Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST BANCORP /PR/ | d388481d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - FIRST BANCORP /PR/ | d388481dex991.htm |

Investor

Presentation Investor Presentation

July 2012

July 2012

Exhibit 99.2 |

Disclaimer

2

This presentation contains “forward-looking statements” concerning First

BanCorp’s (the “Corporation”) future economic performance. The words or phrases “would be,” “will

allow,” “intends to,” “will likely result,” “are expected

to,” “expect,” “anticipate,” “look forward,” “should,” “believes” and similar expressions are meant to identify “forward-

looking statements” within the meaning of Section 27A of the Private Securities

Litigation Reform Act of 1995, and are subject to the safe harbor created by such section. The

Corporation wishes to caution readers not to place undue reliance on any such

“forward-looking statements,” which speak only as of the date made, and to advise readers that

various factors, including, but not limited to, uncertainty about whether the Corporation and

FirstBank Puerto Rico (“FirstBank” or “the Bank”) will be able to fully comply with

the written agreement dated June 3, 2010 that the Corporation entered into with the Federal

Reserve Bank of New York (the “FED”) and the order dated June 2, 2010 (the

“Order”)that FirstBank entered into with the FDIC and the Office of the

Commissioner of Financial Institutions of Puerto Rico that, among other things, require FirstBank to

maintain certain capital levels and reduce its special mention, classified, delinquent and

non-performing assets; the risk of being subject to possible additional regulatory actions;

uncertainty as to the availability of certain funding sources, such as retail brokered CDs;

the Corporation’s reliance on brokered CDs and its ability to obtain, on a periodic basis,

approval from the FDIC to issue brokered CDs to fund operations and provide liquidity in

accordance with the terms of the Order; the risk of not being able to fulfill the

Corporation’s cash obligations or resume paying dividends to the Corporation’s

stockholders in the future due to the Corporation’s inability to receive approval from the FED to

receive dividends from FirstBank or FirstBank’s failure to generate sufficient cash flow

to make a dividend payment to the Corporation; the strength or weakness of the real

estate markets and of the consumer and commercial credit sectors and their impact on the

credit quality of the Corporation’s loans and other assets, including the Corporation’s

construction and commercial real estate loan portfolios, which have contributed and may

continue to contribute to, among other things, the high levels of non-performing

assets, charge-offs and the provision expense and may subject the Corporation to further

risk from loan defaults and foreclosures; adverse changes in general economic

conditions in the United States and in Puerto Rico, including the interest rate scenario,

market liquidity, housing absorption rates, real estate prices and disruptions in the U.S.

capital markets, which may reduce interest margins, impact funding sources and affect demand

for all of the Corporation’s products and services and the value of the

Corporation’s assets; an adverse change in the Corporation’s ability to attract new

clients and retain existing ones; a decrease in demand for the Corporation’s products and

services and lower revenues and earnings because of the continued recession in Puerto Rico and

the current fiscal problems and budget deficit of the Puerto Rico government;

uncertainty about regulatory and legislative changes for financial services companies in

Puerto Rico, the United States and the U.S. and British Virgin Islands, which could affect

the Corporation’s financial performance and could cause the Corporation’s actual

results for future periods to differ materially from prior results and anticipated or projected

results; uncertainty about the effectiveness of the various actions undertaken to stimulate

the United States economy and stabilize the United States’ financial markets, and the

impact such actions may have on the Corporation’s business, financial condition and

results of operations; changes in the fiscal and monetary policies and regulations of the

federal government, including those determined by the Federal Reserve System, the FDIC,

government-sponsored housing agencies and regulators in Puerto Rico and the U.S.

and British Virgin Islands; the risk of possible failure or circumvention of controls and

procedures and the risk that the Corporation’s risk management policies may not be

adequate; the risk that the FDIC may further increase the deposit insurance premium and/or

require special assessments to replenish its insurance fund, causing an additional

increase in the Corporation’s non-interest expense; risks of not being able to

recover the assets pledged to Lehman Brothers Special Financing, Inc.; the impact on the

Corporation’s results of operations and financial condition associated with acquisitions

and dispositions; a need to recognize additional impairments on financial instruments or

goodwill relating to acquisitions; risks that downgrades in the credit ratings of the

Corporation’s long-term senior debt will adversely affect the Corporation’s ability to access

necessary external funds; the impact of the Dodd-Frank Wall Street Reform and Consumer

Protection Act on the Corporation’s businesses, business practices and cost of

operations; and general competitive factors and industry consolidation. The Corporation

does not undertake, and specifically disclaims any obligation, to update any “forward-

looking statements” to reflect occurrences or unanticipated events or circumstances after

the date of such statements except as required by the federal securities laws.

