Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JONES LANG LASALLE INC | d365152d8k.htm |

Exhibit 99.1

Exhibit 99.1

June 2012

William Blair

Growth Stock Conference

.45,500 employees….200 offices….70 countries….1 global platform

Leading Brand Well Positioned for Growth

Market Emerging markets Demand for Outsourcing Top performers Industry

to lead global local and global growth winning investor consolidation

Trends expansion services increases continues mandates continues

Jones Lang LaSalle Opportunity

Capitalize on leading global markets positions for improved transactional and annuity revenue Continue Corporate Solutions leadership; capture emerging sectors (e.g. Healthcare, Infrastructure) Leverage LaSalle’s investment performance and client loyalty for continued wins and capital raising Pursue growth within G5 strategy and financial objectives

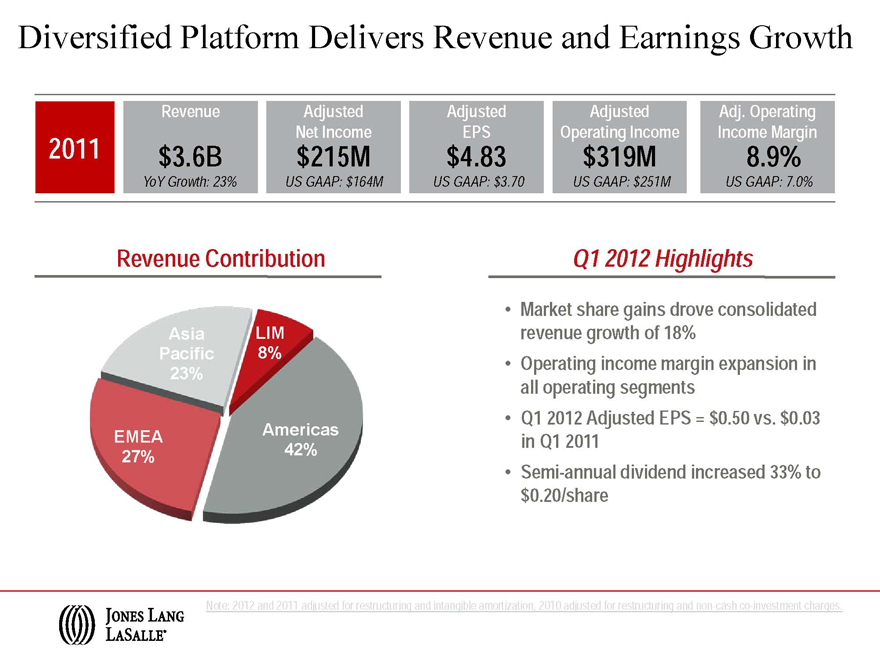

Diversified Platform Delivers Revenue and Earnings Growth

2011

Revenue

$3.6B

YoY Growth: 23%

Adjusted Net Income

$215M

US GAAP: $164M

Adjusted EPS

$4.83

US GAAP: $3.70

Adjusted Operating Income

$319M

US GAAP: $251M

Adj. Operating Income Margin

8.9%

US GAAP: 7.0%

Revenue Contribution

Asia Pacific 23%

EMEA 27%

LIM 8%

Americas 42%

Q1 2012 Highlights

Market share gains drove consolidated revenue growth of 18%

Operating income margin expansion in all operating segments

Q1 2012 Adjusted EPS = $0.50 vs. $0.03 in Q1 2011

Semi-annual dividend increased 33% to $0.20/share

Note: 2012 and 2011 adjusted for restructuring and intangible amortization, 2010 adjusted for restructuring and non-cash co-investment charges.

