Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Texas Mineral Resources Corp. | v316958_8k.htm |

NI 43-101 PRELIMINARY ECONOMIC ASSESSMENT

ROUND TOP PROJECT

Sierra Blanca, Texas

Prepared for

304 Inverness Way South, Suite 365

Englewood, CO 80112

Report Date: June 22, 2012

Effective Date: May 15, 2012

Prepared by

Donald E. Hulse, P.E.

M. Claiborne Newton, III, Ph.D., C.P.G.

Deepak Malhotra, PhD, SME-RM

Zachary J. Black, EIT, SME-RM

TABLE OF CONTENTS

| Section | Page No. | |

| 1 | SUMMARY | 1 |

| 1.1 | Property Description and Ownership | 1 |

| 1.2 | Geology and Mineralization | 1 |

| 1.3 | Exploration Status | 2 |

| 1.4 | Mineral Resource Estimate | 2 |

| 1.5 | Mining and Operations | 5 |

| 1.6 | Environment and Permitting | 9 |

| 1.7 | Economic Analysis | 10 |

| 1.8 | Conclusions | 12 |

| 1.9 | Recommendations | 13 |

| 2 | INTRODUCTION | 15 |

| 2.1 | Terms of Reference and Purpose of the Report | 15 |

| 2.2 | Qualifications of Qualified Persons | 15 |

| 2.2.1 | Details of Personal Inspection | 15 |

| 2.3 | Sources of Information | 16 |

| 2.4 | Units of Measure | 16 |

| 3 | RELIANCE ON OTHER EXPERTS | 17 |

| 4 | PROPERTY DESCRIPTION AND LOCATION | 18 |

| 4.1 | Property Location | 18 |

| 4.2 | Mineral Tenure, Agreement and Royalties | 19 |

| 4.2.1 | Mining Leases | 19 |

| 4.2.2 | Royalty | 19 |

| 4.2.3 | Surface Leases/Ownership | 20 |

| 4.2.4 | Prospecting Permits | 21 |

| 4.3 | Environmental Liabilities | 23 |

| 5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 25 |

| 5.1 | Accessibility | 25 |

| 5.2 | Topography, Elevation, Vegetation and Climate | 25 |

| 5.3 | Local Resources and Infrastructure | 25 |

| 5.3.1 | Rail Access | 25 |

| 5.3.2 | Power | 25 |

| 5.3.3 | Water | 26 |

| 5.3.4 | Natural Gas | 27 |

| 6 | HISTORY | 28 |

| 7 | GEOLOGICAL SETTING AND MINERALIZATION | 29 |

| 7.1 | Regional Geology | 29 |

| 7.2 | Local Geology | 29 |

| 7.3 | Property Geology | 30 |

| 7.3.1 | Stratigraphy | 30 |

| 7.3.2 | Structural Geology | 34 |

| 7.4 | Mineralization | 35 |

| 7.4.1 | Mineralogical Studies | 36 |

| i |

| 7.5 | Alteration | 39 |

| 8 | DEPOSIT TYPES | 41 |

| 9 | EXPLORATION | 42 |

| 9.1 | Surface Sampling | 42 |

| 9.2 | Logging Historical RC Cuttings | 42 |

| 9.3 | Aeromagnetic and Aeroradiometric Survey | 42 |

| 9.3.1 | Summary of Results of Aeromagnetic and Aeroradiometric Survey | 42 |

| 9.4 | Stream Sediment Survey | 44 |

| 9.4.1 | Summary of Results of Stream Sediment Survey | 44 |

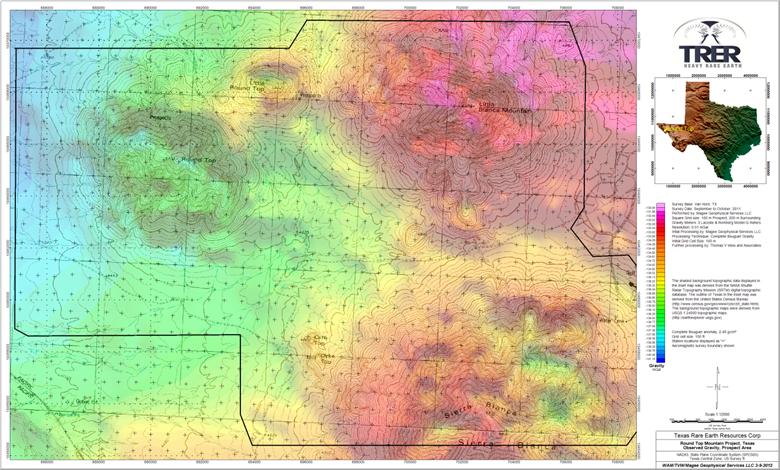

| 9.5 | Gravity Survey | 45 |

| 9.5.1 | Summary of Gravity Survey Results | 45 |

| 10 | DRILLING | 47 |

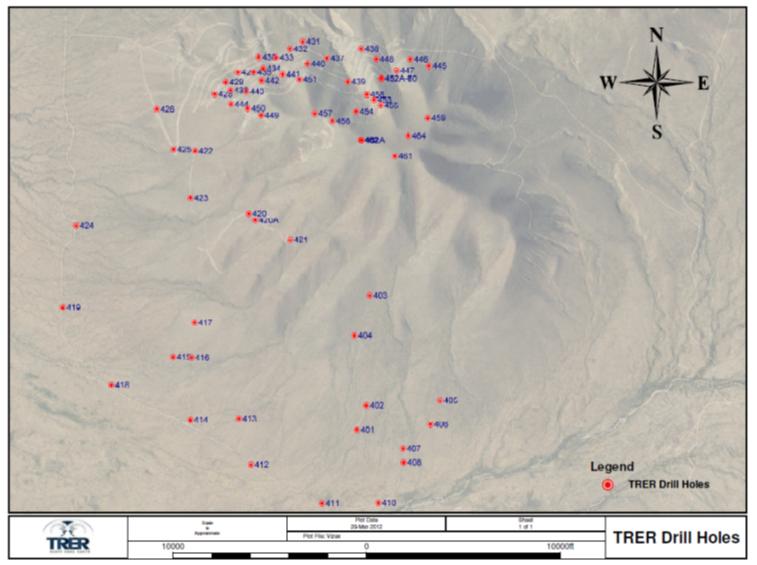

| 10.1 | Introduction | 47 |

| 10.2 | Drilling Procedures and Conditions | 48 |

| 10.3 | Drill Hole Collar Surveys | 49 |

| 10.4 | Drill Hole Logging | 49 |

| 10.5 | Downhole Survey | 49 |

| 10.6 | Extent and Results of Drilling | 50 |

| 10.6.1 | Delineation Drilling | 50 |

| 11 | SAMPLE PREPARATION, ANALYSES AND SECURITY | 52 |

| 11.1 | Reverse Circulation Procedures | 52 |

| 11.1.1 | RC Handling Procedures | 52 |

| 11.1.2 | RC Sample Preparation Procedures | 52 |

| 11.2 | QA/QC Procedures | 53 |

| 11.3 | Sample Shipment and Security | 53 |

| 11.4 | Core Handling Procedures | 54 |

| 11.4.1 | Core Logging Procedures | 54 |

| 11.4.2 | Core Sampling Procedures | 54 |

| 11.4.3 | Core Sampling QA/QC Procedures | 55 |

| 11.4.4 | Core Sample Shipment and Security | 55 |

| 11.5 | Specific Gravity Measurements | 55 |

| 11.6 | Historic Drill Holes | 55 |

| 12 | DATA VERIFICATION | 57 |

| 12.1 | Verification of the Quality Control Program | 57 |

| 13 | MINERAL PROCESSING AND METALLURGICAL TESTING | 58 |

| 13.1 | Phase I Study | 58 |

| 13.2 | Phase II Study | 59 |

| 13.2.1 | Evaluation of Concentration Methods | 59 |

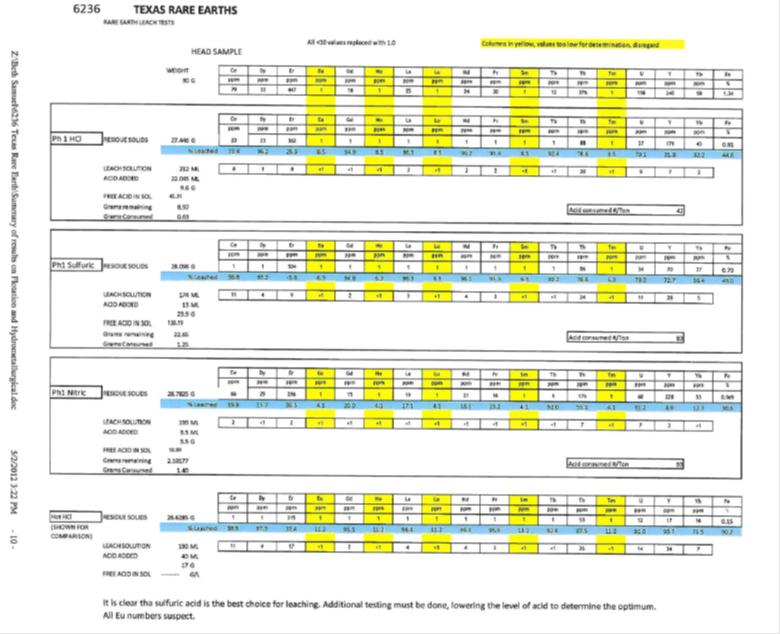

| 13.2.2 | Diagnostic Leach Tests | 61 |

| 14 | MINERAL RESOURCE ESTIMATE | 65 |

| 14.1 | Data Used for REE Grade Estimation | 65 |

| 14.2 | Estimation Methodology | 65 |

| 14.2.1 | Statistical Data | 65 |

| 14.2.2 | Geologic Model | 67 |

| 14.2.3 | Capping | 68 |

| 14.2.4 | Compositing | 68 |

| ii |

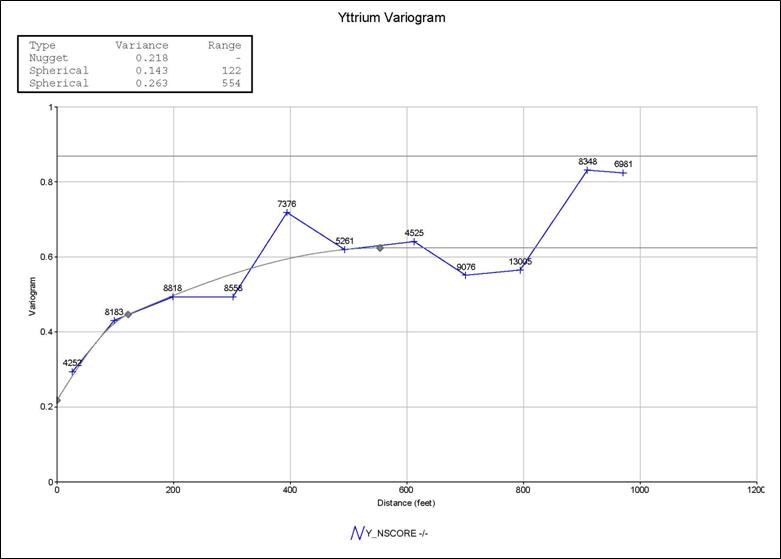

| 14.2.5 | Variography | 69 |

| 14.2.6 | Sequential Gaussian Simulation | 70 |

| 14.3 | Mineral Grade Estimation | 71 |

| 14.3.1 | Sequential Guassian Simulation and Validation | 71 |

| 14.3.2 | Model Validation | 71 |

| 14.4 | Mineral Resource Classification | 73 |

| 14.5 | Mineral Resource Tabulation | 74 |

| 15 | Mineral Reserve Estimate | 78 |

| 16 | MINING METHODS | 79 |

| 16.1 | Pit Design | 79 |

| 16.1.1 | Mining Equipment | 82 |

| 16.1.2 | Support Equipment | 83 |

| 16.1.3 | Estimated Mining Costs | 83 |

| 16.1.4 | Preproduction Development | 84 |

| 17 | RECOVERY METHODS | 85 |

| 17.1 | Process Description | 85 |

| 17.2 | Production Rate and Products | 85 |

| 17.3 | Concentrator | 87 |

| 17.4 | Leaching Facility | 88 |

| 18 | PROJECT INFRASTRUCTURE | 90 |

| 18.1 | Facilities | 91 |

| 18.1.1 | Administration/Office Building | 91 |

| 18.1.2 | Warehouse and Laboratory | 91 |

| 18.1.3 | Truck Shop and Maintenance | 91 |

| 18.2 | Roads | 91 |

| 18.3 | Security | 91 |

| 18.4 | Septic Systems | 92 |

| 18.5 | Water | 92 |

| 18.6 | Power | 92 |

| 18.7 | Fuel | 93 |

| 18.8 | Communications | 93 |

| 18.9 | Product Storage and Loading Facilities | 93 |

| 18.10 | Tailings Facility | 93 |

| 19 | MARKET STUDIES AND CONTRACTS | 94 |

| 19.1 | Rare Earth Demand by Application | 95 |

| 19.2 | Supply/Demand by Element | 96 |

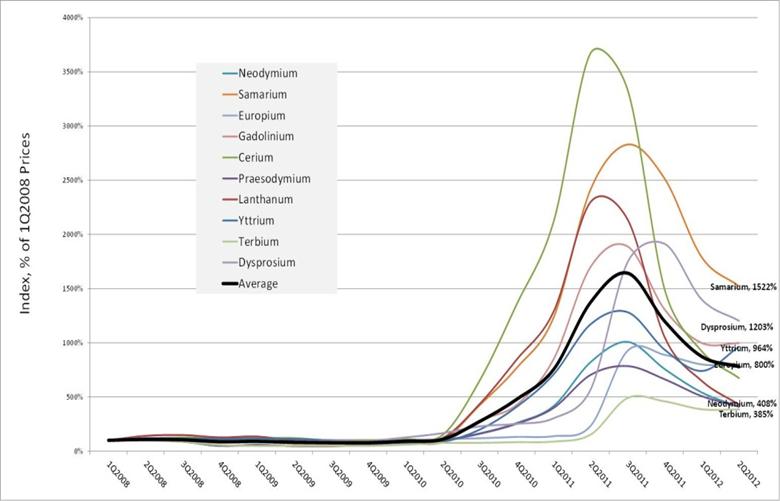

| 19.3 | Rare Earth Pricing | 96 |

| 19.4 | Rare Earth Carbonate Pricing | 98 |

| 19.5 | Contracts for Sales of Products | 98 |

| 20 | ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 99 |

| 20.1 | Environmental | 99 |

| 20.1.1 | Preliminary Evaluation of Potential Environmental Impacts | 99 |

| 20.1.2 | Permitting | 99 |

| 20.1.3 | Current Permitting Efforts | 100 |

| 20.2 | Permit Requirements | 101 |

| 20.2.1 | List of Permits and Registrations | 101 |

| 20.3 | Other Environmental Concerns | 105 |

| iii |

| 21 | CAPITAL AND OPERATING COSTS | 106 |

| 21.1 | Capital Cost Estimate | 106 |

| 21.1.1 | Initial Estimated Capital | 106 |

| 21.1.2 | Sustaining Capital | 107 |

| 21.1.3 | Mine closure and Reclamation Capital | 107 |

| 21.2 | Basis of Estimate | 108 |

| 21.2.1 | Estimate Methodology | 108 |

| 21.3 | Scope of Estimate | 109 |

| 21.3.1 | Mine Development | 109 |

| 21.3.2 | Processing Facility | 109 |

| 21.3.3 | Infrastructure | 109 |

| 21.4 | Operating Cost Estimate | 110 |

| 21.4.1 | Project Cost and Basis | 110 |

| 21.4.2 | Project Manpower | 111 |

| 21.4.3 | Mine Operating Costs | 111 |

| 21.4.4 | Plant Operating Costs | 111 |

| 21.4.5 | General and Administration Costs | 112 |

| 22 | Economic Analysis | 113 |

| 22.1 | Indicative Economic Analysis | 113 |

| 22.1.1 | Production Summary | 115 |

| 22.1.2 | Operating Costs | 118 |

| 22.1.3 | Capital Costs | 119 |

| 22.1.4 | Business Factors | 120 |

| 22.2 | Contracts | 121 |

| 22.3 | Sale Price(s) | 121 |

| 22.4 | Sales | 121 |

| 22.5 | Royalties | 122 |

