Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - InvenSense Inc | Financial_Report.xls |

| EX-31.2 - CERTIFICATION OF THE PRINCIPAL FINANCIAL OFFICER PURSUANT TO SECTION 302 - InvenSense Inc | d342166dex312.htm |

| EX-31.1 - CERTIFICATION OF THE PRINCIPAL EXECUTIVE OFFICER PURSUANT TO SECTION 302 - InvenSense Inc | d342166dex311.htm |

| EX-23.1 - CONSENT OF DELOITTE & TOUCHE LLP - InvenSense Inc | d342166dex231.htm |

| EX-32.1 - CERTIFICATION OF THE PEO AND PFO PURSUANT TO SECTION 906 - InvenSense Inc | d342166dex321.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

For the fiscal year ended April 1, 2012 For the fiscal year ended April 1, 2012x Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the Fiscal year ended April 1, 2012

or

¨ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to

Commission File Number 001-35269

INVENSENSE, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

01-0789977 | |

| (State or other jurisdiction of |

(I.R.S. Employer | |

| Incorporation or organization) |

Identification No.) | |

| 1197 Borregas Avenue Sunnyvale, CA |

94089 | |

| (Address of principal executive offices) |

(Zip code) |

(408) 988-7339

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 Par Value |

New York Stock Exchange LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ¨ |

Accelerated filer ¨ | |

| Non-accelerated filer x |

||

| (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

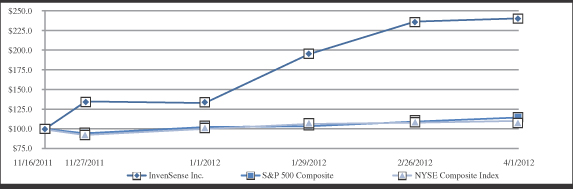

As of October 2, 2011, the last day of the registrant’s most recently completed second quarter; the registrant’s common stock was not publicly traded. The registrant’s common stock began trading on the New York Stock Exchange on November 16, 2011. As of April 1, 2012, the last business day of the registrant’s most recently completed fiscal year, the aggregate market value of registrant's voting and non-voting common stock held by non-affiliates was approximately $ 730.8 million, based upon the closing sale price of the common stock as reported on the New York Stock Exchange. This calculation excludes the shares of common stock held by each officer, director and holder of 5% or more of the outstanding common stock as of April 1, 2012. This calculation does not reflect a determination that such persons are affiliates for any other purposes.

As of June 5, 2012, there were approximately 81,365,631 shares of the registrant's common stock, $0.001 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2012 Annual Meeting of stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K where indicated. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended April 1, 2012. Except with respect to information specifically incorporated by reference in this Annual Report on Form 10-K, the Proxy Statement is not deemed to be filed as part of this Annual Report on Form 10-K.

Table of Contents

INVENSENSE, INC.

2

Table of Contents

Special Note Regarding Forward-Looking Statements and Industry Data

This Annual Report on Form 10-K, including this Management’s Discussion and Analysis of Financial Condition and Results of Operations, includes a number of forward-looking statements that involve many risks and uncertainties. Forward-looking statements are identified by the use of the words “would,” “could,” “will,” “may,” “expect,” “believe,” “should,” “anticipate,” “outlook,” “if,” “future,” “intend,” “plan,” “estimate,” “predict,” “potential,” “targets,” “seek” or “continue” and similar words and phrases, including the negatives of these terms, or other variations of these terms, that denote future events. These forward-looking statements include: our belief that certain end-markets pose significant unrealized opportunities for motion interface functionality, including large near-term opportunities in the market for handheld devices, such as smartphones and tablet devices, and in particular devices that are enabled by the Android operating system or require optical image stabilization for camera functionality; our expectations as to future sales of consumer electronics devices that could potentially integrate motion processors; our anticipation that we will experience future growth, expand our intellectual property portfolio and increase our research and development expenses; our intention to develop and introduce more highly integrated products in the future that include greater motion sensing functionality and further enhancements to on-board motion interface capabilities; our expectation that our products will remain a component of customers’ products throughout any such product’s life cycle; our ability to protect our intellectual property in the United States and abroad; our belief in the sufficiency of our cash flows to meet our needs; and our future financial and operating results. These statements reflect our current views with respect to future events and our potential financial performance and are subject to risks and uncertainties that could cause our actual results and financial position to differ materially and adversely from what is projected or implied in any forward-looking statements included in this Annual Report on Form 10-K. These factors include, but are not limited to, the risks described under Item 1A of Part I — “Risk Factors,” Item 7 of Part II — “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” elsewhere in this Annual Report on Form 10-K and those discussed in other documents we file with the SEC. We make these forward-looking statements based upon information available on the date of this Annual Report on Form 10-K, and we have no obligation (and expressly disclaim any such obligation) to update or alter any forward-looking statements, whether as a result of new information or otherwise except as otherwise required by securities regulations.

As used herein, “InvenSense,” the “Company,” “we,” “our,” and similar terms refer to InvenSense, Inc., unless the context indicates otherwise.

InvenSense®, AirSign®, MotionCommand®, BlurFree®, MotionTrackingTM, MotionProcessingTM, MotionProcessing UnitTM, MotionProcessorTM, DigitalMotionTM, DigitalMotion ProcessorTM, MotionFusionTM, MotionAppsTM, AirLockTM and LoPedTM are our trademarks. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of the respective holders.

3

Table of Contents

Overview

We are the pioneer and a global market leader in motion interface devices that detect and track an object’s motion in three-dimensional space. Our MotionTracking devices combine micro-electro-mechanical system, or MEMS, based motion sensors, such as accelerometers and gyroscopes, with mixed-signal integrated circuits (ICs) and proprietary algorithms and firmware that intelligently calibrate, process and synthesize sensor output for use by software applications via an application programming interface (API). Our MotionTracking devices are differentiated by small form factor, high level of integration, performance, reliability and cost effectiveness.

While our solutions have broad applicability across consumer, industrial, military and other industry verticals, we currently target consumer electronics within a variety of end markets that we believe demand a more intuitive and immersive user experience, such as console and portable video gaming devices, smartphones, tablet devices, digital still and video cameras, smart TVs (including digital set-top boxes, televisions and multi-media HDDs), 3D mice, toys, wearable health and fitness monitors and portable navigation devices. We anticipate that there may be a significant near-term opportunity for our products in the market for handheld devices, such as smartphones and tablet devices, and in particular devices that are enabled by the Android operating system or devices with high resolution cameras where optical image stabilization (OIS) is important to producing quality images.

We believe we are the first provider of a MotionTracking device for consumer applications. Our products span increasing levels of integration, from single-axis gyroscopes to fully-integrated, intelligent dual- and three-axis gyroscopes, and the industry’s only integrated six-axis and nine-axis, MotionTracking devices. The majority of our production volume today derives from our integrated three-axis product families. We started volume shipments of our six-axis Motion Tracking product in September 2011 and introduced a nine-axis MotionTracking device in January 2012. We intend to continue develop even more highly integrated products.

