Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - REGIONS FINANCIAL CORP | d381058dex992.htm |

| EX-99.1 - EX-99.1 - REGIONS FINANCIAL CORP | d381058dex991.htm |

| 8-K - 8-K - REGIONS FINANCIAL CORP | d381058d8k.htm |

Regions Financial

2nd Quarter Earnings

Conference Call

July 24, 2012

Exhibit 99.3 |

2

PRUDENT AND PROFITABLE GROWTH DRIVEN BY SOLID

BUSINESS PERFORMANCE

With each passing quarter, we are better positioned

for ultimate outperformance.

•

Experienced continued growth in

commercial and industrial portfolio

•

Conservative low loan-to-deposit ratio

provides considerable flexibility to take

advantage of lending opportunities that will

benefit future revenue growth

•

Significantly grew mortgage loan

production and related fee income

•

Reduced operating expenses and credit

costs

•

Continued asset quality improvement

2Q12 Financial Highlights

Diluted EPS

$0.20

Pre-tax Pre-provision

Income

$503

million

EPS from Continuing

Operations

$0.20

Impact of Series A

Discount

$0.05

(1)

Non-GAAP–

See

slides

13-17

for

GAAP

to

non-GAAP

reconciliation

1

1 |

3

2Q12 FINANCIAL HIGHLIGHTS

(1)

Non-GAAP–

See slides 13-17 for GAAP to non-GAAP reconciliation

(2) From Continuing Operations

($ in millions, except EPS)

2Q11

1Q12

2Q12

From Continuing Operations

Net Interest Income

$ 856

$ 827

$ 838

$ 11

1%

$ (18)

-2%

Non-Interest Revenue

543

524

507

(17)

-3%

(36)

-7%

Non-Interest Expense

956

913

842

(71)

-8%

(114)

-12%

Pre-tax

Pre-provision

Income

(PPI)

(non-GAAP)

443

438

503

65

15%

60

14%

Net Charge-Offs

548

332

265

(67)

-20%

(283)

-52%

Loan Loss Reserve Reduction

(150)

(215)

(239)

(24)

11%

(89)

59%

Loan Loss Provision

398

117

26

(91)

-78%

(372)

-93%

Preferred Expense

54

54

71

17

31%

17

31%

Net Income Available to Common Shareholders

from Continuing Operations

25

185

280

95

51%

255

NM

Net Income / (Loss) from Discontinued

Operations

30

(40)

4

44

-110%

(26)

-87%

Net Income Available to Common Shareholders

$ 55

$ 145

$ 284

$ 139

96%

$ 229

NM

Diluted EPS

$0.04

$0.11

$0.20

$0.09

82%

$0.16

NM

Diluted EPS from Continuing Operations

$0.02

$0.14

$0.20

$0.06

43%

$0.18

NM

Diluted EPS excluding Preferred Expense

2

$0.06

$0.19

$0.25

$0.06

32%

$0.19

NM

Diluted EPS from Discontinued Operations

$0.02

($0.03)

$0.00

$0.03

NM

($0.02)

