Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMC ENTERTAINMENT INC | eh1200786_ex9901.htm |

| 8-K - FORM 8-K - AMC ENTERTAINMENT INC | eh1200786_8k.htm |

AMC Entertainment Inc. Presentation to Lenders June 13, 2012

Safe Harbor Disclosure All statements, other than statements of historical facts, included in this presentation regarding the prospects of our industry and our prospects, plans, financial position and business strategy may constitute “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, or the Securities Act, and Section 21 E of the Exchange Act . In addition, forward - looking statements generally can be identified by the use of forward - looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “plan,” “foresee,” “believe” or “continue” or the negatives of these terms or variations of them or similar terminology . Although we believe that the expectations reflected in these forward - looking statements are reasonable, we can give no assurance that these expectations will prove to have been correct . All such forward - looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contemplated by the relevant forward - looking statement . Important factors that could cause actual results to differ materially from our expectations include, among others : national, regional and local economic conditions that may affect the markets in which we or our joint venture investees operate ; the levels of expenditures on entertainment in general and movie theatres in particular ; increased competition within movie exhibition or other competitive entertainment mediums ; technological changes and innovations, including alternative methods for delivering movies to consumers ; the popularity of major motion picture releases ; shifts in population and other demographics ; our ability to renew expiring contracts at favorable rates, or to replace them with new contracts that are comparably favorable to us ; our ability to integrate the Kerasotes theatres and achieve anticipated synergies with minimal disruption to our business ; our need for, and ability to obtain, additional funding for acquisitions and operations ; risks and uncertainties relating to our significant indebtedness ; fluctuations in operating costs ; capital expenditure requirements ; changes in interest rates ; and, changes in accounting principles, policies or guidelines . All subsequent written and oral forward - looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements . The forward - looking statements included herein are made only as of the date of this presentation, and we do not undertake any obligation to release publicly any revisions to such forward - looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events .

Private & Confidential Lender Presentation - June 2012 Page 3 AMC Representatives Gerry Lopez Chief Executive Officer & President Craig Ramsey Executive Vice President & Chief Financial Officer Wanda Representatives Lin Zhang Vice President and Chief Financial Officer Geffrey Liu General Manager, Securities and Investments Department and Board Secretary Citi Representatives Derek Van Zandt Managing Director, Global Media & Communications Group Ross MacIntyre Managing Director, Leveraged Finance Chris Herzog Vice President, Leveraged Syndicate

Private & Confidential Lender Presentation - June 2012 Page 4 Agenda x Review acquisition structure and strategic rationale x Review key business highlights x Review FY2012 financial results x Wanda overview x Discuss proposed capital structure plan x Q&A

Private & Confidential Lender Presentation - June 2012 Page 5 Wanda Acquisition

Private & Confidential Lender Presentation - June 2012 Page 6 x On May 20, 2012, Dalian Wanda entered into a merger agreement to acquire AMC Entertainment • Wanda Group (“Wanda”) is a large, privately held corporation with five major businesses: commercial properties, cultural industries, tourism, department stores and luxury hotels • Wanda Cinema Line is the largest movie exhibitor in China with 86 locations and 730 screens Merger overview Key terms x Dalian Wanda will acquire 100% of AMC Entertainment in a transaction valued at $2.6 billion • Dalian Wanda intends to invest an additional $500 million in AMC over time to fund strategic initiatives and manage the balance sheet • Dalian Wanda has received financing commitments from Bank of China, Export - Import Bank, China Merchant Bank and China Bohai Bank in support of the transaction – AMC is not an obligor or guarantor x AMC’s current management team has signed long - term employment agreements and will remain with the company x In connection with the transaction, AMC will cease paying annual management fees to its prior owners x The transaction is expected to close by September 2012 x Closing is subject to completion of customary closing conditions, including P.R.C. and U.S. regulatory approval • Wanda has already received preliminary approval for this transaction from China’s National Development and Reform Commission (NDRC) • Further approvals are required by NDRC, the Ministry of Commerce (MOFCOM) and the State Administration of Foreign Exchange (SAFE), as well as under the U.S.’ Hart - Scott - Rodino Act

