Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NATIONAL FUEL GAS CO | d390182d8k.htm |

National Fuel Gas Company

Investor Presentation

August 2012

Exhibit 99 |

August

2012 National Fuel Gas Company

2

Safe Harbor For Forward Looking Statements

www.nationalfuelgas.com.You

can

also

obtain

this

form

on

the

SEC’s

website

at

www.sec.gov.

This presentation may contain “forward-looking statements” as defined by the

Private Securities Litigation Reform Act of 1995, including statements regarding future prospects, plans,

performance and capital structure, anticipated capital expenditures and completion of

construction projects, as well as statements that are identified by the use of the words “anticipates,”

“estimates,” “expects,” “forecasts,” “intends,”

“plans,” “predicts,” “projects,” “believes,” “seeks,” “will,” “may,” and similar expressions. Forward-looking statements involve risks and

uncertainties, which could cause actual results or outcomes to differ materially from those

expressed in the forward-looking statements. The Company’s expectations, beliefs and projections

contained herein are expressed in good faith and are believed to have a reasonable basis, but

there can be no assurance that such expectations, beliefs or projections will result or be achieved

or accomplished.

In addition to other factors, the following are important factors that could cause actual

results to differ materially from results referred to in the forward-looking statements: factors affecting

the Company’s ability to successfully identify, drill for and produce economically viable

natural gas and oil reserves, including among others geology, lease availability, title disputes,

weather conditions, shortages, delays or unavailability of equipment and services required in

drilling operations, insufficient gathering, processing and transportation capacity, the

need to obtain governmental approvals and permits, and compliance with environmental laws and

regulations; changes in laws, regulations or judicial interpretations to which the

Company is subject, including those involving derivatives, taxes, safety, employment, climate

change, other environmental matters, real property, and exploration and production

activities such as hydraulic fracturing; changes in the price of natural gas or oil; impairments

under the SEC’s full cost ceiling test for natural gas and oil reserves; uncertainty of oil

and gas reserve estimates; significant differences between the Company’s projected and

actual production levels for natural gas or oil; changes in demographic patterns and weather

conditions; changes in the availability, price or accounting treatment of derivative financial

instruments; governmental/regulatory actions, initiatives and proceedings, including

those involving rate cases (which address, among other things, allowed rates of return, rate

design and retained natural gas), environmental/safety requirements, affiliate

relationships, industry structure, and franchise renewal; delays or changes in costs or plans

with respect to Company projects or related projects of other companies, including

difficulties or delays in obtaining necessary governmental approvals, permits or orders or in

obtaining the cooperation of interconnecting facility operators; financial and economic

conditions, including the availability of credit, and occurrences affecting the Company’s

ability to obtain financing on acceptable terms for working capital, capital expenditures and

other investments, including any downgrades in the Company’s credit ratings and changes in

interest rates and other capital market conditions; changes in economic conditions,

including global, national or regional recessions, and their effect on the demand for, and

customers’ ability to pay for, the Company’s products and services; the creditworthiness or

performance of the Company’s key suppliers, customers and counterparties; economic

disruptions or uninsured losses resulting from major accidents, fires, severe weather, natural

disasters, terrorist activities, acts of war, cyber attacks or pest infestation; changes in

price differential between similar quantities of natural gas at different geographic locations,

and the effect of such changes on the demand for pipeline transportation capacity to or from

such locations; other changes in price differentials between similar quantities of oil or

natural gas having different quality, heating value, geographic location or delivery date;

significant differences between the Company’s projected and actual capital expenditures and

operating expenses; changes in laws, actuarial assumptions, the interest rate environment and

the return on plan/trust assets related to the Company’s pension and other post-

retirement benefits, which can affect future funding obligations and costs and plan liabilities;

the cost and effects of legal and administrative claims against the Company or activist

shareholder campaigns to effect changes at the Company; increasing health care costs and the

resulting effect on health insurance premiums and on the obligation to provide other

post-retirement benefits; or increasing costs of insurance, changes in coverage and the

ability to obtain insurance. Forward-looking statements include estimates of oil and gas quantities. Proved oil and

gas reserves are those quantities of oil and gas which, by analysis of geoscience and engineering data,

can be estimated with reasonable certainty to be economically producible under existing economic

conditions, operating methods and government regulations. Other estimates of oil and gas

quantities, including estimates of probable reserves, possible reserves, and resource potential,

are by their nature more speculative than estimates of proved reserves. Accordingly, estimates

other than proved reserves are subject to substantially greater risk of being actually realized.

Investors are urged to consider closely the disclosure in our Form 10-K available at

For a discussion of the risks set forth above and other factors that could cause actual results

to differ materially from results referred to in the forward-looking statements, see “Risk Factors” in

the Company’s Form 10-K for the fiscal year ended September 30, 2011 and Forms 10-Q

for the periods ended December 31, 2011, March 31, 2012, and June 30, 2012. The Company disclaims

any obligation to update any forward-looking statements to reflect events or circumstances

after the date thereof or to reflect the occurrence of unanticipated events. |

August

2012 National Fuel Gas Company

3

Our Business Mix Leads to Long-Term Value Creation

Upstream

Crude Oil

Midstream

Downstream

National Fuel Gas

Supply Corporation

Empire Pipeline, Inc.

National Fuel Gas

Midstream Corporation

National Fuel Gas

Distribution

Corporation

National Fuel

Resources, Inc.

The strategic, operational and financial benefits created by

the integrated mix of assets continues to generate

significant long-term value for the Company in nearly all

economic and commodity price scenarios

Upstream

Natural Gas

Seneca Resources

Corporation

(West Division)

Seneca Resources

Corporation

(East Division) |

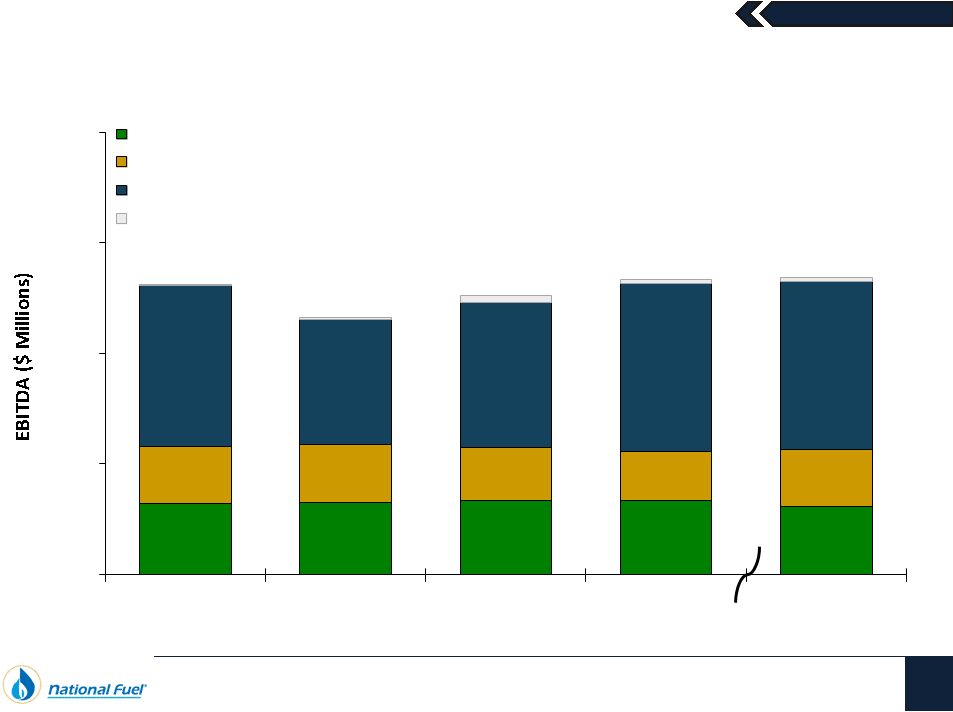

August

2012 $162

25%

$164

28%

$167

26%

$169

25%

$156

23%

$129

20%

$131

23%

$121

19%

$111

17%

$128

19%

$362

55%

$280

48%

$327

52%

$377

57%

$379

56%

$654

$581

$632

$668

$672

$0

$250

$500

$750

$1,000

2008

2009

2010

2011

12 Months Ended

6/30/12

Fiscal Year

Pipeline & Storage Segment

Exploration & Production Segment

Midstream, Energy Marketing & Other

National Fuel Gas Company

4

Integrated Business Mix Provides Financial Balance

Note: A reconciliation of EBITDA to Net Income as presented on the Consolidated Statement of