Investors should refer to the Corporation’s Annual Report on Form 10-K for the year

ended December 31, 2011 for a discussion of such factors and certain risks and uncertainties

to which the Corporation is subject. |

Franchise

Overview Founded in 1948 (63 years)

Headquartered in San Juan, Puerto Rico with

operations in PR, Eastern Caribbean (Virgin

Islands) and Florida

A well diversified operation with over 650,000

retail & commercial customers

2nd largest financial holding company in Puerto

Rico with attractive business mix and

substantial loan market share

A leading bank in the Virgin Islands with over

40% market share

Small presence in Florida serving south Florida

region

151 ATM machines and largest ATM network in

the Eastern Caribbean Region

~2,500 FTE employees

As of Jun 30, 2012

Eastern Caribbean Region or ECR includes United States and British Virgin Islands

FTE = Full Time Equivalent

Well diversified with significant competitive strengths

3

Total Assets -

$12.9B

Total Deposits -

$9.9B

Total Loans -

$10.4B

Puerto Rico: 86% of Assets

48 branches

5 branches

2 branches

38 branches

26 branches

8 In-branch

offices

Florida:

7% of Assets

Eastern Caribbean:

7% of Assets |

Franchise

Overview Strong and uniquely positioned market franchise in

densely populated operating footprints

Strong market share in loan portfolios facilitates

customer relationship expansion and cross sell to

increase deposit share

Unique challenger to Puerto Rico’s largest player

4

Puerto

Rico

Total

Assets

Puerto Rico Total Loans

Puerto

Rico

Deposits,

Net

of

Brokered

Puerto Rico

ECR

Florida

Banking Branches

48

14

11

Wholesale Banking

Retail Banking

Consumer Lending

2

Mortgage Banking

Insurance

Retail Brokerage

3

Wholesale Brokerage

4

($ in millions)

Portfolio

Balance

Market

Share

Portfolio

Balance

Market

Share

Portfolio

Balance

Market Share

1

Banco Popular

$25,303

35.9%

1

Banco Popular

$19,019

36.5%

1

Banco Popular

$17,516

44.8%

2

FirstBank

$10,595

15.0%

2

FirstBank

$8,536

16.4%

2

Banco Santander

$5,080

13.0%

3

Scotiabank

$7,896

11.2%

3

Scotiabank

$5,615

10.8%

3

FirstBank

$3,827

9.8%

4

Banco Santander

$6,948

9.9%

4

Banco Santander

$5,309

10.2%

4

Scotiabank

$3,570

9.1%

5

Oriental Bank

$6,421

9.1%

5

Doral Bank

$4,201

8.1%

5

BBVA

$2,759

7.1%

6

Doral Bank

$5,633

8.0%

6

BBVA

$3,707

7.1%

6

Oriental Bank

$2,068

5.3%

7

BBVA

$5,177

7.4%

7

Other

$2,562

4.9%

7

Doral Bank

$1,934

4.9%

8

Citibank

$1,884

2.7%

8

Oriental Bank

$1,739

3.3%

8

Citibank

$1,888

4.8%

9

Banco Cooperativo

$544

0.8%

9

Citibank

$708

1.4%

9

Banco Cooperativo

$469

1.2%

10

BBU

$7

0.0%

10

Bank of America

$501

1.0%

10

BBU

$19

0.0%

Total

$70,410

100%

11

Banco Cooperativo

$168

0.3%

Total

$39,131

100%

Total

$52,067

100%

Institutions

Institutions

Institutions

1

1

1

1 Puerto Rico only; 2 FirstBank acquired the FirstBank-branded credit card portfolio of

$391MM book balance as of June 30, 2012; 3 Provided through alliance with UBS; 4 Established primarily for

Source: PR Market Share Report prepared with data provided by the Commissioner of Financial

Institutions of Puerto Rico as of 3/31/2012 municipal

financing |

Economic

Environment Continues to Stabilize Puerto Rico

Puerto Rico market showing signs of improvement;