Private & Confidential Lender Presentation - June 2012 Page 7 x Creates world’s largest movie exhibitor x Only theatre operator with exposure to the two largest movie exhibition markets in the world x Marries the heft and size of the U.S. business of AMC with the rapid growth of the Wanda Chinese cinema enterprise x Provides AMC access to additional resources to execute long - term strategic initiatives x Ability to leverage operating expertise and best practices from developed U.S. market in high growth China market x Positions the new AMC/Wanda with unique, exclusive content x Creates global scale and reach for AMC to enhance programming and technology innovation x Long term commitment from existing management team x Wanda and AMC are well - aligned strategically, operationally and philosophically Wanda Acquisition of AMC - Transaction Rationale

Performance Highlights

Private & Confidential Lender Presentation - June 2012 Page 9 Key highlights x Strength of recent box office performance x Highest performing theatres x Leading position in largest, most important markets x Incremental growth from enhancing customer experience • IMAX and 3D deliver a differentiated experience at a higher ticket price • Enhanced seating platforms generate attendance growth • Theatre food & beverage expands to meet consumer tastes, providing revenue upside • Distinct and broad guest engagement through multiple channels

Private & Confidential Lender Presentation - June 2012 Page 10 Recent Industry Box Office Strength Industry Box Office – LTM ($ in billions ) x The US Box Office has historically been volatile on a year - over - year basis, however the long term trend has been positive x CY ’12 results have been positive year - over - year Industry box office Y - o - Y % change by quarter Box Office Performance by Quarter ($ in billions ) % Change Y - o - Y: 20% 12% $7.0 $8.0 $9.0 $10.0 $11.0 $12.0 Trendline $2.15 $1.27 $2.58 $1.42 March QTR June QTD 2011 2012 March 2003 – March 2012 - 30% - 20% - 10% 0% 10% 20% 30% March 2003 – March 2012 17.7% 18.1% 18.3% 18.4% AMC Mkt Share (1) Through May 17, 2012 (1)

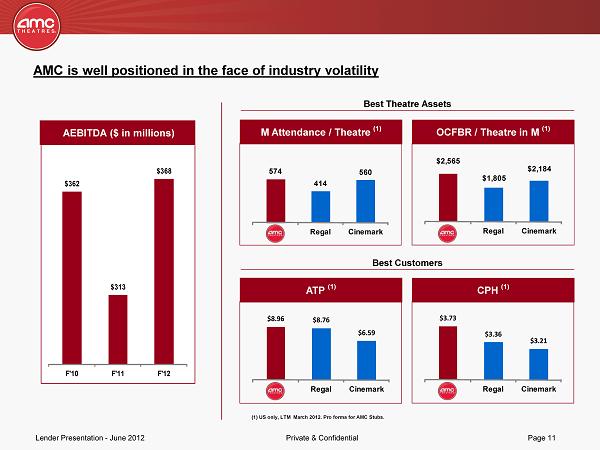

Private & Confidential Lender Presentation - June 2012 Page 11 AMC is well positioned in the face of industry volatility $8.96 $8.76 $6.59 AMC Regal Cinemark $3.73 $3.36 $3.21 AMC Regal Cinemark (1) US only, LTM March 2012. Pro forma for AMC Stubs. M Attendance / Theatre (1) OCFBR / Theatre in M (1) ATP (1) CPH (1) AEBITDA ($ in millions ) 574 414 560 AMC Regal Cinemark $2,565 $1,805 $2,184 AMC Regal Cinemark Best Theatre Assets Best Customers $362 $313 $368 F'10 F'11 F'12

