Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MAXIMUS, INC. | a50372379ex99_1.htm |

| 8-K - MAXIMUS, INC. 8-K - MAXIMUS, INC. | a50372379.htm |

Exhibit 99.2

|

THOMSON REUTERS STREETEVENTS

|

|

EDITED TRANSCRIPT

|

|

MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

|

EVENT DATE/TIME: AUGUST 07, 2012 / 01:00PM GMT

|

|

OVERVIEW:

|

|

Co. reported 3Q12 revenues of $266.4m and GAAP income from continuing operations (net of taxes) $20.5m or $0.59 per diluted share. Expects full-year 2012 revenues to be $1.03-1.06b and adjusted diluted EPS, excluding non-recurring acquisition related charges to be $2.25-2.35.

|

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

1

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

CORPORATE PARTICIPANTS

Lisa Miles MAXIMUS Inc - VP of IR

David Walker MAXIMUS Inc - CFO

Rich Montoni MAXIMUS Inc - CEO

Bruce Caswell MAXIMUS Inc - President, Health Services

CONFERENCE CALL PARTICIPANTS

Charlie Strauzer CJS Securities - Analyst

Brian Gesuale Raymond James - Analyst

Brian Kinstlinger Sidoti & Company - Analyst

Scott Green BofA Merrill Lynch - Analyst

Frank Sparacino First Analysis - Analyst

PRESENTATION

Operator

Greetings, and welcome to the MAXIMUS fiscal 2012 third quarter conference call. At this time, all participants are in a listen-only mode. A brief question and answer session will follow the formal presentation.

(Operator Instructions)

As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Ms. Lisa Miles Vice President of Investor Relations for MAXIMUS. Thank you. Ms. Miles, you may begin.

Lisa Miles - MAXIMUS Inc - VP of IR

Good morning, thank you for joining us on today's conference call. I would like to point out that we have posted a presentation to our website under the investor relations page to assist you in following along with today's call.

With me is today Rich Montoni, Chief Executive Officer and David Walker, Chief Financial Officer. Following Rich's prepared comments, we will open the call up for Q&A.

Before we begin, I would like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in exhibit 99.1 out of our SEC filings. We encourage you to review the summary of these risks in our most recent 10K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

And with that, I'll turn the call over to Dave.

David Walker - MAXIMUS Inc - CFO

Thanks Lisa, good morning everyone. Once again, MAXIMUS reported another quarter of solid top and bottom line results.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

2

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

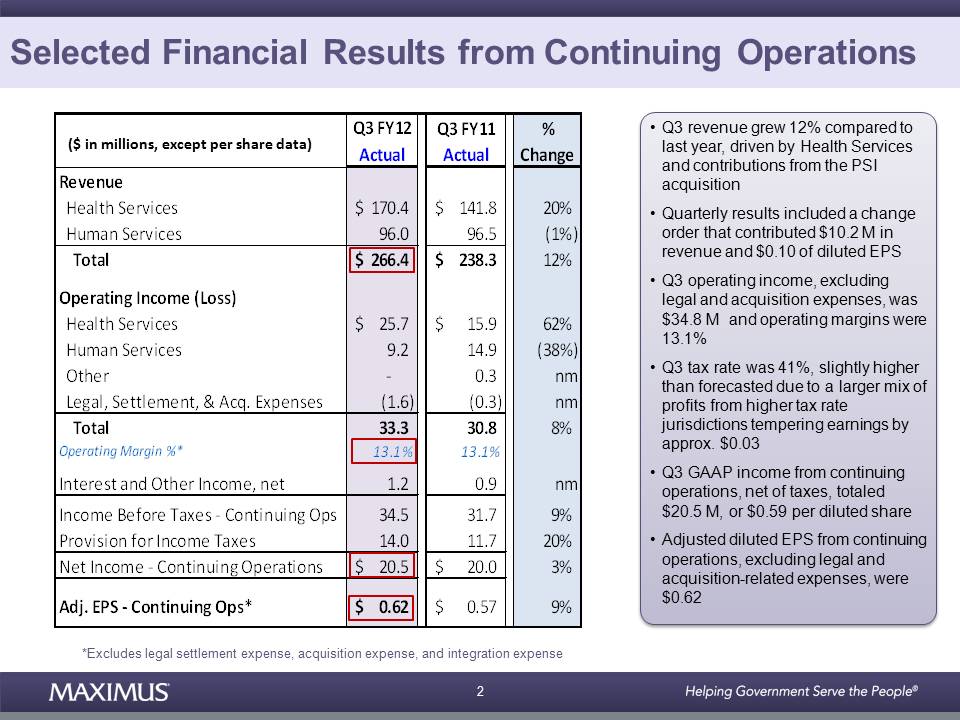

Revenue increased 12% to $266.4 million compared to the same period last year. The year-over-year increase was driven by the health services segment and contributions from the PSI acquisition which closed on April 30. Results for the third quarter include a change order that was previously expected to occur in the fourth quarter and contributed $10.2 million of revenue and approximately $0.10 of diluted earnings per share.

Third quarter operating income, excluding legal and acquisition expenses, totaled $34.8 million with total Company operating margins of 13.1%. Our tax rate in the quarter was 41% which was slightly higher than forecasted due to a larger mix of profits taxable from higher tax jurisdictions. This rate increase tempered earnings by approximately $0.03.

For the third quarter, GAAP income from continuing operations net of taxes totaled $20.5 million, or $0.59 per diluted share. Excluding legal, settlement and acquisition related expenses, adjusted earnings per share from continuing operations were $0.62.

Also during the quarter, we made significant progress with the PSI acquisition. We're pleased to report that the integration is largely complete and we are live with all PSI employees now using MAXIMUS payroll and financial systems. As always, we have included a supplemental table in the PowerPoint presentation to help investors understand the quarter's highlights. The same table can also be found on the last page of this morning's press release.

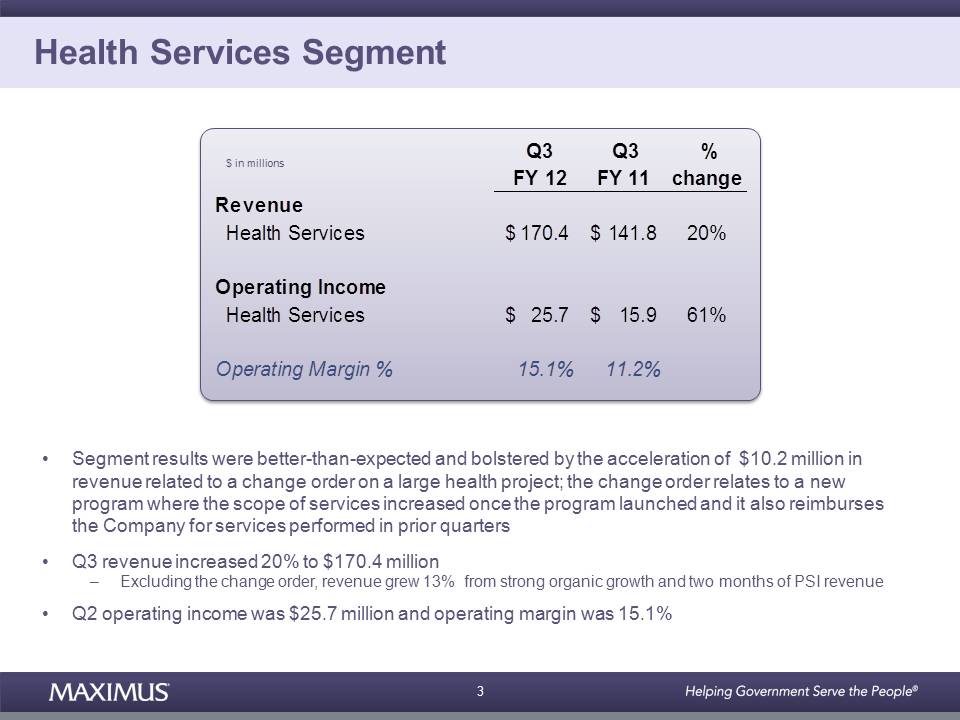

Moving onto results by segment. Third quarter financial results from the health services segment were better than expected and bolstered by the acceleration of the $10.2 million related to the change order this quarter. The team was able to finalize the contract amendment with the client at the end of June, slightly ahead of schedule. As a reminder, the contract amendment relates to a new program where the scope of services increased once the program was launched, and it also reimburses the Company for services performed in prior quarters.

