Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - PAN AMERICAN GOLDFIELDS LTD | Financial_Report.xls |

| EX-31.1 - PAN AMERICAN GOLDFIELDS LTD | ex_31-1.htm |

| EX-32.2 - PAN AMERICAN GOLDFIELDS LTD | ex_32-2.htm |

| EX-32.1 - PAN AMERICAN GOLDFIELDS LTD | ex_32-1.htm |

| EX-31.2 - PAN AMERICAN GOLDFIELDS LTD | ex_31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D. C. 20549

FORM 10-Q

QUARTERLY REPORT UNDER SECTION 13 or 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended May 31, 2012

Commission file number 000-23561

PAN AMERICAN GOLDFIELDS LTD.

(Exact name of small business issuer as specified in its charter)

|

Delaware

|

84-1431797

|

|

|

(State or other jurisdiction of incorporation)

|

(IRS Employer Identification Number)

|

|

906 – 595 Howe Street

Vancouver, BC

|

V6C 2T5

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (604) 681-1163

Check whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No þ

As of July 18, 2012, the registrant had 89,672,135 shares of common stock issued and outstanding.

1

PART 1 – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(Expressed in U.S. Dollars)

May 31, 2012

2

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Consolidated Balance Sheets

(Expressed in U.S. Dollars)

|

May 31,

2012

|

February 29,

2012

|

|||||||

|

(Unaudited)

|

||||||||

|

Assets

|

||||||||

|

Current

|

||||||||

|

Cash and cash equivalents

|

$ | 74,819 | $ | 117,892 | ||||

|

Accounts receivable

|

605,729 | 282,683 | ||||||

|

Inventory

|

- | 64,202 | ||||||

|

Prepaid expenses

|

30,384 | 50,686 | ||||||

| 710,932 | 515,463 | |||||||

|

Equipment (note 4)

|

26,963 | 166,204 | ||||||

|

Total assets

|

$ | 737,895 | $ | 681,667 | ||||

|

Liabilities

|

||||||||

|

Current

|

||||||||

|

Accounts payable and accrued liabilities

|

$ | 1,820,803 | $ | 1,358,302 | ||||

|

Loans payable (note 8)

|

6,484 | 12,887 | ||||||

|

Total liabilities

|

1,827,287 | 1,371,189 | ||||||

|

Stockholders’ deficiency

|

||||||||

|

Capital stock

|

||||||||

|

Preferred stock

|

||||||||

|

Authorized: 20,000,000 shares without par value (note 9)

|

||||||||

|

Issued: nil

|

||||||||

|

Common stock

|

||||||||

|

Authorized: 200,000,000 shares without par value

|

||||||||

|

Issued: 71,977,691 (2012 – 71,192,397) (note 10)

|

34,317,125 | 34,232,125 | ||||||

|

Additional paid-in capital

|

16,244,830 | 15,986,080 | ||||||

|

Stock subscriptions

|

557,238 | 557,238 | ||||||

|

Accumulated deficit from prior operations

|

(2,003,427 | ) | (2,003,427 | ) | ||||

|

Accumulated deficit during the exploration stage

|

(50,403,556 | ) | (49,701,810 | ) | ||||

|

Accumulated other comprehensive income

|

198,398 | 240,272 | ||||||

|

Total stockholders’ deficiency

|

(1,089,392 | ) | (689,522 | ) | ||||

|

Total liabilities and stockholders’ deficiency

|

$ | 737,895 | $ | 681,667 | ||||

Going-concern (note 3)

Commitments (notes 6 and 12)

Subsequent events (note 15)

The accompanying notes are an integral part of these consolidated financial statements.

3

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Consolidated Statements of Operations and Comprehensive Loss

(Expressed in U.S. Dollars)

(Unaudited)

|

Period from

|

||||||||||||

|

March 1, 2004

|

||||||||||||

|

(Inception of

|

||||||||||||

|

Exploration

|

||||||||||||

|

Three Months Ended May 31

|

Stage)

|

|||||||||||

|

2012

|

2011

|

to May 31, 2012

|

||||||||||

|

Net sales

|

$ | 1,053,354 | $ | 328,128 | $ | 4,838,799 | ||||||

|

Cost of goods sold

|

323,602 | 153,946 | 2,008,977 | |||||||||

|

Gross margin

|

729,752 | 174,182 | 2,829,822 | |||||||||

|

Expenses

|

||||||||||||

|

General and administrative

|

825,715 | 894,496 | 24,041,874 | |||||||||

|

Mineral Exploration

|

644,940 | 55,393 | 10,776,795 | |||||||||

|

Impairment of mineral property costs

|

160,000 | 168,105 | 18,420,059 | |||||||||

|

Operating loss

|

(900,903 | ) | (943,812 | ) | (50,408,906 | ) | ||||||

|

Other income (expenses)

|

||||||||||||

|

Deposit on equipment written off

|

- | - | (25,300 | ) | ||||||||

|

Foreign exchange loss

|

(17,933 | ) | (29,048 | ) | (607,782 | ) | ||||||

|

Interest

|

(6,493 | ) | (20,259 | ) | (5,361,799 | ) | ||||||

|

Other income

|

242,056 | 4,092 | 661,372 | |||||||||

|

Gain on disposal of assets

|

- | - | 15,130 | |||||||||

|

Gain on sale of assets

|

32,143 | - | 4,420,517 | |||||||||

|

Gain (loss) on settlement of debt

|

(50,616 | ) | 14,665 | 903,212 | ||||||||

|

Net loss

|

(701,746 | ) | (974,362 | ) | (50,403,556 | ) | ||||||

|

Other comprehensive income (loss)

|

||||||||||||

|

Foreign exchange translation adjustment

|

(41,874 | ) | (35,807 | ) | 198,398 | |||||||

|

Total comprehensive loss

|

$ | (743,620 | ) | $ | (1,010,169 | ) | $ | (50,205,158 | ) | |||

|

Total loss per share – basic and diluted

|

$ | (0.01 | ) | $ | (0.02 | ) | ||||||

|

Weighted average number of shares of

|

71,439,584 | 58,132,033 | ||||||||||

|

common stock – basic and diluted

|

||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Consolidated Statements of Cash Flows

(Expressed in U.S. Dollars)

(Unaudited)

|

Three Months Ended May 31

|

Period From March 1, 2004 (Inception of Exploration Stage)

To May 31

|

|||||||||||

|

2012

|

2011

|

2012

|

||||||||||

|

Operating activities

|

||||||||||||

|

Net loss

|

$ | (701,746 | ) | $ | (974,362 | ) | $ | (50,403,556 | ) | |||

|

Adjustments to reconcile net (loss) to net cash flows

|

||||||||||||

|

Write-off of note receivable

|

- | - | 57,500 | |||||||||

|

Impairment of mineral property costs

|

- | 150,000 | 14,421,668 | |||||||||

|

Issuance of shares for consulting services

|

- | - | 510,590 | |||||||||

|

Issuance of shares for interest costs

|

- | - | 82,500 | |||||||||

|

Discount on convertible debenture

|

- | - | 569,549 | |||||||||

|

Deposit on equipment written off

|

- | - | 25,300 | |||||||||

|

Gain on disposal of assets

|

- | - | (15,130 | ) | ||||||||

|

Gain on sale of assets

|

77,572 | - | (4,312,382 | ) | ||||||||

|

Non-cash component of (gain) loss on settlement of debt

|

50,616 | (14,665 | ) | (945,027 | ) | |||||||

|

Beneficial conversion feature

|

- | - | 4,081,091 | |||||||||

|

Stock-based compensation

|

258,750 | 370,675 | 12,499,186 | |||||||||

|

Amortization

|

7,017 | 11,921 | 353,320 | |||||||||

|

Net change in operating assets and liabilities:

