Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Forestar Group Inc. | d393204dex991.htm |

| 8-K - FORM 8-K - Forestar Group Inc. | d393204d8k.htm |

Second Quarter 2012

Financial Results

August 8, 2012

Exhibit 99.2

Accelerating Value Realization, Growing Through Strategic Investments and Delivering the

Greatest Value from Every Acre |

Notice to Investors

2

This presentation contains “forward-looking statements” within the meaning of

the federal securities laws. Forward-looking statements are typically

identified by words or phrases such as “will,” “anticipate,”

“estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,”

and other words and terms of similar meaning. These statements reflect management’s

current views with respect to future events and are subject to risk and uncertainties.

We note that a variety of factors and uncertainties could cause our actual results to

differ significantly from the results discussed in the forward-looking statements,

including the timing to consummate the proposed merger, the risk that a condition to

closing of the proposed merger may not be satisfied; our ability to achieve the

synergies and value creation contemplated by the proposed merger; our ability to

promptly and effectively integrate Credo’s businesses, and the diversion of management

time on merger-related matters. Other factors and uncertainties that might

cause such differences include, but are not limited to: general economic, market, or

business conditions; changes in commodity prices; the opportunities (or lack thereof)

that may be presented to us and that we may pursue; fluctuations in costs and expenses

including development costs; demand for new housing, including impacts from mortgage

credit availability; lengthy and uncertain entitlement processes; cyclicality of our

businesses; accuracy of accounting assumptions; competitive actions by other companies;

changes in laws or regulations; and other factors, many of which are beyond our control.

Except as required by law, we expressly disclaim any obligation to publicly revise any

forward-looking statements contained in this news release to reflect the occurrence

of events after the date of this presentation. This

presentation includes Non-GAAP financial measures. The required reconciliation to GAAP financial

measures can be found on our website at www.forestargroup.com.

|

Second Quarter 2012

Financial Results

3

3

Accelerating Value Realization, Growing Through Strategic Investments and Delivering the

Greatest Value from Every Acre |

Accelerating Value Realization Drives Improved

Second Quarter 2012 Financial Results

($ in Millions, except per share data)

2nd

Quarter

2012

2nd

Quarter

2011

Net Income (Loss)

$0.8

($3.9)

Earnings (Loss) Per Share

$0.02

($0.11)

Segment Earnings:

Mineral Resources

$3.9

$3.1

Real Estate

7.7

1.0

Fiber Resources

0.6

0.7

Total Segment Earnings

$12.2

$4.8

Second Quarter 2012 Weighted Average Diluted Shares Outstanding were 35.4

million •

Q2 2012 results include after-tax expenses of $1.6 million, or $0.05 per share related to

pending acquisition of CREDO Petroleum •

Q2 2011 results include after-tax expenses of $1.8 million, or $0.05 per share related to

withdrawn private debt offerings 4 |

Continuing to Strengthen Balance Sheet and Liquidity

5

($ in millions)

2nd Quarter

2012

2nd Quarter

2011

Cash and Cash Equivalents

$45

$6

Total Debt

$202

$261

Total Debt / Total Capital

28%

34%

Liquidity

*

$189

$115

2012 Significant Transactions:

($ in millions)

Timing

Cash

Debt

Reduction

Palisades West –

sale of 25% interest

Q1 2012

$32

--

Light Farms -

sale of 800 acres

Q2 2012

25

($31)

Multifamily ventures

-

reimbursements

Q2 2012

11

--

Total

$68

($31)

*

Liquidity = cash + available revolver |

Second Quarter 2012

Operating Highlights

6

Accelerating Value Realization By Increasing Oil Production and Residential Lot Sales and

Growing Net Asset Value by Capitalizing on Strategic Growth and Investment

Opportunities |

Building

Momentum

-

Second

Quarter Highlights

Oil production up over 120% vs. Q2 2011

Seven

additional

wells

completed

–

541

total

producing

wells

Closed

venture

for

development

in

downtown

Austin

-

Eleven

Closed

venture

for

development

in

Denver

Tech

Center

-

360°

Sold

427

residential

lots

-

up

over

50%

vs.

