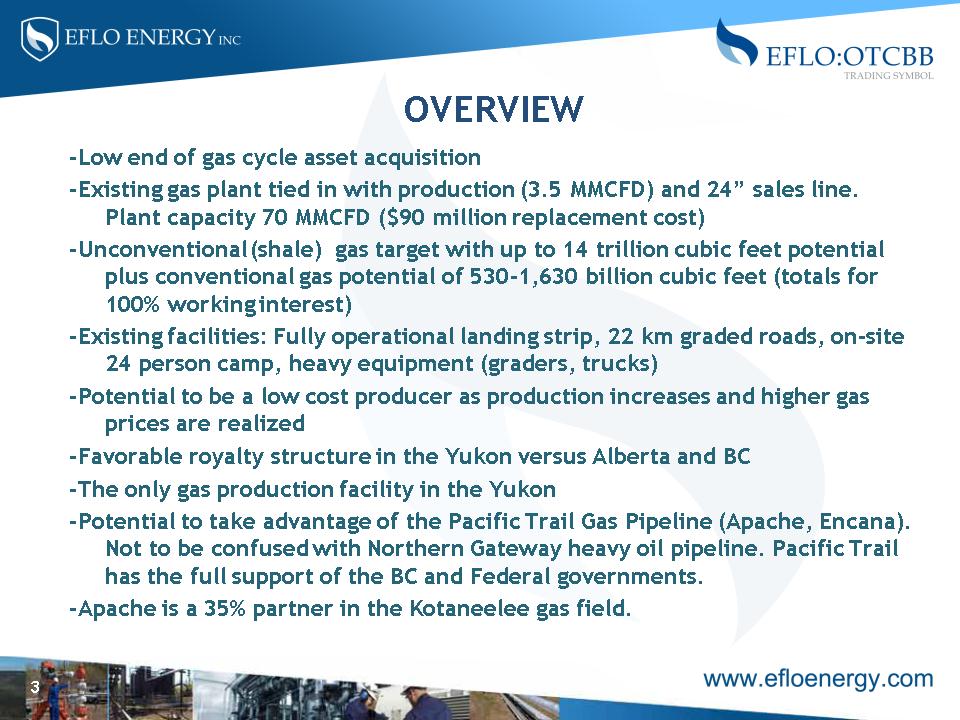

OVERVIEW -Low end of gas cycle asset acquisition -Existing gas plant tied in with production (3.5 MMCFD) and 24” sales line. Plant capacity 70 MMCFD ($90 million replacement cost) -Unconventional (shale) gas target with up to 14 trillion cubic feet potential plus conventional gas potential of 530-1,630 billion cubic feet (totals for 100% working interest) -Existing facilities: Fully operational landing strip, 22 km graded roads, on-site 24 person camp, heavy equipment (graders, trucks) -Potential to be a low cost producer as production increases and higher gas prices are realized -Favorable royalty structure in the Yukon versus Alberta and BC -The only gas production facility in the Yukon -Potential to take advantage of the Pacific Trail Gas Pipeline (Apache, Encana). Not to be confused with Northern Gateway heavy oil pipeline. Pacific Trail has the full support of the BC and Federal governments. -Apache is a 35% partner in the Kotaneelee gas field. *

