Attached files

Table of Contents

As filed with the Securities and Exchange Commission on June 8, 2012

Registration Number 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MDS ENERGY PUBLIC 2012 PROGRAM

(Exact name of Registrant as Specified in its Charter)

Delaware

(State or other jurisdiction of incorporation or organization)

1311

(Primary Standard Industrial Classification Code Number)

Not Applicable

(IRS Employer Identification Number)

409 Butler Road

Suite A

Kittanning, Pennsylvania, 16201

(855) 807-0807

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael D. Snyder, President

MDS Energy Development, LLC

409 Butler Road

Suite A, Kittanning, Pennsylvania, 16201

(855) 807-0807

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a Copy to:

Wallace W. Kunzman, Jr., Esq.

Gerald A. Bollinger, Esq.

Kunzman & Bollinger, Inc.

5100 N. Brookline

Suite 600

Oklahoma City, Oklahoma 73112

As soon as practicable after this Registration Statement becomes effective.

(Approximate Date of Commencement of Proposed Sale to the Public)

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller Reporting Company | x | |||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered (4) |

Unit Amounts to be |

Dollar Amounts |

Proposed Price per Unit |

Proposed Maximum Aggregate Offering Price |

Compact New Fees | |||||

| Investor General Partner Units (1) |

29,400 | $294,000,000 | $10,000 | $294,000,000 | $33,692.40 | |||||

| Converted Limited Partner Units (2) |

29,400 | - 0 - | - 0 - | - 0 - | - 0 - | |||||

| Limited Partner Units (3) |

600 | $6,000,000 | $10,000 | $6,000,000 | $687.60 | |||||

| TOTAL |

30,000 | $300,000,000 | $10,000 | $300,000,000 | $34,380 | |||||

| (1) | “Investor General Partner Units” means up to 29,400 investor general partner interests offered to participants in the program. |

| (2) | “Converted Limited Partner Units” means up to 29,400 limited partner units into which the investor general partner units automatically will be converted by the managing general partner with no additional price paid by the investor. |

| (3) | “Limited Partner Units” means up to 600 initial limited partner interests offered to participants in the program. |

| (4) | The partnerships reserve the right to adjust the number of Investor General Partner Units, Limited Partner Units and Investor General Partner Units converted to Limited Partner Units set forth above so long as they do not exceed 30,000 in the aggregate. |

The Registrant hereby amends this Registration Statement on such dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

MDS ENERGY PUBLIC 2012 PROGRAM

CROSS REFERENCE SHEET

| Item of Form S-1 | Caption in Prospectus | |||

| Item 1. |

Forepart of the Registration Statement and Outside Front Cover Page of Prospectus | Front Page of Registration Statement and Outside Front Cover Page of Prospectus | ||

| Item 2. |

Inside Front and Outside Back Cover Pages of Prospectus | Inside Front and Outside Back Cover Pages of Prospectus | ||

| Item 3. |

Summary Information, Risk Factors and Ratio of Earnings to Fixed Charges | Summary of the Offering; Risk Factors | ||

| Item 4. |

Use of Proceeds | Capitalization and Source of Funds and Use of Proceeds | ||

| Item 5. |

Determination of Offering Price | Terms of the Offering | ||

| Item 6. |

Dilution | No units will be issued in this offering to the managing general partner and its affiliates except subscriptions described on the Front Cover Page of the Prospectus, which the managing general partner does not anticipate. Discounted units being offered are described in “Plan of Distribution.” | ||

| Item 7. |

Selling Security Holders | The program does not have any selling security holders. | ||

| Item 8. |

Plan of Distribution | Plan of Distribution | ||

| Item 9. |

Description of Securities to be Registered | Summary of the Offering; Terms of the Offering; Summary of Partnership Agreement | ||

| Item 10. |

Interests of Named Experts and Counsel | Legal Opinions; Experts | ||

| Item 11. |

Information with respect to the Registrant | |||

| (a) Description of Business |

Proposed Activities; Management | |||

| (b) Description of Property |

Proposed Activities | |||

| (c) Legal Proceedings |

Litigation | |||

| (d) Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters |

The partnerships composing the program have no markets in which their units are being traded and they have not yet paid any dividends. | |||

| (e) Financial Statements |

Financial Information Concerning the Managing General Partner and MDS Energy Public 2012-A LP | |||

| (f) Selected Financial Data |

All of the partnerships composing the program have been formed, but none of the partnerships have yet conducted any activities. Thus, the program does not have this information for the partnerships. | |||

Table of Contents

| Item of Form S-1 | Caption in Prospectus | |||

| (g) Supplementary Financial Information |

All of the partnerships composing the program have been formed, but none of the partnerships have yet conducted any activities. Thus, the program does not have this information for the partnerships. | |||

| (h) Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Management’s Discussion and Analysis of Financial Condition, Results of Operations, Liquidity and Capital Resources | |||

| (i) Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

There have been no changes in and disagreements with accountants on accounting and financial disclosure. | |||

| (k) Directors and Executive Officers |

Management | |||

| (l) Executive Compensation |

Management | |||

| (m) Security Ownership of Certain Beneficial Owners and Management |

Management | |||

| (n) Certain Relationships and Related Transactions |

Compensation; Management; Conflicts of Interest | |||

| Item 12. |

Disclosure of Commission Position on Indemnification for Securities Act Liabilities | Fiduciary Responsibilities of the Managing General Partner | ||

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS DATED JUNE 8, 2012

MDS ENERGY PUBLIC 2012 PROGRAM

Up to 29,400 Investor General Partner Units, which will be automatically converted to up to 29,400 Limited Partner Units after drilling is completed in the partnership, and up to 600 Limited Partner Units, which are collectively referred to as the “units,” (1) at $10,000 per Unit

$2 Million (200 Units) Minimum Aggregate Subscriptions

$300,000,000 (30,000 Units) Maximum Aggregate Subscriptions

The program reserves the right to adjust the number of Investor General Partner Units, Limited Partner Units and Investor General Partner Units converted to Limited Partner Units in each partnership so long as they do not exceed 30,000 units in the aggregate

| (1) | You may elect to buy either investor general partner units in the partnership then being offered that will be automatically converted to limited partner units after the partnership’s drilling is completed, or limited partner units. The type of unit you buy will not change your share of the partnership’s costs, revenues and cash distributions, however, there are material differences in the federal income tax effects and liability between investor general partner units and limited partner units as discussed in “Summary of the Offering – Description of Units.” |

These securities are speculative and involve a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors,” page 14, which includes the following:

| • | The partnership’s drilling operations involve the possibility of a total or partial loss of your investment because the partnership may drill nonproductive wells (“dry holes”) or wells that are productive, but do not produce enough revenue to return the investment made. |

| • | The partnership’s revenues are directly related to its ability to market the natural gas and oil produced from the wells it drills and natural gas and oil prices are volatile. If natural gas and oil prices decrease, your investment return will decrease. |

| • | Most, if not all, of the partnership’s wells will be drilled vertically to the Marcellus Shale geological formation in western Pennsylvania, which will provide little or no geological diversification of risk, and will be classified as natural gas wells that may produce some oil or natural gas liquids. |

| • | Your partnership distributions will be a return of capital until you have received 100% of your investment. |

| • | Cash distributions to you from the partnership every month are not guaranteed. |

| • | You will have unlimited joint and several liability for partnership obligations if you choose to invest as an investor general partner until you are converted to a limited partner. |

| • | A lack of liquidity or a public market for the units makes it extremely difficult for you to sell your units. |

| • | There is a lack of conflict of interest resolution procedures between the managing general partner and you and the other investors. |

| • | You must rely totally on the managing general partner and its affiliates to manage the partnership and its business. |

| • | Substantial fees will be paid by the partnership to the managing general partner and its affiliates. |

| • | You and the managing general partner will share in costs disproportionately to your sharing of revenues. |

| • | Proposed changes in the federal income tax laws, if enacted, would reduce your tax benefits from an investment in the partnership. |