For the third quarter, health services revenue grew 20% to $170.4 million compared to the same period last year. Excluding revenue from the change order, third quarter revenue from the health segment still grew 13%, benefiting from strong organic growth in the core business and two months of revenue from PSI. Health services operating income totaled $25.7 million for the third quarter and resulted in segment operating margin of 15.1%.

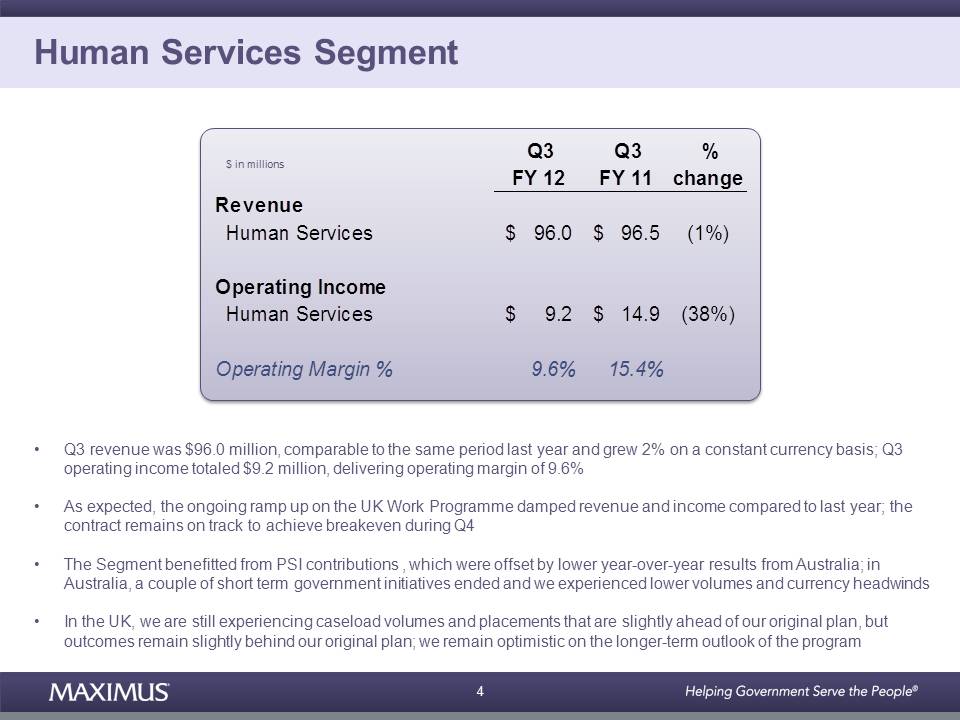

Turning to human services, third quarter revenue for the segment totaled $96 million, which was comparable to the same period last year and grew 2% on a constant currency basis. Segment operating income for the third quarter totaled $9.2 million, delivering an operating margin of 9.6%.

As expected, the ongoing ramp up on the UK work program dampened human services revenue and income compared to the third quarter of last year. But the contract remains on track to achieve breakeven during the fourth quarter. The segment also benefited from contributions from PSI which were offset by lower year-over-year results from our Australian operations.

In Australia, we completed work on a couple of short term government initiatives such as green jobs program. We also experienced lower volumes of job seekers relative to last year and were impacted by unfavorable currency headwinds.

During the last conference call, we refined our financial estimates for the UK work program for fiscal 2013. We continue to track towards those targets, and our longer-term outlook remains unchanged. Operationally in the UK, we are still experiencing case load volumes and placements that are slightly ahead of our original plan, but outcomes remain slightly behind our expectations.

Over the last couple of quarters, we've had several questions from the investment community about work program vendor performance measures and possible reallocations of work. We still expect that the government will issue performance metrics in early autumn, and we are confident that we will be in the upper quartile of performance. Further, we don't expect to see any reallocation of work until January 2013. Our willingness to take on additional work will depend upon the terms and conditions and the regions that are up for reallocation. Overall, we remain optimistic on the longer term outlook of the work program, and we believe it will be a solid contributor to financials over the life of the contract.

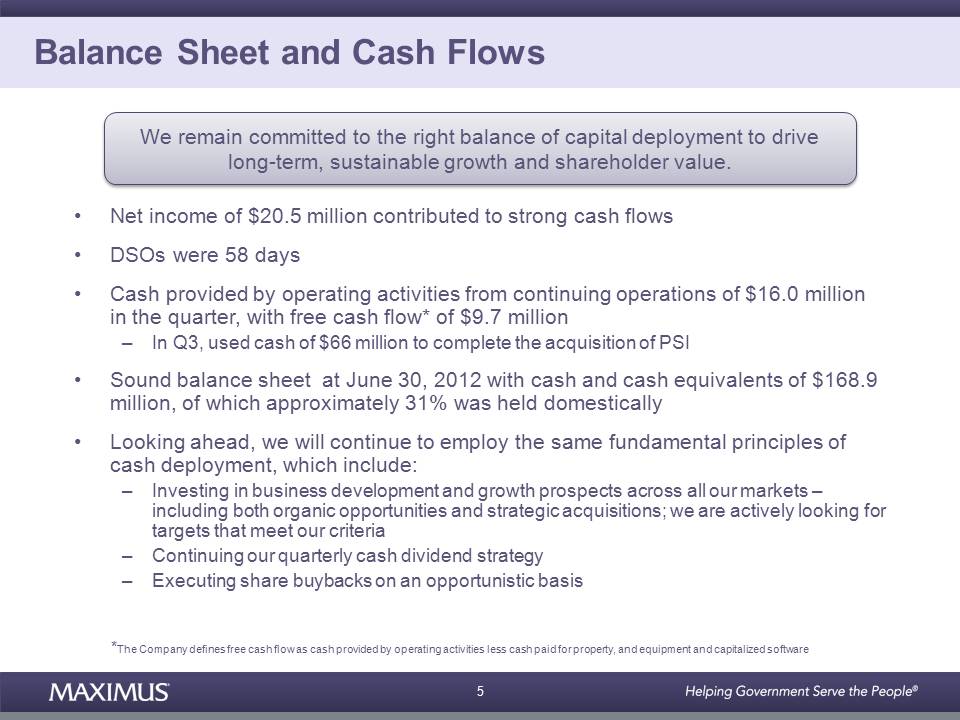

Moving onto cash flow and balance sheet items, third quarter net income of $20.5 million contributed to another quarter of solid cash flows. Day sales outstanding totaled 58 days in the quarter.

For the third quarter, cash provided by operating activities from continuing operations totaled $16 million with free cash flow of $9.7 million. During the quarter, we used cash of $66 million to complete the acquisition of PSI. Even with this large cash outflow, our balance sheet remains healthy with a solid cash position. At June 30, we had approximately $168.9 million in cash and cash equivalents, of which approximately 31% was held domestically.

