Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - PETROSONIC ENERGY, INC. | v319861_ex2-1.htm |

| EX-99.2 - EXHIBIT 99.2 - PETROSONIC ENERGY, INC. | v319861_ex99-2.htm |

| EX-10.4 - EXHIBIT 10.4 - PETROSONIC ENERGY, INC. | v319861_ex10-4.htm |

| EX-99.3 - EXHIBIT 99.3 - PETROSONIC ENERGY, INC. | v319861_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - PETROSONIC ENERGY, INC. | v319861_ex99-1.htm |

| EX-10.3 - EXHIBIT 10.3 - PETROSONIC ENERGY, INC. | v319861_ex10-3.htm |

| EX-10.6 - EXHIBIT 10.6 - PETROSONIC ENERGY, INC. | v319861_ex10-6.htm |

| EX-10.5 - EXHIBIT 10.5 - PETROSONIC ENERGY, INC. | v319861_ex10-5.htm |

| EX-10.2 - EXHIBIT 10.2 - PETROSONIC ENERGY, INC. | v319861_ex10-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

July 27, 2012

PETROSONIC ENERGY, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 000-53881 | 98-0585718 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

Suite 204, 205 – 9th Avenue SE , Calgary, AB, Canada, T2G 0R3

(Address of Principal Executive Offices)

(403) 708-7869

(Issuer's Telephone Number)

Suite 300, 714 – 1st Street, SE, Calgary, AB CANADA, T2G 2G8

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Cautionary Notice Regarding Forward-Looking Statements

This Current Report on Form 8-K (“Form 8-K”) and other reports filed by the Registrant from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, the Registrant’s management as well as estimates and assumptions made by the Registrant’s management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to the Registrant or the Registrant’s management identify forward-looking statements. Such statements reflect the current view of the Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) relating to the Registrant’s industry, the Registrant’s operations and results of operations and any businesses that may be acquired by the Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Registrant believes that the expectations reflected in the forward looking statements are reasonable, the Registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the Registrant’s pro forma financial statements and the related notes filed with this Form 8-K.

Unless otherwise indicated, in this Form 8-K, references to “we,” “our,” “us,” the “Company” or the “Registrant” refer to Petrosonic Energy, Inc. (previously Bearing Mineral Exploration, Inc.), a Nevada corporation and its majority-owned subsidiary, Petrosonic Albania Sha, a body corporate under the laws of Albania (“AlbaniaCo”).

Unless otherwise indicated, all monetary references are to Canadian dollars.

Section 1 – Registration’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

The information contained in Item 2.01 below is incorporated by reference herein.

Section 2 – Financial Information

Item 2.01 Completion of Acquisition or Disposition of Assets.

On July 27, 2012 (the “Closing Date”), we acquired certain assets (the “Assets”) from Sonoro Energy Ltd., (“Sonoro”), including (i) certain technology relating to the treatment and upgrading of heavy oil by sonicated solvent de-asphalting, (ii) 60,000 shares of AlbaniaCo pursuant to a share purchase agreement (the “Share Purchase Agreement”), and (iii) sonic reactors located in Albania and Richmond, British Columbia and a solvent recovery system located in or around Turin, Italy (the “Transaction”), pursuant to the terms of the Asset Purchase and Sale Agreement, dated July 27, 2012 (the “Purchase Agreement”).

| 2 |

Pursuant to the terms of the Purchase Agreement, in exchange for the Assets, we agreed to pay to Sonoro the following consideration: (i) $250,000, (ii) a convertible debenture in the principal amount of $250,000 (the “Debenture”) and (iii) a 10% royalty interest in our realized net revenues for a period of 10 years from the time we commence commercial operations, which is defined as the date upon which we process an average of 50 barrels of feed stock per day over a period of 30 consecutive days utilizing the technology acquired.

The Purchase Agreement contains customary representations, warranties, and conditions to closing. The foregoing description of the terms and conditions of the Purchase Agreement and the transactions contemplated thereunder that are material to the Company does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement. Pursuant to the Purchase Agreement, certain key personnel will enter into a non-competition and non-solicitation agreement with the Company (the “Non-Compete Agreement”) and the Company and Sonoro will enter into a consulting agreement (the “Consulting Agreement”).

Prior to the Transaction, we were a public reporting “shell company,” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended and the rules and regulations promulgated thereunder (“Exchange Act”). Accordingly, pursuant to the requirements of Item 2.01(a)(f) of Form 8-K, set forth below is the information that would be required if the Registrant were filing a general form for registration of securities on Form 10 under the Exchange Act, for the Registrant’s common stock, which is the only class of its securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the Transaction.

Contemporaneous with the completion of the Transaction, we have entered into a license agreement with Sonoro (the “Iraq License Agreement”) for commercialization of the Company’s technology in the Republic of Iraq, provided that under the terms of the Iraq License Agreement, Sonoro shall not be obligated to pay the Company any license fees or royalty payments.

The Debenture, the Non-Compete Agreement, the Consulting Agreement, the Share Purchase Agreement, and the Iraq License Agreement are attached to this report as Exhibits 10.2 through 10.6, respectively, and the terms and conditions are incorporated herein. The foregoing statements are not intended to be a complete description of all terms and conditions.

From and after the Closing Date, our primary operations will consist of utilizing the Assets to develop a business relating to the treatment and upgrading of heavy oil by sonicated solvent de-asphalting and operating the business of AlbaniaCo (the “Business”). Therefore, we disclose information about the Business in this Form 8-K.

For accounting purposes, the Purchase Agreement has been accounted for under the Purchase Method of accounting by the Registrant. The financial statements of the Business are set forth in Exhibit 99.1 and Exhibit 99.2 of this Current Report. For pro forma financial information, see Exhibit 99.3 of this Current Report.

| 3 |

DESCRIPTION OF BUSINESS

History

We were incorporated under the laws of the State of Nevada on June 11, 2008, under the name “Bearing Mineral Exploration, Inc.”, with authorized capital stock of 75,000,000 shares at $0.001 par value. We were organized for the purpose of conducting gold exploration activities on a mineral claim located in the Province of Newfoundland, Canada. We were not able to establish the existence of a commercially minable gold deposit and therefore have acquired the Business and shifted our focus to opportunities in the treatment and upgrading of heavy oil by sonicated solvent de-asphalting.

On April 17, 2012, we issued 20,000,003 (1,777,778 pre-split) shares of our common stock to Art Agolli, our sole officer and director, in exchange for all of his right, title and interest in a letter of intent with Sonoro for the purchase of the Assets.

On April 18, 2012, concurrent with his resignation as a director of the Company, Gerhard Schlombs surrendered 22,500,000 (2,000,000 pre-split) shares of the Company’s common stock to the corporate treasury for cancellation.

On May 16, 2012, we effected an 11.25-for-1 forward stock split of our Common Stock and an increase in our authorized number of common shares to 843,750,000. Additionally, on May 16, 2012, we changed our name to “Petrosonic Energy, Inc.” and on July 27, 2012 we entered into the Purchase Agreement to acquire the Assets from Sonoro (the “Purchase Agreement”).

Overview

Petrosonic has developed a commercial process which improves heavy oil densities by 6 to 15 API1 from as low as 8 API, reduces viscosities of oil by 99% to pipeline specifications and reduces sulphur and heavy metals by over 50%.

