Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASPEN INSURANCE HOLDINGS LTD | d397060d8k.htm |

Exhibit 99.1

INVESTOR PRESENTATION

S SECOND CO QU QUARTER 2012

Aspen Insurance Holdings Limited

SAFE HARBOR DISCLOSURE

This slide presentation is for information purposes only. It should be read in conjunction conjunction with our financial financial supplement posted on our website on the Investor Relations page and with other documents filed filed or to be filed shortly by Aspen Insurance Holdings Limited (the “Company” Company or “Aspen”) Aspen ) with the US Securities and Exchange Commission.

Non-GAAP Financial Measures

In presenting Aspen’s Aspen s results, management has included and discussed certain “non non-GAAP financial measures” measures , as such term is defined in Regulation G. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain explain Aspen’s Aspen s results of operations in a manner that allows for a more complete understanding of the underlying underlying trends in Aspen’s business. However, However these measures should not be viewed as a substitute for those determined in accordance with GAAP. The reconciliation of such non-GAAP financial measures to their respective most directly comparable GAAP financial measures in accordance with Regulation g G is included herein or in the financial supplement, pp , as applicable, pp , which can be obtained from the Investor Relations section of Aspen’s p website at www.aspen.co

Application of the Safe Harbor of the Private Securities Litigation Reform Act of 1995:

This presentation contains, written or oral “forward forward-looking statements” statements within the meaning of the US fede deral ral securities laws. These These statements are made pursuant to the safe harbor provisions of the Private Secur Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as “expect expect,” “intend intend,” “plan plan,” “believe believe,” “do do not believe,” “aim aim,” “project project,” “anticipate anticipate,” “seek seek,”

“will,” “estimate,” “may,” “continue,” “guidance,” and similar expressions of a future or forward-looking nature.

All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in these statements. Aspen believes these factors include, but are not limited to: the possibility of greater frequency frequency or severity of claims and loss activity, including as a result of natural or man-made (including economic and political political risks) catastrophic or material loss events, than our underwriting, reserving, reinsurance purchasing or investment practices have anticipated; the reliability of, and changes in assumptions to, natural and man-made catastrophe pricing, p g, accumulation and estimated loss models; ; evolving g issues with respect p to interpretation p of coverage g after major j loss events and any y intervening g legislative g or governmental action and changing judicial interpretation and judgments on insurers insurers’ liability to various risks; the effectiveness of our loss limitation limitation methods; changes in the total industry losses, or our share of total industry losses, resulting from past events and, with respect to such events, our reliance on loss reports received from cedants and loss adjustors, our reliance on industry loss estimates estimates and those generated by modeling techniques, changes in rulings on flood damage or other exclusions as a result of prevailing lawsuits and case law; the impact of acts of terrorism and acts of war and related legislation; decreased demand for our insurance or reinsurance products and cyclical changes in the insurance and reinsurance sectors; any changes in our reinsurers’ credit quality and the amount and timing of reinsurance recoverables; ; changes g in the availability, y, cost or q quality y of reinsurance or retrocessional coverage; g ; the continuing g and uncertain impact p of the current depressed economic environment in many of the countries in which we operate; the persistence of the global financial crisis crisis and the Eurozone debt crisis; the level of inflation in repair costs due to limited availability of labor and materials after catastrophes; changes in insurance and reinsurance market conditions; increased competition on the basis of pricing pricing, capacity, coverage terms or other factors and the related related demand and supply dynamics as contracts come up for renewal; a decline in our operating subsidiaries’ ratings with Standard & Poor’s (“S&P”), A.M. Best Company, Inc. (“A.M. Best”) or Moody’s Investor Service (“Moody’s”); our ability to execute our business plan to enter new markets, introduce new products and develop new distribution ib channels, including their integration into our existing operations; changes g in g general economic conditions, , including g inflation, , foreign g currency y exchange g rates, , interest rates and other factors that could affect our investment p portfolio; ; the risk of a material decline in the value or liquidity of al all or parts of our investment portfolio; changes in our ability to exercise capital management initiatives or to arrange banking facilities as a result result of prevailing market changes or changes in our financial position; changes in government regulations or tax laws in jurisdictions where we conduct business; Aspen Holdings or Aspen Bermuda becoming subject to income income taxes in the United States or the United Kingdom; loss of key personnel; and increased counterparty risk due to the credit impairment of financial institutions. For a more detailed description of these uncertainties and other factors, please see the “Risk Factors” section in Aspen’s Annual Report on Form 10-K as filed with the US Securities and Exchange Commission on February 28, 2012. Aspen undertakes no obligation g to publicly p y update p or revise any y forward-looking g statements, , whether as a result of new information, , future events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made.

In addition, any estimates relating to loss events involve the exercise of considerable judgment and reflect a combination of ground-up evaluations, information available to date from brokers and cedants cedants, market intelligence, initial tentative loss reports and other sources. The actuarial range of reserves and management’s management s best estimate represents a distribution from our internal capital model for reserving risk risk based on our then current state of knowledge and explicit and implicit assumptions relating to the incurred pattern of claims, the expected ultimate settlement amount, inflation and dependencies between lines of business. Due to the complexity of factors contributing g to the losses and the preliminar p y nature of the information used to p prepare p these estimates, , there can be no assurance that Aspen’s p ultimate losses will remain within the stated amounts.