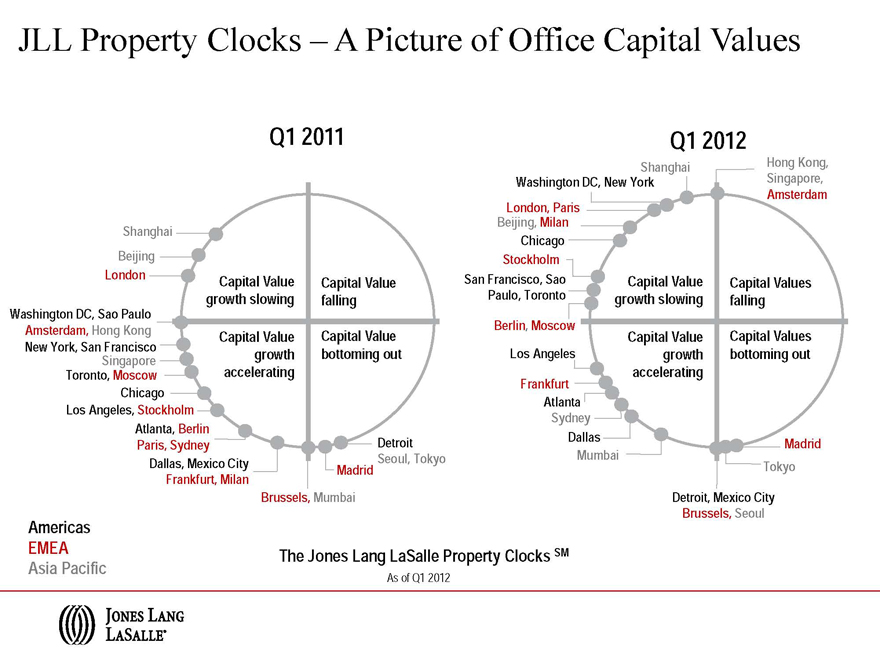

JLL Property Clocks – A Picture of Office Capital Values

Q1 2011

Shanghai Beijing London

Washington DC, Sao Paulo Amsterdam, Hong Kong New York, San Francisco Toronto, Singapore Moscow Chicago Los Angeles, Stockholm

Atlanta, Berlin

Paris, Sydney Dallas, Mexico City Frankfurt, Milan Brussels, Mumbai

Detroit

Seoul, Tokyo

Madrid

Capital Value Capital Value

growth slowing falling

Capital Value Capital Value

growth bottoming out

accelerating

Q1 2012

Shanghai Hong Kong,

Washington DC, New York Singapore,

Amsterdam

Beijing, London, Milan Paris Chicago Stockholm San Francisco, Sao Paulo, Toronto Berlin, Moscow Los Angeles Frankfurt Atlanta Sydney Dallas Mumbai

Madrid Tokyo Detroit, Mexico City Brussels, Seoul

Capital Value Capital Values

growth slowing falling

Capital Value Capital Values

growth bottoming out

accelerating

Americas EMEA Asia Pacific

The Jones Lang LaSalle Property Clocks SM

As of Q1 2012

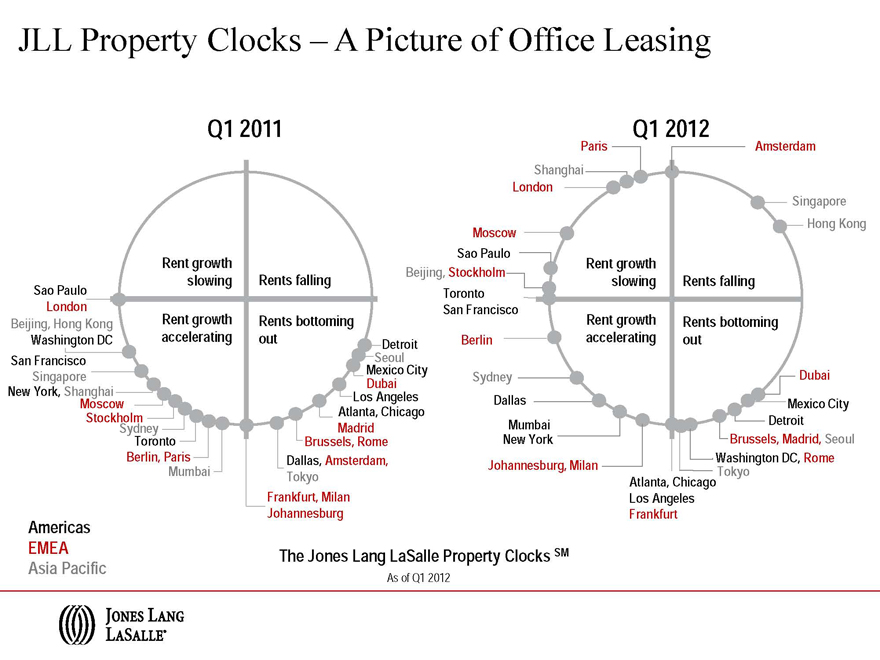

JLL Property Clocks – A Picture of Office Leasing

Q1 2011

Rent growth

slowing Rents falling

Rent growth Rents bottoming

accelerating out

Sao Paulo

London

Beijing, Hong Kong Rent

Washington DC

San Francisco

Singapore

New York, Shanghai

Moscow

Stockholm

Sydney

Toronto

Berlin, Paris

Mumbai

Detroit Seoul Mexico City Dubai

Atlanta, Los Angeles Chicago Madrid Brussels, Rome Dallas, Amsterdam, Tokyo Frankfurt, Milan Johannesburg

