Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STREAMLINE HEALTH SOLUTIONS INC. | d366903d8k.htm |

Exhibit 99.1

| Investor Presentation June 2012 Nasdaq: STRM |

| Disclosure Statements TRADEMARKS Product or company names referenced herein may be trademarks or registered trademarks of their respective owners. |

| Proprietary solutions uniquely capture and convert unstructured data into EMR digital files, accelerate coding and billing, fill gaps in the RCM cycle and provide analytics to improve the hospitals efficiencies across the enterprise Suite of solutions improve financial performance Company Highlights Front-end workflows and automation tools fully integrate with leading hospital EMR and clinical systems Integrates with leading EMR, financial and clinical systems 95% client retention due to subject matter expertise and seamless integration into hospital workflows High client retention with deeply embedded solutions Over $58 million in identified up-sell and cross-sell cumulative revenue opportunities within existing client base Installed base of top tier clients presents sizable opportunity SaaS model enhances recurring revenue profile - Q1 FYE Jan 31 2013 recurring revenue grew 32% over Q1 of FYE Jan 31 2012 Highly scalable SaaS model New management team with extensive HCIT experience repositioned Company for growth and profitability as evidenced by double digit growth in key areas and $3 million improvement in Net Income Proven management team and successful turn-around STRM trades at a discount to other public HCIT companies despite comparable revenue growth and gross margin profile Valuation arbitrage compared to other HCIT companies |

| FYE Jan 2012 FYE Jan 2011 76% Recurring revenue % total 65% 14% Recurring revenue growth 5% 48% Gross margin 36% 22% EBITDA margin 12% $27.4 Backlog ($ millions) $17.6 Renewed Momentum and Demonstrated Results Strong Revenue Backlog Increasing Recurring Revenue Key Strategic Goals and Accomplishments in FYE Jan 2012 Key Financial Improvements Achieved |

| Market Focus Real-time access to key financial performance metrics that enable healthcare organizations to identify opportunities and to maximize their financial performance with integrated workflows Business Analytics Transform unstructured data into digital assets and manage them efficiently and seamlessly across disparate clinical, administrative, and financial information systems Content Management Streamline Health provides revenue cycle solutions that help healthcare providers improve efficiencies and business processes across the enterprise Revenue Cycle Cloud-based SaaS solutions that help healthcare providers improve efficiency |

| Issues Solutions Healthcare Issues Streamline Addresses Opportunities Limit patient care & provider financial performance Technology required to streamline healthcare and manage costs Address critical pain points for hospitals |

| Growing Addressable Market Current Market Focus Potential New Markets Compelling Market Fundamentals Gartner and Cerner estimates |

| Patient Care Continuum Workflow Solutions Enterprise Applications Solutions Across the Patient Care Continuum Patient Access Health Information Management (HIM) Patient Financial Services (PFS) AccessAnyWare OpportunityAnyWare Billing & Collection Audit Reconciliation Registration Admission Discharge Coding MD Referral |

| Current Clients Prestigious Client Base |

| Financial Update: YOY Comparison Highlights Successful Execution 31.5% YOY growth 8.8 percentage point YOY margin expansion 15.9 percentage point YOY margin expansion Revenue ($ in millions) Adj. EBITDA ($ in millions) Gross Profit ($ in millions) |

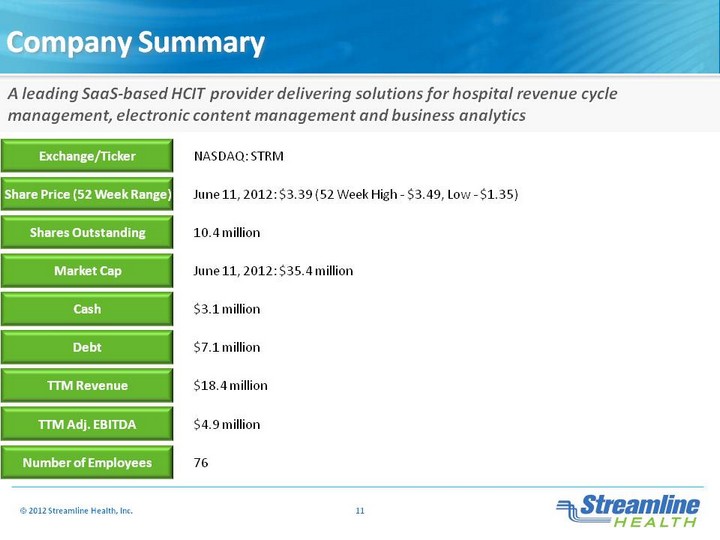

| NASDAQ: STRM Exchange/Ticker Company Summary June 11, 2012: $3.39 (52 Week High - $3.49, Low - $1.35) Share Price (52 Week Range) 10.4 million Number of Employees June 11, 2012: $35.4 million $3.1 million $7.1 million $18.4 million $4.9 million 76 Shares Outstanding Market Cap Cash Debt TTM Revenue TTM Adj. EBITDA |