|

||||||||||||

|

Prepaid expense

|

19,164 | 36,156 | (32,464 | ) | ||||||||

|

Accounts receivable

|

(386,118 | ) | 24,874 | (371,561 | ) | |||||||

|

Inventory

|

64,202 | - | - | |||||||||

|

Deposits

|

- | - | (194,809 | ) | ||||||||

|

Notes payable

|

- | - | 109,337 | |||||||||

|

Accounts payable and accrued liabilities

|

505,554 | (175,427 | ) | 7,752,630 | ||||||||

|

Cash used in operating activities

|

(104,989 | ) | (570,828 | ) | (15,812,258 | ) | ||||||

|

Investing activity

|

||||||||||||

|

Sale of equipment

|

49,650 | - | 82,966 | |||||||||

|

Purchase of property and equipment

|

- | - | (603,617 | ) | ||||||||

|

Cash provided by (used in) investing activity

|

49,650 | - | (520,651 | ) | ||||||||

|

Financing activities

|

||||||||||||

|

Proceeds from loans payable

|

- | - | 316,617 | |||||||||

|

Proceeds from notes payable

|

- | - | 3,162,196 | |||||||||

|

Proceeds from convertible debentures

|

- | - | 7,462,500 | |||||||||

|

Proceeds from exercise of options

|

- | - | 78,000 | |||||||||

|

Proceeds from exercise of warrants

|

- | - | 3,144,377 | |||||||||

|

Repayment of loans payable

|

(6,403 | ) | (6,395 | ) | (303,252 | ) | ||||||

|

Repayment of notes payable

|

- | - | (586,620 | ) | ||||||||

|

Repayment of convertible debentures

|

- | - | (2,051,047 | ) | ||||||||

|

Stock subscriptions

|

45,000 | 670,904 | 2,363,262 | |||||||||

|

Issuance of common stock (net)

|

- | - | 2,756,994 | |||||||||

|

Cash provided by financing activities

|

38,597 | 664,509 | 16,343,027 | |||||||||

|

Inflow (outflow) of cash and cash equivalents

|

(16,742 | ) | 93,681 | 10,118 | ||||||||

|

Effect of foreign currency translation on cash

|

(26,331 | ) | 646 | 42,624 | ||||||||

|

Cash and cash equivalents, beginning

|

117,892 | 407,912 | 22,077 | |||||||||

|

Cash and cash equivalents, ending

|

$ | 74,819 | $ | 502,239 | $ | 74,819 | ||||||

Supplemental cash flow information (note 14)

The accompanying notes are an integral part of these consolidated financial statements.

5

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

|

1.

|

BASIS OF PRESENTATION

|

Pan American Goldfields Ltd. (formerly Mexoro Minerals, Ltd and Sunburst Acquisitions IV, Inc.) ("Panam" or the “Company”) was incorporated in the state of Delaware on March 23, 2010 and on July 2, 2010 changed its name to Pan American Goldfields Ltd. pursuant to an agreement and plan of merger between the Company and Mexoro Minerals Ltd. The Company was formed to seek out and acquire business opportunities. Between 1997 and 2003, the Company was engaged in two business acquisitions and one business opportunity, none of which generated a significant profit or created sustainable business. All were sold or discontinued. The Company had previously been pursuing various business opportunities and, effective March 1, 2004, the Company changed its operations to mineral exploration. Currently, the main focus of the Company’s operations is in Mexico and Argentina.

In February 2011, the Company entered into an agreement with Compañia Minera Alto Rio Salado S.A. (“Compañia Minera”), a private Argentine entity, for the acquisition of the 15,000 hectares Cerro Delta Project in northwest La Rioja Province, Argentina. The agreement became effective in March 2011. Under the terms of the agreement, the Company is required to pay $150,000 upon signing (paid) the agreement, $200,000 on the first anniversary (the Company has paid $140,000 of the $200,000 amount due and is negotiating the terms for the balance of the payment), $500,000 on the second anniversary, $750,000 on the third anniversary, $1.2 million on the fourth anniversary, and $2.2 million on the fifth anniversary of the signing, with a final option payment of $5 million to purchase a 100% interest in the Cerro Delta project payable on the sixth anniversary of the signing. The vendor will retain a 1% net smelter return (“NSR”) (note 6).

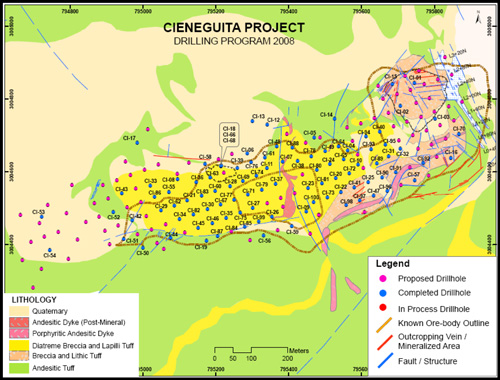

On February 12, 2009, the Company entered into a joint venture through a definitive agreement for development of its Cieneguita project with Minera Rio Tinto, S.A. de C.V. (“MRT”), a private company duly incorporated pursuant to the laws of Mexico. The purpose of the joint venture is to put the Cieneguita property into production. Pursuant to the agreement, MRT is to provide the necessary working capital to begin and maintain mining operations at Cieneguita, which are estimated to be $3,000,000. MRT plans to spend 100% of the money to earn 74% of the net cash flow from production (notes 5 and 6). The Company will receive 20% of the net cash flows from production.

In September 2011, the Company executed an amended and restated development agreement for the restructure of its Cieneguita joint venture related to the Cieneguita project. Under the restructured joint venture agreement the Company receives 20% of the net operating profits after royalties for material processed through a small-scale pilot operation and mined from the first 15 meters depth of the Cieneguita deposit until December 31, 2012. For all other material processed from the property, the Company's interest is 80% and MRT is reduced to a 20% working interest, subject to certain dilution provisions (note 6).

On May 25, 2004, the Company completed a “Share Exchange Agreement” with Sierra Minerals and Mining, Inc. (“Sierra Minerals”), a Nevada corporation, which caused Sierra Minerals to become a wholly-owned subsidiary of the Company. Sierra Minerals held certain rights to properties in Mexico that the Company now owns or has an option to acquire. Through Sierra Minerals, the Company entered into a joint venture agreement with MRT. In August 2005, the Company cancelled the joint venture agreement in order to directly pursue mineral Exploration opportunities through a wholly-owned Mexican subsidiary, Sunburst Mining de Mexico S.A. de C.V. (“Sunburst de Mexico”). On August 25, 2005, the Company, Sunburst de Mexico and MRT entered into agreements providing Sunburst de Mexico the right to explore and exploit certain properties in Mexico. In December 2005, the Company and Sunburst de Mexico entered into a new agreement with MRT (the “New Agreement”) (note 6). On January 20, 2006, Sierra Minerals was dissolved.