This process is especially beneficial to producers with the following intrinsic challenges:

| · | Stranded heavy oil due to transportation issues |

| · | Diluent supply issues |

| · | Limited refining markets (light oil refiners struggle with heavy oil) |

| · | Heavy discounts due to |

| o | Density adjustments |

| o | High sulphur content |

| o | High metals content |

1 The American Petroleum Institute gravity, or API gravity, is a measure of how heavy or light a petroleum liquid is compared to water; one of the qualitative measures for crude oil

| 4 |

Depending on regional markets, traditional heavy oil discounts (10 API oil with >2% sulfur) are 35-40% and we believe such discounts could be reduced to only 10-20% through our process. On 5,000 barrels of oil per day (“bopd”) this would equate to increased revenues of approximately $6/barrel (bbl) or around $11 million per year (based on $100/bbl brent oil). Capital costs are expected to be between $0.5-1 million per 1,000 bbls capacity. Operating costs will be between $2-3 per bbl on a stand alone facility basis.

Petrosonic plans to have its first 1,000 bopd stand-alone facility operational by September 2012 in Albania. Expected annual cashflows from the initial 1,000 bopd facility are expected to reduce heavy oil price discounts historically received in Albania from 40% to 20% as a result of achieving a 18-23 API oil. Petrosonic believes that with significant heavy oil production growth anticipated from the approximately 8 billion barrels of oil reserves believed to be present in Albania, if we are able to successfully capture a portion of this processing business, Petrosonic expects to expand its facilities over the next 3-5 years to 15,000 bopd as Albanian oil production increases.

If we are able to successfully establish our first commercial facility, we believe heavy oil producers will want to integrate the Petrosonic system at their cost into their treatment facilities. Petrosonic would sell the process solution and retain a royalty fee under this type of development. While revenue per facility will be less (estimated at 50%), no capital and minimal support will be required. This strategy would allow for faster growth. Petrosonic may also choose to develop its own stand alone facilities to capture further upside and long term value creation.

Further upside opportunities exist in several other applications which the Company is in advanced stage of development, including, heavy oil sands separation (both from oil sands and ecology pits), and oil separations from drill cuttings.

Vision and Strategy

| · | Petrosonic hopes to provide its shareholders with returns and cash flow growth by leveraging its experience and intellectual property within the heavy oil business. |

| · | Petrosonic plans to use an initial model of building its own stand-alone facilities to prove, optimize and develop business growth opportunities with small to medium sized producers. To achieve higher returns and growth, the Company will license out on a fee for service basis or royalty basis its processes to be integrated into producer’s treatment facilities. |

| · | Where there is a distinct advantage Petrosonic may capture heavy oil resources prospects or participate jointly in them. Any resource level participation would require higher returns on investment and be required to stand on its own prior to the benefits of applying Petrosonic’s technology. |

| · | We believe Petrosonic’s leadership in oil processing technology compiled with a strong background in the heavy oil industry is expected to result in a superior rate of return to shareholders from direct and indirect operations. This will be further leveraged if the Company is able to financially participate in the underlying oil assets, especially by acquiring these in advance. |

| 5 |

Key Success Factors

The Company’s success will be dependent upon:

| · | Our ability to attract and develop numerous projects once the first project is complete; |

| · | Access to an ample producer oil supply and our ability to find equitable profit distribution; |

| · | Our development and distribution of asphalt within the market; |

| · | Our ability to minimize the technical risk through avoidance of scale up issues; |

| · | Alleviation of market risk through the use of strategic partners which can gain quick access to markets; and |

| · | Alleviation of financial risk through partnering. |

Priorities

Immediate priorities of the Company are;

| · | Strengthening the operations and management of the Company as it moves forward in the oil sector; |

| · | Moving ahead with the processing facility in Albania; |

| · | Establishing a second country oil processing project; and |

| · | Building a firm backlog of projects with financing commitments. |

The Industry

Traditional Heavy Oil Opportunities

Crude oil is the world’s most actively traded commodity. Heavy crude oil is a type of highly viscous crude oil that does not flow easily (sometimes referred to as non-conventional oil). Typically, it is defined as crude oil with an API gravity of less than 22 API. For example, Canadian extra-heavy crude (Athabasca bitumen) has a viscosity of 10,000+ cP (the cgs physical unit for dynamic viscosity is the poise (P). It is more commonly expressed, particularly in ASTM standards, as centipoise (cP). Water at 20 °C has a viscosity of 1.0020 cP), about the same as cold molasses, and API gravity between 8-14 API. In comparison, WTI, a type of light crude oil used as a benchmark in oil pricing of New York Mercantile Exchange’s oil futures, has an API of approximately 39.6. Naturally, heavy oils can be upgraded to high quality light synthetic oils using specialized refining processing.

Heavy oil is a relative term, compared to light crude oil, but relates to specific technical issues of its own on production, transportation, and refining. Usually a diluent is added to carry heavy crude to facilitate its flow in pipelines.

| 6 |

Global Need, Supply and Production

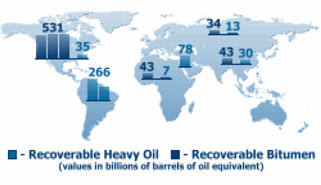

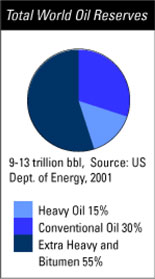

The exact number of reserves of heavy oil varies according to different sources, but it is generally accepted that the amount of recoverable heavy oil is greater than remaining reserves of conventional oil. According to Schlumberger, the current world oil reserves consist of 9-13 trillion barrels of oil, 30% of which are conventional sources, 40% heavy and extra-heavy sources and 30% oil sands bitumen sources. 2

Estimated heavy oil production is around 5 million barrels per day and growing. The projected reduction in conventional oil in the next few years is focusing the industry towards the more effective exploitation of non conventional reserves, heavy oil resources in particular.3

Source: (http://www.slb.com/content/services/solutions/reservoir/heavy_oil.asp)

Production and transportation of heavy oil has unique challenges that must be overcome in order for it to become a significant contributor to the production gap left by conventional oil and global growing demand.

| Heavy Oil | Bitumen | |||||||

| North America | 35.3 | 530.9 | ||||||

| South America | 265.7 | 0.1 | ||||||

| Africa | 7.2 | 43 | ||||||

| Middle East | 78.2 | 0.0 | ||||||

| Asia | 29.6 | 42.8 | ||||||

| Russia | 13.4 | 33.7 | ||||||

| Western Hemi | 301 | 531 | ||||||

| Eastern Hemi | 128.4 | 119.5 | ||||||

| Worldwide* | 429.4 | 650.5 | ||||||

| *Does not include extra-heavy |

| and oil sand sources of bitumen (i.e. Canada,Venezuela) |

| Source: US Geological Survey |

2 http://www.slb.com/content/services/solutions/reservoir/heavy_oil.asp

3 http://www.slb.com/content/services/solutions/reservoir/heavy_oil.asp

| 7 |

According to a US Geological Survey, heavy oils are found around the world, with an estimated 69% of the world’s technically recoverable heavy oil and 82% percent of the technically recoverable natural bitumen located in the Western Hemisphere. The Eastern Hemisphere, however, contains an estimated 85% of the world’s light oil reserves.

