Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Net Element, Inc. | v315977_8k.htm |

INVESTOR PRESENTATION Business combination with Cazador Acquisition Corporation Ltd. June 12, 2012

Important notices Additional information Neither Net Element Inc . (“NETE”), Cazador Acquisition Corporation Ltd . (“CAZA”) nor any of their respective affiliates makes any representation or warranty as to the accuracy or completeness of the information contained in this presentation . The sole purpose of the presentation is to provide a summary overview of the proposed transaction discussed herein and is not intended to be all - inclusive or to contain all the information that an individual may desire in considering the proposed transaction discussed herein . It is not intended to form the basis of any investment decision or voting decision in respect of the proposed transaction . In connection with the proposed transaction, CAZA and NETE will prepare and file with the U . S . Securities and Exchange Commission (the “SEC”) a joint proxy statement/prospectus (which will be included in a registration statement on Form S - 4 of CAZA registering the CAZA shares to be issued to NETE’s shareholders pursuant to the proposed transaction (the “Registration Statement”)) . When completed, a definitive joint proxy statement/prospectus and a form of proxy will be mailed to the shareholders of CAZA and the shareholders of NETE . Before making any investment or voting decision, shareholders are urged to read the joint proxy statement/prospectus carefully and in its entirety because it will contain important information about the proposed transaction . Shareholders will be able to obtain, without charge, a copy of the joint proxy statement/prospectus and other relevant documents filed with the SEC when they become available through the SEC’s website at http : //www . sec . gov . Shareholders will also be able to obtain, without charge, a copy of the joint proxy statement/prospectus and other relevant documents when they become available by contacting NETE’s Chief Financial Officer, Jonathan New, at 1450 S . Miami Avenue, Miami, FL 33130 , telephone number ( 305 ) 507 - 8808 , or from NETE’s website at http : //www . netelement . com . CAZA and NETE and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction . Information about NETE’s directors and executive officers is set forth in NETE’s annual report on Form 10 - K for the fiscal year ended December 31 , 2011 . Information about CAZA’s directors and executive officers is set forth in CAZA’s annual report on Form 10 - K for the fiscal year ended December 31 , 2011 . Additional information regarding the interests of such potential participants in the proposed transaction, which may be different than those of the NETE’s shareholders and/or CAZA’s shareholders generally, will be included in the joint proxy statement/prospectus and other relevant documents filed with the SEC when they become available . This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction . No offer or sale of securities will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended . All statements and projections as to the future financial condition and results of operations of the combined company were prepared by NETE’s and CAZA’s management based upon various estimates and assumptions, that, while considered reasonable by NETE and CAZA, are inherently subject to significant transaction, financing, business, economic, competitive, regulatory and other uncertainties and contingencies, many of which are beyond the control of NETE and CAZA . Such statements and projections have been provided to assist in an evaluation of the proposed transaction, but are not to be relied upon as any representation of future results that may be attained . The projections contained herein have not been subjected to any accounting review or evaluation and have not received the approval of any accounting firm . Furthermore, because the projected financial information is based on estimates and assumptions about circumstances and events that have not yet taken place and are subject to variation, there can be no assurance that the projected results will be attained . 1

Important notices (cont’d) Forward - Looking Statements This presentation contains forward - looking statements that reflect NETE’s and CAZA’s current beliefs, expectations or intentions regarding future events . Any statements contained in this presentation that are not statements of historical fact may be deemed forward - looking statements . Words such as “will,” “may,” “could,” “should,” “expect,” “expected,” “proposed,” “contemplated,” “plan,” “planned,” “project,” “forecast”, “going forward,” “intend,” “anticipate,” “anticipated,” “believe,” “estimate,” “estimated,” “predict,” “potential,” “continue,” and similar expressions are intended to identify such forward - looking statements . These forward - looking statements include, without limitation, NETE’s and CAZA’s expectations with respect to the combined company’s plans, objectives, expectations and intentions with respect to future operations ; statements and projections as to the future financial condition and results of operations of the combined company ; approval and adoption of the merger agreement by the requisite number of shareholders ; and the timing of the completion of the proposed transaction . All forward - looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward - looking statements, many of which are generally outside the control of NETE and CAZA and are difficult to predict . Examples of such risks and uncertainties include, but are not limited to : (i) the failure of the merger to close for any reason ; (ii) general business and economic conditions ; (iii) the performance of financial markets ; (iv) risks relating to the consummation of the contemplated merger, including the risk that required shareholder approval and regulatory agencies might not be obtained in a timely manner or at all or that other closing conditions are not satisfied ; (v) the impact of the merger on the markets for the combined company’s products and services ; (vi) the employees of NETE and CAZA not being combined and integrated successfully ; (vii) operating costs and business disruption following the merger, including adverse effects on employee retention and on NETE’s business relationships with third parties ; (viii) the inability of the combined company following the closing of the merger to meet NASDAQ’s listing requirements and the failure of the combined company’s securities to be listed or continue to be listed on NASDAQ ; (ix) the amount of cash available to the combined company following the merger being insufficient to allow NETE or the combined company to achieve their business goals (particularly with respect to the proposed operations of TOT Money) ; and (x) the future performance of the combined company following the closing of the merger . Additional factors that could cause actual results to differ materially from those expressed or implied in the forward - looking statements can be found in the most recent annual report on Form 10 - K and the subsequently filed quarterly reports on Form 10 - Q and current reports on Form 8 - K filed by each of NETE and CAZA with the SEC, as well as in the Registration Statement and joint proxy statement/prospectus when they become available . Each of NETE and CAZA anticipate that subsequent events and developments may cause their views and expectations to change . Neither NETE nor CAZA assumes any obligation, and they specifically disclaim any intention or obligation, to update any forward - looking statements, whether as a result of new information, future events or otherwise . Notes regarding financial information The financial information and data contained in this presentation is derived from NETE’s unaudited financial statements and may not conform to Regulation S - X . Accordingly, such information and data may be adjusted and presented differently in the proxy statement materials to be mailed to CAZA shareholders . Non - GAAP Financials This presentation includes certain estimated financial information and forecasts presented as pro forma financial measures that are not derived in accordance with generally accepted accounting principles (“GAAP”) and which may be deemed to be non - GAAP financial measures within the meaning of Regulation G promulgated by the SEC . NETE and CAZA believe that the presentation of these non - GAAP financial measures serve to enhance the understanding of the financial performance of NETE after the proposed transaction . However, these non - GAAP financial measures should be considered in addition to, and not as substitutes for or superior to, financial measures of financial performance prepared in accordance with GAAP . Pro forma financial measures may not be comparable to similarly titled pro forma measures reported by other companies . 2

