Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RALCORP HOLDINGS INC /MO | d378738d8k.htm |

Exhibit

99.1 |

Kevin Hunt, Chief Executive Officer and President

Scott Monette, Chief Financial Officer

Matt Pudlowski, Director Business Development

Ralcorp Holdings, Inc. |

2

Forward Looking Statements

Please note that this presentation contains forward-looking statements as

defined in the Private Securities Litigation Reform

Act

of

1995.

The

words

“anticipate,”

“plan,”

“estimate,”

“expect,”

“intend,”

“will,”

“should”

and

similar

expressions, as they relate to us, are intended to identify forward-looking

statements. These statements reflect management’s current beliefs,

assumptions and expectations and are subject to a number of factors and risks that may

cause actual results to differ materially. These factors and risks include but are

not limited to: (i) changes in actual or expected results of operations (ii)

our ability to effectively manage future sales growth along with the growth from

acquisitions or continue to make acquisitions at the rate at which we have been

acquiring in the past; (iii) significant increases in the costs of certain

commodities, packaging or energy used to manufacture our products; (iv) our ability to

continue to compete in our business segments and our ability to retain our market

position; (v) our ability to maintain a meaningful price gap between our

products and those of our competitors, successfully introduce new products or

successfully manage costs across all parts of the Company; (vi) significant

competition within the private brand business; (vii) our ability to

successfully implement business strategies and ongoing or future cost savings initiatives to

reduce costs; (viii) the loss of a significant customer; (ix) allegations that our

products cause injury or illness, product recalls and product liability

claims and other litigation; (x) our ability to anticipate changes in consumer preferences and

trends; (xi) our ability to service our outstanding debt or obtain additional

financing; (xii) disruptions in the U.S. and global capital and credit

markets; (xiii) fluctuations in foreign currency exchange rates; (xiv) the termination or

expiration of current co-manufacturing agreements; (xv) consolidations among

the retail grocery and foodservice industries; (xvi) change in estimates in

critical accounting judgments and changes to or new laws and regulations

affecting our business; (xvii) termination of existing anti-dumping measures

imposed against certain foreign imports of dry pasta; (xviii) losses or

increased funding and expenses related to our qualified pension plan; (xix) labor strikes or

work stoppages by our employees; (xx) bankruptcy of a significant customer; (xxi)

impairment in the carrying value of goodwill or other intangibles; and

(xxii) changes in weather conditions, natural disasters and other events beyond our

control; and other risks and uncertainties described from time to time in our

periodic reports filed with the Securities and Exchange Commission.

Ralcorp does not assume any obligation to update any forward-looking statements

or the information contained

herein

as

a

result

of

new

information

or

future

events

or

developments,

except

as

required

by

law.

This presentation includes certain non-GAAP financial measures. The required

reconciliations from these non-GAAP financial measures to their comparable

GAAP financial measures are included in the appendix to this presentation.

|

3

Additional Information

Market and Industry

This presentation includes industry and trade association data, forecasts and

information that we have prepared based, in part, upon data, forecasts and

information obtained from independent trade associations, industry publications and

surveys

and

other

independent

sources

available

to

us.

Some

data

also

are

based

on

our

good

faith

estimates, which

are derived from management’s knowledge of the industry and from independent

sources. These third-party publications and surveys generally state that

the information included therein is believed to have been obtained from

sources believed to be reliable. We have not independently verified any of the data

from third-party sources nor have we

ascertained

the

underlying

economic

assumptions

on

which

such

data

are

based.

Similarly,

we

believe

our internal

research is reliable, even though such research has not been verified by any

independent sources. Other Data

Financial data regarding the Sara Lee private-brand dough business have been

prepared based upon information provided

by

Sara

Lee

Company.