AHL: NYSE

2

CONTENTS

• Who We Are & What We Do

• The Aspen p Approach pp

• Aspen Aspen’s s Natural Catastrophe Exposures: Major Peril Zones

• Delivering g Strong g Investment Returns

• Proactive Management g of Capital p

• Financial Highlights 2Q 2012 and YTD 2012

• Appendix

• Investment Portfolio by Asset Type

• Eurozone Investment Exposure p

• Reserve Position

AHL: NYSE

| 3 |

|

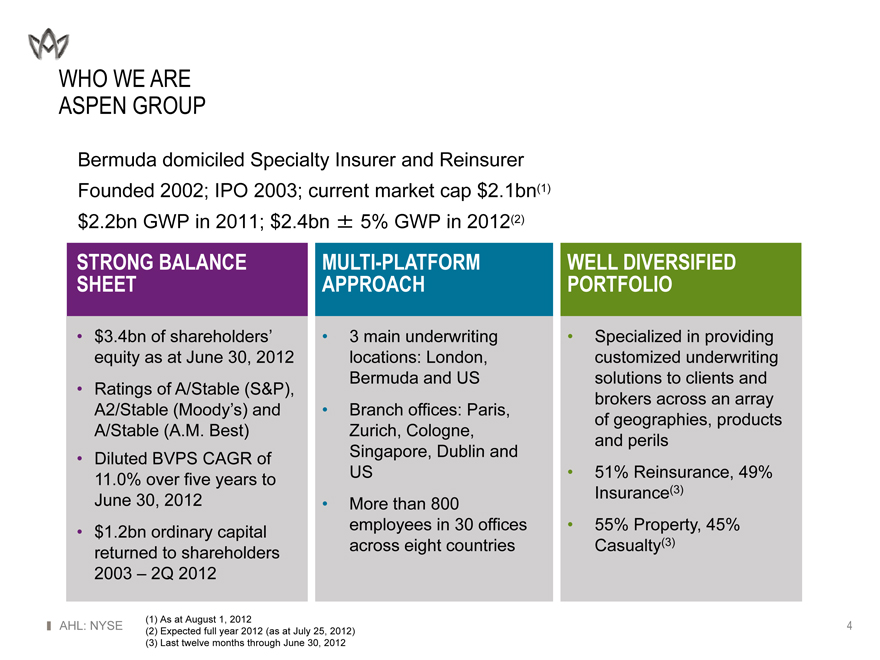

WHO WE ARE ASPEN GROUP

Bermuda domiciled Specialty Insurer and Reinsurer Founded 2002; IPO 2003; current market cap $2.1bn(1) $2.2bn GWP in 2011; $2.4bn ± 5% GWP in 2012(2)

STRONG BALANCE SHEET

• $3.4bn of shareholders shareholders’ equity as at June 30, 2012

• Ratings of A/Stable (S&P),

A2/Stable (Moody(Moody’s) s) and

A/Stable (A( .M. Best) )

• Diluted BVPS CAGR of 11.0% over five years y to June 30, 2012

• $1.2bn ordinary y capital p returned to shareholders 2003 – 2Q 2012

MULTI-PLATFORM APPROACH

• 3 main underwriting g locations: London, Bermuda and US

• Branch offices: Paris, Zurich, , Cologne, g , Singapore, Dublin and US

• More than 800 employees p y in 30 offices across eight countries

WELL DIVERSIFIED PORTFOLIO

• Specialized p in providing p g customized underwriting solutions to clients and brokers across an array of geographies, g g p products p and perils

• 51% Reinsurance, , 49% Insurance(3)

• 55% % Property, p y, 45% % Casualty(3) ( )

(1) As at August 1, 2012

(2) Expected full year 2012 (as at July 25, 2012) (3) Last twelve months through June 30, 2012

AHL: NYSE

4

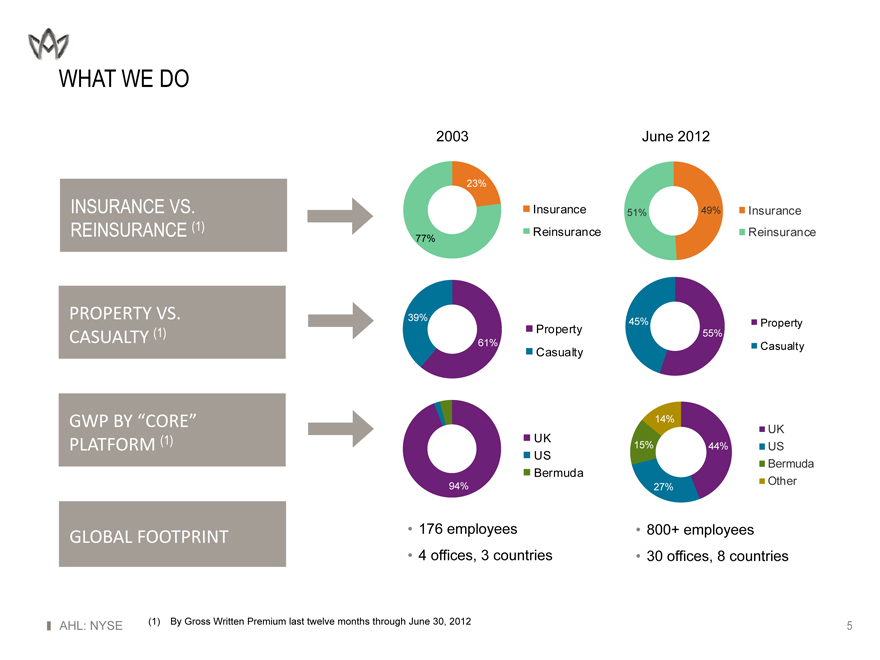

WHAT WE DO

INSURANCE VS. REINSURANCE ( (1) )

