Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - C. H. ROBINSON WORLDWIDE, INC. | d383785d8k.htm |

| EX-99.1 - PRESS RELEASE - C. H. ROBINSON WORLDWIDE, INC. | d383785dex991.htm |

Earnings Conference Call –

Second Quarter 2012

July 24, 2012

John Wiehoff, Chairman & CEO

Chad Lindbloom, CFO

Angie Freeman, VP Investor Relations

Exhibit 99.2 |

2

Safe Harbor Statement

Except for the historical information contained herein, the matters set forth in

this presentation and the accompanying earnings release are

forward-looking statements that represent our expectations, beliefs,

intentions or strategies concerning future events. These forward-looking statements are

subject to certain risks and uncertainties that could cause actual results to

differ materially from our historical experience or our present

expectations, including, but not limited to such factors as changes in

economic conditions, including uncertain consumer demand; changes in market demand and

pressures on the pricing for our services; competition and growth rates within the

third party logistics industry; freight levels and increasing costs and

availability of truck capacity or alternative means of transporting

freight,

and

changes

in

relationships

with

existing

truck,

rail,

ocean

and

air

carriers;

changes in

our

customer

base

due

to

possible

consolidation

among

our

customers;

our

ability

to

integrate

the

operations

of

acquired

companies

with

our

historic

operations

successfully;

risks

associated with litigation and insurance coverage; risks associated with operations

outside of the U.S.; risks associated with the potential impacts of changes

in government regulations; risks associated with the produce industry,

including food safety and contamination issues; fuel prices and

availability; the impact of war on the economy; and other risks and uncertainties

detailed in our Annual and Quarterly Reports.

Any forward-looking statement speaks only as of the date on which such

statement is made, and we undertake no obligation to update such statement

to reflect events or circumstances arising after such date. All remarks made

during our financial results conference call will be current at the time of the

call and we undertake no obligation to update the replay.

|

3

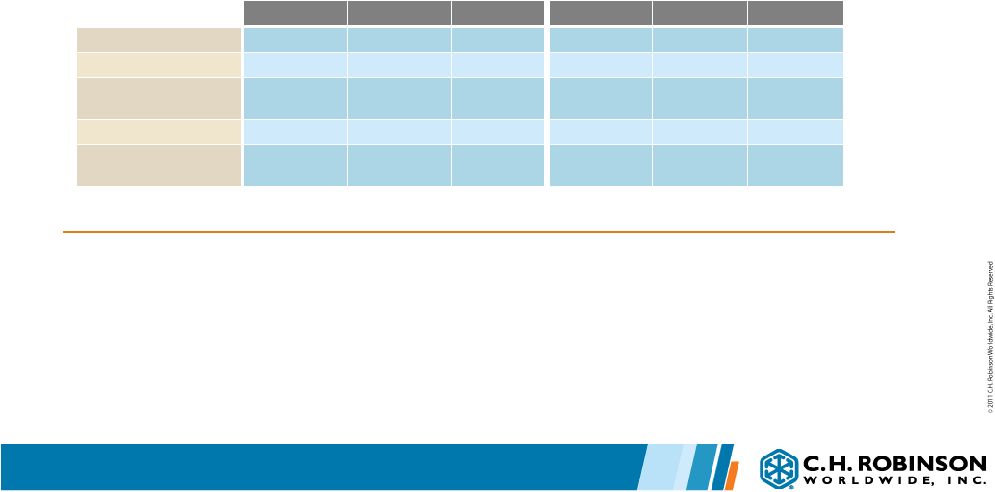

Q2 2012 Results

2012

2011

% Change

2012

2011

% Change

Total revenues

$2,955,714

$2,707,662

9.2%

$5,507,828

$5,073,134

8.6%

Total net revenues

$425,523

$417,866

1.8%

$840,269

$808,207

4.0%

Income from operations

$184,914

$180,095

2.7%

$354,459

$336,810

5.2%

Net income

$114,582

$111,023

3.2%

$221,082

$208,051

6.3%

Earnings per share

(diluted)

$0.71

$0.67

6.0%

$1.36

$1.26

7.9%

Three months ended June 30

Six months ended June 30

In thousands, except per share amounts |

4

Transportation Results Q2 2012

•

Volume growth and pricing increases in most services.

