Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GOLD RESOURCE CORP | d372692d8k.htm |

6-26-12

2012 Annual Meeting

Exhibit 99.1 |

This

brochure contains statements that plan for or anticipate the future.

Forward-looking statements include statements about the Company's ability

to develop and produce gold or other precious metals, statements

about

our future business plans and strategies, statements about future revenue

and the receipt of working capital, and most other statements that are not

historical in nature. Forward-looking statements are often identified by

words such as "anticipate," "plan," "believe," "expect,"

"estimate," and the like. Because forward-looking statements involve

future risks and uncertainties, there are factors that could cause actual

results to differ

materially from those expressed or implied, including those described in our

filings with the SEC. Prospective investors are urged not to put undue

reliance on these forward-looking statements.

This presentation is to be read in conjunction with the most current 10K

available at the Securities & Exchange Commission website

www.sec.gov. or

www.Goldresourcecorp.com

Forward Looking Statements

Forward Looking Statements |

Engineered To Maximize Shareholder Value

Engineered To Maximize Shareholder Value

Delivering an aggressive growth profile of low cost, high

margin production

Demanding high returns on owner invested capital

Distributing meaningful monthly dividends to maximize

total return to owners

Shareholder Focused Precious Metal Producer |

2011

Performance Highlights 2011 Performance Highlights

|

2011

Performance Highlights 2011 Performance Highlights

|

2011

Performance Highlights 2011 Performance Highlights

|

2011

Performance Highlights 2011 Performance Highlights

|

2011

Performance Highlights 2011 Performance Highlights

|

2011

Performance Highlights 2011 Performance Highlights

|

2011

Performance Highlights 2011 Performance Highlights

|

Value

Creation Value Creation

2011 set a strong foundation from which to

continue to build shareholder value |

Value

Creation Value Creation

Growth Equity

and

Income Equity |

GROWTH

EQUITY

Value Creation

Value Creation

2011

66,159 oz AuEq

$87 Million

$58 Million

Mine

Gross

Profit

=

sales

–

cost

of

sales

AuEq = precious metal gold equivalent ounce

Oz = ounce

Value Created

Cumulative Funds Raised “IPO”

6-20-12

2006 2007 2008

2009 2010 2011 2012

Market Capitalization

0

200,000,000

400,000,000

600,000,000

800,000,000

1,000,000,000

1,200,000,000

1,400,000,000

1,600,000,000

Record Production

Record Mine Gross Profit

Record Net Income

Aggressive Production Profile

USD BILLIONS |

2010

2011 2012

USD/

Month

$0.06 / share monthly dividend

$0.72 annually

2011 dividends = 30.5% MGP

$26.5M of $87.5 MGP

MGP

/

Mine

Gross

Profit

=

sales

–

cost

of

sales

Value Creation

Value Creation

Dividends may vary in amount and consistency or be discontinued at

management’s discretion depending on variables including but not limited

to operational cash flows, Company development requirements and

strategies, spot gold and silver prices, taxation, general market conditions

and other factors described in the Company’s public filings.

INCOME

EQUITY

1/3

1/3

1/3

$0.00

$0.02

$0.04

$0.06

Consecutive Monthly Dividends

since commercial production July 2010

Targeted Annualized

MGP Deployment

Growth

Taxes

Dividend

Total dividends / share paid to date

$0.95 |

Dividend Impact

Dividend Impact |

$1.00 / share

“IPO” $1.01 / share returned to shareholders

since “IPO”

Assumes June 2012 div. @ $0.06

payable in July

Fiscal discipline and commitment to

shareholders

Major Milestone

Major Milestone

Total dividends to exceed “IPO”

