Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DYCOM INDUSTRIES INC | form8k.htm |

Exhibit 99.1

Credit Suisse 2012 Engineering

and Construction Conference

and Construction Conference

June 7, 2012

1

Forward-Looking Statements and Non-GAAP

Information

Information

Forward-Looking Statements and Non-GAAP

Information

Information

This presentation contains “forward-looking statements” which are statements relating to future events, future

financial performance, strategies, expectations, and competitive environment. All statements, other than

statements of historical facts, contained in this presentation, including statements regarding our future financial

position, future revenue, prospects, plans and objectives of management, are forward-looking statements.

Words such as “believe,” “expect,” “anticipate,” “estimate,” “intend,” “forecast,” “may,” “should,” “could,” “project,”

“looking ahead” and similar expressions, as well as statements in future tense, identify forward-looking

statements. You should not read forward looking statements as a guarantee of future performance or results.

They will not necessarily be accurate indications of whether or at what time such performance or results will be

achieved. Forward-looking statements are based on information available at the time those statements are

made and/or management’s good faith belief at that time with respect to future events. Such statements are

subject to risks and uncertainties that could cause actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements. Important factors that could cause such

differences include, but are not limited to factors described under Item 1A, “Risk Factors” of the Company’s

Annual Report on Form 10-K for the year ended July 30, 2011, and other risks outlined in the Company’s

periodic filings with the Securities and Exchange Commission (“SEC”). The forward-looking statements in this

presentation are expressly qualified in their entirety by this cautionary statement. Except as required by law, the

Company may not update forward-looking statements even though its situation may change in the future.

financial performance, strategies, expectations, and competitive environment. All statements, other than

statements of historical facts, contained in this presentation, including statements regarding our future financial

position, future revenue, prospects, plans and objectives of management, are forward-looking statements.

Words such as “believe,” “expect,” “anticipate,” “estimate,” “intend,” “forecast,” “may,” “should,” “could,” “project,”

“looking ahead” and similar expressions, as well as statements in future tense, identify forward-looking

statements. You should not read forward looking statements as a guarantee of future performance or results.

They will not necessarily be accurate indications of whether or at what time such performance or results will be

achieved. Forward-looking statements are based on information available at the time those statements are

made and/or management’s good faith belief at that time with respect to future events. Such statements are

subject to risks and uncertainties that could cause actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements. Important factors that could cause such

differences include, but are not limited to factors described under Item 1A, “Risk Factors” of the Company’s

Annual Report on Form 10-K for the year ended July 30, 2011, and other risks outlined in the Company’s

periodic filings with the Securities and Exchange Commission (“SEC”). The forward-looking statements in this

presentation are expressly qualified in their entirety by this cautionary statement. Except as required by law, the

Company may not update forward-looking statements even though its situation may change in the future.

This presentation includes certain “Non-GAAP” financial measures as defined by SEC rules. We believe that the

presentation of certain Non-GAAP financial measures provides information that is useful to investors because it

allows for a more direct comparison of our performance for the period with our performance in the comparable

prior-year periods. As required by the SEC, we have provided a reconciliation of those measures to the most

directly comparable GAAP measures on the Regulation G slides included at the end of this presentation. We

caution that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, our

reported GAAP results.

presentation of certain Non-GAAP financial measures provides information that is useful to investors because it

allows for a more direct comparison of our performance for the period with our performance in the comparable

prior-year periods. As required by the SEC, we have provided a reconciliation of those measures to the most

directly comparable GAAP measures on the Regulation G slides included at the end of this presentation. We

caution that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, our

reported GAAP results.

