Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ABERCROMBIE & FITCH CO /DE/ | d399183d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - ABERCROMBIE & FITCH CO /DE/ | d399183dex991.htm |

| EX-99.2 - EXHIBIT 99.2 - ABERCROMBIE & FITCH CO /DE/ | d399183dex992.htm |

| EX-99.4 - EXHIBIT 99.4 - ABERCROMBIE & FITCH CO /DE/ | d399183dex994.htm |

Exhibit 99.3

Exhibit 99.3 EST. 1892 Abercrombie & Fitch NEW YORK INVESTOR PRESENTATION 2012 SECOND QUARTER

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF

1995 A&F cautions that any forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) contained in this presentation or made by management or spokespeople of A&F involve risks and

uncertainties and are subject to change based on various important factors, many of which may be beyond the Company’s control. Wo

rds such as “estimate,” “project,” “plan,” “believe,” “expect,” “anticipate,” “intend,” and similar expressions may identify forward-looking

statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise our forward-looking statements. The factors included in the disclosure under the heading “FORWARD-LOOKING STATEMENTS AND RISK

FACTORS” in “ITEM 1A. RISK FACTORS” of A&F’s Annual Report on Form 10-K for the fiscal year ended January 28, 2012, in some cases have affected and in the future could affect the Company’s financial performance and

could cause actual results for the 2012 fiscal year and beyond to differ materially from those expressed or implied in any of the forward-looking statements included in this presentation or otherwise made by management. OTHER INFORMATION All dollar

and share amounts are in thousands unless otherwise stated. Sub-totals and totals may not foot due to rounding.

rds such as “estimate,” “project,” “plan,” “believe,” “expect,” “anticipate,” “intend,” and similar expressions may identify forward-looking

statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise our forward-looking statements. The factors included in the disclosure under the heading “FORWARD-LOOKING STATEMENTS AND RISK

FACTORS” in “ITEM 1A. RISK FACTORS” of A&F’s Annual Report on Form 10-K for the fiscal year ended January 28, 2012, in some cases have affected and in the future could affect the Company’s financial performance and

could cause actual results for the 2012 fiscal year and beyond to differ materially from those expressed or implied in any of the forward-looking statements included in this presentation or otherwise made by management. OTHER INFORMATION All dollar

and share amounts are in thousands unless otherwise stated. Sub-totals and totals may not foot due to rounding.

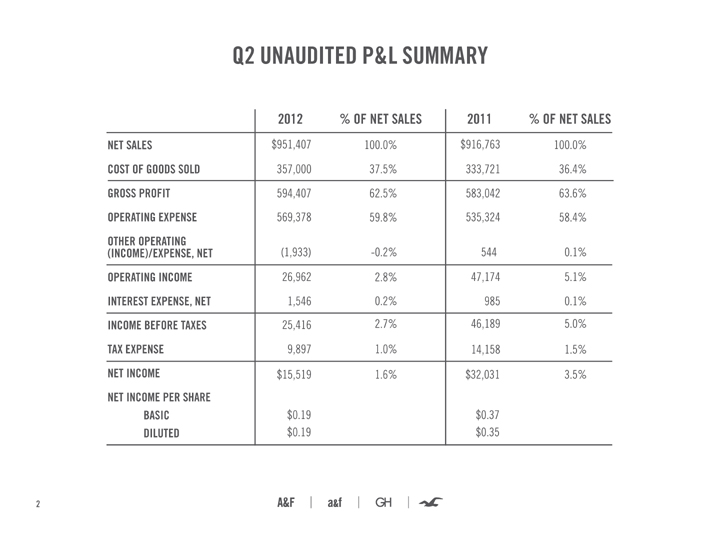

Q2 UNAUDITED P&L SUMMARY 2012 % OF NET SALES 2011 % OF NET SALES NET SALES $951,407 100.0% $916,763 100.0% COST OF GOODS SOLD 357,000 37.5% 333,721 36.4% GROSS PROFIT 594,407 62.5% 583,042 63.6% OPERATING EXPENSE 569,378 59.8% 535,324 58.4% OTHER OPERATING (INCOME)/EXPENSE, NET (1,933) -0.2% 544 0.1% OPERATING INCOME 26,962 2.8% 47,174 5.1% INTEREST EXPENSE, NET 1,546 0.2% 985 0.1% INCOME BEFORE TAXES 25,416 2.7% 46,189 5.0% TAX EXPENSE 9,897 1.0% 14,158 1.5% NET INCOME $15,519 1.6% $32,031 3.5% NET INCOME PER SHARE BASIC $0.19 $0.37 DILUTED $0.19 $0.35

