Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Energy Transfer, LP | d368824d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Energy Transfer, LP | d368824dex991.htm |

June 18, 2012

ETP

HoldCo Corp.

Exhibit 99.2 |

Energy Transfer Partners, L.P.

Sunoco, Inc.

3738 Oak Lawn Ave.

1818 Market Street, Suite 1500

Dallas, TX 75219

Philadelphia, PA 19103

Attention: Investor Relations

Attention: Investor Relations

Phone: (214)

981-0795

Phone: (215) 977-6764

E-mail:

InvestorRelations@energytransfer.com

E-mail:

SunocoIR@sunocoinc.com

Forward Looking Statements

2

SAFE HARBOR FOR FORWARD-LOOKING STATEMENTS

PARTICIPANTS IN THE SOLICITATION

IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC

In connection with the proposed business combination transaction between Energy Transfer Partners,

L.P. (“ETP”) and Sunoco, Inc. (“Sunoco”), ETP plans to file with the U.S.

Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that

will contain a proxy statement/prospectus to be mailed to the Sunoco shareholders in connection

with the proposed transaction. THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS WILL CONTAIN IMPORTANT INFORMATION

ABOUT ETP, SUNOCO, THE PROPOSED TRANSACTION AND RELATED MATTERS. INVESTORS AND SECURITY HOLDERS ARE

URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS CAREFULLY WHEN THEY

BECOME AVAILABLE. Investors and security holders will be able to obtain free copies of the

registration statement and the proxy statement/prospectus and other documents filed with the SEC by ETP and Sunoco through the web site maintained by the SEC

at www.sec.gov. In addition, investors and security holders will be able to obtain free copies

of the registration statement and the proxy statement/prospectus by phone, e-mail or

written request by contacting the investor relations department of ETP or Sunoco at the following:

ETP and Sunoco, and their respective directors and executive officers, may be deemed to be

participants in the solicitation of proxies in respect of the proposed transactions

contemplated by the merger agreement. Information regarding directors and executive officers of

ETP’s general partner is contained in ETP’s Form 10-K for the year ended December

31, 2011, which has been filed with the SEC. Information regarding Sunoco’s directors and executive officers is contained in Sunoco’s definitive proxy statement dated

March 16, 2012, which is filed with the SEC. A more complete description will be available in the

registration statement and the proxy statement/prospectus. Statements in this document regarding the proposed transaction between ETP and Sunoco, the expected

timetable for completing the proposed transaction, future financial and operating results,

benefits and synergies of the proposed transaction, future opportunities for the combined company, and any other statements about ETP, Energy Transfer Equity, L.P. (“ETE”),

Sunoco Logistics Partners, L.P. (“SXL”) or Sunoco managements’ future expectations,

beliefs, goals, plans or prospects constitute forward looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical

fact (including statements containing the words “believes,” “plans,” “anticipates,”

“expects,” estimates and similar expressions) should also be considered to be forward

looking statements. There are a number of important factors that could cause actual results or events

to differ materially from those indicated by such forward looking statements, including: the ability

to consummate the proposed transaction; the ability to obtain the requisite regulatory

approvals, Sunoco shareholder approval and the satisfaction of other conditions to consummation of the

transaction; the ability of ETP to successfully integrate Sunoco’s operations and

employees; the ability to realize anticipated synergies and cost savings; the potential impact of

announcement of the transaction or consummation of the transaction on relationships, including

with employees, suppliers, customers and competitors; the ability to achieve revenue growth; national, international, regional and local economic, competitive and regulatory

conditions and developments; technological developments; capital and credit markets conditions;

inflation rates; interest rates; the political and economic stability of oil producing nations;

energy markets, including changes in the price of certain commodities; weather conditions;

environmental conditions; business and regulatory or legal decisions; the pace of deregulation of

retail natural gas and electricity and certain agricultural products; the timing and success of

business development efforts; terrorism; and the other factors described in the Annual Reports

on Form 10-K for the year ended December 31, 2011 filed with the SEC by ETP, ETE, SXL and Sunoco.

ETP, ETE, SXL and Sunoco disclaim any intention or obligation to update any forward looking

statements as a result of developments occurring after the date of this document. |

Overview of ETP HoldCo Transaction

Energy Transfer Equity, L.P. (“ETE”) and Energy Transfer Partners, L.P.

(“ETP”) will combine the businesses of Southern Union Company

(“SUG”) and Sunoco, Inc. (“SUN”) under an ETP-controlled entity, ETP HoldCo Corporation

(“ETP HoldCo”)

-

ETE will contribute SUG in exchange for a 60% equity interest

-

ETP will contribute SUN in exchange for a 40% equity interest

•

Prior to the contribution of SUN to ETP HoldCo, SUN’s interests in Sunoco

Logistics Partners L.P. (“SXL”) will be transferred to ETP

-

ETP will control ETP HoldCo through a majority of Board seats

The ETP HoldCo transaction will be completed concurrently with the SUN acquisition,

expected to close in the third or fourth quarter of this year

Resolves timing of ETE’s dropdown of the SUG assets without the need for

external equity or debt financing. Simplifies organizational structure by

combining SUG and SUN under a single ETP-controlled entity -

Improves transparency to investors and analysts as SUG and SUN businesses will be