2

Positioned for strong equity returns

n A leading supplier of specialty contracting services to

telecommunication providers nationwide

telecommunication providers nationwide

n Telecommunications networks fundamental to economic progress

n End market opportunities driving organic growth, margin expansion

and increased earnings potential

and increased earnings potential

Ø Wireless backhaul

Ø Rural fiber networks

Ø Fiber deployments to businesses

Ø Wireless network upgrades

Ø FTTx deployments

n Footprint expansion with customers as market share increases

n Capital allocation strategy designed to produce strong equity

returns

3

Nationwide Footprint and Significant

Resources

Resources

n Headquartered in Palm Beach Gardens, Florida

n Nationwide footprint

} Operates in 48 states and in Canada

} 31 operating subsidiaries and hundreds of field offices

n Fiscal 2012 third quarter revenues of $296.1 million grew 17.3% year over year,

highest third quarter organic growth rate in 8 years

highest third quarter organic growth rate in 8 years

n Strong financial profile

} Cash and equivalents $66.7 million at April 28, 2012

} Availability on revolving credit agreement of $185.9 million at April 28, 2012

} 7.125% Senior Subordinated Notes due 2021

n Approximately 8,200 employees

Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures.

4

Services Crucial to Customer Success

Engineering

Underground Facility Locating

Outside Plant & Equipment Installation

Premise Equipment Installation

Wireless Services

5

Intensely Focused on

Telecommunications Market

Telecommunications Market

Contract Revenue $296.1 million

Quarter Ended April 28, 2012

6

Strong Secular Trend

Sources: U.S. Telecom, The Broadband Association

Cisco Visual Networking Index

U.S. National Bureau of Economic Analysis

“When the stability of an entire economy depends on the speed, intelligence, quality

of service, robustness and security of its Internet backbone, will a just good network

be good enough?”

of service, robustness and security of its Internet backbone, will a just good network

be good enough?”

John Chambers, Chairman and CEO, Cisco, Inc.

7

Key Driver: Wireless Backhaul

“Our third key strategic initiative-investing in fiber builds to as many towers in our service area as is

economically feasible. This initiative supports the anticipated long-term growth in data transport,

much of which is driven by wireless data traffic and expands our addressable customer footprint by

enabling fiber access points to other strategic locations where viable along those routes. During the

first quarter, we completed about 650 fiber builds. This was in line with our expectations and we

continue to anticipate completing 4,000 to 5,000 builds in 2012 as our fiber to the tower construction

continues to ramp throughout the year.”

economically feasible. This initiative supports the anticipated long-term growth in data transport,

much of which is driven by wireless data traffic and expands our addressable customer footprint by

enabling fiber access points to other strategic locations where viable along those routes. During the

first quarter, we completed about 650 fiber builds. This was in line with our expectations and we

continue to anticipate completing 4,000 to 5,000 builds in 2012 as our fiber to the tower construction

continues to ramp throughout the year.”

Stewart Ewing, EVP & CFO, CenturyLink, Inc. - May 2012

•Very attractive returns to our customers

•Telephone, cable and other companies aggressively deploying fiber to

provide wireless backhaul services

provide wireless backhaul services

•Continues to provide significant growth opportunities

Sources: FCC OBI Technical Paper 6,

Mobile Broadband: The Benefits of

Additional Spectrum

Mobile Broadband: The Benefits of

Additional Spectrum

8

Key Driver: Rural Fiber Networks

The American Recovery and Reinvestment Act

(ARRA) provided the Department of Commerce’s

National Telecommunications and Information

Administration (NTIA) and the U.S. Department of

Agriculture’s Rural Utilities Service (RUS) with

$7.2 billion to expand broadband services in the

United States.

(ARRA) provided the Department of Commerce’s

National Telecommunications and Information

Administration (NTIA) and the U.S. Department of

Agriculture’s Rural Utilities Service (RUS) with

$7.2 billion to expand broadband services in the

United States.

Cumulatively, total Federal expenditures have now exceeded $1 billion

(approximately seven percent of the total NTIA funds awarded) and have

been matched by recipient funds of more than $500 million.

(approximately seven percent of the total NTIA funds awarded) and have

been matched by recipient funds of more than $500 million.