Among the more notable heavy oil reserves are: Venezuela’s Orinoco Heavy Oil Belt; Canada’s Athabasca Oil Sands; Russia’s Volga-Ural Basin; Brazil’s offshore Campos Basin; Alaska’s Prudhoe Bay; and China’s Luda field in Bohai Bay.4

Significance of Traditional Heavy Oil for Petrosonic

Around the globe, some of the most prolific oilfields are reaching maturity and have begun to experience reduced production rates.5 What large conventional oilfields remain lie mostly in the lands of Middle Eastern, OPEC nations. At the same time, the world’s demand for oil continues to grow every year, fueled in part by the rapidly growing economies of China and India. This declining availability of conventional oil combined with rising demand has driven up oil prices and put more pressure on the search for alternate energy sources.

Into the picture come the tremendous deposits of heavy oil and bitumen that are found in the Western hemisphere. These non-conventional resources are more difficult to extract, so they have barely been touched in the past. With the price of oil reaching new highs in 2005 and 2006, investments in these more challenging oil deposits are rapidly accelerating.

In fact, the U.S. oil industry alone has invested $86 billion in “frontier hydrocarbons” since 2000 (Heavy Oil Magazine, Aug 2006), developing technologies to recover and convert inferior grades of oil, such as heavy oil and bitumen, into a more usable form for refineries, and to turn waste and residue hydrocarbons into high-value products.

The worldwide importance of heavy oils will continue to emerge as the price of oil remains high and the demand for it remains strong. For example, the tight worldwide oil supply is expected to continue to force crude prices higher and turn Canada’s oil sands into the single largest contributor to net new global supply by the end of the decade, according to CIBC World Markets: “All of the net increase in oil production is expected to come from non-conventional sources,” says Jeff Rubin, chief economist at CIBC World Markets, “While deepwater oil is the primary source today, we forecast that the Canadian oil sands will become the single largest contributor to incremental global supply by 2010.”

Industry Trends in Production and Transport of Heavy Oil

The market factors behind Petrosonic upgrading derive from the oil industry’s needs relative to the production and refining infrastructure. As production shifts more to heavier oil it becomes necessary for refining capacity to adapt to it, either by pre-upgrading the oil or by major refining changes. Until then heavy oil producers face a penalty due to refining and pipeline infrastructure limitations driven by:

| · | The ability to produce and transport heavy oil within the same systems as that established for conventional oil, i.e. using existing transport pipelines; |

| · | The need to maintain low capital costs and operating costs; |

| · | Delivery of heavy oil to the point of sale with reduced expenditures on diluents; |

4 http://www.slb.com/content/services/solutions/reservoir/heavy_oil.asp

5 http://www.slb.com/content/services/solutions/reservoir/heavy_oil.asp

| 8 |

| · | Production and transportable technology that allows the exploitation of heavy oil reserves at lower total cost, particularly for smaller fields – without massive infrastructure expenditures. |

Issues for Heavy Oil Producers

Pursuant to the aforementioned industry pressures, heavy oil producers, especially small to medium size ones face price penalties:

| · | Traditional heavy oil is both more viscous and dense than conventional oil; |

| · | API similar to bitumen from oil sands (Canadian Athabasca bitumen API between 8-14 API); |

| · | Peaking global supply increases the production of less attractive and higher cost oil resources; |

| · | Smaller producers face high costs due need to blend heavy oil with diluents for pipeline transportation or face penalties for failure to meet pipeline specifications for viscosity and API (approximately 22 API); |

| · | Fixed producer “upgrading” facilities to increase the API have been limited by the poor economics of small scale and short production life; |

| · | Upgrading is generally limited to de-asphalting (removal of heavy asphaltene components – up to 16% by mass) and vis-breaking (low temperature cracking). |

Oil Sands

The world’s two largest sources of bitumen (and related extraction and recovery operations) are in Canada and in Venezuela. There is also known oil shale or bituminous reserves in USA, Mexico, South America, Africa, Kazakhstan and other locations.

In Canada, oil sands are found in three locations in the province of Alberta: The Athabasca, Peace River and Cold Lake regions. They cover 141,000 square kilometers (Camp, 1976, 1977; Cameron Engineers, 1978; Alberta Energy, 2002). The Athabasca is the largest deposit area, located in the northeast part of Alberta. The total bitumen in place in Alberta is estimated at 1.7 to 2.5 trillion barrels (Morgan, 2001; Alberta Energy, 2002).

In 2005 about 1 million barrels of oil per day were being produced from oil sands primarily from three projects: Suncor, Syncrude joint venture and Albion Sands (Athabasca Oil Sands Project) joint venture. It is estimated that production will triple to 2.8-3 million barrels per day by 2015. About 300 billion barrels are estimated to be recoverable using current open pit mining and in-situ technologies (Mathieson and Stenason, 2001). The amount of this reserve is equivalent to over $30 trillion at current prices of oil.

| 9 |

Oil Sands Production in Canada

The Canadian oil sands industry is dominated by large integrated multi-national companies, including Albion Sands Energy Inc., Canadian Natural Resources Limited, Chevron, EnCana Corporation Husky Energy Inc. Imperial Oil Resources Limited Petro-Canada (Fort Hills), Shell Canada Limited, Suncor Energy Inc. and Syncrude Canada Ltd.

Upcoming players include (with projects under development or already underway) TOTAL (Joslyn), Exxon Mobil, Synenco, Fort Hills (UTS), Kearl Lake Project with Imperial Oil Resources Limited, and BP (British Petroleum).

Alberta’s oil sands (1.74 trillion barrels)6 are not only the world’s largest capital project but now represent 60 per cent of the world’s investable oil reserves.7 But to produce one million barrels of oil a day, industry requires withdrawals of enough water from the Athabasca River to sustain a city of two million people every year.8 Despite some recycling, the majority of this water never returns to the river and is pumped into some of the world’s largest man-made dykes containing toxic waste.9 By 2015, the Canadian Association of Petroleum Producers predicts that oil sands production may total as much as three million barrels a day.10

Oil sands extraction usually takes at least two tons of oil sand to fill one barrel of upgraded synthetic crude oil. Furthermore, for every barrel of synthetic oil produced in Alberta, more than 80 kg of greenhouse gases are released into the atmosphere, and 3 to 5 barrels of waste water are dumped into tailing ponds.11 Production waste streams released into ponds have still relatively large amounts of unrecovered bitumen and expensive diluents (as much as 4%). In large volumes typical for the oil extraction, these waste streams pose major environmental burden as well as lost economic potential, creating a multibillion dollar opportunity.

Bitumen and naphtha recovery processes involve separation of the complex mixtures of mineral matter (sand, clay), water and small amounts of soluble organic from the bitumen. Current operators use a combination of energy (hydro-transport, heat, conventional mixing) chemical (caustic) addition, flotation and light solvent dilation to achieve the necessary separations.