We

have

not

independently verified any of the data nor have we ascertained the

underlying economic assumptions on which such data are based.

|

4

Agenda

Agenda

Fiscal 2012 Highlights

Fiscal 2013 Headwinds and Tailwinds

About Ralcorp

Private-Brand Market

Growth-through-Acquisition Strategy

–

Amortization & ROIC

Financial Position

Conclusion |

Fiscal

2012 Highlights Fiscal 2012 Highlights

Bloomfield Stabilization Plan

Volume/Price/Commodities Equation

Recent Acquisitions

–

Refrigerated Dough

–

Petri

–

Gelit

5

Highlights |

Fiscal

2013 Headwinds / Tailwinds Volume and Pricing

Loss of Bloomfield Customer

Higher tax Rate (35.25%)

Lower Commodity Costs (1.5%-2.0% of 2012 COGS)

Bloomfield Inefficiencies

Oklahoma Plant Closure ($10-$12 million)

Refrigerated Dough Synergies ($6-$8 million)

Petri / Gelit Acquisition Accretion ($0.10 / share)

6

Headwinds

Tailwinds |

7

About Ralcorp

Ralcorp is the leader in private-brand food production and a major producer of

foodservice products in North America.

Spun-off from Ralston-Purina

(NYSE: “RAH”)

Sales: $987 million

Categories: Cereals, crackers, baby food

Operated: United States

Employees:

2,500

(2)

Plants: 6

(2)

1994

Completed the spin-off of Post on

February 3, 2012

Sales: $4.2 billion

(1)

Categories: 22 major product categories

Operate: United States, Canada, Italy

Employees: 10,000

Plants: 41

The New Ralcorp

Note:

(1) Management estimates based on FY 2011; excludes Post; Includes Refrigerated

Dough. (2)

Based

on

Company’s

FY

1994

filings

and

internal

data:

excludes

resort

operations,

seasonal

resort

employees

and

branded

baby

food. |

Cereal

Products

21%

Ralcorp Segment and Product Overview

Source: Company filings

Note: Reflects trailing 12 months as of September 30, 2011. Pro forma for

acquisition of Sara Lee Dough. Numbers do not add to 100% due to rounding off.

Note: Snacks, Sauces & Spreads comprises Crackers & Cookies, Snack Nuts,

Candy & Chips and Sauces & Spreads. Pasta consists entirely of American Italian Pasta Company. Frozen

Pro

Forma

Net

Sales

by

Segment

Pro

Forma

Net

Sales

by

Product

8

Pasta

14%

Snacks, Sauces &

Spreads

39%

Frozen Bakery

Products

26%

Pasta

14%

Crackers &

Cookies

12%

Nutritional

Bars, Other

8%

Snack Nuts,

Candy & Chips

14%

Sauces &

Spreads

13%

Ready-to-Eat

Cereal

11%

Refrigerated

Dough

7%

Griddle

7%

Hot Cereal

1%

Cookies

5%

Breads

5%

Frozen, Other

2%

Bakery comprises Griddle, Breads, Cookies, Frozen Dough, Other and Refrigerated

Dough. Cereal Products comprises Ready-to-Eat Cereal, Hot Cereal and Nutritional Bars, Other. |

Consistent and Proven Record of Delivering Strong

Returns to Shareholders

9

Source: Bloomberg (includes dividends)

¹

Large Cap Food: Campbell, ConAgra, General Mills, Heinz, Hershey, Kellogg and Kraft

Foods. ²

Mid Cap Food: B&G Foods, Flowers Foods, Hain, Lancaster, McCormick,

Synders-Lance and TreeHouse. Last 10 Years

(80)%

(20)%

40%

100%

160%

220%

280%

340%

400%

Oct-02

Sep-04

Aug-06

Jul

-08

Jul

-10

Jun

-12

Daily from 01-Oct-2002 to 02-Jul-2012

Ralcorp

Large Cap Food¹

Mid Cap Food²

S&P 500 Index

273.1 %

228.6 %

105.1 %

95.9 % |

10

Private-Brand Market

Private-Brand Market |

Highly Fragmented Market With Substantial Growth

Opportunities

EBITD

A

Margin

Source:

Company

filings,

presentations

and

other

materials;

Packaged

Facts

–

The

Future

of

Food

Retailing

in

the

U.S., 3rd Edition

U.S. Private Label Market Growth

11

2011 U.S. Private Label Market Share

78%

6%

16%

Consolidated

Competitors

($ in billions)

All Others

$87

$92

$97

$103

$108

$113

2009A

2010A

2011E

2012E

2013E

2014E

total U.S. private label sales (food and beverage).

Note:

Consolidated

Competitors

include

Dean

Foods,

Cott,

TreeHouse

and

Smithfield.