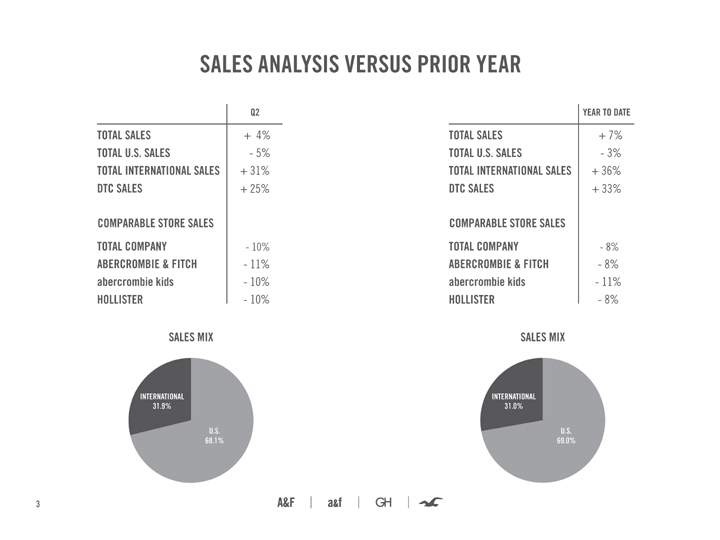

SALES ANALYSIS VERSUS PRIOR YEAR Q2 YEAR TO DATE TOTAL SALES + 4% TOTAL SALES + 7% TOTAL U.S. SALES—5% TOTAL U.S. SALES—3% TOTAL INTERNATIONAL SALES + 31% TOTAL INTERNATIONAL SALES + 36% DTC SALES + 25% DTC SALES + 33% COMPARABLE STORE SALES COMPARABLE STORE SALES TOTAL COMPANY—10% TOTAL COMPANY—8% ABERCROMBIE & FITCH—11% ABERCROMBIE & FITCH—8% abercrombie kids—10% abercrombie kids—11% HOLLISTER—10% HOLLISTER—8% SALES MIX SALES MIX

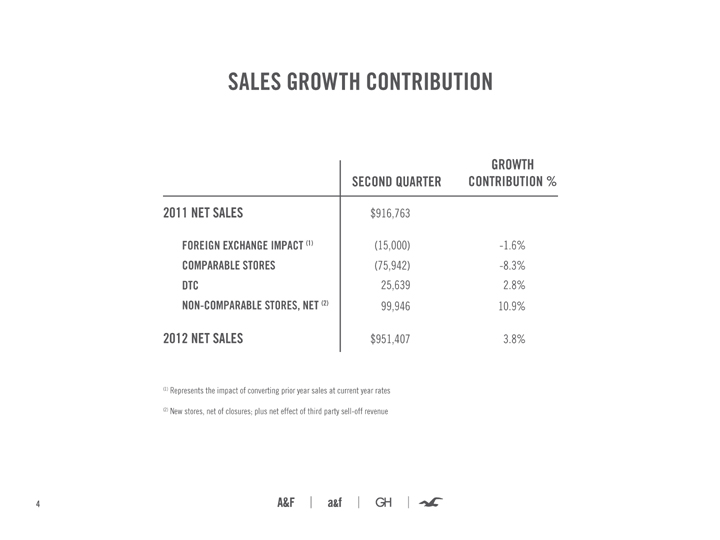

SALES GROWTH CONTRIBUTION GROWTH SECOND QUARTER CONTRIBUTION % 2011 NET SALES $916,763 FOREIGN EXCHANGE IMPACT (1) (15,000) -1.6% COMPARABLE STORES (75,942) -8.3% DTC 25,639 2.8% NON-COMPARABLE STORES, NET (2) 99,946 10.9% 2012 NET SALES $951,407 3.8% (1) Represents the impact of converting prior year sales at current year rates (2) New stores, net of closures; plus net effect of third party sell-off revenue

