Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Anthem, Inc. | d378958d8k.htm |

| EX-99.1 - JOINT PRESS RELEASE, DATED JULY 9, 2012 - Anthem, Inc. | d378958dex991.htm |

WellPoint and Amerigroup:

Leadership in High Growth

Government Managed Care

July 9, 2012

Exhibit 99.2 |

Agenda

2

Angela Braly, Chair, President & CEO, WellPoint, Inc.

•

Transaction overview

•

Strategic rationale

Jim Carlson, Chairman & CEO, Amerigroup Corp.

•

Benefits of WellPoint-Amerigroup combination

Wayne DeVeydt, Executive Vice President & CFO, WellPoint, Inc.

•

Financial review

•

Q&A

Jim Truess, Executive Vice President & CFO, Amerigroup Corp

|

3

3

3

3

Safe Harbor Statement

Cautionary Statement Regarding Forward-Looking Statements

•

This communication contains certain “forward-looking” statements as that term is

defined by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Statements that are predictive in nature, that

depend on or relate to future events or conditions, or that include words such as “believes”, “anticipates”, “expects”, “may”,

“will”, “should”, “estimates”, “intends”, “plans”

and other similar expressions are forward-looking statements. Forward-looking

statements involve known and unknown risks and uncertainties that may cause our actual results in

future periods to differ materially from those projected or contemplated in the

forward-looking statements as a result of, but not limited to, the following factors: the

failure to receive, on a timely basis or otherwise, the required approvals by Amerigroup’s stockholders and government

or regulatory agencies; the risk that a condition to closing of the proposed transaction may not be

satisfied; Amerigroup’s and WellPoint’s ability to consummate the merger; the

possibility that the anticipated benefits and synergies from the proposed transaction cannot

be fully realized or may take longer to realize than expected; the failure by WellPoint to obtain the necessary

debt financing arrangements set forth in the commitment letter received in connection with the

merger; the possibility that costs or difficulties related to the integration of

Amerigroup’s and WellPoint’s operations will be greater than expected; operating costs and

business disruption may be greater than expected; the ability of Amerigroup to retain and hire key

personnel and maintain relationships with providers or other business partners pending the

consummation of the transaction; and the impact of legislative, regulatory and competitive

changes and other risk factors relating to the industries in which Amerigroup and WellPoint operate, as

detailed from time to time in each of Amerigroup’s and WellPoint’s reports filed with the

Securities and Exchange Commission (the “SEC”). There can be no assurance that the

proposed transaction will in fact be consummated.

•

Additional information about these factors and about the material factors or assumptions underlying

such forward-looking statements may be found under Item 1.A in each of Amerigroup’s

and WellPoint’s Annual Report on Form 10-K for the fiscal year ended December 31,

2011, and Item 1.A in each of Amerigroup’s and WellPoint’s most recent Quarterly Report on Form 10-Q for

the quarter ended March 31, 2012. Amerigroup and WellPoint caution that the foregoing list of

important factors that may affect future results is not exhaustive. When relying on

forward-looking statements to make decisions with respect to the proposed transaction,

stockholders and others should carefully consider the foregoing factors and other uncertainties and potential events.

All subsequent written and oral forward-looking statements concerning the proposed transaction or

other matters attributable to Amerigroup and WellPoint or any other person acting on their

behalf are expressly qualified in their entirety by the cautionary statements referenced

above. The forward-looking statements contained herein speak only as of the date of this communication.

Neither Amerigroup nor WellPoint undertakes any obligation to update or revise any

forward-looking statements for any reason, even if new information becomes available or

other events occur in the future, except as may be required by law. |

4

Safe Harbor Statement

Additional Information and Where to Find It

•

This communication is being made in respect of the proposed transaction involving Amerigroup and

WellPoint. The proposed transaction will be submitted to the stockholders of Amerigroup

for their consideration. In connection with the proposed transaction, Amerigroup will

prepare a proxy statement to be filed with the SEC. Amerigroup and WellPoint plan to file with

the SEC other documents regarding the proposed transaction. STOCKHOLDERS ARE URGED TO

READ THE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS

CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. The definitive proxy statement will be mailed

to Amerigroup’s stockholders. You may obtain copies of all documents filed with the

SEC concerning the proposed transaction, free of charge, at the SEC’s website at www.sec.gov. In

addition, stockholders may obtain free copies of the documents filed with the SEC by Amerigroup by

going to Amerigroup’s Investor Relations website page by clicking the "Investors"

link at www.amerigroup.com or by sending a written request to Amerigroup’s Secretary at

Amerigroup Corporation, 4425 Corporation Lane, Virginia Beach, Virginia 23462, or by

calling the Secretary at (757) 490-6900.

