Attached files

| file | filename |

|---|---|

| 8-K - TECHPRECISION CORPORATION FORM 8-K - TECHPRECISION CORP | techprecision8k.htm |

Investor Presentation

June 19, 2012

NOTE: All information provided in this presentation has been previously disclosed as

public information from presentations, investor conferences and 8K/10Q/10K

public information from presentations, investor conferences and 8K/10Q/10K

© 2012. All rights reserved.

© 2012. All rights reserved.

2

Safe Harbor Statement

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: Any

statements set forth in this presentation that are not historical facts are forward-looking

statements that involve risks and uncertainties that could cause actual results to differ materially

from those in the forward-looking statements, which may include, but are not limited to, such

factors as unanticipated changes in product demand, increased competition, downturns in the

economy, failure to comply with specific regulations pertaining to government projects,

fluctuation of revenue due to the nature of project lifecycles, and other information detailed

from time to time in the Company filings and future filings with the United States Securities and

Exchange Commission. The forward-looking statements contained in this presentation are made

only of this date, and the Company is under no obligation to revise or update these forward-

looking statements.

statements set forth in this presentation that are not historical facts are forward-looking

statements that involve risks and uncertainties that could cause actual results to differ materially

from those in the forward-looking statements, which may include, but are not limited to, such

factors as unanticipated changes in product demand, increased competition, downturns in the

economy, failure to comply with specific regulations pertaining to government projects,

fluctuation of revenue due to the nature of project lifecycles, and other information detailed

from time to time in the Company filings and future filings with the United States Securities and

Exchange Commission. The forward-looking statements contained in this presentation are made

only of this date, and the Company is under no obligation to revise or update these forward-

looking statements.

Revenue Distribution

© 2012. All rights reserved.

3

Ø In FY2006 & FY2007 GTAT

(AKA: GT Solar) was <50% of

Ranor/TPCS revenue and the

(AKA: GT Solar) was <50% of

Ranor/TPCS revenue and the

Ø Company lost money: FY2006

Net Loss ($428,148)

Net Loss ($428,148)

Ø FY2007 Net Loss ($385,588)

Ø From FY2008 - FY2011 GTAT

was >50% of Ranor/TPCS’

revenue and the Company was

profitable; however the

Company revenue and

profitability was very

dependent on one customer

in just one market segment

was >50% of Ranor/TPCS’

revenue and the Company was

profitable; however the

Company revenue and

profitability was very

dependent on one customer

in just one market segment

Ø The last shipment to GTAT

from the Ranor factory

occurred in August 2011

from the Ranor factory

occurred in August 2011

Business Focus

© 2012. All rights reserved.

4

• One of the few large-scale, manufacturing engineering, precision

machining, fabrication and assembly/test companies with facilities in

the United States and China

machining, fabrication and assembly/test companies with facilities in

the United States and China

• Providing Product Solutions by applying expertise in “design for

manufacture” principles to take large-scale prototype technology and

migrate to production units at scalable volumes

manufacture” principles to take large-scale prototype technology and

migrate to production units at scalable volumes

• Well-positioned to capitalize on growing medical, defense, alternative

energy and nuclear markets

energy and nuclear markets

• Strategically position with tier-1 customers to support mutual growth

Profitable Growth Strategy

© 2012. All rights reserved.

5

• Complete the “turn-around” for the Ranor-Massachusetts division by diversifying the

Company away from the historical concentration of one-customer (>50% Revenue)

and improve operational processes/ERP

Company away from the historical concentration of one-customer (>50% Revenue)

and improve operational processes/ERP

• Target high-margin product solutions with more predictable cost and long-term

purchase agreement structures

purchase agreement structures

• Continue successful deployment of proactive Business Development and Strategic

Sales processes to expand our product solutions

Sales processes to expand our product solutions

• Expand business through our global manufacturing advantage

• Significantly increase capacity for WCMC division; Asia consumption

• Establish 2nd Production facility in United States in FY2013 to support growth in the

Medical, Nuclear and Defense sectors for products

Medical, Nuclear and Defense sectors for products

Product Solution Strategy

© 2012. All rights reserved.