•

Consolidated transportation net revenue margin declined in the quarter to

10-year low. 2012

2011

% Change

2012

2011

% Change

Total revenues

$2,476,805

$2,269,036

9.2%

$4,653,602

$4,260,058

9.2%

Total net revenues

$369,006

$367,847

0.3%

$736,222

$710,767

3.6%

Net revenue margin

14.9%

16.2%

-8.1%

15.8%

16.7%

-5.2%

Three months ended June 30

Six months ended June 30

TRANSPORTATION in thousands

TRANSPORTATION NET REVENUE MARGIN PERCENTAGE

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Q1

17.7%

17.8%

16.8%

17.4%

18.3%

20.2%

18.2%

22.6%

17.4%

17.2%

16.9%

Q2

16.1%

15.9%

15.4%

16.3%

17.1%

17.9%

15.4%

20.6%

15.8%

16.2%

14.9%

Q3

15.6%

16.0%

15.9%

16.3%

17.5%

18.0%

15.9%

19.8%

16.6%

16.4%

Q4

16.2%

15.8%

16.0%

15.7%

18.3%

17.7%

19.0%

18.3%

17.6%

16.3% |

5

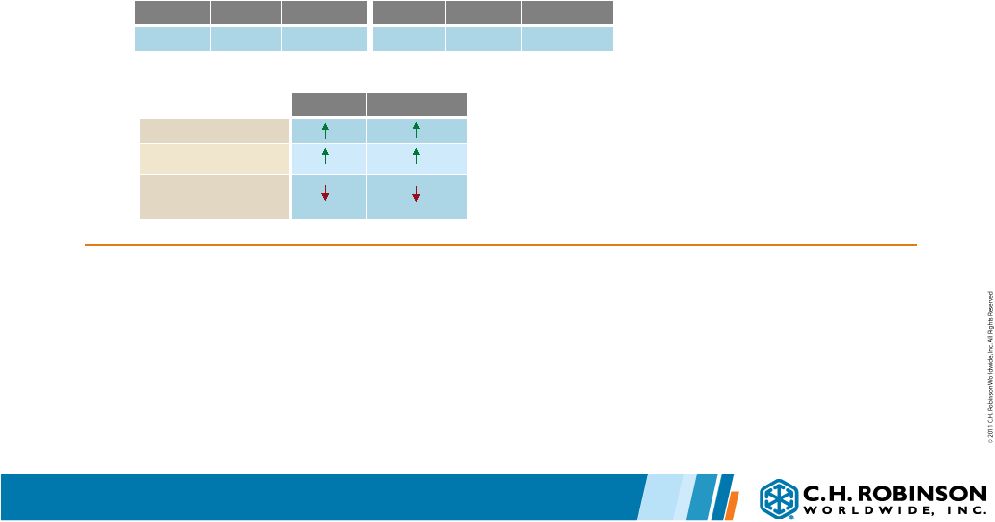

Truck Results Q2 2012

2012

2011

% Change

2012

2011

% Change

$312,638

$314,302

-0.5%

$628,047

$608,802

3.2%

Three months ended June 30

Six months ended June 30

TRUCK NET REVENUES in thousands

Quarter

Year to Date

Volume

10%

9%

Pricing *

1%

1%

Net revenue margin

TRUCKLOAD

Quarter

Year to Date

Volume

17%

15%

Pricing

Net revenue margin

LTL

Year over year change

Year over year change

*Excluding estimated impact of fuel

•

Strong Truckload volume growth offset by net revenue margin decline.

•

Truckload cost per mile increased faster than price per mile. Fuel not a factor in

net revenue margin •

Less-than-Truckload net revenue growth of approximately 12 percent driven

primarily by volume growth, partially offset by decreased net revenue

margin. compression in the second quarter of 2012 compared to the second quarter of 2011. |

6

Intermodal Results Q2 2012

•

Net revenue decline due to net revenue margin compression, partially offset by

volume growth. •

Net revenue margin decline due to changing mix of business and increased cost of

capacity. •

Investment in additional 500 containers primarily to replace older leased

equipment. New containers will be put into service by the end of third

quarter 2012. Owned containers continue to support new opportunities and

stronger carrier relationships. 2012

2011

% Change

2012

2011

% Change

$10,019

$10,862

-7.8%

$19,730

$20,462

-3.6%

Three months ended June 30

Six months ended June 30

INTERMODAL NET REVENUES in thousands

Quarter

Year to Date

Volume

Pricing

Net revenue margin

Year over year change |

7

Ocean & Air Results Q2 2012

2012

2011

% Change

2012

2011

% Change

Ocean

$16,958

$16,400

3.4%

$32,719

$31,970

2.3%

Air

$10,577

$11,435

-7.5%

$19,450

$20,620

-5.7%

Three months ended June 30

Six months ended June 30

NET REVENUES in thousands

Quarter

Year to Date

Volume

Pricing

Net revenue margin

OCEAN

Quarter

Year to Date

Volume

Pricing

Net revenue margin

AIR

Year over year change

Year over year change

•

Ocean net revenue growth due to increased pricing, partially offset by volume

declines. •

Air net revenue decline due to decreased pricing. Air volumes increased and

net revenue margin expanded.