6

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

|

2.

|

SIGNIFICANT ACCOUNTING POLICIES

|

|

(a)

|

Recent accounting pronouncements

|

|

(i)

|

On June 16, 2011, the FASB issued Accounting Standards Update (“ASU”) 2011-05, which revises the manner in which entities present comprehensive income in their financial statements. The new guidance removes the presentation options in ASC 220 and requires entities to report components of comprehensive income in either (1) a continuous statement of comprehensive income or (2) two separate but consecutive statements. The ASU does not change the items that must be reported in other comprehensive income. The amendments are effective for fiscal years, and interim periods within those years, beginning after December 15, 2011. The Company does not expect the provisions of ASU 2011-05 to have a material effect on the financial position, results of operations or cash flows of the Company, as the Company currently presents a continuous statement of operations and comprehensive income (loss).

|

|

(ii)

|

On May 12, 2011, the FASB issued ASU 2011-04. The ASU is the result of joint efforts by the FASB and IASB to develop a single, converged fair value framework. Thus, there are few differences between the ASU and its international counterpart, IFRS 13. This ASU is largely consistent with existing fair value measurement principles in U.S. GAAP; however it expands ASC 820’s existing disclosure requirements for fair value measurements and makes other amendments. The ASU is effective for interim and annual periods beginning after December 15, 2011. The Company does not expect the provisions of ASU 2011-05 to have a material effect on the financial position, results of operations or cash flows of the Company.

|

|

(iii)

|

In May 2010, the FASB issued ASU 2010-19, Foreign Currency (Topic 830): Foreign Currency Issues: Multiple Foreign Currency Exchange Rates. The amendments in this update are effective as of the announcement date of March 18, 2010. Implementation of ASU 2010-19 did not have a material effect on the financial position, results of operations or cash flows of the Company.

|

|

(iv)

|

In April 2010, the FASB issued ASU 2010-17, Revenue Recognition-Milestone Method (Topic 605): Milestone Method of Revenue Recognition. The amendments in this update are effective on a prospective basis for milestones achieved in fiscal years, and interim periods within those years, beginning on or after June 15, 2010. Early adoption is permitted. If a vendor elects early adoption and the period of adoption is not the beginning of the entity’s fiscal year, the entity should apply the amendments retrospectively from the beginning of the year of adoption. Implementation of ASU 2010-17 did not have a material effect on the financial position, results of operations or cash flows of the Company.

|

7

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

|

3.

|

GOING CONCERN

|

The accompanying financial statements have been prepared on a going concern basis. The Company has a history of operating losses and will need to raise additional capital to fund its planned operations. As at May 31, 2012, the Company had a cumulative loss, during its exploration period, of $50,403,556 (February 29, 2012 - $49,701,810). These conditions raise substantial doubt about the Company’s ability to continue as a going concern.

The Company intends to reduce its cumulative loss through the attainment of profitable operations from its investment in Mexican and Argentine mining ventures (note 6). In addition, the Company has conducted private placements of common stock and convertible debt (note 10), which have generated a portion of the initial cash requirements for its planned mining ventures (note 6).

In May 2012, the Company converted subscription proceeds of $45,000 and issued 300,000 shares of common stock in a private placement. The subscribers to the subscription proceeds have agreed to purchase one unit for each $0.20 of subscription proceeds. Each unit consists of one share of the Company’s common stock and one warrant each exercisable at $0.30, which expires in two years.

In February 2012, the Company completed a private placement of 4,500,000 units at $0.20 per unit for total gross proceeds of $900,000. Each unit consisted of one share of common stock and one warrant to purchase one share of common stock, each exercisable at $0.30, expiring in two years from the closing date.

In June 2011, the Company completed a private placement of 1,500,000 units at $0.20 per unit, for total proceeds of $300,000. Each unit consisted of one share of common stock and one warrant to purchase one share of common stock, each exercisable at $0.30, expiring in two years from the closing date.

In March 2011, the Company completed a private placement of 6,560,000 units at $0.20 per unit, for total proceeds of $1,312,000. Each unit consisted of one share of common stock and one warrant to purchase one share of common stock. Each warrant is exercisable for one share of common stock at an exercise price of $0.30 per share for a period of two years from the closing date.

In July 2009, the Company signed a definitive agreement to sell its Guazapares project located in southwest Chihuahua, Mexico to Paramount Gold de Mexico, SA de C.V., the Mexican subsidiary of Paramount Gold and Silver Corp. (“Paramount”) for a total consideration of up to $5,300,000. The purchase price is to be paid in two stages. The first payment of $3,700,000 was released from escrow in February 2010, as the transfer of the 12 claims to Paramount was completed. An additional payment of $1,600,000 is due if, within 36 months following execution of the letter of agreement (July 10, 2009), either (i) Paramount Gold de Mexico SA de C.V. is sold by Paramount, either through a stock sale or a sale of substantially all of its assets, or (ii) Paramount’s San Miguel project is put into commercial production. As of July 18, 2012, none of the two events occurred.

8

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

|

4.

|

EQUIPMENT

|

|

May 31,

2012

|

February 29,

2012

|

|||

|

Cost

|

Accumulated Depreciation

|

Net Book

|

Net Book

|

|

|

Value

|

Value

|

|||

|

$

|

$

|

$

|

$

|

|

|

Software

|

23,488

|

18,113

|

5,375

|

5,944

|

|

Machinery

|

13,449

|

5,712

|

7,737

|

142,957

|

|

Vehicles

|

71,099

|

64,104

|

6,995

|

9,418

|

|

Computers

|

25,383

|

25,310

|

73

|

98

|

|

Office equipment

|

15,113

|

8,330

|

6,783

|

7,787

|

|

148,532

|

121,569

|

26,963

|

166,204

|

|

|

5.

|

JOINT VENTURE WITH MRT

|

On February 12, 2009, the Company entered into a joint venture through a definitive agreement for development of its Cieneguita project with MRT. The purpose of the joint venture is to put Cieneguita property into production. As per the agreement, MRT is to provide the necessary working capital to begin and maintain mining operations estimated to be $3,000,000. MRT will spend 100% of the funds in exchange for a 75% interest in the net cash flow from production. The agreement was amended in December 2009 for MRT to earn a 74% interest in the net cash flow from production (note 6).

In September 2011, the Company executed an amended and restated development agreement for the restructure of its Cieneguita joint venture related to the Cieneguita project. Under the restructured joint venture agreement the Company receives 20% of the net operating profits after royalties for material processed through a small-scale pilot operation and mined from the first 15 meters depth of the Cieneguita deposit until December 31, 2012. For all other material processed from the property, the Company's interest is 80% and MRT is reduced to a 20% working interest, subject to certain dilution provisions (note 6).

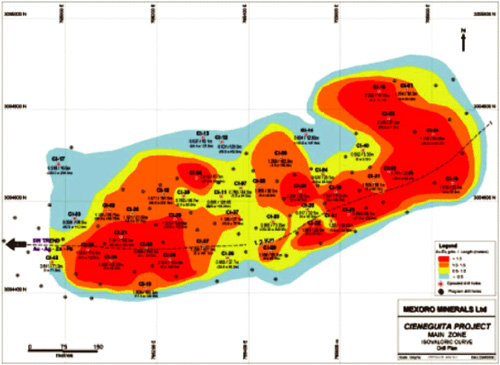

The agreement limits the mining of the mineralized material that is available from the surface to a depth of 15 meters or approximately 10% of the mineralized material found as of the date of the definitive agreement. The Company incurs no obligations to the joint venture’s creditors as the operations and working capital requirements are controlled by MRT and as such, the Company has concluded that it is not the primary beneficiary of the joint venture. Accordingly, the Company’s share of income and expenses are reflected in these financial statements under the proportionate consolidation method.

The Company’s proportionate share of revenues was $1,053,354 and proportionate share of the net profit was $592,048 for the three months ended May 31, 2012. The Company’s proportionate share of accounts receivable of the joint venture was $535,962 respectively, at May 31, 2012. The joint venture did not have any other assets or liabilities at May 31, 2012.

