Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Hicks Acquisition CO II, Inc. | d371090d8k.htm |

0

Innovative Coating & Microencapsulation Product Solutions

Business Combination with Hicks Acquisition Company II, Inc.

June 2012

Exhibit 99.1 |

1

Disclaimer

1

Securities Law Information

In connection with the proposed transactions with Appleton Papers Inc. (together with its successor

after converting into a limited liability company, “Appvion”) and its current owner, Paperweight Development

Corp. (“PDC”), Hicks Acquisition Company II, Inc. (“HACII”) intends to file

with the SEC a proxy statement and mail a definitive proxy statement and other relevant documents to HACII stockholders. HACII

stockholders and other interested persons are advised to read, when available, HACII’s preliminary

proxy statement, and any amendments thereto, and the definitive proxy statement in connection with

HACII’s solicitation of proxies for the special meeting to be held to approve the transactions

because these proxy statements will contain important information about Appvion, HACII, and the proposed

transactions. The definitive proxy statement will be mailed to HACII stockholders as of a record

date to be established for voting on the proposed transactions. Stockholders will also be able to obtain a copy

of the preliminary and definitive proxy statements once they are available, without charge, at the

Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov or by directing a request to

Hicks Acquisition Company II, Inc., 100 Crescent Court, Suite 1200, Dallas, Texas 75201, telephone

214-615-2300. HACII and its directors and officers may be deemed participants in the solicitation of proxies to

HACII’s stockholders. A list of the names of those directors and officers and a description of their interests in

HACII is contained in HACII’s annual report on Form 10-K for the fiscal year ended December

31, 2011, which is filed with the SEC, and will also be contained in HACII’s proxy statement when it becomes

available. HACII’s stockholders may obtain additional information about the interests of the

directors and officers of HACII in the transactions in reading HACII’s proxy statement and other materials to be filed

with the SEC when such information becomes available.

Safe Harbor Statement

This presentation has been prepared exclusively for the purpose of providing summary information about

Appvion and its business to HACII stockholders pending the distribution of the definitive proxy

statement. It does not constitute a solicitation for or an offer by or, on behalf of HACII or

Appvion or, of any securities or investment advisory services. This presentation includes “forward-looking statements” within the meaning of the

safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “expect,”

“estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “poised”, “believes,” “predicts,” “potential,” “continue,” and

similar expressions are intended to identify such forward-looking statements.

Forward-looking statements in this presentation include matters that involve known and unknown risks, uncertainties and other factors that may cause actual results, levels of

activity, performance or achievements to differ materially from results expressed or implied by this

presentation. Such risk factors include, among others: uncertainties as to the timing of the transaction,

approval of the transaction by HACII’s stockholders; the satisfaction of other closing conditions

to the transaction, including the receipt of any required regulatory approvals; costs related to the transaction;

costs and potential liabilities of Appvion relating to environmental regulation and litigation

(including Lower Fox River); potential failure of Appvion’s former parent to comply with its indemnification obligations;

costs of compliance with environmental laws; Appvion’s substantial amount of indebtedness; the

ability of Appvion to develop and introduce new and enhanced products, improve productivity and reduce

operating costs; Appvion’s reliance on a relatively small number of customers and third parties

suppliers; the cessation of papermaking and transition to base stock supplied under the long-term supply

agreement with Domtar; the global credit market crisis and economic weakness; competitors in its

various markets; volatility of raw materials costs; Appvion’s underfunded pension plans; future legislation or

regulations intended to reform pension and other employee benefit plans; and Appvion’s current

owner PDC’s legal obligations to repurchase common stock from employees and former employees, which

may lead to a default under the Appvion’s agreements governing its indebtedness or constrain

Appvion’s ability to reinvest and make new investments. Actual results may differ materially from those

contained in the forward-looking statements in this presentation. Appvion and HACII undertake

no obligation and do not intend to update these forward-looking statements to reflect events or circumstances

occurring after the date of this presentation. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this presentation. All forward-looking

statements are qualified in their entirety by this cautionary statement.

Notes Regarding Financial Information of Appvion

The financial information and data contained in this presentation is derived from Appvion’s

unaudited financial statements and may not conform to Regulation S-X. Accordingly, such information and data may

be adjusted and presented differently in the proxy statement materials to be mailed to HACII

stockholders. Non-GAAP Information

Appvion is providing Adjusted EBITDA information, which is defined as net income of Appvion, including

net income attributable to any non-controlling interest, determined in accordance with all applicable and

effective U.S. generally accepted accounting principles (“GAAP”) pronouncements up to

December 31, 2011, before interest income or expense, income taxes and any gains or losses resulting from the

change in estimate relating to the Tax Receivable Agreement, depreciation, amortization, losses or

gains resulting from adjustments to the fair value of the contingent consideration, stock-based compensation

expense, extraordinary or non-recurring expenses and all other extraordinary non-cash items for

the applicable period as a complement to GAAP results. Adjusted EBITDA measures are commonly used by

management and investors as a measure of leverage capacity, debt service ability and liquidity.

