Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DUKE REALTY CORP | d365467d8k.htm |

RELIABLE. ANSWERS.

REIT WEEK: 2012 NAREIT INVESTOR FORUM

JUNE 12-14

Exhibit 99.1 |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

40 Years Timeline

2 |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

Focus on:

Increasing cash flow

Maximizing return on

assets

3

Strategy for Success

Focus on:

Improving coverage ratios

Improving ratings

Focus on:

Portfolio repositioning

Strategic acquisitions &

dispositions

Development opportunities

Strategies for delivering shareholder value |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

Strategic Focus

4

Solid Q1 start and executing across all three aspects of our strategy

Operations

Strategy

Asset

Strategy

Capital

Strategy

2012 Goals and Objectives

Q1 2012 Update

•

Lease-up portfolio, manage cap ex; reach

positive same property income growth

•

Balance execution with capital strategy

relative to level and quality of cash flow

and same property NOI

•

Development starts of $150 to $250

million focus on medical office and build-

to-suit

•

Total portfolio occupancy as of quarter end 92.1%, up

1.4% from year-end; industrial portfolio at 93.6%; medical

office at 90.1%

•

Approximately 8.7 million square feet of leases completed

•

Debt to EBITDA @ 6.6x (7.38x excl. Blackstone); 4.7%

Same Property NOI growth

•

$120.8MM development starts. Two 100% leased bulk

industrial projects (at 6.9% stabilized yield) and one 100%

leased medical office (at 7.4% stabilized yield)

•

Continue strong momentum from 2011 on

repositioning of portfolio

•

Pursue acquisitions of medical and

industrial assets

•

Continue pruning suburban office

primarily in Midwest

•

Closed

on

over

$157MM

of

acquisitions

during

the

quarter,

weighted 45% in medical office and 55% in industrial

•

$63.7MM in dispositions of non-core assets

•

Opportunistically access capital markets .

. . push out maturity schedule further

•

Continue improving coverage ratios

•

Maintain minimal balance on line of credit

•

Fixed charge ratio of 1.81x

•

Issued $150MM of equity through ATM program

•

Redeemed Series M Preferred shares of $168MM

•

Zero credit facility balance and $15MM of cash at quarter

end |

2012 Duke Realty Corporation

OPERATIONS STRATEGY

5 |

2012 Duke Realty Corporation

6

Focus on Fundamentals

LEASING OF

PORTFOLIO

STRATEGIC

NEW DEVELOPMENT

AND LAND DISPOSITION

AFFO PAYOUT

Maximize return on assets

OPERATIONS STRATEGY |

2012 Duke Realty Corporation

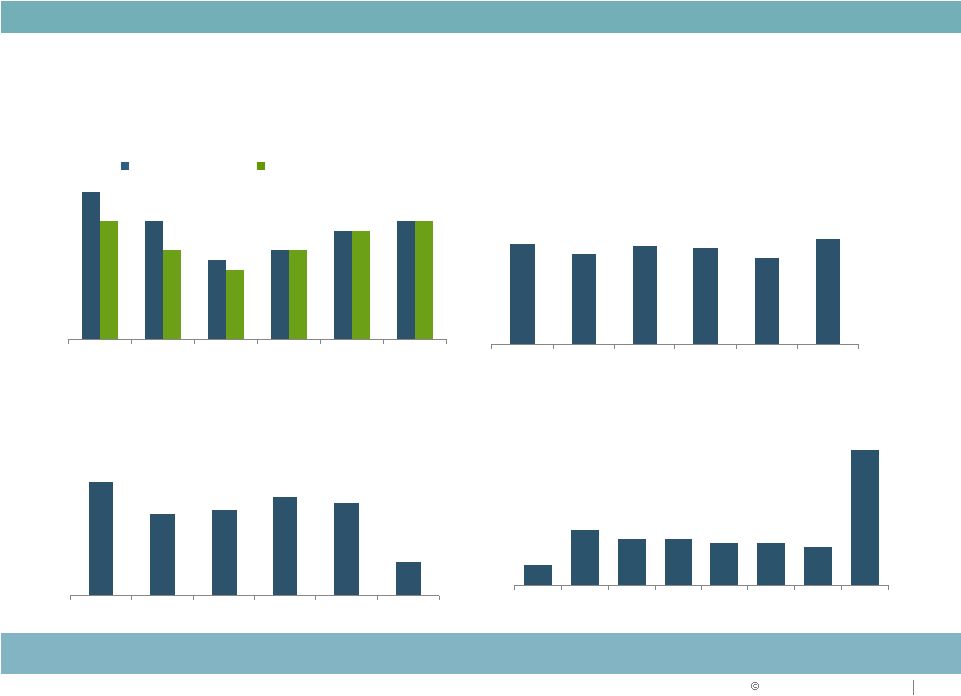

2007

2008

2009

2010

2011

2012 YTD

29.9

2007

2008

2009

2010

2011

2012 YTD

Consistent Operating Performance

Stabilized Occupancy (%)

Strong

historical

stabilized

occupancy

–

fundamentals

improving

Lease Renewals (%)