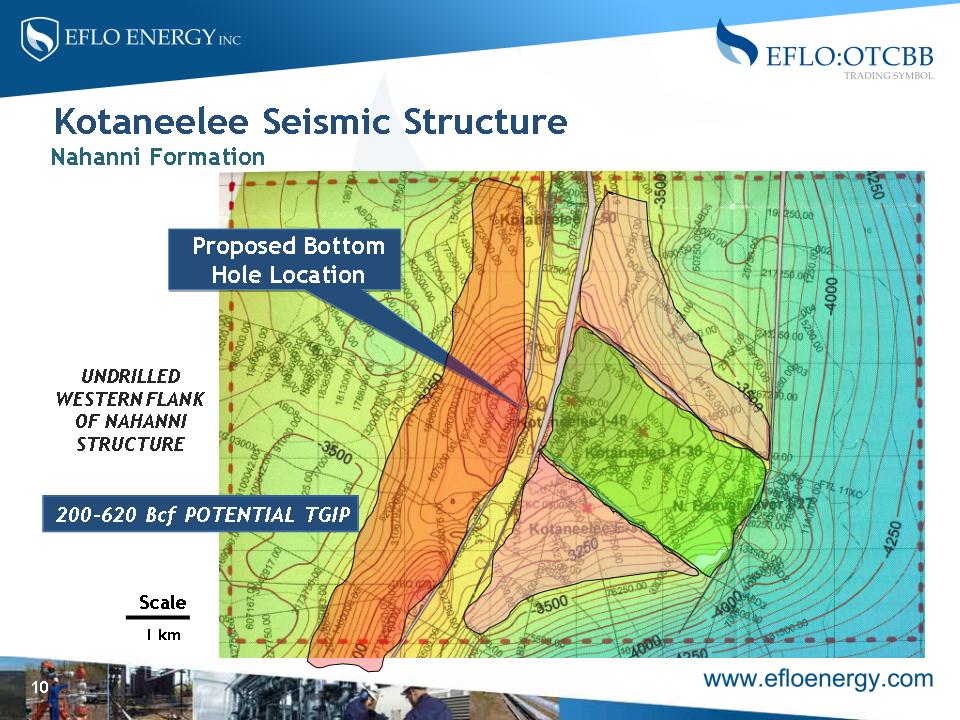

Kotaneelee Gas Field (Liard Basin, Yukon) EFLO is currently the operator with a 23% working interest In the process of acquiring up to 65% working interest Apache owns the remaining 35% of the project Total Shale Gas in Place (“TGIP”): 8 to 14 Tcf Recoverable: RGIP 1.8 to 3.3 Tcf Conventional Nahanni West: TGIP 200 to 620 Bcf RGIP 60 to 214 Bcf Analog Nahanni East 234 Bcf rec. to date Flett Conventional Resource: TGIP of 160 Bcf (mapped) East 8 sections of RGIP 67 Bcf Potential Flett on Westside 170 to 850 Bcf TGIP Potential RGIP 55 – 282 Bcf Underutilized gas plant and infrastructure (70 MMCFD) Replacement Cost = $90 million Current Production = 3.5 MMCFD (in just 1 well) 30,188 acres ~(50 sections), 10 yr lease term (expiry 2020) TGIP=total gas in place TCF=trillion cubic feet BCF=billion cubic feet *Internal estimate of resource and reserves (100% working interest) Significant Gas Resources* *

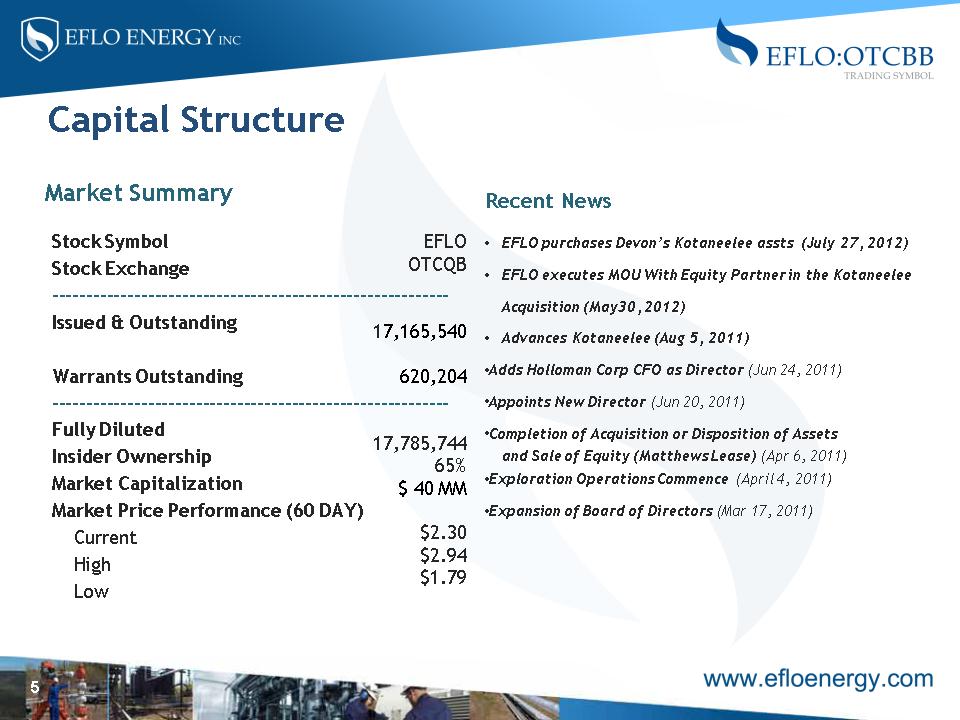

Capital Structure Stock Symbol Stock Exchange ---------------------------------------------------------- Issued & Outstanding Warrants Outstanding ---------------------------------------------------------- Fully Diluted Insider Ownership Market Capitalization Market Price Performance (60 DAY) Current High Low Recent News EFLO purchases Devon’s Kotaneelee assts (July 27, 2012) EFLO executes MOU With Equity Partner in the Kotaneelee Acquisition (May30, 2012) Advances Kotaneelee (Aug 5, 2011) Adds Holloman Corp CFO as Director (Jun 24, 2011) Appoints New Director (Jun 20, 2011) Completion of Acquisition or Disposition of Assets and Sale of Equity (Matthews Lease) (Apr 6, 2011) Exploration Operations Commence (April 4, 2011) Expansion of Board of Directors (Mar 17, 2011) Market Summary * EFLO OTCQB 17,165,540 620,204 17,785,744 65% $ 40 MM $2.30 $2.94 $1.79

