Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934.

For the quarterly period ended June 30, 2012

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934.

Commission File Number 1-33094

AMERICAN CARESOURCE HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

DELAWARE | 20-0428568 | |||

(State or other jurisdiction of | (I.R.S. employer | |||

incorporation or organization) | identification no.) | |||

5429 LYNDON B. JOHNSON FREEWAY | ||||

SUITE 850 | ||||

DALLAS, TEXAS | ||||

75240 | ||||

(Address of principal executive offices) | ||||

(Zip code) | ||||

(972) 308-6830

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes xNo o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “accelerated filer”,” large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Non-accelerated filer o |

Accelerated filer o (do not check if a smaller reporting company) | Smaller Reporting Company x |

Indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: The number of shares of common stock of registrant outstanding on August 6, 2012 was 17,121,450.

TABLE OF CONTENTS

AMERICAN CARESOURCE HOLDINGS, INC.

FORM 10-Q

FOR THE QUARTER ENDED JUNE 30, 2012

PART I. | FINANCIAL INFORMATION |

ITEM 1. | Financial Statements |

AMERICAN CARESOURCE HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(amounts in thousands, except per share data)

Three months ended June 30, | Six months ended June 30, | ||||||||||||||

2012 | 2011 | 2012 | 2011 | ||||||||||||

Net revenues | $ | 8,215 | $ | 11,308 | $ | 17,616 | $ | 24,385 | |||||||

Cost of revenues: | |||||||||||||||

Provider payments | 6,078 | 8,815 | 12,873 | 18,624 | |||||||||||

Administrative fees | 364 | 503 | 828 | 1,175 | |||||||||||

Claims administration and provider development | 909 | 1,211 | 1,943 | 2,379 | |||||||||||

Total cost of revenues | 7,351 | 10,529 | 15,644 | 22,178 | |||||||||||

Contribution margin | 864 | 779 | 1,972 | 2,207 | |||||||||||

Selling, general and administrative expenses | 1,455 | 1,553 | 2,895 | 3,015 | |||||||||||

Depreciation and amortization | 221 | 191 | 440 | 381 | |||||||||||

Total operating expenses | 1,676 | 1,744 | 3,335 | 3,396 | |||||||||||

Loss before income taxes | (812 | ) | (965 | ) | (1,363 | ) | (1,189 | ) | |||||||

Income tax provision (benefit) | 17 | (320 | ) | 24 | (322 | ) | |||||||||

Net loss | $ | (829 | ) | $ | (645 | ) | $ | (1,387 | ) | $ | (867 | ) | |||

Loss per basic and diluted common share | $ | (0.05 | ) | $ | (0.04 | ) | $ | (0.08 | ) | $ | (0.05 | ) | |||

Basic and diluted weighted average common shares outstanding | 17,131 | 16,962 | 17,110 | 16,962 | |||||||||||

See accompanying notes.

1

AMERICAN CARESOURCE HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS

(amounts in thousands except per share amounts)

June 30, 2012 (Unaudited) | December 31, 2011 | ||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 10,605 | $ | 11,315 | |||

Accounts receivable, net | 3,338 | 4,317 | |||||

Prepaid expenses and other current assets | 515 | 559 | |||||

Deferred income taxes | 6 | 6 | |||||

Total current assets | 14,464 | 16,197 | |||||

Property and equipment, net | 1,684 | 1,829 | |||||

Other assets: | |||||||

Deferred income taxes | 223 | 226 | |||||

Other non-current assets | 16 | 16 | |||||

Intangible assets, net | 832 | 896 | |||||

$ | 17,219 | $ | 19,164 | ||||

LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||

Current liabilities: | |||||||

Due to service providers | $ | 3,049 | $ | 3,678 | |||

Accounts payable and accrued liabilities | 1,033 | 1,237 | |||||

Total current liabilities | 4,082 | 4,915 | |||||

Commitments and contingencies | |||||||

Stockholders’ equity: | |||||||

Preferred stock, $0.01 par value; 10,000 shares authorized, none issued | — | — | |||||

Common stock, $0.01 par value; 40,000 shares authorized; 17,121 and 17,076 shares issued and outstanding in 2012 and 2011, respectively | 171 | 171 | |||||

Additional paid-in capital | 22,575 | 22,300 | |||||

Accumulated deficit | (9,609 | ) | (8,222 | ) | |||

Total stockholders' equity | 13,137 | 14,249 | |||||

$ | 17,219 | $ | 19,164 | ||||

See accompanying notes.

2

AMERICAN CARESOURCE HOLDINGS, INC.

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

(Unaudited)

(amounts in thousands)

Additional | Total | |||||||||||||||||

Common Stock | Paid-in | Accumulated | Stockholders' | |||||||||||||||

Shares | Amount | Capital | Deficit | Equity | ||||||||||||||

Balance at December 31, 2011 | 17,076 | $ | 171 | $ | 22,300 | $ | (8,222 | ) | $ | 14,249 | ||||||||

Net loss | — | — | — | (1,387 | ) | (1,387 | ) | |||||||||||

Stock-based compensation expense | — | — | 252 | — | 252 | |||||||||||||

Issuance of common stock as equity incentive awards, net of tax withholdings | 41 | — | 23 | — | 23 | |||||||||||||

Issuance of common stock upon conversion of restricted stock units, net of tax withholdings | 4 | — | — | — | — | |||||||||||||

Balance at June 30, 2012 | 17,121 | $ | 171 | $ | 22,575 | $ | (9,609 | ) | $ | 13,137 | ||||||||

See accompanying notes.

3

AMERICAN CARESOURCE HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(amounts in thousands)

Six months ended June 30, | |||||||

2012 | 2011 | ||||||

Cash flows from operating activities: | |||||||

Net loss | $ | (1,387 | ) | $ | (867 | ) | |

Adjustments to reconcile net loss to net cash used in operations: | |||||||

Non-cash stock-based compensation expense | 252 | 445 | |||||

Depreciation and amortization | 440 | 381 | |||||

Amortization of long-term client agreement | 125 | 125 | |||||

Client administration fee expense related to warrants | — | 67 | |||||

Deferred income taxes | 3 | (330 | ) | ||||

Changes in operating assets and liabilities: | |||||||

Accounts receivable | 979 | 213 | |||||

Prepaid expenses and other assets | (69 | ) | (130 | ) | |||

Accounts payable and accrued liabilities | (181 | ) | (232 | ) | |||

Due to service providers | (629 | ) | (2,459 | ) | |||

Net cash used in operating activities | (467 | ) | (2,787 | ) | |||

Cash flows from investing activities: | |||||||

Investment in software development costs | (138 | ) | (353 | ) | |||

Additions to property and equipment | (97 | ) | (19 | ) | |||

Net cash used in investing activities | (235 | ) | (372 | ) | |||

Cash flows from financing activities: | |||||||

Payment of income tax withholdings on net exercise of equity incentives | (8 | ) | — | ||||

Net cash used in financing activities | (8 | ) | — | ||||

Net decrease in cash and cash equivalents | (710 | ) | (3,159 | ) | |||

Cash and cash equivalents at beginning of period | 11,315 | 14,512 | |||||

Cash and cash equivalents at end of period | $ | 10,605 | $ | 11,353 | |||

Supplemental cash flow information: | |||||||

Cash paid for taxes | $ | 45 | $ | — | |||

Supplemental non-cash financing activity: | |||||||

Income tax withholdings on conversion of equity incentives | $ | — | $ | 16 | |||

Accrued bonus paid with equity incentives | $ | 23 | $ | — | |||

See accompanying notes.

