Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HARVARD BIOSCIENCE INC | d393304d8k.htm |

Tools to Advance Life Science Research

and Regenerative Medicine

NASDAQ HBIO

August 2012

Exhibit 99.1

Copyright © Harvard Bioscience 2012 |

2

Safe Harbor Statement

This presentation contains forward-looking statements within the

meaning of the federal securities laws. You can identify these statements by our use of such words as “will,”

“guidance,” “objectives,”

“optimistic,” “future,” “expects,” “plans,” “estimates,” “continue,” “drive,” “strategy,” “potential,” “potentially,” “growth,”

“long-term,” “projects,” “projected,”

“intends,” “believes,” “goals,”

“sees,” “seek,” “develop,” “possible,” “new,” “emerging,” “opportunity,” “pursue” and similar expressions that do not relate to historical matters. Forward-

looking statements in this presentation may include, but are not

limited to, statements or inferences about the Company’s or management’s beliefs or expectations, the Company’s

anticipated future revenues and earnings, the strength of the

Company’s market position and business model, the impact of acquisitions or potential acquisitions, the outlook for the life

sciences industry and the field of regenerative medicine, opportunities

or potential opportunities in the field of regenerative medicine, the Company’s business strategy, the positioning of

the Company for growth, the market demand and opportunity for the

Company’s current products, or the products it is developing or intends to develop and the Company’s plans,

objectives and intentions that are not historical facts. These statements involve known and unknown risks, uncertainties and

other factors that may cause the Company’s actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Factors that may cause the Company’s actual results to differ

materially from those in the forward-looking statements include the

Company’s failure to identify potential acquisition candidates, successfully integrate acquired businesses or

technologies, successfully negotiate favorable pricing and other terms

with acquisition candidates to enable potential acquisitions to close, complete consolidations of business functions,

expand our distribution channels, expand our product offerings,

introduce new products or commercialize new technologies on a timely basis, including in the field of regenerative

medicine, unanticipated costs relating to acquisitions, unanticipated

costs arising in connection with the Company’s consolidation of business functions and any restructuring initiatives,

lack of demand or decreased demand for the Company’s products due

to changes in our customers’ needs, success of our efforts with our distributor to promote sales of our microvolume

spectrophotometer product and success of our strategies to increase the

sales of other products, our ability to obtain regulatory approvals, including FDA approval, for our products

including any products in the field of regenerative medicine, the

current size or anticipated size of the regenerative medicine market, the existence and size of opportunities in the

regenerative medicine market, our financial position, general economic

outlook, or other circumstances, overall economic trends, the seasonal nature of purchasing in Europe, economic,

political and other risks associated with international revenues and

operations, the impact of the current economic and financial crisis, additional costs of complying with recent changes in

regulatory rules applicable to public companies, our ability to manage

our growth, our ability to retain key personnel, competition from our competitors, technological changes resulting in

our products becoming obsolete, future changes to the operations or the

activities of our subsidiaries due to manufacturing consolidations, our ability to meet the financial covenants

contained in our credit facility, our ability to protect our

intellectual property and operate without infringing on others’ intellectual property, potential costs of any lawsuits to protect or

enforce our intellectual property, economic and political conditions

generally and those affecting pharmaceutical and biotechnology industries, research funding levels from endowments at

our university customers, impact of any impairment of our goodwill or

intangible assets, our acquisition of Genomic Solutions failing to qualify as a tax-free reorganization for federal tax

purposes, our ability to utilize deferred tax assets after the release

of our valuation allowances, the amount of earn-out consideration that the Company receives in connection with the

disposition of the Company’s Capital Equipment Business segment

and factors that may impact the receipt of this consideration, such as the revenues of the businesses disposed of, plus

factors described under the heading “Item 1A. Risk Factors”

in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, filed with the SEC on March 15,

2012 or described in the Company’s other public filings. The

Company’s results may also be affected by factors of which the Company is not currently aware. The Company may not

update these forward-looking statements, even though its situation

may change in the future, unless it has obligations under the federal securities laws to update and disclose material

developments related to previously disclosed information. Except as

otherwise noted herein, any forward looking statements represent our estimates as of August 2, 2012 and should not be

relied upon as representing our estimates as of any other date.