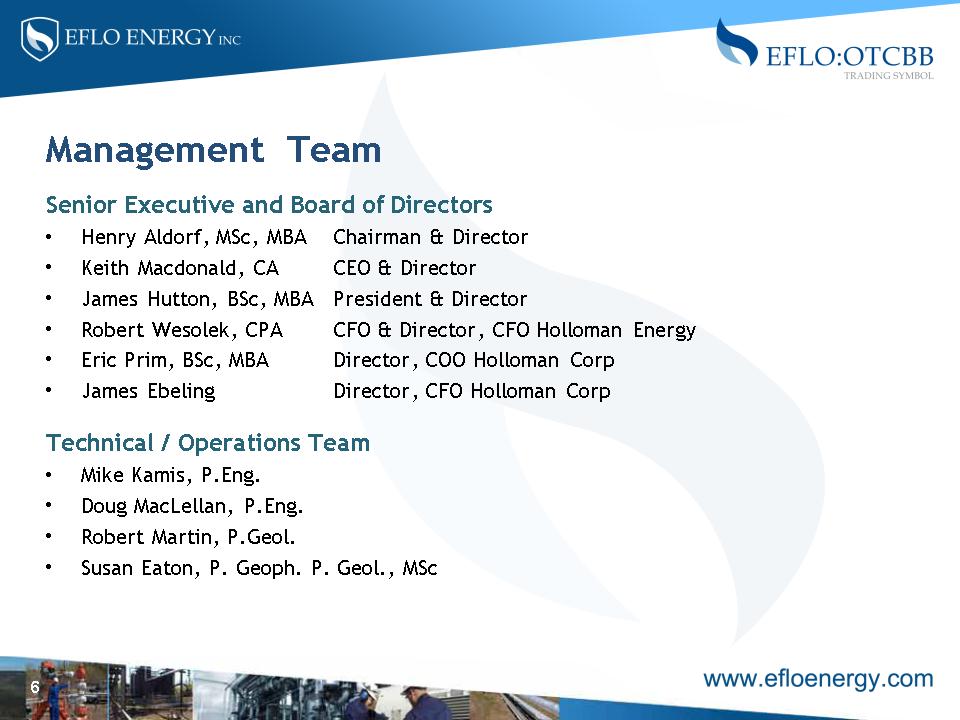

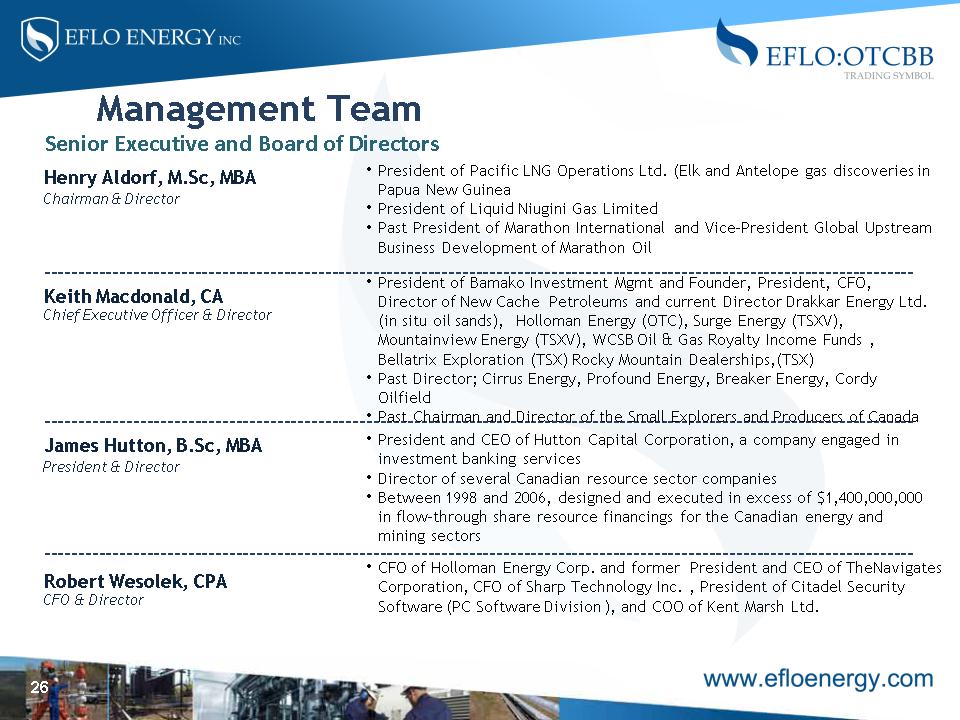

Management Team Senior Executive and Board of Directors Henry Aldorf, MSc, MBA Chairman & Director Keith Macdonald, CA CEO & Director James Hutton, BSc, MBA President & Director Robert Wesolek, CPA CFO & Director, CFO Holloman Energy Eric Prim, BSc, MBA Director, COO Holloman Corp James Ebeling Director, CFO Holloman Corp Technical / Operations Team Mike Kamis, P.Eng. Doug MacLellan, P.Eng. Robert Martin, P.Geol. Susan Eaton, P. Geoph. P. Geol., MSc *

Kotaneelee Gas Field Scale Kotaneelee Gas Field, Yukon 30,188 Gross Acres, Two Producing Gas Wells and a 70 MMCFD Gas Processing Facility Project Location Map *

