Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - CADUCEUS SOFTWARE SYSTEMS CORP. | Financial_Report.xls |

| EX-32 - SOX SECTION 906 CERTIFICATION OF THE CEO & CFO - CADUCEUS SOFTWARE SYSTEMS CORP. | exhibit321.htm |

| EX-31 - SOX SECTION 302(A) CERTIFICATION OF THE CEO & CFO - CADUCEUS SOFTWARE SYSTEMS CORP. | exhibit311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

(Mark One) | ||

|

[X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

|

For the fiscal year ended |

March 31, 2012 | |

|

[ ] |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

|

For the transition period from |

[ ] to [ ] | |

|

Commission file number |

333-144509 | |

|

CADUCEUS SOFTWARE SYSTEMS CORP. |

|

(Exact name of registrant as specified in its charter) |

|

Nevada |

|

98-0534794 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

42A High Street, Sutton Coldfield, West Midlands, United Kingdom |

|

B72 1UJ |

|

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant's telephone number, including area code: |

|

+44 0121 695 9585 |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange On Which Registered |

|

N/A |

|

N/A |

Securities registered pursuant to Section 12(g) of the Act:

|

N/A | |

|

(Title of class) | |

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. | |

|

|

Yes ¨ No x |

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act | |

|

|

Yes ¨ No x |

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. | ||||||||

|

|

Yes ¨ No x | |||||||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). |

| |||||||

|

|

Yes x No ¨ |

| ||||||

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | ||||||||

|

|

¨ | |||||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| ||||||||

|

Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| ||||

|

Non-accelerated filer |

¨ |

Smaller reporting company |

x |

| ||||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | ||||||||

|

|

Yes ¨ No x | |||||||

The aggregate market value of Common Stock held by non-affiliates of the Registrant on September 30, 2011 was US$9,772,200 based on a US$0.0445 average bid

and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

|

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date. | |

|

276,700,000 as of July 16, 2012 |

|

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

TABLE OF CONTENTS

3

PART I

Item 1. Business

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this current report and unless otherwise indicated, the terms "we", "us", "our" and "our company" mean Caduceus Software Systems Corp., unless otherwise stated.

General Overview

We were incorporated as a Nevada company on December 13, 2006. On March 1, 2011 we changed our name from Bosco Holdings Inc., to Caduceus Software Systems Corp., and increased our authorized capital to 400,000,000 shares of common stock. As of March 3, 2011 we also undertook a forward split of our issued and outstanding shares on a basis of 1 old for 8 new. We maintain our business offices at 42a High Street, Sutton Coldfield, West Midlands, United Kingdom, and our telephone number is +44-0121-695-9585.

Previous Business

Until June 9, 2011, we were engaged in the business of marketing and distributing laminate flooring in both the mass wholesale and retail markets throughout North America. We entered into a marketing and sales distribution agreement with our supplier, Bossco-Laminate Co., Ltd., a private Russian company. However, we were not able to find sufficient investment in order to expand our business and our management was forced to change our business focus.

Current Business

On June 9, 2011 we entered into and closed a licensing agreement with Sygnit Corporation for the exclusive license to software optimized for use in medical the medical industry for patient management, patient appointment scheduling, physician memorandum recording, medical symptom and ailment recording and digital image recording. We are now a medical software company that offers a suite of medical management applications, collectively named Caduceus MMS, that focus on an alternative to traditional patient administration systems: reducing the time and expense involved in managing appointment scheduling; providing practitioners with a comprehensive set of resource, prescription, and contraindication libraries, and; a sophisticated architecture designed to minimize the billing submission time while maximizing the successful reimbursements to the clinic.

4

Products and Services

Through the license agreement with Sygnit, we are able to provide a suite of software to medical professionals. Our software offerings are designed in stages so that each component and phase carefully addresses both the practitioner’s administrative and level-of-service requirements. Unlike most EHR (Electronic Health Recording) or EMB (Electronic Medical Billing) systems that handle either billing or scheduling, Caduceus MMS is equipped to manage an entire practice. In order to remain streamlined Caduceus MMS is structured as a set of closely interrelated service units, scalable modules, and upgradeable libraries.

We expect that Caduceus MMS will primarily be installed and used in a clinical or office environment, thus it was primarily designed to be implemented in a local network on standard Windows-based computer systems. In this configuration, the software requires almost no additional hardware outlay; it can be installed and used almost immediately. With the addition of server and imaging modules, Caduceus MMS can be adapted to take advantage of more equipment. This premise gives the client a shallow investment curve to overcome, rather than being forced to pay tens to hundreds of thousands to prepare the typical complex EHR.

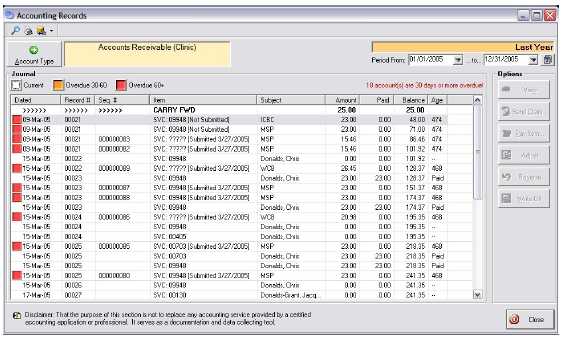

Caduceus MMS Accounting Records Screenshot

5

Caduceus MMS Patient Billing Screenshot

The service units of the Caduceus MMS, such as the highly predictive ‘Recall and Reminder’ service, perform specific universal tasks giving the software adaptive intelligence.

The Recall and Reminder service continuously monitors the status of appointments, remittance deadlines, overdue accounts, claims remitting, and follow-ups. Building Caduceus

MMS with many dedicated processing units greatly improves its adaptability and automation when compared to competing EHRs that rely on a complex system core.

