Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Chile Mining Technologies Inc. | exhibit31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Chile Mining Technologies Inc. | Financial_Report.xls |

| EX-32.2 - EXHIBIT 32.2 - Chile Mining Technologies Inc. | exhibit32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - Chile Mining Technologies Inc. | exhibit31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Chile Mining Technologies Inc. | exhibit32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: March 31, 2012

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from

____________to _____________

Commission File No. 000-53132

CHILE MINING TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

| Nevada | 26-1516355 |

| (State or other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) |

| organization) |

Jorge Canning 1410

Ñuñoa, Santiago

Republic of Chile

(Address of principal executive offices)

+(56) (02) 813 1087

(Registrant’s telephone

number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-Accelerated Filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act)

Yes [ ] No [X]

As of September 30, 2011 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the shares of the registrant’s common stock held by non-affiliates (based upon the closing price of such shares as reported on the Over-the-Counter Pink Exchange) was approximately $6,729,186.

There were a total of 10,182,150 shares of the registrant’s common stock outstanding as of July 13, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

None.

CHILE MINING TECHNOLOGIES INC.

| Annual Report on FORM 10-K |

| For the Fiscal Year Ended March 31, 2012 |

TABLE OF CONTENTS

PART I

| Item 1. | Business. | 2 |

| Item 1A. | Risk Factors. | 13 |

| Item 1B. | Unresolved Staff Comments. | 20 |

| Item 2. | Properties. | 20 |

| Item 3. | Legal Proceedings. | 27 |

| Item 4. | (Removed and Reserved). | 27 |

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 27 |

| Item 6. | Selected Financial Data | 28 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 28 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 36 |

| Item 8. | Financial Statements and Supplementary Data. | 36 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 36 |

| Item 9A. | Controls and Procedures. | 36 |

| Item 9B. | Other Information. | 38 |

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance. | 38 |

| Item 11. | Executive Compensation. | 41 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 42 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 42 |

| Item 14. | Principal Accounting Fees and Services | 45 |

PART IV

| Item 15. | Exhibits, Financial Statement Schedules. | 46 |

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those identified in Item 1A, “Risk Factors” included herein, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation, except as required by law, to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

Use of Terms

Except as otherwise indicated by the context, references in this report to:

-

the “Company,” “we,” “us,” or “our,” are to the combined business of CMT and its 99.9% owned subsidiary, Minera, but do not include the stockholders of CMT;

-

“CMT” are to Chile Mining Technologies Inc., a Nevada corporation;

-

“Minera” are to Sociedad Minera Licancabur, S.A., a Chilean company;

-

“Chile” and “Chilean” are to the Republic of Chile;

-

“Peso” are to the Chilean peso, the legal currency of Chile;

-

“U.S. dollar,” “$” and “US$” are to the legal currency of the United States.

-

“SEC” are to the United States Securities and Exchange Commission;

-

“Securities Act” are to the Securities Act of 1933, as amended;

-

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

-

“Exploration” means the process of locating commercially viable concentrations of minerals to mine; and

-

“Exploitation” means the act of extracting a mineral resource from source material.

1

PART I

| ITEM 1. | BUSINESS. |

Overview

We are a mineral extraction company based in the Republic of Chile, with copper as our principal “pay metal.” Our founders, Messrs. Jorge Osvaldo Orellana Orellana and Jorge Fernando Pizarro Arriagada, have refined the electrowin process in a way that permits the electrowin process to be used at a relatively small mine and/or tailings sites. Electrowinning is a process in which positive and negative electrodes are placed in an acidic solution containing copper ions, and an electric current passed through the solution causes the copper to be deposited on the negative electrodes so that it can be collected.

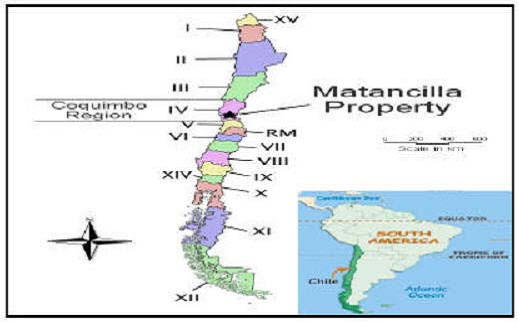

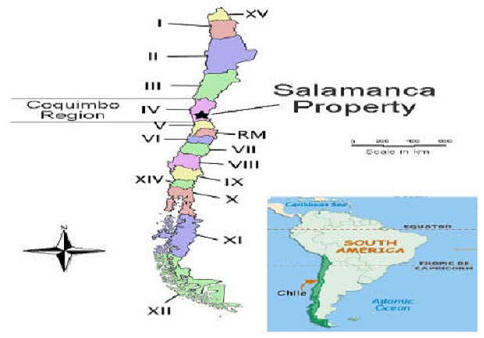

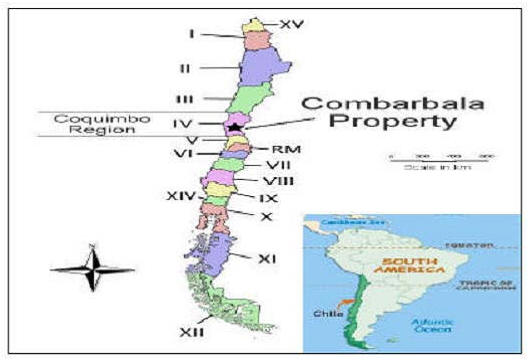

We have obtained rights to conduct our mineral extraction operations at several sites in and around the Coquimbo region, which is located in north-central Chile, approximately 400 kilometers north of Santiago. While these sites each have their own mineral deposits, we will procure the majority of our source material from non-traditional sources, including tailings, ore, or a combination thereof, by purchasing rights to such source material at smaller sites, where it is not economical for larger open-pit mining companies to operate, due largely to the transportation costs associated with moving source materials to fixed processing sites.

By utilizing Minimum Intrusion Non-traditional Input, or MINI, plants, we are able to build scalable, less expensive plants closer to source material deposits, thereby resulting in significant processing savings. In addition, since smaller sites generally require higher copper prices, due to transportation costs, to operate profitably, these deposits can currently be purchased at a discount. By utilizing this strategy, we are able to reduce costs and operate profitably with smaller deposits.

The initial design capacity of each MINI plant is between approximately 1,200 and 2,000 metric tons of annual copper cathode output. Each MINI plant can be expanded on a modular basis in increments of 1,500 metric tons. We believe that the installed cost for a new 1,500 metric ton MINI plant, with the ability to produce tailings, at the average location, is about $3,000,000, or $2,000 per metric ton of annual capacity. Expanding the capacity of an existing MINI plant will cost between $400 and $800 per metric ton, depending on the site. Once the available source material deposits at and around the site of an existing MINI plant have been depleted, we anticipate that we can recover up to 70% of the cost of constructing a new MINI plant by relocating the support structures and processing equipment from the original MINI plant.

By reducing unit costs and carefully managing the average source material grade, we estimate that the MINI plant technology will allow us to break even at copper prices as low as US$1.00 per pound, or US$2,205 per metric ton. As of July 5, 2012, copper was trading at $7,760 per metric ton on the London Metals Exchange, or LME. As the price of finished copper has increased, however, there has been increased interest in raw copper ore from a number of “higher cost” producers that can increase their production volumes by buying ore in the market from small miners. Historically, these producers would not have been interested in raw ore purchases, as they could not generate profits at lower finished copper prices. However the increase in finished copper prices has made third-party purchase attractive for a number of additional producers. While the additional producers entering the market for minerals has not had an affect on the cost of the ore, it has put the miners into a stronger negotiating position on the sales of their ore. As such, the market now demands that producers must purchase the ore by providing payment upon delivery of the ore, as opposed to the historical practice of providing payment following the sale of the finished copper. This shift in the market has affected our need for working capital substantially, in that we now require approximately $1 million per MINI plant to purchase enough ore to operate at full capacity.