| 22.5.1 | Property Taxes | 123 |

| 22.5.2 | Federal Income Tax | 123 |

| 22.6 | Sensitivity Analysis | 124 |

| 22.7 | Breakeven Analysis | 126 |

| 22.8 | Economic Projections | 126 |

| 23 | ADJACENT PROPERTIES | 128 |

| 24 | OTHER RELEVANT DATA AND INFORMATION | 129 |

| 25 | INTERPRETATIONs AND CONCLUSIONS | 130 |

| 26 | RECOMMENDATIONS | 132 |

| 26.1 | Future Exploration | 132 |

| 26.2 | Environmental Studies and Mine Planning | 132 |

| 26.3 | Metallurgical Studies | 133 |

| 26.4 | Pre-Feasibility Study | 133 |

| 27 | REFERENCES | 136 |

| 28 | Certificate of Author Forms | 138 |

| iv |

LIST OF FIGURES

| FIGURE | PAGE |

| Figure 1-1 Preliminary Pit Design | 7 |

| Figure 1-2 Case Descriptions | 10 |

| Figure 4-1 Location Map of Project Area, 2012 | 18 |

| Figure 4-2 Surface Leases Adjacent and Including Round Top | 21 |

| Figure 4-3 Prospecting Permits | 23 |

| Figure 5-1 Potential Water Sources for Round Top Project, 2012 | 26 |

| Figure 7-1 Round Top Stratigraphic Column | 31 |

| Figure 7-2 Round Top Peak Structural Geology, 2012 | 35 |

| Figure 7-3 Photo Micrograph of Yttrofluorite Crystal | 38 |

| Figure 9-1 Aeromagnetic Map of Total Magnetic Intensity Reduced to Pole | 43 |

| Figure 9-2 Aeroradiometric Map of Thorium Distribution | 44 |

| Figure 9-3 Map of Observed Gravity Values | 46 |

| Figure 10-1 Historic Drill Hole Locations on Round Top Peak | 47 |

| Figure 10-2 TRER’s RC Drillhole Distribution, 2011 Campaign | 48 |

| Figure 10-3 Proposed Delineation Drill Holes, 2012 | 51 |

| Figure 14-1 Probability Plot of Select REEs Z-Scores Displaying Normality | 67 |

| Figure 14-2 Geologic Cross Section Looking North at 1465000 N | 68 |

| Figure 14-3 Spherical Variogram of Yttrium with Normalized Variogram Model Parameters | 70 |

| Figure 14-4 Distribution of Average Grade for Yttrium | 72 |

| Figure 14-5 Average Block Yttrium Content on Bench Elevation 4525 | 73 |

| Figure 16-1 Existing Surface Topography | 81 |

| Figure 16-2 Preliminary Pit Design | 81 |

| Figure 17-1 TRER Processing Flow Diagram | 86 |

| Figure 18-1 Project Land Status | 90 |

| Figure 19-1 Supply and Demand (TREO and CREO) | 95 |

| Figure 19-2 Historical Prices | 97 |

| Figure 19-3 Economic Analysis Price Cases | 98 |

| LIST OF TABLES | |

| TABLE | PAGE |

| Table 1-1 Mineral Resource Estimate | 1 |

| Table 1-1 Summary of Material included in the Mine Plan* | 8 |

| Table 1-3 Unit Operating Cost Summary | 9 |

| Table 1-4 Preliminary Permit Summary | 9 |

| Table 1-5 PEA Financial Highlights (Millions USD) | 12 |

| Table 1-6 Proposed Two Phased Budget through pre-feasibility stage. | 14 |

| Table 4-1 Summarized Lease Agreements Pay Schedule | 19 |

| Table 4-2 TRER Permit Numbers and Associated Acres | 22 |

| Table 7-1 Sedimentary Formations in the Round Top Peak Project Area | 32 |

| Table 7-2 Rare Earth Minerals Identified from Round Top | 37 |

| Table 13-1 Rare Earth Oxide Head | 59 |

| Table 13-2 Summary of Flotation Test Results | 61 |

| Table 13-3 Leaching Test Results | 63 |

| Table 13-4 Diagnostic Leach Tests at MSRDI | 64 |

| Table 14-1 Descriptive Statistics of REE’s within the Rhyolite | 66 |

| Table 14-2 Composite Descriptive Statistics within the Rhyolite | 69 |

| Table 14-3 Correlation Coefficients of the REEs Compared to Yttrium | 71 |

| Table 14-4 Simulated Model Summary Statistics | 72 |

| Table 14-5 Mineral Resource Estimate | 75 |

| 5 |

| Table 16-1 Summary of Material included in the Mine Plan | 82 |

| Table 16-2 Mine Capital Equipment List - Round Top Project | 82 |

| Table 16-3 Estimated Mining Cost | 84 |

| Table 17-1 REE’s Targeted for Recovery | 85 |

| Table 19-1 Global Rare Earth growth by Application | 95 |

| Table 20-1 Preliminary Permit Summary | 101 |

| Table 21-1 80,000 tpd Concentrator with 10,000 mt Hydromet/Separation Facility | 107 |

| Table 21-2 Distribution of Indirect Costs | 108 |

| Table 21-3 Average Operating Costs per Ton of Plant Feed | 111 |

| Table 21-4 Average Annual Operating Cost | 111 |

| Table 22-1 Case Descriptions | 113 |

| Table 22-2 PEA Financial Highlights (Millions USD) | 114 |

| Table 22-3 General Assumptions | 115 |

| Table 22-4 PEA Operating Highlights | 116 |

| Table 22-5 Oxide Grades | 117 |

| Table 22-6 Production Summary | 118 |

| Table 22-7 Unit Operating Costs | 119 |

| Table 22-8 Capital Costs Detail | 120 |

| Table 22-9 Pricing (USD) | 121 |

| Table 22-10 Sales Summary | 122 |

| Table 22-11 Revenue Summary | 122 |

| Table 22-12 Royalty Summary Base Case (Millions USD) | 123 |

| Table 22-13 Property Tax Summary (Millions USD) | 123 |

| Table 22-14 Federal Income Tax Summary – Base Case (Millions USD) | 124 |

| Table 22-15 Capital Sensitivity | 125 |

| Table 22-16 Operating Cost Sensitivity | 125 |

| Table 22-17 Grade Sensitivity | 125 |

| Table 22-18 Breakeven Analysis | 126 |

| Table 26-1 Proposed Two Phased Budget through Pre-Feasibility Stage | 134 |

| vi |

| 1 | SUMMARY |

Gustavson Associates, LLC (Gustavson) was commissioned by Texas Rare Earth Resources (TRER) to prepare a Preliminary Economic Assessment (PEA) for the Round Top Rare Earth Element Project (Round Top Project or the Project). The Project is located in Hudspeth County, Texas. This technical report presents the results of the PEA in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) and Canadian Institute of Mining, Metallurgy and Petroleum (CIM) “Best Practices and Reporting Guidelines”, November 27, 2010.. The effective date of this report is May 15, 2012.

| 1.1 | Property Description and Ownership |

The Round Top Project is located approximately 10 miles northwest of Sierra Blanca in Hudspeth County, Texas; and approximately 85 miles southeast of El Paso, Texas. The Round Top Project consists of two 19-year Mining Lease Agreements with the General Land Office of the State of Texas (GLO). Mining Lease No. M-113629 consists of 860 acres on land that is owned by GLO, and Mining Lease No. M-113117 consists of 90 acres on land which is owned by TRER. The lease agreements provide TRER with the full use of the property identified, including all rights with respect to the surface and subsurface for any and all purposes, together with the rights of ingress and egress for the purposes of mineral exploration, development, and exploitation of minerals. TRER is currently in negotiations with the GLO to expand the mineral lease area and address additional surface requirements. In addition, TRER is in the process of developing a plan to acquire private land that will be necessary for the development of the project.

| 1.2 | Geology and Mineralization |

The Round Top Project consists of a Tertiary rhyolite intrusion that is enriched in both heavy and light rare earth elements (REEs). The stratigraphy is relatively simple, with Tertiary rhyolite laccoliths cutting Tertiary diorite dikes and intruding Cretaceous marine sedimentary rocks. The Project is located in the Trans-Pecos region, and has been structurally affected by Laramide thrusting and folding, subduction magmatism, and Basin and Range crustal extension. The main structures on the property are landslide and slump faulting, and north-northwest-trending normal faults.

