Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Investors Bancorp Inc | d369373d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - Investors Bancorp Inc | d369373dex21.htm |

| EX-99.1 - JOINT PRESS RELEASE ANNOUNCING THE MERGER - Investors Bancorp Inc | d369373dex991.htm |

June 15,

2012 Acquisition of

Marathon Banking Corporation

Exhibit 99.2 |

2

Forward-looking statements

Certain statements contained herein are "forward looking statements" within the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Such forward looking statements may

be

identified

by

reference

to

a

future

period

or

periods,

or

by

the

use

of

forward

looking

terminology,

such

as

"may," "will," "believe," "expect," "estimate,"

"anticipate," "continue," or similar terms or variations on those

terms, or the negative of those terms. Forward looking statements are subject to numerous

risks, as described in our SEC filings, and uncertainties, including, but not limited

to, those related to the real estate and economic environment, particularly in the

market areas in which the Company operates, competitive products and pricing, fiscal

and monetary policies of the U.S. Government, changes in government regulations affecting financial

institutions, including regulatory fees and capital requirements, changes in prevailing

interest rates, acquisitions and the integration of acquired businesses, credit risk

management, asset-liability management, the financial and securities markets and

the availability of and costs associated with sources of liquidity. The Company wishes

to caution readers not to place undue reliance on any such forward looking statements, which

speak only as of the date made. The Company wishes to advise readers that the factors listed

above could affect the Company's financial performance and could cause the Company's

actual results for future periods to differ materially from any opinions or statements

expressed with respect to future periods in any current statements. The Company does

not undertake and specifically declines any obligation to publicly release the results of any revisions,

which may be made to any forward looking statements to reflect events or circumstances after

the date of such statements or to reflect the occurrence of anticipated or

unanticipated events. |

3

Transaction highlights

Adds

scale

and

critical

mass

to

Investors’

New

York

metro

franchise

Marathon adds 13 NY-area branches with $783 million in deposits and $569

million of loans Pro forma, Investors will have 22 branches and $1.3 billion

in deposits in New York –

Represents 22% of total branches and 15% of total deposits

Improved

deposit

ranking

in

Brooklyn

(#21

#14)

and

Queens

(#43

#15)

Strong

performing

bank

with

excellent

asset

quality

1

Clean, well-managed commercial bank with strong lending and deposit

franchise –

Diverse

commercial

loan

portfolio

(54%

commercial

real

estate,

32%

multifamily,

8%

C&I)

–

28% noninterest-bearing deposits; 0.60% cost of deposits

Strong asset quality (0.8% NPAs / Assets, 1.1% NPLs / Loans)

ROAA

of

0.72%

despite

excess

liquidity

(73%

loan

/

deposit

ratio,

27%

cash

/

assets

2

Financially attractive

Valuation metrics compare favorably to recent transactions in the region

5%

and

7%

accretive

to

earnings

in

2013

and

2014,

respectively

3

–

EPS accretion reaching 8-9% beyond 2014

Strong IRR of 18%

Minimal dilution to fully-converted tangible book value per share (2.5%)

Projected to return to pre-closing tangible book value levels within 6

months Relatively small transaction (approximately 8% of market cap)

provides for limited execution risk Possible

second-step

conversion

valuation

improvement

resulting

from

enhanced

NY

metro

presence

1.

Note: Financial data as of or for the quarter ending March 31, 2012.

2.

Includes cash & equivalents.

3.

Earnings accretion excludes the impact of non-recurring transaction

costs. ) |

4

% of ISBC branches in New York

Pro forma branch coverage

11%

22%

ISBC

ISBC Pro Forma

Investors Bancorp

Marathon

Source: SNL Financial and company reports.

* Deposit data as of 3/31/2012. Deposit Ranking as of 6/30/2011.

