Attached files

As filed with the Securities and Exchange Commission on July 17, 2012

Registration Statement No.333-●

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

GRYPHON GOLD CORPORATION

(Exact name of registrant as specified in its charter)

|

Nevada

|

1041

|

92-0185596

|

||

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer Identification No.)

|

611 N. Nevada Street

Carson City, Nevada 89703

(604) 261-2229

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dorsey & Whitney LLP

1400 Wewatta Street

Suite 400

Denver, Colorado 80202

(303) 629-3400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Kenneth G. Sam, Esq.

Jason K. Brenkert, Esq.

Dorsey & Whitney LLP

1400 Wewatta Street

Suite 400

Denver, Colorado 80202

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. x

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (Check one):

| Large Accelerated Filer o | Accelerated Filer | Non-Accelerated Filer o | Smaller Reporting Company x |

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be

registered |

Amount

to be registered

|

Proposed maximum

offering price per unit |

Proposed maximum

aggregate offering price |

Amount of

registration fee (4)

|

|

Common Stock acquirable upon exercise of Series O Warrants to be offered for resale by selling stockholders (1)

|

3,250,000

|

$0.1175

|

$376,000

|

$43.09

|

|

Common Stock acquirable upon exercise of Series R Warrants to be offered for resale by selling stockholders (2)

|

1,500,000

|

$0.1175

|

$176,250

|

$20.20

|

|

Common Stock acquirable upon exercise of Series T Warrants to be offered for resale by selling stockholders (3)

|

14,062,500

|

$0.1175

|

$1,652,344

|

$189.36

|

|

TOTAL

|

18,812,500

|

$2,204,594

|

$253.32

|

|

|

(1)

|

Consisting of shares of common stock issuable upon exercise of Series O Warrants at $0.30 per share, expiring on January 21, 2013.

|

|

|

(2)

|

Consisting of shares of common stock issuable upon exercise of Series R Warrants at Cdn$0.1862 per share, expiring on March 20, 2015.

|

|

|

(3)

|

Consisting of shares of common stock issuable upon exercise of Series T Warrants at Cdn$0.16 per share, expiring on April 18, 2015.

|

|

|

(4)

|

The registration fee is calculated pursuant to Rule 457(c) of the Securities Act based on the average of the high and low bid price of the Registrant’s common stock on July 12, 2012, as reported by the FINRA OTC Bulletin Board.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended (the “Securities Act”), or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| The information contained in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted . |

Subject To Completion: Dated July 17, 2012

PRELIMINARY PROSPECTUS

Gryphon Gold Corporation

18,812,500 SHARES OF COMMON STOCK

This prospectus relates to the sale, transfer or distribution of up to 18,812,500 shares of common stock, par value $0.001 per share, of Gryphon Gold Corporation by the selling security holders described herein. The price at which the selling security holders may sell the shares of common stock will be determined by the prevailing market price for the shares or in negotiated transactions. The shares of common stock registered for resale include:

|

●

|

3,250,000 shares of common stock acquirable by selling security holders upon exercise of Series O Warrants at $0.30 per share, until January 21, 2013;

|

|

●

|

1,500,000 shares of common stock acquirable by selling security holders upon exercise of Series R Warrants at Cdn$0.1862 per share, until March 20, 2015; and

|

|

●

|

14,062,500 shares of common stock acquirable by selling security holders upon exercise of Series T Warrants at Cdn$0.16 per share,until April 18, 2015.

|

We will not receive any proceeds from the sale or distribution of the common stock by the selling security holders. We may receive proceeds from the exercise of the warrants, if any, and will use the proceeds from any exercise for general working capital purposes.

Our common stock is currently listed on the Over-the-Counter Bulletin Board under the symbol ‘‘GYPH.OB” and on the Toronto Stock Exchange under the symbol “GGN”. As of July 12, 2012, the last reported sale price of our common stock was $0.12 per share on the Over-the-Counter Bulletin Board and Cdn.$0.12 per share on the Toronto Stock Exchange. We convert Canadian dollar data into United States dollars using the noon rate of exchange of Cdn$1.00 = US$1.02 on June 29, 2012 as reported by the Bank of Canada.

Investing in our common stock involves a high degree of risk. You should read this entire prospectus carefully, including the section entitled "Risk Factors" beginning on page 13.

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

THE DATE OF THIS PROSPECTUS IS JULY 17, 2012

TABLE OF CONTENTS

You should rely only on the information contained or incorporated by reference in this prospectus and in any free writing prospectus that we have authorized for use in connection with this offering. Neither we, the underwriter nor the Canadian agent has authorized any other person to provide you with additional or different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we, the underwriter nor the Canadian agent is making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Some of the industry and market data contained in this prospectus are based on independent industry publications or other publicly available information, while other information is based on our internal sources. Although we believe that each source is reliable as of its respective date, the information contained in such sources has not been independently verified, and neither we, the underwriter nor the Canadian agent can assure you as to the accuracy or completeness of this information.

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before buying shares of our common stock. You should read the entire prospectus carefully, especially the "Risk Factors" section and our consolidated financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in shares of our common stock. Unless the context provides otherwise, all references to “Gryphon,” “Gryphon Gold,” “we,” us,” “our,” or similar terms, refer to Gryphon Gold Corporation and its wholly owned subsidiaries.

In this prospectus all references to "$" or "dollars" mean the U.S. dollar, and unless otherwise indicated all currency amounts in this prospectus are stated in U.S. dollars. All references to "Cdn.$" refer to the Canadian dollar. All financial statements have been prepared in accordance with accounting principles generally accepted in the United States and are reported in U.S. dollars.

The Company

Incorporation and Address

We, Gryphon Gold Corporation, were formed under the laws of the State of Nevada on April 24, 2003.

We own 100% of the issued and outstanding shares of our operating subsidiary, Borealis Mining Company, which we refer to as “BMC”. BMC was formed under the laws of the State of Nevada on June 5, 2003.

Our principal business office, which also serves as our administration and financial office, is located in the United States at 611 N. Nevada Street, Carson City, Nevada, 89703 and our telephone number is (604) 261-2229.