INTRODUCTION

Executive summary • NETE is a technology driven internet group with two core businesses - Mobile commerce and payment processing (“MCPP”) - Entertainment and culture internet destinations (“E&C”) • NETE was repositioned in April 2010 to leverage its access to an unmatched engineering and development team and the growing demand for mobile commerce solutions and entertainment based mobile applications (“apps”) • NETE has invested over $22 million in business and technology development - 60 in - house engineering and support staff in 2 facilities and a university in Russia - 6 patents pending, 12 IP technologies and 2 industry awards • NETE is unifying its technological aptitude with its unrivaled access to key leaders of the Russian telecom, music and social - media communities to launch Russian based innovative services, web destinations and apps • The proposed merger follows $34 million of combined share purchases by global investor Kenges Rakishev and leading Russian entertainment entrepreneur Igor Krutoy • The merger with CAZA provides NETE with capital to help monetize, grow and create shareholder value from its investments and business development 4 Net Element, Inc . (“NETE”) is an ideal merger partner for Cazador Acquisition Corporation Ltd . (“CAZA”) as it has all the necessary elements, except capital, to crystallize its growth and value generation potential

Net Element evolution • Recapitalize and become cash flow positive - TOT Money formed (Jun 2012) - Merger with CAZA announced (Jun 2012) - Kenges Rakishev purchases $32 million in NETE shares (May 2012) 1 - Igor Krutoy agrees to invest $2 million in NETE and forms Music1 JV in Russia (Apr 2012) 2 • Investment in development team and new properties - Felix Vulis joins NETE Board (Dec 2011) - Music Brain and Yapik launched (Oct 2011) - Emerson Fittipaldi named Chairman of Motorsport (Aug 2011) - Increase development team (2011) - Legal Guru JV (Mar 2011) - Music1 acquisition (Feb 2011) - Motorsport acquisition (Feb 2011) • Decision to focus on internet based ventures - Openfilm and initial development team acquisitions (Dec 2010) 5 NETE is strategically positioned for growth, specially in Russia and other emerging markets 1. Mr. Rakishev’s purchase consists of $2 million invested in NETE and $30 million purchased from an affiliate of Mike Zoi. 2. Investment made on June 6, 2012.

Post - merger management team Executive Position Background Francesco Piovanetti Chief Executive Officer and Board Director ▪ Current CEO of CAZA and Arco Capital Corporation Ltd. ▪ Over 15 years of experience working in various areas of private equity, capital markets and investment banking ▪ Worked in various senior executive roles at Arco Capital, Deutsche Bank and Deloitte Dmitry Kozko President and Board Director ▪ Co - Founder of Openfilm and the repositioned NETE ▪ EVP of Business Development of NETE since Dec 2010 and a director since Oct 2011 ▪ Technology entrepreneur since 2006 Richard Lappenbusch EVP and Chief Strategic Officer ▪ Accomplished executive with approximately 20 years experience in strategic and product development across the television, film, internet, and software industries ▪ Worked in various senior management roles at Microsoft Corporation from 1993 to 2009 ▪ Conceived, designed and launched MSNBC Ivan Onuchin Chief Technology Officer ▪ CTO of NETE since 2010 ▪ Developed four patent - pending technologies ▪ Professor of advanced mathematics at the Russian Academy of Sciences Jonathan New Chief Financial Officer ▪ CFO of NETE since Mar 2008 ▪ Certified Public Accountant with over 25 years of experience ▪ Worked in various senior accounting positions at Häagen - Dazs, Virtacon, RAI Credit Corporation and Prudential of Florida 6