price / share

Sept. 2006 |

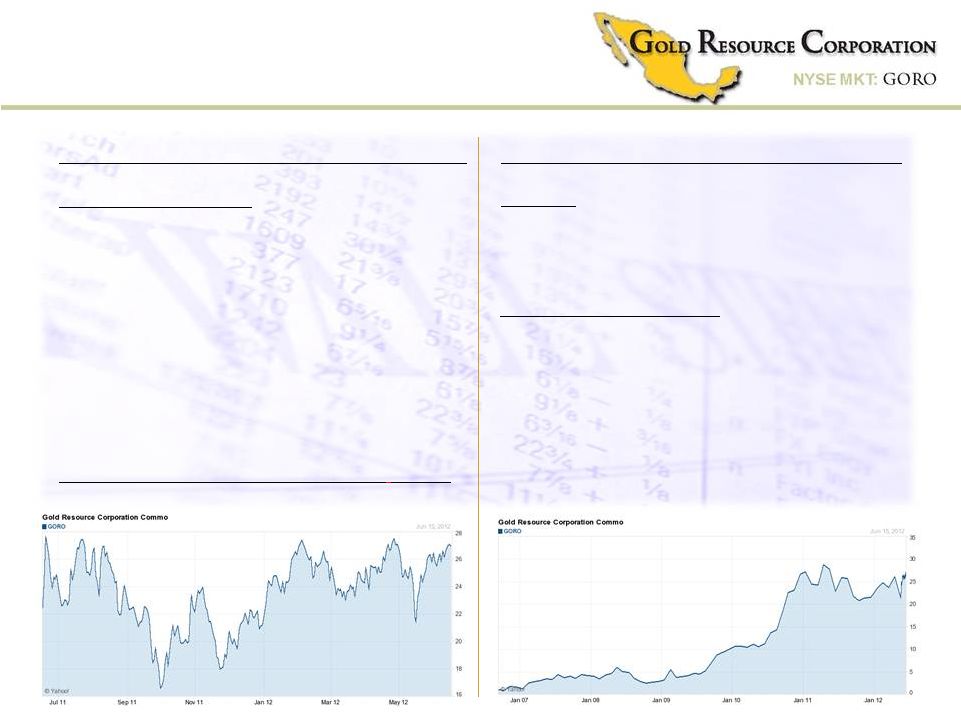

Dividend Impact On Share Price

Dividend Impact On Share Price

Performance?

Performance?

GORO-

Gold Resource

Corporation

~2 YEARS

July , 2010

-

Commercial

Production -

Initial

Dividend

GLD –

SPDR Gold

Trust (ETF) |

GTU

– Central Gold

Trust

XAU –

Index, precious

metal Co’s (#16 Co’)

GORO-

Gold Resource

Corporation

~2 YEARS

GDXJ –

Market Vectors

Junior Gold Miners ETF

(#86 Co’s)

Dividend Impact On Share Price

Dividend Impact On Share Price

Performance?

Performance?

July , 2010

-

Commercial Production

-

Initial Dividend

June, 2012

-

Consistent Monthly

Dividends |

UNWPX

– US Global

Investors

World Precious

Minerals Fund

(#183 Co’s)

GORO-

Gold Resource

Corporation

~2 YEARS

Dividend Impact On Share Price

Dividend Impact On Share Price

Performance?

Performance? |

Dividend & Yields

Dividend & Yields

Company

Annual Dividend

Estimate

Yield

%

Share Price Close

6/18/2012

Agnico Eagle

U.S.$0.81

1.9%

U.S.$42.40

Barrick

U.S.$0.80

2.0%

U.S.$40.19

Goldcorp

U.S.$0.54

1.4%

U.S.$39.72

Kinross

U.S.$0.16

1.8%

U.S.$ 9.17

Newmont

U.S.$1.40

2.8%

U.S.$50.85

Yamana

U.S.$0.22

1.4%

U.S.$16.35

Royal Gold

U.S.$0.60

0.8%

U.S.$79.49

PEER AVERAGE

1.7%

Gold Resource

U.S.$0.72

2.7%

U.S.$27.66

Source: Based on each company’s annual public filing and Bloomberg.

|

Committed to Gold and Silver

Committed to Gold and Silver

“GRC Eagles”

rounds

Unique

Gold

and

Silver

Dividend

Program

No

Other

Known

Program

of

its

Kind |

Gold

and Silver Dividend Program Gold and Silver Dividend Program

“GRC Eagles”