Initially, we plan to sell our copper cathodes to Madeco, the largest cable producer in Chile. Based on our discussions with Madeco, we expect that the selling price will be at a 3% discount from the price for copper, adjusted for purity, on the LME. We expect that sales will be made under purchase orders where cash will be paid upon delivery. We anticipate that this arrangement will provide us with immediate cash flow with which we will use to fund our current operations. In the future, as business volume grows, we may elect to sell our copper cathodes at the generally higher prices prevailing on the LME.

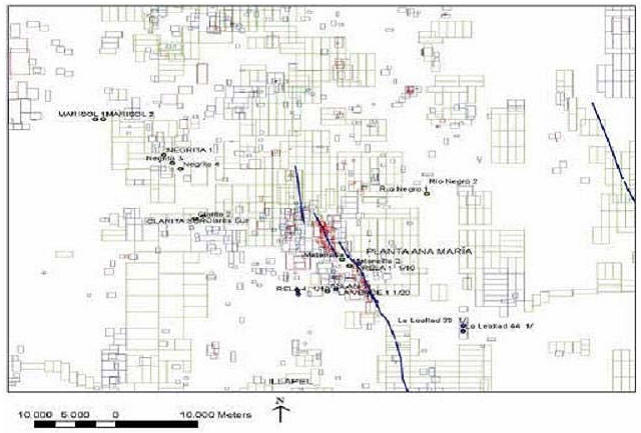

Since our inception on January 2, 2008, we have focused our activities on acquiring mineral rights and sites on which to construct our MINI plants. Since starting construction in the fall of 2008, we have successfully completed our first scalable MINI plant, designated as the Ana Maria plant, located about 30 kilometers northeast of the town of Illapel, in the mining district of Matancilla. We have been testing the production of copper cathodes at the Ana Maria plant since late April 2009. In July 2009, we produced our first commercial run of copper cathodes.

2

We commenced operations at the Ana Maria plant in July 2009. The Ana Maria plant was taken off-line the first week of May 2010 in order to increase the capacity of this facility. As a result, the total capacity of the Ana Maria plant increased from 120 metric tons per month to 180 metric tons per month, effectively increasing its capacity by 50%. We resumed operations at the plant with the additional capacity in place at the beginning of August 2010. We believe that the site can be progressively expanded to about 5,000 metric tons per annum on a modular basis in increments of 500 to 1,000 metric tons, subject to the market price for copper and the grade and quantity of source materials available to be processed.

The purity level of the copper we have produced to date is evidenced by the analysis of acceptance from Madeco. Prior to the mineral being processed, we are able to verify the levels of copper and other minerals in order to adjust the chemicals used to ensure the highest concentrations of copper are extracted. In addition, we are also further enhancing our electrowin-based recovery techniques to reduce costs and improve the yield of the copper out of the mineral spectrum.

Our second plant, Santa Filomena, is approximately 75% complete as of the date of this report, and we have also begun preparatory work at one additional site we have under our control, in anticipation of the construction of additional MINI plants over the next 18 to 24 months.

To date, the majority of our capital expenditures have been used for the construction of our facilities.

Corporate History

CMT was incorporated in the State of Nevada on September 26, 2007 under the name “SMSA El Paso I Acquisition Corp.,” to effect the reincorporation of Senior Management Services of El Paso Sunset, Inc., a Texas corporation, or SMSA Texas, from Texas to Nevada (which was completed by a merger of SMSA Texas into CMT on October 1, 2007) as part of the implementation of a Chapter 11 reorganization plan of SMSA Texas and its affiliated companies, or the SMS Companies, which filed a petition for Chapter 11 reorganization on January 17, 2007. During the three years prior to filing the reorganization petition, the SMS Companies operated a chain of skilled nursing homes in Texas, which prior to the bankruptcy proceedings consisted of 14 nursing facilities, ranging in size from approximately 114 beds to 325 beds. In 2005, the SMS Companies obtained a secured credit facility from a financial institution, which eventually was comprised of an $8.3 million term loan and a revolving loan of up to $15 million. By late 2006, the SMS Companies were in an “overadvance” position, whereby the amount of funds by the lender exceeded the amount of collateral eligible to be borrowed under the credit facility.

Beginning in September 2006, the SMS Companies entered into the first of a series of forbearance agreements whereby the lender agreed to forebear from declaring the financing in default provided that the SMS Companies obtained a commitment from a new lender to refinance and restructure the credit facility. The SMS Companies were unsuccessful in obtaining a commitment from a new lender and, on January 5, 2007, the lender declared the SMS Companies in default and commenced foreclosure and collection proceedings. Subsequently, on January 17, 2007, the SMS Companies filed a petition for reorganization under Chapter 11 of the Bankruptcy Code. The First Amended, Modified Chapter 11 Plan, or the Plan, as presented by the SMS Companies and their creditors was approved by the United States Bankruptcy Court, Northern District of Texas - Dallas Division, on August 1, 2007. The Plan provided that certain identified claimants as well as unsecured creditors, in accordance with the allocation provisions of the Plan, and our new controlling stockholder would receive “new” shares of our post-reorganization common stock, pursuant to Section 1145(a) of the Bankruptcy Code.

Halter Financial Group, Inc., or Halter Financial, participated with the SMS Companies and their creditors in structuring the Plan. As part of the Plan, Halter Financial provided $115,000 to be used to pay professional fees associated with the Plan confirmation process. Halter Financial was granted an option to be repaid through the issuance of equity securities in 23 of the SMS Companies, including CMT. Halter Financial exercised the option and as provided in the Plan 80% of our outstanding common stock, or 400,000 shares, was issued to Halter Financial in satisfaction of Halter Financial’s administrative claims. The remaining 20% of our outstanding common stock, or 100,016 shares, was issued to 455 holders of unsecured debt. The 500,016 shares were issued pursuant to Section 1145 of the Bankruptcy Code. Effective September 26, 2007, Halter Financial transferred its 400,000 shares to Halter Financial Investments, L.P., or HFI, a Texas limited partnership controlled by Timothy P. Halter.

3

We were subject to the jurisdiction of the bankruptcy court until we consummated the exchange transaction described below with LAV in November 2008. As we timely consummated a merger or acquisition with a qualifying entity, we filed a certificate of compliance with the bankruptcy court which stated that the requirements of the Plan had been met, resulting in the discharge to be deemed granted. Thereafter, the post discharge injunction provisions set forth in the Plan and the confirmation order became effective.

On November 18, 2008, we entered into a share exchange agreement with Latin America Ventures, Inc., or LAV, a Nevada corporation, and the sole stockholder of LAV, Mr. Pierre Galoppi, pursuant to which Mr. Galoppi transferred 100% of the issued and outstanding shares of the capital stock of LAV to us in exchange for 1,500,000 newly issued shares of our common stock that constituted approximately 75% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of such exchange. As a result of this transaction, Mr. Galoppi became our controlling stockholder and LAV became our subsidiary. LAV was organized on September 15, 2008 as a Nevada corporation and was formed to seek and identify a privately-held operating company located in Latin America desiring to become a publicly held company by combining through a reverse merger or acquisition transaction. On December 15, 2008, we entered into an agreement and plan of merger with LAV pursuant to which LAV was merged with and into us, with CMT continuing as the surviving corporation. In connection with the merger, our name was changed to from “SMSA El Paso I Acquisition Corp.” to “Latin America Ventures, Inc.” The parent-subsidiary merger and name change became effective on December 30, 2008.

