Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ACCURIDE CORP | acw12-8kq2.htm |

| EX-99.1 - EX-99.1 - ACCURIDE CORP | acw12-99d1.htm |

Second Quarter 2012

Earnings Call

Earnings Call

1

Statements contained in this news release that are not purely historical are forward-

looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding Accuride’s expectations, hopes, beliefs and

intentions with respect to future results. Such statements are subject to the impact

on Accuride’s business and prospects generally of, among other factors, market

demand in the commercial vehicle industry, general economic, business and

financing conditions, labor relations, governmental action, competitor pricing activity,

expense volatility and other risks detailed from time to time in Accuride’s Securities

and Exchange Commission filings, including those described in Item 1A of

Accuride’s Annual Report on Form 10-K for the fiscal year ended December 31,

2011. Any forward-looking statement reflects only Accuride’s belief at the time the

statement is made. Although Accuride believes that the expectations reflected in

these forward-looking statements are reasonable, it cannot guarantee its future

results, levels of activity, performance or achievements. Except as required by law,

Accuride undertakes no obligation to update any forward-looking statements to

reflect events or developments after the date of this news release.

looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding Accuride’s expectations, hopes, beliefs and

intentions with respect to future results. Such statements are subject to the impact

on Accuride’s business and prospects generally of, among other factors, market

demand in the commercial vehicle industry, general economic, business and

financing conditions, labor relations, governmental action, competitor pricing activity,

expense volatility and other risks detailed from time to time in Accuride’s Securities

and Exchange Commission filings, including those described in Item 1A of

Accuride’s Annual Report on Form 10-K for the fiscal year ended December 31,

2011. Any forward-looking statement reflects only Accuride’s belief at the time the

statement is made. Although Accuride believes that the expectations reflected in

these forward-looking statements are reasonable, it cannot guarantee its future

results, levels of activity, performance or achievements. Except as required by law,

Accuride undertakes no obligation to update any forward-looking statements to

reflect events or developments after the date of this news release.

Forward Looking Statements

2

Second Quarter 2012 Earnings

Ø Opening Comments

• CEO Update

• Industry Highlights

• Plan Execution

Ø Financial Information

• Second Quarter Results

• 2012 Outlook

Ø Q&A

Ø Closing Comments

Rick Dauch

President & CEO

Greg Risch

Vice President & CFO

Rick Dauch

Greg Risch

Rick Dauch

3

4

2nd Quarter Highlights

5

• STRONG performance across the Wheels & Brillion business units

• Imperial stabilizing:

• Decatur “under control” operationally - organizationally, delivery, quality, scheduling

• New business wins at Daimler & Navistar ($12 to $15 million)

• CAPEX Projects on schedule and on-budget:

• AL wheel capacity 2-3 weeks ahead of schedule in Camden & Monterrey

• Gunite >25% of new equipment installed and operating

• Cost structure reduction initiatives:

• Steel wheel capacity consolidation & capability studies (London & Mexico facilities)

• Gunite Elkhart, IN facility closure announced

• ERP migration launched

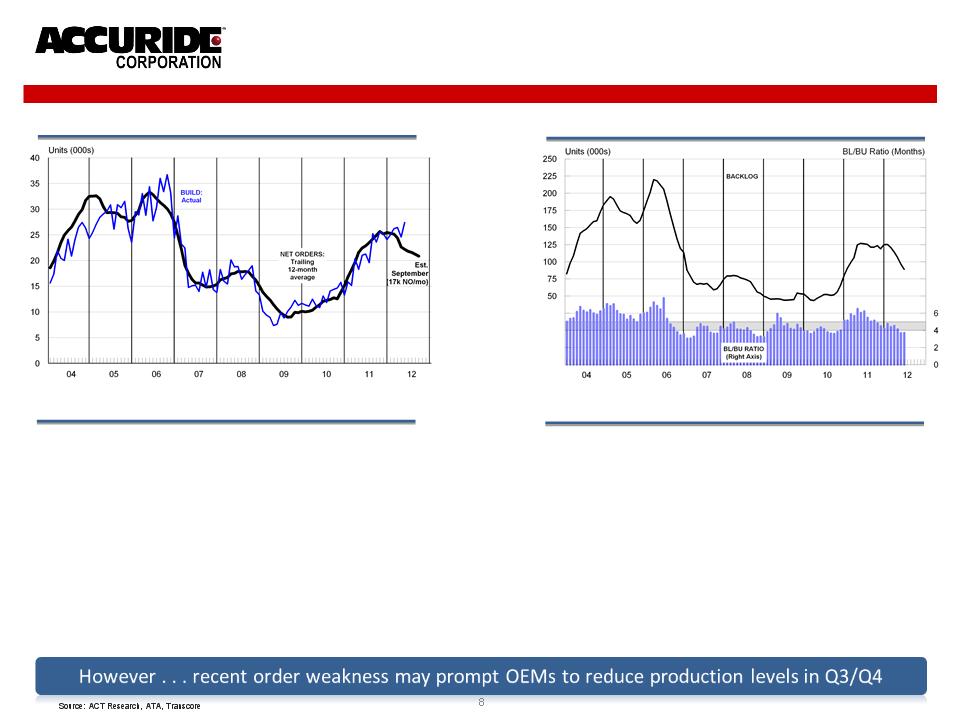

• Class 8 Truck Orders < OEM Builds by +20% ... significant production cuts in 3Q/4Q

• Imperial profitability: TN à TX consolidation delayed 6-8 months from original timing

• Aluminum wheel demand > Accuride capacity (7-day operations)

• Soft Gunite aftermarket demand (offshore pricing impact)

• Unfavorable anti-dumping ruling creating pressure in the steel wheel aftermarket

6

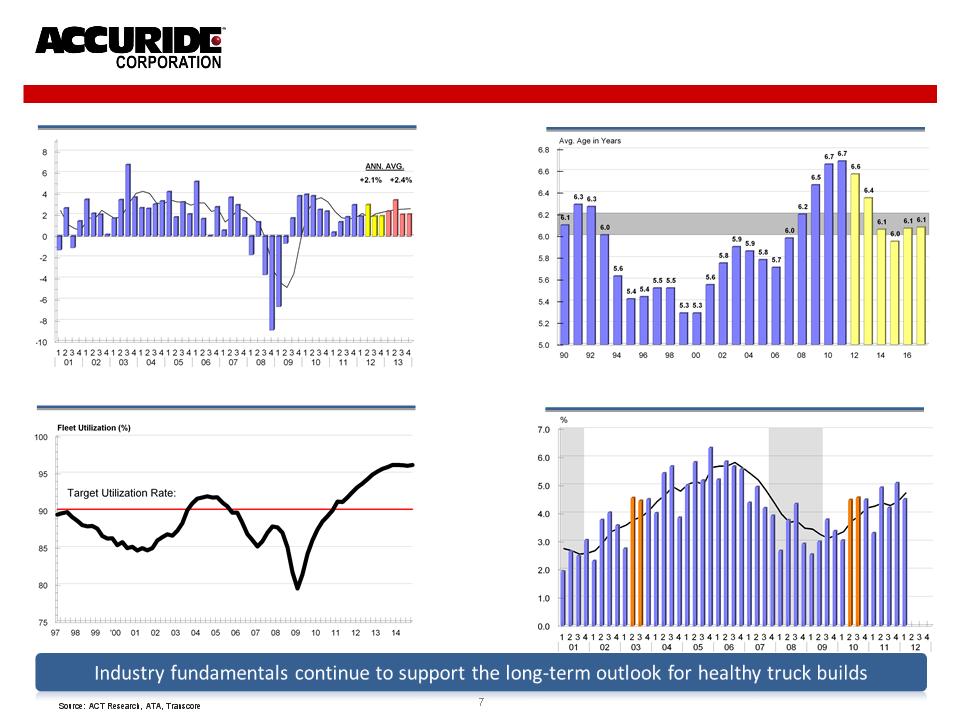

Industry Fundamentals

Average Age: Class 8 Fleet

Carrier Profitability

Real Gross Domestic Product

Class 8 Fleet Utilization

Net Order Weakness

Class 8 Backlog

OEM Momentum

Class 8 Net Orders vs. Builds

Fleet Concerns

• Uncertain global market conditions

• European debt situation

• Middle East political volatility

• US political uncertainty in an election year

• Fuel price volatility

• New CAFE standards on the horizon (2014/2018)

• Lumpy freight associated w/slow economic recovery

• It is difficult to slow production quickly

• We are still at the front end of an upward cycle

(i.e. no one wants to risk losing share)

