Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

NEW AMERICA ENERGY CORP.

(Exact Name of Registrant in its Charter)

|

Nevada

|

2860

|

N/A

|

|

(State or other Jurisdiction of

|

(Primary Standard Industrial Classification

|

(IRS Employer Identification No.)

|

|

Incorporation)

|

Code)

|

3651 Lindell Rd., Ste D#138, Las Vegas, NV 89103

(800) 508-6149

(Address and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

Copies of communications to:

Gregg E. Jaclin, Esq.

Anslow & Jaclin, LLP

195 Route 9 South, Suite 204

Manalapan, NJ 07726

Tel. No.: (732) 409-1212

Fax No.: (732) 577-1188

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.[ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ]

|

Smaller reporting company [X]

|

1

CALCULATION OF REGISTRATION FEE

|

Proposed

|

Proposed

|

|||||||||||

|

Maximum

|

Maximum

|

Amount of

|

||||||||||

|

Title of Each Class of Securities

|

Amount to be

|

Offering Price

|

Aggregate

|

Registration

|

||||||||

|

to be Registered

|

Registered (1)

|

Per Share (2)

|

Offering Price

|

Fee (3)

|

||||||||

|

Common Stock, par value $0.001 per share, issuable pursuant to the Investment Agreement

|

9,500,000

|

$

|

0.05

|

$

|

475,000

|

$

|

54.44

|

|

(1)

|

We are registering 9,500,000 shares of our common stock (“Shares”) that we will put to Fairhills Capital Offshore Ltd. (“Fairhills” or “Selling Security Holder”) pursuant to an investment agreement (the “Investment Agreement”) between Fairhills and the registrant entered into on March 28, 2012, and as amended on May 1, 2012 and on July 5, 2012. In the event of stock splits, stock dividends or similar transactions involving the common stock, the number of common shares registered shall, unless otherwise expressly provided, automatically be deemed to cover the additional securities to be offered or issued pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”). In the event that the adjustment provisions of the Investment Agreement require the registrant to issue more shares than are being registered in this registration statement, for reasons other than those stated in Rule 416 of the Securities Act, the registrant will file a new registration statement to register those additional shares.

|

|

|

(2)

|

The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o) of the Securities Act on the basis of the closing bid price of the common stock of the registrant as reported on the OTCBB on July 23, 2012.

|

|

|

|

||

|

(3)

|

New America Energy Corp. filed a Registration Statement on Form S-1 on June 4, 2012 (File No. 333-181867), which was amended on July 6, 2012 and withdrawn on July 24, 2012 before any part of it was declared effective by the Securities and Exchange Commission. Pursuant to Rule 457(p), we request that the $76.21 that we paid for the filing fee for the June 4, 2012, Registration Statement be applied to the Registration Statement herein.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH SECTION 8(a), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission (“SEC”) is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

2

PRELIMINARY PROSPECTUS

9,500,000 SHARES OF

NEW AMERICA ENERGY CORP.

COMMON STOCK

This prospectus relates to the resale of up to 9,500,000 shares of common stock, par value $0.001 per share (the “Shares”), issuable to Fairhills Capital Offshore Ltd., a Cayman Islands exempted company (“Fairhills”), a selling stockholder pursuant to a “put right” under an investment agreement (the “Investment Agreement”) that we entered into with Fairhills. The Investment Agreement permits us to “put” shares of our common stock to Fairhills over a period of up to thirty-six (36) months. We will not receive any proceeds from the resale of these shares of common stock. However, we will receive proceeds from the sale of securities pursuant to our exercise of this put right offered by Fairhills. Fairhills will bear all costs associated with this registration, except for accounting fees and expenses. Fairhills is deemed an underwriter for our common stock.

The selling stockholder may offer all or part of the Shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. Fairhills is paying all of the registration expenses incurred in connection with the registration of the Shares except for accounting fees and expenses and we will not pay any of the selling commissions, brokerage fees and related expenses.

Our Common Stock is quoted on the Over-the-Counter Bulletin Board (“OTCBB”) under the ticker symbol “NECA.” On July 23, 2012, the closing price of our common stock was $0.05 per share.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” TO READ ABOUT FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN SHARES OF OUR COMMON STOCK.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Date of This Prospectus is: _____, 2012

3

|

PAGE

|

|

|

Prospectus Summary

|

5 |

|

Risk Factors

|

7 |

|

Use of Proceeds

|

13 |

|

Dilution

|

13 |

|

Selling Security Holder

|

13 |

|

Plan of Distribution

|

15 |

|

Description of Securities

|

16 |

|

Description of Business

|

17 |

|

Description of Property

|

22 |

|

Legal Proceedings

|

35 |

|

Management Discussion and Analysis of Financial Condition and Financial Results

|

36 |

|

Directors, Executive Officers, Promoters and Control Persons

|

41 |

|

Executive Compensation

|

44 |

|

Security Ownership of Certain Beneficial Owners and Management

|

45 |

|

Certain Relationships and Related Transactions and Director Independence

|

46 |

|

Other Expenses of Issuance and Distribution

|

48 |

|

Indemnification of Directors and Officers

|

48 |

|

Recent Sale of Unregistered Securities

|

48 |

|

Exhibits and Financial Statement Schedules

|

50 |

|

Undertakings

|

51 |

|

Index to Financial Statements

|

55 |

4

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this Prospectus. This summary does not contain all the information that you should consider before investing in the common stock of New America Energy Corp. (referred to herein as the “Company,” “NECA”, “we,” “our,” and “us”). You should carefully read the entire Prospectus, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements before making an investment decision.

Business Overview

New America Energy Corp. (formerly “Atheron, Inc.”) was incorporated in Nevada on May 8, 2006, as a development stage company, initially developing a technology for ethanol-methanol gasoline. The Company did not progress the development of this technology.

On November 5, 2010, we underwent a change of control and the Company’s newly appointed sole director and majority shareholder approved a name change to New America Energy Corp. and a twenty-five (25) new for one (1) old forward stock split of the Company’s issued and outstanding shares of common stock, such that its issued and outstanding shares of common stock increased from 2,150,000 to 53,750,000. This forward split did not affect the number of the Company’s authorized common shares, which remains at 75,000,000.

On November 16, 2010, the Nevada Secretary of State accepted for filing the Certificate of Amendment to the Company’s Articles of Incorporation to change our name from Atheron, Inc. to New America Energy Corp. The forward stock split and name change became effective with the Over-the-Counter Bulletin Board at the opening of trading on December 1, 2010, under the Company’s trading symbol “NECA”.

On February 3, 2011 we entered into property acquisition agreements with First Liberty Power Corp. (“FLPC”) and GeoXplor Inc. (“GeoXplor”). Pursuant to the terms of the agreements, we acquired an option, as well as exploration rights, in certain unpatented mining claims located in Southern Utah known as the “Uravan Property”. On May 31, 2011, we amended the agreement to extend the payment date for an additional 120 days. The Company did not pay the required option payments under the agreements and the property was lost on September 30, 2011.

On May 31, 2011, we entered into a property acquisition agreement with GeoXplor Corp. to acquire an option, as well as exploration rights, in certain unpatented mining claims located in Clayton Valley, Nye County, Nevada. Subsequently on October 27, 2011, we entered into an amended property acquisition agreement whereby we acquired additional claims.