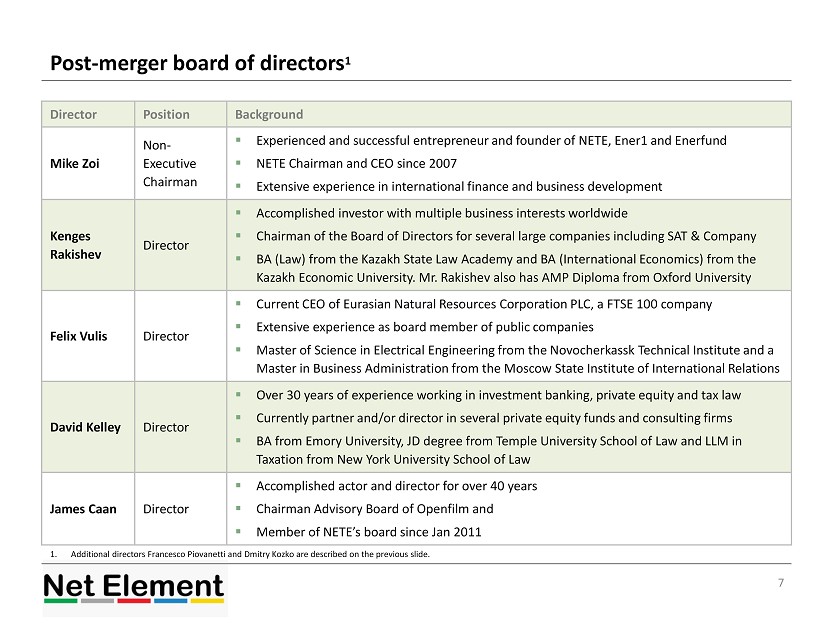

Post - merger board of directors 1 7 1. Additional directors Francesco Piovanetti and Dmitry Kozko are described on the previous slide. Director Position Background Mike Zoi Non - Executive Chairman ▪ Experienced and successful entrepreneur and founder of NETE, Ener1 and Enerfund ▪ NETE Chairman and CEO since 2007 ▪ Extensive experience in international finance and business development Kenges Rakishev Director ▪ Accomplished investor with multiple business interests worldwide ▪ Chairman of the Board of Directors for several large companies including SAT & Company ▪ BA (Law) from the Kazakh State Law Academy and BA (International Economics) from the Kazakh Economic University. Mr. Rakishev also has AMP Diploma from Oxford University Felix Vulis Director ▪ Current CEO of Eurasian Natural Resources Corporation PLC, a FTSE 100 company ▪ Extensive experience as board member of public companies ▪ Master of Science in Electrical Engineering from the Novocherkassk Technical Institute and a Master in Business Administration from the Moscow State Institute of International Relations David Kelley Director ▪ Over 30 years of experience working in investment banking, private equity and tax law ▪ Currently partner and/or director in several private equity funds and consulting firms ▪ BA from Emory University, JD degree from Temple University School of Law and LLM in Taxation from New York University School of Law James Caan Director ▪ Accomplished actor and director for over 40 years ▪ Chairman Advisory Board of Openfilm and ▪ Member of NETE’s board since Jan 2011

Net Element – Strategically positioned for growth 8 • Over $22 million invested in business and technology development which is now on the verge of monetization • TOT Money launched and will shortly start operations - Expected to become the cornerstone of NETE’s mobile commerce and payments processing platform - Expected to be cash flow positive by the end of 2012 • Music1 joint venture scheduled to launch in July 2012 - Envisioned to become NETE’s flagship of the entertainment and culture business - Potential to become Russia’s premier destination for music and music videos - Preferential joint venture economics to NETE • Additional MCPP and E&C destinations anticipated to enhance earnings potential, subscriber growth and traffic • Strong financial position going forward with 2013 forecast EBITDA of $7.3 million • High caliber management, board members and advisors committed to the success of the company

BUSINESS OVERVIEW

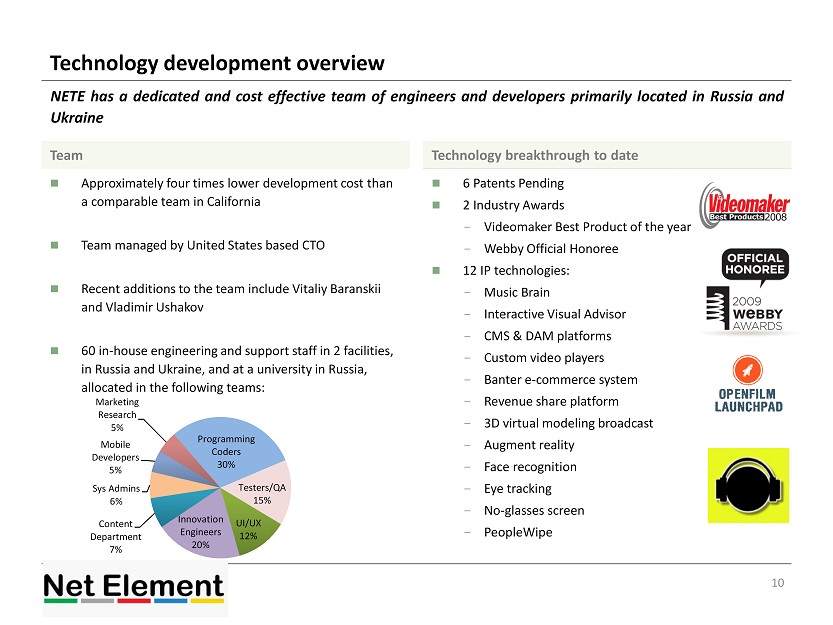

Technology development overview Team • Approximately four times lower development cost than a comparable team in California • Team managed by United States based CTO • Recent additions to the team include Vitaliy Baranskii and Vladimir Ushakov • 60 in - house engineering and support staff in 2 facilities, in Russia and Ukraine, and at a university in Russia, allocated in the following teams: Technology breakthrough to date • 6 Patents Pending • 2 Industry Awards - Videomaker Best Product of the year - Webby Official Honoree • 12 IP technologies: - Music Brain - Interactive Visual Advisor - CMS & DAM platforms - Custom video players - Banter e - commerce system - Revenue share platform - 3D virtual modeling broadcast - Augment reality - Face recognition - Eye tracking - No - glasses screen - PeopleWipe 10 NETE has a dedicated and cost effective team of engineers and developers primarily located in Russia and Ukraine Programming Coders 30% Testers/QA 15% UI/UX 12% Innovation Engineers 20% Content Department 7% Sys Admins 6% Mobile Developers 5% Marketing Research 5%