Looking ahead, we will continue to employ the same fundamental principles of cash deployment which include investing in business development and growth prospects across all our markets, including both organic opportunities and strategic acquisitions. And we are actively looking for targets that meet our criteria, continuing our quarterly cash dividend strategy and finally, executing our share buybacks on an opportunistic basis. But most importantly, the team remains committed to growing the business, getting a reasonable return on investments and delivering long-term shareholder value.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

3

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

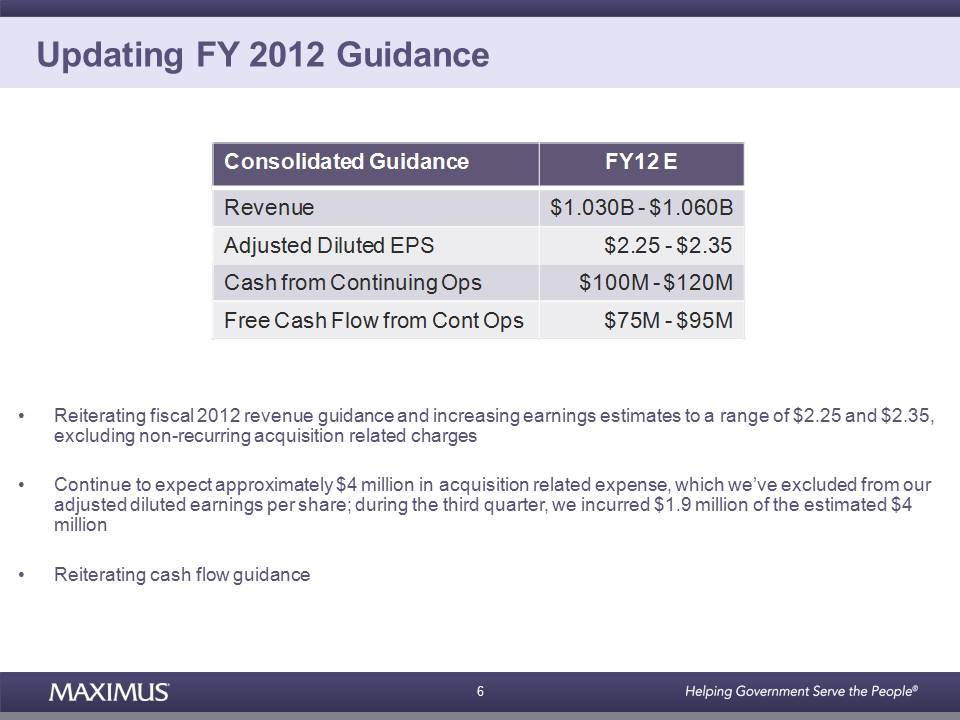

Before I hand the call over to Rich, I'll wrap up with updated guidance. We are reiterating our fiscal 2012 revenue guidance, and we still expect full year revenue to range between $1.03 billion and $1.06 billion. On the bottom line, we are increasing our earnings estimates for fiscal 2012. We now expect adjusted diluted earnings per share for the full year to range between $2.25 and $2.35, excluding nonrecurring acquisition related charges.

As we stated on our last earnings call, we continue to expect approximately $4 million in acquisition related expense, which we have excluded from our adjusted diluted earnings per share. And during the third quarter, we incurred $1.9 million of the estimated $4 million.

Moving onto cash flows, we are reiterating our guidance for fiscal 2012. We still expect cash provided by operating activities derived from continuing operations to be in the range of $100 million to $120 million, and we still expect free cash flow from continuing operations to be in the range of $75 million to $95 million.

And with that, I'll turn the call over to Rich.

Rich Montoni - MAXIMUS Inc - CEO

Thanks, David, and good morning, everyone. With another solid quarter of financial results behind us, we were able to raise our earnings outlook for the year and affirm the growth platform for fiscal 2013. Today I'll focus my comments on some notable events since our last call, including healthcare reform and new awards in both current and new geographies. I'd like to start off with an update on our domestic operations.

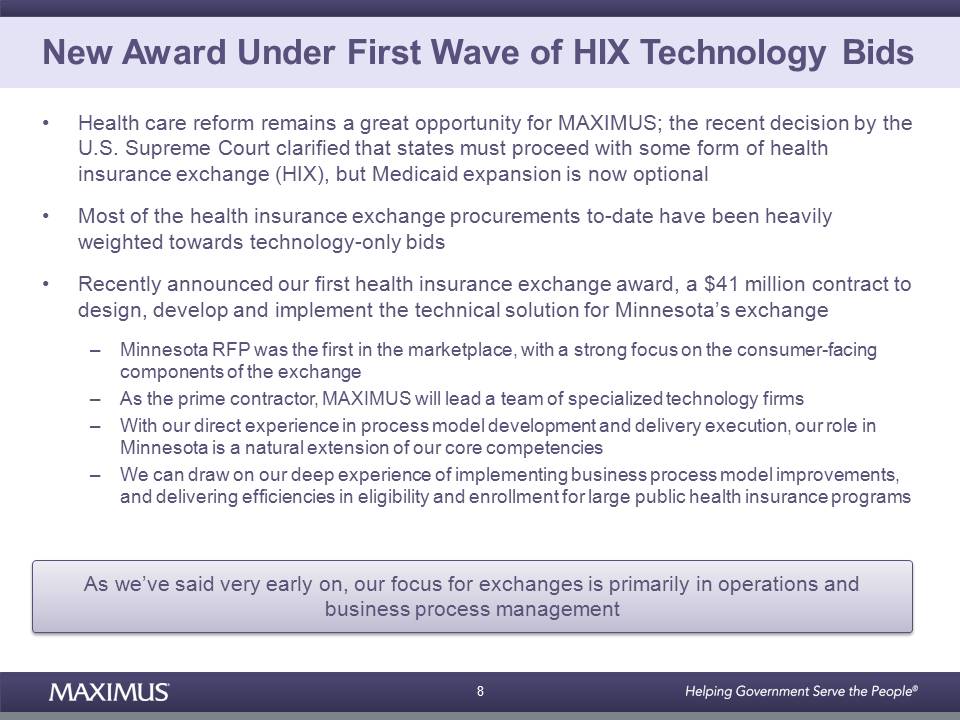

On the health services side, the Supreme Court's decision early this summer reaffirmed that healthcare reform remains a great opportunity for MAXIMUS. The court's decision clarified that states must proceed with some form of health insurance exchange, but Medicaid expansion is now optional. Let's start with the state Hicks procurement environment. Most of the procurements to date have been heavily weighted towards technology only bids.

We recently announced our first health insurance exchange award, a $41 million contract to design, develop and implement the technical solution for Minnesota's exchange. The Minnesota RFP was the first in the marketplace with a strong focus on the consumer facing components of the exchange. As we have said early on, our focus for exchanges is primarily in operations in business process management.

As the prime contractor, MAXIMUS will lead a team of specialized technology firms. With our direct experience in process model development and delivery execution, our role in Minnesota is a natural extension of our core competencies. We can draw on our deep experience of implementing business process model improvements in delivering efficiencies in eligibility enrollment for large public health insurance programs.

As we begin our work on the Minnesota exchange, we continue to remain well positioned for the downstream future operations of the exchanges. We believe there are only a handful of BPO vendors who are logical players in the health insurance exchange operations market.

As the deadline approaches for exchange operations to begin in the fall of 2013, states are evaluating their procurement approaches. We believe that some states will look to leverage existing service center infrastructures and contractual relationships. Consequently, we think we're in a really good position to win our fair share of exchange operations awards.

Looking down the pipeline, we believe that approximately 20 states, most of which have received substantial grants, are best positioned for state based exchange. Twelve of these 20 states recently affirmed to the Secretary of Health and Human Services their intent to create state based health insurance exchanges.

Approximately 24 states remain undecided. These states are considering whether to develop their own exchange or adopt either of the federally facilitated exchange, or FFE, or state partnership models. Either as a long-term solution or as a temporary bridge to a fully state based exchange. The remaining six states will most likely participate in the FFE.