Market share calculations based on LTM Sep 2011 sales as a percentage of estimated

2011 |

Private Brand Foods Have Had Impressive

Long-Term Growth Rates

Source: Hoch Banerji (1993), A.C. Nielsen, BEA, Conference Board, Canback Dangel

analysis. 14%

15%

16%

17%

18%

19%

1972

1974

1976

1978

1980

1982

1984

1986

1988

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

Generics Era

-

National-Brand Equivalent Era

Private Brand Era

12 |

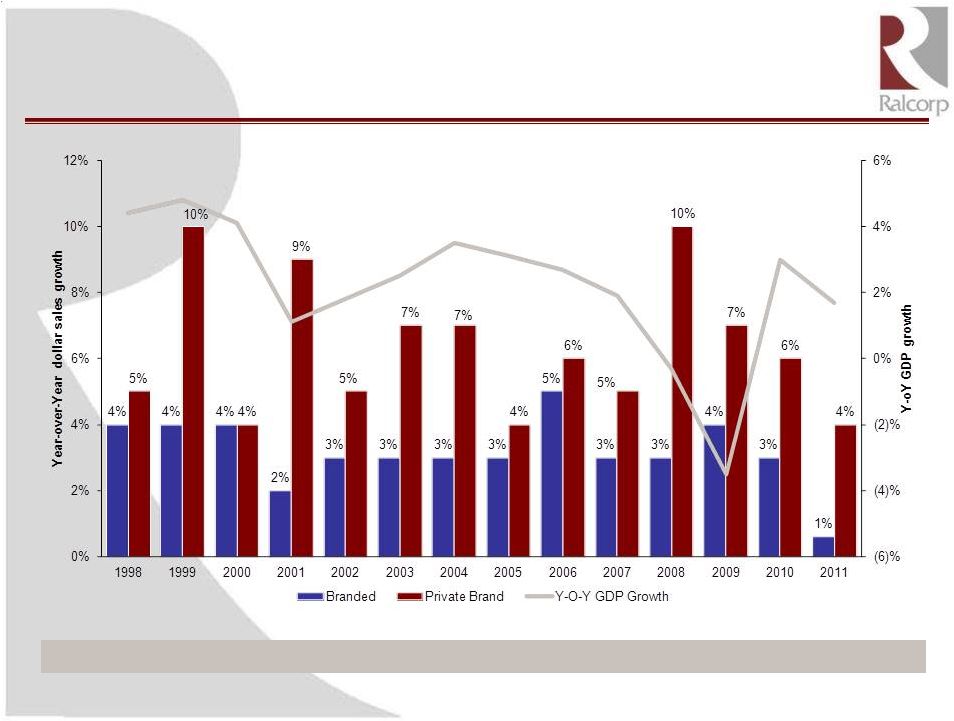

Private-Brand Food Has Grown Throughout the

Economic Cycle

13

Source: A.C. Nielsen.

Private-Brand Growth Is Not Dependent on a Weak Economy

|

14

Retailer Concentration a Major Driver in Private-Brand

Growth

Source:

Symphony

IRI

Special

Report

–

Private

Label

in

Europe;

Wall

Street Estimates

United States

~23% Share

United Kingdom

Canada

~36% Share

Private Brand Growth Highly Correlated to Retailer Concentration

~57% Share |

15

Private-Brand Food Economics Are Powerful for

Private-Brand Food Economics Are Powerful for

Retailers and Consumers

Retailers and Consumers

Source: Wall Street research.

National Brand

Private Brand

$10.00

Price to

Consumer

$7.00

Price to

Consumer

$7.50

Retailer's

Cost

$4.00

Retailer's

Cost

$2.50

Retailer's Gross

Profit

$3.00

Retailer's Gross

Profit

Consumer saves 30%

Retailer’s gross profit increases 20%

Significant Margin Opportunity for Retailers and Price Benefit for Consumers

|

Ralcorp Leads Private Brands in Attractive Categories

Ralcorp Leads Private Brands in Attractive Categories

16

Source: IRI FDMx 52-weeks ending October 2, 2011

#1

#2

#1

#1

#1

#1

#1

#1

Ralcorp

Position:

60%

30%

65%

45%

70%

90%

50%

70%

Cereal

Cookies

Crackers

Snack Nuts

Pasta

Refrigerated

Dough

Peanut

Butter

Jams |

Ralcorp Categories Have Favorable Growth Dynamics

Ralcorp Categories Have Favorable Growth Dynamics

17

Source: Symphony IRI FDMW 52-weeks ending December 25, 2011

Note: Reflects 2007-2011 category growth; Category breakdown percentages may not

add to 100% due to rounding. Ralcorp share of private-brand sales represents

management estimates.