Strong lease renewal percentages

Stabilized occupancy

In-service occupancy

Leasing Activity

New

Leases

and

Renewals

–

Consistent

Execution

(in

millions

of

square feet)

Lease Maturity Schedule

Lease maturities are well balanced with no one year accounting for

more than 12%

Demonstrated ability to

maintain consistency through economic cycles

95%

92%

92%

89%

88%

91%

91%

89%

89%

87%

7

OPERATIONS STRATEGY

92%92%

72%

79%

77%

69%

84%

21.4

22.7

25.9

24.5

8.7

2007

2008

2009

2010

2011

2012 YTD

80%

5%

13%

11%

11%

10%

10%

9%

32%

2012

2013

2014

2015

2016

2017

2018

2019+ |

2012 Duke Realty Corporation

1.5%

(0.2%)

(0.2%)

3.2%

(0.6%)

0.2%

(1.0%)

0.0%

1.0%

2.0%

3.0%

4.0%

Suburban Office Peers

Industrial Peers

5-Year Avg.

1-Year Avg.

Annual Same-Store

NOI Growth

(1)

%, y-y

Sources SNL and company filings

Duke Realty

Suburban Office Peers

(2)

Industrial Peers (3)

Consistent NOI Growth Outperformance

Relative Performance vs. Peers

OPERATIONS STRATEGY

8

Notes

1.

Based on simple average of year-over-year annual same-property cash NOI growth, includes

2007 - 2011 2.

Suburban Office Peers include BDN, CLI, HIW, LRY and PKY; weighted by historical market cap 3.

Industrial includes DCT, EGP, FR, FPO, PSB, AMB and PLD; weighted by historical market cap |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