NTIA BTOP Quarterly Program Status Report - March 2012

•Demand has absorbed significant industry capacity

•Dycom currently working on dozens of projects in multiple states

•Meaningfully increased exposure to rural service providers

9

$3.9 Billion

Addressable Business Services Market

$53.5 Billion

•Emerging as an industry battleground

•Multi-year cap-ex trajectory provides visible revenue opportunities

•Leverages Dycom’s existing cable engineering and construction resources

“I think we are getting most of our growth from SME and now Metro E and midsize are starting

to come in. We are offering three products really on the midsize. It is both - it is the Metro E

product, the ethernet, it is PRI, PBX equivalent, and now a hosted voice solution. [….] I think

the growth will continue to ramp in Metro E. And I think the growth rate will remain relatively

steady because we are growing it on a larger basis. We think the overall opportunity is $20

billion to $30 billion. We at about a $2.2 billion run rate now, so that is only a 10% penetration.”

to come in. We are offering three products really on the midsize. It is both - it is the Metro E

product, the ethernet, it is PRI, PBX equivalent, and now a hosted voice solution. [….] I think

the growth will continue to ramp in Metro E. And I think the growth rate will remain relatively

steady because we are growing it on a larger basis. We think the overall opportunity is $20

billion to $30 billion. We at about a $2.2 billion run rate now, so that is only a 10% penetration.”

Brian Roberts, CEO, Comcast Corporation - May 2012

Sources: Company Filings

Company Transcripts

10

Key Driver: Wireless Network Upgrades

“If you look at the data from last year, of 2011 over 2010, mobility traffic more than doubled.

And if you look at the forecast going forward in the next four years mobility traffic is going to

grow 1200% over the next four years. And within that, three quarters of that growth is driven

by video.”

And if you look at the forecast going forward in the next four years mobility traffic is going to

grow 1200% over the next four years. And within that, three quarters of that growth is driven

by video.”

Frank Calderoni, EVP & CFO, Cisco Systems - February 2012

•Wireless network spending increasing faster than overall spending

•Entered wireless market via NeoCom acquisition in December 2010 and is further

expanding its wireless services to key customers

expanding its wireless services to key customers

•Strong growth opportunities as industry migrates from 3G to 4G technologies

Sources: CTIA

Collins Stewart, LLC

11

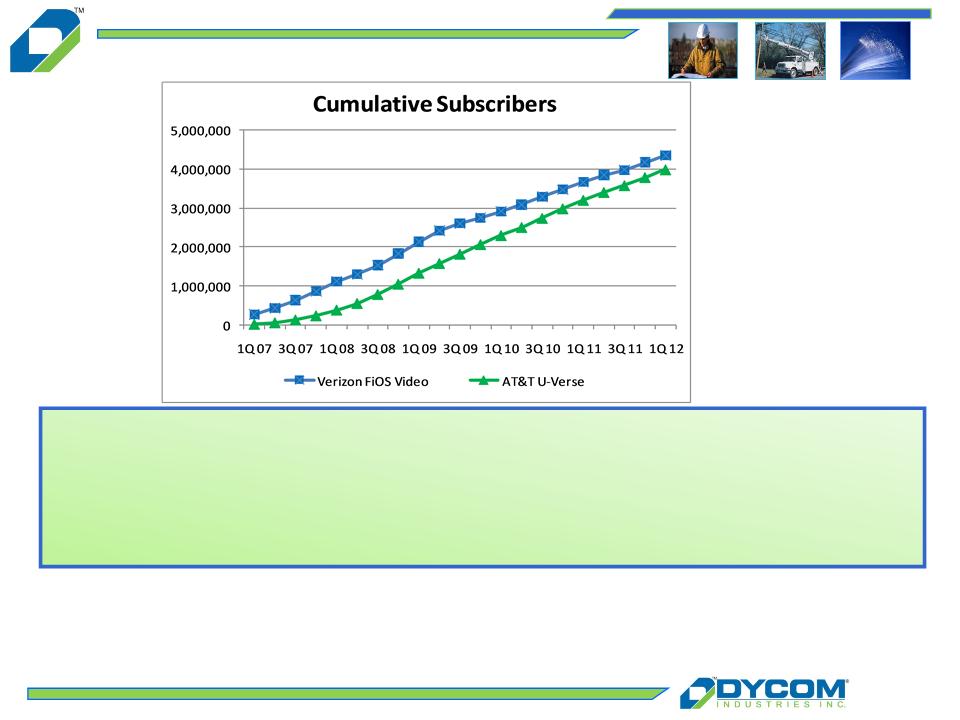

Key Driver: FTTx Deployments

“…our Prism TV service represents a very compelling entertainment alternative to

cable TV services in the eight markets where it is currently available. We remain

focused on expanding our Prism TV enabled footprint and in driving additional

subscriber growth in the months ahead.”

cable TV services in the eight markets where it is currently available. We remain

focused on expanding our Prism TV enabled footprint and in driving additional

subscriber growth in the months ahead.”