Q2

2011

1,435 lots under option contracts

Sold over 105,000 tons of fiber

99% of available land leased for recreation

Announced

definitive

agreement

to

acquire

CREDO

Petroleum

Sold

800

acres

for

$56

mm

($3.4

mm

gain)

-

Light

Farms

ventur

$1.1 mm earnings from loan secured by real estate in Houston

7

Note: Wells owned by third-party lessee / operator

SINGLE-FAMILY

TIMBERLAND MULTIFAMILY

FORESTAR MINERALS,

O

IL

&

GAS |

Second Quarter 2012

Minerals –

Oil & Gas Highlights

Building

Momentum

By

Driving

Leasing

and

Exploration

to

Increase

Production

and

Reserves

8 |

Increased Oil Production Driving Higher Royalties

Segment Earnings Reconciliation

Q2 2011 vs. Q2 2012

9

($ in millions)

Note: Wells owned by third-party lessee / operator

* Increased costs principally related to additional staffing and

production taxes

Mineral Resources

$3.1

$2.5

($0.3)

($1.4)

*

$3.9

$0.0

$2.0

$4.0

$6.0

Q2 2011

Royalties Leasing, Delay Cost of Sales &

Net of Equity

Interests

Rentals &

Other

Operating

Expenses

Q2 2012

Q2 2012 Highlights

•

Oil production up over 120% vs.

Q2 2011

•

Royalties up 60% or $2.5 million

vs. Q2 2011

•

Received over $400,000 in delay rentals

•

7 additional wells

completed; 541 total

producing wells |

Growth in

Drilling Activity Well Count

Q1 2011 –

Q2 2012

10

Forestar’s Share of

Annual Oil Production

2008 –

2012

Strategy Execution Driving Increased Oil Production

* Excludes any benefit from Credo acquisition

475

500

525

550

0

50,000

100,000

150,000

200,000

250,000

Note: Includes ventures; wells owned and operated by third party lessees / operators |