Five Year Category Growth

2.2%

6.6%

9.6%

6.4%

8.7%

3.2%

4.0%

6.3%

0.2%

0.5%

2.4%

4.6%

5.9%

4.1%

1.4%

Cereal

Cookies

Crackers

Snack Nuts

Pasta

Refrig.

Dough

Peanut

Butter

Jams

Private Brand

Branded

(0.1%)

33%

11%

16%

9%

33%

24%

21%

19%

% Private

Brand:

$1,445

$8,328

$5,583

$5,415

$2,728

$1,974

$1,787

$1,240

Category

Size: |

18

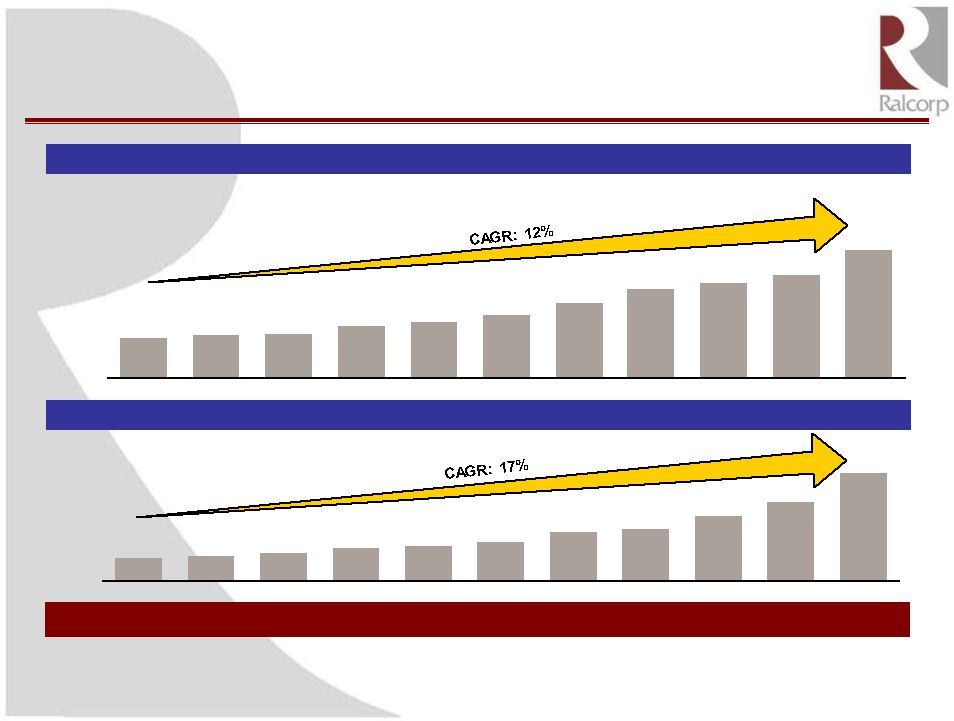

Consistent Private Brand Operating Performance

Consistent Private Brand Operating Performance

10%

10%

11%

11%

11%

10%

11%

10%

12%

13%

14%

Margin

Net

Sales

Adjusted EBITDA

(1)

$1,178

$1,280

$1,304

$1,558

$1,675

$1,850

$2,233

$2,644

$2,821

$3,061

$3,787

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

$114

$127

$140

$165

$179

$193

$244

$256

$324

$396

$536

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Average Organic Growth = 3.6%

($ in millions)

Source: Company filings for 2002-2011.

