Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF KPMG LLP - MacDermid Group Inc. | d327158dex231.htm |

| EX-23.2 - CONSENT OF KPMG LLP - MacDermid Group Inc. | d327158dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 22, 2012.

Registration No. 333-175473

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 8

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MacDermid Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2890 | 45-2568333 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1401 Blake Street

Denver, Colorado 80202

(720) 479-3060

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Daniel H. Leever

Chairman and Chief Executive Officer

1401 Blake Street

Denver, Colorado 80202

(720) 479-3060

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Craig F. Arcella Kris F. Heinzelman Cravath, Swaine & Moore LLP Worldwide Plaza 825 Eighth Avenue New York, New York 10019-7475 (212) 474-1000 Fax: (212) 474-3700 |

Peter M. Labonski Keith L. Halverstam Latham & Watkins LLP 885 Third Avenue New York, New York 10022-4834 (212) 906-1200 Fax: (212) 751-4864 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be registered |

Proposed maximum offering price per share |

Proposed aggregate offering price(1)(2) |

Amount of registration fees(3) | ||||

| Common Stock, $0.01 par value per share |

$200,000,000 | $23,220 | ||||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933. |

| (2) | Does not include shares that the underwriters have the option to purchase to cover over-allotments. See “Underwriting”. |

| (3) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

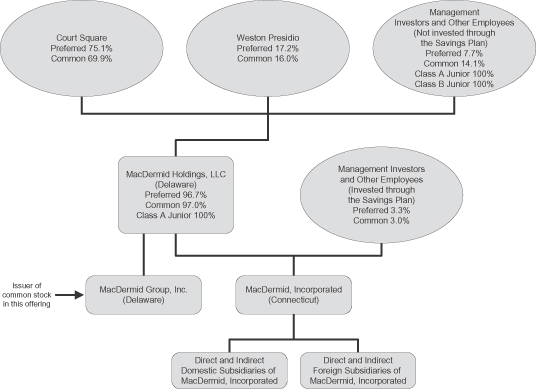

This Registration Statement on Form S-1 (this “Registration Statement”) is being filed by MacDermid Group, Inc., a newly formed Delaware corporation, in connection with a proposed registered public offering of shares of its common stock (the “Offering”). Prior to the completion of the Offering, MacDermid Group, Inc. is a direct, wholly owned subsidiary of MacDermid Holdings, LLC, which, prior to the completion of the Offering, is the holding company parent for MacDermid, Incorporated, the main U.S. operating entity for the MacDermid business and the direct or indirect parent entity of all the MacDermid operating companies.

In connection with, and immediately prior to the completion of, the Offering, MacDermid Holdings, LLC and the MacDermid, Incorporated Profit Sharing and Employee Savings Plan, which is the existing minority stockholder of MacDermid, Incorporated, will exchange the capital stock of MacDermid, Incorporated for the common stock of MacDermid Group, Inc., and MacDermid Holdings, LLC will liquidate and distribute the shares of MacDermid Group, Inc. then held by it to the holders of its membership interests. Immediately following completion of the Offering, the common stock of the registrant will be owned by (1) the entities and persons who purchase the common stock of the registrant pursuant to the Offering, (2) the MacDermid, Incorporated Profit Sharing and Employee Savings Plan and (3) the entities and persons that, immediately prior to the completion of the reorganization transactions described above, own membership units in MacDermid Holdings, LLC, which include certain affiliates and funds of Court Square Capital Partners and Weston Presidio, Daniel H. Leever, the chairman and chief executive officer of MacDermid, Incorporated, and certain other current and former members of the management of the MacDermid business.

See “The Corporate Reorganization” in the prospectus that forms a part of this Registration Statement for additional information regarding the corporate structure of the MacDermid entities.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 22, 2012

Shares

MacDermid Group, Inc.

Common Stock

This is the initial public offering of our common stock. We are selling shares of common stock. Prior to this offering, there has been no public market for our common stock. The initial public offering price of our common stock is expected to be between $ and $ per share. We have applied to list our common stock on the New York Stock Exchange under the symbol “MRD”.

Prior to the completion of this offering, the existing stockholders of MacDermid, Incorporated will exchange the capital stock of that entity for our common stock, and our parent entity will liquidate and distribute the shares of our common stock it then holds to the holders of its membership interests. These transactions will result in our holding all of the outstanding capital stock of MacDermid, Incorporated, the main U.S. operating entity for the MacDermid business and the direct or indirect parent entity of all the MacDermid operating companies. See “The Corporate Reorganization” for further information.

The underwriters have a 30-day option to purchase a maximum of additional shares to cover over-allotments of shares.

We are an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for future filings. Investing in our common stock involves risks. See “Risk Factors” beginning on page 18.

| Price to Public |

Underwriting |

Proceeds, before | ||||

| Per Share |

$ | $ | $ | |||

| Total |

$ | $ | $ |

Delivery of the shares of our common stock will be made on or about , 2012.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Credit Suisse | Morgan Stanley | Deutsche Bank Securities |

Lazard Capital Markets

| Stifel Nicolaus Weisel | Oppenheimer & Co. | RBC Capital Markets |

The date of this prospectus is , 2012.

Table of Contents

Table of Contents

| 1 | ||||

| 18 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 44 | ||||

| 45 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

48 | |||

| 90 | ||||

| 104 | ||||

| 110 | ||||

| 117 | ||||

| 121 | ||||

| 122 | ||||

| DESCRIPTION OF CERTAIN INDEBTEDNESS OF MACDERMID , INCORPORATED |

126 | |||

| 130 | ||||

| MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS FOR NON-U.S. STOCKHOLDERS |

132 | |||

| 135 | ||||

| 139 | ||||

| 139 | ||||

| 139 | ||||

| F-1 |

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

Dealer Prospectus Delivery Obligation

Until , 2012 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The principal executive offices of MacDermid Group, Inc. are located at 1401 Blake Street, Denver, Colorado 80202, and the telephone number at this address is (720) 479-3060. Our website address is www.macdermid.com. Information on, or accessible through, our website is not a part of, and will not be deemed to be incorporated into, this prospectus or the registration statement of which this prospectus forms a part. Investors should not rely on any such information in deciding whether to purchase our common stock.

i

Table of Contents

The following summary highlights certain information contained elsewhere in this prospectus. It does not contain all of the information that may be important to you in making an investment decision. You should read this entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors” and the financial data and related notes included elsewhere in this prospectus, before making a decision to invest in our common stock.

Our Company

We are a global producer of high technology specialty chemical products and provider of technical services with a proven track record of success and innovation spanning our 90-year history. Our business involves the manufacture of a broad range of specialty chemicals, which we create by blending raw materials, and the incorporation of these chemicals into multi-step technological processes. These specialty chemicals and processes together encompass the products we sell to our customers in the electronics, metal and plastic plating, graphic arts, and offshore oil production and drilling industries. We refer to our products as “dynamic chemistries” due to their delicate chemical compositions, which are frequently altered during customer use. Our dynamic chemistries are used in a wide variety of attractive niche markets, and based on 2011 net sales, we believe that the majority of our operations hold leading positions in the product markets they serve, including, with respect to Electronic Solutions and Industrial Solutions, the number one or number two market share positions in the product markets they serve.

We generate revenue through the manufacture and sale of our dynamic chemistries and by providing highly technical post-sale service to our customers through our extensive global network of specially trained service personnel. Our personnel work closely with our customers to ensure that the chemical composition and function of our dynamic chemistries are maintained as intended. Among the more than 3,500 customers that we served as of December 31, 2011 are some of the world’s preeminent companies, such as LG, Molex, Samsung, FIAT, Ford, GM, Stanley Black & Decker and major companies in the offshore oil and gas industries. We believe that we are able to service our customers and attract new customers successfully through our extensive global network of 14 manufacturing sites and 21 technical service facilities, including 8 research and development centers, in 24 countries.