The Company may not update these forward-looking statements, even though its situation may change in the future, unless it

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine

has obligations under the federal securities laws to update and

disclose material developments related to previously disclosed information. |

3

Use Of Non-GAAP Information

In this presentation, we have included non-GAAP financial

information including adjusted operating income from continuing

operations, adjusted income from continuing operations and adjusted earnings per diluted share

from continuing operations. We believe that this non-GAAP financial

information provides investors with an enhanced understanding of

the underlying operations of the business. For the periods presented, these non-GAAP

financial measures of income have excluded certain gains and expenses

primarily resulting from business combination accounting or

events that we do not believe are related to the underlying operations of the business

such as gain from adjustment of acquisition contingencies, expenses

from amortization of intangibles related to acquisitions, fair

value adjustments of inventory and backlog related to acquisitions, asset write-down expenses,

costs related to acquisition initiatives, restructuring expenses

(including related inventory write-downs), discontinued

operations and stock-based compensation expense. They also exclude the tax effect of reconciling

items, reversal of the liability related to the uncertain tax positions

and the corresponding accrued interest, utilization of deferred

tax assets that had full valuation allowance and in the third quarter of 2010 it included the

effect of reversing valuation allowances on certain deferred tax

assets. This non-GAAP financial information approximates

information used by our management to internally evaluate the operating results of the Company.

Tabular reconciliations of our non-GAAP adjusted operating income

and adjusted net income per diluted share from continuing

operations for the periods presented to the comparable GAAP financial information is included in

this presentation in Appendices A and

B. The non-GAAP financial information provided in this presentation

should be considered in addition to, not as a substitute for,

the financial information provided and presented in accordance with GAAP.

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

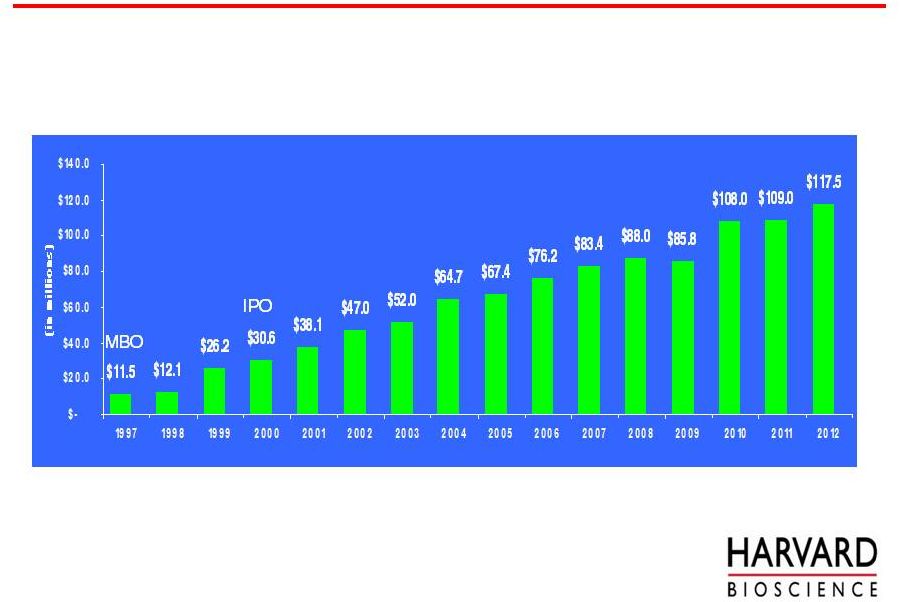

4

Investment Highlights

•

2011 revenue of $109m and 35c non-GAAP EPS in Core Life Science

Research Tools (LSRT) Business:

•

Profitable, mature steady growth business.