Q1 2012

Paris Shanghai London

Moscow Sao Paulo Beijing, Stockholm Toronto San Francisco Berlin Sydney Dallas New Mumbai York

Johannesburg, Milan

Atlanta, Chicago Los Angeles Frankfurt

Dubai Mexico City Detroit Brussels, Madrid, Seoul Washington DC, Rome Tokyo

Rent growth

slowing Rents falling

Rent growth Rents bottoming

accelerating out

Singapore Hong Kong

Amsterdam

Americas EMEA Asia Pacific

The Jones Lang LaSalle Property Clocks SM

As of Q1 2012

Mid-Year 2012: The Current Environment

Cyclical recovery progresses at variable speeds

Investment sales and leasing in early stages of cyclical upswing

Momentum going into 2012, yet slowing due to Euro- worries

Asia leads the recovery, followed by the Americas and CEE

Western Europe lags… with large differences within the Eurozone

Euro-crisis has a direct impact on European real estate debt availability

Muted impact on credit availability for Real Estate in the rest of the world

Asia Real Estate Picture Positive

Continuing growth; watching euro

Banks in great shape

Few distressed sales

Investment sales down slightly

Rental growth varies but demand healthy

Credit easing in China, and generally

Japan finally growing after 20 years

Intra-regional trade offsetting falling trade with Europe

Americas Real Estate Confident

Business led recovery

No rapid job growth yet

Banks strengthening

Controlled restructuring sales

2012 investment sales volume up 10-15%

CMBS attempts another return

Tenant confidence up

Office vacancy decline continues

Euro(pe) Volatility Continues

Banks pull back to domestic-centered lending

Southern Europe hardest hit by Euro-crisis

Economies and real estate fundamentals stronger in Northern Europe

London, Paris, Munich attract “safe haven” capital

Distressed sales accelerate

Tenant confidence is weak

Fundamentals are flat

Jones Lang LaSalle Global Growth Strategy

G1

Build our local and regional leasing and capital markets businesses