On May 12, 2010, we completed a reverse acquisition transaction through a share exchange with Minera and its shareholders whereby we acquired 99.9% of the issued and outstanding capital stock of Minera in exchange for 6,000,000 shares of our common stock, par value $0.001, which constituted 83.33% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Minera became our subsidiary and the former shareholders of Minera became our controlling stockholders. Jorge Osvaldo Orellana Orellana, our Chairman and Chief Executive Officer, who is also one of the former shareholders of Minera, retained one share of Minera, constituting 0.1% of Minera’s issued and outstanding capital stock. We structured the acquisition of Minera to allow Mr. Orellana to retain one share of Minera in order to comply with Chilean legal requirements that a Sociedad Anónim, like Minera, have at least two record owners of its capital stock. Upon the closing of the reverse acquisition, Mr. Orellana entered into a nominee agreement with us pursuant to which he agreed to act as the record holder of such share, but agreed that all other rights to the share, including the right to receive distributions on the share, vote the share and be the beneficial owner of the share, rest in the Company. Minera was incorporated as a “sociedad anónima cerrada” under the laws of Chile on January 2, 2008. Under Chilean law a “sociedad anónima cerrada” is functionally the same as a corporation under U.S. law. As a result of the reverse acquisition, we have assumed the business and operations of Minera. On June 16, 2010, we changed our name to “Chile Mining Technologies Inc.” to more accurately reflect our new business operations.

On May 12, 2010, we also completed a private placement in which we issued and sold to certain accredited investors an aggregate of 2,089,593 shares of our common stock for an aggregate purchase price of $5,809,000, or $2.78 per share, and warrants to purchase up to 1,044,803 shares of our common stock. The warrants have a term of four years, bear an exercise price of $3.61 per share (subject to customary adjustments for stock splits, stock combinations, reclassifications and similar events), are exercisable on a net exercise or cashless basis and are exercisable by investors at any time after the closing date. This private placement occurred on the same day, but immediately after, the reverse acquisition transaction described above. As a result of this private placement, we raised approximately $5.8 million in gross proceeds, which left us with approximately $4.5 million in net proceeds after the deduction of offering expenses in the amount of approximately $1.3 million.

In connection with the private placement, we also agreed to certain “make good” provisions. Under the “make good” provisions, we issued additional “make good” warrants to the investors to purchase up to an aggregate of 2,089,593 shares of our common stock, at an exercise price of $0.01 per share, which will only become exercisable if we do not meet certain financial performance targets in 2011 and 2012. The “make good” provisions established minimum net income thresholds of $14,382,102 and $15,179,687 for the 2011 and 2012 fiscal years, respectively. We did not meet the minimym net income thresholds for either 2011 or 2012, and accordingly all shares underlying the make good warrants vested and are currently exercisable.

4

On May 8, 2012, we entered into a securities purchase agreement with certain accredited investors, pursuant to which we agreed to issue and sell to such investors (i) up to $3.5 million of eleven percent (11%) secured convertible notes, which notes are convertible into shares of the Company’s common stock at $2.00 per share and (ii) warrants to purchase such number of shares of Common Stock equal to 50% of the number of shares of common stock that the notes purchased by the investors may be convertible into, at an exercise price of $2.00 per share. On May 8, 2012, we completed the initial closing with the investors in which we issued and sold (i) notes in the aggregate original principal amount of $2,120,000, and (ii) warrants to purchase an aggregate of 530,000 shares of common stock, in exchange for aggregate gross proceeds of $2,120,000. On June 7, 2012, we effected a second and final closing pursuant in which we issued and sold to investors (i) notes in the aggregate original principal amount of $1,015,000 and (ii) warrants to purchase an aggregate of 253,750 shares of common stock, for aggregate gross proceeds of $1,015,000.

Our Industry

Overview of the Global Copper Industry

Copper, in the form of copper cathodes, is an internationally traded commodity, and its prices are determined by the major metals exchanges – the New York Mercantile Exchange, or COMEX, the LME, and the Shanghai Futures Exchange, or SHFE. Prices on these exchanges generally reflect the worldwide balance of copper supply and demand, but are also influenced significantly, from time to time, by speculative actions and currency exchange rates. Copper consumption is closely associated with industrial production and therefore tends to follow economic cycles. During an expansion, demand for copper tends to increase, thereby driving up the price. As a result, copper prices are volatile and cyclical.

According to data from ICSG, the refined copper market balance for 2012 is expected to show a deficit of approximately 240,000 metric tons, as increased economic activity is expected to boost demand in copper end-use markets.

World copper mine production in 2012 is expected to rise by approximately 5.1% to approximately 16.9 million metric tons. Capacity utilization rates are expected to improve to around 81% in 2012, up from 79% in 2011. World refined copper production for 2012 is projected to increase by 2.5% in 2012, to around 20.15 million metric tons. In 2013, it is anticipated that refined copper production will increase by about 6.9%

The recent global economic crisis has significantly reduced world refined copper usage. However, increased economic activity has increased demand, and the ICSG expects world refined usage to increase by 2.5% in 2012 to 20.4 million metric tons. Industrial demand growth in China, which accounts for more than 30% of global refined copper consumption, is expected to grow by approximately 3.6% in 2012.

For 2013, improved macro-economic conditions are expected to generate copper demand growth of 3.9%: Chinese usage is foreseen to increase by 4.9% and the rest of the world by 3.3% . In addition, in 2013, with improved concentrate availability, refined copper production is expected to grow by 6.9%, electrowin copper production and secondary refined production are expected to grow by about 160,000 metric tons and 190,000 metric tons, respectively, in 2012, and by about 130,000 metric tons and 180,000 metric tons, respectively, in 2013.

The above information from ICSG is available on their website at www.icsg.org.

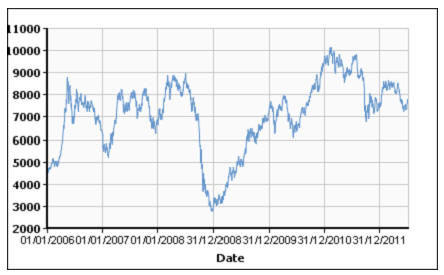

The graph below presents LME spot copper prices and reported stocks of copper at the LME from January 1, 2006 through July 6, 2012.

5

Copper Mining in Chile

Chile is not only the largest copper producer in the world, but also the country with the largest worldwide reserves of the red metal, reveals the latest commodity report by the U.S. Geological Survey (USGS).

According to the USGS, Chile has 28% of the world reserves, more than twice the reserves that neighbour Peru, second global copper producer. It means that the South American country has reserves of 190,000 million tons of copper, 26% more than it was thought (150,000 million tons), which guarantees copper extraction for the next 100 years, at the current extraction rate.

The steady rise in copper prices has made of Chile's economy one of the strongest and most robust of Latin America, as the red metal represents over 40% of the country’s exports, and its main source of income. Chile currently produces more than a third of the worldwide copper.

Copper has been mined and refined in Chile since pre-Columbian times. In the Spanish colonial period dating from 1535 to 1818, the year when independence from Spain was declared in Chile, several dozen small mines were worked by hand, producing around 125,000 metric tons of copper, according to the Chilean Copper Commission (Comisión Chilena del Cobre), or Cochilco. In the period following the establishment of the Republic of Chile until 1900, and as a result of significant British and U.S. investment in new mining technology, about 1,650,000 metric tons of copper was mined at several hundred sites, averaging about 33,000 metric tons per year between 1875 and 1900. Generally, only ore bearing more than 10% copper was mined in shallow pits or short underground mines. Many of our tailings in the Coquimbo region date from this period.