Business Overview

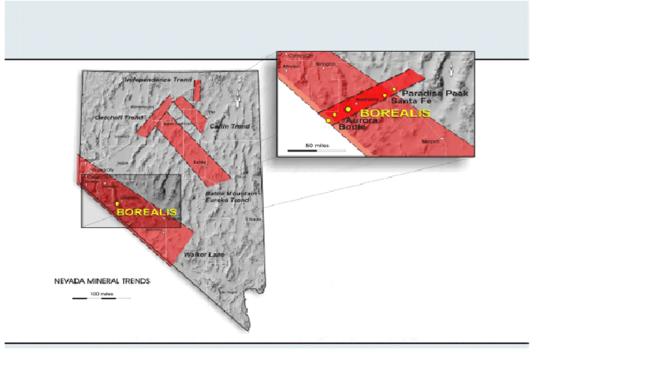

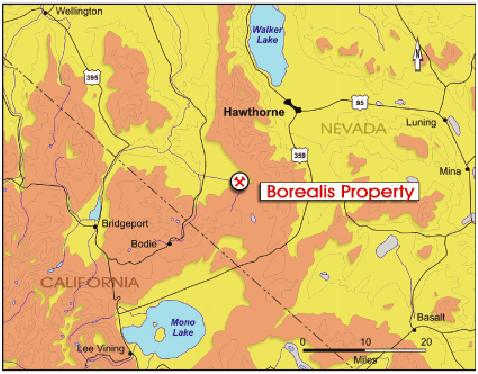

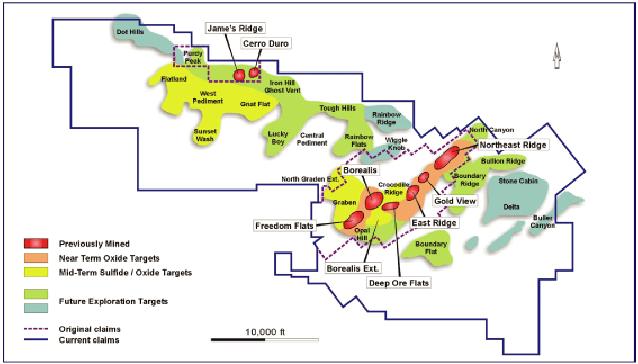

Gryphon Gold is in the business of acquiring, exploring, and developing gold properties in the United States, emphasizing the State of Nevada. Our objective is to increase value of our shares through the exploration, development and extraction of gold deposits, on our Borealis Property, located in Nevada’s Walker Lane Gold Belt.

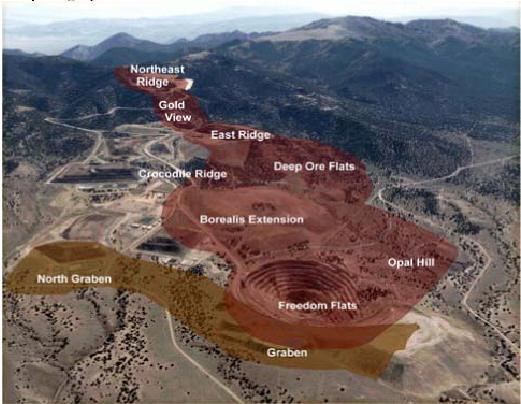

In the spring of 2010, we developed a plan for the start-up of the Borealis Project on a staged basis. The object of the plan was to raise sufficient capital to begin gold recovery and to use internal cash flow to grow the operation to the full 42,000 ounces per year as presented in the 2009 Study design. All of the capital and operating cost were based upon the 2009 Study design and numbers, with updates of critical operating parameters and confirmation of critical capital expenditures.

On October 21, 2010, we announced that we had developed a new strategic plan to potentially expedite production at the Borealis Property. The focus was to finalize critical data pertaining to the Freedom Flats releach at the Borealis Property and then to finance the scaled-down version of the mine start-up. The Phase 1 concept of the board of directors’ (the “Board”) plan is to begin gold recovery from the previously mined and partially leached Freedom Flats oxide heap. The plan required the construction of a new leach pad and ponds. Gold recovery to bullion was planned to occur in the fourth month after ground breaking and would have occurred through a toll process or at an Adsorption Desorption Recovery plant (referred to as an “ADR”).

In November 2010, we began the sample collection from the Freedom Flats releach to confirm the critical data pertaining to heap gold grade (oz. per ton) and gold and silver recovery. Metallurgical test work, being conducted by an independent Nevada testing firm, began in November 2010.

In April 2011, we received the Pre-Feasibility Study which provided updated capital and operating cost estimates for our plan. The object of Phase 1 was to raise sufficient capital to begin gold recovery and to use internal cash flow to expand operations to allow us to extract in excess of 42,000 ounces per year gold equivalent Pre-Feasibility Study design, although our current target is to extract 25,000 to 30,000 ounces of gold and gold equivalents. The plan contemplated the construction of a leach pad and ponds. The April 2011 Pre-Feasibility Study shows an average annual production of over 42,000 ounces a year gold-equivalent for six years, $12.7 million in initial capital costs (consisting of initial construction costs of $8.61 million, bonding costs of $3 million, $0.41 million in additional indirect capital costs and a $0.75 million contingency) and average life-of-mine cash operating cost of $851 per ounce of gold. While the Pre-Feasibility Study forms the basis for the classification of some of the gold and silver resources on the Borealis Property as proven or probable reserves, as defined in accordance with the Definition Standards on Mineral Resources and Mineral Reserves of the Canadian Institute of Mining, Metallurgy and Petroleum, adopted for the purposes of NI 43-101, the Pre-Feasibility Study is not a bankable feasibility study and cannot form the basis for proven or probable reserves on the Borealis Property for the purposes of U.S. securities laws. For the purposes of reporting under U.S. securities laws, only a “final” or “bankable” feasibility study which uses the three-year, historical average price may form the basis of the classification of mineralization as “proven reserves” or “probable reserves.

Pursuant to the Pre-Feasibility Study, Phase 1 of our plan was anticipated to cost approximately $12.7 million and to provide cash flow that will fund Phase 2. This next Phase was anticipated to expand the leach pad; increase the crushing and mining equipment; construct the permanent gold recovery plant and begin mining in the Borealis Property’s East Ridge open pit. Cash flows from the Phase 2 is expected to provide the capital required to expand the mine to full production. The main activities associated with full production were: push back of the Freedom Flats pit exposing high grade oxide gold, development of roads

7

and infrastructure, and pre-stripping and development of the remaining oxide reserves. The capital was also anticipated to provide the funding needed to continue the exploration required to expand the oxide resources for expansion of mine life.

Based upon our plan under the Pre-Feasibility Study and the financing Gryphon Gold obtained in May 2011, Gryphon Gold broke ground on June 6, 2011. The loading of material to the heap leach pad commenced on August 13, 2011 and we shipped gold and silver loaded on carbon on October 8, 2011 to and independent refiner.

In the course of initial development, the Borealis Project was severely limited in the amount of material that could be placed on the leach pad as a result of the contractor being unable to produce the leach pad overliner in a timely manner. This challenge was not remedied until mid-December, 2011. Also during this period the crusher was removed from the site for nearly two months for emergency maintenance and a smaller less efficient temporary crusher was used, however tonnage delivery was reduced as this crusher availability was limited due to unforeseen continual maintenance requirements. In addition, the pump that delivers solutions to the leach pad from the barren ponds was undersized, resulting in a reduced flow to the pad of less than 50% of design capacity. This problem was remedied in March 2012, with the installation of an additional pump. Because of these delays and challenges, additional financing was required to complete and develop Phase II, and we successfully closed a $15,000,000 financing on April 12, 2012.

