Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REPUBLIC AIRWAYS HOLDINGS INC | v320133_8k.htm |

Annual Shareholder’s Meeting August 1, 2012

Disclaimer 2 © Republic Airways Holdings Inc. Statements in this presentation, as well as oral statements that may be made by officers or directors of Republic Airways Holdings Inc., its advisors, affiliates or subsidiaries (collectively or separately the “Company”), that are not historical fact constitute “forward - looking statements”. Such forward - looking statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from historical results or from any results expressed or implied by the forward - looking statements. Such risks and uncertainties are outlined in the Company’s Annual Report on Form 10 - K, most recent Quarterly Report and other documents filed with the SEC from time to time. The Company cautions users of this presentation not to place undue reliance on forward - looking statements, which may be based on assumptions and anticipated events that do not materialize. Certain financial figures presented herein have been presented on a non - GAAP basis. Reconciliations for non - GAAP financial measures to our reported U.S. GAAP measures are included in the appendix to this document. Disclaimer Non - GAAP Information

Agenda I. 2011 in review II. 1 st Half 2012 results III. 2012 Objectives IV. 2013 and the Future at RJET V. Questions VI. Contacts VII. Appendix © Republic Airways Holdings Inc. 3

I. 2011 IN REVIEW ► Additional EJets with Delta ► Successful restructuring of Frontier ► Announcement of separation 4 © Republic Airways Holdings Inc.

2011 Consolidated Results 5 © Republic Airways Holdings Inc. ► Revenue increased from additional CPA flying on the EJets, and stronger fares on the branded business ► Increased maintenance expenses on 50 - seat ERJs deteriorated Republic profits ► Impairment of 50 - seat ERJs and related assets was a significant, non - cash charge in Q4 2011 ► A 37.3% increase in fuel price per gallon produced a headwind of $140 million for the Frontier segment *See appendix for listing of items. 2010 Republic Frontier 2011 Operating Revenues 2,653.7$ 1,533.9$ 1,330.6$ 2,864.5$ Operating Expenses Fuel Expense 616.9 303.4 517.7 821.1 All Other Expenses 1,903.4 1,247.4 901.6 2,149.0 Operating Income (loss) 133.4 (16.9) (88.7) (105.6) Other Income (expense) (154.9) (130.2) (6.6) (136.8) Income (loss) before Income Taxes (GAAP) (21.5) (147.1) (95.3) (242.4) Items 76.4 203.7 48.2 251.9 Ex-item Income (loss) before Income Taxes 54.9$ 56.6$ (47.1)$ 9.5$ ASMs (millions) 26,547 14,450 11,778 26,228 Block Hours (thousands) 973 731 219 951 For the Years Ended December 31,

2011 Business Improvement Plan ► Frontier restructuring scorecard shows significant turn around ► Continued efforts to optimize the network and reduce spending ► New management team engaged and on - site in Denver 6 © Republic Airways Holdings Inc. (a) Included ERJ lease reductions not yet achieved. Airbus lease reductions came in ahead of target (b) Expect to obtain the remaining savings in 2012 ($$ in MM) Original Target Amount Achieved Frontier Total Fleet and Network 25.0$ 50.0$ Total Labor and Benefits 25.0 27.0 Fuel Conservation 10.0 10.0 Total Aircraft Leases 30.0 26.3 (a) Total Distribution and Advertising 10.0 7.5 Total Other 20.0 15.0 (b) Total Restructuing Target 120.0$ 135.8$