6

• Historically the Company produced piece-part (highly competitive/less value-ad to

customers) vs. product solutions (less competitive/more value-ad to customers)

customers) vs. product solutions (less competitive/more value-ad to customers)

• Product Solution involves supplying the Manufacturing Engineering, Large-parts,

small parts (mechanical and electrical) in a complete/tested solution

small parts (mechanical and electrical) in a complete/tested solution

• Example: solar furnace “piece-part” vs. sapphire furnace “product solution”

Electro/Mechanical

Actuation Cylinder

Assembled and

Tested Assembly

Tested Assembly

Small Value-ad

Parts (Completed

Assembly)

Parts (Completed

Assembly)

Support and Install

Frame (Completed

Assembly)

Frame (Completed

Assembly)

Sapphire Furnace

“Product Solution”

Solar Furnace

“Piece Part”

Strategic Production Solutions for Profitable Growth

© 2012. All rights reserved.

7

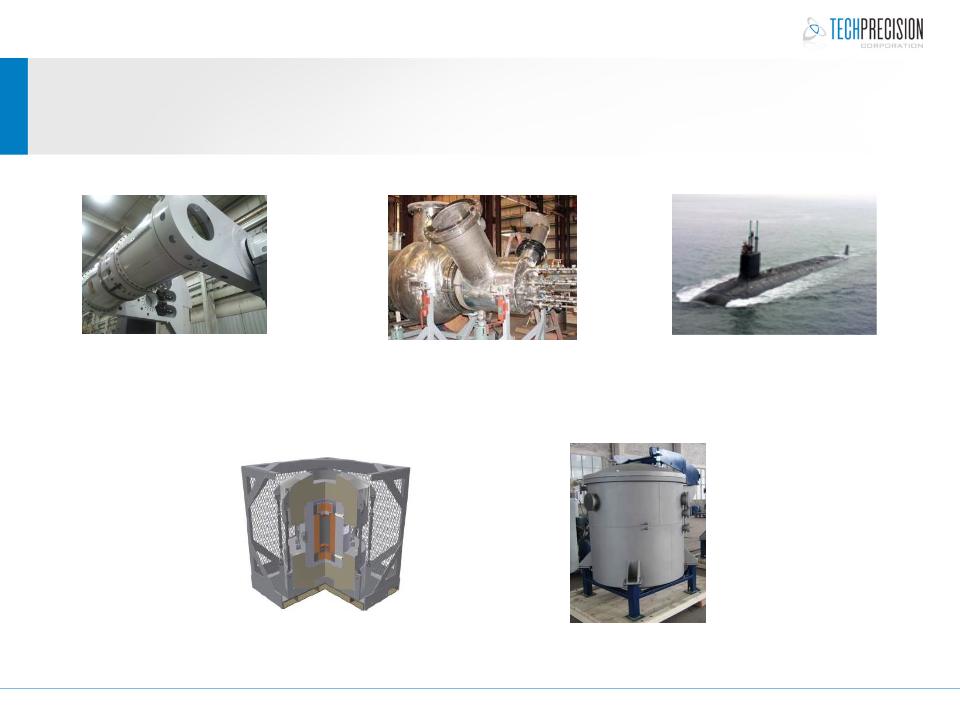

AOS: Nuclear Isotope and Fissile

(pending) Transport Casks

(pending) Transport Casks

Mevion: S250 Proton Beam

Cancer Treatment

(510k Clearance)

Cabot: Carbon Black

Furnaces

GDEB: Confidential

Virginia Class Product

Assemblies

Virginia Class Product

Assemblies

GTAT: Sapphire Furnaces

FY2013 Customer and Sector Pipeline

© 2012. All rights reserved.

8

Alternative Energy:

Sapphire Pipeline: $6 - $12M

PolySi/Solar Pipeline: $5 - $8M

Nuclear: $7 - $12M

Defense and Aerospace: $10 - $14M

Medical: $8 - $10M

Commercial Industrial: $4 - $6M

Served Markets: “Achieving Balance” in FY2013

9

© 2012. All rights reserved.

FY2011: Single Customer

Dependence and Risk

Dependence and Risk

FY2013 Outlook:

Balance with Multiple Customers

www.TechPrecision.com