9

Positioned for NAV Growth

KEY NAV GROWTH DRIVERS

Increased

management &

service fees

Accretive future

development

Portfolio occupancy of 92.1%

Strong leasing pipeline

Demonstrated track record of 69-80% renewal rate

Will benefit from uptick in third party and JV partners development and

construction activity

Property

management

and

leasing

fees

-

will

trend

higher

as

occupancy

improves

Current pipeline of 686K SF of medical office, 344K SF of suburban office

2012 estimated development starts of $200 to $300 million

Land for 44 million SF of new development, 70% industrial

Acquisitions focused on asset strategy

Industrial and medical office assets

Higher rental rate growth markets

Rent roll downs burning off and positive same property NOI performance

Research forecasts market wide average annual rent growth of 3.2% from

2013-16 Source: PPR, Green Street and Duke Realty

Lease up

existing vacancy

Increase Rents/

Reduced Capex

Accretive future

acquisitions |

2012 Duke Realty Corporation

10

Land and Development Capabilities

$498

million

HELD FOR DEVELOPMENT

Industrial

Office

Midwest

26.3

2.8

Indianapolis, Chicago,

Cincinnati, Columbus,

Minneapolis, and

St. Louis major

positions

East

3.8

2.1

New Jersey,

Baltimore,

Washington D.C., and

Raleigh

Southeast

8.5

1.3

Atlanta, Central

Florida, and, South

Florida

Southwest

5.8

0.7

Phoenix, Dallas, and

Houston

Total

44.4 million SF

6.9 million SF

Attractive positions contribute to future development and value

Development –

Amounts in million SF

Office

30%

Industrial

70%

OPERATIONS STRATEGY |

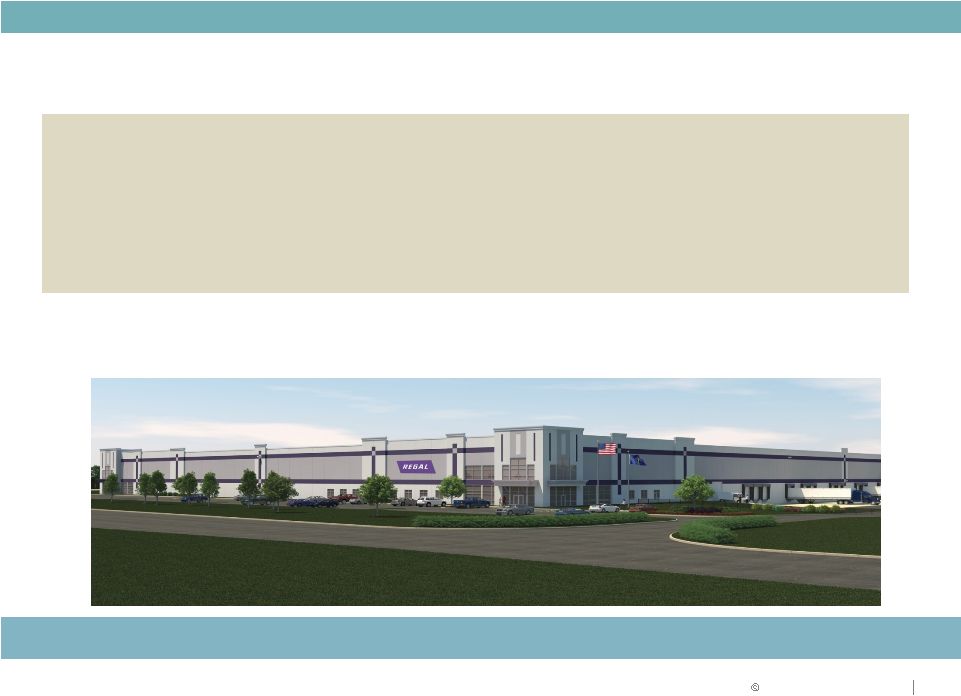

2012 Duke Realty Corporation

OPERATIONS STRATEGY

11

Indianapolis –

Industrial

OPERATIONS STRATEGY

Expand Industrial

•

Regal Beloit build-to-suit bulk distribution facility

•

376,000 square feet, ten year lease term to growing global manufacturing

company

•

Duke Realty won with strategic land position

•

$15 million project, 10 year average yield of 8.15% |

2012 Duke Realty Corporation

OPERATIONS STRATEGY

12

Northeast U.S. –

Bulk Industrial Build-to-Suit

Repeat business new development with growing tenant

•

Regional distribution center build-to-suit in Delaware for Amazon

•

1,015,000 square feet

•

Twelve year lease term

•

$82 million project, 12 year average yield 8.33% |

2012 Duke Realty Corporation

OPERATIONS STRATEGY

13

Indianapolis –

Medical Office

Grow Medical Office

•

Wishard Faculty Office Building

•

Aa2 rated system sponsored by Marion County

•

275,000 square feet

•

Thirty year lease term

•

50/50 Joint Venture with Hospital System

•

On campus of new hospital to open in 2013

•

$90 million project, 30 year average yield of 8.37% |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