6

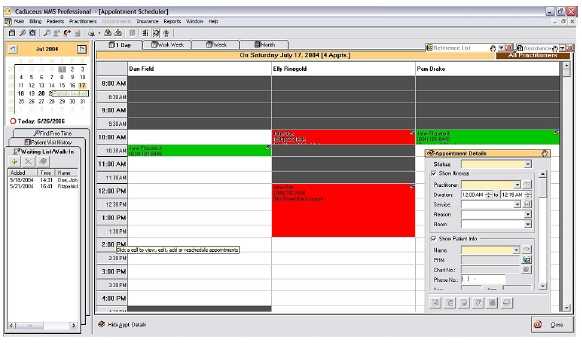

Caduceus MMS Appointment Scheduler Screenshot

Given the above, each installation of Caduceus MMS can be configured with anywhere from the most minimal set of modules to a full complement of features depending on the requirements, budget, and hardware layout of the target client. Modules like the Human Anatomical Mapping Tool, Imaging Module, or Document Editor or Prescription Writer can be added, as the clinic’s needs change. Additionally, some modules will also introduce new service units, which in turn expand the usefulness of the software system. Some of the more common modules that the software will come equipped with are as follows:

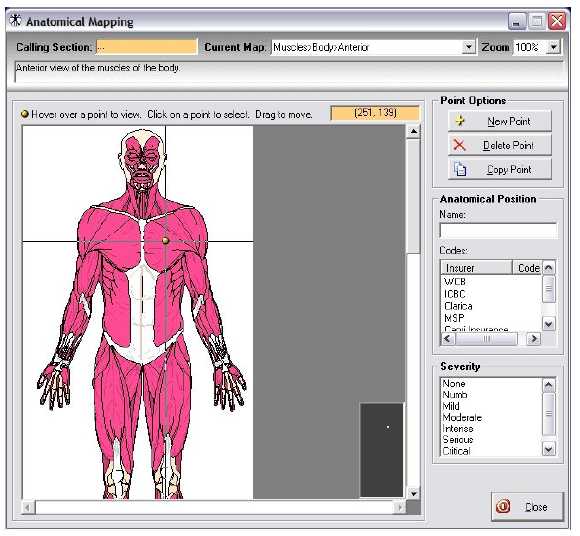

Human Anatomical Mapping Tool

The Human Anatomical Mapping Tool is a graphical image of the human body. This tool allows the doctor to visually mark on the human body symptoms and ailments of the patient, and put notes on that specific area. It is a lot easier to use than writing notes about ailments without a visual picture. It aims to allow the doctor to quickly see and remember where the ailment is and it can track the progression of treatment for that precise part of the body.

7

Caduceus MMS Anatomical Mapping Module Screenshot

Imaging Module

The imaging module is an add-on (an extra component that is separate from the core software) to save and store scanned images and associate them to the patient. X-rays and medical images can be scanned digitally at clinics. (Most clinics are equipped with specialized scanners for x-rays.) It is saved in a digital file. The imaging module will allow it to store the image in a secure manner into the database.

This module has been created but is not fully tested. It will need to be tested for various images and image sizes to see if the software's database can handle them.

Document Editor or Prescription Writer

These modules allow the doctor to write down official documents that are requested by the patient or to issue doctor referrals or for formal correspondence. The prescription writer is a module that allows the doctor to write prescriptions with the doctor letter head, and replaces the need for doctors to carry prescription notepads as the official way to write-up prescriptions

8

Without the ability to install modules Caduceus MMS would offer the client limited scope, become cumbersome and too large to navigate effectively if it were to be developed past its initial scope, and be virtually impossible to stage to grow with a growing practice.

Many libraries within the Caduceus MMS such as codes, treatments, localization resources, contraindications, regulatory protocols, reports, and facilities are continuously updated, thus allowing the client to stay up-to-date. Caduceus MMS is supplied to the customer with over 650 diagnostic explanatory codes, almost 5000 treatments (virtually covering all medical treatments known today), more than 6100 ICD-9 and ICD-10 diagnostic codes, and it understands over 80 parts of the body. These numbers are not for bragging, but do exceed the resources provided by Caduceus’ closest competitors. A comprehensive set of libraries translates into an application than can immediately manage different medical situations quickly.

Other libraries can be built by the consumer over time. An example is the Insurance Module, which has no restrictions on the data input which can be included by the consumer, and can therefore record a variety of insurance providers.

We anticipate undertaking further development into mobile device interfaces, Linux operating system support, biometrics and additional modules.

Market, Customers and Distribution Methods

We believe that we will market our software product in the following four areas of the healthcare industry:

- Healthcare patient information management.

- Electronic Healthcare Recording (EHR)

- Electronic Medical Billing systems (EMBs)

- Contact management and Appointment Scheduling and booking

In 2007, US healthcare expenditures accounted more than $2.26 trillion or $7,439 per person. Given this figure, the US had the third highest healthcare expenditure per capita, and except for East Timor, spent more than any other nation-state on earth.

Our management believes that given the general outlook towards reform of the medical system, American healthcare providers and consumers are interested in reducing the costs of healthcare without compromising service.

The Congressional Budget Office has pointed out that, "about half of all growth in health care spending in the past several decades was associated with changes in medical care made possible by advances in technology." Although currently prepared for use in Canada, the software can be easily expanded to any region or jurisdiction in Canada, the United States, United Kingdom, Australia, and the Caribbean. With the implementation of future language libraries, it can be offered in French, Spanish, German, Italian, Japanese or Chinese.

The Bureau of Labor Statistics in the United States estimated that in 2008 there were approximately 661,400 practicing physicians, and projected that number to increase to 805,500 by 2018. Since Caduceus MMS was constructed to accommodate 47 of the 49 recognized medical specialties (excluding surgical specialties), it is well poised to work with most of the industry. We anticipate that we will begin selling our software to 0.5% of the active market, or about 3,307 physicians. Furthermore, because Caduceus MMS can be made to operate in any jurisdiction, this target market covers all geographic regions in the United States, all ages, both sexes and in both public and private settings.

9

We anticipate that we will distribute our software largely through online sources. Software used to be sold off-the-shelf from software vendors. The current model is via the Internet, where customers buy the software by paying for it online or by calling into a payment centre, and the software is distributed by online download. For certain cases where the software requirements setup, depending on the licensing and support levels purchased, if pricing permits, the distribution, or rather installation of the software may be done onsite at the premises of the customers’ offices.

Competition

We have various competitors in our market. Some of the competitors are large software providers who can supply software which is able to be used, though not tailored for, the medical services industry, and some have specialized medical software.

Competitors in the appointment and booking, scheduling space are Maximizer, Microsoft Windows and Office & Outlook. Competitors for the Electronic Medical Billing include ClinCare, and EZClaim. Competitors for the Electronic Health Records include AdvancedMD, QHR, and PowerMed.

Our largest potential competition will come from EMR vendors currently operating in the industry. However, most EMR vendors have chosen to develop their applications concentrating on either billing or scheduling. Caduceus MMS includes structures that handle billing, remitting, diagnosing, patient recording, scheduling, expense and accounting ledger, an insurance provider database, direct medical agency server connection, as well as predictive logic. Our most notable potential competitors are QHR Software Inc.’s Optimed and Accuro systems and Clinic Essentials.

Many of the software companies with which we compete for financing and consumers have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on developing their software systems. This advantage could enable our competitors to develop a more competitive, more attractive software system. Such competition could adversely impact our ability to attain the financing necessary for us to further develop, market and distribute our software.