projected positive GNP growth of 0.9% for 2012

Economic Activity Index continues to reflect

stabilization with certain improving trends

Retail Sales show a stable trend over the last two

years

New car sales have shown a positive year over year

trend since December 2009

Government efforts to control fiscal imbalances have

been showing results

The deficit as of January 2009 was $3B; it was reduced

to $2.1B in 2010, to $1B in 2011, to $610 MM in 2012

and is projected at $332 MM for fiscal year 2013

Public/private partnerships (PPPs) are in process to

improve physical/functional infrastructure and build

strategic/regional projects to jump-start the

economy

PPP for Toll Roads PR-22 and PR-5 / $1.4B

investment

PPP for Modernization and New construction of

Schools / $756 MM investment

PPP for Luis Muñoz Marín International Airport

Improving unemployment trend

5

GDB -

Economic Activity Index

Puerto Rico GNP & Yearly

% Growth

2000 –

2011

Unemployment Rate

2

1 GDB Puerto Rico (www.bgfpr.com). Index and its indicators are subject to monthly

revisions. Data used for GDB-EAI is adjusted for seasonality and variability

2 PR Planning Board (www.jp.gobierno.pr). GNP in millions and at constant prices of

1954. Estimate as of April 19, 2012. Years are from July 1 to June 30 of next year (fiscal year) |

6

Building Franchise Value

Executing Strategic Plan Toward Goal to Return to Profitability

During

the

recent

cycle

(consolidations,

capital

raise,

economic

challenges),

Management

focused

on strengthening the franchise and succeeded in solidifying its strong #2 position in PR

Balance Sheet

Improving risk profile; focusing on reducing NPAs

Executing on opportunities to reduce cost of funds

Franchise Value

Expanding products mix and maximizing cross selling opportunities

Growing core

deposits

Sustaining

well

diversified

loan

production

across

multiple

line

of

businesses

and

geographies

Managing expenses carefully; continued focus on operational excellence

Capital

Strong capital base to support execution of Strategic Plan

Risk Management

Proactive approach to risk management

In compliance with Regulatory Agreements

Enhancing BOD talent with additional financial and risk management expertise

|

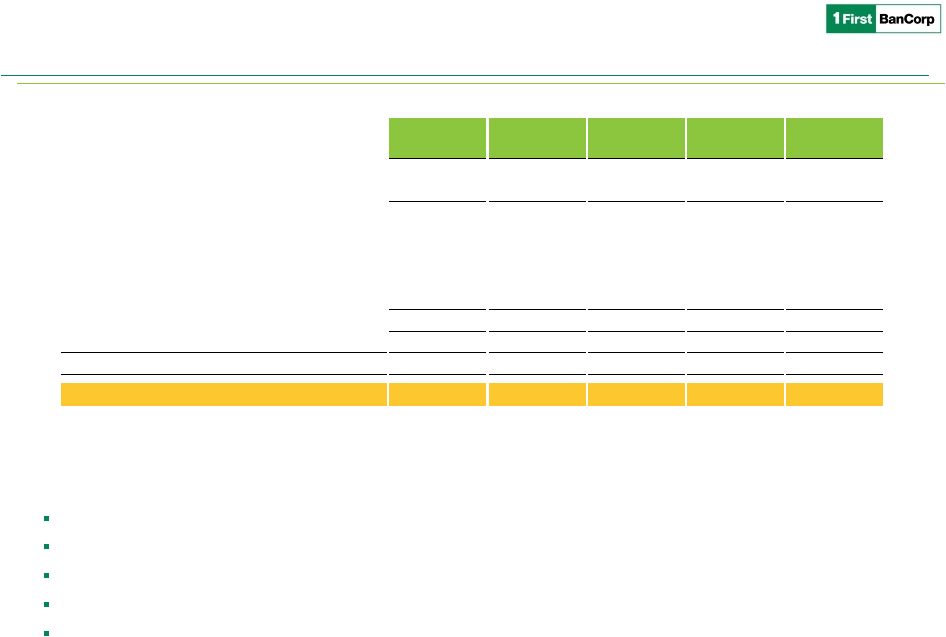

Focus on

Rebuilding Earnings 2Q 2012 Highlights

Net income of $9.4 million is the first quarterly profit since 1Q 2009

Improvement of $3.1 MM in pre-tax pre-provision income

Improvement

of

24

bps

in

net-interest

margin

reaching

3.44%

for

the

quarter

compared

to

3.20%

in

the

last

quarter

Continued trend of reductions in provision for loan losses, the sixth consecutive quarter of

reduction Capital remains strong with total capital ratio, tier 1 and leverage reaching

17.3%, 16.0% and 12.5%, respectively 1 Non-GAAP financial measure

2 Fair value adjustments on derivatives and financial liabilities measured at fair value

3 See reconciliation on page 19

4 See reconciliation on page 20

Achieved profitability in 2Q 2012 and continued improvement in PTPP earnings

7

($ in millions, except per share results)

Income Statement

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

Net interest income, excluding valuations

95.6

$

96.8

$

100.3

$

101.6

$

108.2

$

Valuations

(1.2)

(2.5)

(1.7)

0.3

0.5

GAAP Net Interest Income

94.4

94.3

98.6

101.9

108.7

Provision for loan and lease losses

59.2

46.4

42.0

36.2

24.9

Non-interest income

40.4

18.4

13.0

14.7

16.5

Equity in (losses) gains of unconsolidated entities

(1.5)

