Attached files

| file | filename |

|---|---|

| 8-K - COPANO ENERGY, L.L.C. FORM 8-K - Copano Energy, L.L.C. | form8-k.htm |

Exhibit 99.1

1

June 2012

Investor Presentation

June 18, 2012

NASDAQ: CPNO

2

Disclaimer

Forward-Looking Statements

This presentation includes “forward-looking statements,” as defined in the federal securities laws. Statements that

address activities or events that Copano believes will or may occur in the future are forward-looking statements. These

statements include, but are not limited to, statements about future producer activity and Copano’s total distributable

cash flow and distribution coverage. These statements are based on management’s experience and perception of

historical trends, current conditions, expected future developments and other factors management believes are

reasonable.

address activities or events that Copano believes will or may occur in the future are forward-looking statements. These

statements include, but are not limited to, statements about future producer activity and Copano’s total distributable

cash flow and distribution coverage. These statements are based on management’s experience and perception of

historical trends, current conditions, expected future developments and other factors management believes are

reasonable.

Important factors that could cause actual results to differ materially from those in the forward-looking statements

include the following risks and uncertainties, many of which are beyond Copano’s control: the volatility of prices and

market demand for natural gas and natural gas liquids; Copano’s ability to continue to obtain new sources of natural

gas supply; the impact on volumes and resulting cash flow of technological, economic and other uncertainties inherent

in estimating future production; producers’ ability to drill and successfully complete and attach new natural gas

supplies; the NGL content of new gas supplies; Copano’s ability to access or construct new processing, fractionation

and transportation capacity; the availability of downstream transportation and other facilities for natural gas and NGLs;

mechanical failures and other operational risks affecting the performance of Copano’s processing plants and other

facilities, higher construction costs or project delays due to inflation, limited availability of required resources, or the

effects of environmental, legal or other uncertainties; general economic conditions; the effects of government

regulations and policies; and other financial, operational and legal risks and uncertainties detailed from time to time in

Copano’s quarterly and annual reports filed with the Securities and Exchange Commission.

include the following risks and uncertainties, many of which are beyond Copano’s control: the volatility of prices and

market demand for natural gas and natural gas liquids; Copano’s ability to continue to obtain new sources of natural

gas supply; the impact on volumes and resulting cash flow of technological, economic and other uncertainties inherent

in estimating future production; producers’ ability to drill and successfully complete and attach new natural gas

supplies; the NGL content of new gas supplies; Copano’s ability to access or construct new processing, fractionation

and transportation capacity; the availability of downstream transportation and other facilities for natural gas and NGLs;

mechanical failures and other operational risks affecting the performance of Copano’s processing plants and other

facilities, higher construction costs or project delays due to inflation, limited availability of required resources, or the

effects of environmental, legal or other uncertainties; general economic conditions; the effects of government

regulations and policies; and other financial, operational and legal risks and uncertainties detailed from time to time in

Copano’s quarterly and annual reports filed with the Securities and Exchange Commission.

Copano undertakes no obligation to update any forward-looking statements, whether as a result of new information or

future events.

future events.

3

Eagle Ford Shale

Update

Eagle Ford Shale

Growth Projects

Business Segment

Outlook

Agenda

Eagle Ford Shale

Update

Eagle Ford Shale

Growth Projects

Business Segment

Outlook

4

Long-term Value of Eagle Ford Strategy Unchanged

Eagle Ford Shale play considered one of the best in North America

• Size, quality and proximity to markets

Copano assets well positioned

• Existing pipes and processing capacity with significant tailgate market access

• New, large-diameter pipelines in service

Created and investing $1 billion in organic projects

• Capital invested at 5x multiple

Executed producer contracts totaling up to 1,000,000 MMBtu/d of committed

volumes

volumes

• Weighted average term of approximately 10 years

• Committed volumes over the terms of the agreements total approximately 3.3 Tcf of rich

