Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PNC FINANCIAL SERVICES GROUP, INC. | d365749d8k.htm |

The PNC

Financial Services Group, Inc. Morgan Stanley Financials Conference

June 12, 2012

Exhibit 99.1 |

DRAFT

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information

This presentation includes “snapshot” information about PNC used by way of

illustration. It is not intended as a full business or financial review and

should be viewed in the context of all of the information made available by PNC in its SEC

filings. The presentation also contains forward-looking statements regarding

our outlook for earnings, revenues, expenses, capital levels and ratios, liquidity levels, asset levels, asset quality, financial

position, and other matters regarding or affecting PNC and its future business and

operations. Forward-looking statements are necessarily subject to numerous

assumptions, risks and uncertainties, which change over time. The forward-looking statements in this presentation are qualified by the factors affecting

forward-looking statements identified in the more detailed Cautionary Statement

included in the Appendix, which is included in the version of the presentation materials posted on our corporate website at

www.pnc.com/investorevents. We provide greater detail regarding some of these as well as

other factors in our 2011 Form 10-K, as amended by Amendment No. 1 thereto, and

first quarter 2012 Form 10-Q, including in the Risk Factors and Risk Management sections and in the Legal

Proceedings and Commitments and Guarantees Notes of the Notes to Consolidated Financial

Statements in those reports, and in our subsequent SEC filings. Our

forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss in this presentation or

in SEC filings, accessible on the SEC’s website at www.sec.gov and on PNC’s

corporate website at www.pnc.com/secfilings. We have included web addresses in

this presentation as inactive textual references only. Information on these websites is not part of this presentation.

Future events or circumstances may change our outlook and may also affect the nature of the

assumptions, risks and uncertainties to which our forward-looking statements are

subject. Forward-looking statements in this presentation speak only as of the date of this presentation. We do not

assume any duty and do not undertake to update those statements. Actual results or

future events could differ, possibly materially, from those anticipated in

forward-looking statements, as well as from historical performance. In this presentation, we sometimes refer to adjusted results to help illustrate the impact of

certain types of items. This information supplements our results as reported in

accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that

this additional information and the reconciliations we provide may be useful to investors,

analysts, regulators and others as they evaluate the impact of these respective items

on our results for the periods presented due to the extent to which the items may not be indicative of our ongoing

operations. We may also provide information on pretax pre-provision earnings (total

revenue less noninterest expense) and on tangible book value per share (calculated as

book value per share less total intangible assets, other than servicing rights, per share). We believe that pretax pre-

provision earnings, a non-GAAP measure, is useful as a tool to help evaluate our earnings

created by operating leverage. And we believe that tangible book value per share, a

non-GAAP measure, is useful as a tool to help to better evaluate growth of the company’s business apart from the

amount, on a per share basis, of intangible assets other than servicing rights included in

book value. Where applicable, we provide GAAP reconciliations for such additional

information, including in the Appendix and/or other slides on our corporate website at

www.pnc.com/investorevents.

In certain discussions, we may also provide information on yields and margins for all

interest-earning assets calculated using net interest income on a

taxable-equivalent basis by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on

taxable investments. We believe this adjustment may be useful when comparing yields and

margins for all earning assets. We may also use annualized, proforma, estimated

or third party numbers for illustrative or comparative purposes only. These may not reflect actual results.

This presentation may also include discussion of other non-GAAP financial measures, which,

to the extent not so qualified therein or in the Appendix, is qualified by GAAP

reconciliation information available on our corporate website at www.pnc.com under “About PNC–Investor Relations.”

|

DRAFT

Today’s Discussion

Our successful business model positions us well for

the future

We have opportunities to capture organic growth

Our disciplined growth strategies provide

opportunities to deliver significant long-term

shareholder value

PNC Continues to Build a Great Company.

PNC Continues to Build a Great Company. |

DRAFT

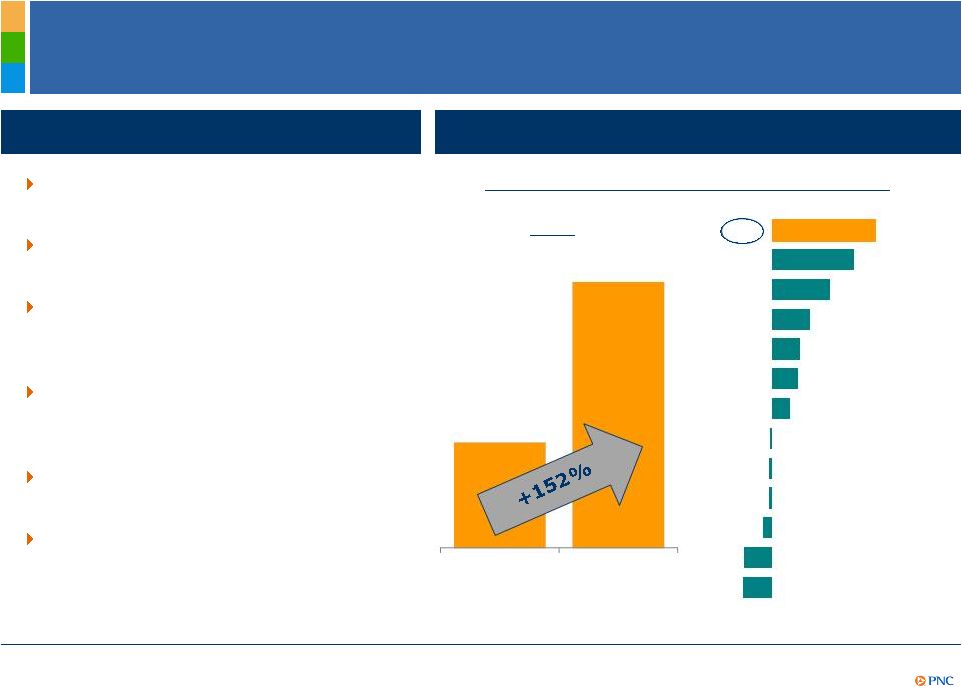

Executing Our Business Model has Delivered Value

CMA

BAC

FITB

STI

RF

KEY

$17.58

$44.27

Peer banks identified in the Appendix. Peer Source: SNL DataSource. (1) Tangible book value

per share calculated as book value per share less goodwill and certain other intangible