The federal government is in the process of building the technology for their exchange, and we expect to see additional procurements for the operations and other support functions later this year. We believe MAXIMUS is well positioned to support the federal exchange initiatives through our federal services subsidiary. Regardless of the model or path the states choose, it's important to note that healthcare reform is a multi-year effort and that revenue from health insurance exchanges will not reach mature levels until fiscal 2015 or 2016.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

4

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

The Supreme Court ruling also gives states additional flexibility on the timing and scope of Medicaid expansion. So, states are carefully studying the economic impacts of Medicaid expansion.

With 100% federal funding initially decreasing to 90% in later years, states may have a hard time turning down federal dollars for services and programs that they currently fund largely from their own budgets. States must also consider how hospitals will handle lower disproportionate hospital share, or DISH payments, for uninsured individuals without the additional coverage from Medicaid. And there's been substantial discussion on how Medicaid expansion can benefit local economies through job creation in the health services industry.

However, a recent GAO survey of state budget directors highlights concerns that the technology and administrative cost of Medicaid expansion would outweigh prospective savings for states in the near-term. Some states are awaiting for the November elections, while others are requesting additional flexibility through the waiver process, such as block grants or unrestricted lump sum payments. So, we recognize that not every state will proceed with Medicaid expansion, and those that do may implement at different points in time.

Following the Supreme Court ruling, the congressional budget office revised their coverage expectations under healthcare reform. CBO has now stated that the direction of states remains uncertain and now estimates that 11 million new enrollees will come in by 2022, down 35% from their original estimate of 17 million. Based on this estimated 35% reduction, we have modified our expectations for the annual total addressable market under Medicaid expansion accordingly.

We now expect this addressable market to range between $130 million and $200 million annually. The low end of the range establishes a floor if certain states never expand Medicaid. However, we think that the more likely scenario is that over time, many states will ultimately elect to expand their Medicaid programs over the coming years.

As a result of the Affordable Care Act's enhanced outreach in streamline eligibility rules and systems, most Medicaid programs, even those in the nonexpansion states, will likely experience increased enrollments of currently eligible individuals. This is often referred to as the welcome mat or the woodwork effect. So, moving forward, we continue to expect that states will seek multiple paths to drive efficiencies and contain cost, including shifting Medicaid populations into managed care.

California is one state that is taking a number of steps to increase efficiencies and manage cost. The state has a plan in motion to shift Medi-Cal/Medicaid populations from additional counties into managed care beginning in mid 2013. The state also plans to move Medicare benefits for its dual eligibles into Medi-Cal, and we are in the early planning stages to support the state on both of these efforts. Under the two initiatives, the state estimates savings of approximately $1.7 billion by the end of 2014.

Additionally, California's fiscal 2013 budget includes an initiative to move the children served by the Healthy Families CHIP program into Medi-Cal. The transition is currently expected to begin no earlier than January 2013, will be done in multiple phases and is expected to last a full year. We are working closely with a managed risk medical insurance board and the department of healthcare services on how we can best support the transition planning, design and implementation activities.

We are in active discussions with our California clients, and we believe we may likely retain several of the operational functions we perform in the CHIP program today. The program generated just over $50 million in revenue in fiscal 2011. Since the shift from Healthy Families into Medi-Cal won't be a one to one revenue match, we know revenue will be lower. But at this point in time, we cannot speculate on how much until we finalize the scope of work that we will likely continue to perform.

New Hampshire is another state that's moving individuals into managed care in response to the increased Medicaid expenditures and the need to improve services to beneficiaries. MAXIMUS is one of small but strategic contracts with the state to operate a temporary call center, to assist Medicaid participants with the self selection and enrollment in the managed care plans. We are pleased to develop relationships and serve the Medicaid population in a new state.

Turning now to our federal operations, we are very much on track with our expansion strategy. As we mentioned previously, we are enhancing our current offerings and looking at new agencies in adjacent markets where we can apply our core competencies. In contrast to the defense contracting market, we see promising new emerging opportunities in the health and human services space.

Our sales pipeline for longer-term federal opportunities has grown significantly over the last 18 months. And we have successfully added seven new government wide acquisition contracts, or what's referred to as GWACs, to our available contracting vehicles. And we recently won a CMS duals program assessment contract which is small, but strategic and in our swim lane. The progress of our federal services team is sewing the seeds for growth for fiscal 2013 and beyond.

Finally, wrapping up our domestic update with human services, the integration of PSI is moving forward as planned. The additional resources we've picked up, including top flight proposal and solution teams, are a tremendous asset to our business development efforts. Let me share a couple of examples.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

5

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

MAXIMUS recently started work on a new child support services project in Missouri under a three year $5.7 million contract, which also carries an additional three option years thereafter. We have also expanded our geographic presence with a one year $2 million work force services contract in South Carolina for the Jobs Upfront Mean More Pay, or JUMMP program. This program has four additional one year option periods following the base contract.

Moving now to our international operations. I just returned from a visit to UK where I had the pleasure of meeting with the team. I am pleased that overall the program operations remain on track and as David noted, we still expect the contract to breakeven during the fourth quarter, setting us on the right path for fiscal 2013. As you know, the economy continues to be a challenge for the UK and the work program has received both positive and negative media attention. However, the government and MAXIMUS both remain committed to the success of this important welfare reform initiative.

We also have good news out of Australia to share this morning. We were recently awarded a contract with a new client, the Department of Immigration and Citizenship. The 20 month contract has an estimated value between $15 million and $20 million, depending on the specific client volumes and has a 12 month extension option. This new work should more than offset a couple of short term initiatives that were completed earlier this year.

Under this new award, MAXIMUS will provide client support in independent observer services for the young, unaccompanied asylum-seekers and refugees arriving in Australia. MAXIMUS is excited to be delivering these very important support services for Department of Immigration and Citizenship to clients originating from countries around the world.

And finally, we have a very exciting development in the expansion of our global operations. MAXIMUS has been selected to operate a pilot program to provide assistance to job seekers in Saudi Arabia. The contract was signed in June, and operations went live last week. The program is expected to provide 15 months of revenue in the range of $12 million to $15 million.

MAXIMUS is serving job seekers through five sites, providing case management support and addressing barriers to employment. Each site has a business development officer to develop and maintain relationships with employers and local industries. As we have mentioned before, governments around the world face similar challenges with social issues, and we are pleased to expand our core service offerings to a promising new geography.

Moving onto new awards in the sales pipeline, at August 3, fiscal year-to-date signed contracts wins totaled $1.2 billion and new contracts pending of those that are awarded but unsigned totaled $185.8 million. Our pipeline of total sales opportunities is at record levels of $3.4 billion at August 3. Most notably, of the $3.4 billion in total pipeline, we have submitted proposals totaling $1.7 billion of contract value that we are awaiting decision on. The overall sales pipeline represents many growth opportunities across both segments and all geographies.

As a reminder, investors should expect routine fluctuations between the pipeline and new sales categories. These shifts are driven by the different stages in the procurement process, as well as the timing of when contracts are awarded and ultimately signed.

In closing, I am pleased with our progress and our short-term goals to grow the business. Domestically, the integration of PSI continues to go well. We signed our first health insurance exchange contract, and we are on our way to winning our fair share of healthcare reform work. And we are making very substantial progress gaining more traction in our federal operations.

Internationally, we continue to expand the global footprint of our work force services operations with a new pilot program in Saudi Arabia and a new population in Australia. And our UK contract remains on track to achieve breakeven status before the end of the fiscal year. With increased EPS guidance for the remainder of fiscal 2012, fiscal year 2013 is shaping up to be a great year as a result of the full year's contribution from PSI, a profitable contract in the UK and the many domestic and global opportunities on the horizon.

With that, let's open it up for questions. Operator?

QUESTION AND ANSWER

Operator

(Operator Instructions) One moment while we poll for questions. Our first question comes from the line of Charlie Strauzer with CJS Securities. Please proceed with your question.

Charlie Strauzer - CJS Securities - Analyst

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

6

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

Hi, good morning.