In the face of competition, we may not be successful in developing, marketing and distributing our software. Despite this, we hope to compete successfully in the software industry by:

- keeping our development costs low;

- Focusing on the competitive advantages of our product;

- Efficiently marking to our core customer base; and

- using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities.

Competitive Advantages

Caduceus MMS is supplied to the customer with over 650 diagnostic explanatory codes, almost 5000 treatments (virtually covering all medical treatments known today), more than 6100 ICD-9 and ICD-10 diagnostic codes, and it understands over 80 parts of the body. These figures provide the Caduceus MMS suite a competitive advantage over any other software system currently on the market.

Caduceus MMS is the only mainline EMR system that is designed for three-dimensional adaptability: vertically through the use of powerful, predictive services such as the Recall and Reminder, Code Control, or Claims Remittances services; horizontally by way of its coverage of almost all specialties, and; laterally in its complete scalability via modules and localization libraries. Fundamentally, its core is relatively small compared to competing systems, but when measured with its many features and capabilities can rival even the most hardened application.

10

Caduceus MMS’ interface – the part of the software that will interact directly with the user, whether receptionist or doctor – has been designed to employ a shallow learning curve by using cleanly arranged screens. Most competitors present data in cluttered screens, leading to user fatigue and inevitably data entry errors.

In order to gain access to the widest possible market, we have kept the initial cost of ownership low by ensuring that Caduceus MMS can be implemented into specifically simple network environments.

Most importantly, rather than concentrating Caduceus MMS in either the back office as an administrative tool, or reception area, it is capable of running an entire clinic from front to back.

Intellectual Property

Sygnit Inc. owns a copyright to the Caduceus MMS software which we license from them. We have not filed for any protection of our trademark, and we do not have any other intellectual property other than a copyright to the contents of our website: www.caduceusmms.com.

Research and Development

We did not incur any research and development expenses during the period from December 13, 2006 (inception) to our most recent fiscal year ended March 31, 2012. We anticipate that we will spend $20,000 on research and development during the next 12 months.

Government Regulation

We are not currently subject to direct federal, state or local regulation and we do not believe that government regulation will have a material impact on the way we conduct our business.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Employees

As of our year ended March 31, 2012, we did not have any employees. Derrick Gidden, one of our directors and our sole officer spends approximately 20 hours per week on our operations on a consulting basis.

Item 1A. Risk Factors

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 1B. Unresolved Staff Comments

As a “smaller reporting company”, we are not required to provide the information required by this Item.

11

Item 2. Properties

We currently rent an office totaling approximately 200 square feet in area at a cost of approximately $250 per month and leased out by Derrick Gidden, one of our directors and our sole officer. Our office is located at 5614C 42a High Street, Sutton Coldfield, West Midlands, United Kingdom, B72 1UJ. Our telephone number is +44-0121-695-9585.

Item 3. Legal Proceedings

We know of no material, existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our company.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is quoted on the OTC Bulletin Board under the Symbol "CSOC". We received approval on September 3, 2008 for trading under the symbol “BCHO”. On March 4, 2011, our symbol was changed to our current symbol “CSOC” in connection with our change of name.

The following table reflects the high and low bid information for our common stock obtained from Stockwatch and reflects inter-dealer prices, without retail mark-up, markdown or commission, and may not necessarily represent actual transactions.

The high and low bid prices of our common stock for the periods indicated below are as follows:

|

OTC Bulletin Board | ||

|

Quarter Ended |

High |

Low |

|

March 31, 2012 |

$0.039 |

$0.0071 |

|

December 31, 2011 |

$0.095 |

$0.015 |

|

September 30, 2011 |

$0.18 |

$0.065 |

|

June 30, 2011 |

$0.15 |

$0.07 |

|

March 31, 2011 |

$2.15 |

$0.00 |

|

December 31, 2010(2) |

$N/A |

$N/A |

|

September 30, 2010(2) |

$N/A |

$N/A |

|

June 30, 2010 |

$0.25 |

$0.0088 |

|

March 31, 2010 |

$0.25 |

$0.25 |

(1) The first trade in our common stock occurred on September 3, 2008 and our stock did not trade from September 18, 2008 to January 6, 2010

(2) No trade occurred during this period.

12

As of July 11, 2012, there were 48 holders of record of our common stock. As of such date, 276,700,000 shares of our common stock were issued and outstanding.

Our common shares are issued in registered form. Island Stock Transfer, 100 2nd Avenue South, Suite 705S, St. Petersburg, FL 33701 (Telephone: (727) 289-0010) is the registrar and transfer agent for our common shares.

Dividend Policy

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our board of directors.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

Other than as disclosed herein, we did not sell any equity securities which were not registered under the Securities Act during the year ended March 31, 2012 that were not otherwise disclosed on our quarterly reports on Form 10-Q or our current reports on Form 8-K filed during the year ended March 31, 2012.

Equity Compensation Plan Information

We currently do not have any equity compensation plans.

Convertible Securities

We do not have any outstanding convertible securities.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fourth quarter of our fiscal year ended March 31, 2012.

Item 6. Selected Financial Data

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with our audited financial statements and the related notes for the years ended March 31, 2012 and March 31, 2011 that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this annual report.

Our audited financial statements are stated in United States dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Purchase of Significant Equipment

We do not intend to purchase any significant equipment over the next twelve months.

13

Personnel Plan

We do not expect any material changes in the number of employees over the next 12 month period (although we may enter into employment or consulting agreements with our officers or directors). We do and will continue to outsource contract employment as needed.

Results of Operations

For the Year Ending March 31, 2012 and 2011

|

|

|

|

Year Ended |

| |||

|

|

|

|

March 31 |

| |||

|

|

|

|

2012 |

|

|

2011 |

|

|

|

Revenue |

$ |

Nil |

|

$ |

Nil |

|

|

|

Operating Expenses |

$ |

5,111,665 |

|

$ |

24,039 |

|

|

|

Net Loss |

$ |

(5,111,665 |

) |

$ |

(24,789 |

) |

Expenses

Our operating expenses for our years ended March 31, 2012 and 2011 are outlined in the table below:

|

|

|

|

Year Ended |

| |||

|

|

|

|

March 31 |

| |||

|

|

|

|

2012 |

|

|

2011 |

|

|

|

General and administrative expenses |

$ |

145,532 |

|

$ |

24,003 |

|

|

|

Foreign exchange loss |

$ |

1,133 |

|

$ |

36 |

|

|

|

Impairment of licensing agreement cost |

$ |

4,965,000 |

|

$ |

Nil |

|

|

|

Interest expense |

$ |

Nil |

|

$ |

750 |

|

Operating expenses for year ended March 31, 2012 increased by 21,164% as compared to the comparative period in 2011 primarily due to an impairment of licensing agreement costs.