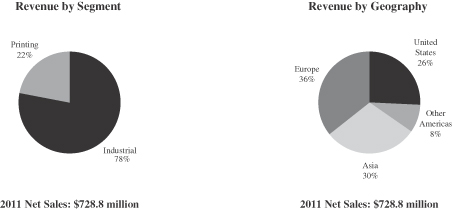

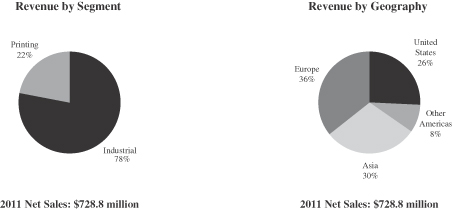

For the 12 months ended December 31, 2011, we generated net sales, operating profit, net income attributable to MacDermid, Incorporated and Adjusted EBITDA of $728.8 million, $55.9 million, $1.0 million and $151.7 million, respectively, and for the three months ended March 31, 2012, we generated net sales, operating profit, net income attributable to MacDermid, Incorporated and Adjusted EBITDA of $182.2 million, $27.1 million, $4.9 million and $38.5 million, respectively. For a reconciliation of net income (loss) attributable to MacDermid, Incorporated to Adjusted EBITDA, see “—Summary Consolidated Financial Data” and the footnotes contained therein.

We dedicate extensive resources to research and development and highly technical, post-sale customer service, while limiting our investments in fixed assets and capital expenditures. We refer to this approach as our “asset-lite, high-touch” business model, which emphasizes the “bookends” of our operations—innovation and technical service. As of March 31, 2012, approximately 1,000 of the approximately 2,100 people we employed were research and development chemists and experienced technical sales and service personnel. We believe that our business model enables us to focus on high growth market opportunities, maintain high margins and a high return on invested capital, and generate stable and strong cash flows. Given that our annual capital expenditures have been consistently less than 2% of our annual net sales, we believe that our cash conversion rate (the proportion of our profits converted into cash flow) is higher than a majority of the companies in our sector.

Our businesses are benefiting from global growth trends in many of our end markets, including the increasing use of electronic devices such as mobile phones and computers, growth in worldwide automotive production and increasing oil production from offshore, sub-sea wells. In addition, over the last several years, we have increased

1

Table of Contents

our focus on growth in emerging markets. In 2011, approximately 37% of our net sales, approximately 37% of our gross profit and approximately 41% of our Adjusted EBITDA was generated in Asia (predominately in the greater China region) and Brazil as compared with approximately 36% of our net sales, approximately 36% of our gross profit and approximately 45% of our Adjusted EBITDA in 2009 in the same regions. We believe that we are also effectively expanding the existing market for our dynamic chemistries by developing new applications within our existing markets. These new applications include: surface coatings for solar panels, plated antennas for smart mobile devices, flexographic plates for printing consumer packaging materials, decorative components for automobile interiors and control system fluids used to prevent oil from seeping from ocean floor valves.

On April 12, 2007, MacDermid, Incorporated, the direct or indirect parent entity of all the MacDermid operating companies and a publicly traded company since 1966, was acquired by a group led by our chairman and chief executive officer, Daniel H. Leever and certain funds of Court Square Capital Partners and Weston Presidio. In connection with that acquisition, the common stock of MacDermid, Incorporated ceased to be listed on the New York Stock Exchange.

Our Businesses

We report our business in two operating segments: an Industrial segment and a Printing segment. In the fiscal year ended December 31, 2011, our Industrial and Printing segments generated net sales of $568.6 million and $160.2 million, respectively. For the three months ended March 31, 2012, our Industrial and Printing segments generated net sales of $140.5 million and $41.7 million, respectively.

Industrial—The Industrial segment supplies technological solutions and dynamic chemistries used for finishing metals and non-metallic surfaces for automotive and other industrial applications, electro-plating metal surfaces, manufacturing circuit boards and other electronic devices for the electronics industry, fluids for the offshore oil and gas markets and specialty coated industrial films. As the regional sales mix in this segment has shifted over the past several years from more industrialized nations towards emerging markets, such as Asia and South America, we have invested significantly in these regions, including developing state-of-the-art facilities in Suzhou, China, and São Paulo, Brazil, to better serve our customers there. We have over 600 personnel and three manufacturing facilities in Asia and remain focused on further increasing our presence in the region.

The Industrial segment is composed of the following three businesses:

Electronic Solutions. We believe we are one of the leading global suppliers of chemical compounds to the printed circuit board fabrication industry based on our 2011 net sales. In this business, we design and formulate a complete line of proprietary “wet” dynamic chemistries that our customers use to process the surface of the printed circuit boards and other electronic components they manufacture. Our product portfolio in this business is focused on niches such as final finishes, through hole metallization and circuit formation, in which we are a small cost to the overall finished product, but a critical component for maintaining the products’ performance. Growth in this business is driven by demand in telecommunication, wireless devices and computers, and the increasing use of electronics in automobiles.

Industrial Solutions. We believe that we have a leading position worldwide in industrial metal and plastic finishing chemistries based on 2011 net sales. In this business, our dynamic chemistries are used for finishing, cleaning and providing surface coatings for a broad range of metal and non-metal surfaces. These coatings may have functional uses, such as improving wear and tear or providing corrosion resistance for appliance parts, or decorative uses, such as providing gloss finishes to components used in automotive interiors. As of December 31, 2011, we manufactured more than 1,000 chemical compounds for these surface coating applications, including cleaning, activating, polishing, electro and electroless plating, phosphatizing, stripping and coating, anti-tarnishing and rust inhibiting for metal and plastic surfaces. Growth in this business is primarily driven by increased world-wide automobile production and demand for appliances, computers and general engineering hardware.

2

Table of Contents

Offshore Solutions. We produce water-based hydraulic control fluids for major oil companies and drilling contractors for offshore deep water production and drilling applications. Production fluids are used in the control systems that open and close critical valves for the deep water oil extraction and transportation process. Drilling fluids are used in control systems to operate valves on the ocean floor. We believe there is significant growth potential for this business as the oil and gas industry continues to grow, as evidenced by the $66.5 billion of capital that is forecasted to be spent globally by deep oil and gas producers from 2011 through 2016, a 109% increase over the prior five-year period, and as oil is produced from new sub-sea wells.

Printing—Through the Printing segment, we supply an extensive line of flexographic plates that are used in the commercial packaging and commercial printing industries. We manufacture photopolymers used to produce printing plates for transferring images onto commercial packaging, including packaging for consumer food products, pet food bags, corrugated boxes, labels and beverage containers. In addition, we also produce photopolymer printing plates for the flexographic and letterpress newspaper and publications markets. Our products are used to improve print quality and printing productivity. The growth in this segment is driven by consumer demand and advertising.

Our Competitive Strengths

We believe that the following are our key competitive strengths:

Leading Market Position in Attractive Niche Markets. We believe, based on our 2011 net sales, that a majority of our operations hold leading positions in the product markets they serve, including the number one or number two market share positions held by Electronic Solutions and Industrial Solutions in the product markets they serve. We also believe that the combination of our global presence, history of innovation, process know-how, strong commitment to research and development, dedication to customer service and broad range of proprietary products distinguishes us from our competitors, allowing us to maintain our leading market share positions. Furthermore, we believe the diversity of the niche markets we serve will enable us to continue our growth throughout economic cycles and mitigate the impact of a downturn in any single market.

