Attached files

| file | filename |

|---|---|

| S-1/A - AMENDMENT NO.2 TO FORM S-1 - Pentair Ltd. | d269062ds1a.htm |

| EX-5.1 - OPINION OF HOMBURGER AG - Pentair Ltd. | d269062dex51.htm |

| EX-3.2 - FORM OF ORGANIZATIONAL REGULATIONS - Pentair Ltd. | d269062dex32.htm |

| EX-3.1 - FORM OF ARTICLES OF ASSOCIATION - Pentair Ltd. | d269062dex31.htm |

| EX-8.1 - OPINIONS OF MCDERMOTT WILL & EMERY LLP - Pentair Ltd. | d269062dex81.htm |

| EX-3.3 - FORM OF COMMON SHARE CERTIFICATE - Pentair Ltd. | d269062dex33.htm |

| EX-10.1 - FORM OF TRANSITION SERVICES AGREEMENT - Pentair Ltd. | d269062dex101.htm |

| EX-10.2 - FORM OF 2012 TAX SHARING AGREEMENT - Pentair Ltd. | d269062dex102.htm |

| EX-21.1 - SUBSIDIARIES OF TYCO FLOW CONTROL INTERNATIONAL, LTD. - Pentair Ltd. | d269062dex211.htm |

Exhibit 8.2

July 17, 2012

Merger of Panthro Merger Sub, Inc.

with and into Pentair, Inc.

Ladies and Gentlemen:

We have acted as counsel for Pentair, Inc. (the “Company”), a Minnesota corporation, in connection with the proposed merger (the “Merger”) of Panthro Merger Sub, Inc. (“Merger Sub”), a Minnesota corporation and a wholly owned indirect subsidiary of Tyco Flow Control International Ltd. (“Spinco”), a corporation limited by shares (Aktiengesellschaft) organized under the laws of Switzerland, with and into the Company with the Company surviving, pursuant to the Merger Agreement, dated as of March 27, 2012, by and among the Company, Merger Sub, Spinco, Panthro Acquisition Co. (“AcquisitionCo”), a Delaware corporation and a wholly owned direct subsidiary of Spinco, and Tyco International Ltd. (“Tyco International”), a corporation limited by shares (Aktiengesellschaft) organized under the laws of Switzerland (the “Merger Agreement”), and described by the registration statement on Form S-4 (Registration No. 333-181250) and the registration statement on Form S-1 (Registration No. 333-181253), each filed by Spinco with the Securities and Exchange Commission (the “SEC”) on May 8, 2012, which includes in each case the Proxy Statement/Prospectus, and any amendments thereto (the “Registration Statements”).

Any capitalized term used herein and not otherwise defined shall have the meaning given to such term in the Merger Agreement and the Other Transaction Agreements (as defined in the Merger Agreement and which include the Separation and Distribution Agreement and the Tax Sharing Agreement). References to any agreement or document include all schedules and exhibits thereto.

Pursuant to Section 5.10(b) of the Merger Agreement, you have requested that we render the opinion set forth below. In rendering our opinion, we have examined (i) the Merger Agreement and the Other Transaction Agreements, (ii) the Registration

Statements, (iii) the representations made by Tyco International, Spinco, AcquisitionCo and Merger Sub in their letter, dated as of the date hereof, and by the Company in its letter, dated as of July 16, 2012, in each case delivered to us for purposes of this opinion (the “Representation Letters”), (iv) the request for rulings related to the Merger submitted by Tyco International, Spinco and the Company to the Internal Revenue Service (the “IRS”), including all exhibits and enclosures (as modified by all supplemental submissions thereto) (the “Ruling Request”), and (v) such other documents and corporate records as we have deemed necessary or appropriate for purposes of our opinion. In such examination, we have assumed the genuineness of all signatures, the legal capacity of natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as duplicates or certified or conformed copies and the authenticity of the originals of such latter documents. We have not, however, undertaken any independent investigation of any factual matter set forth in any of the foregoing.