4

AMERICAN CARESOURCE HOLDINGS, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(tables in thousands, except per share data)

1. Description of Business and Basis of Presentation

American CareSource Holdings, Inc. (“ACS,” “Company,” the “Registrant,” “we,” “us,” or “our”) is an ancillary services company that offers cost effective access to a comprehensive national network of ancillary healthcare service providers. The Company sells its services to a number of healthcare companies including preferred provider organizations ("PPOs"), third party administrators (“TPAs”), insurance companies, large self-funded organizations, various employee groups and other middle-market organizations. The Company offers payors this solution by:

• | lowering its payors’ ancillary care costs throughout its network of high quality, cost effective providers that the Company has under contract at more favorable terms than they could generally obtain on their own; |

• | providing payors with a comprehensive network of ancillary healthcare service providers that is tailored to each payor’s specific needs and is available to each payor’s covered persons for covered services; |

• | providing payors with claims management, reporting and processing and payment services; |

• | performing network/needs analysis to assess the benefits to payors of adding additional/different service providers to the payor-specific provider networks; and |

• | credentialing network service providers for inclusion in the payor-specific provider networks. |

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), interim reporting requirements of Form 10-Q and Rule 8-03 of Regulation S-X of the rules and regulations of the Securities and Exchange Commission (“SEC”). Consequently, financial information and disclosures normally included in financial statements prepared annually in accordance with GAAP have been condensed or omitted. Balance sheet amounts are as of June 30, 2012 and December 31, 2011 and operating results are for the three and six months ended June 30, 2012 and 2011, and include all normal and recurring adjustments we consider necessary for the fair, summarized presentation of our financial position and operating results. As these are condensed financial statements, readers of this report should, therefore, refer to the consolidated financial statements and the notes included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011, filed with the SEC on March 9, 2012.

The Company uses the “management approach” for reporting information about segments in annual and interim financial statements. The management approach is based on the way the chief operating decision-maker organizes segments within a company for making operating decisions and assessing performance. Reportable segments are based on products and services, geography, legal structure, management structure and any other manner in which management disaggregates a company. Based on the “management approach” model, the Company has determined that its business is comprised of a single operating segment.

Our interim results of operations are not necessarily indicative of results of operations that will be realized for the full fiscal year.

2. Revenue Recognition

The Company recognizes revenue on the services that it provides, which includes (i) providing payor clients with a comprehensive network of ancillary healthcare providers, (ii) providing claims management, reporting, processing and payment services, (iii) providing network/need analysis to assess the benefits to payor clients of adding additional/different service providers to the client-specific provider networks and (iv) providing credentialing of network service providers for inclusion in the client payor-specific provider networks. Revenue is recognized when services are delivered, which occurs after processed claims are billed to the client payors and collections are reasonably assured. The Company estimates revenues and costs of revenues using average historical collection rates and average historical margins earned on claims. Periodically, revenues are adjusted to reflect actual cash collections so that revenues recognized accurately reflect cash collected.

5

The Company determines whether it is acting as a principal or agent in the fulfillment of the services rendered. After careful evaluation of the key gross and net revenue recognition indicators, the Company acknowledges that while the determination of gross versus net reporting is highly judgmental in nature, the Company has concluded that its circumstances are most consistent with those key indicators that support gross revenue reporting.

Following are the key indicators that support the Company’s conclusion that it acts as a principal when settling claims for service providers through its contracted service provider network:

• | The Company is the primary obligor in the arrangement. The Company has assessed its role as primary obligor as a strong indicator of gross reporting. The Company believes that it is the primary obligor in its transactions because it is responsible for providing the services desired by its client payors. The Company has distinct, separately negotiated contractual relationships with its client payors and with the ancillary healthcare providers in its networks. The Company does not negotiate “on behalf of” its client payors and does not hold itself out as the agent of the client payors when negotiating the terms of the Company’s ancillary healthcare service provider agreements. The Company’s agreements contractually prohibit client payors and service providers to enter into direct contractual relationships with one another. The client payors have no control over the terms of the Company’s agreements with the service providers. In executing transactions, the Company assumes key performance-related risks. The client payors hold the Company responsible for fulfillment, as the provider, of all of the services the client payors are entitled to under their contracts; client payors do not look to the service providers for fulfillment. In addition, the Company bears the pricing/margin risk as the principal in the transactions. Because the contracts with the client payors and service providers are separately negotiated, the Company has complete discretion in negotiating both the prices it charges its client payors and the financial terms of its agreements with the service providers. Since the Company’s profit is the spread between the amounts received from the client payors and the amount paid to the service providers, it bears significant pricing/margin risk. There is no guaranteed mark-up payable to the Company on the amount the Company has contracted. Thus, the Company bears the risk that amounts paid to the service provider will be greater than the amounts received from the client payors, resulting in a loss or negative claim. |

• | The Company has latitude in establishing pricing. As stated above, the Company has complete latitude in negotiating the price to be paid to the Company by each client payor and the price to be paid to each contracted service provider. This type of pricing latitude indicates that the Company has the risks and rewards normally attributed to a principal in the transactions. |

• | The Company changes the product or performs part of the services. The Company provides the benefits associated with the relationships it builds with the client payors and the service providers. While the parties could deal with each other directly, the client payors would not have the benefit of the Company’s experience and expertise in assembling a comprehensive network of service providers, in claims management, reporting and processing and payment services, in performing network/needs analysis to assess the benefits to client payors of adding additional/different service providers to the client payor-specific provider networks, and in credentialing network service providers. |

• | The Company has complete discretion in supplier selection. One of the key factors considered by client payors who engage the Company is to have the Company undertake the responsibility for identifying, qualifying, contracting with and managing the relationships with the ancillary healthcare service providers. As part of the contractual arrangement between the Company and its client payors, the payors identify their obligations to their respective covered persons and then work with the Company to determine the types of ancillary healthcare services required in order for the payors to meet their obligations. The Company may select the providers and contract with them to provide services at its discretion. |

• | The Company is involved in the determination of product or service specifications. The Company works with its client payors to determine the types of ancillary healthcare services required in order for the payors to meet their obligations to their respective covered persons. In some respects, the Company is customizing the product through its efforts and ability to assemble a comprehensive network of providers for its payors that is tailored to each payor’s specific needs. In addition, as part of its claims processing and payment services, the Company works with the client payors, on the one hand, and the providers, on the other, to set claims review, management and payment specifications. |

• | The supplier (and not the Company) has credit risk. The Company believes it has some level of credit risk, but that risk is mitigated because the Company does not remit payment to providers unless and until it has received payment from the relevant client payors following the Company’s processing of a claim. |

• | The amount that the Company earns is not fixed. The Company does not earn a fixed amount per transaction nor does it realize a per-person per-month charge for its services. |

6

The Company has evaluated the other indicators of gross and net revenue recognition, including whether or not the Company has general inventory risk. The Company does not have any general inventory risk, as its business is not related to the manufacture, purchase or delivery of goods and it does not purchase in advance any of the services to be provided by the ancillary healthcare service providers. While the absence of this risk would be one indicator in support of net revenue reporting, as described in detail above, the Company has carefully evaluated all of the key gross and net revenue recognition indicators and has concluded that its circumstances are most consistent with those key indicators that support gross revenue reporting.

If the Company were to report its revenues net of provider payments rather than on a gross reporting basis, for the three and six months ended June 30, 2012, its net revenues would have been approximately $2.1 million and $4.7 million, respectively. For the three and six months ended June 30, 2011, its net revenues would have been approximately $2.5 million and $5.8 million, respectively.

The Company records a provision for refunds based on an estimate of historical refund amounts. Refunds are paid to payors for overpayments on claims, claims paid in error, and claims paid for non-covered services. In some instances, we will recoup payments made to the ancillary service provider if the claim has been fully resolved. The evaluation is performed periodically and is based on historical data. We present revenue net of the provision for refunds on the consolidated statement of operations.