The Company is currently focused exclusively on the acquisition and development of mineral resource properties.

We are considered to be an exploration stage company, as we have not generated any revenues from operations.

Our common stock is traded over-the-counter on the OTCBB under the ticker symbol “NECA.”

On March 28, 2012, we entered into an investment agreement (the “Investment Agreement”) with Fairhills Capital Offshore Ltd., a Cayman Islands exempted company (“Fairhills”). Pursuant to the terms of the Investment Agreement, Fairhills has committed to purchase up to Three Million Dollars ($3,000,000) of our common stock over a period of up to thirty-six (36) months.

On May 1, 2012, we entered into an amendment to the Investment Agreement (the “Amendment”). Pursuant to the Amendment, the purchase price of the shares shall be equal to a discount of Twenty-Five percent (25%) percent from the lowest volume weighted average price during the ten (10) trading days immediately prior to receipt by Fairhills of a put notice (as defined in the Investment Agreement.)

In connection with the Investment Agreement, we also entered into a registration rights agreement (the “Registration Rights Agreement”) with Fairhills. Pursuant to the Registration Rights Agreement, we are obligated to file a registration statement with the Securities and Exchange Commission (“SEC”) covering Eighteen Million (18,000,000) shares of the common stock underlying the Investment Agreement within 21 days after the closing of the Investment Agreement. In addition, we are obligated to use all commercially reasonable efforts to have the registration statement declared effective by the SEC within 120 days after the closing of the Investment Agreement and maintain the effectiveness of such registration statement until termination in accordance with the Investment Agreement.

5

At an assumed purchase price under the Investment Agreement of $0.04595 (equal to 75% of the closing price of our common stock of $0.0612 on May 25, 2012), we will be able to receive up to $436,525 in gross proceeds, assuming the sale of the entire 9,500,000 Shares being registered hereunder pursuant to the Investment Agreement. At an assumed purchase price of $0.04595 under the Investment Agreement, we would be required to register 55,788,357 additional shares to obtain the balance of $2,563,475 under the Investment Agreement. We are currently authorized to issue 75,000,000 shares of our common stock; however our management intends to request that our shareholders approve an increase in our authorized capital stock. Fairhills has agreed to refrain from holding an amount of shares which would result in Fairhills from owning more than 4.99% of the then-outstanding shares of our common stock at any one time.

There are substantial risks to investors as a result of the issuance of shares of our common stock under the Investment Agreement. These risks include dilution of stockholders, significant decline in our stock price and our inability to draw sufficient funds when needed.

Fairhills will periodically purchase our common stock under the Investment Agreement and will, in turn, sell such shares to investors in the market at the market price. This may cause our stock price to decline, which will require us to issue increasing numbers of common shares to Fairhills to raise the same amount of funds, as our stock price declines.

Effective March 28, 2012, we entered into a debt instrument with Fairhills whereby Fairhills provided us with a $200,000 loan which is due by September 28, 2012, and carries a 2% annual rate of interest. The note is not convertible into our common stock and we have agreed that we will not use the funds raised in the Fairhills financing to repay this note. The note was secured by 3,333,333 shares of our restricted common stock owned by our director and officer, Rick Walchuk. These shares shall be held in escrow by Fairhills’s counsel and will be forfeited to Fairhills if we default on the note.

Midsouth Capital Inc. (“Midsouth”) who brokered the agreement with Fairhills will receive certain commissions for the financings with Fairhills pursuant to an agreement whereby Midsouth is the Company’s non-exclusive financial advisor, investment banker and placement agent for the purpose of assisting the Company to raise capital. The Company agreed to: (i) issue 80,000 Shares; (ii) a success fee of 10% of the amount for any capital raised; (iii) 150,000 restricted Shares, with piggy back registration rights, per $1,000,000 of capital raised for a period of two years. Pursuant to our agreement with MidSouth we have issued Midsouth 80,000 Shares, and paid them a stock fee of 30,000 additional Shares and a cash fee of $20,000 based on 10% of the initial $200,000 funded by Fairhills.

Where You Can Find Us

Our principal executive office location and mailing address is 3651 Lindell Road, Ste. D#138, Las Vegas, Nevada. Our telephone number is 800-508-6149.

THE OFFERING

|

Common stock offered by Selling Stockholder

|

9,500,000 shares of common stock.

|

|

Common stock outstanding before the offering

|

52,692,133 shares of common stock as of the date hereof.

|

|

Common stock outstanding after the offering

|

62,192,133 shares of common stock.

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of Shares by the selling stockholder. However, we will receive proceeds from the sale of securities pursuant to the Investment Agreement. The proceeds received under the Investment Agreement will be used for payment of general corporate and operating expenses.

|

|

OTCBB Trading Symbol

|

NECA.OB

|

|

Risk Factors

|

The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors”.

|

6

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this Prospectus before making an investment decision with regard to our securities. The statements contained in or incorporated into this Prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Much of the information included in this Prospectus includes or is based upon estimates, projections or other "forward-looking statements". Such forward-looking statements include any projections or estimates made by us and our management in connection with our business operations. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein.

Such estimates, projections or other "forward-looking statements" involve various risks and uncertainties as outlined below. We caution the reader that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other "forward-looking statements".

RISKS RELATING TO OUR COMPANY

We currently have no source of operating cash flow and we have a history of operating losses.

We have no revenues from operations, our mineral property interests are in the exploration stage and we have a history of operating losses. We will not receive revenues from operations at any time in the near future, and we have no prior year’s history of earnings or cash flow. We have incurred losses. There can be no assurance that our operations will ever generate sufficient revenues to fund our continuing operations or that we will ever generate positive cash flow from our operations. Further, we can give no assurance that we will attain or sustain profitability in any future period.

We are currently a mining exploration stage company. See “Item 2 Properties” of this Report for more information regarding our mining claims.

According to SEC definitions, our mining claims do not have any proven or probable reserves. A “reserve,” as defined by the SEC, is that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. A reserve requires a feasibility study demonstrating with reasonable certainty that the deposit can be economically extracted and produced. We have not carried out any feasibility study with regard to our mining claims. As a result, we currently have no reserves and there are no assurances that we will be able to prove that there are reserves on our mining concessions.

Mineral exploration is highly speculative in nature and there can be no certainty of our successful development of profitable commercial mining operations.

The exploration and development of mineral properties involve significant risks that even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few explored properties develop into producing mines. Substantial expenses may be incurred to locate and establish mineral reserves, develop metallurgical processes, and construct mining and processing facilities at a particular site. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade, and proximity to infrastructure; metals prices which are highly cyclical; drilling and other related costs that appear to be rising; and government regulations, including those related to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals, and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital.

There is no certainty that the expenditures made by us towards the exploration and evaluation of mineral deposits will result in discoveries of commercial quantities of ore.

7

The Company may be unable to obtain the funds necessary to finalize our property option agreement.