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this preliminary prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

[MDS Securities, LLC] – Dealer-Manager

Table of Contents

i

Table of Contents

TABLE OF CONTENTS

ii

Table of Contents

TABLE OF CONTENTS

iii

Table of Contents

TABLE OF CONTENTS

iv

Table of Contents

It is the obligation of the managing general partner (the “sponsor”) and the persons selling the units to make every reasonable effort to assure that the units are suitable for you based on your investment objectives and financial situation, regardless of your income or net worth. However, you should invest in a partnership only if you are willing to assume the risk of a speculative, illiquid, and long-term investment. Also, subscriptions to a partnership will not be accepted from IRAs, Keogh plans and qualified retirement plans because the partnership’s income would be characterized as unrelated business taxable income, which is subject to federal income tax.

Generally, you are required to execute your own subscription agreement, and the managing general partner will not accept any subscription agreement that has been executed by someone other than you. The only exception is if you have given someone else the legal power of attorney to sign on your behalf and you meet all of the conditions in this prospectus.

The decision to accept or reject your subscription will be made by the managing general partner, in its sole discretion, and is final. The managing general partner will not accept your subscription until it has reviewed your apparent qualifications, and the suitability determination must be maintained by the managing general partner during your partnership’s term and for at least six years thereafter.

Pennsylvania Investors: Because the minimum closing amount is less than 10% of the maximum closing amount allowed to a partnership in this offering, you are cautioned to carefully evaluate the partnership’s ability to fully accomplish its stated objectives and inquire as to the current dollar volume of partnership subscriptions. In addition, subscription proceeds received by a partnership from Pennsylvania investors will be placed into a short-term escrow (120 days or less) until subscriptions for at least 5% of the maximum offering proceeds have been received by the partnership, which for MDS Energy Public 2012-A LP means that subscriptions for at least $15,000,000 have been received by the partnership from investors, including Pennsylvania investors. If the appropriate minimum has not been met at the end of each escrow period, the partnership must notify the Pennsylvania investors in writing by certified mail or any other means whereby a receipt of delivery is obtained within 10 calendar days after the end of each escrow period that they have a right to have their investment returned to them. If an investor requests the return of such funds within 10 calendar days after receipt of notification, the issuer must return such funds within 15 calendar days after receipt of the investor’s request.

General Suitability Requirements for Purchasers of Limited Partner Units

Limited partner units may be sold to you if you meet either of the following requirements:

| • | a net worth of not less than $330,000, exclusive of home, home furnishings, and automobiles; or |

| • | a net worth of not less than $85,000, exclusive of home, home furnishings, and automobiles, and had during the last tax year gross income of at least $85,000, without regard to an investment in the partnership. |

In addition, if you are a resident of Iowa, Michigan, Missouri, or Pennsylvania, then you must not make an investment in a partnership which is in excess of 10% of your net worth, exclusive of home, home furnishings and automobiles and if you are a resident of Kentucky, then you must not make an investment in a partnership which is in excess of 10% of your liquid net worth. Further, if you are a resident of Ohio or Oregon you must not make an investment in a partnership which would, after including your previous investments in prior MDS Energy Development programs, if any, and any other similar natural gas and oil drilling programs, exceed 10% of your net worth, exclusive of home, home furnishings and automobiles. Also, if you are a resident of Alabama, then you must not make an investment in a partnership which would, after including your previous investments in prior MDS Energy Development’s programs, if any, and any other similar natural gas and oil drilling

1

Table of Contents

programs, exceed 10% of your liquid net worth, exclusive of home, home furnishings and automobiles. Finally, if you are a resident of Kansas or Massachusetts, it is recommended by the Office of the Kansas Securities Commissioner and the Massachusetts Securities Division, respectively, that you should limit your investment in the program and substantially similar programs to no more than 10% of your liquid net worth. Liquid net worth is that portion of your net worth (total assets minus total liabilities) that is comprised of cash, cash equivalents and readily marketable securities. Readily marketable securities may include investments in an IRA or other retirement plan that can be liquidated within a short time, less any income tax penalties that may apply for early distribution.

General Suitability Requirements for Purchasers of Investor General Partner Units

If you are a resident of any of the following states or jurisdictions:

| 1. Alaska, |

12. Louisiana, |

23. Rhode Island, | ||

| 2. Colorado, |

13. Maryland, |

24. South Carolina, | ||

| 3. Connecticut, |

14. Mississippi, |

25. South Dakota, | ||

| 4. Delaware, |

15. Missouri, |

26. Utah, | ||

| 5. District of Columbia, |

16. Montana, |

27. Vermont, | ||

| 6. Florida, |

17. Nebraska, |

28. Virginia, | ||

| 7. Georgia, |

18. Nevada, |

29. West Virginia, | ||

| 8. Hawaii, |

19. New Hampshire, |

30. Wisconsin, or | ||

| 9. Idaho, |

20. New York, |

31. Wyoming, | ||

| 10. Illinois, |

21. North Dakota, |

|||

| 11. Kentucky, |

22. Puerto Rico, |

|||

then investor general partner units may be sold to you if you meet either of the following requirements:

| • | a net worth of not less than $330,000, exclusive of home, home furnishings, and automobiles; or |

| • | an individual net worth or joint net worth with your spouse in excess of $1,000,000, inclusive of home, home furnishings and automobiles; or |

| • | a net worth of not less than $85,000, exclusive of home, home furnishings, and automobiles, and had during the last tax year gross income of at least $85,000, without regard to an investment in the partnership. |

Additionally, if you are a resident of Missouri, then you must not make an investment in a partnership which is in excess of 10% of your net worth, exclusive of home, home furnishings and automobiles, and if you are a resident of Kentucky, then you must not make an investment in a partnership which is in excess of 10% of your liquid net worth.

However, if you are a resident of the states set forth below, then different suitability requirements apply to you if you purchase investor general partner units.

2

Table of Contents

Special Suitability Requirements for Purchasers of Investor General Partner Units

| • | If you are a resident of any of the following states: |

| 1. Alabama, |

8. Maine, |

15. Ohio, | ||

| 2. Arizona, |

9. Massachusetts, |

16. Oklahoma, | ||

| 3. Arkansas, |

10. Michigan, |

17. Oregon, | ||

| 4. California, |

11. Minnesota, |

18. Pennsylvania, | ||

| 5. Indiana, |

12. New Jersey, |

19. Tennessee, | ||

| 6. Iowa, |

13. New Mexico, |

20. Texas, or | ||

| 7. Kansas, |

14. North Carolina, |

21. Washington | ||

and you subscribe for investor general partner units, then you must meet any one of the following special suitability requirements:

| • | an individual or joint net worth with your spouse of $330,000 or more, without regard to the investment in the partnership, exclusive of home, home furnishings, and automobiles, and a combined gross income of $150,000 or more for the current year and for the two previous years; or |

| • | an individual net worth or joint net worth with your spouse in excess of $1,000,000, inclusive of home, home furnishings and automobiles; or |

| • | an individual or joint net worth with your spouse in excess of $750,000, exclusive of home, home furnishings, and automobiles; or |

| • | a combined “gross income” as defined in Internal Revenue Code Section 61 in excess of $200,000 in the current year and the two previous years. |

