Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMPAL-AMERICAN ISRAEL CORP | exhibit_99-1.htm |

| 8-K - 8-K - AMPAL-AMERICAN ISRAEL CORP | zk1211809.htm |

Exhibit 99.2

August 2012 COMPANY PRESENTATION

* About Ampal: Ampal-American Israel Corporation (“Ampal” or the “Company”) and its subsidiaries acquire interests primarily in businesses located in the State of Israel or that are Israel-related. Ampal is seeking opportunistic situations in a variety of industries, with a focus on energy, chemicals and related sectors. Ampal’s goal is to develop or acquire majority interests in businesses that are profitable and generate significant free cash flow which Ampal can control. For more information about Ampal please visit our web site at www.ampal.com. Safe Harbor Statement on Forward-Looking Statements Certain information in this presentation includes forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934 , as amended) and information relating to Ampal that are based on the beliefs of management of Ampal as well as assumptions made by and information currently available to the management of Ampal. When used in this presentation, the words "anticipate," "believe," "estimate," "expect," "intend," "plan," and similar expressions as they relate to Ampal or Ampal's management, identify forward-looking statements. Such statements reflect the current views of Ampal with respect to future events or future financial performance of Ampal, the outcome of which is subject to certain risks and other factors which could cause actual results to differ materially from those anticipated by the forward-looking statements, including among others, the economic and political conditions in Israel, the Middle East, including the situation in Iraq and Egypt, and the global business and economic conditions in the different sectors and markets where Ampal's portfolio companies operate. Should any of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results or outcomes may vary from those described herein as anticipated, believed, estimated, expected, intended or planned. Subsequent written and oral forward-looking statements attributable to Ampal or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements in this paragraph. Please refer to Ampal's annual, quarterly and periodic reports on file with the Securities and Exchange Commission for a more detailed discussion of these and other risks that could cause results to differ materially. Ampal assumes no obligation to update or revise any forward-looking statements. Use of Non-GAAP Financial Measures Ampal uses certain non-GAAP financial measures in this presentation. Ampal uses non-GAAP financial measures as supplemental measures of performance and believes these measures provide useful information to investors in evaluating our operations, period over period. However, non-GAAP financial measures have limitations as analytical tools, and should not be considered in isolation or as a substitute for Ampal’s financial results prepared in accordance with GAAP. In addition, investors should note that any non-GAAP financial measures Ampal uses may not be the same non-GAAP financial measures, and may not be calculated in the same manner, as that of other companies. Reconciliations of our non-GAAP financial measures are included in this presentation.