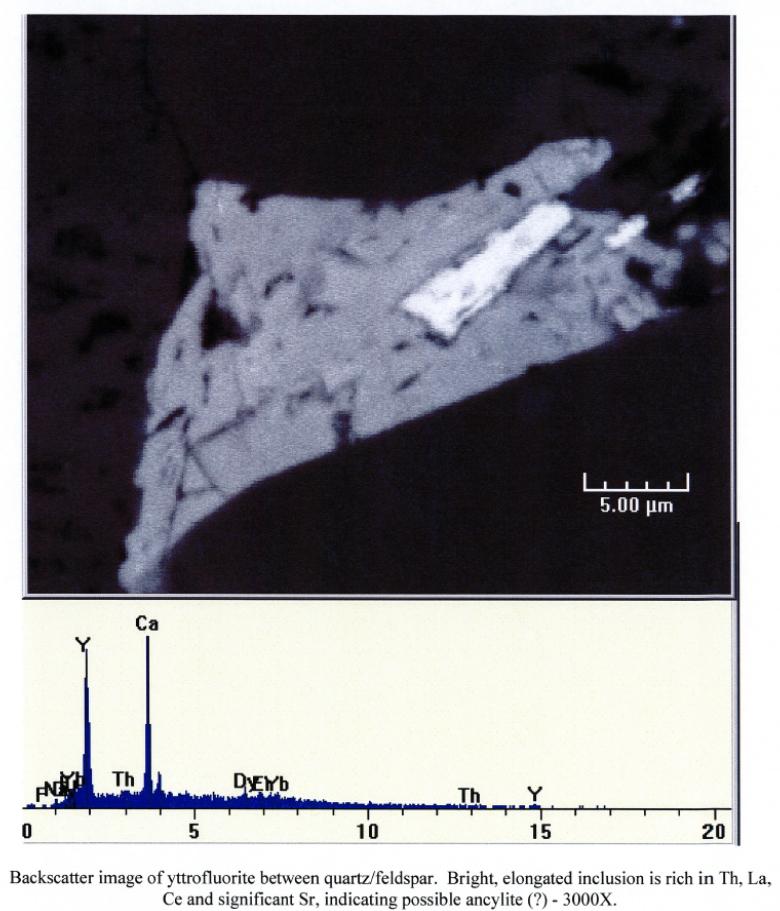

Round Top rhyolite is enriched in Heavy Rare Earth Elements (HREEs). Statistical review of the current data shows that an estimated 70% of the total REE’s grade being HREEs. REE mineralization occurs primarily as disseminated microcrystals of varieties of fluorite (such as yttrium-rich yttrofluorite) where HREEs have substituted for calcium, and as other REE-bearing accessory minerals. REE minerals occur mainly in vugs and as crystal coatings, suggesting late-stage crystallization from an incompatible element-rich fluid.

| 1 |

The Round Top rhyolite was divided into five different alteration phases based on the intensity of hematitic and hydrothermal alteration: red rhyolite, pink rhyolite, tan rhyolite; brown rhyolite and gray rhyolite. Hematitic alteration is a replacement of the magnetite by hematite and gives the rhyolite a red to pink color. Hydrothermal alteration was late and gives the rhyolite a tan to brown color. Mostly unaltered, gray rhyolite was also documented.

Initial geochemical testwork, presented in Section 13, suggests that the gray and pink rhyolite units have the highest REE content, averaging between 554 and 615 parts per million (ppm) total REE + Yttrium (Y). Red and tan rhyolites, which may be strongly vapor-phase altered, contain about 8% lower abundance of REE and the brown rhyolite, which may be altered hydrothermally or by groundwater, contains about 23% less REE than the gray and pink varieties.

| 1.3 | Exploration Status |

Since January 2010, TRER has conducted the following exploration activities: surface sampling, logging cuttings from historical reverse circulation drilling, aeromagnetic survey, aeroradiometric survey, stream sediment survey, gravity survey, and exploratory drilling. These studies showed the distribution of REEs.

| 1.4 | Mineral Resource Estimate |

Table 1-1 below shows the measured, indicated, and inferred mineral resources estimated within the Round Top Project, with an effective date of May 15, 2012. Mineral resources are reported using a 428 ppm Yttrium equivalent cutoff. Mineral Resources are not Mineral Reserves and do not demonstrate economic viability. There is no certainty that all or any part of the Mineral Resource will be converted to Mineral Reserves.

| 2 |

Table 1-1 Mineral Resource Estimate

| Round Top Measured Mineral Resources | ||||||

| Metric Tonnage 127,353kt | ||||||

| Element Symbol | gpt | Conversion Factor | Element Oxide | Oxide kg | Oxide % | |

| Lanthanum | La | 20.3 | 1.173 | La2O3 | 3,031,000 | 0.002% |

| Cerium | Ce | 81.1 | 1.171 | Ce2O3 | 12,096,000 | 0.009% |

| Praseodymium | Pr | 10.4 | 1.17 | Pr2O3 | 1,551,000 | 0.001% |

| Neodymium | Nd | 28.8 | 1.166 | Nd2O3 | 4,274,000 | 0.003% |

| Samarium | Sm | 10.6 | 1.16 | Sm2O3 | 1,560,000 | 0.001% |

| Total LREOs | 22,512,000 | 0.018% | ||||

| Europium | Eu | 0.19 | 1.158 | Eu2O3 | 29,000 | 0.000% |

| Gadolinium | Gd | 10.6 | 1.153 | Gd2O3 | 1,556,000 | 0.001% |

| Terbium | Tb | 3.6 | 1.151 | Tb2O3 | 529,000 | 0.000% |

| Dysprosium | Dy | 31.8 | 1.148 | Dy2O3 | 4,652,000 | 0.004% |

| Holmium | Ho | 8.1 | 1.146 | Ho2O3 | 1,176,000 | 0.001% |

| Erbium | Er | 32.9 | 1.143 | Er2O3 | 4,787,000 | 0.004% |

| Thulium | Tm | 7.1 | 1.142 | Tm2O3 | 1,033,000 | 0.001% |

| Ytterbium | Yb | 56.6 | 1.139 | Yb2O3 | 8,213,000 | 0.006% |

| Lutetium | Lu | 8.9 | 1.137 | Lu2O3 | 1,288,000 | 0.001% |

| Yttrium | Y | 221.4 | 1.269 | Y2O3 | 35,777,000 | 0.028% |

| Total HREOs | 59,040,000 | 0.046% | ||||

| Total REOs | 81,552,000 | 0.064% | ||||

| Round Top Indicated Mineral Resource | ||||||

| Metric Tonnage 231,797kt | ||||||

| Element Symbol | gpt | Conversion Factor | Element Oxide | Oxide kg | Oxide % | |

| Lanthanum | La | 20.3 | 1.173 | La2O3 | 5,519,000 | 0.002% |

| Cerium | Ce | 80.9 | 1.171 | Ce2O3 | 21,968,000 | 0.009% |

| Praseodymium | Pr | 10.4 | 1.17 | Pr2O3 | 2,818,000 | 0.001% |

| Neodymium | Nd | 28.8 | 1.166 | Nd2O3 | 7,777,000 | 0.003% |

| Samarium | Sm | 10.5 | 1.16 | Sm2O3 | 2,831,000 | 0.001% |

| Total LREOs | 40,913,000 | 0.018% | ||||

| Europium | Eu | 0.20 | 1.158 | Eu2O3 | 53,000 | 0.000% |

| Gadolinium | Gd | 10.5 | 1.153 | Gd2O3 | 2,819,000 | 0.001% |

| Terbium | Tb | 3.6 | 1.151 | Tb2O3 | 958,000 | 0.000% |

| Dysprosium | Dy | 31.6 | 1.148 | Dy2O3 | 8,405,000 | 0.004% |

| Holmium | Ho | 8.0 | 1.146 | Ho2O3 | 2,131,000 | 0.001% |

| Erbium | Er | 32.7 | 1.143 | Er2O3 | 8,677,000 | 0.004% |

| Thulium | Tm | 7.1 | 1.142 | Tm2O3 | 1,870,000 | 0.001% |

| Ytterbium | Yb | 56.4 | 1.139 | Yb2O3 | 14,901,000 | 0.006% |

| Lutetium | Lu | 8.9 | 1.137 | Lu2O3 | 2,338,000 | 0.001% |

| Yttrium | Y | 220.6 | 1.269 | Y2O3 | 64,883,000 | 0.028% |

| Total HREOs | 107,035,000 | 0.046% | ||||

| Total REOs | 147,948,000 | 0.064% | ||||

| 3 |

| Round Top Measured + Indicated Mineral Resources | ||||||

| Metric Tonnage 359,150 kt | ||||||

| Element Symbol | gpt | Conversion Factor | Element Oxide | Oxide kg | Oxide % | |

| Lanthanum | La | 20.3 | 1.173 | La2O3 | 8,550,000 | 0.002% |

| Cerium | Ce | 81.0 | 1.171 | Ce2O3 | 34,064,000 | 0.009% |

| Praseodymium | Pr | 10.4 | 1.17 | Pr2O3 | 4,369,000 | 0.001% |

| Neodymium | Nd | 28.8 | 1.166 | Nd2O3 | 12,051,000 | 0.003% |

| Samarium | Sm | 10.5 | 1.16 | Sm2O3 | 4,391,000 | 0.001% |

| Total LREO’ | 63,425,000 | 0.018% | ||||

| Europium | Eu | 0.20 | 1.158 | Eu2O3 | 82,000 | 0.000% |

| Gadolinium | Gd | 10.6 | 1.153 | Gd2O3 | 4,375,000 | 0.001% |

| Terbium | Tb | 3.6 | 1.151 | Tb2O3 | 1,487,000 | 0.000% |

| Dysprosium | Dy | 31.7 | 1.148 | Dy2O3 | 13,057,000 | 0.004% |

| Holmium | Ho | 8.0 | 1.146 | Ho2O3 | 3,307,000 | 0.001% |

| Erbium | Er | 32.8 | 1.143 | Er2O3 | 13,464,000 | 0.004% |

| Thulium | Tm | 7.1 | 1.142 | Tm2O3 | 2,903,000 | 0.001% |

| Ytterbium | Yb | 56.5 | 1.139 | Yb2O3 | 23,114,000 | 0.006% |

| Lutetium | Lu | 8.9 | 1.137 | Lu2O3 | 3,626,000 | 0.001% |

| Yttrium | Y | 220.9 | 1.269 | Y2O3 | 100,660,000 | 0.028% |

| Total HREOs | 166,075,000 | 0.046% | ||||

| Total REOs | 229,500,000 | 0.064% | ||||

| Round Top Inferred Mineral Resource | ||||||

| Metric Tonnage 674,675kt | ||||||

| Element Symbol | gpt | Conversion Factor | Element Oxide | Oxide kg | Oxide % | |