In the 20th century, Chile established itself as the world leader in copper production. In the early 1970s, Salvador Allende’s leftist government nationalized several of the larger foreign-owned copper mining and smelting operations into a state-owned entity known as Codelco. By 1975, the four Codelco properties produced 682,300 metric tons, representing 82% of Chilean copper output. Following the 1976 reorganization, Codelco alone produced 890,000 metric tons in 1977, with Chuquicamata generating 579,000 metric tons, or 65%, of the corporate total, and, another Codelco mine, El Teniente, reaching 276,000 metric tons. From 1983 to 1989, Codelco increased its production from 1,100,000 metric tons to 1,240,000 metric tons, reflecting a pattern of steady reinvestment in extraction, processing, and refining capacity. With the renovation of production capabilities, Codelco emerged as one of the lowest cost producers of copper in the global industry, allowing it to survive a long period in the late 1980s and early 1990s when metals prices were depressed. With the emergence of the Chinese and other Asian economies, Codelco’s output and profitability increased with the demand for copper causing higher prices.

In 1986, Augusto Pinochet’s government liberalized the mining law of Chile, limiting the Codelco mineral claims to those that it had already explored and staked, and permitting private enterprise, domestic and foreign, to reenter the mining business for copper and all other minerals in the country. In addition to several small, locally-owned mining companies, many major international mining companies such as Australia-based BHP-Billiton, Canada-based Aur Resources Inc., and South Africa-based Anglo-American plc, began to develop modern, high-capacity copper mining projects, most of which came on line in the late 1990s, increasing Chilean national copper output by over 400% from 1989, and global market share from about 17% to approximately 35% in 2010.

6

Our Competitive Strengths

We believe that the following competitive strengths enable us to compete effectively and to capitalize on the growth of the market for copper:

-

Use of MINI plant Design. Our overall strategy is to extract copper from source material for the lowest possible cost using MINI plant design. We believe that the MINI plant offers major advantages in (1) making smaller-sized ore deposits and tailings sites economically viable over the expected range of copper prices; (2) reducing electricity and water requirements in a country where the resources are scarce and relatively expensive; (3) increasing portability as the source material at a commercially feasible site depletes; and (4) increasing our proximity to smaller third-party mining operations.

-

First to Market. To our knowledge, we are the first company in Chile to utilize a scalable MINI plant concept to process relatively small deposits and tailings sites. Being an early entrant to the market provides us with know- how and experience that are essential to the profitable exploitation of these sites. Any new market entrants that might become our competitors in the future will require time to develop operational processes and experience and general know-how before they can effectively compete with us.

-

Low level of Competition. We currently have no competitors in Chile that extract copper from smaller or abandoned tailings sites utilizing MINI plants like we do. Although we can provide no assurances that other mining companies will not enter the market of extracting copper utilizing the MINI plant concept, we believe that we will have a competitive advantage over any new market entrant as a result of our ongoing operational experience.

-

Experienced Management Team. Each member of our management team has extensive experience in the mining industry in Chile. All members of our senior management team have advanced degrees, and include a geologist and a mechanical engineer. Our senior management team has worked together at our Chilean subsidiary, Minera, and on other projects before the inception of Minera for over fifteen years. This experience provides us with the ability to identify new mining opportunities, analyze such opportunities for profitability and develop processes to exploit any opportunities we identify.

Our Operational Strategy

We are committed to enhancing profitability and cash flows through the following strategies:

-

Expansion. Since starting construction in the fall of 2008, we have successfully completed the first MINI plant, designated as the Ana Maria plant, located about 30 kilometers northeast of the town of Illapel, in the mining district of Matancilla. Construction of our second MINI plant, Santa Filomena, is approximately 75% complete and we anticipate the construction of additional MINI plants over the next 18 to 24 months. We have identified additional sites suitable for our MINI plants. As discussed in greater detail under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources – Overall Liquidity and Capital Resources,” our ability to effectively expand our operations is dependent on our ability to obtain sufficient funds, through a financing, bank loans or a combination thereof.

-

Exploration. Utilizing the operational platform that we have developed, we intend to create other sources of revenue within the Chilean mining industry. We plan to create a mineral exploration department and utilize our experienced management and operational teams to explore mining opportunities in Chile.

Our Products

Our main product is copper, in the form of copper cathode. Copper is the world’s third most widely used metal and an important component in the world’s infrastructure. Copper has unique chemical and physical properties, including high electrical conductivity and resistance to corrosion, as well as excellent malleability and ductility that has made it a superior material for use in the electrical energy, telecommunications, building construction, transportation and industrial machinery businesses. Copper is also an important metal in non-electrical applications such as plumbing, roofing and, when alloyed with zinc to form brass, in many industrial and consumer applications.

7

Initially, we plan to sell our copper cathodes to Madeco, the largest cable producer in Chile. Based on our discussions with Madeco, we expect that the selling price will be at a 3% discount from the price for copper, adjusted for purity, on the LME. We expect that sales will be made under purchase orders where cash will be paid upon delivery. We anticipate that this arrangement will provide us with immediate cash flow with which to fund our current operations. In the future, as business volume grows, we may elect to sell our copper cathodes at the generally higher prices prevailing on the LME.

Our Plants

Since starting construction in the fall of 2008, we have successfully completed our first scalable MINI plant, designated as the Ana Maria plant, located about 30 kilometers northeast of the town of Illapel, in the mining district of Matancilla. We have been testing the production of copper cathodes at the Ana Maria plant since late April 2009. In July 2009, we produced our first commercial run of copper cathodes.

We commenced operations at the Ana Maria plant in July 2009. The Ana Maria plant was taken off-line the first week of May 2010 in order to increase the capacity of this facility. As a result, the total capacity of the Ana Maria plant increased from 120 metric tons per month to 180 metric tons per month, effectively increasing its capacity by 50%. We resumed operations at the plant with the additional capacity in place at the beginning of August 2010. Due to the increased needs for working capital to purchase ore, the plant is not yet operating at significant levels of production. We believe that the site can be progressively expanded to about 5,000 metric tons per annum on a modular basis in increments of 500 to 1,000 metric tons, subject to the market price for copper and the grade and quantity of source materials available to be processed. We are also further enhancing our electrowin-based recovery techniques to reduce costs and improve the yield of the copper out of the mineral spectrum.

Construction of our second MINI plant, Santa Filomena is approximately 75% complete, and we have also begun preparatory work at one additional site and we anticipate the construction of additional MINI plants over the next 18 to 24 months. We have identified several additional sites suitable for our MINI plants.

The table below summarizes the capacity of each of our current and planned MINI plants.

| District | Plant | Initial Production | Initial Capacity/Year | |||

| Matancilla | Ana Maria | Operating | 1,500 MT (1) | |||

| Salamanca | Santa Filomena | 2nd Quarter 2013 | 1,500 MT | |||

| Combarbala | Gabriella | 4th Quarter 2013 | 1,500 MT |

(1) Since we commenced operations at the Ana Maria plant, total annual capacity has been increased to 2,225 metric tons.