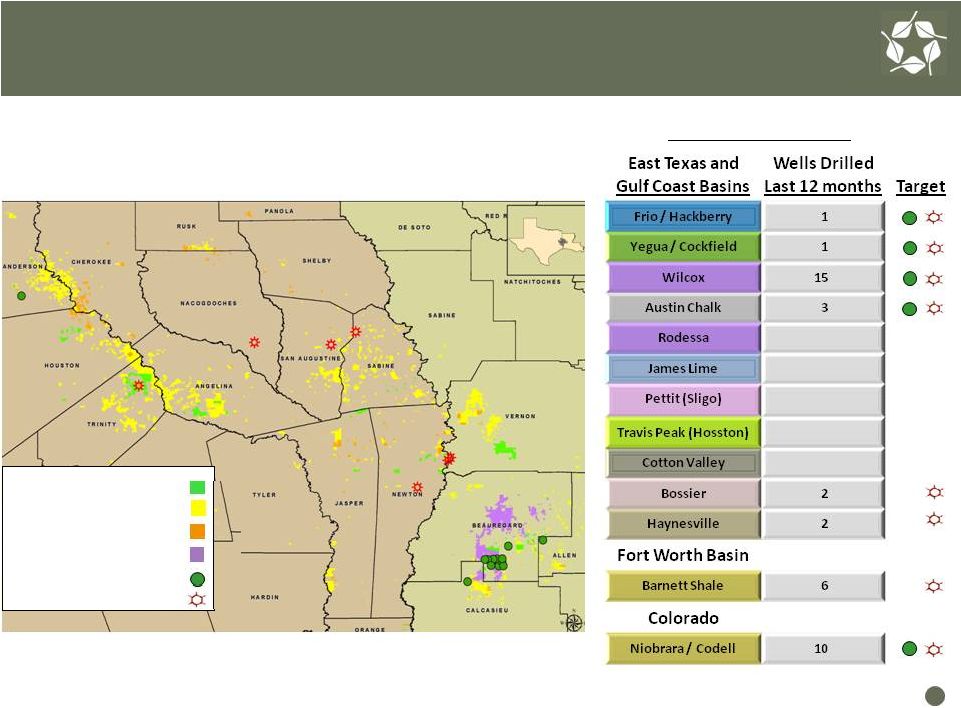

Target

Formations 2011-2012 Well Completions

East Texas & Louisiana*

11

Acres

Leased

Available

for

Lease

Held

by

Production

Acres

with

Option

New Oil Wells

New

Gas

Wells

Exploration and Drilling Activity Focused on

Multiple Basins and Formations

* Map excludes 6 wells located in Barnett Shale in North Texas and

9 wells in Colorado |

Second Quarter 2012

Fiber Resources Highlights

12

Building Momentum Through Sustainable Harvests and Maximizing Recreational Lease Activity

|

Stable Fiber Resources Results

Segment Earnings Reconciliation

Q2 2011 vs. Q2 2012

Q2 2012 Highlights

Sold over 105,700 tons of fiber

Higher fiber sales principally reflect timing

of harvests

99% of land leased for recreation

$8.84/acre average price for rec leases

Fiber Sales

Q2 2011 –

Q2 2012

($ in millions)

Fiber Resources

$0.7

($0.2)

($0.2)

($0.1)

$0.6

$0.0

$0.5

$1.0

Q2 2011

Fiber

Sales

Rec

Leases

Termination

of timber

lease

Costs

Q2 2012

83,400

105,700

$10.21

11.66

Fiber Sales (Tons)

Average Price / Ton

$

$0.4

13 |

Second Quarter 2012

Real Estate Highlights

Building

Momentum

By

Increasing

Residential

Lot

Sales

and

Capitalizing

on

Growth

Opportunities

14 |

Impending Shortage of Quality Lots Driving

Demand In Good Locations

15

Note: Includes ventures

Forestar

Residential Lot Sales

U.S. Housing Markets

Vacant Developed Lot Classification

Source: MetroStudy Top 40 U.S. Housing Markets

Class

Starts / Month

A

+4

B

3 –

4

C

2 –

3

D

1 –

2

F

< 1 |

Accelerating Value Realization Driving Improved

Second Quarter Results

Q2 2012 Highlights

Segment Earnings Reconciliation

Q2 2011 vs. Q2 2012

16

($ in millions)

Note: Includes Ventures

Real Estate

*Includes $1.1 million in earnings from loan secured by Discovery at Springs Trails project in

Houston Light Farms venture sold 800 acres for $56

million

-

$3.4

million

gain

on

sale

Sold 427 residential lots, up over 50% vs.

Q2 2011

109 remaining lots sold at River Plantation

for $19,700 per lot

Sold 933 acres of undeveloped land for $2.6

million ($2,800 / acre) |

Increased Lot Sales and Strong Backlog Reflect Benefit

Of Our Market Position and Lower Inventories in Texas

Residential Lot Sales

Q1 2011 –

Q2 2012

Residential Lots Under Option Contract

Q2 2011 –

Q2 2012

Note: Includes ventures

River Plantation –

Tampa, FL

Life of Project Economics:

($ in millions

)

Total

Revenues $30.1

Total

Costs

(23.3)

Project Cash flow

$6.8

17

*

Q2 2012 avg. lot price is $53,300/lot excluding sale of remaining

109 lots at River Plantation in Tampa for $19,700/lot

|

Barrington Kingwood

Acquired 180 developed lots (Q3 2011) for $9 million

Includes $4 million in reimbursement rights

Q2 2012 Sales Activity:

11

lots

sold

-

$102,500

/

lot

$46,900 / lot avg. margin

Gross Profit -

$515,600

Discovery at Spring Trails:

Acquired non-performing bank loan for $21mm in Q2 2011

Secured by first lien on Discovery at Spring Trails community

Previous

owner

investment

-

$49mm

Equity $17mm

Debt $32mm

Q2 2012 Earnings = $1.1 million

Houston, Texas

Campus

18

Real Estate Investments Generating Cash Flow & Earnings

These acquisitions generated $1.6 million in earnings in 2nd Quarter 2012

|

Timely

Developing

a

Low

Capital

-

High

Return

Multifamily Business

19

Multifamily Projects

Ownership

Units

June 2012

Occupancy

NOI

*

Cap Rates

Stabilized Multifamily Assets

Broadstone –

Houston, TX

100%

401

98%

$3.3 million

5.5% -

6.5%

Las Brisas –

Austin, TX

59%

414

95%

$2.4 million

6.0% -

7.0%

Under Construction

Promesa –

Austin, TX

100%

289

39%

**

--

Eleven –

Austin, TX

25%

257

--

--

360°

–

Denver, CO

20%

304

--

--

*

Based upon annualized YTD Q2 2012 results

**

Represents leased units

Business model is to leverage our existing sites and investments

with capital from our partners to create and realize value

|

Promesa –Leasing Activity Building Momentum

289-unit Class A multifamily property located

in Northwest Austin

First units delivered in April 2012;

approximately 80% complete

39% leased

$29 million total investment at Q2 2012; total

investment at completion = $34 million

Targeting stabilization in Q2 2013

20

Austin multifamily occupancy rates >96% |

Eleven –

Multifamily Venture with Canyon-Johnson

21

21

257-unit Class A multifamily property

Designed for certification under Austin Energy

Green Building program

Construction commenced in June, first units

expected Q3 2013

$3.7 million reimbursement of prior

investment with 25% ownership + fees &

promoted interests |

Eleven

-

Preferred Location in Strong Market

22

22

Located adjacent to downtown Austin

Austin multifamily market remains strong:

Occupancy rates: 95.6%

Annual Rent Growth: 6.1%

Job Growth: 3.3%

Close proximity to 30,000 jobs in

downtown Austin, 24,000 jobs and over

50,000 students at University of Texas,

and 69,000 State of Texas employees

High visibility

Convenient access to cultural and

entertainment offerings

Eleven Site Location

Preferred Location

: |

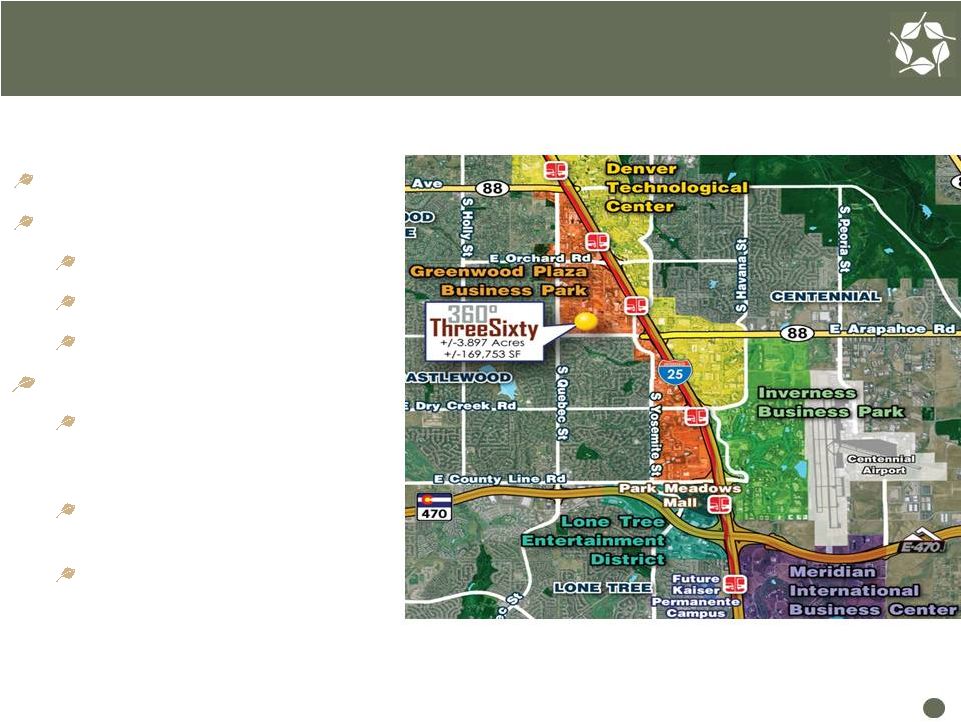

304-unit Class A multifamily property

Designed to obtain Energy Star certification

Construction commenced in July with first units

expected Q3 2013

$7.2 million reimbursement of prior investment with

20% ownership + fees and promoted interests

360°

–

Multifamily Venture with Guggenheim Real Estate

23 |

Denver Tech Center submarket

Multifamily market remains strong:

Occupancy rates: 95.4%

Rent Growth: 5.7%

Job Growth: 2.0%

Close proximity to 30 million sq.ft.

of office space and 150,000

employees

Convenient access to I-25 and

Arapahoe Light Rail station

Near Denver cultural and

entertainment venues

360°-

Excellent Location in Strong Multifamily Market

24

Preferred Location

|

Second Quarter 2012

Strategic Initiatives

25

Accelerating Value Realization, Optimizing Transparency and Raising NAV Through Disciplined

Investments |

Our

Focus: Triple In FOR 26

Initiatives

Q2 -

2012 Activity

F

ocus

on

Accelerating

Value

Realization

Triple Residential Lot Sales

•

Lot sales up over 50% from Q2 2011 levels

•

Oil production up over 120% from Q2 2011

•

Total segment earnings up over 150% from Q2 2011

Triple Oil & Gas Production (Mcfe)

Triple Total Segment Earnings

O

ptimize

Transparency

&

Disclosure

Expand Reported Oil and Gas Resource Potential

•

Acquisition of CREDO Petroleum expands Forestar’s

ability to report oil and gas reserve categories

Additional Transparency on Water Interests

Report Corporate Sustainability Results

R

aise

NAV

Through

Strategic

and

Disciplined

Investments

Growth Opportunities which Prove Up Net Asset Value and

Exceed Return Requirements

•

Announced definitive agreement to acquire CREDO

Petroleum

•

Closed

multifamily

venture

Eleven

-

Austin,

TX

•

Closed multifamily venture 360

°

-

Denver, CO

•

$1.1 million in earnings from loan secured by

Discovery at Spring Trails project in Houston

Accelerate

Participation

in

Oil

&

Gas

Working

Interests

Develop Low-Capital, High-Return Multifamily Business |

Credo: Compelling Combination Value Drivers

Combination creates meaningful scale through production and reserve growth, additional

ownership and operations in strategic basins and improves transparency and disclosures

Value Drivers

2011 Metrics

*

CRED

FOR Combined Increased Scale /

Doubles Production

and Reserves

Meaningful

Ownership

and Operations in

Prolific Basins

Disclosure

Benefits

Additional transparency on Forestar minerals

FOR

YE

2011

reserves

98%

PDP’s

–

Yet

to

report

PUD’s

($ in millions)

Production (BOE)

301,000

422,200

723,200

Reserves (MMBOE)

4.1

3.0

7.1

% Oil

48%

35%

42%

PV-10

**

$62

$81

$143

Undiscounted Future Net Cash Flows

**

$116

$134

$250

Net Mineral Acreage

***

125,000

594,000

719,000

Basins

4

5

8

States

9

7

14

*

Note: Based on Credo Form 10-K for the year ended 10/31/11 and Forestar Form 10-K for

the year ended 12/31/11, before income taxes 27

***

Note: Includes both fee and leasehold interests; Forestar acres as of Q2 2012 **

Represent Non-GAAP financial measures. Forestar’s required reconciliation to

GAAP financial measures can be found on our website at

www.forestargroup.com,

and Credo’s required reconciliation is in its Form 10-K for the year ended

10/31/11. |

Accelerating Value Realization

Increasing oil production and proven reserves

Growing lot sales and increasing market share

Realizing value from stabilized commercial assets

Capitalizing on growth opportunities and investments to generate

near-term cash flow and earnings

Building Momentum By Accelerating Value Realization, Optimizing Transparency and Growing

NAV 28 |

Anna Torma

SVP Corporate Affairs

Forestar Group Inc.