PROPERTY VS. CASUALTY (1)

GWP BY “CORE” CORE

PLATFORM (1) ( )

GLOBAL FOOTPRINT

2003 June 2012

23%

Insurance 51% 49% Insurance

77% Reinsurance Reinsurance

39% 45% Property

Propertyp y 55%

61% Casualtyy

Casualty

14%

UK

UK 15% 44% US

US

Bermuda

Bermuda

94% 27% Other

• 176 employees • 800+ employees

• 4 offices, 3 countries • 30 offices, 8 countries

(1) ( ) By y Gross Written Premium last twelve months through g June 30, , 2012

AHL: NYSE

5

WHAT WE DO

REINSURANCE: OVERVIEW AND STRATEGY

ASPEN APPROACH:

• Established market leader

• Presence in major j market hubs enables close proximity p y to customers

• Deep expertise and understanding of client needs and risks

• Focus on smaller, specialized companies and risks to maintain p portfolio diversity y

• Focus on clients where reinsurance and reinsurance relationships are a vital part of their business needs

ANALYSIS OF GWP BY BUSINESS LINE (1)

24%

25%

27%

24%

Property Catastrophe Reinsurance

Other Property Reinsurance

Casualty Reinsurance

Specialty Reinsurance

PROPERTY CATASTROPHE OTHER PROPERTY CASUALTY REINSURANCE SPECIALTY REINSURANCE

REINSURANCE REINSURANCE

• Treaty Catastrophe • Treaty Risk Excess • US Casualty Treaty • Credit & Surety

• Treatyy Pro Rata • International Casualtyy Reinsurancee su a ce

• Global Property Facultative Treatyy • Agricultureg

• Global Casualty Facultative • Other Specialty including

Aviation, Energy and

Marine

(1) ( ) Gross Written Premium for the last twelve months through g June 30, , 2012

AHL: NYSE

6

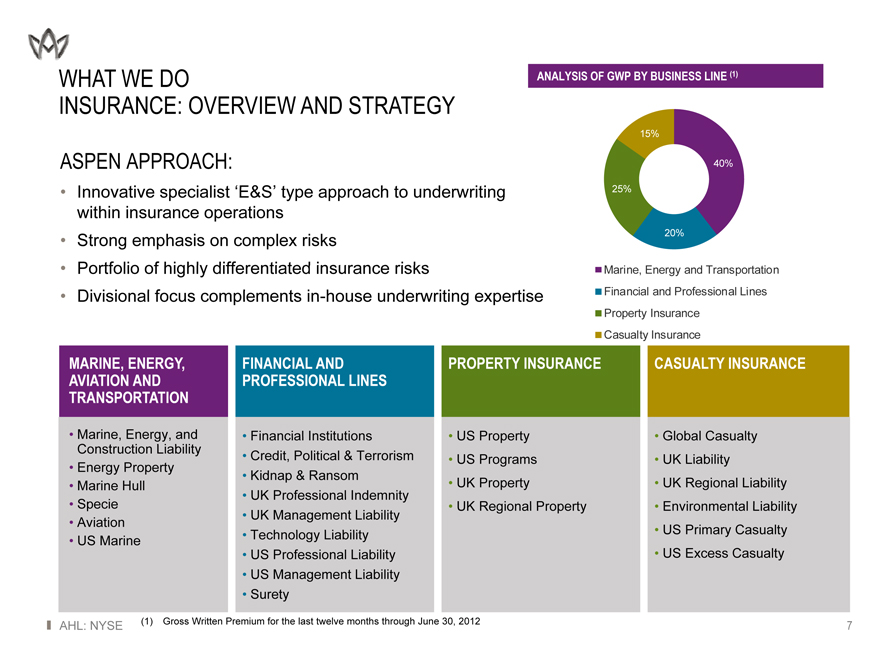

WHAT WE DO

INSURANCE: OVERVIEW AND STRATEGY

ASPEN APPROACH:

• Innovative specialist ‘E&S’ E&S type approach to underwriting within insurance operations

• Strong g emphasis p on complex p risks

• Portfolio o t o o of o highly g y differentiated d e e t ated insurance su a ce risks s s

• Divisional focus complements in-house underwriting expertise

ANALYSIS OF GWP BY BUSINESS LINE (1) ( )

15%5%

40%

25%

20%

Marine, , Energy gy and Transportation p Financial and Professional Lines Property Insurance Casualty Insurance

MARINE, ENERGY, FINANCIAL AND PROPERTY INSURANCE CASUALTY INSURANCE

AVIATION AND PROFESSIONAL LINES

TRANSPORTATION

• Marine, Energy, and • Financial Institutions • US Property • Global Casualty

ConstructionCo s uc o Liabilityab y • Credit, Political & Terrorism • US Programs • UK Liability

• Energy Property • Kidnap & Ransom

• Marine Hull • UK Propertyp y • UK Regionalg Liabilityy

• UK Professional Indemnity

• Specie • UK Regional Property • Environmental Liability

• UK Managementg Liabilityy

• Aviation • Technology Liability • US Primary Casualty

• US Marine

• US Professional Liability • US Excess Casualty

• US Management Liability

• Suretyy

(1) ( ) Gross Written Premium for the last twelve months through g June 30, , 2012

AHL: NYSE

7

THE ASPEN APPROACH

REINSURANCE: 2012 AND BEYOND

Business

Key Elements

REINSURANCE

Continue diversification strategy gy by y p product and g geography, g p y, with a focus on more pronounced p g growth in emerging g g markets Further development of local market strategy with dedicated teams in:

• Continental Europe p ( (Zurich), ), Asia ( (Singapore), g p ), Latin America ( (Miami) ) and Middle East ( (London) ) Implementation of cross-selling strategy to drive synergies across Property, p y, Casualty y and Specialty p y Lines Improving p g the Market

• Provide our underwriters with data and facts to support the argument for improved p prices p

• Development of specific actions, by product and territory, to achieve more adequate rates

Selective Growth in Exposures We Know and and Understand, Subject to Market Conditions

AHL: NYSE

8

THE ASPEN APPROACH INSURANCE: 2012 AND BEYOND

Business

Key Elements

US INSURANCE

INTERNATIONAL INSURANCE

Strong leadership

Established teams – Property, Professional Liability, Management Liability, Inland Marine/Ocean Cargo, Primary Casualty, Surety, Excess Casualty, Environmental Liability and Programs

Building momentum – teams executing on strategies with all licenses in place

Round out ‘London Market’ portfolio

Further development of UK regional platform

Established a foothold in Swiss insurance market

Strong demand for Marine, Energy, Political Risk and Kidnap & Ransom

Selective Growth in Exposures We Know and and Understand, Subject to Market Conditions

AHL: NYSE

9

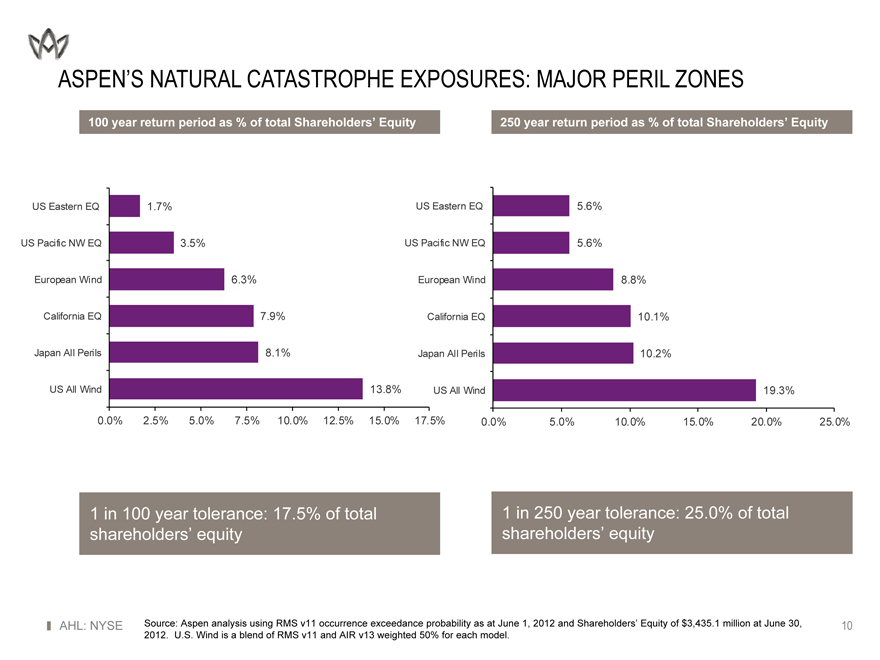

ASPEN’S ASPEN S NATURAL CATASTROPHE EXPOSURES: MAJOR PERIL ZONES

100 y year return p period as % of total Shareholders’ Equity q y

US Eastern EQ 1.7%

US Pacific NW EQ 3.5%

European Wind 6.3%

California EQ 7.9%

Japan All Perils 8.1%

US All Wind 13.8%

0.0% 2.5% 5.0% 7.5% 10.0% 12.5% 15.0% 17.5%

US Eastern EQ 5.6%

US Pacific NW EQ 5.6%

European Wind 8.8%

California EQ 10.1%

Japan All Perils 10.2%

US All Wind 19.3%

0.0% 5.0% 10.0% 15.0% 20.0% 25.0%

(1)

1 in 100 year y tolerance: 17.5% of total shareholders’ shareholders equity

(1) 1 in 250 year tolerance: 25.0% of total shareholders’ shareholders equity q y

Source: Aspen analysis using RMS v11 occurrence occurrence exceedance probability as at June 1, 2012 and Shareholders Shareholders’ Equity of $3,435.1 million at June 30, 2012. U.S. Wind is a blend of RMS v11 and AIR v13 weighted 50% for each model.