Adjusted EBITDA is not considered a measure of financial performance under GAAP, and the items excluded

from Adjusted EBITDA are significant components in understanding and assessing our financial

performance. Adjusted EBITDA should not be considered in isolation or as an alternative to, or superior to,

such GAAP measures as net income, cash flows provided by or used in operating, investing, or financing

activities or other financial statement data presented in our consolidated financial statements as an

indicator of financial performance or liquidity. Reconciliations of non-GAAP financial

measures are provided in the accompanying tables. Since Adjusted EBITDA is not a measure determined in accordance

with GAAP and is susceptible to varying calculations, Adjusted EBITDA, as presented, may not be

comparable to other similarly titled measures of other companies.

|

Why

Appvion? 2

•

Company focused on specialty coating formulations, microencapsulation and related

know-how •

#1 market position in all markets with >50% share

•

High growth areas including direct thermal coated products and Encapsys

segment Appvion

Leadership

•

Asset-light model freeing up capital for growth investments

•

Low execution risk on business plan (Domtar strategic alliance, non-core asset

divestitures complete)

•

HACII merger accelerates balance sheet transformation / deleveraging

Transformation

Complete

•

Successfully repositioned company for growth

•

Senior management rolling equity into the combined company

Management

Invested in Future

Success

•

Best-in-class margins (+549bps since 2009) and FCF (+$63 million/yr)

•

Conservative 2012PF EBITDA target of $131 million

•

Enhanced FCF available to fund growth, debt reduction, and shareholder value

(equity repurchases/dividends)

Strong Free Cash

Flow

(1)

Profile

(1) Defined as PF Adj. EBITDA less Capital Expenditures

|

Experienced and Proven Management Team

3

•

Chairman, President and CEO of Appvion since 2005

•

Prior

to

joining,

served

in

a

variety

of

senior

management

roles

within

a

diverse

range

of

sectors

that include industrial manufacturing, drug and medical devices

•

MBA, Northwestern University’s Kellogg School of Management

Mark Richards

Chairman, President

and CEO

•

Senior Vice President of Finance and CFO of Appvion since 2006

•

Prior to joining, served in a variety of senior financial roles within a diverse

range of industries that include banking, manufacturing and consumer

packaged goods •

Masters degree in finance and BBA in business, University of Iowa

Tom Ferree

Senior Vice President

and CFO

•

Vice President of Human Resources of Appvion since July 2009

•

Previously

served

in

a

variety

of

HR

roles

since

joining

Appvion

in

1982

•

Business Administration, Human Resources from the University of

Wisconsin-Oshkosh •

Senior Professional Human Resources certification since 2005

Kerry Arent

VP, Human

Resources

•

Senior Vice President since January 2012

•

Joined the Company in November 2005 as Vice President of Marketing and

Strategy •

Prior to joining, served in a variety of executive marketing positions with

Kimberly-Clark •

MBA, Northwestern University’s Kellogg School of Management

Kent Willetts

SVP, Encapsys®

Business Unit

•

Vice President of Thermal since April 2012

•

Joined the Company in April 1993 as a procurement manager

•

Previous roles in direct thermal and successful start-up of

Encapsys® Jamie Hillend

VP, Thermal |

Global

Leader in Specialty Coating Formulation and Microencapsulation •

Appvion was created from over 100 years of Appleton experience, technology and

know-how •

Leading global converter of direct thermal coated paper and specialty carbonless

products –

Market leading innovative products and services

–

#1 North American market position with over 50% share

–

Exclusive distribution with key partners

•

High-growth

Encapsys

®

business

with

leadership

position

in

chemical

microencapsulation

technology

–

Highly attractive global P&G partnership

–

Robust growth profile with blue chip partners in established brands

–

Validation

of

strategic

plan

and

growth

outlook

from

widely

recognized

3

rd

party

industry

consultant

–

Expanded business to other commercial customers

•

Globally recognized brands with blue-chip customers across diverse and attractive

end markets –

Include

NCR

Paper*,

Appleton

®

and

Encapsys

®

•

Low-cost, high velocity, flexible, lean inspired business model

–

Established culture of excellence with demonstrated ability to reduce operating

costs and improve quality and service •

High margins, low capital intensity and working capital needs

•

Reputable

and

trusted

history

of

operating

as

a

public

reporting

company

–

Seasoned public filer and Sarbanes-Oxley (SOX) compliant

–

Independent board; adhere to best practices in corporate governance

4

* NCR Paper is a registered trademark of NCR Corporation licensed to Appleton

Papers Inc. |

Appvion: Successfully Repositioned

5

•

Domtar

strategic

alliance

–

a

paradigm

shift

(2012)

–

Industry comments: “Elegant”, “innovative”,

“creative” –

Strips out fixed costs and substantially reduces go forward capital

expenditures –

Facilitates a significant reduction of working capital

–

Frees up cash flow and management attention to focus on growth areas

•

Direct

thermal

market

leadership

–

investing

in

our

future

(2008)