Private & Confidential Lender Presentation - June 2012 Page 12 Source: Rentrak and Nielsen Claritas (1) As of March 29 , 2012. Major Market Benefits x Higher population density and growth x Better demographics – affluence, diversity x Visibility / importance to U.S. box office x Real estate scarcity Leading position in largest, most important markets 1 New York 40.2% 1 2 Los Angeles 27.2 2 3 Chicago 43.4 1 4 Philadelphia 28.0 2 5 Dallas 28.7 2 6 San Francisco 22.5 2 7 Atlanta 31.1 2 8 Washington DC 33.9 2 9 Boston 30.0 2 10 Houston 29.1 2 x AMC is in 24 of the top 25 U.S. markets; in 21 of those markets AMC is #1 or #2 in Box Office Revenues (1) 10 Largest U.S. Markets Market AMC Share LTM Box Office Rank 1 2 3 Top Three Theatres

Private & Confidential Lender Presentation - June 2012 Page 13 x Premium format pricing is 39% to 68% above traditional 2D x 16% of attendance in IMAX, ETX and 3D; ~$121 million premium admissions revenue x Building programming consistency and differentiation with IMAX (e.g., MI4) x Consumer demand for 3D seems to have settled at 55% - 60% of gross per movie x F’12, circuit - wide ATP was up 1.8%; traditional 2D up 2.8% ATP by Format (1) IMAX and 3D deliver a differentiated experience at a higher ticket price IMAX 3D # of Titles IMAX 3D (1) As of 3/29/2012 LTM Box Office Revenue (1) 15 24 36 C'09 C'10 C'11 C'12 36+ 14 15 21 C'09 C'10 C'11 C'12 19+ x 2.5% screens; 6% revenue x 128 installed; + 1 planned x nearly 2x closest competitor x 14 movies in C’09 x 21 movies in C’11 x 44% screens; 15% revenue x 2,208 installed x 15 movies in C’09 x 36 movies in C’11 $8.37 $ 11.64 $ 13.75 $14.06 Traditional 3D ETX IMAX 79% 15% 1% 5% Traditional 3D ETX IMAX

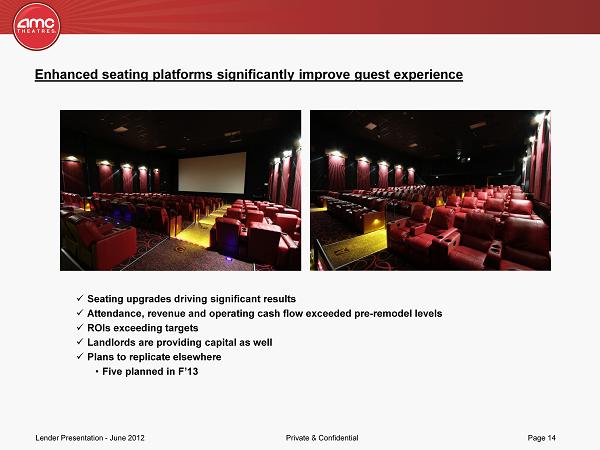

Private & Confidential Lender Presentation - June 2012 Page 14 x Seating upgrades driving significant results x Attendance, revenue and operating cash flow exceeded pre - remodel levels x ROIs exceeding targets x Landlords are providing capital as well x Plans to replicate elsewhere • Five planned in F’13 Enhanced seating platforms significantly improve guest experience