In addition, if you are a resident of Iowa, Michigan or Pennsylvania, then you must not make an investment in a partnership which is in excess of 10% of your net worth, exclusive of home, home furnishings, and automobiles. Further, if you are a resident of Ohio or Oregon, then you must not make an investment in a partnership which would, after including your previous investments in prior MDS Energy Development’s programs, if any, and any other similar natural gas and oil drilling programs, exceed 10% of your net worth, exclusive of home, home furnishings and automobiles. Also, if you are a resident of Alabama, then you must not make an investment in a partnership which would, after including your previous investments in prior MDS Energy Development’s programs, if any, and any other similar natural gas and oil drilling programs, exceed 10% of your liquid net worth, exclusive of home, home furnishings and automobiles. Finally, if you are a resident of Kansas or Massachusetts, it is recommended by the Office of the Kansas Securities Commissioner and the Massachusetts Securities Division, respectively, that you should limit your investment in the program and substantially similar programs to no more than 10% of your liquid net worth. Liquid net worth is that portion of your net worth (total assets minus total liabilities) that is comprised of cash, cash equivalents and readily marketable securities. Readily marketable securities may include investments in an IRA or other retirement plan that can be liquidated within a short time, less any income tax penalties that may apply for early distribution.

If there is a sale of a unit to a fiduciary account, then all of the suitability standards set forth above must be met by the beneficiary, the fiduciary account, or the donor or grantor who directly or indirectly supplies the funds to purchase the units if the donor or grantor is the fiduciary.

3

Table of Contents

Restrictions Imposed by the USA Patriot Act and Related Acts

In accordance with the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, as amended (the “USA PATRIOT Act”), the units offered hereby may not be offered, sold, transferred or delivered, directly or indirectly, to any “Prohibited Shareholder,” which means anyone who is:

| • | a “designated national,” “specially designated national,” “specially designated terrorist,” “specially designated global terrorist,” “foreign terrorist organization,” or “blocked person” within the definitions set forth in the Foreign Assets Control Regulations of the U.S. Treasury Department; |

| • | acting on behalf of, or an entity owned or controlled by, any government against whom the U.S. maintains economic sanctions or embargoes under the Regulations of the U.S. Treasury Department; |

| • | within the scope of Executive Order 13224 – Blocking Property and Prohibiting Transactions with Persons who Commit, Threaten to Commit, or Support Terrorism, effective September 24, 2001; |

| • | subject to additional restrictions imposed by the following statutes or regulations, and executive orders issued thereunder: the Trading with the Enemy Act, the Iraq Sanctions Act, the National Emergencies Act, the Antiterrorism and Effective Death Penalty Act of 1996, the International Emergency Economic Powers Act, the United Nations Participation Act, the International Security and Development Cooperation Act, the Nuclear Proliferation Prevention Act of 1994, the Foreign Narcotics Kingpin Designation Act, the Iran and Libya Sanctions Act of 1996, the Cuban Democracy Act, the Cuban Liberty and Democratic Solidarity Act and the Foreign Operations, Export Financing and Related Programs Appropriation Act or any other law of similar import as to any non-U.S. country, as each such act or law has been or may be amended, adjusted, modified or reviewed from time to time; or |

| • | designated or blocked, associated or involved in terrorism, or subject to restrictions under laws, regulations, or executive orders as may apply in the future similar to those set forth above. |

[The rest of this page is intentionally left blank.]

4

Table of Contents

This is a summary and does not include all of the information that may be important to you. You should read this entire prospectus and the attached exhibits before you decide to invest in a partnership. Throughout this prospectus when there is a reference to you it is a reference to you as a potential investor or participant in the partnership.

Also, this prospectus is only for the offer and sale of units in the program’s first partnership, MDS Energy Public 2012-A LP. If units are offered for the other partnerships, this prospectus will be amended at that time by filing an amendment to the program’s Registration Statement with the Securities and Exchange Commission (the “SEC”).

Business of the Partnerships and the Managing General Partner

MDS Energy Public 2012 Program, which is sometimes referred to in this prospectus as the “program,” consists of up to three Delaware limited partnerships. These limited partnerships are sometimes referred to in this prospectus in the singular as a “partnership” or in the plural as the “partnerships.” Units in the partnerships will be offered and sold in a series beginning with the offering of units in the first partnership, MDS Energy Public 2012-A LP. See “Terms of the Offering” for a discussion of the terms and conditions involved in making an investment in a partnership. Each partnership has a maximum 50 year term, although the managing general partner intends to terminate each partnership when its wells become uneconomical for the partnership to continue to operate, which may be approximately 15 years or longer.

Each partnership will be a separate business entity from the other partnerships. A limited partnership agreement will govern the rights and obligations of the partners of each partnership, a form of which is attached to this prospectus as Exhibit (A). For a summary of the material provisions of the limited partnership agreement that are not covered elsewhere in this prospectus see “Summary of Partnership Agreement.” You will be a partner only in the partnership in which you invest. You will have no interest in the business, assets or tax benefits of the other partnerships in this program, unless you also made a separate investment in the other partnerships. Thus, your investment return will depend solely on the operations and success or lack of success of the partnership or partnerships in which you invested.

Each partnership will drill primarily development wells as described in “Proposed Activities.” A development well means a well drilled within the proved area of a natural gas or oil reservoir to the depth of a stratigraphic horizon known to be productive. As used in this prospectus, the term “natural gas” sometimes includes natural gas liquids, if any are present in the raw natural gas stream produced from a well. Currently, the partnerships do not hold any interests in any properties or prospects on which the wells will be drilled.

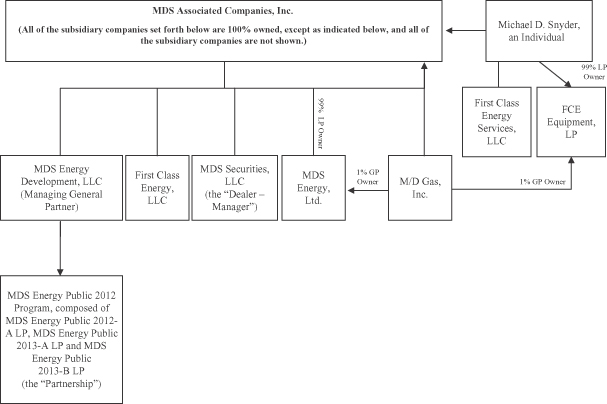

The managing general partner of each partnership is MDS Energy Development, LLC, a Pennsylvania limited liability company, which is sometimes referred to in this prospectus as “MDS Energy Development.” The address and telephone number of the partnerships and the managing general partner are 409 Butler Road, Suite A, Kittanning, Pennsylvania, 16201, (855) 807-0807. The managing general partner will also serve as each partnership’s general drilling contractor and operator and it will supervise the drilling, completing and operating of the wells to be drilled by the partnerships. As discussed in “Compensation,” the managing general partner and its affiliates will receive substantial fees and profits in connection with this offering.

As set forth in “Prior Activities,” the managing general partner’s affiliates, MDS Energy, Ltd. and M/D Gas, Inc., have previously sponsored and serve as managing general partner of six private drilling partnerships, in the aggregate. Also, MDS Energy Development is currently sponsoring its first private drilling partnership, and M/D Gas, Inc., an affiliate of the managing general partner, will sponsor its fifth private drilling partnership in 2012.