–

State-of-the-art asset base installed and operating

–

Expanding margins and cash flow with mix shift, Domtar alliance and lean sigma

operational excellence –

Demonstrated ability to grow 2-3x market using coating capabilities and

geographic growth •

Encapsys

–

leveraging

a

core

technology

(2007)

–

50+ years of microencapsulation expertise applied to a broad range of attractive,

high-growth, global markets –

Rich in intellectual property and technical know-how; robust development

pipeline –

Proven lower capital intensity, high cash flow, scalable business model

•

Optimize balance of the portfolio (ongoing)

–

Carbonless is redirecting substantial cash flow into growing, global and profitable

segments –

Divested non-core assets

(1) Defined as Adj. EBITDA less Capital Expenditures.

|

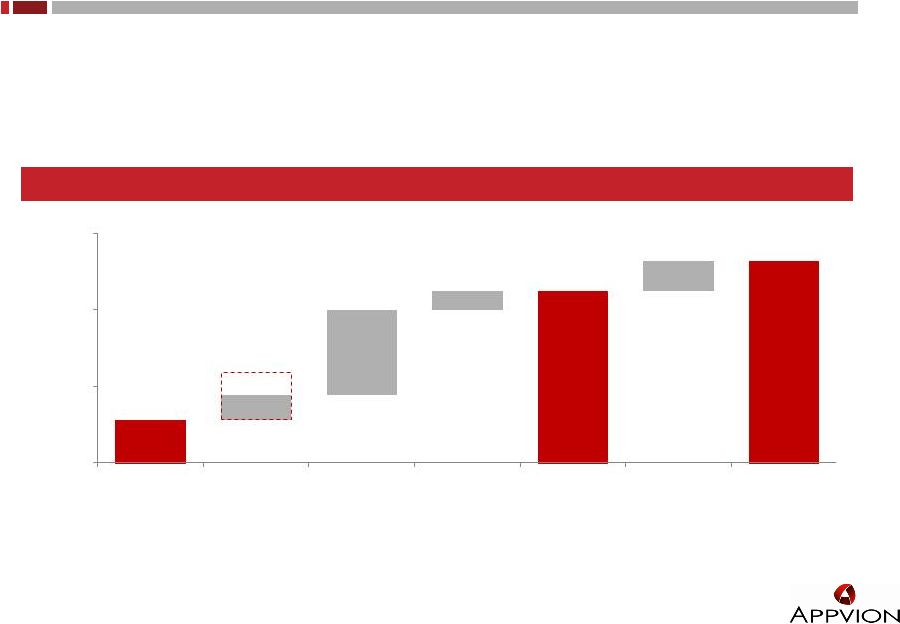

6

ASSET-LIGHT SPECIALTY

TRADITIONAL

COATING, FORMULATION

PAPER BUSINESS

& APPLICATION BUSINESS

MODEL

FOCUS ON GROWING,

GLOBAL DIRECT THERMAL

AND

MICROENCAPSULATION

+$107 million revenue growth (4.5% CAGR)

+549 bps EBITDA margin expansion

+20% reduction in CapEx

+$63 million increase in Free Cash Flow

(1)

Appvion: Delivering Results

6

2009

2012

(1) Defined as Adj. EBITDA less Capital Expenditures.

Note: Segment figures do not include corporate overhead.

(EBITDA in $ Millions)

$141

$131

$73

Appvion’s Business Transformation

15.9%

15.1%

9.6%

% Margin

Carbonless

Thermal

Encapsys

$65

$63

$64

$9

$64

$68

$6

$15

$24

2009

2012PF

2013E |

7

Appvion: Attractive Long-Term Equity Returns

7

•

Compelling

free

cash

flow

(1)

across

Appvion

portfolio

–

Well positioned in growing end markets

–

Improving margins through direct thermal mix shift

–

Domtar

strategic

alliance

strengthens

free

cash

flow

(1)

–

Provides opportunity to reinvest, pay down debt and consider a dividend

•

Transaction substantially enhances Appvion’s balance sheet and credit

profile –

Enables accelerated growth

–

Eliminates ESOP repurchase obligations

–

Provides a significant deleveraging event

–

Opportunity to refinance existing indebtedness and further increase free cash

flow •

Potential for additional upside returns

–

Encapsys

®

technology and operating model scalable across global markets and blue chip

companies –

Scale and market position provide opportunity for international expansion

–

(1) Defined as PF Adj. EBITDA less Capital Expenditures.