assets. Further information is provided in the Appendix. PNC

% change 12/31/2007 to 3/31/2012

Staying core funded and

disciplined in our deposit pricing

Committed to our moderate risk

philosophy

Leveraging customer relationships

and our strong brand to grow high

quality, diverse revenue streams

Creating positive operating

leverage while investing in

innovation

Remaining disciplined with our

capital

Executing on our strategies

Tangible book value per share

PNC’s successful business model

121%

86%

56%

41%

39%

27%

-3%

-4%

-5%

-14%

-41%

-43%

PNC

WFC

USB

JPM

COF

MTB

BBT

152%

12/31/2007

3/31/2012

1 |

DRAFT

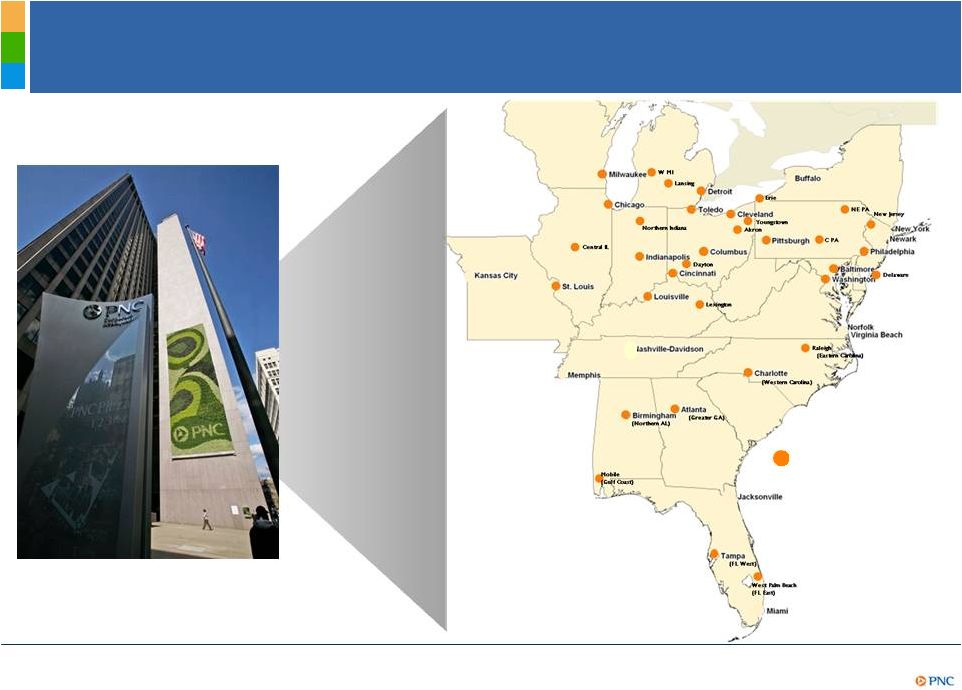

Our Franchise Provides Significant Opportunities for

Growth

PNC’s revenue growth strategies:

–

Expanding into large, faster growing markets with

successful Regional President “Go To Market”