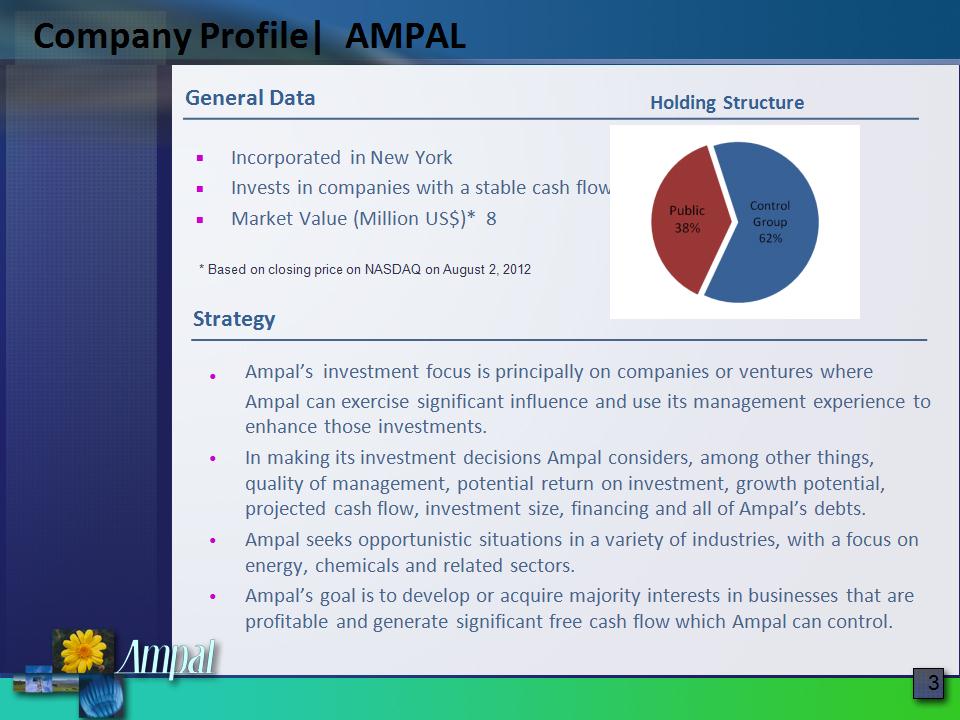

Incorporated in New York Invests in companies with a stable cash flow Market Value (Million US$)* 8 * Company Profile| AMPAL General Data Holding Structure * Based on closing price on NASDAQ on August 2, 2012 Ampal’s investment focus is principally on companies or ventures where Ampal can exercise significant influence and use its management experience to enhance those investments. In making its investment decisions Ampal considers, among other things, quality of management, potential return on investment, growth potential, projected cash flow, investment size, financing and all of Ampal’s debts. Ampal seeks opportunistic situations in a variety of industries, with a focus on energy, chemicals and related sectors. Ampal’s goal is to develop or acquire majority interests in businesses that are profitable and generate significant free cash flow which Ampal can control. Strategy

On December 19, 2011, Ampal requested that the trustees of its Series A, Series B and Series C Debentures, which are listed on the Tel Aviv Stock Exchange (the "Debentures"), convene a meeting of the holders of the Debentures (the “Holders”) to discuss Ampal’s proposal to postpone the principal payments due on the Debentures for 24 months while continuing to make the interest payments as scheduled. Presently, Ampal does not have sufficient cash and other resources to service its debt and finance its ongoing operations. This fact raises substantial doubts as to Ampal's ability to continue as a going concern if Ampal does not reach agreement with the Holders, obtain additional financing or otherwise raise capital through the sale of assets or otherwise. Ampal’s management is in the process of negotiations with the Holders’ committees to restructure the debt to the Holders, but there is no assurance that the negotiations will succeed. On July 17, 2012, Ampal published a new proposed outline for arrangement (as was amended on July 30, 2012) (the "New Term Sheet") to be voted on by the Debenture holders by ballot on August 6, 2012. The New Term Sheet sets out the proposed guiding principles for a detailed agreement to modify the terms of all of the outstanding Debentures. The New Term Sheet reflects the ongoing negotiations with the committees formed by the Holders. As of the publishing of this presentation, the results of the Debenture holders’ vote have not been published by the Debenture holders’ trustees. * Restructuring of Certain Indebtedness

Energy

* EMG | East Mediterranean Gas – EMG Profile EMG was established and registered in Egypt in 2000 and has constructed an off-shore gas pipeline from El-Arish (Egypt) to Ashkelon (Israel) as well as on-shore facilities. Egypt has undertaken to export up to 7 BCM of natural gas annually for 20 years renewable to Israel through EMG. EMG’s contracts with Israeli customers for Egyptian natural gas may have terms of up to 20 years, with a total of 140 BCM. During 2011 and 2012, several alleged terror attacks on EMG’s gas supplier in Sinai interrupted EMG’s gas flow. During April 2012, Egyptian General Petroleum Corporation (“EGPC”) and the Egyptian Natural Gas Holding Company (“EGAS”) notified EMG that they were terminating the Gas Supply and Purchase Agreement (the “Source GSPA”) between the parties. EMG considers the termination attempt unlawful and in bad faith, and consequently demanded its withdrawal. EGPC and EGAS declined to withdraw their termination notice. EMG informed EGPC and EGAS that their attempt to terminate was wrongful and, both in isolation and in combination with their other conduct, constituted repudiation of the GSPA, permitting EMG to exercise its right to terminate the GSPA at common law. Ampal’s investment in EMG had a carrying amount of $260.4 million as of December 31, 2011. Due to the purported termination of the Source GSPA and the uncertainties in Egypt, management decided to write-off the entire amount of the investment in EMG. Ampal did not record future compensation from the arbitrations against Egypt as an ass