Eagle Ford Shale gas

Eagle Ford Shale gas

Increasing contribution from fee-based cash flows

• Vast majority of our Eagle Ford shale contracts include fixed fees for gathering,

processing, transportation and fractionation services, and producer volume commitments

with deficiency payments

processing, transportation and fractionation services, and producer volume commitments

with deficiency payments

Based on today’s operating environment, we expect to maintain current

distribution level in the near-term, and our long-term view of distribution

growth is unchanged

distribution level in the near-term, and our long-term view of distribution

growth is unchanged

5

Eagle Ford Shale Processing

We expect combined actual NGL recoveries to remain above or near

contractually fixed recoveries for the balance of the year

contractually fixed recoveries for the balance of the year

• Margins from fixed recovery contract terms are in addition to the fixed fees we collect for our

midstream services

midstream services

Houston Central performance

• 200 MMcf/d cryo achieving better than designed recoveries since late April

• While lean oil plant has been achieving lower NGL recoveries from richer natural gas, overall

recoveries at the Houston Central complex (cryo plus lean oil) are ranging from slightly above to

slightly below weighted-average fixed-recovery contract levels

recoveries at the Houston Central complex (cryo plus lean oil) are ranging from slightly above to

slightly below weighted-average fixed-recovery contract levels

• Upon completion of new, highly efficient cryo expansion:

-Copano’s margins benefit from upside under fixed-recovery contracts

-Copano retains most of the margin benefit from ethane rejection capability

Third-party plant performance

• Eagle Ford Gathering’s recoveries at third-party plants are above fixed recovery contract levels

• Net impact to Copano of recoveries at third-party plants offsets lower Houston Central recoveries

High NGL content creates near-term liquids-handling constraints but ultimately

results in long-term value for Copano

results in long-term value for Copano

6

Houston Central Complex Expansion Projects

New 400 MMcf/d cryogenic expansion expected in service 1Q 2013

• Average recoveries will improve when the new cryogenic expansion comes online

• When Formosa’s new fractionator becomes operational in 2Q 2013, recoveries will

further improve with access to additional NGL handling capacity

further improve with access to additional NGL handling capacity

The second 400 MMcf/d cryogenic expansion further enhances recoveries

when placed in service in 2014

when placed in service in 2014

• Supported by recently announced producer contract and higher recovery rates

• Lean oil plant will be used for overflow or interruptible volume services

• Expected capital investment of $190 million at a 5x multiple

- Major capital spending begins 2H 2013

These expansions will provide Copano 1 Bcf/d of highly efficient

processing capacity backed by long-term producer commitments

processing capacity backed by long-term producer commitments

• Key driver to creating long-term unitholder value from rich Eagle Ford Shale play

7

Long-term Eagle Ford Shale Gas Contracts(1)

Eagle Ford Shale will drive shift to fee-based volumes

(2) Includes substantial, long-term acreage dedication from GeoSouthern in northern Eagle Ford Shale.