consolidated under ETP for financial reporting purposes

-

Allows for more efficient commercial management and incremental commercial and

operational synergies -

Enhances distribution growth prospects at both ETE and ETP

3 |

Pro

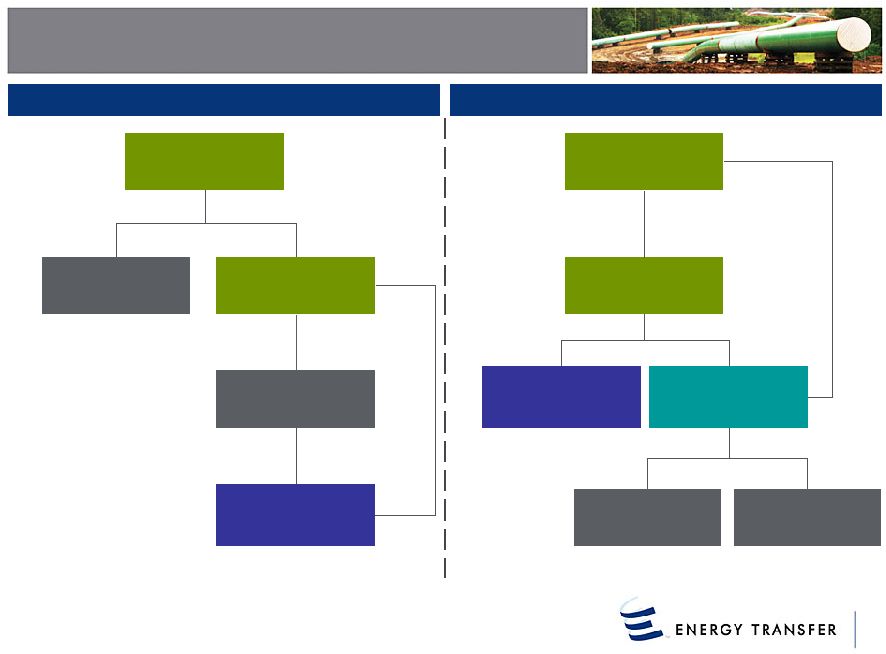

Forma Organizational Structure 4

Previously Announced Structure

Pro Forma ETP HoldCo Structure

100.0% IDRs, 2.0%

GP and 32.4% LP

Interest

Energy Transfer

Partners, L.P.

Energy Transfer

Equity, L.P.

100.0% IDRs, GP

Interest and

21.9% LP Interest

Sunoco Logistics

Partners L.P.

ETP HoldCo

Sunoco, Inc.

Southern Union

Company

60%

Equity

Interest

40%

Equity Interest

100.0% Equity

Ownership

32.4%

LP Interest

Sunoco Logistics

Partners L.P.

Energy Transfer

Partners, L.P.

Sunoco, Inc.

100.0%

IDRs and

2.0% GP

Interest

Energy Transfer

Equity, L.P.

100.0% IDRs, GP

Interest and

21.9% LP Interest

Southern Union

Company

100.0% Interest

Note: Excludes ETE’s interests in Regency Energy Partners LP

|

Pro

Forma ETP Combined Asset Footprint 5

Note: Excludes Sunoco’s retail marketing outlets

|

Pro

Forma ETP – Significant Size and Scale

6

Summary Asset Overview

Status Quo

SUN &

Pro Forma

ETP

SXL

SUG

ETP

Pipelines (miles):

Natural Gas

24,294

-

15,700

39,994

Natural Gas Distribution (LDCs)

-

-

15,173

15,173

NGL

2,110

40

-

2,150

Crude Oil

-

5,400

-

5,400

Refined Products

-

2,500

-

2,500

Total

26,404

7,940

30,873

65,217

Operating Metrics:

Natural Gas Throughput (Bcfpd)

23

-

6

28

NGL Throughput (Mbpd)

677

107

-

784

LNG Throughput (Bcfpd)

-

-

2

2

Crude Oil Throughput (Mbpd)

-

1,747

-

1,747

Refined Products Throughput (Mbpd)

-

522

-

522

Natural Gas Processing Capacity (MMcfpd)

2,942

-

475

3,417

Natural Gas Treating Capacity (MMcfpd)

1,985

-

585

2,570

Natural Gas Conditioning Capacity (MMcfpd)

846

-

-

846

NGL Processing Capacity (Mbpd)

251

-

-

251

Natural Gas Storage (Bcf)

74

-

101

176

NGL Storage (Mbbl)

47,000

1,000

-

48,000

LNG Storage Capacity (Bcf)

-

-

9

9

Crude Oil Storage (Mbbl)

-

25,000

-

25,000

Refined Products Storage (Mbbl)

-

16,000

-

16,000

Facilities:

Natural Gas Storage Facilities

3

-

6

9

NGL Storage Facilities

2

1

-

3

Crude Oil Storage Facilities

-

4

-

4

Refined Products Storage Facilities

-

44

-

44

Natural Gas Process., Treat., Cond. Facilities

35

-

10

45

NGL Processing Facilities

4

-

-

4

Retail Marketing Outlets

-

4,900

-

4,900

Note: Joint venture assets shown on consolidated basis; includes projects under construction

Pipeline Mileage

NGL

8%

Natural Gas

92%

Natural Gas

62%

Crude Oil

8%

NGL

3%

LDCs

23%

Refined

Products

4%

Throughput*

NGL

15%

Natural Gas

85%

NGL

10%

Crude Oil

22%

Refined

Products

6%

LNG

4%

Natural Gas

58%

Storage Capacity*

NGL

79%

Natural Gas

21%

LNG

1%

Crude Oil

21%

Refined

Products

13%

NGL

41%

Natural Gas

24%

* Throughput and storage capacity converted on a 6:1 Mcf:Bbl basis

|