Proprietary Technology and Service Oriented Business Model. Our commitment to technological innovation and our extensive intellectual property portfolio of over 750 issued patents enables us to develop our cutting-edge products. In order to continue to provide innovative products and highly technical service to our customers, we place a premium on maintaining a specialized and qualified employee base. Our global sales and service personnel possess extensive knowledge of and experience in our local markets. For instance, our technical management team serving our Asian markets has, on average, over 20 years of experience, including decades of joint product development with our key customers located in the greater China region. We believe that our proprietary technology, extensive industry experience and customer service-focused business model are difficult for our competitors to replicate. As a result, and in order to avoid the transition risks that go along with switching suppliers, customers elect not to switch from our products to those of our competitors. Switching suppliers generally does not make sense for our customers from a cost-benefit standpoint: the cost of our products is low relative to the potential cost savings, as switching expenses (including conducting expensive trials to ensure quality assurance and compliance with regulatory requirements, industry standards and internal protocols) can be significant.

The key role our products play in improving the efficacy of our customers’ manufacturing processes and reducing their total costs, combined with our extensive experience in local markets, our focus on highly technical customer service and the significant customer switching risks and costs inherent in our industry, have enabled us to establish and maintain our long-term customer relationships. We leverage these close relationships to identify opportunities for new products and position our portfolio of products within the ever-changing business environment.

3

Table of Contents

Track Record of Targeted Growth. We have a demonstrated history of achieving targeted growth by expanding into new, fast-growing geographic markets, generating growth in our higher margin businesses and enhancing our product offerings by drawing on our core competencies to extend our existing technologies into adjacent markets. We believe that the experience and knowledge gained through our history of innovation and track record of successfully entering new markets enables us to identify and capitalize on future growth opportunities.

| • | We have, for example, grown our presence in emerging markets (specifically Asia (predominately in the greater China region) and Brazil), as demonstrated by the increase in net sales in these markets to 37% of total net sales in 2011 as compared to 36% of total net sales in 2009. We have updated facilities and increased headcount to expand our operations in the greater China region, which is now home to three state-of-the-art facilities and 600 employees. We are focused on continuing to increase our presence in emerging markets. |

| • | We generated 78% of our 2011 net sales from our higher growth, higher margin Industrial segment, compared to 61% of our net sales in 2005. |

| • | We have significantly expanded our Offshore Solutions business over the last six years, representing a 2005-2011 net sales compound annual growth rate of over 12%. |

Strong Free Cash Flow Generation. Our high gross profit margins, combined with the low capital expenditure requirements and low fixed cost structure that result from our “asset-lite, high-touch” business model, allow us to generate strong free cash flow through all economic cycles. Our fixed asset base is modern and well-maintained and, accordingly, requires low, and often discretionary, capital expenditures. Our fixed manufacturing costs during 2011 were approximately 11% of our 2011 net sales, and our maintenance capital expenditures, which are capital expenditures made to upgrade our existing assets, during 2011 were approximately 0.6% of our 2011 net sales. Our business model has allowed us to generate free cash flow even during economic downturns, including the global economic downturn that began in 2008. For example, in the year ended December 31, 2009, we generated $49.0 million in net cash flows provided by operating activities, and we used $6.5 million for capital expenditures and received $2.6 million of proceeds from the disposition of fixed assets.

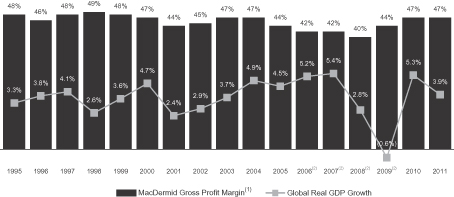

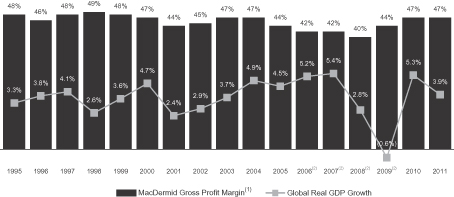

Our key proprietary technology, service oriented business model and the high costs our customers would incur to switch suppliers have allowed us to achieve stable, industry-leading margins throughout our history and have protected our market share. The following chart highlights the stability of our margins since 1995:

Stable Financial Performance Through Economic Cycles

| (1) | Gross profit is defined as net sales minus cost of sales. The percentages represent gross profit margin, which is defined as gross profit divided by net sales. Gross profit for years 1995 to 2000 is for fiscal years ending March 31. |

| (2) | Gross profit margins are net of discontinued operations. |

4

Table of Contents

Customer, Product, Application, End-Market and Geographic Diversity. We offer a broad range of products and services to diverse end markets, ranging from electronics to printing to offshore oil drilling. As of December 31, 2011, we served more than 3,500 customers globally, with no single customer accounting for more than 3% of our 2011 net sales. We have a significant presence in the rapidly growing Asian and Brazilian markets, with approximately $269 million in 2011 net sales to customers in those regions. In addition, each of our product lines serves numerous and often unrelated end markets. Our customer, product and geographic diversity help to mitigate the effects of any adverse event affecting a specific industry, end market or region.

Limited Raw Material Concentration and Low Exposure to Energy Prices. We use in excess of 1,000 chemicals as raw materials in the manufacture of our proprietary products, with no single raw material representing more than 3% of our cost of sales in 2011. Further, the raw materials that are of greatest importance to our global operations are, in most cases, obtainable from multiple sources worldwide. In addition, energy costs, which have historically been volatile, only represented approximately 2% of our cost of sales in 2011.

Experienced Management Team with Significant Equity Investment. Our senior management team is led by Daniel H. Leever, our chairman and chief executive officer, who has approximately 31 years of experience with the MacDermid business and has been our chief executive officer since 1990. Our senior management team comprised of our executive officers and our divisional business managers has, on average, 29 years of industry experience and 18 years of experience with our company. Our management has been responsible for successfully implementing a number of strategic initiatives designed to enhance growth, improve productivity, reduce costs and expand margins. We believe that our employee ownership, stemming from our history as an employee-owned company including through our profit sharing and employee savings plan, and use of a variable compensation structure has allowed us to maintain throughout our history an “owner mentality” among our workforce that has proven instrumental to our success.

Our Business Strategy

Our business strategy is focused on maximizing cash flow through our “asset-lite, high-touch” business model with continued emphasis on the “bookends” of our operations—innovation and technical service. Building on our competitive strengths, we intend to continue to grow our business, improve profitability and strengthen our balance sheet by pursuing the following integrated strategies:

Build Our Core Businesses. We believe that we can capitalize on our technical capabilities, sophisticated process know-how, strong customer relationships and deep industry knowledge to enhance growth and generate significant free cash flow.

| • | Extend Product Breadth: We intend to extend many of our product offerings through the development of new applications for our existing products in our existing markets. For example, we are extending our |

5

Table of Contents

| capabilities for films used in in-mold decoration for high-end automotive interiors to exteriors and other applications. We are also leveraging our capabilities in plating technology in printed circuits and automotive applications to meet the emerging technological and environmental needs of our customers. |

| • | Continue to Grow Internationally with Our Customers: We intend to continue to grow internationally by expanding our product sales to our existing multinational customers as they penetrate emerging regions. We continue to make investments, especially in technical staff, in high-growth markets such as the greater China region and Brazil in order to better service our customers. |