During the three and six months ended June 30, 2012 and 2011, two of the Company’s clients, identified in the Company's annual report on Form 10-K for the year ended December 31, 2011, comprised a significant portion of the Company’s revenues. The following is a summary of the approximate amounts of the Company’s revenue and accounts receivable contributed by each of those clients as of the dates and for the periods presented (amounts in thousands):

Periods ended June 30, 2012 | Periods ended June 30, 2011 | ||||||||||||||||||||||||||||||||||

As of June 30, 2012 | Three months | Six months | As of June 30, 2011 | Three months | Six months | ||||||||||||||||||||||||||||||

Accounts Receivable | Net Revenue | % of Total Revenue | Net Revenue | % of Total Revenue | Accounts Receivable | Net Revenue | % of Total Revenue | Net Revenue | % of Total Revenue | ||||||||||||||||||||||||||

Material Client Relationship | $ | 1,366 | $ | 3,050 | 37 | % | $ | 5,953 | 34 | % | $ | 1,864 | $ | 3,071 | 27 | % | $ | 8,178 | 33 | % | |||||||||||||||

MultiPlan, Inc. (formerly Viant Holdings, Inc.) | 154 | 682 | 8 | 1,706 | 10 | 1,067 | 2,455 | 22 | 5,259 | 22 | |||||||||||||||||||||||||

All Others | 2,125 | 4,544 | 56 | 10,067 | 57 | 2,531 | 5,850 | 52 | 11,252 | 46 | |||||||||||||||||||||||||

Allowance for Uncollectable Receivables/Provision for refunds | (307 | ) | (61 | ) | (1 | ) | (110 | ) | (1 | ) | (165 | ) | (68 | ) | (1 | ) | (304 | ) | (1 | ) | |||||||||||||||

$ | 3,338 | $ | 8,215 | 100 | % | $ | 17,616 | 100 | % | $ | 5,297 | $ | 11,308 | 100 | % | 24,385 | 100 | % | |||||||||||||||||

3. Earnings (Loss) Per Share

For purposes of this calculation, outstanding stock options, stock warrants, and unvested restricted stock units are considered common stock equivalents using the treasury stock method, and are the only such equivalents outstanding. For the three and six months ended June 30, 2012, options to purchase approximately 2.2 million shares of common stock, warrants to purchase 358,334 shares of common stock and approximately 10,000 unvested restricted stock units were excluded from the calculation as their impact would be anti-dilutive.

7

4. Software Development Costs

The Company capitalizes costs associated with internally developed software, developed for internal use only, during the application development stage. Application development stage costs generally include costs associated with internal-use software configuration, coding, installation and testing. Costs of significant upgrades and enhancements that result in additional functionality also are capitalized, whereas costs incurred for maintenance and minor upgrades and enhancements are expensed as incurred. Capitalized costs include external direct costs of materials and services utilized in developing or obtaining internal-use software and payroll and payroll-related expenses for employees who are directly associated with and devote time to the internal-use software projects. Capitalization of such costs begins when the preliminary project stage is complete and ceases no later than the point at which the project is substantially complete and ready for its intended purpose. Capitalized costs are amortized using the straight-line method over the useful life of the software, which is typically five years.

During the three and six months ended June 30, 2012, the Company capitalized approximately $61,000 and $138,000, respectively. During the three and six months ended June 30, 2011, the Company capitalized approximately $237,000 and $353,000, respectively.

5. Warrants

The Company entered into an agreement as of February 25, 2011 with an employee, whereby the Company agreed to issue warrants to purchase 250,000 shares of common stock with an exercise price of $1.67. The warrants have a term of 5 years and vest in increments over a time period of 2 years depending on the achievement of defined, agreed upon revenue targets generated by new clients. The agreement also obligates the Company to issue warrants to purchase up to an additional 500,000 shares of common stock (issued in 250,000 increments) pursuant to the achievement of additional defined agreed upon revenue targets. During the twelve months ended December 31, 2011, we did not recognize compensation costs associated with these warrants due to the low probability of vesting.

On February 1, 2012, certain terms of the agreement were modified, including the revenue targets and the total number of shares under the initial and future warrants. The warrants initially granted now cover 133,334 shares to be purchased at an exercise price of $0.50, 66,667 of which vested immediately, and the remaining 66,667 shares vesting upon the achievement of certain revenue targets. The number of shares underlying warrants to be issued under the agreement in the future was reduced to 266,666 shares (issued in 133,333 increments) based upon the achievement of additional defined agreed upon revenue targets.

During the six months ended June 30, 2012, we recognized compensation costs of approximately $21,000 associated with the initial vesting of 66,667 shares. Additional costs associated with the warrants will be recognized based on the probability that the revenue targets will be reached. That probability will be re-evaluated and updated based on current market conditions, on a quarterly basis, and compensation costs will be adjusted accordingly.

6. Subsequent Events

We evaluate events and transactions that occur after the balance sheet date as potential subsequent events. No material event occurred subsequent to June 30, 2012.

8

FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements can be identified by forward-looking words such as “may,” “will,” “expect,” “intend”, “anticipate,” “believe,” “estimate” and “continue” or similar words and discuss the Company’s plans, objectives and expectations for future operations, including its services, contain projections of the Company’s future operating results or financial condition, and discuss its expectations with respect to the growth in health care costs in the United States, the demand for ancillary benefits management services, and the Company’s competitive advantages, or contain other “forward-looking” information.

Such forward-looking statements are based on current information, assumptions and belief of management, and are not guarantees of future performance. Substantial risks and uncertainties could cause actual results to differ materially from those indicated by such forward-looking statements, including, but not limited to, the Company’s inability to attract or maintain providers or clients or achieve its financial results, changes in national health care policy, federal or state regulation, and/or rates of reimbursement including without limitation the impact of the Patient Protection and Affordable Care Act, Health Care and Educational Affordability Reconciliation Act and medical loss ratio regulations, general economic conditions (including the economic downturns and increases in unemployment), lower than anticipated demand for ancillary services, shifts from higher margin services to services with lower profit margins, pricing, market acceptance/preference, the Company’s ability to integrate with its clients, consolidation in the industry that are impacting the Company’s key clients and the resulting transition plans, changes in the business decisions by significant clients, inability to collect on the claims billed to our clients, increased competition, implementation and performance difficulties, and other risk factors detailed from time to time in the Company’s periodic filings with the Securities and Exchange Commission, including its annual report on Form 10-K for the year ended December 31, 2011 and the quarterly reports on Form 10-Q filed for each of the subsequent quarters.

Do not place undue reliance on these forward-looking statements, which speak only as of the date this document was prepared. All forward-looking statements included herein are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable securities laws and regulations, the Company undertakes no obligation to update or revise these forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events.

9

ITEM 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

GENERAL

Management’s discussion and analysis provides a review of the Company’s operating results for the three and six months ended June 30, 2012 and its financial condition at June 30, 2012. The focus of this review is on the underlying business reasons for significant changes and trends affecting the net revenues, operating results and financial condition of the Company. This review should be read in conjunction with the accompanying unaudited consolidated financial statements and the audited consolidated financial statements and the notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2011.

OVERVIEW

American CareSource Holdings, Inc. (“ACS,” “Company,” the “Registrant,” “we,” “us,” or “our”) works to help its clients control healthcare costs by offering cost containment strategies, primarily through the utilization of a comprehensive national network of ancillary healthcare service providers. The Company markets its services to a number of healthcare companies including third party administrators (“TPAs”), insurance companies, large self-funded organizations, various employee groups and preferred provider organizations ("PPOs"). The Company offers payors this solution by:

• | lowering its payors’ ancillary care costs throughout its network of high quality, cost effective providers that the Company has under contract at more favorable terms than they could generally obtain on their own; |

• | providing payors with a comprehensive network of ancillary healthcare service providers that is tailored to each payor’s specific needs and is available to each payor’s members for covered services; |

• | providing payors with claims management, reporting and processing and payment services; |

• | performing network/needs analysis to assess the benefits to payors of adding additional/different service providers to the payor-specific provider networks; and |

• | credentialing network service providers for inclusion in the payor-specific provider networks. |

The Company has assembled a network of ancillary healthcare service providers that supplement or support the care provided by hospitals and physicians and includes 30 service categories. We have a dedicated provider development function comprised of eight full-time employees, whose primary responsibility is to contract with providers and strategically grow our network of ancillary service providers.