(4.4)

1.7

(6.2)

(2.5)

Non-interest expense

86.4

83.0

85.9

85.2

86.9

Pre-tax net income (loss)

(12.3)

(21.1)

(14.6)

(11.0)

10.9

Income tax (expense) benefit

(2.6)

(2.9)

(0.2)

(2.1)

(1.5)

Net income (loss)

(14.9)

$

(24.0)

$

(14.8)

$

(13.1)

$

9.4

$

30.0

$

29.1

$

28.5

$

34.8

$

37.9

$

Net Interest Margin, excluding valuations (%)

2.64%

2.82%

2.99%

3.20%

3.44%

Net

income

(loss)

per

common

share-basic

2,4

(1.04)

$

(1.46)

$

1.36

$

(0.06)

$

0.05

$

Adjusted Pre-tax pre-provision earnings

1,3 |

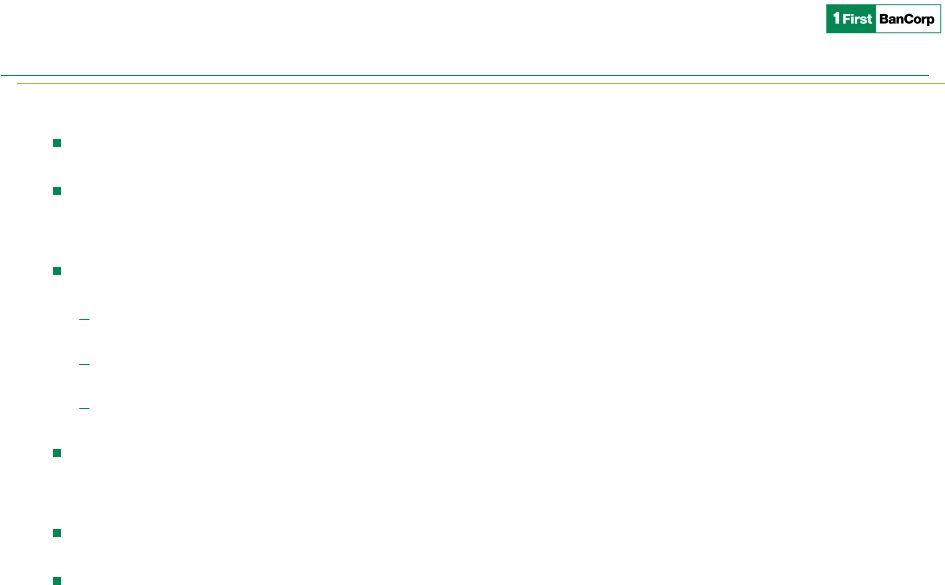

Building Franchise

Value Puerto Rico

Opportunities for ongoing market share gains on selected

products based on fair share of market

–

Largest opportunity on deposit products, electronic

banking & transaction services

–

Selected loan products growth for balanced risk/return

to manage risk concentration and diversify income

sources

Acquired FirstBank-branded credit card portfolio from FIA

Card Services, N.A.

–

Diversifies revenue stream and loan portfolio

composition

–

Opportunity to broaden and deepen relationships

Florida

Expansion prospects in Florida given long term

demographic trends

–

Continue focus in core deposit growth, commercial and

transaction banking and conforming residential

mortgages

Virgin Islands

Solidify leadership position by further increasing customer

share of wallet

Targeted strategies for growth

8

Market Share in Main Market

1

15%

8%

18%

13%

19%

16%

10%

16%

12%

10%

7%

10%

6%

10%

11%

85%

92%

82%

87%

81%

84%

90%

84%

88%

90%

93%

91%

94%

90%

89%

Assets

Personal Loans

Commercial Loans

Construction

Auto/Leasing

Small Personal Loans

Mortgage Originations

Credit Cards

Insurance

ACH Transactions

POS Terminals

ATM Terminals

Debit Cards

Deposits

Branches

FirstBank

Other Banks

2

2

4

3

2

2

3

4

3

4

2

4

3

4

5

Rank

Source: Office of the Commissioner of Financial Institutions of Puerto Rico as of 3/31/2012

and internal reports; commercial loans include loans collateralized by real estate; Insurance share is for

income information included in regulatory reports filed by banks for the year 2009