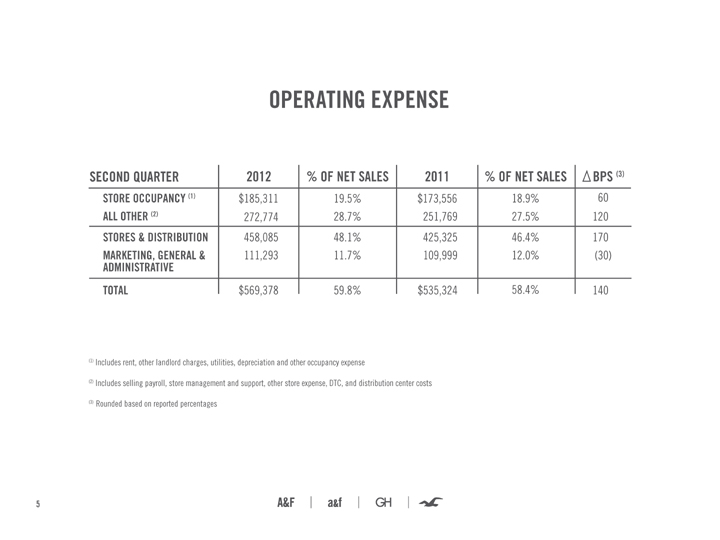

OPERATING EXPENSE SECOND QUARTER 2012 % OF NET SALES 2011 % OF NET SALES BPS (3) STORE OCCUPANCY (1) $185,311 19.5% $173,556 18.9% 60 ALL OTHER (2) 272,774 28.7% 251,769 27.5% 120 STORES & DISTRIBUTION 458,085 48.1% 425,325 46.4% 170 MARKETING, ADMINISTRATIVE GENERAL & 111,293 11.7% 109,999 12.0% (30) TOTAL $569,378 59.8% $535,324 58.4% 140 (1) Includes rent, other landlord charges, utilities, depreciation and other occupancy expense (2) Includes selling payroll, store management and support, other store expense, DTC, and distribution center costs (3) Rounded based on reported percentages

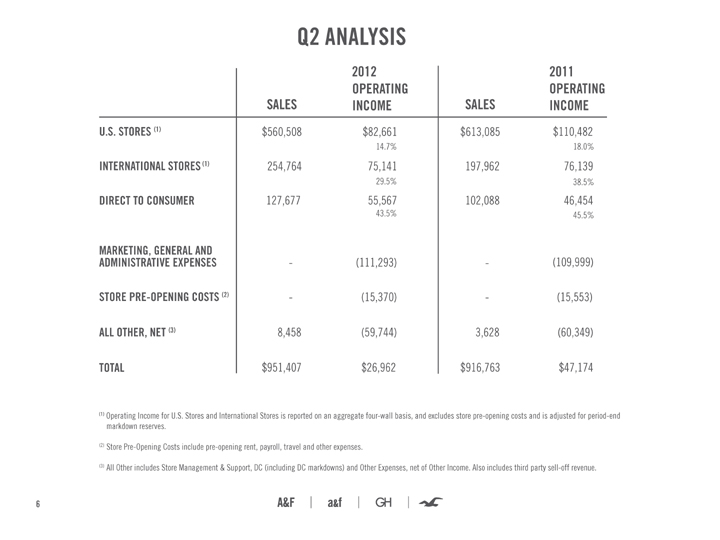

Q2 ANALYSIS 2012 2011 OPERATING OPERATING SALES INCOME SALES INCOME U.S. STORES (1) $560,508 $82,661 $613,085 $110,482 14.7% 18.0% INTERNATIONAL STORES (1) 254,764 75,141 197,962 76,139 29.5% 38.5% DIRECT TO CONSUMER 127,677 55,567 102,088 46,454 43.5% 45.5% MARKETING, GENERAL AND (109,999) ADMINISTRATIVE EXPENSES—(111,293)—STORE PRE-OPENING COSTS (2)—(15,370)—(15,553) ALL OTHER, NET (3) 8,458 (59,744) 3,628 (60,349) TOTAL $951,407 $26,962 $916,763 $47,174 (1)Operating Income for U.S. Stores and International Stores is reported on an aggregate four-wall basis, and excludes store pre-opening costs and is adjusted for period-end markdown reserves. (2) Store Pre-Opening Costs include pre-opening rent, payroll, travel and other expenses. (3) All Other includes Store Management & Support, DC (including DC markdowns) and Other Expenses, net of Other Income. Also includes third party sell-off revenue.