Income and Earnings is included at the end of this presentation. Utility

Segment |

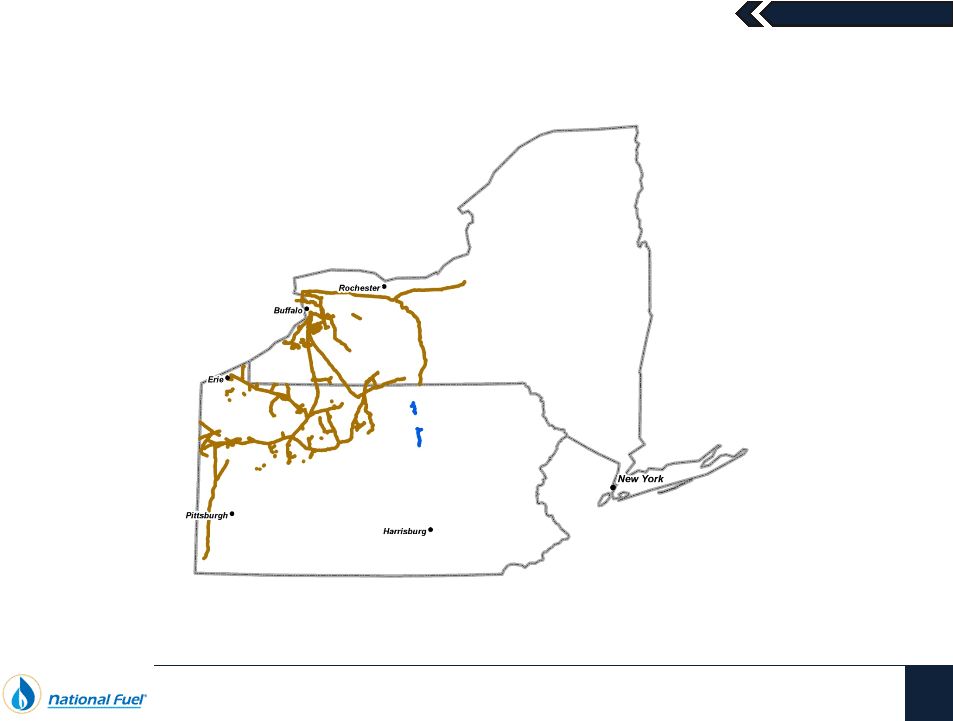

August

2012 National Fuel Gas Company

5

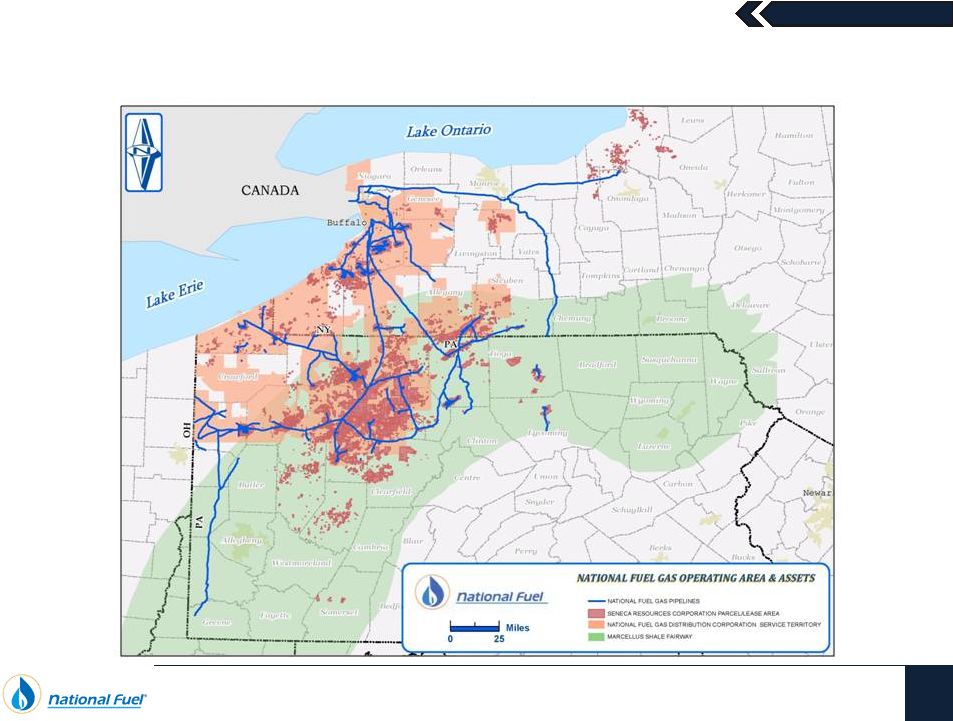

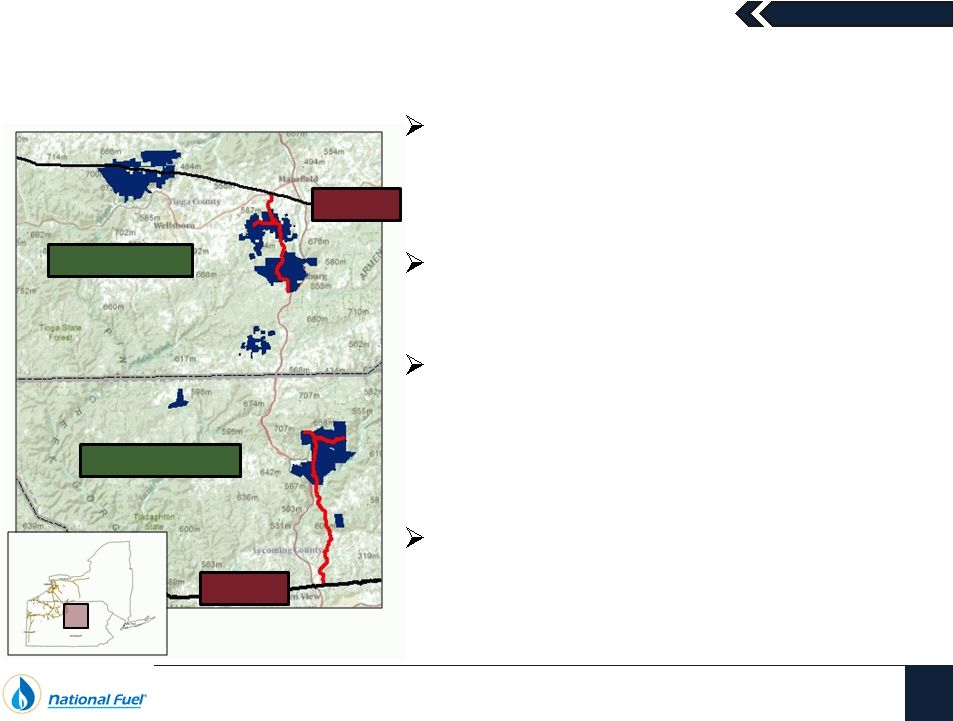

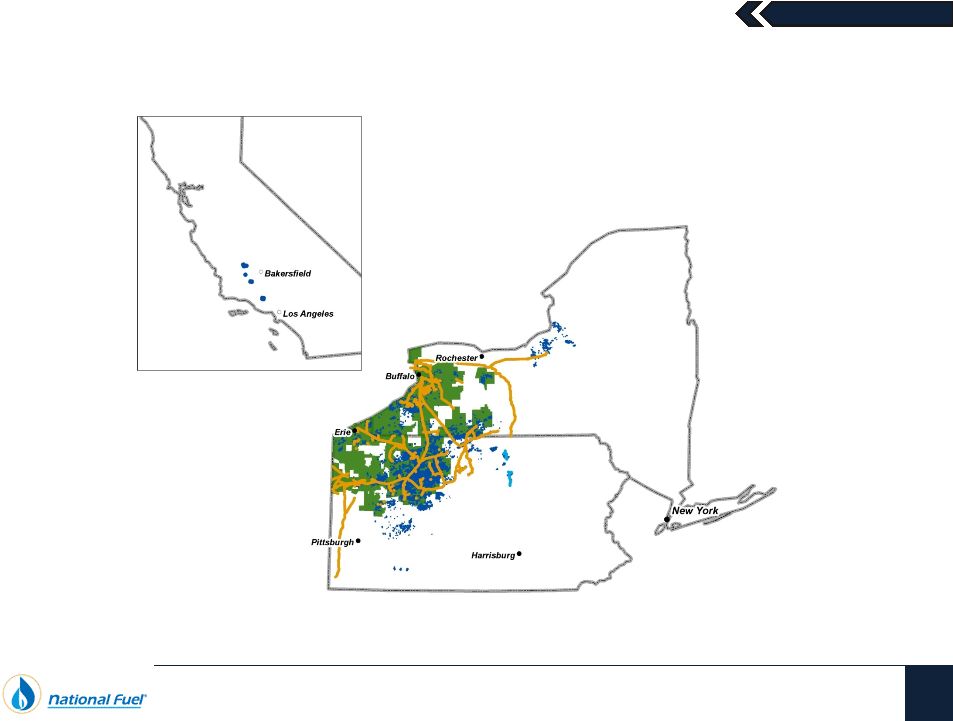

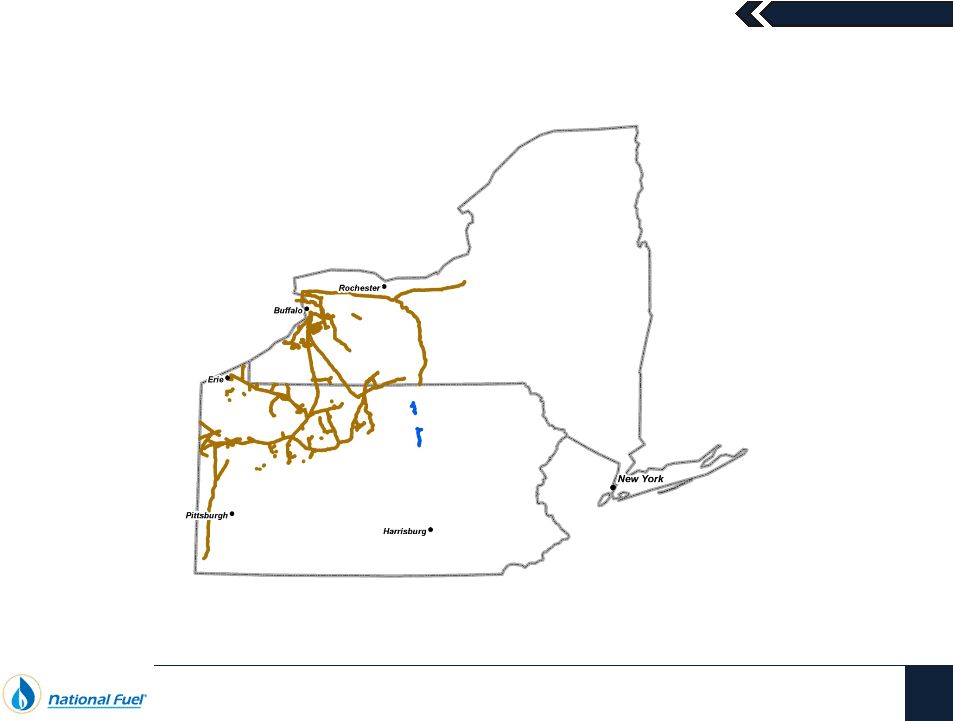

Highly Integrated Assets with Significant Marcellus Exposure…

|

August

2012 National Fuel Gas Company

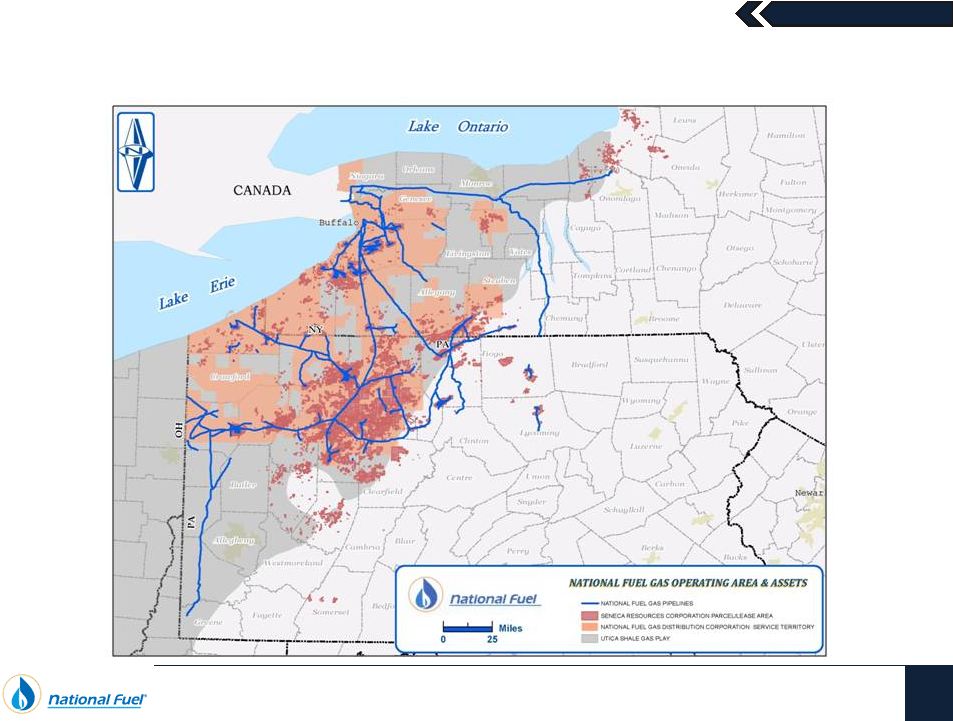

6

…And Exposure to Growth from the Utica Shale |

August

2012 National Fuel Gas Company

Business Mix Allows for Strategic Capital Allocation

Predictable Earnings and Cash Flow

Capital Allocation Priorities

7

Ongoing maintenance capital spending in regulated businesses

Returning earnings to shareholders through consistent dividends

Flexible, return-driven growth capital spending |

August

2012 National Fuel Gas Company

8

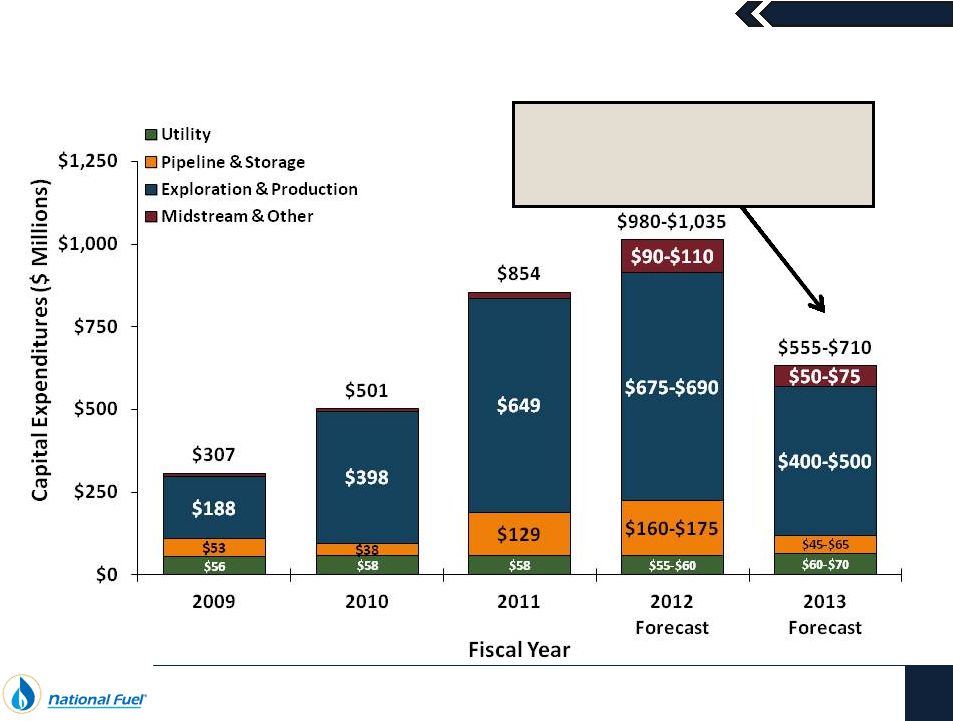

Capital Spending Flexibility to Maintain Financial Strength

Note: A reconciliation to Capital Expenditures as presented on the Consolidated Statement of

Cash Flows is included at the end of this presentation. To the extent additional

infrastructure expansions are available, additional capital

remains flexible and will be deployed

based upon return-driven decision making |

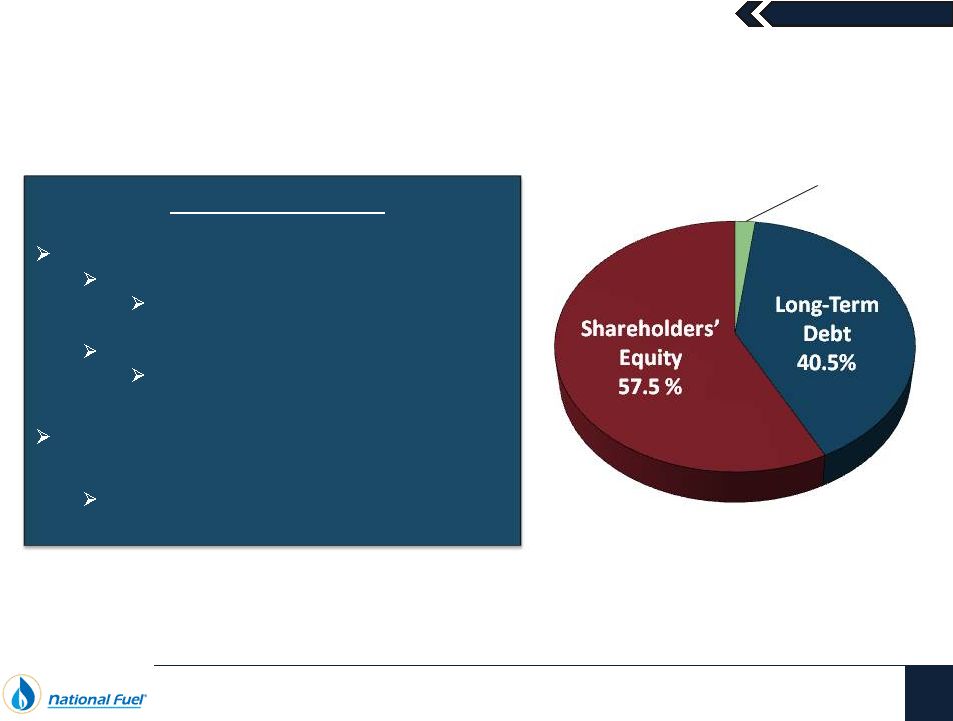

August

2012 Short-Term

Debt

2.0%

National Fuel Gas Company

9

Strong Balance Sheet and Liquidity Position

$3.458 Billion

(1)

As of June 30, 2012

(1) Includes Notes Payable to Banks and Commercial Paper of $70.2 million and Current Portion

of Long-Term Debt of $250.0 million as of June 30, 2012.