Frontier Restructuring Was Very Successful 7 © Republic Airways Holdings Inc. ► Frontier saw significant improvements from the first half of 2011 to the second half 2011, largely due to the restructuring efforts June 30, Dec 31, 2011 2011 Change Percent Operating Revenues 620.4$ 710.1$ 89.7$ 14.5% Operating Expenses Fuel Expense 243.6 274.1 30.5 12.5% All Other Expenses 444.8 456.7 11.9 2.7% Operating Income (loss) (68.0) (20.7) 47.3 69.6% Other Income (expense) (3.6) (3.1) 0.5 -13.9% Income (loss) before Income Taxes (GAAP) (71.6)$ (23.8)$ 47.8$ 66.8% Items 1.4 46.8 45.4 nm Ex-item Income (loss) before Income Taxes (70.2)$ 23.0$ 93.2$ 132.8% ASMs (millions) 5,668 6,110 442 7.8% Block Hours (thousands) 107 113 6 5.3% Fuel Price per Gallon 3.25$ 3.28$ 0.03$ 0.9% For the six months ended

2011 Accomplishments Fleet ► Implemented an aggressive restructuring at Frontier, resulting in better than targeted results ► Focusing Frontier with single fleet, with six new A320s, four used Airbus aircraft, and an order for 80 fuel - efficient Airbus NEO aircraft ► Amendment with Delta provided for more EJet aircraft flying on the fixed - fee agreement Commercial ► Airline Performance Analysis System (APAS) implementation for better insight into financial performance of routes, markets, and the entire Frontier network Operations/Administrative ► Expansion of charter operations with Apple Vacations, one of the country’s largest tour operators ► Improve AQR score from 9 th to 4 th place in North America Liquidity Initiatives ► Sale of intangible assets within the entities and restructuring of E190 purchase agreement resulted in over $70m in liquidity enhancements in Q4 - 2011 8 © Republic Airways Holdings Inc.

II. 1 ST HALF 2012 RESULTS ► Additional CPA flying announced on ERJs and Q400s with United ► Streamlining Frontier Network ► Separate Frontier management in Denver 9 © Republic Airways Holdings Inc.

1 st Half 2012 Republic Results 10 © Republic Airways Holdings Inc. ► More aircraft under fixed - fee arrangements ► Significantly reduced pro - rate losses by grounding 50 - seat regional jets ► We continue to grow our Republic business with new CPA opportunities 13.1 31.9 27.6 (11.3) 2.5 - 10.0 20.0 30.0 40.0 50.0 1st Half 2011 Reduced Pro - rate losses Parked AC Other 1st Half 2012 2011 2012 Change Percent Operating Revenues 778.4$ 712.7$ (65.7)$ -8.4% Operating Expenses Fuel Expense 163.9 114.1 (49.8) -30.4% All Other Expenses 534.9 504.6 (30.3) -5.7% Operating Income (loss) 79.6 94.0 14.4 18.1% Other Income (expense) (66.5) (62.1) 4.4 -6.6% Income (loss) before Income Taxes (GAAP) 13.1$ 31.9$ 18.8$ 143.5% ASMs (millions) 6,979 6,720 (259) -3.7% Block Hours (thousands) 355 347 (9) -2.4% For the six months ended June 30,