We secure contracts with ancillary service providers by offering them the following:

• | inclusion in a nationwide network that provides exposure to our client payors and their aggregate member lives; |

• | an array of administrative and back-office services, such as collections and appeals; |

• | increased claims volume through various "soft steerage" mechanisms; and |

• | advocacy in the claims appeals process. |

10

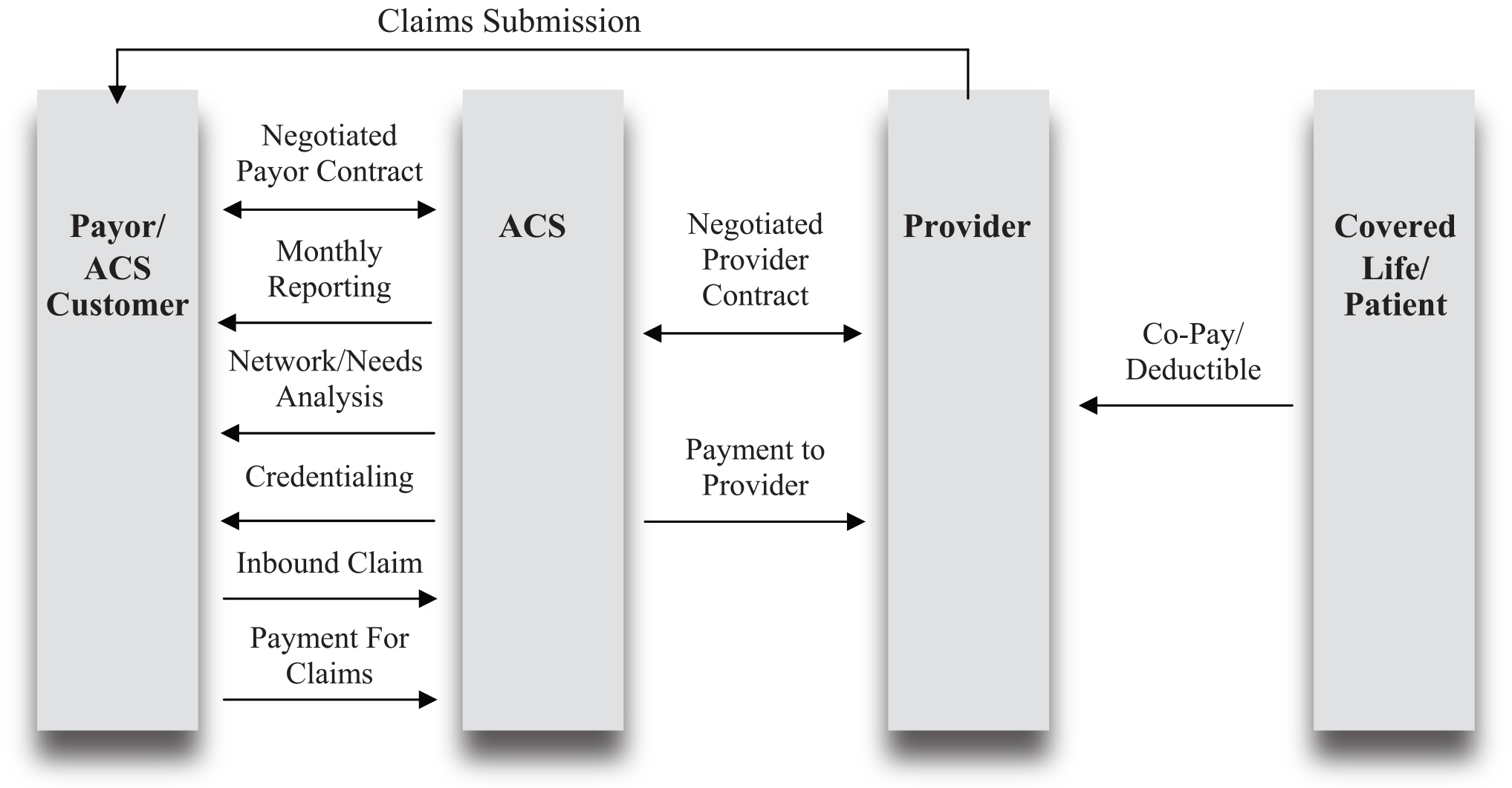

The Company’s business model, illustrating the relationships among the persons involved, directly or indirectly, in the Company’s business and its generation of revenue and expenses, is depicted below:

Payors route healthcare claims to us after service has been performed by participant providers in our network. We process those claims and charge the payor according to its contractual rate for the services according to our contract with the payor. In processing the claim, we are paid directly by the payor or the insurer for the service. We then pay the provider of service according to its independently-negotiated contractual rate. We assume the risk of generating positive margin, the difference between the payment we receive for the service and the amount we are obligated to pay the provider of service.

The Company recognizes revenues for ancillary healthcare services when services by providers have been authorized and performed, the claim has been billed to the payor and collections from payors are reasonably assured. Cost of revenues for ancillary healthcare services consist of amounts due to providers for providing ancillary healthcare services, client administration fees paid to our client payors to reimburse them for routing the claims to us for processing, and the Company’s related direct labor and overhead of processing billings, collections and payments. The Company is not liable for costs incurred by independent contract service providers until payment is received by it from the payors. The Company recognizes actual or estimated liabilities to independent contract service providers as the related revenues are recognized.

The Company is seeking growth in the number of client payors and service provider relationships it secures by focusing on providing in-network services for its payors and aggressively pursuing additional TPAs, self-insured employers and other direct payors as its primary sales targets. The Company believes this strategy should increase the volume of claims the Company can process in addition to the expansion in the number of lives that are eligible to receive ancillary healthcare benefits. No assurances can be given that the Company can expand its service provider or payor relationships, nor that any such expansion will result in an improvement in the results of operations of the Company.

In addition, under the Minimum Loss Ratio ("MLR") regulations included in the Affordable Care Act, it is possible that a portion of the fees our existing and prospective payors are contractually required to pay us and that do not qualify as 'incurred claims' may not be included as expenditures for activities that improve healthcare quality. Such a determination may make it more difficult for us to retain existing clients and/or add new clients, because our clients' or prospective clients' MLR may otherwise not meet the specified targets. This may reduce our net revenues and profit margins. See "Recent and pending healthcare reforms could materially adversely affect our revenues, financial position and our results of operations" under "Item 1.A. Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2011.

11

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Management’s discussion and analysis of our financial condition and results of operations is based upon our condensed consolidated financial statements. These condensed consolidated financial statements have been prepared following the requirements of accounting principles generally accepted in the United States (“GAAP”) for interim periods and require us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including those related to revenue recognition, provider cost recognition, the resulting contribution margins, potential impairment of intangible assets and stock-based compensation expense. As these are condensed consolidated financial statements, you should also read expanded information about our critical accounting policies and estimates provided in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” under the heading “Critical Accounting Policies,” included in our Annual Report on Form 10-K for the year ended December 31, 2011. There have been no material changes to our critical accounting policies and estimates from the information provided in our Form 10-K for the year ended December 31, 2011.

OVERVIEW

We have experienced revenue declines over the past two years, primarily related to the declines in the business of our two largest clients, both of which are preferred provider organizations ("PPOs"). Due to a variety of factors affecting the healthcare industry generally, the economy and for other reasons, revenue from each of our two largest clients continued to decline (with downturns in their own businesses) resulting in quarterly declines in our revenue from those accounts that ranged between 14% and 57% during the periods between 2010 and the current quarter. Because of the significance of the revenue concentration from these two clients (approximately 98% in 2008), the declines of the business of these clients has had a significant negative impact on our operating results over the past three years (including 2012 to date), despite our new business development efforts.

In 2010, we began focusing our sales efforts on third-party administrators ("TPAs"), insurance companies, self-funded organizations, employer groups and direct payors, as we believe we can more competitively impact those relationships. TPAs, in their fiduciary capacity, assist their clients (primarily employer groups) with cost containment; the ancillary network solution we provide is a valuable component to add to a TPA's portfolio. There are approximately 500 TPAs nationwide, with approximately 20% of those being our target market. According to research reported by the Employee Benefit Research Institute, as recently as 2008, approximately 55% of employees with health insurance were covered by a self-insured plan. In light of changes in healthcare legislation and the size of the self-insured market, we believe that TPAs are an important element of that market, with needs that we can address, primarily from a cost containment standpoint.

