Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AIR PRODUCTS & CHEMICALS INC /DE/ | d369002d8k.htm |

Exhibit 99.1

Strategy for Success Growing in Latin America: Indura & Air Products June 19 2012

Forward looking statement This presentation contains “forward-looking statements” within the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements about growth, projections, and business outlook. These forward-looking statements are based on management’s reasonable expectations and assumptions as of the date this release. Actual performance and financial results may differ materially from projections and estimates expressed in the forward-looking statements because of many factors not anticipated by management, including, without limitation, deterioration in Latin American economic and business conditions; weakening demand for the Company’s products; future financial and operating performance of major customers and industries served by the Company in Latin America; unanticipated contract terminations or customer cancellations or postponement of projects and sales; the success of commercial negotiations; asset impairments due to economic conditions or specific product or customer events; the impact of competitive products and pricing; interruption in ordinary sources of supply of raw materials; costs and outcomes of litigation or regulatory activities; market acceptance of the products and applications; achieving anticipated acquisition synergies; the timing, impact, and other uncertainties of future acquisitions or divestitures; significant fluctuations in interest rates and foreign currencies from that currently anticipated; the continued availability of capital funding sources for the Company’s Latin American operations; the impact of environmental, healthcare, tax or other legislation and regulations; the impact of new or changed financial accounting guidance; and other risk factors described in the Company’s Form 10K for its fiscal year ended September 30, 2011. The Company disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this document to reflect any change in the Company’s assumptions, beliefs or expectations or any change in events, conditions, or circumstances upon which any such forward-looking statements are based.

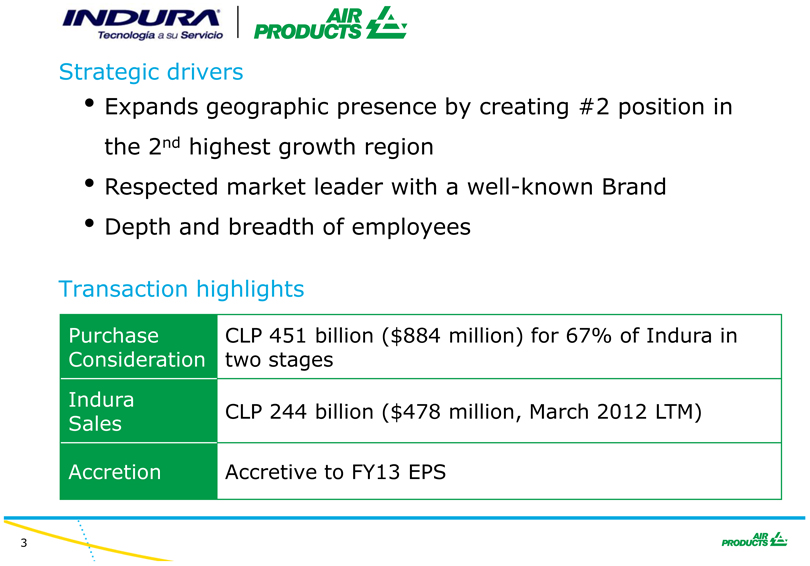

Strategic drivers Expands geographic presence by creating #2 position in the 2nd highest growth region Respected market leader with a well-known Brand Depth and breadth of employees Transaction highlights Purchase CLP 451 billion ($884 million) for 67% of Indura in Consideration two stages Indura CLP 244 billion ($478 million, March 2012 LTM) Sales Accretion Accretive to FY13 EPS Indura AIR PRODUCTS Tecnologia a su servicio

Indura: The largest independent industrial gas company in Latin America: 2,300 employees Liquid Bulk 15% 50,000 customers 20 production plants Packaged Gases & Hardgoods Strong brand name and recognition 100 retail stores 40 transfills Welding and safety equipment