Capital Resources

Total Short-Term Capacity: $1,085 Million

Committed Credit Facility: $750 Million

Syndicated facility extends until January 6,

2017

Uncommitted Lines of Credit: $335 Million

$20.2 million of outstanding short-term

notes payable to banks as of June 30, 2012

$300.0 Million Commercial Paper Program

backed by Committed Credit Facility

$50.0 million of outstanding commercial paper

as of June 30, 2012 |

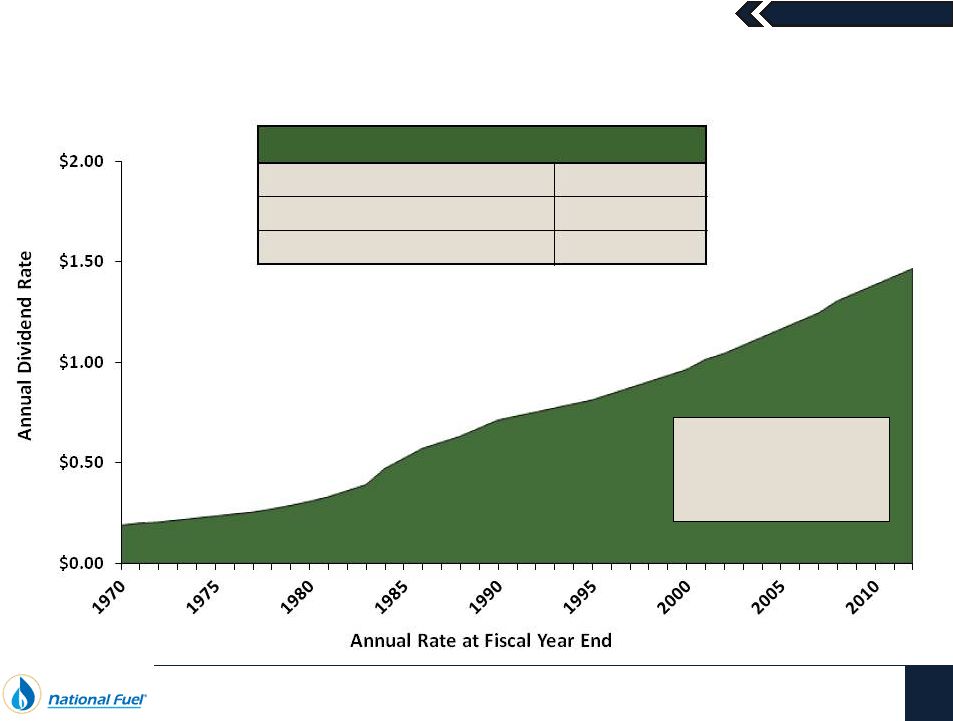

August

2012 National Fuel Gas Company

10

Dividend Track Record

Current

Dividend Yield

(1)

3.0%

(1) As of July 31, 2012

Dividend Consistency

Consecutive Dividend Payments

110 Years

Consecutive Dividend Increases

42 Years

Current

Annualized Dividend Rate

$1.46

per Share |

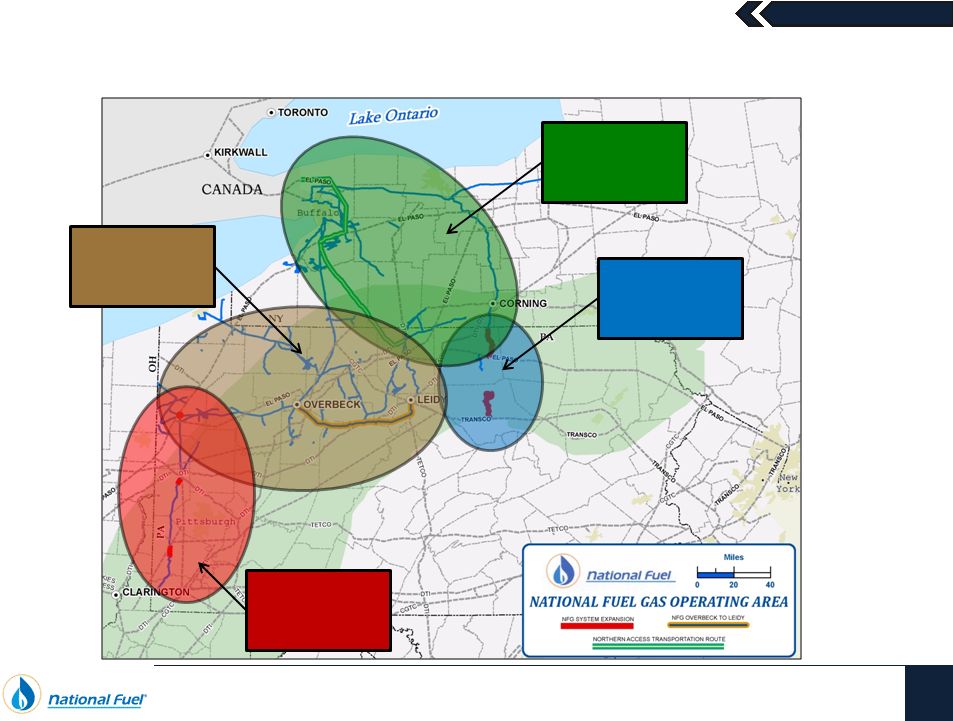

August

2012 Pipeline & Storage / Midstream

11 |

August

2012 Pipeline & Storage / Midstream

12

Ongoing Expansion to Transport Appalachian Production

Longer-Term

Infrastructure

Expansions

Shipping Gas

to Canada &

Northeast

Serving

Southwest PA

Producers

Gathering

Marcellus

Production |

August

2012 Pipeline & Storage / Midstream

13

A Closer Look at the Expansion Progress

MERCER

EXPANSION

PROJECT

(2014 In-Service)

LINE “N”

2012

EXPANSION

(Under Construction)

LINE “N”

EXPANSION

(In-Service)

TROUT RUN

GATHERING SYSTEM

(In-Service)

COVINGTON

GATHERING

SYSTEM

(In-Service)

CENTRAL TIOGA

COUNTY EXTENSION

(2014/2015)

TIOGA COUNTY

EXTENSION

(In-Service)

NORTHERN ACCESS

EXPANSION

(Under Construction)

WEST TO EAST

OVERBECK TO LEIDY |

August

2012 Midstream

14

Using a History of Excellence to Serve Appalachian Producers

Midstream’s gathering systems are

critical to unlock remote, but highly

productive Marcellus acreage

History of operational success and

efficiency within Pennsylvania

Original priority had been to assist

Seneca’s growing development

program and utilize those systems to

gather 3

rd

party producer volumes

As a result of Seneca’s delayed

development plans, the current focus is

shifting to expanding infrastructure for

others in the basin

Transco

Lycoming County

Tioga County

TGP 300 |

August

2012 Pipeline & Storage

15

Regulatory Rate Filings

National

Fuel

Gas

Supply

Corporation

Filed a general rate case with FERC on

October 31, 2011 as part of an agreement

from a 2006 rate settlement

On April 14, 2012 an agreement in

principle was reached to settle the rate

case, with new rates effective May 1,

2012

Rates are effective subject to refund

beginning May 1, 2012

Empire Pipeline, Inc.