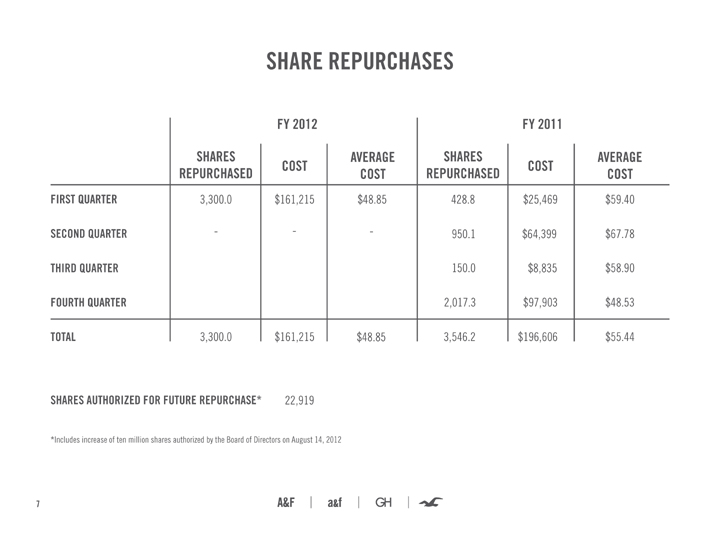

SHARE REPURCHASES FY 2012 FY 2011 SHARES AVERAGE SHARES AVERAGE COST COST REPURCHASED COST REPURCHASED COST FIRST QUARTER 3,300.0 $161,215 $48.85 428.8 $25,469 $59.40 SECOND QUARTER—— 950.1 $64,399 $67.78 THIRD QUARTER 150.0 $8,835 $58.90 FOURTH QUARTER 2,017.3 $97,903 $48.53 TOTAL 3,300.0 $161,215 $48.85 3,546.2 $196,606 $55.44 SHARES AUTHORIZED FOR FUTURE REPURCHASE* 22,919 *Includes increase of ten million shares authorized by the Board of Directors on August 14, 2012

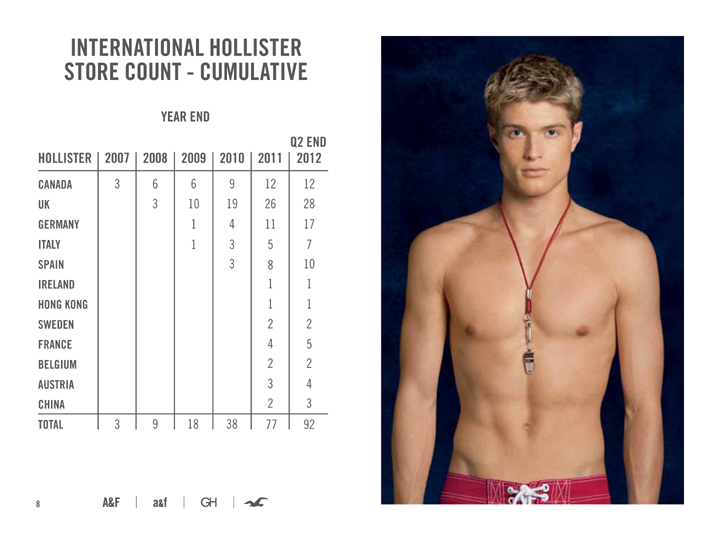

INTERNATIONAL HOLLISTER STORE COUNT—CUMULATIVE YEAR END Q2 END HOLLISTER 2007 2008 2009 2010 2011 2012 CANADA 3 6 6 9 12 12 UK 3 10 19 26 28 GERMANY 1 4 11 17 ITALY 1 3 5 7 SPAIN 3 8 10 IRELAND 1 1 HONG KONG 1 1 SWEDEN 2 2 FRANCE 4 5 BELGIUM 2 2 AUSTRIA 3 4 CHINA 2 3 TOTAL 3 9 18 38 77 92