In rendering this opinion, we have assumed, with your consent, that (i) the Distribution and the Merger will be consummated in accordance with the provisions of the Merger Agreement and the Other Transaction Agreements and the Ruling Request (without waiver or modification of any provisions thereof), (ii) the statements concerning the Distribution and the Merger set forth in the Merger Agreement and the Other Transaction Agreements, the Registration Statements and the Ruling Request are, and will remain, true, complete and correct at all times up to and including the Effective Time (iii) the representations made by Tyco International, Spinco, AcquisitionCo, Merger Sub and the Company in the Representation Letters are, and will remain, true, complete and correct at all times up to and including the Effective Time and (iv) any statement or representation made in the Merger Agreement, the Other Transaction Agreements, the Representation Letters or the Ruling Request qualified by belief, knowledge, materiality or any similar qualification is true, correct and complete without such qualification. We have also assumed that the parties have complied with and, if applicable, will continue to comply with, the covenants contained in the Merger Agreement and the Other Transactions Agreements. If any of these assumptions are untrue for any reason, our opinion as expressed below may be adversely affected and may not be relied upon.

Our opinion is based on current provisions of the Internal Revenue Code of 1986, as amended (the “Code”), Treasury Regulations promulgated thereunder, published pronouncements of the IRS and case law, any of which may be changed at any time with retroactive effect. Any change in applicable laws or the facts and circumstances surrounding the Merger, or any inaccuracy in the statements, facts, assumptions or representations upon which we have relied, may affect the continuing validity of our opinion as set forth herein. We assume no responsibility to inform you of any such change or inaccuracy that may occur or come to our attention. Finally, our opinion is limited to the tax matters specifically covered hereby. No opinion should be inferred as to (i) any other tax consequences of the Merger or (ii) the tax consequences of the Merger under any state, local or foreign law, or with respect to other areas of United States Federal taxation. We are members of the Bar of the State of New York, and we do not express any opinion herein concerning any law other than the federal law of the United States.

2

Based upon the foregoing, and subject to the limitations, qualifications and assumptions set forth herein, we are of opinion that (i) the Merger will be treated as a tax-free reorganization within the meaning of Section 368(a) of the Code, (ii) Spinco, AcquisitionCo and the Company each will be a “party to the reorganization” within the meaning of Section 368(b) of the Code and (iii) the transfer of common stock of the Company by the Company shareholders pursuant to the Merger, other than by shareholders of the Company who are U.S. persons and are or will be “five-percent transferee shareholders” within the meaning of Treasury Regulation Section 1.367(a)-3(c)(5)(ii) but who do not enter into gain recognition agreements within the meaning of Treasury Regulation Sections 1.367(a)-3(c)(1)(iii)(B) and 1.367(a)-8, will qualify for an exception to Section 367(a)(1) of the Code.

We are furnishing this opinion to you solely in connection with the filing of the Registration Statements. We hereby consent to the filing of this opinion with the SEC as an exhibit to each of the Registration Statements. In giving this consent, we do not thereby concede that we are within the category of persons whose consent is required under Section 7 of the Act or the General Rules and Regulations of the SEC thereunder.

| Very truly yours, |

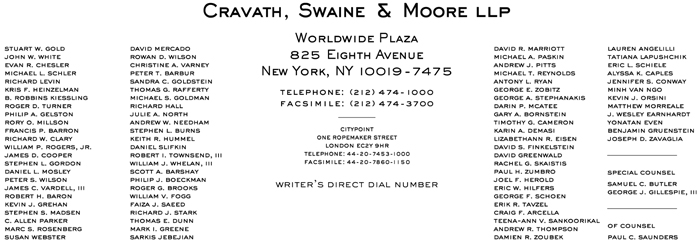

| /s/ Cravath, Swaine & Moore LLP |

Pentair, Inc.

5500 Wayzata Boulevard, Suite 800

Golden Valley, Minnesota 55416

3