AHL: NYSE

10

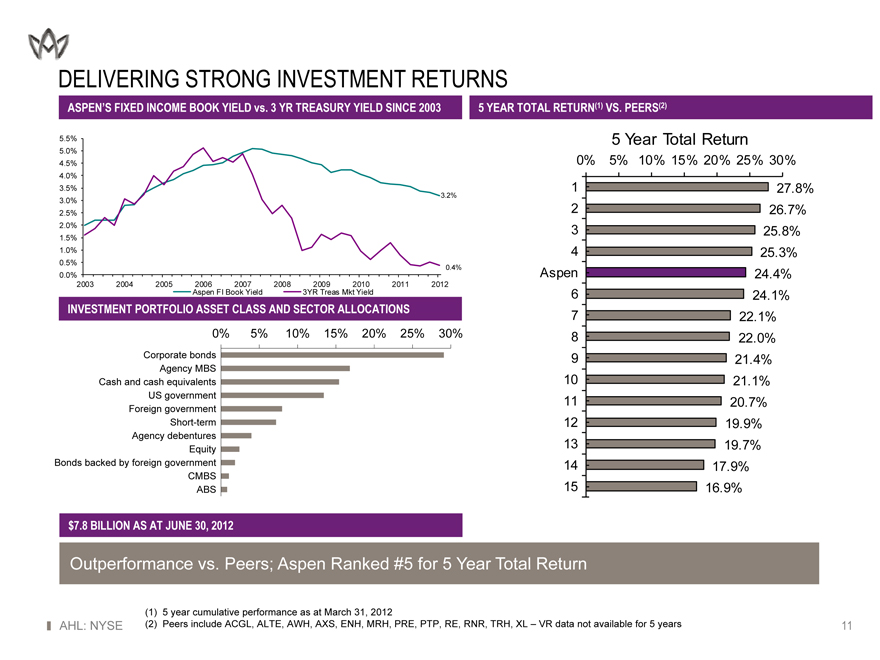

DELIVERING STRONG INVESTMENT RETURNS

ASPEN’S ASPEN S FIXED INCOME BOOK YIELD vs. 3 YR TREASURY YIELD SINCE 2003

5.5%

5.0%

4.5%

4.0%

3.5%

3.2%

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%% 0.4%

0.0%

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Aspen FI Book Yield 3YR Treas Mkt Yield

INVESTMENT PORTFOLIO ASSET CLASS AND SECTOR ALLOCATIONS

0% 5% 10% 15% 20% 25% 30%

Corporatep bonds

Agency MBS

CashCas aandd cascash equequivalentsa e s

US government

Foreign government

Short-term

Agency debentures

Equityq y

Bonds backed by foreign government

CMBSCS

ABS

5 YEAR TOTAL RETURN(1) VS. PEERS(2)

5 Year Total Return

0% 5% 10% 15% 20% 25% 30%

1 27.8%

2 26.7%

3 25.8%

4 25.3%

Aspen 24.4%

6 24.1%

7 22.1%

8 22.0%

9 21.4%

10 21.1%

11 20.7%

12 19.9%

13(1) 19.7%

14 17.9%

15 16.9%

$7.8 BILLION AS AT JUNE 30,, 2012

Outperformance vs. Peers; Aspen Ranked #5 for 5 Year Total Return

(1) ( ) 5 y year cumulative p performance as at March 31, , 2012

(2) Peers include ACGL, ALTE, AWH, AXS, ENH, MRH, PRE, PTP, RE, RNR, TRH, XL – VR data not available for 5 years

AHL: NYSE

11

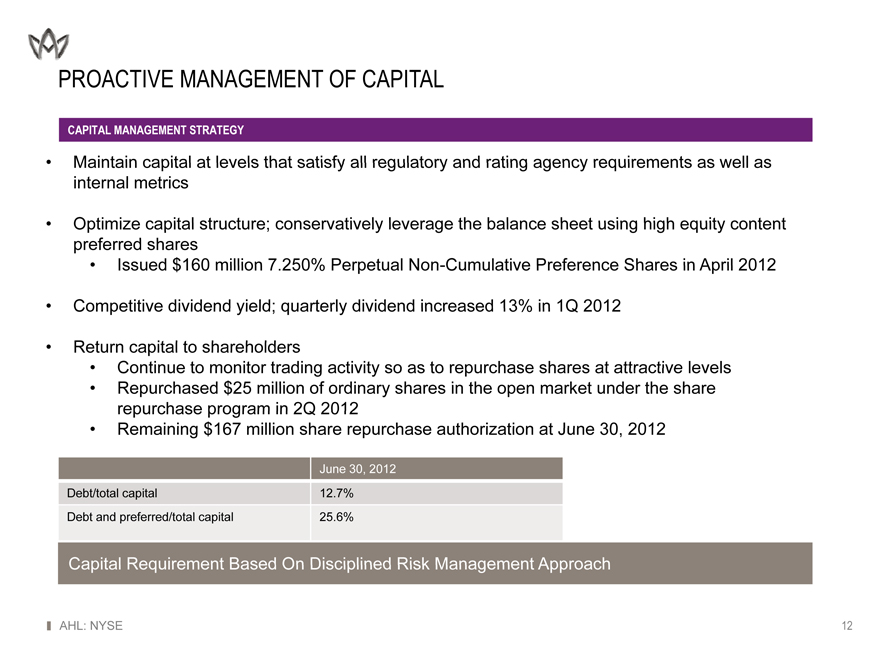

PROACTIVE MANAGEMENT OF CAPITAL

CAPITAL MANAGEMENT STRATEGY

Maintain capital at levels that satisfy y all regulatory regulatory g y and rating g agency g y requirements as well as internal te a metrics et cs

Optimize p capital p structure; ; conservatively y leverage leverage g the balance sheet using g high g equity q y content preferred shares

• Issued $160 million 7.250% Perpetual Non-Cumulative Preference Shares in April 2012 Competitive dividend yield; quarterly quarterly dividend increased 13% in 1Q 2012

Return capital to shareholders

• Continue to monitor trading g activity y so as to repurchase shares at attractive levels

• Repurchased epu c ased $255 million o of o ordinary o d a y shares s a es in the t e open ope market a et under u de the t e share s a e repurchase program in 2Q 2012

• Remaining g $167 million share repurchase p authorization at June 30, , 2012

(1)