Under the terms of our option agreement for our mining claims, we are required to expend a total of $1,000,000 on exploration and make property payments of $300,000. $100,000 was required to be expended prior to May 31, 2012, with a further $200,000 to be expended by May 31, 2013, $300,000 to be expended by May 31, 2014 and the remaining $400,000 to be expended on or before May 31, 2015. We have failed to make the May 31, 2012 payment and are currently in negotiations to extend the payment period. As such, we may be currently in default of the property option agreement. Currently we do not have sufficient funds to expend the exploration funds and property payments required under the option agreement. We have been successful in obtaining financing for operations by way of loans and financings and we currently have a financing agreement for up to $3,800,000 but as an exploration company it is often difficult to obtain adequate financing when required, and it is not necessarily the case that the terms of such financings will be favorable. If we fail to obtain additional financing on a timely basis, we could forfeit our mineral property interests and/or reduce or terminate operations.

Because our business involves numerous operating hazards, we may be subject to claims of a significant size, which would cost a significant amount of funds and resources to rectify. This could force us to cease our operations.

Our operations are subject to the usual hazards inherent in exploring for minerals, such as general accidents, explosions, chemical exposure and cratering. The occurrence of these or similar events could result in the suspension of operations, damage to or destruction of the equipment involved and injury or death to personnel. Operations also may be suspended because of machinery breakdowns, abnormal climatic conditions, failure of subcontractors to perform or supply goods or services or personnel shortages. The occurrence of any such contingency would require us to incur additional costs, which would adversely affect our business.

Damage to the environment could also result from our operations. If our business is involved in one or more of these hazards, we may be subject to claims of a significant size that could force us to cease our operations.

Mineral resource exploration, production and related operations are subject to extensive rules and regulations of federal, provincial, state and local agencies. Failure to comply with these rules and regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the mineral industry. Although we intend to substantially comply with all applicable laws and regulations, because these rules and regulations frequently are amended or interpreted, we cannot predict the future cost or impact of complying with these laws.

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulations could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, provincial, state and federal governments, non-compliance with applicable regulatory requirements could subject us to penalties, fines and regulatory actions, the costs of which could harm our results of operations. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

Our operations and properties are subject to extensive laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to health and safety. These laws and regulations may do any of the following: (i) require the acquisition of a permit or other authorization before exploration commences; (ii) restrict the types, quantities and concentration of various substances that can be released in the environment in connection with exploration activities; (iii) limit or prohibit mineral exploration on certain lands lying within wilderness, wetlands and other protected areas; (iv) require remedial measures to mitigate pollution from former operations; and (v) impose substantial liabilities for pollution resulting from our proposed operations.

The exploration of mineral reserves are subject to all of the usual hazards and risks associated with mineral exploration, which could result in damage to life or property, environmental damage, and possible legal liability for any or all damages. Difficulties, such as unusual or unexpected rock formations encountered by workers but not indicated on a map, or other conditions may be encountered in the gathering of samples and information, and could delay our exploration program. Even though we are at liberty to obtain insurance against certain risks in such amounts we deem adequate, the nature of those risks is such that liabilities could exceed policy limits or be excluded from coverage. We do not currently carry insurance to protect against these risks and there is no assurance that we will obtain such insurance in the future. There are also risks against that we cannot, or may not elect to insure. The costs, which could be associated with any liabilities, not covered by insurance or in excess of insurance coverage or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, adversely affecting our financial position, future earnings, and/or competitive positions.

The prices of metals are highly volatile and a decrease in metal prices can have a material adverse effect on our business.

The profitability of natural resource operations are directly related to the market prices of the underlying commodities. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations in the metals market from the time exploration for a mine is undertaken and the time production can commence can significantly affect the profitability of a mine. Accordingly, we

8

may begin to develop a minerals property at a time when the price of the underlying metals make such exploration economically feasible and, subsequently, incur losses because metal prices have decreased. Adverse fluctuations of metals market prices may force us to curtail or cease our business operations.

Mining operations generally involve a high degree of risk.

Mining operations are subject to all the hazards and risks normally encountered in the exploration, development and production of base or precious metals, including unusual and unexpected geological formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Mining operations could also experience periodic interruptions due to bad or hazardous weather conditions and other acts of God. Milling operations are subject to hazards such as equipment failure or failure of retaining dams around tailing disposal areas, which may result in environmental pollution and consequent liability.

If any of these risks and hazards adversely affect our mining operations or our exploration activities, they may: (i) increase the cost of exploration to a point where it is no longer economically feasible to continue operations; (ii) require us to write down the carrying value of one or more mines or a property; (iii) cause delays or a stoppage in the exploration of minerals; (iv) result in damage to or destruction of mineral properties or processing facilities; and (v) result in personal injury, death or legal liability. Any or all of these adverse consequences may have a material adverse effect on our financial condition, results of operations, and future cash flows.

We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in developing mineral reserves.

The natural resource market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We will be competing with many exploration companies that have significantly greater personnel, financial, managerial and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

We may not have access to all of the supplies and materials we need to begin exploration, which could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials prior to undertaking exploration programs. If we cannot find the products, equipment and materials we need, we will have to suspend our exploration plans until we do find the products, equipment and materials.

We are an exploration stage company, and there is no assurance that a commercially viable deposit or “reserve” exists in the property in which we have claim.

We are an exploration stage company and cannot assure you that a commercially viable deposit, or “reserve,” exists on our mineral properties. Therefore, determination of the existence of a reserve will depend on appropriate and sufficient exploration work and the evaluation of legal, economic and environmental factors. If we fail to find commercially viable deposits, our financial condition and results of operations will be materially adversely affected.

We depend on our officers and directors and the loss of these individuals could adversely affect our business.

Our Company is completely dependent on our two officers and directors, Rick Walchuk and Alexander Tsingos. We currently have no employees and the loss of either or both of these individuals could significantly and adversely affect our business. We do not carry any life insurance on our directors and officers.

9

RISKS RELATING TO AN INVESTMENT IN OUR SECURITIES

Our Common Stock Price May be Volatile

The trading price of our common stock may fluctuate substantially. The price of our common stock, at any given time, may be higher or lower than the price you pay for your shares, depending on many factors, some of which are beyond our control and may not be directly related to our operating performance. These factors include the following: (i) price and volume fluctuations in the overall stock market from time to time; (ii) volatility resulting from trading in derivative securities related to our common stock including puts, calls, long-term equity anticipation securities, or leaps, or short trading positions; (iii)actual or anticipated changes in our earnings or fluctuations in our operating results or changes in the expectations of securities analysts; (iv) general economic conditions and trends; (v) loss of a major funding source; or (vi) departures of key personnel.

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. We are engaged in the business of exploring and, if warranted and feasible, developing natural resource properties. Our mining claims are in the exploration stage only and are without proven reserves of natural resources. Accordingly, we have not generated any revenues nor have we realized a profit from our -operations to date and there is little likelihood that we will generate any revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of natural resources, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional monies through the sale of our equity securities or debt in order to continue our business operations.

We may, in the future, issue additional common shares that would reduce investors’ percent of ownership and may dilute our share value.

The future issuance of common shares may result in substantial dilution in the percentage of our common shares held by our then existing stockholders. We may value any common shares issued in the future on an arbitrary basis. The issuance of common shares for future services or acquisitions or other corporate actions may have the effect of diluting the value of the common shares held by our investors, and might have an adverse effect on any trading market for our common shares.

Market for Penny Stock has suffered in recent years from patterns of fraud and abuse.

Stockholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include: (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced salespersons; (iv) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and, (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequential investor losses.

Our common shares are subject to the “Penny Stock” Rules of the SEC, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted regulations that generally define a "penny stock" to be any equity security other than a security excluded from such definition by Rule 3a51-1 under the Securities Exchange Act of 1934, as amended. For the purposes relevant to our Company, it is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions.

Our common shares are currently regarded as a “penny stock”, since our shares are not listed on a national stock exchange or quoted on the NASDAQ Market within the United States, to the extent the market price for its shares is less than $5.00 per share. The penny stock rules require a broker-dealer to deliver a standardized risk disclosure document prepared by the SEC, to provide a customer with additional information including current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer's account, and to make a special written determination that the penny stock is a suitable investment for the purchaser, and receive the purchaser's written agreement to the transaction.

To the extent these requirements may be applicable; they will reduce the level of trading activity in the secondary market for the common shares and may severely and adversely affect the ability of broker-dealers to sell the common shares.

10

FINRA sales practice requirements may also limit a stockholders ability to buy and sell our stock.

In addition to the penny stock rules promulgated by the SEC, which are discussed in the immediately preceding risk factor, FINRA rules require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the ability to buy and sell our stock and have an adverse effect on the market value for our shares.

Our common stock may experience extreme rises or declines in price, and you may not be able to sell your shares at or above the price paid.

Our common stock may be highly volatile and could be subject to extreme fluctuations in response to various factors, many of which are beyond our control, including (but not necessarily limited to): (i) the trading volume of our shares; (ii) the number of securities analysts, market-makers and brokers following our common stock; (iii) changes in, or failure to achieve, financial estimates by securities analysts; (iv) actual or anticipated variations in quarterly operating results; (v) conditions or trends in our business industries; (vi) announcements by us of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; (vii) additions or departures of key personnel; (viii) sales of our common stock; and (ix) general stock market price and volume fluctuations of publicly-trading and particularly , microcap companies.

Investors may have difficulty reselling shares of our common stock, either at or above the price they paid for our stock, or even at fair market value. The stock markets often experience significant price and volume changes that are not related to the operating performance of individual companies, and because our common stock is thinly traded it is particularly susceptible to such changes. These broad market changes may cause the market price of our common stock to decline regardless of how well we perform as a company. In addition, there is a history of securities class action litigation following periods of volatility in the market price of a company’s securities. Although there is no such shareholder litigation currently pending or threatened against the Company, such a suit against us could result in the incursion of substantial legal fees, potential liabilities and the diversion of management’s attention and resources from our business. Moreover, and as noted below, our shares are currently traded on the OTCBB and, further, are subject to the penny stock regulations. Price fluctuations in such shares are particularly volatile and subject to manipulation by market-makers, short-sellers and option traders.

We have not and do not intend to pay any cash dividends on our common shares and, consequently, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We have not, and do not, anticipate paying any cash dividends on our common shares in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

A decline in the price of our common stock could affect our ability to raise further working capital, it may adversely impact our ability to continue operations and we may go out of business.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. Because we may attempt to acquire a significant portion of the funds we need in order to conduct our planned operations through the sale of equity securities, or convertible debt instruments, a decline in the price of our common stock could be detrimental to our liquidity and our operations because the decline may cause investors to not choose to invest in our stock. If we are unable to raise the funds we require for all our planned operations, we may be forced to reallocate funds from other planned uses and may suffer a significant negative effect on our business plan and operations, including our ability to develop new products and continue our current operations. a result, our business may suffer, and not be successful and we may go out of business. We also might not be able to meet our financial obligations if we cannot raise enough funds through the sale of our common stock and we may be forced to go out of business.

Fairhills will pay less than the then-prevailing market price for our common stock.

The common stock to be issued to Fairhills pursuant to the Investment Agreement will be purchased at a 25% discount from the lowest volume weighted average price during the ten (10) trading days immediately prior to receipt by the Investor of the Put Notice. Fairhills has a financial incentive to sell our common stock immediately upon receiving the shares to realize the profit equal to the difference between the discounted price and the market price. If Fairhills sells the shares, the price of our common stock could decrease. If our stock price decreases, Fairhills may have a further incentive to sell the shares of our common stock that it holds. These sales may have a further impact on our stock price.

11

Your ownership interest may be diluted and the value of our common stock may decline, if and when, we exercise our put rights pursuant to the Investment Agreement with Fairhills.

Effective April 30 2012, and as amended May 1, 2012, we entered into a $3,000,000 Investment Agreement with Fairhills. Pursuant to the Investment Agreement, when we deem it necessary, we may raise capital through the private sale of our common stock to Fairhills at a price equal to a 25% discount from the lowest volume weighted average price during the ten (10) trading days immediately prior to receipt by the Investor of the Put Notice. Because the put price is lower than the prevailing market price of our common stock, to the extent that the put right is exercised, your ownership interest may be diluted.

We are registering an aggregate of 18,000,000 shares of common stock to be issued under the Investment Agreement. The sale of such shares could depress the market price of our common stock.

We are registering an aggregate of 18,000,000 Shares of common stock under the registration statement of which this prospectus forms a part for issuance pursuant to the Investment Agreement. Notwithstanding Fairhills’ ownership limitation, the 18,000,000 Shares would represent approximately 25.7% of our shares of common stock outstanding immediately after our exercise of the put right under the Investment Agreement. The sale of these Shares into the public market by Fairhills could depress the market price of our common stock.

At an assumed purchase price under the Investment Agreement of $0.04595 (equal to 75% of the closing price of our common stock of $0.0612 on May 25, 2012), we will be able to receive up to $436,524 in gross proceeds, assuming the sale of the entire 9,500,000 Shares being registered hereunder pursuant to the Investment Agreement. At an assumed purchase price of $0.04595 under the Investment Agreement, we would be required to register 55,788,357 additional shares to obtain the balance of $2,563,475 under the Investment Agreement. We are currently authorized to issue 75,000,000 shares of our common stock. Fairhills has agreed to refrain from holding an amount of shares which would result in Fairhills from owning more than 4.99% of the then-outstanding shares of our common stock at any one time. Due to the floating offering price, we are not able to determine the exact number of shares that we will issue under the Investment Agreement.

We may not have access to the full amount available under the Investment Agreement.

We have not drawn down funds and have not issued shares of our common stock under the Investment Agreement with Fairhills. Our ability to draw down funds and sell shares under the Investment Agreement requires that the registration statement, of which this Prospectus is a part, be declared effective by the SEC, and that this registration statement continue to be effective. In addition, the registration statement of which this prospectus is a part registers 9,500,000 Shares issuable under the Investment Agreement, and our ability to access the Investment Agreement to sell any remaining shares issuable under the Investment Agreement is subject to our ability to prepare and file one or more additional registration statements registering the resale of these shares. These subsequent registration statements may be subject to review and comment by the staff of the SEC, and will require the consent of our independent registered public accounting firm. Therefore, the timing of effectiveness of these subsequent registration statements cannot be assured. The effectiveness of these subsequent registration statements is a condition precedent to our ability to sell the shares of common stock subject to these subsequent registration statements to Fairhills under the Investment Agreement. Even if we are successful in causing one or more registration statements registering the resale of some or all of the shares issuable under the Investment Agreement to be declared effective by the SEC in a timely manner, we will not be able to sell shares under the Investment Agreement unless certain other conditions are met. Accordingly, because our ability to draw down amounts under the Investment Agreement is subject to a number of conditions, there is no guarantee that we will be able to draw down any portion or all of the $3,000,000 available to us under the Investment Agreement.