Interests of Participants

•

Amerigroup and WellPoint and each of their respective directors and executive officers may be deemed

to be participants in the solicitation of proxies from the stockholders of Amerigroup in

connection with the proposed transaction. Information regarding Amerigroup’s

directors and executive officers is set forth in Amerigroup’s proxy statement for its 2012

annual meeting of stockholders and its Annual Report on Form 10-K for the fiscal year ended

December 31, 2011, which were filed with the SEC on April 27, 2012 and February 24, 2012,

respectively. Information regarding WellPoint’s directors and executive officers is

set forth in WellPoint’s proxy statement for its 2012 annual meeting of shareholders and

its Annual Report on Form 10-K for the fiscal year ended December 31, 2011, which were

filed with the SEC on April 2, 2012 and February 22, 2012, respectively. Additional information

regarding persons who may be deemed to be participants in the solicitation of proxies in respect of

the proposed transaction will be contained in the proxy statement to be filed by Amerigroup

with the SEC when it becomes available. |

Advancing Our Future Growth Potential

5

•

Acquiring a leading company in the high growth government-sponsored

marketplace •

Broadens Medicaid footprint to include 19 states that have nearly 60% of

nation’s Medicaid enrollment

•

Establishes

presence

in

13

states

with

significant

dual

eligible

opportunities

•

Advances capabilities in seniors & persons with disabilities market and

long-term services & support programs

•

Enhances competitive positioning for health insurance exchanges

•

Doubles proportion of state-sponsored membership

•

Accretive in the first year and strong long-term return on investment*

* Estimated based on current projections. |

6

6

Key Transaction Terms

•

$92.00 per share in cash to acquire all outstanding Amerigroup shares

•

Transaction value of approximately $4.9 billion

•

Financed through cash on hand, commercial paper and debt issuance

Price

Path to

Completion

Operational

•

Amerigroup shareholder vote

•

Regulatory approvals including Hart-Scott-Rodino, state departments of

insurance and other regulators

•

Anticipated closing by the end of the first quarter 2013*

•

Amerigroup will be a subsidiary focused on effectively managing state

sponsored programs and further expanding this business

•

Key Amerigroup management team members to remain with WellPoint

* Estimated based on current projections. |

7

7

Now is the Right Time for this Highly

Compelling Opportunity

Eyes wide open

Right deal,

Right time

•

Recognized issues

•

Medicaid MCOs are

trading at a premium to

historical levels

•

With political and

economic distinctions,

states will take varying

approaches to fiscal

challenges

•

Compelling opportunity

•

Significant growth

opportunities ahead

•

Managed care is a solution to

state fiscal issues

•

Best partner to serve the

rapidly-emerging dual eligible

and Medicaid mandates |

Total Expenditures: $457 billion

8

8

Medicaid Managed Care is

Underpenetrated and Poised for Growth

8

8

Sources: www.statehealthfacts.org, CMS, HMA, Wall Street equity research.

Unmanaged

Comprehensive Managed Care

8

Current

Future (2014)

Total Expenditures: $587 billion

29M

24M

(45%)

$359B

$98B

(21%)

Total Beneficiaries: 53 million

$184B

(31%)

$403B

27M

41M

(60%)

Total Beneficiaries: 68 million |

9

9

Outsized Growth Potential

9

9

2012 –

2020

RFP Pipeline –

~$50 Billion

9

2012 –

2014

2013 –

2022

Long-term

Services and

Support

Dual Eligibles |

Dual

Eligible Opportunity 10

37 million people

51 million people

20

population

31

15%

population

39%

Dual Eligibles

9 million people

$300 billion

opportunity

Duals are managed through government programs and account for

$300 billion growing to $700 billion in 10 years

Sources: Kaiser Family Foundation, www.statehealthfacts.org, Wall Street equity

research %

of

Medicare

% of costs

of

Medicaid

of

costs |

11

11

Adjacent Growth: Long-Term Services and

Support (“LTSS”)

Medicare /

CareMore

Medicaid

Capabilities

Geographic

footprint

LTSS

Opportunity

LTSS Opportunity

Positioning to Capture Market Share

LTSS model of care is scalable, cost efficient and synergistic with CareMore

Significant and broad growth opportunity

in Medicaid (~15 million lives today) High-cost

populations in every state Home

and community based services Amerigroup has 5

LTSS programs

CareMore provides additional

capabilities

Duals initiative creates stimulative

effect for LTSS

CMS currently working with more than

two dozen states |

Government Business Expected to Increase

Income Distribution By State

% of 2010 state population

<133% of Federal Poverty Level

133-200% of Federal Poverty Level

200-400% of Federal Poverty Level

>400% of Federal Poverty Level

11

Virginia

25

8

Ohio

30

32

11

New Hampshire

17

8

Nevada

New York

Total

29

11

Wisconsin

23

10

26

13

Missouri

29

11

12

Maine

24

11

Kentucky

33

11

Indiana

29

Georgia

33

10

Connecticut

19

9

Colorado

24

9

California

32

11

Approximately 29% of the

population in our Blue

markets have incomes that

would make them eligible

for Medicaid under PPACA

Approximately 38% of the

population in our Blue

markets have incomes that

would make them eligible

for exchange subsidies

State

12

Source: MPACT 5.0.0, WLP estimates.