strategy

–

Improving brand awareness to help drive customer

growth

–

Launching innovative new products that address client

needs

–

Improving cross-sell penetration

–

Repositioning our branches to capture greater share of

wallet

–

Capturing the investment and retirement assets

opportunity |

DRAFT

Regional Presidents Model Key to Delivering PNC’s

Capabilities to Local Markets

Connecting

large bank

products and

services to

local markets…

Regional Presidents

Markets |

DRAFT

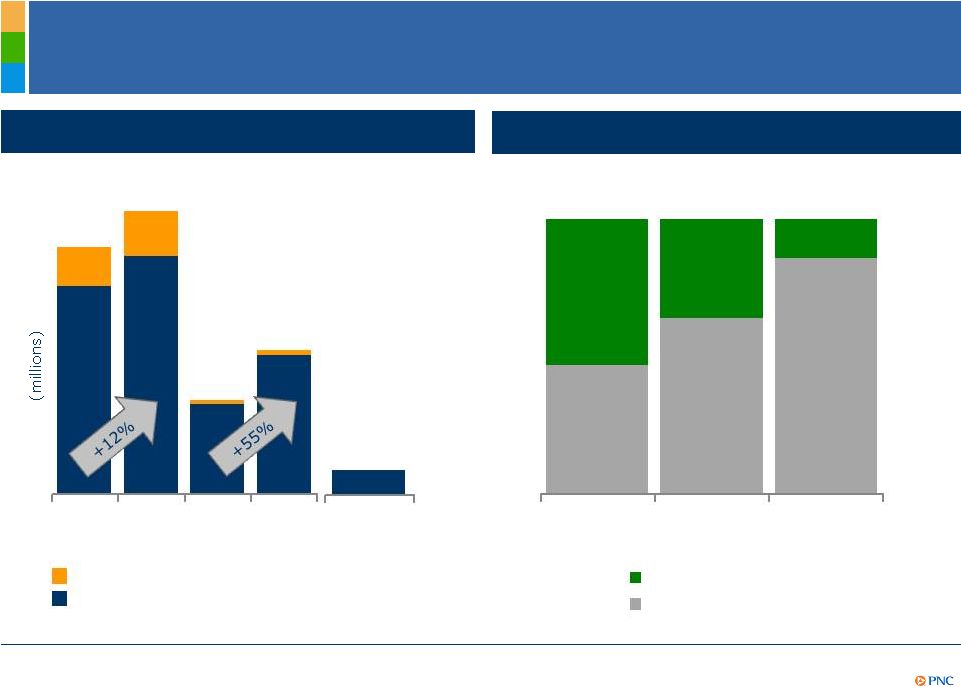

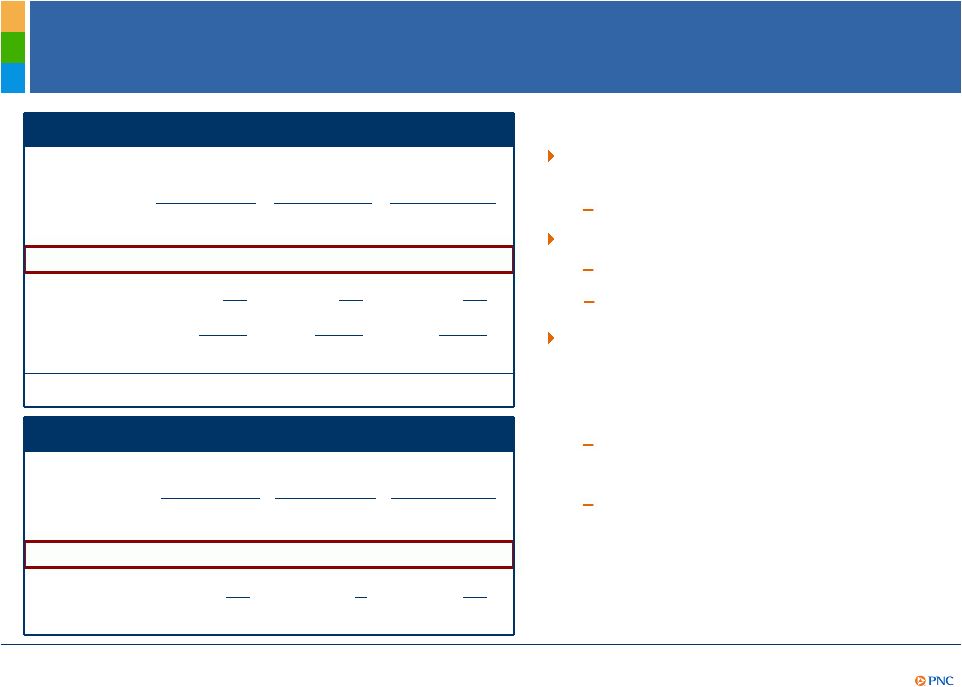

Expanding the PNC Model in Underpenetrated Markets

Philadelphia

Philadelphia

Chicago

RBC

markets

4

$xx

2010

2011

2010

2011

2012

$105

$118

$40

$62

AMG sales

Corporate Banking sales

RBC

markets

Chicago

Total Corporate Banking and AMG sales

Corporate Banking cross-sell sales by type

14

$

Non-

Credit Sales

Credit Sales

47%

64%

86%

53%

36%

14%

1

1

2

3

3

AMG refers to Asset Management Group. (1) Year over year total market sales. (2) RBC markets

defined as Eastern Carolina, Western Carolina, Greater Georgia, Northern Alabama and

Gulf Coast; March and April 2012 annualized revenues. AMG sales not yet significant to RBC

markets as we are in the build-out phase. (3) For the full year 2011. (4) March and April

2012. |

DRAFT

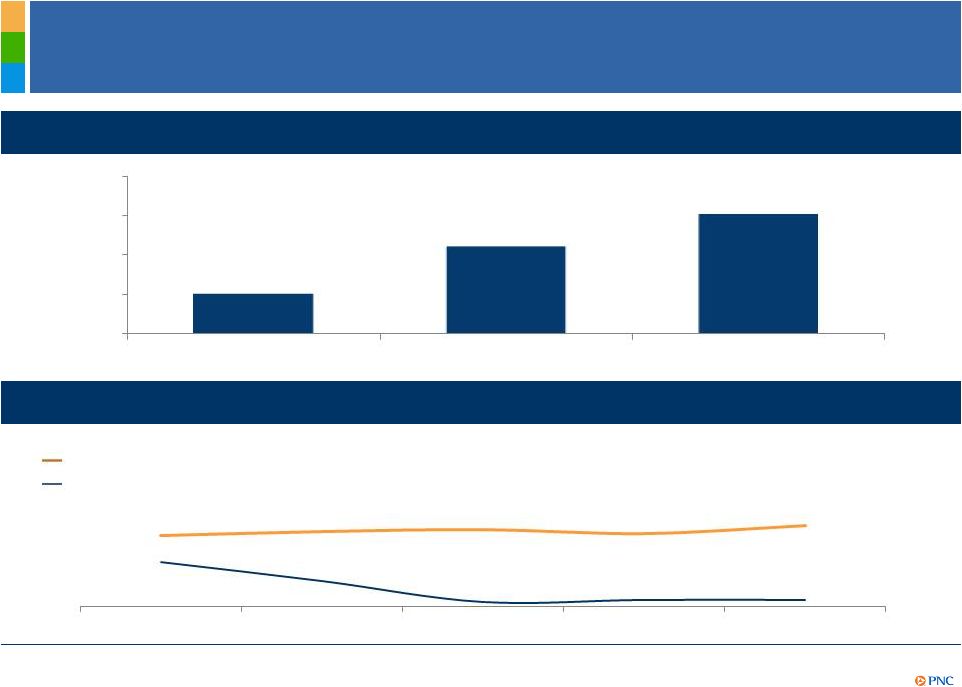

Improving Brand Awareness and Customer Confidence

National Customer Confidence

PNC customer confidence

2

US

population

confidence

in

banking

industry

3

PNC’s Brand Awareness

1

Significant relative increase in PNC’s customer confidence

Investments in PNC’s brand producing results

55%

67%

75%

45%

55%

65%

75%

85%

2H 2009

2010

2011

53%

55%

56%

54%

58%

41%

32%

22%

23%

23%

2007

2008

2009

2010

2011

(1) Source: TNS Consumer Brand and Advertising Performance Research report dated as of 4Q11.

(2) Confidence is measured at PNC by asking “PNC is a name I can always

trust” and “PNC always delivers on what they promise.” A respondent is considered Confident if they

answer a “5” Strongly Agree to both items. Source: Gallup June 2011. (3) Confidence

is measured in the banking industry by asking ”Please tell me how much confidence

you, yourself, have in banks – a great deal, quite a lot, some, or very little?” Source: Gallup June 2011. |

DRAFT

Launching New Products that Enhance Customer

Experience

Investing in technology across all

customer segments

Product innovation driving

customer growth

PNC’s customer service

differentiation:

–

Information organized based

on how customers think

–

Integrated experience

Giving customers choice

Driven by product innovation

Future service delivery model |

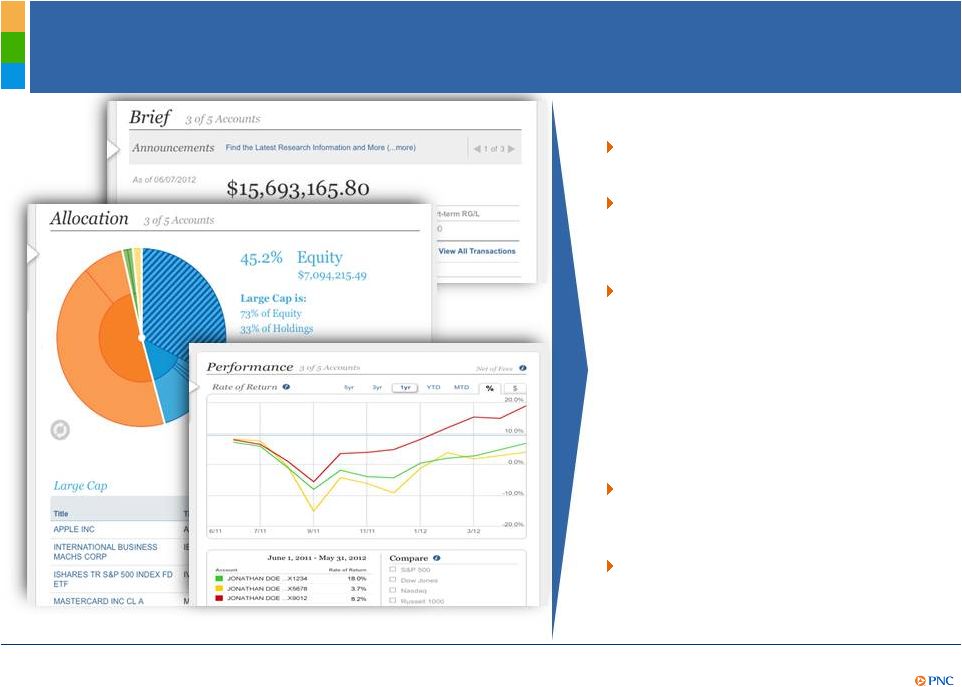

DRAFT

Launching New Products that Enhance Customer

Experience -

PNC Wealth Insight

®

Optimized for tablet and PC

Customer demand for

transparency, information

Launched last fall to Wealth

clients

–

70% adoption rate

Key features:

–

Aggregate and customize

–

Dynamic grouping

–

Personal rate of return

–

Integrated with banking

–

Collaborate with advisor

Recently recognized by

Forrester®, Change Sciences®

and CIO 100

Expanding to mass affluent |

DRAFT

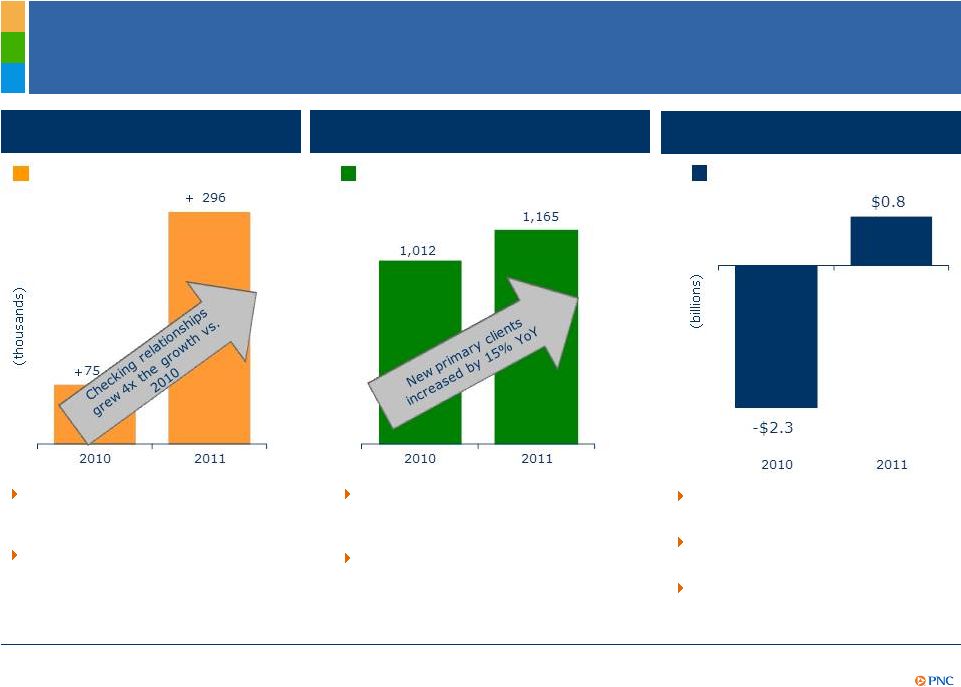

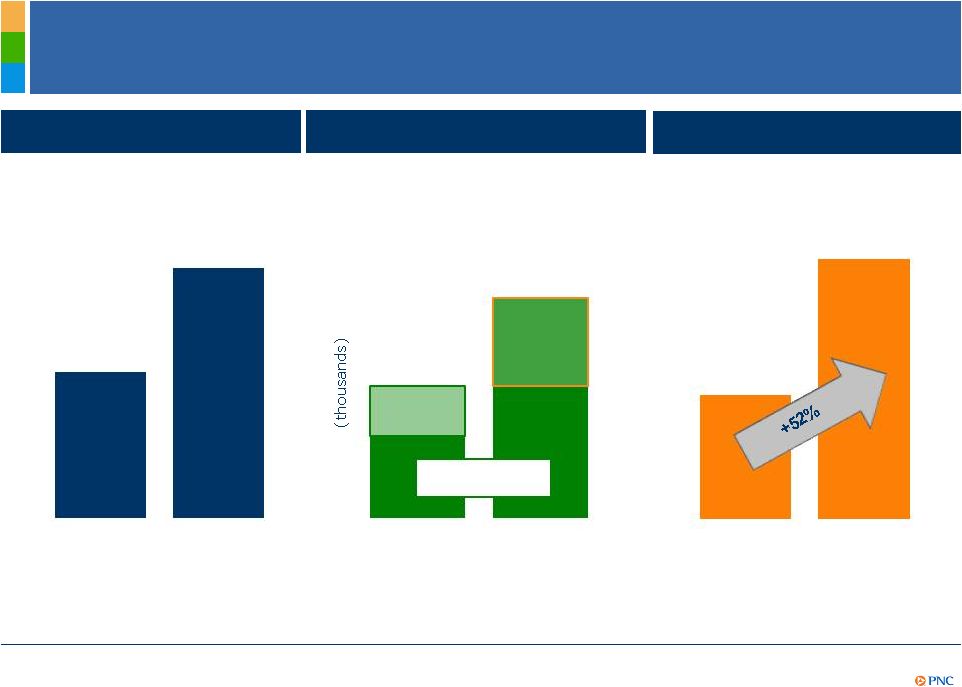

Growing Client Relationships

Asset Management Group

Retail Banking

Corporate & Institutional Banking

Discretionary AUM Total

Net Flows

4

2011

referral

sales

up

52%

vs.

2010

2011 new primary clients³

up 26%

vs. 2010

Total sales have increased by 38%

for 2011 vs. 2010

New clients represent 12% of total

existing primary clients at

December 31, 2011

Strong 2011 sales across all

markets and client segments

2011 total growth of 5.4%, greater

than 1.2% footprint population

growth

Active online bill payment customers

showed

total

growth²

of

2.4%

from

3Q11, 13% from 4Q10

Corporate Banking new primary

clients³

Checking relationship growth

1

5

(1) Checking relationship growth refers to consumer and small business accounts including