Leverage our Capabilities to Grow into New Markets and Applications. Building on our core competencies in product innovation, applications development and technical services, we intend to expand into new high-growth markets and extend our existing technologies to develop new products for new applications in markets that are adjacent to those we currently serve. Examples of our initiatives include:

| • | Plating for Solar Cell Metallization: We are developing a chemistry solution using light-induced, electroless silver technology to enhance the conductivity and reduce the usage of screened silver paste on solar cells that will result in a higher manufacturing yield from such solar cells at a lower cost to our customers. In the longer term, we believe that we can extend our technology to create a new way of manufacturing crystalline silicon solar cells and eliminate the need for silver paste. |

| • | Plating for Molded Interconnect Devices: We are extending our “plating on plastics” technology into antenna manufacturing for smartphones. We believe that our technology results in a higher manufacturing yield and lower cost to our customers. We believe that we increased our market share in this product in 2011. |

| • | Light-Emitting Diode (LED) Lighting Market: We are developing products for thermal management systems and using silver as a wire-bondable and reflective finish option to enhance energy conversion into light. |

| • | High Value PET Recycling: As worldwide demand for recycled polyethylene terephthalate (PET) grows, we are leveraging our strong position in Europe for specialized cleaners and defoamers that are used in recycling plastic products made of PET to expand that business globally, especially in emerging markets such as the greater China region and South America. Our specialized cleaners and defoamers enable recycled PET to be used in higher value applications such as bottle resin. |

| • | Digital Flexographic Printing: We have developed an innovative LUX® process, which uses a flat top dot processing technology that significantly increases the quality and consistency of the printed image from a flexographic printing plate in a manner that is more efficient and cost effective for our customers. |

| • | Metals: We believe the metals industry presents an opportunity to introduce new products, and extend existing products, in an adjacent market. We define the metals industry as flat-rolled steel producers and processors, aluminum producers (including can making), and tube and pipe extruding. We have been successful at penetrating the steel market with our tin plating chemistries, including cleaners and passivates. We have hired specialists in rolling lubricants and metal pre-treatment with the expectation of rapid expansion of our business in this market. We believe the addressable market for metals is over $750 million. |

Maintain Our Technology Leadership Position. Our continued success in product innovation and applications development is a result of our focused commitment to technology research and development. This commitment has historically allowed us to sustain and enhance growth and profitability and further penetrate our target markets, including our existing customer base. Because the highly technical service we provide to our customers is an integral part of their successful use of our products, our service personnel become well acquainted with our customers. These close customer relationships enable us to identify and forecast the needs of our customers and draw upon our intellectual property portfolio and technological expertise to create new products.

6

Table of Contents

Continue to Pursue Operational Efficiencies. We consistently focus on opportunities to reduce operating expenses through facility optimization, product and raw material rationalization and by maintaining a relatively low fixed cost structure that supports our growth strategy. In 2009, during the economic crisis, we permanently reduced costs by over $40 million annually by closing certain manufacturing facilities and executing a series of operational restructuring initiatives that streamlined our organizational structure and reduced our workforce in our manufacturing and general and administrative functions. These cost reductions resulted in an increase in our Adjusted EBITDA margin for 2011 by over 48.1% compared to 2009. Net income attributable to MacDermid, Incorporated was $1.0 million in 2011 compared to a net loss attributable to MacDermid, Incorporated of $82.8 million in 2009. For a reconciliation of net income (loss) attributable to MacDermid, Incorporated to Adjusted EBITDA, see “—Summary Consolidated Financial Data” and the footnotes contained therein. Our operational restructuring initiatives were primarily responsible for an increase in our gross profit margin percentage from 43.8% for the year ended December 31, 2009 to 46.7% for the year ended December 31, 2011, representing a 6.6% increase.

Maximize Cash Flow. Our ability to maintain strong cash flows results from our business model and growth strategies. Historically, we have been able to generate significant cash flow as a result of the low capital expenditure requirements and low fixed cost structure that result from our “asset-lite, high-touch” business model and by focusing on growing our higher margin businesses. We intend to continue to focus on maximizing our cash flow because it enables us to further invest in our business, reduce our debt and provide value to our stockholders.

Focus on Human Capital. The success of our business depends on our ability to continue to capitalize on our technical capabilities, unique process know-how, strong customer relationships and industry knowledge. Our technical expertise and history of innovation reflect the specialized and highly skilled nature of our research and development personnel. Our strong customer relationships and familiarity with our local markets result from the work of our highly talented and experienced sales and service personnel. As such, we intend to continue to focus on attracting, retaining and developing the best human talent across all levels of our organization, which is key to our ability to successfully operate and grow our business.

Risks Related to Our Business

Investing in our common stock involves substantial risk, and our ability to successfully operate our business is subject to numerous risks, including those that are generally associated with our industry. Any of the risks set forth in this prospectus under the heading “Risk Factors” may limit our ability to successfully execute our business strategy. Some of the principal challenges or risks facing the company include, among others:

| • | Our products are sold in industries that are sensitive to general economic conditions. If there are delays or reductions in the purchasing of our customers’ products as a result of economic downturns, demand for our products and services would decline, and our net sales would be adversely affected. |

| • | Our business model is focused on limiting investments in fixed assets and capital expenditures. However, the markets for our proprietary technology and our customers’ needs are frequently changing, which makes it difficult for us to forecast the need for increases in capital expenditures and assets. If we do elect to increase capital expenditures, but such expenditures and any costs incurred as a result of a more capital-intensive asset base are not offset by increases in net sales, our business and financial condition may be harmed. |

| • | Our industry is intensely competitive, and some of our competitors may have greater financial, technical and marketing resources than we do and may devote greater resources to promoting and selling certain products. If we do not develop and deploy new cost effective products, processes and technologies on a timely basis and adapt to changes in our industry and the global economy, our reputation may be harmed, we may lose customers and our market share may decline. |

7

Table of Contents

| • | We have substantial international operations, and our operational success depends on our ability to adapt to and prevail in different legal, regulatory, economic, social and political conditions. Further, the success of our business in emerging markets requires us to respond effectively to rapid changes in conditions in these countries. |

| • | Our proprietary technology is critically important to our business, and the failure of our patents, applicable intellectual property law or our confidentiality agreements to protect our intellectual property and other proprietary information could significantly harm our ability to compete in our industry and could materially adversely affect our business and results of operations. |

| • | Our business is subject to various governmental regulations and laws, compliance with which may cause us to incur significant expenses, and if we fail to maintain satisfactory compliance with certain regulations, we could be subject to civil or criminal penalties. |

| • | We are focused on research and development and on highly technical customer service and, accordingly, we rely on our ability to attract and retain skilled employees. The departure of certain key personnel could have an adverse impact on our operations, including, for example, as a result of customers choosing to follow a regional manager to one of our competitors. |

| • | We have a substantial amount of indebtedness, which could adversely affect our financial position. |

In addition to the foregoing, you should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific risks set forth in this prospectus under the heading “Risk Factors” in deciding whether to invest in our common stock.

