Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - James River Coal CO | v320757_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - James River Coal CO | v320757_ex99-1.htm |

EXHIBIT 99.2

Shareholder Update August 2012

2 Forward - Looking Statements Certain statements in this press release and other written or oral statements made by or on behalf of us are "forward - looking statements" within the meaning of the federal securities laws . Statements regarding future events and developments and our future performance, as well as management's expectations, beliefs, plans, estimates or projections relating to the future, are forward - looking statements within the meaning of these laws . Forward looking statements include, without limitation, statements regarding future sales and contracting activity, projected fuel escalators and all guidance figures . These forward - looking statements are subject to a number of risks and uncertainties . These risks and uncertainties include, but are not limited to, the following : our cash flows, results of operation or financial condition ; the consummation of acquisition, disposition or financing transactions and the effect thereof on our business ; our ability to successfully integrate International Resource Partners LP and its related entities (IRP) ; governmental policies, regulatory actions and court decisions affecting the coal industry or our customers’ coal usage ; legal and administrative proceedings, settlements, investigations and claims ; our ability to obtain and renew permits necessary for our existing and planned operation in a timely manner ; environmental concerns related to coal mining and combustion and the cost and perceived benefits of alternative sources of energy ; inherent risks of coal mining beyond our control, including weather and geologic conditions or catastrophic weather - related damage ; our production capabilities ; availability of transportation ; our ability to timely obtain necessary supplies and equipment ; market demand for coal, electricity and steel ; competition ; our relationships with, and other conditions affecting, our customers ; employee workforce factors ; our assumptions concerning economically recoverable coal reserve estimates ; future economic or capital market conditions ; our plans and objectives for future operations and expansion or consolidation ; and the other risks detailed in our reports filed with the Securities and Exchange Commission (SEC) . Management believes that these forward - looking statements are reasonable ; however, you should not place undue reliance on such statements . These statements are based on current expectations and speak only as of the date of such statements . We undertake no obligation to publicly update or revise any forward - looking statement, whether as a result of future events, new information or otherwise . Note : Adjusted EBITDA as used in this Presentation is defined in the Company’s Press Release, which, along with this Presentation, was filed on August 9 , 2012 with the SEC on Form 8 - K .

3 Agenda ● Operations Review ● Opening Comments ● Market Review ● 2012 Guidance ● Miscellaneous

4 Opening Comments Summary ● Maintaining a Strong Balance Sheet with Available Liquidity of $191.9 Million ● Q - 2 Adjusted EBITDA of $22.3 Million; CapEx of $23.0 Million ● Reached Agreements to Ship 816,000 Tons of Metallurgical (≈3/4) and Thermal/Industrial (≈1/4) Coal in 2012 at an Average Sales Price of $114.83 Per Ton ● Received 5 New Surface Mining Permits from State and Federal Regulatory Agencies ● Confirming All Current 2012 Operating and Financial Guidance; CapEx Remains Under Review

5 Agenda ● Operations Review ● Opening Comments ● Market Review ● 2012 Guidance ● Miscellaneous

6 Operations Review New Surface Mine Permits Issued Company Mine Estimated Tonnage Mine Life Triad Freelandville 4.2 Million Tons 8 Years Triad Log Creek 5.8 Million Tons 7 Years Hampden (WV) Canebrake 1.9 Million Tons 8 Years JR Coal Service (KY) Wolfpen 2.9 Million Tons 7 Years JR Coal Service (KY) Stacy Branch 3.4 Million Tons 9 Years

7 Operations Review Central Appalachia Market Adjustments ● Adjusting CAPP Production to Soft Market Conditions ● Idled Multiple Mines ● Reduced Shifts and Days at All Operations ● No Delays or Deferrals in Utility Contract Shipments

8 Operations Review ● Developed In - Seam Slope in the Bledsoe Abner Branch Mine ● Expected to Improve Cost and Quality ● Converted Bell County Garmeada Mine to “Super - Section” ● Continued to Upgrade Equipment Fleet at Hampden Met Mines ● Completed Several Surface Mine Reclamation Projects ● Began Development of 3.3 Million Ton Underground Replacement Mine at Blue Diamond Central Appalachia Operations Projects