41,000 relationships acquired by acquisition in 2011. (2) Total growth includes 4,000

customer accounts acquired by acquisition in 2011. (3) A Corporate Banking primary client is defined as a

corporate banking relationship with annual revenue generation of $50,000 or more or, within

corporate banking, a commercial banking client relationship with annual revenue

generation of $10,000 or more. AMG primary client relationships are defined as client relationships with annual

revenue generation of $10,000 or more. (4) AUM refers to Assets Under Management. Total net

flows defined as net changes from clients including dividends received. (5) New client

sales referred to AMG by Retail Banking or C&IB. |

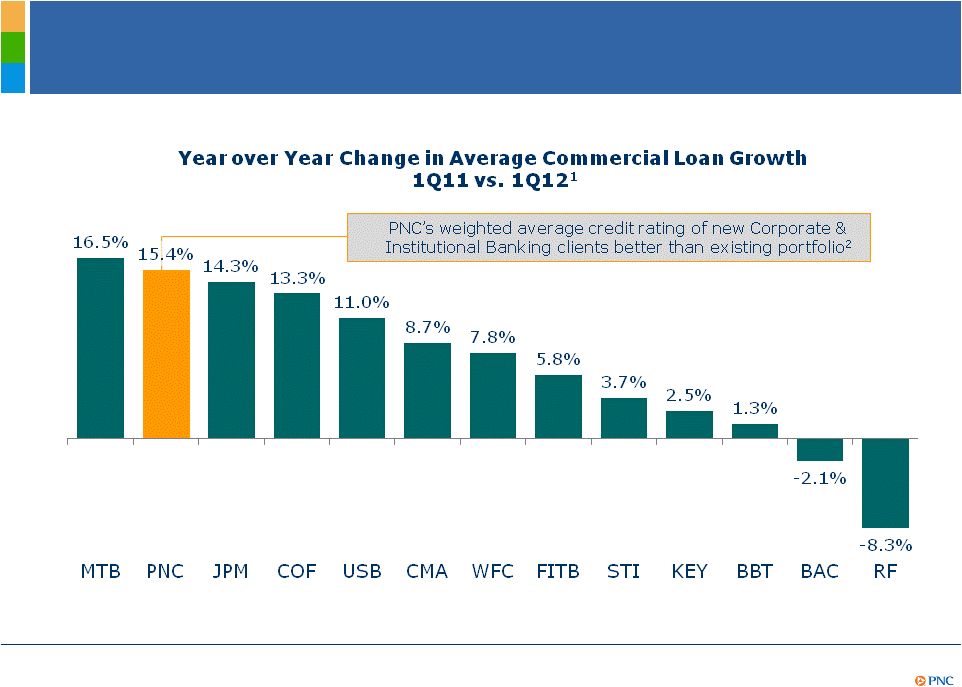

DRAFT

Generating Strong Commercial Loan Growth and

Gaining Share

(1) Peer Source: Company reports. JPM and COF loan growth reflects commercial banking segment

reported in company reports. PNC 1Q12 average commercial loan balance of $92,481

million includes impact of RBC Bank (USA) acquisition. PNC’s commercial loan balance includes

commercial,

commercial

real

estate

and

equipment

lease

financing.

(2)

New

Corporate

&

Institutional

Banking

clients

during

first

quarter

2012 include both organic client growth and acquired clients as part of the RBC Bank (USA)

transaction compared to existing client portfolio as of 12/31/2011.

|

DRAFT

(1) Percentage of new consumer households as measured within three months with a primary

checking account having at least two services and

one

additional

bank

deposit

or

loan

product

with

us.(2)

A

Corporate

Banking

primary

client

is

defined

as

a

corporate

banking

relationship

with annual revenue generation of $50,000 or more or, within corporate banking, a commercial

banking client relationship with annual revenue generation of $10,000 or more. (3)

Referral channel sales are new sales from clients referred to AMG by Retail Banking or Corporate

and Institutional Banking.

New retail banking consumer

household

cross-sell

penetration

Asset Management Group referral

channel

sales

Average revenue per average new

corporate

banking

primary

clients

$150

$250

Within 1 year

Actual

Within 3 years

Goal

34%

44%

2010

2011

Cross-sell

opportunity

38% non-

credit sales

Asset Management Group

Retail Banking

Corporate & Institutional Banking

2010

2011

$100

Average new

primary clients

Capturing Cross-Sell Opportunities

st

1

2

3 |

DRAFT

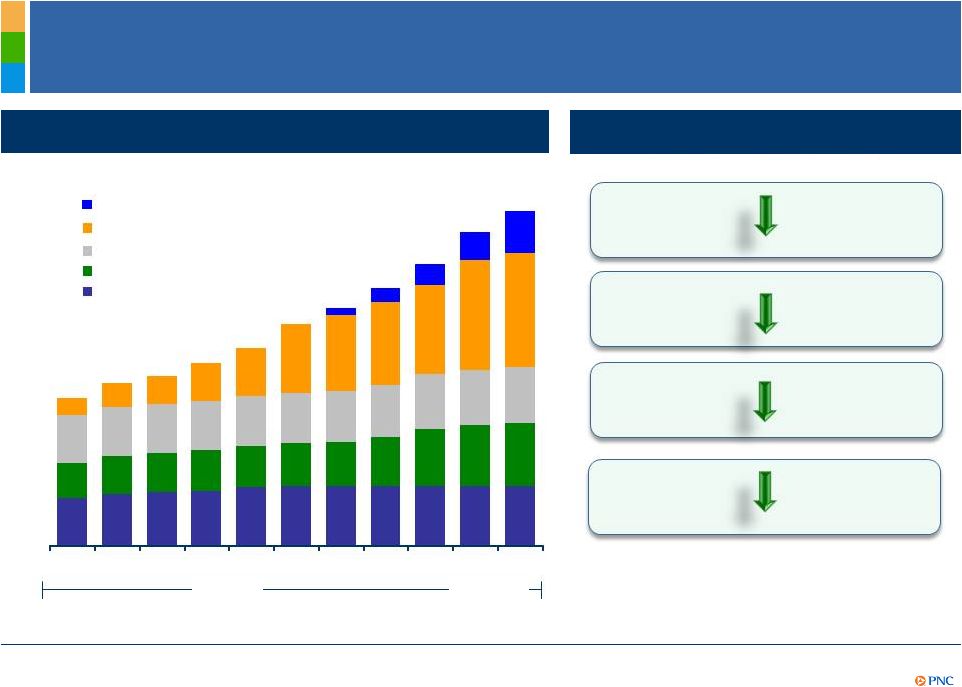

Changing Customer Behavior

Mobile

Online

ATM

Call center

Branch

U.S. banking transactions by channel (billions)

(1) Source: Tower Group, McKinsey & Company. (2) Source: Novantas. Represents the average

annual change measured in 2008-2011. U.S. branch transaction activity

(average annual change)