Opportunistically acquire and integrate additional technological capabilities |

Business Overview |

9

Segment Snapshot

9

Specialty Coatings

Microencapsulation

–

Direct Thermal –

A World Leader

–

Carbonless –

The World Leader

–

Direct Thermal: Point of Sale products, mission-

critical labels and transportation and gaming

products

–

Carbonless: Multipart business forms and non-bank

note security papers

•

Trusted supplier to industry leading global customers

•

Proprietary technologies backed by patents and 60+

years of technical “know-how”

•

Business Segment

–

Encapsys

®

–

Redefining

the

Market

•

Products

–

Microcapsules that improve product performance

and reduce cost

2012PF Financial

Breakdown

(1)

EBITDA

56% from Growth

Segments

Revenue

(1)

Pro Forma for the Domtar supply agreement.

International

23%

North

America

77%

Thermal

45%

Encapsys

11%

Carbonless

44%

•

•

•

•

Leading converter of specialty coated paper products,

including direct thermal and carbonless papers

Global leader with exclusive distribution to key partners

Business Segments

Products |

Direct

Thermal Products: A Phenomenal Growth Story •

A global leader with #1 market position in North America

–

Trusted partner to leading global customers

–

Well-invested, state-of-the-art low cost coating

capabilities

–

Robust proprietary technology developed over 50+

years

•

Produced by applying a complex thermal sensitive coating

to paper or film base stocks

–

Developed the technology in late 1960’s

–

Led market with every major enhancement

•

+$2.1bn global market growing at 4-7% annually

–

Demand driven by consumer transactions

–

Not susceptible to typical paper industry cycles

•

Primary applications include:

–

POS products for retail receipts and coupons

–

Mission-critical label, tag and ticket products

–

Transportation and gaming products

•

Key Customers

–

Avery Dennison, RR Donnelley and UPM Raflatac

Demonstrated Revenue Growth

10

Substantial Adj. EBITDA Improvement

($ Millions)

($ Millions)

(Margin %)

July 2008:

Coater startup

$3

$9

$18

$34

$64

$68

0%

4%

8%

12%

16%

20%

$0

$20

$40

$60

$80

2008

2009

2010

2011

2012PF

2013E

$280

$281

$342

$371

$417

$442

$0

$100

$200

$300

$400

$500

2008

2009

2010

2011

2012PF

2013E

Note: 2012PF and 2013E projections based on management guidance. Excludes intercompany eliminations

and corporate overhead. |

Carbonless Paper: The Market Leader

•

Leader in a mature, global $2.5bn market

–

#1 market share in North America and worldwide

–

Top two industry participants account for over 90% of the

domestic market

–

Exclusive distribution with largest merchants

•

Technology innovator with demonstrated ability to manage

market decline

–

Introduced digital product that can run on offset or digital

press

–

Selective export opportunities

•

Carbonless products used in multipart business forms (i.e.,

invoices, packing lists, application forms and receipts)

–

Most recognized global brand:

•

Security products incorporate secure technologies

(watermarks, taggants, embedded fibers, machine-readable)

•

Significant free cash flow generation

–

Minimal ongoing capital expenditure requirements

–

Ability to redeploy into growth segments, debt reduction

or dividends

11

Historical and Projected Revenue

Stable Adj. EBITDA Profile

($ Millions)

($ Millions)

(Margin %)

Note: 2012PF and 2013E projections based on management guidance. Excludes intercompany eliminations

and corporate overhead. |

Key

Event: Transformational Base Stock Supply Agreement •

15-year strategic alliance with Domtar provides access to high

quality, integrated base stock

–

Announced February 2012

–

Provides ~$30 million in annual EBITDA improvement

–

Eliminates high-cost, out-dated manufacturing facility

–

No net cash costs

~$30 million working capital reduction funds shutdown

costs

•

Continues transformation to a higher-margin, higher value-add,

lower fixed-cost converter

–

Focus management and capital on core competencies

–

Reduces

commodity

exposures

and

“locks-in”

purchasing

of base stock paper

–

Shutter high-cost, non-integrated base stock paper

production assets in West Carrollton

–

Significantly improves cash flow generation profile

•

Contractual;

implementation

underway

–

substantially

complete

by Q4 2012

12

Base Stock Transformation

25%

65%

35%

75%

2011

Pro Forma

Internal Production

Purchased from 3rd Parties |

13

•

Microencapsulation is the delivery of chemistry in very small capsules to provide

for the controlled release of active ingredients

•

Produced using a chemical wall polymerization process

–

Low capital intensity process

•

Leveraged technical know how from carbonless business to

commercialize technology

–

Original technology introduced in the 1950s

–

Refreshed technology with over 60 granted patents in the

last five years

–

Rapidly expanding capabilities with new capsule wall technologies

•

Technology delivers significant value by improving product

performance at a lower cost

–

Extends existing product useful life by adding new benefits

–

Enabling technology for new products

–

Drives reformulations that lower product costs

–

Many proven applications including fragrances, flavor masking,

nutraceuticals, adhesives, biocides, and herbicides

•

Encapsys®

recognized as industry leader

–

Trusted partner to leading global customer base

–

Well-invested, state-of-the-art, scalable coating

capabilities –

“Big”

company friendly with best-in-class operating controls

and processes

Microcapsules on a human hair

(5-15 microns)