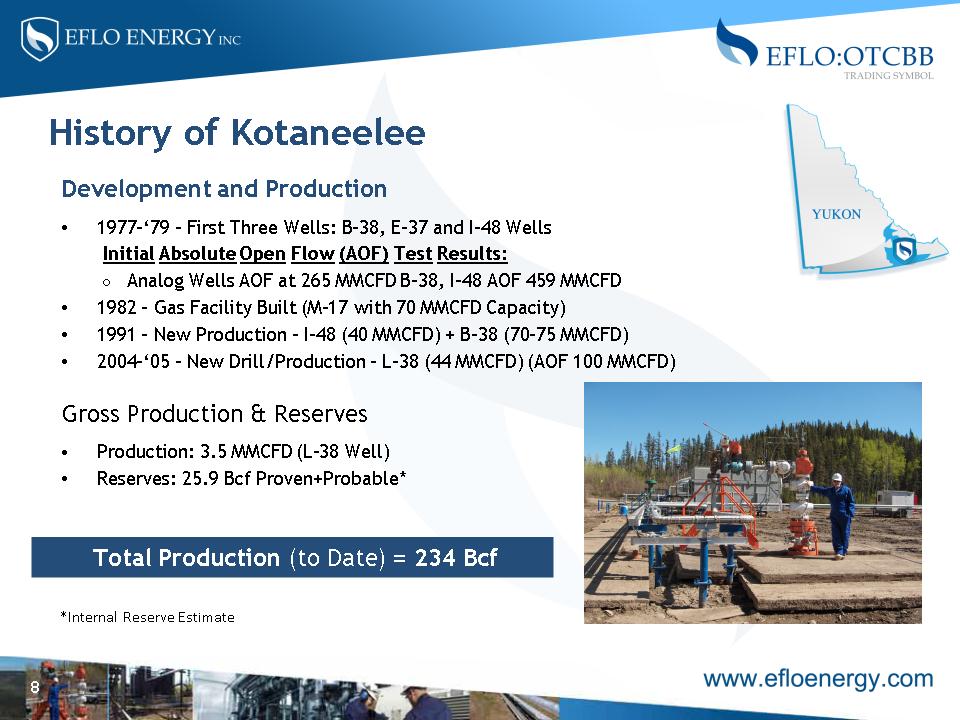

History of Kotaneelee Development and Production 1977-‘79 - First Three Wells: B-38, E-37 and I-48 Wells Initial Absolute Open Flow (AOF) Test Results: Analog Wells AOF at 265 MMCFD B-38, I-48 AOF 459 MMCFD 1982 - Gas Facility Built (M-17 with 70 MMCFD Capacity) 1991 - New Production - I-48 (40 MMCFD) + B-38 (70-75 MMCFD) 2004-‘05 – New Drill/Production - L-38 (44 MMCFD) (AOF 100 MMCFD) Gross Production & Reserves Production: 3.5 MMCFD (L-38 Well) Reserves: 25.9 Bcf Proven+Probable* *Internal Reserve Estimate Total Production (to Date) = 234 Bcf *

Infrastructure Gas Plant & Facilities – Kotaneelee Gas Processing Capacity: 70 MMCFD (Gas Dehydration) Outlet Gas Compression: 1200 psig– added in 2005 Water Disposal: 6,000 bopd (M-17 Well) Sales Line: 24” Sales Line to Fort Nelson Flarestack, Pipeline, Storage Tanks, Local Airstrip, Barge Dock, etc. Local Processing Plant - Fort Nelson Owned by Spectra Energy Current Capacity = 1 BCFD (Expanding to 1.7 BCFD) Only Gas Facility in the Yukon & the Only Gas Facility on West Bank, Liard River *

Kotaneelee Seismic Structure Nahanni Formation *

New Well Drill Plans (L-48) Proposed West Nahanni Location New Well - L-48 Proposed Location Nahanni Nahanni New Well - L-48 Proposed Location B-38 I-48 AOF 459 MMCFD AOF 265 MMCFD *

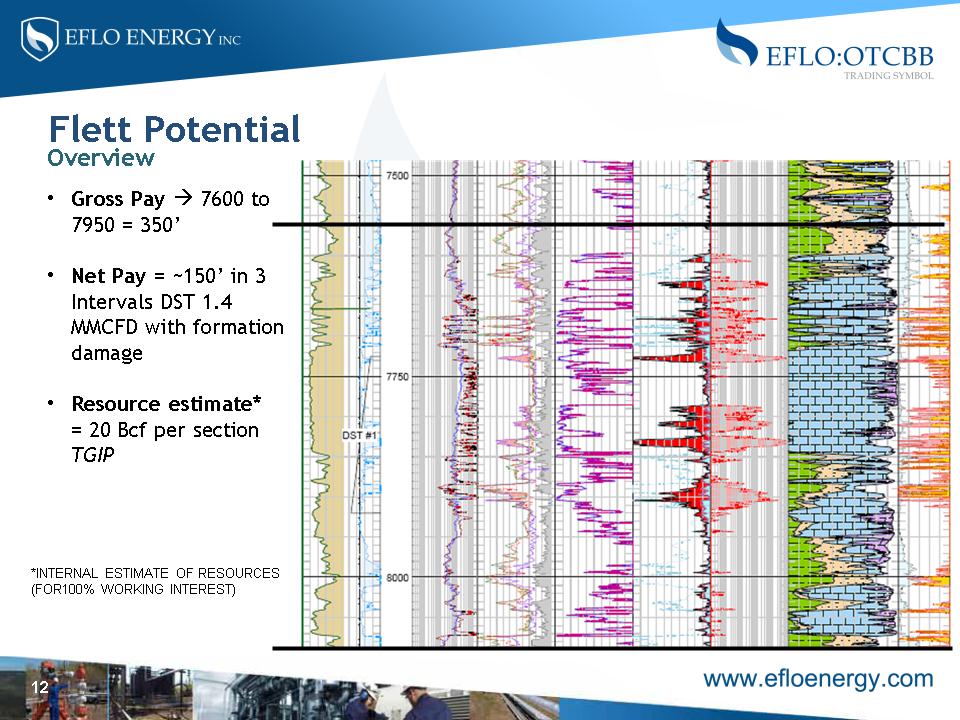

Flett Potential Gross Pay 7600 to 7950 = 350’ Net Pay = ~150’ in 3 Intervals DST 1.4 MMCFD with formation damage Resource estimate* = 20 Bcf per section TGIP Overview *INTERNAL ESTIMATE OF RESOURCES (FOR100% WORKING INTEREST) *