• OEMs have a “cushion”

• Backlog

• Inventory

• Seasonality of orders (summer weakness)

• Low order cancellation rates

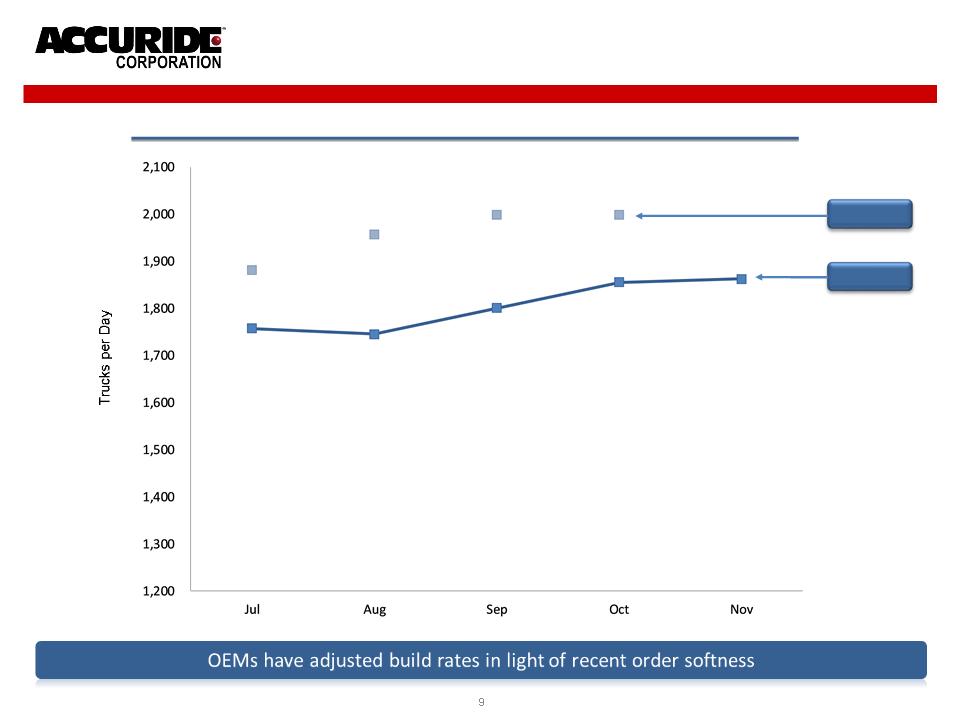

OEM Build Rate Adjustments

Forecasted OEM Build Rates: June vs. July

June

Schedules

Schedules

July

Schedules

Schedules

Source: ACT & FTR

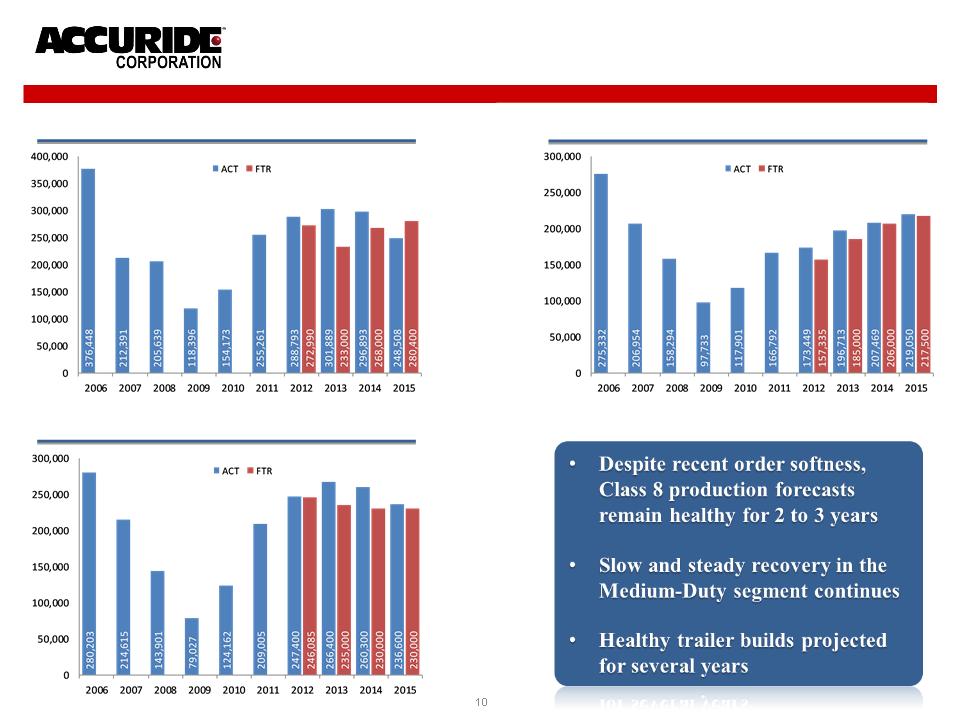

Industry Builds

Class 8 Truck Production

Medium-Duty Truck Production

Trailer Production

11

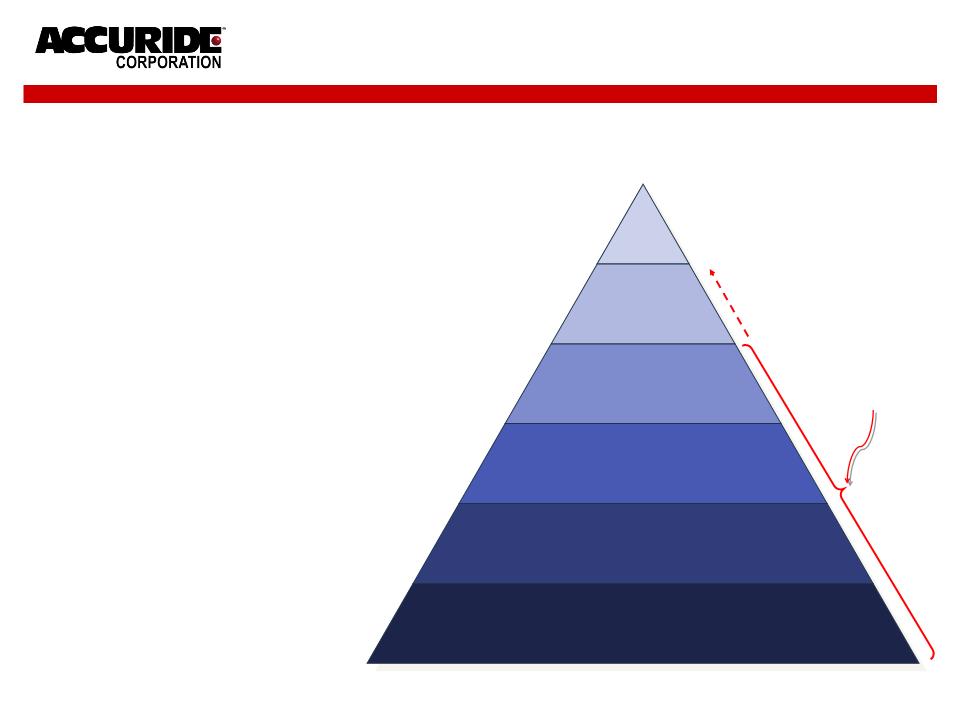

Strategic Objectives

Ø #1-2 globally in wheel-end systems

Ø ROIC > 20% through a cycle

Ø >80% of revenue from CORE products

Ø Balanced geographical revenues:

• 40% North America

• 30% Asia

• 20% Europe

• 10% South America

Ø >95% retention of personnel

Ø Maximize ACW share price

Accuride Vision: Accuride will be the premier supplier of wheel-end system

solutions to the global commercial vehicle industry

solutions to the global commercial vehicle industry

12

Share

Price

Grow Globally

Create a Competitive

Cost Structure &

LEAN Operating Culture

Divest Non-Core Assets

Fix Core Business & Operations

Customer Centric, Technology Leadership

Ethical People, Selfless Leaders, Team Oriented

Our Focus

“Fix & Grow” Accuride

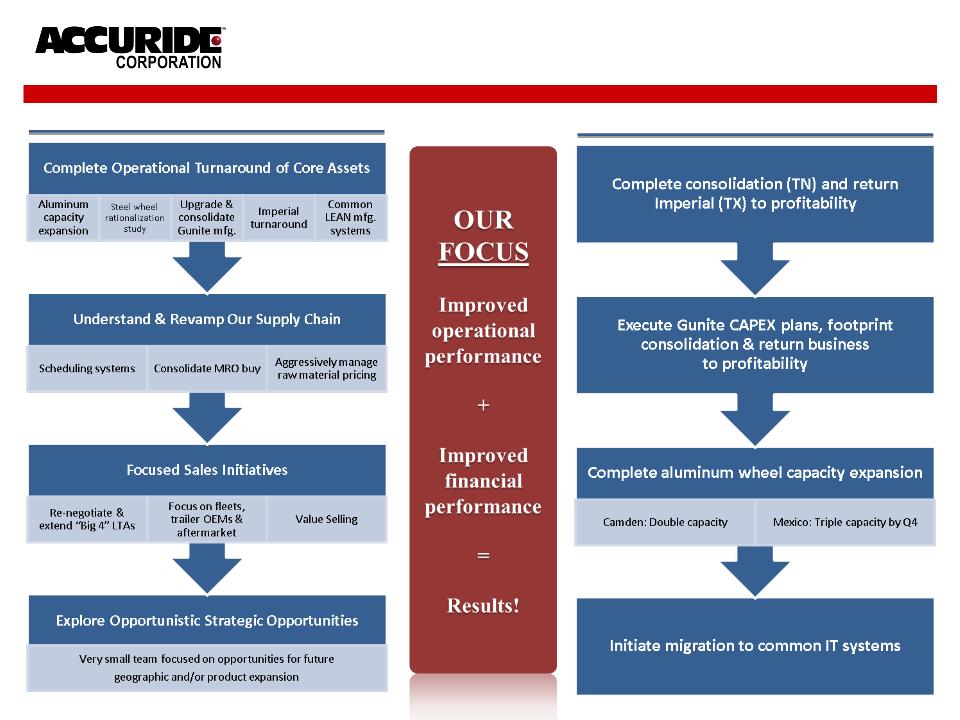

“Fix” (6-12 months):

• Invest to catch up

• Clean and organize

• Close or fix uncompetitive operations

• Rationalize / consolidate capacity

• Divest non-core assets

• Reassign, release, reduce

• Upgrade from outside

• Standardize

• Understand LEAN

“Grow” (12-18 months):

• Invest to leapfrog

• World class standards

• Open new facilities

• Build and expand

• Acquire “core” assets

• Add and expand

• Promote from within

• Benchmark

• Operate LEAN

Strategic Objectives

Accuride Vision: Accuride will be the premier supplier of wheel-end system

solutions to the global commercial vehicle industry

solutions to the global commercial vehicle industry

14

Share

Price

Grow Globally

Create a Competitive

Cost Structure &

LEAN Operating Culture

Divest Non-Core Assets

Fix Core Business & Operations

Customer Centric, Technology Leadership

Ethical People, Selfless Leaders, Team Oriented

Our Focus

Fix (6-12 months):

– New Senior Leadership team in place

– Critical Technical staff repopulated

– HR development systems introduced

– Brillion to positive FCF (Jun) & Net Income

– Gunite & Imperial turn-around in process

– Common & LEAN systems introduced

– ERP system selection

– Non-core assets divested or identified

– Plant consolidations underway

Grow (12-18 months):

– Acquired Camden

– 2x Alum wheel capacity

– Imperial business wins

– M&A growth opportunities

Transformation & Execution

2012 - A Year of Execution

15

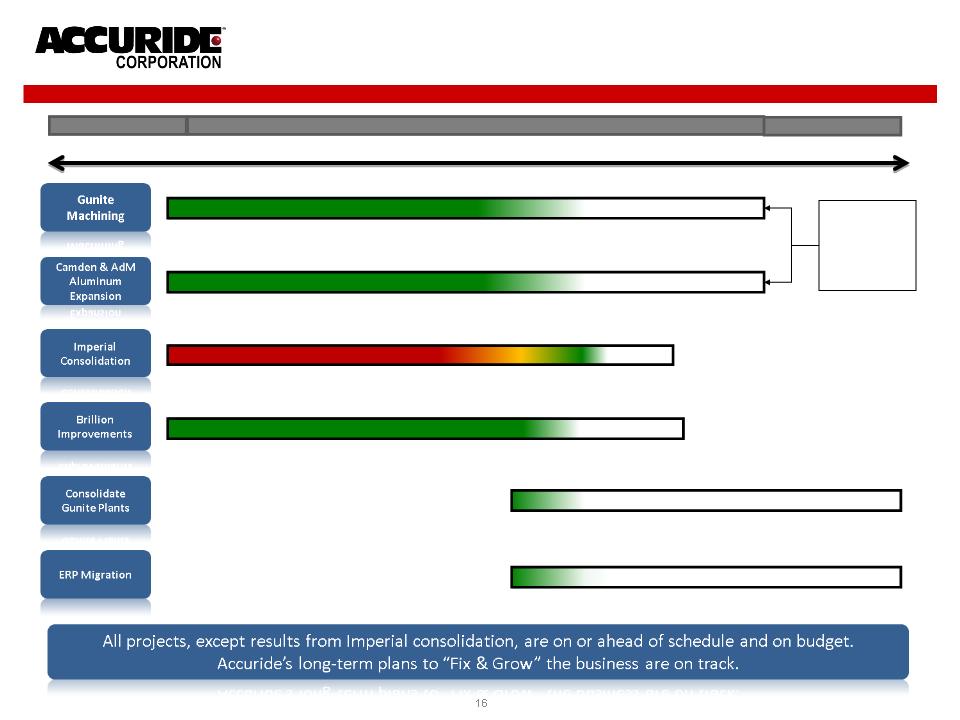

Top Priorities - Q3 2012

Project Timeline

Q4

Q1

Q2

Q3

Q4

Q1

2011

2012

Ahead

of schedule

&

on budget

2013

Q4 2013 ---->

Aluminum Capacity Timeline

MC1 & MC2

Equipment

Arrival

Equipment

Arrival

Building

Renovation

Renovation

MC1 & MC2

Ramp-Up

Ramp-Up

MC1 & MC2

commercial

commercial

Machine Line

1 Equipment

Arrival

Arrival

Machine Line 1

capacity added

Machine Line

2 Equipment

Arrival

2 Equipment

Arrival

Machine

Line 1

Ramp-Up

Line 1

Ramp-Up

Machine Line 2

Ramp- Up

Machine Line 2

commercial

commercial

Acme

Polish

Installed

Polish

Installed

JAN

FEB

MAR

APR

MAY

JUN

AUG

SEP

OCT

NOV

JUL

17

MC3 & MC4

Equipment

Arrival

Equipment

Arrival

Dec

AHEAD OF SCHEDULE &

ON BUDGET

ON BUDGET

Gunite CAPEX Timeline

Slack Line

Installation

Installation

Slack Line

Full

Production

Full

Production

Drum Machine

Line 1

Equipment

Arrival

Line 1

Equipment

Arrival

Drum

Machine

Line 1 Full

Production

Machine

Line 1 Full

Production

Site

Preparation

Preparation

Drum Machine

Line 2

Line 2

Full Production

Drum Machine

Line 3

Equipment

Arrival

Line 3

Equipment

Arrival

Drum Machine

Line 3

Line 3

Full Production

18

Hub Machine

Line Equipment

Arrival

Line Equipment

Arrival

JAN

FEB

MAR

APR

MAY

JUN

AUG

SEP

OCT

NOV

JUL

Dec

ON TRACK & ON BUDGET

Elkhart

Closure

(Q1 2013)