Marathon

ISBC Pro Forma

County

Deposits*

($mn)

Branch

(#)

Deposits*

($mn)

Branch

(#)

New York

Queens, NY

$329

5

$370

7

Kings, NY

238

4

506

8

New York, NY

71

1

71

1

Nassau, NY

74

1

270

3

Richmond, NY

9

1

9

1

Suffolk, NY

80

2

721

12

1,306

22

New Jersey

Bergen, NJ

53

1

77

2

Total Deposits

$774

13

$1,383

24

Deposit Rank*

County

Marathon

Investors

Pro Forma

Queens, NY

17

43

15

Kings, NY

19

21

14 |

5

Overview of Marathon

History

Founded in 1989 as Marathon National Bank of New York (MNBNY)

Marathon Banking Corporation (MBC) is established as the bank holding company in 1997

Piraeus Bank S.A. acquires control of MBC in 1999

–

MNBNY operates autonomously of Piraeus Bank S.A. as a U.S. community bank with no

cross-border transactions with Greece

Acquires

Interbank

of

New

York

in

2004

($276

million

assets)

and

the

deposits

of

Ocwen

Bank

in

2005

($193

million deposits)

13 branches in metropolitan New York, headquartered in Astoria, Queens

Financial Summary

1

Assets: $902 million

Loans: $569 million

Deposits: $783 million

Tangible Equity: $89 million

NPAs / Assets: 0.8%

ROAA: 0.72%

1. As of or for the quarter ending March 31, 2012.

|

6

Transaction overview

Transaction Value:

$135 million

Consideration:

100% cash

Transaction Pricing Multiples

Marathon

Comparable

Transactions

Price / Tangible Book Value:

1.51x

1.84x

Deposit Premium:

5.8%

8.2%

Required Approvals:

Customary regulatory approvals

Expected Closing:

4Q 2012

Other:

Paul Strathoulopoulos (current Chairman & CEO of Marathon Banking

Corporation) to be added to Investors Bank Board of Directors

Advisory Board to be created

Marathon depositors to receive the same second-step subscription and

liquidation rights as Investors’

depositors

1.

Median value of comparable transactions, which include United Financial / New

England Bancshares, Valley National / State Bancorp, Brookline / Bancorp

Rhode Island, Susquehanna / Abington, People's United / Danvers 1

|

7

Pro forma financial impact

Financial returns

IRR of 18%

5%

and

7%

accretive

to

EPS

in

2013

and

2014,

respectively

1

EPS accretion reaching 8-9% beyond 2014

Pro forma TBV capital position

2.5% dilution to fully-converted tangible book value, returning to current

levels in 6 months Tangible

common

ratio:

Current

8.5%

Pro

forma

8.0%

Assumptions

Cost savings of $6.9 million (30% of core non-interest expenses), phased in

70% in 2013 and 100% thereafter; no revenue synergies assumed

Pre-tax restructuring costs of $15.2 million, approximately 50% incurred at

time of closing and remainder expensed in 2013

Core deposit intangibles of $7.8 million

1.5% of non-CD deposits amortized over 10 years (Sum of Years Digits)

$15.0 million gross credit and $4.5 million securities-related mark ($6.4

million net of reserves and tax)

Offset by pre-tax interest rate marks on loan and deposit portfolios of $10.0

million ($6.5 million after-tax)