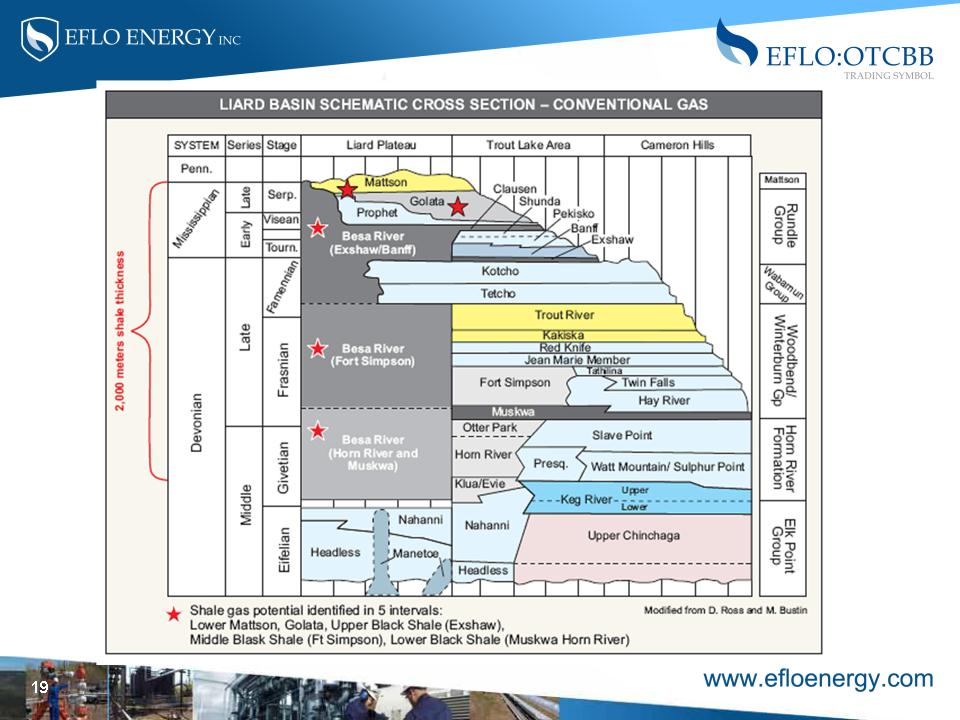

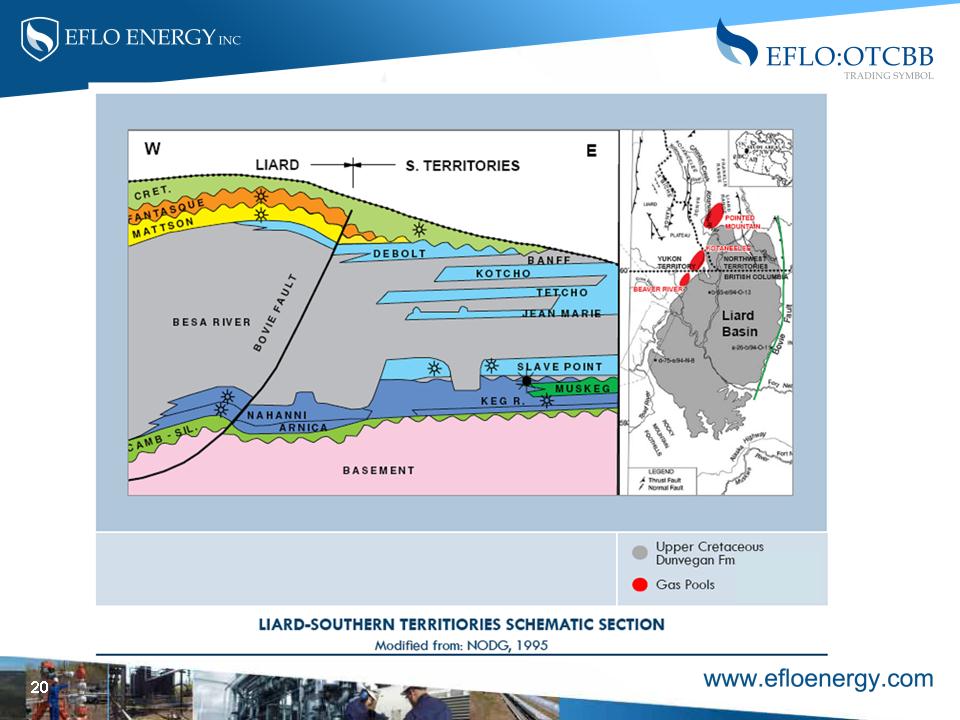

8 to 14 TCF in multiple shale gas sections ranging in thickness from 200 to 300 feet (figures for 100% working interest) NW extension of the prolific Horn River Deeper by 3,000’ and higher pressures Total Organic Content (TOC) up to 6% and 7% in sections, comparable to Horn River Basin for gas maturity TGIP estimates at Horn River EnCana over 220 Bcf per section EOG over 300 Bcf section IP’s for 5 Muskwa wells Average of 13 MMCFD in Horn River EOG IP’s average 18 MMCFD (Peak 23.9 MMCFD) Mapped over ¾ of 50 sections Shale Gas Potential* *Internal resource estimate, some data is for possible analog sites in which we do not have an interest TGIP Estimate at Kotaneelee 220 to 260 Bcf per Section Continuous Gas Shales Resource Play Extending off Kotaneelee Lease* *