Business segments Mobile commerce and payment processing • TOT Money - Mobile payment gateway - Initial operations being developed in Russia - Strong relationships with operators and DST 1 - Anticipated to become a driver of free cash flow • Legal Guru - Innovative client connection platform • YAPIK and Komissionka - Barter and trade platform - Partnership with Russia’s third largest mobile operator, MegaFon Entertainment and culture • Music1 - Expected to become Russia’s online music destination - Partnership with Russia’s equivalent of “American Idol” - Internet platform for ARS Records • Motorsport.com - 260,000 monthly unique visitors - Top five web destination for motorsport fans 2 - Established in 1993 • Openfilm - Community for film enthusiasts and professionals 11 NETE is on the verge of becoming a robust mobile commerce and media company with a portfolio of entertainment and culture destinations targeted to Russia and other emerging markets 1. Refers to Digital Sky Technologies. 2. Alexa Internet, Inc.

overview Description • TOT Money will be a mobile payment platform that facilitates transactions via SMS on any phone and mobile network • TOT Money is expected to launch operations in mid - July 2012 with the following: - Contracts with top four mobile operators in Russia - Relationship with DST’s platforms, including, mail.ru, odnaklasniki, vkontakte, and mamba - Agreements with content providers representing 70% of the Russian Premium SMS market - Bank financing of up to $20 million - Experienced and proven industry CEO - Scalable to full mobile commerce payments platform • Over the next 24 months, TOT Money is expected to be NETE’s primary free cash flow contributor Evolving business model 1 Mr . Rakishev’s investment and involvement is helping NETE’s entrance into Russia’s lucrative SMS payment processing sector 12 1. MTS Research, November 2011. 36 - 52% 76 - 89% Premium SMS (RPU ~$1.60) Mobile Commerce (RPU ~$10.00) 14 - 10% 5 0 - 38% 10 - 1% 14 - 10% Mobile Operators Content providers / vendors

TOT Money’s competitive advantages • Advanced technological platform • Capacity to divert traffic to TOT Money as a result of long standing relationships with major portals and telecoms • Hired proven CEO of third largest premium SMS company - Long term relationships in the content provider community - Known for quality customer service and on time payments - We expect that content providers will follow CEO to TOT Money • TOT Money will have ample financing to capture traffic from competitors - Relationship with telecoms will allow TOT Money to reduce negative working capital - Provide better and consistent payment terms Barriers to entry • Capital investment to develop technological platform • Access to mobile operators and major portals limited to a handful of individuals with no interest in altering the current market dynamics - Relationship driven business - Four mobile operators control 94% of the active SIM cards in Russia 1 - Four payment platforms (including the one from the former employer of TOT Money’s CEO) account for 71% of the payments processed in Russia 2 • Capital required to capture traffic from existing competitors 13 Although TOT Money will be a new participant in the Premium SMS segment, it is expected to quickly position itself as a market leader as a result of its competitive advantages and barriers to entry overview (cont’d) 1. Content - Review.com, May 2012. 2. Content - Review.com, April 2012.

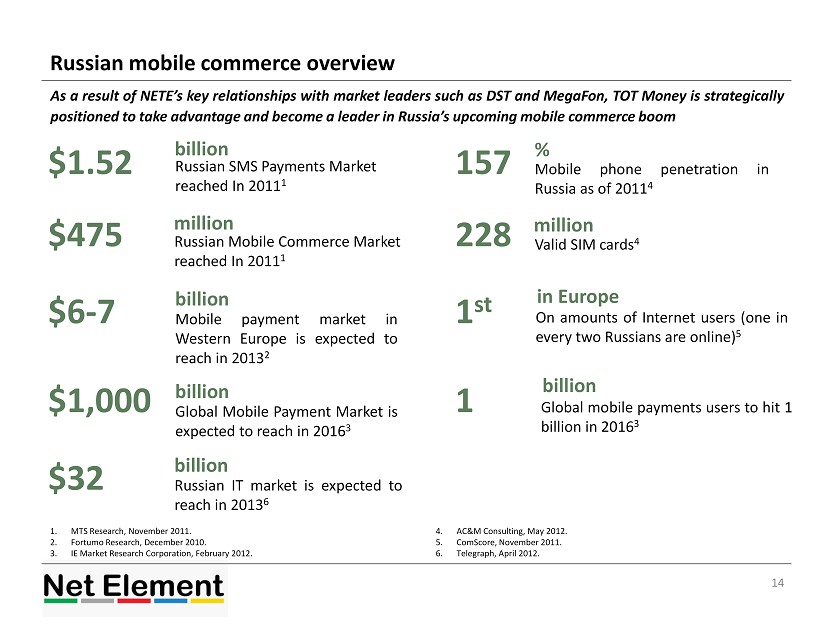

14 As a result of NETE’s key relationships with market leaders such as DST and MegaFon, TOT Money is strategically positioned to take advantage and become a leader in Russia’s upcoming mobile commerce boom billion $1.52 Russian SMS Payments Market reached In 2011 1 million $475 Russian Mobile Commerce Market reached In 2011 1 Mobile payment market in Western Europe is expected to reach in 2013 2 billion $6 - 7 Mobile phone penetration in Russia as of 2011 4 % 157 Valid SIM cards 4 million 228 On amounts of Internet users (one in every two Russians are online) 5 in Europe 1 st Global Mobile Payment Market is expected to reach in 2016 3 billion $1,000 Global mobile payments users to hit 1 billion in 2016 3 billion 1 Russian IT market is expected to reach in 2013 6 billion $32 Russian mobile commerce overview 1. MTS Research, November 2011. 2. Fortumo Research, December 2010. 3. IE Market Research Corporation, February 2012. 4. AC&M Consulting, May 2012. 5. ComScore, November 2011. 6. Telegraph, April 2012.