Petrosonic Opportunity

We believe Petrosonic will be able to take advantage of an opportunity that traditional upgrading technology cannot address – upstream upgrading on smaller scales. The viability of upgrading is constantly changing due to production mix, refining infrastructure costs, and oil pricing. However, there are three markets for small upgraders that make sense:

| · | Pipeline systems where access to the pipeline requires blending of heavy oil. Condensate prices and heavy oil differentials have been stable for some time and long term projections indicate that low condensate prices following the global economic slow-down will be short-lived; |

| · | Heavy oil producers in markets where light oil dominates refinery infrastructure. Internationally there are several markets like this; and |

6 Alberta Energy:http://www.energy.gov.ab.ca/1876.asp.

7 CIBC World Markets, December 8, 2000, p 1.

8 Down to the Last Drop: The Athabasca River and the Oil Sands, Pembina Institute, March 2006, p.ii.

9 Canada’s Oil Sands: Opportunities and Challenges to 2015: An Update, NEB, June 2006, p.38.

10 Canadian Oil Sands Outlook, EIA 2007 Annual Energy Outlook, March 2007.

11 Environmental Research and Studies Centre, University of Alberta, 2007.

| 10 |

| · | Markets where upgrading asphalt by-products can command premium prices. This is especially attractive in North America given the economic infrastructure stimulus measures being implemented. |

To take advantage of these opportunities Petrosonic must be able to:

| · | Economically upgrade heavy oil from small and medium sized producers right in the field; |

| · | Add value and allow producers to capture a larger share of the market price for refinery products; |

| · | Provide operating plants to heavy oil producers in return for tolling process fees or purchase heavy oil at a premium to blenders; |

Upgraded oil provides uplift in crude’s value and eliminates issues related to transport of crude oil to pipeline and refinery companies.

The Petrosonic Process

The Petrosonic heavy oil process will enable heavy sour oil (HSO) and bitumen (from most heavy oil and oil sands fields in the world) to be converted from nominally an API gravity of 8-14 degrees to a value-added synthetic crude oil of between 18 and 23 API. This is achieved through the reduction of undesirable constituents of the raw heavy oil and/or bitumen. The process incorporates two stages: solvent de-asphalting and distillation.

While solvent de-asphalting and distillation are both proven and well known technologies, the innovation associated with the Petrosonic upgrading process lies in the rapid de-asphalting achieved by sonication of the de-asphalting phase with the Petrosonic reactor stage.

Petrosonic Test Data

The Company has completed an extensive test program of heavy oils both in house and independently with the complete Petrosonic upgrading process which has shown to consistently achieve the target improvements in API. The tests were carried out in our R&D site in Richmond, British Columbia (in house) and the lab work for the specifics of the de-asphalted oil and asphaltenes generated was carried out by Alberta Research Council in their laboratory (independent) in Edmonton, Alberta. The tests were carried out during 2010 and 2011. For Canadian bitumen samples this represents an upgrade from nominally 10° API to 25° API. The test program included heavy oils and bitumen from the Canadian Athabasca and Lloydminster fields, heavy oil from USA refineries, and crude oil from two international oil producers. The testing was conducted at Petrosonic’s Sonoprocess™ Facility in Richmond, British Columbia and at the Petrosonic Facility located in Albania. The Petrosonic upgraded oil quality is typically:

| ○ | Density - from 23° to 28° API gravity, meeting pipeline specifications; |

| ○ | Viscosity - less than 100 cSt at 25°C (greater than 99% reduction), meeting pipeline specifications; |

| ○ | Liquid yields - From 85% to 92% by volume depending on the quantity and quality of asphaltene by-product required; |

| ○ | Sulphur - reduction by up to 40% by mass; |

| ○ | Heavy Metals - typical reduction of Vanadium up to 80% and Nickel by up to 88% by mass. |

| 11 |

The following table illustrates some of the data from the extensive test program that PETROSONIC has conducted. This is critical in establishing the application of the Petrosonic process on a broad basis.

The table below (Table 1) shows key performance parameters for Alberta/Cold Lake Oil:

Table 1

| Analysis | Raw Bitumen | Upgraded Oil [Petrosonic ID: 090309E-2] | ||||||

| Total Acid Number (TAN) | 1.24 | 1.18 | ||||||

| API Gravity | 14.4 | 26.0 | ||||||

| Density @15oC | 0.9690 | 0.8982 | ||||||

| Nickel | 46 | 17 | ||||||

| Vanadium | 95 | 38 | ||||||

| Sulphur | 3.62 | 2.46 | ||||||

Table 2 shows a PONA (fundamental heavy oil testing of paraffins, olefins, napthenes and aromatics) summary by hydrocarbon group for Alberta/Cold Lake oil using commercially available light naphtha:

Table 2

| Raw Bitumen | Upgraded Oil [Petrosonic ID: 090309E-2] | |||||||||||||||

| Group | % Wt | % Mol | % Wt | % Mol | ||||||||||||

| Aromatics | 14.175 | 14.871 | 17.318 | 18.545 | ||||||||||||

| i-Paraffins | 25.572 | 23.856 | 24.912 | 24.031 | ||||||||||||

| Naphthenes | 30.728 | 33.450 | 19.017 | 20.217 | ||||||||||||

| Olefins | 11.431 | 11.147 | 5.064 | 4.837 | ||||||||||||

| Paraffins | 4.715 | 4.695 | 30.547 | 29.677 | ||||||||||||

| Oxygenates | 0.000 | 0.000 | 0.000 | 0.000 | ||||||||||||

| Unidentified | 13.380 | 11.981 | 3.142 | 2.694 | ||||||||||||

| Plus | 0.000 | 0.000 | 0.000 | 0.000 | ||||||||||||

| TOTAL | 100.00 | 100.00 | 100.00 | 100.00 | ||||||||||||

Table 3 shows a PONA summary by carbon number for Alberta/Cold Lake oil. Table 3 reflects the effectiveness of the Petrosonic upgrading process through the clear reduction in the oil’s carbon number from C9/C10 to C7/C8, which indicates clearly the generation of new lighter end fractions, each having a lower density and thus serving to increase the API. Given the high sensitivity of the API calculation to density, even small changes in density create significant gains in API quality.

| 12 |

Table 3

| Carbon # | Raw Bitumen | Upgraded Oil [Petrosonic Code 090309E-2] | ||||||||||||||

| % Wt | % Mol | % Wt | % Mol | |||||||||||||

| C4 | 0.001 | 0.002 | - | - | ||||||||||||

| C5 | 0.060 | 0.100 | 0.079 | 0.125 | ||||||||||||

| C6 | 3.063 | 4.296 | 2.979 | 4.053 | ||||||||||||

| C7 | 17.245 | 21.005 | 21.711 | 25.435 | ||||||||||||

| C8 | 17.245 | 18.619 | 33.183 | 33.915 | ||||||||||||

| C9 | 29.209 | 27.721 | 25.799 | 23.367 | ||||||||||||

| C10 | 17.940 | 15.127 | 10.057 | 8.179 | ||||||||||||

| C11 | 1.511 | 1.149 | 2.512 | 1.868 | ||||||||||||

| C12 | - | - | 0.478 | 0.328 | ||||||||||||

| C13 | - | - | 0.049 | 0.030 | ||||||||||||

| C14 | - | - | 0.010 | 0.006 | ||||||||||||

| >C15 | 13.726 | 11.981 | 3.143 | 2.694 | ||||||||||||

| TOTAL | 100.00 | 100.00 | 100.00 | 100.00 | ||||||||||||

The following table (Table 4) illustrates some of the data from the extensive test program that Petrosonic has conducted. This is critical in establishing the application of the Petrosonic process on a broad basis.