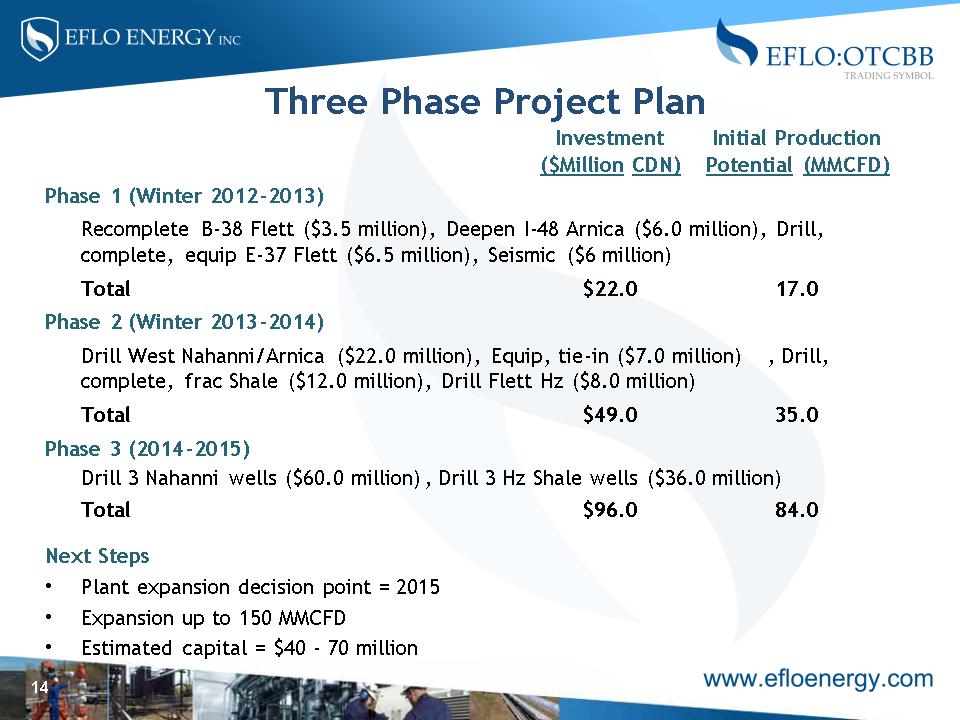

Three Phase Project Plan Investment Initial Production ($Million CDN) Potential (MMCFD) Phase 1 (Winter 2012-2013) Recomplete B-38 Flett ($3.5 million), Deepen I-48 Arnica ($6.0 million), Drill, complete, equip E-37 Flett ($6.5 million), Seismic ($6 million) Total $22.0 17.0 Phase 2 (Winter 2013-2014) Drill West Nahanni/Arnica ($22.0 million), Equip, tie-in ($7.0 million) , Drill, complete, frac Shale ($12.0 million), Drill Flett Hz ($8.0 million) Total $49.0 35.0 Phase 3 (2014-2015) Drill 3 Nahanni wells ($60.0 million) , Drill 3 Hz Shale wells ($36.0 million) Total $96.0 84.0 Next Steps Plant expansion decision point = 2015 Expansion up to 150 MMCFD Estimated capital = $40 - 70 million *

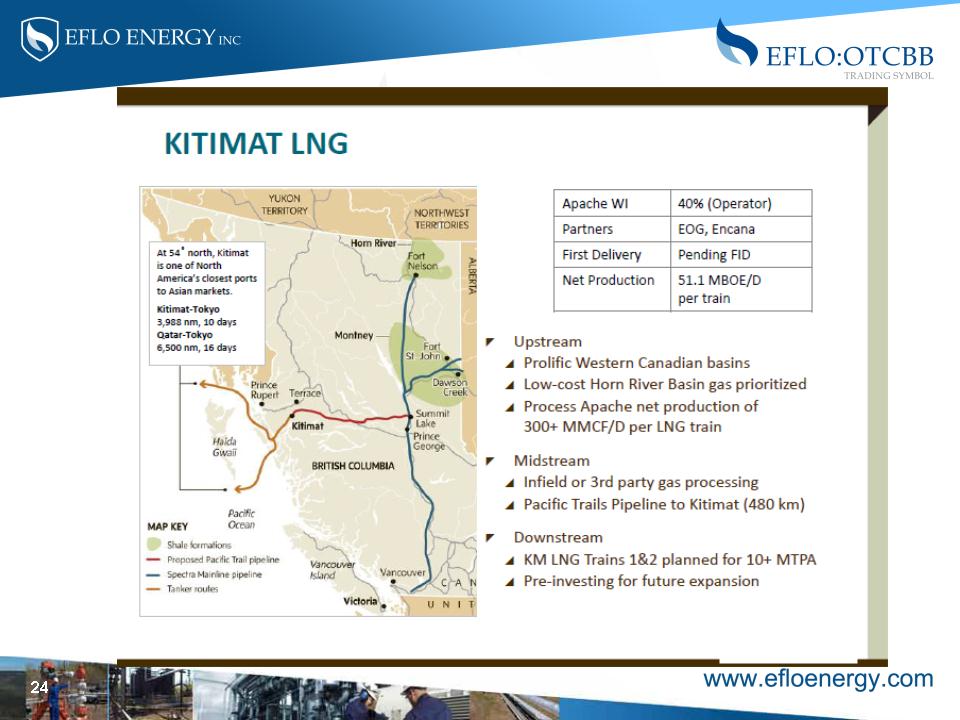

Area Market Options Domestic Market Distribution Intra Alberta East Canada & NE USA Midwest USA PNW California BC Interior and PNW Asia Export – Kitimat Export Kitimat 2014? LNG ST 2 *