Revenue

We have not earned any revenues since our inception and we do not anticipate earning revenues in the near future.

Liquidity and Financial Condition

Working Capital

|

|

|

|

At |

|

|

At |

|

|

Percentage |

|

|

|

|

March 31, |

|

|

March 31, |

|

|

Increase/ |

| |

|

|

|

2012 |

|

|

2011 |

|

|

(Decrease) |

| |

|

Current Assets |

$ |

9,173 |

|

$ |

1,903 |

|

|

382% |

||

|

Current Liabilities |

$ |

75,631 |

|

$ |

77,950 |

|

|

(6% |

) | |

|

Working Capital (Deficit) |

$ |

(66,458 |

) |

$ |

(76,047 |

) |

|

(18% |

) |

14

Cash Flows

|

|

|

Year Ended |

|

|

Year Ended |

|

|

|

|

March 31, |

|

|

March 31, |

|

|

|

|

2012 |

|

|

2011 |

|

|

Net Cash used in Operating Activities |

$ |

(117,559 |

) |

$ |

(15,190 |

) |

|

Net Cash used in Investing Activities |

$ |

Nil |

|

$ |

Nil |

|

|

Net Cash Provided by Financing Activities |

$ |

124,829 |

|

$ |

12,587 |

|

|

Increase (Decrease) in Cash During the Period |

$ |

7,270 |

$ |

(2,603 |

) |

We estimate that our expenses over the next 12 months will be approximately $260,000 as described in the table below. These estimates may change significantly depending on the nature of our future business activities and our ability to raise capital from shareholders or other sources.

Specifically, we estimate our operating expenses and working capital requirements for the next 12 months to be as follows:

|

|

Target completion |

Estimated |

|

Legal and accounting fees |

12 months |

50,000 |

|

Research and development |

12 months |

20,000 |

|

Management and operating costs |

12 months |

75,000 |

|

Salaries and consulting fees |

12 months |

80,000 |

|

Fixed asset purchases |

12 months |

10,000 |

|

General and administrative |

12 months |

25,000 |

|

Total |

|

260,000 |

Future Financings

We will require additional financing in order to enable us to proceed with our plan of operations, as discussed above, including approximately $260,000 over the next 12 months to pay for our ongoing expenses. These expenses include legal, accounting and audit fees as well as general and administrative expenses. These cash requirements are in excess of our current cash and working capital resources. Accordingly, we will require additional financing in order to continue operations and to repay our liabilities. There is no assurance that any party will advance additional funds to us in order to enable us to sustain our plan of operations or to repay our liabilities.

We anticipate continuing to rely on equity sales of our common stock in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing stockholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our planned business activities.

We presently do not have any arrangements for additional financing for the expansion of our exploration operations, and no potential lines of credit or sources of financing are currently available for the purpose of proceeding with our plan of operations.

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

15

Going Concern

We have generated only nominal revenues and are dependent upon obtaining outside financing to carry out our operations and pursue our business development activities. If we are unable to generate future cash flows, raise equity or secure alternative financing, we may not be able to continue our operations and our business plan may fail. You may lose your entire investment.

If our operations and cash flow improve, our management believes that we can continue to operate. However, no assurance can be given that management's actions will result in profitable operations or an improvement in our liquidity situation. The threat of our ability to continue as a going concern will cease to exist only when our revenues have reached a level able to sustain our business operations.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with the accounting principles generally accepted in the United States of America. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management’s application of accounting policies. We believe that understanding the basis and nature of the estimates and assumptions involved with the following aspects of our financial statements is critical to an understanding of our financial statements.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Foreign Currency Translation

The financial statements are presented in United States dollars. In accordance with ASC-830, “Foreign Currency Matters”, foreign denominated monetary assets and liabilities are translated into their United States dollar equivalents using foreign exchange rates which prevailed at the balance sheet date. Non monetary assets and liabilities are translated at the exchange rates prevailing on the transaction date. Revenue and expenses are translated at average rates of exchange during the year. Gains or losses resulting from foreign currency transactions are included in results of operations.

Fair Value of Financial Instruments

The carrying value of cash, accounts payable and accrued liabilities, loans from related party and loan payable approximates their fair value because of the short maturity of these instruments. Unless otherwise noted, it is management’s opinion our company is not exposed to significant interest, currency or credit risks arising from these financial instruments.

16

Income Taxes

Our company follows the liability method of accounting for income taxes. Under this method, deferred income tax assets and liabilities are recognized for the estimated tax consequences attributable to differences between the financial statement carrying values and their respective income tax basis (temporary differences). The effect on deferred income tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. At March 31, 2012, a full-deferred tax asset valuation allowance has been provided and no deferred tax asset has been recorded.

Basic and Diluted Loss Per Share

Our company computes loss per share in accordance with ASC-260, “Earnings per Share” which requires presentation of both basic and diluted earnings per share on the face of the statement of operations. Basic loss per share is computed by dividing net loss available to common shareholders by the weighted average number of outstanding common shares during the period. Diluted loss per share gives effect to all dilutive potential common shares outstanding during the period. Dilutive loss per share excludes all potential common shares if their effect is anti-dilutive.

Our company has no potential dilutive instruments and accordingly basic loss and diluted loss per share are equal.

Long-Lived Assets

Our company has adopted ASC-360, “Property, Plant and Equipment” which requires that long-lived assets and certain identifiable intangibles held and used by our company be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Events relating to recoverability may include significant unfavorable changes in business conditions, recurring losses, or a forecasted inability to achieve break-even operating results over an extended period. Our company evaluates the recoverability of long-lived assets based upon forecasted undiscounted cash flows. Should impairment in value be indicated, the carrying value of intangible assets will be adjusted, based on estimates of future discounted cash flows resulting from the use and ultimate disposition of the asset. ASC-360 also requires assets to be disposed of be reported at the lower of the carrying amount or the fair value less costs to sell. During the year ended March 31, 2012, our company recorded a $4,965,000 impairment expense and reduced the license agreement book value to $0 (Note 5).

Research and Development

Our company accounts for research and development costs in accordance with the ASC-730, “Research and Development”. Under ASC-730, all research and development costs must be charged to expense as incurred. Accordingly, internal research and development costs are expensed as incurred. Third-party research and developments costs are expensed when the contracted work has been performed or as milestone results have been achieved. Company-sponsored research and development costs related to both present and future products are expensed in the period incurred. Our company incurred research and development expenditures of $0 for the period from December 13, 2006 (date of inception) to March 31, 2012.