Filing did not propose any changes to the

current rate structure

Filed a cost and revenue study on

March 14, 2012 as part of a 2006 FERC

order related to Empire’s transition to

a FERC-regulated interstate pipeline |

August

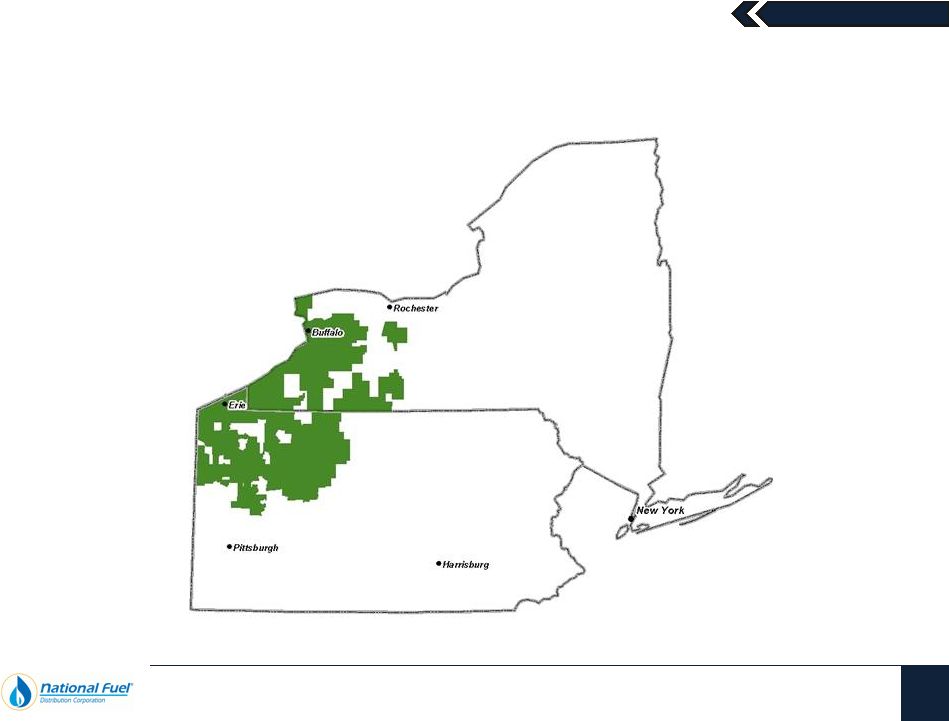

2012 Utility

16 |

August

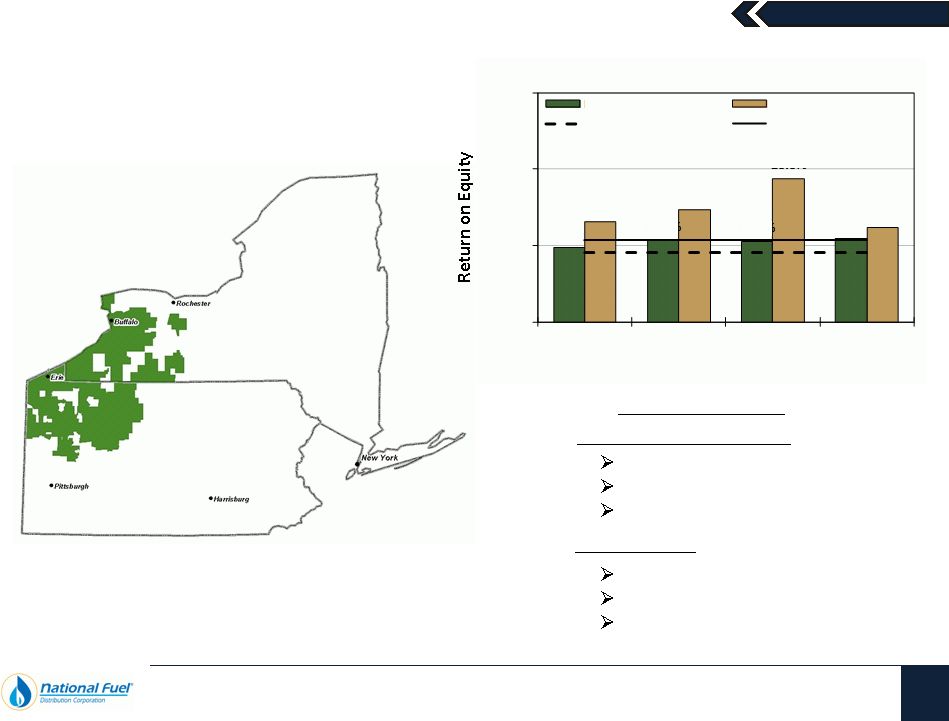

2012 Rate Mechanisms

Low Income Rates

Choice Program/POR

Merchant Function Charge

Revenue Decoupling

90/10 Sharing

Weather Normalization

Utility

17

Providing Financial Stability

9.8%

10.6%

10.5%

10.9%

13.2%

14.7%

18.8%

12.4%

0.0%

10.0%

20.0%

30.0%

2009

2010

2011

TME

6/30/2012

Fiscal Year

Return on Equity

NY

PA

Allowed ROE -

NY

Approx. Settled ROE -

PA

New York & Pennsylvania

New York only |

August

2012 Utility

18

Continued Cost Control Helps Provide Earnings Stability

Low natural gas prices,

combined with a focus on

cost control, continue to

help reduce expenses

$178

$164

$167

$168

$168

$25

$27

$14

$11

$9

$203

$191

$181

$179

$177

$0

$50

$100

$150

$200

$250

2008

2009

2010

2011

12 Months Ended

June 30, 2012

Fiscal Year

All Other O&M Expenses

O&M Expense -

Uncollectibles |

August

2012 Utility

19

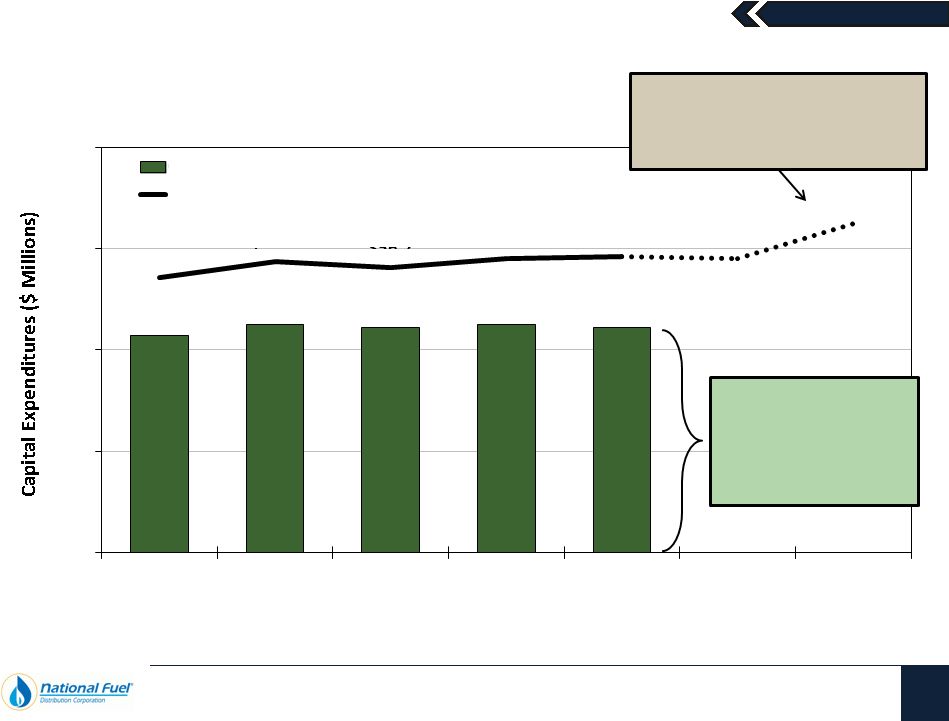

Strong Commitment to Safety

The Utility remains

focused on consistent

spending to maintain the

ongoing safety and

reliability of its system

The anticipated increase in 2013

capital expenditures is largely due

to the implementation of a new

Customer Information System

$42.8

$45.1

$44.4

$45.0

$44.3

$54.2

$57.5

$56.2

$58.0

$58.4

$55-$60

$60

$70

$0

$20

$40

$60

$80

2007

2008

2009

2010

2011

2012

Forecast

2013

Forecast

Fiscal Year

Capital Expenditures for Safety

Total Capital Expenditures

- |

August

2012 Exploration & Production

20 |

August

2012 Seneca Resources

21

Ongoing Strategic Responses to Low Gas Prices

Maintain Focus

on California

Crude Oil

Ongoing

Delineation in

Appalachia

Delaying

Marcellus

Completions

Reduction

In Rig Count

Production

Curtailment

•

Generated $175 million of EBITDA in the first nine months of fiscal 2012

•

Increased capital spending in California

•

Continue to delineate Seneca’s Utica Shale acreage potential

•

Evaluate Marcellus rich-gas potential in the Western Development Area

•

Delaying completions in Tioga County (DCNR Tract 595) due to low natural gas

prices on TGP 300

•

Seneca began fiscal 2012 with 6 rigs and will operate a 3 rig program in fiscal 2013

•

EOG advised Seneca that it likely will not be drilling any wells in fiscal 2013

•

Managing production volumes and future completions in Tioga County, targeting

consistent gross volumes of 130 MMcf per day into TGP 300, which is equivalent

to existing firm sales commitments |

August

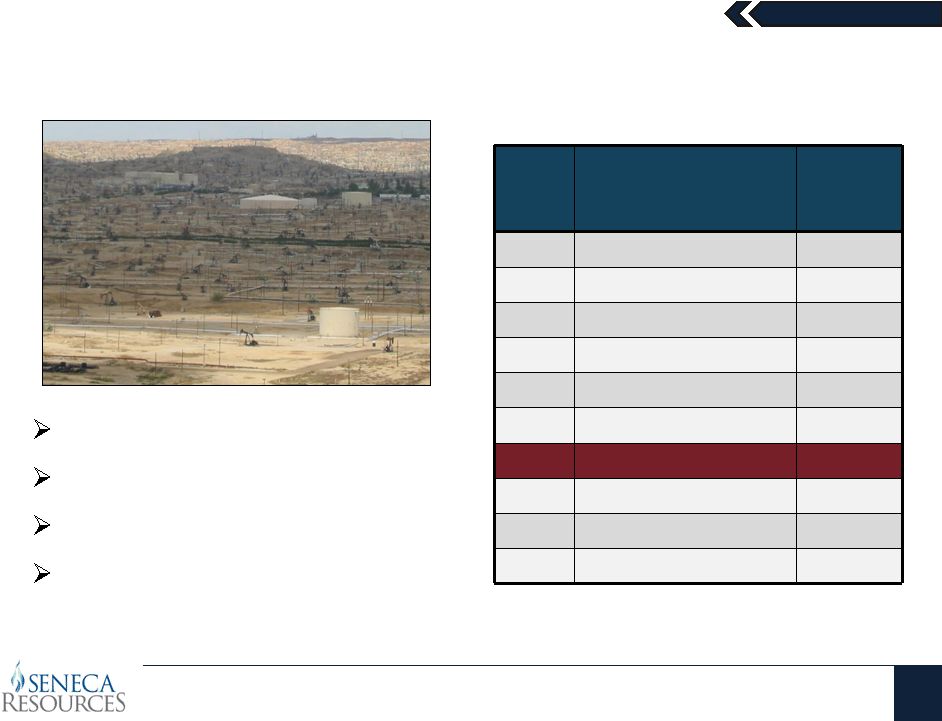

2012 California

22

Stable Production and Increasing Cash Flows

Net Acreage: 11,833 Acres

Net Wells: 1,322

Oil Gravity: 12 –

37°

Api

NRI: 87.64

Rank

Company

California

2011

BOEPD

1

Occidental

164,796

2

Chevron

163,153

3

Aera (Shell/Exxon)

149,974

4

Plains Exploration

36,775

5

Venoco Inc.

18,988

6

Berry Petroleum

18,872

7

Seneca Resources

9,209

8

Macpherson Oil

9,022

9

E&B Natural Resources

5,992

10

ExxonMobil

3,238 |

August

2012 California

23

Stable Production Fields

South Lost Hills

~1,700 BOEPD

Monterey Shale

Primary

215 Active Wells

Sespe

~1,200 BOEPD

Sespe Formation

Primary

188 Active Wells

North Lost Hills

~1,200 BOEPD

Tulare & Etchegoin Formation

Primary & Steamflood

181 Active Wells

North Midway Sunset

~4,400 BOEPD

Potter & Tulare Formation

Steamflood

728 Active Wells

South Midway Sunset

~1,000 BOEPD

Antelope Formation

Steamflood

109 Active Wells |

August

2012 California

24

Strong Margins Support Significant Free Cash Flow

Average Revenue

in First Nine Months

of Fiscal 2012

$86.23 per BOE

$8.64

3.18

$2.60

$2.37

$1.03

Non

Steam Fuel LOE

Steam Fuel

G&A

Production & Other Taxes

Other Operating Costs

EBITDA

Fiscal Year 2012 (First Nine Months) EBITDA per BOE

$

$67.64

Note: A reconciliation of Exploration & Production West Division EBITDA to Exploration

& Production Segment Net Income is included at the end of this presentation. |

August

2012 Seneca Resources

25

California –

Recent Initiatives Driving Near-Term Growth

Production Increase Drivers

1.

North Midway Sunset Steaming

2.

South Midway Sunset Field Extensions

3.

Sespe Infill Drill Program

8,500

9,000

9,500

10,000

Actual

Forecast

8,000 |

August

2012 26

Midway Sunset South Activity Update

2011 Drill Program

2012 Drilling Locations

Updip Sand Pinch-out

Approx. Oil/Water Contact

100 ft

100 ft

50 ft

Antelope “A-1”

and “A-2”

Sands

Antelope “B”

and “C”

Sands

Antelope “A-1”

Sand

Seneca Western Minerals 251T

Extended 251 Pool to the West

Seneca Western Minerals 242I

Extended 252 Pool to the West

100 ft

400’

50 ft

50 ft

50 ft

Seneca Resources

2011 Drill Program: 12 Wells / 4 Injectors

2012 Drill Program: 23 Wells / 3 Injectors |

August

2012 27

350’

Thick

(Medium Blue)

800’

Thick

(Dark Red)

~550’

Thick

(Green)

White Star –

5 Acre Tests

Powell –

10 Acre Tests

Powell 4

61 BOEPD

1 Oil 11/11

WS 534-33

42 BOEPD

1 Oil 1/12

White Star –

10 Acre Test

WS 48-33

1 Production

August 2012

WS 533-33

88 BOEPD

1 Oil 1/12

“X”

SANDS ISOCHORE (Thickness)

Seneca Resources

Sespe Field –

2011 Drilling Highlights and Results

Powell 3

136 BOEPD

1 Oil 10/11

2011 Sespe Highlights

5 Wells Drilled (Two 5-acre infill tests)

Estimated EURs: 150-200 MBoe/Well

1 Mile

st

st

st

st

st |

August

2012 28

Oak Flat (10)

Frankel A (5)

Thornbury (10/5)

Coldwater Tests

“X”

SANDS ISOCHORE (Thickness)

Seneca Resources

Sespe Field –

2012 Drill Plan Builds Upon 2011 Successes

350’

Thick

(Medium Blue)

800’

Thick

(Dark Red)

~550’

Thick

(Green)