Note: Excludes non-cash unusual and non-recurring items. Net Sales and Adjusted EBITDA pro

forma for separation of Post. (1) Adjusted EBITDA is defined as earnings before interest, income taxes, depreciation, and

amortization, excluding Post separation costs, merger and integration costs, provision for legal settlement,

adjustments for economic hedges, accelerated depreciation, gains / losses on forward sale contracts,

gain on sale of securities, acquired inventory valuation adjustments, goodwill and trademark

impairment losses, merger termination fees, and equity method earnings in Vail Resorts, Inc. A

reconciliation from Adjusted EBITDA to the comparable GAAP financial measure is included in the

appendix. A reconciliation from Adjusted EBITDA to the comparable GAAP financial measure is

included in the appendix. Adjusted EBITDA metrics not pro forma for acquisitions. FY 2008-FY 2011.

|

EBITDA Trajectory Driven by Acquisitions and

EBITDA Trajectory Driven by Acquisitions and

Strong

Strong

Organic Growth

Organic Growth

Source: Company filings, management

Note: Pro Forma for separation of Post (not pro forma for acquisition of

Refrigerated Dough). 19

Ralcorp Has Delivered 11% Organic Growth Annually Since 2008

($ in millions)

2008

Acquisitions

2011

Organic |

20

Private-Brand Food Key Takeaways

Private-Brand Food Key Takeaways

Private brands deliver greater profitability to retailers than branded

products Driven by improved product and packaging, private-brand food

growth has accelerated over the last two decades and the trend is expected

to continue U.S. private-brand market has $100 billion in annual sales

and remains highly fragmented

Ralcorp is uniquely positioned to capitalize on the private-brand opportunity

with leading positions in key product categories

|

21

Growth-through-Acquisition Strategy

Growth-through-Acquisition Strategy |

22

We Have Completed 30 Private-Brand Acquisitions Since

We Have Completed 30 Private-Brand Acquisitions Since

1997, Totaling Over $3.3 Billion in Combined Annual Sales

1997, Totaling Over $3.3 Billion in Combined Annual Sales

Ralcorp Management has a Successful Track Record of Identifying and Integrating

Acquisitions ($ in millions)

Petri

May-12

$50 Sales

Gelit S.r.l.

June-12

$40 Sales

Flavorhouse

Apr-98

$62 Sales

Sugarkake

Aug-98

$30 Sales

Nutcracker

Sep-98

$42 Sales

Martin Gillet

Mar-99

$70 Sales

Cascade Cookies

Jan-00

$19 Sales

Southern Roasted

Mar-99

$28 Sales

Linette

May-00

$28 Sales

Ripon Foods

Oct-99

$64 Sales

Red Wing

Jul-00

$348 Sales

Wortz

Apr-97

$69 Sales

Lofthouse

Jan-02

$70 Sales

Bakery Chef

Dec-03

$171 Sales

Concept 2 Bakers

Feb-04

$34 Sales

Medallion Foods

Jun-05

$43 Sales

Western Waffles

Nov-2005

$75 Sales

Parco Foods

Feb-06

$50 Sales

Cottage Bakery

Nov-06

$125 Sales

Bloomfield Bakers

Mar-07

$188 Sales

Torbitt & Castleman

Jan-01

$80 Sales

Beta Brands

Jan-07

$10 Sales

Pastificio Annoni

Dec-11

$13 Sales

J.T.Bakeries

May-10

$39 Sales

N.A.B. / PL Floods

May-10

$57 Sales

Sepp’s

Jun-10

$29 Sales

Harvest Manor

Mar-09

$180 Sales

AIPC

Jul-10

$569 Sales

Pastries Plus

Aug-07

$10 Sales

Refrigerated Dough

Oct-11

$306 Sales |

23

Auction

(40 % of Deals)

Reputation

Sourcing Acquisitions: Ralcorp’s Unique Model

Sourcing Acquisitions: Ralcorp’s Unique Model

Relationships

(60

%

of

Deals) |

24

Ralcorp’s Acquisition Pipeline is Robust with Nearly 50

Ralcorp’s Acquisition Pipeline is Robust with Nearly 50

Potential Private-Brand M&A Targets

Potential Private-Brand M&A Targets

>$500

Revenue

Scale:

>$100

<$500

<$100

($ in millions)

Category growth potential

Attractive margins or

margin expansion

opportunities

Strong cash flow

characteristics

Earnings accretion

Attractive returns

Acquisition Criteria

High

Low

Synergies |

(1)

Based on FY 2011 Frozen Bakery products segment profit plus depreciation and amortization.