8

Eagle Ford Shale

Update

Eagle Ford Shale

Growth Projects

Business Segment

Outlook

Agenda

Eagle Ford Shale

Update

Eagle Ford Shale

Growth Projects

Business Segment

Outlook

9

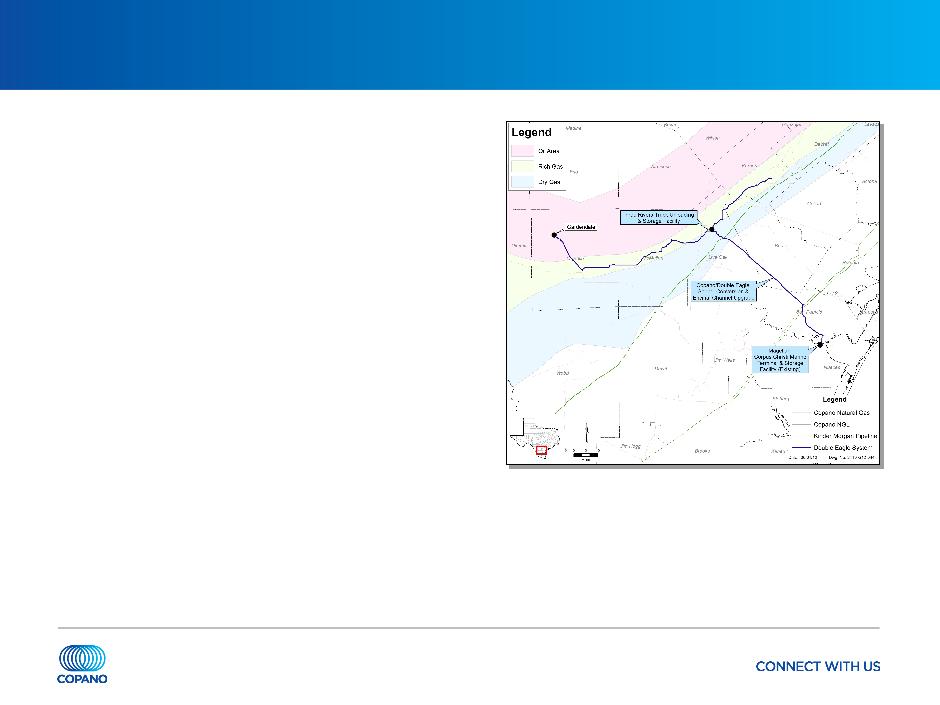

DK Pipeline Southwest Extension

Further extend DK pipeline by adding

approximately 65 miles of 24” pipeline

southwest into McMullen County

approximately 65 miles of 24” pipeline

southwest into McMullen County

• Provides access to significant new

Eagle Ford Shale volumes

Eagle Ford Shale volumes

• Ties additional existing Copano

gathering systems directly to Houston

Central complex

gathering systems directly to Houston

Central complex

• Supported by new, long-term volume

commitment from Petrohawk Energy

commitment from Petrohawk Energy

Expect to begin service 2Q 2013

Estimated capital investment of

approximately $120 million

approximately $120 million

10

Double Eagle Condensate Pipeline Joint Venture

50/50 JV with Magellan Midstream

• Constructing 140-mile condensate gathering

system

system

• Utilizes Copano’s existing 14” Goebel

pipeline and dual-line rights of way

pipeline and dual-line rights of way

• 100,000 Bbls/d of nominal capacity

• Ties into existing and expanded Magellan

storage and loading docks at the Port of

Corpus Christi

storage and loading docks at the Port of

Corpus Christi

• Interconnected to local petrochemical plants

and refineries via Magellan terminal

and refineries via Magellan terminal

• Pipeline from Three Rivers to Corpus Christi

expected to begin service as early as 1Q

2013; remaining assets 2Q 2013

expected to begin service as early as 1Q

2013; remaining assets 2Q 2013

Executed long-term, fee-based contracts with Talisman and Statoil

Estimated capital investment of approximately $100 million (includes Copano’s net

JV costs and costs to convert Goebel pipeline)

JV costs and costs to convert Goebel pipeline)

11

Summary of Eagle Ford Shale Infrastructure

Announced total capital investment of over $930 million

In excess of 1 Bcf/d of pipeline and processing capacity

Greater than 100,000 Bbls/d of fractionation capacity

12

Eagle Ford Shale

Update

Eagle Ford Shale

Growth Projects

Business Segment

Outlook

Agenda

Eagle Ford Shale

Update

Eagle Ford Shale

Growth Projects

Business Segment

Outlook

13

Texas Recent Developments

Saint Jo system - north Barnett Shale

Combo

Combo

• Plant fully committed under long-term,

fee-based contracts

fee-based contracts

• Plant running at or above nameplate

capacity

capacity

• Treating capacity expansion at Saint Jo

plant completed March 2012

plant completed March 2012

- Provides for a maximum of 110 MMcf/d of

inlet capacity

inlet capacity

- Capital investment of $12 million

- Increased contract fees for treating

• Southeast extension of Saint Jo

gathering system

gathering system

- Gathering incremental to current processed

volume at Saint Jo

volume at Saint Jo

- Expect initial service beginning 3Q 2012

- Capital investment of $12.5 million

(includes pipe and compression)

(includes pipe and compression)

14

Texas Recent Developments

Eagle Ford Shale

• Copano’s total Eagle Ford Shale volumes (including Eagle Ford Gathering volumes)

averaged approximately 430,000 MMBtu/d in 1Q 2012

averaged approximately 430,000 MMBtu/d in 1Q 2012

Lake Charles plant

• Processed approximately 133,000 MMBtu/d in 1Q 2012

- Currently running on an opportunistic basis

- At current pricing, anticipated monthly net gross margin of approximately $500K -