Phase II is anticipated to include a leach pad expansion and mobilization of a larger crusher unit as well as the completion of the ADR. In order to get to expand production mining activities we will have to commence in the Borealis Pit. Main activities to expand the Borealis Project’s production will include;

|

●

|

Development of roads, power and other infrastructure

|

|

●

|

Pre-stripping and development of the remaining oxide reserves

|

|

●

|

Efficient mining and processing of approximately 3-5 million tons per year

|

The initial mine plan is estimated at 3 years with an additional 3 years if drilling will confirm our current oxide resource In year seven reclamation will begin with heap wash down. Expansion of the mine life past the initial 6-year estimate is dependant on the expansion of current mineralization or the discovery of additional mineralization through further exploration drilling on the property.

As mentioned, groundbreaking occurred for the construction of the Borealis Project on June 6, 2011. By December, 2011, 605 ounces of gold was loaded on carbon and delivered to and independent refiners. When the refinery informed us that they could no longer accept deliveries we built additional inventories until the fourth quarter where we delivered and sold an additional 975 ounces of gold to Waterton Global Value, L.P.

During the fourth quarter, our ADR plant was 90% complete and became operational. On March 30, 2012, we produced our first bar of doré containing 418 ounces of gold and 724 ounces of silver.

Recent Developments

On April 25, 2011, we released the Pre-Feasibility Study for the development of the Borealis Property. The mineralization data and the economic analysis data contained in the Pre-Feasibility Study supersedes and replaces the data contained in the Technical Report, the Preliminary Assessment and the 2009 Study. The Pre-Feasibility Study evaluated a potential oxide heap leach mining and production operation on the Borealis Property and estimated that such an operation would have a six-year mine life with an average annual production of 42,000 ounces per year gold equivalent and require $12.7 million in initial capital costs (consisting of initial construction costs of $8.61 million, bonding costs of $3 million, $0.41 million in additional indirect capital costs and a $0.75 million contingency) with an average life-of-mine cash operating cost of $851 per ounce of gold. Life of mine capital costs include $12.9 million in direct costs, $8.86 million of indirect costs, $1.2 million of contingency costs, for total life of mine capital costs of $23 million. The Pre-Feasibility Study is not a bankable feasibility study and cannot form the basis for proven or probable reserves on the Borealis Property.

On May 26, 2011, we announced that on site construction work for the Borealis Project was scheduled to begin on June 6, 2011, that heap leach pad construction was scheduled for early June with pad loading scheduled for late July, that all major components for Phase 1A had been placed on order and delivery complied with the anticipated time line and that we anticipate first revenue from gold sales as early as October, 2011.

On June 6, 2011, we began site work at the Borealis Project. During the current fiscal year we completed construction of the new leach pad, both preg and barren ponds, carbon columns, roads, grounds and power distribution system.

As at March 31, 2012 the ADR was 90% complete and operational. To date, we have invested $19.6 million in construction of the total site and the mineral property at Borealis. We poured our first bar on March 30, 2012 and have poured gold each week since then. We expect our operating cost per ounce to be in the $900-$1,000 per ounce range.

8

Recent Capital Raises

May Common Stock Offering

On May 18, 2011, we closed a public offering of 80,000,000 shares of our common stock at a price of $0.125 per share for aggregate gross proceeds of approximately $10,000,000. As part of the offering the underwriters were granted an over-allotment option to cover over-allotments, if any. In connection with the closing of the initial offering, one underwriter exercised its over-allotment option in full for an additional 6,000,000 shares of our common stock at $0.125 per share for additional gross proceeds of $750,000. On May 24, 2011, the second underwriter exercised their over-allotment option in part for an additional 3,060,000 shares of our common stock at a price of $0.125 per share for additional gross proceeds of $382,500.

July Debenture Offering

On July 27, 2011, we closed a $3,169,514 debt offering of units at a price of $1,000 CAD per unit. The offering was led by Acumen Capital Finance Partners Limited in Canada and by Roth Capital Partners in the United States. Each unit consists of $1,000 CAD principal amount of 10% secured subordinated debentures maturing July 28, 2012 and 1,500 Series P Warrants. Each warrant entitles the holder thereof to purchase one share of common stock at a price of $0.20 USD per share until January 27, 2013. We also issued each of Acumen and Roth 112,500 Broker Warrants exercisable to acquire shares of common stock at a price per share of US$0.20, until January 27, 2013.

The debentures bear interest from the date of issue at 10.0% per annum, payable quarterly on March 31,June 30, September 30, and December 31 of each year commencing on September 30, 2011. The debentures were issued under the Trust indenture, which contains customary terms, conditions and covenants. The debentures were secured by a pledge of shares of BMC and a general security interest in the assets of Gryphon Gold. We repaid these debentures in April 2012.

November Debenture Offering

On November 22, 2011 we closed another $4.3 million debt offering of units. The offering was led by Acumen Capital Finance Partners Limited in Canada and by Roth Capital Partners in the United States. Each unit consists of $1,000 CAD principal amount of 10% secured subordinated debentures maturing November 23, 2012 and 750 Series Q Warrants. Each warrant entitles the holder thereof to purchase one share of common stock at a price of $0.40 per share until May 22, 2013.

The debentures bear interest from the date of issue at 10.0% per annum, payable quarterly on March 31, June 30, and September 30. The debentures were issued under a Trust Indenture, which contains terms, conditions, covenants and restrictive covenants, including restrictive covenants that limited our ability to issue equity and debt securities. The debentures were secured by a pledge of the shares of BMC and a general security interest in our assets which was subordinate to the security interest granted to holders of the debentures issued on July 27, 2011. We repaid these debentures in April 2012.

Waterton Global Value, L.P. – Bridge Loan

On March 20, 2012, we entered into a Bridge Loan facility with Waterton Global Value, L.P. for $1,500,000. The loan was to be paid within 60 days or be subject to immediate repayment from the $15,000,000 Senior Credit Facility. Security for the loan was a perfected lien and a first priority security interest in all tangible and intangible properties and assets of Gryphon Gold. The loan accrued interest at a rate of 15% per annum and was subject to a $30,000 structuring fee, a fee of $100,000 for legal and other related expenses, as well as the issuance of 1,500,000 Series R Warrants, each entitling the lender to purchase one common share of Gryphon Gold stock at a strike price of Cdn$0.1862 per share. The warrants expire on March 20, 2015.

In conjunction with the bridge loan the noteholders of the July and November 2011 debentures were issued an aggregate total of 14,955,308 Series S Warrants, each exercisable to acquire our common shares at a price of $0.164 until September 20, 2013.