* EMG | East Mediterranean Gas – BIT Arbitrations On May 3, 2012, the Company announced that it had filed a request for arbitration against the Arab Republic of Egypt, in connection with the Company’s investment in EMG for the breach of the bilateral investment treaty (“BIT”) between Egypt and the United States. Other EMG investors, including Ampal affiliates and co-investors in EMG, also requested arbitration under Egypt’s BITs with Poland and Germany. In the treaty arbitrations, the EMG investors claim that Egypt breached its international obligations under the applicable investment treaties by failing to provide fair and equitable treatment and full protection and security to their investments, impairing their investments through unreasonable and discriminatory measures, failing to observe the Egyptian State’s obligations toward their investments, and expropriating their investments. Through the arbitrations, the investors seek, among other relief, significant monetary compensation for damages caused by Egypt’s treaty violations. In accordance with the BIT between Egypt and the United States, Ampal’s request for arbitration was submitted to the World Bank’s International Centre for Settlement of Investment Disputes (“ICSID”). Several other US entities and a German citizen who invested in EMG have also filed requests for arbitration pursuant to the ICSID convention. Mr. Yosef A. Maiman – a Polish national – and three Ampal-affiliated entities that he controls, submitted a request for arbitration under Egypt’s BIT with Poland pursuant to the Arbitration Rules of the United Nations Commission on International Trade Law (“UNCITRAL”). Additionally, Ampal has also been advised by EMG that EMG has initiated arbitration proceedings against the government-owned Egyptian gas supplier alleging a breach of various provisions of its gas purchase agreement. EMG seeks, in part, to enforce the undertakings included in the gas purchase agreement. On May 5, 2012, EGPC and EGAS filed a Notice of Arbitration against EMG at the Cairo Regional Centre for International Commercial Arbitration for alleged breaches by EMG of its obligations under the Source GSPA. EGAS and EGPC seek, among other things, declaratory relief, monetary damages of not less than approximately $182 million and injunctive relief ordering EMG to desist from pursuing the above-mentioned arbitration filed by EMG against EGPC and EGAS. The Company’s management believes, based on advice of its legal counsel, that there is a reasonable chance of recovering significant monetary compensation for damages through the above described arbitrations.

* Renewable Energy GWE is owned equally by Clal and Ampal (50%/50%) GWE focuses on the new development and acquisition of controlling interests in renewable energy, including wind energy projects outside of Israel GWE currently has projects in Greece and Poland, which are in varying stages of development, with a total capacity of over 250 mega watts (“MW”) As of June 30, 2012, GWE has received a production license for 4 projects for a total capacity of approximately 90MW wind farms, and a 20MW photovoltaic project, all in Greece Global Wind Energy (“GWE”)

* Renewable Energy Production of Bio-Ethanol fuel from sugarcane. The Project includes the development of a 11,000 hectare sugar cane plantation (Agricultural Project) and the design, construction and operation of an ethanol production plant (Industrial Project). 10,000 hectares are already available for the Project, including purchased and leased land. The Colombian government supports the development of the ethanol industry and, since 2000, has adopted a series of measures to encourage the supply and demand for ethanol and to create a regulatory framework to set prices, including the adoption of a series of laws, decrees and resolutions to stimulate carburant alcohol production, sale and consumption, and including the Colombian Law that stipulates mandatory 10% blending of ethanol for gasoline use in urban areas. Ampal holds a loan of approximately US$22 million convertible to 25% of the Project, to be converted upon the first withdrawal from the financing bank. Ethanol Project in Colombia