5

Table of Contents

Risk Factors

This offering involves numerous risks, including risks related to a partnership’s oil and gas operations, risks related to an investment in a partnership, and tax risks. You should carefully consider a number of significant risk factors inherent in and affecting the business of the partnership and this offering, including the following:

| • | your partnership’s drilling operations involve the possibility of a total or partial loss of your investment, because the partnership may drill nonproductive wells (“dry holes”) or wells that are productive, but do not produce enough revenue to return the investment made. |

| • | The partnership’s revenues are directly related to its ability to market the natural gas and oil produced from the wells it drills and natural gas and oil prices, which are volatile and uncertain. If natural gas and oil prices decrease, then your investment return will decrease. |

| • | Most, if not all, of each partnership’s wells: |

| • | will be vertical wells that will be drilled to the Marcellus Shale geological formation in western Pennsylvania, which will provide little or no geological diversification of risk; and |

| • | will be classified as natural gas wells that may produce some oil or natural gas liquids. |

| • | Your partnership distributions will be a return of capital until you have received 100% of your investment. |

| • | You will have unlimited joint and several liability for partnership obligations if you choose to invest as an investor general partner until you are converted to a limited partner. |

| • | There is a lack of liquidity or a public market for the units, which makes it extremely difficult for you to sell your units and necessitates a long-term investment commitment from you. |

| • | You must rely totally on the managing general partner and its affiliates to manage the partnership and its business. |

| • | There are certain conflicts of interest between the managing general partner and you and the other investors, and a lack of procedures to resolve the conflicts. |

| • | Substantial fees will be paid by the partnership to the managing general partner and its affiliates. |

| • | You and the other investors and the managing general partner will share in the partnership’s costs disproportionately to the sharing of its revenues. |

| • | The partnership’s monthly cash distributions to you and the other investors are not guaranteed, and may be deferred if its revenues are used for partnership operations or reserves. |

| • | The managing general partner and its affiliates have limited experience in drilling vertical wells in the Marcellus Shale geological formation in western Pennsylvania and little or no production history for vertical Marcellus Shale wells in the area. See “Risks Factors” and “Proposed Activities.” |

| • | Previously, there was no severance tax on natural gas and oil production from wells situated in Pennsylvania. In 2012, however, a new state fee on wells drilled to the Marcellus Shale geological formation in Pennsylvania was enacted into law, which will materially reduce your partnership’s cash distributions to you and its other investors. See “Federal Income Tax Consequences – Severance and Ad Valorem (Real Estate) Taxes.” |

| • | Taxable income may be allocated to you and the other investors in excess of your respective cash distributions from the partnership. |

| • | If only the minimum subscription proceeds are received the partnership’s ability to spread the risks of drilling will be greatly reduced as described in “Compensation – Drilling Contracts.” |

6

Table of Contents

| • | Currently, the partnerships do not hold any interests in any properties or prospects on which the wells will be drilled and the managing general partner has absolute discretion in determining which properties or prospects will be drilled by the partnerships. |

| • | The managing general partner will subordinate a portion of its share of the partnership’s net production revenues to increase the partnership’s distributions to you and the other investors if you and the partnership’s other investors do not receive the cumulative cash distributions described in “– Eight Year – 60% Subordination,” below. If the partnership’s wells produce small volumes of natural gas and oil and/or natural gas and oil prices decrease, however, then even with subordination your cash flow from the partnership may not return the intended distributions during the subordination period or all of your investment over the term of the partnership. |

| • | Proposed changes in the federal income tax laws, if enacted, would reduce your tax benefits from an investment in the partnership. See “Risk Factors – Federal Income Tax Risks – Changes in the Law May Reduce Your Tax Benefits From an Investment in a Partnership” and “Federal Income Tax Consequences.” |

Terms of the Offering

The time period for the offer and sale of units in the partnership began on the date of this prospectus. Each partnership will offer a minimum of 200 units, which is $2 million, and the partnerships, in the aggregate, will offer a maximum of 30,000 units which is $300 million. The maximum subscription proceeds for each partnership will be the lesser of:

| • | the amount of $300 million; or |

| • | $300 million less the amount of subscriptions sold in the preceding partnerships. |

The nonbinding targeted subscription proceeds for MDS Energy Public 2012-A LP are $100 million, although it may raise the entire $300 million, in which event no units would be offered or sold in the remaining partnerships, and its closing date is December 31, 2012, which will not be extended. The nonbinding targeted subscription proceeds for MDS Energy Public 2013-A LP are $100 million and its nonbinding targeted closing date is July 31, 2013, which may be extended by the managing general partner, in its discretion, up to December 31, 2013. The nonbinding targeted subscription proceeds for MDS Energy Public 2013-B LP are $100 million and its nonbinding targeted closing date is December 31, 2013, which will not be extended. If MDS Energy Public 2012-A LP and MDS Energy Public 2013-A LP reach the maximum subscription amount of $300 million, in the aggregate, then MDS Energy Public 2013-B LP will not be offered. See the table in “Terms of the Offering – Subscription to a Partnership.”

Units are offered at a subscription price of $10,000 per unit, provided that units in each partnership also may be sold to certain investors at discounted prices as described in “Plan of Distribution.” All subscriptions must be paid 100% in cash at the time of subscribing. Your minimum subscription in a partnership is one unit ($10,000). Larger fractional subscriptions will be accepted in $1,000 increments, beginning, for example, with $11,000, $12,000, etc.

You may elect to purchase units as either an investor general partner or a limited partner as described in “– Description of Units,” below. Under the partnership agreement no investor, including investor general partners, may participate in the management of the partnership or its business. The managing general partner will have exclusive management authority for the partnership.

Subscription proceeds for each partnership will be held in a separate interest bearing escrow account at Citizens Bank of Pennsylvania, N.A. until receipt of the minimum subscription proceeds, excluding any subscriptions by

7

Table of Contents

the managing general partner or its affiliates. On receipt of the minimum subscription proceeds, the managing general partner on behalf of a partnership will break escrow, transfer the escrowed subscription proceeds to a partnership account, and begin the partnership’s activities, including drilling. After breaking escrow, additional subscription proceeds may be paid directly to a partnership account for the partnership. In this regard, subscription proceeds will earn interest until they are paid to the managing general partner for use in your partnership’s drilling activities, and will be credited to your account and paid to you no later than your partnership’s first cash distribution from operations. See “Terms of the Offering.” If subscription proceeds of $2 million are not received by the final offering termination date for your partnership, which is December 31, 2012 for MDS Energy Public 2012-A LP, and December 31, 2013 for MDS Energy Public 2013-A LP and MDS Energy Public 2013-B LP, then your subscription amount will be promptly returned to you from the escrow account with interest and without deduction for any fees

Pennsylvania Investors: Because the minimum closing amount is less than 10% of the maximum closing amount allowed to a partnership in this offering, you are cautioned to carefully evaluate the partnership’s ability to fully accomplish its stated objectives and inquire as to the current dollar volume of partnership subscriptions. In addition, subscription proceeds received by a partnership from Pennsylvania investors will be placed into a short-term escrow (120 days or less) until subscriptions for at least 5% of the maximum offering proceeds have been received by the partnership, which for MDS Energy Public 2012-A LP means that subscriptions for at least $15,000,000 have been received by the partnership from investors, including Pennsylvania investors. If the appropriate minimum has not been met at the end of each escrow period, the partnership must notify the Pennsylvania investors in writing by certified mail or any other means whereby a receipt of delivery is obtained within 10 calendar days after the end of each escrow period that they have a right to have their investment returned to them. If an investor requests the return of such funds within 10 calendar days after receipt of notification, the issuer must return such funds within 15 calendar days after receipt of the investor’s request.

