Attached files

| file | filename |

|---|---|

| 8-K - INCOME OPPORTUNITY - INCOME OPPORTUNITY REALTY INVESTORS INC /TX/ | ari8k081512.htm |

|

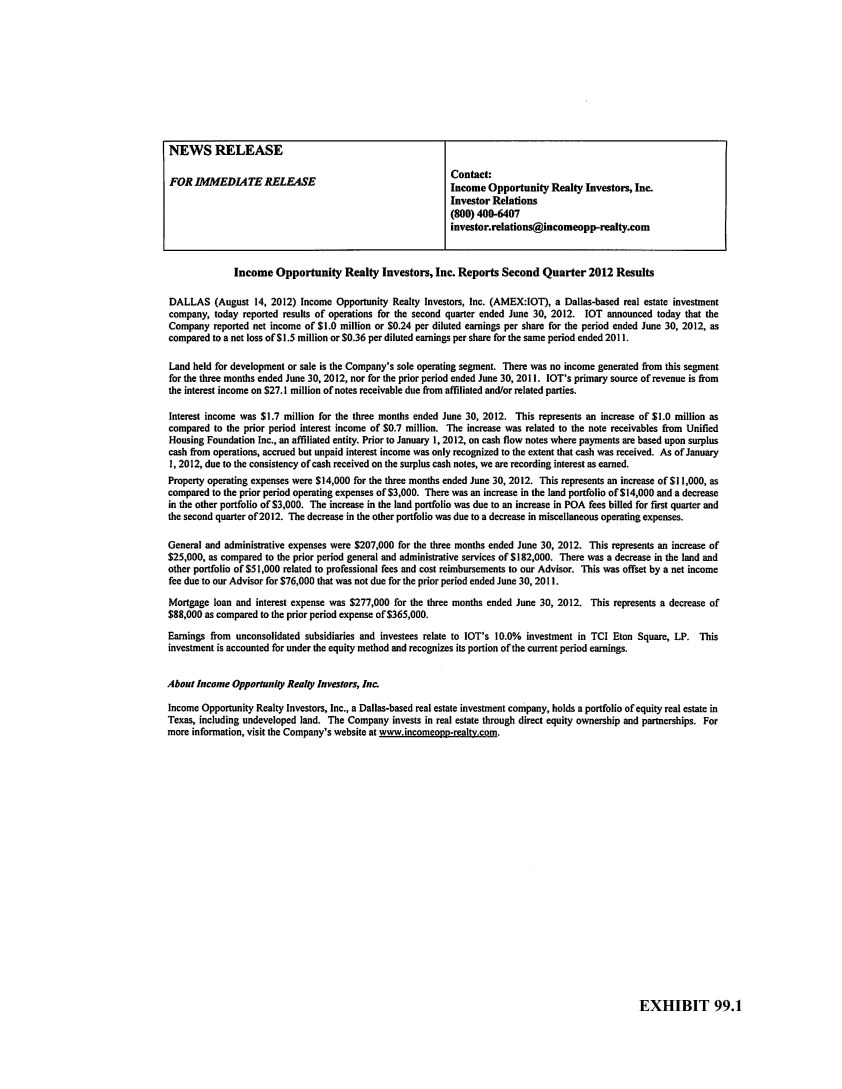

INCOME OPPORTUNITY REALTY INVESTORS, INC.

|

||||||||||||||||

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

||||||||||||||||

|

(unaudited)

|

||||||||||||||||

|

For the Three Months Ended June 30,

|

For the Six Months Ended June 30,

|

|||||||||||||||

|

2012

|

2011

|

2012

|

2011

|

|||||||||||||

|

(dollars in thousands, except share and per share amounts)

|

||||||||||||||||

|

Revenues:

|

||||||||||||||||

|

Rental and other property revenues

|

$ | - | $ | - | $ | - | $ | - | ||||||||

|

Expenses:

|

||||||||||||||||

|

Property operating expenses (including $14 and $0 for the three months

and $43 and $2 for the six months ended 2012 and 2011 respectively from

affiliates and related parties)

|

14 | 3 | 45 | 11 | ||||||||||||

|

General and administrative (including $117 and $61 for the three months

and $200 and $116 for the six months ended 2012 and 2011 respectively

from affiliates and related parties)

|

207 | 182 | 360 | 276 | ||||||||||||

|

Advisory fee to affiliates

|

205 | 211 | 402 | 431 | ||||||||||||

|

Total operating expenses

|

426 | 396 | 807 | 718 | ||||||||||||

|

Operating loss

|

(426 | ) | (396 | ) | (807 | ) | (718 | ) | ||||||||

|

Other income (expense):

|

||||||||||||||||

|

Interest income (including $1,713 and $723 for the three months and $2,896

and $1,017 for the six months ended 2012 and 2011 respectively from

affiliates and related parties)