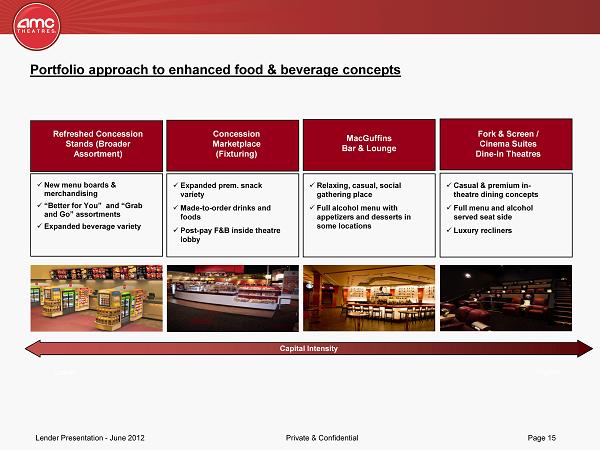

Private & Confidential Lender Presentation - June 2012 Page 15 Capital Intensity Lower Higher Refreshed Concession Stands (Broader Assortment) Concession Marketplace (Fixturing) MacGuffins Bar & Lounge Fork & Screen / Cinema Suites Dine - in Theatres x New menu boards & merchandising x “Better for You” and “Grab and Go” assortments x Expanded beverage variety x Expanded prem. snack variety x Made - to - order drinks and foods x Post - pay F&B inside theatre lobby x Relaxing, casual, social gathering place x Full alcohol menu with appetizers and desserts in some locations x Casual & premium in - theatre dining concepts x Full menu and alcohol served seat side x Luxury recliners Portfolio approach to enhanced food & beverage concepts

Private & Confidential Lender Presentation - June 2012 Page 16 x CPH from $ 3.42 to $ 3.73 in F’2012 (PF AMC Stubs) • For every $1.00 generated in ticket gross profit we generate an additional $ 0.77 in concession gross profit $3.24 $3.42 $3.73 F'10 F'11 F'12 AMC concession per patron continues to provide revenue upside x Outpacing competitors in absolute dollars and growth Historical Concession per Patron $4.23 $3.24 Admissions Concessions F’12 Gross Profit per Patron $3.42 $3.26 $3.06 $3.73 $3.36 $3.21 AMC Regal Cinemark 2011 2012 Concession per Head (1) (1) As of March 2012

Private & Confidential Lender Presentation - June 2012 Page 17 AMC builds guest engagement in theatres and sustains online x AMC Stubs loyalty program acquired 3.2 million members in launch year x Higher guest satisfaction – increased to 51.6% “top box” x Greater digital engagement • Refreshed AMCTheatres.com website with 4+ million monthly uniques • Weekly emails to 4+ million • Facebook 3+ million likes • AMC mobile app launched in March (100,000 downloads in first 5 days)

Private & Confidential Lender Presentation - June 2012 Page 18 Financial Update

Private & Confidential Lender Presentation - June 2012 Page 19 Historical Operating Results Consolidated Summary Operating Statement (1) Excludes preopening expense, theatre and other closure expense (income) and disposition of assets and gains. (2) Excludes stock - based compensation. (3) Adj . EBITDAR defined as Adjusted EBITDA plus rent. (4) Adjusted EBITDA for the period(s) presented includes the indicated amount of cash dividends received from NCM. We present such dividends here because they are included in the cal cul ation of comparable measures in the indentures governing AMC's existing notes and AMC's credit facilities. This measure has important limitations as an analytical tool and you should not consider it in isolation, or as a substitute for analysis of AMC‘s results as reported under U.S. GAAP. You are encouraged to evaluate these ad justments and the reasons we consider them appropriate for supplemental analysis. 52 weeks ended (in millions) 3/29/12 3/31/2011 % change Admissions revenues $1,777 $1,698 5% Concessions revenues 710 664 7% Other revenues 113 75 51% Total revenues 2,600 2,437 7% Film exhibition costs 945 888 6% Concession costs 97 83 17% Operating expense (1) 705 656 7% G&A expense - other (2) 49 57 - 14% NCM Dividend (33) (36) - 8% Adj. EBITDAR (3) 837 789 6% Rent 469 476 - 1% Adj. EBITDA (4) $368 $313 18% Net cash provided by operating activities $197 $92 114% Capital Expenditures, net 139 124 11% Net cash provided by operating activities, less capital expenditures, net $58 ($32) -