Deposit

Withdrawal

Check

Cashing

Total

-7% to -9%

-3% to -6%

-17% to -19%

-4% to -5%

Actual

Forecast

0

25

50

75

100

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

1

2 |

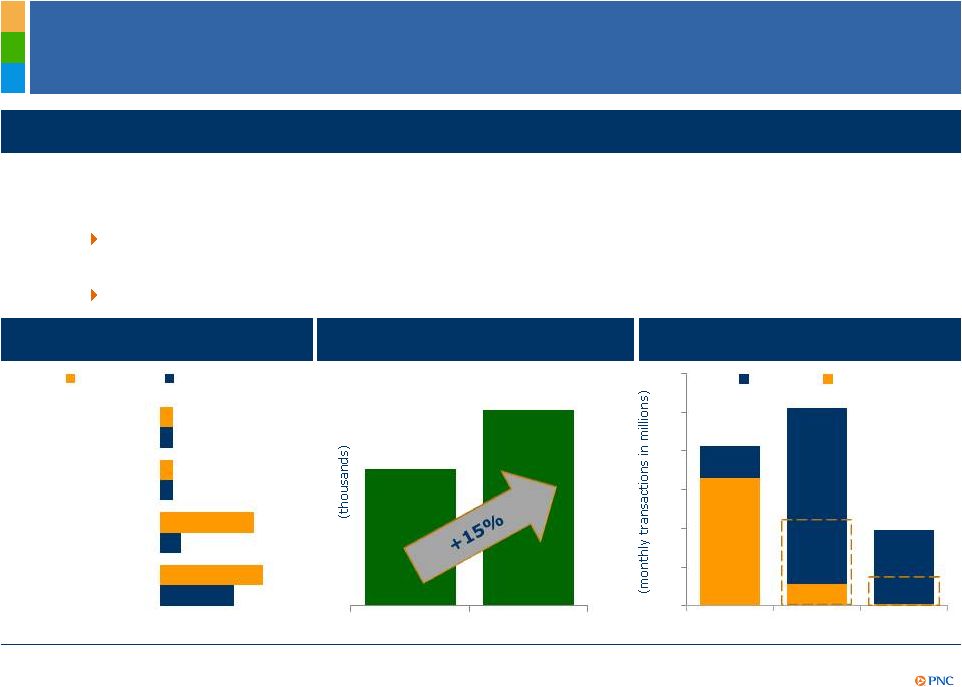

DRAFT

Serving Customers Tomorrow –

Lower Cost to Serve

Cost per transaction

Continue to deliver industry leading customer loyalties while we

evolve to a lower cost

structure

Lower cost to serve by migrating certain customer transactions toward lower cost

channels

Significant cost save opportunity with virtual sales kiosks and alternative formats

Active online banking

customers

1

ATM channel migration

opportunity

3,519

3,057

Goals

Withdrawals

Deposits

Check

cashing

40%

potential

20%

potential

(1) Active online banking customer is defined as a customer who has signed on at least once in

the past 3 months. 2010

2011

Teller

ATM

0

2

4

6

8

10

12

Branch

Call Center

ATM

Online/ Mobile

Business

Consumer |

DRAFT

Serving Customers Tomorrow –

Grow Revenue

Approximately 20% of PNC’s customers are primarily non-branch transactors

–

Lower share of wallet relative to branch-heavy customers

–

Significant affluent opportunity

Use CIM across relevant channels to:

–

Offer higher margin products to Virtual Wallet customers

–

Cross-sell credit card

–

Offer review of investment and retirement plan

Significant opportunity to capture greater share of wallet

Use

customer

insights

about

transactional

behaviors

and

needs

to

inform

cross-channel

actions

Customer Interaction Management (CIM) capability enables delivery of targeted offers

Goals |

DRAFT

Branches to operate as a

team of customer

solution experts

Multiple physical formats

in the network

Differentiated experience

by customer segment

Integrated digital and call

center for sales and self-

service

Highlights

Extensive full

function ATM

network

Smaller special

segment “stores”

& kiosks

Remote sales

force specialists

Mobile stores,

street teams and

educational events

PNC’s Vision -

Branch as Part of our Future Network |

DRAFT

Capturing the Investment and Retirement Assets

Opportunity

Client -

Focused

Mass Market

< $100K

Affluent

$100K

-

$1

MM

High Net Worth

> $1 MM

Differentiated

Multi

-Channel

Approach

“Go-to-Market”

Strategy

Focused on growth in all client segments

Diverse channel approach to deepen customer relationships and

share of wallet

Distinctive “concierge”

branch service model which directs

customers to appropriate channel for highest service level

Single platform drives exceptional user experience

Strong product capabilities across all client investment risk

spectrum

Call center

Internet

Branch

Salesforce

Call center

Internet

Branch

Call center

Internet

Mass market represents clients with <$100K in investable assets. Affluent represents

clients with investable assets between $100K and $1 million. High net worth represents

clients with over $1 million in investable assets.

|

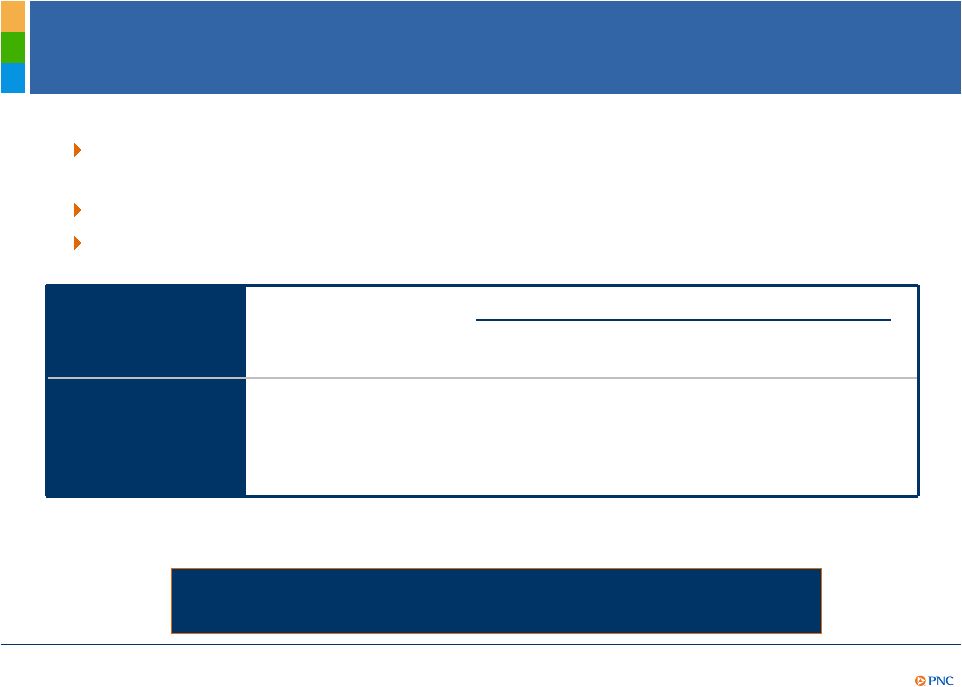

DRAFT

We have identified more than 600 initiatives to deliver our savings

goals

–

94 initiatives are estimated to achieve savings of greater than $1

million

Our Continuous Improvement Drives Capacity For

Future Investments

Expense Reduction Goals

Estimated 2012 Financial

Impact (in millions)

% Complete

Total PNC Efficiency initiatives

$400

43%

RBC Bank (USA) integration

150

90%

Total

$550

59%

(1) Year-to-date 5/31/2012.