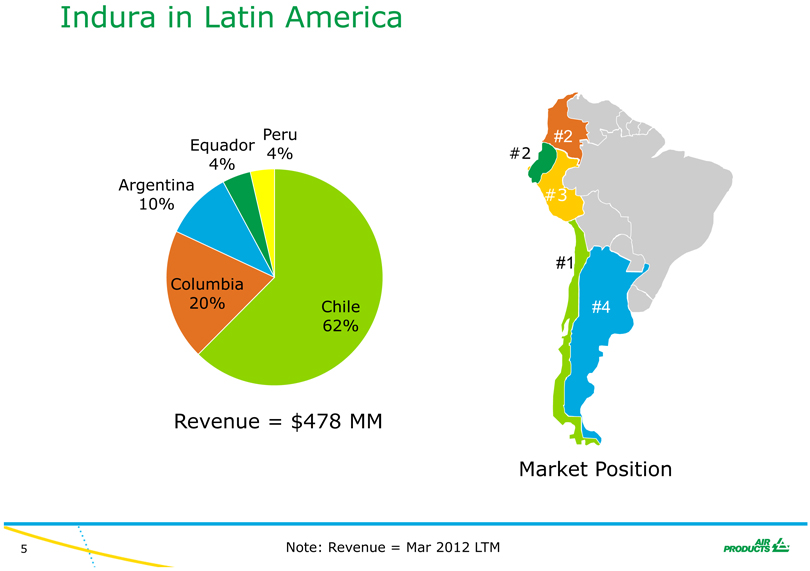

5 Chile 62% Columbia 20% Argentina 10% Equador 4% Peru 4% #2 #4 #1 #3 Indura in Latin America Revenue = $478 MM #2 Market Position Note: Revenue = Mar 2012 LTM

6 Latin American market offers high growth potential 0% 1% 2% 3% 4% 5% 6% 7% Asia Latin America US / Canada Europe 2013 – 2022 Manufacturing Growth Rates Expect double-digit Latin America Industrial Gas Market Growth

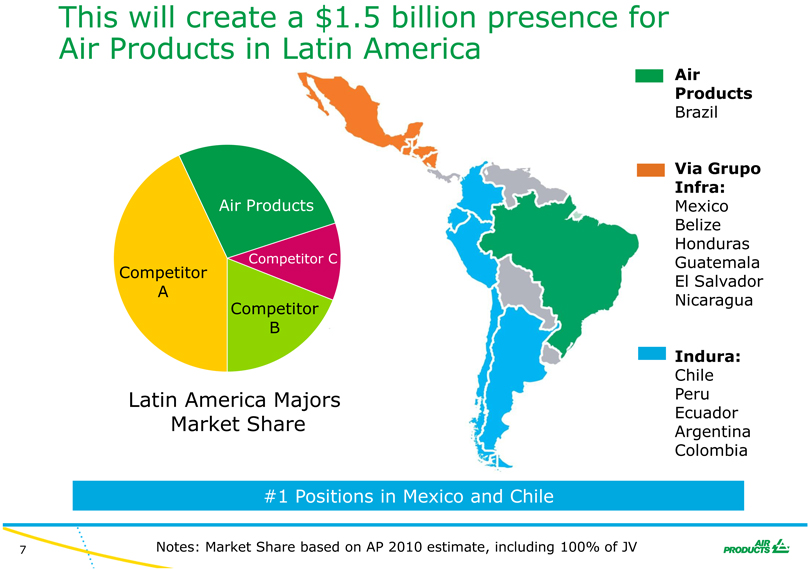

7 This will create a $1.5 billion presence for Air Products in Latin America Air Products Brazil Via Grupo Infra: Mexico Belize Honduras Guatemala El Salvador Nicaragua Indura: Chile Peru Ecuador Argentina Colombia Notes: Market Share based on AP 2010 estimate, including 100% of JV Latin America Majors Market Share Competitor C #1 Positions in Mexico and Chile Competitor A Air Products Competitor B

8 Acquisition economics Purchase Consideration (67%) CLP 451 B ($884MM) -Equity CLP 351 B -Proportional debt CLP 100 B Revenue Mar LTM (100%) CLP 244 B ($478MM) EBITDA Mar LTM (100%) CLP 52 B ($102MM) EBITDA Multiple 13x EPS Accretive in FY13 and beyond Briones family has a put option for their remaining interest

9 Value creation Cost synergies -Independent corporate costs -Purchasing -Shared services -Best practices (Indura Air Products ) Growth opportunities -Broaden on-site presence -Application extension -New offerings (Indura Air Products ) -Extension of Indura brand

10 Wrap-up Compelling strategic drivers -Expands geographic presence by creating #2 position in the 2nd highest growth region -Respected market leader with a well-known Brand -Depth and breadth of Employees Significant value creation Excellent fit with 2015 goals