Table 4

| Raw | Upgraded | |||||||||||||||||||||||||||||||||||||||||||

| Country | Specific Source | API | Vanadium (g) | Nickel (g) | Sulphur (%) | Total Acid Number (TAN) | API | Vanadium (g) | Nickel (g) | Sulphur (%) | Total Acid Number (TAN) | |||||||||||||||||||||||||||||||||

| Canada | CP | 10.6 | 169.0 | 80.0 | 4.5 | 0.98 | 24.5 | 29.2 | 12.0 | 2.64 | 0.73 | |||||||||||||||||||||||||||||||||

| Canada | CDL | 14.4 | 95.0 | 46.0 | 3.62 | 1.24 | 26.0 | 38.0 | 17.0 | 2.46 | 1.18 | |||||||||||||||||||||||||||||||||

| US (Texas) | TG | 17.4 | 12.0 | 5.4 | 3.73 | 0.59 | 27.9 | 4.2 | 1.9 | 2.78 | 0.99 | |||||||||||||||||||||||||||||||||

| US (Texas) | TK | 14.9 | 15.0 | 16.0 | 3.85 | 0.56 | 27.5 | 4.4 | 4.2 | 2.51 | 0.58 | |||||||||||||||||||||||||||||||||

| US (Texas) | TQ | 11.2 | 15 | 16 | 3.33 | 1.71 | 25.9 | 2.9 | 3.1 | 2.51 | 0.55 | |||||||||||||||||||||||||||||||||

| Albania | AB | 10.8 | 348.4 | 68.5 | 5.96 | 0.56 | 25.1 | 56 | 8.6 | 3.96 | 0.3 | |||||||||||||||||||||||||||||||||

| Albania | AD | 10.2 | 287.0 | 57.0 | 3.98 | 0.52 | 29.0 | 65.9 | 12.2 | 3.27 | 0.73 | |||||||||||||||||||||||||||||||||

| Albania | AM | 21.0 | 110.0 | 19.0 | 2.43 | 1.07 | 31.9 | 48.4 | 7.7 | 2.88 | 0.85 | |||||||||||||||||||||||||||||||||

| Venezuela | VP | 9.4 | 492.0 | 105.0 | 4.26 | 5.26 | 21.7 | 220 | 45.4 | 2.96 | 3.68 | |||||||||||||||||||||||||||||||||

| US (Utah) | US | 14.5 | 23.8 | 12.2 | 1.18 | 3.19 | 32.5 | 1.7 | 1.0 | 0.62 | 0.26 | |||||||||||||||||||||||||||||||||

| 13 |

Stages in the Petrosonic Process

Step 1: Solvent De-asphalting

The primary process of solvent de-asphalting dissolves bitumen in a common paraffinic solvent. The solvent is selected to ensure complete dissolution of the oil-soluble component of the bitumen with the solvent to form a De-asphalted Oil (DAO) while the insoluble hydrocarbon component known as asphaltenes are readily filtered through simple separation. This asphaltene fraction is concentrated with heavy metals such as nickel and vanadium as well as sulphur.

The Petrosonic reactor, using its patented low-frequency / high-energy / high-amplitude reactor design, allows for significant improvement in the mass transfer efficiency of the solvent de-asphalting step in particular, cutting the de-asphalting time required from 6 to 10+ hours to 2 minutes.

Step 2: Solvent Recovery

At the completion of the two-stage Petrosonic upgrading process, the upgraded oil is required to be separated from the solvent through a standard solvent recovery process such as an evaporator or distillation column. Given the significant differential in boiling points of the upgraded oil and the solvent for recovery, the separation process is economical and readily applicable to recover solvent with a solvent residual of less than 4% remaining in the oil and probably below 2%. Such a small solvent residual in the oil is well within the expected quality parameters for pipeline and refinery specifications. The recovered solvent is reused at the solvent de-asphalting stage to complete the closed loop on the Petrosonic upgrading process.

| 14 |

Petrosonic’s Technology

SonoProcess

We believe Petrosonic’s technology advantage is based upon the use of our Petrosonic reactor technology and the unique cavitational and enhanced mass transfer effects that it provides. Petrosonic has developed a unique competency in the design of enhanced mass transfer energy processes and the proprietary applications that result from this.

In recent years the use of cavitational technologies and ultrasound has been researched extensively for oil processing – usually in the context of desulphurization or “cold cracking”. Our own research does not support this and we make no claims that it can create a unique upgrading process. The chemistries used in the Petrosonic process are established and our advantage is that we make these more effective.

The Company looks to maintain its initial technical advantage derived from the Petrosonic Sonoprocess™ for heavy oil by adding complementary proprietary process technologies to this.

The Petrosonic reactor has been designed and built in a variety of configurations but all Petrosonic process development is undertaken on full scale units:

| · | Petrosonic reactors are based on low-frequency / high-amplitude Petrosonic energy reactors; |

| · | A patented electromagnetic drive puts a massive steel bar into resonance and this allows efficient transfer of energy to the reaction chambers; |

| · | There are no moving parts and so Petrosonic reactors have a high reliability and operational availability; |

| · | The reaction chambers are attached at the mid-node points one half wavelength from the drive system, enabling the reactors to apply Petrosonic energy to physical, chemical and biological processes; |

| · | Petrosonic reactors are thus able to achieve more sustainable processes – better reactivity, less reagents, less energy, greater effectiveness and more product for overall economic advantage. |

Direct Sonicated Separation

The previous holder of the technology has also carried out independent tests on oil sands to determine if the technology could be effective in a low cost primary separation process. Preliminary tests with a proprietary process protocol produced results comparable with existing technology.

However, the effectiveness of this technology is but a first step due to the massive scale of oil sands projects. At this time the Company believes the volume of material that would need to be processed requires a “next generation” of Petrosonic reactor technology. Existing scale technology may be applicable to small scale oil sands production.

The Company has directed its efforts towards a more immediate but directly related application – the treatment of drill cuttings. This is not the same scale of opportunity but offers immediate access to market and cash flow generation based on modest investment of capital.

| 15 |

Petrosonic Heavy Oil Process Patents

As part of the transaction with Sonoro Energy the company has acquired the following Heavy Oil Process provisional and PCT applications based on the Company’s Sonoprocess™:

| · | Patent/Application No: WO2009111871. Jurisdiction: WIPO. Title: Method for Treating Heavy Crude Oil. Application Status: Published. |

| · | Patent/Application No: EA201071060. Jurisdiction: Eurasisa. Title: Method for Treating Heavy Crude Oil. Status: Pending. |

| · | Patent/Application No: EP2260089. Jurisdiction: Europe. Title: Method for Treating Heavy Crude Oil. Status: Pending. |

| · | Patent/Application No: 2156/MUMNP/2010. Jurisdiction: India. Title: Method for Treating Heavy Crude Oil. Status: Pending. |

| · | Patent/Application No: US 61/035,690. Jurisdiction: United States. Title: Method for Treating Heavy Crude Oil. Status: Company will appeal the expired priority claim to reinstate the priority claim. |

Competition

Currently heavy oil is upgraded by refineries and upgraders (refineries that upgrade crude to synthetic crude grade level but not to full end products such as diesel, jet fuel etc). These facilities refine large quantities of crude from 60,000 to 500,000 bbl/day and they are capital intensive, require long lead times, significant engineering and intensive water use.