(2) Based on 10.0x LTM EBITDA multiple.

Total Price Paid

$ 725 million

Implied EBITDA

Multiple

(1)

5.7x

Implied Value at

Current Multiple

(2)

$ 1,272

million

Implied Value

Creation (%)

25

Case Study: Building Platform –

Case Study: Building Platform –

Frozen Bakery Division

Frozen Bakery Division

($ in millions)

Target

Revenue

Cascade Cookie

Company

$19

Lofthouse Foods

70

Bakery Chef

171

C2B

34

Western Waffles

75

Parco

50

Cottage Bakery

125

Pastries Plus

10

Sepp’s

29

Total

$592

75% |

Acquisitions Key Driver of Value, But Contribute

Acquisitions Key Driver of Value, But Contribute

Amortization Reducing EPS Benefit

Amortization Reducing EPS Benefit

26

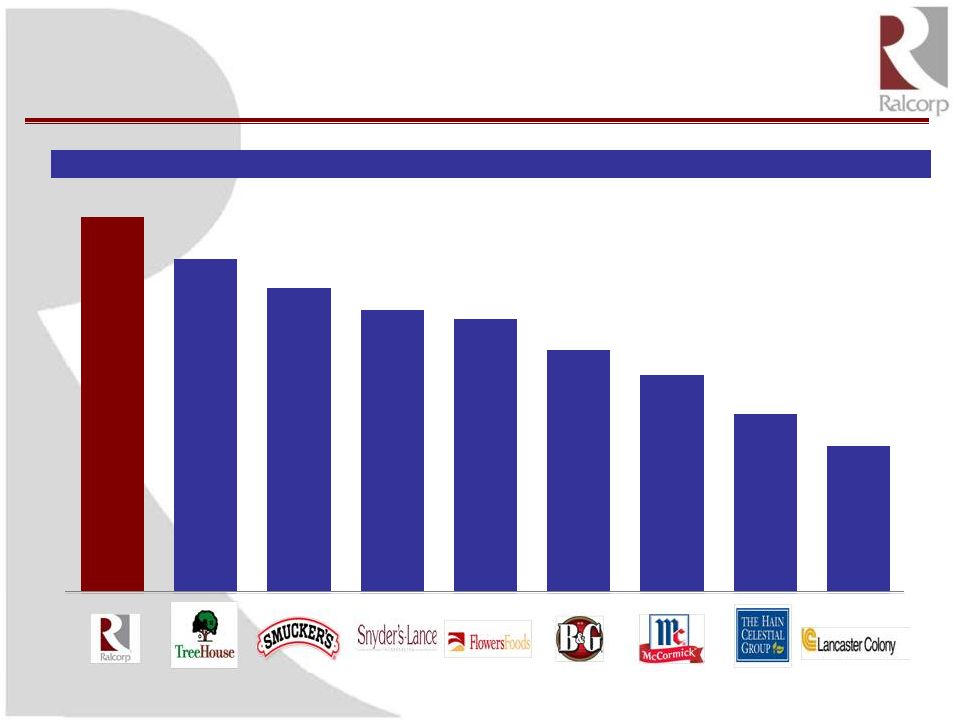

D&A Highest Among Peer Group as % of Sales

4.5%

4.0%

3.7%

3.4%

3.3%

2.9%

2.6%

2.2%

1.8%

Peer Median: 3.1% |

Ralcorp Trading Level Relative to Peers

Ralcorp Trading Level Relative to Peers

27

17.3 x

13.7 x

18.5 x

(1.0)x

(2.6)x

Ralcorp IBES Consensus

Adjustment for Post

Stake (1)

Adjustment for D&A in-

line with Peers (2)

Ralcorp Adjusted for Post

Stake & D&A

Mid Cap Median (3)

Note: Ralcorp IBES Consensus reflects share price of $68.03 and FY 2013E EPS of $3.94; Reflect figures

related to FY 2013E (1)

Calculated by reducing share price by proportional share of 19.7% stake in Post valued at

$218mm.