|

1,713 | 723 | 2,896 | 1,017 | ||||||||||||

|

Mortgage and loan interest

|

(277 | ) | (365 | ) | (552 | ) | (646 | ) | ||||||||

|

Earnings from unconsolidated subsidiaries and investees

|

(12 | ) | (50 | ) | (23 | ) | (50 | ) | ||||||||

|

Total other income

|

1,424 | 308 | 2,321 | 321 | ||||||||||||

|

Income (loss) from continuing operations before tax

|

998 | (88 | ) | 1,514 | (397 | ) | ||||||||||

|

Income tax expense

|

- | (503 | ) | (3 | ) | (502 | ) | |||||||||

|

Net income (loss) from continuing operations

|

998 | (591 | ) | 1,511 | (899 | ) | ||||||||||

|

Discontinued operations:

|

||||||||||||||||

|

Loss from discontinued operations

|

- | (1,437 | ) | (9 | ) | (1,435 | ) | |||||||||

|

Income tax benefit from discontinued operations

|

- | 503 | 3 | 502 | ||||||||||||

|

Net loss from discontinued operations

|

- | (934 | ) | (6 | ) | (933 | ) | |||||||||

|

Net income (loss)

|

998 | (1,525 | ) | 1,505 | (1,832 | ) | ||||||||||

|

Earnings per share - basic

|

||||||||||||||||

|

Income (loss) from continuing operations

|

$ | 0.24 | $ | (0.14 | ) | $ | 0.36 | $ | (0.22 | ) | ||||||

|

Loss from discontinued operations

|

- | (0.22 | ) | - | (0.22 | ) | ||||||||||

|

Net income (loss) applicable to common shares

|

$ | 0.24 | $ | (0.36 | ) | $ | 0.36 | $ | (0.44 | ) | ||||||

|

Earnings per share - diluted

|

||||||||||||||||

|

Income (loss) from continuing operations

|

$ | 0.24 | $ | (0.14 | ) | $ | 0.36 | $ | (0.22 | ) | ||||||

|

Loss from discontinued operations

|

- | (0.22 | ) | - | (0.22 | ) | ||||||||||

|

Net income (loss) applicable to common shares

|

$ | 0.24 | $ | (0.36 | ) | $ | 0.36 | $ | (0.44 | ) | ||||||

|

Weighted average common share used in

computing earnings per share

|

4,168,214 | 4,168,214 | 4,168,214 | 4,168,214 | ||||||||||||

|

Weighted average common share used in

computing diluted earnings per share

|

4,168,214 | 4,168,214 | 4,168,214 | 4,168,214 | ||||||||||||

|

INCOME OPPORTUNITY REALTY INVESTORS, INC.

|

||||||||

|

CONSOLIDATED BALANCE SHEETS

|

||||||||

|

(unaudited)

|

||||||||

|

June 30,

|

December 31,

|

|||||||

|

2012

|

2011

|

|||||||

|

(dollars in thousands, except share

and par value amounts)

|

||||||||

|

Assets

|

||||||||

|

Real estate land holdings, at cost

|

$ | 24,511 | $ | 24,511 | ||||

|

Total real estate

|

24,511 | 24,511 | ||||||

|

Notes and interest receivable from related parties

|

27,073 | 31,612 | ||||||

|

Less allowance for doubtful accounts

|

(1,826 | ) | (1,826 | ) | ||||

|

Total notes and interest receivable

|

25,247 | 29,786 | ||||||

|

Cash and cash equivalents

|

11 | 1 | ||||||

|

Investments in unconsolidated subsidiaries and investees, subject to sales contract

|

14 | 37 | ||||||

|

Receivable and accrued interest from related parties

|

58,206 | 52,160 | ||||||

|

Other assets

|

1,507 | 1,546 | ||||||

|

Total assets

|

$ | 109,496 | $ | 108,041 | ||||

|

Liabilities and Shareholders’ Equity

|

||||||||

|

Liabilities:

|

||||||||

|

Notes and interest payable

|

$ | 28,470 | $ | 28,588 | ||||

|

Deferred gain (from sales to related parties)

|

5,127 | 5,127 | ||||||

|

Accounts payable and other liabilities

|

193 | 125 | ||||||

| 33,790 | 33,840 | |||||||

|

Commitments and contingencies:

|

||||||||

|

Shareholders’ equity:

|

||||||||

|

Common stock, $.01 par value, authorized 10,000,000 shares; issued 4,173,675 shares in 2012 and 2011

|

42 | 42 | ||||||

|

Treasury stock at cost, 5,461 in 2012 and 2011

|

(39 | ) | (39 | ) | ||||

|

Paid-in capital

|

61,955 | 61,955 | ||||||

|

Retained earnings

|

13,748 | 12,243 | ||||||

|

Total shareholders' equity

|

75,706 | 74,201 | ||||||

|

Total liabilities and shareholders' equity

|

$ | 109,496 | $ | 108,041 | ||||

|

The accompanying notes are an integral part of these financial statements.

|

||||||||