Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RAYMOND JAMES FINANCIAL INC | d393514d8k.htm |

August 9, 2012

1

Exhibit 99.1 |

FORWARD LOOKING STATEMENTS

2

This presentation may contain forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of

1995. Such statements are based upon the current beliefs and expectations of

Raymond James’ management and are subject to significant risks and uncertainties.

Actual results may differ from those set forth

in the forward-looking statements. Factors that could cause Raymond James’

actual results to differ materially from those described in the forward-looking

statements can be found in Raymond James’ Annual Report on Form 10-K

for the year ended September 30, 2011, and the Quarterly Reports on

Form 10-Q for the quarters ended December 31, 2011, March 31, 2012, and June 30, 2012

each of which has been filed with the Securities and Exchange Commission and are available

on the Raymond James website (www.raymondjames.com) and on the Securities and Exchange Commission’s

website (www.sec.gov). Raymond James does not undertake to

update the forward-looking statements to reflect the impact of circumstances or

events that may arise after the date of the forward-looking statements. |

PAUL

REILLY CEO, Raymond James Financial

3 |

RAYMOND JAMES CORE VALUES

4

INTEGRITY

INDEPENDENCE

CONSERVATISM

CLIENT

FIRST |

RAYMOND JAMES CORE VALUES

5 |

CONTINUED PROFITABILITY

6

Trailing 10 Years

98

Consecutive Profitable Quarters |

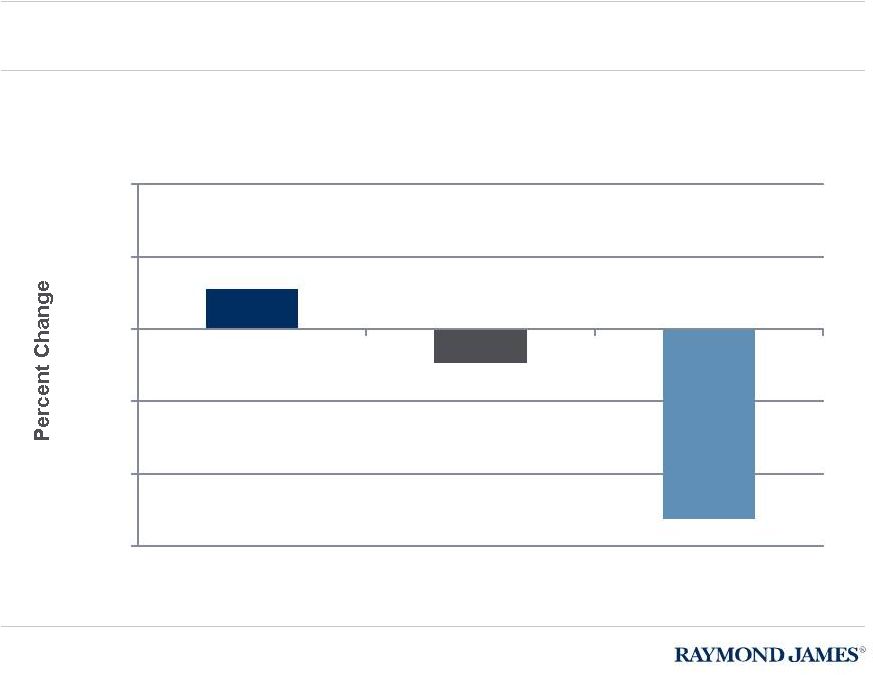

RAYMOND JAMES FINANCIAL

7

RJF Stock Price vs. Sector, Five-Year Change

11%

-9%

-52%

-60%

-40%

-20%

0%

20%

40%

RJF

S&P 500

DJ US Financials Index

Five Years Ended June 30, 2012 |

RAYMOND JAMES FINANCIAL

Core Business Total Revenue, Nine Months Ended

8

Other

$37 mil

1%

Other

$36 mil

1%

Private

Client

Group

$1.8 bil

64%

Capital

Markets

$559 mil

20%

Asset

Mgmt.

176 mil

%

RJ Bank

$251 mil

9%

$

6

June 30, 2012

$2,804,432,000

Private

Client

Group

$1

6 bil

%

Capital

Markets

$513 mil

20%

Asset

Mgmt

169 mil

%

RJ Bank

$214 mil

%

June 30, 2011

$2,565,289,000

.