9

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

|

6.

|

MINERAL PROPERTIES

|

The Company incurred exploration expenses as follows in the three months ended May 31, 2012:

|

Cieneguita

|

Cerro Delta

|

New Projects

|

Total

|

|

|

$

|

$

|

$

|

$

|

|

|

Geological, geochemical, geophysics

|

-

|

130,000

|

130,000

|

|

|

Field work preparations

|

-

|

239,178

|

-

|

239,178

|

|

Travel

|

3,904

|

-

|

-

|

3,904

|

|

Consulting

|

231,637

|

-

|

-

|

231,637

|

|

Equipment

|

36,055

|

-

|

-

|

36,055

|

|

General

|

2,615

|

892

|

659

|

4,166

|

|

274,211

|

370,070

|

659

|

644,940

|

The Company incurred exploration expenses as follows in the three months ended May 31, 2011:

|

Cieneguita

|

Cerro Delta

|

Total

|

|

|

$

|

$

|

$

|

|

|

Geological, geochemical, geophysics

|

10,977

|

25,515

|

36,492

|

|

Travel

|

2,924

|

-

|

2,924

|

|

Consulting

|

3,828

|

10,552

|

14,380

|

|

Equipment

|

575

|

-

|

575

|

|

General

|

1,022

|

-

|

1,022

|

|

19,326

|

36,067

|

55,393

|

10

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

6.MINERAL PROPERTIES (continued)

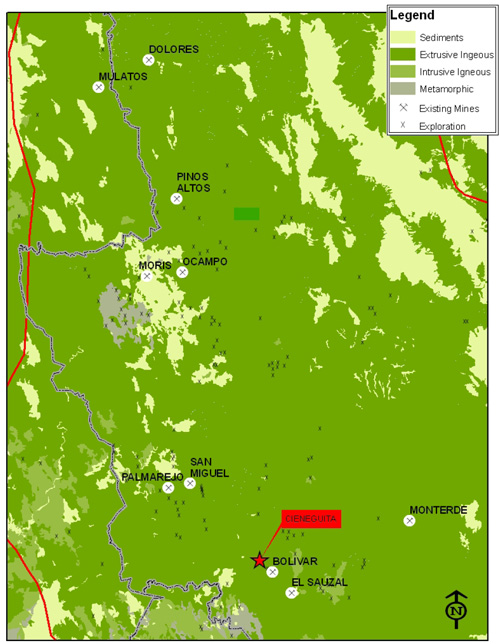

Since May 2004, the Company has held interests in gold exploration properties in Mexico.

In August 2005, the Company formed its wholly owned subsidiary, Sunburst de Mexico, which allowed the Company to take title to the properties in the name of Sunburst de Mexico. On August 25, 2005, the Company entered into property agreements with MRT, which provided Sunburst de Mexico options to purchase the mineral concessions of the Cieneguita and Guazapares properties and the right of refusal on three Encino Gordo properties. The Company also entered into an development and sale agreement, in October 2006, with Minera Emilio S.A. de C.V. for the mineral concessions of the Sahuayacan property.

In August 2005, the parties also entered into an operator’s agreement, that gave MRT the sole and exclusive right and authority to manage the Cieneguita property, and a share option agreement which granted MRT the exclusive option to acquire up to 100% of all outstanding shares of Sunburst de Mexico if the Company did not comply with the terms of the property agreements. The operator’s agreement and share option agreement were subsequently cancelled when the Company and Sunburst de Mexico entered into a new contract with MRT as described below under “Encino Gordo”.

In February 2009, the Company entered into An Exploration agreement with MRT, which was amended in December 2009. Pursuant to the terms of the amended development agreement, MRT agreed to invest up to $8,000,000 to put the first phase of the Cieneguita project into production and complete a feasibility study. The first phase of production is limited to the mining of the mineralized material that is available from the surface to a depth of 15 meters (“First Phase Production”). In exchange, the Company assigned MRT an interest to 74% of the net cash flows from First Phase Production and MRT would earn a 54% ownership interest by spending up to $4,000,000 to take the Cieneguita project through the feasibility stage.

In September 2011, the Company executed an amended and restated development agreement for the restructure of its Cieneguita joint venture related to the Cieneguita project. Under the restructured joint venture agreement the Company receives 20% of the net operating profits after royalties for material processed through a small-scale pilot operation and mined from the first 15 meters depth of the Cieneguita deposit until December 31, 2012. For all other material processed from the property, the Company's interest is 80% and MRT is reduced to a 20% working interest, subject to certain dilution provisions (note 6).

11

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

6.MINERAL PROPERTIES (continued)

The material provisions of the property agreements are as follows:

Cieneguita

MRT assigned to Sunburst de Mexico, with the permission of the Cieneguita property’s owner, Corporativo Minero, S.A. de C.V. (“Corporativo Minero”), all of MRT’s rights and obligations acquired under a previous agreement (the Cieneguita option agreement), including the exclusive option to acquire the Cieneguita property for a price of $2,000,000. Prior to assigning the Cieneguita property to the Company, MRT had paid $350,000 to Corporativo Minero. As the Cieneguita property was not in production by May 6, 2006, Sunburst de Mexico was required to pay $120,000 to Corporativo Minero to extend the contract. Corporativo Minero agreed to reduce the obligation to $60,000, of which $10,000 was paid in April 2006 and the balance paid on May 6, 2006. The Company made this payment to Corporativo Minero and the contract was extended.

The Company had the obligation to pay a further $120,000 per year for the next 13 years and the balance of the payments in the 14th year, until the total amount of $2,000,000 was paid. The Company renegotiated the payment due May 6, 2007, to $60,000 payable on November 6, 2007, which was paid, and the balance of $60,000 was paid on December 20, 2007. The Company paid $60,000 on May 12, 2008, of the $120,000 due on May 6, 2008, and the balance was paid in June 2008. The Company paid $30,000 each for a total of $120,000 on May 22, 2009, June 26, 2009, September 4, 2009 and November 20, 2009. In 2010, the Cieneguita project was put into production under the development agreement as described above and the payment terms were changed based on the following formula:

The Company must pay the Cieneguita owners $20 per ounce of gold produced from the Cieneguita property to the total of $2,000,000 due. In the event that the price of gold is above $400 per ounce, the property payments payable to the Cieneguita owners from production will be increased by $0.10 for each dollar increment over $400 per ounce. The total payment of $2,000,000 does not change with fluctuations in the price of gold. Non-payment of any portion of the $2,000,000 total payment will constitute a default. In such case, the Cieneguita owners will retain ownership of the concessions, but the Company will not incur any additional default penalty.

In September 2011, the Company, MRT and Corporativo Minero entered into a new agreement, where Corporativo Minero is entitled to a monthly payment of $30,000, to be paid from the net cash flows from production at Cieneguita until the completion of the first 15 meters of production or December 31, 2012, whichever occurs first.

Based on production at Cieneguita, the joint venture paid $90,000 during the three months ended May 31, 2012 (February 29, 2012 - $227,241) to the Cieneguita owners. As of May 31, 2012, Corporativo Minero has been paid a total of $1,267,241 for the Cieneguita property. The Company is not in default on its payments for the Cieneguita property.

12

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

6.MINERAL PROPERTIES (continued)

On February 12, 2009, the Company entered into a definitive agreement for development of the Cieneguita project with MRT. The definitive agreement covered project financing of up to $9,000,000. The major points of the agreement were as follows:

|

(i)

|

MRT and/or its investors will subscribe for $1,000,000 of a secured convertible debenture at 8% interest (payable in stock or cash). The debenture was convertible into units at $0.60 per unit. Each unit comprised two common shares and one warrant. Each warrant is exercisable at $0.50 per share for a period of three years. The placement will be used for continued development of the Company’s properties and general working capital.

|

|

(ii)

|

MRT is to provide the necessary working capital to begin and maintain mining operations estimated to be $3,000,000 used for the purpose of putting the Cieneguita property into production. MRT will spend 100% of the money to earn 75% of the net cash flow from production. The agreement will limit the mining to the mineralized material that is available from surface to a depth of 15 meters or approximately 10% of the mineralized material found to date.

|

|

(iii)

|

MRT will spend up to $5,000,000 to take the Cieneguita property through the feasibility stage. In doing so, MRT will earn a 60% interest in the Company’s rights to the property. After the expenditure of the $5,000,000 all costs will be shared on a ratio of 60% to MRT and 40% to the Company. If the Company elects not to pay its portion of costs after the $5,000,000 has been spent, the Company’s position shall revert to a 25% carried interest on the property.

|

To generate funding for the Company’s continued operations, the Company issued $1,500,000 of convertible debentures in March 2009, of which an aggregate of $880,000 was issued to Mario Ayub, a former director of the Company, and his affiliated entity, MRT. Pursuant to the terms of the convertible debentures, the holders irrevocably converted the debentures into a 10% ownership interest in the Cieneguita project and a 10% interest in the net cash flow from First Phase Production.