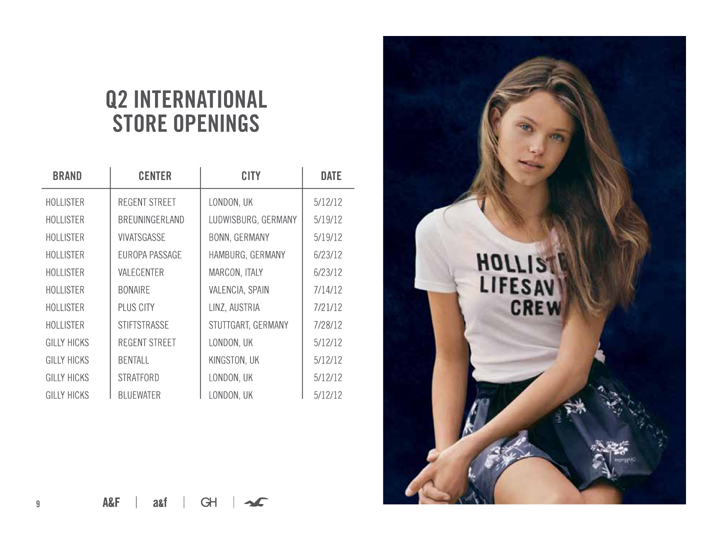

Q2 INTERNATIONAL STORE OPENINGS BRAND CENTER CITY DATE HOLLISTER REGENT STREET LONDON, UK 5/12/12 HOLLISTER BREUNINGERLAND LUDWISBURG, GERMANY 5/19/12 HOLLISTER VIVATSGASSE BONN, GERMANY 5/19/12 HOLLISTER EUROPA PASSAGE HAMBURG, GERMANY 6/23/12 HOLLISTER VALECENTER MARCON, ITALY 6/23/12 HOLLISTER BONAIRE VALENCIA, SPAIN 7/14/12 HOLLISTER PLUS CITY LINZ, AUSTRIA 7/21/12 HOLLISTER STIFTSTRASSE STUTTGART, GERMANY 7/28/12 GILLY HICKS REGENT STREET LONDON, UK 5/12/12 GILLY HICKS BENTALL KINGSTON, UK 5/12/12 GILLY HICKS STRATFORD LONDON, UK 5/12/12 GILLY HICKS BLUEWATER LONDON, UK 5/12/12