FOUR PROPOSED LNG PLANTS for BRITISH COLUMBIA LNG Canada (Shell, Mitsubishi, Kogas, Petrochina) –Kitimat Kitimat LNG (Apache, Encana, EOG)-Pacific Trail Pipeline Petronas-Progress (Prince Rupert) BC LNG (Haisla First Nations, LNG Partners of Houston) Exports to Asia *

Land Acquisitions and M & A Activity Recent Developments and updates $15 billion proposed acquisition of Nexen by CNOOC (July 23, 2012) Progress Energy $5.5 billion acquisition by Petronas (Malaysia)-June 18, 2012 Apache Liard Basin announcement “THE BEST SHALE GAS RESERVOIR IN NORTH AMERICA”, 210 TCF net gas in place, 48 TCF net sales gas and 21 MMCFD IP on third test well (June 14, 2012) Harvest Energy Trust take-over by Korean National Oil Company (Dec. 16, 2009) Northern Cross Announces Equity Funding; CNOOC Equity Investments Land Sale Bonus at June 24 Auction; $110 Million for 116,612 acres Average price of $662 per acre Beaver River parcels (closest sales) $950 to $1,084 18.5 Million and $48.3 Million spent (‘08 and ’09) Average price $600 per acre Kotaneelee Land Value NOW at $20 to $33 Million (100% working interest) Initial Estimate = 30,188 acres @ $662 to $1,084 per acre *

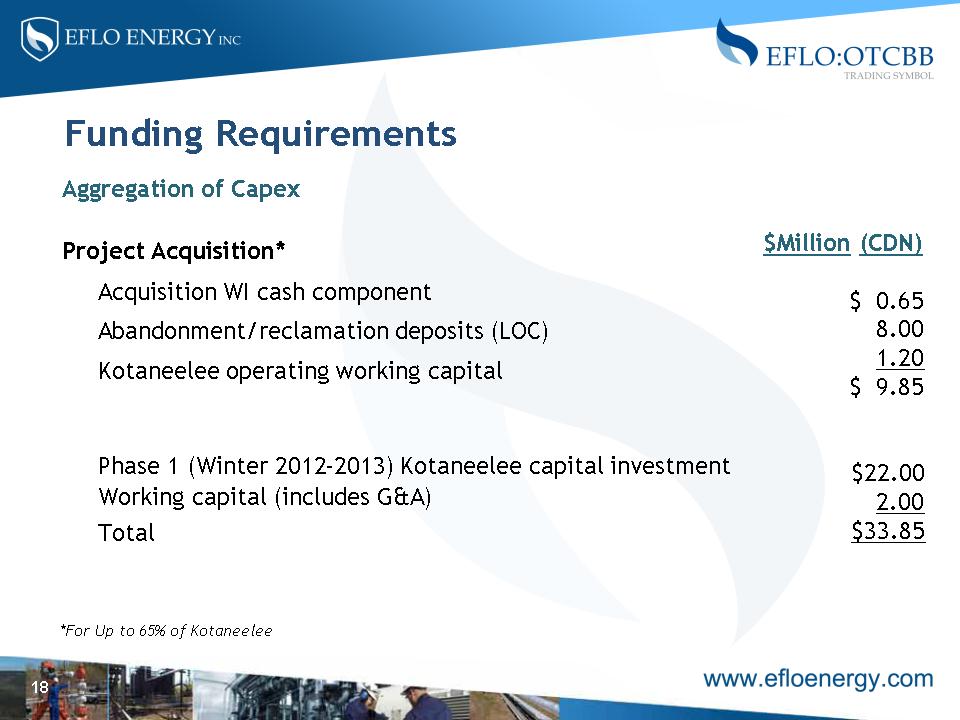

Funding Requirements Aggregation of Capex Project Acquisition* Acquisition WI cash component Abandonment/reclamation deposits (LOC) Kotaneelee operating working capital Phase 1 (Winter 2012-2013) Kotaneelee capital investment Working capital (includes G&A) Total *For Up to 65% of Kotaneelee * $Million (CDN) $ 0.65 8.00 1.20 $ 9.85 $22.00 2.00 $33.85

*

*

*

*

*

*

Corporate Overview EFLO ENERGY Inc. EFLO ENERGY Inc. Stock Symbol EFLO Stock Exchange OTC Capital Markets Date of Inception July 22, 2008 Head Office 333 N Sam Houston Pkwy East, Suite 600 Houston, Texas 77060 Regulator US Security and Exchange Commission Jurisdiction United States of America Classification Natural Resources – Oil and Gas Transfer Agent SIGNATURE STOCK TRANSFER, INC. 2632 Coachlight Court, Plano, Texas 75093, Telephone 972.612.4120 Year End August 31 Website www.efloenergy.com Advisory Team Corporate Banking - Wells Fargo Legal Counsel (CAN) - Bennett Jones, Calgary Legal Counsel (CAN) - Beadle Woods, Vancouver Legal Counsel (USA) - Hart and Trinen, Denver Financial Auditor - Weaver and Tidwell LLP Engineering - Apex Energy Consultants Reserve Engineers - AJM Petroleum Consultants Insurance - Iridium Risk Advisors *