64

$

7

8 |

RAYMOND JAMES FINANCIAL

Core Business Pre-Tax Income, Nine Months Ended

9

Other

($72 mil)

Other

($92 mil)

Private

Client

Group

155 mil

38%

Capital

Markets

$73 mil

18%

Asset

Mgmt.

$48 mil

12%

RJ Bank

131 mil

32%

June 30

, 2011

335,

418,000

$

$

$

Private

Client

Group

160

36

Capital

Markets

$60 mil

14%

Asset

Mgmt.

$49

11%

RJ Bank

$170 mil

39%

June 30, 2012

$347,218,000

$

mil

%

*Pie charts indicate contribution of each of Raymond James’ four core business units as it

relates to the other core business units. Percentages do not reflect contribution to Total

Pre-Tax Income and dollar amounts do not add to Total Pre-Tax Income due to

“Other” category (-$92 mil for 2012 and -$72 for 2011). Other includes Emerging

Markets, Securities Lending Proprietary Capital and miscellaneous other income/expense.

|

RAYMOND JAMES FINANCIAL

10

Core Business Total Revenue, Three Months Ended

Other

3%

Other

0%

Private

Client

Group

$685 mil

61%

Capital

Markets

$257 mil

23%

Asset

Mgmt.

$61 mil

5%

RJ Bank

$90 mil

8%

June 30, 2012

$1,115,762,000

Private

Client

Group

$568 mil

65%

Capital

Markets

$165 mil

19%

Asset

Mgmt.

$58 mil

7%

RJ Bank

$83 mil

9%

March 31, 2012

$889,853,000 |

RAYMOND JAMES FINANCIAL

11

Core Business Pre-Tax Income, Three Months Ended

Other

($31 mil)

Private

Client

Group

$64 mil

38%

Capital

Markets

$28 mil

17%

Asset

Mgmt.

RJ Bank

$60 mil

35%

June 30,

2012

124,

870,

000

$17 mil

10%

$

Other

($44 mil)

Private

Client

Group

46 mil

32%

Capital

Markets

$22 mil

16%

Asset

Mgmt.

17 mil

12%

RJ Bank

$57 mil

40%

March 31, 2012

$111,497,000

$

$

*Pie charts indicate contribution of each of Raymond James’ four core business units as it

relates to the other core business units. Percentages do not reflect contribution to Total

Pre-Tax Income and dollar amounts do not add to Total Pre-Tax Income due to

“Other” category (-$44 mil for 2012 and -$31 for 2011). Other includes Emerging

Markets, Securities Lending Proprietary Capital and miscellaneous other income/expense.

|

CHANGING COMPETITIVE LANDSCAPE

FIRST UNION-WACHOVIA CORP

STRONG FINANCIAL CORP

MARQUETTE FINANCIAL GROUP INC

RAGEN MACKENZIE GROUP INC.

H.D. VEST

PRUDENTIAL SECURITIES INC.

GOLDEN WEST FINANCIAL CORP.

A.G. EDWARDS INC.

INTERSTATE/JOHNSON LANE INC.

EVERGREEN

BANK OF AMERICA

MERRILL LYNCH

THE ADVEST GROUP INC.

HERZOG HEINE GEDULD INC.

MIDLAND WALWYN INC.

MERRILL LYNCH & CO.

FLEETBOSTON FINANCIAL CORP.

COUNTRYWIDE FINANCIAL CORP.

U.S. TRUST CORP.

JP MORGAN & CHASE

J.P. MORGAN & CO. INC.

HAMBRECHT & QUIST GROUP

THE BEACON GROUP LLC

BANK ONE CORP.

THE BEAR STEARNS COS. INC.

FIRST CHICAGO NBD CORP.

UBS

PAINEWEBBER GROUP INC.

PIPER JAFFRAY COS. INC. PRIVATE

CLIENT BRANCH NETWORK

J.C. BRADFORD & CO.