Waterton Global Value, L.P. – Senior Credit Facility

On April 18, 2012, we entered into a Senior Secured Gold Stream non-revolving credit facility with Waterton Global Value L.P (the “Facility”), in the aggregate amount of $15,000,000. The full $15,000,000 was advanced to us on April 19, 2012, and we used the proceeds to pay off the Bridge Loan of $1,500,000 entered into with Waterton Global Value, L.P. in March 20, 2012, as well as our Cdn$3,000,000 10% subordinated secured notes, due in July of 2013, and our Cdn$4,500,000 10% subordinated secured notes, due November 27, 2013. The Facility loan accrues interest at 5% per annum and is repayable in 12 equal monthly installments commencing in May 2013. The amount of monthly repayments will be based on a formula using 80% of the gold spot price as the value of the gold. On each repayment date, we may pay the monthly repayment amount in gold to Waterton Global Value, L.P.'s gold account, or, if requested by Waterton Global Value, L.P., pay the amount in cash. The Senior Facility bears an interest rate at 5% per annum. The loan is secured by a first priority charge on the assets of Gryphon Gold and BMC.

We paid Waterton a non-refundable structuring fee equal to 1% of the draw-down amount and issued Waterton 14,062,500 Series T Warrants, exercisable to acquire shares of common stock at a price of Cdn$0.16 per share until April 18, 2015.

9

As part of the Senior Facility, we entered into a Gold and Silver Supply Agreement with Waterton whereby Waterton has the right to purchase all of the gold and silver produced by BMC at the Borealis property. The Gold and Silver Supply agreement is effective from the closing date of the Senior Facility until the Borealis Property ceases operations.

Our Management

James T. O’Neil serves as our Chief Executive Officer (CEO). Mr. O’Neil began his career with ASARCO in 1973 where he ended up as Vice President-Finance and Administration from 2001-2004. From 2004-2006 Mr. O’Neil was Vice President-Finance, Controller, & Treasurer with Apollo Gold Corporation. From 2006 until present, Mr. O’Neil served as CFO and Chief Operations Officer of Jipangu International.

Robert L. Chapman serves as our Chief Financial Officer. Mr Chapman brings over 30 years of mining and financial experience to the Gryphon team. Mr Chapman spent 11 years at the Goldstrike Operation for Barrick Gold, was Executive Vice President and Chief Financial Officer for Apollo Gold from 2002 – 2005, spent three years as Regional Vice President of Business Services for Newmont Mining Corp and operated a mining/financial consulting company for several years.

Steven K. Jones serves as our Vice President Exploration. Mr Jones brings 34 years of mining and exploration experience to the Gryphon team. Mr Jones spent 4 years with Phillips Petroleum as an exploration geologist, 2 years with Getty Mining as a consulting exploration geologist, 4 years with Pegasus Gold as a Senior Geologist, 14 years with Kennecott Exploration as a manager of geology, and 10 years as an international consulting geologist

Lisanna M. Lewis serves as one of our Vice Presidents and our Treasurer and Secretary.

10

The Offering

This is an offering of up to 18,812,500 shares of our common stock by certain selling stockholders.

|

Shares Offered By the Selling

|

18,812,500 shares of common stock, $0.001 par value per share,

|

||

|

Stockholders

|

including:

|

||

|

●

●

●

|

3,250,000 shares of common stock acquirable by selling security holders upon exercise of Series O Warrants at $0.30 per share, until January 21, 2013;

1,500,000 shares of common stock acquirable by selling security holders upon exercise of Series R Warrants at Cdn$0.1862 per share, until March 20, 2015; and

14,062,500 shares of common stock acquirable by selling security holders upon exercise of Series T Warrants at Cdn$0.16 per share,until April 18, 2015.

|

||

|

Offering Price

|

Determined at the time of sale by the selling stockholders

|

||

|

Common Stock Outstanding

|

194,103,382 common shares

|

||

|

as of June 29, 2012

|

|||

|

Use of Proceeds

|

We will not receive any of the proceeds of the shares offered by the selling stockholders. We may receive proceeds from the exercise of the warrants, if any, and will use the proceeds from any exercise for general working capital purposes | ||

|

Dividend Policy

|

We currently intend to retain any future earnings to fund the development and growth of our business. Therefore, we do not currently anticipate paying cash dividends.

|

||

|

Risk Factors

|

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page 13 of this prospectus.

|

||

|

Listing Symbols

|

Our common stock is currently listed on the Over-the-Counter Bulletin Board under the symbol “ GYPH.OB” and on the Toronto Stock Exchange under the symbol “GGN”.

|

||

The number of shares of our common stock that will be outstanding immediately after this offering, assuming full exercise of the Series O, Series R and Series R Warrants, will be 212,865,882 shares of common stock based on the number of issued and outstanding shares of common stock as of June 29, 2012.

11

Summary Financial Data

The following consolidated statements of operations data for the fiscal years ended March 31, 2012 and 2011 and consolidated balance sheet data as at March 31, 2012 and 2011 are derived from our audited consolidated financial statements, which are included elsewhere in this prospectus. Our financial statements are prepared and presented in accordance with generally accepted accounting principles in the United States (U.S. GAAP). Our historical results for any period are not necessarily indicative of our future performance. You should read the following information in conjunction with “Management’s Discussion and Analysis of Financial Condition and Operating Results” and our financial statements and related notes included elsewhere in this prospectus.

|

CONSOLIDATED STATEMENT OF

OPERATIONS DATA: |

|||||||

|

Year Ended

March 31, |

||||||||

|

2012

|

2011

|

|||||||

|

Revenue

|

$ | NIL |

$NIL

|

|||||

|

Loss for the period from continuing operations

|

$ | (5,121,372 | ) | $ | (3,383,599 | ) | ||

|

Net loss for period

|

$ | (5,121,372 | ) | $ | (2,747,891 | ) | ||

|

Total loss per share

|

$ | (0.03 | ) | $ | (0.03 | ) | ||

|

Basic and diluted weighted average number of common shares outstanding

|

$ | 181,395,836 | $ | 90,075,261 | ||||

|

CONSOLIDATED BALANCE SHEET DATA:

|

| At March 31, 2012 |

||||||||

|

2012

|

2011

|

|||||||

|

Cash

|

$ | 602.343 | 837,457 | |||||

|

Total assets

|

$ | 30,212,382 | 4,260,541 | |||||

|

Total current liabilities

|

$ | 6,964,235 | 397,106 | |||||

|

Asset retirement obligation liability

|

$ | 1,675,877 | 51,300 | |||||

|

Deficit accumulated during exploration stage

|

$ | (43,072,173 | ) | (37,950,801 | ) | |||

|

Total stockholders’ equity

|

$ | 11,236,368 | 3,812,135 | |||||

12

An investment in our common stock involves a high degree of risk. You should carefully consider the risk factors described below together with all of the other information contained in this prospectus, including our consolidated financial statements and the notes thereto, before deciding whether to invest in shares of our common stock. Each of these risks could have a material adverse effect on our business, operating results, financial condition and/or growth prospects. As a result, the trading price of our common stock could decline and you might lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our operations.

Risks Related to Our Operations

We will require future financing to enable us to continue operations.

We have just begun operating on the Borealis Property and may not have sufficient capital to fully fund all of our obligations, and we recognized that additional resources were required to enable us to continue operations.