6300 Bee Cave Road

Building Two, Suite 500

Austin, TX 78746

512-433-5312

annatorma@forestargroup.com

29 |

Second Quarter 2012 Appendix

-

Segment KPI’s

30 |

Q2

2012

Q2

2011

YTD

2012

YTD

2011

Leasing Activity

Net Acres Leased

-

-

2,532

805

7,366

Avg. Bonus / Acre

-

-

$187

$357

$289

Royalties

*

Oil Produced (Barrels)

61,600

27,900

130,700

59,900

Average Price / Barrel

$94.64

$102.23

$96.19

$91.69

Natural Gas Produced (MMCF)

420.4

373.5

872.7

840.3

Average Price / MCF

$2.31

$3.92

$2.79

$3.81

Total BOE

131,600

90,200

276,200

199,900

Average Price / BOE

$51.65

$47.88

$54.34

$43.46

Segment Revenues ($ in Millions)

$7.1

$4.6

$16.6

$11.9

Segment Earnings ($ in Millions)**

$3.9

$3.1

$9.8

$8.7

Producing Wells

*

(end of period)

541

501

541

501

31

MINERAL RESOURCES SEGMENT KPI'S * Includes our share of venture production:

82 MMCf & 172 MMcf in Q2 2012 and YTD Q2 2012; 128 MMCf and 286 MMcf in Q2 2011 and YTD Q2 2011

** Note: Segment results include costs associated with the development of our water initiatives:

$1.0 million in Q2 2012; $0.8 million in Q2 2011; $2.3 million in YTD Q2 2012 and $1.9

million in YTD Q2 2011

|

Q2

2012

Q2

2011

YTD

2012

YTD

2011

Residential Lot Sales

Lots Sold

427

283

712

497

Average Price / Lot

$44,700

$52,400

$48,000

$50,600

Gross Profit / Lot

$14,800

$20,600

$17,200

$19,700

Commercial Tract Sales

Acres Sold

38

4

38

24

Average Price / Acre

$47,000

$185,300

$47,000

$157,900

Land Sales

Acres Sold

933

781

1,388

3,410

Average Price / Acre

$2,800

$3,300

$2,600

$2,500

Segment Revenues ($ in Millions)

$26.6

$19.6

$44.6

$40.8

Segment Earnings

(Loss) ($ in Millions)

$7.7

$1.0

$19.2

$3.6

**

Q2

2012

results

include

$3.4

million

gain

on

sale

of

800

acres

from

Light

Farm

venture.

***

YTD Q2 2012 results include $11.7 million gain on sale of 25% interest in

Palisades West Note: Includes ventures

**

***

*

Includes 109 residential lots sold at $19,700/lot to closeout River Plantation community in

Tampa, Florida *

32

REAL ESTATE

SEGMENT KPI'

S |

Q2

2012

Q2

2011

YTD

2012

YTD

2011

Fiber Sales

Pulpwood Tons Sold

80,800

70,700

105,200

136,300

Average Pulpwood Price / Ton

$9.24

$9.22

$9.46

$9.20

Sawtimber Tons Sold

24,900

12,700

29,300

28,200

Average Sawtimber Price / Ton

$19.46

$15.69

$19.47

$16.40

Total Tons Sold

105,700

83,400

134,500

164,500

Average Price / Ton

$11.66

$10.21

$11.64

$10.44

Recreational Leases

Average Acres Leased

131,800

197,400

131,400

198,800

Average Lease Rate / Acre

$8.84

$8.96

$8.82

$8.93

Segment Revenues ($ in Millions)

$1.5

$1.3

$2.3

$2.7

Segment Earnings ($ in Millions)

$0.6

$0.7

$1.0

$1.3

*Includes $0.2 million gain on termination of timber lease

Note: Fiber resources segment earnings negatively impacted by sale of over 74,000 acres of

timberland during 2011 *

*

33

FIBER

RESOURCES SEGMENT KPI'S |

Anna Torma

SVP Corporate Affairs

Forestar Group Inc.

6300 Bee Cave Road

Building Two, Suite 500

Austin, TX 78746

512-433-5312

annatorma@forestargroup.com

34 |