Microencapsulation: Proven technology |

Encapsys

®

Partners

Procter & Gamble

•

Launched

partnership

with

P&G

in

2007

by

encapsulating

fragrance

for

laundry

products

•

Encapsys

®

provided unique solution for P&G product line

•

Encapsys

®

partnered with P&G and perfected fragrance encapsulation for Liquid

Downy –

Improved efficacy

–

Significant reduction in product cost

•

Relationship began with one product and proliferated across multiple business units

and product lines

•

P&G has adopted Encapsys as a strategic business platform, deploying it across

its global business units

Other Partners

14

Priority

Markets

Products

Household

•

Laundry care

•

Toilet products

•

Acquisition targets

Food / Pharma

•

Physical encapsulation

•

FDA compliant

•

Phase change material

Industrial

•

Biocides

•

Paints and coatings

Personal Care

•

Antiperspirants

•

Hair care

•

Herbicides

AgChem

•

Insecticides

•

Fungicides |

Microencapsulation: Serving a sizeable growing market

15

•

$4 billion global market growing 10% annually

–

Wide market appeal with applications in food, pharma,

AgChem, industrial, paints & coatings, oil & gas,

personal and household care, and nutraceuticals

•

Strategic review by widely recognized specialty chemical

consulting firm

–

Endorsed

projections

that

Encapsys®

can

grow

to

multiples of its current size by 2016

–

Addressable market increased from $2 billion to $4

billion

–

Opportunity to grow faster than current model by

acquiring capabilities and products

•

Focused on large joint development pipeline to drive

growth

–

16 development partners and greater than 20 active

projects under development (preponderance with

Fortune 500 companies)

–

Partners include Troy, Entropy and a global Fortune

500 consumer packaged goods companies

Demonstrated Revenue Growth

Robust Adj. EBITDA Growth Profile

($ Millions)

($ Millions)

(Margin %)

Note: 2012PF and 2013E projections based on management guidance. Excludes intercompany eliminations

and corporate overhead. |

Financial Summary |

Consolidated Financial Summary

Revenue

Adjusted EBITDA

Capital Expenditures

(1)

Free Cash Flow

(1)(2)

Note:

2012PF

and

2013E

projections

based

on

management

guidance.

2012

PF

Adj.

EBITDA

and

capital

expenditures

Pro

Forma

for

Domtar

transaction.

See

EBITDA

reconciliation on page 29.

(1) Excludes Capital Expenditures related to Domtar transaction implementation in

2012 and 2013. (2) Defined as Adj. EBITDA less Capital Expenditures.

17

($ Millions)

($ Millions)

($ Millions)

($ Millions)

(EBITDA Margin %)

$762

$850

$857

$869

$887

2013E

$650

$750

$850

$950

2009

2010

2011

2012PF

5%

8%

10%

13%

15%

18%

20%

$0

$50

$100

$150

2009

2010

2011

2012PF

2013E

$73

$79

$89

$131

$141

$15

$12

$25

$18

$16

$20

$27

$0

$10

$20

$30

2009

2010

2011

2012E

2013E

$48

$61

$73

$111

$114

$0

$20

$40

$60

$80

$100

$120

2009

2010

2011

2012PF

2013E |

EBITDA

Bridge Analysis 18

2011A to 2013E

(2)

(1)

Unaudited run-rate EBITDA for the four months ending April 2012. Excludes

pension benefit and contract savings. (2)

Contracted EBITDA improvement is annualized to reflect full-year impact of

Domtar Supply Agreement. (3)

Impact of lower pension expense due to freeze of salaried defined benefit.

•

•

Additional ~$30 million in contracted annualized EBITDA improvement

•

Ongoing EBITDA benefit due to reduced pension expense

$102

Run-Rate

(1)

(3)

$89

$8

$28

$6

$131

$10

$141

$75

$100

$125

$150

2011A

Business

Growth

Contract

Savings

Lower Pension

Expense

2012PF Adj.

Business

Growth

2013E

Base

business

EBITDA

ahead

of

plan

(1) |

19

Current and Post-Transaction Balance Sheet

19

Assumes

net

proceeds

from

the

transaction

are

applied

as

cash

to

balance

sheet

that

will

be

utilized

for

general

corporate

purposes,

debt

reduction,

and

warrant

repurchases.

Includes

$18.2

million

of

additional

2

Lien

notes

issued

upon

change

of

control.

Assumes all Public Warrantholders elect for Option A of the proposed warrant

amendment (as detailed on page 29), resulting in cash proceeds used for warrant

repurchases

of

$9.4

million

(assuming

payment

of

$0.625

per

each

of

15

million

outstanding

public

warrants

at

closing).

Assumes 2012E PF Adj. EBITDA of $131 million.