24

27

26

26

30

27

32

30

31

29

25

29

25

32

27

33

40

46

31

29

28

33

30

30

46

32

30

42

35

33 |

13

13

Amerigroup is Exceptionally Attractive

•

Superior pure-play government managed care platform and management team

•

Leader in serving high needs populations

•

Disciplined approach to growth –

thoughtfulness in selecting markets

•

Well-positioned for future RFPs

* SPD= Seniors & Persons with Disabilities; LTSS = Long-Term Services &

Support; MA = Medicare Advantage. 1,711

1,579

1,788

1,931

2,024

2007

2008

2009

2010

2011

Premium revenue

Membership

$3,872

$4,445

$5,159

$5,783

$6,301

2007

2008

2009

2010

2011

(Members in ‘000s)

($ in millions)

•

40% of revenues from SPD, LTSS, MA and dual members*

|

14

14

Geographic Breadth and Diversification

14

14

14

•

19 combined Medicaid states (excludes OH)

•

17 primarily fully insured

•

2 ASO (SC, MA)

•

30% of Amerigroup membership is in

WellPoint Blue markets

Pro Forma Combination

Pro Forma Combination

2014 Duals Combined Opportunity

2014 Duals Combined Opportunity

Near-term Duals Opportunity

WellPoint states

Amerigroup states

WellPoint & Amerigroup

Recently-awarded

•

Presence in 13 states with near-term dual

eligible opportunities

•

Potential for nearly $16 billion of revenue*

* Estimated based on current projections. |

15

15

Large and Attractive Government Managed

Care Presence

Sources: Kaiser Family Foundation, CMS, Wall Street equity research.

•

19 combined states comprise more than $180 billion of the nation’s $300

billion dual spending WellPoint becomes a leader in the four largest dual

spending states ($ in millions, lives in thousands)

Medicaid

Dual

ABD

Uninsured

Duals

enrollment

eligible lives

lives

lives

spending ($)

California

7,327

1,168

1,268

7,084

$36,559

New York

4,741

724

680

2,779

35,009

Texas

3,764

609

617

6,259

17,551

Florida

2,853

561

485

3,868

16,232

Massachusetts

1,417

251

193

324

9,899

New Jersey

1,039

200

168

1,286

7,780

Tennessee

1,204

276

174

947

7,593

Wisconsin

1,144

215

108

531

7,004

Georgia

1,497

262

229

1,844

6,850

Virginia

884

168

149

988

5,345

Louisiana

892

182

175

790

5,148

Indiana

1,035

149

118

837

4,921

Washington

1,121

144

138

839

4,864

South Carolina

808

149

112

737

4,286

Maryland

902

108

108

731

4,146

West Virginia

335

77

80

262

2,346

Kansas

326

62

46

347

2,215

New Mexico

546

53

60

449

1,736

Nevada

265

38

41

517

1,157

Total

32,100

5,398

4,948

31,418

$180,639

% of US total

59%

61%

63%

65%

60% |

Similar

cultures and organizational values 16

•

Track records of excellent customer service, strong clinical care management

and deep provider collaboration

•

Strong and valued relationships with federal, state and local governments

•

Focus on access, affordability and consumer experience

•

Commitment to improving health care costs and quality

•

Management teams committed to successfully integrating and achieving future

growth targets |

Name

Role

Age

Years with

Amerigroup

Remaining with

Company?