Glen Post III, EVP & COO, CenturyLink, Inc. - May 2012

•A key competitive response by telephone companies to cable MSO’s

•CenturyLink just beginning scale deployments

•Dycom is leveraging prior, extensive FTTx experience with Verizon and AT&T

Sources: Company Filings

12

Subsidiaries

Dycom’s Nationwide Presence

Local Credibility, National Capability

13

Focused on High Value Profitable Growth

n Anticipating emerging technology trends which drive

capital spending

capital spending

n Deliberately targeting high quality, long-term industry

leaders which generate the vast majority of the

industry’s profitable opportunities

leaders which generate the vast majority of the

industry’s profitable opportunities

n Selectively acquiring businesses which complement

our existing footprint and enhance our customer

relationships

our existing footprint and enhance our customer

relationships

n Leveraging our scale and expertise to expand margins

through best practices

through best practices

14

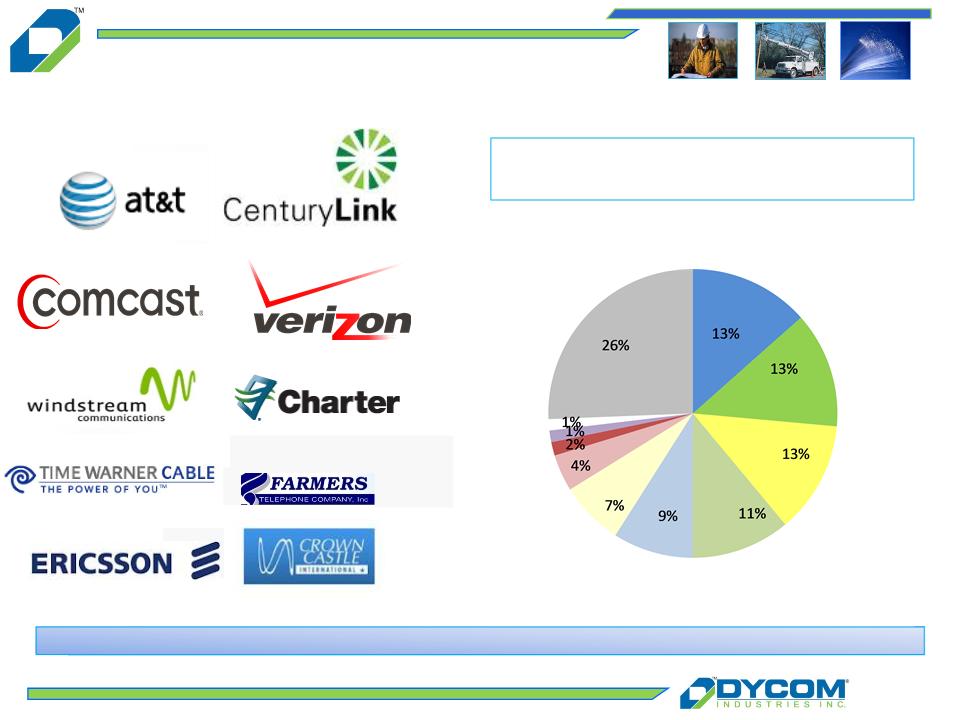

Blue-chip, predominantly investment grade clients comprise the vast majority of revenue

Well Established Customers

Quarter Ended April 28, 2012

Customer Revenue Breakdown

Comcast

AT&T

CenturyLink

Verizon

Windstream

Charter

Ericcson

Time Warner

Cable

Other

Farmers Telephone

Crown Castle

15

Durable Customer Relationships

For comparison purposes, when customers have been combined through acquisition or merger, their revenues have been combined for all periods.