14

Tampa –

Medical Office

•

VA Primary Care Annex at Tampa

•

Leased to Department of Veterans Affairs

•

120,000 square feet

•

$41 million project, 20 year average yield of 8.20%

Grow Medical Office |

2012 Duke Realty Corporation

ASSET STRATEGY

15 |

2012 Duke Realty Corporation

16

Flex disposition

Savannah

Washington DC

Healthcare

Asset Strategy

Dugan

CBRERT

Premier

Suburban

Office

Disposition

Proven ability to execute

ASSET STRATEGY

$1 Billion

Repositioning Track Record

$1 Billion

2005

2006

2007

2009

2010

2011 |

2012 Duke Realty Corporation

17

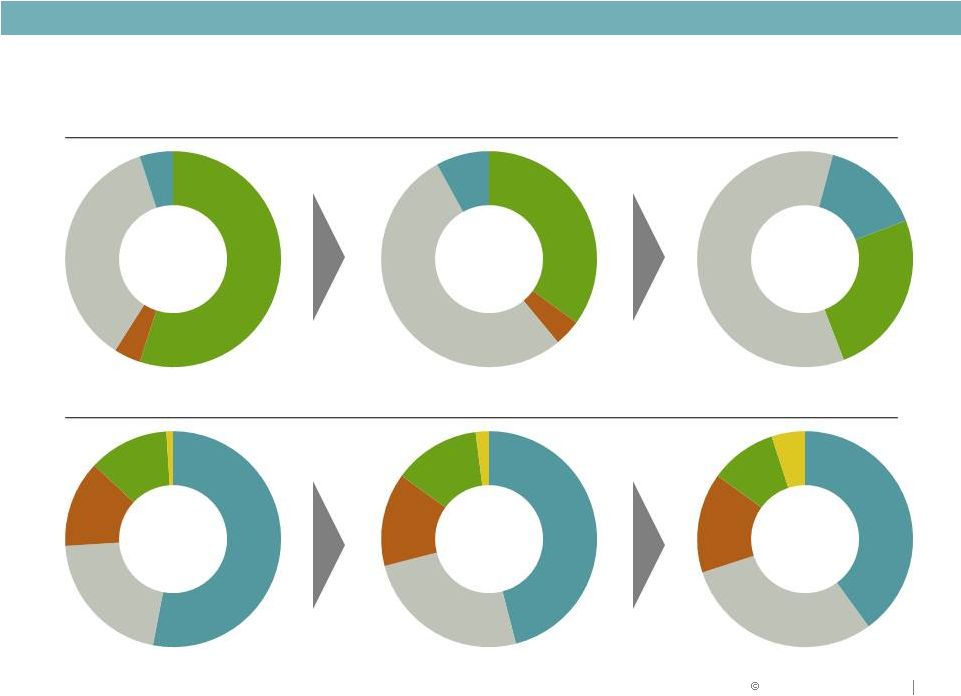

Asset Strategy

March 31, 2012

BY PRODUCT

2009

2013

BY GEOGRAPHY

ASSET STRATEGY

2009

2013

2012

Southeast

21%

Southeast

24%

Southeast

30%

2012

Office

55%

Retail

4%

Industrial

36%

Medical

Office

5%

Office

32%

Retail

4%

Industrial

53%

Medical

Office

11%

Office

25%

Industrial

60%

Medical

Office

15%

Midwest

53%

East

13%

West

1%

Midwest

40%

East

15%

South

10%

West

5%

Midwest

46%

East

14%

South

14%

West

2%

South

12% |

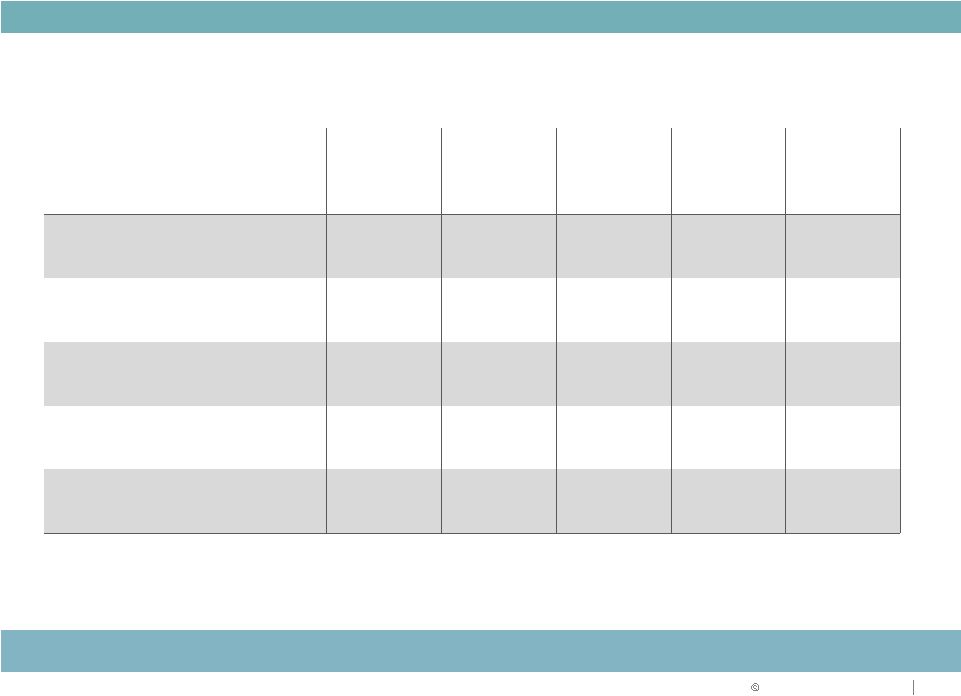

2012 Duke Realty Corporation

18

Asset Strategy: Road Map

($ in millions)

Investment

12/31/10

Investment

3/31/12

ACTION PLAN

Investment

2013

PRODUCT TYPE

Amount

%

Amount

%

Acquisitions /

Developments /

Repositioning

Amount

%

Industrial

$3,645

45%

$4,264

53%

$656

$4,920

60%

Office

3,770

46%

2,529

32%

(479)

2,050

25%

Medical Office

515

6%

840

11%

390

1,230

15%

Retail

280

3%

305

4%

(305)

0

0%

$8,210

100%

$7,938

100%

$262

$8,200

100 %

REGION

Midwest

$3,970

48%

$3,710

46%

($430)

$3,280

40%

Southeast

2,270

28%

1,884

24%

526

2,460

30%

East

955

11%

1,089

14%

141

1,230

15%

South

950

12%

1,092

14%

(272)

820

10%

West

65

1%

163

2%

247

410

5%

$8,210

100%

$7,938

100%

$262

$8,200

100%

Portfolio sale accelerates suburban office repositioning

ASSET STRATEGY |

2012 Duke Realty Corporation

19

New, High Quality Portfolio with Long-term Leases

ASSET STRATEGY

Premier portfolio of assets

Portfolio average

Bulk

Industrial

Suburban Office

Medical

Office

Property age

10.4 years

13.1 years

4.2 years

Property size

221,000 SF

117,000 SF

82,000 SF

Lease term

7.1 years

7.3 years

11.7 years

Tenant size

76,000 SF

12,000 SF

10,000 SF |

2012

Duke Realty Corporation 20

Premier Quality Industrial Portfolio

ASSET STRATEGY

<100,000

100,000-250,000

250,000-500,000

>500,000

% to Total Square Feet

10%

26%

29%

35%

Building Square Footage (000's)

11,000

29,000

31,000

39,000

No. of Buildings

164

188

88

52

Average Tenant Size

18,700

49,100

150,000

382,500

Occupancy (at Q1

2012) 86.2%

90.5%

94.7%

97.2%

Building Size

Portfolio Metric

Industry

Leading

Focus

on

Newer

Built,

Modern

Bulk

Warehouse

Type

with strong performance characteristics |

2012 Duke Realty Corporation

MEDICAL OFFICE STRATEGY &

Performance Update

21 |

2012 Duke Realty Corporation

22

Healthcare Data Points

The nation’s largest industry

•

Represents more than 17% of GDP, predicted to exceed

23% by 2020

•

Americans spend more than 5% of pre-tax income on

healthcare. Lower income brackets pay 15% or more

($7,800 per capita health expenditures in 2008/2009)

Reform

•

Increased number of people insured expected to increase

by 30 to 50 million –

increased demand for care

•

Number of physicians will increase –

more space

demand

•

Hospitals expect margin pressure and need to increase

market share –

Hospitals seeking capital partners for

“non-core assets”