We were incorporated in the State of California in June 2003 and reincorporated in the State of Delaware in October 2004. Our principal executive offices are located at 1197 Borregas Avenue, Sunnyvale, CA 94089. Our telephone number is (408) 988-7339. Our website is located at www.invensense.com and our investor relations website is located at ir.invensense.com

Our fiscal year is a 52 or 53 week period ending on the Sunday closest to March 31. Our three most recent fiscal years ended on April 1, 2012 (“fiscal year 2012”), April 3, 2011 (“fiscal year 2011”) and March 28, 2010 (“fiscal year 2010”). Fiscal year 2012 and fiscal year 2010 were comprised of 52 weeks and fiscal year 2011 was comprised of 53 weeks.

Our net revenue was $153.0 million, $96.5 million and $79.6 million for fiscal years 2012, 2011 and 2010, respectively, and our net income was $36.9 million, $9.3 million and $15.1 million for these periods, respectively.

In fiscal years 2012 and 2011, our products were incorporated in multiple smartphones and tablets from leading manufacturers, including Acer, Asus, HTC, LG, Motorola, Samsung and ZTE. Our net revenue was derived from multiple end markets, including smartphones and tablets, video gaming, digital still and video cameras, digital television and set-top box remote controls, 3D mice, toys, wearable health and fitness monitors, portable navigation devices and other consumer electronics. Nintendo incorporates our dual-axis and three-axis gyroscope into its Wii MotionPlus accessory, Wii Remote Plus controllers and its 3D handheld gaming device, the 3DS.

4

Table of Contents

We utilize a fabless business model, working with third parties to manufacture our products, while the critical test and calibration functions are performed in our wholly owned subsidiary located in Hsinchu, Taiwan. We sell our products through our direct worldwide sales organization and through our indirect channel of distributors to manufacturers of consumer electronics devices, original design manufacturers and contract manufacturers. We are headquartered in Sunnyvale, California and had 263 employees worldwide as of April 1, 2012.

Industry Background

Over the last decade, advances in technology have led to a rapid proliferation of consumer electronics devices used for communication, entertainment, convenience and business. In order to differentiate products and increase sales in intensely competitive markets, consumer electronics device manufacturers have been eager to adopt new device functionalities, expand use cases and create new, compelling user interfaces and interactive experiences using technologies, such as touch screen and, more recently, motion-based functions.

Several mass market smartphone manufacturers have successfully introduced consumers to touch screen technology and basic motion-based features, such as tilt control, which enables a screen to switch between portrait and landscape mode based on a device’s orientation. Since then, more advanced motion sensing and processing capabilities that facilitate motion-based video gaming, device control, assisted navigation and advanced display functionality are becoming a part of the standard feature set of smartphones and tablet devices. These capabilities are also being incorporated into a range of other consumer electronics devices. The momentum behind the adoption of motion interfaces in consumer electronics illustrates how technology can change the way consumers interact with electronics devices, as well as their expectations for future consumer products. Nintendo’s Wii was the first mass market video gaming console to incorporate basic motion-based functions, introducing consumers to a motion-based video gaming experience. Since its introduction in November 2006, the Nintendo Wii has sold over 94 million units. Following the introduction of the Wii, Nintendo has continued to innovate and provide consumers with an increasingly immersive motion-based video gaming experience that can interface with natural human motions with the 3D handheld gaming device, the Nintendo 3DS.

The Key Motion Sensors

Sensors that are able to detect motion in three-dimensional space have been commercially available for several decades and have been used in automobiles, aircraft and ships. However, the size, power consumption, cost, manufacturing methods, calibration requirements and other design complexities involved in integration of motion sensors have historically prevented their mass adoption in consumer electronics.

While other kinds of motion sensor technologies may potentially become available commercially, we believe the following four principal types of motion sensors are important for motion interface in free space:

| • | Accelerometers (G-sensors) measure linear acceleration and tilt angle. Single and multi-axis accelerometers detect the combined magnitude and direction of linear, rotational and gravitational acceleration. They can be used to provide limited motion sensing functionality. For example, a device with an accelerometer can detect rotation from vertical to horizontal state in a fixed location. As a result, accelerometers are primarily used for simple motion sensing applications in consumer devices, such as changing the screen of a mobile device from portrait to landscape orientation. |

| • | Gyroscopes (Gyros) measure the angular rate of rotational movement about one or more axes. Gyroscopes can measure complex motion accurately in free space, tracking the position and rotation of a moving object. In contrast, accelerometers primarily detect the fact that an object has moved or is moving in a particular direction. Unlike accelerometers and compasses, gyroscopes are not affected by errors related to external environmental factors, such as gravitational and magnetic fields. Hence, gyroscopes greatly enhance the responsiveness of the motion sensing capabilities of devices and are |

5

Table of Contents

| used for advanced motion sensing applications in consumer devices, such as full gesture recognition, movement detection and motion simulation in video gaming. |

| • | Magnetic Sensors (Compasses) detect magnetic fields and measure their absolute position relative to Earth’s magnetic north and nearby magnetic materials. Information from magnetic sensors can also be used to correct errors from other motion sensors, such as gyroscopes. One example of how compass sensors are used in consumer devices is reorienting a displayed map to match up with the general direction a user is facing. Many smartphones and tablet devices have begun incorporating compasses to enable enhanced gaming and location-based applications. |

| • | Pressure Sensors (Barometers) measure relative and absolute altitude through the analysis of changing atmospheric pressure. Pressure sensors can be used in consumer devices for sports and fitness or location-based applications where information can be used for elevations or floor-specific location. |

Challenges in Adoption of Motion Sensors in Consumer Electronics

Early adoption of motion sensors in consumer electronics was limited primarily to accelerometers that provided basic motion sensing capabilities. Devices incorporating these early motion sensors experienced strong demand, as they provided consumers with applications that included a more intuitive user interface. More recently, consumer devices have expanded their incorporation of other motion sensors, including gyroscopes, compasses and pressure sensors.

As consumers continue to become more accustomed to motion-enabled applications, there is a significant opportunity to deliver a broader spectrum of consumer electronics devices that can provide robust motion interface. However, there are several challenges that motion sensor vendors need to overcome in order to deliver a product that can achieve mass adoption in consumer electronics markets.

In order to digitize full real-life motion, system designers are limited to using discrete motion sensor components, such as gyroscopes, accelerometers and compasses, as well as a separate microcontroller in their already space-constrained products. Such an approach can create many performance, form factor, firmware and software design and cost challenges. In addition, using discrete motion sensors from various suppliers requires customized and costly system-level calibration by customers on the factory floor to meet required performance and precision standards.

Consumer electronics devices typically have significant form factor limitations within which sensors and related digital circuitry must fit. Furthermore, system designers of consumer electronics operate with system-level constraints, such as total system cost, as well as significant time-to-market challenges given the rapid product cycles prevalent in the industry. While system designers may desire to incorporate motion interface capabilities in their devices, adding multiple discrete sensors and additional digital control circuitry to the system design may be unacceptable in terms of total system cost, performance or time-to-market.

To enable multi-sensor integration for full motion interface, system designers also need firmware and software capabilities to receive, process and synthesize motion sensor data. They also need calibration algorithms and APIs that can interpret the motion sensor data and make it easily accessible to application processors for consumption by end applications. Finally, MotionTracking devices must be cost effectively produced in high volume and must overcome significant challenges in sensor design, including precision and noise, vibration and performance requirements. Without these capabilities, the development of compelling motion interface-based applications may be prohibitively difficult for most consumer electronics device manufacturers and application developers.