16

n Master Service Agreements (MSA’s)

} Multi-year, multi-million dollar

arrangements covering thousands of

individual work orders

arrangements covering thousands of

individual work orders

} Generally exclusive requirement contracts

n Long-term contracts relate to specific projects

with terms in excess of one year from the

contract date

with terms in excess of one year from the

contract date

n Dycom is party to numerous MSA’s and other

arrangements with customers that extend for

periods of one or more years and generally has

multiple agreements with each customer

n Short-term contracts relate to spot market

requirements

requirements

n Significant majority of contracts are based on

units of delivery

units of delivery

Revenue By Contract Type

Quarter Ended April 28, 2012

Quarter Ended April 28, 2012

Anchored by Long-Term Agreements

17

Robust Cash Flow - Investing for Growth

$842 million

Cash flow from operations

Cash flow from operations

$184 million

provided by other financing and investing activities and beginning cash on hand

$349 million

Business

acquisitions

Business

acquisitions

$393 million

Capital

expenditures,

net

expenditures,

net

$284 million

Share

repurchases

Share

repurchases

Cumulative Cash Flows Fiscal 2002 - Fiscal 2011

Note: Amounts hereon represent cumulative cash flow amounts for fiscal 2002 - fiscal 2011;

See “Regulation G Disclosure” a summary of amounts.

See “Regulation G Disclosure” a summary of amounts.

$1.026

Billion

Billion

Available

for

Investment

for

Investment

18

Capital Allocated to Maximize

Shareholder Returns

Shareholder Returns

n Organic growth, robust free cash flow and renewed confidence in

industry outlook promotes capital allocation strategy to further

expand shareholder returns

industry outlook promotes capital allocation strategy to further

expand shareholder returns

n Acquisitions of NeoCom Solutions and Communication Services in

FY 2011 supplement organic growth and contribute to equity returns

FY 2011 supplement organic growth and contribute to equity returns

n Share repurchases of approximately 15% of outstanding shares in

fiscal 2011 and fiscal 2012 creates incremental shareholder value

and reduces equity claims on future earnings

fiscal 2011 and fiscal 2012 creates incremental shareholder value

and reduces equity claims on future earnings

Financial Update

20

n Organic revenue growth of 17.3% during Q3-2012

n Margins and earnings expanding

n Strong balance sheet

n Solid cash flows and liquidity

n Capital structure designed to produce strong equity returns

Financial Overview

21

Contract Revenue Growth

Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures.

(a)Fiscal 2010 includes an incremental week as the result of our 52/53 week fiscal year.

(b)Trailing Twelve Months Q3-12 (“TTM”) includes contract revenues of $883.1 million for the nine months ended April 28, 2012 and $303.7 million for

the three months ended July 30, 2011.

the three months ended July 30, 2011.

Quarterly results exhibit seasonal weather patterns

Organic growth trends improving since fiscal 2009

Five consecutive quarters of organic growth

22

Margins and Earnings Expansion

Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures.

(a)The amounts and percentages for EBITDA - Adjusted and amounts for Income from continuing operations -Non-

GAAP are Non-GAAP financial measures adjusted to exclude certain items.

GAAP are Non-GAAP financial measures adjusted to exclude certain items.

Year over year expansion for the last seven quarters

Adjusted EBITDA expanding in recent periods

Earnings growth from higher revenues and tight

cost controls

cost controls

Adjusted EBITDA improving from stronger

performance and operating leverage

performance and operating leverage

23

Solid Cash Flow

(a) Trailing Twelve Months (“TTM”) Q3-12 cash flow from operating activities includes of $68.5 million for the nine months ended April 28, 2012 and $(8.2) million for the

three months ended July 30, 2011.

three months ended July 30, 2011.

(b) Capital expenditures are presented net of proceeds from the sale of assets. Trailing Twelve Months Q3-12 cap-ex, net includes of $42.3 million for the nine months

ended April 28, 2012 and $26.6 million for the three months ended July 30, 2011.

ended April 28, 2012 and $26.6 million for the three months ended July 30, 2011.