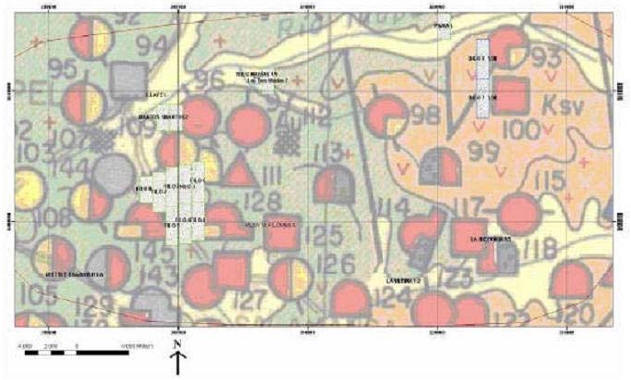

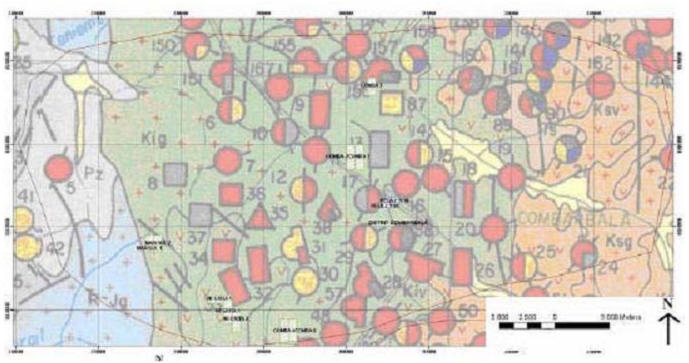

We have obtained the rights to conduct our mineral extraction operations at our first 2 planned sites, Matancilla and Salamanca properties. We have agreements in place for the mineral rights at one additional property. These agreements require deposits to be fully executed and anticipate executing these agreements once the Company has the required funds.

Plant Operations

Summary Overview of Our Extraction Process

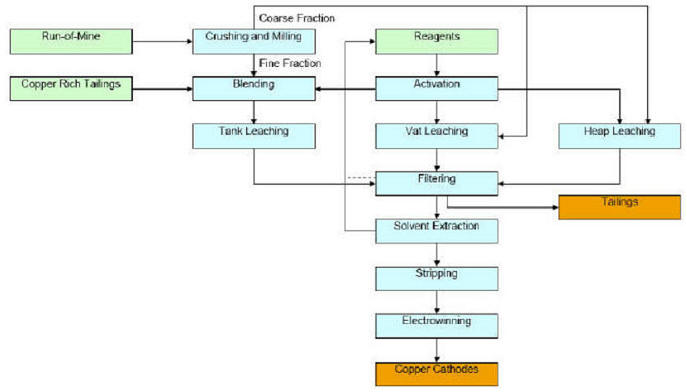

The following chart illustrates the process of extracting copper from source material:

8

As shown in the chart above, source material in the form of ore, identified as “run-of-mine,” is initially crushed and milled, with the larger fragments sent for leaching in either vats or in large mounds. The smaller fragments are blended with copper tailings and leached in tanks. The larger fragments are piled in a heap which is lined with an impervious layer, and the leaching solution is sprayed over the top of the heap, and allowed to percolate downward through the heap. The heap design incorporates collection sumps which allow the leach solution that has collected dissolved metal ions to be pumped our and mixed with a 2g/liter solution of acid for further processing. Each leaching process, which differs chemically and operationally, involves the introduction of acids to the source material, which liquefies the copper contained in the source material, thereby separating it from the rock and other materials in the source material. The resulting acidic solution is then filtered and ultimately placed into tanks where the electrowin process is introduced. During the electrowinning process, positive and negative electrodes are placed in the acidic solution containing the copper ions, and an electric current passed through the solution causes the copper to be deposited on the negative electrodes for collection in the form of the copper cathodes. As a result of the electrowinning process, a reaction occurs in carrying out the transfer of copper, which clears a positive hydrogen ion which then associates with molecules of chlorine and nitrate (which are added artificially), resulting in the formation of hydrochloric acid and nitric acid. The addition of sodium chloride and nitrate in bulk is unique to our process and allows us to collect the hydrochloric acid and nitric acid for use in future processing.

The price of copper on the LME fluctuates daily, and, more significantly, by quarter of the year, with prices tending to be stronger in the April to September period, and weaker in the October to March period, subject to global supply and demand. Output from each MINI plant is also subject to a number of factors revolving around overall mechanical reliability of the processing equipment, the ore grade, and weather conditions.

The economic advantages of the MINI plant are driven by the ability to achieve profitable operation by reducing the cost of: (1) transportation of the source material to the plant site; (2) leaching agents; (3) electric power; (4) water; (5) total manpower; and (6) capital cost recovery of the installed plant. Most elements of the unit costs tend to increase as the world price of copper rises. In periods of price retreats, some elements such as leaching agents and feed stock have dropped below their peak period costs. Electric power and water costs tend to be relatively stable, but are generally quite high in Chile due to geography and the desert-like climate, which affects most regions where mines have been exploited.

As the Chilean economy is very closely tied to copper, many of our direct costs fluctuate based on the price of copper. At certain copper prices, the Company estimates that it could produce 1 lb. of copper for as low as $1.00 per pound. The following table illustrates the costs associated with producing one pound of copper, based on our current budget estimates for the Ana Maria plant (assuming copper price of $3.00/lb. ):

9

| Cost Element | Unit Cost |

| Copper Ore/Mining Operations – Average 2.0% grade | 0.59 |

| Receiving, Scaling & Crushing | 0.11 |

| Leaching and Processing Operations | 0.46 |

| Administration | 0.10 |

| Sales Expenses | 0.02 |

| Maintenance | 0.05 |

| Depreciation of Plant & Equipment | 0.15 |

| TOTAL COST PER POUND – US$ | 1.48 |

Crushing Operations

The crushing operation begins with weighing ore on bascules located in the ore collection area. The bascules weigh the totality of the ore that is received in order to provide an accurate weight. Samples are then taken in the trucks in order to define the ore humidity and an initial grade. Once samples are taken, the ore is moved to the loadout bin, which has a capacity of 25 tons. The ore is then delivered to a 1.2m x 1.8m jaw crusher by way of a pneumatic feeder and a conveyor belt, and the crushed ore is discharged on a conveyor belt to a vibrating sieve that has two screening decks, one consisting of half-inch screens and the other a 6mm mesh. Ore larger than 0.5 inches is delivered to a crusher with a 4.5 inch cone, which reduces the ore and returns to the sieve.

Ore smaller than 0.5 inches and larger than 6mm is used in our heap leaching operations. All ore smaller than 6mm is weighed and used in our agitation leaching operations.

Heap Leaching Operations

The heap leach sites are located within 3,940 feet in distance and 99 feet in height relation to our solvent extraction sites. The area in which heaps are located is 132 x 164 feet and consists of 4 heaps. The area is leveled with an inclination of 5% and is compacted with granulated millet. To waterproof the heaps, their surface is coated with a 0.75cm thick high-density polyethylene pad that is fused at the joints.

This ore used in our heap leaching operations should have an estimated grade of 1.5% of soluble copper and an acid consumption average of 5 to 8 kg of acid per kg of copper extracted. Each heap should measure 40m wide x 50m long and 2m high, resulting in an approximate capacity of 5000 tons of ore per heap. In addition, a 2 inch drenaflex system is installed on the fine ore that was spread to prevent damage to the pad and to ensure proper drainage of the heap.

The ore from the heaps is irrigated with a solution of refined acidity ranging from 10 to 15 grams of mineral acid per liter under a drip irrigation system, and an irrigation rate of about 8 liters per square meter per hour. This delivers approximately 280 liters of pregnant leach solution, or PLS, per minute with an average of 4 to 5 grams per liter of copper, an acidity of 2 grams per liter of acid and a pH of 2. A heap with a copper concentration of less than 4 grams per liter will proceed to recirculation of the PLS to re-supply the heap with the same solution to obtain a concentration of 4 or more grams of copper per liter.