As a result, we believe most system designers would prefer an intelligent, integrated, scalable system-level motion interface platform that incorporates multiple motion sensors, digital control circuitry, APIs and motion application software together in one solution: a MotionTracking device.

6

Table of Contents

The Opportunity for MotionTracking Devices

Similar to the development of the microprocessor enabling the emergence of the personal computer and the multitude of applications that now run on that platform, as well as the development of the graphics processor enabling compelling, life-like graphics for numerous video gaming and professional applications, we believe the introduction of an intelligent, integrated motion interface platform can enable realization of the full potential of motion sensors and make motion-based applications ubiquitous in consumer electronics.

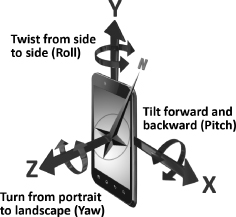

We define motion interface as the ability to detect, measure, synthesize, analyze and digitize an object’s motion in three-dimensional free space. The illustration below shows how a smartphone moves in 3D space, either by rotating around or moving along any of its three principle axes. By incorporating motion sensors, such as a three-axis gyroscope, a three-axis accelerometer and a three-axis compass, the smartphone’s movement can be accurately tracked in free space. The gyroscope tracks the rotation of the smartphone as it tilts forward or backward (pitch), turns from portrait to landscape (yaw) and twists from side to side (roll), while the accelerometer measures the linear movement of the smartphone as it moves up or down (y-axis), left or right (x-axis) and toward or away from the user (z-axis), and the compass measures the device orientation or pointing direction relative to magnetic north. The analog data from the gyroscope, accelerometer and compass can be digitized and synthesized using complex algorithms to support motion-based user interfaces and other applications, such as motion-based video games and on-screen menu navigation.

We define a MotionTracking device as a complete system that integrates various motion sensors with digital control and processing, and provides sensor fusion algorithms, high-level programming interfaces, calibration algorithms and motion application software. Motion interface can offer device designers, consumers and application developers two fundamental benefits: a mechanism to intuitively and seamlessly interface with consumer electronics by translating the full range of natural human motion to digital signals, and an application ecosystem based on motion interface.

Since consumers and application developers were first introduced to motion sensing capabilities in electronics, their desire and vision for more advanced motion-based user interface capabilities in devices has increased and expanded rapidly. As a result, an increasing number of device manufacturers, platform providers and application developers are introducing products and software that take advantage of motion interface capabilities. In particular, motion interfaces have been added to leading operating systems, such as the Android operating system from Google.

There are a number of consumer electronics devices in the market today, such as console and portable video gaming devices, smart TVs, smartphones, tablet devices, digital still and video cameras, toys and navigation devices, toys, and health and fitness accessories, that have incorporated motion interface technologies.

7

Table of Contents

We believe the following consumer electronics end-markets present examples of significant opportunities for motion interface:

| • | Smartphones: While many smartphones use basic motion sensing capabilities to provide tilt sensing, screen rotation and basic video gaming functionality, the latest generation of smartphones are increasingly incorporating complete motion interface technology that can deliver enhanced user experiences in the areas of web, media and menu navigation. In addition, motion interface technology can provide a range of other capabilities, such as more responsive motion-based video gaming, enhanced still and video image stabilization, improved pedestrian navigation, secure authentication through gestures, as well as gesture and character shortcuts that accelerate common tasks on the device. |

| • | Tablets: While still a nascent market, tablet devices are rapidly being adopted by consumers and enterprises. Similar to smartphones, early generations of tablet devices use basic motion sensing capabilities to provide tilt-sensing and screen rotation, but it is expected that newer generations of these devices will incorporate complete motion interface technology to provide a wide range of motion-based capabilities. |

| • | Video gaming: Motion interface technology in console and portable video gaming devices provides an immersive video gaming experience by accurately tracking body and hand movements, and is significantly more intuitive than traditional button and joystick based interfaces. The Nintendo Wii and the recently introduced Nintendo 3DS is representative of this motion interface technology in the video gaming market. |

| • | Smart TVs: Digital televisions (DTVs), set-top boxes and multi-media HDDs, which constitute the smart TV market, are becoming increasingly more interactive through the addition of interactive menus and applications, internet browsing, video-on-demand services and viewing of personal media content. This has created the need for a user interface device with the functionality of a computer mouse and the ability to operate without a desk, for example while sitting on a living room couch. With a motion-based approach to menu and web navigation, users can interface with an on-screen menu or use hand motions in a manner similar to motion- based video gaming controllers. Further, a motion controlled remote would allow additional functionality, including gesture shortcuts and games, to be embedded into the system. |

| • | Optical Image Stabilization (OIS) for Camera Phone Modules: Camera phone modules are a commonly used feature in mobile handset devices today. Current market trends are driving smartphone manufacturers to differentiate their products by including even higher, 8 MP or greater resolution camera phone modules into their devices, thus enabling the smartphone to act as a substitute for traditional digital still cameras (DSCs). Cameras of this resolution benefit from stabilization technologies to eliminate the distortive effects of hand jitter which causes image blur, especially in low lighting conditions. Because these problems are further amplified by the small form factor of handset devices, which are more prone to hand jitter, consumers have been encouraged to continue to use their DSCs. Advancements in camera module assembly and availability of smaller and high performance gyroscopes have made it possible to incorporate the OIS function into handset camera modules while providing image qualities comparable to that of a DSC. |

| • | Other emerging opportunities: There are many other possible applications for motion interface in products used by consumers daily. For example, manufacturers of digital still and video cameras, toys, navigation devices, wearable sensors, healthcare monitoring equipment, health and fitness equipment, and industrial tools have or may in the future expand the use of motion interface technologies. The use of MotionTracking devices in these devices can significantly enhance their performance, intelligence, safety and functionality. |

8

Table of Contents

The InvenSense Solution

We have developed proprietary, intelligent, integrated single-chip MotionTracking devices that enables intuitive and immersive user interfaces. As a result of our modular and scalable platform architecture, our current and planned products span increasing levels of integration, from standalone single-chip gyroscopes to fully integrated multi-sensor, multi-axis digital MotionTracking devices. In fiscal years 2011 and 2012, the majority of our product volume was derived from our two-axis and three-axis gyroscopes. In September 2011, we announced that our six-axis MotionTracking devices were available for high volume shipment and began shipments in our fourth quarter of fiscal year 2012.