$900K

$900K

15

Texas Outlook

Saint Jo system

• Copano’s largest producer continues an active drilling program in the area

• Leasing activity continues

Eagle Ford Shale

• Approximately 240 rigs currently running in the Eagle Ford Shale

• Continue to expect volume increases on both wholly owned and joint venture assets for

the balance of 2012 and beyond

the balance of 2012 and beyond

Expect segment gross margin in 2Q 2012 to be higher by $3 - $5 million

compared to 1Q 2012 due to successful repair of the cryo at Houston Central

and volume growth from the Eagle Ford Shale

compared to 1Q 2012 due to successful repair of the cryo at Houston Central

and volume growth from the Eagle Ford Shale

16

Oklahoma Recent Developments

Woodford Shale

• Volumes on the Cyclone Mountain system up in 2Q 2012 from 1Q 2012

• Treating and compression capacity optimization ongoing

Mississippi Lime

• Drilling near Copano infrastructure continues to be active

• Expanding Osage system gathering footprint by installing approximately 34 miles of 8”

and 12” pipe to provide additional gathering, processing and nitrogen treating services to

Mississippi Lime producers

and 12” pipe to provide additional gathering, processing and nitrogen treating services to

Mississippi Lime producers

17

Oklahoma Outlook

Rich gas (primarily Hunton dewatering and Mississippi Lime)

• Drilling activity remains steady in 2Q 2012 compared to 1Q 2012

• 3 rigs running in the Hunton, 6 rigs in the Mississippi Lime and 10 rigs in other rich gas

areas

areas

• In the Mississippi Lime, volume growth expected as drilling activity increases

Lean gas (primarily Woodford Shale)

• Modest volume increases due to wells drilled in 1Q 2012; however, production should

decline in the second half of the year due to normal well decline and reduced drilling

activity

decline in the second half of the year due to normal well decline and reduced drilling

activity

• No active rigs

Expect gross margin to be flat to slightly lower in 2Q 2012 compared to 1Q

2012 due to lower commodity prices, partly offset by volume growth in the

Woodford Shale and continued development in the Mississippi Lime

2012 due to lower commodity prices, partly offset by volume growth in the

Woodford Shale and continued development in the Mississippi Lime

18

Rocky Mountains Outlook

Drilling and dewatering activity will be driven by commodity prices and

producer economics

producer economics

• 2Q 2012 volumes for Bighorn expected to be lower compared to 1Q 2012

• 2Q 2012 volumes for Fort Union expected to be lower compared to 1Q 2012

2Q 2012 Adjusted EBITDA expected to be $3 million higher compared to 1Q

2012, as distribution from Fort Union should include Copano’s share of annual

payments for treating deficiency fees Fort Union earned in 2011

2012, as distribution from Fort Union should include Copano’s share of annual

payments for treating deficiency fees Fort Union earned in 2011

19

Appendix

20

Introduction to Copano

Independent midstream company founded in 1992

• Producer focused

• Entrepreneurial approach

• Focus on long-term accretive growth

• Publicly traded LLC

- No general partner or incentive distribution rights

- Tax benefits similar to MLPs, but with corporate governance of a C-corp

Service throughput volumes approximate 2,232,000 MMBtu/d of natural gas(1)

Over 7,000 miles of active pipelines

10 natural gas processing plants with over 1.2 Bcf/d of combined processing

capacity

capacity

One NGL fractionation facility with total capacity of 44,000 Bbls/d

(1) Based on 1Q 2012 results. Includes unconsolidated affiliates.

21

Area of Operations

Operating segments

• Texas

• Oklahoma

• Rocky Mountains

Copano currently has assets in five

U.S. resource plays

U.S. resource plays

• Eagle Ford Shale

• North Barnett Shale Combo

• Woodford Shale

• Mississippi Lime

• Powder River Basin Niobrara

22

Liquidity and Capitalization

As of March 31, 2012, total available liquidity approximately $385 million

23

Shifting Contract Mix

Continued shift towards a more fee-based mix

• Eagle Ford Shale and north Barnett Shale Combo volume growth are key drivers

|

Contract Mix as a % of Gross Margin

|

|||

|

|

1Q 2010

|

4Q 2011

|

1Q 2012

|

|

Fee-based

|

27%

|

47%

|

58%

|

|

|

|

|

|

|

Percentage-of-

proceeds |

39%

|

27%

|

26%

|

|

Keep-

whole/Other |

36%

|

41%

|

22%

|

|

Net hedging

|

-2%

|

-15%

|

-6%

|

|

Net commodity

exposed |

73%

|

53%

|

42%

|

Note: Includes Copano’s share of gross margin from unconsolidated affiliates. Approximate percentages based on Copano internal financial planning models.