Private & Confidential Lender Presentation - June 2012 Page 20 Consolidated Key Analyticals – F’12 Q4 (3/29/12) Consolidated Key Analyticals 52 weeks ended 3/29/12 3/31/2011 % change Average Screens 4,977 5,086 (2%) Attendance (000's) 199,884 194,412 3% APS (annualized, 000's) 40.2 38.2 5% Average Ticket Price $8.89 $8.73 2% Concessions per Head $3.55 $3.42 4% Other revenues per Head $0.57 $0.39 46% Film ExhibitionCosts % 53.2% 52.3% 90bps Admissions GP per Screen (annualized, 000's) $167 $159 5% Concession Costs % 13.7% 12.5% 120bps Concession GP per patron $3.06 $2.99 2% Operating Expense % of Revenues 26.9% 27.1% 0bps G&A Expense - Other % 1.9% 2.3% (40bps) Rent per Screen (annualized, 000's) $94.2 $93.6 1% Adj. EBITDAR margin (1) 30.9% 30.9% 0bps Adj. EBITDA margin (1) 12.9% 11.4% 150bps (1) Does not include NCM dividends

Private & Confidential Lender Presentation - June 2012 Page 21 Wanda Overview

Private & Confidential Lender Presentation - June 2012 Page 22 Wanda Overview x Wanda, established in 1988, is the one of the largest private companies in China, specializing in: • Commercial Properties • Luxury Hotels • Tourism • Cultural Businesses • Department Stores x Wanda has approximately $17 billion in contracted revenues and $42 billion in assets Strategic Plan x Under Wanda’s ownership, AMC will continue to be managed by the same executive team with the same strategy focused on providing a premier customer experience • All management and U.S. programming decisions will be made in the U.S. • Employee headcount levels are expected to remain unchanged x Wanda will receive quarterly operating updates from senior management regarding the status and performance of the business x Wanda intends to invest an additional $500 million in AMC over time to fund strategic initiatives and manage the balance sheet • Wanda plans to make its first investment of $50mm at closing to fund the retirement of the remaining $140mm 8.0% Senior Subordinated Notes $500mm Equity Infusion

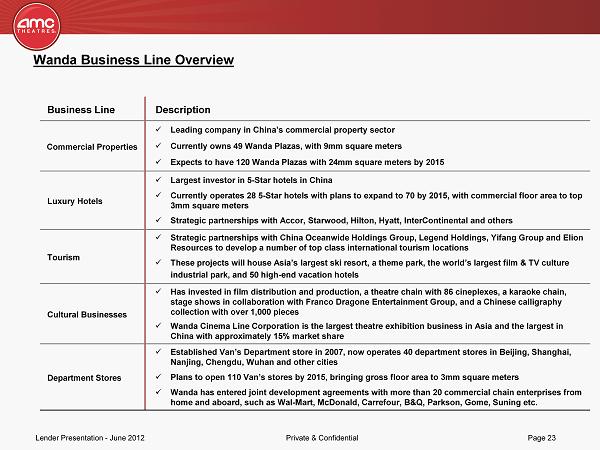

Private & Confidential Lender Presentation - June 2012 Page 23 Wanda Business Line Overview Business Line Description Commercial Properties x Leading company in China’s commercial property sector x Currently owns 49 Wanda Plazas, with 9mm square meters x Expects to have 120 Wanda Plazas with 24mm square meters by 2015 Luxury Hotels x Largest investor in 5 - Star hotels in China x Currently operates 28 5 - Star hotels with plans to expand to 70 by 2015, with commercial floor area to top 3mm square meters x Strategic partnerships with Accor, Starwood, Hilton, Hyatt, InterContinental and others Tourism x Strategic partnerships with China Oceanwide Holdings Group, Legend Holdings, Yifang Group and Elion Resources to develop a number of top class international tourism locations x These projects will house Asia’s largest ski resort, a theme park, the world’s largest film & TV culture industrial park, and 50 high - end vacation hotels Cultural Businesses x Has invested in film distribution and production, a theatre chain with 86 cineplexes , a karaoke chain, stage shows in collaboration with Franco Dragone Entertainment Group, and a Chinese calligraphy collection with over 1,000 pieces x Wanda Cinema Line Corporation is the largest theatre exhibition business in Asia and the largest in China with approximately 15% market share Department Stores x Established Van’s Department store in 2007, now operates 40 department stores in Beijing, Shanghai, Nanjing, Chengdu, Wuhan and other cities x Plans to open 110 Van’s stores by 2015, bringing gross floor area to 3mm square meters x Wanda has entered joint development agreements with more than 20 commercial chain enterprises from home and aboard, such as Wal - Mart, McDonald, Carrefour, B&Q, Parkson , Gome , Suning etc.