•

May reduce reimbursements –

real estate efficiency a

priority –

larger deals and floor plates

Healthcare systems growing and physician employment

changing

MEDICAL OFFICE STRATEGY |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

23

Source: AHA Trendwatch Chartbook, 2011

Trends in Inpatient Days and Outpatient Visits

Outpatient demand drives occupancy in MOB’s |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

Trends in Medical Practice Ownership

Hospitals are increasing physician employment to create efficiencies and to

position themselves to become Accountable Care Organizations

24

Source: MGMA Physician Compensation and Production Survey Report; Wall Street

Journal, 10/8/10 Hospital-owned practices creating access to better credit

generally Physicians are seeking employment in the declining reimbursement environment |

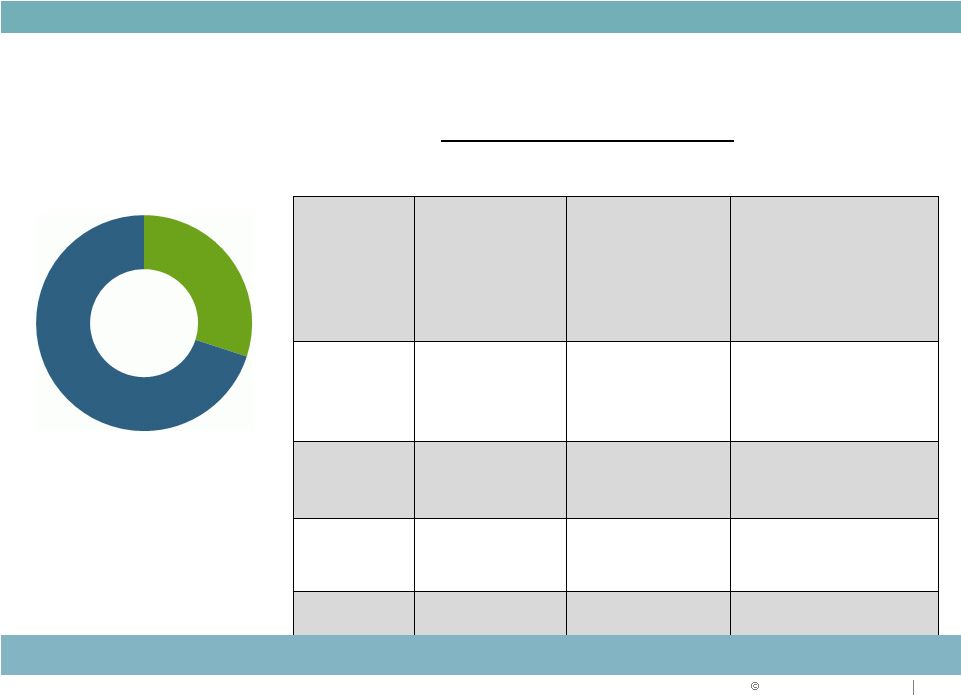

Medical Office Portfolio at March 31, 2012

In-Service

Under

Development

Total

Properties

44

6

50

Investment $

$695 M

$145 M

$840 M

Square Feet

3.59 M

685 K

4.28 M

Occupancy

91%

86%

90%

MEDICAL OFFICE STRATEGY

©

2012

Duke

Realty

Corporation

25

Local

15%

Regional

55%

National

30%

Specialty

Hospital

7%

MOB

On-Campus

86%

MOB Off-Campus

7%

Portfolio investment

by product type

Portfolio investment by

hospital system |

2012 Duke Realty Corporation

Top Health System Relationships

26

MEDICAL OFFICE STRATEGY

Lease Maturity (% of Total Sq. Ft.)

High credit tenants and limited lease maturity result in stable and growing

cash flow

Health System

Credit Rating

(

Moody's)

Rentable

SF

Baylor Health Care System

Aa2

461,000

Ascension Health

Aa1

367,000

Health & Hospital Corp Marion

County

Aa1

274,000

Scott & White Healthcare

A1

195,000

Franciscan Alliance, Inc.

Aa3

192,000

Carolinas Medical Center

Aa3

190,000

US Oncology, Inc.

(McKesson)

Baa2

182,000

Veterans Administration (US

Govt

Agencies)

Aaa

117,000 |

RELIABLE. ANSWERS.