(2)

Actual as of

As Adjusted for

4/1/2012

this Transaction

(1)

Interest Rate

Maturity

Call Date

Cash & Equivalents

7

$

108

$

Revolving Credit Facility

-

$

-

$

Variable

Feb -

2015

Senior Secured 1st Lien Notes

301

301

10.500%

Jun -

2015

Mar -

2013

2nd Lien Notes

162

180

11.250%

Dec -

2015

NA

Senior Subordinated Notes

32

32

9.750%

Jun -

2014

Jun -

2012

Industrial Revenue Bonds

9

9

Variable

2013 / 2017

State of Ohio Loan

8

8

Variable

May -

2017

Columbia County, Wisconsin Forgivable Note

0

0

Variable

May -

2019

Total Debt

512

$

530

$

Net Debt

505

$

422

$

Net Debt / PF Adj. EBITDA

(3)

3.9x

3.2x

(1)

Note: Assumes no HACII shareholder redemptions.

(2)

(3)

nd |

Transaction Summary |

Transaction Overview

•

Appvion

to

become

publicly

traded

through

a

business

combination

with

Hicks

Acquisition Company II, Inc. (Nasdaq: HKAC)

•

Post-closing Appvion will trade on Nasdaq under ticker APVN

•

Appvion

enterprise

value

of

$684

million

(1)

Transaction

•

Appvion will receive up to $149.3 million in cash, less fees, expenses and HACII

redemptions, which will be used to delever balance sheet and repurchase

public warrants (as described in footnote 2 below)

•

Pro

Forma

net

debt

of

$422

million

(2)

(3.2x

2012E

PF

Adjusted

EBITDA)

at

close

•

Appvion employee shareholders will receive 9.6 million shares and retain

approximately

•

Earn-out shares provide significant shareholder-aligned incentive

Consideration

•

Management team led by Mark Richards, Chairman and CEO

•

Management intends to roll a substantial portion of its long-term incentive

earnings •

Board will be comprised of 9 members (6 independent directors with the remaining

representatives from Appvion and Hicks)

Management and Board

•

July 2012

Expected Closing

21

(1)

Excludes value of 3.0 million earnout shares issued in connection with the transaction. (2)

Assumes all Public Warrantholders elect for Option A of the proposed warrant amendment (as detailed on

page 29), resulting in cash proceeds used for warrant repurchases of $9.4 million (assuming

payment of $0.625 per each of 15 million outstanding public warrants at closing).

(3)

Ownership percentages are calculated as basic ownership and exclude warrants, options and

redemptions from the ownership calculation. Any redemptions by HACII shareholders would

proportionally lower HACII’s ownership percentage and raise the ownership percentage of ESOP participants.

37%

ownership

(3) |

Transaction Valuation and Ownership

Pro Forma Valuation

Pro Forma Appvion Ownership

(2)

22

Appleton

37%

HAC

Founders

Public

57%

Employees

7%

(4)

Implied Enterprise Value

684

$

Pro Forma Net Debt

(1)

(422)

Pro Forma Fully Diluted Equity Value

262

$

Fully Diluted Shares (mm)

(2)

26.3

Implied Share Price

9.95

$

Implied Multiple

(3)

2012PF

2013E

TEV / PF Adj. EBITDA

5.2x

4.9x

TEV / PF Adj. EBITDA -

CapEx

6.2x

5.4x

(1)

Assumes all Public Warrantholders elect for Option A of the proposed warrant amendment (as detailed on

page 29), resulting in cash proceeds used for warrant repurchases of $9.4 million (assuming

payment of $0.625 per each of 15 million outstanding public warrants at closing).

(2)

Excludes 1.0 million earnout shares with a strike price of $12.50 and 2.0 million earnout shares with

a strike price of $15.00 issued in connection with the transaction.

(3)

Based on PF Adj. EBITDA of $131 and $141 million and capital expenditures of $20 and $15 million in

2012E and 2013E, respectively.

(4)

Includes current and former employees.