Our MotionTracking devices are comprised of several fundamental proprietary components:

| • | Our MEMS-based motion sensors combined with our mixed-signal circuitry for signal processing provide the functionality required to measure motion in three-dimensional space. The high performance of our sensors is enabled by our proprietary Nasiri-Fabrication platform. |

| • | Our MotionFusion technology consists of a hardware acceleration engine we refer to as a Digital Motion Processor (DMP) and sensor fusion firmware. MotionFusion technology enables the conversion of analog signals to digital signals and intelligently assimilates them into usable data. |

| • | Our MotionApps platform provides application programming interfaces (API) and calibration algorithms that simplify access to complex functionality commonly needed by our customers. This platform utilizes the output from the MotionFusion layer to enable system designers to use the sensor data in their applications without the need to understand detailed motion sensor outputs and develop related motion interface algorithms. We are designing our MotionApps platform to be interoperable with major mobile operating systems, such as Google’s Android and Microsoft’s Windows. In addition, we have developed numerous system level APIs for various third-party applications and motion sensors. |

The competitive advantages of our technology and solutions are:

| • | Highly integrated and cost-effective solutions enabled by our patented Nasiri-Fabrication platform. The foundation of our MotionTracking devices is our patented Nasiri-Fabrication platform, which enables integration of standard MEMS with CMOS (also known as CMOS-MEMS) in a small, cost-effective wafer-level solution. Combining a MEMS wafer with an industry standard CMOS wafer reduces the number of MEMS manufacturing steps, perform wafer-level testing, and use wafer-level packaging, thereby reducing back-end costs of packaging and testing and improving overall product yield and performance. In addition to our CMOS-MEMS process, we have developed low-cost, high-throughput proprietary test and calibration systems, which further reduce back-end costs. We believe we have pioneered a technological breakthrough in high-volume manufacturing of low-cost, high-performance MEMS motion processors. Combining this unique high-volume fabrication capability with our other core proprietary technologies, we are able to deliver our MotionTracking devices with industry-leading integration and cost-effectiveness. |

| • | Ability to rapidly accelerate time-to-market by leveraging our MotionApps platform. Our MotionApps platform promotes faster adoption and accelerates time-to-market for our customers. We achieve this by providing easy-to-use APIs that can be easily integrated into different operating systems, calibration algorithms and an applications engine that supports pre-configured motion-processing applications. These features eliminate the need for our customers to develop separate software libraries, thereby reducing the time required to develop motion-based applications. In addition, our MotionApps platform enables device manufacturers with limited motion interface experience to rapidly incorporate higher level motion-enabled applications in their products. To further accelerate adoption of our products, we have been collaborating with major operating systems providers, such as Google, and processor and microcontroller providers to incorporate our solutions into their reference designs. |

9

Table of Contents

| • | Scalable MotionTracking devices with opportunities for continuing integration. Our Nasiri-Fabrication platform enables the integration of multiple motion sensors, such as gyroscopes and accelerometers, on a single chip with processing capability. Our latest generation of MotionTracking devices have both an embedded three-axis gyroscope and three-axis accelerometer on the same chip, enabling integrated six-axis motion interface functionality. As a result of integrating multiple sensors, our products can eliminate the traditional calibration steps required with discrete solutions as well as offload the intensive motion interface computation requirements from the host processor. Over time, we believe we can integrate more advanced features and functionalities into our solution. |

| • | Flexible manufacturing, performance and reliability. Most MEMS devices are manufactured in proprietary in-house fabrication facilities utilizing numerous fabrication steps, esoteric substrates and MEMS-specific manufacturing processes that are not compatible for integration with standard CMOS fabrication processes. Nasiri-Fabrication allows us to utilize a fabless business model without relying on specialty foundries for MEMS manufacturing. Our fabless model enables cost-effective, high-volume production and provides us with the flexibility to quickly react to our customers’ needs. Additionally, our ability to perform wafer-level testing combined with our close collaborative relationships with third-party foundries enables us to better control the manufacturing process and product yields, resulting in lower cost and improved device performance and reliability. |

Technology

Our technology is comprised of five core proprietary components: our Nasiri-Fabrication platform; our advanced MEMS motion sensor designs; our application specific mixed-signal circuitry for sensor signal processing; our sensor fusion algorithms in firmware that intelligently assimilate data from multiple sensors for use by end applications; and finally our MotionApps platform consisting of application programming interfaces (APIs) and calibration algorithms. Although all five components are critical to providing complete MotionTracking devices, our Nasiri-Fabrication platform is the core differentiating technology.

Nasiri-Fabrication Platform

The cornerstone of our technology is our patented Nasiri-Fabrication platform, which we believe gives us a sustainable and differentiated competitive advantage. Nasiri-Fabrication is a standard “six mask” MEMS-specific bulk silicon fabrication process that enables direct bonding of MEMS components with related signal conditioning and logic circuitry that are fabricated using standard complementary metal oxide semiconductor (CMOS) processes. CMOS is a pervasive semiconductor technology used by nearly every semiconductor vendor and available at many foundries for fabrication of semiconductor devices. MEMS is a well established technology that leverages several fundamental principles of semiconductor fabrication to manufacture micron-size physical structures in small form factors. We use MEMS processes to create wafers containing the structural layers used for our motion sensors, and standard CMOS fabrication technology to create wafers to provide drive and signal conditioning circuits, as well as the logic circuitry that processes sensor signals to deliver complete MotionTracking devices.

Our Nasiri-Fabrication platform combines separately manufactured MEMS and CMOS wafers, forming a complete and integrated wafer in a single bonding step. Though this bonding process uses off-the-shelf semiconductor processing equipment, the bonding technology itself is patented. Following the bonding process, the combined wafer (also known as a CMOS-MEMS wafer) undergoes another patented pad-opening step, which uses a standard sawing technique to open electrical wire bond pads, allowing wafer-level testing.

The resulting CMOS-MEMS wafers are then tested using standard automated wafer probers, after which the wafers are diced into thousands of individual chips, which are then packaged. These finished products then go through one final testing and calibration operation using in-house proprietary testers before being shipped to

10

Table of Contents

customers. We have successfully employed our Nasiri-Fabrication platform in the high-volume production of 150 mm and 200 mm wafers.

One of the significant advantages of our Nasiri-Fabrication platform is its impact on product packaging and testing. The back-end cost of packaging and testing MEMS products fabricated with competing processes accounts for a significant percentage of total product cost. Our Nasiri-Fabrication platform was developed specifically to address this fundamental challenge with MEMS technology. By enabling full fabrication of CMOS-MEMS wafers at standard CMOS foundries and following the same back-end fabrication process used for CMOS wafers, our Nasiri-Fabrication platform has enabled a significant reduction in back-end costs.

Products

Our products include the industry’s only MotionProcessor units (MPUs), in addition to our inertial measurement units (IMUs) and MEMS gyroscopes. All of our core products are single-chip integrated solutions and are intended for use by electronics manufacturers in their devices to enable motion- based applications. We believe our products provide industry-leading performance at compelling price points with minimal footprint. We also provide customers with a proprietary MotionApps platform, which contains algorithms and APIs to enhance their time-to-market and facilitate integration of our products into their devices.

Our most advanced products include our MPUs and IMUs, which integrate multiple sensors with advanced mixed-signal circuitry. Our latest generation product, the nine-axis MPU-9150, combines our three-axis MEMS gyroscope, three-axis MEMS accelerometer, MotionFusion technology and MotionApps platform with a third-party three-axis e-compass. This provides all of the capabilities required for complete nine-axis motion interface on a single chip. In addition, we have recently introduced our new IDG-2020 and IXZ-2020 families of dual-axis gyroscopes with significantly reduced package sizes to address the need for optical image stabilization (OIS) technology in camera phones.