NM

2Q12 vs. 1Q12

2Q12 vs. 2Q11

1 |

4

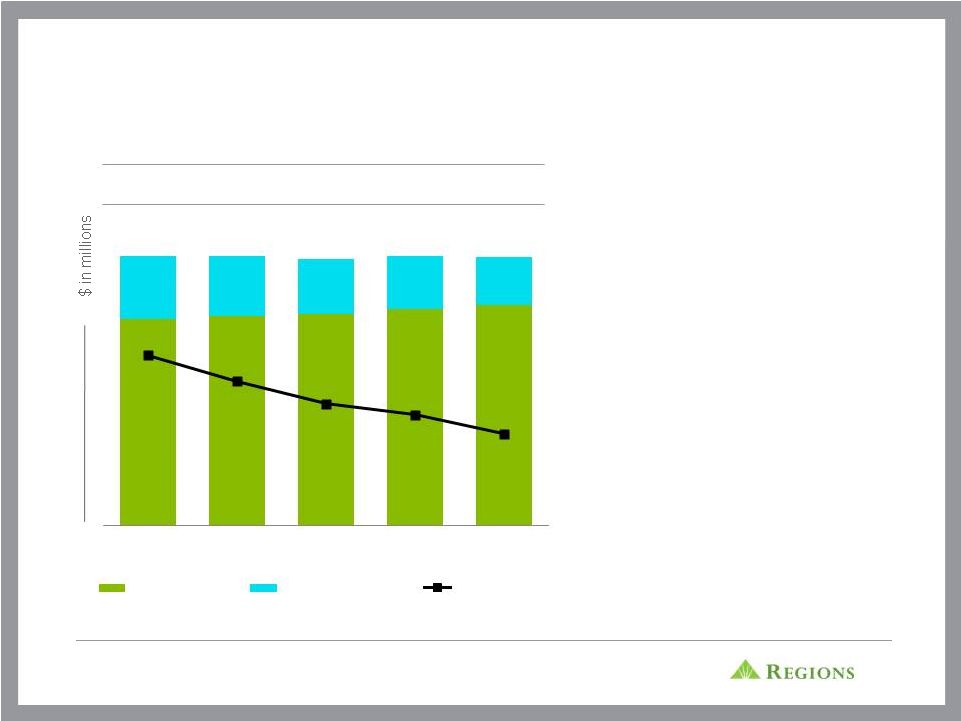

COMMERCIAL AND INDUSTRIAL LOANS GREW 4% OVER

LAST QUARTER

•

Commercial & industrial loan balances

on an average basis increased $902

million, or 4% linked quarter reflecting

strength in our middle market portfolio

•

Commercial & industrial line utilization

rose 130 basis points to 44.4%

•

Investor real estate totaled $9.4 billion

at quarter end and has now been

reduced to 12% of total loans down

from 17% one year ago

•

Loan yield remained flat linked quarter

despite the low rate environment

* Average Balances

Commercial and Industrial Loan Balances*

9% increase Y-O-Y

Total Loan Balances* and Loan Yields

$23,506

$23,953

$24,310

$24,748

$25,650

2Q11

3Q11

4Q11

1Q12

2Q12

$81,106

$80,513

$78,702

$77,168

$76,670

4.27%

4.31%

4.35%

4.29%

4.29%

2Q11

3Q11

4Q11

1Q12

2Q12

Avg. Loan Balance

Loan Yield |

5

FUNDING MIX CONTINUES TO IMPROVE AS DEPOSIT

COSTS DECLINED 5 BPS

•

Avg. time deposits as a % of avg.

deposits decreased to 18% in 2Q12

from 23% in 2Q11

•

Deposit repricing opportunities

remain, maturities include:

•

3Q12 -

$2.9B at 1.2%

•

4Q12 -

$3.0B at 2.1%

•

1H13 -

$4.6B at 1.8%

•

2H13 -

$1.9B at 0.8%

•

Deposit costs declined 5 bps linked

quarter, down 21 bps year-over-year

•

Total funding mix improved to 60 bps,

down 20 bps from one year ago

* Average Balances

Deposit Balances* and Deposit Costs

73,616

74,778

75,381

77,008

78,688

22,506

21,369

19,774

19,053

17,175

$96,122

$96,147

$95,155

$96,061

$95,863

53 bps

46 bps

40 bps

37 bps

32 bps

2Q11

3Q11

4Q11

1Q12

2Q12

Low Cost Deposits

Time Deposits + Other

Deposit Cost |

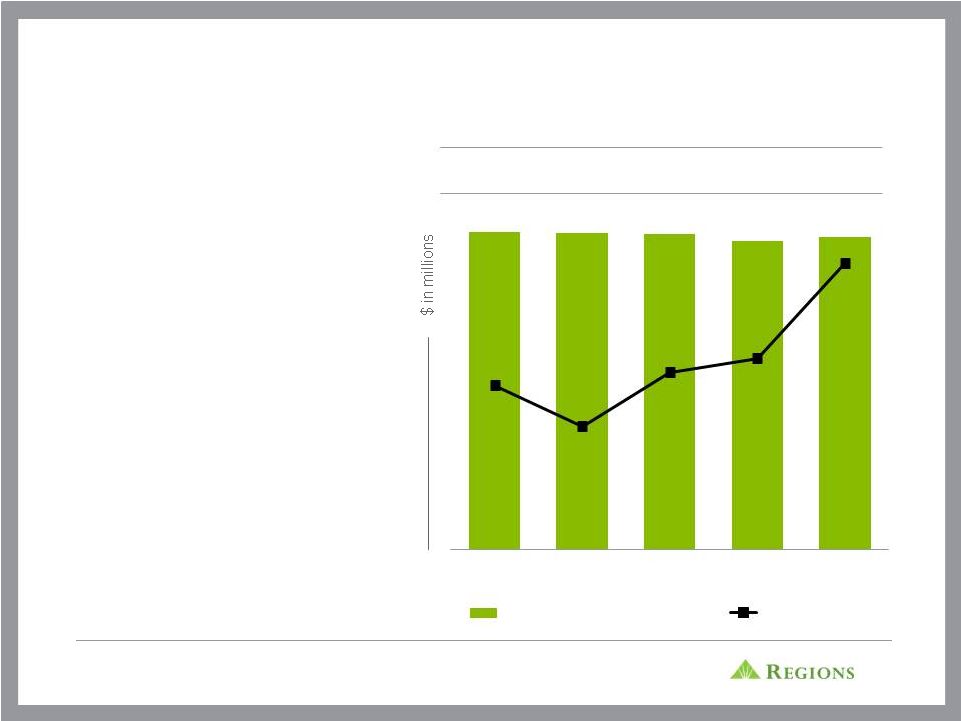

6

NET INTEREST MARGIN IMPROVES 7 BPS

•

Net interest margin favorably impacted by

improvements in deposit costs, lower

excess cash and lower non-accrual

balances

•

Cash reserves negatively impacted net

interest margin 8 bps in 2Q12 compared to

13 bps in 1Q12, an improvement of 5 bps

•

Non-accruals negatively impacted net

interest margin 7 bps in 2Q12 compared to

10 bps in 1Q12, an improvement of 3 bps

•

Securities portfolio totals $27 billion as a

result of cash deployment

•

Net interest margin expected to remain

relatively stable in second half of 2012

(1)

From continuing operations

Net

Interest

Income

and

Net

Interest

Margin¹

$864

$859

$858

$839

$850

3.07%

3.04%

3.08%

3.09%

3.16%

2Q11

3Q11

4Q11

1Q12

2Q12

Net Interest Income (FTE)

Net Interest Margin |

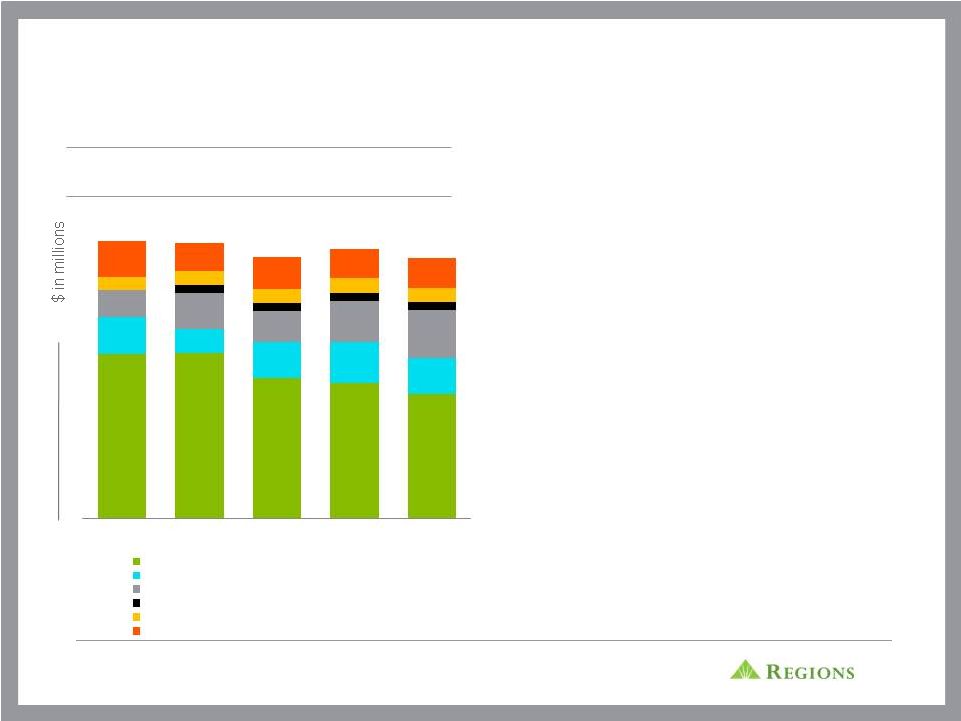

7

NON-INTEREST REVENUE DRIVEN BY 17% INCREASE IN

MORTGAGE INCOME

•

Non-interest revenue decreased 3%

linked quarter

•

Mortgage revenues increased 17%

linked quarter and 80% over last year

•

HARP II expected to increase

mortgage volume by $1 billion in

2012

•

Service charges declined due to the

establishment of a reserve for certain

customer fee refunds resulting from a

change in the company’s non-sufficient

funds policy

Fee

Income

by

Quarter

1

(1)

From continuing operations adjusted to exclude security gains and leveraged lease

terminations gains–Non-GAAP, see appendix for GAAP to Non-GAAP

reconciliation 308

310

263

254

233

70

44

68

77

67

50

68

57

77

90

-

15

14

15

25

27

26

28

26

66

52

60

55

57

$519

$516

$490

$505

$488

2Q11

3Q11

4Q11

1Q12

2Q12

Service charges

Capital Markets, Investment Income & Trust

Mortgage Income

Credit Card Income

Insurance Income

Other

16 |

8

REDUCTION IN CREDIT COSTS DRIVE NON-INTEREST

EXPENSES DOWN 8% LINKED QUARTER

(1) Non-GAAP excludes 4Q11 goodwill impairment

Non-Interest

Expenses

•

Diligent and continued focus on reducing

expenses through efficiencies

•

Non-interest expenses were 8% lower than

prior quarter and down 12% year-over-year

•

Other real estate expenses decreased $13

million over prior quarter or 57%

•

Held for sale experienced net gains of $26

million related to property sales, reflecting asset

value improvements

•

Headcount reduced by 544 positions, or 2%

over the last year

Other Real Estate and HFS Expenses

$956

$850

$871

$913

$842

2Q11

3Q11

4Q11

1Q12

2Q12

$41

$48

$33

$15

$(16)