Henry Aldorf, M.Sc, MBA Chairman & Director ------------------------------------------------------------------------------------------------------------------------------- Keith Macdonald, CA Chief Executive Officer & Director ------------------------------------------------------------------------------------------------------------------------------- James Hutton, B.Sc, MBA President & Director ------------------------------------------------------------------------------------------------------------------------------- Robert Wesolek, CPA CFO & Director President of Bamako Investment Mgmt and Founder, President, CFO, Director of New Cache Petroleums and current Director Drakkar Energy Ltd. (in situ oil sands), Holloman Energy (OTC), Surge Energy (TSXV), Mountainview Energy (TSXV), WCSB Oil & Gas Royalty Income Funds , Bellatrix Exploration (TSX) Rocky Mountain Dealerships,(TSX) Past Director; Cirrus Energy, Profound Energy, Breaker Energy, Cordy Oilfield Past Chairman and Director of the Small Explorers and Producers of Canada Senior Executive and Board of Directors Management Team CFO of Holloman Energy Corp. and former President and CEO of TheNavigates Corporation, CFO of Sharp Technology Inc. , President of Citadel Security Software (PC Software Division ), and COO of Kent Marsh Ltd. President of Pacific LNG Operations Ltd. (Elk and Antelope gas discoveries in Papua New Guinea President of Liquid Niugini Gas Limited Past President of Marathon International and Vice-President Global Upstream Business Development of Marathon Oil President and CEO of Hutton Capital Corporation, a company engaged in investment banking services Director of several Canadian resource sector companies Between 1998 and 2006, designed and executed in excess of $1,400,000,000 in flow-through share resource financings for the Canadian energy and mining sectors *

Eric Prim B.Sc, MBA Director --------------------------------------------------------------------------------------------------------------------------------- James Ebeling Director President of Pilot Energy Solutions Inc. and Senior VP of Holloman Corp since 1997 and former senior technical manager with Hunt Energy (1982-1987) and Rexene Corporation (1987-1997) Professional Engineer in Texas: 8 issued or pending U.S. energy tech patents Senior Executive and Board of Directors Current CFO of Holloman Corporation and former Vice President of SUEZ Energy North America, Inc. (key involvement in variety of multi-billion dollar energy related projects) and former Senior Vice President of; Hawkins Oil and Gas) Transworld Oil Company, Anchor Coupling, and The Charter Company Management Team (cont’d) *

Mike Kamis, P.Eng ------------------------------------------------------------------------------------------------------------------------------ Doug M. MacLellan, P. Eng ------------------------------------------------------------------------------------------------------------------------------- Susan Eaton, P.Geo/Geoph, M.Sc -------------------------------------------------------------------------------------------------------------------------------------------- Robert Martin, P.Geol Principal and President of APEX Consulting Inc. (specializing in Oil and Gas) +30 years of industry experience in all aspects of the domestic and global petroleum industry, with emphasis in reservoir and evaluation engineering Participated in all aspects of petroleum engineering with emphasis on reserves and economic feasibility evaluations +30 years of management experience with major and junior O&G companies; technical /engineering, production, operations, financial s (i.e. production, reservoir, & economics of gas, conventional /oil sands (in situ and mineable) Former President, COO, and CEO of several public O&G resource companies +10 years of consulting experience in all areas of the global energy industry Global venture capitalist and O&G industry /government liaison Active member of the Canadian Petroleum Assoc., Canadian Heavy Oil Assoc., Alberta Chamber of Resources and The Oil Sands Task Force Operations Management Management Team (cont’d) +28 years as a Senior Project Manager in the global O&G industry with; Esso Resources Canada Ltd. Suncor Energy Inc., Husky Oil Operations Ltd, Gov. of Canada, MNC and VP Exploration for several junior O&G companies Assoc. of Professional Engineers, Geologists and Geophysicists of Alberta Technical Advisor for; top equity financiers in the Canadian O&G space Explorer, Alberta Oil ,Business Edge & New Technology Magazine contributor +30 years of petroleum and minerals exploration & exploitation experience Past President of LongBow Energy, consultant to the VP Ex. for Daybreak Several successful O&G exploration projects and well discoveries *

The Yukon Jurisdiction: Canadian Territory Location: North-Western Canada (between BC and Alaska) Land mass: 474,391 km2 (equal to the size of Spain) Capital City: Whitehorse (3/4 of Total Populous) Land Travel: Alaskan and Dempster (Paved Highways/Road Access) Ports (ice free): Haines and Skagway, Alaska First Nations: 8 linguistic groups, 14 tribes/clans Majority of land claims/sovereignty agreements finalized Key Industry: Mining (gold, silver, copper, diamonds, and base metals) Second largest global underdeveloped Iron ore deposit Terrain: Boreal Cordillera Ecozone Population: 34,246 / Density: 0.065 /km2 Website: www.gov.yk.ca A Klondike Territory *