Concentrations of Credit Risk

Financial instruments and related items, which potentially subject our company to concentrations of credit risk, consist primarily of cash and cash equivalents. At March 31, 2012, our company has cash in the amount of $9,173. Our company places its cash and temporary cash investments with credit quality institutions

17

Revenue Recognition

Our company will recognize revenue in accordance with ASC-605, “Revenue Recognition,” which requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and the collectability of those amounts.

Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded. Our company will defer any revenue for which the product has not been delivered or is subject to refund until such time that our company and the customer jointly determine that the product has been delivered or no refund will be required.

Advertising

Our company follows the policy of charging the costs of advertising to expenses incurred. Our company incurred $0 in advertising costs during the year ended March 31, 2012 and December 30, 2010.

Stock-based Compensation

Our company records stock based compensation in accordance with the guidance in ASC-718, “Compensation - Stock Compensation,” which requires our company to recognize expenses related to the fair value of its employee stock option awards. This eliminates accounting for share-based compensation transactions using the intrinsic value and requires instead that such transactions be accounted for using a fair-value-based method. Our company recognizes the cost of all share-based awards on a graded vesting basis over the vesting period of the award.

Recent Accounting Pronouncements

Our company management has reviewed recent accounting pronouncements issued through the date of the issuance of financial statements. In management’s opinion, except for those pronouncements detailed below, no other pronouncements apply or will have a material effect on our company’s financial statements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 8. Financial Statements and Supplementary Data

18

CADUCEUS SOFTWARE SYSTEMS CORP.

(A Development Stage Company)

FINANCIAL STATEMENTS

March 31, 2012

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM F-1

BALANCE SHEETS F-2

STATEMENTS OF OPERATIONS F-3

STATEMENTS OF STOCKHOLDERS’ DEFICIT F-4

STATEMENTS OF CASH FLOWS F-5

NOTES TO THE FINANCIAL STATEMENTS F-6

19

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders

Caduceus Software Systems Corp.

We have audited the accompanying balance sheet of Caduceus Software Systems Corp. (A Development Stage “Company”) as of March 31, 2012 and the related statements of operation, changes in shareholders’ equity and cash flows for the year then ended March 31, 2012, and for the period from December 13, 2006 (inception) to March 31, 2012. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Caduceus Software Systems Corp. as of March 31, 2012 and the result of its operations and its cash flows for the year then ended and for the period from December 13, 2006 (inception) to March 31, 2012 in conformity with U.S. generally accepted accounting principles.

The financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company’s losses from operations raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

____________________

PLS CPA, A Professional Corp.

July 16, 2012

San Diego, CA. 92111

F-1

20

|

CADUCEUS SOFTWARE SYSTEMS CORP. (A Development Stage Company) Balance Sheets | |||||

|

| |||||

|

| |||||

|

|

|

March 31, 2012 |

March 31, 2011 | ||

|

Assets |

|||||

|

Current Assets |

|

|

| ||

|

|

Cash |

$ 9,173 |

$ 1,903 | ||

|

Total Current Assets |

9,173 |

1,903 | |||

|

Total Assets |

$ 9,173 |

$ 1,903 | |||

|

|

|

|

| ||

|

|

|

|

| ||

|

Liabilities and Stockholders’ Deficit | |||||

|

|

|

| |||

|

Current Liabilities |

|

| |||

|

|

Accounts payables and accrued liabilities |

$ 37,958 |

$ 12,691 | ||

|

|

Accrued interest on related party loans |

– |

1,860 | ||

|

|

Loans from related party |

11,813 |

62,368 | ||

|

|

Loan payable |

25,860 |

1,031 | ||

|

|

Total Current Liabilities |

75,631 |

77,950 | ||

|

|

|

| |||

|

Stockholders’ Deficit |

|

| |||

|

|

Common stock, $0.001 par value, 400,000,000 shares authorized; 276,700,000 shares issued and outstanding (March 2011 – 209,600,00 shares) |

276,700 |

209,600 | ||

|

|

Additional paid-in capital |

4,869,954 |

(184,200) | ||

|

|

Deficit accumulated during the development stage |

(5,213,112) |

(101,447) | ||

|

Total Stockholders’ Deficit |

(66,458) |

(76,047) | |||

|

Total Liabilities and Stockholders’ Deficit |

$ 9,173 |

$ 1,903 | |||

|

|

| ||||

|

The accompanying notes are an integral part of these financial statements. F-2 | |||||

21

|

CADUCEUS SOFTWARE SYSTEMS CORP. (A Development Stage Company) Statements of Operations |

|

|

|

|

|

Year Ended March 31, 2012 |

Year Ended March 31, 2011 |

From Inception on December 13, 2006 through March 31, 2012 |

|

|

|

|

|

|

Revenue |

$ – |

$ – |

$ – |

|

|

|||

|

Expenses |

|

|

|

|

General and administrative expenses |

$ 145,532 |

$ 24,003 |

$ 245,083 |

|

Foreign exchange loss |

1,133 |

36 |

1,169 |

|

Impairment of licensing agreement cost (Note 5) |

4,965,000 |

– |

4,965,000 |

|

Total Expenses |

5,111,665 |

24,039 |

5,211,252 |

|

Net loss before other expenses |

(5,111,665) |

(24,039) |

(5,211,252) |

|

Other Expenses |

|

|

|

|

Interest expense |

– |

(750) |

(1,860) |

|

Net loss for the period |

$ (5,111,665) |

$ (24,789) |

$ (5,213,112) |

|

Loss per common share – Basic and diluted |

$ (0.02) |

$ (0.00) |

|

|

Weighted Average Number of Common Shares Outstanding |

263,503,000 |

209,600,000 |

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements. F-3 | |||

22

|

CADUCEUS SOFTWARE SYSTEMS CORP. (A Development Stage Company) Statements of Stockholders’ Deficit From Inception on December 13, 2006 to March 31, 2012