1 Puerto Rico only |

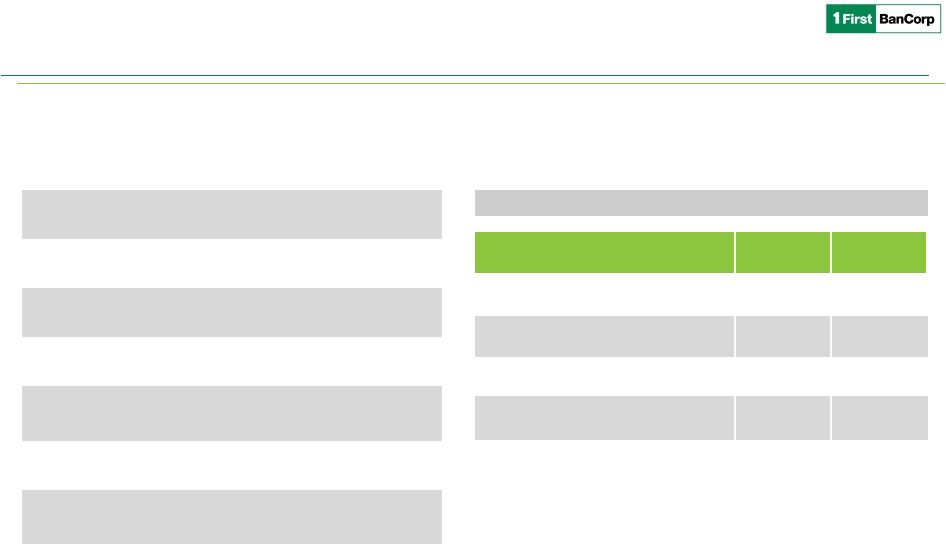

1 Net of

Brokered CDs Successful execution of deposit growth strategy; $148 MM

during 2Q 2012 and $1.3B since 2009

Expanded electronic services offering to support deposit

growth strategy

Cost of interest bearing deposits, net of brokered CDs,

decreased to 1.13% from 1.51% in 2011

Reduced reliance on brokered CDs

Building Franchise Value

Successful deposits growth over recent years

9

($ in millions)

Deposits, Net of Brokered CDs

Total Deposit Composition

Cost of Deposits

$1,505

$2,090

$2,126

$2,065

$448

$470

$481

$584

$774

$763

$915

$959

$2,381

$2,477

$2,654

$2,826

$-

$6,500

2009

2010

2011

Jun 2012

CDs & IRAs

Government

Commercial

Retail

$5,108

$5,800

$6,176

$6,434

Interest Bearing

57%

Non-interest

Bearing

8%

Brokered CDs

35%

2.20%

1.79%

1.51%

1.13%

1.87%

1.56%

1.34%

0.99%

0.00%

1.00%

2.00%

3.00%

2009

2010

2011

2Q 2012

Interest Bearing Deposits, Net of Brokered CDs

Total Deposits, Net of Brokered CDs

1

35% of deposits are brokered CDs, down from 60% in 2009 |

Well Diversified

Loan Portfolio Strong origination activity in Q2 vs. Q1:

Residential

mortgages

increased

$32

million

20%

Consumer:

Auto

loans

increased

$29

million

25%

Consumer:

Personal

loans

increased

$13

million

31%

Consumer: Credit card utilization activity of $34 million

C&I loan

originations

increased

$151

million

66%

Reentered credit card business with the acquisition of

$406 MM credit card portfolio of ~140K active FirstBank-

branded credit cards

Expanding products mix in commercial and small &

middle market business

Strong Origination Capabilities

10

($ in millions)

$13,421

$11,403

$10,081

$9,899

$4,867

$3,369

$2,244

$1,848

$1,340

$821

$802

$1,166

$19,628

$15,593

$13,127

$12,914

$0

$20,000

2009

2010

2011

June 2012

Total loans, net of ALLL

Investments & Money Markets

Cash & Other

$3,596

$3,417

$2,874

$2,764

$1,898

$1,716

$1,562

$1,950

$6,942

$5,822

$5,695

$5,217

$1,493

$701

$428

$365

$20

$301

$16

$60

$13,949

$11,957

$10,575

$10,357

$-

$15,000

2009

2010

2011

Jun 2012

Residential

Consumer

Commercial & CRE

Construction

Loans Held for Sale

$140

$148

$160

$162

$194

$139

$149

$163

$160

$202

$34

$271

$446

$344

$237

$391

$19

$25

$14

$10

$16

$569

$768

$680

$569

$838

$

$1,300

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

Residential

Consumer

Credit Cards

Commercial & CRE

Construction

Loan Originations

Loan Portfolio |

Improved Risk

Profile Reduced

NPLs

by

35%

since

peak

in

1Q

2010

1,

and

stabilized

migration to NPL

Reduced

exposure

to

construction

loans

by

76%

since

peak

2

, a

major driver of losses

Decreasing charge-off trend

Heightened focus on opportunistic loan sales, organic workouts,

note sales and OREO disposition through Special Assets Group

OREO increased $30MM mainly due to foreclosed commercial

properties as a result of the Special Asset Group’s focus on

resolutions, allowing greater flexibility in disposition strategies

Commercial NPLs are being carried at 58% of unpaid principal

balance, net of specific reserves

1 As of June 30, 2012

2 From December 31, 2008 to June 30, 2012

3 Net Carrying Amount = % of carrying value net of reserves and accumulated

charge-offs 4 Non performing loan breakdown on page 19

11

($ in millions)

