Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SunCoke Energy, Inc. | d370130d8k.htm |

Exhibit 99.1 |

Some of the

information included in this presentation contains “forward-looking statements” (as defined in Section 27A of the

Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as

amended). Such forward-looking statements are based on management’s beliefs and

assumptions and on information currently available. Forward-looking statements include the

information concerning SunCoke’s possible or assumed future results of operations, business strategies,

financing plans, competitive position, potential growth opportunities, potential operating performance

improvements, effects resulting from our separation from Sunoco, the effects of competition and

the effects of future legislation or regulations. Forward- looking statements include all

statements that are not historical facts and may be identified by the use of forward-looking

terminology such as the words “believe,” “expect,” “plan,”

“intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,”

“will,” “should” or the negative of these terms or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may

differ materially from those expressed in these forward-looking statements. You should not put

undue reliance on any forward-looking statements.

In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995,

SunCoke has included in its filings with the Securities and Exchange Commission cautionary

language identifying important factors (but not necessarily all the important factors) that

could cause actual results to differ materially from those expressed in any forward-looking statement made

by SunCoke. For more information concerning these factors, see SunCoke's Securities and Exchange

Commission filings. All forward-looking statements included in this presentation are

expressly qualified in their entirety by such cautionary statements. SunCoke does not have any

intention or obligation to update any forward-looking statement (or its associated cautionary language),

whether as a result of new information or future events or after the date of this presentation, except

as required by applicable law. This presentation includes certain non-GAAP financial

measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations

of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of

the presentation. Investors are urged to consider carefully the comparable GAAP measures and the