Chemicals

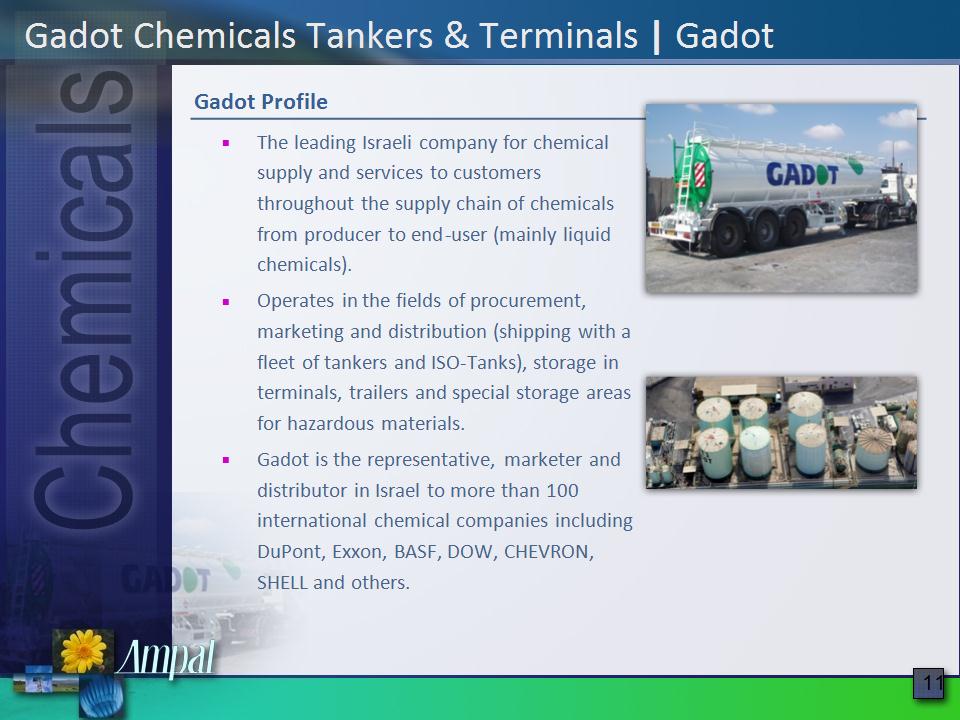

* Gadot Chemicals Tankers & Terminals | Gadot The leading Israeli company for chemical supply and services to customers throughout the supply chain of chemicals from producer to end-user (mainly liquid chemicals). Operates in the fields of procurement, marketing and distribution (shipping with a fleet of tankers and ISO-Tanks), storage in terminals, trailers and special storage areas for hazardous materials. Gadot is the representative, marketer and distributor in Israel to more than 100 international chemical companies including DuPont, Exxon, BASF, DOW, CHEVRON, SHELL and others. Gadot Profile

* Gadot Chemicals Tankers & Terminals | Gadot Years of experience in storage, handling, packaging, transporting and shipping hazardous materials. Provides services to the entire chemicals supply chain in Israel. Geographic Areas of Activity: Israel, Western Europe, South and Central America, USA. Clients, including major Israeli companies: Teva, Makhteshim, ICL, Palsan, HP and others. Chemicals Field