We added 13 new clients in 2010, which generated approximately $5.9 and $11.9 million of revenue in 2010 and 2011, respectively. While those accounts contribute an estimated $10-12 million of revenue annually, they have only partially offset the revenue declines from our significant legacy clients. During 2011, we signed only four new accounts.

Early in 2012, we made investments in our sales function in an effort to expand sales distribution channels, improve sales processes, evaluate marketing opportunities and most importantly, increase our number of sales personnel, which was four at June 30, 2012, compared to 2.5 full-time employees during most of 2011. Additionally, we have engaged two sales consultants, each of whom has an extensive background in the healthcare industry. The Company believes that it has a unique business model and offers a solid value proposition to our clients, as well as our providers, by delivering superior discounts through our network of contracted ancillary healthcare service providers. In 2012, the Company's objectives continue to be to (1) add new significant client contracts, (2) control our cost structure to limit operating losses, (3) preserve our existing cash balances for investments in the business model and/or other strategic initiatives, and (4) investigate and identify strategic initiatives that the Company can execute in the short and long-term that will bring value to our stockholders. Nevertheless, until we can replace a greater amount of the revenue that we have lost from our two largest clients, we will continue to experience operating losses.

12

ANALYSIS OF RESULTS OF OPERATIONS

The following table sets forth a comparison of our results of operations for the following periods presented:

Second Quarter | Six Months | ||||||||||||||||||||||||||||

Change | Change | ||||||||||||||||||||||||||||

2012 | 2011 | $ | % | 2012 | 2011 | $ | % | ||||||||||||||||||||||

Net revenue | $ | 8,215 | $ | 11,308 | $ | (3,093 | ) | (27.4 | )% | $ | 17,616 | $ | 24,385 | $ | (6,769 | ) | (27.8 | )% | |||||||||||

Variable costs: | |||||||||||||||||||||||||||||

Provider payments | 6,078 | 8,815 | 2,737 | 31.0 | 12,873 | 18,624 | 5,751 | 30.9 | |||||||||||||||||||||

Administrative fees | 364 | 503 | 139 | 27.6 | 828 | 1,175 | 347 | 29.5 | |||||||||||||||||||||

Total variable costs | 6,442 | 9,318 | 2,876 | 30.9 | 13,701 | 19,799 | 6,098 | 30.8 | |||||||||||||||||||||

Percent of net revenue | 78.4 | % | 82.4 | % | 77.8 | % | 81.2 | % | |||||||||||||||||||||

Variable flowthrough | 1,773 | 1,990 | (217 | ) | (10.9 | ) | 3,915 | 4,586 | (671 | ) | (14.6 | ) | |||||||||||||||||

Variable margin | 21.6 | % | 17.6 | % | 22.2 | % | 18.8 | % | |||||||||||||||||||||

Non-variable costs: | |||||||||||||||||||||||||||||

Claims administration | 652 | 830 | 178 | 21.4 | 1,359 | 1,651 | 292 | 17.7 | |||||||||||||||||||||

Provider development | 257 | 381 | 124 | 32.5 | 584 | 728 | 144 | 19.8 | |||||||||||||||||||||

Sales & marketing | 503 | 367 | (136 | ) | (37.1 | ) | 1,069 | 678 | (391 | ) | (57.7 | ) | |||||||||||||||||

Finance & administration | 952 | 1,186 | 234 | 19.7 | 1,826 | 2,337 | 511 | 21.9 | |||||||||||||||||||||

Total non-variable costs | 2,364 | 2,764 | 400 | 14.5 | 4,838 | 5,394 | 556 | 10.3 | |||||||||||||||||||||

Percent of net revenue | 28.8 | % | 24.4 | % | 27.5 | % | 22.1 | % | |||||||||||||||||||||

Loss before depreciation, amortization, and income taxes | (591 | ) | (774 | ) | 183 | 23.6 | (923 | ) | (808 | ) | (115 | ) | (14.2 | ) | |||||||||||||||

Percent of net revenue | (7.2 | )% | (6.8 | )% | (5.2 | )% | (3.3 | )% | |||||||||||||||||||||

Depreciation and amortization | 221 | 191 | (30 | ) | (15.7 | ) | 440 | 381 | (59 | ) | (15.5 | ) | |||||||||||||||||

Income tax provision (benefit) | 17 | (320 | ) | (337 | ) | (105.3 | ) | 24 | (322 | ) | (346 | ) | (107.5 | ) | |||||||||||||||

Net loss | $ | (829 | ) | $ | (645 | ) | $ | (184 | ) | (28.5 | )% | $ | (1,387 | ) | $ | (867 | ) | $ | (520 | ) | (60.0 | )% | |||||||

The following discussion compares the historical results of operations on a basis consistent with GAAP for the three and six months ended June 30, 2012 and 2011.

Net Revenues

The Company’s net revenues are generated from ancillary healthcare service claims. Revenue is recognized when we bill our client payors for services performed and collection is reasonably assured. The Company estimates revenues using average historical collection rates. When estimating collectibility, we assess the impact of items such as non-covered benefits, denied claims, deductibles and co-payments. Periodically, revenues and related estimates are adjusted to reflect actual cash collections so that revenues recognized accurately reflect cash collected. There are no assurances that actual cash collections will meet or exceed estimated cash collections.

13

The following tables set forth a comparison of our net revenues and billed claims for the following periods presented ended June 30 (in thousands):

Net Revenue | Billed Claims Volume | |||||||||||||||||||||||||

Second Quarter | Change | Second Quarter | Change | |||||||||||||||||||||||

(in thousands) | 2012 | 2011 | $ | % | 2012 | 2011 | Claims | % | ||||||||||||||||||

Legacy clients: | ||||||||||||||||||||||||||

Material Client Relationship | $ | 3,050 | $ | 3,071 | $ | (21 | ) | (1 | )% | 8 | 21 | (13 | ) | (62 | )% | |||||||||||

MultiPlan, Inc. (formerly Viant, Inc.) | 682 | 2,455 | (1,773 | ) | (72 | ) | 4 | 11 | (7 | ) | (64 | ) | ||||||||||||||

Principal Life Insurance Company | — | 663 | (663 | ) | (100 | ) | — | 3 | (3 | ) | (100 | ) | ||||||||||||||

Other legacy clients | 1,821 | 2,038 | (217 | ) | (11 | ) | 14 | 14 | — | — | ||||||||||||||||

Sub-total | 5,553 | 8,227 | (2,674 | ) | (33 | ) | 26 | 49 | (23 | ) | (47 | ) | ||||||||||||||

Clients implemented in 2010 - 2012 | 2,723 | 3,149 | (426 | ) | (14 | ) | 16 | 18 | (2 | ) | (11 | ) | ||||||||||||||

Total gross revenue | $ | 8,276 | $ | 11,376 | $ | (3,100 | ) | (27 | )% | 42 | 67 | (25 | ) | (37 | )% | |||||||||||

Provision for refunds | (61 | ) | (68 | ) | 7 | (10 | ) | — | — | — | nm | |||||||||||||||

Net Revenue | $ | 8,215 | $ | 11,308 | $ | (3,093 | ) | (27 | )% | 42 | 67 | (25 | ) | (37 | )% | |||||||||||

Net Revenue | Billed Claims Volume | |||||||||||||||||||||||||

Six Months | Change | Six Months | Change | |||||||||||||||||||||||

(in thousands) | 2012 | 2011 | $ | % | 2012 | 2011 | Claims | % | ||||||||||||||||||

Legacy clients: | ||||||||||||||||||||||||||

Material Client Relationship | $ | 5,953 | $ | 8,178 | $ | (2,225 | ) | (27 | )% | 20 | 40 | (20 | ) | (50 | )% | |||||||||||

MultiPlan, Inc. (formerly Viant, Inc.) | 1,706 | 5,259 | (3,553 | ) | (68 | ) | 9 | 24 | (15 | ) | (63 | ) | ||||||||||||||

Principal Life Insurance Company | 43 | 1,523 | (1,480 | ) | (97 | ) | — | 7 | (7 | ) | (100 | ) | ||||||||||||||