2Q11

3Q11

4Q11

1Q12

2Q12

1 |

CONTINUED MOMENTUM IN ASSET QUALITY METRICS

NPL Gross Migration

NPLs and Coverage Ratio

Business Services Criticized Loans

Loan Loss Provision

43% Decline*

31% Decline in Total NPLs*

31% Decline*

93% Decline*

*Year-over-year change

**Excludes loans held for sale

$2,784

$2,710

$2,372

$2,151

$1,915

112%

109%

116%

118%

120%

2Q11

3Q11

4Q11

1Q12

2Q12

NPLs**

ALL / NPL**

$555

$755

$561

$381

$315

2Q11

3Q11

4Q11

1Q12

2Q12

$7,899

$7,305

$6,370

$5,979

$5,436

2Q11

3Q11

4Q11

1Q12

2Q12

396

355

279

192

136

152

156

150

140

129

(150)

(156)

(134)

(215)

(239)

$398

$355

$295

$117

$26

2Q11

3Q11

4Q11

1Q12

2Q12

Business Services and HFS

Consumer

Reserve Reduction

9 |

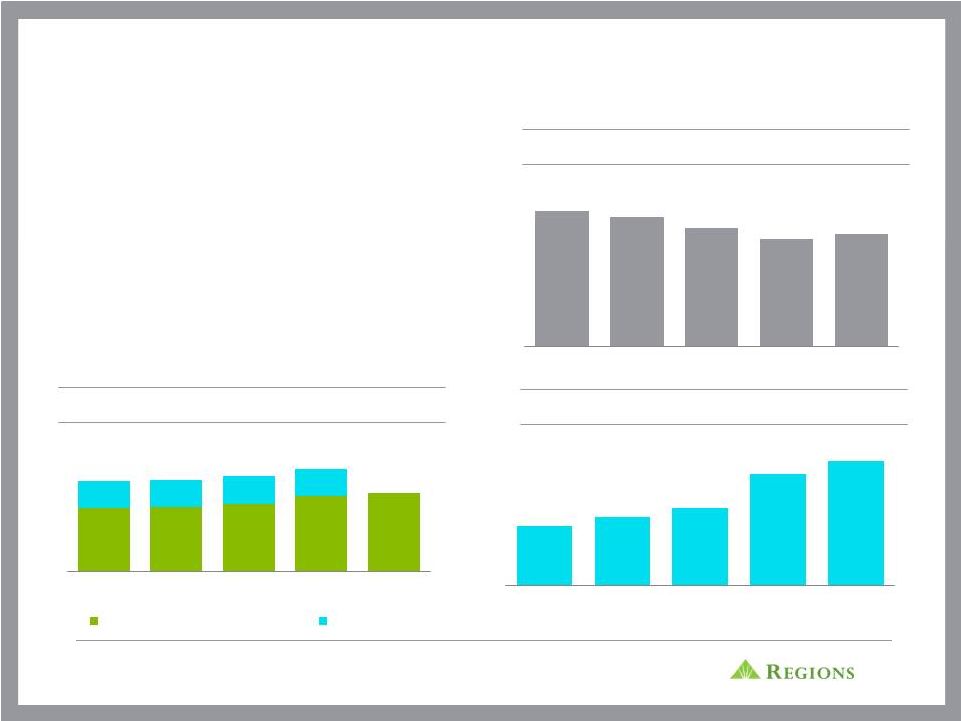

10

STRONG CAPITAL RATIOS

Loan to Deposit Ratio

Tier 1 Capital Ratio

Tier 1 Common Ratio

(1)

Current Quarter ratios are estimated

(2)

Non-GAAP –

See appendix for reconciliation

(3)

Includes Series A Preferred Stock and associated warrant

(4)

Based on ending balances

•

The impact of the warrant redemption related to the

repayment of Series A preferred stock was $45

million during the second quarter

•

Basel III Tier 1 Common ratio estimated under the

new proposed rules at 8.0%

•

Low loan to deposit ratio allows Regions to be

ready for loan growth when the market demand

increases

(1)

(1)

(2)

(3)

84%

83%

81%

79%

80%

2Q11

3Q11

4Q11

1Q12

2Q12

8.8%

9.0%

9.4%

10.5%

11.0%

3.8%

3.8%

3.9%

3.8%

12.6%

12.8%

13.3%

14.3%

11.0%

2Q11

3Q11

4Q11

1Q12

2Q12

Tier 1 Capital Excluding TARP

TARP Impact

7.9%

8.2%

8.5%

9.6%

10.0%

2Q11

3Q11

4Q11

1Q12

2Q12

(2)

(4) |

11

APPENDIX |

12

FORWARD-LOOKING STATEMENTS |

13

NON-GAAP RECONCILIATION: NET INCOME / (LOSS) AND

EARNINGS PER SHARE

(1)

There are no preferred shares allocable to discontinued operations.