Jim Carlson

Chairman and CEO

60

9

Jim Truess

Executive Vice President and CFO

46

6

Richard Zoretic

Executive Vice President and COO

54

9

17

17

Proven Management Team

•

Amerigroup has approximately 6,600 associates in total

|

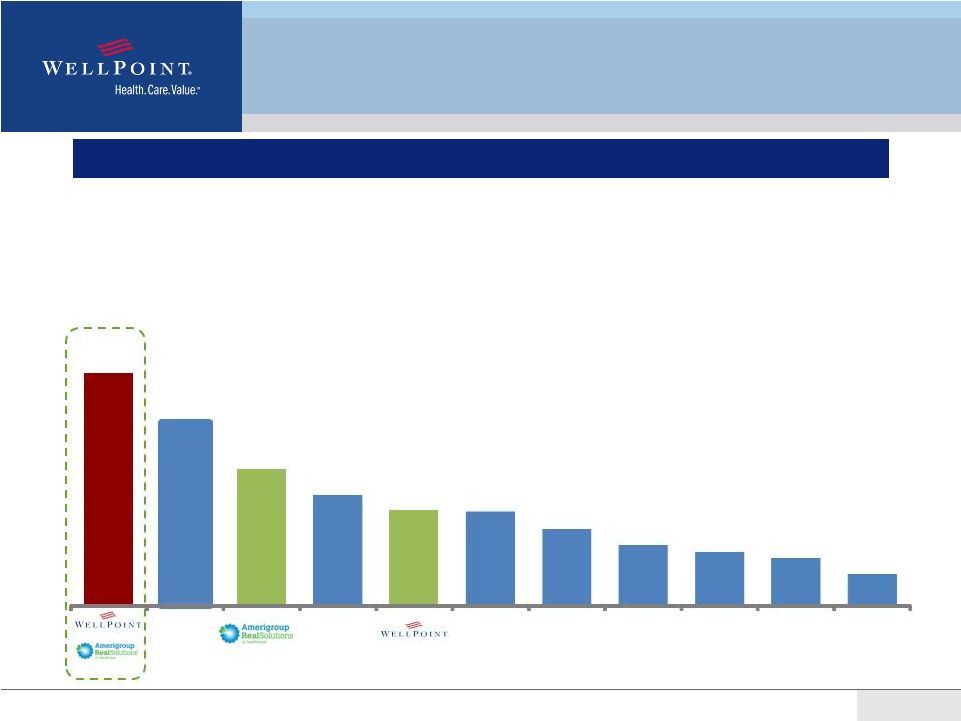

Furthers WellPoint’s Leadership in

Government Managed Care

•

Pro forma Medicaid membership of more than 4.5 million lives

•

Pro forma 2012E Medicaid revenue of more than $12 billion*

Creates Market Leader in the Medicaid Space

18

Note: Medicaid membership as of 3/31/12, except for Amerigroup as of May 2012 and

Company H as of 12/31/11. * Estimated based on current projections.

(# of Medicaid members in thousands)

Company

A

Company

B

Company

C

Company

D

Company

E

Company

F

Company

G

Company

H

4,525

3,590

2,658

2,150

1,867

1,825

1,486

1,174

1,034

924

614 |

19

19

Doubles Proportion of State Sponsored

Membership

19

19

Note: WLP data as of 3/31/12 and Amerigroup data as of May 2012

Total Membership: 33.7 million

Total Membership: 36.4 million

Current WellPoint Business Mix

Pro forma Business Mix

19

Senior

4%

BlueCard

15%

State

Sponsored

6%

Individual

6%

National

Accounts

21%

Local Group

44%

FEP

4%

Senior

4%

BlueCard

14%

State

Sponsored

12%

Individual

5%

National

Accounts

20%

Local Group

41%

FEP

4% |

20

20

Pro Forma Financial Data & Synergies*

* Estimated based on current projections.

Medical

Members

36.4 million in total

More than 4.5

million Medicaid

1 in 9 Americans &

1 in 12 Medicaid

recipients

2012E

Revenue

Total revenue:

More than

$70 billion

Medicaid revenue:

More than

$12 billion

Financial

Metrics

Low SG&A

expense ratio

Strong statutory

capital position

Annual

Synergies

Fully integrated:

More than

$125 million

Investment income

Administrative

efficiencies

PBM and other

ancillary services |

21

21

Financially Compelling*

* Estimated based on current projections.

•

No change to 2012 guidance

•

Accretive in 2013, including one time transaction

and integration costs

•

Increasing accretion in 2014, exceeding $1.00 per

share by 2015

EPS

•

Double-digit long-term cash on cash return

•

Mid-teens IRR

ROI

•

Pro forma debt to capital ratio up to 39%

•

Intention to steadily lower over 18-24 months

•

Expect solid investment grade debt rating

Balance

Sheet |

22

22

Continued Commitment to Delivering

Shareholder Value

Share Buybacks

Invest in Core Business

Invest in Future Growth

Opportunities

Dividends

Capital Allocation

Strategy |

23

23

A Compelling Combination

•

Furthers our objective of creating the best health care value in

the industry

•

Advances leadership in government sponsored managed care

•

Enhances future growth potential in multiple market segments

•

Strong long-term return on investment for shareholders*

•

Retains proven management team with a highly compatible culture

* Estimated based on current projections. |

24

24

24

24 |