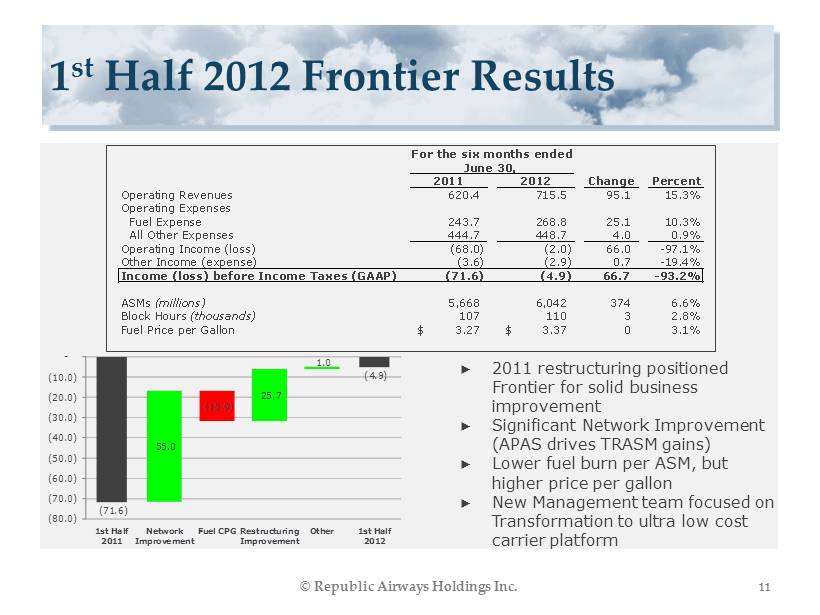

1 st Half 2012 Frontier Results 11 © Republic Airways Holdings Inc. ► 2011 restructuring positioned Frontier for solid business improvement ► Significant Network Improvement (APAS drives TRASM gains) ► Lower fuel burn per ASM, but higher price per gallon ► New Management team focused on Transformation to ultra low cost carrier platform (71.6) (4.9) 55.0 (15.0) 25.7 1.0 (80.0) (70.0) (60.0) (50.0) (40.0) (30.0) (20.0) (10.0) - 1st Half 2011 Network Improvement Fuel CPG Restructuring Improvement Other 1st Half 2012 2011 2012 Change Percent Operating Revenues 620.4 715.5 95.1 15.3% Operating Expenses Fuel Expense 243.7 268.8 25.1 10.3% All Other Expenses 444.7 448.7 4.0 0.9% Operating Income (loss) (68.0) (2.0) 66.0 -97.1% Other Income (expense) (3.6) (2.9) 0.7 -19.4% Income (loss) before Income Taxes (GAAP) (71.6) (4.9) 66.7 -93.2% ASMs (millions) 5,668 6,042 374 6.6% Block Hours (thousands) 107 110 3 2.8% Fuel Price per Gallon 3.27$ 3.37$ 0 3.1% For the six months ended June 30,

1 st Half 2012 Consolidated Results 12 © Republic Airways Holdings Inc. ► Significant improvement as a direct result of business improvements at Frontier in the second half of 2011 ► Utilization of EJet aircraft under fixed - fee agreements mitigated parked aircraft costs ► RJET management now focused on Chautauqua restructuring effort (58.5) 27.0 55.0 27.6 (15.0) 25.7 (11.3) 3.5 (80.0) (60.0) (40.0) (20.0) - 20.0 40.0 1st Half 2011 Network Improvement Reduced Pro - rate Fuel CPG Restructuring Improvement Parked AC Other 1st Half 2012 2011 2012 Change Percent Operating Revenues 1,398.8$ 1,428.2$ 29.4$ 2.1% Operating Expenses Fuel Expense 407.6 382.9 (24.7) -6.1% All Other Expenses 979.6 953.3 (26.3) -2.7% Operating Income (loss) 11.6 92.0 80.4 693.1% Other Income (expense) (70.1) (65.0) 5.1 -7.3% Income (loss) before Income Taxes (GAAP) (58.5)$ 27.0$ 85.5$ -146.2% ASMs (millions) 13,073 12,762 (311) -2.4% Block Hours (thousands) 479 457 (22) -4.7% Fuel Price per Gallon 3.27$ 3.24$ (0.03)$ -0.9% Change in Cash (3.5)$ 39.7$ 43.2$ 1234.3% For the six months ended June 30,

2012 Liquidity Improvements 13 © Republic Airways Holdings Inc. ► Total cash at approximately 14% of trailing twelve month revenue, which is considered below adequate levels for an airline of our size. ► Remain in compliance with our debt covenants ► Cash is in line from previous quarter with goal to increase unrestricted balance in Q3 and Q4 ► Sept. 30 unrestricted Cash forecast ($190 - $200) ► Evaluating further liquidity generating initiatives in 2H - 2012 $191.3 $184.7 $219.3 $177.5 $180.3 $235.5 $204.8 $151.4 $219.0 $230.1 $426.8 $389.5 $370.7 $396.5 $410.4 $ - $100 $200 $300 $400 $500 6/30 9/30 12/31 3/31 6/30 Restricted Cash Total

III. 2012 OBJECTIVES ► Continued growth on the Republic segment ► Reduce CASM on the Frontier segment 14 © Republic Airways Holdings Inc.