(2)

In the second quarter of 2010, Regions recorded a $200 million charge to account for

a probable, reasonably estimable loss related to a pending settlement of regulatory matters. At that

time, Regions assumed that the entire charge would be non-deductible for income

tax purposes. $75 million of the regulatory charge relates to continuing operations. The settlement was

finalized during the second quarter of 2011. At the time of settlement, Regions had

better information related to tax implications. Approximately $125 million of the settlement charge will be

deductible for federal income tax purposes. Accordingly, during the second quarter

of 2011, Regions adjusted federal income taxes to account for the impact of the deduction. The

adjustment reduced Regions' provision for income taxes by approximately $44 million

for the second quarter of 2011, of which approximately $17 million relates to continuing operations. .

`

(1)

($ amounts in millions, except per share data)

06/30/12

03/31/12

12/31/11

9/30/11

6/30/11

Net income (loss) available to common shareholders (GAAP)

284

$

145

$

(602)

$

101

$

55

$

Preferred dividends and accretion (GAAP)

71

54

54

54

54

Income (loss) from discontinued operations, net of tax (GAAP)

4

(40)

(467)

14

30

Income (loss) from continuing operations (GAAP)

A

351

$

239

$

(81)

$

141

$

79

$

B

284

$

145

$

(602)

$

101

$

55

$

Goodwill impairment, net of tax

-

-

731

-

-

Regulatory charge and related tax benefit

-

-

-

-

(44)

C

284

$

145

$

129

$

101

$

11

$

B

284

$

145

$

(602)

$

101

$

55

$

4

(40)

(467)

14

30

D

280

185

(135)

87

25

-

-

253

-

-

-

-

-

-

(17)

E

280

$

185

$

118

$

87

$

8

$

F

1,418

1,283

1,259

1,261

1,260

A/F

0.25

$

0.19

$

(0.06)

$

0.11

$

0.06

$

B/F

0.20

$

0.11

$

(0.48)

$

0.08

$

0.04

$

`

D/F

0.20

$

0.14

$

(0.11)

$

0.07

$

0.02

$

E/F

0.20

$

0.14

$

0.09

$

0.07

$

0.01

$

Earnings per common share from continuing operations,

excluding goodwill impairment and regulatory charge and

related tax benefit -

diluted (non-GAAP)

Income from continuing operations available to common

shareholders, excluding goodwill impairment and regulatory

charge and related tax benefit (non-GAAP)

Weighted-average diluted shares

Earnings (loss) per common share -diluted (GAAP)

Earnings (loss) per common share from continuing operations -

diluted (GAAP)

Earnings (loss) per common share from continuing operations,

excluding preferred dividends and accretion -diluted (non-

GAAP)

Regulatory charge and related tax benefit from continuing

operations

(2)

As of and for Quarter Ended

Net income (loss) available to common shareholders (GAAP)

Income available to common shareholders, excluding goodwill

impairment and regulatory charge and related tax benefit (non-

GAAP)

Net income (loss) available to common shareholders (GAAP)

Income (loss) from discontinued operations, net of tax (GAAP)

Income (loss) from continuing operations available to common

shareholders (GAAP)

Goodwill impairment from continuing operations (non-

deductible)

The table below presents earnings (loss) per share from continuing operations, excluding preferred

dividends and accretion (non-GAAP). The table also presents computations of earnings (loss) and certain other financial measures, excluding goodwill impairment

and regulatory charge and related tax benefit (non-GAAP) all recorded in 2011. The preferred

dividends and accretion, goodwill impairment charge, and the regulatory charge and related tax benefit are included in financial results presented in accordance with

generally accepted accounting principles (GAAP). Regions believes that the exclusion of the

preferred dividends and accretion, goodwill impairment and the regulatory charge and related tax benefit in expressing earnings (loss) and certain other financial

measures, including "earnings (loss) per common share, excluding preferred dividends and

accretion" and "earnings (loss) per common share, excluding goodwill impairment and regulatory charge and related tax benefit" provides a meaningful base for period-

to-period comparisons, which management believes will assist investors in analyzing the operating

results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of

Regions' business because management does not consider the preferred dividends and accretion,

goodwill impairment and regulatory charge and related tax benefit to be relevant to ongoing operating results. Management and the Board of Directors utilize

these non-GAAP financial measures for the following purposes: preparation of Regions' operating

budgets; monthly financial performance reporting; monthly close-out reporting of consolidated results (management only); and presentations to investors of

Company performance. Regions believes that presenting these non-GAAP financial measures will permit

investors to assess the performance of the Company on the same basis as that applied by management and the Board of Directors. Non-GAAP financial

measures have inherent limitations, are not required to be uniformly applied and are not audited.

Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and

should not be considered in isolation, or as a substitute for analyses of results as reported under

GAAP. In particular, a measure of earnings that excludes the preferred dividends and accretion, goodwill impairment charge, and the regulatory charge and related

tax benefit does not represent the amount that effectively accrues directly to stockholders (i.e. the

preferred dividends and accretion, goodwill impairment charge, and the regulatory charge are reductions in earnings and stockholders' equity). |

14

NON-GAAP RECONCILIATION: PRE-TAX PRE-PROVISION

INCOME

The Pre-Tax Pre-Provision Income from Continuing Operations table below presents computations

of pre-tax pre-provision income from continuing operations excluding certain

adjustments (non-GAAP). Regions believes that the exclusion of these adjustments provides a

meaningful base for period-to-period comparisons, which management believes will assist

investors in analyzing the operating results of the Company and predicting future

performance. These non-GAAP financial measures are also used by management to assess the performance

of Regions' business. It is possible that the activities related to the adjustments may recur;

however, management does not consider the activities related to the adjustments to be

indications of ongoing operations. Regions believes that presentation of these non-GAAP financial

measures will permit investors to assess the performance of the Company on the same basis as that

applied by management. Non-GAAP financial measures have inherent limitations, are

not required to be uniformly applied and are not audited. Although these non-GAAP financial

measures are frequently used by stakeholders in the evaluation of a company, they have limitations as

analytical tools, and should not be considered in isolation, or as a substitute for analyses

of results as reported under GAAP. In particular, a measure of income that excludes

certain adjustments does not represent the amount that effectively accrues directly to

stockholders. ($ amounts in millions)

6/30/12

3/31/12

12/31/11

9/30/11

6/30/11

common shareholders (GAAP)

280

$

185

$

(135)

$

87

$

25

$

95

$

51.4%

255

$

NM

71

54

54

54

54

17

31.5%

17

31.5%

126

82

18

17

(34)

44

53.7%

160

NM

taxes (GAAP)

477

321

(63)

158

45

156

48.6%

432

NM

26

117

295

355

398

(91)

-77.8%

(372)

-93.5%

(non-GAAP)

503

438

232

513

443

65

14.8%

60

13.5%

-

-

253

-

-

-

-

-

-

excluding goodwill impairment (non-GAAP)

503

438

485

513

443

65

14.8%

60

13.5%

Quarter Ended

2Q12

vs. 1Q12

2Q12

vs. 2Q11

Income (loss) from continuing operations available to

Preferred dividends (GAAP)

Income tax expense (benefit) (GAAP)

Income (loss) from continuing operations before income

Provision for loan losses (GAAP)

Pre-tax pre-provision income from continuing operations

Pre-tax pre-provision income from continuing operations,

Goodwill impairment |

15

NON-GAAP RECONCILIATION: FEE INCOME RATIOS AND

EFFICIENCY RATIOS

($ amounts in millions)

6/30/12

3/31/12

12/31/11

9/30/11

6/30/11

Continuing Operations

Non-interest expense (GAAP)

842

$

913

$

1,124

$

850

$

956

$

Adjustments:

Securities impairment, net

(2)

-

(2)

-

-

Branch consolidation and property and equipment charges

-

-

2

-

(77)

Goodwill impairment

-

-

(253)

-

-

Adjusted non-interest expense (non-GAAP)

G

840

$

913

$

871

$

850

$

879

$

Net interest income, taxable-equivalent basis (GAAP)

850

$

839

$

858

$

859

$

864

$

Non-interest income (GAAP)

507

$

524

$

507

$

513

$

543

$

Adjustments:

Securities (gains) losses, net

(12)

(12)

(7)

1

(24)

Leveraged lease termination (gains) losses, net

(7)

(7)

(10)

2

-

Adjusted non-interest income (non-GAAP)

H

488

505

490

516

519

Adjusted total revenue (non-GAAP)

I

1,338

$

1,344

$

1,348

$

1,375

$

1,383

$

Fee income ratio (non-GAAP)

H/I

36.5%

37.6%

36.4%

37.5%

37.5%

Efficiency ratio (non-GAAP)