G2

Strengthen our winning positions in Corporate Solutions

Capture the leading share of global capital flows for investment sales

G3

Grow LaSalle Investment Management’s leadership position G4

G5

Connections

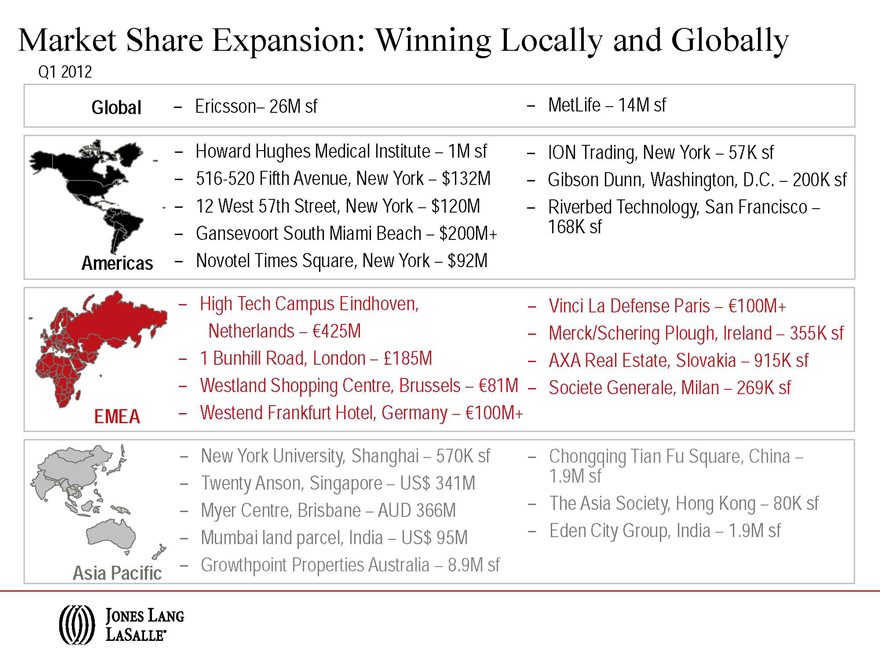

Market Share Expansion: Winning Locally and Globally

Q1 2012

Global—Ericsson– 26M sf—MetLife – 14M sf

Americas

Howard Hughes Medical Institute – 1M sf 516-520 Fifth Avenue, New York – $132M

12 West 57th Street, New York – $120M

Gansevoort South Miami Beach – $200M+ Novotel Times Square, New York – $92M

ION Trading, New York – 57K sf

Gibson Dunn, Washington, D.C. – 200K sf Riverbed Technology, San Francisco – 168K sf

EMEA

High Tech Campus Eindhoven, Netherlands – €425M

| 1 |

|

Bunhill Road, London – £185M |

Westland Shopping Centre, Brussels – €81M Westend Frankfurt Hotel, Germany – €100M+

Vinci La Defense Paris – €100M+ Merck/Schering Plough, Ireland – 355K sf AXA Real Estate, Slovakia – 915K sf Societe Generale, Milan – 269K sf

Asia Pacific

New York University, Shanghai – 570K sf Twenty Anson, Singapore – US$ 341M Myer Centre, Brisbane – AUD 366M Mumbai land parcel, India – US$ 95M Growthpoint Properties Australia – 8.9M sf

Chongqing Tian Fu Square, China –1.9M sf The Asia Society, Hong Kong – 80K sf Eden City Group, India – 1.9M sf

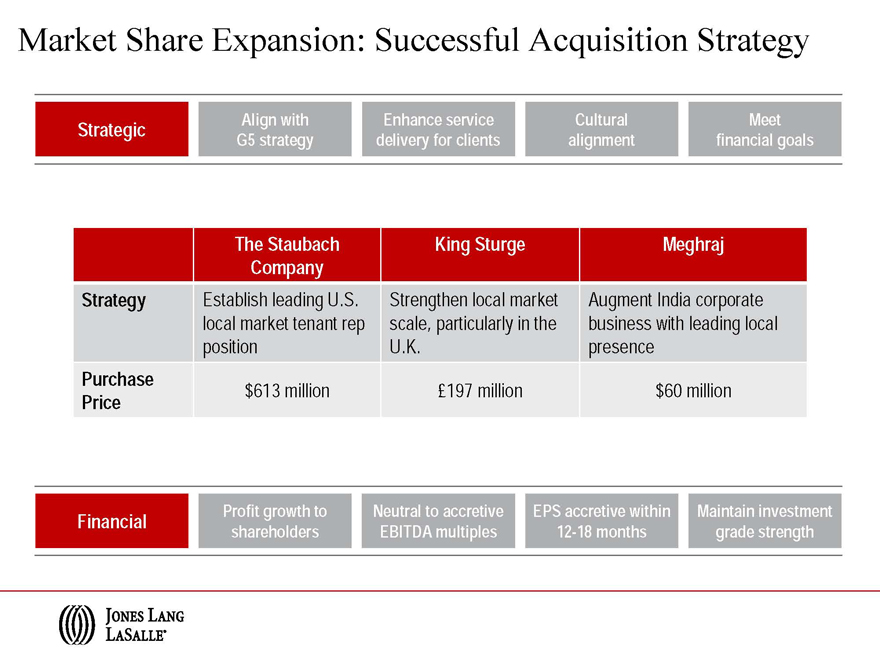

Market Share Expansion: Successful Acquisition Strategy

Strategic Align with Enhance service Cultural Meet

G5 strategy delivery for clients alignment financial goals

The Staubach King Sturge Meghraj

Company

Strategy Establish leading U.S. Strengthen local market Augment India corporate

local market tenant rep scale, particularly in the business with leading local

position U.K. presence

Purchase

Price $613 million £197 million $60 million

Financial Profit growth to Neutral to accretive EPS accretive within Maintain investment