1. Excluding non-recurring transaction costs.

|

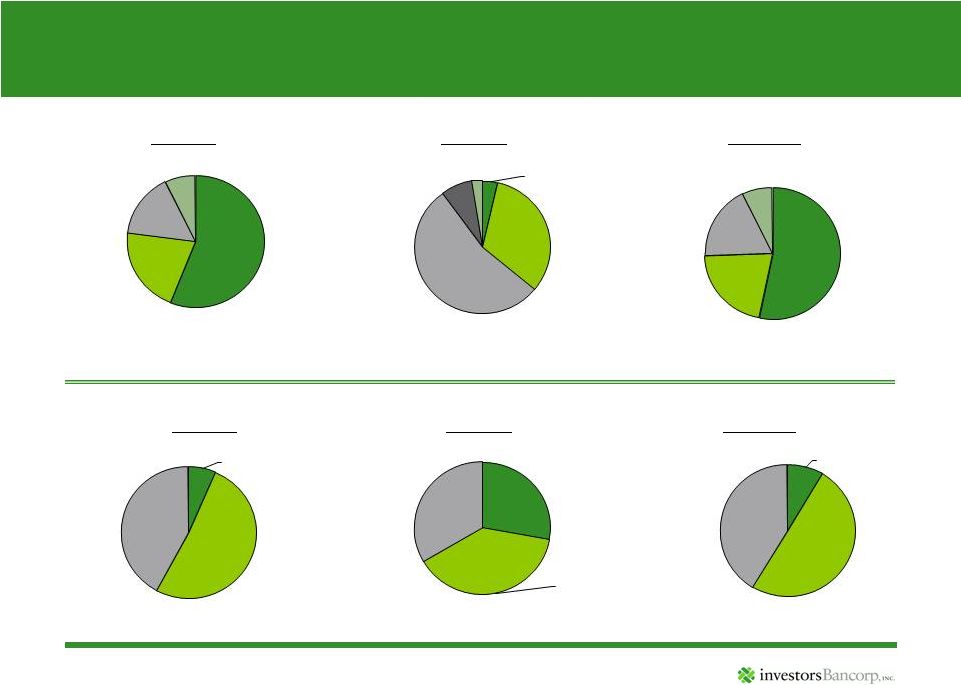

8

Investors

Marathon

Pro Forma

Loan Composition

Deposit Composition

$9,162 million

$569 million

$9,732 million

Yield: 5.02%

Yield: 5.83%

Yield: 5.07%

Loans / Deposits: 117%

Loans / Deposits: 73%

Loans / Deposits: 113%

$7,856 million

$783 million

$8,639 million

Cost: 0.97%

Cost: 0.60%

Cost: 0.93%

Investors

Marathon

Pro Forma

1-4

Family

56%

Multi-

Family

21%

Com'l RE

16%

Other

7%

Multi-

Family

32%

Com'l RE

54%

C&I

8%

Other

2%

1-4

Family

4%

1-4

Family

54%

Multi-

Family

21%

Com'l RE

18%

Other

7%

Other

Trans,

MM &

Savings

51%

CDs

42%

Non-

interest

7%

CDs

34%

Other

Trans,

MM &

Savings

Non-

interest

28%

CDs

41%

Non-

interest

9%

Other

Trans,

MM &

Savings

50%

Source: SNL Financial and company reports. Based on regulatory data as of or for the quarter ending

March 31, 2012 Pro forma loan & deposit composition |

9

Pro forma balance sheet

$ in millions

ISBC Actual

3/31/12

Pro Forma

At Close

Assets

$11,263

$12,377

Loans

9,164

9,979

Intangibles

1

43

86

Deposits

7,801

8,984

Shareholders’

Equity

996

1,063

Tangible common equity /

tangible assets

8.5%

8.0%

1.

Includes goodwill and core deposit intangibles (“CDI”), excludes MSR.

CDI shown net of deferred tax liability. |

10

Investors Bancorp’s track record as an acquiror

Brooklyn Federal Bancorp MHC (January 2012)

$400 million of deposits / 5 branches in Brooklyn and Long Island

–

0.25x

tangible

book

value

/

0.5%

adjusted

deposit

premium

1

Sold or hedged commercial loan portfolio to a real estate investment firm

Deposit franchise of Millennium bcpbank (October 2010)

$600

million

of

deposits

/

17

branches

in

NJ,

NY,

MA

2

–

0.11% deposit premium

Acquired

approximately

$200

million

of

performing

commercial

and

residential

loans

6 New Jersey branches from Banco Popular North America (October 2009)

6 branches / $227 million deposits

–

1.0% deposit premium

Acquired no loans as part of the transaction

American Bancorp of New Jersey (May 2009)

$680 million in assets / 5 full-service branches in northern New Jersey

$98 million transaction value paid through a combination of stock and cash

–

1.01x tangible book value, 1.2% deposit premium

Summit Federal Bankshares MHC (June 2008)

$110 million in assets / 5 full-service branches in northern New Jersey

Merger was a combination of mutual enterprises

1.

Based on cash paid to minority shareholders and adjusted TBV (adjusted for credit

mark, loan sale) 2.

Four Massachusetts-based branches subsequently sold in May 2011.

|

Investor

Presentation |