•

Continued volatility in global forwarding marketplace.

|

8

Other Logistics Services Results Q2 2012

•

Other Logistics Services includes Transportation Management Services, Customs,

Warehousing, and Small Parcel.

•

Transportation Management and Customs primarily drove net revenue growth in the

quarter. •

Continued success with integrated, outsourced logistics arrangements is driving

growth. 2012

2011

% Change

2012

2011

% Change

$18,814

$14,848

26.7%

$36,276

$28,913

25.5%

Three months ended June 30

Six months ended June 30

NET REVENUES in thousands

|

9

Sourcing Results Q2 2012

•

Sourcing net revenue growth driven by increased volumes and expanded net revenue

margin. •

Excluding Timco, which was acquired on September 26, 2011, we estimate Sourcing

net revenues grew approximately 8% in the quarter.

•

Growth with large customers drove volume increases.

2012

2011

% Change

2012

2011

% Change

Total revenues

$462,597

$423,536

9.2%

$822,327

$783,564

4.9%

Total net revenues

$40,205

$34,929

15.1%

$72,148

$67,928

6.2%

Net revenue margin

8.7%

8.2%

5.4%

8.8%

8.7%

1.2%

Three months ended June 30

Six months ended June 30

SOURCING in thousands |

10

Payment Services Results Q2 2012

2012

2011

% Change

2012

2011

% Change

$16,312

$15,090

8.1%

$31,899

$29,512

8.1%

Three months ended June 30

Six months ended June 30

PAYMENT SERVICES Net Revenues in thousands

Quarter

Year to Date

Volume

Pricing

Year over year change

•

Net revenue growth due primarily to transaction volume increases.

•

Fuel services, MasterCard

®

, and permit services drove net revenue growth. |

11

Summarized Income Statement

2012

2011

% Change

2012

2011

% Change

Total net revenues

$425,523

$417,866

1.8%

$840,269

$808,207

4.0%

Operating expenses:

Personnel expenses

$177,184

$178,945

-1.0%

$360,622

$354,054

1.9%

Percent of net revenues

41.6%

42.8%

42.9%

43.8%

Other operating expenses

$63,425

$58,826

7.8%

$125,188

$117,343

6.7%

Percent of net revenues

14.9%

14.1%

14.9%

14.5%

Total Operating expenses

$240,609

$237,771

1.2%

$485,810

$471,397

3.1%

Income from Operations

$184,914

$180,095

2.7%

$354,459

$336,810

5.2%

Percent of net revenues

43.5%

43.1%

42.2%

41.7%

Three months ended June 30

Six months ended June 30

•

For the quarter, operating expenses grew slower than net revenues.

•

Average

headcount

grew

approximately

9%.

•

For the quarter, personnel expense decrease due to declines in incentive

compensation plans that are based on growth in earnings.

•

Other operating expense growth driven primarily by increased travel and claims,

partially offset by a decrease in provision for doubtful accounts.

In thousands

11 |

12

2012

2011

% Change

2012

2011

% Change

Net cash provided by

operating activities

$32,944

$26,241

25.5%

$110,028

$78,854

39.5%

Capital expenditures, net

$11,150

$10,155

9.8%

$24,970

$19,785

26.2%

Three months ended June 30

Six months ended June 30

Quarter

Year to Date

Shares repurchased

637,261

1,704,978

Average price per

share

$59.23

$63.19

Total cost of shares

repurchased

$37,743

$107,733

June 30, 2012

Cash & investments

$240,627

Current assets

$1,707,601

Total assets

$2,239,999

Current liabilities

$949,341

Stockholders’

investment

$1,278,190

Long term debt

$0

CASH FLOW DATA

2012

BALANCE SHEET DATA

REPURCHASES OF COMMON STOCK

Other Financial Information

In thousands, except share and per share amounts |

13

Current Period Comments & Summary

•

July 1-

23, 2012:

•

North American Truckload volume growth per business day was approximately

11% •

Total net revenue per business day declined approximately 1.5%

-

Net revenue per business day July 1-23, 2012:

approximately $6.7 million

-

Net revenue per business day July 1-25, 2011:

approximately $6.8 million

-

Net revenue per business day Q3 2011:

$6.6 million

•

The economic and freight environments continue to pose challenges.

•

We are adapting, taking market share and aggressively selling.

•

We continue to invest in our growth and competitive position.

•

Our scale and financial stability continue to be important advantages.

|

|