| Lanthanum | La | 20.3 | 1.173 | La2O3 | 16,077,000 | 0.002% |

| Cerium | Ce | 81.0 | 1.171 | Ce2O3 | 63,957,000 | 0.009% |

| Praseodymium | Pr | 10.4 | 1.17 | Pr2O3 | 8,205,000 | 0.001% |

| Neodymium | Nd | 28.8 | 1.166 | Nd2O3 | 22,649,000 | 0.003% |

| Samarium | Sm | 10.5 | 1.16 | Sm2O3 | 8,243,000 | 0.001% |

| Total LREOs | 119,131,000 | 0.018% | ||||

| Europium | Eu | 0.21 | 1.158 | Eu2O3 | 160,000 | 0.000% |

| Gadolinium | Gd | 10.6 | 1.153 | Gd2O3 | 8,209,000 | 0.001% |

| Terbium | Tb | 3.6 | 1.151 | Tb2O3 | 2,790,000 | 0.000% |

| Dysprosium | Dy | 31.6 | 1.148 | Dy2O3 | 24,490,000 | 0.004% |

| Holmium | Ho | 8.0 | 1.146 | Ho2O3 | 6,210,000 | 0.001% |

| Erbium | Er | 32.8 | 1.143 | Er2O3 | 25,268,000 | 0.004% |

| Thulium | Tm | 7.1 | 1.142 | Tm2O3 | 5,457,000 | 0.001% |

| Ytterbium | Yb | 56.5 | 1.139 | Yb2O3 | 43,401,000 | 0.006% |

| Lutetium | Lu | 8.9 | 1.137 | Lu2O3 | 6,811,000 | 0.001% |

| Yttrium | Y | 220.4 | 1.269 | Y2O3 | 188,671,000 | 0.028% |

| Total HREOs | 311,467,000 | 0.046% | ||||

| Total REOs | 430,598,000 | 0.064% | ||||

| 4 |

At the date of this PEA, there are some risks that could materially affect the potential development of the Mineral Resources. These are two classes of risk, both currently considered minimal.

| · | Acquisition of Surface Rights |

TRER will need to acquire surface rights, in addition to the mining leases currently held with the State of Texas, including, but not necessarily limited to, the surface rights for its planned location of process facilities and processed ore disposal areas. Some of these surface rights will need to be purchased from neighboring land owners. If TRER is not able to acquire such surface rights or it becomes too costly to acquire such surface rights, this could have a material adverse effect on TRER’s plans and the potential to develop the Round Top Project.

| · | Processed Ore Disposal |

The enriched material and adjacent rock contain trace values of radioactive elements. It is not yet known whether the resulting material from processed ore will be classified as treated rock or as a contaminated mineral material. Although there seems to be no doubt that the project can be permitted, the classification of the processed ore could change the costs for disposing of or treating this material. These costs could have an adverse impact on the project economics including, but not limited to, the results of the PEA described herein.

| 1.5 | Mining and Operations |

This PEA, including the Round Top mine plan within this PEA, includes inferred mineral resource. Inferred mineral resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the results of this PEA will be realized. Mineral resources that are not mineral reserves have no demonstrated economic viability.

In connection with the PEA, a conceptual design of the mine operations has been completed. The Round Top Project is expected to be a pit mine operation to be mined with 45° inter-ramp wall angles. Daily production rates are estimated to be 80,000 metric tons or 88,000 short tons. Ore will be crushed and ground, then undergo separation consisting of flotation, leaching, solvent extraction and precipitation. The separator capacity is estimated to be 10,000 metric tons per year.

For purposes of the PEA, it has been assumed that mining and processing operations will operate 24-hours per day, 7-days per week.

| 5 |

The Round Top mine plan is based on common truck loader production methods. An initial road will be pioneered up the mountain, with two phases developed to increase available working faces. The rhyolite will be mined in two 25 foot lifts on 50 foot benches. This gives a good match of medium sized equipment (150 ton trucks and wheel loaders with a 22 yard (yd) bucket) with an assumed daily production rate of 80,000 metric tons or 88,000 short tons. The truck/loader method was chosen at this stage for low estimated costs and because it is a common mining practice for mines with similar production rates and is well understood in the industry. TRER currently plans to own, operate, and maintain all equipment. Estimated mining cost per metric ton of rock is $1.94.

Pit slopes have been designed at 45° inter-ramp wall angle. In most of the pit, the contact between the rhyolite and limestone is shallower than this. Fracturing within the rhyolite is not yet completely understood and this may affect pit slopes, at least locally. Haul roads are designed at a width of 100 feet, which provides a safe truck width (23 feet) to running surface width ratio of approximately 4:1. The maximum grade of the haul roads is 10%.

Due to the constant REE grades within the rhyolite, it is the applicable qualified person’s opinion that traditional economic analyses of the pit limit are not meaningful. The overburden removal required for rhyolite production is minimal. The mine plan was developed to address a significant constraint on the ability to mine, being the presence of limestone enriched in radioactive elements below the rhyolite. As a result, there is a potential risk that such presence of radioactive elements could have future environmental impact, which might adversely affect the costs for disposal and nature of treatment that would be required to dispose of waste.

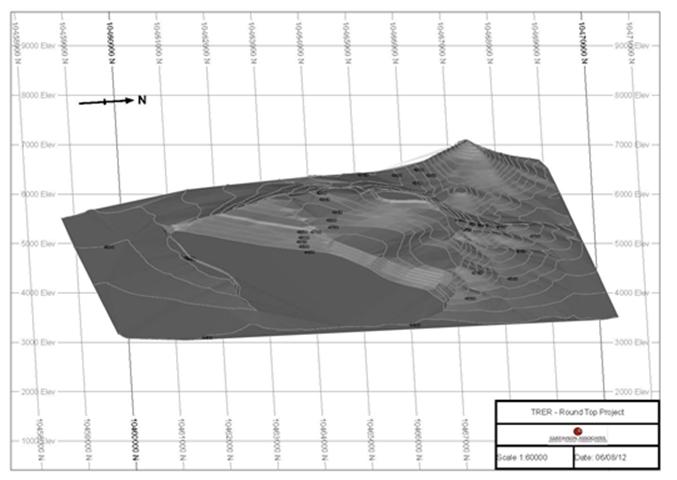

The preliminary pit design is shown in Figure 1-1 and the quantities of within the pit as shown in Table 1-2.

| 6 |

Figure 1-1 Preliminary Pit Design

| 7 |

Table 1-2 below shows the material that the mine plan in the PEA assumes will be mined. As shown below, the PEA, including the mine plan used in the PEA, includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability. There are no mineral reserves estimated for the Round Top Project.

Table 1-2 Summary of Material included in the Mine Plan*

| Round Top – Material included in the Mine Plan Summary | |||||||||

| Classification | Measured | Indicated | Measured & Indicated | Inferred | |||||

| Metric ton (x1000) | 70,664 | 126,567 | 197,231 | 534,840 | |||||

| Symbol | Oxide | Grade REE (ppm) | REO Content (metric tons) | Grade REE (ppm) | REO Content (metric tons) | Grade REE (ppm) | REO Content (metric tons) | Grade REE (ppm) | REO Content (metric tons) |

| La | La2O3 | 20.32 | 1,684 | 20.32 | 3,017 | 20.32 | 4,701 | 20.32 | 12,747 |

| Ce | Ce2O3 | 81.00 | 6,703 | 81.00 | 12,005 | 81.00 | 18,708 | 81.00 | 50,730 |

| Pr | Pr2O3 | 10.40 | 860 | 10.40 | 1,540 | 10.40 | 2,400 | 10.40 | 6,508 |

| Nd | Nd2O3 | 28.92 | 2,383 | 28.81 | 4,251 | 28.85 | 6,634 | 28.80 | 17,960 |

| Sm | Sm2O3 | 10.54 | 864 | 10.54 | 1,547 | 10.54 | 2,411 | 10.54 | 6,539 |

| Eu | Eu2O3 | 0.21 | 17 | 0.20 | 29 | 0.20 | 46 | 0.21 | 127 |

| Gd | Gd2O3 | 10.57 | 861 | 10.57 | 1,542 | 10.57 | 2,404 | 10.57 | 6,518 |

| Tb | Tb2O3 | 3.64 | 296 | 3.60 | 524 | 3.61 | 820 | 3.59 | 2,213 |

| Dy | Dy2O3 | 32.19 | 2,612 | 31.71 | 4,608 | 31.89 | 7,219 | 31.64 | 19,427 |

| Ho | Ho2O3 | 8.05 | 652 | 8.05 | 1,168 | 8.05 | 1,820 | 8.05 | 4,934 |

| Er | Er2O3 | 32.82 | 2,651 | 32.82 | 4,748 | 32.82 | 7,399 | 32.82 | 20,064 |

| Tm | Tm2O3 | 7.10 | 573 | 7.10 | 1,026 | 7.10 | 1,599 | 7.10 | 4,337 |

| Yb | Yb2O3 | 56.56 | 4,552 | 56.56 | 8,153 | 56.56 | 12,705 | 56.56 | 34,452 |

| Lu | Lu2O3 | 8.89 | 714 | 8.89 | 1,279 | 8.89 | 1,994 | 8.89 | 5,406 |

| Y | Y2O3 | 224.4 | 20,121 | 223.0 | 35,819 | 223.5 | 55,940 | 220.6 | 149,693 |

| Total REO | 45,542 | 81,257 | 126,799 | 341,655 | |||||

* Readers are cautioned that this is not a mineral resource estimate. The mineral resources estimate for the Round Top Project is shown in Table 1-1.

Waste products from mine activities include a stream that are expected to show hazardous waste characteristics, and a stream that does not show hazardous waste characteristics. As such, two on-site impoundments are expected to manage the two waste streams.

Infrastructure to support mining and processing activities (i.e., buildings, roads, water/wastewater systems, power, communication, and fuel) currently do not exist on site. A detailed description of TRER’s plans in respect of project infrastructure is outlined in Section 18.

The estimated unit operating costs for the operation are shown in Table 1-3.

| 8 |

Table 1-3 Unit Operating Cost Summary

| Item | Estimated Unit Cost |

| Total Throughput (t/d) | 80,000 |

| Mining (US$/tonne mined) | $ 1.94 |

| Milling/ Flotation (US$/tonne processed) | $9.15 |

| HydroMetallurgy/Refining (US$/tonne processed) | $3.50 |

| G&A (US$/tonne processed) | $0.85 |

| Oxide Storage ($/kg inventory) | $0.05 |

The life-of-mine capital costs estimate totals $3.0 billion, include pre-construction costs of $91.9 million, project construction costs of $2.1 billion and sustaining capital of $859.2 million dollars. Also, included in the capital costs estimate is a 25% contingency.

| 1.6 | Environment and Permitting |

The Table 1-4 includes a summary of the major federal and state environmental permits that may be applicable to the Round Top Project. An asterisk denotes an authorization that, based on current information, is expected to be required even without further factual and legal evaluation. These permits, including applicability criteria and agency process, are discussed in more detail in Section 20.