2012 Sespe Plans

6 Wells Planned (2 5-acre infill wells)

Estimated EURs: 140-170 MBoe/Well

1 Mile

Proposed Bottom Hole Locations |

August

2012 Seneca Resources

29

Monterey Shale Play

Monterey Shale Play

Belridge Field

5 AMIs across the field

Seneca WI: 12.5%

Seneca NRI: 11.1%

Producing (Gross): 50 BOPD

3-4 Delineation Wells Planned

AMI Outlines

Gross Thickness of Monterey Interval |

August

2012 Seneca Resources

30

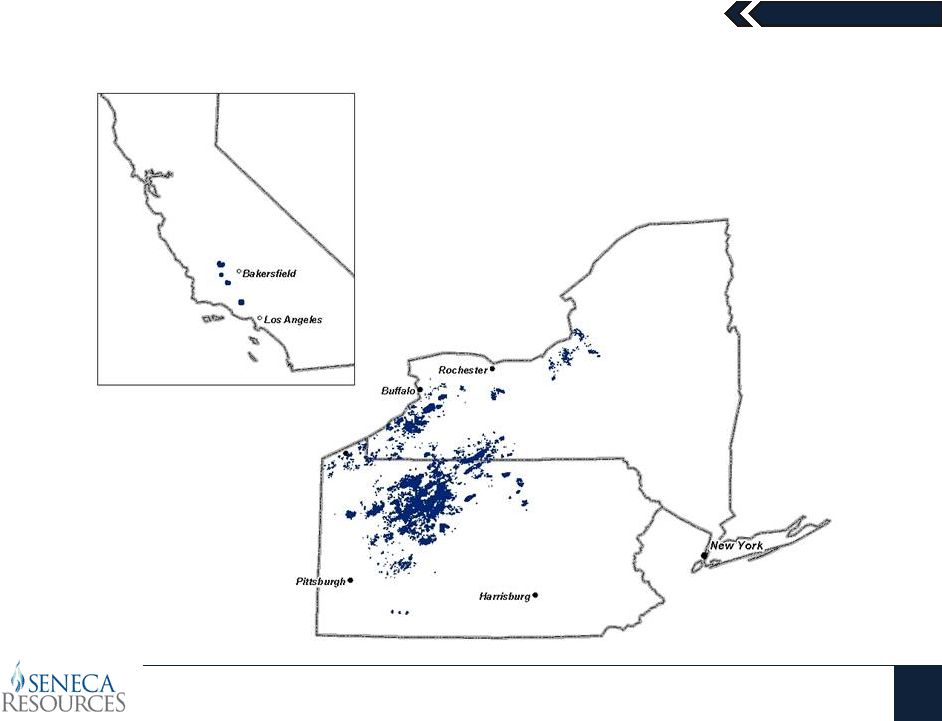

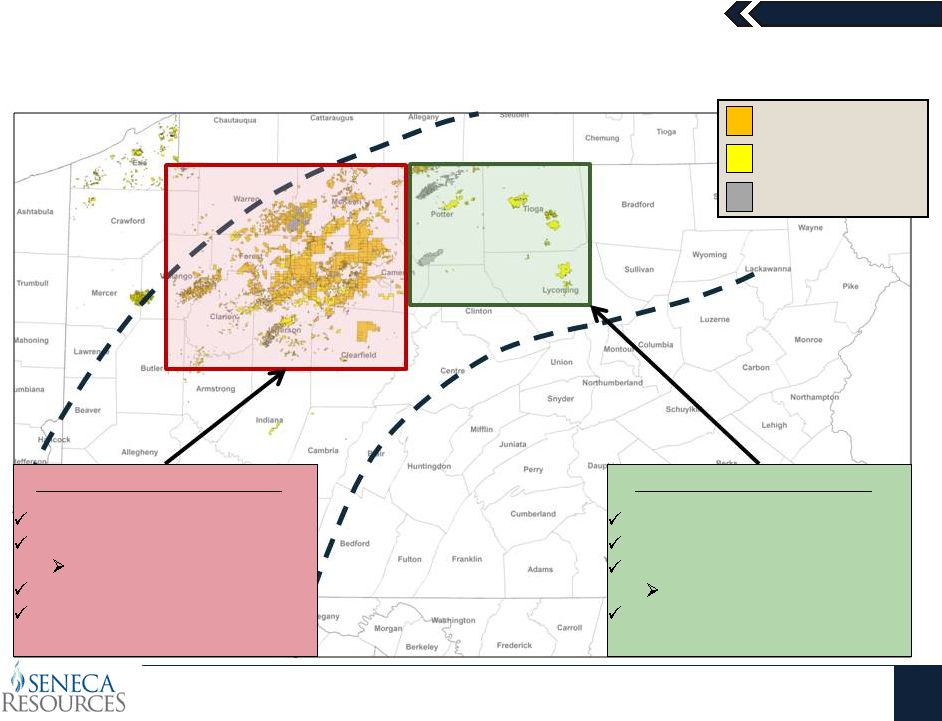

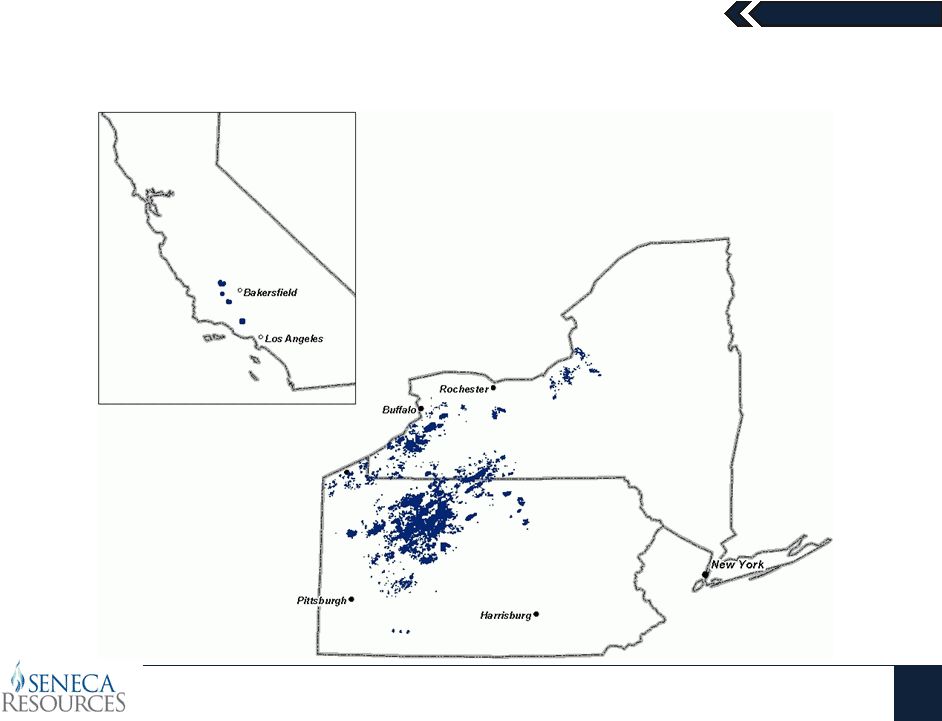

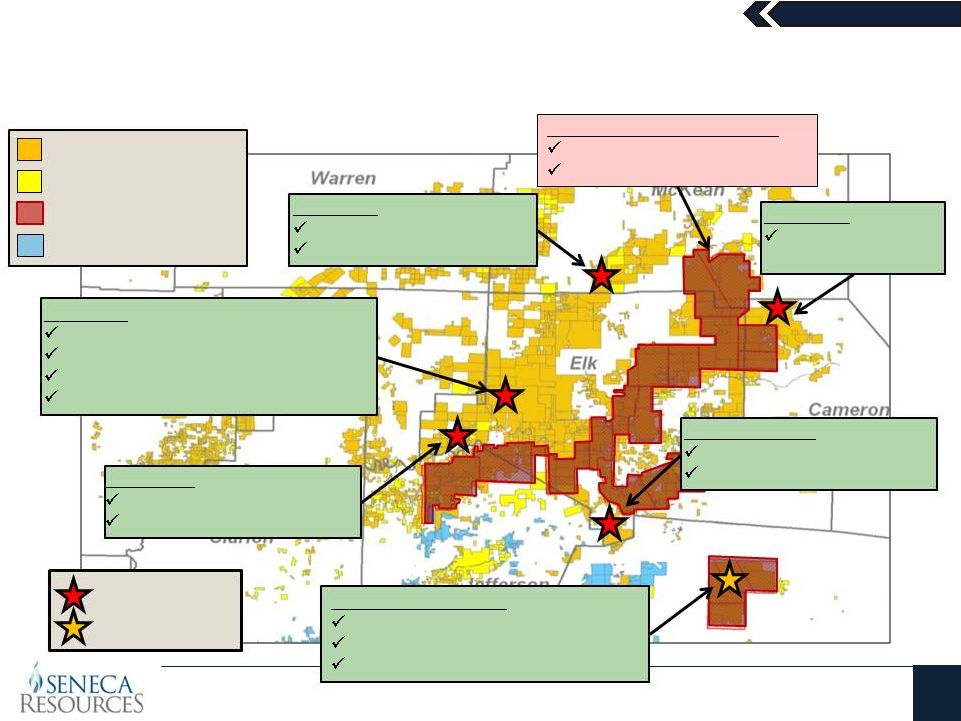

Expansive Pennsylvania Acreage Position

SRC Lease Acreage

SRC Fee Acreage

Eastern Development Area

Net Acreage: 55,000 acres

Mostly leased (16-18% royalty)

No near-term lease expiration

First large expiration: 2018

Ongoing development drilling in

Western Development Area

Net acreage:

~700,000 acres

Own most mineral rights

Minimal

royalty obligation

Minimal

lease expiration

Evaluating Marcellus rich-gas

NFG Storage Acreage

and Utica Shale potential

Tioga and Lycoming Counties |

August

2012 Seneca Resources

31

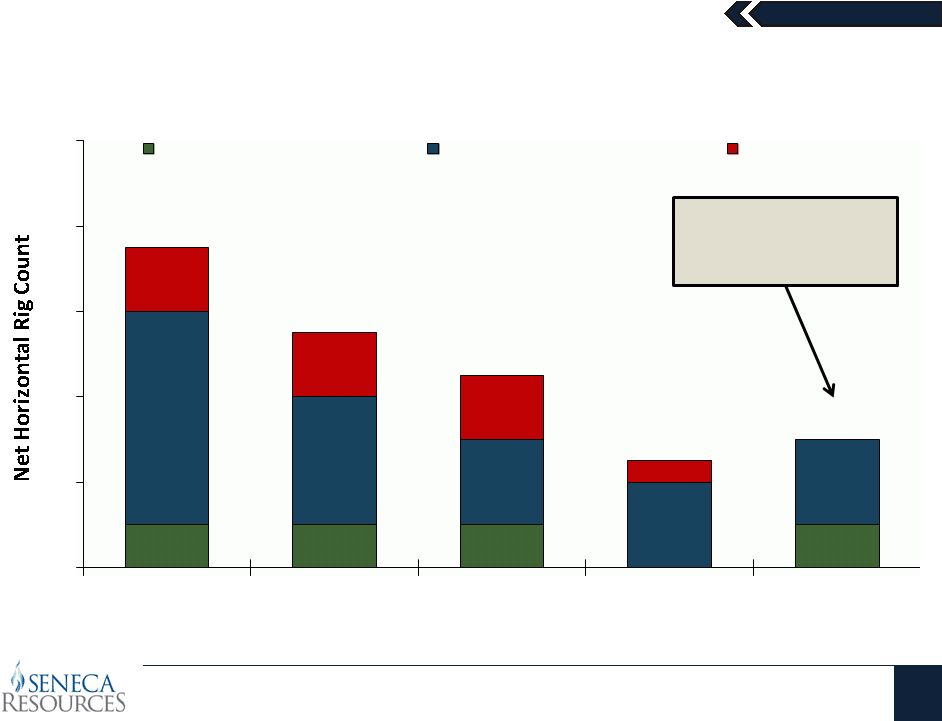

Net Rig Count (Working Interest)