24

Expansion Capital Expenditures

Board approved 2012 expansion capex of approximately $375 million

25

Hedging Strategy

Continued shift towards a more fee-based contract mix

• Reliance on hedging will decrease as contract mix changes over time

2012 hedged near policy limits for all products except ethane

• Approximately 90% of propane, butane, natural gasoline and condensate exposure

hedged

hedged

• Approximately 40% of ethane exposure hedged

2013 hedging positions continue to be added

• Between 60% and 80% of butane, natural gasoline and condensate exposure hedged

• Approximately 75% of propane exposure hedged

• No ethane hedges for 2013

26

Commodity-Related Margin Sensitivities

Matrix reflects 1Q 2012 wellhead and plant inlet volumes, adjusted using

Copano’s 2012 planning model

Copano’s 2012 planning model

(1) Consists of Texas and Oklahoma Segment gross margins.

27

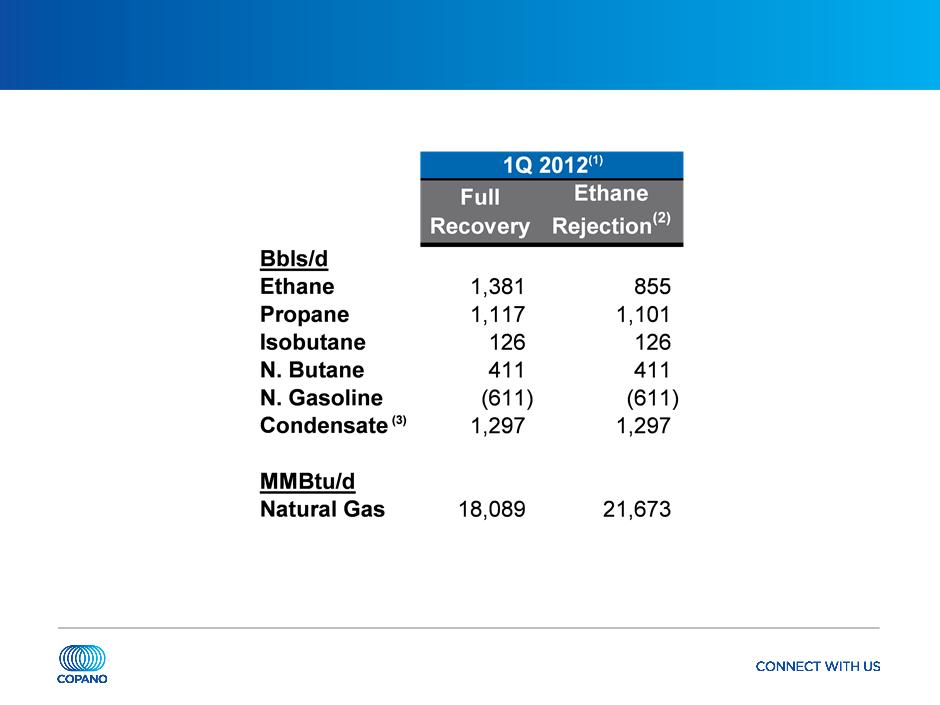

Texas Net Commodity Exposure

Note: See explanation of processing modes in this Appendix.

(1) Source: Copano Energy internal financial planning models. Based on 1Q 2012 daily wellhead/plant inlet volumes.

(2) Fractionation at Houston Central complex permits significant reductions in ethane recoveries in ethane rejection mode. To optimize profitability, plant operations can also be adjusted

to partial recovery mode.

(3) At the Houston Central complex, pentanes+ may be sold as condensate.