reconciliations to those measures provided in the Appendix, or on our website at

www.suncoke.com. |

|

|

|

|

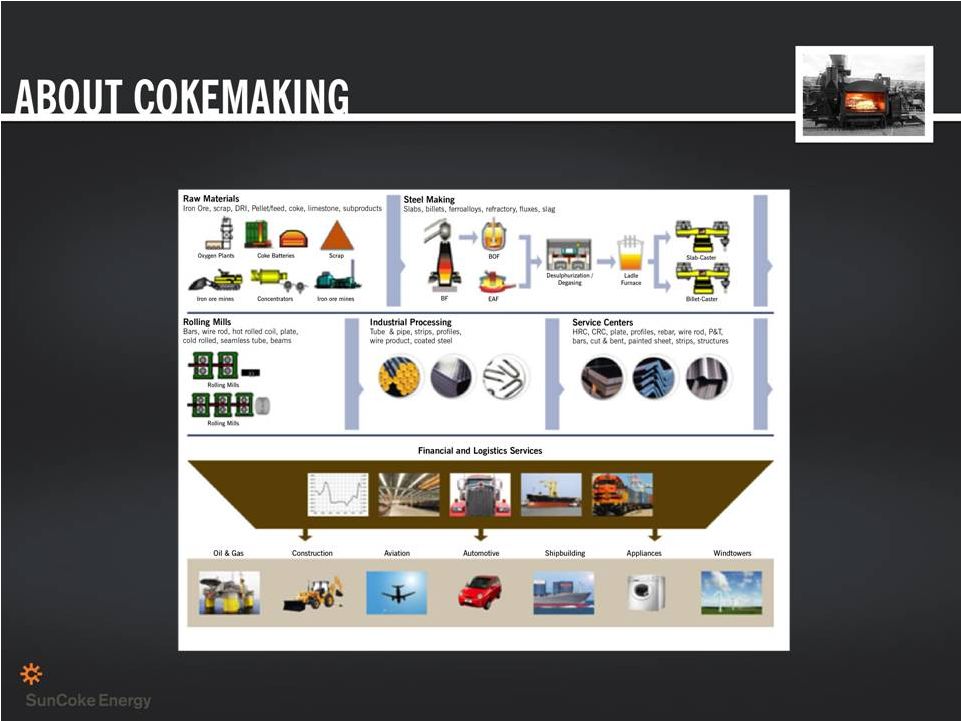

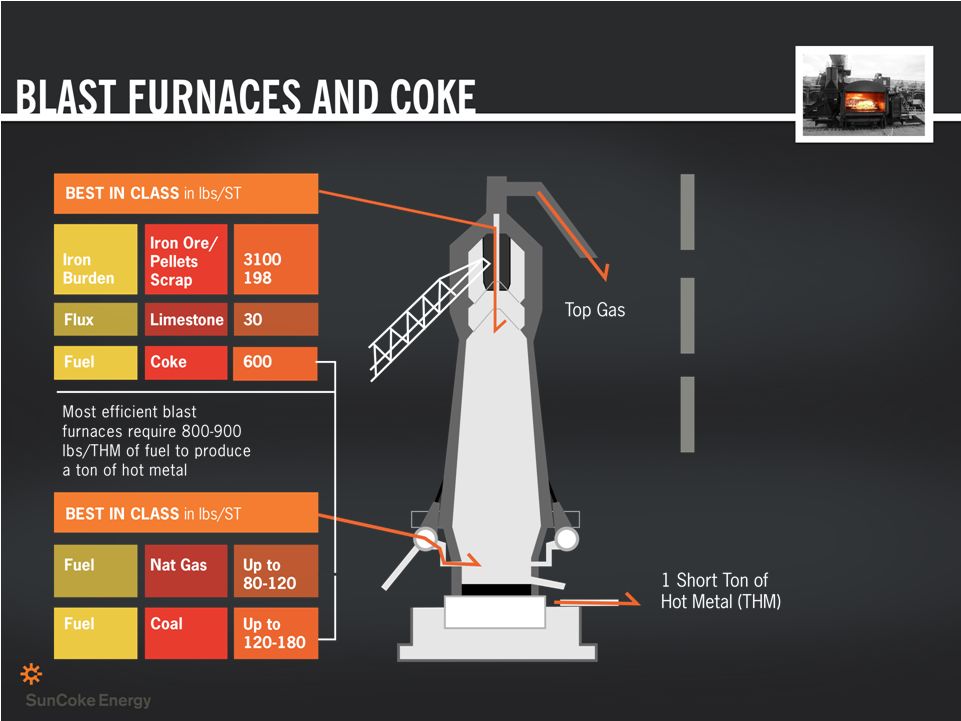

Blast furnaces are the

most efficient and

proven method of

reducing iron oxides into

liquid iron

Coke is a vital material to

blast furnace steel making

We believe that stronger,

larger coke is becoming more

important as blast furnaces

seek to optimize fuel needs |

-

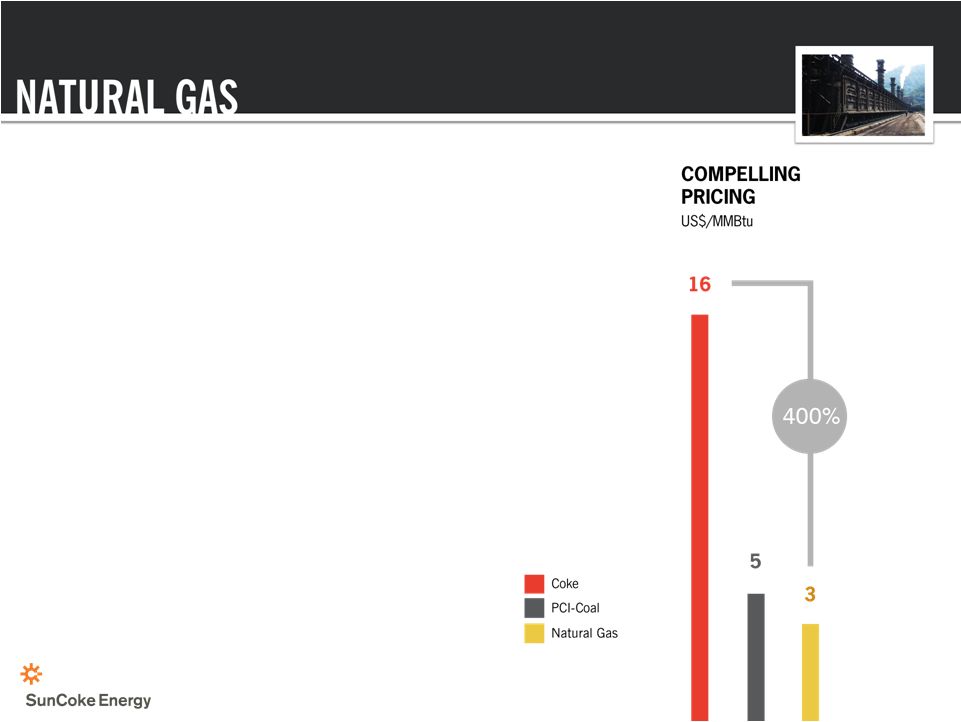

Natural gas cannot replace 100% of coke needs in

a blast furnace

-

At best, we believe natural gas can

replace about 30%

-

In order to optimize use of natural gas, stronger and larger

coke is required

-

Alternative iron oxide-reducing technologies take time to

implement, require significant capital commitments

and are energy intensive

-

Both low-cost natural gas and power are required to

make alternative technologies viable

CHALLENGING EXECUTION

Source: CRU, SXC Analysis |

-

Largest independent producer of

metallurgical coke in the Americas

-

Six cokemaking facilities (five in the U.S.