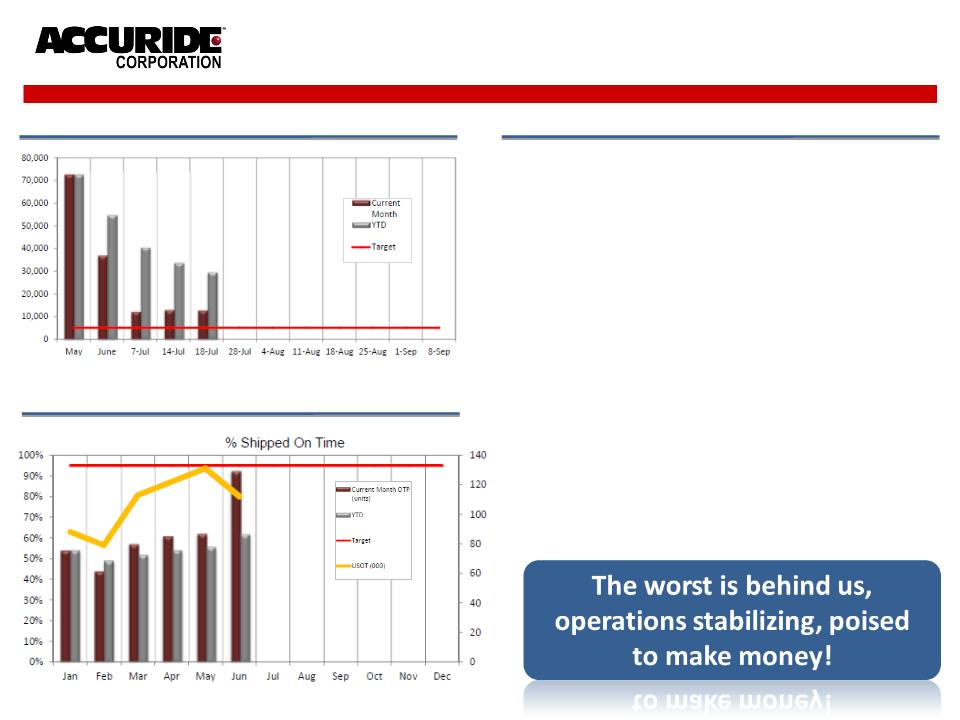

Imperial Progress

19

Past Due Reductions

On Time Delivery

Imperial Improvements Underway

• Upgraded Business Unit and Plant Leadership

teams (TX, TN)

teams (TX, TN)

• Elimination of past due situation at customers

• Completion of TX-TN consolidation projects:

• Transferred presses safely, up and

running consistently

running consistently

• PPAP remaining parts at TX

• TN2 expansion and bumper consolidation

from TN1

from TN1

• TX polish plant expansion and new

process launch

process launch

• Reduce labor costs

• Fix ERP & scheduling systems in TX

• Addressing key commercial issues with customers

• $12 to $15 million in new business awards

20

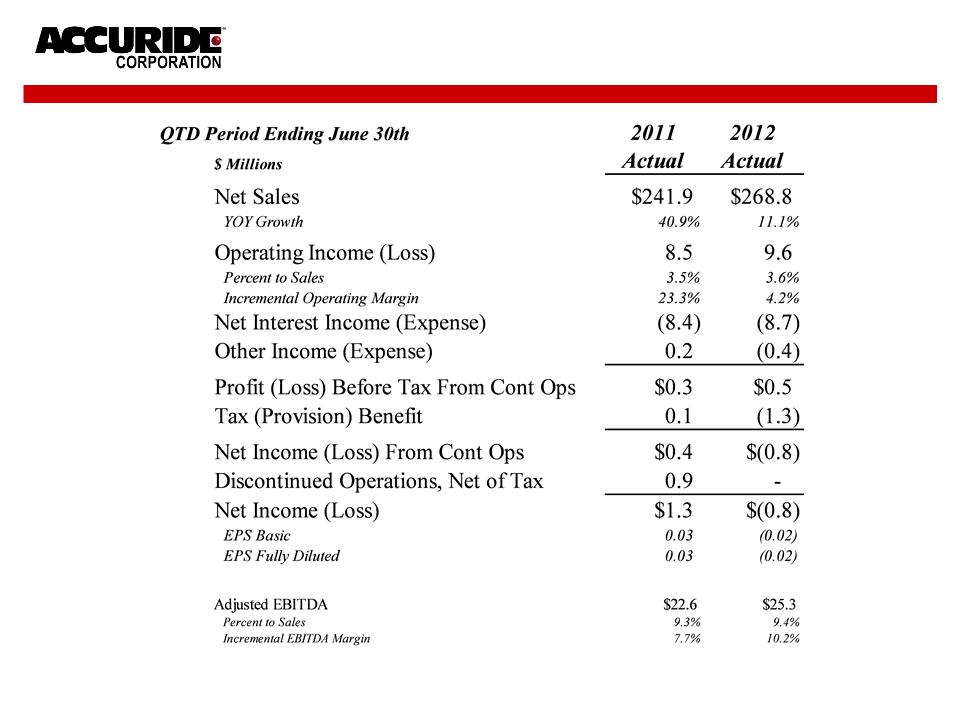

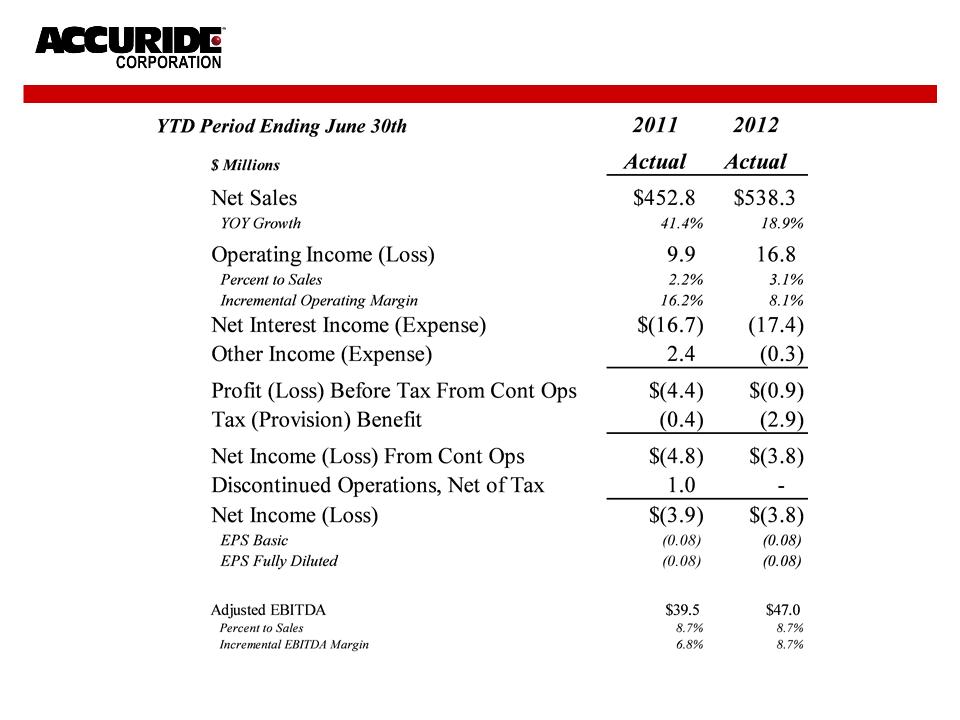

Summary Income Statement

21

Summary Income Statement

22

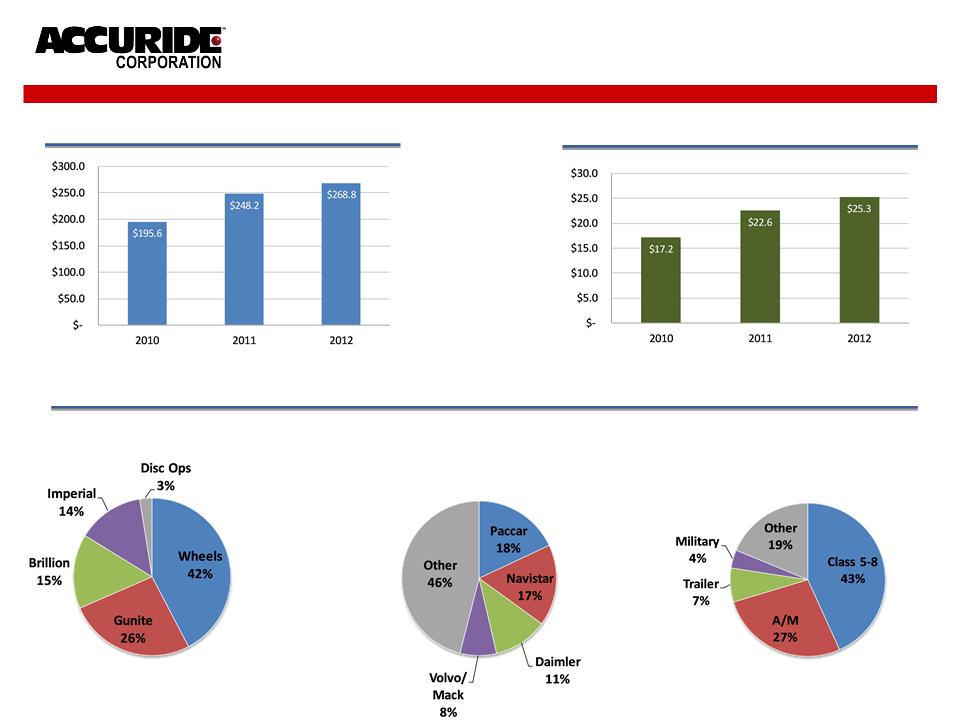

Consolidated Results

Q2 Consolidated Revenue

Q2 Consolidated EBITDA

Consolidated Revenue Breakout

(2011 Full Year)