Description of Units

On subscribing for units in the partnership being offered at the time, you may elect to buy either:

| • | investor general partner units; or |

| • | limited partner units. |

The partnerships will not issue certificates for their units, but your ownership of your unit(s) will be recorded on your partnership’s books and records. Also, the type of unit you buy will not affect the allocation of the partnership’s costs, revenues, and cash distributions among you and its other investors. There are, however, material differences in the federal income tax effects and liability associated with each type of unit.

Investor General Partner Units.

| • | Tax Effect. If you invest in the partnership as an investor general partner, then your share of the partnership’s deduction in 2012 for intangible drilling costs will not be subject to the passive activity limitations on losses. For example, the managing general partner anticipates that you may claim a deduction in 2012 in an amount equal to approximately 81.6% of your subscription amount, $8,160 per unit if you pay $10,000 for a unit, which includes your deduction for intangible drilling costs for all of the wells to be drilled by the partnership. See “Risk Factors – Federal Income Tax Risks – Changes in the Law May Reduce Your Tax Benefits From an Investment in a Partnership,” “Compensation – Drilling Contracts,” and “Federal Income Tax Consequences – Limitations on Passive Activity Losses and Credits,” “– Drilling Contracts,” and “– Alternative Minimum Tax.” |

| • | Intangible drilling costs generally means those costs of drilling and completing a well that are currently deductible, as compared to lease costs which must be recovered through the depletion |

8

Table of Contents

| allowance and costs for equipment in the well which generally must be recovered over time through depreciation deductions, with the exception of bonus depreciation as discussed in “Investment Objectives.” For example, intangible drilling costs include all expenditures made for any well before production in commercial quantities for wages, fuel, repairs, hauling, supplies and other costs and expenses incident to and necessary for drilling the well and preparing the well for production of natural gas or oil. Intangible drilling costs also include the expense of plugging and abandoning any well before a completion attempt. |

Additionally, a 50% bonus depreciation allowance for your share of your partnership’s qualified equipment costs in wells drilled, completed and placed in service in 2012, if any, may allow you to claim an additional deduction in 2012 if you invest in MDS Energy Public 2012-A LP. See “Federal Income Tax Consequences – Depreciation and Cost Recovery Deductions.”

| • | Liability. If you invest in the partnership as an investor general partner, then you will have unlimited liability regarding the partnership’s activities. This means that if: |

| • | the partnership’s insurance proceeds from any source; |

| • | the managing general partner’s indemnification of you and the other investor general partners; and |

| • | the partnership’s assets; |

were not sufficient to satisfy the partnership liability for which you and the other investor general partners were also liable solely because of your status as general partners of the partnership, then the managing general partner would require you and the other investor general partners to make additional capital contributions to the partnership to satisfy the liability. In addition, you and the other investor general partners will have joint and several liability, which means generally that a person with a claim against the partnership may sue all or any one or more of the partnership’s general partners, including you, for the entire amount of the liability. You will be able to determine if your units are subject to assessibility based on whether you buy investor general partner units, which are subject to assessibility, or limited partner units, which are not subject to assessibility. See “Actions To Be Taken By Managing General Partner To Reduce Risks of Additional Payments by Investor General Partners” and “Proposed Activities – Insurance Claims.”

Although past performance is no guarantee of future results, the investor general partners in the prior partnerships sponsored by the managing general partner’s affiliates, MDS Energy, Ltd. and M/D Gas, Inc., have not had to make any additional capital contributions to their partnerships because of their status as investor general partners. See “Prior Activities.”

Your investor general partner units in the partnership will be automatically converted by the managing general partner to limited partner units after all of the partnership’s wells have been drilled and completed. In this regard, a well is deemed to be completed when production equipment is installed on the well, even though, for example, the well may not yet be connected to a pipeline for production of natural gas in the case of a natural gas well.

Once your units are converted, you will have the lesser liability of a limited partner under Delaware law for the partnership’s obligations and liabilities arising after the conversion. However, you will continue to have the responsibilities of a general partner for the partnership’s liabilities and obligations incurred before the effective date of the conversion. For example, you might become liable for the partnership’s liabilities in excess of your subscription amount during the time the partnership is engaged in drilling activities and for environmental claims that arose during drilling activities, but were not discovered until after the conversion.

9

Table of Contents

Limited Partner Units.

| • | Tax Effect. If you invest in a partnership as a limited partner, then your use of your share of the partnership’s deductions for intangible drilling costs and, if you invest in MDS Energy Public 2012-A LP, 50% bonus depreciation of qualified equipment costs for wells placed in service in 2012, if any, will be limited to offsetting your net passive income from “passive” trade or business activities. Passive trade or business activities generally include the partnership and other limited partner investments, but passive income does not include salaries, dividends or interest. This means that you will not be able to deduct your share of the partnership’s deductions for intangible drilling costs and bonus depreciation, if any, in the year in which you invest unless you have net passive income from investments other than the partnership. However, any portion of your share of the partnership’s deductions for intangible drilling costs and any bonus depreciation that you cannot use in 2012, because you do not have sufficient net passive income in that year, may be carried forward indefinitely until you can use it to offset your net passive income from the partnership or your other passive activities, if any, in subsequent tax years. See “Risk Factors – Federal Income Tax Risks – Changes in the Law May Reduce Your Tax Benefits From an Investment in a Partnership” and “Federal Income Tax Consequences – Limitations on Passive Activity Losses and Credits.” |

| • | Liability. If you invest in the partnership as a limited partner, then you will have limited liability for the partnership’s liabilities and obligations. This means that you will not be liable for the partnership’s liabilities or obligations beyond the amount of your initial investment in the partnership and your share of the partnership’s undistributed net assets, subject to certain exceptions set forth in “Summary of Partnership Agreement – Liability of Limited Partners.” |

Use of Proceeds

Each partnership must receive minimum subscription proceeds of $2 million to close, and the maximum subscription proceeds may not exceed $300 million. Regardless of whether a partnership receives the minimum or the maximum subscription proceeds, the subscription proceeds from you and the other investors will be used to pay 100% of the:

| • | intangible drilling costs of drilling and completing the partnership’s wells; and |

| • | equipment costs of drilling and completing the partnership’s wells. |

The managing general partner will contribute the leases to each partnership and pay all of the partnership’s organization and offering costs. See “Capitalization and Source of Funds and Use of Proceeds” and “Compensation – Organization and Offering Costs,” and “– Lease Costs.”

Eight Year – 60% Subordination Feature

Each partnership will be a separate business entity from the other partnerships in the program, and you will be a partner only in the partnership in which you invest. You will have no interest in the business, assets or tax benefits of the other partnerships in the program unless you also made an investment in the other partnerships. Thus, your investment return will depend solely on the operations and success or lack of success of the particular partnership in which you invest.

10

Table of Contents

Each partnership is structured to provide you and its other investors with cumulative cash distributions, including all distributions from operations to you and the other investors before the first 12-month subordination period begins, based on a subscription price of $10,000 per unit regardless of the actual subscription price you paid for your units, equal to at least:

| • | 10% of capital (which is $1,000 per $10,000 unit) in each of the first five 12-month periods; and |

| • | 7.5% of capital (which is $750 per $10,000 unit) in each of the next three 12-month subordination periods. |

Each partnership’s first 12-month subordination period will begin on the earlier of when the partnership begins receiving revenues from all of its productive wells, if any, or 12 months after the partnership’s final closing. To help achieve this investment feature, the managing general partner will subordinate up to 60% of its share, as managing general partner, of partnership net production revenues during the partnership’s 96-month, in the aggregate, subordination period.

| • | Partnership net production revenues means gross revenues after deduction of the related operating costs, direct costs, administrative costs, and all other costs not specifically allocated. |

Subordination distributions will be determined by debiting or crediting current period partnership revenues to the managing general partner as may be necessary to provide the distributions to you and the other investors. At any time during the subordination period the managing general partner is entitled to an additional share of partnership revenues to recoup previous subordination distributions to the extent your cash distributions from the partnership would exceed the targeted returns of capital described above. The specific formula for determining subordination distributions is set forth in Section 5.01(b)(4)(a) of the partnership agreement. See “– Participation in Costs and Revenues and Distributions,” below.