Solid operating cash flows

n Funding organic growth

n Reflecting efficient conversion of

earnings to cash

earnings to cash

Targeted capital spending

supports organic growth and

supports organic growth and

fleet efficiency

24

Strong Balance Sheet

Financial profile positioned to

address emerging industry

opportunities

address emerging industry

opportunities

n Fiscal 2021 maturity of Senior

Subordinated Notes

Subordinated Notes

n Over $250 million of liquidity from cash

on hand and availability under Senior

Credit agreement

on hand and availability under Senior

Credit agreement

n Repurchased $10.9 million of common

shares during Q3-12

shares during Q3-12

Net debt declines from solid cash

flows in fiscal 2012

flows in fiscal 2012

n Ratio of Net Debt to EBITDA-Adjusted

suitable for growth

suitable for growth

Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures.

(a)The ratio of Net debt to EBITDA-Adjusted is a Non-GAAP financial measure adjusted to exclude certain items.

25

Strategy for Success

Organic

Growth

Growth

Lower Share Count

Higher

Equity

Returns

Equity

Returns

Supplemental schedules

Regulation G Disclosures

27

Regulation G Disclosure

(a) Year-over-year growth percentage is calculated as follows: (i) revenues in the current twelve month period less (ii) revenues in the comparative prior twelve month period;

divided by (ii) revenues in the comparative prior twelve month period.

divided by (ii) revenues in the comparative prior twelve month period.

(b) For the Trailing Twelve Months (“TTM “) Q3-12, TTM Q3-11, and FY 2011, revenues from business acquired reflect revenues from businesses acquired during Q2-11.

(c) Non-GAAP adjustments in FY 2010 reflect adjustments in Q4-10 result from the Company’s 52/53 week fiscal year of $20.1 million. The Q4-10 Non-GAAP adjustments

reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks. The result, representing one week of contract revenues, is

subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP basis for comparison purposes.

reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks. The result, representing one week of contract revenues, is

subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP basis for comparison purposes.

(d) Trailing Twelve Months Q3-12 includes contract revenues of $883.1 million for the nine months ended April 28, 2012 and $303.7 million for the three months ended July 30,

2011.

2011.

(e) Trailing Twelve Months Q3-11 includes contract revenues of $732.1 million for the nine months ended April 28, 2011 and $281.5 million for the three months ended July 31,

2010.

2010.

Amounts may not foot due to rounding.

28

Amounts may not foot due to rounding.

(a) Year-over-year growth (decline) percentage is calculated as follows: (i) revenues in the quarterly period less (ii) revenues in the comparative prior year quarter period;

divided by (ii) revenues in the comparative prior year quarter period.

divided by (ii) revenues in the comparative prior year quarter period.

(b) For Q3-12, GAAP and Non-GAAP revenue growth percentages are the same as revenues from business acquired in 2011 were included for the full quarter in each

period and there were no other Non-GAAP adjustments in either period. For Q1-11, GAAP and Non-GAAP revenue growth percentages are the same as there were no

Non-GAAP adjustments in either period.

period and there were no other Non-GAAP adjustments in either period. For Q1-11, GAAP and Non-GAAP revenue growth percentages are the same as there were no

Non-GAAP adjustments in either period.

(c) Non-GAAP adjustments in Q2-12, Q3-11 and Q2-11 reflect revenues from businesses acquired during Q2-11. Non-GAAP adjustments in Q1-12 reflect storm

restoration revenues ($3.7 million) and revenues from businesses acquired during Q2-11 ($14.5 million). Non-GAAP adjustments in Q4-11 reflect storm restoration

revenues ($14.1 million) and revenues from businesses acquired during Q2-11 ($14.1 million). Non-GAAP adjustments in Q4-10 result from the Company’s 52/53 week

fiscal year. The Q4-10 Non-GAAP adjustments reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks. The

result, representing one week of contract revenues, is subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP basis for

comparison purposes. Non-GAAP adjustments in Q3-09, Q2-09, and Q1-09 reflect storm restoration revenues recognized during those periods.

restoration revenues ($3.7 million) and revenues from businesses acquired during Q2-11 ($14.5 million). Non-GAAP adjustments in Q4-11 reflect storm restoration

revenues ($14.1 million) and revenues from businesses acquired during Q2-11 ($14.1 million). Non-GAAP adjustments in Q4-10 result from the Company’s 52/53 week

fiscal year. The Q4-10 Non-GAAP adjustments reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks. The

result, representing one week of contract revenues, is subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP basis for

comparison purposes. Non-GAAP adjustments in Q3-09, Q2-09, and Q1-09 reflect storm restoration revenues recognized during those periods.