Our current high-volume products are three-axis MPUs and IMUs and six-axis MPUs. Our IMU-3000 products combine the three-axis MEMS gyroscope with mixed-signal circuitry and a secondary input port that interfaces with third-party digital accelerometers to deliver a complete six-axis MotionFusion output to the host processor. Our MPU-3000 goes beyond the IMU-3000’s capability by adding our MotionApps platform to deliver advanced motion interface functionality. Our MPU-6000 improves on our MPU-3000 by adding a three-axis digital accelerometer to deliver six-axis motion interface functionality without reliance on third-party MEMS products in the same 4x4mm form factor and pin compatible configuration as our other product lines.

Our gyroscopes are designed to measure rotational motion around one or more axes and provide the results through an analog or digital output. We have developed a series of the world’s first multi-axis gyroscopes that have achieved competitive cost targets per axis while meeting the package size and the appropriate level of rotational sensing accuracy to be suitable for a broad variety of consumer electronics.

11

Table of Contents

The table below sets out our key product lines, including available versions and new products available for sampling to selected customers, and descriptions of key performance parameters for each of our product families. Except as otherwise indicated, package sizes and operating voltage for our digital output product families (MPU, IMU and digital gyroscopes) are 4x4x0.9mm and 2.1V to 3.6V, respectively.

| Product Families | Product Families | Key Features | ||

| MPU (MotionProcessing Units) |

MPU-9150 |

¨ Nine-axis: three-axis digital gyroscope + three-axis digital accelerometer + three axis e-compass ¨ MotionFusion ¨ MotionApps | ||

| MPU-6000 | ¨ Six-axis: three-axis digital gyroscope + three-axis digital accelerometer ¨ MotionFusion ¨ MotionApps | |||

| MPU-3000 | ¨ Three-axis digital gyroscope ¨ MotionFusion ¨ MotionApps | |||

| IMU (Inertial Measurement Units) |

IMU-3000 | ¨ Three-axis digital gyroscope ¨ MotionFusion | ||

| Digital Gyroscopes |

ITG-3000 |

¨ Three-axis digital output | ||

| IDG-2020 and IXZ-2020 | ¨ Dual-axis digital output ¨ 3×3×0.90mm package size | |||

| IDG-2000 | ¨ Dual-axis digital output |

Markets and Customers

Our customers consist of the world’s largest consumer electronics makers, including Acer, Asus, HTC, LG Electronics, Nintendo, Motorola, Pantech, RIM, Samsung and ZTE. These customers are in multiple consumer market segments, including smartphones and tablets, console and portable video gaming devices, digital television and set-top box remote controls, remote controlled toys and other household consumer and industrial devices.

Historically we have relied on Nintendo for a significant portion of our net revenue. Nintendo accounted for approximately 31%, 73% and 85% of our net revenue for fiscal years 2012, 2011 and 2010, respectively, with the majority of those sales relating to the Wii platform. For fiscal year 2012, two other customers, HTC and Samsung, accounted for 15% and 12% of total net revenue respectively. The loss of any of these customers would have a material adverse effect on our business. No other customers accounted for more than 10% of total net revenue for fiscal years 2012, 2011 or 2010.

Seasonality of Business

Our business is subject to seasonality because of the nature of our target markets. At present, virtually all of our motion interface products are sold in the consumer electronics market. Sales of consumer electronics tend to be weighted towards holiday periods, and many consumer electronics manufacturers typically experience seasonality in sales of their products. Seasonality affects the timing and volume of orders for our products as our customers tend to increase production of their products that incorporate our solutions in the first three quarters of our fiscal year in order to build inventories for the holiday season. Sales of our products tend to correspondingly increase during these quarters and to significantly decrease in the fourth quarter of our fiscal year.

12

Table of Contents

Backlog

As of April 1, 2012, our backlog from customers was $17.1 million, compared to $30.1 million as of April 3, 2011. Due to varying customer order patterns, backlog may not be a reliable indicator of fiscal quarter or fiscal year sales.

Sales and Marketing

We sell our products through our direct worldwide sales organization and through our indirect channel of distributors to manufacturers of consumer electronics devices, original design manufacturers and contract manufacturers.

Our product marketing, business development and application solution engineering teams focus on leveraging our core MotionTracking devices across end markets and operate with a common mission to drive and promote motion interface applications and use cases. These teams are responsible for all new applications and market specific engagements, providing customized technical and application support, and identifying opportunities and strategic relationships. Furthermore, they work closely with ecosystem partners to further promote and enable the motion interface market. For example, these teams may engage with microcontroller suppliers, operating system platform vendors, application providers, independent software developers, and system solution platform vendors. Further, the technical marketing and application engineering teams actively engage with new customers during their design-in processes to educate them on the value proposition of our MotionTracking devices, identify how they could utilize our solutions in their products and provide them with the most suitable solutions, application programming interfaces (APIs) and potential reference designs. We believe these activities could result in continued adoption of our MotionTracking devices by new customers.

We work directly with large original equipment manufacturer (OEM) customers to assist them in developing solutions and applications that may lead to more demand for our products. Early adoptees in new market segments typically take 6 to 12 months to evaluate their need for motion interface before the start of any development activities, which typically take an additional 6 to 12 months. For customers that have already adopted motion interface, we typically undertake a shorter sales cycle. If successful, this process culminates in the use of our product in their system, which we refer to as a design win. Volume production can begin shortly after the design win. For our larger OEM customers, we believe that our direct customer engagement approach, ecosystem partnerships and adoption of our APIs into major software operating systems provides us with significant differentiation in the customer sales process by aligning us more closely with the changing needs of these OEM customers and their end markets. We actively utilize field application engineers as part of our sales process to better engage the customer with our products. To effectively service our other customers, we achieve greater reach and operating leverage by using manufacturers’ representatives and distributors.

Our direct customer engagement model extends to service and support. We work closely with our customers to ensure the successful installation and ongoing support of our products. We support our customers with a team of experienced account managers, sales professionals and field application engineers who provide business planning, and pre-sale and operational sales support.

Our external marketing strategy is focused on building our brand and driving customer demand for our MotionTracking devices. Our internal marketing organization is responsible for branding, collateral generation, channel marketing and sales support activities. We focus our resources on programs, tools and activities that can be leveraged by our global channel partners to extend our marketing reach, such as sales tools and collateral, product awards and technical certifications, training, regional seminars and conferences, webinars and various other demand-generation activities.

13

Table of Contents

Manufacturing

Our Nasiri-Fabrication platform combines MEMS with standard complementary metal oxide semiconductors (CMOS) at the wafer level, which has allowed us to pioneer the industry’s first high-volume, commercial MEMS fabless business model. This fabless approach allows us to focus our engineering and design resources on product development and design. In addition, as we do not own wafer fabrication facilities, we are able to reduce our fixed costs and capital expenditures. In contrast to many fabless MEMS companies, which utilize standard process technologies and design rules established by their MEMS foundry partners, we have developed our own proprietary Nasiri-Fabrication platform and collaborated with our foundry partners to install our fabrication technology on their equipment in their facilities solely for manufacturing our products. Through close collaboration with our CMOS-MEMS foundry partners, we are able to maintain control over the manufacturing process, which has historically resulted in favorable yields for our products.