Medical Office NOI and Portfolio Occupancy

Medical office business projected to reach or exceed 15% of total asset base by

2013

NOI in

$millions

Annual NOI

Portfolio Occupancy

*Projected for lease up of unstabilized and completed development assets

*

As of 3/31/2012 |

28

MEDICAL OFFICE STRATEGY

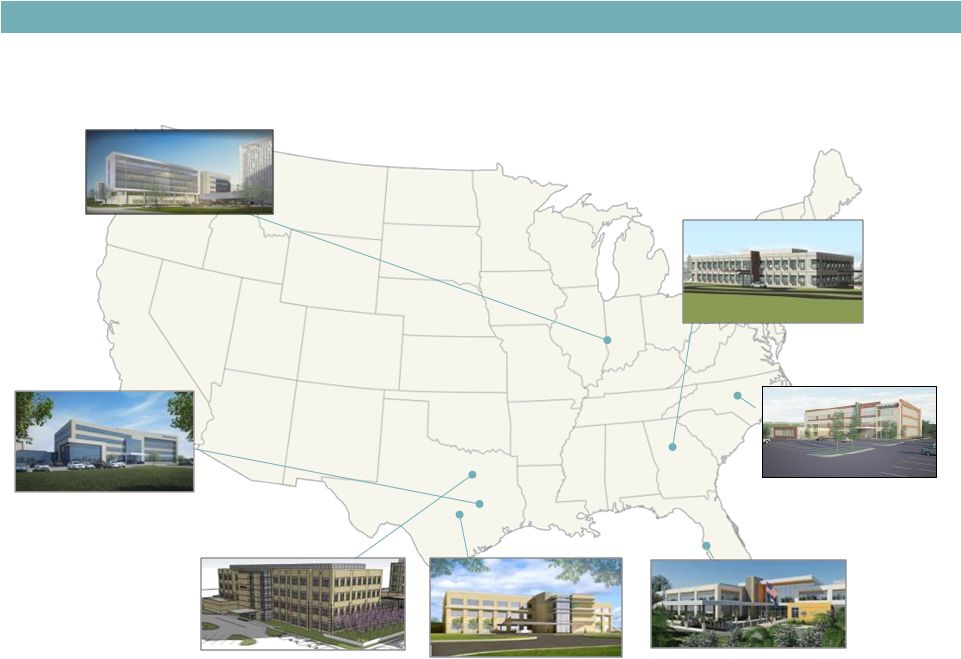

Recent Healthcare Developments

Baylor McKinney MOB I

McKinney, TX

115,000 SF, 69%

preleased

WakeMed Raleigh

Medical Park

Raleigh, NC

86,000 SF, 58% preleased

North Fulton MOB

Atlanta, GA

52,000 SF, 52% preleased

VA Tampa

Tampa, FL

117,000 SF, 100% preleased

Scott and White MOB

Marble Falls, TX

67,000 SF, 100% preleased

Scott & White MOB

College Station, TX

128,000 SF, 100% preleased

Wishard Health FOB

Indianapolis, IN

275,000 SF, 100% preleased |

2012 Duke Realty Corporation

Our Plan

Existing healthcare assets $840 Million

New developments $200 Million in 2012

Acquire $200-$250 Million in 2012 and 2013

Our Focus

Goal: Grow Medical Office to over $1.2 Billion by 2013

29

MEDICAL OFFICE STRATEGY

On-campus assets

Major hospital system relationships |

2012 Duke Realty Corporation

CAPITAL STRATEGY AND 2012 GUIDANCE

30 |

2012 Duke Realty Corporation

Capital Strategy Focus

31

Reducing leverage

Increasing coverage ratios

Maintaining size and quality of unencumbered asset base

Executing portfolio repositioning in alignment with capital strategy

objectives

Further improve balance sheet strength and ratings

1

2

3

4

CAPITAL STRATEGY |

2012 Duke Realty Corporation

32

Key Metrics & Goals

2009

Actual

2010

Actual

2011

Actual

2012

1Q

Actual

Goal

Debt to Gross Assets

44.5%

46.3%

46.8%

47.3

45.0%

Debt + Preferred to Gross

Assets

54.9%

55.5%

55.6%

54.3

50.0%

Fixed Charge Coverage

Ratio

1.79 : 1

1.79 : 1

1.82 : 1

1.81:1

2.00 : 1

Debt/EBITDA

6.65

7.31

6.02*

6.56**

< 6.00

Debt + Preferred/EBITDA

8.47

8.88

7.34*

7.64**

< 7.75

CAPITAL STRATEGY

Progressing toward strategic plan goals

*Timing of Blackstone transaction. Including adjustments to TTM EBITDA for Blackstone transaction

results in recast 2011 Debt to EBITDA of 7.03x and Debt+Preferred/EBITDA of 8.58x . **

For 1Q 2012, recast Debt to EBITDA of 7.38x and Debt+Preferred/EBITDA of 8.59x |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

Relative Performance of Duke Realty vs. All Comps

Notes

1.

Comparables include BDN, CLI, DCT, EGP, FR, HIW, LRY, OFC, and PLD; PLD and AMB are

included historically; figures shown on a market cap weighted basis

2.

DRE stock price as of end of trading 5/31/12, @ $13.84

3.

DRE performance since 10/20 announcement of $1.1Bn office divestiture. Based upon

10/20/11 close of $10.68 YTD

2012

(2)

Since -

10/20

(3)

Ind Comps

-4.0%

S&P 400

-1.7%

FY 2011

DRE

+2.1%

Ind Comps

+13.6%

DRE

+17.6%

S&P 500

+5.2%

RMS

+8.8%

S&P 400

+5.9%

RMS

+8.7%

S&P 500

+2.1%

RMS

+19.4%

Ind Comps

+25.8%

DRE

+34.7%

S&P 400

+10.9%

S&P 500

+9.3%

Comps

-6.0%

S&P 400

-1.7%

DRE

+2.1%

Comps

+13.0%

DRE

+17.6%

S&P 500

+5.2%

RMS

+8.8%

S&P 400

+5.9%

RMS

+8.7%

S&P 500

+2.1%

FY

2011

YTD

2012

(2)

RMS

+19.4%

Comps

+22.6%

DRE

+34.7%

S&P 400

+10.9%

S&P 500

+9.3%

Since -

10/20

(3)

Industrial and Suburban Office Comps

Industrial Comps

% Total Shareholder Return

33 |

Notes

1.