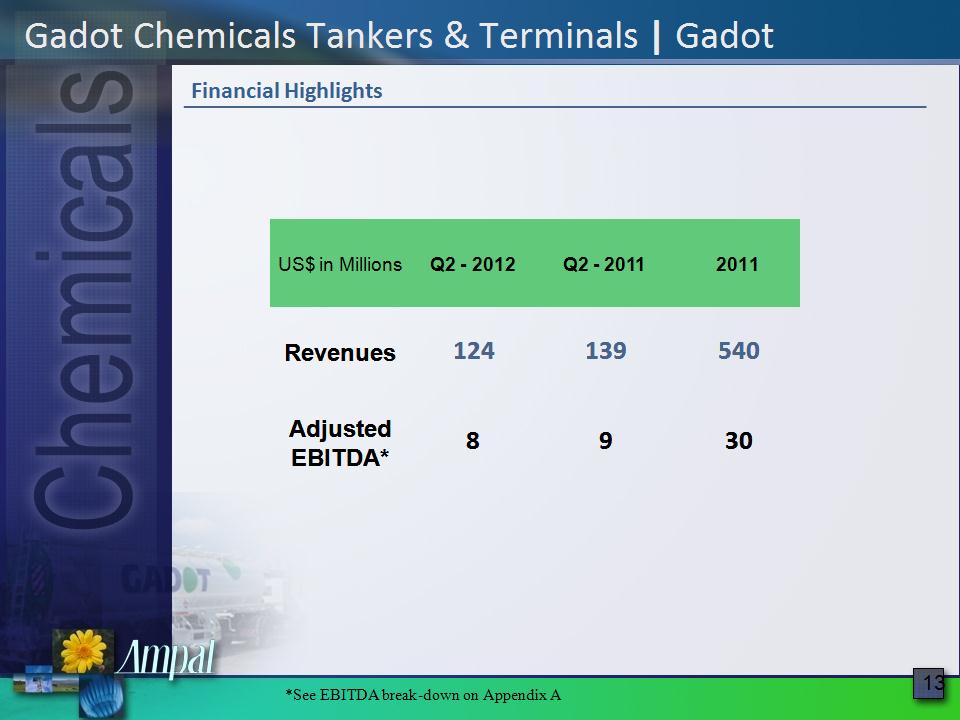

* Gadot Chemicals Tankers & Terminals | Gadot Financial Highlights US$ in Millions Q2 – 2012 Q2 – 2011 2011 Revenues 124 139 540 Adjusted EBITDA* 8 9 30 *See EBITDA break-down on Appendix A