EDWARD JONES

AMERIPRISE

LPL

STIFEL

COMMONWEALTH

FIDELITY

TD AMERITRADE

LINCOLN FINANCIAL

RW BAIRD

CITIGROUP

PIPER JAFFRAY

COWEN

BMO

RBC

JEFFERIES

GOLDMAN SACHS

HARRIS WILLIAMS

MOELIS

VINING SPARKS

KBW

LAZARD

CHARLES SCHWAB

BANK OF AMERICA

MORGAN STANLEY

12 |

CHANGING COMPETITIVE LANDSCAPE

BANK OF AMERICA

MERRILL LYNCH

JP MORGAN & CHASE

UBS

EDWARD JONES

AMERIPRISE

LPL

STIFEL

COMMONWEALTH

FIDELITY

TD AMERITRADE

LINCOLN FINANCIAL

RW BAIRD

CITIGROUP

PIPER JAFFRAY

COWEN

BMO

RBC

JEFFERIES

GOLDMAN SACHS

HARRIS WILLIAMS

MOELIS

VINING SPARKS

KBW

LAZARD

CHARLES SCHWAB

MORGAN STANLEY

13 |

WHY

MORGAN KEEGAN? 14

1

Culture

2

Strategic Benefit

Price

4

3

Ability to Integrate |

15

POSITIVE IMPACT ON BUSINESS UNITS

Equity Capital

Markets

Private Client Group

Ranking by

Number of Deals

14

th

9

th

Ranking by Par

Amount

19

th

8

th

Number of Financial

Advisors

Fixed Income |

FOUNDATION FOR SUCCESS

Management Commitment

Advisor Commitment

16 |

DAY

1 ACCOMPLISHMENTS 17

Trading Inventory Shared

Benefits Integrated

Payroll Converted

Email Cross-Functional |

VISION FOR GROWTH

STRATEGIC THINKING

EXECUTION

+

18 |

Full transition to Raymond

James brand

Institutional and Municipal

Retail trading transitioned to

Raymond James

broker/dealer

Full transition to Raymond

James brand

Transitioned to

Raymond James

broker/dealer

INTEGRATION TIMELINE OVERVIEW

PCG

Equity Capital

Markets

Fixed Income

Within 30 days

Within 12 months

Within 24 months

Transition to

Raymond James

broker/dealer

Public Finance

19 |

RJ

20

CULTURE: SERVICE/CLIENT ORIENTATION

WIREHOUSES

BOUTIQUES

REGIONALS

CUSTODIANS

THE PREMIER

ALTERNATIVE TO

WALL STREET

INDEPENDENTS

VISION FOR GROWTH |

CULTURE: SERVICE/CLIENT ORIENTATION

WIREHOUSES

BOUTIQUES

REGIONALS

CUSTODIANS

THE PREMIER

ALTERNATIVE TO

WALL STREET

INDEPENDENTS

VISION FOR GROWTH

21 |

JEFF JULIEN

Executive Vice President,

Finance

Chief Financial Officer and

Treasurer

22 |

RJF

HIGHLIGHTS 23

Total Assets

$21 billion

Total Shareholders’

Equity

$3.2 billion

Shares Outstanding

137.4 million

Book Value Per Share

Leverage (Assets/Equity)

6.7x

Leverage Ex. RJ Bank

$1.3 billion

Corporate Debt

$23.29

5.4x

Balance Sheet Highlights, as of June 30, 2012 |

24

RJF HIGHLIGHTS

Total Revenues

Net Revenues

Net Income

Net Income Per Share (diluted)

Shareholders’

Equity

Market Capitalization

As of June 2011

Nine Months

Ended

June 2011

Change*

$2.8 billion

$2.7 billion

$213 million

$1.60

$3.2 billion

$4.7 billion

$2.6 billion

$2.5 billion

$209 million

$1.65

$2.6 billion

$4.1 billion

9%

9%

1%

(3%)

23%

15%

Nine Months

Ended

June 2012

As of June 2012

* Percentage change in this table reflects calculations from actual numbers and

cannot be recalculated from the figures shown due to rounding

differences. Change* |

25

RJF HIGHLIGHTS

Total Revenues

Net Revenues

Net Income

Net Income Per Share (diluted)