As of May 31, 2012

2.

Includes LRY, HIW, CLI, BDN, and OFC

3.

Includes PLD, FR, EGP, DCT, and LRY

4.

DCT’s beta only available since its IPO. Barra began tracking DCT’s

beta in Dec 2006 Duke Realty and Peers Barra Beta Analysis

Beta Trends are Slowly Improving Consistent with Asset and Capital Strategy….

Working on Further Lowering Beta

Source: Barra Beta and Morgan Stanley

CAPITAL STRATEGY

©

2012

Duke

Realty

Corporation

34 |

2012 Duke Realty Corporation

35

CAPITAL STRATEGY

Executing on capital strategy objectives

CAPITAL SOURCE

2007

2008

2009

2010

2011

2012

YTD

TOTAL

Common Stock

$230

-

$575

$311

-

$150

$1,266

Preferred Stock

-

$300

-

-

-

-

$300

Unsecured Debt

$300

$325

$500

$250

-

$300

$1,675

Secured Debt

-

-

$270

-

-

-

$270

Asset Dispositions

$785

$475

$300

$533

$1,650

$65

$3,808

TOTAL

$1,315

$1,100

$1,645

$1,094

$1,650

$515

$7,319

•

Investment grade rated debt for over 15 years

•

Proven access to multiple capital sources

•

Available line of credit -

$850 million capacity

•

Dividend covered by AFFO

Continue to strengthen balance sheet

($ in millions) |

Strong support from high quality fixed income investors

36

$300 million 10 year senior

notes offering

T+ 280 (coupon of 4.375%)

Significantly oversubscribed

Lowest coupon in 10 year senior

notes execution ever

60% of top 30 investors new

CAPITAL STRATEGY

$300,000,000

4.375% Senior Notes due June 15, 2022

Issuer:

Duke Realty Limited Partnership

Ratings (Moody’s / S&P)*:

Baa2/BBB-

(stable/stable)

Securities:

Senior unsecured

Format:

SEC registered

Principal Amount:

$300,000,000

Trade Date:

June 6, 2012

Settlement Date:

June 11, 2012 (T+3)

Maturity Date:

June 15, 2022

Interest Payment Dates:

June 15 and December 15, beginning December 15, 2012

Benchmark Treasury:

1.75% due May 15, 2022

Benchmark Treasury Price / Yield:

100-24+ / 1.666%

Spread to Benchmark Treasury:

+280 bps

Yield to Maturity:

4.466%

Coupon:

4.375% per annum (payable semi-annually)

Price to Public:

99.271%

Optional Redemption:

CUSIP/ ISIN:

26441Y AV9 / US26441YAV92

Joint Book-Running Managers:

Barclays Capital Inc.

RBC Capital Markets, LLC

Wells Fargo Securities, LLC

Senior Co-Managers:

J.P. Morgan Securities LLC

Morgan Stanley & Co. LLC

Scotia Capital (USA) Inc.

UBS Securities LLC

Co-Managers:

Credit Suisse Securities (USA) LLC

PNC Capital Markets LLC

SunTrust Robinson Humphrey, Inc.

U.S. Bancorp Investments, Inc.