Financials

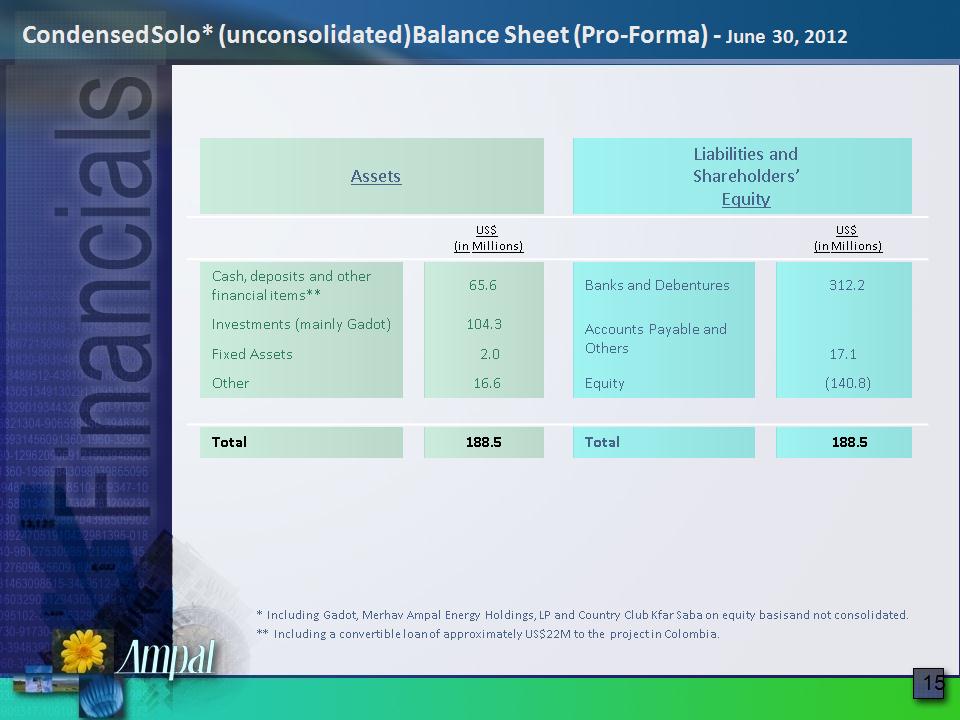

* Condensed Solo* (unconsolidated) Balance Sheet (Pro-Forma) – June 30, 2012 * Including Gadot, Merhav Ampal Energy Holdings, LP and Country Club Kfar Saba on equity basis and not consolidated. ** Including a convertible loan of appromately US$22M to the project in Colombia. Assets Assets Assets Liabilities and Shareholders’ Equity Liabilities and Shareholders’ Equity Liabilities and Shareholders’ Equity US$ (in Millions) US$ (in Millions) Cash, deposits and other financial items** 65.6 Banks and Debentures 312.2 Investments (mainly Gadot) 104.3 Accounts Payable and Others Fixed Assets 2.0 Accounts Payable and Others 17.1 Other 16.6 Equity (140.8) Total 188.5 Total 188.5

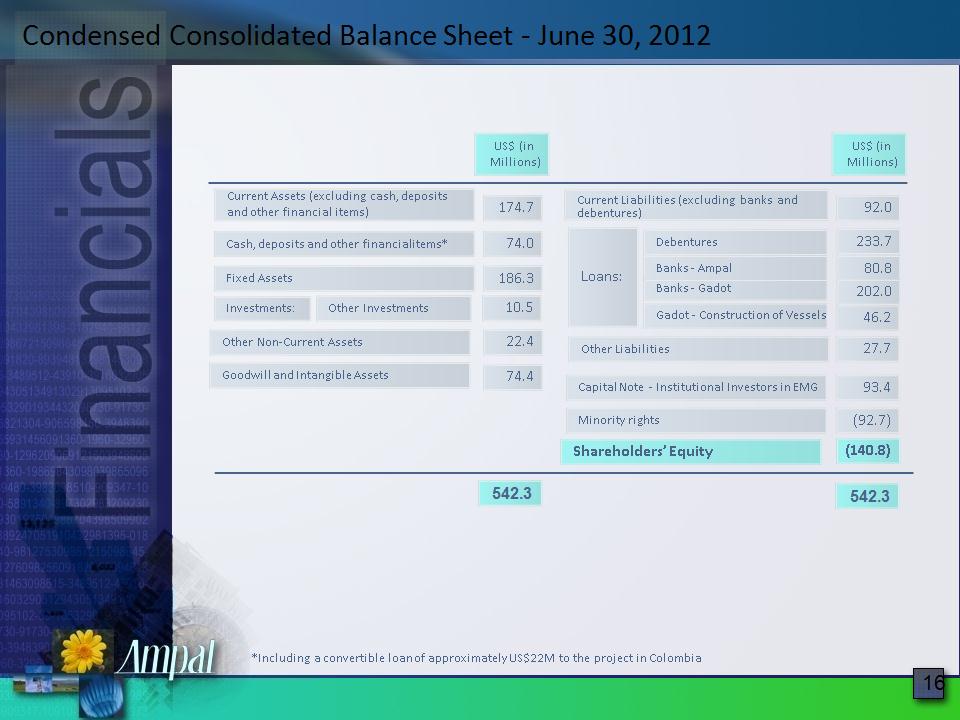

Current Liabilities (excluding banks and debentures) Current Assets (excluding cash, deposits and other financial items) * Condensed Consolidated Balance Sheet – June 30, 2012 Cash, deposits and other financial items* Fixed Assets Investments: Other Investments 174.7 74.0 542.3 186.3 10.5 US$ (in Millions) Gadot – Construction of Vessels Other Liabilities Capital Note – Institutional Investors in EMG 92.0 542.3 46.2 27.7 93.4 US$ (in Millions) Banks – Gadot Banks – Ampal 233.7 80.8 202.0 Debentures Loans: Shareholders’ Equity (140.8) *Including a convertible loan of approximately US$22M to the project in Colombia Other Non-Current Assets 22.4 Goodwill and Intangible Assets 74.4 Minority rights (92.7)

Thank you!