Certain Restrictions on the extent of puts and the delivery of advance notices may have little, if any, effect on the adverse impact of our issuance of shares in connection with the Investment Agreement, and as such, Fairhills may sell a large number of shares, resulting in substantial dilution to the value of the shares held by existing shareholders.

Fairhills has agreed, subject to certain exceptions listed in the Investment Agreement, to refrain from holding an amount of shares which would result in Fairhills or its affiliates owning more than 4.99% of the then-outstanding shares of our common stock at any one time. These restrictions, however, do not prevent Fairhills from selling shares of common stock received in connection with a put, and then receiving additional shares of common stock in connection with a subsequent put. In this way, Fairhills could sell more than 4.99% of the outstanding common stock in a relatively short time frame while never holding more than 4.99% at one time.

12

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus contains certain forward-looking statements. When used in this Prospectus or in any other presentation, statements which are not historical in nature, including the words “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” “may,” “project,” “plan” or “continue,” and similar expressions are intended to identify forward-looking statements. They also include statements containing a projection of revenues, earnings or losses, capital expenditures, dividends, capital structure or other financial terms.

The forward-looking statements in this Prospectus are based upon our management’s beliefs, assumptions and expectations of our future operations and economic performance, taking into account the information currently available to them. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties, some of which are not currently known to us that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial condition we express or imply in any forward-looking statements. These forward-looking statements are based on our current plans and expectations and are subject to a number of uncertainties and risks that could significantly affect current plans and expectations and our future financial condition and results.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Prospectus might not occur. We qualify any and all of our forward-looking statements entirely by these cautionary factors. As a consequence, current plans, anticipated actions and future financial conditions and results may differ from those expressed in any forward-looking statements made by or on our behalf. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented herein.

USE OF PROCEEDS

We will not receive any proceeds from the sale of Shares by the selling stockholder. However, we will receive proceeds from the sale of securities pursuant to the Investment Agreement. The proceeds received from any “Puts” tendered to Fairhills under the Investment Agreement will be used for payment of general corporate and operating expenses.

The sale of our common stock to Fairhills in accordance with the Investment Agreement will have a dilutive impact on our shareholders. As a result, our net loss per share could increase in future periods and the market price of our common stock could decline. In addition, the lower our stock price is at the time we exercise our put option, the more shares of our common stock we will have to issue to Fairhills in order to drawdown pursuant to the Investment Agreement. If our stock price decreases during the Pricing Period, then our existing shareholders would experience greater dilution.

SELLING SECURITY HOLDER

We are registering for resale shares of our common stock that will be issued and outstanding held by the selling stockholder identified below. We are registering the Shares to permit the selling stockholder to resell the shares when and as they deem appropriate in the manner described in the “Plan of Distribution.” The selling stockholder may not transfer its obligations under the Investment Agreement. As of the date of this Prospectus there are 52,692,133 shares of common stock issued and outstanding.

The following table sets forth:

|

·

|

the name of the selling stockholder,

|

|

·

|

the number of shares of our common stock that the selling stockholder beneficially owned prior to the offering for resale of the shares under this Prospectus,

|

|

·

|

the maximum number of shares of our common stock that may be offered for resale for the account of the selling stockholder under this Prospectus, and

|

|

·

|

the number and percentage of shares of our common stock to be beneficially owned by the selling stockholder after the offering of the shares (assuming all of the offered shares are sold by the selling stockholder).

|

13

On March 28, 2012 we entered into an investment agreement (the “Investment Agreement”) with Fairhills. Pursuant to the terms of the Investment Agreement, Fairhills has committed to purchase up to Three Million Dollars ($3,000,000) of our common stock over a period of up to thirty-six (36) months.

On May 1, 2012, we entered into an amendment to the Investment Agreement (the “Amendment”). Pursuant to the Amendment, the purchase price of the shares shall be equal to a discount of Twenty-Five percent (25%) percent from the lowest volume weighted average price during the ten (10) trading days immediately prior to receipt by Fairhills of a put notice (as defined in the Investment Agreement. In connection with the Investment Agreement, we also entered into a registration rights agreement (the “Registration Rights Agreement”) with Fairhills. Pursuant to the Registration Rights Agreement, we are obligated to file a registration statement with the Securities and Exchange Commission (“SEC”) covering Eighteen Million (18,000,000) shares of the common stock underlying the Investment Agreement within 21 days after the closing of the Investment Agreement. In addition, we are obligated to use all commercially reasonable efforts to have the registration statement declared effective by the SEC within 120 days after the closing of the Investment Agreement and maintain the effectiveness of such registration statement until termination in accordance with the Investment Agreement.

At an assumed purchase price under the Investment Agreement of $0.04595 (equal to 75% of the closing price of our common stock of $0.0612 on May 25, 2012), we will be able to receive up to $436,525 in gross proceeds, assuming the sale of the entire 9,500,000 Shares being registered hereunder pursuant to the Investment Agreement. At an assumed purchase price of $0.04595 under the Investment Agreement, we would be required to register 55,788,357 additional shares to obtain the balance of $2,563,475 under the Investment Agreement. We are currently authorized to issue 75,000,000 shares of our common stock; however our management intends to request that our shareholders approve an increase in our authorized capital stock. Fairhills has agreed to refrain from holding an amount of shares which would result in Fairhills from owning more than 4.99% of the then-outstanding shares of our common stock at any one time.

At the time the transaction was negotiated between the parties the price of the stock was substantially higher than the current trading price and based upon same we believed that we would be able to receive the full amount of the financing. However since such time the market value of our common stock has decreased and we do not believe that we will receive the full amount under the Investment Agreement unless there is an increase in the price of our common stock.

On March 28, 2012, we entered into a debt instrument with Fairhills whereby Fairhills provided us with a $200,000 loan which is due by September 28, 2012 and carries a 2% annual rate of interest. The note is not convertible into our common stock and we have agreed that we will not use the funds raised in the Fairhills financing to repay this note. The note was secured by 3,333,333 shares of our restricted common stock owned by our director and officer, Rick Walchuk. These shares shall be held in escrow by Fairhills’s counsel and will be forfeited to Fairhills if we default on the note.

In connection with the March 28, 2012 debt instrument with Fairhills, we paid a commission to Midsouth of 30,000 Shares and a cash fee of $20,000. Midsouth is the Company’s non-exclusive financial advisor, investment banker and placement agent for the purpose of assisting the Company to raise capital. Such commission was pursuant to the Company’s agreement to compensate Midsouth for its services with (i) the issuance of 80,000 Shares; (ii) a success fee of 10% of the amount for any capital raised; and (iii) 150,000 restricted Shares, with piggy back registration rights, per $1,000,000 of capital raised for a period of two years.

The selling stockholder has never served as our officer or director or any of its predecessors or affiliates within the last three years. The selling stockholder does have a material relationship with us based on the financing agreement and loan set forth above.