•

$115m-$120m revenue and 39-42c EPS guidance for 2012

•

17% 14-year average revenue growth

•

12% 14-year average non-GAAP adjusted EPS growth

•

Regenerative Medicine Device (RMD) Business

•

Five patients already treated with regenerated tracheal transplants,

clinical trial begun •

Heart,

lung,

kidney

and

liver

transplant

bioreactors

in

research

stage

•

Clinical stem cell injector syringe pump will be submitted for

regulatory review this year •

Investment stage business: 13c EPS investment in 2012. Exploring

strategic alternatives for funding this at a higher level

•

We believe this nascent market could potentially grow to hundreds of

millions of dollars annually •

Commitment to Stockholder Value Creation

•

Management holds 14% of shares and beneficially owns 16% in

options •

$10m stock repurchase completed in 2010 at $3.24 per share

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Regenerative Medicine |

IPO

MBO

5

Core LSRT Business –

Strong, Consistent Growth

Revenue From Continuing Operations

14 year

CAGR

17%

*Est.

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine

* The 2012 revenue estimate is the midpoint of our guidance of $115

- $120 million as of August 2, 2012 was calculated using exchange rates (USD

1.55/GBP and USD 1.25/Euro) approximating July 5, 2012 rates, excludes

any further acquisitions and assumes a continuation of the business

conditions as we see them at this time. Guidance is valid only as of

the date of issue and is not being updated to today’s date or confirmed. |

6

Core LSRT Business -

Strong EPS Growth

Non-GAAP Adjusted Diluted EPS From

Continuing Operations

Note: See reconciliation of US GAAP diluted earnings per share to

non-GAAP adjusted diluted earnings per share in Appendix A and

Appendix B. The 2012 estimate for non-GAAP adjusted diluted EPS

from continuing operations is the midpoint of our guidance of $0.39 to

$0.42 as of August 2, 2012 and was calculated using exchange rates (USD

1.55/GBP and USD 1.25/Euro) approximating August 2, 2012 rates

and excludes further acquisitions and assumes a continuation of

the business conditions as we see them at this time. Guidance is

valid only as of

the date of issue and is not being updated to today’s date or

confirmed. MBO

IPO

GNSL

Acquired

(Divested

2007)

SOX

14 year

CAGR

12%

*Est.

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

7

Core LSRT Business Strategy

Our strategy is to have a broad range of relatively inexpensive products

that have strong positions in niche markets in life

science research:

This gives us high operating margins and low volatility

We grow through a combination of organic growth (driven by adding sales

people and launching new products) and tuck-under

acquisitions: This has given us growth through booms and

busts We improve our operations:

So we can invest in growth without decreasing margins

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

8

Core Life Science Business Has Two Divisions

Market sizes and shares are management estimates and have not been

independently verified Physiology Division

Molecular Biology Division

Business

Position:

Global market leader

Major player

Products:

Syringe pumps, isolated organ

systems, electroporators,

behavioral research products

Plastic lab consumables,

Electrophoresis products,

Spectrophotometers

Market Size:

Approx. $400m pa

Approx. $2.4bn pa

Average

Order:

Approx. $1,000

Approx. $1,000

Growth

Driver for

2012:

New products, additional sales

New products, additional sales people

The name Harvard is used under a license agreement between Harvard

Bioscience and Harvard University

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

9

Harvard Apparatus Physiology Products

Syringe Pumps

market leader

Cell & Tissue Incubators

market leader

Electroporation

strong #2 with

new technology

Neuroscience Research

Systems

Animal Ventilators

market leader

Organ Systems

market leader

Market sizes and shares are management estimates and have not been

independently verified Copyright © Harvard Bioscience 2012 Tools to Advance Life Science

Research and Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

10

Molecular Biology Products

Biochrom

Spectrophotometers

Market sizes and shares are management estimates and have not been

independently verified Hoefer

Electrophoresis

Denville

Pipette Tips

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

11

Acquisitions

•

Acquisitions are a core part of our growth strategy:

•

We

focus

on

“tuck-under”

acquisitions

of

product

lines

that

are

complementary to our current ones

•

Our “sweet spot”

is $3.0-$8.0 million in revenue

•

Typically below the radar of the big companies

•

Typically immediately accretive to non-GAAP adjusted EPS

•

There are usually both revenue and cost synergies

•

We have completed 25 acquisitions in 14 years. Our most recent

acquisitions were CMA Microdialysis (July 2011), AHN

Biotechnologie (February 2012) and Modular SFC (May 2012).

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

12

•

Recent improvements:

•

Panlab and Coulbourn were restructured in Q1 2012

•

Hoefer’s San Francisco, CA facility was relocated in Q4 2011

Operational Improvement

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

13

Base Business EPS Growth Model –

3-5 Year Plan

Organic Growth

3-7%

+

Tuck under Acquisitions

10-15%

+

Operational Improvements

0-5%

=

Total Expected Average EPS Growth

15-20%

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

Regenerative

Technology for Saving Lives |

15

Mr. Beyene is

alive and well

at 12

months**

Mr. Lyles

died of

pneumonia at

3.5 months..

Ms. Castillo is

alive and well at

4 years*

Hannah

Warren’s

surgery has

been approved

by the FDA

Ms. Tuulik is

alive and well

at 1 month

Mr. Zozula is

alive and well

at 1 month

Clinical Success with Regenerated Tracheas

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine

*

Clinical

transplantation

of

a

tissue

engineered

airway,

Macchiarini

et

al,

The

Lancet,

November 19

th

2008

**

Tracheobronchial transplantation with a stem-cell-seeded

bioartificial nanocomposite: a

proof-of-concept

study.

Macchiarini

et

al.,

The

Lancet,

November

25

th

2011.

If patients continue to do well we will have a cure for tracheal

cancer. |

The

Patient

was

“condemned

to

die”-

Dr.

Macchiarini

16

The patient and Prof. Macchiarini before

the surgery

CAT scan used to make the

scaffold. The 6cm tumor is in

green

The scaffold prior to seeding

with bone marrow stem cells

Seeding the cells in the

InBreath bioreactor

The seeded graft after 2 days of

culture

Mr. Beyene

after the

surgery

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

The InBreath

Bioreactor System 17

Inbreath and vented culture lid

Inbreath and sealed sterile transport lid

Inbreath inside sterile transport box

Sterile transport box

Non-sterile thermally insulated outer

transport box.

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

18

Save lives

Target life threatening conditions like tracheal and esophageal cancer,

and transplants for heart, lung, liver and kidney. Not low medical

value skin, bone or muscle. Easier to get ethics committee (IRB)

and regulatory (Humanitarian Use Device) approval for

first-in-man, greatly reducing clinical trial risk and

cost. High medical value and higher cost alternatives (donor organs

and cancer therapeutics) create high per procedure revenue

potential. Medical devices, not cell therapy

Easier, less expensive regulatory pathway.

Bioreactors are 510k exempt, injectors are 510k and scaffolds (for

tracheal cancer) are orphan device PMA.

Collaborate with the best

Prof. Macchiarini at the Karolinska Institutet is our key clinical

collaborator. Dr. Harald Ott at Massachusetts General Hospital is a

key research collaborator. We have several other research

collaborators at leading universities/hospitals. Capital

efficient Investigator led first-in-man and clinical trials

greatly reduces clinical trial cost. Revenue from 510k approved

injectors creates early cash flow. Regenerative Medicine Strategy

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

19

Tracheal Cancer –

Possible Pricing Levels

Approaches to pricing organ regeneration products:

1. avoided cost of donor organ procurement

$40-90k

2. price of cancer therapeutics*

Yervoy for melanoma

$120k per patient

Zelboraf for melanoma

$56k per treatment

Adcetris for lymphoma

$120k per patient

Hence, a price in the $50k per procedure range would likely be attractive

to payors and sustainable in the long term

* These treatments typically extend life by several months. While we do

not yet have statistically robust data, Mr. Beyene

is

alive

and

well

at

13

months

post

surgery

and

Mr.