1 |

DRAFT

Strong Capital and Liquidity Position

1Q12 highlights

Basel III Tier 1 common ratio

2013 Target

Basel III

8.0% -

8.5%

1

Basel III requirements

Basel I Tier 1 common ratio of 9.3% at quarter

end

Target Basel III Tier 1 common ratio estimated to

be between 8.0-8.5% by year-end 2013

Capital priorities:

–

Build capital to support client growth and

business investment

–

Maintain appropriate capital in light of

economic uncertainty

–

Return excess capital to shareholders

Strong liquidity position

–

Loan-to-deposit ratio of 85%

–

Parent company two year liquidity coverage

of 114%

2

3

3.5%

4.0%

4.5%

5.1%

5.8%

6.4%

7.0%

2013

2014

2015

2016

2017

2018

2019

1

(1) Proforma estimate is based on PNC’s Basel I Tier 1 common ratio of 9.3% as of

3/31/12, adjusted by 1.6% to reflect projected retained earnings using First Call 2012

and 2013 estimates and the current dividend payout, and a decrease of 2.5%-3.0% primarily representing the estimated increase in risk

weighted assets due to current Basel II methodology regarding credit, operational and market

risks. This includes the assumed treatment of our investment in BlackRock and

sub-investment grade securities (assuming no AOCI double counting) in accordance with Basel II. This estimate is subject to further

regulatory guidance and clarity, and is based on the phase-in (beginning in 2013) of the

Basel III framework in effect as of 3/31/12. (2) Regulatory requirements are inclusive

of the capital conservation buffer and subject to further regulatory guidance and clarity. (3) Parent company liquidity coverage

defined as liquid assets divided by funding obligations within a two year period. |

DRAFT

Impact of Recent Increase in Repurchase Demands

1

Experiencing recent elevated levels of

GSE-related repurchase demands

Top reasons cited for recent claims:

As a result, PNC expects to add

residential mortgage repurchase

reserves of approximately $350 million

in 2Q12

(1) Does not include home equity loans. (2) 2Q12 represents quarter to date as of May 31st.

(3) Estimate. (4) As of 5/31/12 Residential Mortgage Repurchase New Claims

($ millions)

Vintage:

Qtr Avg

2011

1Q12

2Q12

2004 & prior

$14

$7

$21

2005-2008

150

177

234

2009-2011

29

29

33

Total

$193

$213

$288

% GSE

84%

88%

87%

Losses

$(41)

$(40)

$(76)

Residential

Mortgage

Sold

Loan

Portfolio

-

Remaining

UPB

($ billions)

Vintage:

GSE

Non-GSE

Total

2004 & prior

$23

$14

$37

2005-2008

24

21

45

2009-2011

22

9

31

Total

$69

$44

$113

Primarily in 2005-08 vintages

Property values

Missing documentation

Will result in life-to-date accrued

losses of $1.6 billion

Barring significant changes in the

future behaviors and demand

patterns of investors, we believe

we are appropriately reserved

against future demands

2

4 |

DRAFT

Outlook

1

–

Full Year 2012 vs. 2011

PNC is Positioned to Deliver Strong Results in 2012.

Estimated % Change

Combined

Balance sheet

Loans

Increase mid to high teens

Combined

Income

statement

Total revenue

Increase high single digits

Noninterest expense

Increase

high

single

digits

4,5

Loan loss provision

Improving

Strong balance sheet and revenue growth expected to drive higher

earnings

Credit costs expected to improve

RBC Bank (USA) acquisition expected to be accretive in 2012

2

2

6

3

(1) Refer to the Cautionary Statement in the Appendix, including assumptions. (2) Reflects

combined PNC and RBC Bank (USA). (3) Estimated change for 2012 is based on comparable

2011 results. (4) Bold item reflects revision to previous guidance. (5) Excluding legal and regulatory

related contingencies, integration costs and capital actions related to TPS redemptions for

2011 and 2012. (6) Excluding legal and regulatory related contingencies. |

DRAFT

Cautionary Statement Regarding Forward-Looking

Information

Appendix

This presentation includes “snapshot” information about PNC used by way of

illustration and is not intended as a full business or financial review. It

should not be viewed in isolation but rather in the context of all of the information made available by PNC in its SEC filings.

We also make statements in this presentation, and we may from time to time make other

statements, regarding our outlook for earnings, revenues, expenses, capital levels and

ratios, liquidity levels, asset levels, asset quality, financial position, and other matters regarding or

affecting PNC and its future business and operations that are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act.

Forward-looking statements are typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “see,” “look,”

“intend,” “outlook,” “project,” “forecast,”

“estimate,” “goal,” “will,” “should” and other similar words and expressions. Forward-looking

statements are subject to numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date made. We do not assume any duty

and do not undertake to update forward-looking statements. Actual results or

future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as

from historical performance.

Our forward-looking statements are subject to the following principal risks and

uncertainties. Our businesses, financial

results and balance sheet values are affected by business and economic conditions, including the following:

o

Changes in interest rates and valuations in debt, equity and other financial

markets.

o

Disruptions in the liquidity and other functioning of U.S. and global financial

markets.

o

The impact on financial markets and the economy of the downgrade by Standard

& Poor’s of U.S. Treasury obligations and other U.S. government-backed

debt, as well as issues surrounding the level of U.S. and European government debt and concerns regarding the

creditworthiness of certain sovereign governments, supranationals and financial institutions

in Europe.

o

Actions by Federal Reserve, U.S. Treasury and other government agencies,

including those that impact money supply and market interest rates.

o

Changes in customers’, suppliers’ and other counterparties’

performance and creditworthiness.

o

Slowing or failure of the current moderate economic expansion.

o

Continued effects of aftermath of recessionary conditions and uneven spread of

positive impacts of recovery on the economy and our counterparties, including adverse

impacts on levels of unemployment, loan utilization rates, delinquencies, defaults and counterparty

ability to meet credit and other obligations.

o

Changes in customer preferences and behavior, whether due to changing business

and economic conditions, legislative and regulatory initiatives, or other factors.