In December 2009, Mario Ayub and MRT agreed to resell an aggregate 4% ownership interest in the Cieneguita project back to the Company, along with 4% of the net cash flow from First Phase Production, in return for $550,000. In a private transaction not involving the Company, the other holders contributed their remaining 6% ownership interest in the Cieneguita project to a newly formed entity, Marje Minerals SA (“Marje Minerals”).

In December 2009, the Company amended the development agreement and its agreements with the debenture holders. According to the amended development agreement, the ownership interest in the Cieneguita project and the net cash flows from the First Phase Production were held by the Company, MRT and Marje Minerals as follows:

|

Holder

|

Ownership Percentage

|

Net Cash Flow Interest From First Phase Production

|

Net Cash Flow Interest Following First Phase Production

|

|

MRT

|

54% (1)

|

74%

|

54% (1)

|

|

Marje Minerals

|

6%

|

6%

|

6%

|

|

Panam

|

40%

|

20%

|

40%

|

(1) Was to be earned by MRT by spending $4,000,000 to take the Cieneguita project through the feasibility stage.

Any additional costs for the First Phase Production and the feasibility study for the Cieneguita project, after MRT invested $8,000,000, would have been shared by the Company, MRT and Marje Minerals on a pro-rata basis based on their respective ownership percentages in the Cieneguita project.

13

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

6.MINERAL PROPERTIES (continued)

The major terms of the amended development agreement with MRT and Marje Minerals were as follows:

|

(i)

|

MRT purchased $1,000,000 of secured convertible debentures at 8% interest (payable in stock or cash). The proceeds from this investment were used for continued development and exploration of the Cieneguita project and general working capital. On November 5, 2009, MRT exercised its conversion rights on the debenture and MRT was issued 3,333,333 common shares and a warrant to purchase 1,666,667 shares of common stock at an exercise price of $0.50 per share.

|

|

(ii)

|

MRT agreed to provide the necessary working capital to begin and maintain mining operations, estimated to be $3,000,000, to put the first phase of the Cieneguita project into production. In exchange for these funds, the Company assigned MRT an interest to 74% of the net cash flow from First Phase Production. The agreement limits the mining during First Phase Production to the mineralized material that is available from the surface to a depth of 15 meters.

|

|

(iii)

|

MRT committed to spend up to $4,000,000 to take the Cieneguita project through the feasibility stage. In doing so, the Company assigned MRT a 54% interest in its rights to the Cieneguita project. After the expenditure of the $4,000,000, all costs will be shared on a pro rata ownership basis (i.e. 54% to MRT, 40% to the Company and 6% to Marje Minerals). If any party cannot pay its portion of the costs after the $4,000,000 has been spent, then their ownership position in the Cieneguita project will be reduced by 1% for every $100,000 invested by the other owners. The Company’s ownership interest in the Cieneguita project, however, cannot be reduced below 25%. In addition, the Company has the right to cover Marje Minerals’ pro rata portion of costs if they cannot pay their portion of the costs. In return, the Company will receive 1% of Marje Minerals’ ownership position in the Cieneguita project for every $100,000 the Company invests on their behalf.

|

|

(iv)

|

The MRT agreement was contingent on the Company repaying its debenture to Paramount. In March 2009, the Company repaid $1,000,000, or approximately two-thirds of the debt, and Paramount released a security interest it had on the Cieneguita project. In October 2009, the Company repaid the remaining amount of the debt and Paramount released its security interests on the Sahuayacan, Guazapares and Encino Gordo properties.

|

In September 2011, the Company executed a new amended and restated development agreement with MRT and Marje Minerals, for the restructure of its Cieneguita joint venture. Under the restructured joint venture agreement the Company receives 20% of the net operating profits after royalties for material processed through a small-scale pilot operation and mined from the first 15 meters depth of the Cieneguita deposit until December 31, 2012. For all other material processed from the property, the Company's interest is 80% and MRT is reduced to a 20% working interest, subject to certain dilution provisions. The Company also bought back 6% interest in Cieneguita from Marje Minerals in exchange for 3,333,333 common shares of the Company.

14

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

6.MINERAL PROPERTIES (continued)

Under the agreement, the parties agreed to restructure their respective ownership interests in the Cieneguita project as follows:

|

Holder

|

Ownership Percentage

|

Net Cash Flow Interest From First Phase Production

|

Net Cash Flow Interest Following First Phase Production

|

|

MRT

|

20%

|

74%

|

20%

|

|

Marje Minerals

|

0%

|

6%

|

0%

|

|

Panam

|

80%

|

20%

|

80%

|

The Company and MRT shall be responsible for the cost of a feasibility study on a pro rata basis based on their respective amended ownership percentages of the Cieneguita project.

Marje Minerals will also assume approximately $490,000 in debt of the Company in consideration for receiving half of all monthly net cash flows that the Company is entitled from operations on the first 15 meters, if any, until the sooner of December 31, 2012 or until Marje Minerals receives $490,000 from these cash flows (note 7).

Encino Gordo

On December 8, 2005, the Company and Sunburst de Mexico entered into a “New Agreement” with MRT to exercise their option under the sale and purchase of the mining concessions agreement, dated August 18, 2005, to obtain two mining concessions in the Encino Gordo region. The New Agreement also provided the Company the option to obtain three additional concessions in the Encino Gordo region.

The following are additional material terms of the New Agreement:

|

(a)

|

The share option agreement with MRT was cancelled;

|

|

(b)

|

The Company granted MRT the option to buy all of the outstanding shares of Sunburst de Mexico for $100 if the Company failed to transfer $1,500,000 to Sunburst de Mexico by April 30, 2006. On April 6, 2006, MRT agreed to waive its option to purchase the shares of Sunburst de Mexico and also waived the Company’s obligation to transfer $1,500,000 to Sunburst de Mexico. The property agreements were modified to change the NSR to a maximum of 2.5% for all properties covered by the agreements. The property agreements contained NSRs ranging from 0.5% to 7%;

|

|

(c)

|

The Company agreed to issue 2,000,000 shares of the Company’s common stock to MRT within four months of the date of signing of the New Agreement. These shares were issued to MRT and its assignee at the market value of $1.05 per share on February 23, 2006, and $2,100,000 was charged to operations for the year ended February 28, 2006. This issuance fulfilled the Company’s payment obligations under the previous property agreements;

|

|

(d)

|

The Company agreed to issue 1,000,000 additional shares of the Company’s common stock to MRT if and when the Cieneguita property is put into production and reaches 85% of production capacity over a 90-day period, as defined in the New Agreement; and

|

|

(e)

|

The operator’s agreement with MRT was cancelled.

|

15

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

6.MINERAL PROPERTIES (continued)

Sunburst de Mexico purchased two of the Encino Gordo concessions from MRT for a price of 1,000 pesos (approximately US$100), and MRT assigned to Sunburst de Mexico a first right of refusal to acquire three additional Encino Gordo concessions. The total payments to acquire 100% of these three additional concessions were as follows: $10,000 on June 30, 2006 (paid); $25,000 on December 31, 2006 (paid), $50,000 on December 31, 2007 ($20,000 of this payment was made on January 3, 2008 and the balance was paid on February 29, 2008) and $75,000 on December 31, 2008 (the payment was not made and the Company was in default). In August 2009, the Company decided to surrender the Encino Gordo 2 mining concession eliminating any future concession payments on these properties.

In May 2012, the Company transferred its interest in concessions at the Encino Gordo project located in the Barranca region of Chihuahua State in Mexico, which included two concessions owned by the Company and two additional concessions the Company had the option to acquire, to MRT. In connection with the transfer, MRT paid $100,000 cash, waived $200,000 in payments the Company owed to MRT in connection with the Encino Gordo Project and agreed to assume all of the Company’s obligations related to the transferred concessions.