Lyles

died

at

3.5

months

post

surgery.

Ms.

Castillo

is

alive

and

well

at

over

4

years

post

surgery

but

she

was

treated

for

an

occlusion

in

her

left

main

bronchus,

not

tracheal

cancer.

The two Russian patients had tracheal trauma and are alive and well at

1 month. Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research

and Regenerative Medicine |

20

The lungs were regenerated in a Harvard Apparatus LB2 lung bioreactor.

The work was done at Massachusetts General Hospital in

collaboration with Dr. Harald Ott*. The regenerated transplanted

lungs showed near normal lung function, exchanging carbon dioxide

and oxygen and showing near normal pressure/volume loops. The rats

lived for 14 days off the ventilator before they were sacrificed

for research. Natural lung

Regenerated lung

Pre-clinical Success with Regenerated Lungs

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine

Medicine,

July13th 2010

* Regeneration and orthotopic transplantation of a bioartificial lung.

Ott et al, Nature |

Product Stage

by Clinical Indication 21

Development

Pre-Clinical

First-in-man

Tracheal Cancer

Kidney Transplant

Liver Transplant

Heart Transplant

Lung Transplant

Esophageal Cancer

Clinical Trial

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

Revenue

Opportunity 22

Clinical

Patients

Market

Indication:

per year:

Potential:

Trachea (cancer/trauma)

3,000

$150m

Esophagus (cancer)

40,000

$2,000m

Heart and lung (transplant)

12,000*

$600m

*The

12,000

procedures

does

not

account

for

patients

currently

on

the

waiting

list

due

to

a

lack

of

donor organs.

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

23

Harvard Apparatus research

syringe pump being used to

inject stem cells into a heart

infarct –

the inspiration for our

clinical stem cell injector.

Prototype of the clinical version which we expect to

submit to the regulatory agencies in 2012. The market

for high end clinical syringe pumps is approx. $80m per

year

Stem Cell Therapy Injector

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine

Photo courtesy Brigham and Womens’ Hospital, Boston |

24

Commitment To Stockholder Value

•

Management holds approximately 14% of shares + 16% in options

•

We believe tuck-under growth strategy can be financed with cash,

cash flow and credit line, therefore no dilution

•

Modest debt leverage helps drive EPS without undue financial risk

•

$10m stock repurchase completed. 3.1m shares (approx. 10% of shares

outstanding) bought at an average price of $3.24 per share

•

Pursuing strategic alternatives to fund the Regenerative Medicine

Devices business

-

Accelerates maximizing revenue potential

-

Provides clarity on profitability of core LSRT business

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

25

Investment Highlights

•

2011 revenue of $109m and 35c non-GAAP EPS in Core Life Science

Research Tools (LSRT) Business:

•

Profitable, mature steady growth business.

•

$115m-$120m revenue and 39-42c EPS guidance for 2012

•

17% 14-year average revenue growth

•

12% 14-year average non-GAAP adjusted EPS growth

•

Regenerative Medicine Device (RMD) Business

•

Five patients already treated with regenerated tracheal transplants,

clinical trial begun •

Heart,

lung,

kidney

and

liver

transplant

bioreactors

in

research

stage

•

Clinical stem cell injector syringe pump will be submitted for

regulatory review this year •

Investment stage business: 13c EPS investment in 2012. Exploring

strategic alternatives for funding this at a higher level

•

We believe this nascent market could potentially grow to hundreds of

millions of dollars annually •

Commitment to Stockholder Value Creation

•

Management holds 14% of shares and beneficially owns 16% in

options •

$10m stock repurchase completed in 2010 at $3.24 per share

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

NASDAQ

HBIO Tools to Advance Life Science Research

and Regenerative Medicine

Additional Information

Copyright © Harvard Bioscience 2012

|

27

Appendix A

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Regenerative Medicine

1997

1998

1999

2000 (IPO)