Three Months

Ended

March 31, 2012

Change*

$1.1 billion

$1.09 billion

$76 million

$0.55

$890 million

$872 million

$69 million

$0.52

25%

25%

11%

6%

Three Months

Ended

June 30, 2012

* Percentage change in this table reflects calculations from actual numbers and

cannot be recalculated from the figures shown due to rounding

differences. |

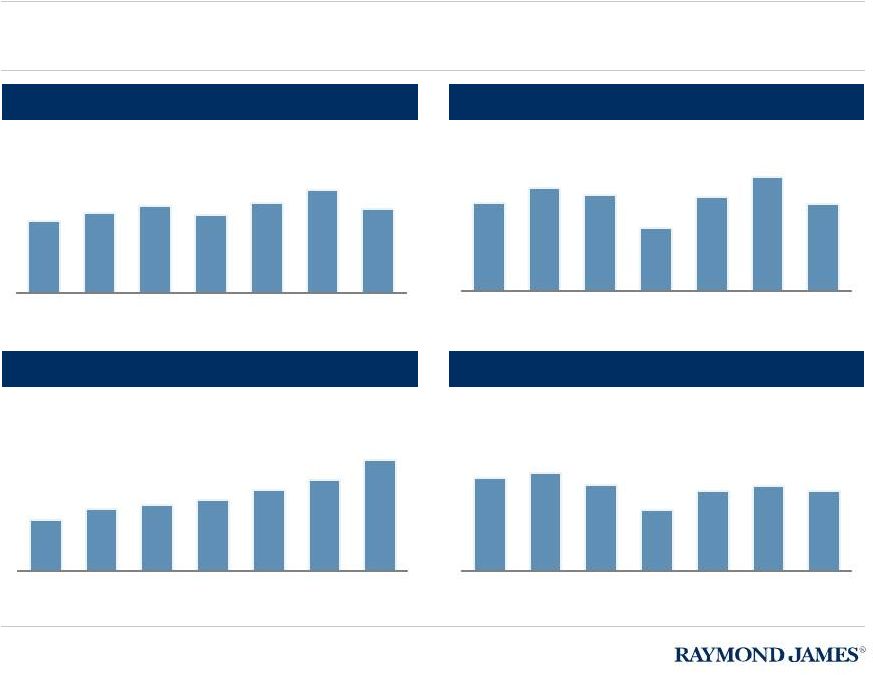

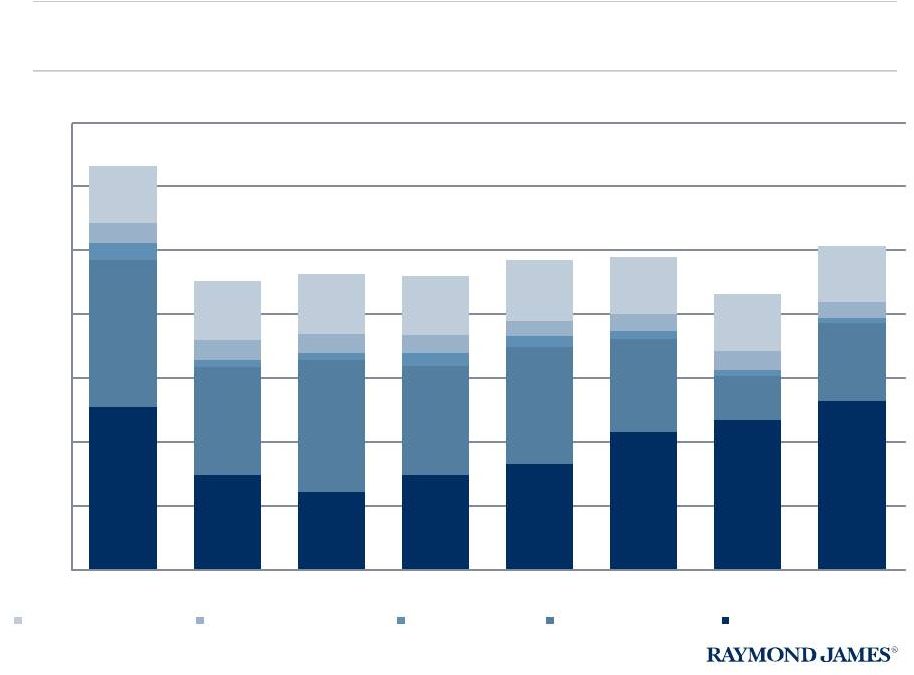

2011 Five-Year CAGR 5%

26

Net Revenues ($mm)

Net Income ($mm)

Shareholders’

Equity ($mm)