Table 1-4 Preliminary Permit Summary

| Media | Permit | Agency | When Required |

| Air |

*New Source Review Permit to Construct |

State TCEQ | Must be obtained prior to the start of construction. |

| Title V Federal Operating Permit | US EPA | Application for permit must be filed prior to operating | |

| Water | TPDES Construction Storm Water General Permit | State TCEQ | In advance of commencement of construction |

| *TPDES Industrial Storm Water Multi-Sector General Permit (MSGP) | State TCEQ | In advance of discharging storm water to water in the state from regulated industrial activity | |

|

TPDES Individual Wastewater Discharge Permit

|

State TCEQ | Must be obtained prior to discharging wastewater into waters in the state | |

| Clean Water Act 404 Permit | US Corps of Engineers | 404 Permit must be obtained before placing fill in waters of the US | |

| *Public Water System Authorization | State TCEQ | Approval must be obtained prior to commencement of construction | |

| Water Rights Permit | State TCEQ | Must be obtained prior to using, diverting or appropriating state waters | |

| Waste | * Hazardous or Industrial Waste Management, Waste Streams, and Waste Management Units Registration | State TCEQ | Registration number must be obtained prior to engaging in regulated activity |

| Waste |

*EPA ID Number for Hazardous Waste Activity Hazardous Waste Permit RCRA |

U.S. EPA through the State TCEQ | ID number must be obtained prior to engaging in regulated activity |

|

Hazardous Waste Permit (including financial assurance)

|

State TCEQ | Must be obtained prior to commencement of hazardous waste treatment, storage, or disposal activities. | |

|

*Radioactive Material License

|

State TCEQ | Must be obtained prior to possession of tailings containing NORM waste, as defined by THSC 401.003(26) |

| 9 |

| 1.7 | Economic Analysis |

The economic evaluation for the Round Top Project looked at a range of REE prices and a range of recoveries. The three recovery cases included in the economic analysis were: 64% recovery (Low Case); 72% recovery; and 79% recovery (High Case). A 72% recovery was used as the base case (Base Case). The analysis utilized three price cases as shown in Figure 19.3. The base case was evaluated assuming the mid-point prices as shown in the “Roskill-Rare Earths & Yttrium: Market Outlook to 2015” (Roskill, 2011). Figure 1-2 Case Descriptions summarizes the three cases.

| High Case | |

| 79% Recovery | |

| CREO Pricing: | March 15, 2012 Pricing as shown on Metal Pages |

| Non-CREO: | Priced at 25% of March 15, 2012 pricing |

| This pricing is consistent with carbonate pricing | |

| Base Case | |

| 72% Recovery | |

| CREO Pricing: | Mid-point of Roskill's forecast (Roskill- |

| Rare Earths & Yttrium: market outlook to 2015) | |

| Non-CREO: | Priced at 25% of March 15, 2012 pricing |

| This pricing is consistent with carbonate pricing | |

| Low Case | |

| 64% Recovery | |

| CREO Pricing: | 50% of March 15 Pricing as shown on Metal Pages |

| Non-CREO: | Priced at 25% of March 15, 2012 pricing |

| This pricing is consistent with carbonate pricing | |

Figure 1-2 Case Descriptions

| 10 |

This PEA, including the mine plan, is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty that the results of this PEA, including this mine plan, will be realized. Mineral resources that are not mineral reserves have no demonstrated economic viability.

Table 1-4 shows a projected after-tax 10% net present value (NPV) of $1.2 billion for the Base Case which increases to approximately $4.8 billion in the High Case. The Low Case shows an estimated NPV of $293 million. The estimated internal rate of return (IRR) for the three cases are 36% for the High Case, 19% for the Base Case and 12% for the Low Case. Estimated annual after-tax cash flows at full production range from $1.2 billion in the High Case to $304 million in the Low Case and $482 million in the Base Case.

Life-of-mine projected REOs sold in the Base Case are 271 million kilograms (kgs) and 298 million kgs in the High Case and 240 million kgs in the Low Case. For CREOs, projected life-of-mine kgs sold ranges from 205 million kgs in the High Case to 165 million kgs in the Low Case. Base Case projected life-of-mine CREOs total 187 million kgs.

In all three cases, life-of-mine capital is estimated to total $3.0 billion including $2.1 billion for pre-production capital which includes a contingency of $407 million Life-of mine sustaining capital is projected to be $859 million.

| 11 |

Table 1-5 PEA Financial Highlights (Millions USD)

| Item | High | Base | Low | |||||||||

| After Tax | ||||||||||||

| 10% NPV (2012-2043) | 4,816 | 1,248 | 293 | |||||||||

| IRR (%) | 36% | 19% | 12% | |||||||||

| Life-of-Mine Net Cash flow | 27,596 | 10,292 | 5,791 | |||||||||

| Annual Net Cash Flow @ Full Production | 1,171 | 482 | 304 | |||||||||

| Payback Years | 2.1 | 4.3 | 6.4 | |||||||||

| Before Tax | ||||||||||||

| 10% NPV | 6,900 | 1,818 | 507 | |||||||||

| IRR | 43% | 21% | 14% | |||||||||

| Life-of-Mine Net Cash flow | 38,506 | 13,789 | 7,417 | |||||||||

| Annual Net Cash Flow @ Full Production | 1,636 | 650 | 396 | |||||||||

| Payback Years | 1.8 | 4.1 | 6.4 | |||||||||

| Revenue | ||||||||||||

| Life-of-Mine | 56,286 | 29,923 | 23,121 | |||||||||

| Annual Revenue @ Full Production | 2,245 | 1,194 | 922 | |||||||||

| Life-of-Mine Kgs Sold (000's) | ||||||||||||

| TREO | 297,823 | 271,262 | 240,179 | |||||||||

| CREO | 205,102 | 186,810 | 165,405 | |||||||||

| CREO % | 69% | 69% | 69% | |||||||||

| Margin | ||||||||||||

| Price/TREO kg Sold | $ | 188.99 | $ | 110.31 | $ | 96.27 | ||||||

| Cost/TREO Kg Sold | $ | 49.16 | $ | 47. 91 | $ | 52.32 | ||||||

| Margin | $ | 139.83 | $ | 62.40 | $ | 43.95 | ||||||

| Margin % | 74% | 57% | 46% | |||||||||

| Life-of-Mine Capital | ||||||||||||

| Pre-Production | 1,721 | 1,721 | 1,721 | |||||||||

| Contingency | 407 | 407 | 407 | |||||||||

| Total Pre Production Capital | 2,129 | 2,129 | 2,129 | |||||||||

| Sustaining | 859 | 859 | 859 | |||||||||

| Life-of-Mine | 2,988 | 2,988 | 2,988 | |||||||||

| 1.8 | Conclusions |

The Round Top Project hosts an Eocene-aged peralkaline rhyolite-hosted REE deposit with a high ratio of HREEs to LREEs. The rhyolite body is a mushroom-shaped laccolith, slightly elongated northwest-southeast and dipping gently to the southwest.

The REEs are primarily contained in the minerals yttrofluorite, cerofluorite and bastnaesite, which are very fine-grained and disseminated throughout the rhyolite mainly in microfractures, voids and coatings on predominantly alkali feldspar phenocrysts.

The REEs are hosted within a rhyolite laccolith. Five different colors of rhyolite are common and indicate varying degrees and types of alteration, although this seems to have minimal influence on the REE grades. A preliminary resource model suggests that the deposit has an estimated indicated and measured resource of 359 million metric tons of rock containing 230 million kilograms of REO; and inferred resource of 675 million metric tons of rock containing 431 million kilograms of REOs. Detailed REE grades are shown in Table 1-1.

| 12 |

Side hill open pit mining methods are proposed with on-site processing facilities employing multiple solvent extraction and precipitation methods. Based on preliminary testwork completed to date, process recovery in excess of 70% REE is anticipated. The preliminary flotation and leaching test work suggests, uranium can be separated and leached from the rhyolite host rock. The mineral resource model and project economics should be further investigated with consideration to uranium as a resource.

The PEA assumes a processing rate of 80,000 metric tons of rhyolite per day or 29 million tons per year, which yields an estimated 26 year mine-life. The Base Case NPV at a 10% discount rate is estimated to be $1.2 billion. Life-of-mine capital costs are projected to be $3.0 billion. Life-of-mine total cash flow is projected at $10.3 billion.

It is the qualified persons’ opinion that the resource model described in this report is suitable for preliminary economic evaluation, and assessment of the potential project viability for determination of advancement of the Project. The PEA results justify advancing the Project to a pre-feasibility study.

| 1.9 | Recommendations |

Based on the potential economic viability of this project, the qualified persons’ recommend the following:

| • | Conduct a drilling exploration program to further delineate the REE resource. |

| • | Conduct an environmental baseline study and begin conceptual design of tailings disposal. |

| • | Conduct continued metallurgical process development testing to include a flotation pilot plant to produce a bulk concentrate for detailed metallurgical studies. |

| • | Continue mineralogical characterization of products produced, i.e. concentrate, flotation tails and leach residues. |

| • | Prepare a pre-feasibility study. |

| • | Perform a preliminary review of uranium mineral resource potential. |

A budget of $20 million dollars for exploration and development drilling, assaying, metallurgical testwork, environmental baseline studies and mine and facilities planning is recommended to move the Project through pre-feasibility stage.

The budget is presented in two phases, and a decision will be required after reviewing the results of the first phase as to whether the second phase should be undertaken.

| 13 |

Table 1-6 Proposed Two Phased Budget through pre-feasibility stage.

| Phase I | |

| Drilling, Metallurgy, Environmental | $3,696,000 |

| General and Administrative and Manpower | $1,720,000 |

| TOTAL | $5,416,000 |

| TOTAL with contingency | $6,770,000 |

| Phase II | |

| Drilling, Preliminary Feasibility –Design, Infrastructure | $6,974,500 |

| General and Administrative and Manpower | $3,520,000 |

| TOTAL | $10,494,500 |

| TOTAL with contingency | $13,118,125 |

| 14 |

2 INTRODUCTION

| 2.1 | Terms of Reference and Purpose of the Report |

Gustavson was commissioned by TRER to prepare a PEA for the Round Top Project. The Project is located in Hudspeth County, Texas, U.S.A. This technical report presents the results of the PEA in accordance with NI 43-101 and CIM “Best Practices and Reporting Guidelines”. The effective date of this report is May 15, 2012.

| 2.2 | Qualifications of Qualified Persons |

Mr. Donald Hulse, P.E., V.P. and Principal Mining Engineer for Gustavson, is a Qualified Person as defined by NI 43-101. Mr. Hulse acted as project manager during preparation of this report and is specifically responsible for report Sections 1 through 6, 15, 16, and 18 through 27.

Mr. M. Claiborne Newton, III, Ph.D., C.P.G., Vice President and Director of Geological Services for ECSI, LLC, is a Qualified Person as defined by NI 43-101. Mr. Newton acted as principle geologist during preparation of this report and is specifically responsible for report Sections 7-12.

Mr. Zachary J. Black, EIT, SME-RM, Geological Engineer for Gustavson is a Qualified Person as defined by NI 43-101. Mr. Black acted as geologist during preparation of this report is specifically responsible for report Section 14.

Mr. Deepak Malhotra, PhD, SME-RM, President of Resource Development, Inc. (RDi) is a Qualified Person as defined by NI 43-101. Mr. Malhotra is specifically responsible for report Sections 13 and 17.

2.2.1 Details of Personal Inspection

Mr. Newton worked directly with TRER on the property for a period of three months during the drilling. Mr. Newton made four two-week long trips to the site in 2011, a two-week long visit in March of 2012 and the most recent visit was for eight days May 11-18, 2012. Mr. Newton set up and supervised reverse circulation (RC) drill sampling and quality assurance/quality control (QA/QC) procedures and observed and supervised both RC and drill core sampling from drill to courier. In addition, Mr. Newton reviewed certified laboratory reports and matched them with entries in the TRER database.