Allowance coverage ratio of 4.4%

Net Charge-offs

Non-performing Assets

$1,790

$1,701

$1,669

$1,562

$1,410

$1,390

$1,377

$1,337

$1,332

$1,308

$-

$1,800

Mar 10

Jun 10

Sep 10

Dec 10

Mar 11

Jun 11

Sep 11

Dec 11

Mar 12

Jun 12

Non-performing Loans

Repossessed Assets & Investment Sec.

Loans Held for Sale

$29

$63

$39

$20

$61

$54

$37

$16

$60

$180

$118

$31

$183

$313

$101

$31

$333

$610

$295

$98

$-

$650

2009

2010

2011

2Q 2012 YTD

Residential

Consumer

Commercial & CRE

Construction

Book Value

Accumulated

Charge-offs

Reserves

Net Carrying

Amount

3

C & I

255

$

103

$

69

$

52%

Construction

202

125

40

50%

CRE

240

23

36

77%

Total

697

$

250

$

145

$

58%

Commercial Non-performing Loans

1

Proactively Managing Asset Quality |

12

Path to Profitability

Executing on Key Profitability Improvement Opportunities

Achieve additional reduction of NPAs and classified assets

Continue to execute core deposit strategic plan

Rebuild pre-tax pre-provision income

Execute process improvement and efficiency initiatives

Focus on Rebuilding Earnings

Re-energizing loan production in key focus areas: consumer, auto, residential

mortgages & small commercial

Maximize fee income growth

Enhance credit card business to increase revenues & cross sell opportunity

Further reductions in funding costs

-

$2.2B in Brokered CDs maturing in the next 12 months with avg. cost of 2.04%;

new issuance at current rates could range between 75-125 bps

-

Core deposit pricing reduction

Increase OREO disposition efficiency |

Summary of

Investment Opportunity Strong and uniquely positioned franchise with strengthened

capital base Stable pre-tax, pre-provision earnings with realizable

opportunities for improvement

Executing on our strategic plan

Continued improvements in asset quality

Core-deposit plan

Disciplined ongoing expense management

Fully

reserved

deferred

tax

asset

of

$366.9

MM

that

will

accrete

to

capital

as

the Corporation turns to profitability

Committed management team with proven execution skills

Attractive valuation on a pro-forma tangible book value basis

13 |

Exhibits

Exhibits

Investor Presentation

Investor Presentation

July 2012

July 2012 |

15

Stock Profile

Trading Symbol:

•

FBP

Exchange:

•

NYSE

Share

Price

(7/27/12):

•

$3.86

Shares Outstanding:

•

206,629,311

Market Capitalization

(7/27/12):

•

$795.68 MM

1 Yr. Average Daily Volume:

•

203,410

Price

(7/27/12)

to

Tangible

Book

(6/30/2012):

•

0.601x

Beneficial Owner

Amount

Percent of

Class

Entities affiliated with Thomas H. Lee

Partners, L.P.

50,684,485

24.59%

Entities affiliated with Oaktree Capital

Management, L.P.

50,684,485

24.59%

Wellington Management Company, LLP.

20,336,087

9.87%

United States Department of the

Treasury

1

34,227,696

16.50%

5% or more Beneficial Ownership

1 Includes the U.S. Treasury warrant that entitles it to purchase up to 1,285,899 shares of

Common Stock at an exercise price of $3.29 per share, as adjusted as a result of the issuance of shares of

Common Stock in the Corporation’s recently completed $525MMprivate placement of Common

Stock (the “Capital Raise”). The exercise price and the number of shares issuable upon exercise of

the warrant are subject to further adjustments under certain circumstances to prevent

dilution. The warrant has a 10-year term from its issue date and is exercisable in whole or in part at any time. |