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Revenues

11,464

$

12,154

$

26,178

$

30,575

$

38,088

$

47,009

$

52,024

$

64,745

$

67,431

$

76,181

$

83,407

$

88,049

$

85,772

$

108,179

$

108,864

$

Revenue fourteen -year compound annual growth rate from 1997 to

2011: 17.0% Reconciliation of US GAAP to Non-GAAP

Adjusted: 1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

US GAAP operating income (loss)

2,119

$

2,412

$

1,196

$

(10,438)

$

3,112

$

5,425

$

7,173

$

8,384

$

7,924

$

8,690

$

9,533

$

8,479

$

8,055

$

10,218

$

6,077

$

Restructuring and severance related expenses

-

-

-

-

-

474

-

-

302

-

-

1,771

516

498

640

Inventory write-down due to restructuring

-

-

-

-

-

-

-

-

-

-

-

252

159

79

-

Stock-based compensation expense

-

-

3,284

14,676

2,656

1,269

519

69

-

1,934

2,335

2,003

2,514

2,756

2,863

In-process research and development expense

-

-

-

-

159

-

-

-

-

-

-

-

-

-

-

Amortization of intangible assets

-

27

368

604

956

595

891

1,582

1,664

1,697

1,824

1,966

1,844

2,364

2,746

Fair value adjustments to costs of product sales

-

-

-

-

-

-

336

258

-

50

61

-

-

90

76

Accounts receivable reserve adjustment related to acquistion

-

-

-

-

-

-

-

-

-

-

-

-

-

(237)

-

Non-GAAP adjusted operating income

2,119

$

2,439

$

4,848

$

4,842

$

6,883

$

7,763

$

8,919

$

10,293

$

9,890

$

12,371

$

13,753

$

14,471

$

13,088

$

15,768

$

12,402

$

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

US GAAP earnings (loss) per diluted share from continuing

operations 0.06

$

0.01

$

(5.25)

$

(6.23)

$

0.07

$

0.11

$

0.12

$

0.15

$

0.20

$

0.21

$

0.24

$

0.17

$

0.24

$

0.65

$

0.13

$

Restructuring and severance related expenses

-

-

-

-

-

0.02

-

-

0.01

-

-

0.06

0.02

0.02

0.03

Inventory write-down due to restructuring

-

-

-

-

-

-

-

-

-

-

-

0.01

0.01

-

-

Stock-based compensation expense

-

-

0.19

0.80

0.10

0.05

0.02

-

-

0.06

0.07

0.06

0.08

0.09

0.10

In-process research and development expense

-

-

-

-

0.01

-

-

-

-

-

-

-

-

-

-

Amortization of intangible assets

-

-

0.02

0.03

0.04

0.02

0.03

0.05

0.05

0.05

0.06

0.06

0.06

0.08

0.09

Fair value adjustments to costs of product sales

-

-

-

-

-

-

0.01

0.01

-

-

-

-

-

-

-

Asset write-down

-

-

-

-

-

-

-

-

-

-

-

0.02

-

-

-

Direct acquisition cots

-

-

-

-

-

-

-

-

-

-

-

0.01

0.01

0.01

0.02

Gain from adjustment of acquisition contingencies

-

-

-

-

-

-

-

-

-

-

-

-

(0.09)

(0.01)

-

Common stock warrant interest expense

0.01

0.09

1.74

2.00

-

-

-

-

-

-

-

-

-

-

-

Income taxes

-

-

(0.08)

0.01

(0.03)

(0.01)

(0.01)

(0.02)

(0.07)

(0.06)

(0.07)

(0.07)

(0.03)

(0.47)

(0.09)