June 30, 2012

Debt/total capital 12.7%

Debt and ppreferred/total capitalp 25.6%

Capital Requirement Based On Disciplined Disciplined Risk Management Approach

AHL: NYSE

12

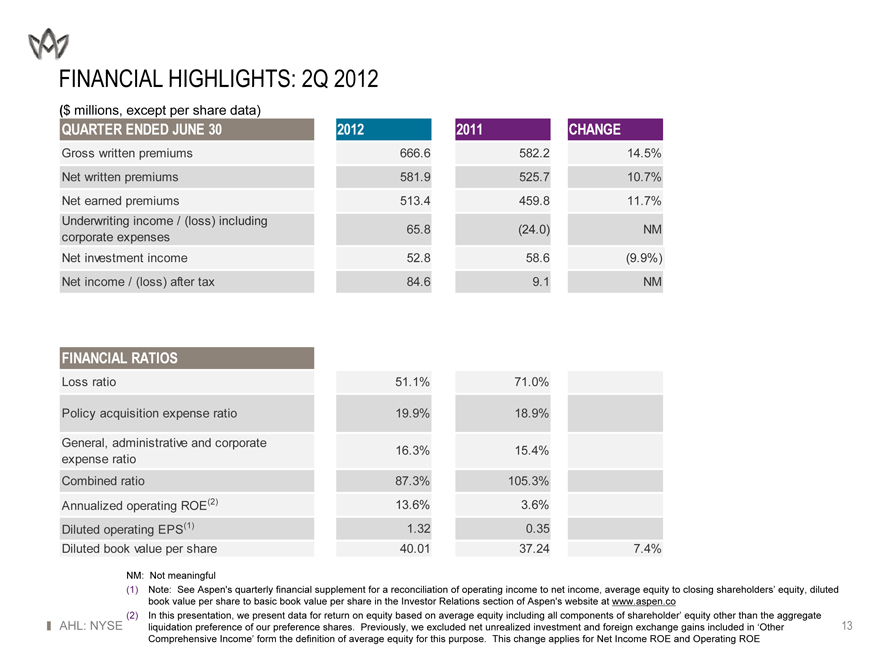

FINANCIAL HIGHLIGHTS: 2Q 2012

($ millions, except per share data)

QUARTER ENDED JUNE 30 2012 2011 CHANGE

Gross written premiums 666.6 582.2 14.5%

Net written premiums 581.9 525.7 10.7%

Net earned premiumsp 513.4 459.8 11.7%

Underwriting income / (loss) including

corporate expenses 65.8(24.0) NM

Net investment income 52.8 58.6(9.9%)

Net income / (loss) after tax 84.6 9.1 NM

FINANCIAL RATIOS

Loss ratio 51.1% 71.0%

Policyy acquisitionq expensep ratio 19.9% 18.9%

General, administrative and corporate 16.3% 15.4%

expense ratio

Combined ratio 87.3% 105.3%

Annualized operating ROE(2)( ) 13.6% 3.6%

Diluted operating EPS(1) 1.32 0.35

Diluted book value per share 40.01 37.24 7.4%

NM: Not meaningful

(1) Note: See Aspen Aspen’s s quarterly financial supplement for a reconcilia iliation tion of operating income to net income, average equity to closing shareholders’ shareholders equity, diluted book value per share to basic book value per share in the Investor Relations section of Aspen’s website at www.aspen.co (2) In this presentation, we present data for return on equity based on average equity including all components of shareholder’ shareholder equity other than the aggregate liquidation preference of our preference shares. Previously, we excluded net unrealized investment and foreign exchange gains included in ‘Other Comprehensive Income Income’ form the definition of average equity equity for this purpose. This change applies applies for Net Income ROE and Operating ROE

AHL: NYSE

13

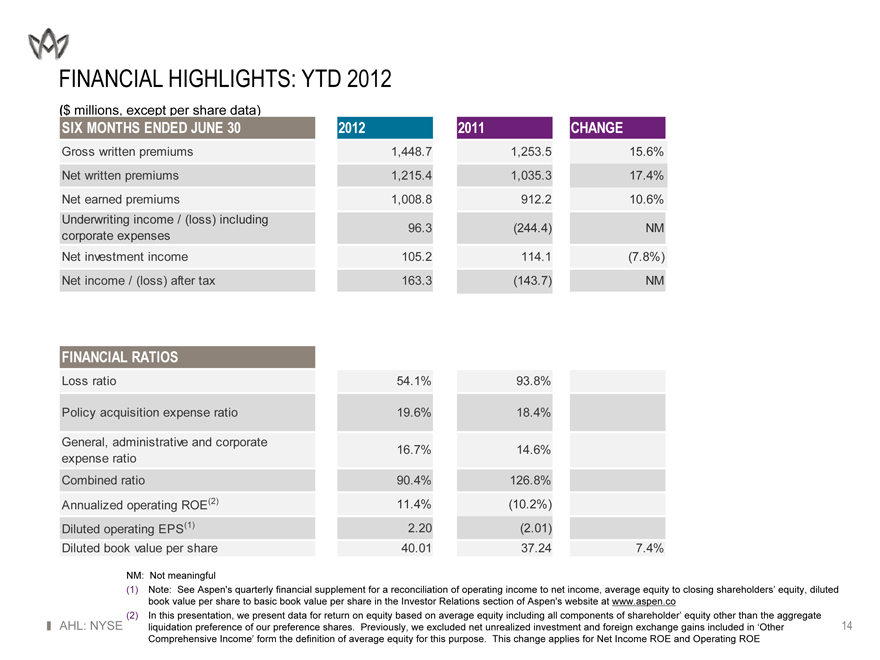

FINANCIAL HIGHLIGHTS: YTD 2012

($ millions, except per share data)