The selling stockholder is neither a broker-dealer nor an affiliate of a broker-dealer. The selling stockholder does not have any agreement or understanding, directly or indirectly, to distribute any of the shares being registered at the time of purchase.

The selling stockholder may offer for sale all or part of the shares from time to time. The table below assumes that the selling stockholder will sell all of the shares offered for sale. A selling stockholder is under no obligation, however, to sell any shares pursuant to this Prospectus.

14

|

Number of

|

||||||||||||

|

Shares of

|

||||||||||||

|

Shares of

|

Maximum

|

Common

|

||||||||||

|

Common Stock

|

Number of

|

Stock

|

||||||||||

|

Beneficially

|

Shares of

|

Beneficially

|

Percent

|

|||||||||

|

Owned prior to

|

Common Stock

|

Owned after

|

Ownership

|

|||||||||

|

Name

|

Offering (1)

|

to be Offered

|

Offering

|

after Offering

|

||||||||

|

Fairhills Capital Offshore Ltd. (2)

|

9,500,000

|

9,500,000

|

0

|

0%

|

__________________

|

(1)

|

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, securities that are currently convertible or exercisable into shares of our common stock, or convertible or exercisable into shares of our common stock within 60 days of the date hereof are deemed outstanding. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as indicated in the footnotes to the following table, each stockholder named in the table has sole voting and investment power with respect to the shares set forth opposite such stockholder’s name.

|

|

(2)

|

As the General Partner, Fairhills Capital Offshore, LP, which is controlled by Edward Bronson, Managing Member, has the voting and dispositive power over the shares owned by Fairhills Capital Offshore Ltd.

|

The selling stockholder and any of its respective pledges, donees, assignees and other successors-in-interest may, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at fixed or negotiated prices. The selling stockholder may use any one or more of the following methods when selling shares:

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

·

|

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

·

|

privately negotiated transactions;

|

|

·

|

short sales after this registration statement becomes effective;

|

|

·

|

broker-dealers may agree with the selling stockholder to sell a specified number of such shares at a stipulated price per share;

|

|

·

|

through the writing of options on the shares;

|

|

·

|

a combination of any such methods of sale; and

|

|

·

|

any other method permitted pursuant to applicable law.

|

The selling stockholder or any of its respective pledgees, donees or other successors in interest, may also sell the shares directly to market makers acting as principals and/or broker-dealers acting as agents for themselves or their customers. Such broker-dealers may receive compensation in the form of discounts, concessions or commissions from the selling stockholder and/or the purchasers of shares for whom such broker-dealers may act as agents or to whom they sell as principal or both, which compensation as to a particular broker-dealer might be in excess of customary commissions. Market makers and block purchasers purchasing the shares will do so for their own account and at their own risk. It is possible that a selling stockholder will attempt to sell shares of common stock in block transactions to market makers or other purchasers at a price per share which may be below the then market price. The selling stockholder cannot assure that all or any of the shares offered in this prospectus will be issued to, or sold by, the selling stockholder. The selling stockholder and any brokers, dealers or agents, upon effecting the sale of any of the shares offered in this prospectus, are "underwriters" as that term is defined under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, or the rules and regulations under such acts. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

Discounts, concessions, commissions and similar selling expenses, if any, attributable to the sale of shares will be borne by the selling stockholder. The selling stockholder may agree to indemnify any agent, dealer or broker-dealer that participates in transactions involving sales of the shares if liabilities are imposed on that person under the Securities Act of 1933.

The selling stockholder may from time to time pledge or grant a security interest in some or all of the shares of common stock owned by it and, if it defaults in the performance of its secured obligations, the pledgee or secured parties may offer and sell the shares of common stock from time to time under this prospectus after we have filed an amendment to this prospectus under Rule 424(b)(3) or any other applicable provision of the Securities Act of 1933 amending the list of selling stockholders to include the pledge or other successors in interest as selling stockholders under this Prospectus.

15

The selling stockholder also may transfer the shares of common stock in other circumstances, in which case the pledgees or other successors in interest will be the selling beneficial owners for purposes of this Prospectus and may sell the shares of common stock from time to time under this Prospectus after we have filed an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act of 1933 amending the list of selling stockholders to include the pledge or other successors in interest as selling stockholders under this Prospectus.

Fairhills has agreed to pay all fees and expenses incident to the registration of the shares of common stock.

The selling stockholder acquired the securities offered hereby in the ordinary course of business and have advised us that it has not entered into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of its shares of common stock, nor is there an underwriter or coordinating broker acting in connection with a proposed sale of shares of common stock by any selling stockholder. If we are notified by any selling stockholder that any material arrangement has been entered into with a broker-dealer for the sale of shares of common stock, if required, we will file a supplement to this Prospectus.

If the selling stockholder uses this Prospectus for any sale of the shares of common stock, it will be subject to the prospectus delivery requirements of the Securities Act of 1933.

Regulation M

The anti-manipulation rules of Regulation M under the Securities Exchange Act of 1934 may apply to sales of our common stock and activities of the selling stockholder.

During such time as it may be engaged in a distribution of any of the shares we are registering by this registration statement, Fairhills is required to comply with Regulation M. In general, Regulation M precludes any selling security holder, any affiliated purchasers and any broker-dealer or other person who participates in a distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase, any security which is the subject of the distribution until the entire distribution is complete. Regulation M defines a "distribution" as an offering of securities that is distinguished from ordinary trading activities by the magnitude of the offering and the presence of special selling efforts and selling methods. Regulation M also defines a "distribution participant" as an underwriter, prospective underwriter, broker, dealer, or other person who has agreed to participate or who is participating in a distribution.

Regulation M under the Exchange Act prohibits, with certain exceptions, participants in a distribution from bidding for or purchasing, for an account in which the participant has a beneficial interest, any of the securities that are the subject of the distribution. Regulation M also governs bids and purchases made in order to stabilize the price of a security in connection with a distribution of the security. We have informed Fairhills that the anti-manipulation provisions of Regulation M may apply to the sales of their shares offered by this prospectus, and we have also advised Fairhills of the requirements for delivery of this prospectus in connection with any sales of the common stock offered by this prospectus.

Pursuant to the Investment Agreement, Fairhills shall not sell stock short, either directly or indirectly through its affiliates, principals or advisors, our common stock during the term of this Agreement.

DESCRIPTION OF SECURITIES

Authorized Capital Stock

We are authorized to issue 75,000,000 shares of common stock, $0.001 par value per share. However we have filed a definitive 14C to increase our authorized capital to 800,000,000 and such action has been approved by the Board of Directors and the Majority Shareholders. It does not require FINRA approval. We anticipate that these actions should be effective by the end of July 2012.

Common Stock

As of the date hereof, 52,692,133 shares of common stock are issued and outstanding.

The holders of our common stock have equal ratable rights to dividends from funds legally available if and when declared by our board of directors and are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs. Our common stock does not provide the right to a preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights. Our common stock holders are entitled to one non-cumulative vote per share on all matters on which shareholders may vote.

16

All shares of common stock now outstanding are fully paid for and non-assessable. We refer you to our Articles of Incorporation, Bylaws and the applicable statutes of the state of Nevada for a more complete description of the rights and liabilities of holders of our securities. All material terms of our common stock have been addressed in this section.