|

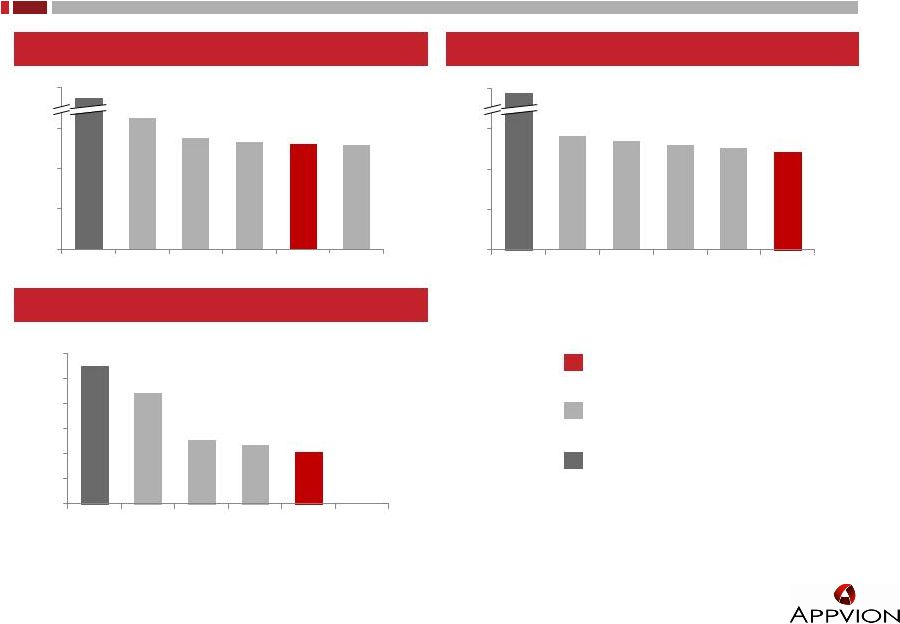

Comparable Companies –

Financial Benchmarking

Net Debt / 2012E EBITDA

23

Note: As of 6/21/2012. Comparable companies includes: Wausau Paper (WPP), Neenah

Paper (NP), Schweitzer-Mauduit (SWM) and Glatfelter Paper (GLT).

(3)

2012E EBITDA Margin %

2011A –

2013E EBITDA Growth

2012E EBITDA –

CapEx Margin %

(1)

(1)

(1)

(2)

(1)

25.1%

15.1%

14.1%

10.4%

9.0%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

SWM

APVN

NP

GLT

WPP

25.8%

11.7%

9.7%

7.2%

6.3%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

APVN

NP

WPP

GLT

SWM

12.8%

11.0%

7.7%

4.2%

NA

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

APVN

NP

WPP

GLT

SWM

3.2x

1.7x

1.3x

1.2x

0.3x

0.0x

1.0x

2.0x

3.0x

4.0x

5.0x

6.0x

APVN

NP

WPP

GLT

SWM

(1)

Based on PF Adj. EBITDA of $131 and $141 million in 2012E and 2013E, respectively. (2)

Excludes $152 million of capital expenditures related to tissue expansion. (3)

As presented in the offering contemplated herein. Assumes 0% HACII shareholder redemptions and assumes

all Public Warrant holders elect Option A (as defined on page 29) of the proposed warrant

amendment resulting in a cash use of $9.4 million at closing of the transaction.

|

Comparable Companies –

Valuation Benchmarking

24

TEV / 2012E EBITDA

(1)

Note: As of 6/21/2012. Comparable companies include Specialty Paper peers: Wausau

Paper (WPP), Neenah Paper (NP), Schweitzer-Mauduit (SWM), Glatfelter Paper (GLT) and

Specialty Chemical / Microencapsulation peers: Balchem Corp. (BCPC).

TEV / 2013E EBITDA

(1)

TEV / 2012E EBITDA -

CapEx

(1)(2)

(3)

12.8x

13.1x

14.0x

13.0x

Appvion

Specialty Paper Comparables

Specialty Chemical /

Microencapsulation Comparables

6.5x

5.5x

5.3x

5.2x

5.1x

0.0x

2.0x

4.0x

6.0x

BCPC

WPP

NP

GLT

APVN

SWM

5.6x

5.4x

5.2x

5.0x

4.9x

0.0x

2.0x

4.0x

6.0x

BCPC

WPP

NP

SWM

GLT

APVN

16.5x

13.3x

7.6x

7.0x

6.2x

NA

0.0x

3.0x

6.0x

9.0x

12.0x

15.0x

18.0x

BCPC

GLT

WPP

NP

APVN

SWM

(1)

(2)

(3)

As presented in the offering contemplated herein. Assumes 0% HACII shareholder

redemptions and assumes all Public Warrant holders elect Option A (as defined on page 29) of the

proposed warrant amendment resulting in a cash use of $9.4 million at closing of

the transaction. Based on PF Adj. EBITDA of $131 and $141 million in 2012E

and 2013E, respectively. Excludes $152 million of capital expenditures

related to tissue expansion. |

Multiple Avenues to Deliver Shareholder Value

25

Deleveraging

Story

Leading

Market

Positions in

Growth

Markets

Strong Free

Cash Flow

Technology

Innovator

Asset Light

Model

Blue Chip

Sponsor

Attractively

Priced

Proven and

Experienced

Management

Team |

Appendix |

Hicks

Equity Partners •

Led by Tom Hicks, Chairman of the Board

–

Founder of one of the most successful private investment firms with 35+ years of

private equity investing experience

•

Supported by team of experienced investment professionals who, combined with Tom

Hicks, have over 150 years of private equity and public company

experience •

Extensive relationships with other financial sponsors, management teams and

financial intermediaries

•

Raised $150 million in October 2010 for Hicks Acquisition Company II, Inc.