overview • Igor Krutoy is Russia’s leading entertainment entrepreneur and a distinguished composer, performer, producer and musical promoter • Mr. Krutoy controls ARS Holdings 15 Music 1 has all the necessary elements to become Russia’s premier music and music video internet destination and app in a region where Pandora, iTunes, Vevo, amongst others, have limited to no presence • ARS Holdings is Russia’s largest media holding company 1 including interest in TV, radio, talent competitions, record production, concert promotion and an extensive catalog of music rights • Mr. Krutoy selected NETE to be his new media partner and agreed to be Music1’s Chairman • The initial focus of the joint venture between Mr. Krutoy and NETE is to make Music1 the premier destination for music content in Russia • Music1 is expected to officially launch end of July as part of the New Wave Concert which according to ARS Holdings has a national and international audience of over 65 million people 1. EMO Export Handbooks.

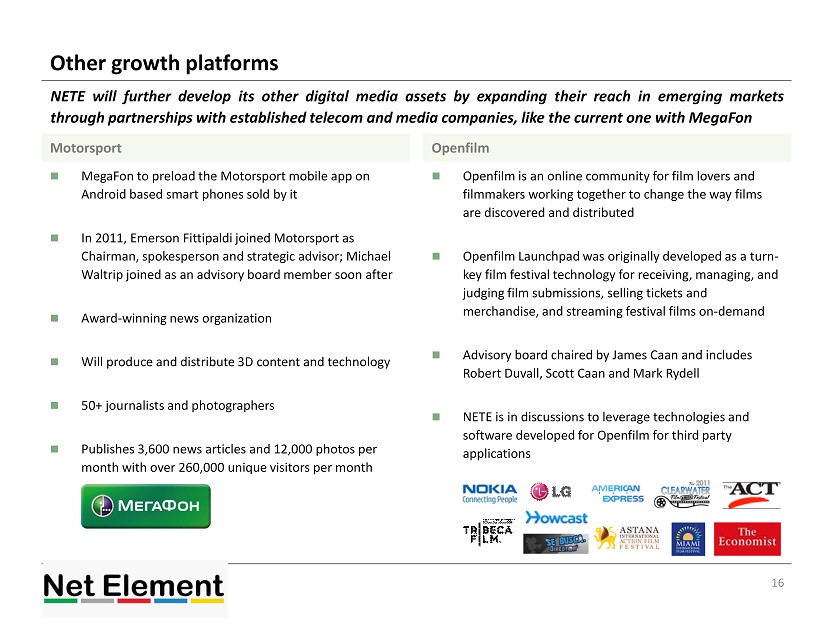

Other growth platforms Motorsport • MegaFon to preload the Motorsport mobile app on Android based smart phones sold by it • In 2011, Emerson Fittipaldi joined Motorsport as Chairman, spokesperson and strategic advisor; Michael Waltrip joined as an advisory board member soon after • Award - winning news organization • Will produce and distribute 3D content and technology • 50+ journalists and photographers • Publishes 3,600 news articles and 12,000 photos per month with over 260,000 unique visitors per month Openfilm • Openfilm is an online community for film lovers and filmmakers working together to change the way films are discovered and distributed • Openfilm Launchpad was originally developed as a turn - key film festival technology for receiving, managing, and judging film submissions, selling tickets and merchandise, and streaming festival films on - demand • Advisory board chaired by James Caan and includes Robert Duvall, Scott Caan and Mark Rydell • NETE is in discussions to leverage technologies and software developed for Openfilm for third party applications 16 NETE will further develop its other digital media assets by expanding their reach in emerging markets through partnerships with established telecom and media companies, like the current one with MegaFon

Other growth platforms (cont’d) Yapik and Komissionka • Social economy app enabling opportunities for buyers and sellers, brands and vendors to conduct transactions • Targeted to university students and trendsetters • Recommendation system based on geo - location, live chats, and social network integration • Yapik currently launched in selected campuses in Florida, including University of Miami and University of Florida • Komissionka to be launched in some MegaFon smart phones as a preloaded app LegalGuru • Online source to help the average person find useful information about the legal problems they face everyday • Free, informative content about the user’s topic in a concise “how to” format • Easy way to assess local subject matter experts and contact them for additional information • Video based solution that will provide insight into the attorney’s expertise, manner and interpersonal style • Scalable to other professions like medicine and finance • LegalGuru technology and expertise to be leveraged for the Russian market as a “how - to” video format destination 17 NETE is currently beta testing mobile commerce and transactional platforms targeted to specific social economic groups The Campus Currency Banter