(2)

Calculated assuming D&A as percentage of sales reduced from 4.5% to 3.1% (median of

Midcap peers) applied to median FY 2013E consensus estimated sales of $4,479mm, assuming

33.5% tax rate and 56.3mm diluted shares outstanding.

(3)

Midcap peers include B&G Foods, Flowers Foods, Hain Celestial, Lancaster, McCormick,

Smucker’s, Synders-Lance and TreeHouse. |

ROIC

Also Negatively Impacted By Private Brand ROIC Also Negatively Impacted By

Private Brand Acquisition Related Intangibles

Acquisition Related Intangibles

$3,522

$992

$2,530

$264

$49

$313

28

Note: ROIC = Tax Effected Operating Income / (Total debt+Book

Equity–Cash); Reflects tax rate of 33.5% Reflects EBIT of $397mm,

pro-forma for Post spin off and acquisition of Sara Lee Dough. Reflects pro-rata $21mm adjustment to EBIT from Sara Lee Dough.

Reflects

debt

of

$1,981,

book

equity

of

$1,672

less

cash

balance

of

$131mm

as

on

31-Mar-2012.

Reflects

$74mm

of

amortization

expense

for

the

LTM

period

ending

31-Mar-2012.

7.5 %

4.9 %

12.4 %

ROIC LTM (1) 31-Mar-2012

Impact of Acquisition Intangible

Adjusted ROIC (Excluding

Acquisition Related Intangible)

(1)

(2)

(3)

After-Tax Operating Profit (3)

Capital

Employed

(2) |

Higher D&A Driven By Amortization of Acquired

Higher D&A Driven By Amortization of Acquired

Intangibles

Intangibles

29

Refrigerated

Dough

(Oct

2011)

AIPC (July 2010)

Post Foods RMT (Aug 2008)

Cash

$

0.9

Receivables

14.7

Inventories

23.1

Other current assets

0.1

Property

62.6

Goodwill

216.6

Other intangible assets

259.6

Total assets acquired

$

577.6

Accounts payable

(14.1)

Other current liabilities

(8.8)

Other liabilities

(3.2)

Total liabilities assumed

(26.1)

Net assets acquired

$

551.5

Cash

$

39.4

Receivables

42.9

Inventories

48.1

Other current assets

21.0

Property

252.2

Goodwill

534.1

Other intangible assets

568.2

Other assets

1.1

Total assets acquired

$

1,507.0

Accounts payable

(24.1)

Other current liabilities

(29.9)

Deferred income taxes

(238.3)

Other liabilities

(4.9)

Total liabilities assumed

(297.2)

Net assets acquired

$

1,209.8

Cash

$

73.3

Receivables

2.6

Inventories

103.9

Other current assets

-

Property

470.5

Goodwill

1,794.1

Other intangible assets

946.8

Other assets

-

Total assets acquired

$

3,391.2

Accounts payable

-

Other current liabilities

(17.0)

Long-term debt

(964.5)

Deferred income taxes

(448.0)

Other liabilities

(74.0)

Total liabilities assumed

(1,503.5)

Net assets acquired

$

1,887.7

Definite Lived Assets

Amount Amortizable

$259.6

$384.4

$245.1

% of Total Assets

Acquired

45%

26%

7%

Annual Amortization

Impact per Share (1)

($0.20)

($0.28)

($0.14)

Transaction Value

~$545mm

~$1.2bn

~$2.6bn

(1) Adjusted share price for 19.7% stake in Post. |

30

Significant Financial Flexibility to Continue Growth Strategy

Significant Financial Flexibility to Continue Growth Strategy

Net Sales: $4.2 billion

Source: Company filings;

Note: Reflects LTM December 2011 financials. Excludes Post and pro forma for

Refrigerated Dough acquisition (1) Refer to appendix for

reconciliation. Net Debt: $1.8 billion

20% Ownership Stake in Post Holdings, Inc.: $200+ million

EBITDA

(1)

: $600 million

Leverage Profile: 3.0 x |

31

Conclusion

Conclusion

Ralcorp is the undisputed leader in the growing private-brand market

Committed to Delivering Superior Shareholder Value

Through Execution of Our Growth Strategy

Strong track record of growth organically and through acquisitions

Unique capabilities to deliver on-trend products to retailers and

consumers Unparalleled capability in sourcing and completing

acquisitions Strong balance sheet and financial flexibility following Post

spin-off |

32

Appendix

Appendix |

33

Ralcorp –

Ralcorp –

Adjusted EBITDA Reconciliation

Adjusted EBITDA Reconciliation

Source: Company filings and management estimates.