8

Table of Contents

Corporate Information

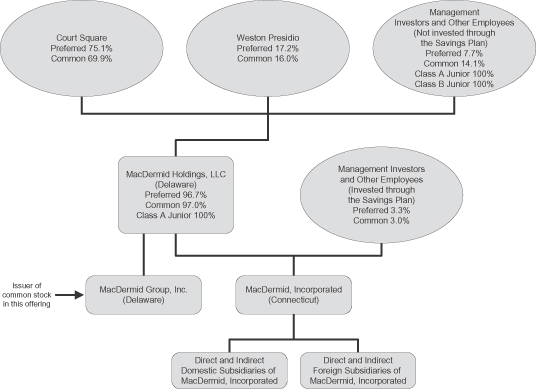

MacDermid Group, Inc. was incorporated in Delaware on June 17, 2011. In connection with, and immediately prior to the completion of, this offering, the existing shareholders of MacDermid, Incorporated will exchange the capital stock of MacDermid, Incorporated for the common stock of MacDermid Group, Inc., and MacDermid Holdings, LLC will liquidate and distribute the shares of MacDermid Group, Inc. then held by it to the holders of its membership interests. Prior to the completion of this offering, MacDermid Group, Inc. is a direct, wholly owned subsidiary of MacDermid Holdings, LLC and has no material assets. The diagram below illustrates our corporate structure immediately prior to the consummation of this offering and reflects actual ownership as of March 31, 2012, giving effect to the cancellation of all treasury shares.

9

Table of Contents

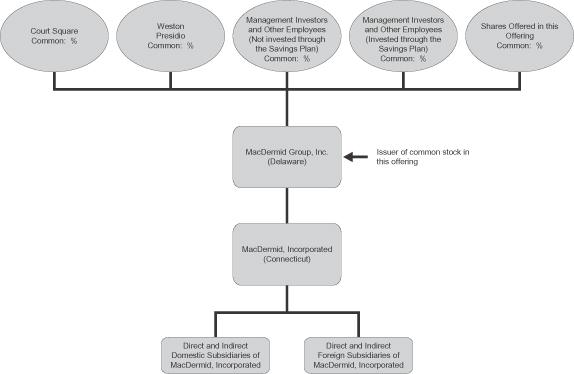

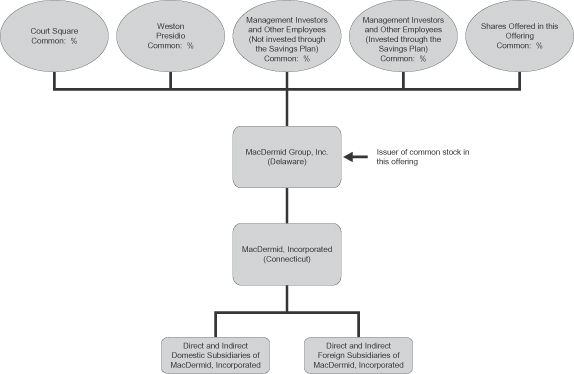

Following the completion of this offering, MacDermid Group, Inc. will be a holding company with no material assets other than its direct 100% ownership interest in MacDermid, Incorporated, which is the main U.S. operating entity for the MacDermid business and the direct or indirect parent entity of all the MacDermid operating companies. The diagram below illustrates our corporate structure immediately following completion of this offering (and assumes a public offering price of $ (the midpoint of the range set forth on the cover of this prospectus)):

Please refer to “The Corporate Reorganization” for additional information about the corporate structure of the MacDermid entities.

Assuming a public offering price of $ (the midpoint of the range set forth on the cover of this prospectus), immediately following the completion of this offering, Court Square will own % and Weston Presidio will own % of our common stock, or % and % of our common stock, respectively, if the underwriters exercise their over-allotment option in full. Accordingly, we will be a “controlled company” within the meaning of the New York Stock Exchange corporate governance standards. As our largest stockholder, Court Square will exercise significant influence over all matters requiring stockholder approval, and Court Square and Weston Presidio collectively will control all matters requiring stockholder approval, including the election of directors, amendment of our certificate of incorporation and approval of significant corporate transactions.

MacDermid, Incorporated

MacDermid, Incorporated, the main U.S. operating entity for the MacDermid business and the direct or indirect parent entity of all the MacDermid operating companies, was established in Waterbury, Connecticut in 1922. On May 9, 1966, shares of MacDermid, Incorporated common stock were registered for trading. From June 22, 1966 to February 8, 1971, the shares traded on the over-the-counter system of trading and from February 8, 1971, when the NASDAQ stock exchange began trading, to February 25, 1998, the shares traded on

10

Table of Contents

the NASDAQ stock exchange. From February 26, 1998 to April 12, 2007, shares of MacDermid, Incorporated traded on the New York Stock Exchange under the symbol “MRD”. On April 12, 2007, MacDermid, Incorporated was acquired by MDI Holdings, LLC, an entity formed by Court Square, Weston Presidio and Daniel H. Leever, our chairman and chief executive officer. MDI Holdings, LLC was the predecessor entity to MacDermid Holdings, LLC.

Principal Stockholders

Court Square Capital Partners

Court Square Capital Partners was formed in 2006 when the entire investment team of Citigroup Venture Capital spun out to form a new entity. Court Square Capital Partners manages investment funds with over $5 billion of assets, including Court Square Capital Partners I, LP and Court Square Capital Partners II, LP. Since 1969, Court Square Capital Partners and its predecessor, Citigroup Venture Capital, have closed over 250 transactions, including investments in Southern Graphics, Fairchild Semiconductor, Intersil, Euramax, Polyfibron Technologies, Triumph Group, Worldspan, Mohawk Carpet, Plantronics and York International. Court Square Capital Partners has a long standing relationship with the company. Joseph M. Silvestri, a managing partner of Court Square Capital Partners II, L.P., has been a director of MacDermid, Incorporated since 1999.

Assuming a public offering price of $ (the midpoint of the range set forth on the cover of this prospectus), immediately following the completion of this offering, Court Square will own approximately %, or % if the underwriters exercise their over-allotment option in full, of the aggregate outstanding common stock of MacDermid Group, Inc.

Weston Presidio

Weston Presidio, founded in 1991, is a private equity firm that has managed five investment funds aggregating over $3.3 billion of assets. The firm focuses its investment activities on growth companies in the consumer, business services and industrial growth sectors. With offices in Boston and San Francisco, Weston Presidio targets middle-market opportunities primarily in the United States. Assuming a public offering price of $ (the midpoint of the range set forth on the cover of this prospectus), immediately following the completion of this offering, Weston Presidio will own approximately %, or % if the underwriters exercise their over-allotment option in full, of the aggregate outstanding common stock of MacDermid Group, Inc.

Our Stockholder Philosophy

In addition to our long heritage of innovation and product leadership, we believe that certain principles dictate our relationship with our stockholders. Chief among these core business principles are the following:

| • | We believe our relationship with our employees is fundamental to our ability to compete effectively. Much of our ability to compete revolves around our employees’ ability to invent new products and supply sales and service support to our customers. Approximately 50% of our employees are involved in these functions. As a result, we believe it is imperative that we continue policies that reward long tenure. |

| • | We develop new products and enter adjacent markets often involving multiyear horizons. We are committed to pursuing these opportunities even if short-term results are affected. |

| • | We focus on building intrinsic value. We place emphasis on strategic growth in targeted focus areas. We measure intrinsic value, the present value of future cash flows, on a per share basis. We believe important factors in our ability to maintain and increase intrinsic value are relatively high margins and a low cost structure. |

| • | We are dedicated to maintaining a conservative investment approach and our belief that the return of capital through stock repurchases and dividends can be the most attractive use of capital. |

11

Table of Contents

| • | We are committed to high standards of personal and corporate ethics and responsibility. |

| • | We hold a conviction that frequent, candid and reliable communications by our management are key to a successful relationship with our stockholders. We believe that, given the complex and unpredictable nature of the factors that drive demand for our products, it is not in the best interests of our stockholders for us to provide quarterly or annual “guidance” regarding future operating results. |