Rich Montoni - MAXIMUS Inc - CEO

Good morning, Charlie, how are you?

Charlie Strauzer - CJS Securities - Analyst

Good, thanks, Rich. Can you expand a little bit more on this growing pipeline of opportunities? It's a pretty big number, and obviously, you said it's pretty broad based across the board. Are there any particularly large single opportunities that have been released from an RFP standpoint currently? And also, if you look at it from opportunities in the new Obamacare related field, are there any in there as well?

Rich Montoni - MAXIMUS Inc - CEO

Glad do that, Charlie. I think you are right, we are very pleased with the sequential increase in our, what we call total pipeline opportunities. It increased to approximately $3.4 billion at the end of the third quarter 2012. But when you look at the growth, the sequential increase, one, it's been in RFP's tracking. The other category is in proposals pending. And I'll speak a little bit more to the proposals pending, because that's a little closer in terms of reality. The RFP's tracking, as you know, tend to be longer-term in nature. So, just talk a little bit about what's happening to that increase in terms in proposals pending to the $1.7 billion number. When we look at the $1.7 billion, we are pleased to see that by far the lion's share of it relates to new work as opposed to rebids. In fact, of the $1.7 billion, about $400 million relates to rebids. That leaves $1.3 billion that's related to new work. And when we look at that, it's interesting to note about $335 million is international and the remaining approximate $1 billion is domestic. And of the domestic component, a good portion of it is related or sparked by ACA, but less than half of it is sparked by ACA. So, I am really pleased to see that the growth is not only across segments. The opportunities is not only across the segments and across geographies, it's really across the entire business., and that's quite pleasing.

Charlie Strauzer - CJS Securities - Analyst

Great. Thank you very much.

Rich Montoni - MAXIMUS Inc - CEO

You bet. Next question please.

Operator

Our next question comes from the line of Brian Gesuale of Raymond James. Please proceed with your question. Brian, you are now on the line.

Brian Gesuale - Raymond James - Analyst

I'm sorry, pipeline looks terrific. Nice job on the quarter. Wondering if you can give us a little bit of insight on how the UK losses have been progressing over the last couple of quarters in that path towards breakeven next quarter?

Rich Montoni - MAXIMUS Inc - CEO

Glad to do that, Brian. And thanks for the comment on pipeline and thanks for the comment on the quarter. On the UK, while we don't disclose precise revenue and loss by quarter information, it's pretty much tracking to where we expected. Which, it delivered a loss in the June quarter and when we tracked the underlining metrics, Brian, in terms of fast forwarding the impacts of the attachments and the placements and the outcomes, we're landing pretty much where we expected to be on our revised guidance. I think last quarter we provided some revised guidance on the UK program based upon where the metrics have been tracking. So, pretty much on board. It delivered a loss this quarter, and we are planning and pushing forward to get it towards breakeven during this fourth quarter. And obviously the plan is to set the stage for growth and profitable fiscal '13 on that project.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

7

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

Brian Gesuale - Raymond James - Analyst

Okay. Great. Thanks very much.

Rich Montoni - MAXIMUS Inc - CEO

Next question, please.

Operator

Our next question comes from the line of Brian Kinstlinger with Sidoti & Company.

Brian Kinstlinger - Sidoti & Company - Analyst

The question I had was, you lay out 20 states that are positioned for exchanges and then I think 24 or 30 that are positioned for FFE. I am wondering, first of all, of those 20 states, how many are states in which MAXIMUS handles enrollments for Medicaid? And then of the 24 to 30, if you can just explain how that's going to be run. Are each of the 24 to 30 going to be operated under the federal system, or will there be one program run by an operator for that entire process?

Rich Montoni - MAXIMUS Inc - CEO

Brian, first of all, it is a two part question, so of break it apart I'm going to ask Bruce to respond to the two questions. You are asking, of the roughly 20 that we think will have their own exchange how many are MAXIMUS clients?

Brian Kinstlinger - Sidoti & Company - Analyst

Clients of Medicaid, right.

Rich Montoni - MAXIMUS Inc - CEO

Correct. And then of the 24 to 30 that will go the federal route, how will all of that work? What will they do? How will they proceed? The later part is a very in depth question, as you can imagine. You have got lots of federal resources that are trying to answer that question. But I'm going to ask Bruce Caswell to take a crack at it.

Bruce Caswell - MAXIMUS Inc - President, Health Services

Sure, I would be happy to. I think Brian, one way to also look at the states is, as we mentioned, a subset of those 20 include 12 that have affirmatively declared to Secretary Sebelius their intent to run a state based exchange and of those 12, 6 are existing MAXIMUS clients. In terms of our Medicaid managed care enrollment broker services and/or the services we provide to streamlined eligibility and enrollment process for Medicaid and CHIP programs. So, 50% of that subset. And then within the broader 20, I'd say the ratio relatively holds. So, you'd find, I am going to say 40% to 50% of that group being existing MAXIMUS clients.

Turning to the second question of how the federal model will proceed, we believe it's likely that the federal government as it has in the past will look to work a combination of leveraging existing procurement vehicles that they have in place that maybe have had head room in them or the ability to expand to accommodate the additional services needed to support the exchange and secondly, a combination of new procurements. It's likely that the work will be segmented in such a matter as it is performed at the state level where you could see call center services being separated from the eligibility and enrollment, if you will, back office administrative services. So, we are ensuring that we are well positioned for either path and to support the multiple procurement strategy that we think is the likely outcome.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

8

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

Brian Kinstlinger - Sidoti & Company - Analyst

Great. Thanks, Bruce.

Bruce Caswell - MAXIMUS Inc - President, Health Services

Next question.

Operator

Our next question comes from the line of Scott Green with Bank of America Merrill Lynch.

Scott Green - BofA Merrill Lynch - Analyst

Hi, thanks for the question. Could you elaborate on the Saudi Arabia market? So, any initial indication of how the government might evaluate results? Is this a fee for service or results oriented pilot? And then, how many other vendors are participating?

Rich Montoni - MAXIMUS Inc - CEO

Good morning, Scott. Great question. As you can appreciate, we are very excited about the Saudi Arabian opportunity, and I'll share with you some of the details. I think the number 1, I think, theme here is that obviously, this is a country that's sophisticated, that has, and we have said all along, that there are many countries on this globe that have similar social issues. They very much are moving forward to improve the employment situation of Saudi nationals. You can go research and see that they have a very sophisticated program to achieve just that. MAXIMUS, I believe, is the third vendor to help in this particular situation, and it's a pilot program.

So, in this pilot, we will have five sites in total. To date we have launched -- I think last week we launched three sites in three separate cities. We have two sites that remain in separate cities. We plan that they will go live next week. We have had a core group of our individuals who have been on the ground for the last six months working with the government to understand the goals of the government and what they hope to achieve in defining the structure of the pilot program. And once we were awarded the work we deployed certain experts from Australian operations and US operations, really to get the program started, to help with the build out of the infrastructure, recruiting staff, training staff. We have done and plan do a majority of the work by hiring locally. And we plan that this pilot will run about 15 months, and there are some performance objectives associated with it.

I would tell you the structure, the pay points, some are fixed in nature, some are variable in nature tied to outcomes. But I also want to emphasize, and this is very important, it being a pilot, that it not be a back end loaded contract structure similar to the UK. That's not structured nearly in that fashion. So, we're excited about it. We'll see how it develops over the longer-term. Our belief is if the results of the pilot are satisfactory that the government has intent to move the program across the entire nation. So, we're very excited about this opportunity, albeit an early pilot program.

Scott Green - BofA Merrill Lynch - Analyst

All right. Great. That's very helpful. Is there any preliminary indication for what a potential expansion could look like in terms of adjustable market, or it's still too early?

Rich Montoni - MAXIMUS Inc - CEO

It's really still too early to put anything out there. It would be sizeable. But again, it depends upon a successful pilot. We have go through that process first.