The next stage requires 1,700 cubic meter pools, a refinery, a 1,200 cubic meter recirculating pool and a 600 cubic meter pool containing PLS. The irrigated solution in heaps with approximately 4 grams of copper per liter will be stored in a 1,100 cubic meter PLS heap pool from which it will be sent to the solvent extraction facility. All solutions transferred between the heaps and the pools of the plant travel through 110mm high-density pipe.

The ore remains in the heaps for approximately 60 days, and is expected to recover 70% of content copper. The heaps are then disassembled and the ore is sent to the run-of-mine heap which will flush the mineral indefinitely to reach copper recovery levels from 85 % to 90%.

The water for our heap leaching operations is collected from an irrigation canal. We collect water for our operations at a rate of approximately 1,200 liters per minute for approximately 4.5 hours per week.

10

Solvent Extraction Operations

The feed stock for our solvent extraction operations is collected from two pools which are located at the plant at a height about 5 meters above the solvent extraction facility. One pool has a capacity of 250 cubic meters, and the second, which receives solution, has a capacity of 200 cubic meters. To begin the extraction process, PLS is mixed with a 20% extractant solution, or organic, in an agitator with a capacity of approximately 4.5 cubic meters. The copper minerals in the solution settle and are separated from the solution. The raffinate, or remaining liquid following collection of extracted minerals, produced in the extraction stage is driven by gravity to two 9 cubic meter tanks and processed through a paraffin filter system to catch any remaining particles of organic. The raffinate is ultimately pumped back to the heaps, where it is irrigated through in order to collect copper and be re-introduced to our solvent extraction facility.

To wash the organic from the copper minerals in the settled solution, the separated solution is pumped into two 4.5 cubic meter agitators where the 20% organic extractant solution is mixed with a cleaning water solution with an acidity of approximately 20 grams per liter. To extract copper from the cleaned and loaded organic solution, there are two agitators where the 20% organic extractant is mixed with electrolytes produced in our electrowinning process, with an acidity of approximately 200 grams per liter of acid and a total of approximately 4.5 cubic meters. The mixture is allowed to settle and the copper-rich electrolytes are separated and pumped to our electrowinning cells and the discharged organic material is sent back through the extraction process.

Electrowinning Operations

The electrowin circuit has 2 parallel banks of cells, each with 16 cells. Each cell has a capacity of 3 cubic meters, and each bank can contain a maximum of 16 cathodes. The circuit is capable of delivering approximately 120 metric tons of copper cathodes per month when operating at maximum capacity, and each cell bank has a rectifier with a capacity up to 10,000 amperes and 32 volts. Each starter cathode is 0.88mm thick and measures 90cm by 90cm. When operating at full capacity, we are able to harvest finished copper cathodes in ten day cycles.

The following table illustrates the projected copper deposition of our Ana Maria facility per harvest operating at full capacity:

| Daily deposition per cell | 132 Kg |

| Daily deposition per cathode | 8.2 Kg |

| Total daily production | 2,109 Kg |

| Total monthly production per bank | 63,261 Kg |

| Total monthly production of the facility | 126,522 Kg |

| Harvest in days | 10 Days |

| Metric tons per harvest | 40.960 Metric Tons |

*All amounts are approximations

Raw Materials

Source material, including tailings and ore, sulfuric acid and water are the principal raw materials used in our current operations. While the properties we have obtained rights to each have their own mineral deposits, we will procure the majority (approximately 88%) of our source material from third parties by purchasing rights to such source material at smaller sites, where it is less economical for larger open-pit mining companies to operate, due largely to the transportation costs associated with moving source materials to fixed processing sites.

While the process of extracting copper from tailings requires the use of sulfuric acid, we utilize a methodology which allows us to extract the sulfuric acid that is contained in the tailings which are either located at our MINI plant site or which are created through the use of our copper extraction process on ore, and then reuse the sulfuric acid to extract copper from future source material. This recycling process helps us minimize our costs of raw materials.

Our operations require significant quantities of water for mining, ore processing and related support facilities. Our operations are in areas where water is scarce and competition among users for continuing access to water is significant.

11

Continuous operation at our MINI plants is dependent on our ability to maintain our water rights and claims and defeat claims adverse to our current water uses in legal proceedings. At present our only MINI plant that is operational is our Matancilla facility. At this facility, we have obtained the right to collect water from the river that flows through the property to satisfy all of the operational needs of the facility.

Our costs for sulfuric acid and electric power vary. However, at present, sulfuric acid costs approximately $190 per metric ton, and electricity costs us between approximately $2.00 and $4.80 per kilowatt hour.

Research and Development

We do not currently engage in any significant levels of research and development and do not have any employees who are solely dedicated to research and development. We do, however, continually monitor industry developments in the mining and processing industries and we regularly analyze our own procedures and methods to further refine and improve them.

Our Competition

We currently have no competitors in Chile that extract copper exclusively from smaller producers or abandoned tailings sites utilizing MINI plants like we do. Although we can provide no assurances that other mining companies will not enter the market of extracting copper utilizing the MINI plant concept, we believe that we will have a competitive advantage over any new market entrant as a result of our ongoing operational experience.

There are, however, other companies in Chile producing copper from tailings. One such company, MVC, a wholly-owned subsidiary of a Canadian publicly traded company, Amerigo Resources Ltd., produces copper and molybdenum concentrates from tailings located in the world’s largest underground copper mine, Codelco’s El Teniente mine. MVC is currently treating all fresh tailings from El Teniente’s present production and has the right to treat the higher grade tailings from a 200 million ton in situ tailings impoundment located next to MVC’s plant. MVC, however, processes a different type of copper ore using a flotation process for copper concentrate, as opposed to our process which utilizes cathodes.

We do not believe that MVC represents significant competition for us for the following reasons:

-

The operations of MVC are in a separate geographic region from where we are currently operating or where we expect to expand our operations;

-

MVC conducts its operations through large capital expenditure at one production site, whereas our business model focuses on conducting operations at multiple production sites with small targeted capital investments to each site; and

-

MVC is focused and dependent on a single customer, whereas our business model combines self-provided source material combined with access to third-party source material.

Intellectual Property

We do not possess any material intellectual property.

Environmental Matters

Chile’s environmental regulations are administered by the Comisión Nacional del Medio Ambiente, or CONAMA. Typically, copper producers and other similar companies are required to prepare and submit environmental impact studies detailing the impact of the copper reclamation and production on the surrounding environment, and to adhere to other environmental regulations. We have obtained written confirmation from CONAMA that our operations fall outside the scope of these environmental regulations because our MINI plant facilities do not produce in excess of 5,000 metric tons of copper per year from ore source material.

Regulation

Our mineral reclamation activities are not regulated by any specific governmental agency, as our activities are not in the public domain. The general policies of the mining industry, however, are administered by the Chilean Ministry of Mining and its departments, and our activities are governed by the Chilean Mining Code, Decree of Mining Security and general labor, commercial, health and environmental regulations. We believe that we are in compliance with all laws and regulations that are applicable to our operations.

12

Our Employees

As of March 31, 2012, we employed 32 full-time employees. The following table sets forth the number of our full-time employees by function.

| Function | Number of Employees |

| General and administration | 5 |

| Executive Officers | 4 |

| Engineering/Technicians | 11 |

| Operations | 12 |

| TOTAL | 32 |

Insurance

We maintain property insurance for our premises located in Santiago, Chile where our executive offices are located. We also maintain property insurance for our automobiles. We do not maintain business interruption insurance or key-man life insurance. We believe our insurance coverage is customary and standard of companies of comparable size in comparable industries in Chile.