At March 31, 2012, we had negative working capital of $7,322,145 with an average cash expenditure rate of $1,000,000 per month in a typical month. This level of activity will change based upon future events. We have instituted a new cost accounting to track production expenditures on a monthly basis. Current assets consisted of $602,343 in cash, $358,005 in accounts receivable, and $171,516 in prepaid expenses, $6,363,016 in metal and supply inventories and $312,549 in deferred debt issue costs. We had $5,004,298 in accounts payable and $1,959,937 in the current portion of our debts.

Subsequent to March 31, 2012, we obtained a $15,000,000 Senior Facility. On April 19, 2012, we drew down the full $15,000,000 and used the proceeds to pay off a Bridge Loan of $1,500,000 entered into with Waterton on March 20, 2012, Cdn$3,000,000 10% subordinated secured notes, due in July of 2013, and Cdn$4,500,000 10% subordinated secured notes, due November 27, 2013. We intend to use the remaining proceeds for working capital and additional capital expenditures related to our Borealis Project. The Senior Facility loan accrues interest at a rate of 5% per annum and is repayable in 12 equal monthly installments commencing in May 2013. We anticipate that the remaining proceeds from the Senior Facility and cash flow from operations will be sufficient to fund our cash requirements to achieve full production and processing capabilities at the Borealis Project. However, no assurance can be given that we will achieve profitability or positive cash flow from operations and we may require additional financing if we encounter unexpected costs or delays.

Our lease for the Borealis Property is subject to our continuing to perform development work, an activity that requires capital.

Our lease for the Borealis Property, which includes claims covering the principal deposits, states that after January 24, 2009 (twelve years from the effective date of the lease) we must be engaged in active mining, development or processing to automatically extend the term of the lease. Development is defined to mean work or construction in preparation for mining or processing a proven or probable reserves, including further exploration of development drilling of such a reserve. If we do not perform any qualifying development activities within a 365-day period, we are subject to losing our lease rights in the Borealis Property. Qualifying work has been completed on an ongoing basis since the January 24, 2009 trigger date. If projected capital costs or operating costs for the Borealis Project exceed current projections, further mine development is delayed or estimated production revenues are delayed or less than projected, without additional financing in the future, we may not be able to continue production and expansion and we may lose the lease to the Borealis Property.

Risks related to the Borealis Property.

Our mining operations may be hazzardous and we are subject to significant regulatory oversight that may disrupt our operations.

Mining operations are inherently hazzardous and subject to unforseen risks of accidents. Our operations are regulated by the Mine Safety and Health Administration (MSHA), and MSHA regulators make regular inspections at our mine site. Although we strive to maintain a safe and reliable work place for all of our employees and we employ a full time Safety Director to insure that safe work practices are followed, we cannot eliminate all risks of accidents or major safety violations at the Borealis Mine Site. An accident may result in injury or death at a mine site and safety violations may result in stop work orders and/or significant fines. Accidents or safety violations may disrupt our operations and have an adverse affect on our production targets and results of operations.

We have limited history of producing metals from our mineral property and there can be no assurance that we can continue to profitably produce precious metals.

While we have moved from the development stage to production, we are subject to risks of a new start-up operation, including, but not limited to:

|

●

|

mechanical break down and unforeseen maintenance issues;

|

|

●

|

equipment capacity limitations and delays in full utilization of equipment and facilities;

|

13

|

●

|

reliability of contractor services and service providers;

|

|

●

|

the ability to find sufficient gold reserves to support a mining operation;

|

|

●

|

the availability and costs of skilled labor and mining equipment;

|

|

●

|

compliance with environmental and other governmental approval and permit requirements;

|

|

●

|

our success depends on our ability to achieve operational results that match design parameters in terms of:

|

|

●

|

ore grade

|

|

●

|

gold and silver metal recoveries

|

|

●

|

operating costs

|

|

●

|

operating efficiencies

|

|

●

|

the availability of funds to finance future development of the property;

|

|

●

|

increases in reclamation bonding;

|

|

●

|

potential opposition from non-governmental organizations, environmental groups, local groups or local inhabitants which may delay or prevent development activities; and

|

|

●

|

potential increases in operating costs and working capital increases due to changes in the cost of fuel, power, materials, supplies, and other costs.

|

The costs, timing and complexities of production may be increased by the remote location of the Borealis Property. It is common in new mining operations to experience unexpected problems and delays during mine start-up and production. In addition, delays in production often occur. Accordingly, we cannot assure you that our activities will result in profitable mining operations or profitably produce metals at any of our properties.

Our exploration activities on the Borealis Property may not be commercially successful, which could lead us to abandon our plans to develop the property and our investments in exploration.

Our long-term success depends on our ability to identify additional mineral deposits on the Borealis Property and other properties we may acquire, if any, that we can then develop into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of gold exploration is determined in part by the following factors:

|

●

|

the identification of potential gold mineralization based on evaluation of the host rock, alteration, structure, geochemistry and proper sampling;

|

|

●

|

availability of government-granted exploration permits;

|

|

●

|

the quality of our management and our geological and technical expertise; and

|

|

●

|

the capital available for exploration.

|

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if we are unable to identify commercially exploitable mineral reserves. The decision to abandon a project may have an adverse effect on the market value of our securities and the ability to raise future financing. We cannot assure you that we will discover or acquire any mineralized material in sufficient quantities on any of our properties to justify commercial operations.

Actual capital costs, operating costs, production and economic returns may differ significantly from those we have anticipated and there are no assurances that our production activities will result in profitable mining operations.

We plan to estimate operating and capital costs for the Borealis Property based on information available to us and that we believe to be accurate. However, costs for labor, regulatory compliance, energy, mine and plant equipment and materials needed for production may significantly fluctuate. In light of these factors, actual costs related to our to proposed budgeted production costs may exceed any estimates we may make. We do not have an operating history upon which we can base estimates of future operating costs related to the Borealis Property, and we intend to rely upon our future economic feasibility

14

of the project and any estimates that may be contained therein. Studies derive estimates of cash operating costs based upon, among other things:

|

●

|

anticipated tonnage, grades and metallurgical characteristics of the material to be mined and processed;

|

|

●

|

anticipated recovery rates of gold and other metals from the material;

|

|

●

|

cash operating costs of comparable facilities and equipment; and

|

|

●

|

anticipated climatic conditions and availability of water.

|

Capital and operating costs, production and economic returns, and other estimates contained in feasibility studies may differ significantly from actual costs, and there can be no assurance that our actual capital and operating costs will not be higher than anticipated or disclosed.

In addition, any calculations of cash costs and cash cost per ounce may differ from similarly titled measures of other companies and are not intended to be an indicator of projected operating profit.

A shortage of critical equipment, supplies, and resources could adversely affect our operations.

We are dependent on certain equipment, supplies and resources to carry out our mining operations, including input commodities, drilling equipment and skilled labor. A shortage in the market for any of these factors could cause unanticipated cost increases and delays in delivery times, which could in turn adversely impact production schedules and costs.