rounds |

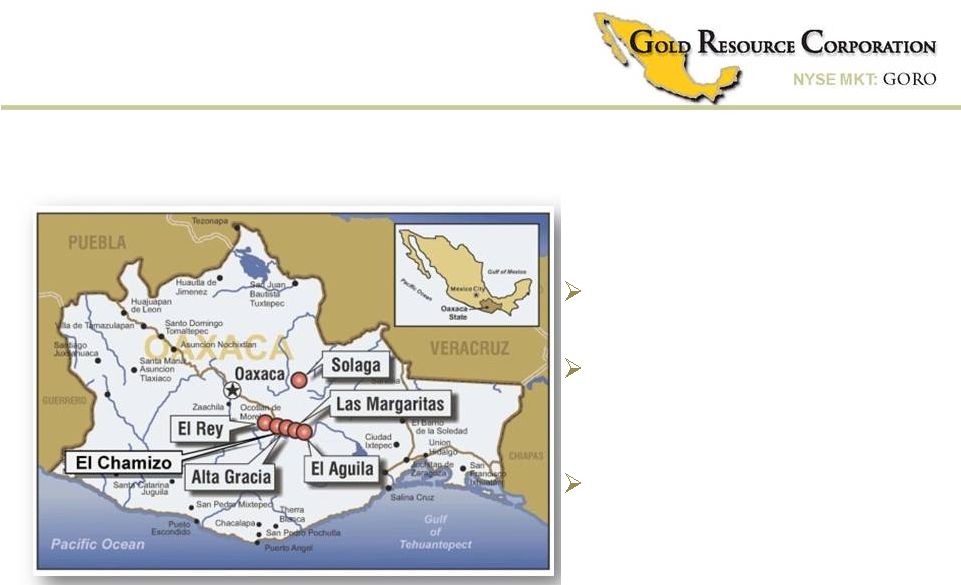

Oaxaca Mining Unit

Oaxaca Mining Unit

Mining friendly jurisdiction

6 potential high-grade gold and silver

properties (+200 square miles)

Dominant land position: 48 kilometer

mineralized structural corridor

Oaxaca Mining Unit

Property

Interest

Production

Development

Exploration

El Aguila

100%

El Rey

100%

Alta Gracia

100%

100%

El Chamizo

100%

Solaga

100%

Las Margaritas |

Flexible Mill Design

Flexible Mill Design

Flotation

Agitated leach

Two mill circuits

2011 Record Mine Gross Profit:

$87

million |

La Arista

Deposit •Multiple en echelon

veins •~500 meters

of strike •~500

meters of depth

•Deposit remains

open Arista Vein

Baja Vein

Arista Underground Mine

Arista Underground Mine

Drill Station

Drill Station |

Arista Mine Development

Arista Mine Development

Sub-level long hole stoping

Development ore

Mine Development

Baja Vein |

Arista Mine Development

Arista Mine Development

Decline

Veins

Main Decline & Vein Drifts

LEVEL 11

Level

11 Veins

Sample #

Au

g/t

Ag

g/t

Cu

%

Pb

%

Zn

%

117652

141.73

1710

2.57

2.47

5.70 |

Arista Mine Development

Arista Mine Development

Internal Estimate, Not SEC Proven & Probable Reserves; see Risk Factors in Company’s

10K Grey Polygons A, B, C and D drilling

indicated grade below cutoff.

Actual mining demonstrated high-

grade and polygons were/are being

mined and processed.

Deposit Open

Deposit Open

A

B

C

D

Polygonal envelope with mine development 3D overlay; internal estimate

Arista vein

(polygon12/09)

Internal Estimate

Primary Ramp |

PRECIOUS METAL

GOLD EQUIVALENT (AuEq) RESOURCE GRADE

VS. PRODUCTION GRADE

Cutoff

IN-SITU

ESTIMATES AuEq

MINED GRADE

PRODUCTION

Grade

PA&H (1)

COMPANY (2)

IN-SITU

13 Month Ave(3)

Grams

Tonnes

oz/t

g/t

YR's

oz/t

g/t

YR's

oz/t

g/t

oz/t

g/t

1*

4,480,711

0.20

6.22

10

7*

2,305,485

0.34

10.58

5

Mined Grade @

Actual Mill Head

9*

1,606,286

13.37

4

20% Dilution

Grade After

9.33

2,962,000

0.53

16.49

7

Estimate

Mining Dilution

0.51

15.86

242,014

0.41

12.75

AuEq

= Precious Metal Gold Equivalent

In-Situ = in place, not accounting for mining dilution

(1) AuEq

Estimate 2012 @ 50:1 Au,Ag

Third Party

Preliminary Estimate

by Pincock

Allen

& Holt (PA&H)

(2) AuEq

Estimate 2009 @ 53:1 Au,Ag

Internal Estimate

(3)