Despite the

recent Moody’s downgrade of PR’s General Obligation Bond and other

associated credits, investors continued to show their confidence by purchasing more

than $2B in bonds for the Schools of the 21st

Century

Projects,

Housing

incentives

enacted

in

Puerto

Rico

were

extended up to December 2012

Retail Sales show a stable trend over the last two years

New car sales have shown a positive year over year trend since

December 2009

Stabilization of the banking system was reflected in financial results and

a leveling of assets in the overall system

In April 2012, Moody's placed on review for downgrade certain ratings

of three Puerto Rican banks due to a weakened economy

The Puerto Rico Electric Power Authority (PREPA) concluded the sale of

a $650 MM bond issue in April 2012

On July 18, 2012 Moody’s downgraded Puerto Rico’s Sales Tax

Financing Corporation’s (COFINA) outstanding sales tax revenue bonds

from Aa2 to Aa3 and the outstanding subordinate sales tax revenue

bonds from A1 to A3

During 2012 the Government has been accessing the market to take

advantage of the low rate environment and reduce their borrowing

cost. More than $6B have been issued to refund existing debt and

reduce borrowings cost

Economic Environment Continues to Stabilize

Puerto Rico

Economic Activity Index continues to reflect stabilization with certain

improving trends

Government efforts to control fiscal imbalances have been showing

results

The deficit as of January 2009 was $3B; it was reduced to $2.1B in 2010,

to $1B in 2011, to $610 MM in 2012 and is projected at $332 MM for

fiscal year 2013

Public/private partnerships (PPPs) are in process to improve

physical/functional infrastructure and build strategic/regional projects

to jump-start the economy

PPP for Toll Roads PR-22 and PR-5 / $1.4B investment

PPP for Modernization and New construction of Schools / $756 MM

investment

Others

are

currently

in

process

Luis

Muñoz

Marín

International

Airport / final bid submission is scheduled for June 2012

In July 2011, Commonwealth issued bonds of $300 MM for

infrastructure projects to continue stimulating the economy

16

-

2

Puerto

Rico

GNP

&

Yearly

%

Growth

2000

–

2011

GDB -

Economic Activity Index

1 GDB Puerto Rico (www.bgfpr.com). Index and its indicators are subject to monthly

revisions. Data used for GDB-EAI is adjusted for seasonality and variability

2 PR Planning Board (www.jp.gobierno.pr). GNP in millions and at constant prices of

1954. Estimate as of April 19, 2012. Years are from July 1 to June 30 of next year (fiscal year)

|

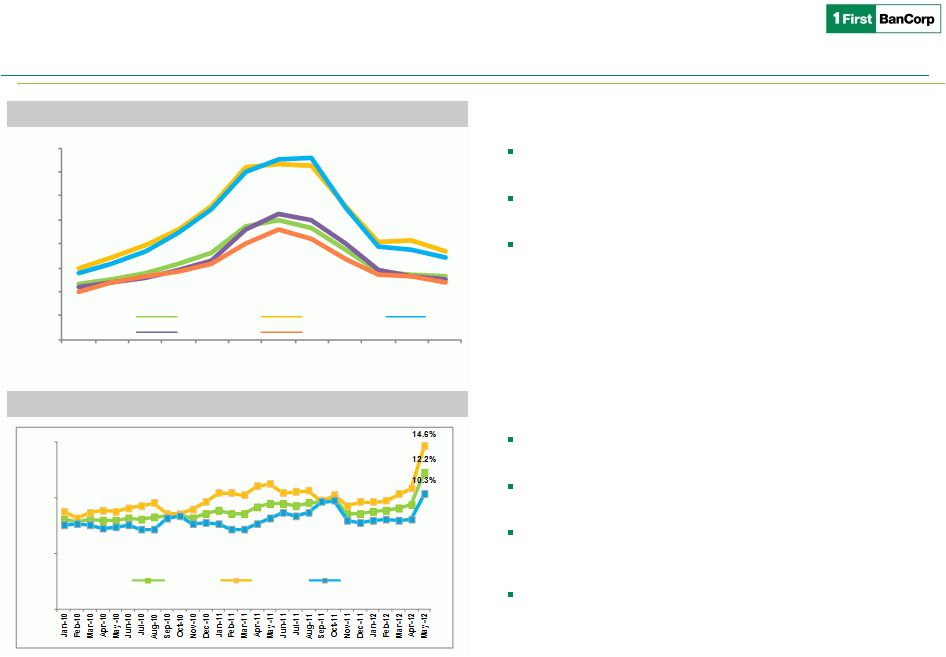

Economic

Environment Continues to Stabilize 17

Florida

May 2012 unemployment rate was 8.6%. It reflects -2.0%

decrease compared to May 2011

Total number of tourist visitors for 2011 increased by

4.4%, when compared to 2010, reaching 85.9 million

Number of homes sold increased 8% in 2011 compared to

prior year but average sales price dropped 3% to $131,700

Virgin Islands

Number of homes sold increased 8% in 2011 compared to

last year but average sales price dropped 3% to $131,700

During May 2012, unemployment rate increased 2.8% to

12.2% from 9.4% in May 2011

1.4 million visitors arrived YTD May 2012, representing a

growth of 2.4% over prior year. Cruise visitors decreased -

1.0% over prior year, but air visitors increased by 13.8%.