We believe that the relationship between our company and our stockholders should be a partnership between like-minded parties, who are committed to these core principles while working toward a common goal. We hope that the individuals and entities purchasing our common stock in this offering will consider their investment in our common stock as a significant part of their long-term investment portfolio. Ideally, our stockholders will be individuals and entities that:

| • | recognize that investing in our common stock is tantamount to acquiring a portion of our business and, accordingly, develop and maintain a comprehensive understanding of our company and the characteristics that differentiate us from our competitors; and |

| • | desire an active role in exercising their rights as stockholders, including by voting their shares of common stock at our stockholder meetings and by reaching out to our management team when questions about our company or its operations arise. |

Terms Used in This Prospectus

Except where the context otherwise requires or where otherwise indicated, all references herein to (a) the “company”, “we”, “us” and “our” refer to, prior to the completion of this offering, MacDermid, Incorporated and its consolidated subsidiaries and, after the completion of this offering, MacDermid Group, Inc. and its consolidated subsidiaries (which will include MacDermid, Incorporated); (b) “Court Square” refer to the affiliates and funds of Court Square Capital Partners that, prior to the completion of this offering, hold membership interests in MacDermid Holdings, LLC and, following the completion of this offering, will own common stock of MacDermid Group, Inc.; and (c) “Weston Presidio” refer to Weston Presidio V, L.P. and its affiliates that, prior to the completion of this offering, hold membership interests in MacDermid Holdings, LLC, and, following the completion of this offering, will own common stock of MacDermid Group, Inc. References herein to “MacDermid Holdings, LLC”, “MacDermid Group, Inc.” and “MacDermid, Incorporated” refer only to each such entity and not to any of its subsidiaries.

Industry and Market Data

We obtained the industry, market and competitive position data described or referred to throughout this prospectus from our own internal estimates and research as well as from industry and general publications and research, surveys and studies conducted by third parties. Prismark Partners LLC is the primary source for our third-party data and forecasts relating to our Electronic Solutions business.

Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable. While we believe our internal company estimates and research are reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source.

MacDermid®, LUX® and the MacDermid logo are our trademarks. Brand names, trademarks, service marks and trade names of other companies and organizations used in this prospectus are for informational purposes only and may be the property of their respective owners.

12

Table of Contents

THE OFFERING

| Common stock offered by us |

shares |

| Common stock to be outstanding after this offering |

shares |

| Over-allotment option |

The underwriters have an option to purchase a maximum of additional shares of common stock from us to cover over-allotments. The underwriters could exercise this option at any time within 30 days from the date of this prospectus. |

| Use of proceeds |

We intend to use the net proceeds from this offering to repay, redeem or repurchase a portion of MacDermid, Incorporated’s outstanding indebtedness and to pay certain fees and expenses as set forth under “Use of Proceeds”. |

| Dividend policy |

We intend to pay quarterly cash dividends in an amount equal to $ per share following completion of this offering. Whether we will do so, however, and the timing and amount of those dividends, will be subject to approval and declaration by our board of directors and will depend on a variety of factors, including the financial results, cash requirements and financial condition of the company, our ability to pay dividends under the agreement governing our senior secured credit facilities, the indenture governing our senior subordinated notes and any other applicable contracts, and other factors deemed relevant by our board of directors. |

| Because MacDermid Group, Inc. is a holding company, its cash flow and ability to pay dividends are dependent upon the financial results and cash flows of MacDermid, Incorporated and its subsidiaries and the distribution or other payment of cash to MacDermid Group, Inc. in the form of dividends or otherwise. |

| Risk factors |

Investing in our common stock involves a high degree if risk. See “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Proposed New York Stock Exchange symbol |

“MRD” |

Unless otherwise indicated, the number of shares of common stock that will be outstanding after this offering:

| • | assumes the consummation of the Corporate Reorganization, which will be a condition to the consummation of this offering; |

| • | excludes approximately shares of our common stock that will be reserved for issuance under our compensation plans following the Corporate Reorganization; |

| • | assumes no exercise of the underwriters’ over-allotment option to purchase additional shares of our common stock; and |

| • | assumes the initial offering price will be $ per share (the midpoint of the range set forth on the cover of this prospectus). |

13

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

MacDermid Group, Inc. was incorporated in Delaware on June 17, 2011. Prior to the completion of this offering, MacDermid Group, Inc. will have no material assets. Following the completion of this offering, MacDermid Group, Inc. will own all of the outstanding capital stock of MacDermid, Incorporated, which is the main U.S. operating entity for the MacDermid business and the direct or indirect parent entity of all the MacDermid operating companies, and the consolidated financial statements of MacDermid Group, Inc. will reflect the assets, liabilities and results of operations of MacDermid, Incorporated and its subsidiaries. Accordingly, the following table sets forth the summary consolidated financial data of MacDermid, Incorporated and its subsidiaries for the years ended December 31, 2011, 2010 and 2009 and as of December 31, 2011 and 2010, which have been derived from the audited financial statements included elsewhere in this prospectus. The following table also presents the summary consolidated financial data of MacDermid, Incorporated and its subsidiaries for the three months ended March 31, 2012 and 2011 and as of March 31, 2012, which have been derived from the unaudited financial statements included elsewhere in this prospectus. The unaudited financial statements have been prepared on the same basis as the audited financial statements and, in the opinion of our management, include all adjustments, including normal recurring adjustments, necessary for a fair presentation in all material respects of the information set forth therein. Results for any historical period are not necessarily indicative of results for any future period.

This summary consolidated financial data should be read in conjunction with, and is qualified by reference to, “Use of Proceeds”, “Capitalization”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and notes thereto included elsewhere in this prospectus.

| Year ended December 31, | Three months ended March 31, |

|||||||||||||||||||

| 2011 | 2010 | 2009 | 2012 | 2011 | ||||||||||||||||

| (amounts in thousands) | (unaudited) | |||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 728,773 | $ | 694,333 | $ | 594,153 | $ | 182,195 | $ | 178,521 | ||||||||||

| Cost of sales |

388,298 | 371,223 | 333,963 | 95,884 | 94,980 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

340,475 | 323,110 | 260,190 | 86,311 | 83,541 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Selling, technical and administrative |

185,649 | 179,786 | 156,508 | 45,746 | 45,629 | |||||||||||||||

| Research and development |

22,966 | 21,005 | 20,103 | 6,718 | 5,359 | |||||||||||||||

| Amortization |

28,578 | 29,694 | 29,868 | 6,655 | 7,362 | |||||||||||||||

| Restructuring(1) |

896 | 6,234 | 4,228 | 114 | (181 | ) | ||||||||||||||

| Impairment charges(2) |

46,438 | — | 68,692 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

284,527 | 236,719 | 279,399 | 59,233 | 58,169 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating profit (loss) |

55,948 | 86,391 | (19,209 | ) | 27,078 | 25,372 | ||||||||||||||

| Other income (expense): |

||||||||||||||||||||

| Interest income |

500 | 696 | 458 | 175 | 108 | |||||||||||||||

| Interest expense(3) |

(54,554 | ) | (56,196 | ) | (60,740 | ) | (13,556 | ) | (14,088 | ) | ||||||||||

| Miscellaneous income (expense)(4) |

9,412 | 15,106 | (5,020 | ) | (4,353 | ) | (16,172 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from continuing operations before income taxes, non-controlling interest and accumulated payment-in-kind dividend on cumulative preferred shares |

11,306 | 45,997 | (84,511 | ) | 9,344 | (4,780 | ) | |||||||||||||

| Income tax (expense) benefit(3) |

(9,953 | ) | (21,723 | ) | 6,427 | (4,366 | ) | (1,145 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from continuing operations |