Conversion of convertible preferred stock and exercise of

common stock warrants on January 1

-

-

3.55

3.54

-

-

-

-

-

-

-

-

-

-

-

Accounts receivable reserve adjustment related to acquistion

-

-

-

-

-

-

-

-

-

-

-

-

-

(0.01)

0

Non-GAAP adjusted earnings per diluted share from continuing

operations

0.07

$

0.10

$

0.17

$

0.15

$

0.19

$

0.19

$

0.17

$

0.19

$

0.19

$

0.26

$

0.30

$

0.32

$

0.30

$

0.36

$

0.28

$

For the years ended December 31,

For the years ended December 31,

For the years ended December 31,

Non-GAAP fourteen -year operating income from continuing

operations compound annual growth rate from 1997 to 2011: 14.0% |

28

Appendix B

US GAAP operating income

8,479

$

8,055

$

2,976

$

2,372

$

1,943

$

2,927

$

1,950

$

2,519

$

220

$

1,387

$

1,229

$

1,299

$

Restructuring and severance related expenses

1,771

516

-

-

283

215

-

(28)

477

167

150

(13)

Inventory write-down due to

restructuring 252

159

-

-

-

79

-

-

-

-

-

-

Stock-based compensation

expense 2,003

2,514

558

675

759

764

552

658

853

800

697

718

Amortization of intangible

assets 1,966

1,844

531

578

593

662

621

689

706

730

678

712

Fair value adjustments to costs

of product sales -

-

-

-

27

63

-

-

57

19

36

39

Accounts receivable

reserve adjustment related to acquistion -

-

-

-

-

(237)

-

-

-

-

-

-

Non-GAAP adjusted operating income from

continuing operations 14,471

$

13,088

$

4,065

$

3,625

$

3,605

$

4,473

$

3,123

$

3,838

$

2,313

$

3,103

$

2,790

$

2,755

$

US GAAP earnings per diluted share from continuing operations

0.17

$

0.24

$

0.07

$

0.06

$

0.44

$

0.08

0.06

$

0.05

$

-

$

0.02

$

0.02

$

0.03

$

Restructuring and severance related expenses

0.06

0.02

-

-

0.01

0.01

-

-

0.02

-

0.01

-

Inventory write-down due to

restructuring 0.01

0.01

-

-

-

-

-

-

-

-

-

-

Stock-based compensation

expense 0.06

0.08

0.02

0.02

0.03

0.03

0.02

0.02

0.03

0.03

0.02

0.02

Amortization of goodwill &

intangibles* 0.06

0.06

0.02

0.02

0.02

0.02

0.02

0.02

0.02

0.02

0.02

0.02

Inventory amortization on

acquisition -

-

-

-

0.01

-

-

-

-

-

-

-

Asset write-down

0.02

-

-

-

-

-

-

-

-

-

-

-

Direct acquisition cots

0.01

0.01

-

-

0.01

-

-

0.01

-

0.01

0.01

-

Gain from adjustment of

acquisition contingencies -

(0.09)

-

(0.01)

-

-

-

-

-

-

-

-

Income taxes (1)

(0.07)

(0.03)

(0.02)

(0.02)

(0.44)

(0.02)

(0.03)

(0.02)

(0.02)

(0.01)

(0.02)

(0.01)

Accounts receivable reserve adjustment related to

acquistion -

-

-

-

-

(0.01)

-

-

-

-

-

-

Non-GAAP adjusted earnings per diluted share

from continuing operations

0.32

$

0.30

$

0.09

$

0.08

$

0.08

$

0.11

$

0.07

$

0.08

$

0.05

$

0.07

$

0.06

$

0.06

$

* Due to rounding, quarterly numbers do not add to total year

(1) Income taxes includes the tax effect of adjusting for the

reconciling items, utilization of certain deferred tax assets that had a full valuation allowance and in the third quarter of 2010 it included the effect

of reversing valuation allowances on certain deferred tax assets as a

reconciling item. It also includes the tax effect from the reversal of the liability related to the uncertain tax positions and the

corresponding accrued interest.