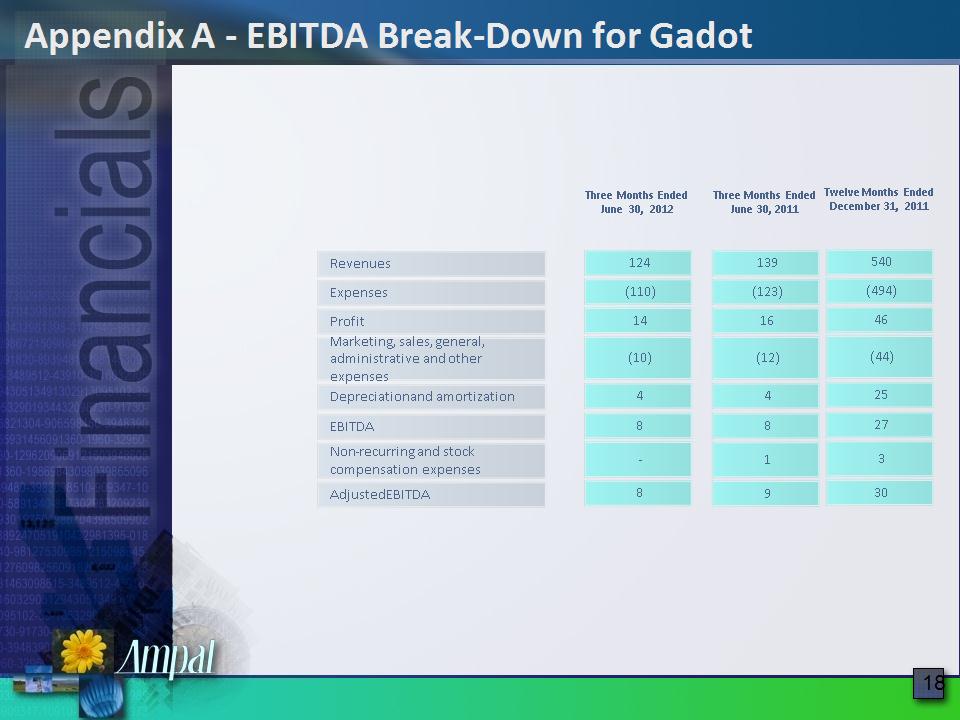

* Appendix A – EBITDA Break-Down for Gadot 124 (110) 14 (10) 4 8 - 8 Three Months Ended June 30, 2012 139 (123) 16 (12) 4 8 1 9 Three Months Ended June 30, 2011 Revenues Expenses Profit Marketing, sales, general, administrative and other expenses Depreciation and amortization EBITDA Non-recurring and stock compensation expenses Adjusted EBITDA Twelve Months Ended December 31, 2011 540 (494) 46 (44) 25 27 3 30

* Adjusted EBITDA is defined as earnings before interest, income tax provision, depreciation and amortization, adjusted for non recurring expenses. Management believes adjusted EBITDA for Gadot to be a meaningful indicator of its performance that provides useful information to investors regarding its financial condition and results of operations. Presentation of adjusted EBITDA is a non-GAAP financial measure commonly used by management to measure operating performance. While management considers adjusted EBITDA to be an important measure of comparative operating performance, it should be considered in addition to, but not as a substitute for, net income and other measures of financial performance reported in accordance with Generally Accepted Accounting Principles. Adjusted EBITDA does not reflect cash available to fund cash requirements. Not all companies calculate adjusted EBITDA in the same manner, and the measure as presented may not be comparable to similarly-titled measures presented by other companies.