Operations at the Borealis Property will require a significant amount of water. The Borealis Property is located in an arid region with an over-appropriated water basin. Successful mining and processing will require careful control of project water usage and efficient reclamation of project solutions back into the process. The figures for our mineralization are estimates based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, mineralization figures presented in this prospectus and in our filings with securities regulatory authorities, press releases and other public statements that may be made from time to time are based upon estimates made by independent geologists and our internal geologists. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineral reserves and grades of mineralization on our properties. Until material is actually mined and processed, mineral reserves and grades of mineralization must be considered as estimates only.

These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that:

|

●

|

these estimates will be accurate;

|

|

●

|

reserves or other mineralization estimates will be accurate; or

|

|

●

|

this mineralization can be mined or processed profitably.

|

Any material changes in mineral reserves estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital.

On June 6, 2011, we broke ground and began construction of the Borealis Project. To date, the leach pad, the ponds, power distribution system, refinery and process plant as well as general facilities are in place. We have $19.6 million dollars invested in our property, plant and equipment at year-end.

Because we have just recently started production at our Borealis Property, mineralization estimates, including reserves estimates, for the Borealis Property may require adjustments or downward revisions based upon actual production experience. In addition, the grade of material ultimately mined, if any, may differ from that indicated by our feasibility studies and drill results. There can be no assurance that minerals recovered in small scale tests will be duplicated in large scale tests under on-site conditions or in production scale.

The mineralization estimates contained in this report have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for gold and silver may render portions of our mineralization, reserve estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability of our Borealis Property. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our results of operations or financial condition.

15

Changes in the market price of gold, silver and other metals, which in the past has fluctuated widely, will affect the profitability of our operations and financial condition.

Our profitability and long-term viability depend, in large part, upon the market price of gold and other metals and minerals produced from our mineral properties. The market price of gold and other metals is volatile and is impacted by numerous factors beyond our control, including:

|

●

|

sales by central banks and other holders, speculators and producers of gold and other metals in response to any of the below factors.

|

|

●

|

the relative strength of the U.S. dollar and certain other currencies;

|

|

●

|

interest rates;

|

|

●

|

global or regional political, financial, or economic conditions;

|

|

●

|

supply and demand for jewelry and industrial products containing metals; and

|

|

●

|

expectations with respect to the rate of inflation;

|

A material decrease in the market price of gold and other metals could affect the commercial viability of our Borealis Property and our anticipated development and production assumptions. Lower gold prices could also adversely affect our ability to finance future development at the Borealis Property, all of which would have a material adverse effect on our financial condition and results of operations. There can be no assurance that the market price of gold and other metals will remain at current levels or that such prices will improve.

Mining is inherently dangerous and subject to conditions or events beyond our control, which could have a material adverse effect on our business.

Mining involves various types of risks and hazards, including:

|

●

|

environmental hazards;

|

|

●

|

power outages;

|

|

●

|

metallurgical and other processing problems;

|

|

●

|

unusual or unexpected geological formations;

|

|

●

|

structural cave-ins or slides;

|

|

●

|

flooding, fire, explosions, cave-ins, pit wall landslides and rock-bursts;

|

|

●

|

inability to obtain suitable or adequate machinery, equipment, or labor;

|

|

●

|

mine safety risk and risk of closure or significant fines;

|

|

●

|

metals losses; and

|

|

●

|

periodic interruptions due to inclement or hazardous weather conditions.

|

These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties, personal injury, environmental damage, delays in mining, increased production costs, monetary losses and possible legal liability.

We do not insure against all risks to which we may be subject in our planned operations.

We currently maintain insurance to insure against general commercial liability claims, losses of equipment and pollution. Our insurance will not cover all of the potential risks associated with a mining company’s operations, and we may be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, we expect that insurance against certain hazards as a result of exploration and production may be prohibitively expensive to obtain for a company of our size and financial means.

Losses from events that are not covered by our insurance policies may cause us to incur significant costs that could negatively affect our financial condition and ability to fund our activities on the Borealis Property. A significant loss could force us to terminate our operations.

We are subject to significant governmental regulations.

Our primary properties, operations and exploration and development activities are in Nevada and are subject to extensive federal, state, and local laws and regulations governing various matters, including:

|

●

|

environmental and wildlife protection;

|

16

|

●

|

management and use of toxic substances and explosives;

|

|

●

|

management of natural resources;

|

|

●

|

exploration, development of mines, production and post-closure reclamation;

|

|

●

|

export controls;

|

|

●

|

price controls;

|

|

●

|

regulations concerning business dealings with native groups;

|

|

●

|

labor standards and occupational health and safety, including mine safety; and

|

|

●

|

historic and cultural preservation.

|

Failure to comply with applicable laws and regulations may result in civil or criminal fines or penalties or enforcement actions, including orders issued by regulatory or judicial authorities enjoining or curtailing operations or requiring corrective measures, installation of additional equipment or remedial actions, any of which could result in us incurring significant expenditures. We may also be required to compensate private parties suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements. It is also possible that future laws and regulations, or a more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspensions of our operations and delays in the development of our properties.

Our activities are subject to environmental laws and regulations that may increase our costs of doing business and restrict our operations.

All of our exploration, potential development and production activities are in the United States and are subject to regulation by governmental agencies under various environmental laws. These laws address, among other things, emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations.

Our operations involve the use of sodium cyanide, which is a toxic material. The use of sodium cyanide is normal for the industry, and appropriate steps are taken to prevent leakage into the environment. However, if the material is discharged, we could incur significant liabilities associated with containment and clean-up, against which we might not be insured.

Additionally, our operations result in emissions of greenhouse gases, which may be subject to increased regulation in the future. In general, environmental legislation is evolving and the trend has been towards stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and increasing responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations requires significant capital outlays, and future changes in these laws and regulations may cause material changes to our operations and future activities. It is possible that future changes in these laws or regulations could have a significant negative impact on our operations at the Borealis Property, or some portion of our business, causing us to re-evaluate those activities at that time.

Land reclamation requirements for our Borealis Property may be burdensome.

Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance.

Reclamation may include requirements to:

|

●

|

control dispersion of potentially deleterious effluents; and

|

|

●

|

reasonably re-establish pre-disturbance land forms and vegetation.

|

In order to carry out reclamation obligations imposed on us in connection with our production, we have set up a provision for our reclamation obligations at the Borealis Property, but this provision may not be adequate. If we are required to carry out unanticipated reclamation work, our financial position could be adversely affected.

Our operations require us to obtain government permits and approvals.

Permits and approvals from various government agencies, such as the State of Nevada and the United States Forest Service, were required in order to construct and begin operations on the Borealis Property. All major operating permits remain in place, but there are still some additional minor permits or permit modifications to be secured. Though these additional permits should be straightforward to obtain, there can be no assurance that delays will not occur in connection with obtaining these additional permits or later renewing the existing ones. In addition, our permits may be revoked in the future for failure to comply with applicable regulations or for other reasons that may be beyond our control.