and one in Brazil)

-

Approximately 5.9 million tons per year

cokemaking capacity

-

1,180 employees (980 U.S. / 200 Brazil)

-

CY 2012 Guidance results driven by strong

coke business performance

-

Successful Middletown startup

-

Improvement at Indiana Harbor

-

Yield/cost improvement at other facilities

(1)

For a definition of Adjusted EBITDA and reconciliation,

please see the appendix. |

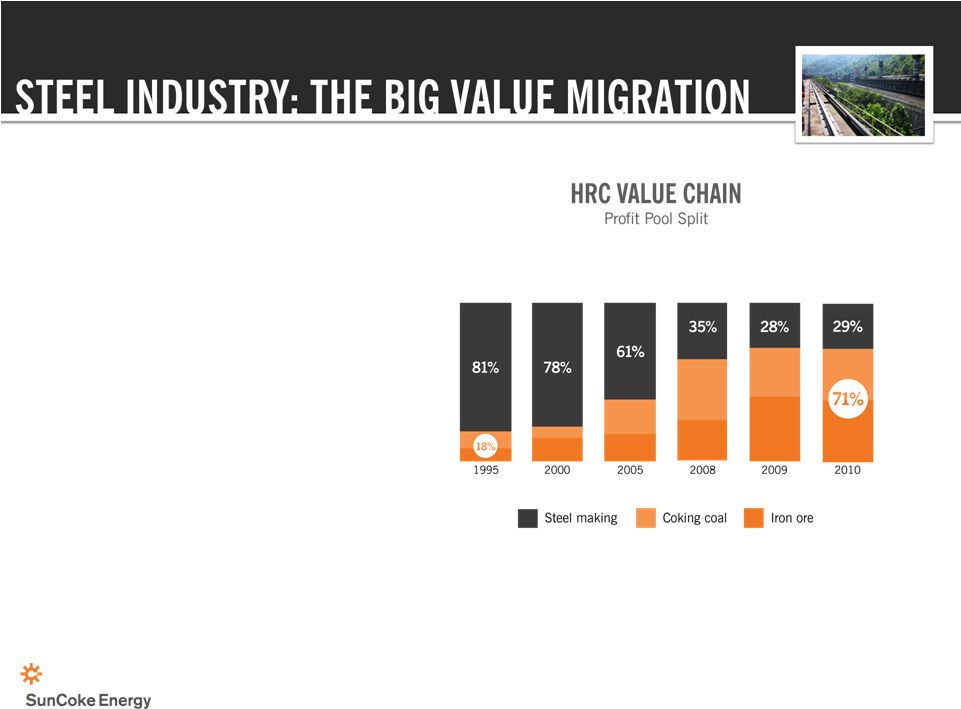

-

Fundamental shift in value allocation

between miners and steel makers in

the last decade

-

Urbanization boom in emerging

economies and iron ore and coal

industry consolidation triggered

price super cycle

-

Traditional fixed-cost intensive

businesses now must focus on

variable cost structure

-

In response, steel makers are

deploying two strategies:

-

Vertical integration

-

Capital rationalization

Source: McKinsey |

|

|

|

|

|

Adjusted EBITDA

represents earnings before interest, taxes, depreciation, depletion and

amortization (“EBITDA”) adjusted for sales discounts and the

deduction of income attributable to non-controlling interests in our

Indiana Harbor cokemaking operations. EBITDA reflects sales discounts included as a

reduction in sales and other operating revenue. The sales discounts represent the

sharing with Adjusted EBITDA would be inappropriately penalized if these

discounts were treated as a reduction of EBITDA since they represent

sharing of a tax benefit which is not included in EBITDA. Accordingly, in computing

Adjusted EBITDA, we have added back these sales discounts. Our Adjusted EBITDA

also reflects the deduction of income attributable to non controlling

interest in our Indiana Harbor cokemaking operations. EBITDA and Adjusted

EBITDA do not represent and should not be considered alternatives to net income

or operating income under United States generally accepted accounting principles

(GAAP) and may not be comparable to other similarly titled measures of

other businesses. Management believes Adjusted EBITDA is an important

measure of the operating performance of the Company’s assets and is indicative

of the Company’s ability to generate cash from operations.

|

|

|