Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TIDEWATER INC | d382680d8k.htm |

| EX-99.2 - TRANSCRIPT TO THE 2012 ANNUAL MEETING OF STOCKHOLDERS - TIDEWATER INC | d382680dex992.htm |

Exhibit 99.1

Exhibit 99.1 |

2

In accordance with the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, the Company notes that certain statements set

forth in this presentation provide other than historical information and are

forward looking. The actual achievement of any forecasted results, or the

unfolding

of

future

economic

or

business

developments

in

any

way

anticipated

or projected by the Company, involve many risks and uncertainties. Among

those risks and uncertainties, many of which are beyond the control of the

Company, are: fluctuations in oil and gas prices; the level of fleet additions by

competitors and vessel overcapacity; changes in levels of capital spending in

domestic and international markets by customers in the energy industry for

exploration, development and production; unsettled political conditions, civil

unrest and governmental actions, especially in higher risk countries of

operations; changing customer demands for different vessel specifications;

acts of terrorism; unsettled political conditions, war, civil unrest and

governmental actions, especially in higher risk countries of operations; foreign

currency fluctuations; and environmental and labor laws. Participants should

consider all of these risk factors as well as other information contained in the

Company’s form 10-K’s and 10-Q’s. |

3

|

4

TOTAL RECORDABLE INCIDENT RATES

0.80

0.00

0.10

0.70

0.60

0.50

0.40

0.30

0.20

2002

2003

2004

2005

2006

2007

2008

2009

2011

2010

CALENDAR YEARS

TIDEWATER

DOW CHEMICAL

CHEVRON

EXXON/MOBIL |

5

Unique global footprint; 50+ years of Int’l experience

Unmatched scale and scope of operations

Strength of International business compliments U.S.

activity

Secular growth

Longer contracts

Better utilization

Higher day rates

Solid customer base of NOC’s and IOC’s |

In

4Q

FY

2012,

~6%

of

vessels/revenue was generated

in

U.S.

GOM;

however,

38

total

active

U.S.-flagged

vessels

provide

good

optionality

to

a

recovery

in

the

U.S.

GOM.

6

Asia/Pac

33(13%)

MENA

35(13%)

SS Africa/Europe

132(50%)

Americas

63(24%) |

Vessel

Count Estimated Cost

AHTS

101

$1,765m

PSV’s

91

$1,934m

Crew boats & Tugs

71

$301m

TOTALS:

263

$4,000m

(1)

.

At 3/31/12, 215 new vessels were in our fleet with ~5.7 year average age

Vessel Commitments

Jan. ’00 –

March ‘12

(1)

$3,640m (91%) funded through 3/31/12

7 |

8

Count

AHTS

2

PSV

18

Crew and Tug

5

Total

25

Vessels Under Construction*

As of March 31, 2012

Estimated

delivery

schedule

–

13

in

FY

‘13,

10

in

FY

‘14

and

2

thereafter.

CAPX of $220m in FY ‘13, $95m in FY ‘14 and $44m in FY ’15.

* Includes 3 new vessel purchase commitments at 3/31/12

8 |

Actual vessel deliveries through 3/31/12; estimated vessel deliveries based on

commitments to build or acquire as of 3/31/12

Through 3/31/12, vessel

commitments include 263 vessels

with a capital cost of $4.0 billion

9 |

10

|

11

**

EPS in Fiscal 2004 is exclusive of the $.30 per share after tax impairment charge.

EPS in Fiscal 2006 is exclusive of the $.74 per share after tax gain from the

sale of six KMAR vessels. EPS in Fiscal 2007 is exclusive of $.37 per share of after

tax gains from the sale of 14 offshore tugs. EPS in Fiscal 2010 is

exclusive of $.66 per share Venezuelan provision, a $.70 per share tax benefit

related to favorable resolution of tax litigation and a $0.22 per share charge for

the proposed settlement with the SEC of the company’s FCPA matter. EPS in Fiscal

2011 is exclusive of total $0.21 per share charges for settlements with DOJ

and Government of Nigeria for FCPA matters, a $0.08 per share charge related to participation in a multi-company U.K.-based pension plan and a $0.06

per share impairment charge related to certain vessels. EPS in Fiscal 2012 is

exclusive of $0.43 per share goodwill impairment charge. Adjusted Return

On Avg. Equity

$8.00

$6.00

$4.00

$2.00

$0.00

Fiscal

2004

Fiscal

2005

Fiscal

2006

Fiscal

2007

Fiscal

2008

Fiscal

2009

Fiscal

2010

Fiscal

2011

Fiscal

2012

$1.03

$1.78

$3.33

$5.94

$6.39

$7.89

$5.20

$2.40

$2.13

4.3%

7.2%

12.4%

18.9%

18.3%

19.5%

11.4%

5.0%

4.3% |

12

Over

a

13-year

period,

Tidewater

has

invested

$4.1

billion

in

CapEx($3.6

billion

in

the

“new”

fleet),

and paid out ~$1 billion through dividends and share repurchases. Over the

same period, CFFO and proceeds from dispositions were $3.6 billion and $732

million, respectively 12

Fiscal Year

$0

$700

$600

$500

$400

$300

$200

$100

$ in millions |

13

~$770 million of available liquidity as of 3/31/12, including $450 million of unused

capacity under committed bank credit facilities.