Growth into 2012 ► Signed CPA for extended flying of twelve E145s for United - Continental through 2014 ► Executed an eight year CPA agreement for 32 Q400 aircraft flying with United - Continental, which includes our 4 owned aircraft previously parked ► Reduced parked aircraft by putting them to back to work; anticipate having all but 11 aircraft back in CPA service by the end of 2012, when original plan anticipated having 27 parked aircraft at end of 2012 ► Aggressively pursuing Chautauqua restructuring program to improve cash flow results $40m - $60m annually and enable us to put idle remaining ERJ aircraft back into service and position us to extend CPA’s at expiry over the next few years. 15 © Republic Airways Holdings Inc.

Our Fleet Plan 16 Frontier ► Frontier fleet will include Airbus only, with pro - rate flying on E190 aircraft through Republic Airline ► More A320 aircraft with more seats per aircraft © Republic Airways Holdings Inc. Republic ► Pro - rate flying of E190 aircraft for Frontier ► New CPA for Q400 aircraft ► New CPA for ERJ aircraft ► Subleased aircraft total 14 ► Only 11 parked aircraft by 12/31/12 ► Sale of 5 E190 aircraft to US Airways 12/10 (plan) 12/12 (plan) 12/13 ERJs CPA 65 60 45 Pro-rate 13 - - Parked - 11 26 CPA/Charter 126 132 163 Pro-rate 32 15 5 Parked 2 - - Airbus A318 5 3 - A319 38 37 37 A320 7 16 21 Total 288 274 297 Frontier Republic Ejets/Q400s

Guidance – Q3 2012 ► Consolidated EPS ► Range of $0.50 - $0.55 earnings per share ► Unrestricted Cash ► Unrestricted $190 - $200 million ► Fuel Cost per Gallon ► $3.05 - $3.15 per gallon ► Frontier TRASM ► $0.124 - $0.126 ► Frontier CASM (excluding fuel) ► $0.074 - $0.076 ► Load factor ► 90% - 92% ► Operating margin ► 7% - 9% ► Republic CASM (including interest and excluding fuel) ► $0.086 - $0.087 ► Pre - Tax margin ► 3% - 5% 17 © Republic Airways Holdings Inc.

IV. 2013 AND THE FUTURE AT RJET 18 © Republic Airways Holdings Inc.

History of IBT Negotiations 8/1/2012 19 © Republic Airways Holdings, Inc. 2007 2008 2009 2010 2011 2012 07/07 – negotiations begin between Teamsters (IBT) and Republic (RJET) 01/08 - 11/08 – IBT and RJET meet and agree on substantial portions of new contract 04/14/09 – IBT and RJET agree to approx. 1/3 of open items 04/15/09 – IBT placed into trustee - ship - delay 07/09 – Trustees withdraw proposal 08/09 – RJET offers proposal, no response from Trustee until 12/10 09/09 – Parties agree to defer negotiations 01/19/10 – IBT Strike Chairman delivers threat of strike, and intent to reopen more articles 12/10 – New IBT Negotiating Committee approaches RJET to resume but withdraws all prior proposals 03/15/11 – IBT submits first proposal, demand RJET negotiate from their proposal solely 04/12/11 – RJET submits counter, IBT files for mediation 02/22/12 – IBT submit 2 nd compensation proposal, 3 rd party analysts determine it would slightly less than double pilot payroll expense 06/02/11 – Parties attend mediation with NMB, Mediator directs parties to work from current contract 04/24/12 – 04/26/12 – IBT and RJET meet in D.C. IBT spends only 1/3 of the allotted time negotiating 10/13/12 – IBT submit 1 st compensation proposal, 3 rd party analysts determine it would more than double pilot payroll expense 07/12 – IBT filed for release from mediation