Seneca anticipates

minimal joint venture

activity in fiscal 2013

Seneca Resources -

Delineation

Seneca Resources -

Development

EOG Resources

0

4

6

8

10

Fiscal 2012 -

Q1

Fiscal 2012 -

Q2

Fiscal 2012 -

Q3

Current Rig

Count

Fiscal 2013

Forecast

2

1.0

1.0

1.0

1.0

5.0

3.0

2.0

2.0

2.0

1.5

1.5

1.5

0.5

7.5

5.5

4.5

2.5

3.0 |

August

2012 Seneca Resources

32

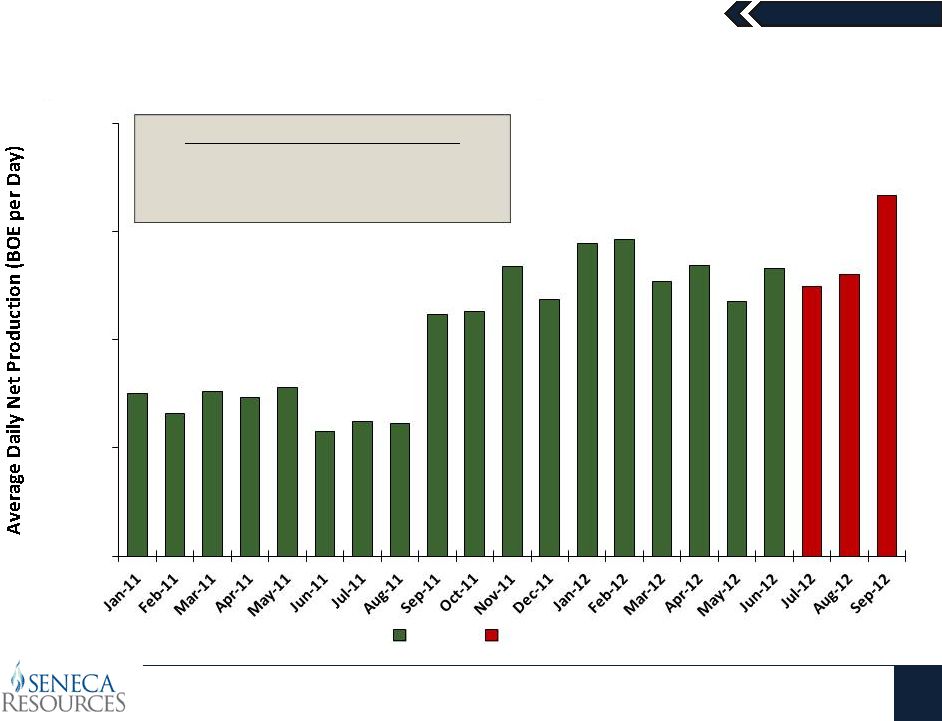

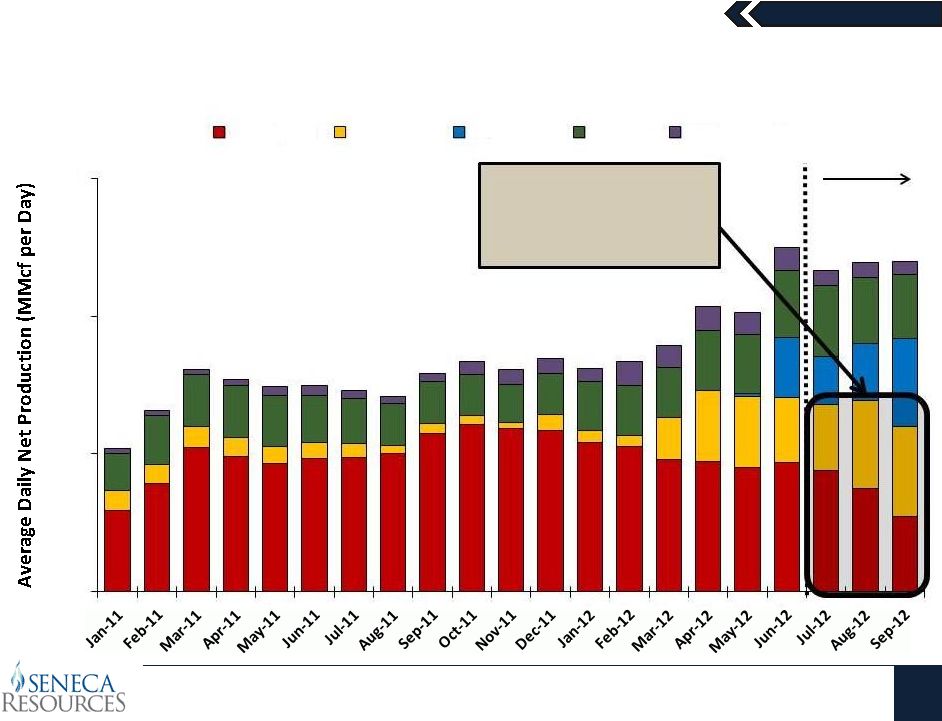

Ramping Marcellus Shale Production

Seneca anticipates

ongoing curtailments of

production into TGP 300

due to low pricing basis

Covington

DCNR 595

DCNR 100

EOG JV

WDA/Other

Forecast

0

75

150

225 |

August

2012 Seneca Resources

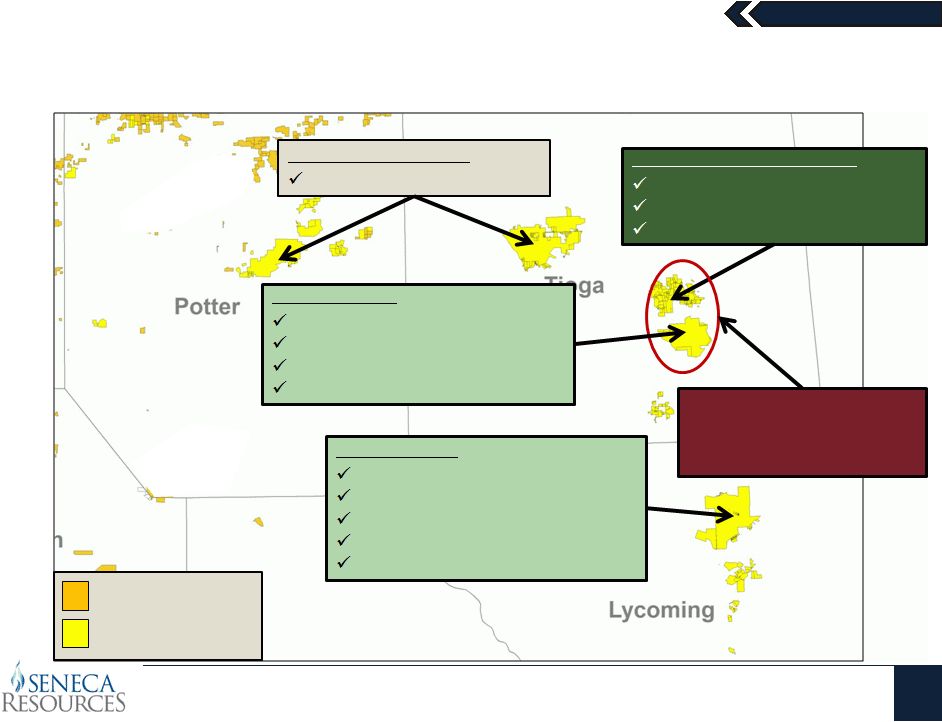

33

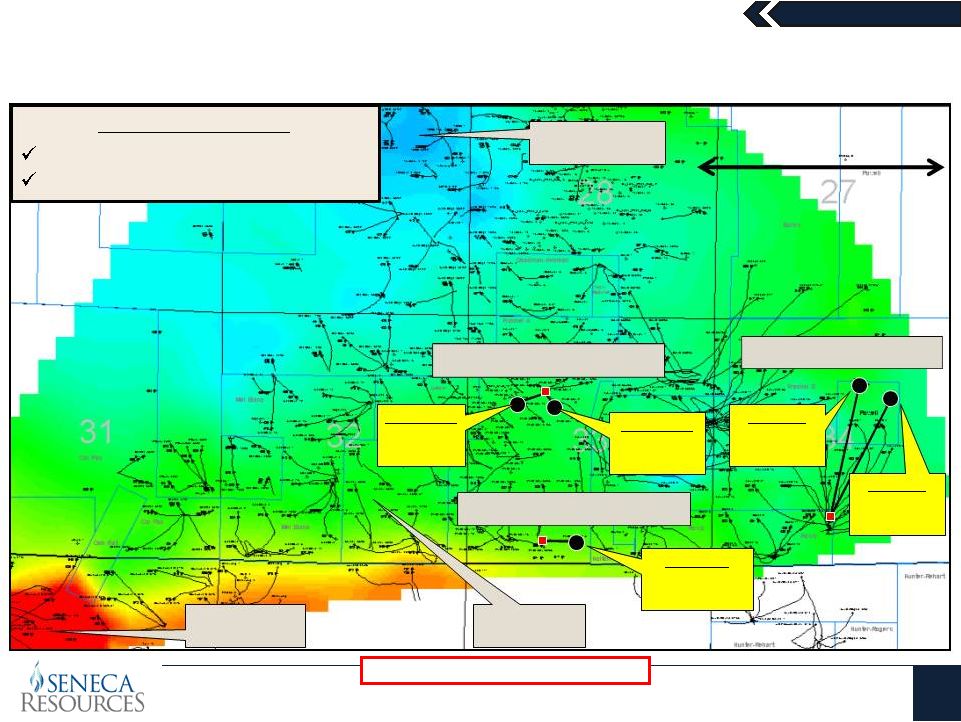

Eastern Development Area (EDA) –

Results & Plan Forward

DCNR Tract 100

17 Wells Drilled; 5 Wells Producing

FY2013: 1-2 Rigs Operating

Peak IPs: 10.1 to 16.1 MMcf per Day

Net Production: ~30 MMcf per Day

Average EUR: 10 Bcf

~20 MMcf per day of gross

production is curtailed due to

very low pricing basis on

uncontracted sales volumes

Covington

–

Fully

Developed

47 Wells Drilled and Producing

Net Production: ~55 MMcf per Day

Average EUR: 5.5 Bcf per Well

DCNR Tracts 007 & 001

Expiration Date: January 2020

DCNR Tract 595

33 Wells Drilled; 19 Wells Producing

FY2013: 0-1 Rigs Operating

Net Production: ~60 MMcf per Day

Average EUR: 7 Bcf per Well

SRC Fee Acreage

SRC Lease Acreage |

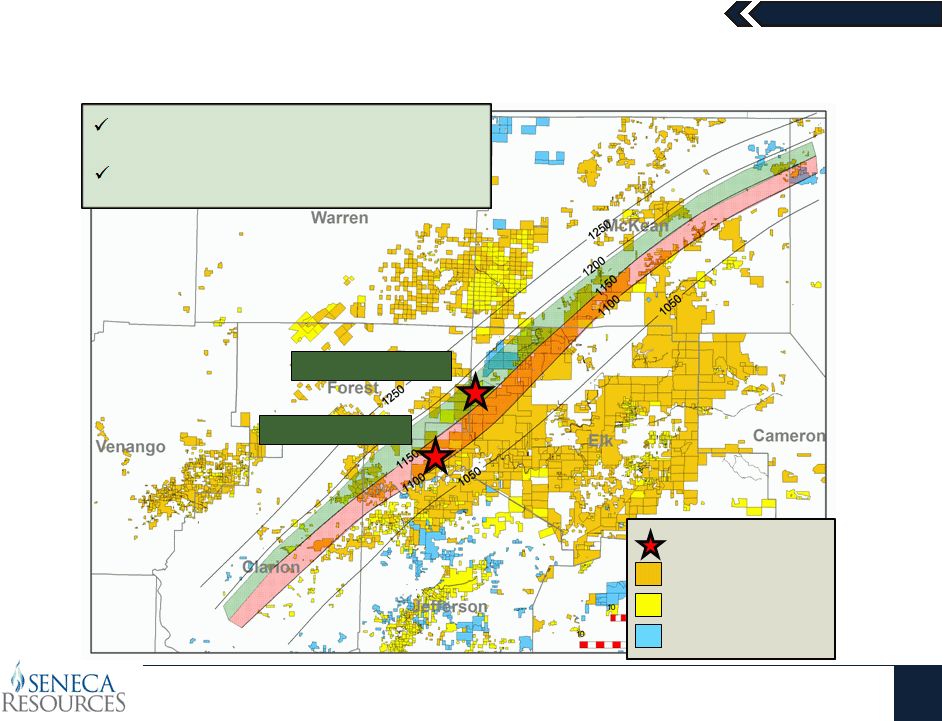

August

2012 Seneca Resources

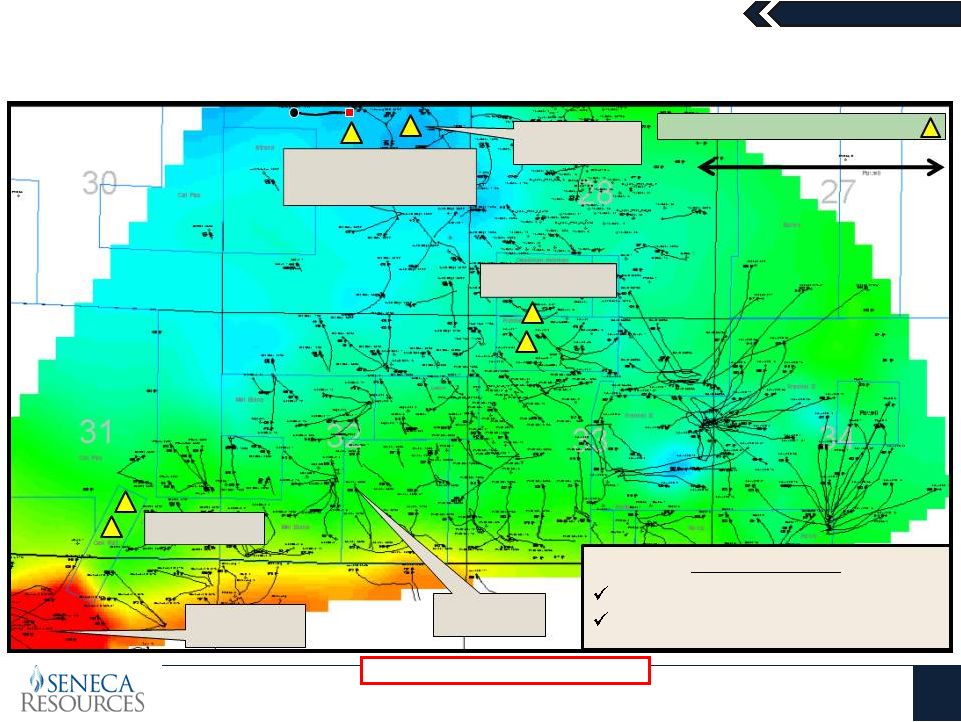

34

Evaluating Marcellus Wet Gas Potential

More

than

100,000

acres

within

the

targeted

window of 1,100 Btu to 1,200 Btu

Will

need

cryogenic

processing

plant

running

in “ethane rejection mode”

processing

SRC Lease Acreage

SRC Fee Acreage

EOG Acreage

Proposed Hz Well

Owl’s Nest (2 Wells)

Church Run (1 Well) |

August

2012 35

Chesapeake

9.5 MMCFD

1,425 BLPD

Chesapeake

3.8 MMCFD

980 BLPD

Chesapeake

3.1 MMCFD

1,015 BLPD

Dry

Wet

Hess

11 MMCFD

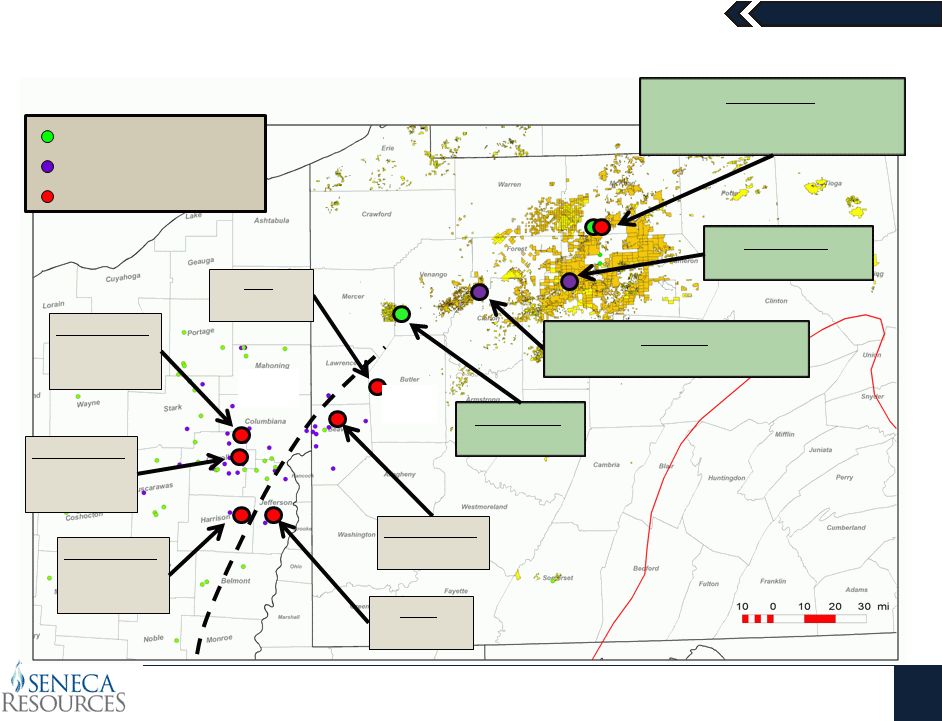

Utica Shale –

Activity Summary

Seneca Resources

Vertical Well Drilled

Horizontal Well Permit

Horizontal Well Drilled

Mt. Jewett

Vertical: Tested Dry Gas

Horizontal: Completing Fall 2012

Henderson

Vertical Well

Tionesta

Horizontal: Completing Fall 2012

Owl’s Nest

Horizontal FY2013

Chesapeake

6.4 MMCFD

Rex

9.2 MMCFD |

August

2012 Seneca Resources

36

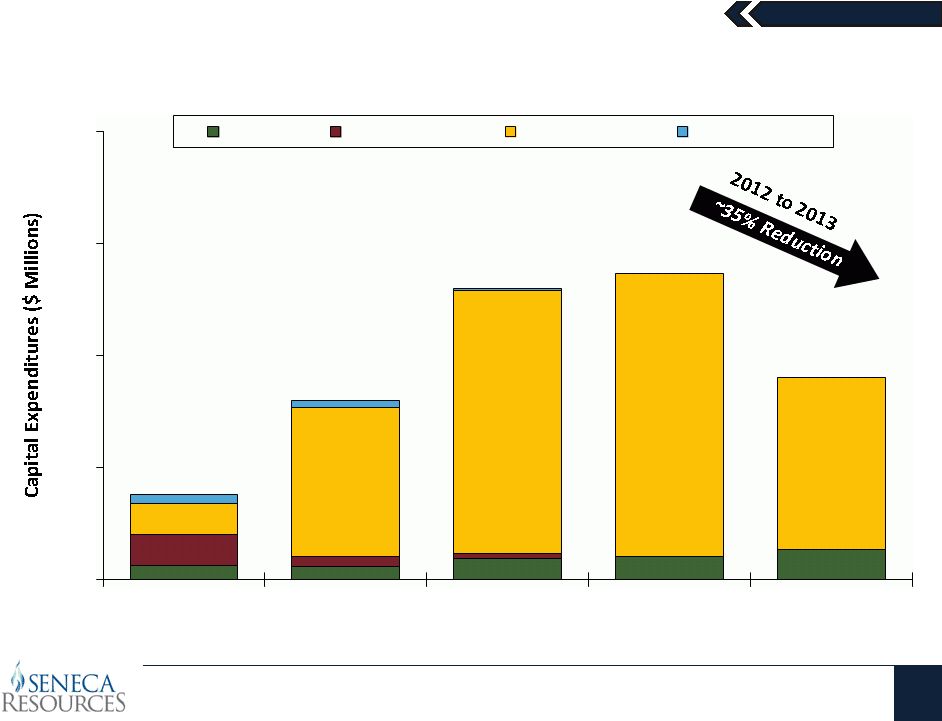

Increased California Spending with Ongoing Marcellus Cuts

(1)