Other legacy clients | 3,478 | 3,844 | (366 | ) | (10 | ) | 27 | 31 | (4 | ) | (13 | ) | ||||||||||||||

Sub-total | 11,180 | 18,804 | (7,624 | ) | (41 | ) | 56 | 102 | (46 | ) | (45 | ) | ||||||||||||||

Clients implemented in 2010 - 2012 | 6,546 | 5,885 | 661 | 11 | 30 | 33 | (3 | ) | (9 | ) | ||||||||||||||||

Total gross revenue | $ | 17,726 | $ | 24,689 | $ | (6,963 | ) | (28 | )% | 86 | 135 | (49 | ) | (36 | )% | |||||||||||

Provision for refunds | (110 | ) | (304 | ) | 194 | (64 | ) | — | nm | |||||||||||||||||

Net Revenue | $ | 17,616 | $ | 24,385 | $ | (6,769 | ) | (28 | )% | 86 | 135 | (49 | ) | (36 | )% | |||||||||||

In addition, the following table sets forth a comparison of processed and billed claims for the following periods presented ended June 30 (in thousands):

Second Quarter | Six Months | |||||||||||||||||||||||

Change | Change | |||||||||||||||||||||||

(in thousands) | 2012 | 2011 | Claims | % | 2012 | 2011 | Claims | % | ||||||||||||||||

Processed | 53 | 82 | (29 | ) | (35 | )% | 108 | 167 | (59 | ) | (35 | )% | ||||||||||||

Billed | 42 | 67 | (25 | ) | (37 | ) | 86 | 135 | (49 | ) | (36 | ) | ||||||||||||

14

Following is a discussion of the changes in net revenue generated by significant client/client grouping for the three and six months ended June 30, 2012 as compared to the same period in 2011:

Material Client Relationship

The decline in billed claims volume from our relationship with one of our material clients for the three months ended June 30, 2012 is due to the following factors:

• | During the first half of 2012, the client commenced a technology platform conversion, which disrupted the claims flow. That disruption negatively impacted our revenue, as we did not receive all claims related to specialty services provided, and the disruption caused claims data to be omitted which inhibited collectibility. As a result, we have significantly reduced our revenue/collection estimates for the three months ended June 30, 2012. We have worked (and continue to work) closely with our client to assist in resolving the claims flow issues. While we expect that the issues will be corrected, we have no assurances the amounts will return to historical levels in future quarters or at the completion date of the conversion; and |

• | The client suffered attrition in its client base during 2011. |

The slight decline in net revenue in the three months ended June 30, 2012 compared to the prior year period is due to adjustments to our estimates of collections in the prior year period related to the mix of specialties provided and amounts paid directly to the service provider by the payors.

The decline in net revenue and billed claims volume from the client for the six months ended June 30, 2012 compared to the same prior year period is due to the technology platform conversion and client attrition discussed above. In addition, the client lost a significant employer group which accounted for approximately $500,000 of revenue to us during the six months ended June 30, 2011.

The performance of the client account during the remainder of 2012 will be affected by attrition in its own client base, its internal strategic initiatives and further technology infrastructure changes. We have no assurances that we will maintain a level of revenue consistent with the first half of 2012 or the prior year.

MultiPlan, Inc. (formerly Viant Holdings, Inc.)

The decline in net revenue and billed claims volume from our relationship with MultiPlan, Inc. ("MultiPlan") is due to the acquisition by MultiPlan of Viant Holdings, Inc. As part of that transition, MultiPlan is methodically moving its payors and employers groups to its existing networks. The transition commenced in mid-2010 and is estimated to be complete at the end of 2012 at which time we do not expect any revenue contributions from the account.

Principal Life Insurance Company

As was announced publicly in late-2010, Principal Life Insurance Company ("Principal") exited the health insurance business. During the course of 2011, Principal transitioned its existing members and groups, which resulted in revenue of $663,000 and $1.5 million to us in the three and six months ended June 30, 2011, respectively. We do not expect to generate meaningful revenue or claims volume from the account in 2012.

Other Legacy Clients

Our other legacy clients consist of 11 various relationships with PPOs, insurance companies and direct payors that were contracted between 2005 and 2009. Most of the accounts have matured and there are only limited opportunities for growth. Through our account management group, we maintain contact with these clients to determine if opportunities exist to serve the accounts and generate incremental revenue.

15

The overall declines in revenue and claims volume from the accounts during the three and six months ended June 30, 2012, as compared to the same prior year periods is due primarily to two factors impacting two of our clients, technology issues and specialty billed mix. During the first quarter of 2012 one of our other clients experienced technology issues related to regulatory compliance, which was subsequently rectified, but it had a negative impact on revenue of approximately $73,000 and $242,000 for the three and six months ended June 30, 2012, respectively. In addition, another legacy client incurred long-term acute care specialty claims of $116,000 in the second quarter of 2011. There were no similar high-dollar claims billed in the current year quarter. A change in patient and specialty mix, as well as benefit plan design changes, can result in an increase of non-covered benefits and is not a factor controlled by us.

Clients implemented in 2010 - 2012

The 13 clients implemented in 2010 consist of 12 TPAs and one PPO, and are the results of the initial stages of our focus on TPAs and direct payors. The accounts generated revenue of approximately $11.9 million during 2011. Through our account management group, we work with these clients to determine ways in which we can bring value to the relationships and to add our network to incremental employer groups in order to maximize our revenue opportunity.

During the three months ended June 30, 2012 revenue for this client group decreased 14% as compared to the same prior year period. The decrease is primarily the result of two clients which experienced technology issues, which negatively impacted claims flow to us. As a result, the impact to second quarter revenue was $305,000. We have worked (and continue to work) closely with our clients to resolve the claims flow issues.

The increase in revenue for this client group during the six months ended June 30, 2012 is due to the following factors:

• | Two clients were implemented in late-2010, thus their claims flow was ramping up in the first six months of 2011; we recognized full claims flow from those two clients in the first half of 2012. In addition, we received claims from these two clients on a post-adjudicated basis; therefore estimated collections are higher on the claims relative to other clients; |

• | Several of our clients added employer groups that previously were not utilizing our network of ancillary providers. Those groups generated incremental revenue during the first half of 2012; and |

• | We implemented four new clients over the course of 2011. For the six months ended June 30, 2012, those four accounts contributed incremental revenue of $236,000 compared to the same period in the prior year. |

During the six months ended June 30, 2012 revenues for our new clients increased approximately 11% compared to the first half of 2011. The growth was generated primarily from the accounts implemented in 2010, most of which are TPAs and direct payors.

The following tables detail the change in revenue generated from different client types (includes all Company clients) for the periods ended June 30:

Second Quarter | ||||||||||||||||||||||||||

2012 | 2011 | Change | ||||||||||||||||||||||||

($ in thousands) | Count | Revenue | % of revenue | Count | Revenue | % of revenue | $ | % | ||||||||||||||||||

TPAs | 25 | $ | 3,730 | 45.1 | % | 20 | $ | 4,198 | 36.9 | % | $ | (468 | ) | (11 | )% | |||||||||||

PPOs | 11 | 3,939 | 47.6 | 10 | 5,705 | 50.2 | (1,766 | ) | (31 | ) | ||||||||||||||||

Direct/Insurance Companies | 3 | 594 | 7.2 | 3 | 1,473 | 12.9 | (879 | ) | (60 | ) | ||||||||||||||||

Other | 1 | 13 | 0.1 | — | — | — | 13 | nm | ||||||||||||||||||

Gross revenue, before provision for refunds | $ | 8,276 | 100.0 | % | $ | 11,376 | 100.0 | % | $ | (3,100 | ) | (27 | )% | |||||||||||||

16

Six Months | ||||||||||||||||||||||||||

2012 | 2011 | Change | ||||||||||||||||||||||||

($ in thousands) | Count | Revenue | % of revenue | Count | Revenue | % of revenue | $ | % | ||||||||||||||||||

TPAs | 25 | $ | 8,427 | 47.5 | % | 20 | $ | 7,971 | 32.3 | % | $ | 456 | 6 | % | ||||||||||||

PPOs | 11 | 7,988 | 45.1 | 10 | 13,461 | 54.5 | (5,473 | ) | (41 | ) | ||||||||||||||||

Direct/Insurance Companies | 3 | 1,298 | 7.3 | 3 | 3,257 | 13.2 | (1,959 | ) | (60 | ) | ||||||||||||||||

Other | 1 | 13 | 0.1 | — | — | — | 13 | nm | ||||||||||||||||||

Gross revenue, before provision for refunds | $ | 17,726 | 100.0 | % | $ | 24,689 | 100.0 | % | $ | (6,963 | ) | (28 | )% | |||||||||||||

Variable Costs

Variable costs are comprised of payments to our providers and administrative fees paid to our clients for converting claims to electronic data interchange and routing them to both the Company for processing and to their payors for payment. Payments to providers are the most significant variable cost and it consists of our payments for ancillary care services in accordance with contracts negotiated separately with providers for specific ancillary services.