17

We also have gold resources outside of our currently permitted boundaries. If we decide to expand operations all permits and approvals will have to be obtained from the state and federal agencies in order for us to proceed.

We may experience difficulty attracting and retaining qualified management to meet the needs of our anticipated growth, and the failure to manage our growth effectively could have a material adverse effect on our business and financial condition.

We are dependent on the services of key executives including, James T. O’Neil, CEO, Steve Jones, Vice President Exploration, Lisanna Lewis, Vice President & Treasurer, Robert Cassinelli, our Project Manager andRobert L. Chapman, CFO, and other highly skilled and experienced employees and consultants focused on our Borealis Property’s production and managing our interests and on-going exploration programs on our other properties. Our management is also responsible for the identification of new opportunities for growth and funding. Due to our relatively small size, the loss of these persons or our inability to attract and retain additional highly skilled employees required for our development activities may have a material adverse effect on our business or future operations. We do not maintain key-man life insurance on any of our key management employees.

We compete with larger, better capitalized competitors in the mining industry.

The mining industry is intensely competitive in all of its phases, including financing, technical resources, personnel and property acquisition. It requires significant capital, technical resources, personnel and operational experience to effectively compete in the mining industry. Because of the costs associated with production, and the expertise required to operate our project, larger companies with significant resources may have an advantage over us. We face strong competition from other mining companies, some with greater financial resources, operational experience and technical capabilities than us. Competition for resources at all levels is currently very intense, particularly affecting the availability of manpower, drill rigs, mining equipment and production equipment. As a result of this competition, we may be unable to maintain or acquire financing, personnel, technical resources or attractive mining properties on terms we consider acceptable or at all.

Title to the Borealis Property may be subject to other claims, which could affect our property rights and claims.

Although we believe we have exercised commercially reasonable due diligence with respect to determining title to properties we own or control through the BMC and the claims that are subject to the Borealis Property mining lease, there is no guarantee that title to such properties will not be challenged or impugned. The Borealis Property may be subject to prior unrecorded agreements or transfers or native land claims and title may be affected by undetected defects. There may be valid challenges to the title of these properties which, if successful, could impair development and/or operations. This is particularly the case in respect of those portions of the Borealis Property in which we hold our interest solely through a lease with the claim holders, as such interest is substantially based on contract and has been subject to a number of assignments (as opposed to a direct interest in the property).

All of the mineral rights to the Borealis Property consist of "unpatented" mining claims created and maintained in accordance with the U.S. general mining laws. Unpatented mining claims are unique property interests, and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations under the U.S. general mining laws, including the requirement of a proper physical discovery of valuable minerals within the boundaries of each claim and proper compliance with physical staking requirements. Also, unpatented mining claims are always subject to possible challenges by third parties or validity contests by the federal government. The validity of an unpatented mining or mill site claim, in terms of both its location and its maintenance, is dependent on strict compliance with a complex body of U.S. federal and state statutory and decisional law. In addition, there are few public records that definitively determine the issues of validity and ownership of unpatented mining claims.

There are differences in U.S. and Canadian practices for reporting reserves and resources.

We are a reporting issuer in Canada and report under Canadian reporting standards outside the United States. Our disclosure outside the United States differs from the disclosure contained in our SEC filings. We generally furnish our disclosure released outside the United States with the SEC as Regulation FD disclosure.

Our reserve and resource estimates disseminated outside the United States are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements, as we generally report reserves and resources in accordance with Canadian practices. These practices are different from the practices used to report reserve and resource estimates in reports and other materials filed with the SEC. It is Canadian practice to report measured, indicated and inferred resources, which are generally not permitted in disclosure filed with the SEC. In the United States, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, “inferred resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations; however, the SEC only permits issuers to report “resources” as in place tonnage and grade without reference to unit measures.

18

Accordingly, information concerning descriptions of mineralization, reserves and resources contained in disclosure released outside the United States, or in the documents incorporated herein by reference, may not be comparable to information made public by other United States companies subject to the reporting and disclosure requirements of the SEC.

We will be required to locate mineral reserves for our long-term success.

Because mines have limited lives based on proven and probable mineral reserves, we will have to continually replace and expand our mineral reserves, if any, when the Borealis Property produces gold and other base or precious metals. Our ability to maintain or increase the property’s annual production of gold and other base or precious metals will be dependent almost entirely on our ability to bring new mines into production.

Our directors may have conflicts of interest as a result of their relationships with other companies.

Certain directors of Gryphon Gold have served or are serving as officers and directors for other companies engaged in natural resource exploration and development and may also serve as directors and/or officers of other companies involved in natural resource exploration and development.

Legislation, including the Sarbanes-Oxley Act of 2002, may make it difficult for us to retain or attract officers and directors.

We may be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of rules and regulations which govern publicly-held companies. Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. We are a small company with a very limited operating history and small revenues and profits, which may influence the decisions of potential candidates we may recruit as directors or officers. The perceived increased personal risk associated with these recent changes may deter qualified individuals from accepting these roles.

While we believe we have adequate internal control over financial reporting, we may be required to provide an auditors attestation on the effectiveness of our internal controls over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002, and any adverse results from such attestation could result in a loss of investor confidence in our financial reports and have an adverse effect on the price of our shares of common stock.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, we have furnished a report by management on our internal control over financial reporting in our annual report on Form 10-K for the year ended March 31, 2012. Such report contains, among other matters, an assessment of the effectiveness of our internal control over financial reporting, including a statement as to whether or not our internal control over financial reporting is effective.

We are currently a “smaller reporting company” as defined under the rules and regulations of the SEC, and therefore, do not have to provide an auditor’s report on the effectiveness of such internal control over financial reporting pursuant to recent changes to Section 404 of the Sarbanes-Oxley Act of 2002. However, if we lose our status as a “smaller reporting company” in the future, we would be required in our annual report on Form 10-K for the following fiscal year to provide an attestation report from our auditors on the effectiveness of such internal control over financial reporting.

While we have evaluated our internal control over financial reporting and have concluded that we have two material weaknesses related to the transformation from exploration and development to production accounting. Complex accounting transactions are apparent relating to our debt terms and our units of production depreciation along with other accounting estimates. We received a bridge loan just before year end that included the issuing of warrants to existing debt holders in return for the forbearance of the debt covenants which created a substantial modification in the terms of the notes. Subsequent to year end and during the audit procedure it was brought to management’s attention that this transaction should be recorded as a loss on the modification of debt instead of accounting for it as a discount to the notes payable. Included in the loss was the fair value of the warrants issued to the existing noteholders and the extinguishing the existing debt discount and offering costs. During the audit process subsequent to year end it was brought to management’s attention that the units of production deprecation method used to calculate plant, property and equipment’s depreciation for the period was calculated incorrectly as the amount for mineral properties was missed during the calculation resulting in a material affect on the financial statements. We intend to remediate these weaknesses by adding additional people to the staff and having a better segregation of duties program among the staff. We will also institute a formal review program for all complex accounting issues. Our intention is to close the books on a monthly basis in order to get more timely information. A review of our IT system will also take place this year. If we are unable to address the weaknesses in our internal control over financial reporting, we could lose investor confidence in the accuracy and completeness of our financial reports, which could have a material adverse effect on our stock price.