shareholders EBITDA multiples 12-18 months grade strength

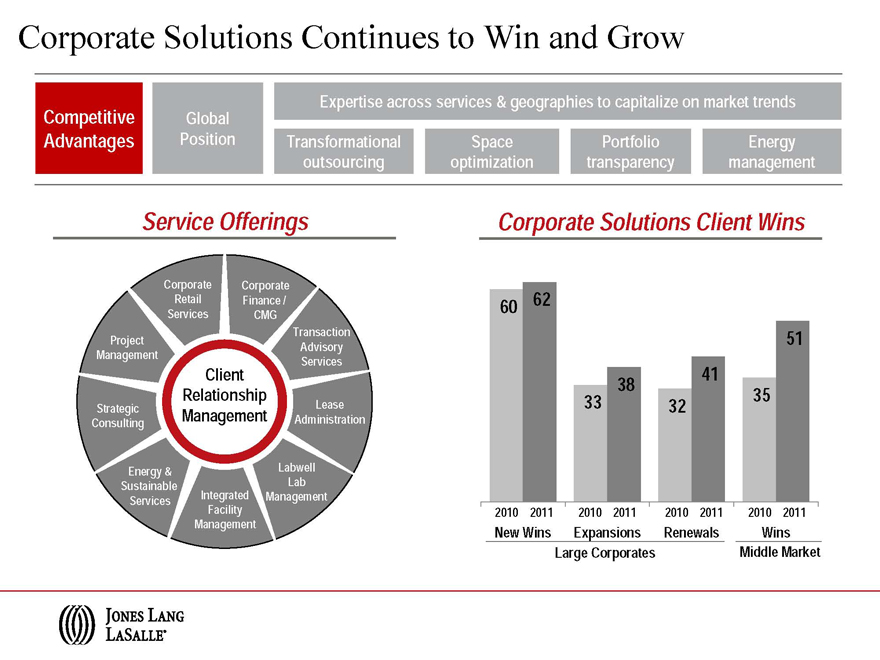

Corporate Solutions Continues to Win and Grow

Expertise across services & geographies to capitalize on market trends

Competitive Global

Advantages Position Transformational Space Portfolio Energy

outsourcing optimization transparency management

Service Offerings

Client Relationship Management

Corporate Retail Services

Project Management

Strategic Consulting

Energy & Sustainable Services

Labwell

Lab

Integrated Management

Facility

Management

Transaction Advisory Services

Lease Administration

Corporate Finance / CMG

Corporate Solutions Client Wins

60 62

38

33

41

32

35

51

2010 2011 2010 2011 2010 2011 2010 2011

New Wins Expansions Renewals Wins

Large Corporates Middle Market

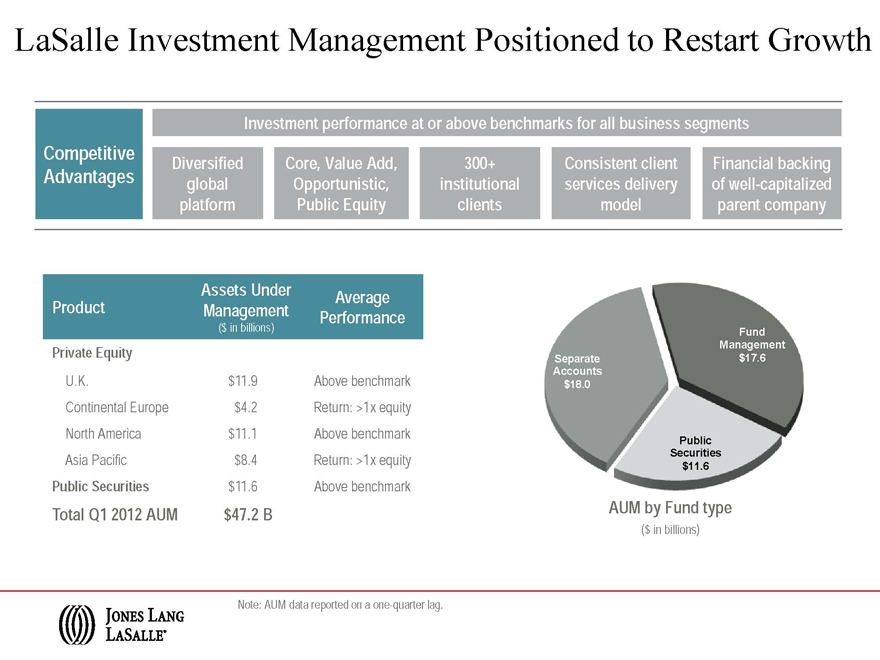

LaSalle Investment Management Positioned to Restart Growth

Investment performance at or above benchmarks for all business segments

Competitive Diversified Core, Value Add, 300+ Consistent client Financial backing