1,353 | 24,274 | (78,084 | ) | 4,978 | (5,925 | ) | |||||||||||||

| (Loss) income from discontinued operations, net of tax(5) |

— | — | (4,448 | ) | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from continuing operations |

1,353 | 24,274 | (82,532 | ) | 4,978 | (5,925 | ) | |||||||||||||

| Less net income attributable to the non-controlling interest |

(366 | ) | (343 | ) | (295 | ) | (91 | ) | (88 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to MacDermid, Incorporated |

987 | 23,931 | (82,827 | ) | 4,887 | (6,013 | ) | |||||||||||||

| Accrued payment-in-kind dividend on cumulative preferred shares |

(40,847 | ) | (37,361 | ) | (34,124 | ) | (10,788 | ) | (9,874 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) attributable to common shares |

$ | (39,860 | ) | $ | (13,430 | ) | $ | (116,951 | ) | $ |

(5,901 |

) |

$ | (15,887 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

14

Table of Contents

| Year ended December 31, | Three months ended March 31, |

|||||||||||||||||||

| 2011 | 2010 | 2009 | 2012 | 2011 | ||||||||||||||||

| (amounts in thousands, except share and per share amounts) | (unaudited) | |||||||||||||||||||

| Other Data: |

||||||||||||||||||||

| EBITDA(6)(8) (unaudited) |

$ | 112,239 | $ | 148,394 | $ | 19,291 | $ | 33,958 | $ | 20,675 | ||||||||||

| Adjusted EBITDA(7)(8) (unaudited) |

$ | 151,723 | $ | 138,443 | $ | 102,463 | $ | 38,533 | $ | 37,165 | ||||||||||

| Net (loss) attributable to MacDermid, Incorporated per share(9) |

||||||||||||||||||||

| Basic: |

||||||||||||||||||||

| (Loss) from continuing operations |

$ | (4.01 | ) | $ | (1.35 | ) | $ | (11.30 | ) | $ | (0.59 | ) | $ | (1.60 | ) | |||||

| (Loss) from discontinued operations |

$ | — | $ | — | $ | (0.45 | ) | $ | — | $ | — | |||||||||

| Net loss |

$ | (4.01 | ) | $ | (1.35 | ) | $ | (11.75 | ) | $ | (0.59 | ) | $ | (1.60 | ) | |||||

| Diluted: |

||||||||||||||||||||

| (Loss) from continuing operations |

$ | (4.01 | ) | $ | (1.35 | ) | $ | (11.30 | ) | $ | (0.59 | ) | $ | (1.60 | ) | |||||

| (Loss) from discontinued operations |

$ | — | $ | — | $ | (0.45 | ) | $ | — | $ | — | |||||||||

| Net loss |

$ | (4.01 | ) | $ | (1.35 | ) | $ | (11.75 | ) | $ | (0.59 | ) | $ | (1.60 | ) | |||||

| Weighted Average Shares Outstanding |

||||||||||||||||||||

| Basic |

9,942,777 | 9,932,862 | 9,951,799 | 9,946,419 | 9,932,132 | |||||||||||||||

| Diluted |

9,942,777 | 9,932,862 | 9,951,799 | 9,946,419 | 9,932,132 | |||||||||||||||

| Pro forma net income per share(10) (unaudited) |

||||||||||||||||||||

| Basic and diluted |

$ | 0.03 | $ | 0.16 | ||||||||||||||||

| Pro forma weighted average number of common shares outstanding (unaudited) |

||||||||||||||||||||

| Basic |

31,387,359 | 31,387,539 | ||||||||||||||||||

| Diluted |

31,509,558 | 31,509,558 | ||||||||||||||||||

| As of March 31, 2012 | ||||

| (unaudited) | ||||

| (amounts in thousands) | ||||

| Balance Sheet Data: |

||||

| Cash and cash equivalents |

$ | 109,311 | ||

| Total assets |

$ | 1,232,981 | ||

| Current installments of long-term debt and capital lease obligations and short-term notes payable |

$ | 11,024 | ||

| Long-term debt and capital lease obligations (excluding current portion) |

$ | 719,412 | ||

| Total debt and capital lease obligations and short-term notes payable |

$ | 730,436 | ||

| Total stockholders’ equity |

$ | 252,865 | ||

| (1) | Charges in the three months ended March 31, 2012 and 2011 and the years ended December 31, 2011, 2010 and 2009 relate to amounts recorded in connection with our operational restructuring initiatives. For a detailed description of these operational restructuring initiatives, see the discussion in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, Note 20 to our audited financial statements and Note 14 to our unaudited financial statements included in this prospectus. |

| (2) | In 2011, we recorded impairment charges of $46.4 million related to a write down of our customer list intangible assets to their estimated fair value as determined in accordance with ASC 360 “Property, Plant and Equipment” (“ASC 360”). In 2009, we recorded (i) impairment charges of $41.2 million related to a write down of our goodwill balance to its estimated fair value as determined in accordance with ASC 350 “Intangibles—Goodwill and Other” (“ASC 350”), (ii) an impairment charge of $26.1 million related to a write down of an indefinite-lived purchased intangible asset to its estimated fair value as determined in accordance with ASC 350, (iii) an impairment charge of $0.2 million related to a write down of a finite-lived purchased intangible asset to its estimated fair value as determined in accordance with ASC 360 and (iv) an impairment charge of $1.2 million related to a write down of equipment to its estimated fair value as determined in accordance with ASC 360. For a detailed description of these impairment charges, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 5 to our audited financial statements included in this prospectus. |

| (3) | Primarily reflects interest expense associated with our long-term debt for periods after the acquisition of MacDermid, Incorporated by MDI Holdings, LLC in 2007. Giving pro forma effect to (i) the sale by us of shares of our common stock in this offering at an assumed initial offering price of $ per share (the midpoint of the range set forth on the cover of this prospectus) after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us and (ii) the application of the net proceeds therefrom as described in “Use of Proceeds”, and assuming such proceeds had been so applied on January 1, 2011, interest expense for the year ended December 31, 2011 and the three months ended March 31, 2012 would have been $ million and $ million, respectively, and income tax (expense) benefit for the year ended December 31, 2011 and the three months ended March 31, 2012 would have been $ million and $ million, respectively. See “Use of Proceeds”. |

| (4) | Represents remeasurement (gain) loss on foreign denominated debt as a result of changes in foreign exchange rates. For a detailed description of these remeasurement gains/losses, see the discussion of our miscellaneous (expense) income in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, Note 17 to our audited financial statements and Note 13 to our unaudited financial statements included in this prospectus. |

| (5) | Reflects loss (gain) from discontinued operations related to the sale of our Offset Printing Blankets business (“Offset”) in 2008. All operating results exclude amounts associated with discontinued operations. |

15

Table of Contents

| (6) | EBITDA represents net (loss) income attributable to MacDermid, Incorporated before interest, taxes, depreciation and amortization. EBITDA is a non-U.S. GAAP measure. We present EBITDA because it is used by management to evaluate operating performance. We consider EBITDA an important supplemental measure of our performance because the calculation adjusts for items that we believe are not indicative of our core operating performance. Our management uses EBITDA to evaluate the operating performance of our business, to aid in period-to-period comparability, for planning and forecasting purposes and to measure results against forecasts. We believe EBITDA is also useful to investors because it is a measure frequently used by securities analysts, investors and others in the evaluation of companies. |

We also use EBITDA because the 9.5% senior subordinated notes due 2017 of MacDermid, Incorporated (the “Senior Subordinated Notes”) and MacDermid, Incorporated’s senior secured credit facilities (the “Credit Facilities”) rely on EBITDA (with additional adjustments) to measure our ability to, among other things, incur additional indebtedness and to make payments, including dividends, that are subject to restrictions under our debt agreements.