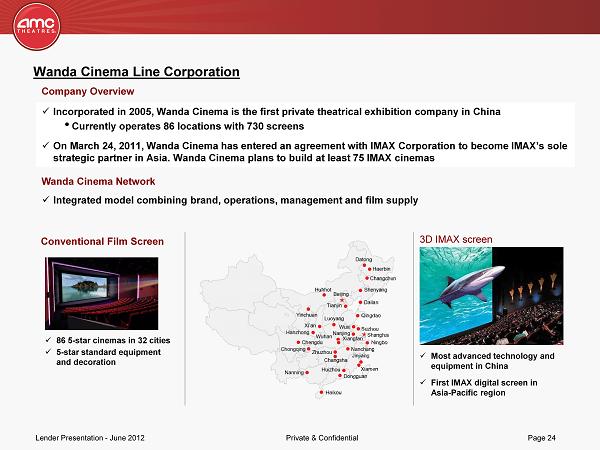

Private & Confidential Lender Presentation - June 2012 Page 24 Wanda Cinema Line Corporation x Incorporated in 2005, Wanda Cinema is the first private theatrical exhibition company in China • Currently operates 86 locations with 730 screens x On March 24, 2011, Wanda Cinema has entered an agreement with IMAX Corporation to become IMAX’s sole strategic partner in Asia. Wanda Cinema plans to build at least 75 IMAX cinemas Company Overview Wanda Cinema Network x Integrated model combining brand, operations, management and film supply Conventional Film Screen 3D IMAX screen x 86 5 - star cinemas in 32 cities x 5 - star standard equipment and decoration x Most advanced technology and equipment in China x First IMAX digital screen in Asia - Pacific region

Private & Confidential Lender Presentation - June 2012 Page 25 Financial Highlights (2011) x Contracted revenue of $17bn x Recognized revenue (Chinese GAAP) of $9.9bn x Assets of $42bn x Expects to increase contracted annual revenue to $32bn and assets to $48bn by 2015 x Cash balance of $7.7bn x Net Leverage of 1.9x x Cash flow from operations $4.9bn x Capital expenditures of $4.5bn $1.7 $2.4 $3.8 $6.9 $9.9 2007A 2008A 2009A 2010A 2011A Revenue ($ in billions) % Growth $3.4 $5.8 $14.3 $29.6 $42.0 2007A 2008A 2009A 2010A 2011A Assets ($ in billions) % Growth -- 70.6% 146.6% 107.0% 41.9% -- 41.2% 58.3% 81.6% 43.5% Note: Balance sheet metrics as of 12/31/2011. Earnings metrics for 2011 calendar year.

Private & Confidential Lender Presentation - June 2012 Page 26 Key Relationships x Wanda received financing commitments from its banks sufficient to manage any refinancing needs related to this transaction x AMC and its subsidiaries will not become obligors in the event that any of these commitments are funded x E&Y provided financial advice and Davis Polk provided legal advice to Wanda on the AMC acquisition

Private & Confidential Lender Presentation - June 2012 Page 27 Wanda Management Team Name and Title Background Wang Jianlin, Chairman x Senior Engineer x 20 years of experience in real estate industry x Founder and principal shareholder x Vice Chairman of the All - China Federation of Industry and Commerce x Deputy to the 17 th Party Congress Ding Benxi, CEO x Senior Engineer x 20 years of experience in real estate industry Zhang Lin, VP and CFO x Many years of experience in corporate finance and financial management

Private & Confidential Lender Presentation - June 2012 Page 28 Proposed Capital Structure Plan