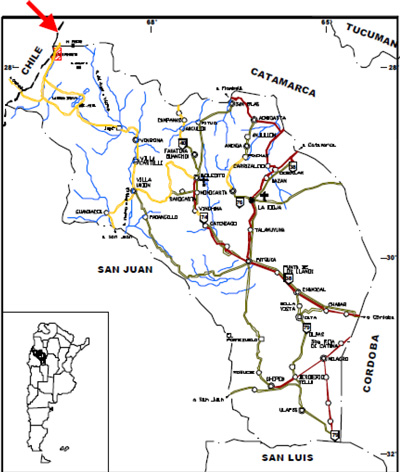

Cerro Delta

In February 2011, the Company management entered into an agreement with Compania Minera Alto Rio Salado S.A., a private Argentine entity, for the acquisition of the 15,000 hectare Cerro Delta project in northwest La Rioja Province, Argentina. Under the terms of the agreement, the Company must pay $150,000 upon signing (paid), and $200,000 on the first anniversary (the Company has paid $140,000 of the $200,000 amount due and is negotiating the terms for the balance of the payments), $500,000 on the second anniversary, $750,000 on the third anniversary, $1.2 million on the fourth anniversary, and $2.2 million on the fifth anniversary of the signing, with a final option payment of $5 million to purchase a 100% interest in the project payable on the sixth anniversary of the signing. The vendor will retain a 1% NSR (note 17).

16

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

|

7.

|

PROMISSORY NOTES

|

As at May 31, 2012, the Company had $nil (February 29, 2012 - $nil) of promissory notes outstanding, comprising the following:

|

(a)

|

During the year ended February 29, 2008, the Company converted accounts payable of $465,994 (Swiss Franc (“CHF”) 565,000) into promissory notes. The Company had an implied obligation to pay the accounts payable in CHF as the funds to pay the expense came from Swiss investors in CHF. Accordingly, the promissory notes were issued in CHF. The notes consisted of one warrant for each CHF 5.00 of notes issued, exercisable at $1.00 each. The principal and interest on the notes became due and payable on April 30, 2008. The interest rate payable during the default period was 12%. In September 2011, the Company executed debt conversion and release agreements to convert promissory notes and related interest charges in the amount of $1,091,645 into Company’s common shares for a total of 3,340,880 shares (note 10).

|

|

(b)

|

During the year ended February 29, 2012, the Company entered into an agreement to convert $17,778 of the promissory notes including accrued interest by issuing 55,000 shares of the Company’s common stock (note 10).

|

|

(c)

|

$10,358 of promissory notes were to be repaid over a 12 month period as part of a debt settlement agreement. These notes bore no interest. In September 2011, the Company assigned these notes to Marje Minerals as part of the amended and restated development agreement (note 6).

|

|

(d)

|

$28,113 of promissory notes bore no interest and had no repayment terms. In September 2011, the Company assigned these notes to Marje Minerals as part of the amended and restated development agreement (note 6).

|

|

8.

|

LOANS PAYABLE

|

As at May 31, 2012, there were loans payable in the amount of $6,484 (February 29, 2012- $12,887), which are all current. The loans are repayable in monthly instalments of $3,272 (February 29, 2012 – $3,272), including interest of 7.50% per annum.

|

9.

|

PREFERRED STOCK

|

The Company is authorized to issue 20,000,000 shares of preferred stock. The Company’s board of directors is authorized to divide the preferred stock into series, and with respect to each series, to determine the preferences and rights and qualifications, limitations or restrictions thereof, including the dividend rights, conversion rights, voting rights, redemption rights and terms, liquidation preferences, sinking fund provisions, and the number of shares constituting the series and the designations of such series. The board of directors could, without stockholder approval, issue preferred stock with voting and other rights that could adversely affect the voting rights of the holders of common stock, which issuance could have certain anti-takeover effects. There were no shares of preferred stock issued or outstanding at May 31, 2012 or February 29, 2012.

17

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

|

10.

|

COMMON STOCK

|

In May 2012, the Company converted subscription proceeds of $45,000 and issued 300,000 shares of common stock in a private placement. The subscribers to the subscription proceeds have agreed to purchase one unit for each $0.20 of subscription proceeds. Each unit consists of one share of the Company’s common stock and two warrants each exercisable at $0.20 and $0.30, which expire in two years.

In April 2012, the Company issued 235,294 common shares pursuant to a debt settlement agreement to settle $40,000 of debt. The shares were valued at the time of issuance at $0.17 per share.

In April 2012, the Company issued 250,000 common shares to a consultant pursuant to a consulting agreement. The shares were valued at the time of issuance at $0.18 per share.

In February 2012, the Company issued 500,000 shares of common stock and warrants to purchase 500,000 shares of common stock at $0.30, expiring on February 29, 2014, to a consultant.

Between September 2011 and February 2012, the Company converted subscription proceeds of $900,000 and issued 4,500,000 shares of common stock in a private placement. The subscribers to the subscription proceeds have agreed to purchase one unit for each $0.20 of subscription proceeds. Each unit consists of one share of the Company’s common stock and one warrant each exercisable at $0.30, which expires in two years.

In December 2011, the Company acquired 6% ownership interest in the Cieneguita project in exchange for 3,333,333 common shares, of which, the Company had issued 1,166,667 common shares as of February 29, 2012.

In October 2011, the Company and note holders agreed to cancel $979,476 of outstanding debt in exchange for 3,340,880 shares of the Company’s common shares. The Company recognized a gain on settlement of debt in the amount of $277,891. In November 2011, the Company also issued 267,271 shares to a consultant as consulting fee relating to the settlement of debt.

In August 2011, the Company negotiated return of 750,000 shares to the treasury from a former president. The shares were valued at the time of issuance at $0.28 per share.

In July 2011, the Company issued 500,000 shares of common stock and warrants to purchase 500,000 shares of common stock at $0.30, expiring on July 21, 2013, to a consultant.

In June 2011, the Company converted subscription proceeds of $300,000 and issued 1,500,000 shares of common stock in a private placement. The subscribers to the subscription proceeds have agreed to purchase one unit for each $0.20 of subscription proceeds. Each unit consists of one share of the Company’s common stock and one warrant each exercisable at $0.30, which expires in two years.

In June 2011, the Company issued 125,000 shares to a consultant pursuant to a consulting agreement.

In June 2011, the Company issued the 423,752 shares pursuant to the April 2011 debt settlement agreement. The shares were valued at the time of the debt settlement agreement of $0.28 per share.

In April 2011, the Company converted subscription proceeds of $347,000 and issued 1,735,000 shares of common stock in a private placement. The subscribers to the subscription proceeds have agreed to purchase one unit for each $0.20 of subscription proceeds. Each unit consists of one share of the Company’s common stock and one warrant each exercisable at $0.30, which expires in two years.

In March 2011, the Company converted subscription proceeds of $665,000 and issued 3,325,000 shares of common stock in a private placement. The subscribers to the subscription proceeds have agreed to purchase one unit for each $0.20 of subscription proceeds. Each unit consists of one share of the Company’s common stock and one warrant each exercisable at $0.30, which expires in two years.

In March 2011, the Company and a note holder agreed to cancel $17,778 in outstanding debt in exchange for 55,000 shares of the Company’s common stock.

In March 2011, the Company issued 500,000 shares of common stock and warrants to purchase 500,000 shares of common stock at $0.30, expiring on December 31, 2002, to a consultant.

18

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

|

11.

|

STOCK COMPENSATION PROGRAM

|

On March 18, 2009, the board of directors approved the granting of stock options according to the 2009 Nonqualified Stock Option Plan (“2009 Option Plan”) whereby the board is authorized to grant to employees and other related persons stock options to purchase an aggregate of up to 6,000,000 shares of the Company's common stock. Subject to the adoption of the 2009 Option Plan, the options were granted and vest, pursuant to the terms of the 2009 Option Plan, in six equal instalments, with the first instalment vesting at the date of grant, and the balance vesting over 2.5 years, every six months.