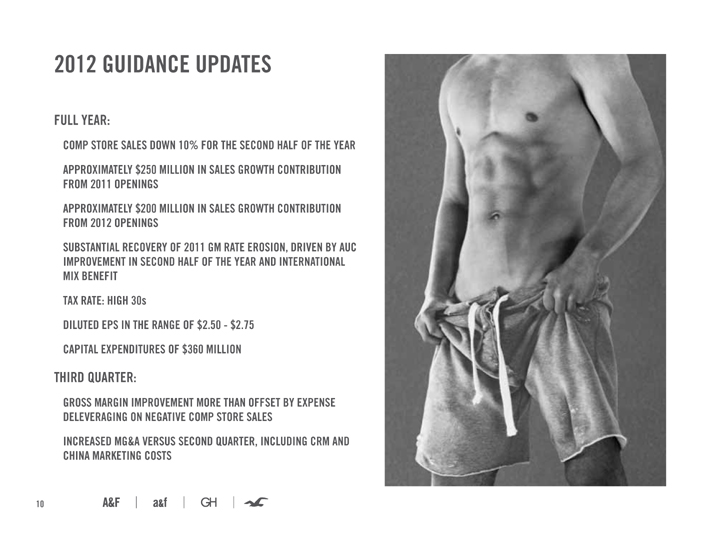

2012 GUIDANCE UPDATES FULL YEAR: COMP STORE SALES DOWN 10% FOR THE SECOND HALF OF THE YEAR APPROXIMATELY $250 MILLION IN SALES GROWTH CONTRIBUTION FROM 2011 OPENINGS APPROXIMATELY $200 MILLION IN SALES GROWTH CONTRIBUTION FROM 2012 OPENINGS SUBSTANTIAL RECOVERY OF 2011 GM RATE EROSION, DRIVEN BY AUC IMPROVEMENT IN SECOND HALF OF THE YEAR AND INTERNATIONAL MIX BENEFIT TAX RATE: HIGH 30s DILUTED EPS IN THE RANGE OF $2.50—$2.75 CAPITAL EXPENDITURES OF $360 MILLION THIRD QUARTER: GROSS MARGIN IMPROVEMENT MORE THAN OFFSET BY EXPENSE DELEVERAGING ON NEGATIVE COMP STORE SALES INCREASED MG&A VERSUS SECOND QUARTER, INCLUDING CRM AND CHINA MARKETING COSTS

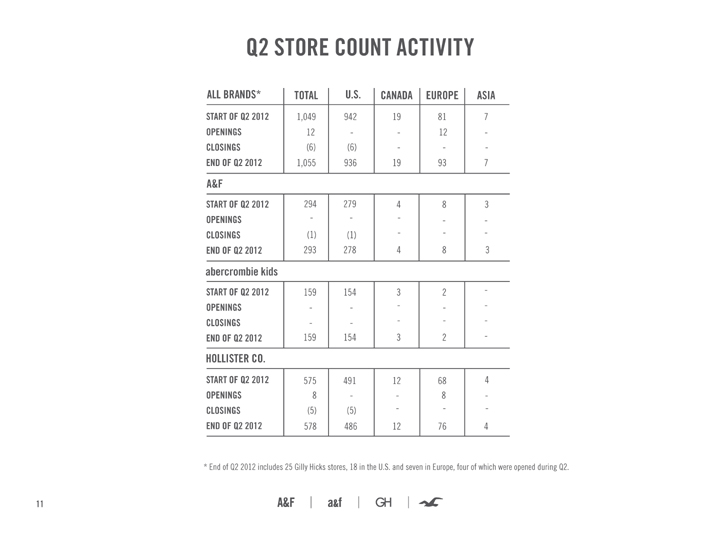

Q2 STORE COUNT ACTIVITY ALL BRANDS* TOTAL U.S. CANADA EUROPE ASIA START OF Q2 2012 1,049 942 19 81 7 OPENINGS 12—- 12—CLOSINGS (6) (6)—— END OF Q2 2012 1,055 936 19 93 7 A&F START OF Q2 2012 294 279 4 8 3 OPENINGS———- CLOSINGS (1) (1)—— END OF Q2 2012 293 278 4 8 3 abercrombie kids START OF Q2 2012 159 154 3 2 -OPENINGS———-CLOSINGS———-END OF Q2 2012 159 154 3 2 -HOLLISTER CO. START OF Q2 2012 575 491 12 68 4 OPENINGS 8—- 8—CLOSINGS (5) (5)—— END OF Q2 2012 578 486 12 76 4 * End of Q2 2012 includes 25 Gilly Hicks stores, 18 in the U.S. and seven in Europe, four of which were opened during Q2.

STRATEGIC UPDATE CAPITAL ALLOCATION PHILOSOPHY INTERNATIONAL STORE PERFORMANCE STORE OPENING PLANS SHARE REPURCHASE PHILOSOPHY DOMESTIC STORE INITIATIVES

CAPITAL ALLOCATION PHILOSOPHY ALLOCATE AVAILABLE CAPITAL TO THOSE INVESTMENTS EXPECTED TO GENERATE THE GREATEST RISK-ADJUSTED RETURNS • HIGH RETURN • OPERATIONAL • SHARE REPURCHASES • DIVIDENDS