Does not include the $34.9 MM acquisition of Ivanhoe’s U.S.-based assets in

California, as this was accounted for as an investment in subsidiaries on the

Statement of Cash Flows, and was not included in Capital Expenditures

$31

$31

$47

~$50

$60-$75

$68

$71

$332

$585

$625-$640

$340-$425

$188

$398

$649

$675-$690

$400-$500

$0

$250

$500

$750

$1,000

2009

2010

2011

2012 Forecast

2013 Forecast

Fiscal Year

California

Upper Devonian

Marcellus/Utica

Gulf of Mexico

(1)

(1) |

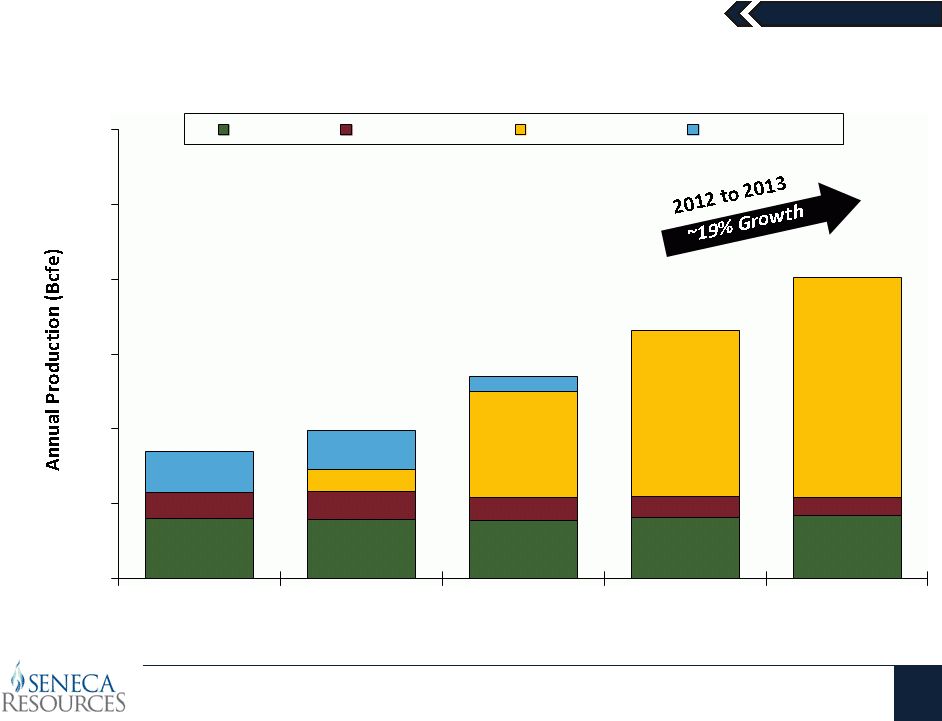

August

2012 Seneca Resources

37

Production Still Growing

20.1

19.8

19.2

20-21

20-22

8.7

9.3

7.9

7

5-7

7.2

35.3

54-57

67-76

13.7

13.3

5.2

42.5

49.6

67.6

81-85

92-105

0

25

50

75

100

125

150

2009

2010

2011

2012 Forecast

2013 Forecast

Fiscal Year

California

Upper Devonian

Marcellus/Utica

Gulf of Mexico |

August

2012 National Fuel Gas Company

38

Appendix |

August

2012 National Fuel Gas Company

39

Fiscal Year 2013 Earnings Guidance Drivers

2013 Forecast

GAAP Earnings per Share

$2.45 -

$2.75

Exploration & Production Drivers

Total Production (Bcfe)

92 -

105

DD&A Expense

$2.30 -

$2.40

LOE Expense

$0.90 -

$1.10

G&A Expense

$59 -

$63 MM

Pipeline & Storage Drivers

O&M Expense

+3%

Revenue

$255 -

$265 MM

Utility Drivers

O&M Expense

+3%

Normal Weather in PA |

August

2012 National Fuel Gas Company

40

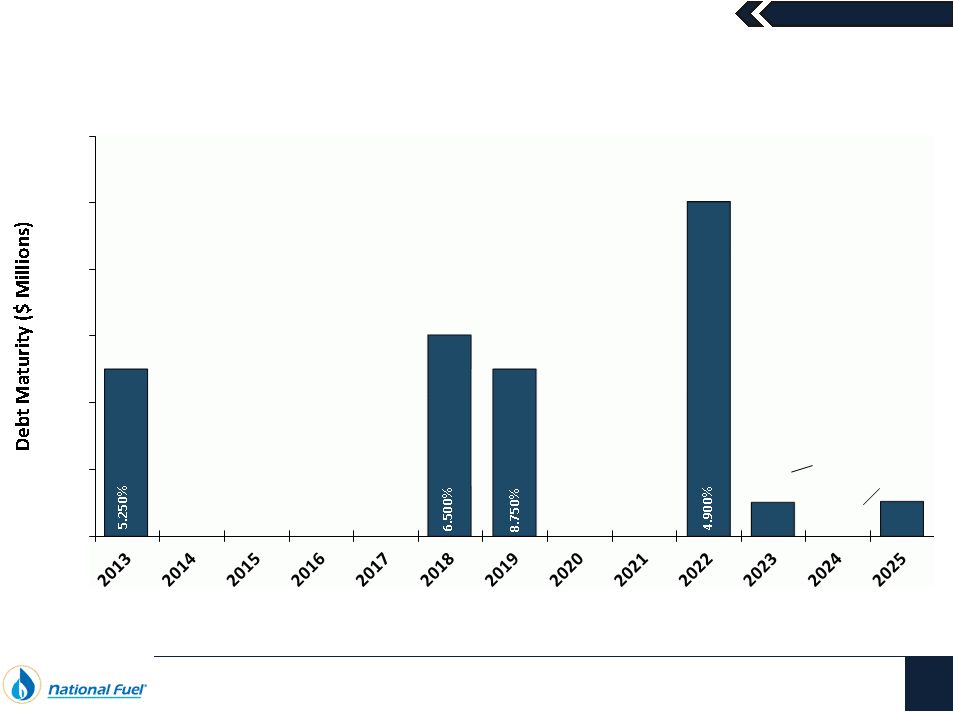

Manageable Debt Maturity Schedule

$250

$300

$250

$500

$49

$50

7.395%

7.375%

$0

$100

$200

$300

$400

$500

$600

Fiscal Year |

August

2012 National Fuel Gas Company

41

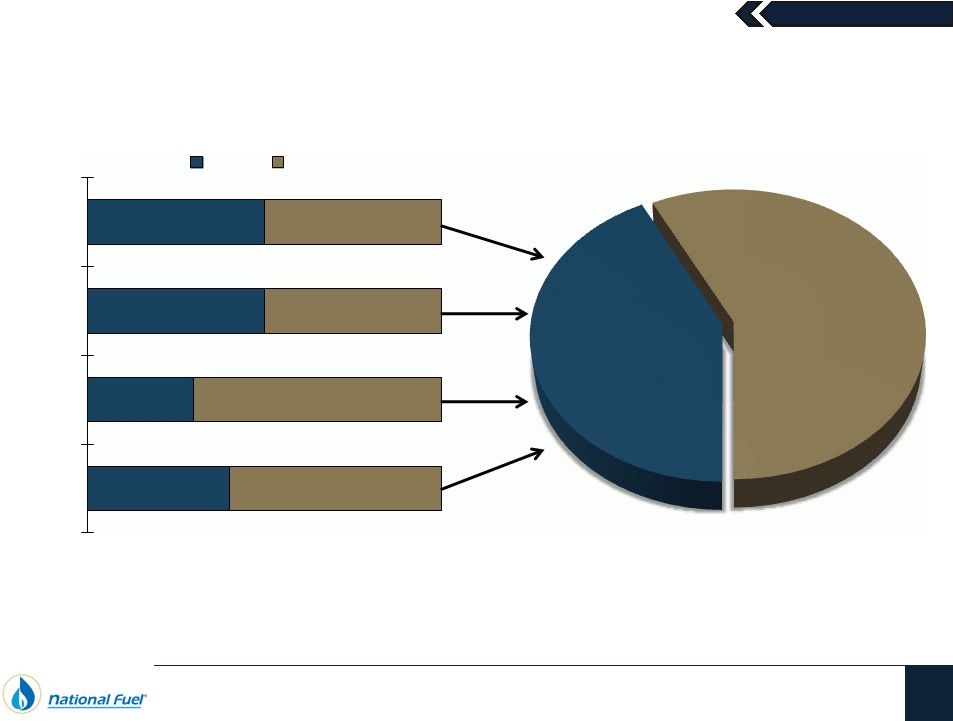

Targeted Capital Structure

Long-Term Consolidated

Capital Structure Target

Capital Structure

Targets by Segment

Debt

35% -

45%

Equity

55% -

65%

40%

30%

50%

50%

60%

70%

50%

50%

All Other

E&P

P&S

Utility

Debt

Equity |

August

2012 Pipeline & Storage / Midstream

42

Appendix |

August

2012 Pipeline & Storage

43

Expansion Initiatives

Project Name

Capacity

(Dth/D)

Est.

CapEx

In-Service

Market

Status

Lamont Compressor Station

40,000

$6 MM

6/2010

Fully Subscribed

Completed

Lamont Phase II Project

50,000

$7.6 MM

7/2011

Fully Subscribed

Completed

Line “N”

Expansion

160,000

$22 MM

10/2011

Fully Subscribed

Completed

Tioga County Extension

350,000

$56 MM

11/2011

Fully Subscribed

Completed

Northern Access Expansion

320,000

~$75 MM

~11/2012

Fully Subscribed

Currently under construction

Line “N”

2012 Expansion

163,000

~$43 MM

~11/2012

Fully Subscribed

Currently under construction

Line “N”

2013 Expansion

30,000

~$4 MM

11/2013

OS Concluded

Negotiating with an anchor shipper for all

capacity

Mercer Expansion Project

150,000

~$30 MM

~6/2014

OS Concluded

In discussions with an anchor shipper

Central Tioga County

Extension

~260,000

~$135 MM

2014/2015

OS Concluded

In discussions with an anchor shipper

West to East

~425,000

~$290 MM

~2015

29% Subscribed

Marketing continues with producers in

various stages of exploratory drilling

Total Firm Capacity: ~1,948,000 Dth/D

Capital Investment: ~$669 MM |

August

2012 Midstream Corporation

44

Expansion Initiatives

Project Name

Capacity

(Mcf/D)

Est.

CapEx

In-Service

Date

Market

Comments

Covington Gathering System

220,000

$54 MM

Multiple

Phases -

Most

In-Service

Capacity Available

[Marketing to

Third Parties]

Completed

–

Flowing into TGP 300

Line. This includes $30 million of

spending to build pipeline and

compression needed to connect

future wells.

Trout Run Gathering System

466,000

$130 MM

May 2012

Capacity Available

[Marketing to

Third Parties]

Completed

–

Flowing into Transco

Leidy Line. This includes $55

million of spending to build

pipeline and compression needed

to connect future wells.

Owl’s Nest Gathering System

200,000

$110 MM

First Phase

FY2014

Fully Subscribed

Preliminary work underway with

development phased in over a five

year period. Any processing costs

would be incremental.

Total Firm Capacity: ~886,000 Mcf/D

Capital Investment: ~$294 MM |

August

2012 Exploration & Production

45

Appendix |

August

2012 National Fuel Gas Company

46

Hedge Positions and Strategy

Natural Gas

Swaps

Volume

(Bcf)

Average

Hedge Price

Fiscal 2012

(1)

12.4

$4.99 / Mcf

Fiscal 2013

46.7

$4.82 / Mcf

Fiscal 2014

27.4

$4.26 / Mcf

Fiscal 2015

17.8

$4.07 / Mcf

Fiscal 2016

17.9

$4.07 / Mcf

Fiscal 2017

17.9

$4.07 / Mcf

Oil Swaps

Volume

(MMBbl)

Average

Hedge Price

Fiscal 2012

(1)

0.4

$77.03 / Bbl

Fiscal 2013

1.5

$92.52 / Bbl

Fiscal 2014

0.6

$95.68 / Bbl

Most hedges executed at sales point to eliminate basis risk

(1)

Fiscal 2012 hedge positions are for the remaining three months of the fiscal year

Seneca has hedged approximately 57% of its

forecasted production for Fiscal 2013 |

August

2012 Marcellus Shale

47

Western Development Area (WDA) –

Results & Plan Forward

Approx. Outline of JV Acreage

200,000 Gross Acres

Seneca 50% W.I. (Avg. 58% NRI)

Punxy (EOG Operated)