There have been other technologies introduced that upgrade heavy oil via other methods such as Headwaters Incorporated’s proprietary HCAT technology or Ivanhoe Energy’s HTL heavy oil upgrading technology. However, these technologies upgrade heavy crudes in smaller volumes and are also very complex, capital intensive and require intense use of energy and water. They also have the associated environmental downsides such as carbon emissions.

Disadvantages of Petrosonic Process/Technology

There are few inherent disadvantages to the Petrosonic process. The technology has been proven on other applications but long-term 24 hour operations have not been attempted as prior successful commercialization efforts did not require long-term, 24 hour operations. In addition, one sonicator at current dimensions can process up to 500 barrels of heavy oil per day. While this processing capacity can be an advantage for small and medium size operations it may be considered as a disadvantage for larger operations.

In addition, there are technical and logistical risks associated with the heavy oil upgrading technology rollout in Albania. These risks can be attributed to two general categories of risk: operational and logistical, which are influenced by the market risk factors which are presented separately.

The design of the equipment was based on an estimation of both the required solvent as well as the regional heavy crude oil expected to be upgraded at site. Any changes and variations in either the solvent or the heavy oil will impact the overall ability to commission the project. Remaining equipment to be ordered is minor in scope but any delays or problems in sources of supply from European sources could lead to minor delays.

| 16 |

The ability to procure suitable safe installation for commissioning the equipment is critical given the limited number of suitable contractors available in Albania. The ability to source and deliver piping, equipment could cause commissioning or optimization delays. The equipment to be assembled into a continuous heavy oil upgrading process has not been operated in the proposed configuration elsewhere. The process is expected to operate as designed but unforeseen assembly and commissioning situations are normal and expected. Remaining equipment to be ordered is minor in scope but any delays or problems in sources of supply from European sources could lead to minor delays.

Marketing and Sales Strategy

Petrosonic’s business model is to provide integrated upgrading systems to heavy oil producers in exchange for revenue sharing in the economic uplift produced as a result of the Sonoprocessing™. Given the relative ease of integration and transportation, the process is designed to be easily applicable to the upstream and midstream constituents. The immediate marketing and sales strategy is to sell our processing services on toll or joint venture basis to heavy oil upstream producers directly. As a result, business models can take on various forms:

| · | Oil Producers: Decrease viscosity and need for diluents; improve quality; increase marketability; increase price |

| · | Pipeline Operators: Decrease viscosity and need for diluent resulting in increased throughput |

| · | Storage & Blending Operators: Increase yield and quality |

| · | Refiners: Increase yield and quality. Rapid de-asphalting with less diluent and less cost. De-bottleneck refinery |

Customers

Our target customers are heavy oil producers, industrial groups that consume heavy oil and refineries that refine heavy oil. In addition, our potential customers consist of heavy oil trading companies and asphalt producers and consumers of asphalt products such as construction companies that require asphaltenes as raw material for production of asphalt. Currently the Company has no customers.

Employees

We have currently 2 full-time employees and 3 part-time employees, as well as, several independent consultants. We plan to hire a Chief Financial Officer and three local operations staff in Albania during the first year of its operations. The Company has identified potential candidates for such positions, and expects to proceed with such hires once it has secured the requisite financing.

| 17 |

Environmental Laws and Regulations

The Company may be subject to various environmental laws and regulations in the countries in which it operates. With respect to Albania, the Company will require an environmental permit for its facility and a fire safety permit. The Company has prepared all the necessary paperwork and information and has applied for the environmental permit and is in discussion with all governmental authorities regarding the issuance of the permit by the end of August 2012. Since the Company does not require any use of water, extensive energy or generate any emissions it does not fall under more complicated and lengthy environmental permit requirements typical for refineries or upgraders. The Company plans to install all necessary equipment required for anti-fire measures and regulations in the country.

Procurement of Equipment

The Company will rely on a third party contractor to manufacture the sonicators and other related equipment according to its patented design and specifications. The company has received quotes from the third party manufacturer and expects that it will be able to obtain all the necessary equipment to grow its processing capacity in the future. The manufacturer has the production and financial capability and capacity to fulfill our orders in the future. In addition, the company has access to several local and international fabricators and engineering firms to carry out the necessary assembly of the equipment and increase capacity of its processing plant in the future.

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this Form 8-K before making an investment decision with regard to our securities. The statements contained in or incorporated into this Form 8-K that are not statements of historic or present facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to our Business

We have incurred losses in prior periods and may incur losses in the future.

We cannot be assured that we can achieve or sustain profitability on a quarterly or annual basis in the future. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. There can be no assurance that future operations will be profitable. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

| 18 |

Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, we may have to cease our activities and investors could lose their entire investment.

There is no assurance that we will operate profitably or generate positive cash flow in the future. We will require additional financing in order to proceed beyond the establishment of our own stand-alone facilities, including the processing facility in Albania. We will also require additional financing to pay the fees and expenses necessary to become and operate as a public company. We will also need more funds if the costs of the development and operation of our existing technologies are greater than we have anticipated. We will also require additional financing to sustain our business operations if we are not successful in earning revenues. We may not be able to obtain financing on commercially reasonable terms or terms that are acceptable to us when it is required. Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, our business could fail and investors could lose their entire investment.

Because we may never earn revenues from our operations, our business may fail and investors may lose all of their investment in our Company.

We have no history of revenues from operations. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our company has a limited operating history. If our business plan is not successful and we are not able to operate profitably, then our stock may become worthless and investors may lose all of their investment in our company.

Prior to completion of the oil processing facility in Albania, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from our processing facilities in the future, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will fail and investors may lose all of their investment in our company.

We may not be fully indemnified against financial losses in all circumstances where damage to or loss of property, personal injury, death or environmental harm occur.

As is customary in our industry, our contracts will typically provide that our customers indemnify us for claims arising from the injury or death of their employees, the loss or damage of their equipment, damage to the reservoir and pollution emanating from the customer’s equipment or from the reservoir (including uncontained oil flow from a reservoir). Conversely, we will typically indemnify our customers for claims arising from the injury or death of our employees, the loss or damage of our equipment, or pollution emanating from our equipment. Our contracts will typically provide that our customer will indemnify us for claims arising from catastrophic events, such as a well blowout, fire or explosion.

Our indemnification arrangements may not protect us in every case. For example, from time to time we may enter into contracts with less favorable indemnities or perform work without a contract that protects us; our indemnity arrangements may be held unenforceable in some courts and jurisdictions; or we may be subject to other claims brought by third parties or government agencies. Furthermore, the parties from which we seek indemnity may not be solvent, may become bankrupt, may lack resources or insurance to honor their indemnities, or may not otherwise be able to satisfy their indemnity obligations to us. The lack of enforceable indemnification could expose us to significant potential losses.

Further, our assets generally are not insured against loss from political violence such as war, terrorism or civil commotion. If any of our assets are damaged or destroyed as a result of an uninsured cause, we could recognize a loss of those assets.

| 19 |

Our operations are subject to environmental and other laws and regulations that may expose us to significant liabilities and could reduce our business opportunities and revenues.