Zach Black visited the property from May 16 to May 25 2012. While there he assisted with monitoring the drilling program, as well as reviewed rock chips, drill logs, drill locations were data entry and quality control of data.

| 15 |

| 2.3 | Sources of Information |

The information, opinions, conclusions, and estimates presented in this report are based on the following:

| • | Information and technical data provided by TRER; |

| • | Review and assessment of previous investigations; |

| • | Assumptions, conditions, and qualifications as set forth in the report; and |

| • | Review and assessment of data, reports, and conclusions from other consulting organizations and previous property owners. |

These sources of information are presented throughout this report and in Section 27 – References. The qualified persons are unaware of any material technical data other than that presented by TRER.

| 2.4 | Units of Measure |

All measurements used in this report are in the metric system, except that maps are in Texas State Plane – feet as required by the State of Texas for permitting purposes unless otherwise specified, and all references to dollars are United States dollars.

| 16 |

| 3 | RELIANCE ON OTHER EXPERTS |

The qualified persons relied in good faith on information provided by TRER regarding property ownership and mineral tenure (Sections 1.1, 4.2.1 and 4.2.3). The qualified persons have not independently verified the status of the property ownership or mineral tenure.

The qualified persons relied on Frank Wells MBA of Lilburn & Associates LLC in Denver Colorado, contracted by TRER, for market studies and pricing (Section 19), specifically, an experienced minerals finance professional, reviewed information from “Roskill, 2011 Rare Earth & Yttrium: Market Outlook to 2015”. Donald E. Hulse, a qualified person, reviewed the qualifications of Frank Wells. The Roskill report is a standard industry reference and the Mr. Hulse considers the use of this information within the PEA to be reasonable. Mr. Hulse compared this results of the Roskill report with contracts in the public domain and with published prices for some of the elements and is of the opinion that the pricing presented herein is within industry norms and suitable for use in the economic analysis.

Mineral commodities are always subject to fluctuations in prices responding to the supply and demand. As the Project moves closer to production, this risk can be mitigated with long term contracts for sale of the products.

| 17 |

| 4 | PROPERTY DESCRIPTION AND LOCATION |

| 4.1 | Property Location |

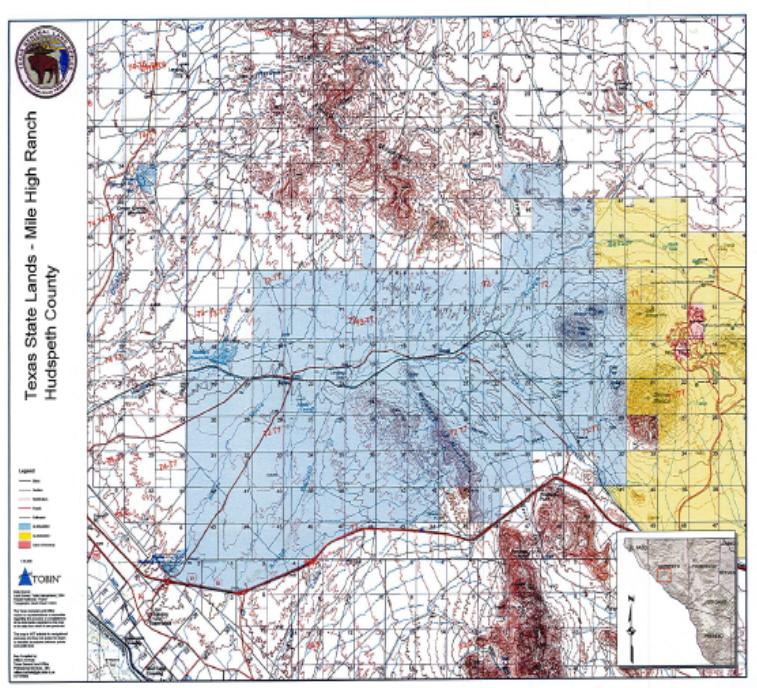

The Round Top Project is located in Hudspeth County, Texas. The nearest town, Sierra Blanca, Texas, is approximately 10 miles to the northwest. Sierra Blanca, the county seat of Hudspeth County, is at the intersection of Ranch Road 1111, Interstate Highway 10, and U.S. Highway 80, 85 miles southeast of El Paso in the south central part of the county. It is also at the junction of the Southern Pacific and Missouri Pacific railroads. The approximate center of the Round Top Project is located at 31.276644° N, 105.474243° W. Figure 4-1 shows the location of the Round Top Project in Texas.

Sierra Blanca, the county seat of Hudspeth County, is at the intersection of Ranch Road 1111, Interstate Highway 10, and U.S. Highway 80, 85 miles southeast of El Paso in the south central part of the county. It is also at the junction of the Southern Pacific and Missouri Pacific railroads. The approximate center of the Round Top Project is located at 31.276644° N, 105.474243° W. Figure 4-1 shows the location of the Round Top Project in Texas.

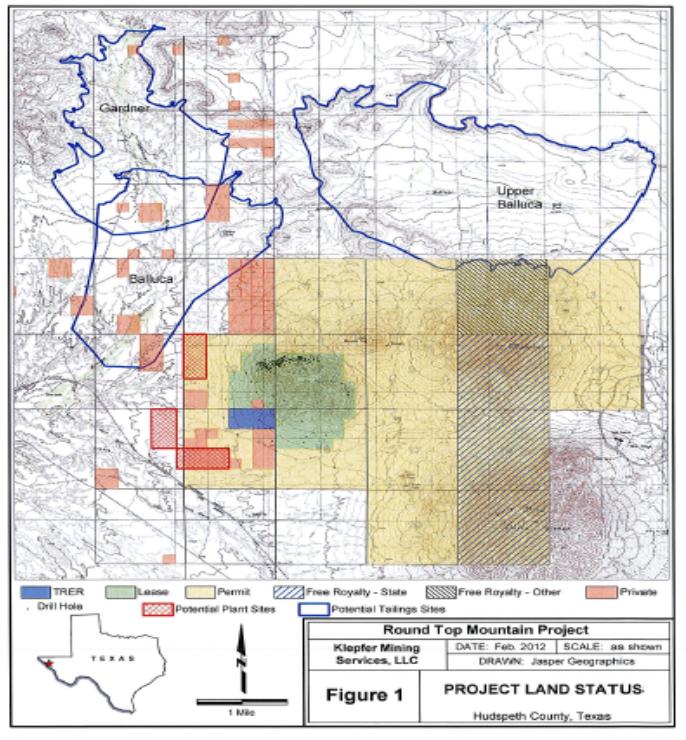

Figure 4-1 Location Map of Project Area, 2012

| 18 |

| 4.2 | Mineral Tenure, Agreement and Royalties |

| 4.2.1 | Mining Leases |

TRER entered into a 19 year Mining Lease Agreement (M-113117) with the GLO dated September 2, 2011, and amended March 29, 2012 in accordance to Chapter 53, subchapter B of the Texas Natural Resource Code. TRER has also entered into an additional 19 year renewable Mining Lease (M-113629), dated November 1, 2011, with the GLO. Leases M-113117 and M-113629 (each a Mineral Lease and together, the Mineral Leases) represent approximately 860 and 90 acres, respectively, for a total of 950 acres in the project area, which would include the potential pit boundaries. The Mineral Leases provide TRER with the full use of the property identified, including all rights with respect to the surface and subsurface for any and all purposes, together with the rights of ingress and egress for the purposes of mineral exploration, development, and exploitation of minerals.

The compensation pay schedule for the Mineral Leases is summarized below:

Table 4-1 Summarized Lease Agreements Pay Schedule

| M-113117 | |

| Anniversary Date 2013 -2014 | $44,718.30 |

| Anniversary Date 2015-2019 | $67,077.45 |

| Anniversary Date 2020-2024 | $134,154.90 |

| Anniversary Date 2025-2029 | $178,873.20 |

| M-113629 | |

| Anniversary Date 2013 -2014 | $4,500.00 |

| Anniversary Date 2015-2019 | $6,750.00 |

| Anniversary Date 2020-2024 | $13,500.00 |

| Anniversary Date 2025-2029 | $18,000.00 |

Payments under the Mineral Leases represent rental and are intended to cover the privilege of deferring commencement of production. TRER shall have a minimum advance royalty of $500,000.00 immediately upon sales of leased minerals in commercial quantities. Thereafter the royalty will become payable on or before the anniversary date of the Mineral Lease.

| 4.2.2 | Royalty |

The Mineral Leases contain the following statutory production royalty payment requirements:

| · | 8% of the market value of uranium and other fissionable material; and |

| · | 6.25% of the market value of all other minerals. |

| 19 |

The royalty calculation contained in the Mining Lease and as agreed to in principle with the GLO is calculated based on

Royalty = 6.25% * (Gross Revenue – processing cost)

Under the terms of the lease agreement, payment of the royalty in kind is at the discretion of the GLO commissioner.

The processing cost includes primary conveying, secondary crushing and screening, tertiary crushing and screening, milling, flotation, thickening, leaching, hydromet/separation, and tailings handling. The Mineral Leases do not allow for the deduction of drill, blast, load, haul, or primary crushing costs from the royalty calculation.

| 4.2.3 | Surface Leases/Ownership |

TRER is currently in negotiations with the GLO to acquire access to the surface rights that will be necessary to develop the deposit. Primary considerations are for the placement of all mining, processing and infrastructure facilities on state owned land with secondary preference to private land. Currently, all land identified for the potential surface facilities are under surface lease to third parties or owned by private parties. The area immediately to the west of the property is under lease by Southwest Range and Wildlife Foundation (Sentinel Mountain Associates, L.P.) (State of Texas Surface Lease SL. 20040002). The area immediately to the east of the Project is also held by the Southwest Range and Wildlife Foundation (Surface Lease SL 20060006). Figure 4-2 identifies the approximate boundaries of SL 20040002 and 20060006.

| 20 |

Figure 4-2 Surface Leases Adjacent and Including Round Top

(Source Texas General Land Office, 2011)

TRER is in the process of developing a plan to acquire private land owners’ surface rights that may be required for the development of the project, and believes it is a reasonable expectation that it will be able to acquire such surface rights prior to the completion of a feasibility study. If surface rights are not obtained from private land owners for a conventional tailings facility then it will not be possible to develop the Project in the manner currently contemplated, unless an economic alternative tailings option can be secured.

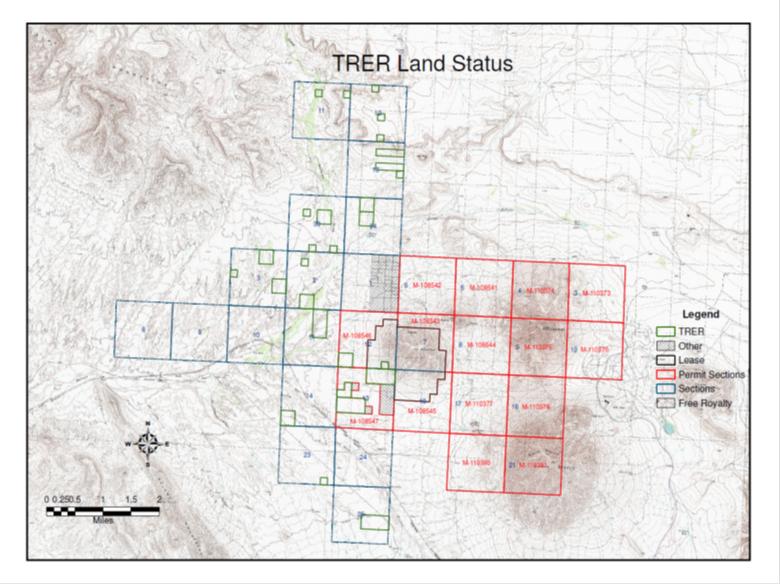

| 4.2.4 | Prospecting Permits |

TRER currently holds 17 prospecting permits covering land in Hudspeth County. The prospecting permits allow for exploration activities on approximately 9,686 acres. Currently, TRER has yet to complete drilling on lands identified within the permits due to the requirement of completing archeological studies. TRER intends to complete archeological studies in all areas for future exploration. To date, all exploration work has occurred on areas with approved archeological assessments. A summary of the prospecting permits is listed in Table 4-2 below:

| 21 |

Table 4-2 TRER Permit Numbers and Associated Acres

| Permit # | Acres |

| M-110385 | 655.67 |

| M-110383 | 640 |

| M- 110381 | 640 |

| M-110380 | 640 |

| M-110378 | 640 |

| M-110377 | 640 |

| M-110376 | 640 |

| M-110375 | 640 |

| M-110374 | 640 |

| M-110373 | 640 |

| M-108547 | 340 |

| M-108546 | 360 |

| M-108545 | 400 |

| M-108544 | 640 |

| M-108543 | 250 |

| M-108542 | 640 |

| M-108541 | 640 |

TRER has approximately 9,686 acres under annual prospecting permits with the State of Texas. TRER entered into the prospecting permits on September 24, 2011 and all are renewable on or before the anniversary date at a cost $1.00 per acre. Figure 4-3 displays the area covered by the prospecting permits.

| 22 |

Figure 4-3 Prospecting Permits

(Source Texas General Land Office, 2011)

| 4.3 | Environmental Liabilities |

The Round Top Project rhyolite has not been mined and has no known existing mining-related environmental liabilities. Drill roads and pads will be reclaimed in accordance with the GLO requirements and Texas Commission on Environmental Quality requirements. There is an existing adit in the Del Rio shale underlying the rhyolite from earlier beryllium exploration, however there are no effluent flows from the adit, and no existing surface waste piles.