Participation in Costs and Revenues and Distributions

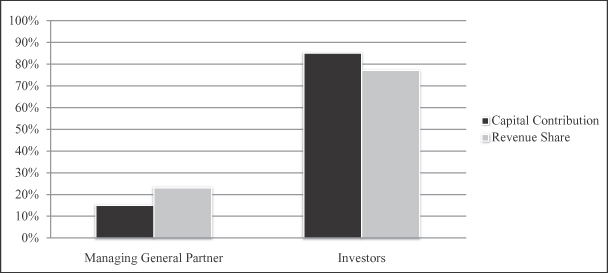

The following table sets forth how each partnership’s costs and revenues will be charged and credited between the managing general partner and you and the other investors in the partnership after deducting from the partnership’s gross revenues the landowner royalties and any other lease burdens. Some of the line items in the table do not have percentages stated, because the percentages will be determined either by the actual costs incurred by the partnership to drill and complete its wells or by the final amount of the managing general partner’s capital contribution to the partnership, which will not be known until after all of the partnership’s wells have been drilled and completed.

| Managing General Partner |

Investors | |||||||

| Partnership Costs |

||||||||

| Organization and offering costs |

100 | % | 0 | % | ||||

| Lease costs |

100 | % | 0 | % | ||||

| Intangible drilling costs (1) |

0 | % | 100 | % | ||||

| Equipment costs (2) |

0 | % | 100 | % | ||||

| Operating costs, administrative costs, direct costs, and all other costs |

(3) | (3) | ||||||

| Partnership Revenues |

||||||||

| Interest income on subscription proceeds (4) |

0 | % | 100 | % | ||||

| Equipment proceeds (2) |

0 | % | 100 | % | ||||

| All other revenues including production revenues and other interest income |

(4)(5)(6) | (4)(5)(6) | ||||||

11

Table of Contents

| (1) | The subscription proceeds of you and the other investors in the partnership will be used to pay 100% of the intangible drilling costs incurred by the partnership in drilling and completing its wells. |

| (2) | The subscription proceeds of you and the other investors in the partnership will be used to pay 100% of the equipment costs incurred by the partnership in drilling and completing its wells. Equipment proceeds, if any, and depreciation also will be allocated 100% to you and the other investors in the partnership. |

| (3) | These costs, which also include plugging and abandonment costs of the wells after the wells have been drilled, produced, and depleted, will be charged to the parties in the same ratio as the related production revenues are being credited. |

| (4) | Your subscription proceeds will earn interest until the escrow account is broken and they are paid to the managing general partner for use in your partnership’s drilling activities. This interest will be credited to your account and paid to you no later than the partnership’s first cash distribution from operations. All other interest income, including interest earned on the deposit of operating revenues, will be credited as natural gas and oil production revenues are credited. |

| (5) | The managing general partner and you and the other investors will share in all of the partnership’s other revenues in the same percentage that their respective capital contributions bear to the partnership’s total capital contributions, except that the managing general partner will receive an additional 8% of the partnership’s revenues. |

| (6) | If a portion of the managing general partner’s partnership net production revenues is subordinated, then the actual allocation of partnership net production revenues between the managing general partner and you and the other investors will vary from the allocation described in (5) above. |

The managing general partner will review the partnership’s accounts at least monthly to determine whether cash distributions are appropriate and the amount to be distributed, if any. The partnership will distribute funds to you and its other investors that the managing general partner does not believe are necessary for the partnership to retain. See “Participation in Costs and Revenues.”

Compensation

As discussed in “Compensation,” the managing general partner and its affiliates will receive substantial fees and profits in connection with this offering. The items of compensation paid to the managing general partner and its affiliates from each partnership are as follows:

| • | The managing general partner will receive a share of the partnership’s revenues, which will be in the same percentage as its capital contribution bears to the partnership’s total capital contributions plus an additional 8% of partnership revenues. A portion of the managing general partner’s revenue share will be subject to its subordination obligation. |

| • | The managing general partner generally will receive a credit to its capital account in an amount equal to the cost of the leases contributed to the partnership, or the fair market value of the leases if the managing general partner has reason to believe that cost is materially more than fair market value, provided that the managing general partner’s credit for leases in the Marcellus Shale primary area it acquires from Snyder Brothers, Inc., or another affiliate, and then contributes to the partnership, if any, will be the fair market value of the leases as set forth in an appraisal of the leases by an independent expert selected by the managing general partner, but not to exceed the actual price paid by the managing general partner. |

| • | The managing general partner will receive a credit to its capital account in an amount equal to the partnership’s organization and offering costs it pays or contributes in services to the partnership, but it will not receive a credit for any organization and offering costs it pays in excess of 15% of the partnership’s subscription proceeds. |

12

Table of Contents

| • | The partnership will enter into the drilling and operating agreement with the managing general partner to drill and complete the partnership’s wells at competitive rates as described in “Compensation –Drilling Contracts.” |

| • | When the partnership’s wells begin producing natural gas or oil in commercial quantities, the managing general partner, as operator of the wells, will receive: |

| • | reimbursement at actual cost for all direct expenses incurred by it on behalf of the partnership; |

| • | well supervision fees for operating and maintaining the wells during producing operations at a competitive rate; and |

| • | compensation at a competitive rate for any services the managing general partner, as operator, provides to the partnership, or reimbursement at actual cost for services provided by third-parties. |

| • | The managing general partner and its affiliates will receive gathering and processing fees at competitive rates for their services in gathering and transporting the partnership’s natural gas production. |

| • | Subject to certain exceptions described in “Plan of Distribution,” MDS Securities, LLC (“MDS Securities”), an affiliate of the managing general partner and the dealer-manager of this offering, will receive on each unit sold to an investor a 3% dealer-manager fee and a 7% sales commission. |

| • | The managing general partner or an affiliate will have the right to charge a competitive rate of interest on any loan it may make to or on behalf of the partnership. If the managing general partner provides equipment, supplies, and other services to the partnership, then it may do so at competitive industry rates. |

The managing general partner anticipates that a most, if not all, of the partnership’s natural gas and oil production will be sold to Snyder Brothers, Inc., an affiliate of the managing general partner, or other affiliates of the managing general partner, at competitive rates that will be determined by the managing general partner, and the managing general partner’s affiliate will receive a competitive profit when the managing general partner’s affiliate resells the production, the amount of which cannot currently be quantified.

| • | The managing general partner will receive reimbursements for its administrative costs on a fully accountable basis, based on actual costs and time devoted to the partnership and its business. |

See “Compensation.”

[The rest of this page is intentionally left blank.]

13

Table of Contents

An investment in a partnership involves a high degree of risk and is suitable only if you have substantial financial means and no need of liquidity in your investment.