We are subject to various laws and regulations relating to the energy industry in general and the environment in particular. An environmental claim could arise with respect to one or more of our current businesses, products or services, or a business or property that one of our predecessors owned or used, and such claims could involve material expenditures. Generally, environmental laws have in recent years become more stringent and have sought to impose greater liability on a larger number of potentially responsible parties. The scope of regulation of our industry and our products and services may increase further following the April 2010 accident in the Gulf of Mexico, including possible increases in liabilities or funding requirements imposed by governmental agencies. We also cannot ensure that our future business, if any, will be profitable in light of new regulations that have been and may continue to be promulgated and in light of the current risk environment and insurance markets. Additional regulation could increase the costs of conducting our business and could materially reduce our business opportunities and revenues if our customers decrease their levels of activity in response to such regulation.

We are subject to significant foreign exchange and currency risks that could adversely affect our operations and our ability to reinvest earnings from operations, as well as mitigate our foreign exchange risk through hedging transactions may be limited.

Since we currently conduct a significant portion our operations outside the United State of America, our business is subject to foreign currency risks, including currency exchange rates fluctuations and difficulties in converting local currencies into U.S. dollars. The exchange rates between the Albanian Lek, the Canadian dollar, the Euro and the U.S. dollar and other foreign currencies is affected by, among other things, changes in local political and economic conditions. Such currency fluctuations may materially affect the Company’s financial position and results of operations and a material change in currency rates in our markets could affect our future results as well as affect the carrying values of our assets.

We generally attempt to denominate our contracts in U.S. dollars or in the currencies of our costs. However, we may enter into contracts that subject us to currency risk exposure, primarily when our contract revenue is denominated in a currency different than the contract costs. We anticipate that a significant portion of our consolidated revenue and consolidated operating expenses will be in foreign currencies. As a result, we will be subject to significant foreign currency risks, including risks resulting from changes in foreign exchange rates and limitations on our ability to reinvest earnings from operations in one country to fund the financing requirements of our operations in other countries.

Customer credit risks could result in losses.

The concentration of our future customers in the energy industry may impact our overall exposure to credit risk as customers may be similarly affected by prolonged changes in economic and industry conditions. Those countries that rely heavily upon income from hydrocarbon exports would be hit particularly hard by a drop in oil prices. Further, laws in some jurisdictions in which we may operate could make collection difficult or time consuming. We will perform ongoing credit evaluations of our customers and generally do not plan to require collateral in support of our trade receivables. While we may maintain reserves for potential credit losses, we cannot assure such reserves will be sufficient to meet write-offs of uncollectible receivables or that our losses from such receivables will be consistent with our expectations.

Global political, economic and market conditions could affect projected results.

Our operating results are based on our current assumptions about oil supply and demand, oil prices, rig count and other market trends. Our assumptions on these matters are in turn based on currently available information, which is subject to change. The oil industry is extremely volatile and subject to change based on political and economic factors outside our control. A weakened global economic climate generally results in lower demand and lower prices for oil, which reduces drilling, processing and production activity, which in turn results in lower revenues and income for us. Worldwide drilling activity and global demand for oil may also be affected by changes in governmental policies and sovereign debt, laws and regulations related to environmental or energy security matters, including those addressing alternative energy sources and the risks of global climate change. Worldwide economic conditions, and the related demand for oil, may in future periods be significantly weaker than we have assumed.

| 20 |

We may be unable to recognize our expected revenues from current and future contracts.

Our potential customers, some of whom may be national oil companies, often have significant bargaining leverage over us and may elect to cancel or revoke contracts, not renew contracts, modify the scope of contracts or delay contracts, in some cases preventing us from realizing expected revenues and/or profits.

Increases in the prices and availability of our raw materials could affect our results of operations.

We use significant amounts of raw materials (including steel and other metals, chemicals, plastics, polymers and energy inputs) for manufacturing our products, facilities and some of our fixed assets. The price of these raw materials has a significant impact on our cost of producing products for sale or constructing fixed assets used in our business. There can be no assurance that the prices of our raw materials will remain within a manageable range and will be readily available. If we are unable to obtain necessary raw materials or if we are unable to minimize the impact of increased raw material costs or to realize the benefit of cost decreases in a timely fashion through our supply chain initiatives or pricing, our margins and results of operations could be adversely affected.

Our long-term growth depends upon technological innovation and commercialization.

Our ability to deliver our long-term growth strategy depends in part on the commercialization of new technology. A central aspect of our growth strategy is to improve our products and services through innovation, to obtain technologically advanced products through internal research and development and/or acquisitions, to protect proprietary technology from unauthorized use and to expand the markets for new technology by leveraging our infrastructure. Our success will depend on our ability to commercialize the technology that we have acquired and demonstrate the enhanced value our technology brings to our customers’ operations. Our major technological advances include, but are not limited to, those related to the design of enhanced mass transfer energy processes and reactors. We cannot be assured of the successful commercialization of, and above-average growth from, our new products and services, as well as legal protection of our intellectual property rights. Any failure in the commercialization of our technology could adversely affect our business and results of operations.

If we are unable to enforce our intellectual property rights or if our intellectual property rights become obsolete, our competitive position could be adversely impacted.

We utilize a variety of intellectual property rights in our services. We view our portfolio of process and design technologies as one of our competitive strengths and we use it as part of our efforts to differentiate our service offerings. We may not be able to successfully preserve these intellectual property rights in the future and these rights could be invalidated, circumvented, challenged or infringed upon. In addition, the laws of some foreign countries in which our services may be sold do not protect intellectual property rights to the same extent as the laws of the United States. If we are unable to protect and maintain our intellectual property rights, or if there are any successful intellectual property challenges or infringement proceedings against us, our ability to differentiate our service offerings could diminish. In addition, if our intellectual property rights or work processes become obsolete, we may not be able to differentiate our service offerings and some of our competitors may be able to offer more attractive services to our customers. As a result, our business and financial performance could be materially and adversely affected.

| 21 |

International and political events may adversely affect our operations.

A significant portion of our revenue will be derived from foreign operations, which exposes us to risks inherent in doing business in each of the countries where we transact business. The occurrence of any of the risks described below could have a material adverse effect on our business operations and financial performance. With respect to any particular country, these risks may include:

| · | expropriation and nationalization of our assets in that country; |

| · | political and economic instability; |

| · | civil unrest, acts of terrorism, force majeure, war, or other armed conflict; |

| · | currency fluctuations, devaluations, and conversion restrictions; |

| · | confiscatory taxation or other adverse tax policies; |

| · | governmental activities that limit or disrupt markets, restrict payments, or limit the movement of funds; |

| · | governmental activities that may result in the deprivation of contract rights; and |

| · | governmental activities that may result in the inability to obtain or retain licenses required for operation. |

Due to the unsettled political conditions in many oil-producing countries, our financial performance is subject to the adverse consequences of war, the effects of terrorism, civil unrest, strikes, currency controls, and governmental actions. Our customer’s operations are conducted in areas that have significant amounts of political risk. In addition, military action or continued unrest in the Middle East could impact the supply and price of oil, disrupt our customer’s operations in the region and elsewhere, and increase our costs related to security worldwide.

Economic and political developments in Albania may adversely affect our business.