|

|

|

| ||

|

Number of Common Shares |

Amount |

Additional Paid-in Capital |

Deficit Accumulated During Development Stage |

Total | |

|

Balance at inception on December 13, 2006 |

– |

$ – |

$ – |

$ – |

$ – |

|

Common shares issued for cash at $0.000025 |

120,000,000 |

120,000 |

(117,000) |

– |

3,000 |

|

Common shares issued for cash at $0.00025 |

89,600,000 |

89,600 |

(67,200) |

– |

22,400 |

|

Net loss for the period |

– |

– |

– |

(390) |

(390) |

|

Balance as of March 31, 2007 |

209,600,000 |

209,600 |

(184,200) |

(390) |

25,010 |

|

Net loss for the year |

– |

– |

– |

(28,741) |

(28,741) |

|

Balance as of March 31, 2008 |

209,600,000 |

209,600 |

(184,200) |

(29,131) |

(3,731) |

|

Net loss for the year |

– |

– |

– |

(28,102) |

(28,102) |

|

Balance as of March 31, 2009 |

209,600,000 |

209,600 |

(184,200) |

(57,233) |

(31,833) |

|

Net loss for the year |

– |

– |

– |

(19,425) |

(19,425) |

|

Balance as of March 31, 2010 |

209,600,000 |

209,600 |

(184,200) |

(76,658) |

(51,258) |

|

Net loss for the year |

– |

– |

– |

(24,789) |

(24,789) |

|

Balance as of March 31, 2011 |

209,600,000 |

209,600 |

(184,200) |

(101,447) |

(76,047) |

|

Common shares pursuant to licensing agreement at $0.075 |

66,200,000 |

66,200 |

4,898,800 |

– |

4,965,000 |

|

Common shares issued for cash at $0.11 |

900,000 |

900 |

99,100 |

– |

100,000 |

|

Related party debt forgiveness |

– |

– |

56,254 |

– |

56,254 |

|

Net loss for the year |

– |

– |

– |

(5,111,665) |

(5,111,665) |

|

Balance as of March 31, 2012 |

276,700,000 |

$ 276,700 |

$ 4,869,954 |

$ (5,213,112) |

$ (66,458) |

|

|

|||||

|

The accompanying notes are an integral part of these financial statements. F-4 | |||||

23

|

CADUCEUS SOFTWARE SYSTEMS CORP. (A Development Stage Company) Statements of Cash Flows

| |||||

|

|

Year Ended March 31, 2012 |

Year Ended March 31, 2011 |

From Inception on December 13, 2006 through March 31, 2012 | ||

|

Operating Activities |

|

|

| ||

|

|

|

|

|

| |

|

|

Net loss for the period |

$ (5,111,665) |

$ (24,789) |

$ (5,213,112) | |

|

|

Adjustment to reconcile net loss to net cash used in operating activities: |

|

|

| |

|

|

|

|

|

| |

|

|

Impairment of licensing agreement cost |

4,965,000 |

– |

4,965,000 | |

|

|

|

|

|

| |

|

|

Changes in operating assets and liabilities: |

|

|

| |

|

|

Accounts payables and accrued liabilities |

25,267 |

6,969 |

37,958 | |

|

|

Due to related party |

3,839 |

1,880 |

5,719 | |

|

|

Accrued interest – related party note |

– |

750 |

1,860 | |

|

|

Net cash used for operating activities |

(117,559) |

(15,190) |

(202,575) | |

|

Financing Activities |

|

|

| ||

|

|

Loans from related party |

– |

11,556 |

60,488 | |

|

|

Proceeds from loan payable |

24,829 |

1,031 |

25,860 | |

|

|

Sale of common stock |

100,000 |

– |

125,400 | |

|

|

Net cash provided by financing activities |

124,829 |

12,587 |

211,748 | |

|

|

|

|

|

| |

|

Net increase (decrease) in cash and equivalents |

7,270 |

(2,603) |

9,173 | ||

|

Cash and equivalents at beginning of the period |

1,903 |

4,506 |

– | ||

|

Cash and equivalents at end of the period |

$ 9,173 |

$ 1,903 |

$ 9,173 | ||

|

|

|

|

| ||

|

Supplemental cash flow information: |

|

|

| ||

|

|

|

|

|

| |

|

Non-cash investing and financing activities: |

|

|

| ||

|

|

|

|

|

| |

|

|

Common stock issued for Licensing Agreement |

$ 4,965,000 |

$ – |

$ 4,965,000 | |

|

|

|

|

|

| |

|

Cash paid for: |

|

|

| ||

|

|

|

|

|

| |

|

|

Interest |

$ – |

$ – |

$ – | |

|

|

Taxes |

$ – |

$ – |

$ – | |

|

| |||||

|

The accompanying notes are an integral part of these financial statements. F-5 | |||||

24

CADUCEUS SOFTWARE SYSTEMS CORP.

(A Development Stage Company)

Notes to the Financial Statements

March 31, 2012

1. NATURE AND CONTINUANCE OF OPERATIONS

The Company was incorporated under the laws of the State of Nevada, U.S. on December 13, 2006 under the name Bosco Holdings Inc. On March 1, 2011, the Company changed its name from Bosco Holdings Inc. to Caduceus Software Systems Corp. The Company is in the development stage as defined under Accounting Codification Standard (“ASC”) 915, “Development Stage Entities”, and its efforts were primarily devoted marketing and distributing laminate flooring to the wholesale and retail markets throughout North America. On June 9, 2011, the Company entered into a Licensing Agreement for the exclusive license to software optimized for use in the medical industry for patient management, patient appointment scheduling, physician memorandum recording, medical symptom and ailment recording and digital image recording. The Company is now in the business of providing medical software to medical professionals. The Company has not generated any revenue to date and consequently its operations are subject to all risks inherent in the establishment of a new business enterprise.

2. GOING CONCERN

The financial statements have been prepared on a going concern basis which assumes the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. For the period from inception, December 13, 2006 through March 31, 2012 the Company has accumulated losses of $5,213,112. There is substantial doubt as to the ability of the company to continue as a going concern. The ability to continue as a going concern is dependent upon the Company generating profitable operations in the future and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management intends to finance operating costs over the next twelve months with existing cash on hand and loans from directors and/or private placement of common stock.

As of March 31, 2012, the Company has excess of current liabilities over its current assets by $66,458, with cash and cash equivalents representing $9,173.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America and are presented in US dollars.

Cash and Cash Equivalents

For purposes of Statements of Cash Flows, the Company considers all highly liquid debt instruments purchased with a maturity date of three months or less to be cash equivalents.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

F-6

25

CADUCEUS SOFTWARE SYSTEMS CORP.

(A Development Stage Company)

Notes to the Financial Statements

March 31, 2012

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Foreign Currency Translation

The financial statements are presented in United States dollars. In accordance with ASC-830, “Foreign Currency Matters”, foreign denominated monetary assets and liabilities are translated into their United States dollar equivalents using foreign exchange rates which prevailed at the balance sheet date. Non monetary assets and liabilities are translated at the exchange rates prevailing on the transaction date. Revenue and expenses are translated at average rates of exchange during the year. Gains or losses resulting from foreign currency transactions are included in results of operations.

Fair Value of Financial Instruments

The carrying value of cash, accounts payable and accrued liabilities, loans from related party and loan payable approximates their fair value because of the short maturity of these instruments. Unless otherwise noted, it is management’s opinion the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments.