Business Segment

Customer

Market Segment

23

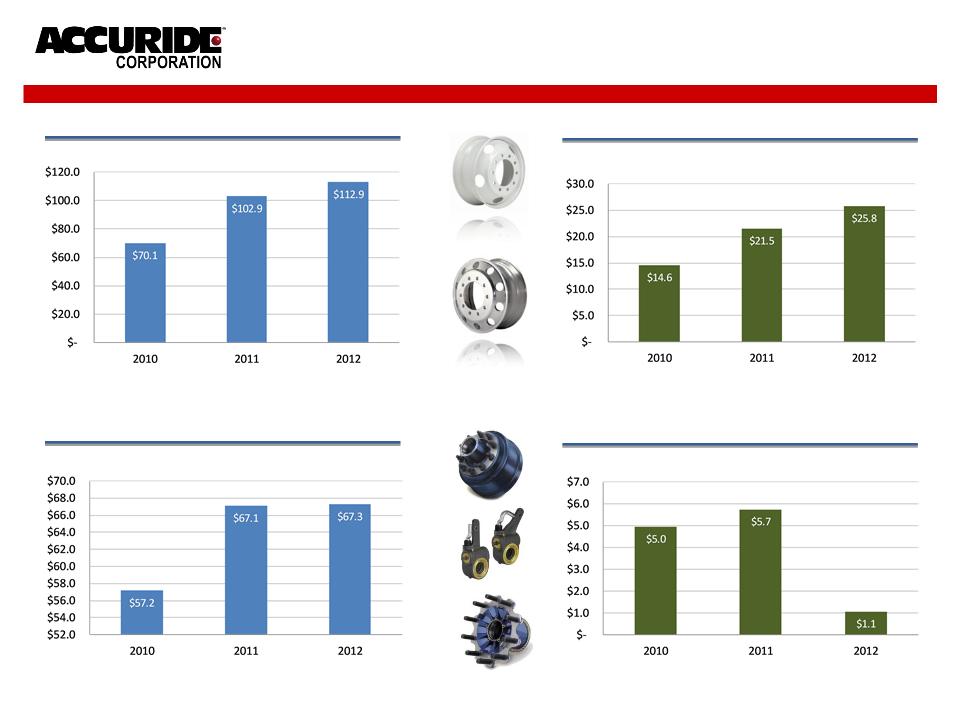

Wheels & Gunite Performance

Q2 Wheels Revenue

Q2 Wheels EBITDA (1)

(1) EBITDA before corporate allocations

Q2 Gunite Revenue

Q2 Gunite EBITDA (1)

(1) EBITDA before corporate allocations

24

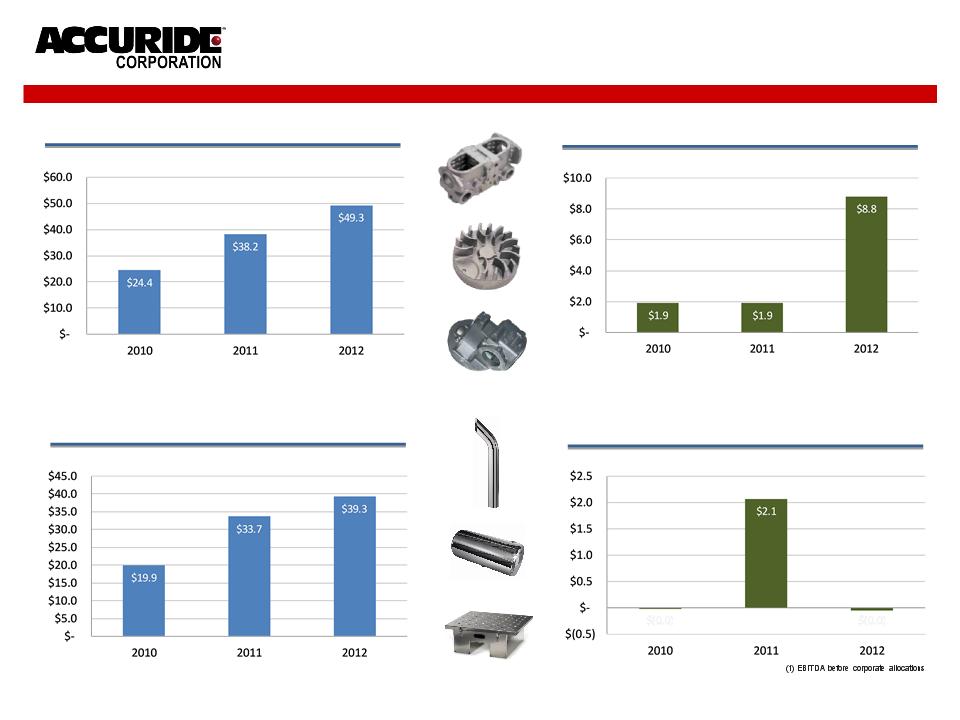

Brillion & Imperial Segments

Q2 Brillion Revenue

Q2 Brillion EBITDA (1)

(1) EBITDA before corporate allocations

Q2 Imperial Revenue

Q2 Imperial EBITDA (1)