Cash & Cash Equivalents

Total Debt

Shareholders Equity

Net Debt / Net Capitalization

Total Debt / Capitalization

$321 million

$950 million

$2,526 million

20%

27%

As of March 31, 2012

13 |

14

$ in Millions, Except Per Share Data

Six Months Ended

Revenues

Net Earnings*

EPS*

Net Cash from Operations

Capital Expenditures

9/30/11

$506

$42

$0.81

$87

$155

3/31/12

$562

$68

$1.33

$135

$202

*9/30/11 Six Month amounts exclude $22.1 million, or $0.43 per share, goodwill

impairment charge in September 2011. |

Prior peak

period (FY2009) averaged quarterly revenue

of $339M, and operating

margin of $174M, or 51%

$500

$400

$300

$200

$100

$-

$300 million

52.7%

52.1%

46.2%

53.8%

55.9%

50.5%

43.6%

36.3%

39.3%

35.1%

42.4%

41.5%

$150 million

50%

Qtr 1

Qtr 2

Qtr 3

Qtr 4

Qtr 1

Qtr 2

Qtr 3

Qtr 4

Qtr 1

Qtr 2

Qtr 3

Qtr 4

Qtr 1

Qtr 2

Qtr 3

Qtr 4

Qtr 1

Qtr 2

Qtr 3

Qtr 4

Fiscal 08

Fiscal 09

Fiscal 10

Fiscal 11

Fiscal 12

Vessel Revenue ($)

Vessel Operating Margin ($)

Vessel Operating Margin (%)

Vessel Cash Operating Margin is defined as Vessel Revenues less Vessel Operating Costs.

15 |

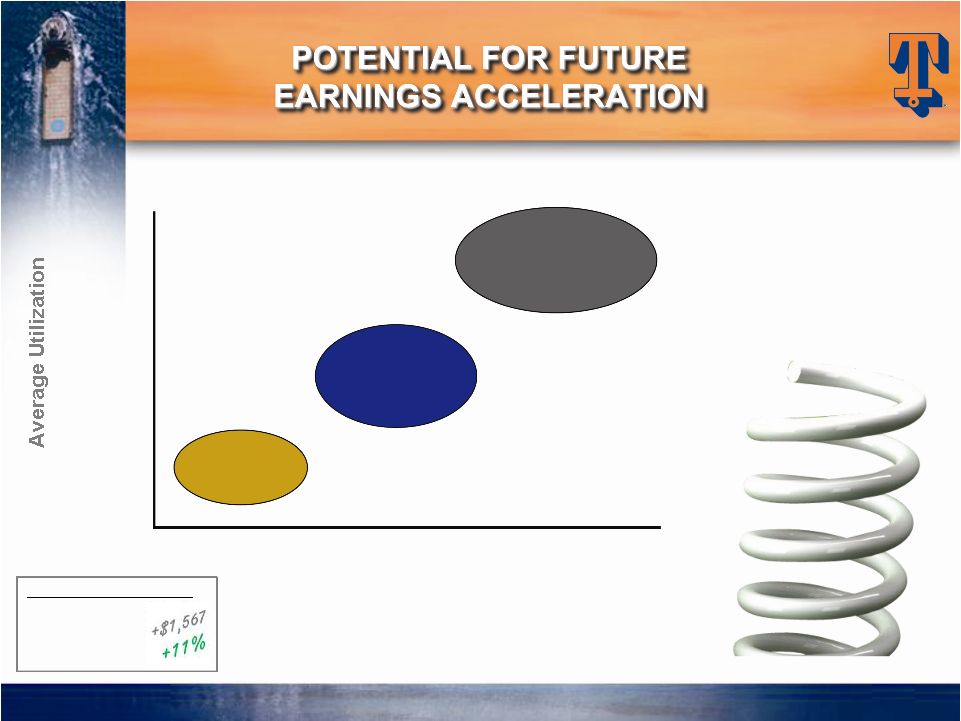

Average Day rates

$15,658*

$17,224

(+ 10%)

$18,946

(+ 10%)

83.2%*

85.0%

90.0%

~$3.40

EPS

~$5.50

EPS

~$9.50

EPS

260 vessel assumption (215 current new vessels + 25 under construction + 20

additional new vessels next year). * 3/31/12 quarterly

actual stats This info is not meant to be a

prediction of future earnings

performance, but simply an

indication of earning sensitivities

resulting from future fleet

additions and reductions and

varying operating assumptions

~$400M+

EBITDA

+$500M

EBITDA

+$700M

EBITDA

Actual Avg Qtrly Day rates

6/30/11 $14,091

9/30/11 $14,291

12/31/11 $14,835

3/31/12 $15,658

16 |

17

|

To recognize

an individual or team that has: Performed heroic acts in time of crisis

Significantly impacted the TDW business

Significantly contributed to our customer success or

relationships

Had a breakthrough idea or contribution resulting in

significant improvements for TDW

Went above and beyond on normal duties and

responsibilities to achieve greatness

18 |

19

|

|

21

|

|