Failure to comply may make it more difficult for us to obtain certain types of insurance, including director and officer liability insurance, and we may be forced to accept reduced policy limits and coverage and/or incur substantially higher costs to obtain the same or similar coverage. The impact of these events could also make it more difficult for us to attract and retain qualified persons to serve on our Board, on committees of our Board, or as executive officers.

We may be subject to legal proceedings that may have an adverse affect on our results of operations.

On January 31, 2012, we were served with a complaint alleging breach of contract that was filed in the First Judicial District Court for the State of Nevada in Carson City by Borealis royalty holders which include the Cavell Trust, Hardrock Mining Company and John W. Whitney. The royalty holders allege that “advance royalties” which we have paid are not recoverable and are payable during the duration of the mining lease. On February 21, 2012 we filed an answer and counterclaim against the plaintiffs for alleged breach of contract claim. Due to the inherent uncertainty of the litigation process, the resolution of any particular legal proceeding and the substantial defense and settlement costs associated with legal proceedings could have a material effect on our future financial position and results of operations. We currently place an amount equal to the accrued offset to the “advance royalties” into escrow pending the outcome of the litigation.

19

Risks Related To Our Securities

The market for our common shares has been volatile in the past, and may be subject to fluctuations in the future.

The market price of our common stock has ranged from a high Cdn$0.35 and a low Cdn$0.13 during the twelve month period ended March 31, 2012. The market price for our common stock closed at Cdn$0.15 on March 31, 2012. The market price of our common stock may fluctuate significantly from its current level in response to quarterly variations in operating results, announcements of technological innovations or new products by us or our competitors, changes in financial estimates by securities analysts, or other events or factors. In addition, the financial markets have experienced significant price and volume fluctuations for a number of reasons, including the failure of the operating results of certain companies to meet market expectations that have particularly affected the market prices of equity securities of many mining companies that have often been unrelated to the operating performance of such companies. These broad market fluctuations, or any industry-specific market fluctuations, may adversely affect the market price of our common stock.

We have convertible securities outstanding, which if fully exercised could require us to issue shares of our common stock and result in dilution to existing stockholders.

As of March 31, 2012, we had 194,103,382 shares of common stock issued and outstanding. We may be required to issue the following shares of common stock upon exercise of options and warrants or conversion of convertible securities:

|

●

|

5,940,000 (inclusive of the 550,000 granted to a consultant outside of the stock option plan) shares of common stock issuable upon vested exercise of options outstanding as of March 31, 2012;

|

|

●

|

30,748,273 shares of common stock issuable upon exercise of warrants outstanding as of March 31, 2012 (732,215 expiring on June 16,2012); and

|

|

●

|

2,727,857 shares of common stock issuable upon converting the $1,909,500 convertible note held by our royalty holders (current exercise amount is $0.70);

|

Subsequent to March 31, 2012, we issued an additional 14,062,500 Series T Warrants, exercisable to acquire shares of common stock at a price of Cdn$0.16 per share until April 18, 2015.

If all of the convertible securities issued and outstanding as of March 31, 2012 are fully exercised or converted, we would issue an additional 39,416,130 shares of common stock, and our issued and outstanding share capital would increase to 233,519,512 shares. If all of the convertible securities issued and outstanding as of June 28, 2012 are fully exercised or converted, we would issue an additional 52,270,165 shares of common stock, and our issued and outstanding share capital would increase to 246,373,547 shares.

Our authorized capital consists of 250,000,000 shares of common stock and 15,000,000 shares of preferred stock, of which we currently have 194,103,382 shares of common stock issued and outstanding and 52,270,165 shares of common stock reserved for issuance, which may adversely affect our ability to raise additional capital through the issuance of equity.

Historically, our primary source of liquidity is cash that we raised by way of issuances of shares of our common stock. Due to the limited number of authorized shares of common stock available for issuance, we may be unable to raise capital by issuing equity securities unless we amend our Articles of Incorporation and increase our authorized capital with stockholder approval. Alternatively, we would be required to raise capital by issuing debt securities, which may be limited due to our obligations under the Senior Facility. We anticipate that any debt financing we secure in the future would require restrictive covenants, which may impair or restrict our financial condition and future operations. We may not be able to obtain additional financing on terms favorable to us, or at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth and to respond to business challenges could be significantly impaired, and our business, results of operations and financial condition may be materially and adversely affected.

The Waterton Senior Credit Facility requires us to repay the amounts we draw down on the credit facility in cash or gold at the option of Waterton.

We entered into the Senior Facility with Waterton Global Value, L.P., and on April 19, 2012 the full $15,000,000 Senior Facility was advanced to us. The Senior Facility loan accrues interest at a rate of 5% per annum and is repayable in 12 equal monthly installments commencing in May 2013. The amount of the monthly repayments will be based on a formula using 80% of the gold spot price as the value of the gold. On each monthly repayment date, we may pay the amount in gold to Waterton Global Value, L.P.'s gold account, or, if requested by Waterton Global Value, L.P., pay the amount in cash. The loan is secured by a first priority charge on the assets of Gryphon Gold and BMC.

Repayment of the Senior Facility may impact our results of operations. The reduced cash flow could severely limit our business growth and future funding.

20

In addition, as part of the Senior Facility, we entered into a Gold and Silver Supply Agreement with Waterton whereby Waterton has the right to purchase all of the gold and silver produced by BMC at the Borealis property. The Gold and Silver Supply agreement is effective from the closing date of the Senior Facility until the Borealis Property ceases operations.

Broker-dealers may be discouraged from effecting transactions in our common shares because they are considered a penny stock and are subject to the penny stock rules.

Rules 15g-1 through 15g-9 promulgated under the Exchange Act impose sales practice and disclosure requirements on certain brokers-dealers who engage in certain transactions involving a “penny stock.” Subject to certain exceptions, a penny stock generally includes any non-NASDAQ equity security that has a market price of less than $5.00 per share. Our common stock has traded below $5.00 per share throughout its trading history. The additional sales practice and disclosure requirements imposed upon broker-dealers may discourage broker-dealers from effecting transactions in our shares, which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market.

A broker-dealer selling penny stock to anyone other than an established customer or “accredited investor,” generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse, must make a special suitability determination for the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt. In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the United States Securities and Exchange Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer’s account and information with respect to the limited market in penny stocks.

In the event that your investment in our shares is for the purpose of deriving dividend income or in expectation of an increase in market price of our shares from the declaration and payment of dividends, your investment will be compromised because we do not intend to pay dividends in the foreseeable future.