Duke Realty Bond Transaction

Prior to March 15, 2022 at the Make-Whole Amount of Treasury plus 45

bps. On or after March 15, 2022, the notes will not

include a Make-Whole Amount |

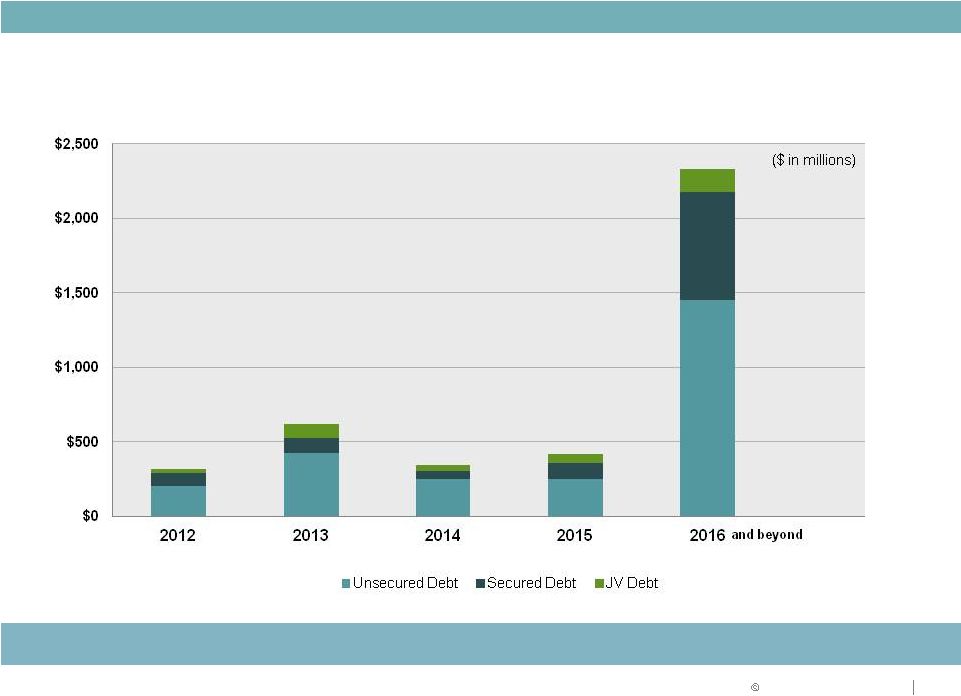

2012 Duke Realty Corporation

37

Liquidity Position

CAPITAL STRATEGY

Manageable debt maturities |

2012

Duke Realty Corporation 2012 Range of Estimates

($ in millions)

Leasing Actions Combined with Modest Rental Rate Increases Drive

Upside

38

Metrics

2011

Actual

Q1 2012

Actual

Pessimistic

Optimistic

Key 2012 Assumptions

Core FFO per share

$1.15

$0.24

$0.94

$1.06

- Blackstone/repositioning dilution $.10 - $.12

- Lower service operations income

- Partially offset by improvement in occupancy of core portfolio

AFFO Payout Ratio

87%

85%

96%

80%

- Annual dividend maintained at $0.68 per share

Avg Occupancy - In-Service

89.7%

91.3%

89.5%

92.5%

- Positive momentum anticipated given industrial and medical office performa

- Lower expirations than 2011 (7% vs. 10%)

- Upside to guidance driven by lease-up of portfolio

Same Property NOI Growth

3.2%

3.6%

(1.5%)

2.5%

- Occupancy increase lower than 2011

- Rental rate pressure remains

Building Acquisitions

$747

$157

$300

$500

- Remain selective regarding property type and location in alignment with

long-term strategy

- Focus on industrial and medical office

Building Dispositions

$1,634

$64

$200

$300

- Continue to prune remaining non-core office portfolio

Land Sale Proceeds

$12

$2

$20

$30

- Selling 10% to 20% of identified non-strategic parcels

- Demand still sluggish

$489

$138

$300

$500

- Comprised of medical office and industrial starts

- Development of $200 to $300 million

- Third party of $100 to $200 million

Construction Volume

$727

$107

$400

$600

- Wind down of BRAC project partially offset by development volume

Service Operations Income

$46

$6

$20

$25

- Reduced fees from BRAC project

General & Admin expense

$40

$12

$43

$38

- In line with 2011

2012 Range of Estimates

Construction and

Development Starts

CAPITAL STRATEGY |

2012 Duke Realty Corporation

39

WHY DUKE REALTY?

Quality portfolio improving with asset strategy

Solid balance sheet improving with capital strategy

Unmatched ability to execute on daily operations

Development capabilities in place with existing land bank

Talent and leadership depth to execute

Delivering on what we say we will do

MEDICAL OFFICE STRATEGY |

RELIABLE. ANSWERS.

2012 Duke Realty Corporation

Forward-Looking Statement

40

This slide presentation contains statements that constitute “forward-looking statements”

within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934 as

amended by the Private Securities Litigation Reform Act of 1995. These forward-looking

statements include, among others, our statements regarding (1) strategic initiatives with respect

to our assets, operations and capital and (2) the assumptions underlying our expectations.

Prospective investors are cautioned that any such forward-looking statements are not

guarantees of future performance and involve risks and uncertainties, and that actual results may differ

materially from those contemplated by such forward-looking statements. A number of important

factors could cause actual results to differ materially from those contemplated by

forward-looking statements in this slide presentation. Many of these factors are beyond

our ability to control or predict. Factors that could cause actual results to differ

materially from those contemplated in this slide presentation include the factors set forth in our

filings with the Securities and Exchange Commission, including our annual report on Form10-K,

quarterly report on Form 10-Q and current reports on Form 8-K. We believe these

forward-looking statements are reasonable, however, undue reliance should not be placed on

any forward-looking statements, which are based on current expectations. We do not

assume any obligation to update any forward-looking statements as a result of new information

or future developments or otherwise. Certain of the financial measures appearing in this slide presentation are or may be considered to be

non-GAAP financial measures. Management believes that these non-GAAP financial measures

provide additional appropriate measures of our operating results. While we believe these

non-GAAP financial measures are useful in evaluating our company, the information should be

considered supplemental in nature and not a substitute for the information prepared in accordance

with GAAP. We have provided for your reference supplemental financial disclosure for these

measures, including the most directly comparable GAAP measure and an associated reconciliation in

our most recent quarter supplemental report, which is available on our website at

www.dukerealty.com. Our

most recent quarter supplemental report also includes the information necessary to

recalculate certain operational ratios and ratios of financial position. The

calculation of these non-GAAP measures may differ from the methodology used by other REITs,

and therefore, may not be comparable.

|