Industry Concessions Over Time 8/1/2012 © Republic Airways Holdings, Inc. 20 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 American Eagle: 1.5% an. increase Bankruptcy ASA: 1% annual increase Merger with ExpressJet Acq . by SkyWest Air Wisconsin: 10 year contract 1.5% annual increase until last year. In 2011, 2 - 6% increase In negotiation Comair: 1.5 to 2.5% annual increase Shut down Bnkrpt . (12.5% ↓) Compass: 1.7 % annual increase (six year contract) ExpressJet: between - 2.8% to 3.4% annual increase during contract term Merger with ASA GoJet: between 1.5% annual increase (2007 to 2013) 1.3 to 17.8 % increase 1.5 % increase Horizon: 2.8% an. Inc. (next review ’13) Mesa: 0% annual increase Bankruptcy Mesaba: 1.5 to 4% annual increase Bankruptcy Bankruptcy Trans States: 1.5% 7.5% to 51.4% (to get closer to market) Pinnacle:0.7% to 22.5% increase in 2011 In negotiations In negotiations due to Restructuring / Bankruptcy Major carriers forced to restructure and merge Regional carriers forced to merge and restructure in response TSA Negotiation Bankruptcy

Republic vs. OA per diem $ / hour Note: See appendix for additional base pay data (by aircraft type & position) Source: Seabury analysis; public data 1.651.65 0.0 0.5 1.0 1.5 2.0 Peer group average Current Republic per diem 1.6 1.7 1.5 1.7 1.4 1.8 1.6 1.8 1.6 1.8 1.7 1.9 1.6 Trans States SkyWest PSA Pinnacle Mesa Horizon GoJet Express Jet Compass Comair ASA Am. Eagle Air Wisc. Captain Rates RJET Avg. Seniority Peer group at RJET average RJET TOS OA TOS E175/190 87.40 (9 yrs) 81.29 119.32 107.13 E170 79.46 (9 yrs) 80.36 108.47 103.85 A145 (s/b E145) 73.41 (8 yrs) 74.60 103.30 97.27 E135/140 61.47 (6 yrs) 60.02 91.94 78.08 FO Proposed Rates RJET Avg. Seniority Peer group at RJET average RJET TOS OA TOS E170/175/190 39.00 (4 yrs) 39.89 42.00 44.73 E135/140/145 39.00 (4 yrs) 38.62 42.00 42.59 Peer group 21 © Republic Airways Holdings, Inc. Republic’s Captain Pay Already Competitive with Peer Group Given competitive pressures and recent Chapter 11 filings, Republic’s competitors are likely to see lower rates as peer group airlines push costs downward

22 © Republic Airways Holdings, Inc. Bid/Ask Overview Republic Offer includes: ► Significant pay increase for First Officers, valued at ~$4M per year ► Increased per diem rate, valued at ~$1M per year ► Total increased Comp over 5 - year period of ~$25M IBT Offer includes: ► Grossly above - market pay rates for all positions, valued at ~$75M per year ► Various work rule changes valued at ~$65M per year ► Total increased Comp over 5 - year period of ~$700M

Scope Opportunities into 2013 ► AMR bankruptcy continues to progress ► Current agreement for 15, 44 - seat E140 aircraft expires in February 2013 ► Opportunity to gain relief from scope restrictions through labor discussions and allow larger aircraft to fly on regional carriers ► We continue to partner with American and look forward to continuing our relationship ► Possible large regional jet opportunities with both Delta and United; the outlook is one of cautious optimism ► We do not believe we will be able to successfully compete for new large RJ flying opportunities until we conclude a new labor agreement 23 © Republic Airways Holdings Inc.