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the holders of the remaining shares will not be able to elect any of our directors.

Holders

As of the date hereof, the shareholders' list for our common stock showed 52,692,133 shares issued and outstanding with 23 registered stockholders.

Note

Effective March 28, 2012, we entered into a debt instrument with Fairhills whereby Fairhills provided us with a $200,000 loan which is due by September 28, 2012, and carries a 2% annual rate of interest. The note is not convertible into our common stock and we have agreed that we will not use the funds raised in the Fairhills financing to repay this note. The note was secured by 3,333,333 shares of our restricted common stock owned by our director and officer, Rick Walchuk. These shares shall be held in escrow by Fairhills’ counsel and will be forfeited to Fairhills if we default on the note.

Dividends

We have never declared or paid any cash dividends on shares of our capital stock. We currently intend to retain earnings, if any, to fund the development and growth of our business and do not anticipate paying cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our board of directors after taking into account various factors, including our financial condition, operating results, cash needs and growth plans.

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

The validity of the shares of our common stock offered under this Prospectus is being passed upon for us by Anslow & Jaclin, LLP. Anslow & Jaclin, LLP does not own any shares of our common stock.

The financial statements as of and for the years ended August 31, 2011 and August 31, 2010 included in this Prospectus and the registration statement have been audited by Silberstein Ungar, PLLC to the extent and for the periods set forth in their report appearing elsewhere herein and in the registration statement, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

Corporate Information

The address of our principal executive office is 3651 Lindell Road, Ste. D#138, Las Vegas, Nevada. Our telephone number is 800-508-6149.

Our common stock is quoted on the OTCBB (“Over-the-Counter- Bulletin-Board”) under the symbol "NECA".

17

New America Energy Corp (formerly “Atheron, Inc.”) was incorporated in Nevada on May 8, 2006, as a development stage company, initially developing a technology for ethanol-methanol gasoline. The Company did not progress the development of this technology.

On November 5, 2010, we underwent a change of control and the Company’s newly appointed sole director and majority shareholder approved a name change to New America Energy Corp. and a twenty-five (25) new for one (1) old forward stock split of the Company’s issued and outstanding shares of common stock. This forward split did not affect the number of the Company’s authorized common shares, which remains at 75,000,000.

On November 16, 2010, the Nevada Secretary of State accepted for filing of the Certificate of Amendment to the Company’s Articles of Incorporation to change our name from Atheron Inc. to New America Energy Corp. The forward stock split and name change became effective at the opening of trading on December 1, 2010.

On June 26, 2012, our Board of Directors approved an Amendment to our Articles of Incorporation to increase in our authorized share capital, from 75,000,000 authorized shares of common stock to 800,000,000 shares of common stock. This amendment will ensure that we have sufficient stock authorized to undertake this financing and any other financings and acquisitions that we may identify.

Subsequent to our Board of Directors' approval of the Amendment, the holders of a total of 27,875,000 of the issued and outstanding shares of our corporation, representing a 53% majority gave us their written consent to the Amendments on June 26, 2012. We first mailed a definitive 14C on or about July 8, 2012. Following the expiration of the twenty-day (20) period mandated by Rule 14c and the provisions of Chapter 78 of the Nevada Revised Statutes, our corporation will file Articles of Amendment to amend our Articles of Incorporation to give effect to the Amendment. The Amendment increasing our authorized capital to 800,000,000 shares of common stock is expected to take place on or about July 28, 2012.

At the report date mineral claims, with unknown reserves, have been acquired. The Company has not established the existence of a commercially mineable ore deposit and therefore has not reached the development stage and is considered to be in the exploration stage.

We do not have any subsidiaries.

Other than as set out herein, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of our business.

Our Current Business

We are an exploration stage company engaged in the exploration of mineral properties.

On February 3, 2011, we entered into property acquisition agreements with First Liberty Power Corp. (“FLPC”), and GeoXplor Inc. (“GeoXplor”). Pursuant to the terms of the agreements, we acquired an option, as well as exploration rights, in certain unpatented mining claims located in Southern Utah which we refer to as the “Uravan Property.” The option was extended to September 30, 2011, however these properties were forfeited at the year-end due to the failure to meet the payment requirements.