29

Regulation G Disclosure

The below table presents the Non-GAAP financial measures of EBITDA and Adjusted EBITDA for the respective periods. EBITDA and Adjusted EBITDA are Non-GAAP financial measures within the meaning of Regulation G

promulgated by the Securities and Exchange Commission. The Company defines EBITDA as earnings before interest, taxes, depreciation and amortization, and defines Adjusted EBITDA as earnings before interest, taxes,

depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense and Adjusting items. The Company believes these Non-GAAP financial measures provide information that is useful to the Company’s

investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the

Company’s results of operations in any particular period. Additionally, the Company uses these Non-GAAP financial measures to evaluate its past performance and prospects for future performance. EBITDA and Adjusted EBITDA

are not recognized terms under GAAP and do not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP

financial measures may not be comparable to other similarly titled measures of other companies. These tables present a reconciliation of EBITDA and Adjusted EBITDA to the most directly comparable GAAP measure.

promulgated by the Securities and Exchange Commission. The Company defines EBITDA as earnings before interest, taxes, depreciation and amortization, and defines Adjusted EBITDA as earnings before interest, taxes,

depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense and Adjusting items. The Company believes these Non-GAAP financial measures provide information that is useful to the Company’s

investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the

Company’s results of operations in any particular period. Additionally, the Company uses these Non-GAAP financial measures to evaluate its past performance and prospects for future performance. EBITDA and Adjusted EBITDA

are not recognized terms under GAAP and do not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP

financial measures may not be comparable to other similarly titled measures of other companies. These tables present a reconciliation of EBITDA and Adjusted EBITDA to the most directly comparable GAAP measure.

30

Regulation G Disclosure

The below table presents the Non-GAAP financial measures of EBITDA and Adjusted EBITDA for the respective periods. EBITDA and Adjusted EBITDA are Non-GAAP financial measures within the meaning of Regulation G

promulgated by the Securities and Exchange Commission. The Company defines EBITDA as earnings before interest, taxes, depreciation and amortization, and defines Adjusted EBITDA as earnings before interest, taxes,

depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense and Adjusting items. The Company believes these Non-GAAP financial measures provide information that is useful to the Company’s

investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the

Company’s results of operations in any particular period. Additionally, the Company uses these Non-GAAP financial measures to evaluate its past performance and prospects for future performance. EBITDA and Adjusted EBITDA

are not recognized terms under GAAP and do not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP

financial measures may not be comparable to other similarly titled measures of other companies. These tables present a reconciliation of EBITDA and Adjusted EBITDA to the most directly comparable GAAP measure.

promulgated by the Securities and Exchange Commission. The Company defines EBITDA as earnings before interest, taxes, depreciation and amortization, and defines Adjusted EBITDA as earnings before interest, taxes,

depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense and Adjusting items. The Company believes these Non-GAAP financial measures provide information that is useful to the Company’s

investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the

Company’s results of operations in any particular period. Additionally, the Company uses these Non-GAAP financial measures to evaluate its past performance and prospects for future performance. EBITDA and Adjusted EBITDA

are not recognized terms under GAAP and do not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP

financial measures may not be comparable to other similarly titled measures of other companies. These tables present a reconciliation of EBITDA and Adjusted EBITDA to the most directly comparable GAAP measure.

(a) Trailing Twelve Months (“TTM”) Q3-12 is comprised of the following periods above: Q3-12, Q2-12, Q1-12, and Q4-11.

31

Regulation G Disclosure

Credit Suisse 2012 Engineering

and Construction Conference

and Construction Conference

June 7, 2012