Hotel occupancy rate for the past twelve months was

52%, a decrease of 4% compared to the same period in

the prior year

US

Virgin

Island’s

Unemployment

Rate

Florida

single

family

median

home

price

1

0.0%

5.0%

10.0%

15.0%

Unemployment Rate

Territory

St. Croix

St. Thomas/ St. John

$

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Statewide

Fort Lauderdale

Miami

Orlando

Tampa

3

1 Florida Association of Realtors, Moody’s Economy.com 2 Seasonally

adjusted, preliminary data provided by the U.S. Bureau of Labor Statistics

3

VI Bureau of Economic Research, Bureau of

Labor Statistics, US Census |

Non-performing Assets

1 Collateral pledged with Lehman Brothers Special Financing, Inc.

18

($ in millions)

Jun 2012

Mar 2012

% change

Non-performing loans

Residential mortgage

333.0

$

341.2

$

0.9%

Commercial mortgage

239.9

244.4

1.7%

Commercial & Industrial

255.3

263.6

-2.4%

Construction

202.1

231.1

-9.3%

Consumer Loans & Finance Leases

35.4

39.1

-1.3%

Total non-performing loans

1,065.7

1,119.4

-2.1%

REO

167.3

135.9

18.9%

Other repossessed property

10.6

12.5

-18.8%

Other assets

1

64.5

64.5

0.0%

Total non-performing assets

1,308.2

1,332.3

-0.4% |

19

Adjusted Pre-tax, Pre-provision Income Reconciliation

($ in thousands)

2Q 2012

1Q 2012

4Q 2011

3Q 2011

2Q 2011

Income (loss) before income taxes

10,901

$

(11,049)

$

(14,600)

$

(21,158)

$

(12,318)

$

Add: Provision for loan and lease losses

24,884

36,197

41,987

46,446

59,184

Less: Net (gain) loss on sale and OTTI of investment

securities

143

1,207

1,014

(12,156)

(21,342)

Add: Unrealized loss (gain) on derivatives instruments

and liabilities measured at fair value

(506)

(283)

1,746

2,555

1,162

Add: Contingency adjustment - tax credits

-

2,489

-

-

-

Add: Loss on early extinguishment of repurchase

agreement

-

-

-

9,012

1,823

Add: Equity in losses (earnings) of unconsolidated

entities

2,491

6,236

(1,666)

4,357

1,536

Adjusted Pre-tax, pre-provision income

37,913

$

34,797

$

28,481

$

29,056

$

30,045

$

Quarter Ended |

1 Includes a

non-cash adjustments of $0.2 MM for the quarter ended June 30, 2011 as an acceleration of the Series G preferred stock discount accretion pursuant to amendments to the exchange agreement with the

U.S. Treasury, the sole holder of the Series G Preferred Stock

2 Excess of carrying amount of the Series G Preferred Stock exchanged over the fair value of

new common shares issued in the fourth quarter of 2011 20

Reconciliation of the (Loss) Earnings per Common Share

($ in thousands, except per share information)

2Q 2012

1Q 2012

4Q 2011

3Q 2011

2Q 2011

Net income (loss)

9,356

$

(13,182)

$

(14,842)

$

(24,046)

$

(14,924)

$

Cumulative convertible preferred stock dividend (Series G)

-

-

(997)

(5,302)

(5,302)

Preferred

stock

discount

accretion

(Series

G)

1

-

-

(145)

(1,795)

(1,979)

Favorable impact from issuing common stock in exchange for

Series

G

preferred

stock,

net

of

issuance

costs

2

-

-

277,995

-

-

Net

income

(loss)

attributable

to

common

stockholders

-

basic

9,356

$

(13,182)

$

262,011

$

(31,143)

$

(22,205)

$

Convertible preferred stock dividends and accretion

-

-

1,142

-

-

Net

income

(loss)

attributable

to

common

stockholders

-

diluted

9,356

$

(13,182)

$

263,153

$

(31,143)

$

(22,205)

$

Average common shares outstanding

205,415

205,217

192,546

21,303

21,303

Average potential common shares

537

-

2,195

-

-

Average

common

shares

outstanding

-

assuming

dilution

205,952

205,217

194,741

21,303

21,303

Basic earnings (loss) per common share

0.05

$

(0.06)

$

1.36

$

(1.46)

$

(1.04)

$

Diluted earnings (loss) per common share

0.05

$

(0.06)

$

1.35

$

(1.46)

$

(1.04)

$ |