The permitting schedule for the Round Top Project may be influenced by the National Environmental Policy Act (NEPA) process due to the placement of a tailings facility if the drainage for the tailings facility is a “jurisdiction” drainage governed by the U.S. Army Corps of Engineers (USACE). NEPA typically requires baseline studies for at least one year, followed by a public review and comment period for scoping and development of an environmental assessment or environmental impact statement. Other anticipated permitting requirements include mine registration, air, ground and surface water, explosives, and utility location. TRER has an application in process for a stormwater permit for the expanded drilling program.

| 23 |

Environmental liabilities and permitting are discussed in greater detail in Section 20.

Proposed mining projects are typically evaluated for a range of social, economic, cultural, and environmental impacts in response to NEPA and state permitting regulations.

| 24 |

| 5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |

| 5.1 | Accessibility |

The Round Top Project is located approximately 10 miles northwest of the town of Sierra Blanca, Texas. The site is accessed from Interstate 10 through a series of unimproved dirt roads. The property is not traversed by county roads and consists of a series of two track and primitive jeep roads. The nearest major airport is located in El Paso, Texas. The site is approximately 3 miles north of Interstate 10. A railroad line is located approximately one to three miles from the Round Top Project and a spur line stops at a stone quarry within three miles of the Round Top Project.

| 5.2 | Topography, Elevation, Vegetation and Climate |

The Sierra Blanca area is considered semi-arid with generally mild temperatures. The prevailing winds are from the southwest. The average year round temperature is approximately 61.6° F, average annual precipitation is 10.41 inches, average annual snowfall is 1.01 inches, and average annual wind speed is approximately 13.90 mph. The elevation of the Round Top Project ranges from approximately 4,000 feet to approximately 6,890 feet, and slopes are moderately steep on the sides of the Sierra Blanca Peaks. The moderate climate and minimal rainfall in the Sierra Blanca region should allow the mine to operate year round.

The area surrounding the Project consists of sandy soils and clump grasses mixed with desert vegetation. Desert vegetation consists of high chaparral grass, grease wood, mesquite shrubs, cactus, and other shrubs and browse. Yucca trees can be common on the surrounding property.

| 5.3 | Local Resources and Infrastructure |

The nearest population center to the Project is Sierra Blanca, Texas. The town of Sierra Blanca is approximately six miles to the southeast of the Round Top Project site. The population was 533 in 2000 and 510 during the 2007 census. Skilled mining labor and support could be found in El Paso, approximately 85 miles to the northeast.

| 5.3.1 | Rail Access |

A major rail line parallels Interstate 10 approximately three to four miles west and south of the mine site. Approximately three miles from the Project site is a commercial rock quarry in operation which produces ballast for the railroad. The rock quarry operation has a rail road spur which is approximately two to three miles from the Project.

| 5.3.2 | Power |

Power is currently supplied to Sierra Blanca through El Paso Electric Services. El Paso Electric Services has approximately 1,643 megawatts of generating capacity. The existing 69 kV line will have to be upgraded from either Caliente or Sparks stations near El Paso. Approximately 75 to 90 miles of line will have to be upgraded for operation of the plant. It is likely that power during construction will be provided by a temporary 69 kV line from the Sierra Blanca transmission line and on-site generators. An actual source of power has not been determined but all potential power suppliers will be evaluated. Upgrading of the El Paso Electric Services transmission lines will be required no matter which power option is selected.

| 25 |

| 5.3.3 | Water |

Water for the project may be obtained from four potential groundwater sources: Red Light Draw/Eagle Flats, Wild Horse/Michigan Flats, the Diablo Plateau aquifer, and the Bone Springs-Victoria Peak aquifer near Dell city in Hudspeth County. The Wild Horse/Michigan Flats and the Bone Spring-Victoria Peak aquifers are all located within groundwater conservation districts and would provide potential permitting hurdles as compared to either Red Light Draw or Eagle Flats. TRER currently is pursuing an agreement with the GLO for exploration into the Red Light Draw area. A report produced by LGB-Guyton Associates a specialty groundwater and environmental engineering consultant has identified Red Light draw as the primary target for water supply for TRER. LGB-Guyton Associates evaluated the groundwater potential simplistically with a ground water model to confirm the source was able to provide 6,000 to 12,000 acre feet/year pumping rates. Figure 5-1 suggests the ground water contained below the GLO property in Red Light Draw will be capable of producing adequate water. The quality of the water is expected to be adequate for process water needs and the water will require treatment to be potable.

Figure 5-1 Potential Water Sources for Round Top Project, 2012

| 26 |

| 5.3.4 | Natural Gas |

Located approximately 28 miles to the north of the Round Top Project area is a transcontinental natural gas pipeline. The pipeline, with an eight-inch diameter pipe, is owned and operated by El Paso Natural Gas. The pipeline allows for the Project to consider utilizing an off take from the pipeline to the plant site for heating of the processing and management buildings. The use of the natural gas versus a propane system on site will need to be evaluated further. Expected uses of the propane/natural gas would be for heating the administration and process mine facilities, as well as for potentially increasing the temperature of the leach acid to a specified temperature. No large demand propane or natural gas fuel requirements are foreseen. Capital assessment assumes propane fuel basis.

The applicable qualified person is of the opinion that the surface rights adequate for mining operations can be acquired. Further discussion of infrastructure can be found in Sections 18 and 21.

| 27 |

| 6 | HISTORY |

Documented exploration began in Sierra Blanca in the 1970s when W.N. McAnulty initiated trenching and limited drilling of fluorite deposits in the vicinity of Sierra Blanca, Texas. McAnulty recognized and identified beryllium mineralization associated with the massive fluorite. Adverse economic conditions for fluorite precluded development. In the 1970s, several uranium companies identified anomalous radiation and associated mineralization associated with the beryllium-fluorite deposit.

During the 1980s, Cabot Corporation (Cabot), a large chemical company with a beryllium fabrication division, initiated exploration at Round Top for beryllium. In 1987, Cyprus Metals Company (Cyprus) entered into a joint venture with Cabot and took over the Project. The Cyprus exploration program drilled Sierra Blanca, Round Top and Little Round Top. Eventually, Cyprus focused on the Round Top Project, specifically the “west end ore zone”. Extensive development drilling (82,000 feet), underground exploration drift (1,115 feet) and trial mining resulted in the completion of a feasibility study in June 1988 (Cyprus Sierra Blanca, Inc., 1988).

During the Cabot-Cyprus development project, the Texas Bureau of Economic Geology (BEG) conducted extensive research at Round Top and the surrounding area. The study identified beryllium mineralization and REE mineralization in the rhyolite. The research resulted in the three publications, one in 1987 on the mineralogy of the rhyolite (Rubin, et al., 1987), another in 1988 on the beryllium mineralization (Rubin et al., 1988), and another in 1990 on the detailed mineralogy and geochemistry of the rhyolite (Price et al., 1990). The 1990 Price, et al., publication, Geological Society of America Special Paper 246, is the most complete publication on Round Top.

In late 2007, Standard Silver Corporation, later to be renamed TRER in 2010, acquired prospecting permits from the GLO. In 2008, approximately 76 pallets, each containing six plastic barrels of catalogued and packed Cyprus drill samples, were located. These samples were well labeled and TRER has the drill logs from these holes. They were relogged extensively and analyzed as part of this report.

| 28 |

7 GEOLOGICAL SETTING AND MINERALIZATION

| 7.1 | Regional Geology |

Regional geology is described by Price et al. (1990) and McAnulty (1980) and is summarized here from those two references. Geologic units exposed in the project area comprise Cretaceous sedimentary rocks, Tertiary igneous rocks and Quaternary alluvium.

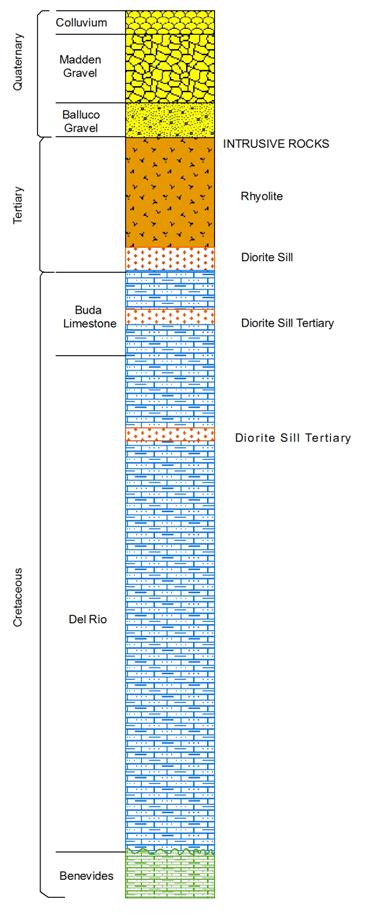

Sedimentary rocks exposed in the Trans-Pecos region are Cretaceous marine deposits of the upper Comanchean and lower Gulfian Series. These sedimentary deposits are transgressive clastics and neritic carbonates that were deposited along the northern edge of the Chihuahua trough and on the southern margin of the Diablo Platform. The regional stratigraphy is shown in Figure 7-1.

Tertiary intrusive rocks include Eocene diorite and rhyolite. Round Top Peak is part of the Sierra Blanca rhyolite laccoliths and lies within the Trans-Pecos region or Texas Lineament Zone. The Trans-Pecos region is characterized by three geologic episodes - Laramide thrusting and folding, subduction magmatism, and Basin and Range crustal extension.

Laramide deformation started in the late Cretaceous and ended in the early Eocene. Deformation was caused by east-northeast compression and resulted in dominantly north-northwest-trending folds and thrusts. The folds and thrusts extend from Chihuahua, Mexico to the east and northeast. Lying near the frontal thrust of this Chihuahua tectonic belt are the Sierra Blanca intrusions.

From middle Eocene to early Oligocene time, approximately 48 to 32 Ma, widespread magmatism occurred in the Trans-Pecos region. Dikes and veins with an east-northeast-strike dominate the region and suggest a continuation of the east-northeast Laramide maximum principal stress direction. Igneous rocks that were intruded during this episode have alkali-calcic and alkaline compositions. Based on these two compositions, the region is divided into a western alkali-calcic belt and an eastern alkaline belt. Lying within the alkali-calcic belt are the Sierra Blanca laccoliths, which include Round Top Peak. The Sierra Blanca laccoliths were intruded about 36 Ma, during the main Trans-Pecos magmatism phase.