G/I

62.8%

67.9%

64.6%

61.8%

63.6%

As of and for Quarter Ended

The table below presents computations of the efficiency ratio (non-GAAP), which

is a measure of productivity, generally calculated as non-interest expense divided by total

revenue. The table also shows the fee ratio (non-GAAP), generally

calculated as non-interest income divided by total revenue. Management uses these ratios to monitor

performance and believes these measures provide meaningful information to

investors. Non-interest expense (GAAP) is presented excluding certain adjustments to arrive at

adjusted non-interest expense (non-GAAP), which is the numerator for the

efficiency ratio. Non-interest income (GAAP) is presented excluding certain adjustments to arrive at

adjusted non-interest income (non-GAAP), which is the numerator for the fee

ratio. Net interest income on a fully taxable-equivalent basis (GAAP) and non-interest income are

added together to arrive at total revenue (GAAP). Adjustments are made to

arrive at adjusted total revenue (non-GAAP), which is the denominator for the fee and efficiency ratios.

Regions believes that the exclusion of these adjustments provides a meaningful base

for period-to-period comparisons, which management believes will assist investors in

analyzing the operating results of the Company and predicting future

performance. These non-GAAP financial measures are also used by management to assess the performance

of

Regions'

business.

It

is

possible

that

the

activities

related

to

the

adjustments

may

recur;

however,

management

does

not

consider

the

activities

related

to

the

adjustments

to

be

indications of ongoing operations. Regions believes that presentation of

these non-GAAP financial measures will permit investors to assess the performance of the Company on

the same basis as that applied by management. |

16

Stockholders' equity (GAAP)

14,455

$

17,534

$

16,499

$

17,263

$

16,888

$

Accumulated other comprehensive (income) loss

(54)

60

69

(92)

177

Non-qualifying goodwill and intangibles

(4,852)

(4,881)

(4,900)

(5,649)

(5,668)

Disallowed deferred tax assets

(336)

(345)

(432)

(506)

(498)

Disallowed servicing assets

(33)

(36)

(35)

(35)

(35)

Qualifying non-controlling interests

92

92

92

92

92

Qualifying trust preferred securities

846

846

846

846

846

Tier 1 capital (regulatory)

10,118

$

13,270

$

12,139

$

11,919

$

11,802

$

Qualifying non-controlling interests

(92)

(92)

(92)

(92)

(92)

Qualifying trust preferred securities

(846)

(846)

(846)

(846)

(846)

Preferred stock

-

(3,429)

(3,419)

(3,409)

(3,399)

Tier 1 common equity (non-GAAP)

O

9,180

$

8,903

$

7,782

$

7,572

$

7,465

$

Risk-weighted assets (regulatory)

P

91,769

92,546

91,449

92,786

93,865

Tier 1 common risk-based ratio (non-GAAP)

O/P

10.0%

9.6%

8.5%

8.2%

7.9%

NON-GAAP RECONCILIATION: TIER 1 COMMON

($ amounts in millions, except per share data)

6/30/12

3/31/12

12/31/11

9/30/11

6/30/11

As of and for Quarter Ended

(1)

Current quarter amount and the resulting ratio is estimated

The following table provides calculations of Tier 1 capital (regulatory) and "Tier 1 common

equity" (non-GAAP). Traditionally, the Federal Reserve and other banking

regulatory bodies have assessed a bank's capital adequacy based on Tier 1 capital, the calculation of

which is not prescribed in amount by federal banking regulations. In connection with the

Company's Comprehensive Capital Assessment and Review ("CCAR"), these regulators are supplementing their assessment of the capital adequacy

of a bank based on a variation of Tier 1 capital, known as Tier 1 common equity. While not

prescribed in amount by federal banking regulations, analysts and banking regulators have

assessed Regions' capital adequacy using the Tier 1 common equity measure. Because Tier 1 common equity is not formally defined by GAAP or

prescribed in any amount by federal banking regulations, this measure is considered to be a

non-GAAP financial measure and other entities may calculate differently than Regions'

disclosed calculations. Since analysts and banking regulators may assess Regions' capital adequacy using Tier 1 common equity, we believe that it is useful to

provide investors the ability to assess Regions' capital adequacy on this same basis.

Tier 1 common equity is often expressed as a percentage of risk-weighted assets. Under the

risk-based capital framework, a company's balance sheet assets and credit equivalent amounts

of off-balance sheet items are assigned to one of four broad risk categories. The aggregated dollar amount in each category is then multiplied by the

risk-weighted category. The resulting weighted values from each of the four categories are

added together and this sum is the risk-weighted assets total that, as adjusted, comprises

the denominator of certain risk-based capital ratios. Tier 1 capital is then divided by this denominator (risk-weighted assets) to determine the Tier 1 capital ratio.

Adjustments are made to Tier 1 capital to arrive at Tier 1 common equity (non-GAAP). Tier 1

common equity (non-GAAP) is also divided by the risk-weighted assets to determine the

Tier 1 common equity ratio (non-GAAP). The amounts disclosed as risk-weighted assets are calculated consistent with banking regulatory requirements.