Scott Green - BofA Merrill Lynch - Analyst

Okay, great. Thank you.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

9

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

Rich Montoni - MAXIMUS Inc - CEO

Okay, Scott, thank you. Next question, please.

Operator

Our next question comes from the line of Frank Sparacino with First Analysis. Please proceed with your question.

Frank Sparacino - First Analysis - Analyst

Hi guys, hi Rich, maybe a question on the UK. It seems like the front end of the process seems to be working well in terms of case load volume. I am just curious on sort of the back end, what some of the issues are and then just any thoughts around the economy there, unemployment rates, et cetera, as you look out over the next 6 to 12 months.

Rich Montoni - MAXIMUS Inc - CEO

I think the way we look at it, Frank, is that when you study the structure of the program, it's very much a program where future results are a function of prior accomplishments. And if you follow through, I will say the journey of an unemployed individual through employment, we end up with pay points that are based upon prior accomplishments.

On the front end we have referrals from the government. We attach a certain percentage of those. And just to make the point, not all of the individuals that are referred to us by the government show up for an interview. We will reach out to 100% of those individuals, but not all of those individuals show up. The forecasted response rate of those individuals when we first modeled the program was in the vicinity of 95%.

As you go through and you experience reality with the program, it will vary from that particular metric and I think in this case, we're pretty close to that original metric. And the next step in the process is that we find the individual an opportunity. We place the individual. In this case, placement is not a pay point, but it's a very, very important milestone in the whole process because the placement is the most important occurrence before you reach an outcome. And an outcome in this case is defined to be somebody being employed of 13 weeks in the case of hard to serve, 26 weeks in the case of other individuals. And so when we monitor these various progress points, we are fine as it relates to the number of referrals, we are fine as it relates to the acceptance of referrals. The placements, I think, are spot-on, the challenge is getting individuals to 13 and 26 weeks.

We believe the main -- and that's not where we initially modeled it to be. It's slightly behind, but that's basically what is assumed in our revised guidance that it's out out there. I think the number one thing is that the economy is a bit softer than we initially modeled, and there is a slight correlation -- there is a correlation between our ability to find somebody a job and keep them in that job and the economy. So, I think the number one driver in all of this has been a softer UK economy. That being said, again, we factored all of this into our current guidance that's out there, and we continue to monitor it very, very closely and we continue to work with our government client to see what can be done to improve those performance metrics and exceed our original expectations in our current guidance. Does that help, Frank?

Frank Sparacino - First Analysis - Analyst

It does. Thank you very much, Rich.

Rich Montoni - MAXIMUS Inc - CEO

Okay. Next question, please, operator.

Operator

(Operator Instructions) Our next question comes from the line of Charlie Strauzer with CJS Securities. Please proceed with your question.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

10

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

Charlie Strauzer - CJS Securities - Analyst

Just a follow up, if you could. If you could perhaps give us a sense of what organic growth was for each of the segments in the quarter and also, how should we think about the margins going into Q4 by segment? Obviously, you had the benefit from the change order, so how should we think of a more normalized margin? Thanks.

Rich Montoni - MAXIMUS Inc - CEO

Hi, Charlie, I'm going to recap your question and I am going to ask Dave Walker to pick them up. But I think you have got a two part question. One is, what are we seeing for organic growth from a segment perspective, and what do we think is going to happen in Q4 from a margin perspective? Walker.

David Walker - MAXIMUS Inc - CFO

Sure. Hey, Charlie. The organic growth in health was 13.9%. The human services actually declined 15%, but that's not a surprise because of the UK year over year, so that was expected with an overall organic growth rate of about. 2% And we were certainly suffering from currency headwinds in the quarter. It was a strong quarter last year. I think we lost about $3.2 million roughly in currency year over year, mainly driven by Australia.

Rich Montoni - MAXIMUS Inc - CEO

And margins for the fourth quarter.

Lisa Miles - MAXIMUS Inc - VP of IR

By segment.

David Walker - MAXIMUS Inc - CFO

Oh, I think it's consistent with our expectations.

Rich Montoni - MAXIMUS Inc - CEO

I think Charlie, overall from a consolidated perspective, we're expecting that we're going to end up in a 12% to 13% range in the fourth quarter. And I actually think it's going to be biased a bit towards human services, which I think will have a stronger operating margin.

Charlie Strauzer - CJS Securities - Analyst

Got it. Great. And what would drive that in Q4 versus (inaudible)?

Rich Montoni - MAXIMUS Inc - CEO

Seasonality becomes a big factor.

Charlie Strauzer - CJS Securities - Analyst

Got it. Okay, great. Thank you very much.

Operator

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

11

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

Our next question comes from the line of Brian Kinstlinger with Sidoti & Company. Please proceed with your question.

Brian Kinstlinger - Sidoti & Company - Analyst

Great, thanks. I want to dig into the proposals outstanding a little bit more. I think that was the most important number that came out. And so on the $335 million roughly of international work, I'm interested to hear how much of that is welfare to work and maybe some of the large deals we talked about at the analyst day about a -- probably about a year ago now or more and if any of those have materialized into RFPs. And then on $1 billion of ACA -- sorry, $1 billion of which just a little bit under half was ACA, are you looking ot bid more on the development side, the IT side or? I know it's not your main focus. Are there going to be a handful of more proposals still for you, even though it's not you main focus? Maybe give us a sense of that. Thanks.

Rich Montoni - MAXIMUS Inc - CEO

Okay. Good question. The two questions to frame them are of the $335 million approximate of the $1.3 billion in new work, and we are talking about proposal submitted. Right Brian?

Brian Kinstlinger - Sidoti & Company - Analyst

Yes.

Rich Montoni - MAXIMUS Inc - CEO

Of that $335 million that we highlighted as international, about half of it is welfare to work. And again, the opportunities are US domestic, Canada and opportunities in Australia. So, I think it's spread across the geographic board. I don't recall particular -- the particular items we presented last June, but I think some of them certainly are new. And I think they're in line with a trend that we laid out at that particular point in time where these countries just have the same compelling reason to move forward.

I think that's the key take away, is that we are actually seeing these governments take a hard look at the existing programs with a compelling need to reengineer them, and they're leading towards firms like MAXIMUS to partner with. I think that's the overall take away internationally and in part, domestic. Your second question was of $1 billion domestic, and I said less than half is ACA sparked, but do we want to do more development work? The answer is not really. Our principle interest is in the business process services side. We've moved forward with this one opportunity feeling quite comfortable with our partners and our capability and also the fact that it was one of the first out there. So, we really wanted to be a player early on, Brian.

Brian Kinstlinger - Sidoti & Company - Analyst

If I can sneak a second on the international, just to be clear, on the analyst day you mentioned five countries in Europe. I won't name them specifically, so competitors don't have to hear that. But you mentioned five countries that are thinking about programs, you are working with, you are in discussions with. Europe, I think is the main focus, not Canada. I am thinking about Australia for welfare to work. Are there any pilots getting close to beginning where it could lead to something large? Like a Saudi Arabia, but more in Europe.

Rich Montoni - MAXIMUS Inc - CEO

Yes, I think -- I don't think it's concentrated in Europe. We continue to watch opportunities in Europe. And it's interesting when what we are experiencing as it relates to new countries stepping up and becoming an opportunity, it can flex from quarter to quarter. You may have a particular country that is very, very interested in moving forward, and then they hit a brick wall as it relates to their funding or their politics or whatever reasons might be and then you will have another country that will suddenly -- which we graded as perhaps a tier 2 opportunity become a tier 1 opportunity. I would say even within the European union, we do see a lot of flux quarter to quarter in terms of who is likely to move forward. I think that the five countries that were previously mentioned, we still see a level of interest. But I would say that the Saudi opportunity was not one that was high on our list at that point in time and moved forward quite quickly.