EBITDA has limitations as an analytical tool, and it does not represent, and should not be considered an alternative to, net (loss) income or operating (loss) earnings as those terms are defined by U.S. GAAP. Some of these limitations are:

| • | EBITDA does not reflect our cash expenditures, or future requirements, for capital expenditures; |

| • | EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| • | EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; and |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements. |

We compensate for these limitations by relying primarily on our GAAP results and using EBITDA only supplementally. See the consolidated statements of cash flows included in the consolidated financial statements of MacDermid, Incorporated included elsewhere in this prospectus. Please see footnote (8) below for a reconciliation of net income (loss) attributable to MacDermid, Incorporated to EBITDA.

| (7) | We present Adjusted EBITDA as a further supplemental measure of our performance. We use Adjusted EBITDA to compare our operating performance over various reporting periods because we believe it provides the most meaningful view of our ongoing operations since it removes from our operating results the impact of items that do not reflect our core operating performance. We believe Adjusted EBITDA is helpful to investors and other interested parties because it provides such persons with the same information that our management uses internally for purposes of assessing our operating performance. |

We prepare Adjusted EBITDA by adjusting EBITDA to eliminate the impact of a number of items. We explain how each adjustment is derived in the subsequent footnote. Potential investors are encouraged to evaluate each adjustment for supplemental analysis. As an analytical tool, Adjusted EBITDA is subject to all the limitations applicable to EBITDA. In addition, other companies in our industry may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. In evaluating Adjusted EBITDA, you should also be aware that in the future we may incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual items.

| (8) | We reconcile net income (loss) attributable to MacDermid, Incorporated to EBITDA and Adjusted EBITDA as follows: |

| Year ended December 31, | Three months ended March 31, |

|||||||||||||||||||

| 2011 | 2010 | 2009 | 2012 | 2011 | ||||||||||||||||

| (amounts in thousands) | (unaudited) | |||||||||||||||||||

| Net income (loss) attributable to MacDermid, Incorporated |

$ | 987 | $ | 23,931 | $ | (82,827 | ) | $ | 4,887 | $ | (6,013 | ) | ||||||||

| Provision (benefit) for income taxes |

9,953 | 21,723 | (6,427 | ) | 4,366 | 1,145 | ||||||||||||||

| Interest expense |

54,554 | 56,196 | 60,740 | 13,556 | 14,088 | |||||||||||||||

| Depreciation expense |

18,167 | 16,850 | 17,937 | 4,494 | 4,093 | |||||||||||||||

| Amortization expense |

28,578 | 29,694 | 29,868 | 6,655 | 7,362 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA (unaudited) |

$ | 112,239 | $ | 148,394 | $ | 19,291 | $ | 33,958 | $ | 20,675 | ||||||||||

| Remeasurement adjustment on foreign denominated debt(a) |

$ | (9,156 | ) | $ | (17,395 | ) | $ | 5,067 | $ | 4,316 | $ | 16,448 | ||||||||

| Equity compensation expense(b) |

727 | 389 | 337 | 98 | 98 | |||||||||||||||

| Restructuring expense(c) |

896 | 6,234 | 4,228 | 114 | (181 | ) | ||||||||||||||

| Impairment charges(d) |

46,438 | — | 68,692 | — | — | |||||||||||||||

| Inventory write-down(e) |

— | 423 | — | — | — | |||||||||||||||

| (Loss) income from discontinued operations, net of tax(f) |

— | — | 4,448 | — | — | |||||||||||||||

| Sponsor management fees(g) |

579 | 398 | 400 | 47 | 125 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA (unaudited) |

$ | 151,723 | $ | 138,443 | $ | 102,463 | $ | 38,533 | $ | 37,165 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

16

Table of Contents

| (a) | Represents remeasurement (gain) loss on foreign denominated debt as a result of changes in foreign exchange rates. Please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, Note 17 to our audited financial statements and Note 13 to our unaudited financial statements included in this prospectus for an additional discussion of these gains/losses. |

| (b) | Reflects non-cash stock compensation expense per ASC 718 “Compensation—Stock Compensation”. |

| (c) | Reflects (i) for the three months ended March 31, 2012, charges related to headcount reductions in our Industrial segment and revisions to accruals related to restructuring, (ii) for the three months ended March 31, 2011, the reversal of charges related to accrued benefits no longer due to employees in our Industrial Europe operations and the reversal of estimated legal costs that were no longer required at our corporate business unit, (iii) in the year ended December 31, 2011, charges related to headcount reductions in our Industrial segment, the reversal of charges related to accrued benefits no longer due to employees in our Industrial Europe operations and the reversal of estimated legal costs that were no longer required at our corporate business unit, (iv) in the year ended December 31, 2010, charges related to headcount reductions in our Industrial segment, charges for lease termination cost and long-term asset write-down expense in our Industrial Europe operations and (v) in the year ended December 31, 2009, charges related to headcount reductions in our Industrial segment and charges related to the moving of certain manufacturing facilities. Please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, Note 20 to our audited financial statements and Note 14 to our unaudited financial statements included in this prospectus for an additional discussion of such charges. |

| (d) | Reflects impairment charges of goodwill and intangible assets. Please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 5 to our audited financial statements included in this prospectus for an additional discussion of such charges. |

| (e) | Reflects inventory that was written off due to our exit from the dry film business in the first quarter of 2010. Please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for an additional discussion of such costs. |

| (f) | Reflects loss (gain) from discontinued operations related to the sale of Offset in 2008 and the sale of our ColorSpan printing business in 2007. |

| (g) | Reflects management fees paid to Court Square and Weston Presidio pursuant to certain advisory agreements. We will pay fees, as described in “Use of Proceeds”, to Court Square and Weston Presidio in connection with the termination of the advisory agreements and the consummation of this offering; however, following the consummation of this offering, we will no longer pay management fees to Court Square or Weston Presidio. |

| (9) | The net loss per share attributable to MacDermid, Incorporated does not give effect to the Exchange, the effect of which is to reflect (i) the effective conversion of MacDermid, Incorporated’s cumulative preferred stock, including the accumulated payment in kind dividend with respect to such preferred stock at the time of the offering, into common stock of MacDermid Group, Inc. and (ii) the effective payment of a stock preference, in the form of MacDermid Group, Inc. common stock, in respect of MacDermid, Incorporated’s common stock, in each case, in accordance with our applicable governing documents. For further information related to our earnings per share calculations, please refer to Notes 2 and 23 to our audited financial statements and Notes 2 and 17 to our unaudited financial statements included in this prospectus. |

| (10) | The pro forma net income per share gives effect to the Exchange, the effect of which is to reflect (i) the effective conversion of MacDermid, Incorporated’s cumulative preferred stock, including the accumulated payment in kind dividend with respect to such preferred stock at the time of the offering, into common stock of MacDermid Group, Inc. and (ii) the effective payment of a stock preference, in the form of MacDermid Group, Inc. common stock, in respect of MacDermid, Incorporated’s common stock, in each case, in accordance with our applicable governing documents. For further information related to our pro forma net income per share calculations, please refer to Notes 2 and 23 to our audited financial statements and Notes 2 and 17 to our unaudited financial statements included in this prospectus. |

17

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including the financial statements and related notes included elsewhere in this prospectus, before making an investment decision. If any of the following risks are realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Business and Industry

Conditions in the global economy may directly adversely affect our net sales, gross profit and financial condition and may result in delays or reductions in our spending that could have a material adverse effect on our results of operations, prospects and stock price.