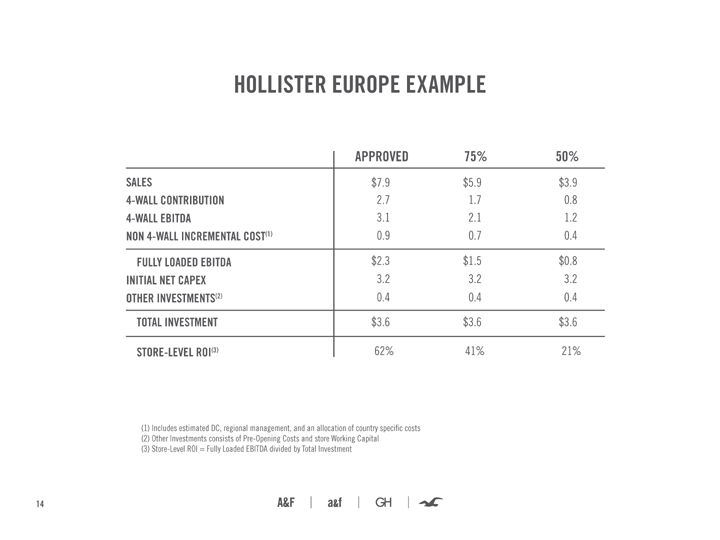

HOLLISTER EUROPE EXAMPLE APPROVED 75% 50% SALES $7.9 $5.9 $3.9 4-WALL CONTRIBUTION 2.7 1.7 0.8 4-WALL EBITDA 3.1 2.1 1.2 NON 4-WALL INCREMENTAL COST(1) 0.9 0.7 0.4 FULLY LOADED EBITDA $2.3 $1.5 $0.8 INITIAL NET CAPEX 3.2 3.2 3.2 OTHER INVESTMENTS(2) 0.4 0.4 0.4 TOTAL INVESTMENT $3.6 $3.6 $3.6 STORE-LEVEL ROI(3) 62% 41% 21% (1) Includes estimated DC, regional management, and an allocation of country specific costs (2) Other Investments consists of Pre-Opening Costs and store Working Capital (3) Store-Level ROI = Fully Loaded EBITDA divided by Total Investment

HOLLISTER EUROPE APPROXIMATELY 90% OF STORES ACHIEVING 4-WALL OPERATING MARGINS OF 30% OR GREATER ON AVERAGE, EXCEEDING APPROVED SALES VOLUME BY APPROXIMATELY 20%

A&F FLAGSHIP EXAMPLE: LONDON SALES $64.2 4-WALL CONTRIBUTION 30.5 4-WALL EBITDA 32.7 NON 4-WALL INCREMENTAL COST(1) 9.6 FULLY LOADED EBITDA $23.1 INITIAL NET CAPEX 24.8 OTHER INVESTMENTS(2) 3.3 TOTAL INVESTMENT $28.1 STORE-LEVEL ROI(3) 82% Sales and EBITDA are on Trailing Twelve Month basis as of 7/28/2012 (1) Includes estimated DC, regional management, an allocation of country specific costs, and net loss of inventory sell-off (2) Other Store-Level ROI Investments consists of Pre-Opening Costs and store Working Capital (3) Store-Level ROI = Fully Loaded EBITDA divided by Total Investment

A&F FLAGSHIPS—EUROPE COMBINED TRAILING TWELVE MONTH STORE-LEVEL ROI GREATER THAN 35% 25% OR HIGHER 4-WALL OPERATING MARGIN IN ALL BUT TWO STORES

A&F INTERNATIONAL OPENINGS CITY TIMING TYPE HONG KONG AUGUST 11, 2012 FLAGSHIP MUNICH Q3 2012 A&F and kids FLAGSHIP DUBLIN Q4 2012 TIER 1 / FLAGSHIP AMSTERDAM Q4 2012 TIER 1 / FLAGSHIP SEOUL 2013 TIER 1 / FLAGSHIP SHANGHAI FALL 2013 FLAGSHIP LONDON TBD kids FLAGSHIP

SHARE REPURCHASE PHILOSOPHY MINIMUM CASH BALANCE OF $350M EXCESS CASH RETURNED TO SHAREHOLDERS THROUGH DIVIDENDS AND SHARE REPURCHASES SUPPLEMENT WITH EXISTING CREDIT FACILITIES OR OTHER DEBT FINANCING AS APPROPRIATE EXECUTE REPURCHASES WHEN STOCK VALUATION IS ATTRACTIVE ON A LONG-TERM BASIS