We do not maintain property insurance for our MINI plants. Because of the modular nature of our MINI plant facilities and the fact that we do not erect any permanent structures at these facilities, we have determined that premiums payable for property insurance would be an inefficient use of our operating capital.

Seasonality

The price of copper on the LME fluctuates during the year, with prices tending to be stronger in the April to September period, and weaker in the October to March period, subject to global supply and demand.

| ITEM 1A. | RISK FACTORS. |

RISKS RELATED TO OUR BUSINESS

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

We have a working capital deficit of $5,172,118 and have incurred a net loss of $13,102,212 for the cumulative period from January 24, 2008 (inception) to March 31, 2012, and have had no significant source of revenue. The future of our Company is dependent upon future profitable operations from the extraction of copper and the growth of our mineral properties. Our management will need to seek additional financing in the future. These conditions raise substantial doubt about our Company’s ability to continue as a going concern.

We have a limited operating history upon which to evaluate our potential for future success.

Our operating subsidiary, Minera, was initially formed as a closed capital corporation (sociedad anónima cerrada) on January 2, 2008 and first began processing copper from its first operational MINI plant in April, 2009. The likelihood of our success must be considered in light of the risks and uncertainties frequently encountered by early stage companies like ours in an evolving market, such as unforeseen capital requirements, failure of market acceptance, failure to establish business relationships, and competitive disadvantages as against larger and more established companies. If we are unsuccessful in addressing these risks and uncertainties, our business will be materially harmed.

13

If we fail to effectively manage our growth and expand our operations, our business, financial condition, results of operations and prospects could be adversely affected.

Our future success depends on our ability to expand our business. Since starting construction in the fall of 2008, we have successfully completed the first MINI plant, designated as the Ana Maria plant, located about 30 kilometers northeast of the town of Illapel, in the mining district of Matancilla. Construction of our second MINI plant, Santa Filomena, is approximately 75% complete, and we have begun preparatory work at one additional site. We anticipate the construction of additional MINI plants over the next 18 to 24 months. We have identified several additional sites suitable for our MINI plants.

As discussed in greater detail under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources – Overall Liquidity and Capital Resources,” our ability to effectively expand our operations is dependant on our ability to obtain sufficient funds, through a financing, bank loans or a combination thereof. We estimate that we will need approximately $3.0 million to fully execute on our business plan. However, even if we are able to obtain these funds, our ability to commence operations at additional sites and establish additional capacity and increase the volume of copper is subject to significant risks and uncertainties, including:

- delays and cost overruns as a result of a number of factors, many of which may be beyond our control, such as problems with equipment vendors and manufacturing services provided by third-party manufacturers;

- the inability to obtain, or delays in obtaining, required approvals by relevant government authorities;

- diversion of significant management attention and other resources; and

- failure to execute our expansion plan effectively.

To accommodate our growth, we will need to implement a variety of new and upgraded operational and financial systems, procedures, and controls, including improvements to our accounting and other internal management systems, by dedicating additional resources to our reporting and accounting function, and improvements to our record keeping systems. We will also need to recruit more personnel and train and manage our growing employee base. Furthermore, our management will be required to maintain and expand our relationships with our existing customer and find new customers for our products. There is no guarantee that our management can succeed in maintaining and expanding these relationships.

The expansion of our business may place significant strain on our personnel, management, financial systems, and operational infrastructure, and may impede our ability to meet any increased demand for our products. Our business growth also presents numerous risks and challenges, which are difficult to quantify but could be significant, including the costs associated with such growth.

If we encounter any of the risks described above, or if we are otherwise unable to establish or successfully operate additional capacity or increase our output, we may be unable to grow our business and revenues, reduce our operating costs, maintain our competitiveness or improve our profitability and, consequently, our business, financial condition, results of operations, and prospects will be adversely affected.

Extended declines in the market prices of copper could adversely affect our earnings and cash flows. Fluctuations in the market price of copper can cause significant volatility in our financial performance and can adversely affect the trading price of our common stock.

Our earnings and cash flows are affected significantly by the market price of copper. The world market price of copper has fluctuated historically and is affected by numerous factors beyond our control. Copper prices declined significantly during the latter part of 2008 from their recent historically high levels and, while prices have steadily recovered, exchange inventories remain at significantly higher levels than the first half of 2008. After averaging $3.61 per pound for the first nine months of 2008, the LME spot copper prices declined to a four-year low of $1.26 per pound in December 2008. The LME spot copper price closed at $3.52 per pound on July 5, 2012. An extended decline in the market price of copper could (1) adversely affect our earnings and cash flows, (2) adversely affect our ability to repay our debt and meet our other fixed obligations, and (3) depress the trading price of our common stock.

In addition, substantially all of our copper cathode sales will be provisionally priced at the time of shipment, subject to final pricing, at a specified future date based on the LME prices on that date. Accordingly, in times of falling copper prices, our revenues during a quarter are negatively affected by lower prices received for sales priced at current market rates and also from a decrease related to the final pricing of provisionally priced sales in prior periods.

14

We estimate that our MINI plant technology will allow us to break even at copper prices as low as $1.00 per pound. If the market price for the copper cathodes we produce falls below $1.00 per pound for a sustained period of time, we may have to further revise our operating plans, including curtailing production, reducing operating costs and capital expenditures and discontinuing certain exploration and development programs. We may be unable to decrease our costs in an amount sufficient to offset reductions in revenues, and may incur losses.

World copper prices have historically fluctuated widely. During the five years ended December 31, 2011, the LME daily closing spot prices ranged from $1.26 to $4.60 per pound for copper. World copper prices are affected by numerous factors beyond our control, including:

- the strength of the U.S. economy and the economies of other industrialized and developing nations, including China, which has become the largest consumer of refined copper in the world;

- available supplies of copper from mine production and inventories;

- sales by holders and producers of copper;

- demand for industrial products containing copper;

- investment activity, including speculation, in copper as a commodity;

- the availability and cost of substitute materials; and

- currency exchange fluctuations, including the relative strength or weakness of the U.S. dollar.

Disruptions in the capital and credit markets related to the current national and worldwide financial crisis, which may continue indefinitely or intensify, could adversely affect our results of operations, cash flows and financial condition, or those of our customers and suppliers.

The current disruptions in the capital and credit markets may continue indefinitely or intensify, and adversely impact our results of operations, cash flows and financial condition, or those of our customers and suppliers. Disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives or failures of significant financial institutions could adversely affect our access to liquidity needed to conduct or expand our businesses or conduct acquisitions or make other discretionary investments, as well as our ability to effectively hedge our currency or interest rate. Such disruptions may also adversely impact the capital needs of our customers and suppliers, which, in turn, could adversely affect our results of operations, cash flows and financial condition.

A surplus in the copper market could lower the market price of copper, which would adversely affect our results of operations.

According to data from the International Copper Study Group, the refined copper market balance for 2012 is expected to show a deficit of approximately 240,000 metric tons. However, a surplus in the copper market could cause the market price of copper to decrease or make it difficult for us to sell all of the copper that we extract, and thereby could adversely affect our results of operations, cash flows and financial condition.

We may require additional capital and we may not be able to obtain it on acceptable terms or at all.

We believe that our current cash, reinvested cash flow from operations will be sufficient to meet our present cash needs. We may, however, require additional cash resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If these resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financing covenants that would restrict our operations. Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

- investors’ perception of, and demand for, securities of Chilean-based companies involved in the mining sector;

- conditions of the U.S. and other capital markets in which we may seek to raise funds;

- our future results of operations, financial condition and cash flows; and

- economic, political and other conditions in Chile.

15

Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could have a material adverse effect on our business, financial condition and results of operations.