The following tables set forth a comparison of the variable cost components of our cost of revenues, for the periods presented ended June 30:

Second Quarter | |||||||||||||||||||||

Change | |||||||||||||||||||||

($ in thousands) | 2012 | % of net revenue | 2011 | % of net revenue | $ | % | |||||||||||||||

Provider payments | $ | 6,078 | 74.0 | % | $ | 8,815 | 78.0 | % | $ | (2,737 | ) | (31 | )% | ||||||||

Administrative fees | 364 | 4.4 | 503 | 4.5 | (139 | ) | (28 | ) | |||||||||||||

Total variable costs | $ | 6,442 | 78.4 | % | $ | 9,318 | 82.5 | % | $ | (2,876 | ) | (31 | )% | ||||||||

Six Months | |||||||||||||||||||||

Change | |||||||||||||||||||||

($ in thousands) | 2012 | % of net revenue | 2011 | % of net revenue | $ | % | |||||||||||||||

Provider payments | $ | 12,873 | 73.1 | % | $ | 18,624 | 76.4 | % | $ | (5,751 | ) | (31 | )% | ||||||||

Administrative fees | 828 | 4.7 | 1,175 | 4.8 | (347 | ) | (30 | ) | |||||||||||||

Total variable costs | $ | 13,701 | 77.8 | % | $ | 19,799 | 81.2 | % | $ | (6,098 | ) | (31 | )% | ||||||||

Provider payments

The 31% decrease in provider payments for the second quarter and first six months of 2012 is consistent with the decline in revenue as discussed above. The decrease in provider payments as a percentage of net revenues compared to the same prior year periods is primarily due to the following:

• | A shift in mix from clients that generate lower margins, relative to other clients, primarily MultiPlan. MultiPlan generated approximately 8% and 10% of our net revenue in the second quarter and first six months of 2012, as compared to approximately 22% in each of the same periods in 2011; and |

• | A shift in mix towards higher margin categories, such as laboratory services, durable medical equipment, infusion services and surgery centers, away from lower margin categories, such as dialysis services. |

17

Administrative fees

Administrative fees paid to clients as a percent of net revenues were 4.4% for the three months ended June 30, 2012 and 2011. Additionally, administrative fees paid to clients during the six months ended June 30, 2012 decreased to 4.7% compared to 4.8% in the same prior year period. The decrease is due to a change in mix from clients with higher administrative fees to clients with lower administrative fees.

Non-variable Costs

Non-variable costs are those that are not contingent on claims activity and are fixed in nature, but can be adjusted. They are comprised of such expenses as salaries and benefits, professional fees, consulting costs, non-cash equity compensation costs and travel and entertainment expenses. A significant driver of these costs are headcount, as payroll, commissions and related benefits (including non-cash equity compensation) account for approximately 62% of our non-variable cost structure during the six months ended June 30, 2012. Our headcount of full-time employees ("FTE's") was 55 and 63 at June 30, 2012 and 2011, respectively.

Following is a discussion of the changes in non-variable costs and related drivers:

Claims administration

Our claims administration function consists of our operations and information technology groups. Our operations group is responsible for all aspects of claims management and processing, including billing, quality assurance and collection efforts. In addition, our operations group is responsible for credentialing contracted ancillary service providers. Our information technology group is responsible for maintaining and enhancing the technological capabilities and applications of the claims management process.

We adjust the headcount of our operations group consistent with the level of claims we process and bill. During the three and six months ended June 30, 2012, we processed 53,000 and 108,000 claims, respectively, compared to 82,000 and 167,000 claims during the same prior year periods.

The following table sets forth a comparison of processed and billed claims for the following periods presented ended June 30 (in thousands):

Second Quarter | Six Months | |||||||||||||||||||||||

Change | Change | |||||||||||||||||||||||

(in thousands) | 2012 | 2011 | Claims | % | 2012 | 2011 | Claims | % | ||||||||||||||||

Processed | 53 | 82 | (29 | ) | (35 | )% | 108 | 167 | (59 | ) | (35 | )% | ||||||||||||

Billed | 42 | 67 | (25 | ) | (37 | ) | 86 | 135 | (49 | ) | (36 | ) | ||||||||||||

Accordingly, we had 19 FTE's in our operations group at June 30, 2012 compared to 23 FTE's as of June 30, 2011. Currently, we process approximately 90% of our claims electronically, making our processes scalable. In the event that we add a significant number of new clients, we don't anticipate the need to make significant investments in our operations group.

Since June 30, 2011, we eliminated two positions in our information technology group as a result of natural attrition, consistent with our focus on controlling costs. In the event of significant strategic information technology initiatives, we may increase our headcount in the future.

Provider Development

Our provider development function is responsible for developing our network of ancillary healthcare service providers, which includes contracting with providers to be included in the network and maintaining a relationship with existing providers, all for the purpose of enhancing our ancillary service provider network for our client payors. We customize networks for our clients, thus as new client contracts are secured, our recruiting activities will increase. While we anticipate having the capacity to increase our activities with our existing headcount, it is possible that if a significant number of clients are added, we will increase headcount in our provider development function.

18

We had eight FTE's in our provider development group at June 30, 2012 compared to nine FTE's as of June 30, 2011. The 33%, decrease in costs related to the provider development function during the three months ended June 30, 2012 as compared to the same prior year period is a result of the headcount reduction and lower overall benefit costs.

Sales and Marketing

Our sales and marketing function consists of our sales and account management groups. Our sales group is primarily responsible for securing new client contracts, while our account management group maintains our existing client relationships, as well as attempts to generate incremental growth from those relationships. The 37% and 58% increase in sales and marketing costs during the three and six months ended June 30, 2012 as compared to the same prior year periods is a result of the following:

• | Increases of approximately $121,000 and $231,000, for the respective periods noted above, are for consulting costs related to (1) the engagement of a consulting firm to lead a major initiative to invest in and improve our sales and marketing function; and (2) engagement of strategic consultants to investigate other sales opportunities outside of the traditional group health market. |

• | The addition of two sales resources to complement our external sales efforts. As of June 30, 2012, we had four FTE's in our external sales force and two FTE's in the account management group. |

Finance and Administration

Our finance and administration function consists primarily of human resources, finance and accounting as well as our Chief Executive Officer, President and Chief Operating Officer and Chief Financial Officer.

The 22% decrease in the finance and administration function is due primarily to the reduction in headcount; as of June 30, 2012, we had ten FTE's in the function, as compared to 13 FTE's at June 30, 2011. The decline in headcount is due to natural attrition, which is gradual reduction in the number of employees by natural or voluntary means. In addition, investor relations expense and recruiting costs decreased as a result of utilizing lower cost consultants and vendors, respectively. However, the decrease was partially offset by $64,000 in consulting fees during the second quarter of 2012 related to various strategic initiatives and the review the organization's structure and alignment.