Brian Kinstlinger - Sidoti & Company - Analyst

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

12

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

All right. Okay, thank you.

Rich Montoni - MAXIMUS Inc - CEO

You bet, thanks. Next question, please.

Operator

Our next question comes from the line of Frank Sparacino with First Analyst. Please proceed with your question.

Frank Sparacino - First Analysis - Analyst

Hi guys, just wanted to follow up on the GWACs, which I am not too familiar with. But just curious as to the type of contracts that you are getting involved with there.

Rich Montoni - MAXIMUS Inc - CEO

Hi Frank, good morning. Bruce, can you respond to that? Bruce Caswell, our federal operations reports up to Bruce, so he's been very, very active and involved in this area.

Bruce Caswell - MAXIMUS Inc - President, Health Services

Absolutely, sure, Frank, good morning. I think that it's fair to characterize these as broad contracts platforms that provide the ability to get our services into the government through a number of means, whether it's the traditional full solutions that we provide in the areas of contact centers and document management and program integrity and appeals and so forth. Or on a more, call it staff aug basis where we are providing specific labor categories and labor elements to the government either as a prime contractor or subcontractor.

The GWACs thta we have been awarded include position as a prime contractor on broad governemnt procurment vehicles as well as a sub to other companies on vehicles that are agency specific but have the ability for other agencies to pull through procurement. So, it's really -- it's a great opportunity for us to I think execute on our strategy, which has been to broaden our reach into selected federal agencies and pull through the full capabilities of the Company. These vehicles are really a preconditioned or a platform element of that strategy.

Rich Montoni - MAXIMUS Inc - CEO

Exactly right. I would emphasize that in the federal space that these vehicles, or GWACs, are akin to a hunting license. It really is necessary, if you are really going to participate in federal work, that you pursue the right vehicles. And as you can appreciate, we are very much focused on civil health and human services related spaces. So, we're really pleased to have picked up these new vehicles. It's very, very important to our concentration. And the other point I would mention is that we still see very meaningful growth opportunities for MAXIMUS, unlike what's happening in other government space and most notably intelligence and defense, which I think are more of a contracting mode. Next question, please.

Operator

Our next question comes from Brian Kinstlinger with Sidoti & Company.

Brian Kinstlinger - Sidoti & Company - Analyst

That was quick. Okay, so I'm going to ask two quick ones and I'll be through. The first one is California. You mentioned you can't -- and I understand it's difficult to understand by folding in Healthy Families into Medi-Cal, what that would cost you in terms of revenue. I saw an article that suggested California wants to save $13 million, which isn't is huge number on that, but that's what they want to save. Would I think all of that is MAXIMUS, or there is other support services that go into that?

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

13

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

And then my second question that's completely unrelated, the $2 million of cost you expect related to the acquisition in the fourth quarter, is that severance? Or what are the other charges that we would see for an additional quarter?

Rich Montoni - MAXIMUS Inc - CEO

Let's take the last one first. Dave Walker, I think, can you respond to that? The $2 million in costs?

David Walker - MAXIMUS Inc - CFO

Sure. There is a big chunk that is severance, that's right. There are termination fees of their payroll vendor, things like that that are in there. I think there is some branding marketing cost.

Brian Kinstlinger - Sidoti & Company - Analyst

Okay.

Rich Montoni - MAXIMUS Inc - CEO

The second question was the $13 million that you read about, California's targeted savings on this California Healthy Families program. Bruce?

Bruce Caswell - MAXIMUS Inc - President, Health Services

Sure. The majority of the savings that are forecasted are really in provider reimbursements because the physicians are paid at a lower rate by the plans under Medi-Cal than they are under Healthy Families. That's the key driver to the savings number.

Brian Kinstlinger - Sidoti & Company - Analyst

That's great insight. Thank you.

Rich Montoni - MAXIMUS Inc - CEO

Next question, please.

Operator

There are no further questions at this time. I would like now to end the Q&A, and this concludes today's teleconference. You may disconnect your lines at this time, and thank you for your participation.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

14

|

AUGUST 07, 2012 / 01:00PM GMT, MMS - Q3 2012 MAXIMUS, Inc. Earnings Conference Call

|

|

DISCLAIMER

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

© 2012 Thomson Reuters. All Rights Reserved.

|

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

15

Fiscal 2012 Third Quarter EarningsDavid N. WalkerChief Financial Officer and TreasurerAugust 7, 2012A number of statements being made today will be forward-looking in nature.Such statements are only predictions and actual events or results maydiffer materially as a result of risks we face, including those discussed inour SEC filings. We encourage you to review the summary of these risks inExhibit 99.1 to our most recent Form 10-K filed with the SEC. TheCompany does not assume any obligation to revise or update theseforward-looking statements to reflect subsequent events or circumstances.

Selected Financial Results from Continuing Operations• Q3 revenue grew 12% compared tolast year, driven by Health Servicesand contributions from the PSIacquisition• Quarterly results included a changeorder that contributed $10.2 M inrevenue and $0.10 of diluted EPS• Q3 operating income, excludinglegal and acquisition expenses, was$34.8 M and operating margins were13.1%• Q3 tax rate was 41%, slightly higherthan forecasted due to a larger mix ofprofits from higher tax ratejurisdictions tempering earnings byapprox. $0.03• Q3 GAAP income from continuingoperations, net of taxes, totaled$20.5 M, or $0.59 per diluted share• Adjusted diluted EPS from continuingoperations, excluding legal andacquisition-related expenses, were$0.62($ in millions, except per share data)*Excludes legal settlement expense, acquisition expense, and integration expense

Health Services Segment• Segment results were better-than-expected and bolstered by the acceleration of $10.2 million inrevenue related to a change order on a large health project; the change order relates to a newprogram where the scope of services increased once the program launched and it also reimbursesthe Company for services performed in prior quarters• Q3 revenue increased 20% to $170.4 million– Excluding the change order, revenue grew 13% from strong organic growth and two months of PSI revenue• Q2 operating income was $25.7 million and operating margin was 15.1%

Human Services Segment• Q3 revenue was $96.0 million, comparable to the same period last year and grew 2% on a constant currency basis; Q3operating income totaled $9.2 million, delivering operating margin of 9.6%• As expected, the ongoing ramp up on the UK Work Programme damped revenue and income compared to last year; thecontract remains on track to achieve breakeven during Q4• The Segment benefitted from PSI contributions , which were offset by lower year-over-year results from Australia; inAustralia, a couple of short term government initiatives ended and we experienced lower volumes and currency headwinds• In the UK, we are still experiencing caseload volumes and placements that are slightly ahead of our original plan, butoutcomes remain slightly behind our original plan; we remain optimistic on the longer-term outlook of the program

Balance Sheet and Cash Flows• Net income of $20.5 million contributed to strong cash flows• DSOs were 58 days• Cash provided by operating activities from continuing operations of $16.0 millionin the quarter, with free cash flow* of $9.7 million– In Q3, used cash of $66 million to complete the acquisition of PSI• Sound balance sheet at June 30, 2012 with cash and cash equivalents of $168.9million, of which approximately 31% was held domestically• Looking ahead, we will continue to employ the same fundamental principles ofcash deployment, which include:– Investing in business development and growth prospects across all our markets –including both organic opportunities and strategic acquisitions; we are actively looking fortargets that meet our criteria– Continuing our quarterly cash dividend strategy– Executing share buybacks on an opportunistic basis*The Company defines free cash flow as cash provided by operating activities less cash paid for property, and equipment and capitalized softwareWe remain committed to the right balance of capital deployment to drivelong-term, sustainable growth and shareholder value.