Risks Related To the Partnerships’ Oil and Gas Operations

No Guarantee of Return of Investment or Rate of Return on Investment Because of Speculative Nature of Drilling Natural Gas and Oil Wells. Natural gas and oil exploration is an inherently speculative activity. Before the drilling of a well the managing general partner cannot predict with absolute certainty:

| • | the volume of natural gas and oil recoverable from the well; or |

| • | the time it will take to recover the natural gas and oil. |

You may not recover any or all of your investment in your partnership, or if you do recover your investment in the partnership you may not receive a rate of return on your investment that is competitive with other types of investment. You will be able to recover your investment only through distributions of the partnership’s net proceeds from the sale of its natural gas and oil from productive wells. The quantity of natural gas and oil in a well, which is referred to as its reserves, decreases over time as the natural gas and oil is produced until the well is no longer economical to operate.

Distributions from a Partnership May Be a Return of Capital Rather Than a Return on Your Investment. All of your partnership’s distributions to you will be considered a return of capital until you have received 100% of your investment. This means that you are not receiving a return on your investment in the partnership, excluding tax benefits, until your total cash distributions from the partnership exceed 100% of your investment. See “Prior Activities.”

Because Some Wells May Not Return Their Drilling and Completion Costs, It May Take Many Years to Return Your Investment in Cash, If Ever. Even if a well is completed by a partnership and produces natural gas and oil in commercial quantities, it may not produce enough natural gas and oil to pay for the costs of drilling and completing the well, even if tax benefits are considered. Thus, it may take many years to return your investment in cash, if ever.

Previous Drilling By Others May Reduce the Partnerships’ Ability to Find Economically Recoverable Quantities of Natural Gas. The partnerships’ Marcellus Shale primary drilling area is located in an area where other oil and gas companies have previously drilled wells and the specific areas where each partnership’s wells will be situated may have already been partially depleted or drained by earlier drilling. This may reduce the partnership’s ability to find economically recoverable quantities of natural gas in those areas.

The Managing General Partner Has Limited Experience in Drilling Vertical Wells in the Marcellus Shale Primary Area. As of January 31, 2012, the managing general partner’s affiliates, including Snyder Brothers, Inc., and the five previous drilling limited partnerships sponsored by the managing general partner’s affiliates, MDS Energy, Ltd. and M/D Gas Inc., had participated in drilling approximately 84 vertical wells in the Marcellus Shale primary area, 70 of which were producing natural gas from the Marcellus Shale geological formation, 11 of which had been drilled but had not yet been placed on line for production of natural gas, and three of which were producing natural gas from shallower geological zones above the Marcellus Shale formation before production from the Marcellus Shale is attempted. Thus, the managing general partner has limited information with respect to the ultimate recoverable reserves and production decline rates of vertical wells drilled in the Marcellus Shale primary area. See “– Risks Related to an Investment in a Partnership – Lack of Production Information Increases Your Risk and Decreases Your Ability to Evaluate the Feasibility of Each Partnership’s Drilling Program” and “Proposed Activities – Primary Area of Operations – Marcellus Shale Geological Formation in Western Pennsylvania.”

14

Table of Contents

Fracturing Each Partnership’s Marcellus Shale Wells Requires Adequate Sources of Water and the Partnership’s Wells Will Produce Water That Must Be Disposed of at a Reasonable Cost and Within Applicable Environmental Rules or the Partnership’s Ability to Produce Natural Gas from a Well Could be Impaired. Each partnership’s natural gas wells in the Marcellus Shale primary area in western Pennsylvania will use a process called hydraulic fracturing, which requires large amounts of water to frack the wells and also results in water discharges that must be treated and disposed of. The use of the water necessary for hydraulic fracturing may increase the partnership’s operating costs and cause delays, interruptions or termination of drilling and operating its wells, the extent of which cannot be predicted, all of which could have an adverse effect on the partnership’s operations and financial performance. The partnership’s ability to transport, treat and dispose of water will affect its production, and the cost of water treatment and disposal may affect its profitability. See “Proposed Activities – Primary Area of Operations – Marcellus Shale Geological Formation in Western Pennsylvania,” and “Competition, Markets and Regulations.”

Each Partnership Will Use Hydraulic Fracturing in Drilling its Marcellus Shale Wells, Which Could Increase the Possibility of Third-Party Claims Against the Partnership Alleging Water Contamination from the Partnership’s Wells. As part of the process of drilling and completing its wells in the Marcellus Shale primary area, each partnership will use hydraulic fracturing, which involves the injection of large amounts of water, sand and small amounts of additives under high pressure into the Marcellus Shale formation in an attempt to increase natural gas production from the wells. See “Proposed Activities – Primary Area of Operations – Marcellus Shale Geological Formation in Western Pennsylvania.” The increased use of hydraulic fracturing has generated national and local publicity over the past few years regarding the possibility that hydraulic fracturing could contaminate nearby water sources, such as lakes, rivers, streams, and drinking water wells or cause minor earthquakes in the area. Also, some lawsuits have been filed against oil and gas operators by third-parties seeking, among other remedies, cash damages for the alleged contamination of their water supplies because hydraulic fracturing was used in drilling nearby wells. Thus, if you are investing in a partnership as an Investor General Partner, your risk may be increased. See “Risk Factors – Risks Related to an Investment in a Partnership – If You Choose to Invest as a General Partner, Then You Have Greater Risk Than a Limited Partner.”

Even though hydraulic fracturing historically has been regulated by the states, the U.S. Environmental Protection Agency (the “EPA”) recently asserted authority over hydraulic fracturing involving diesel additives under the Safe Drinking Water Act, proposed new regulations governing hydraulic fracking on federal lands, Furthermore, a committee of the U.S. House of Representatives is investigating the possibility of environmental contamination from hydraulic fracturing and legislation has been introduced in Congress to require federal regulation of hydraulic fracturing and disclosure of the chemicals used in the fracturing process. Also, Pennsylvania has adopted a variety of new well construction, set back, and disclosure regulations that limit how fracturing can be performed and require various degrees of disclosure of the chemicals used in the fracking fluid. See “Actions to be Taken By Managing General Partner to Reduce Risks of Additional Payments by Investor General Partners” and “Competition, Markets and Regulations.”

The Partnerships May Drill Horizontal Wells and the Managing General Partner Has No Experience in Drilling Horizontal Wells, if Any, and Horizontal Wells are More Expensive and Difficult to Drill and Complete Than Vertical Wells. Although the managing general partner anticipates that all of each partnership’s subscription proceeds will be used to drill vertical developmental wells in the Marcellus Shale primary area, the managing general partner, in its discretion, may cause the partnership to use up to approximately 25% of the partnership’s subscription proceeds to drill development wells horizontally in the Marcellus Shale primary area. Also, up to approximately 20% of the partnership’s subscription proceeds may be used to drill vertical or horizontal wells in other areas of the United States. See “Proposed Activities – Secondary Areas of Operations.” Since the managing general partner has no experience in drilling horizontal wells and little or no information with respect to the ultimate recoverable reserves and the production decline rate associated with horizontal wells in any area, the managing general partner anticipates that the partnership will retain third-party experienced geological and/or engineering consultants and drilling contractors as consultants with respect to any horizontal well to be drilled by a partnership. See “– Risks Related to an Investment in a Partnership – Lack of Production

15

Table of Contents

Information Increases Your Risk and Decreases Your Ability to Evaluate the Feasibility of Each Partnership’s Drilling Program” and “Proposed Activities – Primary Area of Operations – Marcellus Shale Geological Formation in Western Pennsylvania.”