March 31,

June 30,

Sept 30,

Dec 31,

March 31,

June 30,

Sept 30,

Dec 31,

March 31,

June 30,

2008

2009

2010

2010

2010

2010

2011

2011

2011

2011

2012

2012

Revenues

88,049

$

85,772

$

26,300

$

25,905

$

26,453

$

29,521

$

26,312

$

27,143

$

26,381

$

29,027

$

28,322

$

28,496

$

For the years ended

For the quarters ended

Reconciliation of US GAAP to Non-GAAP Adjusted:

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |

29

Appendix C

Low

Estimate

High

Estimate

Low

Estimate

High

Estimate

Non-GAAP adjusted diluted earnings per common share

from continuing operations (A)

$

0.05

(a)

$

0.07

(b)

$

0.26

(c)

$

0.29

(d)

Less the impact of:

Amortization of intangible assets

(0.02)

(e)

(0.02)

(e)

(0.09)

(e)

(0.09)

(e)

Stock-based compensation (FASB ASC Topic 718)

(0.03)

(e)

(0.03)

(e)

(0.10)

(f)

(0.10)

(f)

Tax

(B)

0.02

(e)

0.02

(e)

0.06

(e)

0.06

(e)

GAAP diluted earnings per common share from

continuing operations (A)

$

0.02

$

0.04

$

0.13

$

0.16

Reconciliation of Guidance for Non-GAAP Adjusted Diluted Earnings per

Common Share From Continuing Operations to US GAAP Diluted Earnings

per Common Share (unaudited)

Three Months Ending

September 30, 2012

Year Ending

December 31, 2012

(e)-

Represents amounts related to Life Science Research Tools

business (f) -

Includes expense of $0.09 from Life Science Research Tools business

and $0.01 from Regenerative Medicine Device business. B

-

Includes the tax impact of above mentioned items.

(b) -

Includes income of $0.10 from Life Science Research Tools business and

loss of $0.03 from Regenerative Medicine Device business.

(c) -

Includes income of $0.39 from Life Science Research Tools business and

loss of $0.13 from Regenerative Medicine Device business.

(d) -

Includes income of $0.42 from Life Science Research Tools business and

loss of $0.13 from Regenerative Medicine Device business.

(a) -

Includes income of $0.09 from Life Science Research Tools business and

loss of $0.04 from Regenerative Medicine Device business.

A

-

Assumes no additional acquisitions.

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Regenerative Medicine |

30

Appendix D

For

the

Year

For

the

Year

Six

Months

Ended

March

31,

June

30,

Sept.

30,

Dec.

31,

Dec.

31,

March

31,

June

30,

Sept.

30,

Dec. 31,

Dec.

31,

March

31,

June

30,

June 30,

2010

2010

2010

2010

2010

2011

2011

2011

2011

2011

2012

2012

2012

Organic growth

4.3%

11.0%

4.6%

6.8%

6.1%

-2.1%

-1.6%

-6.3%

-4.4%

-3.8%

4.2%

2.2%

3.2%

Acquisitions

29.9%

36.1%

24.7%

2.3%

21.5%

1.3%

2.8%

4.2%

2.9%

2.9%

4.4%

4.9%

4.7%

Foreign

exchange effect

3.7%

-3.6%

-3.3%

-2.3%

-1.5%

0.9%

3.6%

1.8%

-0.2%

1.5%

-1.0%

-2.1%

-1.6%

Total revenue

growth

37.9%

43.5%

26.0%

6.8%

26.1%

0.1%

4.8%

-0.3%

-1.7%

0.6%

7.6%

5.0%

6.3%

Three Months

Ended

Reconciliation of Changes In Total Revenue Compared to the Same Period

of the Prior Year (Continuing Operations) (unaudited)

Three Months Ended

Three Months Ended

Copyright © Harvard Bioscience 2012

Tools to Advance Life Science Research and

Tools to Advance Life Science Research and

Regenerative Medicine

Regenerative Medicine |