Updating FY 2012 Guidance• Reiterating fiscal 2012 revenue guidance and increasing earnings estimates to a range of $2.25 and $2.35,excluding non-recurring acquisition related charges• Continue to expect approximately $4 million in acquisition related expense, which we’ve excluded from ouradjusted diluted earnings per share; during the third quarter, we incurred $1.9 million of the estimated $4million• Reiterating cash flow guidance

Fiscal 2012 Third Quarter EarningsRichard A. MontoniPresident and Chief Executive OfficerAugust 7, 2012

New Award Under First Wave of HIX Technology Bids• Health care reform remains a great opportunity for MAXIMUS; the recent decision by theU.S. Supreme Court clarified that states must proceed with some form of healthinsurance exchange (HIX), but Medicaid expansion is now optional• Most of the health insurance exchange procurements to-date have been heavilyweighted towards technology-only bids• Recently announced our first health insurance exchange award, a $41 million contract todesign, develop and implement the technical solution for Minnesota’s exchange– Minnesota RFP was the first in the marketplace, with a strong focus on the consumer-facingcomponents of the exchange– As the prime contractor, MAXIMUS will lead a team of specialized technology firms– With our direct experience in process model development and delivery execution, our role inMinnesota is a natural extension of our core competencies– We can draw on our deep experience of implementing business process model improvements,and delivering efficiencies in eligibility and enrollment for large public health insurance programsAs we’ve said very early on, our focus for exchanges is primarily in operations andbusiness process management

Well-Positioned for Downstream Exchange Operations• We believe there are only a handful logical BPO players in the HIX operations market; asthe fall 2013 deadline approaches for exchange operations to begin, states areevaluating procurement approaches and some states may leverage existing servicecenter infrastructures and contractual relationships• Approximately 20 states, most of which have received substantial grants, are bestpositioned for a state-based exchange• Approximately 24 states remain undecided; they are considering whether to develop theirown exchange, or adopt either the Federally Facilitated Exchange (FFE) or StatePartnership models, either as a long-term solution or a temporary bridge to a fully statebasedexchange• Remaining six states will most likely participate in the FFE– The federal government is building the technology for their exchange and we expect to seeadditional procurements for the operations and other support functions later this year– We believe MAXIMUS is well positioned to support the federal exchange initiatives through ourfederal services subsidiaryRegardless of the path states choose, health care reform is a multi-year effort andrevenue from health insurance exchanges will not reach mature levels until FY15 or FY16

States Study Impact of Medicaid Expansion• SCOTUS ruling gives states additional flexibility on Medicaid expansion, so states arecarefully studying the economic impacts of this expansion– With 100% federal funding initially decreasing to 90% in later years, states may have a hard timeturning down federal dollars– States must also consider how hospitals will handle lower disproportionate hospital share (DSH)payments for uninsured individuals without the additional coverage from Medicaid– There’s been substantial discussion on how Medicaid expansion can benefit local economiesthrough job creation in the health services industry• However, recent GAO survey highlights concerns that the costs of Medicaid expansionwould outweigh prospective savings for states in the near term• Some states are waiting for the November elections, while others are requestingadditional flexibility through the waiver process, such as block grants or unrestricted lumpsum paymentsNot all states will proceed with Medicaid expansion,and those that do may implement at different points in time

Revised Total Addressable Medicaid Expansion Market• The Congressional Budget Office revised their coverage expectations noting that thedirection of states remains uncertain; CBO now estimates that 11 million new enrolleeswill come in by 2022, down 35% from their original estimate of 17 million• MAXIMUS has modified our expectations for the annual total addressable market underMedicaid expansion accordingly; we now expect this addressable market to rangebetween $130 million and $200 million annually– Low end of the range establishes a floor if certain states never expand Medicaid– We think the more likely scenario is that many states will ultimately elect to expand theirMedicaid programs over time• As a result of the Affordable Care Act’s enhanced outreach and streamlined eligibilityrules and systems, most Medicaid programs, even those in the non-expansion states,will likely experience increased enrollments of currently eligible individuals– Often referred to as the “welcome mat” or “woodwork” effectWe continue to expect that states will seek multiple paths to drive efficiencies and containcosts, including shifting Medicaid populations into managed care

State Efforts to Increase Efficiencies & Manage Costs• California is expanding Medicaid managed care by shifting additional counties intomanaged care beginning in mid-2013 and also planning to move Medicare benefits for itsdual eligibles into Medi-Cal– We are in the early planning stages to support the state on both efforts– Under the two initiatives, the state estimates savings of approx. $1.7 billion by the end of 2014• California’s FY13 budget includes an initiative to move the children served by the HealthyFamilies CHIP program into Medi-Cal– Transition currently expected to begin no earlier than January 2013, will be done in multiplephases, and is expected to last a full year ― we believe we may likely retain several of theoperational functions we perform in the CHIP program today– The program generated just over $50 million in revenue in FY11; since the shift from HealthyFamilies to Medi-Cal won’t be a one-to-one revenue match, we know revenue will be lower; atthis point in time, we cannot speculate by how much until we finalize the scope of work that wemay continue to perform• New Hampshire is also moving individuals into managed care in response to increasedMedicaid expenditures and the need to improve services for beneficiaries– MAXIMUS has won a small, but strategic, contract with the state to operate a temporary callcenter to assist Medicaid participants with the self-selection and enrollment into managed careplans

Other Initiatives• We remain very much on track with our federal expansion strategy, enhancing ourcurrent offerings and looking at new agencies and adjacent markets where we can applyour core competencies– See promising new emerging opportunities in the health and human services space– Sales pipeline for longer-term federal opportunities grown significantly over the last 18 months– Successfully added seven new Government Wide Acquisition Contract (GWAC) vehicles– Recently won a small, but strategic CMS duals program assessment contract• The integration of PSI is moving forward as planned and the additional resources we’vepicked up are a tremendous asset to our human services business development efforts– Recently started work on a new child support services project in Missouri under a three-year,$5.7 million contract, which also carries an additional three option years thereafter– Also expanded our geographic presence with a one-year, $2 million workforce services contractin South Carolina for the Jobs Upfront Mean More Pay (JUMMP) program; this program has fouradditional one-year option periods following the base contract

Global Operations Continue to Grow• In the United Kingdom, Work Programme operations remain on track and we still expect thecontract to break even during the fourth quarter– The economy continues to be a challenge for the UK and the Work Programme has received bothpositive and negative media attention– However, the government and MAXIMUS both remain committed to the success of this importantwelfare reform initiative• In Australia, we were recently awarded a contract with a new client, the Department ofImmigration and Citizenship– The 20-month contract has an estimated value between $15 million and $20 million, depending onspecific client volumes, and has a 12-month extension option; this new work more than offsets a coupleof short-term initiatives that were completed earlier in the year– MAXIMUS will provide client support and independent observer services for young unaccompaniedasylum seekers and refugees arriving in Australia• MAXIMUS has been selected for a workforce services pilot program in Saudi Arabia– Contract was signed in June, operations went live last week, and the program is expected to provide 15months of revenue in the range of $12 million to $15 million– MAXIMUS is serving job seekers through five sites, providing case management support andaddressing barriers to employment; each site has a business development officer to develop andmaintain relationships with employers and local industriesGovernments around the world face similar challenges with social issues, and we arepleased to expand our core service offerings to new programs and geographies

New Awards and Sales PipelineSales pipeline is at a record level of $3.4 billion; most notably, of this $3.4billion, we are awaiting decisions on submitted proposals that have a totalcontract value of $1.7 billion

Conclusion• Pleased with our progress on our short-termgoals to grow the business:Integration of PSI going wellSigned our first HIX contractGaining more traction in our federal operationsContinue to expand the global footprint with anew pilot program in Saudi Arabia and a newpopulation in AustraliaUK contract remains on track to achievebreakeven before the end of FY12• With increased EPS guidance for theremainder of this fiscal year, FY13 shaping upto be a great year as a result of:A full year’s contribution from PSIA profitable contract in the UKThe many domestic and global opportunitieson the horizon