Net Margin

RJF FIVE-YEAR TRENDS

2011 Five-Year CAGR 7%

26

2,349

2,610

2,813

2,546

2,917

3,334

2,741

2006

2007

2008

2009

2010

2011

3Q12

YTD

214

250

235

153

228

278

213

2006

2007

2008

2009

2010

2011

3Q12

YTD

1,464

1,758

1,884

2,033

2,303

2,588

3,158

2006

2007

2008

2009

2010

2011

3Q12

YTD

9.1%

9.6%

8.4%

6.0%

7.8%

8.3%

7.8%

2006

2007

2008

2009

2010

2011

3Q12

YTD |

PRIVATE CLIENT GROUP TRENDS

27

5.4% CAGR

5-year 2011

* Annualized and adjusted for MK

5.3% CAGR

5-year 2011

1,680

1,987

2,000

1,557

1,903

2,186

1,781

06

07

08

09

10

11

YTD

3Q12

Total Revenue

$ Millions

2,449*

169

222

178

85

160

219

160

06

07

08

09

10

11

YTD

3Q12

Pre-

Tax Income

$ Millions

220*

|

28

PRIVATE CLIENT GROUP TRENDS

7.1% CAGR

5-year 2011

2.4% CAGR

5-year 2011

182

217

197

223

249

256

376

06

07

08

09

10

11

3Q12

Assets

$ Billions

Retail

Institutional

06

07

08

09

10

11

3Q12

Number of Advisors

IAR

RJL

RJ&A

RJFS

MK

4,743

4,659

4,929

5,368

5,350

6,367

5,249 |

PRIVATE CLIENT GROUP

Total

Securities

Commissions/Fees

Revenue

($mm)

$1,263

$1,812

7.4%

Client

Assets

($bil)

$186

$256

6.6%

Fee-based

Assets

($bil)

$47

$82

10.9%

Recurring

Revenue

52%

64%

4.2%

Financial

Advisors

4,666

5,350

2.8%

Avg.

AUA

per

FA

($mm)

37

43

3.1%

Pre-tax

Income

($mm)

169

219

5.3%

#

FAs

T12

>

$1mm

140

264

13.5%

2011

2006

29

5YR

CAGR

2006/2011

Key Statistics |

PRIVATE CLIENT GROUP

Total

Securities

Commissions/Fees

Revenue

($mm)

$469

$576

23%

Client

Assets

($bil)

$290

$356

23%

Fee-based

Assets

($bil)

$86

$95

10%

Recurring

Revenue

63%

64%

2%

Financial

Advisors

5,398

6,367

18%

Avg.

AUA

per

FA

($mm)

$52

$59

13%

Pre-tax

Income

($mm)

$46

$64

18%

#

FAs

T12

>

$1mm

265

293

11%

Q312

Q212

30

% Chg.

Key Statistics |

CAPITAL MARKETS TRENDS

31

5.7% CAGR

5-year 2011

* Annualized and adjusted for MK

816*

503

506

506

533

592

664

06

07

08

09

10

11

YTD

3Q12

Total Revenues

$ Millions

559

93

63

44

73

84

78

60

06

07

08

09

10

11

YTD

3Q12

Pre-

Tax Income

$ Millions

88

* |

CAPITAL MARKETS TRENDS

32

* Annualized based on first two quarters

* *Annualized and adjusted for MK

1% CAGR

5-year 2011

2.8% CAGR

5-year 2011

97

78

60

70

95

101

60

06

07

08

09

10

11

2Q12

Number of Domestic

Underwriting Deals

120

*

218

210

229

198

222

250

164

06

07

08

09

10

11

3Q12

Institutional Equity

Commissions

$ Millions

221** |

CAPITAL MARKETS TRENDS

33

*

Annualized

and

adjusted

for

MK

21.8% CAGR

5-year 2011

0.6% CAGR

5-year 2011

27.2

16.5

1.7

48

38

37

06

07

08

09

10

11

YTD

3Q12

Firm Trading Profits

$ Millions

53

*

28

47

53

108

174

147

168

06

07

08

09

10

11

YTD

3Q12

Institutional Fixed

Income Commissions

$ Millions

273

*

126

- |

ASSET MANAGEMENT GROUP TRENDS

34

1.8% CAGR

5-year 2011

6.1% CAGR

5-year 2011

* Annualized

49

63

62

30

47

66

49

06

07

08

09

10

11

YTD

3Q12

Pre-Tax Income

$ Millions

66

*

208

241

244

177

197

227

176

06

07

08

09

10

11

YTD

3Q12

Total Revenues

$ Millions

234

* |

ASSET MANAGEMENT GROUP TRENDS

35

Assets as of Sep. 30 of each fiscal year. Eagle’s assets shown here include

retail, institutional/sub-advised and long mutual-fund programs,

both managed and non-managed, but exclude the Eagle money-market funds.