Income Taxes

The Company follows the liability method of accounting for income taxes. Under this method, deferred income tax assets and liabilities are recognized for the estimated tax consequences attributable to differences between the financial statement carrying values and their respective income tax basis (temporary differences). The effect on deferred income tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. At March 31, 2012, a full-deferred tax asset valuation allowance has been provided and no deferred tax asset has been recorded.

Basic and Diluted Loss Per Share

The Company computes loss per share in accordance with ASC-260, “Earnings per Share” which requires presentation of both basic and diluted earnings per share on the face of the statement of operations. Basic loss per share is computed by dividing net loss available to common shareholders by the weighted average number of outstanding common shares during the period. Diluted loss per share gives effect to all dilutive potential common shares outstanding during the period. Dilutive loss per share excludes all potential common shares if their effect is anti-dilutive.

The Company has no potential dilutive instruments and accordingly basic loss and diluted loss per share are equal.

Long-Lived Assets

The Company has adopted ASC-360, “Property, Plant and Equipment” which requires that long-lived assets and certain identifiable intangibles held and used by the Company be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Events relating to recoverability may include significant unfavorable changes in business conditions, recurring losses, or a forecasted inability to achieve break-even operating results over an extended period. The Company evaluates the recoverability of long-lived assets based upon forecasted undiscounted cash flows. Should impairment in value be indicated, the carrying value of intangible assets will be adjusted, based on estimates of future discounted cash flows resulting from the use and ultimate disposition of the asset. ASC-360 also requires assets to be disposed of be reported at the lower of the carrying amount or the fair value less costs to sell. During the year ended March 31, 2012, the Company recorded a $4,965,000 impairment expense and reduced the license agreement book value to $0 (Note 5).

F-7

26

CADUCEUS SOFTWARE SYSTEMS CORP.

(A Development Stage Company)

Notes to the Financial Statements

March 31, 2012

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Research and Development

The Company accounts for research and development costs in accordance with the ASC-730, “Research and Development”. Under ASC-730, all research and development costs must be charged to expense as incurred. Accordingly, internal research and development costs are expensed as incurred. Third-party research and developments costs are expensed when the contracted work has been performed or as milestone results have been achieved. Company-sponsored research and development costs related to both present and future products are expensed in the period incurred. The Company incurred research and development expenditures of $0 for the period from December 13, 2006 (date of inception) to March 31, 2012.

Concentrations of Credit Risk

Financial instruments and related items, which potentially subject the Company to concentrations of credit risk, consist primarily of cash and cash equivalents. At March 31, 2012, the Company has cash in the amount of $9,173. The Company places its cash and temporary cash investments with credit quality institutions

Revenue Recognition

The Company will recognize revenue in accordance with ASC-605, “Revenue Recognition,” which requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and the collectability of those amounts.

Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded. The Company will defer any revenue for which the product has not been delivered or is subject to refund until such time that the Company and the customer jointly determine that the product has been delivered or no refund will be required.

Advertising

The Company follows the policy of charging the costs of advertising to expenses incurred. The Company incurred $0 in advertising costs during the year ended March 31, 2012 and December 30, 2010.

Stock-based Compensation

The Company records stock based compensation in accordance with the guidance in ASC-718, “Compensation - Stock Compensation,” which requires the Company to recognize expenses related to the fair value of its employee stock option awards. This eliminates accounting for share-based compensation transactions using the intrinsic value and requires instead that such transactions be accounted for using a fair-value-based method. The Company recognizes the cost of all share-based awards on a graded vesting basis over the vesting period of the award.

Recent accounting pronouncements

The Company management has reviewed recent accounting pronouncements issued through the date of the issuance of financial statements. In management’s opinion, except for those pronouncements detailed below, no other pronouncements apply or will have a material effect on the Company’s financial statements.

F-8

27

CADUCEUS SOFTWARE SYSTEMS CORP.

(A Development Stage Company)

Notes to the Financial Statements

March 31, 2012

4. COMMON STOCK

The total number of common shares authorized that may be issued by the Company is 400,000,000 shares with a par value of one tenth of one cent ($0.001) per share and no other class of shares is authorized. As of March 31, 2012, the Company has issued and outstanding 276,700,000 shares of common stock.

During the year March 31, 2007, the Company issued 209,600,000 shares of common stock for total cash proceeds of $25,400.

On February 21, 2008, the Company's Board of Directors authorized and declared a five-for-one forward stock split of the Company's common stock. The stock split was effected in the form of a stock dividend distribution on March 27, 2008 to the stockholders on record on close of business February 21, 2008. The stockholders received four additional shares of common stock for each share of common stock held as of the close of business on the record date. All shares and per-share data have been restated to reflect this stock split.

On February 16, 2011, the Company's Board of Directors approved an increase to the Company’s authorized capital, and declared an eight-for-one forward stock split of the Company's common stock. Effective March 1, 2011, the Company’s authorized capital increased from 75,000,000 to 400,000,000 shares of common stock. The stock split was effected in the form of a stock dividend distribution on March 3, 2011 to the stockholders on record on close of business February 16, 2011. The stockholders received seven additional shares of common stock for each share of common stock held as of the close of business on the record date. All shares and per-share data have been restated to reflect this stock split.

On June 9, 2011, the Company issued 66,200,000 common stock to Sygnit Corporation (“Sygnit”) pursuant to the licensing agreement (refer to Note 5).

On November 4, 2011, the Company completed a private placement of common stock pursuant to Regulation S of the Securities Act of 1933 (the “Act”) and sold 900,000 units to one corporation and raised $100,000. Each unit consisted of one share of common stock; one series A warrant; and, one series B warrant. Each series A warrant is exercisable into one share of common stock at an exercise price of $0.15 per warrant and each series B warrant is exercisable into one share of common stock at an exercise price of $0.25 per warrant. The series A warrants are exercisable for a period of 36 months from November 4, 2011 and the series B warrants are exercisable for a period of 48 months from November 4, 2011. The transaction took place outside the United States of America and the purchaser was a non-US corporation as defined in Regulation S of the Act.

Share Purchase Warrants

The continuity of share purchase warrants during the period ended March 31, 2012 is as follows:

|

Expiry dates |

Exercise price |

Outstanding at March 31, 2011 |

Issued |

Exercised |

Expired |

Outstanding at March 31, 2012 |

|

November 4, 2014 |

$ 0.15 |

- |

900,000 |

- |

- |

900,000 |

|

November 4, 2015 |

$ 0.25 |

- |

900,000 |

- |

- |

900,000 |

|

|

|

- |

1,800,000 |

- |

- |

1,800,000 |

F-9

28

CADUCEUS SOFTWARE SYSTEMS CORP.