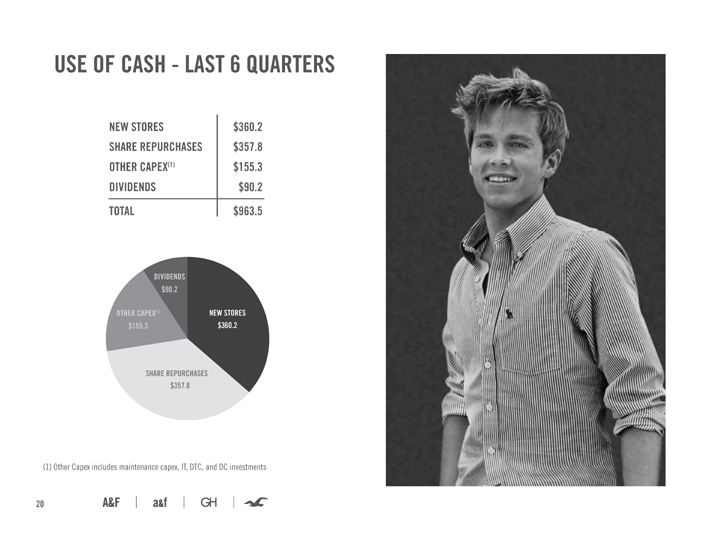

USE OF CASH—LAST 6 QUARTERS NEW STORES $360.2 SHARE REPURCHASES $357.8 OTHER CAPEX(1) $155.3 DIVIDENDS $90.2 TOTAL $963.5 (1) Other Capex includes maintenance capex, IT, DTC, and DC investments

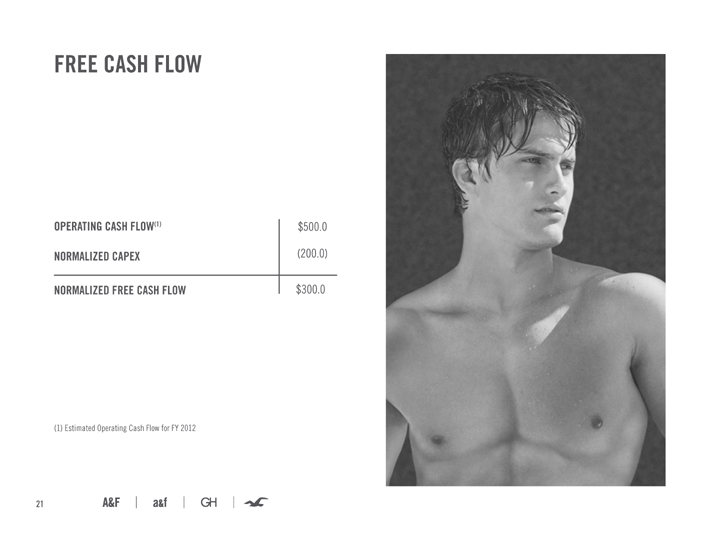

FREE CASH FLOW OPERATING CASH FLOW(1) $500.0 NORMALIZED CAPEX (200.0) NORMALIZED FREE CASH FLOW $300.0 (1) Estimated Operating Cash Flow for FY 2012

DOMESTIC STORE PROFITABILITY INITIATIVES MERCHANDISING INITIATIVES • CONSERVATIVE • SHORTER PRODUCT • INCREASE CHASE INVENTORY OPTIMIZATION • INVENTORY GROWTH • NEW MP&A SYSTEMS INSIGHT & INTELLIGENCE • MACRO, COMPETITOR, • PRIMARY AND SECONDARY

DOMESTIC STORE PROFITABILITY INITIATIVES CUSTOMER ENGAGEMENT • NEW CLUB PROGRAMS EXPENSE & AUC REDUCTION • INTERNATIONAL OPERATING • SIGNIFICANT FALL AUC • CENTRAL COSTS LEVERAGE STORE RATIONALIZATION • 135 STORES CLOSED • 180 EXPECTED CLOSURES • MODEST ANNUAL ACCRETION