-

CONSOLIDATED

(1)

TIER

1

COMMON

RISK-BASED

RATIO |

NON-GAAP RECONCILIATION: TIER 1 CAPITAL

(1) Current quarter amounts and the resulting ratios are estimated

Regions' Series A preferred stock was repurchased on April 4, 2012 and the warrant to purchase 48.3

million shares of Regions common stock was retired on May 2, 2012. The following table

presents the calculations of Tier 1 capital and the Tier 1 capital ratio, adjusted as if the repurchase of the

shares and the retirement of the warrant occurred on the last day of the quarter for each prior period

presented. The amount retired includes the Series A preferred stock plus the remaining

balance of the related discount. ($ amounts in millions)

6/30/12

3/31/12

12/31/11

9/30/11

6/30/11

TIER 1 RISK-BASED RATIO

Stockholders' equity

14,455

$

17,534

$

16,499

$

17,263

$

16,888

$

Accumulated other comprehensive (income) loss

(54)

60

69

(92)

177

Non-qualifying goodwill and intangibles

(4,852)

(4,881)

(4,900)

(5,649)

(5,668)

Disallowed deferred tax assets

(336)

(345)

(432)

(506)

(498)

Disallowed servicing assets

(33)

(36)

(35)

(35)

(35)

Qualifying non-controlling interests

92

92

92

92

92

Qualifying trust preferred securities

846

846

846

846

846

Tier 1 capital as reported

10,118

$

13,270

$

12,139

$

11,919

$

11,802

$

Series

A

Preferred

Stock

Retirement

(Reduction

to

Stockholders' equity)

-

$

(3,500)

$

(3,500)

$

(3,500)

$

(3,500)

$

-

(45)

(45)

(45)

(45)

Tier 1 capital as adjusted to exclude Series A Preferred Stock

10,118

$

9,725

$

8,594

$

8,374

$

8,257

$

Risk-weighted

assets

1

91,769

92,546

91,449

92,786

93,865

Tier

1

capital

ratio

1

11.0%

14.3%

13.3%

12.8%

12.6%

11.0%

10.5%

9.4%

9.0%

8.8%

Quarter Ended

17

Tier

1

capital

ratio

excluding

Series

A

Preferred

Stock

and

associated

warrant

1

Retirement

of

warrant

to

purchase

48.3

million

shares

of

common

stock |

NON-GAAP RECONCILIATION: BASEL III

(1)

Under Basel III, regulatory capital must be reduced by purchased credit card relationship intangible

assets. The majority of these assets are allowed in Basel I capital. (2)

Regions continues to develop systems and internal controls to calculate risk-weighted assets as

required by Basel III. The amount included above is a reasonable approximation based

on our understanding of the requirements, as outlined in the June 2012 Notices of Proposed Rulemakings.

18

The following table provides calculations of Tier 1 common equity (non-GAAP), based on

Regions’ current understanding of Basel III requirements, as proposed by the U.S. Notices

of Proposed Rulemaking released in June 2012. Regions currently calculates its risk-based capital ratios under guidelines adopted by the

Federal Reserve based on the 1988 Capital Accord (“Basel I”) of the Basel Committee on

Banking Supervision (the “Basel Committee”). The calculations provided below are

estimates, based on Regions’ current understanding of the framework, including the Company’s reading of the requirements, and informal

feedback received through the regulatory process. Regions’ understanding of the framework is

evolving and will likely change as the regulations are finalized. The NPR comment period

ends in early September and changes could result. Such changes could result in materially different capital ratios from what we have

estimated. Because the Basel III implementation regulations are not formally defined by GAAP and

have not yet been finalized and codified, these measures are considered to be non-GAAP

financial measures, and other entities may calculate them differently from Regions’ disclosed calculations. Since analysts and

banking regulators may assess Regions’ capital adequacy using the Basel III framework, the Company

believes that it is useful to provide investors the ability to assess Regions’ capital

adequacy on the same basis. Estimate based on June

2012 U.S. Notices of

Proposed Rulemaking

($ amounts in millions)

6/30/2012

Stockholders' equity (GAAP)

14,455

$

Non-qualifying

goodwill

and

intangibles

(1)

(5,005)

Adjustments, including other comprehensive income related to cash flow hedges,

disallowed deferred tax

assets,

threshold

deductions

and

other

adjustments

(548)

Basel III Tier 1 Common Equity (non-GAAP)

8,902

$

Basel I risk-weighted assets (regulatory)

91,769

$

Basel

III

risk-weighted

assets

(non-GAAP)

(2)

111,782

$

Basel III Tier 1 Common Ratio (non-GAAP)

8.0% |

|