(A Development Stage Company)

Notes to the Financial Statements

March 31, 2012

5. LICENSING AGREEMENT

On June 9, 2011, the Company entered into a Licensing Agreement with Sygnit. Pursuant to the Licensing Agreement the Company received an exclusive license to the Caduceus MMS software system developed by Sygnit as well as all peripheral documentation, source code and object code relating to this software and any of its accompanying parts. The license is for a period of 5 years, but if the Company is able to raise an aggregate of $200,000 in financing within 6 months, the license extends perpetually. As consideration for the license, the Company issued 66,200,000 shares of common stock and a director of the Company transferred an additional 63,800,000 shares of common stock to Sygnit. The 66,200,000 shares of common stock issued to Sygnit was recorded at the closing stock price which is $0.075 per common stock for a total fair value of $4,965,000.

On June 30, 2011, the Company reviewed the fair value of licensing agreement for potential impairment. Considering all the facts and circumstances, the Company could not forecast future cash flow with enough certainty. In accordance with US GAAP, the Company recorded a $4,965,000 impairment expense and reduced the license agreement book value to $0.

6. LOAN PAYABLE

As of March 31, 2012, the Company owes an unrelated third party $15,539 (Cdn$15,500) (March 31, 2011 - $1,031). The loan is non-interest bearing, and due on demand.

As of March 31, 2012, the Company owes $10,321 to two unrelated third parties. The loans are non-interest bearing, and are due on demand.

7. RELATED PARTY TRANSACTIONS

As of March 31, 2011, a director of the Company had outstanding loans to the Company in the amount of $56,254. The loan was due upon demand and unsecured. On June 9, 2011, the director agreed to forgive the amount owing to him and the transaction has been recorded as additional paid-in capital during year ended March 31, 2012.

On January 31, 2011, the President of the Company loaned the Company $3,000. The loan is non-interest bearing, due upon demand and unsecured. As of March 31, 2012 the President of the Company loaned the Company another $3,008 (Cdn$3,000) and incurred expenses and consulting fees on behalf of the company for $3,448 for a total of $9,456. The loan is non-interest bearing, due upon demand and unsecured.

As of March 31, 2011, the Company was indebted to the spouse of a former director in the amount of $1,880. The amount was subsequently paid to the related party in April 2011.

During the year ended March 31, 2012 a director of the Company loaned the Company $2,357. The loan is non-interest bearing, due upon demand and unsecured.

During the year ended March 31, 2012, the Company incurred $6,367 (2011 - $Nil) of consulting fees to the President of the Company.

F-10

29

CADUCEUS SOFTWARE SYSTEMS CORP.

(A Development Stage Company)

Notes to the Financial Statements

March 31, 2012

8. CONTINGENCY

The Company disputes charges with RBSM LLP (predecessor auditor) for the review of the Form 8-K and correspondence with the successor auditor during 2008, in amount of $3,025. The Company examined the invoices, and decided that charges for the review of the 8K and correspondence with the successor auditor are excessive.

9. INCOME TAXES

As of March 31, 2012, the Company had net operating loss carry forwards of $146,665 that may be available to reduce future years’ taxable income through 2032. Future tax benefits which may arise as a result of these losses have not been recognized in these financial statements, as their realization is determined not likely to occur and accordingly, the Company has recorded a valuation allowance for the deferred tax asset relating to these tax loss carry-forwards.

|

|

March 31, 2012 |

March 31, 2011 |

|

Net operating loss |

$ (146,665) |

$ (101,447) |

|

Deferred Tax Asset (35%) |

51,333 |

35,506 |

|

Valuation Allowance |

(51,333) |

(35,506) |

|

Deferred Tax Assets as of March 31, 2012 |

$ – |

$ – |

10. SUBSEQUENT EVENTS

The Company has determined that there were no subsequent events up to and including the date of the issuance of these financial statements that warrant disclosure or recognition in the financial statements.

F-11

30

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

There were no disagreements with our accountants related to accounting principles or practices, financial statement disclosure, internal controls or auditing scope or procedure during the two fiscal years and subsequent interim periods.

Item 9A. Controls and Procedures

As required by Rule 13a-15 under the Exchange Act, our management evaluated the effectiveness of the design and operation of our disclosure controls and procedures as of March 31, 2012.

Our management, with the participation of our president (our principal executive officer, principal accounting officer and principal financial officer), evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) promulgated under the Securities Exchange Act of 1934, as amended ( the “Exchange Act”)) as of the end of the period covered by this report. Based on this evaluation, our president has concluded that, as of the end of such period, our disclosure controls and procedures were not effective to ensure that information that is required to be disclosed by us in the reports we file or submit under the Exchange Act is (i) recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms and (ii) accumulated and communicated to our management, including our president, as appropriate, to allow timely decisions regarding required disclosure. The reasons for this finding were the weaknesses in our internal control over financial reporting enumerated below.

Management's Report On Internal Control Over Financial Reporting

Evaluation of Disclosure Controls and Procedures

Our management, including our principal executive officer and principal financial officer, does not expect that our disclosure controls and procedures or our internal controls will prevent all error or fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Due to the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. To address the material weaknesses, we performed additional analysis and other post-closing procedures in an effort to ensure our consolidated financial statements included in this annual report have been prepared in accordance with generally accepted accounting principles. Accordingly, management believes that the financial statements included in this report fairly present in all material respects our financial condition, results of operations and cash flows for the periods presented.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rule 13a-15(f) under the Securities Exchange Act, as amended. Our management assessed the effectiveness of our internal control over financial reporting as of March 31, 2012. In making this assessment, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control-Integrated Framework. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company's annual or interim financial statements will not be prevented or detected on a timely basis. We have identified the following material weaknesses.

31

|

|

1. |

As of March 31, 2012, we did not maintain effective controls over the control environment. Specifically we have not developed and effectively communicated to our employees its accounting policies and procedures. This has resulted in inconsistent practices. Further, the Board of Directors does not currently have any independent members and no director qualifies as an audit committee financial expert as defined in Item 407(d)(5)(ii) of Regulation S-K. Since these entity level programs have a pervasive effect across the organization, management has determined that these circumstances constitute e a material weakness. |

|

|

2. |

As of March 31, 2012, we did not maintain effective controls over financial statement disclosure. Specifically, controls were not designed and in place to ensure that all disclosures required were originally addressed in our financial statements. Accordingly, management has determined that this control deficiency constitutes a material weakness. |

Because of these material weaknesses, management has concluded that the Company did not maintain effective internal control over financial reporting as of March 31, 2012, based on the criteria established in "Internal Control-Integrated Framework" issued by the COSO.

Change In Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting that occurred during our last fiscal year that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Attestation Report of the Registered Public Accounting Firm