FINANCIAL OVERVIEW

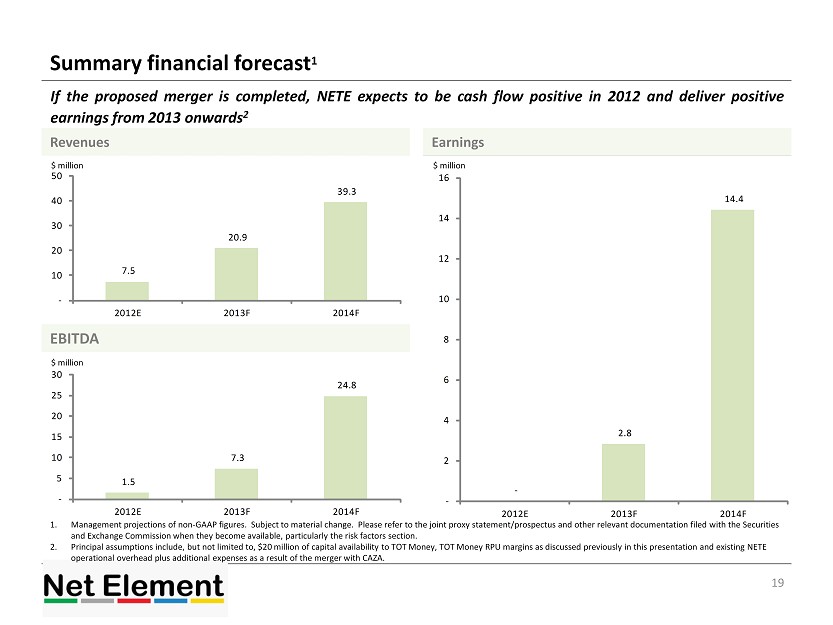

Summary financial forecast 1 Revenues Earnings 19 If the proposed merger is completed, NETE expects to be cash flow positive in 2012 and deliver positive earnings from 2013 onwards 2 EBITDA 1. Management projections of non - GAAP figures. Subject to material change. Please refer to the joint proxy statement/prospectus a nd other relevant documentation filed with the Securities and Exchange Commission when they become available, particularly the risk factors section. 2. Principal assumptions include, but not limited to, $20 million of capital availability to TOT Money, TOT Money RPU margins as di scussed previously in this presentation and existing NETE operational overhead plus additional expenses as a result of the merger with CAZA. $ million 7.5 20.9 39.3 - 10 20 30 40 50 2012E 2013F 2014F $ million 1.5 7.3 24.8 - 5 10 15 20 25 30 2012E 2013F 2014F $ million - 2.8 14.4 - 2 4 6 8 10 12 14 16 2012E 2013F 2014F

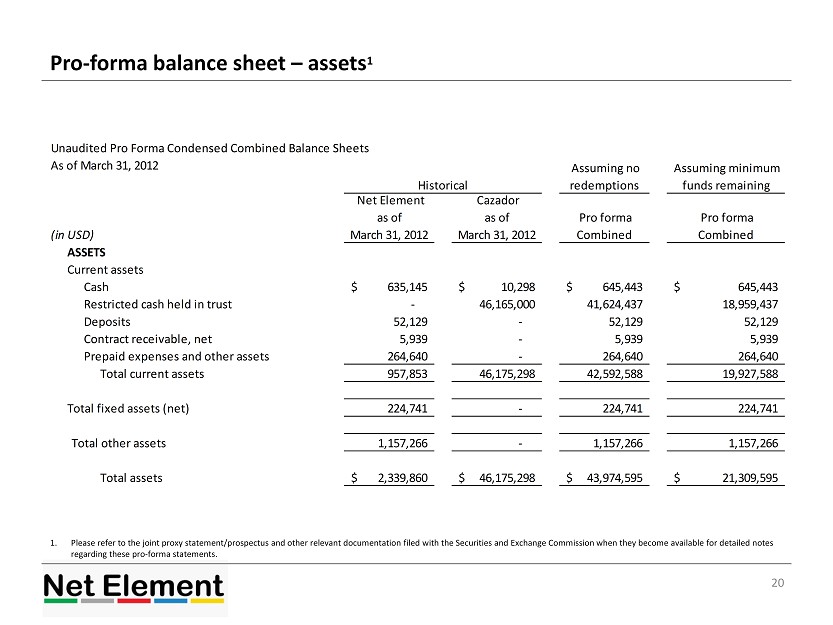

Pro - forma balance sheet – assets 1 20 1. Please refer to the joint proxy statement/prospectus and other relevant documentation filed with the Securities and Exchange Com mission when they become available for detailed notes regarding these pro - forma statements. Unaudited Pro Forma Condensed Combined Balance Sheets As of March 31, 2012 (in USD) Net Element as of March 31, 2012 Cazador as of March 31, 2012 Pro forma Combined Pro forma Combined ASSETS Current assets Cash 635,145$ 10,298$ 645,443$ 645,443$ Restricted cash held in trust - 46,165,000 41,624,437 18,959,437 Deposits 52,129 - 52,129 52,129 Contract receivable, net 5,939 - 5,939 5,939 Prepaid expenses and other assets 264,640 - 264,640 264,640 Total current assets 957,853 46,175,298 42,592,588 19,927,588 Total fixed assets (net) 224,741 - 224,741 224,741 Total other assets 1,157,266 - 1,157,266 1,157,266 Total assets 2,339,860$ 46,175,298$ 43,974,595$ 21,309,595$ Historical Assuming minimum funds remaining Assuming no redemptions