Our business is subject to operational risks that are generally outside of our control and could adversely affect our business.

Mineral reclamation sites, like the sites where we will locate our MINI plants, by their nature are subject to many operational risks and factors that are generally outside of our control and could adversely affect our business, operating results and cash flows. These operational risks and factors include the following:

- unanticipated ground and water conditions;

- adverse claims to water rights and shortages of water to which we have rights;

- adjacent land ownership that results in constraints on current or future operations;

- geological problems, including earthquakes and other natural disasters;

- metallurgical and other processing problems;

- the occurrence of unusual weather or operating conditions and other force majeure events;

- lower than expected ore grades or recovery rates;

- accidents;

- delays in the receipt of or failure to receive necessary government permits;

- the results of litigation, including appeals of agency decisions;

- uncertainty of exploration and development;

- delays in transportation;

- interruption of energy supply;

- labor disputes;

- inability to obtain satisfactory insurance coverage; and

- the failure of equipment or processes to operate in accordance with specifications or expectations.

Continuation of our production is dependent on the availability of a sufficient water supply to support our operations.

Our operations require significant quantities of water for mineral reclamation, ore processing and related support facilities. Our operations are in areas where water is scarce and competition among users for continuing access to water is significant. Continuous production is dependent on our ability to maintain our water rights and claims and defeat claims adverse to our current water uses in legal proceedings.

We cannot predict the potential outcome of any future legal proceedings on our water rights, claims and uses. The loss of some or all water rights for any of our sites, in whole or in part, or shortages of water to which we have rights could require us to curtail or shut down production and could prevent us from pursuing expansion opportunities. Additionally, we have not yet secured adequate water rights to support all of our potential expansion projects, and our inability to secure those rights could prevent us from pursuing some of those opportunities.

An interruption of energy supply could adversely affect our operations and increased production costs could reduce our profitability and cash flow.

Our operations and construction projects require significant amounts of energy. Our principal energy source is electricity. We access electricity from the national power grid and through onsite backup generators that are diesel powered. A disruption in the transmission of energy, inadequate energy transmission infrastructure, or the termination of any of our energy supply contracts could interrupt our energy supply and adversely affect our operations.

Electricity represents a significant portion of our production costs. An inability to procure sufficient electricity at reasonable prices could adversely affect our profits, cash flow and growth opportunities. Our production costs are also affected by the prices of commodities we consume or use in our operations, such as sulfuric acid, steel, reagents, liners, explosives and diluents. The prices of such commodities are influenced by supply and demand trends affecting the mining industry in general and other factors outside our control and such prices are at times subject to volatile movements. Future increases in the cost of these commodities could make our operations less profitable. Increases in the costs of commodities that we consume or use may also significantly affect the capital costs of new projects.

16

We could incur substantial costs in order to comply with, or to address any violations under, environmental laws that could significantly increase our operating expenses and reduce our operating income.

We are subject to Chile’s comprehensive statutory and regulatory environmental requirements relating to, among others:

- the protection of our employees’ health and safety;

- the acceptance, storage, treatment, handling and disposal of hazardous waste;

- the discharge of materials into the air;

- the management and treatment of wastewater and storm water;

- the remediation of soil and groundwater contamination; and

- the restoration of natural resource damages.

We can give you no assurance that we will be in material compliance or avoid fines, penalties and expenses associated with compliance issues in the future.

We are required to obtain, and must comply with, a specific resolution of the Chilean Ministry of Health issued to us in order to conduct our operations. Failure to comply with the resolution, or violations thereto if not remedied, could result in our incurring fines. Further, our operations are conducted primarily outdoors and as such, depending on the nature of the ground cover, could involve the risk of releases of wastes and other regulated materials to the soil during transportation and, possibly, to the groundwater.

In Chile, environmental statutes and regulations have changed rapidly in recent years by requiring greater and more expensive protective measures, and it is possible that we will be subject to more stringent environmental standards in the future. For these reasons and others, we cannot accurately predict future capital expenditures for pollution control equipment, remediation, or other initiatives that may be required. However, we expect that environmental standards will become increasingly more stringent and that the expenditures necessary to comply with those heightened standards will correspondingly increase.

In general, we do not carry environmental impairment liability insurance because we believe the cost of any premiums outweighs the benefit of coverage and that the current legal regime applicable to our operations protects us from any significant liability. If, however, we were to incur significant liability for environmental damage, such as a claim for soil or groundwater remediation, our results of operations and financial condition could be materially and adversely affected.

Certain of our existing stockholders have substantial influence over our company, and their interests may not be aligned with the interests of our other stockholders.

Mr. Jorge Osvaldo Orellana Orellana, our Chairman, Chief Executive Officer and President, beneficially owns approximately 38.18% of our outstanding voting securities. As a result, he has significant influence over our business, including decisions regarding mergers, consolidations, the sale of all or substantially all of our assets, election of directors and other significant corporate actions. This concentration of ownership may also have the effect of discouraging, delaying or preventing a future change of control, which could deprive our stockholders of an opportunity to receive a premium for their shares as part of a sale of our Company and might reduce the price of our shares.

Our management has identified a material weakness in our internal control over financial reporting, which if not properly remediated could result in material misstatements in our future interim and annual financial statements and have a material adverse effect on our business, financial condition and results of operations and the price of our ordinary shares.

The SEC as required by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, adopted rules requiring every public company to include a management report on such company’s internal control over financial reporting in its annual report, which must also contain management’s assessment of the effectiveness of the company’s internal control over financial reporting. In addition, the independent registered public accounting firm auditing the financial statements of a company that is not a non-accelerated filer under Rule 12b-2 of the Exchange Act must also attest to the operating effectiveness of the company’s internal controls.

17

A report of our management is included under Item 9A of this report. Our management has concluded that that our internal controls over financial reporting as of March 31, 2012 were not effective due to certain material weaknesses identified in Item 9A. Our independent registered public accounting firm was not required to attest to the operating effectiveness of our internal controls since we are a non-accelerated filer.

We are in the process of implementing certain initiatives to address these weaknesses as described under Item 9A. However, there is no guarantee that these initiatives will remediate the weaknesses completely. Failure to achieve and maintain an effective internal control environment could result in us not being able to accurately report our financial results, prevent or detect fraud or provide timely and reliable financial and other information pursuant to the reporting obligations we have as a public company, which could have a material adverse effect on our business, financial condition and results of operations. This could further reduce investors’ confidence in our reported financial information, which in turn could result in lawsuits being filed against us by our stockholders, otherwise harm our reputation or negatively impact the trading price of our common stock.

RISKS RELATED TO DOING BUSINESS IN CHILE

Chilean political and economic conditions have a direct impact on our business.

All of our assets are located in Chile and all of our revenues are derived in Chile. Accordingly, our business, financial condition and results of operations depend to a considerable extent upon economic conditions in Chile. Future developments in the Chilean economy could adversely affect our financial condition or results of operations and may impair our ability to proceed with our strategic plan of business. In addition, such developments may impact the market price of our securities.

The Chilean government has exercised and continues to exercise a substantial influence over many aspects of the private sector and has changed monetary, fiscal, tax and other policies to influence the Chilean economy. We have no control over and cannot predict how governmental intervention and policies will affect the Chilean economy or, directly and indirectly, our operations and revenues. Our operations and financial condition, as well as the market price of our securities, may be adversely affected by changes in policies involving exchange controls, taxation, and other matters. In addition, our operations and financial condition, as well as the market price of our securities, may be adversely affected by factors such as:

- fluctuations in currency exchange rates;

- base interest rate fluctuations; and

- other political, diplomatic, social and economic developments in or affecting Chile.