25

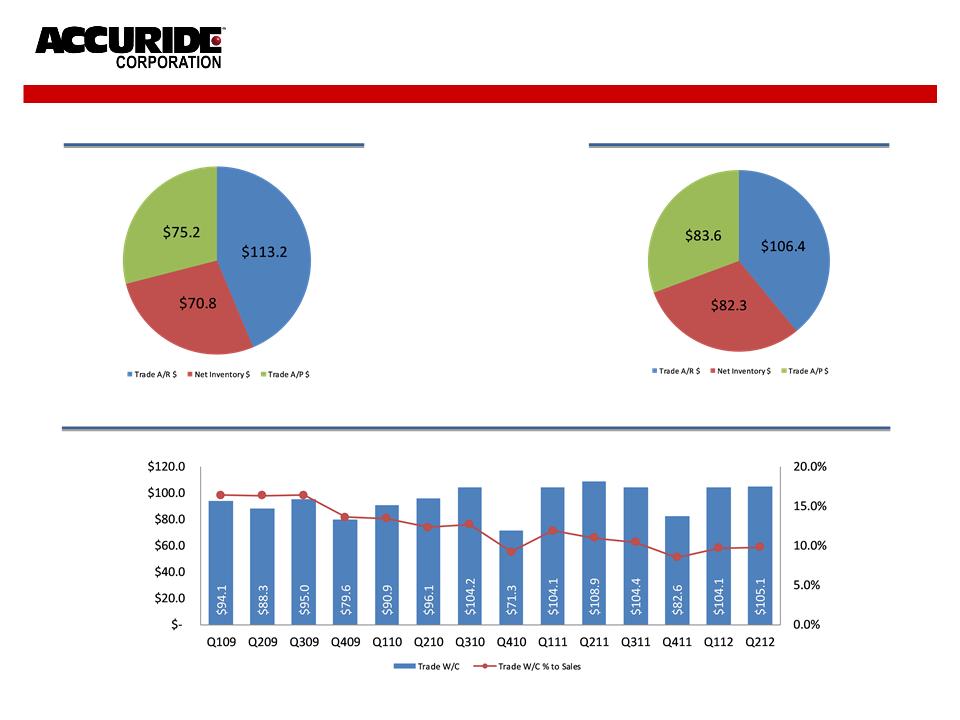

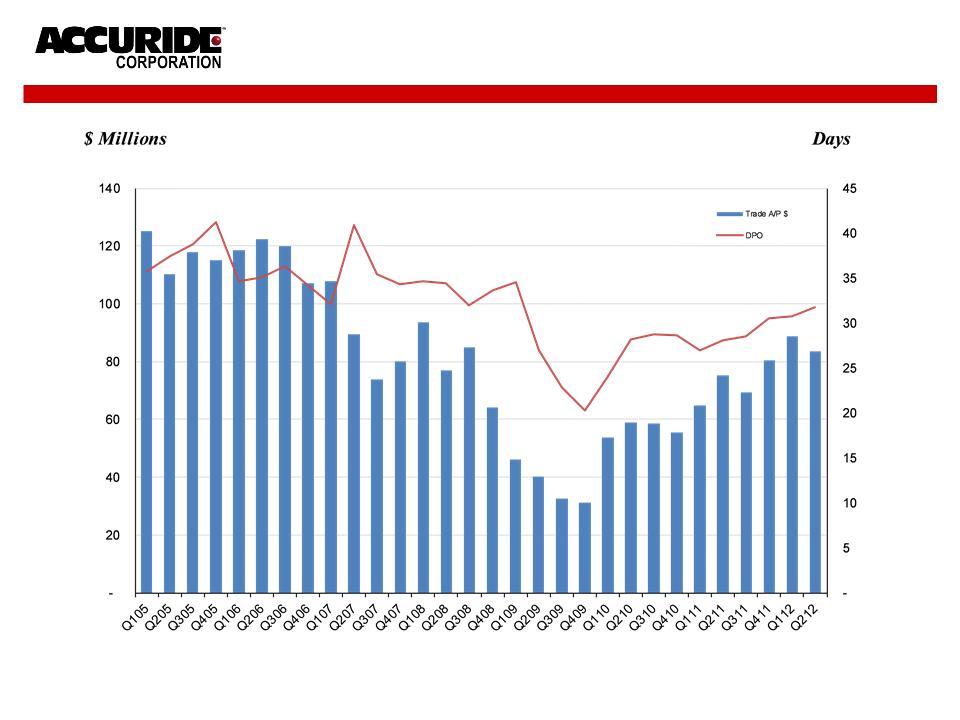

Trade Working Capital

Historical Working Capital Requirements

Q2 2012 Working Capital Breakout

Q2 2011 Working Capital Breakout

26

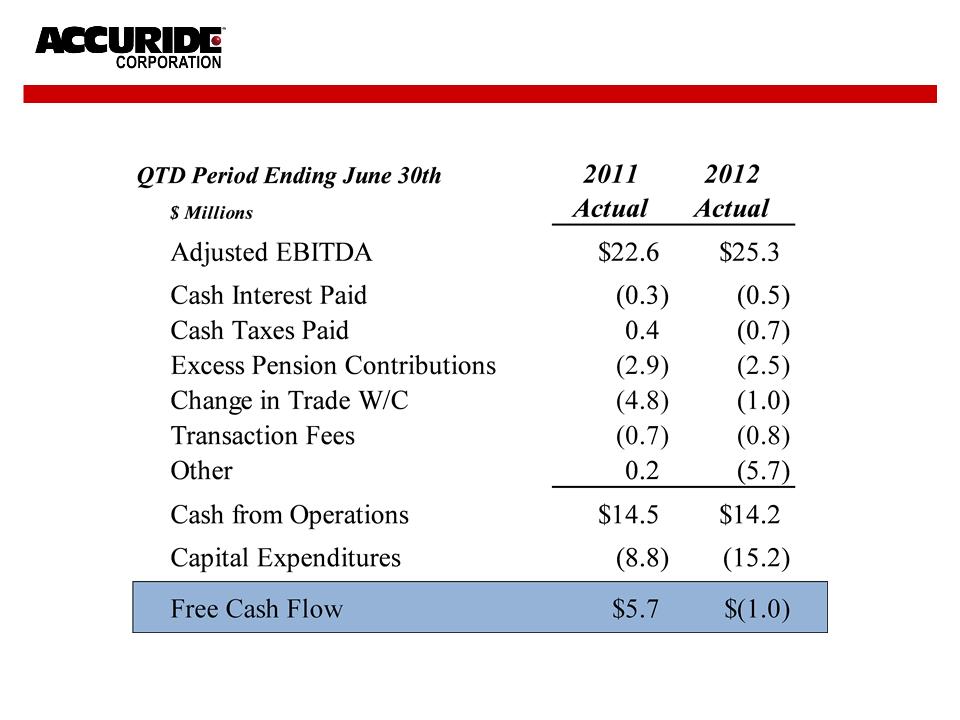

Free Cash Flow

27

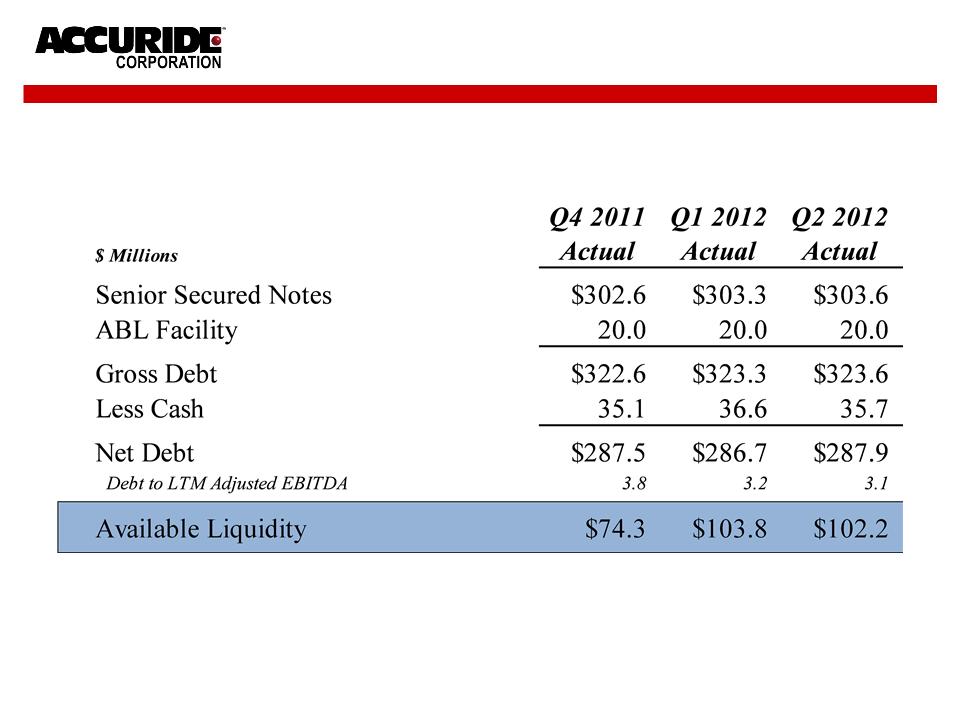

Net Debt & Liquidity

28

29

Full Year Guidance

Class 8 260K to 270K

Class 5-7 165K to 175K

Trailer 230K to 250K

Net Sales $1,000 to $1,025

Adjusted EBITDA $95 to $100

EPS - Diluted $(0.12) to $(0.05)

CAPEX $70

Depreciation & Amortization $53

Cash Interest Expense $32

Excess Pension Contributions $12

Trade Working Capital Source of Cash $9

Free Cash Flow $(10) to $(5)

30

Summary

• “Fix & Grow” Strategy being executed

• Long-term market trends remain favorable

heading into 2013 and beyond despite

near-term softness

heading into 2013 and beyond despite

near-term softness

• Resources focused on key priorities:

• Aluminum Wheels ahead of schedule

• Gunite restructuring on track

• Imperial back under control

• Adequate liquidity and initiatives to

improve it

improve it

• Strategic opportunities exist to “Fix &

Grow” the company

Grow” the company

• We are executing our plan!