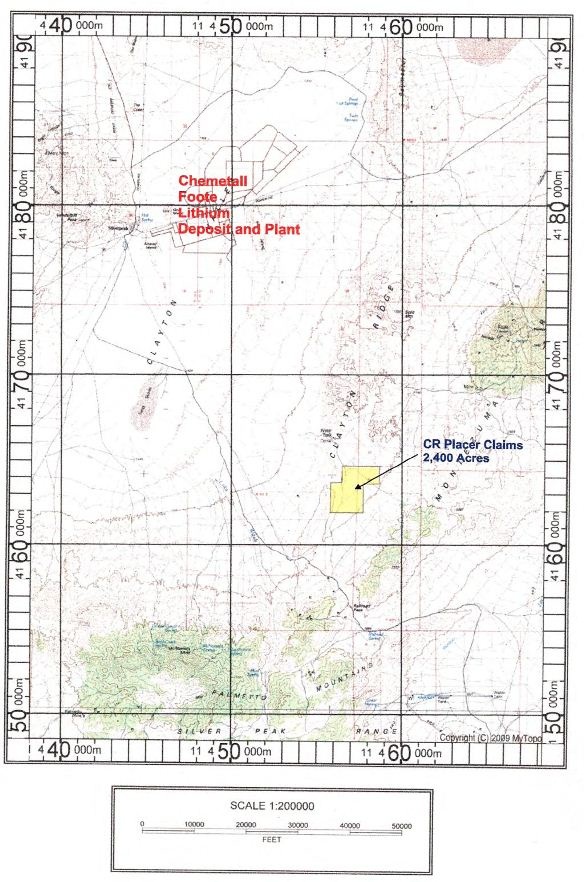

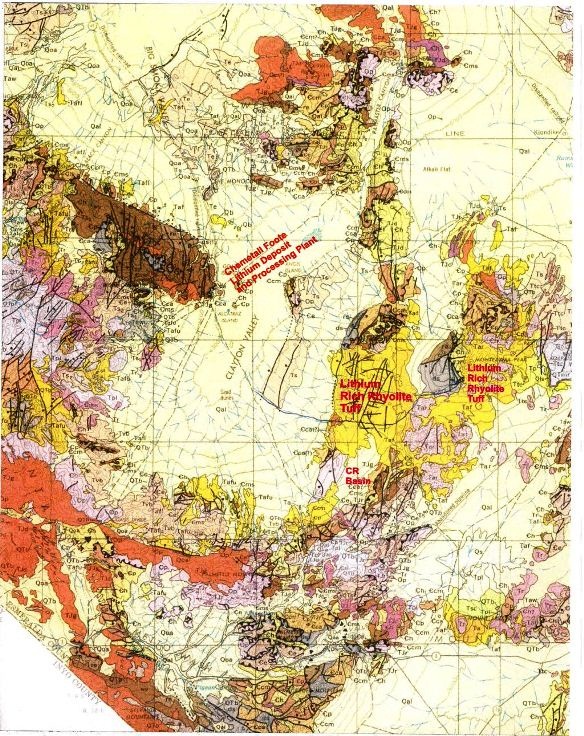

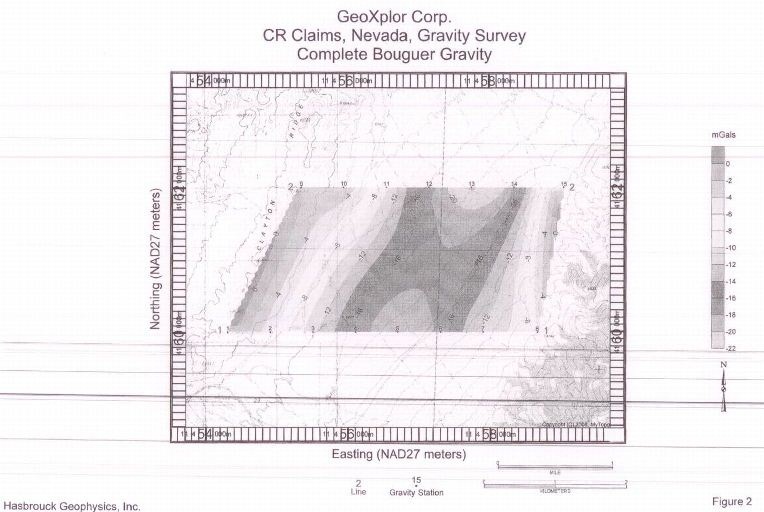

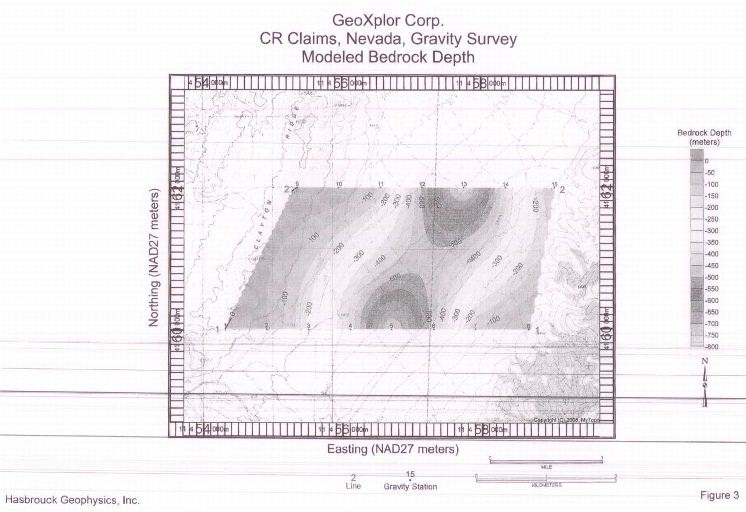

On May 31, 2011, we entered into a property acquisition agreement with GeoXplor Corp. Pursuant to the terms of the agreement we acquired an option, as well as exploration rights, in certain unpatented mining claims located in Clayton Valley, Nye County, Nevada. Subsequently on October 27, 2011, we entered into an amended property acquisition agreement whereby we acquired additional claims. We intend to concentrate on these mineral properties as our core properties.

On June 20, 2012, we entered into an amended purchase agreement whereby we agreed to further amend and entirely replace the amended agreement with the new agreement, which modifies the consideration provided to GeoXplor by us for the Original and New Claims.

The Company is focused exclusively on the acquisition and development of mineral resource properties.

18

Our exploration program will be exploratory in nature and there is no assurance that a commercially viable mineral deposit, a reserve, exists until further exploration, particularly drilling, is undertaken and a comprehensive evaluation concludes economic and legal feasibility. We have not yet generated or realized any revenues from our business operations.

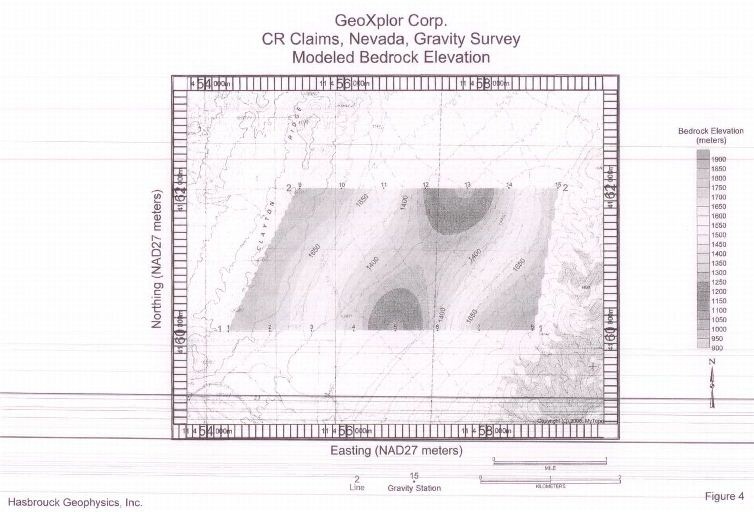

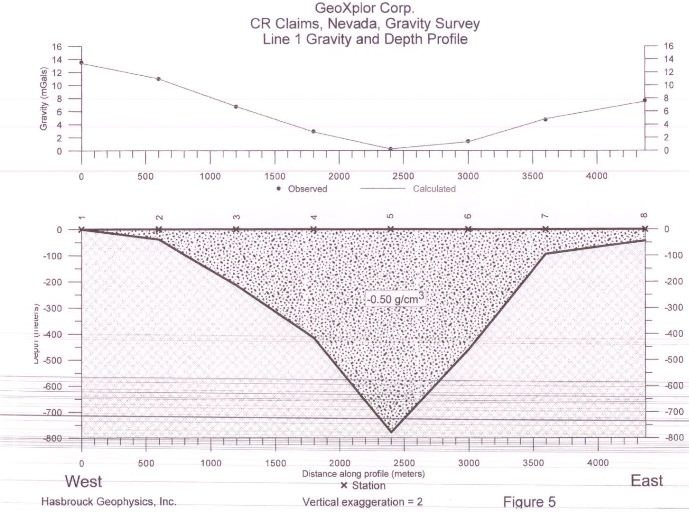

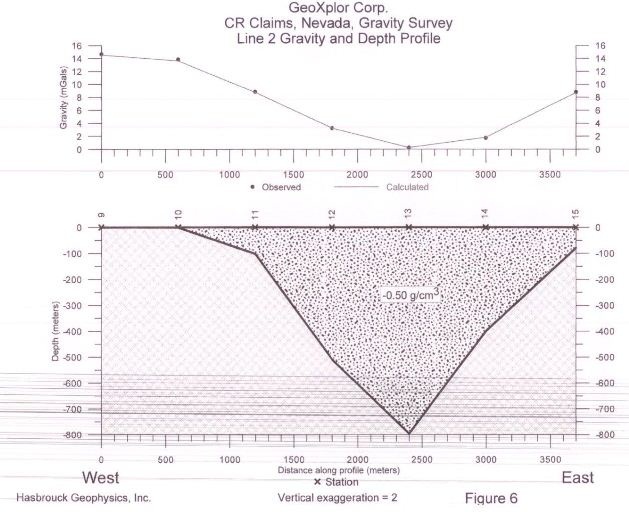

Market, Customers and Distribution Methods