($ in millions)

FY 2001

FY 2002

FY 2003

FY 2004

FY 2005

FY 2006

FY 2007

FY 2008

FY 2009

FY 2010

FY 2011

LTM

12/31/11

Net Earnings

$ 39.9

$ 53.8

$ 7.4

$ 65.1

$ 71.4

$ 68.3

$ 31.9

$ 167.8

$ 290.4

$ 208.8

$ (187.2)

$ (193.2)

Interest expense, net

$ 15.9

$ 5.9

$ 3.3

$ 13.1

$ 16.5

$ 27.3

$ 42.3

$ 54.6

$ 99.0

$ 107.8

$ 134.0

$ 132.7

Income taxes

22.1

30.7

16.9

37.2

36.6

29.9

7.5

86.7

156.9

105.3

83.0

78.9

Depreciation and amortization

41.6

35.8

38.7

47.5

55.8

66.8

82.4

99.5

144.7

166.8

226.5

234.0

Adjustments for economic hedges

-

-

-

-

-

-

-

-

-

-

28.9

39.5

Post separation costs

-

-

-

-

-

-

-

-

-

-

2.8

5.5

Merger and integration costs

-

-

-

-

-

-

-

7.9

31.6

33.1

2.5

7.9

Impairment of intangible assets

-

-

59.0

-

-

-

-

-

-

39.9

503.5

503.5

Provision for legal settlement

-

-

-

-

-

-

-

-

-

7.5

2.5

-

Restructuring/plant closures (excluding depreciation)

2.6

-

14.3

2.4

2.7

0.1

0.9

1.7

0.5

2.5

3.7

3.7

Acquired inventory valuation adjustment

-

-

-

-

-

-

-

23.4

0.4

-

-

-

(Gain) loss on forward sale contracts

-

-

-

-

-

10.6

87.7

(111.8)

(17.6)

-

-

-

Gain on sale of securities

-

-

-

-

-

(2.6)

-

(7.1)

(70.6)

-

-

-

Merger termination fee, net of related expenses

(4.2)

-

-

-

-

-

-

-

-

-

-

-

Equity earnings in Vail Resorts, Inc.

(3.9)

0.8

0.4

(0.4)

(4.5)

(7.0)

(8.9)

(14.0)

(9.8)

-

-

-

Adjusted EBITDA

$ 114.0

$ 127.0

$ 140.0

$ 164.9

$ 178.5

$ 193.4

$ 243.8

$ 308.7

$ 625.5

$ 671.7

$ 800.2

$ 812.5

Pro Forma Acquisition Adjusted Food EBITDA

2.1

1.4

-

8.8

8.9

2.9

12.5

223.7

6.8

143.9

-

37.0

Pro Forma Adjusted EBITDA

$ 116.1

$ 128.4

$ 140.0

$ 173.7

$ 187.4

$ 196.3

$ 256.3

$ 532.4

$ 632.3

$ 815.6

$ 800.2

$ 849.5

Post Segment Profit

$ -

$ -

$ -

$ -

$ -

$ -

$ -

$ 43.3

$ 250.6

$ 220.6

$ 206.0

$ 191.2

Post Depreciation and Amortization

-

-

-

-

-

-

-

9.8

50.6

55.4

58.7

59.0

Post Adjusted EBITDA

$ -

$ -

$ -

$ -

$ -

$ -

$ -

$ 53.1

$ 301.2

$ 276.0

$ 264.7

$ 250.2

Private Brand Adjusted Food EBITDA

$ 114.0

$ 127.0

$ 140.0

$ 164.9

$ 178.5

$ 193.4

$ 243.8

$ 255.6

$ 324.3

$ 395.7

$ 535.5

$ 562.3

Private Brand Pro Forma Adjusted EBITDA

$ 116.1

$ 128.4

$ 140.0

$ 173.7

$ 187.4

$ 196.3

$ 256.3

$ 479.3

$ 331.1

$ 539.6

$ 535.5

$ 599.3 |