In the three months ended May 31, 2012, the Company awarded nil options to purchase common shares (May 31, 2011 – 1,600,000) and recorded stock-based compensation expense for the vesting options of $86,600 (May 31, 2011- $146,175). The following weighted average assumptions were used for the Black-Scholes option-pricing model to value stock options granted in 2012 and 2011:

|

2013

|

2012

|

||

|

Expected volatility

|

-

|

110.11%

|

|

|

Weighted-average volatility

|

-

|

110.11%

|

|

|

Expected dividend rate

|

-

|

-

|

|

|

Expected life of options in years

|

-

|

10

|

|

|

Risk-free rate

|

-

|

3.38%

|

There were no capitalized stock-based compensation costs at May 31, 2012 or May 31, 2011.

The summary of option activity under the 2009 Option Plan as of May 31, 2012, and changes during the period then ended, is presented below:

|

Weighted

|

Number of

|

Weighted-

|

Aggregate

|

||||

|

Average

|

Shares

|

Average

|

Intrinsic

|

||||

|

Exercise

|

Remaining

|

Value

|

|||||

|

Price

|

Contractual

|

||||||

|

Options

|

$

|

Term

|

|||||

|

Balance at March 1, 2012

|

0.34

|

6,215,000

|

|||||

|

Options granted

|

-

|

-

|

|||||

|

Options exercised

|

-

|

-

|

|||||

|

Options cancelled/forfeited

|

-

|

-

|

|||||

|

Balance at May 31, 2012

|

0.34

|

6,215,000

|

7.39

|

-

|

|||

|

Exercisable at May 31, 2012

|

0.37

|

4,915,002

|

7.02

|

-

|

|||

The weighted-average grant-date fair value of options granted during the three months ended May 31, 2012 and May 31, 2011 was $nil and $0.27, respectively.

19

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

11.STOCK COMPENSATION PROGRAM (continued)

A summary of the status of the Company’s non-vested options as of May 31, 2012, and changes during the three months ended May 31, 2012, is presented below:

|

Weighted-average

|

||||

|

Grant-Date

|

||||

|

Non-vested options

|

Shares

|

Fair Value

|

||

|

$

|

||||

|

Non-vested at February 29, 2012

|

1,566,665

|

0.26

|

||

|

Granted

|

-

|

-

|

||

|

Vested

|

(266,667)

|

0.27

|

||

|

Cancelled/forfeited

|

-

|

-

|

||

|

Non-vested at May 31, 2012

|

1,299,998

|

0.27

|

As of May 31, 2012, there was an estimated $291,000 of total unrecognized compensation cost related to non-vested share-based compensation arrangements granted under the 2009 nonqualified stock option plan. That cost is expected to be recognized over a weighted-average period of approximately 1.30 years.

On April 29, 2011, the Company repriced the exercise price of 1,125,000 vested stock options by reducing the exercise prices of $0.36 and $0.44 to $0.28. As a result, the Company recorded incremental stock-based compensation of $6,000 during the year ended February 29, 2012.

20

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

|

12.

|

WARRANTS

|

As at May 31, 2012, the Company had a total of 32,709,567 warrants (February 29, 2012 – 32,011,733) outstanding to purchase common stock. Each warrant entitles the holder to purchase one share of the Company’s common stock. The Company has reserved 32,709,567 shares of common stock in the event that these warrants are exercised.

During the three months ended May 31, 2012, the Company received $nil from warrants exercised.

The following table summarizes the continuity of the Company’s share purchase warrants:

|

Number of

Warrants

|

Weighted Average Exercise Price

|

||

|

Balance, February 28, 2011

|

25,826,733

|

$

|

0.41

|

|

Issued

|

19,060,000

|

0.30

|

|

|

Cancelled/expired

|

(12,875,000)

|

0.30

|

|

|

Exercised

|

-

|

-

|

|

|

Balance, February 29, 2012

|

32,011,733

|

$

|

0.35

|

|

Issued

|

1,600,000

|

0.25

|

|

|

Cancelled

|

(902,166)

|

0.59

|

|

|

Exercised

|

-

|

-

|

|

|

May 31, 2012

|

32,709,567

|

$

|

0.34

|

As at May 31, 2012, the following share purchase warrants were outstanding:

|

Number of Warrants

|

Exercise Price

|

Expiry Date

|

|

|

$

|

|||

|

300,000

|

0.20

|

May 15, 2014

|

|

|

1,000,000

|

0.25

|

April 30, 2022

|

|

|

300,000

|

0.30

|

May 15, 2014

|

|

|

3,000,000

|

0.25

|

July 26, 2020

|

|

|

300,000

|

0.25

|

August 22, 2021

|

|

|

200,000

|

0.25

|

September 6, 2013

|

|

|

500,000

|

0.30

|

December 31, 2012

|

|

|

3,325,000

|

0.30

|

March 17, 2013

|

|

|

1,735,000

|

0.30

|

April 13, 2013

|

|

|

500,000

|

0.30

|

April 29, 2021

|

|

|

1,500,000

|

0.30

|

June 2, 2013

|

|

|

500,000

|

0.30

|

July 21, 2013

|

|

|

4,400,000

|

0.30

|

December 30, 2013

|

|

|

5,000,000

|

0.30

|

December 29, 2016

|

|

|

500,000

|

0.30

|

February 20, 2014

|

|

|

100,000

|

0.30

|

February 28, 2014

|

|

|

500,000

|

0.30

|

February 15, 2022

|

|

|

525,000

|

0.50

|

August 15, 2012

|

|

|

1,666,667

|

0.50

|

November 5, 2012

|

|

|

5,000,000

|

0.50

|

December 24, 2020

|

|

|

200,000

|

0.65

|

June 30, 2012

|

|

|

1,257,900

|

0.75

|

June 2012 to August, 2013

|

|

|

200,000

|

1.30

|

June 30, 2012

|

|

|

200,000

|

2.00

|

June 30, 2012

|

|

|

32,709,567

|

21

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Three Months Ended May 31, 2012

|

13.

|

RELATED PARTY TRANSACTIONS

|

For the three months ended May 31, 2012, the Company paid or accrued management and directors fees of $120,500 (May 31, 2011- $91,000) to certain officers and directors. The Company also paid or accrued $150,556 (May 31, 2011 - $256,350) to certain officers and directors for exploration property, finders’ fee, travel, office and other related expenses.

The Company also paid consulting fees of $nil (May 31, 2011 - $24,000) to a company owned by a director.

As at May 31, 2012, accounts payable of $273,531 (May 31, 2011 - $474,294) was owing to directors and officers of the Company and $nil (May 31, 2011 - $1,826) was owing to a company controlled by a director. In addition, promissory notes of $nil (May 31, 2011 - $11,130) were owed to a company controlled by a director.

All related party transactions are in the normal course of business at the exchange amount agreed to by each party.

|

14.

|

SUPPLEMENTAL CASH FLOW INFORMATION

|

|

Three months ended

May 31,

2012

|

Three months ended

May 31,

2011

|

Period From Inception of Exploration Stage (March 1, 2004) to

May 31,

2012

|

||||

|

$

|

$

|

$

|

||||

|

Interest paid

|

-

|

-

|

310,053

|

|||

|

Common stock issued on conversion of debt

|

40,000

|

10,000

|

4,361,651

|

|||

|

Common stock issued on settlement of notes payable

|

-

|

17,778

|

3,908,812

|

|||

|

Common stock issued for interest costs

|

-

|

-

|

82,500

|

|||

|

Common stock issued for financing costs

|

-

|

-

|

145,000

|

|||

|

Common stock issued for mineral property costs

|

-

|

-

|

799,333

|

|||

|

Common stock issued for bonuses

|

-

|

-

|

512,750

|

|||

|

Shares issued for services

|

45,000

|

127,500

|

921,840

|

|

15.

|

SUBSEQUENT EVENTS

|

In June 2012, the Company issued 194,444 common shares pursuant to a debt settlement agreement to settle $20,000 of debt. The shares were valued at the time of issuance at $0.10 per share.