Assets Under Management: Fee-Based

7.5% CAGR

5-year 2011

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

06

07

08

09

10

11

3Q12

AMS: non

managed

AMS: managed

Eagle |

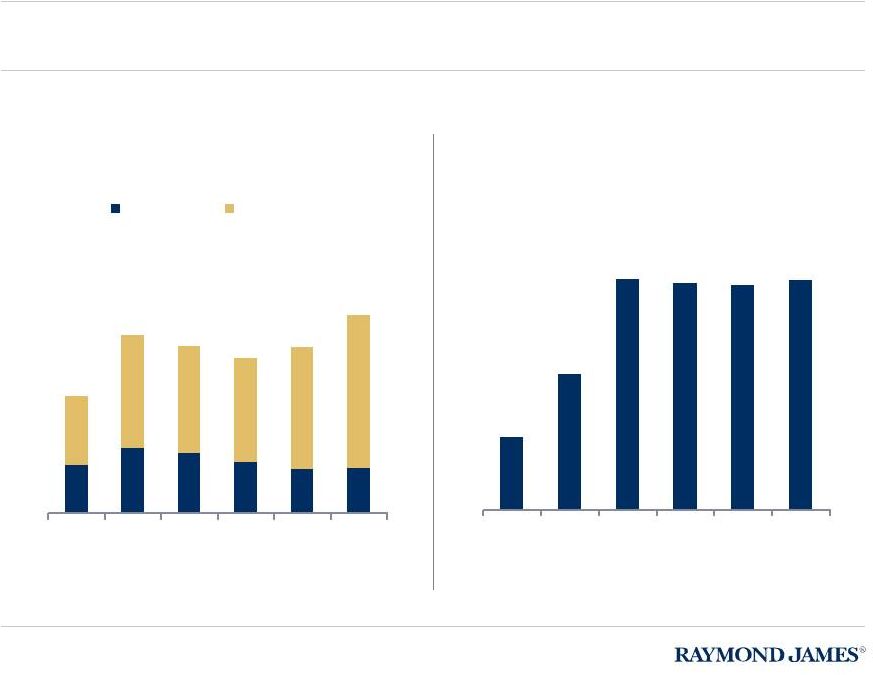

36

RAYMOND JAMES BANK TRENDS

* Annualized

19.7% CAGR

5-year 2011

61% CAGR

5-year 2011

23.8% CAGR

5-year 2011

1

Includes

$1.9

billion

borrowed

overnight

for

regulatory

reasons;

2

Includes

$3.2

billion

excess

for

regulatory

reasons;

3

Includes

$3.5

billion

excess

for

regulatory reasons.