SIX MONTHS ENDED JUNE 30 2012 2011 CHANGE

Gross written premiums 1,448.7 1,253.5 15.6%

Net written premiumsp 1,215, .4 1,035, .3 17.4%%

Net earned premiumsp 1,008.8 912.2 10.6%

Underwriting income / (loss) including

corporate expenses 96.3(244.4) NM

Net investment income 105.2 114.1(7.8%)

Net income / (loss) after tax 163.3(143.7) NM

FINANCIAL RATIOS

Loss ratio 54.1%% 93.8%%

Policy acquisition expense ratio 19.6% 18.4%

General, administrative and corporate 16.7% 14.6%

expense ratio

Combined ratio 90.4% 126.8%

Annualized operating ROE(2)( ) 11.4%(10.2%)

Diluted operating EPS(1) 2.20(2.01)

Diluted book value per share 40.01 37.24 7.4%

NM: Not meaningful

(1) Note: See Aspen Aspen’s s quarterly financial supplement for a reconcilia iliation tion of operating income to net income, average equity to closing shareholders’ shareholders equity, diluted book value per share to basic book value per share in the Investor Relations section of Aspen’s website at www.aspen.co (2) In this presentation, we present data for return on equity based on average equity including all components of shareholder’ shareholder equity other than the aggregate liquidation preference of our preference shares. Previously, we excluded net unrealized investment and foreign exchange gains included in ‘Other Comprehensive Income Income’ form the definition of average equity equity for this purpose. This change applies applies for Net Income ROE and Operating ROE

AHL: NYSE

14

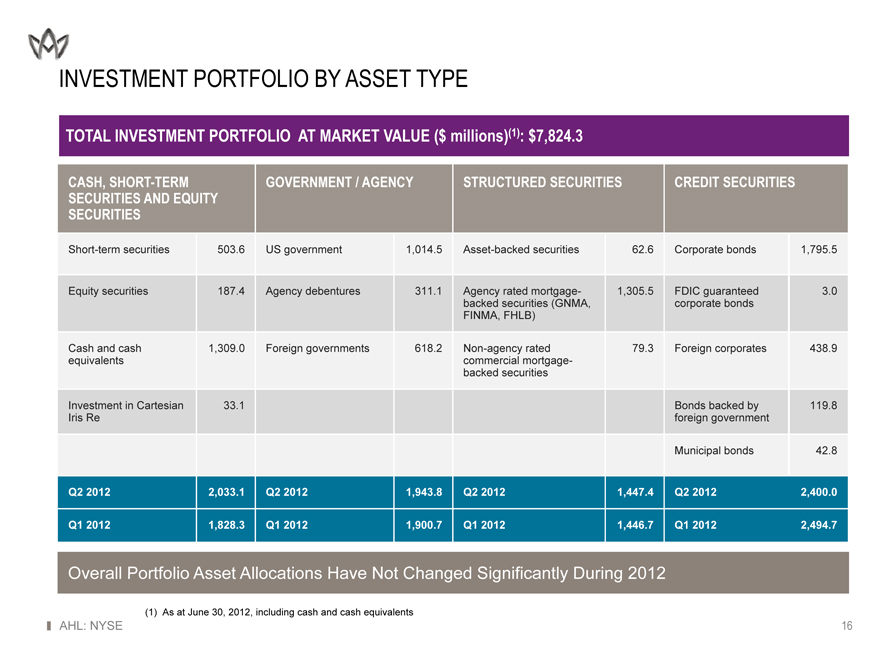

APPENDIX

INVESTMENT PORTFOLIO BY ASSET TYPE

TOTAL INVESTMENT PORTFOLIO AT MARKET VALUE ($ millions)(1)( ): $7,824.3

CASH,, SHORT-TERM GOVERNMENT / AGENCY STRUCTURED SECURITIES CREDIT SECURITIES

SECURITIES AND EQUITY

SECURITIES

Short-term securities 503.6 US government 1,014.5 Asset-backed securities 62.6 Corporate bonds 1,795.5

Equity securities 187.4 Agency debentures 311.1 Agency rated mortgage- 1,305.5 FDIC guaranteed 3.0

backed securities (GNMA,( , corporatep bonds

FINMA, FHLB)

Cash and cash 1,309.0 Foreign governments 618.2 Non-agency rated 79.3 Foreign corporates 438.9

equivalents commercial mortgage-

backed securities

Investment in Cartesian 33.1 Bonds backed byy 119.8

Iris Re foreign government

Municipal bonds 42.8

Q2Q 2012 2,033, .1 Q2Q 2012 1,943, .8 Q2Q 2012 1,447, .4 Q2Q 2012 2,400, .0

Q1 2012 1,828.3 Q1 2012 1,900.7 Q1 2012 1,446.7 Q1 2012 2,494.7

Overall Portfolio Asset Allocations Have Not Changedg Significantlyg y Duringg 2012