A significant portion of our operations and assets are currently located in Albania. As a result, our financial condition, results of operations and business may be affected by and are subject to the general condition of the Albanian economy, the devaluation of the Albania Lek as compared to the U.S. Dollar, Albanian inflation, interest rates, regulation, taxation, social instability and other political, social and economic developments in or affecting Albania, including changes in the laws and policies that govern foreign investment, as well as changes in United States laws and regulations relating to foreign trade and investment, over which we have no control. There can be no assurance as to the future effect of any such changes on our results of operations, financial condition, or cash flows.

The dangers inherent in our operations could cause disruptions and could expose us to potentially significant losses, costs, or liabilities. Any significant interruptions in the operations of any of our facilities could materially and adversely affect our business, financial condition, and results of operations.

| 22 |

Our operations are subject to significant hazards and risks inherent in refining operations and in transporting and storing crude oil. These hazards and risks include, but are not limited to, the following:

| · | natural disasters; |

| · | weather-related disruptions; |

| · | fires; |

| · | explosions; |

| · | pipeline ruptures and spills; |

| · | third-party interference; |

| · | disruption of natural gas deliveries; |

| · | disruptions of electricity deliveries; and |

| · | mechanical failure of equipment at our refineries or third-party facilities |

Any of the foregoing could result in production and distribution difficulties and disruptions, environmental pollution, personal injury or wrongful death claims, and other damage to our properties and the properties of others. There is also risk of mechanical failure and equipment shutdowns both in general and following unforeseen events.

Our activities will initially be conducted at our facility in Albania. This facility constitutes a significant portion of our operating assets. Because of the significance to us of this operation, the occurrence of any of the events described above could significantly disrupt our processing of crude oil, and any sustained disruption could have a material adverse effect on our business, financial condition, and results of operations.

We may incur significant costs to comply with environmental and health and safety laws and regulations.

Our operations and properties are subject to extensive national, state, and local environmental, health, and safety regulations governing, among other things, the generation, storage, handling, use, and transportation of petroleum and hazardous substances, the emission and discharge of materials into the environment, waste management, characteristics, and the monitoring, reporting, and control of greenhouse gas emissions. If we fail to comply with these regulations, we may be subject to administrative, civil, and criminal proceedings by governmental authorities, as well as civil proceedings by environmental groups and other entities and individuals. A failure to comply, and any related proceedings, including lawsuits, could result in significant costs and liabilities, penalties, judgments against us, or governmental or court orders that could alter, limit, or stop our operations.

| 23 |

In addition, new environmental laws and regulations, including new regulations relating to alternative energy sources, new regulations relating to fuel quality, and the risk of global climate change regulation, as well as new interpretations of existing laws and regulations, increased governmental enforcement, or other developments could require us to make additional unforeseen expenditures. Many of these laws and regulations are becoming increasingly stringent, and the cost of compliance with these requirements can be expected to increase over time. We are not able to predict the impact of new or changed laws or regulations or changes in the ways that such laws or regulations are administered, interpreted, or enforced. The requirements to be met, as well as the technology and length of time available to meet those requirements, continue to develop and change. To the extent that the costs associated with meeting any or all of these requirements are substantial and not adequately provided for, there could be a material adverse effect on our business, financial condition, and results of operations.

We may not have sufficient crude oil to be able to run our Albania facility at full capacity.

Our Albania facility will process crude oil from the local regions around the facility. To the extent sufficient local crude oil cannot be contracted to process and we are unable to contract sufficient crude oil from non-local sources to supply the Albania facility, we may not have sufficient crude oil to run the Albania facility at full capacity, which could have a material adverse impact on our business, financial condition, and results of operations.

We could incur substantial costs or disruptions in our business if we cannot obtain or maintain necessary permits and authorizations.

Our operations require numerous permits and authorizations under various laws and regulations, including environmental and health and safety laws and regulations. These authorizations and permits are subject to revocation, renewal, or modification and can require operational changes, which may involve significant costs, to limit impacts or potential impacts on the environment and/or health and safety. A violation of these authorization or permit conditions or other legal or regulatory requirements could result in substantial fines, criminal sanctions, permit revocations, injunctions and/or refinery shutdowns. In addition, major modifications of our operations could require modifications to our existing permits or expensive upgrades to our existing pollution control equipment, which could have a material adverse effect on our business, financial condition, or results of operations.

Risks Associated with our Company and our Securities

We will be required to incur significant costs and require significant management resources to evaluate our internal control over financial reporting as required under Section 404 of the Sarbanes-Oxley Act, and any failure to comply or any adverse result from such evaluation may have an adverse effect on our stock price.

As a smaller reporting company as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, we are required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”). Section 404 requires us to include an internal control report with the Annual Report on Form 10-K. This report must include management’s assessment of the effectiveness of our internal control over financial reporting as of the end of the fiscal year. This report must also include disclosure of any material weaknesses in internal control over financial reporting that we have identified. Failure to comply, or any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have an adverse effect on the trading price of our equity securities. Management believes that its internal controls and procedures are currently not effective to detect the inappropriate application of U.S. GAAP rules. Management realize there are deficiencies in the design or operation of our internal control that adversely affect our internal controls which management considers to be material weaknesses including those described below:

| 24 |

| i) | The Company’s management is relying on external consultants for purposes of preparing its financial reporting package and may not be able to identify errors and irregularities in the financial reporting package before its release as a continuous disclosure document.. |

| ii) | As the Company is governed by one officer who is also a director, there is an inherent lack of segregation of duties and lack of independent governing board. |

Achieving continued compliance with Section 404 may require us to incur significant costs and expend significant time and management resources. We cannot assure you that we will be able to fully comply with Section 404 or that we and our independent registered public accounting firm would be able to conclude that our internal control over financial reporting is effective at fiscal year end. As a result, investors could lose confidence in our reported financial information, which could have an adverse effect on the trading price of our securities, as well as subject us to civil or criminal investigations and penalties. In addition, our independent registered public accounting firm may not agree with our management’s assessment or conclude that our internal control over financial reporting is operating effectively.

All of our assets, and our sole officer and director, are outside the United States, with the result that it may be difficult for investors to enforce within the United States any judgments obtained against us or our directors and officers.

All of our assets are located outside the United States. In addition, our sole officer and director is a national and resident of a country other than the United States, and all or a substantial portion of their assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against us or our director and officers, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. Consequently, you may be effectively prevented from pursuing remedies under United States federal and state securities laws against us or our directors and officers.

Our business is dependent on key executives and the loss of any of our key executives could adversely affect our business, future operations and financial condition.

We are dependent on the services of key executives, including our Chief Executive Officer, Art Agolli. Mr. Agolli has many years of experience and an extensive background in the oil industry in general. We may not be able to replace that experience and knowledge with other individuals. We do not have “Key-Man” life insurance policies on our key executives. The loss of our key executives or our inability to attract and retain additional highly skilled employees may adversely affect our business, future operations, and financial condition.

The elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contain a provision permitting us to eliminate the personal liability of our directors to our company and shareholders for damages for breach of fiduciary duty as a director or officer to the extent provided by Nevada law. The foregoing indemnification obligations could result in the Company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our company and shareholders.

| 25 |

Our stock is categorized as a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations which may limit a shareholder’s ability to buy and sell our stock.

Our stock is categorized as a penny stock. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than US$ 5.00 per share or an exercise price of less than US$ 5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

FINRA sales practice requirements may also limit a shareholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

To date, we have not paid any cash dividends and no cash dividends will be paid in the foreseeable future.