Advantages global Opportunistic, institutional services delivery of well-capitalized

platform Public Equity clients model parent company

Assets Under Average

Product Management Performance

($ in billions)

Private Equity

U.K. $11.9 Above benchmark

Continental Europe $4.2 Return: >1x equity

North America $11.1 Above benchmark

Asia Pacific $8.4 Return: >1x equity

Public Securities $11.6 Above benchmark

Total Q1 2012 AUM $47.2 B

Separate Accounts $18.0

Fund Management $17.6

Public Securities $11.6

AUM by Fund type

($ in billions)

Note: AUM data reported on a one-quarter lag.

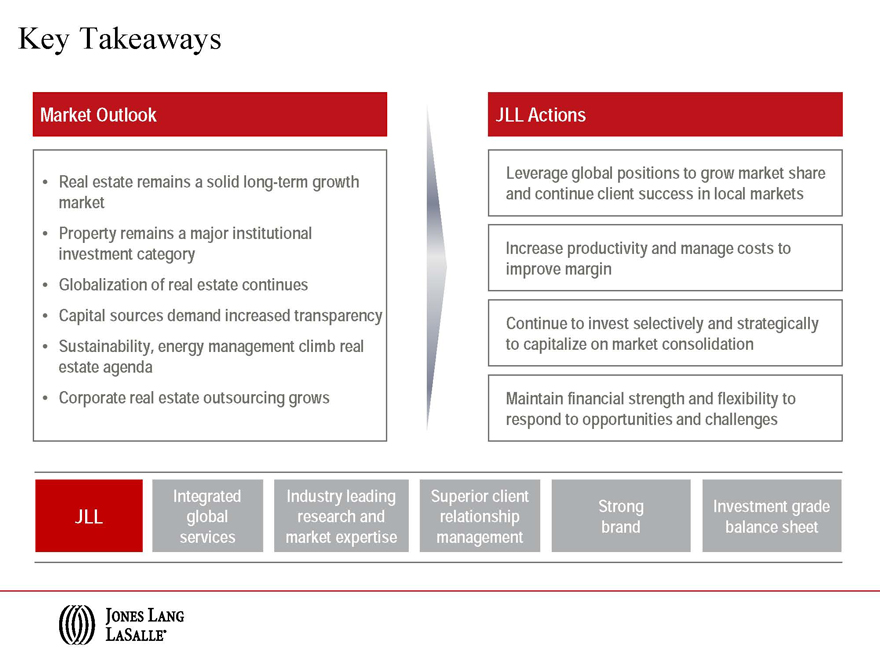

Key Takeaways

Market Outlook

Real estate remains a solid long-term growth market Property remains a major institutional investment category Globalization of real estate continues Capital sources demand increased transparency Sustainability, energy management climb real estate agenda Corporate real estate outsourcing grows

JLL Actions

Leverage global positions to grow market share and continue client success in local markets

Increase productivity and manage costs to improve margin

Continue to invest selectively and strategically to capitalize on market consolidation

Maintain financial strength and flexibility to respond to opportunities and challenges

Integrated Industry leading Superior client

JLL global research and relationship Strong brand Investment balance sheet grade

services market expertise management

Forward looking statements

Statements in this presentation regarding, among other things, future financial results and performance, achievements, plans and objectives and dividend payments may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance, achievements, plans and objectives of Jones Lang LaSalle to be materially different from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include those discussed under “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Quantitative and Qualitative Disclosures about Market Risk,” “Cautionary Note Regarding Forward-Looking Statements” and elsewhere in Jones Lang LaSalle’s Annual Report on Form 10-K for the year ended December 31, 2011 and in the Quarterly Report on Form 10-Q for the quarter ended March 31, 2012 and in other reports filed with the Securities and Exchange Commission. There can be no assurance that future dividends will be declared since the actual declaration of future dividends, and the establishment of record and payment dates, remains subject to final determination by the Company’s Board of Directors. Statements speak only as of the date of this presentation. Jones Lang LaSalle expressly disclaims any obligation or undertaking to update or revise any forward-looking statements contained herein to reflect any change in Jones Lang LaSalle’s expectations or results, or any change in events.

© Jones Lang LaSalle IP, Inc. 2012. All rights reserved. No part of this publication may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of Jones Lang LaSalle IP, Inc.