19

Selling, General and Administrative Expenses

Following is a table showing the components of selling, general and administrative (“SG&A”) expenses as presented per the Statement of Operations for the periods presented ending June 30:

Second Quarter | Six Months | |||||||||||||||||||||||||||||

Change | Change | |||||||||||||||||||||||||||||

($ in thousands) | 2012 | 2011 | $ | % | 2012 | 2011 | $ | % | ||||||||||||||||||||||

Sales and marketing | $ | 503 | $ | 367 | $ | (136 | ) | (37 | )% | $ | 1,069 | $ | 678 | $ | (391 | ) | (58 | )% | ||||||||||||

Finance and administration | 952 | 1,186 | 234 | 20 | 1,826 | 2,337 | 511 | 22 | ||||||||||||||||||||||

Selling, general and administrative expenses | $ | 1,455 | $ | 1,553 | $ | 98 | 6 | % | $ | 2,895 | $ | 3,015 | $ | 120 | 4 | % | ||||||||||||||

Percentage of total net revenues | 17.7 | % | 13.7 | % | 16.4 | % | 12.4 | % | ||||||||||||||||||||||

SG&A expenses as a percentage of total net revenues increased during the three and six months ended June 30, 2012 compared to the same prior year periods, due primarily to the decline in net revenues compared to the same prior year periods. SG&A expenses for the six months ended June 30, 2012 included a severance charge of approximately $70,000. Excluding the severance charge, SG&A declined 6%, or $190,000, in the six months ended June 30, 2012 compared to the same prior year period.

FINANCIAL CONDITION AND LIQUIDITY

As of June 30, 2012 the Company had working capital of $10.4 million compared to $11.3 million at December 31, 2011. Our cash and cash equivalents balance decreased to $10.6 million as of June 30, 2012 compared to $11.3 million at December 31, 2011. We continued to experience a decline in claims volume and resulting revenue, resulting in a net loss during the six months ended June 30, 2012 which used cash despite our cost containment measures. The table below reconciles the loss before income taxes to the net decrease in cash for the six months ended June 30, 2012.

Six months ended June 30, 2012 | |||

Loss before income taxes | $ | (1,363 | ) |

Depreciation and amortization | 440 | ||

Non-cash stock-based compensation expense | 252 | ||

Amortization of long-term client agreement | 125 | ||

Payment of annual premiums for property and casualty insurance | (185 | ) | |

Capital expenditures | (235 | ) | |

Other working capital changes | 256 | ||

Decrease in cash for the six months ended June 30, 2012 | $ | (710 | ) |

We believe our current cash balance of $10.6 million as of June 30, 2012 and expected future cash flows from operations will be sufficient to meet our anticipated cash needs for working capital, capital expenditures and other activities through the foreseeable future. However, our continuing losses will continue to reduce our available cash. We have reduced our non-variable cost structure to preserve our existing cash balances for investments in the business model and/or other strategic initiatives. If operating cash flows are not sufficient to meet our needs, we believe that credit or access to capital through issuance of equity would be available to us. However, as a result of the tightening in the credit markets, low level of liquidity in many financial markets and extreme volatility in fixed income, credit, currency and equity markets, there cannot be assurances that, if necessary, we would be successful in obtaining sufficient capital financing on commercially reasonable terms or at all. We do not have any lines of credit, credit facilities or outstanding bank indebtedness as of June 30, 2012.

INFLATION

Inflation did not have a significant impact on the Company’s costs during the quarters ended June 30, 2012 and June 30, 2011, respectively. The Company continues to monitor the impact of inflation in order to minimize its effects through pricing strategies, productivity improvements and cost reductions.

20

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance sheet arrangements as of June 30, 2012 or 2011 or for the periods then ended.

ITEM 3. | Quantitative and Qualitative Disclosures About Market Risk |

Not applicable.

ITEM 4. | Controls and Procedures |

Evaluation of Disclosure Controls and Procedures. Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of our disclosure controls and procedures as of June 30, 2012. Based upon this evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) are effective to ensure that information required to the disclosed by us in reports we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosures.

Changes in Internal Controls Over Financial Reporting. Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, has concluded that there were no changes in the Company’s internal controls over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) since the last fiscal quarter that have materially affected the Company’s internal controls over financial reporting or are reasonably likely to materially affect internal controls over financial reporting.

21

PART II. | OTHER INFORMATION |

ITEM 1A. | Risk Factors |

The Company has experienced declining revenue over the last two years primarily as a result of the decline in business from its two largest clients. During the first half of 2012, our largest client commenced a technology platform conversion, which disrupted claims flow and continued to suffer attrition in its client base. Our second largest client continues to transition following a business combination. This client continues to migrate its payors and employee groups to network alternatives, negatively impacting the claims volume from this client. We anticipate the transition to continue through 2012 and be complete by December 31, 2012. Although we continue to seek new clients and to expand our product offerings, we expect that our revenues will continue to decline over the next several quarters while we explore various options to offset revenue declines and return to profitability.

In addition to the other information set forth in this report, one should carefully consider the discussion of various risks and uncertainties contained in Part I, “Item 1A. Risk Factors” in our 2011 Annual Report on Form 10-K. We believe those risk factors are the most relevant to our business and could cause our results to differ materially from the forward-looking statements made by us.

ITEM 5. | Other Information |

On September 21, 2011, the Company had received a letter from The NASDAQ Stock Market LLC (“NASDAQ”) stating that for 30 consecutive business days immediately preceding the date of the letter the Company's common stock did not maintain a minimum closing bid price of $1.00 per share (“Minimum Bid Price Requirement”) as required by NASDAQ Listing Rule 5550(a)(2). The Company was provided 180 calendar days, or until March 19, 2012, to regain compliance.

In a letter dated March 20, 2012, NASDAQ stated that although the Company had not regained compliance with the Minimum Bid Price Requirement by March 19, 2012, it is eligible for an additional 180-day compliance period, or until September 17, 2012, based on the Company meeting the continued listing requirements for market value of publicly held shares and all other applicable standards for initial listing on the NASDAQ Capital Market (except for the Minimum Bid Price Requirement) and having notified NASDAQ of its intention to cure the deficiency during the second compliance period by effecting a reverse stock split, if necessary.

At the Company's annual meeting of stockholders, held on June 11, 2012, the stockholders voted to amend the Company's certificate of incorporation for the purposes of effecting a reverse stock split and authorized its Board of Directors to determine, in its sole discretion, whether to effect the amendment, the timing of the amendment, and the specific ratio of the reverse stock split, provided that such ratio is 1-for-2, 1-for-2.5, 1-for-3, 1-for-3.5 or 1-for-4. If the Company's stock does not satisfy the Minimum Bid Price Requirement by the end of the second compliance period, the Board could therefore approve a reverse stock split.

If compliance cannot be demonstrated by September 17, 2012, NASDAQ will provide written notification that the Company’s securities will be delisted. At that time, the Company may appeal NASDAQ’s determination to a hearings panel with a plan to regain compliance. There can be no assurances that the Company will be able to regain compliance with the Minimum Bid Price Requirement.

22

ITEM 6. | Exhibits |

Exhibit 31.1 | Certification Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

Exhibit 31.2 | Certification Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

Exhibit 32.1 | Certifications Pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

Exhibit 101 | The following financial statements and footnotes from the American CareSource Holdings, Inc. Quarterly Report on Form 10-Q for the quarter ended June 30, 2012 formatted in Extensible Business Reporting Language (XBRL): (i) Consolidated Statements of Operations; (ii) Consolidated Balance Sheets; (iii) Consolidated Statement of Stockholders' Equity; (iv) Consolidated Statements of Cash Flows; and (v) the Notes to Unaudited Consolidated Financial Statements.* |

*Pursuant to Rule 406T of Regulation S-T, the Interactive Data Files on Exhibit 101 hereto are deemed not filed or part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, are deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise are not subject to liability under those sections

23

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

AMERICAN CARESOURCE HOLDINGS, INC. | |||

Date: | August 10, 2012 | By: | /s/ Kenneth S. George |

Kenneth S. George | |||

Chairman of the Board of Directors and Chief Executive Officer (Principal Executive Officer) | |||

Date: | August 10, 2012 | By: | /s/ Matthew D. Thompson |

Matthew D. Thompson | |||

Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) | |||

24