80 Wells Drilled; 55 Producing

FY2012: 1 Rig Operating

Gross Production: ~60 MMcf per Day

Owl’s Nest

Drilled 3 Horizontal Wells

Acquiring 3D Seismic

Potential 2013 Wet Gas Development

Expected IPs: 4-5 MMcf per Day

Mt. Jewett

Drilled 3 Horizontal Wells

IPs: 2.4 -

3.1 MMcf per Day

Boone Mountain

Drilled 3 Horizontal Wells

IPs: 3.8 -

4.6 MMcf per Day

Rich Valley

To be completed in

August 2012

Church Run

FY2012: 1 Well

To Test EUR & BTU Content

SRC Fee Acreage

SRC Lease Acreage

SRC Contributed JV Acreage

EOG Contributed JV Acreage

Seneca Operated

EOG Operated |

August

2012 Marcellus Shale

48

Expanding 3D Seismic Coverage

Completed

In Progress

Punxy

West Branch

Mt. Jewett

DCNR 001

DCNR 007

Covington

DCNR 595

DCNR 100

Owl’s Nest |

August

2012 Marcellus Shale

49

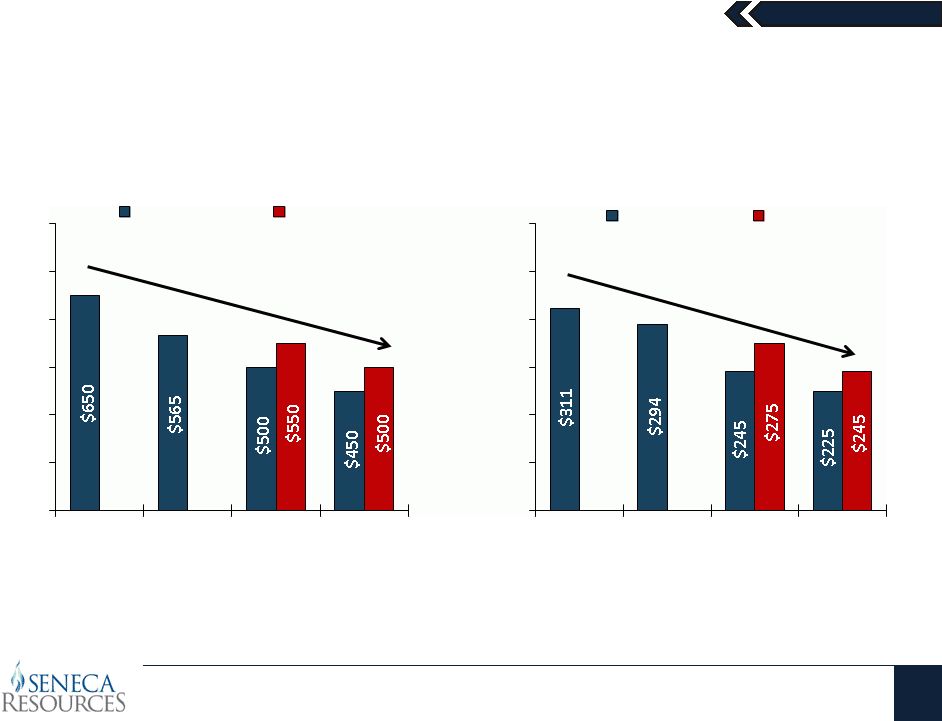

Targeting Continued Cost Reductions

$200

$300

$400

$500

$600

$700

$800

2010

2011

2012

Forecast

2013

Target

Drilling Cost per Lateral Foot

WDA/DCNR 595

DCNR 100

$100

$150

$200

$250

$300

$350

$400

2010

2011

2012

Forecast

2013

Target

Completion Cost per Stage ($000)

WDA/DCNR 595

DCNR 100 |

August

2012 Marcellus Shale

50

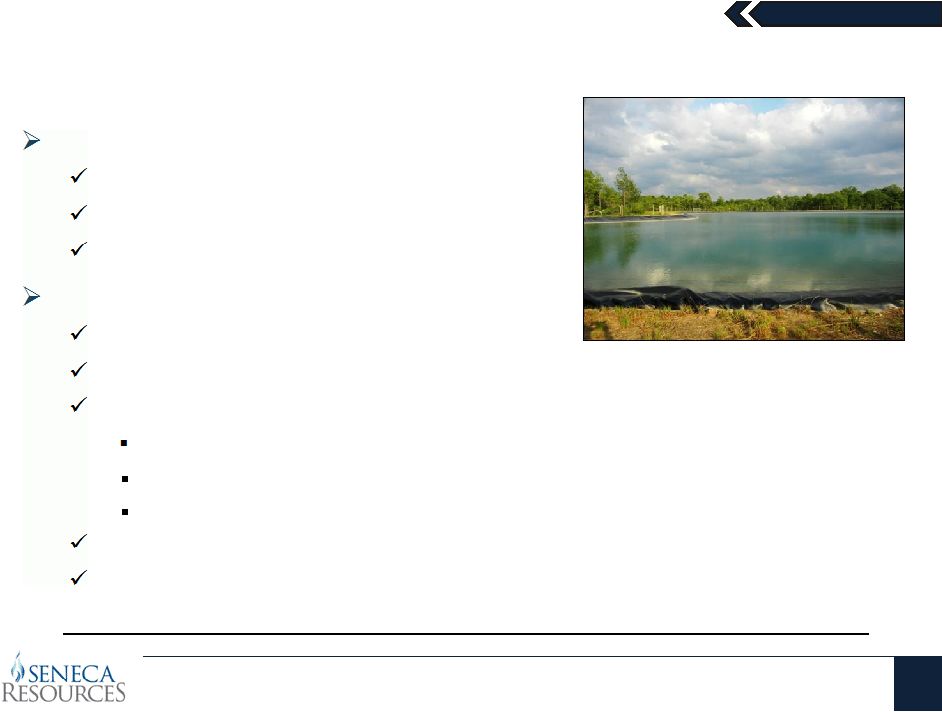

Water Management Program

Water Sourcing:

Coal mine runoff

Permitted freshwater sources

Recycled water

Water Management:

Instituted a “Zero Surface Discharge”

policy

Recycle Marcellus flowback and produced water

Centralized water handling in development areas

Tioga

County

–

DCNR

595

and

Covington

Lycoming

County

–

DCNR

100

Elk County -

Owl’s Nest

Installing new evaporative technology

Investigating underground injection

Seneca is committed to protecting the surface from any type of pollution

|

August

2012 Marcellus Shale

51

“Zero Liquid Discharge Operation”

Utilizing a state-of-the-art evaporative technology to ensure no liquid is

discharged at the surface

Building a centrally located unit in Eastern Development Area (EDA)

Removes all liquids from the production stream

Has the ability to be powered by the waste heat from a compressor station

End products:

Non-hazardous solidified salt material

Clean water vapor emissions |

August

2012 National Fuel Gas Company

52

Comparable GAAP Financial Measure Slides and Reconciliations

This presentation contains certain non-GAAP financial measures. For pages

that contain non-GAAP financial measures, pages containing the most directly

comparable GAAP financial measures and reconciliations are provided in the

slides that follow.

The Company believes that its non-GAAP financial measures are useful to

investors because they provide an alternative method for assessing the

Company’s operating results in a manner that is focused on the performance

of the Company’s ongoing operations, or on earnings absent the effect of

certain credits and charges, including interest, taxes, and depreciation,

depletion and amortization. The Company’s management uses these non-

GAAP financial measures for the same purpose, and for planning and

forecasting purposes. The presentation of non-GAAP financial measures is not

meant to be a substitute for financial measures prepared in accordance with

GAAP. |

Reconciliation of Segment Capital Expenditures to Consolidated Capital Expenditures

($ Thousands)

| FY 2009 | FY 2010 | FY 2011 | FY 2012 Forecast | FY 2013 Forecast | ||||||||||||

| Capital Expenditures from Continuing Operations |

||||||||||||||||

| Exploration & Production Capital Expenditures |

$ | 188,290 | $ | 398,174 | $ | 648,815 | $675,000-690,000 | $400,000-500,000 | ||||||||

| Pipeline & Storage Capital Expenditures - Expansion |

52,504 | 37,894 | 129,206 | $160,000-175,000 | $45,000-65,000 | |||||||||||

| Utility Capital Expenditures |

56,178 | 57,973 | 58,398 | $55,000-60,000 | $60,000-70,000 | |||||||||||

| Marketing, Corporate & All Other Capital Expenditures |

9,829 | 7,311 | 17,767 | $90,000-110,000 | $50,000-75,000 | |||||||||||

|

|

|

|

|

|

|

|

| |||||||||

| Total Capital Expenditures from Continuing Operations |

$ | 306,801 | $ | 501,352 | $ | 854,186 | $980,000-1,035,000 | $555,000-710,000 | ||||||||

| Capital Expenditures from Discountinued Operations |

||||||||||||||||

| All Other Capital Expenditures |

216 | $ | 150 | $ | — | $— | $— | |||||||||

|

|

|

|

|

|

|

|

| |||||||||

| Plus (Minus) Accrued Capital Expenditures |

||||||||||||||||

| Exploration & Production FY 2011 Accrued Capital Expenditures |

$ | — | $ | — | $ | (63,460 | ) | $— | $— | |||||||

| Pipeline & Storage FY 2011 Accrued Capital Expenditures |

— | — | (7,271 | ) | — | — | ||||||||||

| All Other FY 2011 Accrued Capital Expenditures |

— | — | (1,389 | ) | — | — | ||||||||||

| Exploration & Production FY 2010 Accrued Capital Expenditures |

— | (55,546 | ) | 55,546 | — | — | ||||||||||

| Exploration & Production FY 2009 Accrued Capital Expenditures |

(9,093 | ) | 9,093 | — | — | — | ||||||||||

| Pipeline & Storage FY 2008 Accrued Capital Expenditures |

16,768 | — | — | — | — | |||||||||||

| All Other FY 2009 Accrued Capital Expenditures |

(715 | ) | 715 | — | — | — | ||||||||||

|

|

|

|

|

|

|

|

| |||||||||

| Total Accrued Capital Expenditures |

$ | 6,960 | $ | (45,738 | ) | $ | (16,574 | ) | $— | $— | ||||||

| Eliminations |

$ | (344 | ) | $ | — | $ | — | $— | $— | |||||||

|

|

|

|

|

|

|

|

| |||||||||

| Total Capital Expenditures per Statement of Cash Flows |

$ | 313,633 | $ | 455,764 | $ | 837,612 | $980,000-1,035,000 | $555,000-710,000 | ||||||||

|

|

|

|

|

|

|

|

| |||||||||

Reconciliation of Exploration & Production West Division EBITDA to Exploration & Production Segment Net Income

($ Thousands)

| 9 Months Ended June 30, 2012 |

||||

| Exploration & Production - West Division EBITDA |

$ | 174,568 | ||

| Exploration & Production - All Other Divisions EBITDA |

111,944 | |||

|

|

|

|||

| Total Exploration & Production EBITDA |

$ | 286,512 | ||

| Minus: Exploration & Production Net Interest Expense |

(19,794 | ) | ||

| Minus: Exploration & Production Income Tax Expense |

(56,034 | ) | ||

| Minus: Exploration & Production Depreciation, Depletion & Amortization |

(136,262 | ) | ||

|

|

|

|||

| Exploration & Production Net Income |

$ | 74,422 | ||

| Exploration & Production Net Income |

$ | 74,422 | ||

| Exploration & Production - West Division Production (MBoe) |

2,581 | |||

|

|

|

|||

| Exploration & Production - Net Income per West Division Production (Boe) |

$ | 28.83 | ||

| Exploration & Production - West Division EBITDA |

$ | 174,568 | ||

| Exploration & Production - West Division Production (MBoe) |

2,581 | |||

|

|

|

|||

| Exploration & Production - West Division EBITDA per West Division Production (Boe) |

$ | 67.64 | ||

Reconciliation of EBITDA to Net Income

($ Thousands)

| FY 2008 | FY 2009 | FY 2010 | FY 2011 | 12 Months Ended June 30, 2012 |

||||||||||||||||

| Exploration & Production - West Division EBITDA |

$ | 188,008 | $ | 170,611 | $ | 187,838 | $ | 187,603 | $ | 223,155 | ||||||||||

| Exploration & Production - All Other Divisions EBITDA |

174,216 | 109,100 | 139,624 | 189,854 | 156,138 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Exploration & Production EBITDA |

$ | 362,224 | $ | 279,711 | $ | 327,462 | $ | 377,457 | $ | 379,293 | ||||||||||

| Exploration & Production EBITDA |

$ | 362,224 | $ | 279,711 | $ | 327,462 | $ | 377,457 | $ | 379,293 | ||||||||||

| Utility EBITDA |

161,575 | 164,443 | 167,328 | 168,540 | 155,530 | |||||||||||||||

| Pipeline & Storage EBITDA |

129,171 | 130,857 | 120,858 | 111,474 | 128,372 | |||||||||||||||

| Energy Marketing EBITDA |

8,699 | 11,589 | 13,573 | 13,178 | 6,107 | |||||||||||||||

| Corporate & All Other EBITDA |

(8,156 | ) | (5,575 | ) | 2,429 | (2,960 | ) | 2,508 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total EBITDA |

$ | 653,513 | $ | 581,025 | $ | 631,650 | $ | 667,689 | $ | 671,810 | ||||||||||

| Total EBITDA |

$ | 653,513 | $ | 581,025 | $ | 631,650 | $ | 667,689 | $ | 671,810 | ||||||||||

| Minus: Net Interest Expense |

(62,555 | ) | (81,013 | ) | (90,217 | ) | (75,205 | ) | (78,234 | ) | ||||||||||

| Plus: Other Income |

7,164 | 8,200 | 3,638 | 6,706 | 5,954 | |||||||||||||||

| Minus: Income Tax Expense |

(167,672 | ) | (52,859 | ) | (137,227 | ) | (164,381 | ) | (135,003 | ) | ||||||||||

| Minus: Depreciation, Depletion & Amortization |

(169,846 | ) | (170,620 | ) | (191,199 | ) | (226,527 | ) | (255,835 | ) | ||||||||||

| Minus: Exploration & Production Impairment |

(182,811 | ) | — | |||||||||||||||||

| Plus/Minus: Income/(Loss) from Discontinued Operations, Net of Tax |

1,821 | (2,776 | ) | 6,780 | — | — | ||||||||||||||

| Plus: Gain on Sale of Unconsolidated Subsidiaries |

— | — | — | 50,879 | — | |||||||||||||||

| Plus/Minus: Income/(Loss) from Unconsolidated Subsidiaries |

6,303 | 3,366 | 2,488 | (759 | ) | (61 | ) | |||||||||||||

| Minus: Impairment of Investment in Partnership |

— | (1,804 | ) | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income |

$ | 268,728 | $ | 100,708 | $ | 225,913 | $ | 258,402 | $ | 208,631 | ||||||||||