The majority of our wafers are currently provided by Taiwan Semiconductor Manufacturing Corporation, Limited. Wafer foundries manufacture both the MEMS and CMOS wafer, perform the critical wafer level bonding step of Nasiri-Fabrication and deliver the final combined CMOS-MEMS wafer product to us. We have recently qualified GLOBALFOUNDRIES Inc. as a foundry partner and plan to have other CMOS-MEMS foundries qualified for our products in the future.

The completed bonded CMOS-MEMS wafers are shipped to our facility in Taiwan for proprietary wafer level testing. Our products are then assembled and packaged by independent subcontractors in Taiwan and Thailand. We currently outsource our packaging operations to Siliconware Precision Industries Co. Limited, HANA Microelectronics Group, and Lingsen Precision Industries, Limited. The assembled products are then forwarded for final calibration and outgoing functionality test to our wholly owned subsidiary in Hsinchu, Taiwan, prior to shipping to our customers or distributors.

Over the last three years, we have been able to increase our annual manufacturing capacity to over 300 million units in order to meet the volume demands of our customers, as well as potential additional demand. We continue to expand our CMOS-MEMS manufacturing capacity as well as our captive wafer sort, sensor test, and calibration testing facilities in Taiwan.

Research and Development

We have assembled an experienced team of engineers with core competencies in MEMS design and fabrication, CMOS mixed-signal design, and software development. Through our research and development efforts, we have developed a collection of intellectual property and know-how that we are able to leverage across our products and end markets. Our research and development efforts are generally targeted at five areas:

| • | In the area of the Nasiri-Fabrication platform, we intend to continue to invest in our process technology to further refine our technology platform with respect to overall form factor, product performance and process yield enhancement and to expand the platform to enable us to further develop our product offerings beyond what is currently achievable. |

| • | With our heritage in high-volume fabless MEMS manufacturing, we believe we are uniquely positioned to help enable a fabless MEMS ecosystem. We have recently developed an NF-Shuttle program that allows universities and industry peers to license and leverage our technology in the development of CMOS-MEMS based solutions. |

| • | In the area of MEMS development and design, we intend to expand our portfolio of products, exploring new ways of integrating various sensors in a monolithic motion processor that eliminates the need for discrete motion sensors. We are also investing in the development of systems expertise in new markets and applications that leverage our core capabilities. |

14

Table of Contents

| • | In the area of CMOS design and integration, our initiatives include developing analog and digital IC design capabilities and circuit development intellectual property to facilitate our MEMS development roadmap, improving our sensor performance, and adding new functions to our products. |

| • | In the area of software and algorithms, our initiatives include algorithm development for MotionFusion as well as the incorporation of additional functionality into our MotionApps platform. Advances in this area will help to enhance the detection and analysis of complex motion sensor data, as well as enable higher level functionality in the form of APIs and motion-based applications to allow our customers to quickly and efficiently leverage the capabilities of our MotionTracking devices. |

Through our research and development efforts, we intend to continually expand our portfolio of patents and to enhance our intellectual property position. As of April 1, 2012, we had 109 employees involved in research and development. Our engineering design teams are located in Sunnyvale, California. For fiscal years 2012 and 2011, we incurred $19.7 million, and $15.8 million, respectively, in research and development costs.

Intellectual Property Rights

We primarily rely on patent, trademark, copyright and trade secrets laws, confidentiality procedures, and contractual provisions to protect our technology. We focus our patent efforts in the United States, and, when justified by cost and strategic importance, we file corresponding foreign patent applications in strategic jurisdictions, such as Europe, the Republic of Korea, Taiwan, China and Japan. We have 23 issued U.S. patents and 3 issued foreign patents, which will expire between October 2023 and December 2032, and 41 patent applications pending for examination in the United States Patent and Trademark Office and 31 international patent applications pending for examination in Europe, the Republic of Korea, Taiwan, China and Japan which will expire between October 2024 and July 2032.

All of our foreign issued patents and patent applications are related to our U.S. issued patents and patent applications.

Our issued patents and certain of our pending patent applications relate to the Nasiri-Fabrication platform, which allows us to reduce back-end costs and form factor, to create hermetically sealed cavities for MEMS sensors and to improving performance, reliability and integration, and to our sensor design, which reduces sensitivity to interference from environmental sounds and vibrations, enabling higher performance and accuracy. In addition, we have other pending patent applications that relate to mixed-signal circuits and architectures, which have a wide variety of applications, and to algorithms, software and application development, which facilitate offloading motion interface computations from main application processors to our chips.

We intend to continue to file additional patent applications with respect to our technology. We do not know whether any of our pending patent applications will result in the issuance of patents or whether the examination process will require us to narrow our claims. Even if granted, there can be no assurance that these pending patent applications will provide us with protection. Our intellectual property strategy is to, where feasible, defend our IP across the various aspects of our solution. While we license IP and software libraries from third parties, none of these are fundamental to our MotionTracking devices and fabrication platforms.

Employees

As of April 1, 2012, our total headcount was 263, comprised of 109 employees in research and development, 63 employees in sales and marketing, 66 employees in manufacturing operations, and 25 employees in a general and administrative capacity. None of our employees are represented by a labor union with respect to his or her employment with us. We have not experienced any work stoppages, and we consider our relations with our employees to be good.

15

Table of Contents

Competition

We compete with companies that may have substantially greater financial and other resources with which to pursue engineering, manufacturing, marketing and distribution of their products. We currently and primarily compete with the following twelve companies: Analog Devices, Inc., Epson Toyocom Corporation, Kionix, Inc. (a wholly owned subsidiary of Rohm Co., Ltd.), MEMSIC, Inc., Murata Manufacturing Co., Ltd. (Murata), Panasonic Corporation, Robert Bosch GmbH, Sensor Dynamics, Inc. (recently acquired by Maxim Integrated Products, Inc.), Sony Corporation, STMicroelectronics N.V. (STMicro) and VTI Technologies, Inc. (recently acquired by Murata). Currently, we believe STMicro is our primary competitor in the consumer motion sensing market. Over time, we expect continued competition from motion sensor competitors as well as competition from new entrants into the motion interface market.

The principal methods of competition of motion interface technology includes the following:

| • | The design and volume production of new products that anticipate the motion interface and integration needs of customers’ next generation products and applications; |

| • | Scalable operations to meet customers’ volume and timing demands; |

| • | A declining manufacturing and operating cost structure; |

| • | Identification of new and emerging markets, applications and technologies and developing products for these markets; |

| • | Product pricing points, performance and cost effectiveness; |

| • | The recruitment and retention of key employees; |

| • | Intellectual property, including patents and trademarks; |

| • | High product quality, reliability and customer support; |

| • | Financial stability; |

| • | Manufacturing, distribution and marketing capability; |

| • | Brand recognition; |

| • | Size of customer base; and |

| • | Strength and length of key customer relationships. |

We believe we are competitive with respect to these factors, particularly because our products are typically smaller in size, are highly integrated, and achieve high performance specifications at lower price points than competitive products. However, most of our current competitors have longer operating histories, significantly greater resources, greater brand recognition and a larger base of customers than we do.