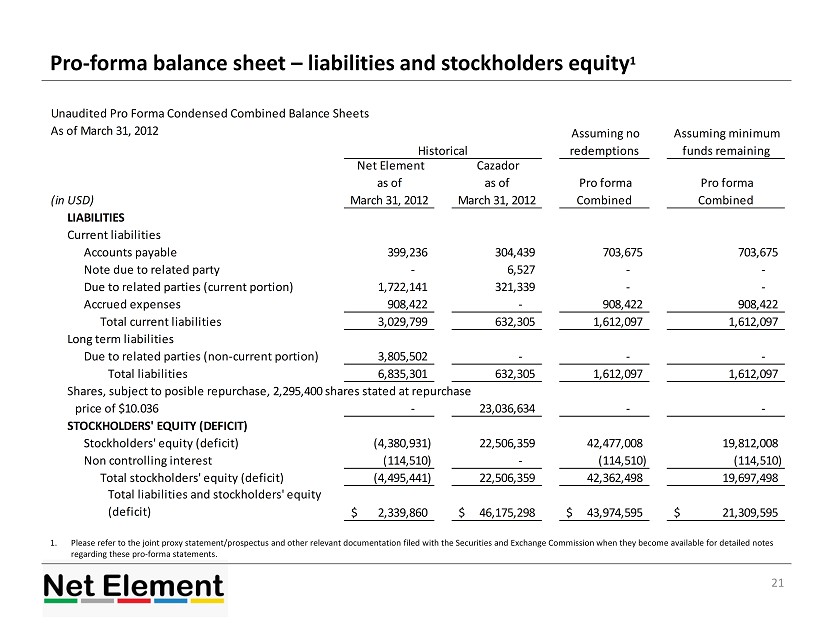

Pro - forma balance sheet – liabilities and stockholders equity 1 21 1. Please refer to the joint proxy statement/prospectus and other relevant documentation filed with the Securities and Exchange Com mission when they become available for detailed notes regarding these pro - forma statements. Unaudited Pro Forma Condensed Combined Balance Sheets As of March 31, 2012 (in USD) Net Element as of March 31, 2012 Cazador as of March 31, 2012 Pro forma Combined Pro forma Combined LIABILITIES Current liabilities Accounts payable 399,236 304,439 703,675 703,675 Note due to related party - 6,527 - - Due to related parties (current portion) 1,722,141 321,339 - - Accrued expenses 908,422 - 908,422 908,422 Total current liabilities 3,029,799 632,305 1,612,097 1,612,097 Long term liabilities Due to related parties (non-current portion) 3,805,502 - - - Total liabilities 6,835,301 632,305 1,612,097 1,612,097 Shares, subject to posible repurchase, 2,295,400 shares stated at repurchase price of $10.036 - 23,036,634 - - STOCKHOLDERS' EQUITY (DEFICIT) Stockholders' equity (deficit) (4,380,931) 22,506,359 42,477,008 19,812,008 Non controlling interest (114,510) - (114,510) (114,510) Total stockholders' equity (deficit) (4,495,441) 22,506,359 42,362,498 19,697,498 Total liabilities and stockholders' equity (deficit) 2,339,860$ 46,175,298$ 43,974,595$ 21,309,595$ Historical Assuming minimum funds remaining Assuming no redemptions