Actual mill headgrade

processed March 1, 2011 to March 31, 2012

*Indicated & Inferred

YR‘s = Mine life years at 440,000 tonnes

mill throughput per year

-

NOT PROVEN AND PROBABLE RESERVES FOR U.S. REPORTING PURPOSES

Arista High-Grade Deposit

Arista High-Grade Deposit

Estimates and Production Grade

Estimates and Production Grade

(Internal and Third Party Estimates, Not SEC Proven & Probable Reserves; see Risk Factors

in Company’s 10K) 0.43

PA&H RESOURCE CRITERIA INCLUDES STANDARDS ESTABLISHED UNDER CANADIAN NI 43-101 FOR

INDICATED AND INFERRED RESOURCES |

Arista Area Expansion Potential

Arista Area Expansion Potential

.73 meters @

9.9 g/t Au,

598 g/t Ag

Drill hole

Surface sample

Rock chip @

12 g/t Au

Arista Mine

development

La Arista

Underground

Mine

Potential feeder vein

2.5m@ 904 g/t Au,

9720 g/t Ag

Channel sample

El Aguila

Open Pit Mine

Potential for deposit expansion and/or new discoveries

El Aguila |

Arista Area Expansion Potential

Arista Area Expansion Potential

Arista

Multiple

Structures

Dr. Ellis 6-21-12

Structure is

Important to

Epithermal Systems

El Aguila |

Exploration Potential

Exploration Potential

6 properties (+200 square miles)

5 properties consolidate 48km

mineralized structural corridor

Mineralization at each end and

along trend |

Alta Gracia

Property Exploration Potential

Exploration Potential

El Rey Property

El Rey Property

Alta Gracia Property

Alta Gracia Property

Las Margaritas

Las Margaritas

Positive 2011 drill campaign

Intercepted multiple mineralized structures

33 intercepts over 200 grams silver (1m intervals)

Discovered high-grade gold vein system

Working with all local interests

Continue extending the existing shaft

Setup an underground drill station

Constructing access road

First to drill this historic district

Historic workings

Las Margaritas

Property

El Rey Property |

Corporate Citizenship

Corporate Citizenship

Plant Nursery/Reforestation

Town Infrastructure

Commitment to Hire Locally

Health Clinic Dental Clinic

Sustainable Development

Student Scholarships |

Substantial

Shareholders Management

~15%

Hochschild Mining plc

~28%

Tocqueville Asset Management

~ 8%

NFJ Investment Group

~ 6%

Blackrock

~ 5%

Vanguard

~ 2%

Exchange

NYSE

MKT:

GORO

Present Capitalization

Shares

Outstanding

53,015,767 Treasury Shares

(104,251)

Options

Outstanding

5,182,000 Warrants Outstanding

0

Shares Fully

Diluted

58,197,767 Debt

0

Hedging

0

Bullion: #1672oz Gold #87641oz Silver ~$5.6Million

Cash

@

3-31-12 $44

Million

Tight Capital Structure

Tight Capital Structure

12 months

Market Cap @ $27.00/share

$1.4Billion Liquidity

Average Daily Volume (3m as of 6-18-12) ~267,000

52 wk Range Low/Hi

$15.06-$28.74

Since 2006 “IPO” |

(Potential

targets and projections. Not guaranteed; see Risk Factors in Company’s 10K)

Potential Catalysts

Potential Catalysts

Increasing production year over year

Adding ounces to known deposits

New deposit discoveries

Secondary exchange listing

Increasing dividends

Additional Mining Unit |

Second Mining Unit

Second Mining Unit

Mining friendly jurisdiction

High-Grade

Accretive

Second Mining Unit Criteria

st

Oaxaca Mining Unit (1 mining unit)

|

The

“Go To” The “Go To”

Gold Company

Gold Company

(GRC targets, performance not guaranteed, see Risk Factors in Company’s

10K) Cash

Cash

Dividends

Dividends

Gold & Silver

Gold & Silver

Dividend

Dividend

Physical

Physical

Treasury

Treasury

Adding

Adding

Ounces

Ounces

Capitalize on

Capitalize on

Opportunities

Opportunities

Low Cost

Low Cost

Producer

Producer

Aggressive

Aggressive

Growth Curve

Growth Curve |

Thank

You For Your Continued Support Thank You For Your Continued Support

Low-Cost Precious Metals Producer

Low-Cost Precious Metals Producer

Growth Equity and Income Equity

Growth Equity and Income Equity

Premier Investment for Precious Metal Exposure

Premier Investment for Precious Metal Exposure |