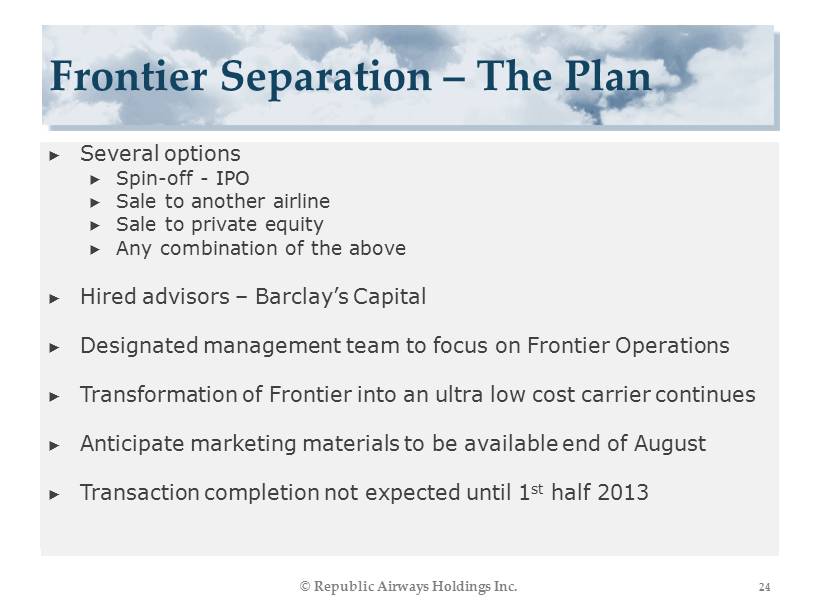

Frontier Separation – The Plan ► Several options ► Spin - off - IPO ► Sale to another airline ► Sale to private equity ► Any combination of the above ► Hired advisors – Barclay’s Capital ► Designated management team to focus on Frontier Operations ► Transformation of Frontier into an ultra low cost carrier continues ► Anticipate marketing materials to be available end of August ► Transaction completion not expected until 1 st half 2013 24 © Republic Airways Holdings Inc.

RJET’s Vision 25 © Republic Airways Holdings Inc. ► Spin off Frontier Airlines while maintaining, where profitable, E190 flying on prorate basis ► Return to CPA only operations – focusing the business ► Restructure ~$600M of debt and lease obligations for 84 50 - seat or smaller aircraft ► Fully align timing of aircraft obligations and CPA expiration dates ► Secure competitive 5 - year CBA with IBT pilot group ► Return grounded ERJ - 145 and/or aircraft coming off CPAs back to service ► Improve return on fixed assets ► Rebuild balance sheet liquidity and profitability to be creditworthy to fund new aircraft purchases ► Seek new 70 - seat+ CPA flying by maintaining cutting - edge competitive costs and superior products and services Restructure debt, leases, and CBAs Return idle 50 - seat fleet to service Grow 70+ - seat CPA flying by being “best in class” 1 2 4 ▪ A substantially restructured Chautauqua would be in a position to complete for the limited amount of 50 - seater CPAs expiring over the next few years ▪ Restructuring gains cannot be reversed by a non - competitive Pilot CBA Outcomes Spin off Frontier 3

V. QUESTIONS 26 © Republic Airways Holdings Inc.

V. CONTACT INFO Media Inquiries: Peter Kowalchuk RJETMedia@rjet.com (317)471 - 2470 27 © Republic Airways Holdings Inc. Investor Inquiries: Margaret Miller Margaret.Miller@rjet.com (317)246 - 2628

VII. APPENDIX 28 © Republic Airways Holdings Inc. ► Reconciliations to GAAP basis accounting

Appendix A Description of items: 29 © Republic Airways Holdings Inc. 2010 Republic Frontier 2011 Integration and fleet transition expenses 56.4 13.3 40.0 53.3 Non-recurring impairment 11.5 191.1 - 191.1 Fuel excise tax and mark-to-market hedge adjustments 6.2 - (3.8) (3.8) Gain on sale of assets - (2.4) - (2.4) Severe storm/ hailstorm impact 7.5 2.0 12.0 14.0 Reduction of Midwest lease obligations (5.2) - - - 76.4$ 204.0$ 48.2$ 252.2$