Our forward-looking financial statements are subject to the risk that economic and financial market conditions will be

substantially different

than we are currently expecting. These statements are based on our current view that the

moderate economic expansion will persist in 2012 and interest rates will remain very

low. |

DRAFT

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

•

Legal and regulatory developments could have an impact on our ability to operate our

businesses, financial condition, results of operations, competitive position,

reputation, or pursuit of attractive acquisition opportunities. Reputational impacts could affect matters such as business

generation and retention, liquidity, funding, and ability to attract and retain

management. These developments could include:

o

Changes resulting from legislative and regulatory reforms, including major reform of the

regulatory oversight structure of the financial services industry and changes to laws

and regulations involving tax, pension, bankruptcy, consumer protection, and other industry

aspects, and changes in accounting policies and principles. We will be impacted by

extensive reforms provided for in the Dodd-Frank Wall Street Reform and Consumer

Protection Act (the “Dodd-Frank Act”) and otherwise growing out of the recent financial crisis, the

precise nature, extent and timing of which, and their impact on us, remains uncertain.

o

Changes to regulations governing bank capital and liquidity standards, including due to the

Dodd-Frank Act and to Basel III initiatives.

o

Unfavorable resolution of legal proceedings or other claims and regulatory and other

governmental investigations or other inquiries. In addition to matters relating

to PNC’s business and activities, such matters may include proceedings, claims, investigations, or inquiries

relating to pre-acquisition business and activities of acquired companies, such as

National City. These matters may result in monetary judgments or settlements or

other remedies, including fines, penalties, restitution or alterations in our business practices and in

additional expenses and collateral costs, and may cause reputational harm to PNC.

o

Results of the regulatory examination and supervision process, including our failure to

satisfy requirements of agreements with governmental agencies.

o

Impact on business and operating results of any costs associated with obtaining rights in

intellectual property claimed by others and of adequacy of our intellectual property

protection in general.

•

Business and operating results are affected by our ability to identify and effectively manage

risks inherent in our businesses, including, where appropriate, through effective use

of third-party insurance, derivatives, and capital management techniques, and to meet evolving regulatory

capital standards. In particular, our results currently depend on our ability to manage

elevated levels of impaired assets.

•

Business and operating results also include impacts relating to our equity interest in

BlackRock, Inc. and rely to a significant extent on information provided to us by

BlackRock. Risks and uncertainties that could affect BlackRock are discussed in more detail by BlackRock in its

SEC filings.

•

Our acquisition of RBC Bank (USA) presents us with risks and uncertainties related to the

integration of the acquired businesses into PNC, including:

o

Anticipated benefits of the transaction, including cost savings and strategic gains, may be

significantly harder or take longer to achieve than expected or may not be achieved in

their entirety as a result of unexpected factors or events.

o

Our ability to achieve anticipated results from this transaction is dependent also on the

extent of credit losses in the acquired loan portfolios and the extent of deposit

attrition, in part related to the state of economic and financial markets. Also, litigation and

regulatory and other governmental investigations that may be filed or commenced relating to

the pre-acquisition business and activities of RBC Bank (USA), could impact the

timing or realization of anticipated benefits to PNC.

o

Integration of RBC Bank (USA)’s business and operations into PNC may take longer than

anticipated or be substantially more costly than anticipated or have unanticipated

adverse results relating to RBC Bank (USA)’s or PNC’s existing businesses. PNC’s ability to integrate

RBC Bank (USA) successfully may be adversely affected by the fact that this transaction

results in PNC entering several geographic markets where PNC did not previously have

any meaningful retail presence. |

DRAFT

Cautionary Statement Regarding Forward-Looking

Information (continued)

•In addition to the RBC Bank (USA) transaction, we grow our business in part by acquiring

from time to time other financial services companies, financial services assets and

related deposits and other liabilities. These other acquisitions often present risks and uncertainties analogous to those

presented by the RBC Bank (USA) transaction. Acquisition risks include those presented

by the nature of the business acquired as well as risks and uncertainties related to

the acquisition transactions themselves, regulatory issues, and the integration of the acquired businesses into PNC after

closing.

•Competition can have an impact on customer acquisition, growth and retention and on

credit spreads and product pricing, which can affect market share, deposits and

revenues. Industry restructuring in the current environment could also impact our business and financial performance through

changes in counterparty creditworthiness and performance and in the competitive and regulatory

landscape. Our ability to anticipate and respond to technological changes can

also impact our ability to respond to customer needs and meet competitive demands.

•Business

and

operating

results

can

also

be

affected

by

widespread

disasters,

dislocations,

terrorist

activities

or

international

hostilities

through

impacts on the economy and financial markets generally or on us or our counterparties

specifically. We provide greater detail regarding these as well as other factors in our

2011 Form 10-K, as amended by Amendment No. 1 thereto, and first quarter 2012 Form

10-Q, including in the Risk Factors and Risk Management sections and the Legal Proceedings and Commitments and Guarantees

Notes

of

the

Notes

to

Consolidated

Financial

Statements

in

those

reports,

and

in

our

subsequent

SEC

filings.

Our

forward-looking

statements

may

also be subject to other risks and uncertainties, including those we may discuss elsewhere in

this presentation or in SEC filings, accessible on the SEC’s website at

www.sec.gov and on our corporate website at www.pnc.com/secfilings. We have included these web addresses as inactive textual

references only. Information on these websites is not part of this document.

Any annualized, proforma, estimated, third party or consensus numbers in this presentation are

used for illustrative or comparative purposes only and may not reflect actual

results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts who cover

that company. The analysts’

opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs

alone, are not those of PNC or its management, and may not reflect PNC’s or other

company’s actual or anticipated results. Appendix |

DRAFT

Non-GAAP to GAAP Reconcilement

In millions except per share data

Dec. 31, 2007

Mar. 31, 2012

% Change

Common shareholders' equity

$14,847

$33,408

Common shares outstanding

341

528

Book value per common share

$43.60

$63.26

45%

Goodwill and other intangible assets other than servicing rights

$8,853

$10,035

Common shareholders' equity less specified intangible assets

$5,994

$23,373

Common shares outstanding

341

528

Tangible book value per common share

$17.58

$44.27

152%

PNC

believes

that

tangible

book

value

per

common

share,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

to

better

evaluate

growth

of

the

company's

business

apart

from

the

amount,

on

a

per

share

basis,

of

goodwill

and

other

intangible

assets, other than servicing rights, included in book value per common share.

As of

Appendix |

DRAFT

Peer Group of Banks

The PNC Financial Services Group, Inc.

PNC

BB&T Corporation

BBT

Bank of America Corporation

BAC

Capital One Financial, Inc.

COF

Comerica Inc.

CMA

Fifth Third Bancorp

FITB

JPMorgan Chase

JPM

KeyCorp

KEY

M&T Bank

MTB

Regions Financial Corporation

RF

SunTrust Banks, Inc.

STI

U.S. Bancorp

USB

Wells Fargo & Co.

WFC

Ticker

Appendix |