TRANSACTION OVERVIEW

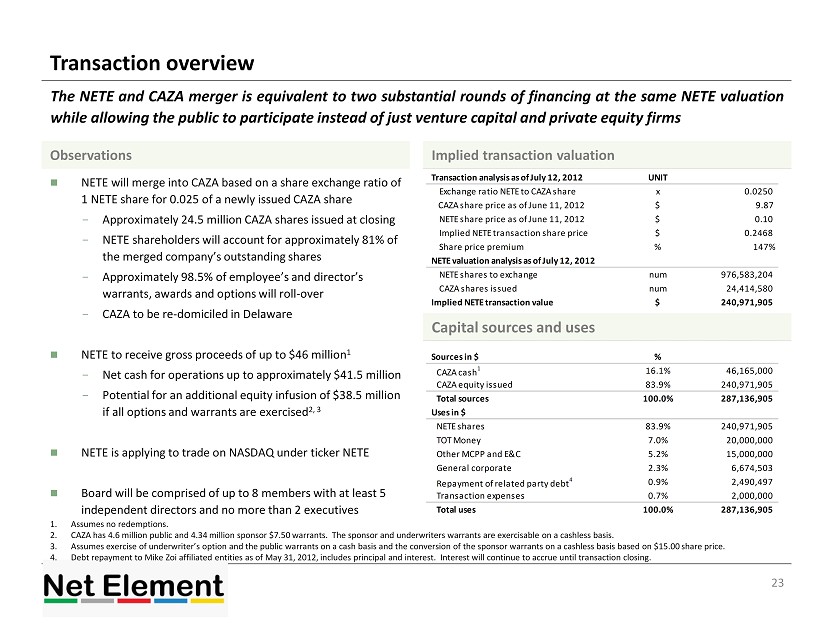

Transaction overview Observations • NETE will merge into CAZA based on a share exchange ratio of 1 NETE share for 0.025 of a newly issued CAZA share - Approximately 24.5 million CAZA shares issued at closing - NETE shareholders will account for approximately 81% of the merged company’s outstanding shares - Approximately 98.5% of employee’s and director’s warrants, awards and options will roll - over - CAZA to be re - domiciled in Delaware • NETE to receive gross proceeds of up to $46 million 1 - Net cash for operations up to approximately $41.5 million - Potential for an additional equity infusion of $38.5 million if all options and warrants are exercised 2, 3 • NETE is applying to trade on NASDAQ under ticker NETE • Board will be comprised of up to 8 members with at least 5 independent directors and no more than 2 executives Implied transaction valuation 23 The NETE and CAZA merger is equivalent to two substantial rounds of financing at the same NETE valuation while allowing the public to participate instead of just venture capital and private equity firms 1. Assumes no redemptions. 2. CAZA has 4.6 million public and 4.34 million sponsor $7.50 warrants. The sponsor and underwriters warrants are exercisable o n a cashless basis. 3. Assumes exercise of underwriter’s option and the public warrants on a cash basis and the conversion of the sponsor warrants o n a cashless basis based on $15.00 share price. 4. Debt repayment to Mike Zoi affiliated entities as of May 31, 2012, includes principal and interest. Interest will continue t o a ccrue until transaction closing. Capital sources and uses Transaction analysis as of July 12, 2012 UNIT Exchange ratio NETE to CAZA share x 0.0250 CAZA share price as of June 11, 2012 $ 9.87 NETE share price as of June 11, 2012 $ 0.10 Implied NETE transaction share price $ 0.2468 Share price premium % 147% NETE valuation analysis as of July 12, 2012 NETE shares to exchange num 976,583,204 CAZA shares issued num 24,414,580 Implied NETE transaction value $ 240,971,905 Sources in $ % CAZA cash 1 16.1% 46,165,000 CAZA equity issued 83.9% 240,971,905 Total sources 100.0% 287,136,905 Uses in $ NETE shares 83.9% 240,971,905 TOT Money 7.0% 20,000,000 Other MCPP and E&C 5.2% 15,000,000 General corporate 2.3% 6,674,503 Repayment of related party debt 4 0.9% 2,490,497 Transaction expenses 0.7% 2,000,000 Total uses 100.0% 287,136,905

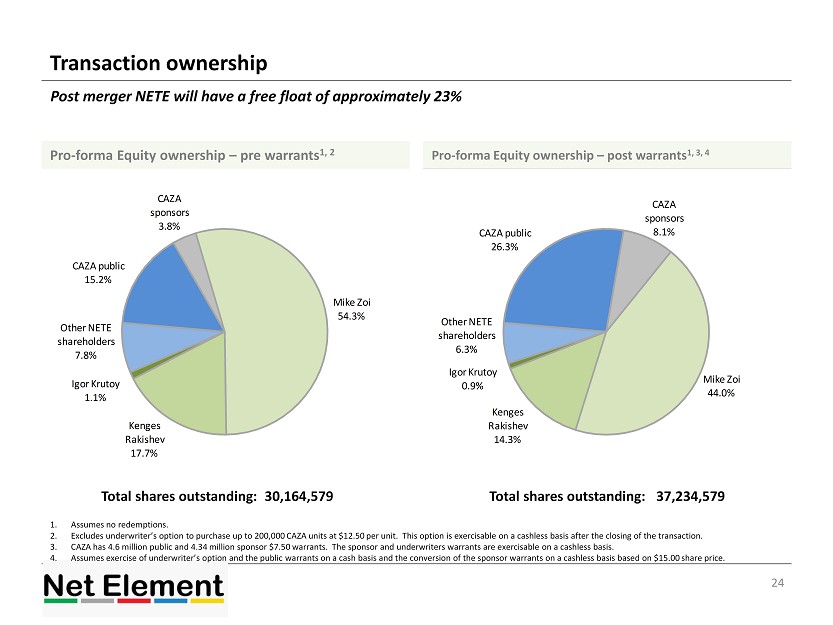

Transaction ownership Pro - forma Equity ownership – pre warrants 1, 2 Pro - forma Equity ownership – post warrants 1, 3, 4 24 1. Assumes no redemptions. 2. Excludes underwriter’s option to purchase up to 200,000 CAZA units at $12.50 per unit. This option is exercisable on a cashl ess basis after the closing of the transaction. 3. CAZA has 4.6 million public and 4.34 million sponsor $7.50 warrants. The sponsor and underwriters warrants are exercisable o n a cashless basis. 4. Assumes exercise of underwriter’s option and the public warrants on a cash basis and the conversion of the sponsor warrants o n a cashless basis based on $15.00 share price. Post merger NETE will have a free float of approximately 23 % CAZA public 15.2% CAZA sponsors 3.8% Mike Zoi 54.3% Kenges Rakishev 17.7% Igor Krutoy 1.1% Other NETE shareholders 7.8% Total shares outstanding: 30,164,579 Total shares outstanding: 37,234,579 CAZA public 26.3% CAZA sponsors 8.1% Mike Zoi 44.0% Kenges Rakishev 14.3% Igor Krutoy 0.9% Other NETE shareholders 6.3%

Net Element – Strategically positioned for growth 25 • Over $22 million invested in business and technology development which is now on the verge of monetization • TOT Money launched and will shortly start operations - Expected to become the cornerstone of NETE’s mobile commerce and payments processing platform - Expected to be cash flow positive by the end of 2012 • Music1 joint venture scheduled to launch in July 2012 - Envisioned to become NETE’s flagship of the entertainment and culture business - Potential to become Russia’s premier destination for music and music videos - Preferential joint venture economics to NETE • Additional MCPP and E&C destinations anticipated to enhance earnings potential, subscriber growth and traffic • Strong financial position going forward with 2013 forecast EBITDA of $7.3 million • High caliber management, board members and advisors committed to the success of the company