9 Operations Review Midwest ● Continued Matching Production to Shipments ● Freelandville 404 Corp of Engineers Permit Allows Mine to Get to Normal Mining Sequence Improving Production and Cost ● Began Development of 600,000 Ton Hurricane Creek Surface Mine to Replace Augusta Surface Mine

10 Agenda ● Operations Review ● Opening Comments ● Market Review ● 2012 Guidance ● Miscellaneous

11 Metallurgical Coal ● Supply Has Remained High Due to: ● Resolution of Labor Issues in Australia ● U.S. Producers Emphasizing Met Over Thermal Market Review Demand Supply ● International Macroeconomic Concerns ● Demand Has Slowed – But Only Slightly ● Australian Prices Have Come Down Sharply ● U.S. Customers are Asking for 2013 Proposals We Are Cautious Through the End of the Year

12 Thermal Coal ● CAPP Prices Have Risen ≈ 25% in the Past 6 Weeks ● Stockpiles are Coming Down Due to Production Cutbacks and Summer Temperatures ● Utilities are Waiting Until Fall Before Issuing 2013 RFP’s Market Review Demand Supply ● Production Cutbacks Have Continued ● Selling of Excess Coal by Utilities has Been Reduced We See Continued Firming From A Very Low Base

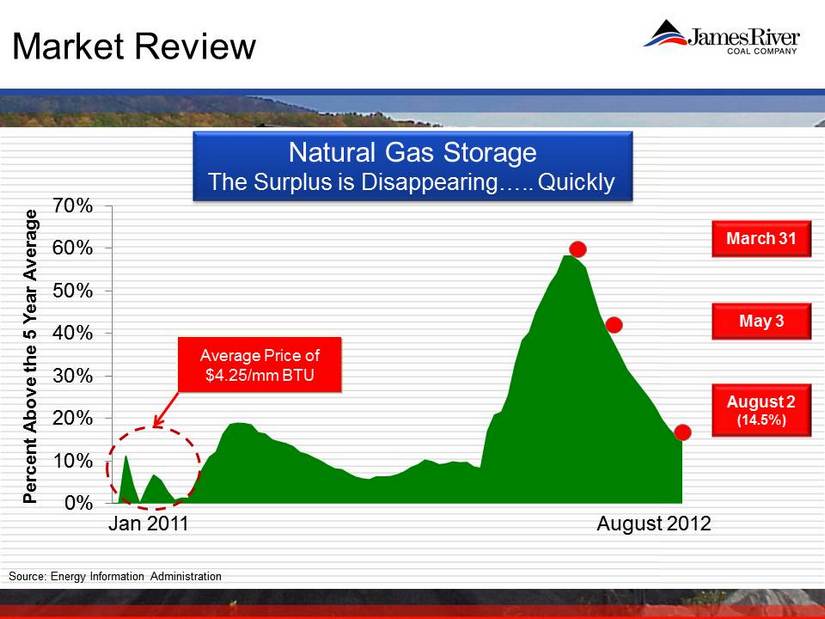

Market Review Natural Gas Storage The Surplus is Disappearing….. Quickly 0% 10% 20% 30% 40% 50% 60% 70% Jan 2011 August 2012 Source: Energy Information Administration March 31 May 3 August 2 (14.5%) Average Price of $4.25/mm BTU Percent Above the 5 Year Average

14 Agenda ● Operations Review ● Opening Comments ● Market Review ● 2012 Guidance ● Miscellaneous

15 2012 Guidance Capital Expenditure Guidance Remains Withdrawn Due to Ongoing Reviews by the Operations Management Team No Change to Operating and Financial Guidance Issued March 2012 Updated Guidance

16 Agenda ● Operations Review ● Opening Comments ● Market Review ● 2012 Guidance ● Miscellaneous

Miscellaneous 17 Upcoming Investor Conferences and Meetings (Webcast May be Accessed at www.jamesrivercoal.com) September 14, 2012 Sterne Agee Executive Summit Boston October 1 - 4, 2012 Johnson Rice Energy Conference New Orleans November 14, 2012 Dahlman Rose 3 rd Annual Global Metals, Mining & Materials New York November 29, 2012 UBS Mini Coal Conference Boston 3rd Quarter Report – November 7 th or 8 th

18 Question and Answer Session