28

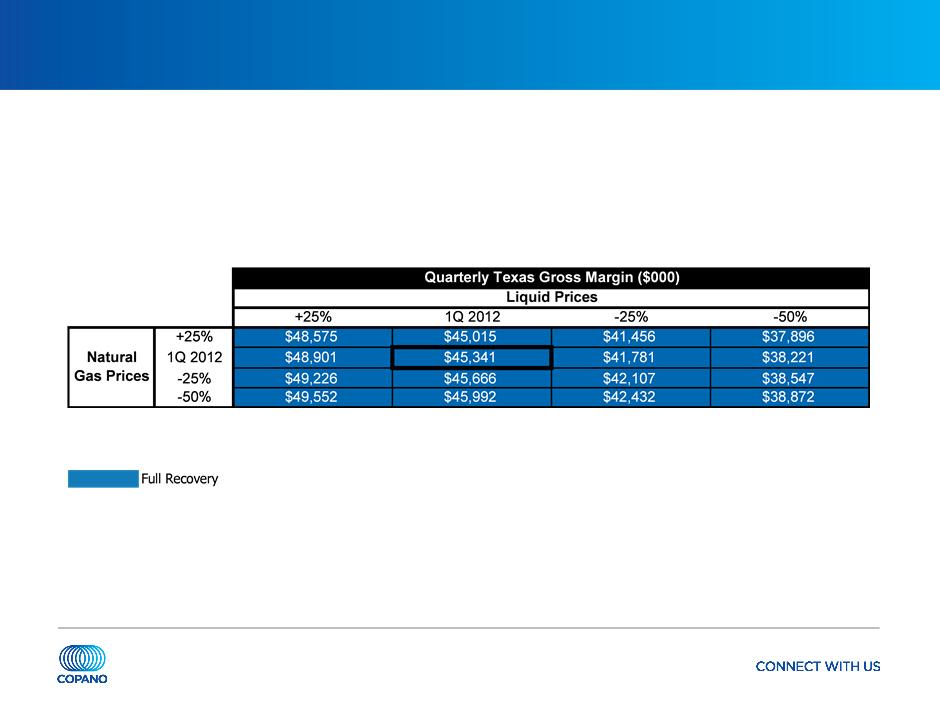

Texas Commodity Price Sensitivities

Texas segment gross margins excluding hedge settlements

• Matrix reflects 1Q 2012 volumes and operating conditions, adjusted using Copano’s

2012 planning model

2012 planning model

Note: Please see this Appendix for definitions of processing modes and additional details.

29

Oklahoma Net Commodity Exposure

Note: See explanation of processing modes in this Appendix. Values reflect rounding.

(1) Source: Copano Energy internal financial planning models.

(2) Ethane rejection at Paden plant is limited by nitrogen rejection facilities.

(3) Reflects impact of producer delivery point allocations, offset by field condensate collection and stabilization.

30

Oklahoma Commodity Price Sensitivities

Oklahoma segment gross margins excluding hedge settlements

• Matrix reflects 1Q 2012 volumes, adjusted using Copano’s 2012 planning model

Note: Please see this Appendix for definitions of processing modes and additional details.

31

Rocky Mountains Sensitivities

1Q 2012 Adjusted EBITDA volume sensitivity (positive or negative impact)

• Bighorn: 10,000 MMBtu/d = $250,000(1)

• Fort Union: 10,000 MMBtu/d = immaterial impact until physical volumes exceed long-

term contractual volume commitments

term contractual volume commitments

- 1Q 2012 pipeline throughput: 658,874 MMBtu/d

- 1Q 2012 revenue based on 786,377 MMBtu/d of volume commitments

Note: See this Appendix for reconciliation of Adjusted EBITDA. Values reflect rounding.

(1) Impact on Adjusted EBITDA based on Copano’s interest in the unconsolidated affiliate.

32

Hedging Impact of Commodity Price Sensitivities

Commodity hedging program supplements cash flow in 2012 through 2013

during less favorable commodity price periods

during less favorable commodity price periods

33

Processing Modes

|

Full Recovery

|

|

|

|

Texas and Oklahoma - If the value of

recovered NGLs exceeds the fuel and gas shrinkage costs of recovering NGLs |

|

Ethane Rejection

|

|

|

|

Texas and Oklahoma - If the value of ethane

is less than the fuel and shrinkage costs to recover ethane (in Oklahoma, ethane rejection at Paden plant is limited by nitrogen rejection facilities) |

34

Reconciliation of Non-GAAP Financial Measures

Adjusted EBITDA

• We define adjusted EBITDA as:

- net income (loss);

- plus interest and other financing costs, provision for income taxes, depreciation, amortization and impairment expense, non-cash

amortization expense associated with our commodity derivative instruments, distributions from unconsolidated affiliates, loss on

refinancing of unsecured debt and equity-based compensation expense;

amortization expense associated with our commodity derivative instruments, distributions from unconsolidated affiliates, loss on

refinancing of unsecured debt and equity-based compensation expense;

- minus equity in earnings (loss) from unconsolidated affiliates and unrealized gains (losses) from commodity risk management

activities; and

activities; and

- plus or minus other miscellaneous non-cash amounts affecting net income (loss) for the period.