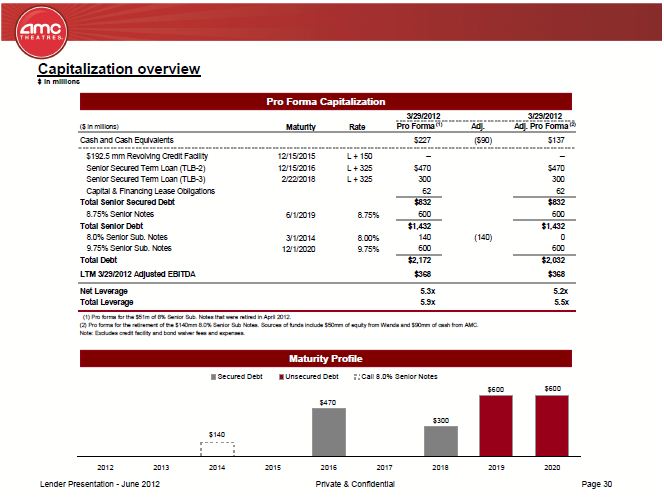

Private & Confidential Lender Presentation - June 2012 Page 29 x Seek consents from lenders to waive the change of control provision in AMC’s $962.5mm Credit Facility x Also seek to change AMC’s fiscal year to calendar year - end $600mm 8.75% Senior Notes and $600mm 9.75% Senior Subordinated Notes • AMC will seek change of control waivers from bondholders to keep the existing bonds in place $140mm 8.0% Senior Subordinated Notes • AMC intends to retire the 8.0% Senior Subordinated Notes at par upon closing of the transaction – This will be funded by a $50mm equity contribution from Wanda and $90mm of AMC cash on hand – The repayment will reduce total leverage by approximately 0.4x Transaction Overview Additional Capital Structure Plans

Private & Confidential Lender Presentation - June 2012 Page 30 Capitalization overview $ in millions Pro Forma Capitalization Maturity Profile $140 $300 $470 $600 $600 2012 2013 2014 2015 2016 2017 2018 2019 2020 Secured Debt Unsecured Debt Call 8.0% Senior Notes 3/29/2012 3/29/2012 ($ in millions) Maturity Rate Pro Forma (1) Adj. Adj. Pro Forma (2) Cash and Cash Equivalents $227 ($90) $137 $192.5 mm Revolving Credit Facility 12/15/2015 L + 150 -- -- Senior Secured Term Loan (TLB - 2) 12/15/2016 L + 325 $470 $470 Senior Secured Term Loan (TLB - 3) 2/22/2018 L + 325 300 300 Capital & Financing Lease Obligations 62 62 Total Senior Secured Debt $832 $832 8.75% Senior Notes 6/1/2019 8.75% 600 600 Total Senior Debt $1,432 $1,432 8.0% Senior Sub. Notes 3/1/2014 8.00% 140 (140) 0 9.75% Senior Sub. Notes 12/1/2020 9.75% 600 600 Total Debt $2,172 $2,032 LTM 3/29/2012 Adjusted EBITDA $368 $368 Net Leverage 5.3x 5.2x Total Leverage 5.9x 5.5x (1) Pro forma for the $51m of 8% Senior Sub. Notes that were retired in April 2012. (2) Pro forma for the retirement of the $140mm 8.0% Senior Sub Notes. Sources of funds include $50mm of equity from Wanda and $9 0mm of cash from AMC. Note: Excludes credit facility and bond waiver fees and expenses.

Private & Confidential Lender Presentation - June 2012 Page 31 Indicative timeline Date Event June 13 th Lender Conference Call June 21 st Lender Consents Due June 25 th Finalize and Close Amendment May 2012 June 2012 S M T W T F S S M T W T F S 1 2 3 4 5 1 2 6 7 8 9 10 11 12 3 4 5 6 7 8 9 13 14 15 16 17 18 19 10 11 12 13 14 15 16 20 21 22 23 24 25 26 17 18 19 20 21 22 23 27 28 29 30 31 24 25 26 27 28 29 30