31

32

33

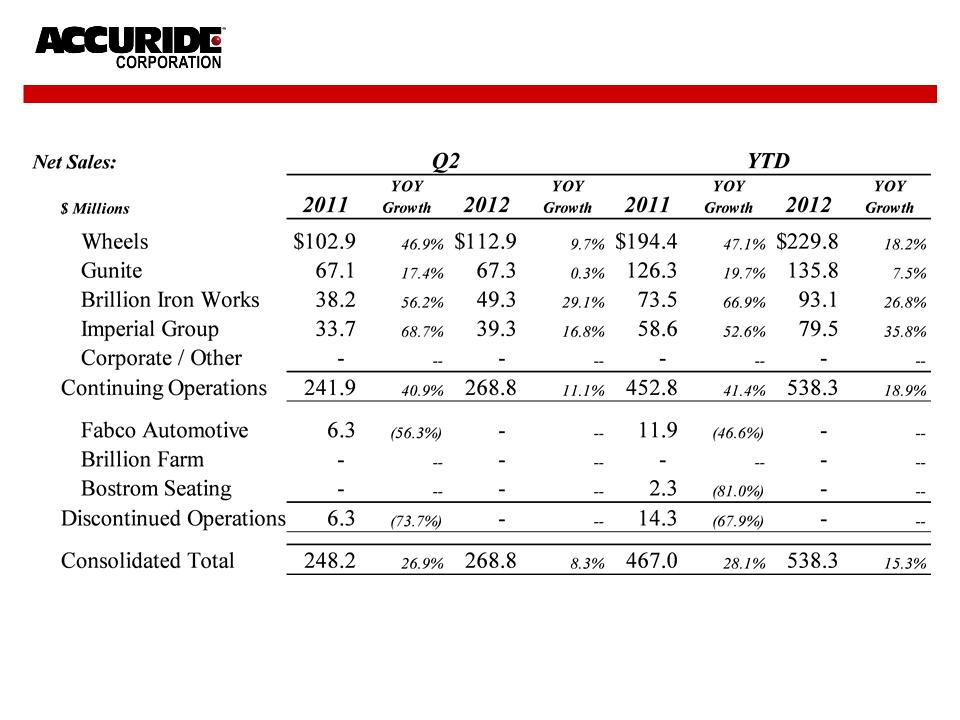

Segment Revenue

34

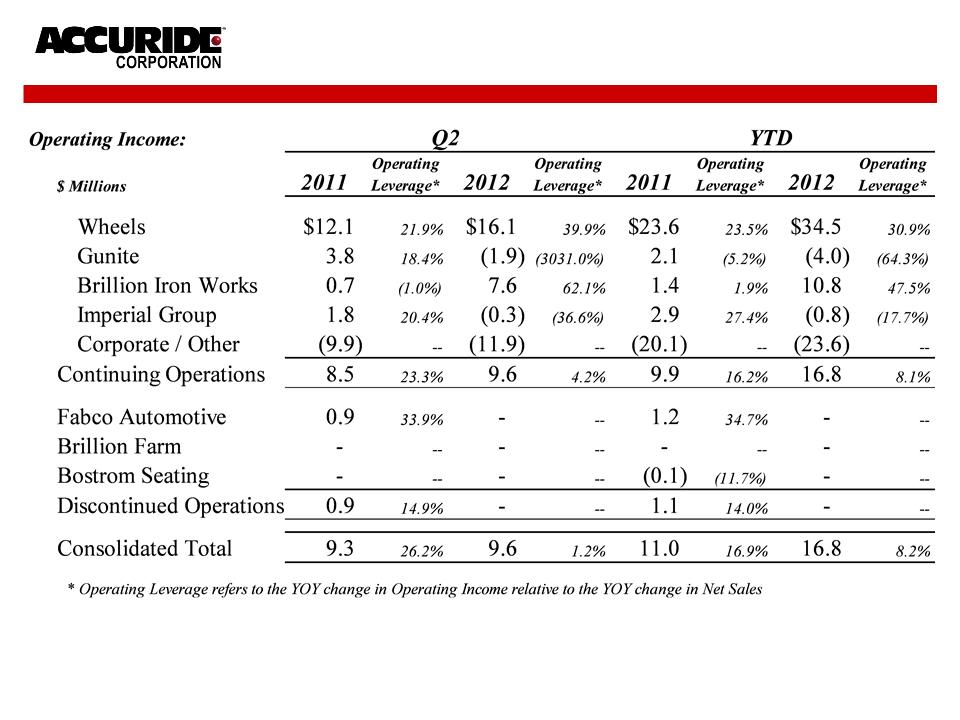

Segment Operating Income

35

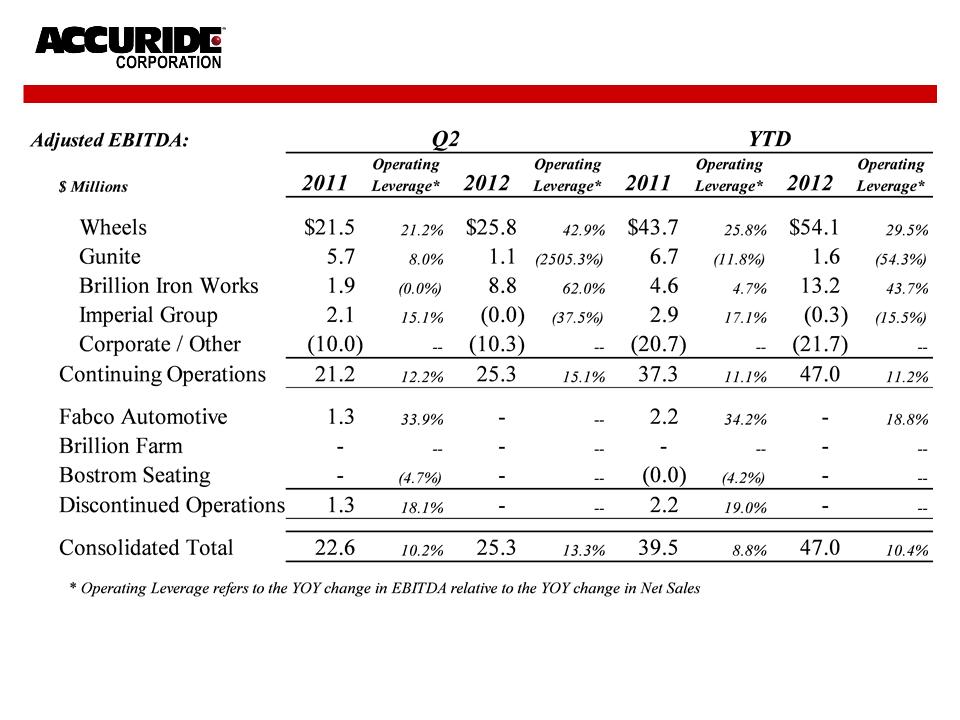

Segment Adjusted EBITDA

36

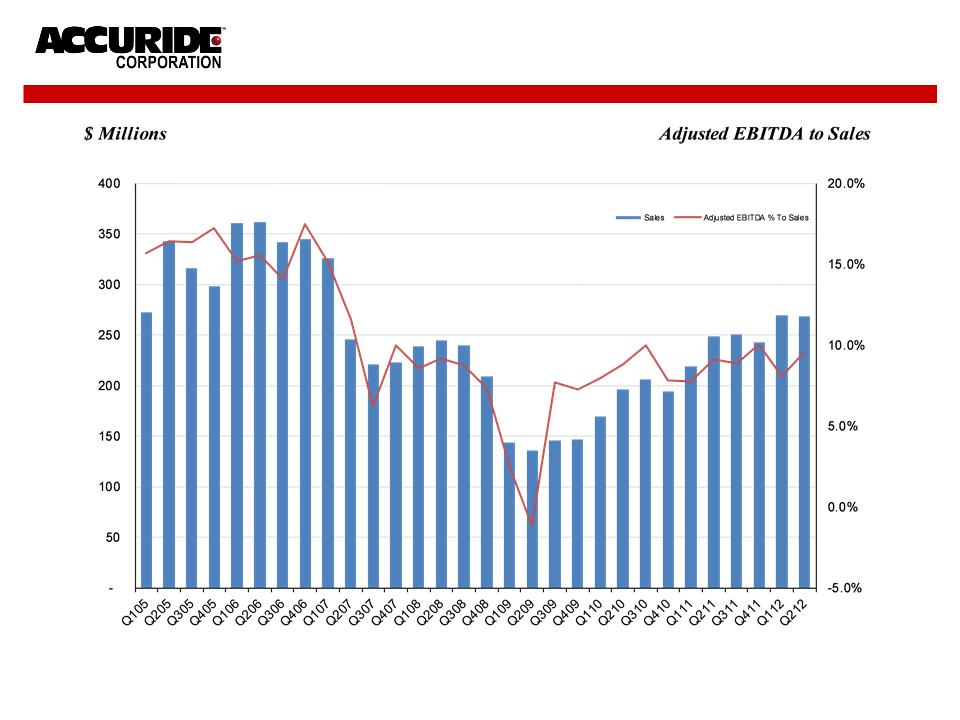

Sales & Adjusted EBITDA

37