On July 13, 2012, the Company completed a $2.1 million private placement offering (the “Offering”). In the Offering, the Company issued 17,500,000 shares of its common stock at a subscription price of $0.12 per share. Of the aggregate purchase price, $1,050,000 was paid in cash and $1,050,000 was paid through the transfer of real property in Argentina valued at $1,050,000.

The Company intends to liquidate the real property it acquired as soon as practical. The Company intends to use the net proceeds from the Offering for working capital and general corporate purposes, including supporting the scoping study for its Cieneguita Project in Mexico and the exploration program for its Cerro Delta Project in Argentina.

The Company paid a finder’s fee of $84,000 and 700,000 shares of common stock.

On July 16, 2012, the Board of Directors of the Company approved the conversion of outstanding fees in the amount of $51,900 owed to the Company’s directors into shares of the Company’s common stock, at a conversion price of $0.10 per share.

22

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this Form 10-Q, including statements in the following discussion which are not statements of historical fact, constitute "forward-looking statements". These statements, which may be identified by words such as “plans”, “intends”, "anticipates", “hopes”, “seeks”, “will”, "believes", "estimates", "should", "expects" and similar expressions include our expectations and objectives regarding our present and future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in such forward-looking statements. Numerous factors and future events could cause us to change such plans and objectives or fail to successfully implement such plans or achieve such objectives, or cause such present and future operations to fail to produce revenues, income or profits. Such risks and uncertainties include those set forth under this Item 2, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere in this Form 10-Q and in our Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”). These forward-looking statements represent beliefs and assumptions only as of the date of this report. We undertake no obligation to update the forward-looking information to reflect actual results or changes in the factors affecting such forward-looking information. No statements contained in the following discussion should be construed as a guarantee or assurance of future performance or future results. We advise you to carefully review the reports and documents we file from time to time with the SEC, particularly our annual reports on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K. As used in this management’s discussion and analysis, the terms “Pan American”, the “Company”, “we”, “us”, and “our” mean Pan American Goldfields Ltd.

Overview

We are a development stage company and have generated only limited revenues from our Cieneguita project to date, and have not yet generated or realized any revenue from our other exploration projects. As of May 31, 2012, we had $74,819 in our bank account.

In September 2011, we executed an amended and restated development agreement (the ”Agreement”) pursuant to a binding letter agreement signed in June 2011 with Minera Rio Tinto, S.A. de C.V. an entity organized under the laws of the United Mexican States (“MRT”) and Marje Minerals S.A., an entity organized under the laws of the United Mexican States (“Marje Minerals”), concerning the restructuring of the prior agreements between the parties, including their respective ownership interests in our Cieneguita project in Chihuahua State, Mexico.

The parties agreed to restructure their respective ownership interests in the Cieneguita project as follows:

|

Holder

|

Ownership Percentage

|

Net Cash Flow Interest From First Phase Production

|

Net Cash Flow Interest Following First Phase Production

|

|

MRT

|

20%

|

74%

|

20%

|

|

Marje Minerals

|

0%

|

6%

|

0%

|

|

Pan American

|

80%

|

20%

|

80%

|

We receive 20% of the net operating profits after royalties for material processed through a small-scale pilot operation and mined from the first 15 meters depth of the Cieneguita deposit until December 31, 2012. To discourage deeper mining by MRT all other material processed (below 15 meters) from the property, our interest is 80% and MRT is reduced to a 20% working interest, subject to certain dilution provisions. In comparison, the current market rate for contract mining in the region is for the property owner to receive approximately 20% of net cash flow while the contract miner receives 80% for mining and processing and selling the resulting concentrate.

Pan American and MRT shall be responsible for the cost of the feasibility study on a pro rata basis based on their respective amended ownership percentages of the Cieneguita project.

In August 2011, we appointed Hernan Celorrio as an advisor to the board of directors and as a director of Recursos Argentinos SA, our newly formed subsidiary in Argentina. Mr. Celorrio, a lawyer, is an expert in Argentinean mining law and has an extensive background in the industry. He is currently the vice president of the Argentine-Chilean Chamber of Commerce and a director of the executive committee and president of the Mining Committee of the Argentine Canadian Chamber of Commerce. He is also the president of the Argentine Mining Foundation (FUNDAMIN).

In July 2011, we entered into an agreement with M3 Engineering and Technology Corporation (“M3”) for the execution and completion of a National Instrument 43- 101 (“NI 43-101”) compliant Preliminary Economic Assessment (“PEA”) for the Cieneguita project.

23

In February 2011, we entered into an agreement with Compania Minera Alto Rio Salado S.A., a private Argentine entity, for the acquisition of the 15,000-hectare Cerro Delta Project in northwest La Rioja Province, Argentina. Under the terms of the agreement, we must pay $150,000 upon signing (paid), $200,000 (the Company has paid $140,000 and is negotiating payment for the remainder) on the first anniversary, $500,000 on the second anniversary, $750,000 on the third anniversary, $1.2 million on the fourth anniversary, and $2.2 million on the fifth anniversary of the signing, with a final option payment of $5 million to purchase a 100% interest in the Cerro Delta Project payable on the sixth anniversary of the signing. The vendor will retain an 1% net smelter revenue (“NSR”).

In conjunction with the acquisition of the Cerro Delta Project, we completed a private placement of 6,560,000 units at $0.20 per unit, for total proceeds of $1,312,000. Each unit consists of one share of common stock and a warrant to purchase one share of common stock. Each warrant is exercisable for one share of common stock at a conversion price of $0.30 for a period of two years from the closing date.

In October 2010, we appointed Miguel F. Di Nanno as President and Chief Operating Officer, replacing George Young effective as of October 15, 2010. Mr. Young remains on our board of directors. Mr. Di Nanno has experience in mining and energy exploration and most recently served as president of Somuncurah S.R.L. and AupaS.A., both exploration and development firms focused in Argentina. He has also previously served as the chief operating officer of the Grosso Group, an exploration and new mining business development firm and as the representative and country manager in Argentina for Palladon Ventures Ltd., a gold and silver exploration company. He has a degree in Mining Engineering – Ore Dressing from the National University of San Juan.

In July 2010, we appointed Neil Maedel, Randy Buchamer and Gary Parkison to our board of directors. Mr. Maedel is an investment banker specializing in international resource projects; Mr. Buchamer has extensive experience in business administration and finance; and Mr. Parkison is qualified geologist and project manager with expertise in exploration and development of minerals and metals projects. All of the newly appointed directors have technical and financial industry experience base that will assist us with operations and our planned listing on either the Toronto Stock Exchange or the TSX Venture Exchange, consistent with our status as a producing resource company.

In July 2010, we reincorporated from the State of Colorado to the State of Delaware. The reincorporation was effected pursuant to an agreement and plan of merger (the “Merger Agreement”), by and between us and Pan American Goldfields Ltd., a Colorado corporation (formerly Mexoro Minerals Ltd.), with Pan American being the surviving corporation. Accordingly, the rights of our shareholders are now governed by Delaware General Corporation Law and the certificate of incorporation and bylaws of Pan American are filed with the State of Delaware.

In May 2010, management decided to drop the Sahuayacan Project due to lack of economic thicknesses and grades of gold mineralization encountered in the drilling program, eliminating any future concession payments for this Project.

Our continued existence and plans for future growth depend on the receipt of funds from our partner MRT from the ongoing operations at the Cieneguita Project. Should there be an interruption in this cash flow it will be necessary to obtain additional capital to operate either through the issuance of additional debt or equity.