Basin and Range extension and region-wide normal faulting began about 31 Ma. This extension and related minor volcanism postdate the intrusion of the Sierra Blanca laccoliths.

| 7.2 | Local Geology |

Five mountains, Sierra Blanca, Triple Hill, Little Blanca Round Top, and Little Round Top, form the Sierra Blanca Peaks. The Sierra Blanca Peaks consist of five rhyolite laccoliths that were intruded into Cretaceous age sedimentary rocks. Sedimentary rocks in the area are Cretaceous Washita Group. The peaks are widely covered by colluvium and surrounded by alluvium. The Cretaceous rocks are only exposed in deep arroyos and along the flanks of the mountains. Three formations - the Buda Limestone, the Del Rio shale and the Benevides formation - are exposed at the surface in the Sierra Blanca Peaks area. Numerous titanium-rich hornblende-porphyry diorite dikes and sills are exposed along the flanks of the peaks and in localized areas of thin alluvium cover. The age of these dikes is about 48 Ma (Early Eocene), which predates the main phase of magmatism (Price et al., 1990).

| 29 |

The rhyolite laccoliths were intruded into the Cretaceous sedimentary rocks and cut and altered the diorite dikes and sills. The fine grain size and presence of vesicles in the rhyolite suggests near-surface intrusion. The age of the Sierra Blanca rhyolites is estimated to be 36 Ma (Late Eocene) based on one K-Ar date. Uplifted sedimentary cover was eroded from the tops of the Sierra Blanca laccoliths leaving the present surface expression of the peaks (Price et al., 1990).

The bases of the intrusive bodies are undulating and in contact with several different formations. The rhyolite intrusions are floored by a shallow thrust fault that truncates underlying Cretaceous sedimentary rocks. Strata on the flanks of the laccoliths are steeply dipping due to deformation from the underlying intrusion (McAnulty, 1980).

| 7.3 | Property Geology |

The Round Top Peak rhyolite is one of five rhyolite laccoliths that were intruded into a structurally complex zone located on the northern margin of the Chihuahua Tectonic Belt. The Round Top Peak laccolith was intruded into Cretaceous age Washita and Fredericksburg Groups. The Cretaceous sediments were domed upward by the rhyolite intrusion and later eroded, exposing the Round Top Peak rhyolite. Sedimentary rocks exposed on the surface flanking Round Top Peak consist of the Benevides formation of the Fredericksburg group and the Buda Limestone and Del Rio formations of the Washita group.

The rhyolite is cut by a set of faults that generally strike northwest and dip steeply southwest. Normal separation has been noted on some of these faults, but the orientation with respect to other regional faults suggests they may primarily be right-lateral strike-slip faults. The rhyolite is highly brecciated and moderately altered along these zones.

| 7.3.1 | Stratigraphy |

Figure 7-1 is a stratigraphic column of the Round Top area and Table 7-1 gives a detailed description of the strata.

| 30 |

Figure 7-1 Round Top Stratigraphic Column

Source: Albritton and Smith 1965, modified by TRER 2012

| 31 |

Table 7-1 Sedimentary Formations in the Round Top Peak Project Area

| Formation | Age | Description |

| Colluvium | Quaternary | Cobble size fragments forming talus slopes that creep down the side of Round Top Peak by gravity. |

| Madden Gravel | Quaternary | Mixture of limestone, sandstone, intrusive rocks, and conglomerate. Sand to boulder size, angular to sub-angular grains |

| Balluco Gravel | Quaternary | Mixture of limestone, sandstone, intrusive rocks and conglomerate. Sand to boulder size, angular to sub-angular grains. |

| Buda Limestone | Cretaceous | Micritic limestone with thin shale partings and nodular limestone with fossil oysters. |

| Del Rio | Cretaceous | Dominated by olive brown to black fissile shale, with micritic limestone interbeds. Near the top of the formation is a massive limestone unit overlying a quartz sandstone bed. |

| Benevides | Cretaceous | Dominated by light cream to olive-tan fissile shale, with interbeds of quartz sandstone and lenses of nodular limestone. Abundant fossils especially pelecypods and echinoids. |

Quaternary

Quaternary rocks in the project area are represented by colluvium and alluvium deposits. The slopes of Round Top Peak are covered with colluvium and talus slopes. Surrounding the mountain is Quaternary age alluvium. This alluvium is divided into two formations, the Madden and Balluco Gravels (Albritton and Smith, 1965). Near the flanks of the peak, these two formations contain abundant fragments of different colored rhyolite that eroded from Round Top Peak. In addition to the rhyolite, limestone, sandstone, and diorite are also present. The alluvium and colluvium are now being dissected and exposed in arroyos.

Tertiary

Tertiary rocks in the project area are represented mainly by the rhyolite intrusions, though the diorite dikes are also thought to be Tertiary in age. Round Top Peak is likely the youngest intrusion in the project area. The age of the rhyolite intrusions, ~36.2 Ma, is represented by one K-Ar date on an annite-rich biotite from Sierra Blanca Peak (Price et al., 1990).

Table 7-2 is a representative whole-rock analysis of the Round Top rhyolite. It contains >72% SiO2, >10% Na2O+K2O and > 1% fluorine. The rock contains modal cryolite (Na3AlF6) and normative acmite and Na2SiO3 and can be classified as a peralkaline-cryolite rhyolite. The rhyolite has a fine-grained, microporphyritic texture consisting of quartz, alkali-feldspar, and Li-mica phenocrysts in an aphanitic groundmass. The cores of the alkali-feldspars consist of Na-plagioclase or albite, and the Li-mica is zoned with a brown interior grading outward to clear on the crystal margins. Cryolite occurs as discrete grains intergrown with groundmass quartz and as inclusions in quartz overgrowths on phenocrysts. Cryolite can also occur as clear crystals coating fractures and locally cementing rhyolite breccias. Rutilated quartz is also present and occurs in association with the cryolite as intergrowths.

| 32 |

The color of the rhyolite varies, and recent drill data indicates five different colors of rhyolite which indicate five alteration phases: red, gray, pink, tan, and brown. These different rhyolite colors represent different degrees of alteration that took place during the later stages of crystallization. The red and pink colors are caused by the replacement of magnetite by hematite. The tan and brown coloration in the rhyolite indicates most of the iron has been removed or altered to goethite and/or limonite. The feldspars in the tan rhyolite can be (replaced by kaolinite, and in isolated locations this alteration phase can have fluorite-filled fractures. The gray rhyolite is essentially unaltered and has variable magnetite content. The different colored units are generally tens to hundreds of feet thick and laterally extensive. However, some of the rhyolite displays flow-banding with gray (unaltered) and pink (hematite altered) alternating bands. Some of the red rhyolite contains beige and gray discontinuous bands associated with microfractures. There is a crude vertical zonation with gray rhyolite predominating at the top of the laccolith, red and pink rhyolite predominating in the central zone of the body and gray and tan rhyolite predominating at the base of the rhyolite. Initial geochemical testwork, based on a small number of composites and presented in Section 13, suggests that the gray and pink rhyolite units have the highest REE content, averaging between 554 and 615 ppm total REE + Y. Based on a small number of composites, red and tan rhyolites, which may be strongly vapor-phase altered, contain about 8% lower abundance of REE. The brown rhyolite, which may be hydrothermally or groundwater-altered, contains about 23% less REE than the gray and pink varieties.

Cretaceous strata within the project area are cut by diorite dikes and sills that have an age of 48 Ma (McAnulty, 1980). These diorite intrusions were emplaced during a magmatic episode that took place after compressional folding in the Trans-Pecos region. On Round Top Peak, these dikes and sills are exposed in bulldozer cuts on the flanks and along the back of the exploration decline on the north side of the mountain. They vary in thickness from under 2 feet to over 100 feet thick. In some locations, the sills are in direct contact with the rhyolite and are partially replaced and veined by fluorite. In addition to surface exposures, drill data indicates the rhyolite is locally in direct contact with the diorite sills, suggesting the rhyolite intrusion followed the pre-existing diorite intrusion pathways.

The dikes and sills are described by Price et al. (1990) to be a titanium-rich hornblende-porphyry diorite. Other investigators describe the rock type to be diorite (McAnulty, 1980). Albritton and Smith (1965) describe the dikes and sills as having a variable composition consisting of andesite, hornblende-andesite porphyry, and latite porphyry. Within the project area, the sills encountered during drilling and exposed in bulldozer cuts appear to be a hornblende-porphyry diorite.

Cretaceous

Formations represented by the Cretaceous Washita Group are exposed on the surface in drainages and on the flanks of Round Top Peak. The youngest Washita Group formation in the project area is the Buda Limestone. Drilling shows this formation is discontinuous with a variable thickness. The contact between the Buda Limestone and the rhyolite is undulating and locally altered and mineralized. Near the outer margins of the rhyolite intrusion, the limestone formation thins and is locally absent. Outcrops of Buda Limestone on the northern slope of Round Top Peak present as a micritic limestone interbedded with thin shale partings. Fossil oysters are found in the micritic limestone beds.

| 33 |

On the north side of the Round Top laccolith, the Del Rio Formation is exposed in a deep arroyo. The Del Rio Formation is also exposed on the east and south slopes of the peak. The exposed section is composed of olive brown shale with interbeds of quartz sandstone and nodular limestone. The olive brown shale grades into a black shale with depth. Drilling shows the Del Rio Formation is in direct contact with the overlying Round Top rhyolite. Under the rhyolite intrusion, the Del Rio is a black to brown shale or black fine grained sandstone. The contact between the Del Rio and the rhyolite is undulating caused by earlier local folding and thrusting of the sedimentary rocks.

The oldest sedimentary rocks exposed on the surface within the project area belong to the Benevides Formation and are part of the Fredericksburg Group. On the east side of Round Top Peak, the contact between the upper Benevides and lower Del Rio Formations is exposed. The Benevides Formation is composed of olive-tan shale interbedded with quartz sandstone and nodular limestone. The formation is characterized by abundant pelecypods and echinoids.

| 7.3.2 | Structural Geology |

On the slopes of Round Top Peak the dominant structures are slumps and landslide faults. These structures are mostly found on the south and east side of the mountain. Steep and divergent structural attitudes and hummocky topography characterize the slumps and landslide faults. On Round Top Peak, the upper Benevides and Del Rio Formations were deformed by landslide faulting.

Drill data and the geologic model indicate Round Top Peak, including the rhyolite, is cut by a number of northwest trending faults that developed during early Basin and Range tectonism, some of which are shown in Figure 7-2. These faults are steeply dipping, ranging from 75 degrees to near vertical. Normal separation on these faults varies from 50 to 100 feet (ft) and the faults offset the intrusive floor. In addition to normal slip, these faults also may have experienced right-lateral strike-slip shearing. Brittle fracturing and brecciation in the rhyolite were common in the vicinity of the faults.

Drill data indicates these faults are filled with fault gouge, clay, and breccia. Rhyolite along these fracture zones are highly brecciated and commonly brown in color from hydrothermal or groundwater alteration. On the west side of the laccolith, the faults are closely spaced varying from 100 ft to 500 ft and on the east side they are over 500 ft apart. The east side is subsequently less fractured.

| 34 |

Faults on the west side of Round Top Peak show late-stage hydrothermal mineralization and alteration.

Figure 7-2 Round Top Peak Structural Geology, 2012

Faults on the west side are mineralized with fluorite, chalcedony, calcite and clay. Mineralized faults have fluorite and chalcedony replacing angular rhyolite breccia fragments. Calcite, clay and fluorite fill open spaces within the fault zones and in adjacent fractured rocks.