115

280

343

277

282

251

06

07

08

09

10

11

YTD

3Q12

Total Revenue

$ Millions

335

405

16

27

112

80

112

173

170

06

07

08

09

10

11

YTD

3Q12

Pre-Tax Income

$ Millions

227

*

6.3

1

11.1

06

07

08

09

10

11

3Q12

Assets

$ Billions

10.8

9.0

9.4

3.1

11.4

2

3 |

RAYMOND JAMES BANK

Trends

-

-

-

-

-

-

-

-

-

-

-

as of 9/30 -

-

-

-

-

-

-

-

6/30/12

-

-

-

-

-

-

-

-

-

-

-

as of 9/30 -

-

-

-

-

-

-

-

6/30/12

37

4,724

7,225

6,782

6,281

6,730

8,045

07

08

09

10

11

YTD

Total Loans

$ Millions

Residential

Corporate

47

88

150

147

146

149

07

08

09

10

11

YTD

Total Loan Loss

Reserves

$ Millions |

RAYMOND JAMES BANK

Asset Composition

6/30/12 Total Assets $9.4 billion

Top 5 Corporate Loan Industry

Concentrations

Business Systems &

Services

3.8%

Media

3.6%

Pharmaceuticals

3.1%

Telecommunications

2.9%

Hospitals

2.9%

*Investments at market value, net of unrealized loss of $34 million

pre-tax 38

Residential

Loans

$1.8

Commercial

& Industrial

Loans

$5.3

Commercial

Real Estate

$1.0

Cash

$0.8

Investments*

$0.5 |

RAYMOND JAMES BANK

Tier 1 Capital

Tier 1 Risk Based Capital

Total Risk Based Capital

Tangible Common Equity to Risk Weighted Assets

10.9%

11.5%

12.8%

11.2%

Credit Ratios as of June 30, 2012

39 |

RAYMOND JAMES BANK

Quarterly Loan Loss Provision and Charge-Offs

$4.8 charge-

offs

$9.3

provisions

40 |

RAYMOND JAMES BANK

41

$631

$451

$462

$459

$484

$489

$431

$506

$254

$147

$121

$147

$165

$215

$233

$264

$230

$169

$207

172

$184

$145

$69

$121

$26

$11

$10

$19

$17

$13

$11

$8

$32

$32

$31

29

$24

$26

$30

$24

$89

$92

$93

$92

$95

$90

$88

$89

$0

$100

$200

300

$400

$500

$600

$700

10

Dec

Mar

11

Jun

11

Sep

11

Dec

11

Mar

12

Jun

12

Residential Substandard

Residential Special Mention

Corporate Doubtful

Corporate Substandard

Corporate Special Mention

$

$

$

Sep

10

-

-

-

-

-

-

-

-

Criticized Loan Trend ($ in millions) |

RAYMOND JAMES BANK

Non-Performing Asset Trend ($ in millions)

42

$86

$87

$88

88

$92

$87

$87

$87

$68

$49

$44

$52

$42

$24

$16

$13

$8

$9

$9

9

$7

$7

$8

$4

$20

$12

$11

$10

$8

$5

$6

$5

$0

$20

$40

60

$80

$100

$120

$140

$160

$180

$200

Sep

10

Dec

10

Mar

11

Jun

11

Sep

11

Dec

11

Mar

12

Jun

12

Commercial OREO

Residential OREO

Commercial NPLs

Residential NPLs

$182

$157

$152

$159

$148

$124

$117

$109

$

$

$

-

-

-

-

-

-

-

- |

RAYMOND JAMES FINANCIAL

Net Interest Earnings

43

* Annualized

269

06

07

08

09

10

11

YTD 3Q12

Other

Stock Loan/Stock Borrow

Retail Balances

Raymond James Bank

227

332

387

326

308

361*

173 |

RAYMOND JAMES FINANCIAL

A 100 basis point rise in short-term interest rates would equate to

an increase of approximately $110 million in pre-tax earnings

$49 mm

$48 mm

$13 mm

$110 mm

Net Interest

Earnings

Client Account

and Service

Fees

Money Market

Mutual Fund

Fees

Estimated

Incremental

Pre-Tax

Earnings

44 |

RAYMOND JAMES FINANCIAL

Transactional vs. Recurring Revenues

Transactional

Recurring

45

52%

59%

61%

53%

54%

55%

56%

48%

41%

39%

47%

46%

45%

44%

0%

10%

20%

30%

40%

50%

60%

70%

2006

2007

2008

2009

2010

2011

3Q12

Percentage of Total Revenues |

RAYMOND JAMES FINANCIAL

$350 @

6.90%

Debt Maturities ($ in millions)

$300 @

8.60%

$250 @

5.625%

46

$250 @

4.25%

2016

2019

2024

2042 |

RAYMOND JAMES FINANCIAL

47

Return on Equity

*2012 YTD Non GAAP ROE: 11.1%

11.1*

18.7

10.0

19.0

21.

24.4

29.

26.

19.4

.7

22.

19.0

19.8

16.

21.0

0.0

5.0

.0

15.0

20.0

25.0

30.0

35.0

3

0

9

4

1

13.3

9.7

9.7

12.8

13.1

15.

15.6

13.0

7.

9

10.6

11.

3

8

10

18

7

9. |

RAYMOND JAMES FINANCIAL

June 30, 2012

Debt / EBITDA

2.12x

Assets / Equity

6.70x

Debt / Total Capitalization

30%

Total capital (to risk-weighted assets)

17.9%

Tier

I capital (to risk-weighted assets)

16.9%

Tier

I capital (to adjusted assets)

13.7%

Note: Excludes non-controlling interests; RJF , Assumes debt issued in 2012 was

outstanding for entire fiscal year. Summary Metrics

48 |

RAYMOND JAMES FINANCIAL

(in thousands)

RJF Cash Balance at 6/30/12

Cash on hand (includes cash invested by RJ&A)

$616,000

Dividends

available*:

RJ&A

$62,000

RJ Bank

$65,000

Morgan Keegan

$163,000

COLI borrowings available (3 days)

$122,000

Uncommitted, unsecured lines of credit (RJF only)

$100,000

Total cash available to RJF:

$1,128,000

*A portion is subject to regulatory approval.

Liquidity Analysis

49 |

August 9, 2012

50 |