Legal Proceedings

From time to time we are involved in litigation that we believe is of the type common to companies engaged in our line of business, including intellectual property and employment issues. Regardless of the merit or resolution of any such litigation, complex intellectual property litigation is generally costly and can divert the efforts and attention of our management and technical personnel. Although occasional adverse decisions or settlements may occur, management believes that the final disposition of such matters will not have a material effect on our business, financial position, results of operations or cash flows.

On May 16, 2012, STMicroelectronics, Inc. (“STI”) filed a patent infringement complaint in the Northern District of California against us, alleging infringement of U.S. Patent Nos. 6,504,253; 6,846,690; 6,405,592;

16

Table of Contents

6,546,799; 6,928,872; 7,450,332; 7,409,291; 5,874,850; and 5,986,861 (collectively, the “Asserted Patents”). STI alleges that certain lnvenSense Micro-Electro-Mechanical Systems products and services, including but not limited to InvenSense's ITG-3200, MPU-6050, IDG-500, and IMU-3000 product lines, infringe one or more claims of the Asserted Patents. As this litigation has only recently been initiated, we believe it is not yet possible to assess the merits of the plaintiffs claim and or the amount of damages, if any, that could be awarded in the event of an unfavorable outcome. We intend to contest the case vigorously.

On July 20, 2010, plaintiff Wacoh Company filed a complaint in the District of Delaware against us and four other companies in the business of making gyroscopes for various applications, alleging infringement of U.S. Patent Nos. 6,282,956 and 6,865,943. The complaint sought unspecified monetary damages, costs, attorneys’ fees and other appropriate relief. In January 2012, we prevailed on a motion to sever the case against us from the cases against other companies and to transfer the case to the Northern District of California. We intend to continue to contest the case vigorously. Our management believes that this lawsuit has no merit and believes that the overall outcome of this complaint will not have a material effect on our business, financial position, results of operations, or cash flows.

Corporate and Available Information

The following filings are made available through our investor relations website after we file them with the SEC: Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and our Proxy Statements for our annual meetings of stockholders. These filings are also available for download free of charge on our investor relations website. We also provide a link to the section of the SEC’s website at www.sec.gov that has all of our public filings, including Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, all amendments to those reports, our Proxy Statements, and other ownership related filings. Further, a copy of this Annual Report on Form 10-K is located at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330.

We webcast our earnings calls and certain events we participate in or host with members of the investment community on our investor relations website. Additionally, we provide notifications of news or announcements regarding our financial performance, including SEC filings, investor events, press and earnings releases, and blogs as part of our investor relations website. Investors and others can receive notifications of new information posted on our investor relations website in real time by signing up for email alerts and RSS feeds. Further corporate governance information, including governance guidelines, board committee charters, and code of conduct, is also available on our investor relations website under the heading “Corporate Governance.” The contents of our websites are not intended to be incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC, and any references to our websites are intended to be inactive textual references only.

Additional information required by this Item 1 are incorporated by reference in Item 6, “Selected Financial Data”, Item 7, “Management's Discussion and Analysis of Financial Condition and Results of Operations” and Item 8, “Financial Statements and Supplementary Data” of this Annual Report on Form 10-K.

17

Table of Contents

Our operations and financial results are subject to various risks and uncertainties, including those described below, which could adversely affect our business, financial condition, results of operations, cash flows, and the trading price of our common stock.

Risks Related to Our Business

We are dependent upon the continued market acceptance and adoption of motion interface and, in particular, the adoption of our MotionTracking devices in consumer electronics products.

Our products are currently used to provide motion sensing and processing functionality, primarily in consumer electronics products for video gaming and mobile and handheld devices, including smartphones and tablet devices. Motion sensing utilizes gyroscopes, accelerometers and other sensors (increasingly integrated together to reduce the number of discrete sensors) to measure the motion of the device when manipulated by the user, and enables applications such as re-orienting a screen on a smartphone from portrait mode to landscape mode and providing an interface for motion-based commands for video gaming. A motion interface platform, on the other hand, is a complete system-level solution that delivers improved functionality and performance because it integrates various motion sensors with digital control and processing, and provides high-level programming interfaces. Motion interface is a relatively new technology for many consumer electronics products that can be utilized in a number of applications, including motion-based video games or user interfaces for smartphones. We have developed a MotionProcessing platform that we consider to be proprietary.

Market adoption and acceptance of motion interface technology, including our MotionTracking devices, in consumer electronics products is dependent on a number of factors that are outside of our control. For example, device manufacturers must decide whether incorporating the improved functionality and performance that comes with motion interface will result in improved sales and market acceptance of their products. In addition, device manufacturers may not be able to integrate motion sensing or processing technologies into their products in a manner that they, or their customers, consider to deliver cost-effective, compelling functionality, and developers may not introduce applications that employ motion interface in a compelling way. In addition, there are a number of companies that claim intellectual property ownership over motion as a user interface, and these claims could discourage manufacturers from integrating motion interface technology into their products.

We are particularly dependent upon the continued adoption of MotionTracking devices, including our MotionTracking devices, in mobile handheld devices, including smartphones and tablet devices. While smartphone manufacturers have begun to incorporate advanced motion sensing functionality, including three-axis gyroscopes, into their devices, if applications that utilize this functionality are not developed or if consumers do not find the applications provided by motion interface technology compelling, mobile device manufacturers may curtail their adoption of this technology. Consequently, our net revenue may fall short of our expectations and operating results could be adversely affected. Any unanticipated delay in the launch or decline in the volume of our customers’ smartphone and tablet device platforms into which we have been designed may negatively impact our net revenue.

The adoption of MotionTracking devices, and, in particular, our MotionTracking devices, in mobile handheld devices and other consumer electronics products, is dependent to a substantial degree upon the development of software applications written by third-party developers that utilize motion interface technology to provide a compelling user experience and consumer demand for such applications. If consumers or device manufacturers do not find the enhanced performance of devices employing motion interface technology to be compelling or sufficient to justify the additional cost of including the technology in their products, our net revenue and operating results may be adversely affected.

18

Table of Contents

We face intense competition based on a number of factors, including price, and we expect competition to increase in the future, which could have an adverse effect on our net revenue, potential net revenue growth rate and market share.

The market for motion interface products is highly competitive, particularly in the market for consumer electronics, which is highly sensitive to price. In the market for consumer electronics, we compete to various degrees on the basis of our products’ size, price, integration, performance, product roadmap, and reliability. Competition may increase and intensify if more and larger semiconductor companies, or the internal resources of large, integrated original equipment manufacturers, or OEMs, enter our markets. Increased competition could result in price pressure, reduced profitability and loss of market share, any of which could materially and adversely affect our business, net revenue and operating results.