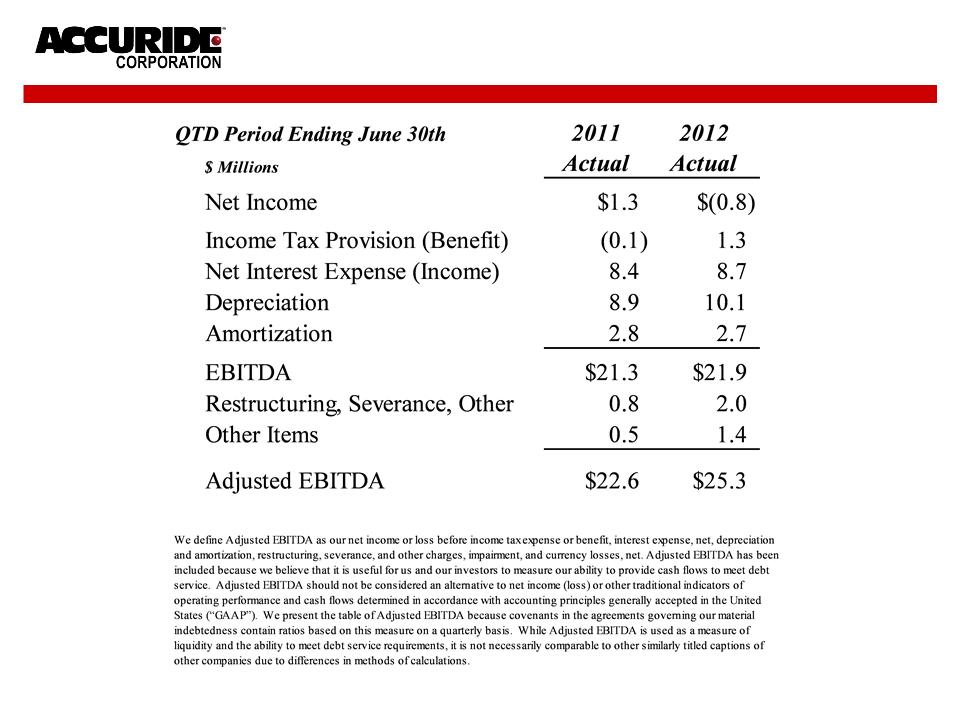

Net Income to EBITDA Reconciliation

38

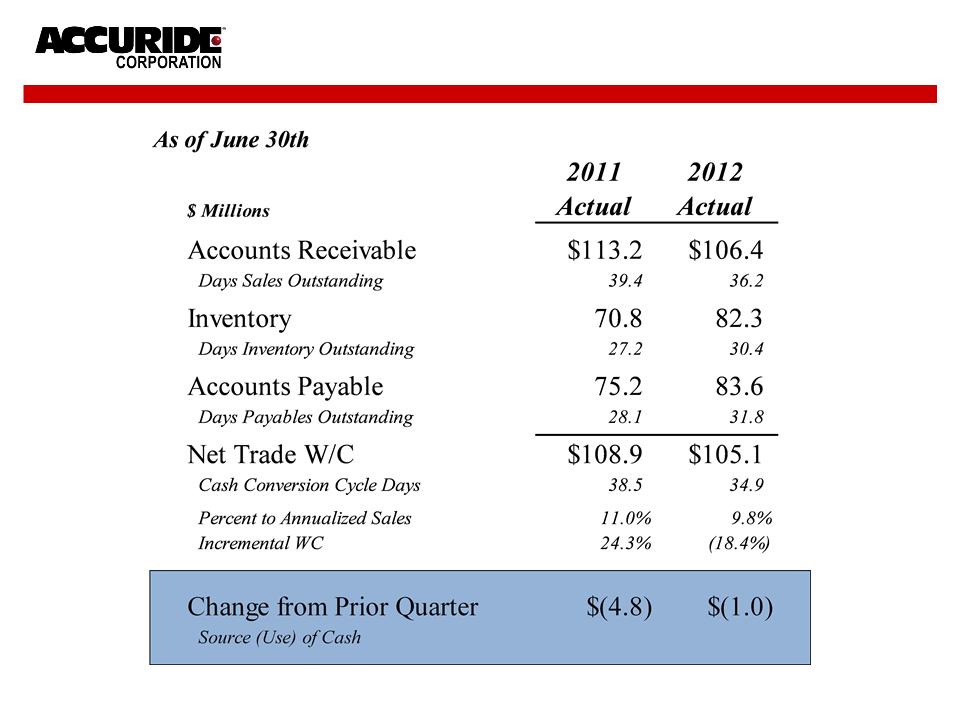

Trade Working Capital

39

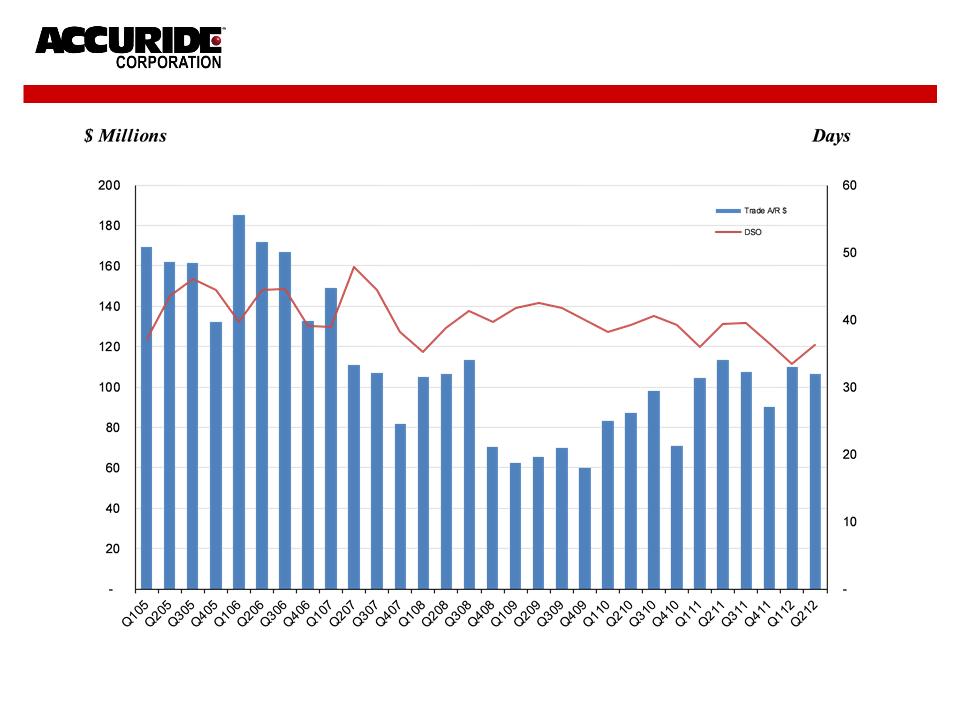

Customer Receivables - Net

40

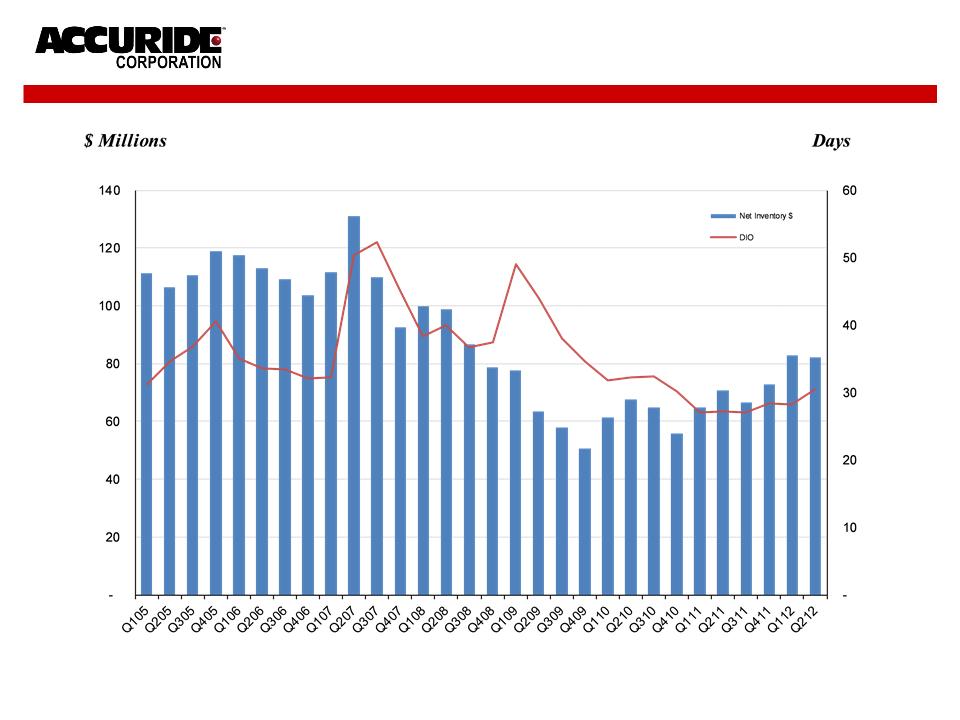

Inventories - Net

41

Accounts Payable

42