(“HAC II”) •

Successfully raised $552 million for Hicks Acquisition Company I, Inc. in September

2007 –

Merged with Resolute Energy in September 2009

–

One of the most successful transactions for SPACs of similar size

Blue Chip Sponsor

27 |

Sources & Uses and Historical Financial Summary

28

($ Millions)

Sources & Uses

Financial Summary

2008A

2009A

2010A

2011A

2012PF

2013E

(1)

Revenue

855

$

762

$

850

$

857

$

869

$

887

$

% Growth

NA

(10.9%)

11.6%

0.9%

1.3%

2.1%

Gross Profit

171

$

159

$

165

$

170

$

216

$

229

$

% Margin

20.1%

20.8%

19.5%

19.8%

24.9%

25.8%

Adjusted EBITDA

66

$

73

$

79

$

89

$

131

$

141

$

% Margin

7.7%

9.6%

9.3%

10.4%

15.1%

15.9%

Adjusted EBIT

13

$

17

$

30

$

41

$

91

$

98

$

% Margin

1.5%

2.2%

3.5%

4.7%

10.4%

11.1%

Capital Expenditures

(2)

95

$

25

$

18

$

16

$

20

$

27

$

% Sales

11.1%

3.2%

2.1%

1.8%

2.3%

3.0%

Sources of Funds

Cash Held in Trust

(3)

143

$

Total Sources

143

$

Uses of Funds

Cash to Balance Sheet

(4)

101

$

Warrant Repurchase

(5)

9

Change of Control Payments

(6)

13

Legal & Accounting

5

Fees, incl. ESOP Advisory

12

Other Transaction Costs

1

Total Uses

143

$

(1)

Figures do not reflect the impact of the Business Combination with Hicks Acquisition Company II, Inc. (2)

Excludes Capital Expenditures related to Domtar transaction implementation in 2012 and 2013. (3)

Based on actual cash held in trust as of April 1, 2012, net of assumed redemption of 0%. Net of

Deferred Underwriting & Selling Group fees of $6.7 million.

(4)

Assumes net proceeds from the transaction are applied as cash to balance sheet that will be utilized

for general corporate purposes and debt reduction.

(5)

Assumes all Public Warrantholders elect for Option A of the proposed warrant amendment (as detailed in

page 29), resulting in cash proceeds used for warrant repurchases of $9.4 million (assuming

payment of $0.625 per each of 15 million outstanding public warrants at closing).

(6)

Includes costs associated with existing incentive plans and necessary consents. |

•

HACII and Appvion have proposed to amend the terms of the warrant agreement to

reduce by half the number of shares of common stock of HACII issuable upon

exercise of HACII’s outstanding warrants, subject to a potential minor

adjustment as detailed under Option B •

This amendment must be approved by warrant holders who own at least 65 percent of

the outstanding public warrants

•

Public warrant holders would be able to elect one of two options:

–

Option A:

amended warrant plus cash

Each existing warrant would be amended to be exercisable for half a share (instead

of one full share), plus

Payment of $0.625 per warrant at closing

•

Economic equivalent of receiving $1.25 per foregone warrant

–

Option B:

amended warrant plus earnout share right

Each existing warrant would be amended to be exercisable for half a share (instead

of one full share), plus

Receive a right to purchase an additional 0.0879 shares per warrant

•

Exercisable at $0.0001 once the common stock has traded at $12.00 per share for a

defined period of time prior to the fifth anniversary of the closing of the

transaction In the case of Option B, the warrant holder would have the

ability to exercise one part of the warrant independently from the

other •

HACII’s founder will receive economic equivalent of Option B, but in earnout

shares that will be subject to forfeiture

•

Warrant holders who do not make an election will automatically receive Option

A •

Public election of Option B is capped at warrants exercisable for 400,000

shares Summary of Proposed Warrant Amendment

29 |

Pro Forma Adjusted EBITDA

Reconciliation 30

($ Millions)

2009

2010

2011

2012PF

2013E

(1)

(Loss)

Income

from

Continuing

Operations

Before

Income

Taxes

24

$

(35)

$

(2)

$

(103)

$

55

$

Depreciation, Amortization and Other

57

51

49

40

43

Net Interest Expense

(43)

65

61

54

48

Restructuring Expense

-

-

-

123

(5)

Net Debt Extinguishment Expense

51

7

-

-

-

Litigation Settlement, net

-

-

(23)

-

-

Foreign Exchange (Gain) Loss

(2)

1

1

-

-

Other Income

-

(1)

0

4

-

EBITDA

87

$

88

$

86

$

117

$

141

$

Environmental Insurance Expense Recovery

-

(9)

-

-

-

Debt Extinguishment Expenses

4

-

-

-

-

Alternative Fuels Tax Credit

(18)

-

-

-

-

Litigation Settlement, net

-

-

3

-

-

Domtar Suppy Agreement Run-Rate Adjustment

-

-

-

14

-

Adjusted EBITDA

73

$

79

$

89

$

131

$

141

$

(1) Represents the median of management forecast. Figures do not reflect the impact of the Business

Combination with Hicks Acquisition Company II, Inc. |