(1) ( ) As at June 30, , 2012, , including g cash and cash equivalents q

AHL: NYSE

16

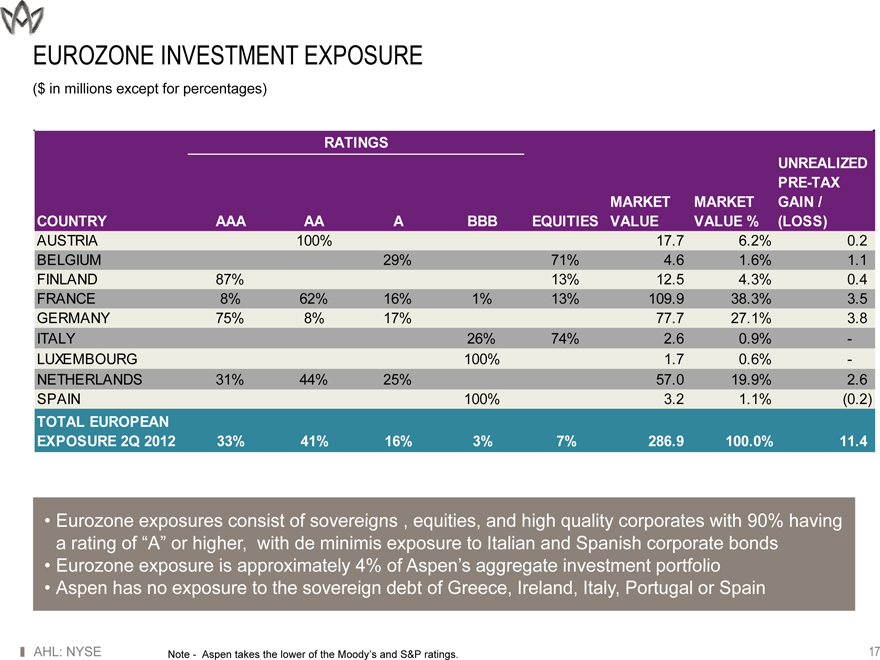

EUROZONE INVESTMENT EXPOSURE

($ in millions except for percentages)

RATINGS

UNREALIZED

PRE-TAX

MARKET MARKET GAIN /

COUNTRY AAA AA A BBB EQUITIES VALUE VALUE %(LOSS)

AUSTRIA 100% 17.7 6.2% 0.2

BELGIUM 29% 71% 4.6 1.6% 1.1

FINLAND 87% 13% 12.5 4.3% 0.4

FRANCE 8% 62% 16% 1% 13% 109.9 38.3% 3.5

GERMANY 75% 8% 17% 77.7 27.1% 3.8

ITALY 26% 74% 2.6 0.9% -

LUXEMBOURG 100% 1.7 0.6% -

NETHERLANDS 31% 44% 25% 57.0 19.9% 2.6

SPAIN 100% 3.2 1.1%(0( .2))

TOTAL EUROPEAN

EXPOSURE 2Q 2012 33% 41% 16% 3% 7% 286.9 100.0% 11.4

• Eurozone exposures p consist of sovereigns g , equities, q and high g quality q y corporates p with 90% having g a rating of “A” A or higher, with de minimis exposure to Italian and Spanish corporate bonds

• Eurozone exposure is approximately 4% of Aspen’s Aspen s aggregate investment portfolio

• Aspen p has no exposure p to the sovereign g debt of Greece, , Ireland, , Italy, y, Portugal g or Spain p

Note—Aspen takes the lower of the Moody’s y and S&P ratings g .

AHL: NYSE

17

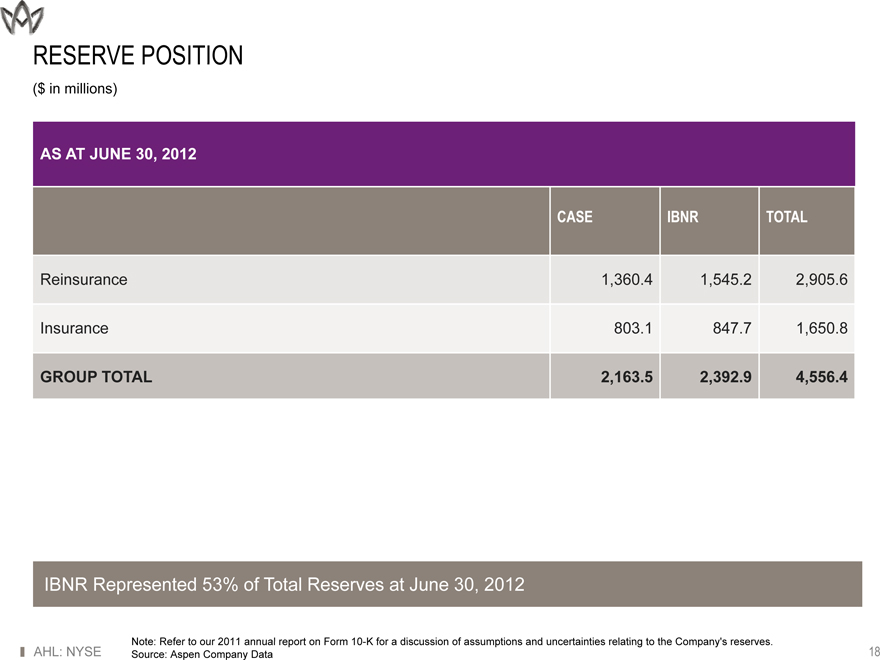

RESERVE POSITION

($ in millions)

AS AT JUNE 30, 2012

CASE IBNR TOTAL

Reinsurance 1,360., 4 1,545., 2 2,905., 6

Insurancesu a ce 803.1 847.8 7 1,650.,650 8

GROUP TOTAL 2,163.5 2,392.9 4,556.4

IBNR Represented 53% of Total Reserves at June 30, 2012

Note: Refer to our 2011 annual report on Form 10-K for a discussion of assumptions and uncertainties uncertainties relating to the Company’s Company s reserves. Source: Aspen Company y Data

AHL: NYSE

18