Horizontal wells are more expensive to drill and complete than vertical wells, because of increased costs associated with the drilling rigs needed to drill a horizontal well, including multiple fracking of the wells and additional casing for the wells, as discussed in “Compensation – Drilling Contracts.” This increased cost to the partnerships may not result in greater recoverable reserves. In addition, horizontal wells will be more susceptible to mechanical problems associated with completing the wells, such as casing collapse and lost equipment, than vertical wells. Further, fracking the formation in a horizontal well is more complicated than fracking the same geological formation in a vertical well. Thus, there is a greater risk of loss of the well or cost overruns associated with horizontal drilling as compared with vertical drilling.

Federal and State Legislation and Regulations Related to Hydraulic Fracturing Could Result in Increased Costs and Operating Restrictions or Delays. Bills have been introduced in Congress since 2009 that would subject hydraulic fracturing to federal regulation under the Safe Drinking Water Act. If adopted, these bills could result in additional permitting requirements for hydraulic fracturing operations as well as various restrictions on those operations. These permitting requirements and restrictions could result in delays in drilling operations as well as increased costs to make the wells productive. Moreover, the bills introduced in Congress would require the public disclosure of certain information regarding the chemical makeup of hydraulic fracturing fluids, many of which are proprietary to the service companies that perform the hydraulic fracturing operations. Such disclosure could make it easier for third-parties to initiate litigation against a partnership in the event of perceived problems with drinking water wells in the vicinity of a partnership well or other alleged environmental problems. In addition, Pennsylvania has adopted a position that will, in effect, require the partnership to truck wastewater from its wells in the Marcellus Shale primary area in western Pennsylvania to Ohio and dispose of the wastewater in injection wells. In this regard, in December 2011, there was an earthquake near Youngstown, Ohio that prompted Ohio officials to at least temporarily shut down a wastewater disposal well in the area to evaluate whether the disposal well may have caused or played a part in precipitating the earthquake. Pennsylvania also has adopted new regulations that impose additional requirements concerning the casing and cementing of wells, withdrawal of water for use in high-volume hydraulic fracturing of wells, baseline testing of nearby water wells, and the types of chemicals that may be used in hydraulic fracturing operations. These permitting requirements and restrictions could result in delays in operations at well sites as well as increased costs to make wells productive, which would increase the cost of drilling and completing the wells and reduce the amount of partnership distributions to you and the other investors in the partnership.

Recently Adopted EPA Rules Regulating Air Emissions from Natural Gas and Oil Operations Could Cause the Partnerships to Incur Increased Capital Expenditures and Operating Costs. Even though hydraulic fracturing historically has been regulated by the states, the U.S. Environmental Protection Agency (the “EPA”) recently asserted authority over hydraulic fracturing involving diesel additives under the Safe Drinking Water Act. Also, in April 2012, the EPA issued final rules under the Clean Air Act that establish new air emission controls for natural gas and oil production and natural gas processing operations, some of which, such as the rule requiring reduced emissions controls (“RECs”) on newly fractured wells, do not become effective until January 1, 2015. These rules include new standards to reduce emissions of sulfur dioxide, volatile organic compounds (“VOCs”) and other hazardous air pollutants frequently associated with natural gas and oil production and processing activities, which mandate the use of “green completions” for hydraulic fracturing. A “green completion” captures most of the natural gas that otherwise might escape into the air. Until January 1, 2015, operators generally are allowed under the new rules to vent the natural gas and natural gas liquids that come to the surface during completion of the fracturing process. Although the managing general partner anticipates that all of the partnerships’ wells will be drilled, completed and placed in service before January 1, 2015, the EPA’s new rules may still require a number of modifications to a partnership’s operations, including additional reporting requirements and possibly the installation of additional equipment, which would result in significant costs, including increased capital expenditures and operating costs, and could adversely impact the partnership’s business.

16

Table of Contents

In addition, Congress has considered legislation to reduce emissions of greenhouse gases, and almost one-half of the states have already taken legal measures to reduce emissions of greenhouse gases. The adoption of any legislation or regulation that requires additional reporting of greenhouse gases or further limits emissions of greenhouse gases from a partnership’s equipment and operations that are in addition to the EPA’s new rules under the Clean Air Act discussed above could further increase the partnership’s costs to monitor and report on greenhouse gas emissions or reduce emissions of greenhouse gases associated with its operations, and also could adversely affect demand for the natural gas and oil that the partnership produces. Furthermore, a committee of the U.S. House of Representatives is investigating the possibility of environmental contamination from hydraulic fracturing and legislation has been introduced in Congress to require federal regulation of hydraulic fracturing and disclosure of the chemicals used in the fracturing process. Also, Pennsylvania has adopted a variety of new well construction, set back, and disclosure regulations that limit how fracturing can be performed and require various degrees of disclosure of the chemicals used in the fracking fluid. See “Actions to be Taken By Managing General Partner to Reduce Risks of Additional Payments by Investor General Partners” and “Competition, Markets and Regulations.”

Climate Change Legislation or Regulations Restricting Emissions of Greenhouse Gases (“GHGs”) Could Result in Increased Operating Costs. In response to findings that emissions of carbon dioxide, methane, and other GHGs endanger public health and the environment by contributing to the warming of the earth’s atmosphere and other climate changes, the EPA has adopted regulations under the federal Clean Air Act that require entities that produce certain gases to inventory, monitor and report such gases. In November 2010, the EPA published a final GHG emissions reporting rule relating to natural gas processing, transmission, storage, and distribution activities, which requires reporting beginning in 2012 for emissions occurring in 2011. Additionally, in 2010, the EPA issued rules to regulate GHG emissions through traditional major source construction and operating permit programs. These permitting programs require consideration of and, if deemed necessary, implementation of best available control technology to reduce GHG emissions. As a result, the partnerships’ operations could face additional costs for emissions control and higher costs of doing business.

Nonproductive Wells May be Drilled Even Though the Partnerships’ Operations are Primarily Limited to Development Drilling. A partnership may drill some wells that are nonproductive, which is referred to as a “dry hole,” and must be plugged and abandoned. If one or more of the partnership’s wells are nonproductive, then the partnership’s productive wells, if any, may not produce enough revenues to offset the loss of investment in the nonproductive wells. See “Prior Activities.”

Also, drilling for natural gas and oil involves the risk of curtailments, delays or cancellations as a result of factors such as the following:

| • | the prices of natural gas and oil, which are volatile; |

| • | unusual geological formations; |

| • | higher or unusual pressures in the wellbore, which were not anticipated; |

| • | fires; |

| • | blowouts; |

| • | cave ins; |

| • | loss of drilling fluid circulation; |

| • | title problems; |

| • | facility or equipment malfunctions; |

| • | shortages or delivery delays of equipment and services; |

| • | adverse weather conditions; |

17

Table of Contents

| • | subsurface conditions causing a cratering or shifting of the wellbore; |

| • | drilling through or encountering an underground mine; |

| • | wet formations; |

| • | excessive water; |

| • | steeply dipping, heaving or faulted formation(s); and |

| • | impenetrable zones. |

Any of these risks can cause substantial losses, in some cases including personal injury or loss of life, damage to or destruction of property, pollution, environmental contamination or loss of wells and regulatory penalties, and could curtail natural gas or oil production from a well or could require a well to be re-drilled or other remedial action to be taken.

In addition, porosities and permeabilities in the Marcellus Shale are very low, so to unlock the hydrocarbons and make the wells productive frack treatments using large amounts of water must be performed as discussed in “Proposed Activities – Primary Area of Operation – Marcellus Shale Geological Formation in Western Pennsylvania.” Porosity is the percentage of void space between particles that is available for occupancy by either liquids or gases; and permeability is the property of porous rock that allows fluids or gas to flow through it.