We face competition primarily from integrated semiconductor manufacturers, such as Analog Devices, Inc., Epson Toyocom Corporation, Kionix, Inc. (a wholly owned subsidiary of Rohm Co., Ltd.), MEMSIC, Inc., Murata Manufacturing Co., Ltd. (Murata), Panasonic Corporation, Robert Bosch GmbH, Sensor Dynamics, Inc. (recently acquired by Maxim Integrated Products, Inc.), Sony Corporation, STMicroelectronics N.V. and VTI Technologies, Inc. (recently acquired by Murata), from in-house development organizations within some of our potential customers and from smaller companies specializing in MEMS and motion-sensing products, including those that provide motion-sensing products offering less functionality at a lower cost, such as accelerometers. Our primary competitor in most of our target markets is STMicroelectronics. We also compete with large, sophisticated platform developers that may prefer to integrate less sophisticated motion sensors and to develop their own motion interface application interfaces for developers, marginalizing the total solution we offer. Additionally, competitors that have traditionally focused on industrial or automotive applications for MEMS motion sensors may pursue the consumer electronics market, thus intensifying competition for our products. We expect competition in the markets in which we participate to increase in the future as existing competitors improve or expand their product offerings.

Most of our current competitors have longer operating histories, significantly greater resources, greater brand recognition and a larger base of customers than we do. Some of our competitors also have in-house vertically integrated manufacturing capabilities. In addition, these competitors may have greater credibility with our existing or prospective customers and in some cases are already providing components for products to such existing and prospective customers that may in the future include MotionTracking devices. Moreover, many of our competitors have been doing business with our customers or potential customers for a long period of time and have established relationships that may provide them with information regarding future market trends and requirements that may not be available to us. Additionally, some of our larger competitors may be able to provide greater incentives to customers through rebates and similar programs. Finally, some of our competitors with multiple product lines may bundle their products to offer customers a broader product portfolio at a more competitive price point. These factors may make it difficult for us to gain or maintain market share.

The average selling prices of our products could decrease, which could have a material adverse effect on our net revenue and gross margins.

Our primary customers expect the average selling prices of our products to continue to decrease over time as a result of agreements we enter into with our customers from time to time, competitive pricing pressures, new product introductions by us or our competitors, product end-of-life programs and for other reasons. We have experienced and may continue to experience substantial period-to-period fluctuations in future operating results due to the erosion of the average selling prices of our products. If we are unable to offset any reductions in our average selling prices by implementing internal cost reduction programs, increasing our sales volumes or introducing new products with higher gross margins, our net revenue and gross margins will decline, which could have a material adverse effect on our results of operations.

19

Table of Contents

To date, a significant amount of our net revenue has been attributable to demand for our products in the video gaming market. This market may decline or remain flat. Even if the market grows, such growth may not benefit the video game consoles that incorporate our products. Any of these potential developments could have a material adverse effect on our business, net revenue and operating results.

We derive a significant amount of our net revenue from the video gaming market. Currently, there are three major providers of video gaming consoles, and our products have only been incorporated by one of these console providers. While the other two video gaming companies have introduced video gaming accessories or consoles that incorporate motion-based video gaming functionality, our MotionTracking devices have not been incorporated into these new products. Future generations of video gaming consoles and video gaming accessories may not adopt motion interface at all or, if they do, may use our competitors’ products, internally developed solutions or alternative technologies not based on MEMS sensors. If we are not successful in obtaining design wins in new generations of video gaming accessories or consoles, if video gaming consoles or accessories that incorporate our products are not successful, or if video games that utilize the functionality provided by our MotionProcessing products are not successful, our net revenue and operating results will decline. Further, while the overall video gaming market has performed well over the past several years, even if we achieve design wins, the video gaming market or the market for specific products incorporating our solutions may not continue to grow or may decline for a number of reasons outside of our control, including competition among video gaming companies, market saturation, the lack of compelling video game titles or the emergence of alternative forms of entertainment.

Additionally, the video gaming market is subject to volatility from changes in the macroeconomic environment as well as industry specific trends, such as trends resulting from announcements by one of the major video gaming companies or from the console cycle of video gaming consoles. Any decline or volatility in the overall video gaming industry could cause our net revenue and operating results to fall short of expectations or decline.

Revenue delays could result from shortages of key third party components to our customers and injunctions of our customer products from intellectual property claims by their competitors.

We are depend on our customers for our net revenue and our net revenues could be negatively impacted by shortages of key third party components to our customers and injunctions of our customer products from intellectual property claims by their competitors.

We currently depend on Nintendo for a material portion of our net revenue, and the loss of, or a substantial reduction in orders from, Nintendo would significantly reduce our net revenue and adversely impact our operating results.

Nintendo Co. Limited accounted for approximately 31% of our net revenue for fiscal year 2012. We expect that sales to Nintendo will continue to account for a substantial portion of our net revenue for the foreseeable future. The loss of, or a substantial reduction in orders from, Nintendo would have a significant negative impact on our business. While we work closely with Nintendo to develop forecasts for periods of up to one year, these forecasts are not legally binding and may be unreliable, and we do not typically obtain firm purchase orders or commitments from Nintendo that extend beyond a short period. Nintendo, like other customers, might increase, cancel, reduce or reschedule forecasts and orders with us on relatively short notice, which could expose us to the risks of insufficient capacity or excess inventory and could have a material adverse impact on our operating results.

To date, a substantial majority of the products we have sold to Nintendo have been incorporated into the Wii MotionPlus accessory, the Wii Remote Plus controller used with the Nintendo Wii video gaming console and the 3DS gaming console. Because a large portion of our net revenue is tied to Nintendo gaming products, we expect to remain dependent on the continued success of products and related video games utilizing motion interface for the foreseeable future.

20

Table of Contents

The Wii is in the fifth year of its console cycle, which refers to the life cycle of video game consoles, which we believe is typically about five years. Nintendo has announced its intention to introduce a successor to the Wii. If sales of the successor console are not as significant as sales of the Wii console and sales of the Wii console decline should Nintendo discontinue the Wii console, our sales based on Wii MotionPlus accessories and Wii Remote Plus controllers included with new console sales will also decline.

Nintendo may choose to develop a second source for motion interface components in order to reduce its exposure to the risks associated with a single source of supply. In addition, Nintendo may in the future choose to adopt a solution that is different from ours or use motion interface components or MotionTracking devices supplied by competitors or developed internally. Any of these developments would significantly harm our business.

If we fail to develop and introduce new or enhanced products on a timely basis, our ability to attract and retain customers could be impaired, and our competitive position could be harmed.

We operate in a dynamic environment characterized by rapidly changing technologies and industry standards, and rapid technological obsolescence. To compete successfully, we must design, develop, market and sell new or enhanced products that provide increasingly higher levels of performance, integration and reliability and meet the cost expectations of our customers. A key element of our product strategy is to integrate additional sensors and motion interface functionality into our products. For instance, we have expanded our product line from three-axis gyroscopes to a six-axis device that includes a three-axis gyroscope, three-axis accelerometer and motion interface functionality. In addition, our latest generation product, the nine-axis MPU-9150, combines our three-axis MEMS gyroscope, three-axis MEMS accelerometer, MotionFusion technology and MotionApps platform with a third-party three-axis e-compass. The introduction of new products by our competitors, the market acceptance of products based on new or alternative technologies, or the emergence of new industry standards could render our existing or future products obsolete.

If we fail to successfully manage the transition to products using our next generation six-and nine-axis MotionProcessors or more highly integrated products, we will lose net revenue and our operations could be materially and adversely affected.