Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Clarus Corp | v315453_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Clarus Corp | v315453_ex99-1.htm |

Corporate Presentation June 2012 NASDAQ | BDE

1 NASDAQ | BDE Please note that in this presentation we may use words such as “appears,” “anticipates,” “believes,” “plans,” “expects,” “intends,” “future,” and similar expressions which constitute forward - looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward - looking statements are made based on our expectations and beliefs concerning future events impacting the Company and therefore involve a number of risks and uncertainties. We caution that forward - looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward - looking statements. Potential risks and uncertainties that could cause the actual results of operations or financial condition of the Company to differ materially from those expressed or implied by forward - looking statements in this presentation include, but are not limited to, the overall level of consumer spending on our products; general economic conditions and other factors affecting consumer confidence; disruption and volatility in the global capital and credit markets; the financial strength of the Company's customers; the Company's ability to implement its growth strategy; the Company's ability to successfully integrate and grow acquisitions; the Company's ability to maintain the strength and security of its information technology systems; stability of the Company's manufacturing facilities and foreign suppliers; the Company's ability to protect trademarks and other intellectual property rights; fluctuations in the price, availability and quality of raw materials and contracted products; foreign currency fluctuations; our ability to utilize our net operating loss carryforwards; and legal, regulatory, political and economic risks in international markets. More information on potential factors that could affect the Company's financial results is included from time to time in the Company's public reports filed with the Securities and Exchange Commission, including the Company's Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, and Current Reports on Form 8 - K. All forward - looking statements included in this presentation are based upon information available to Black Diamond as of the date of this presentation, and speak only as the date hereof. We assume no obligation to update any forward - looking statements to reflect events or circumstances after the date of this presentation . FORWARD LOOKING STATEMENTS

2 NASDAQ | BDE Leading global designer and manufacturer of innovative active outdoor performance products Double - digit top - line growth at Black Diamond Equipment since 1990 OUR 5 CONSTRUCTS : Passion and Intimacy – gets us up in the morning Innovation – drives us (in all we do) Efficiency – sustains us Value and Service – implicit in all we do Style – the means by which we accomplish our goals is as important as what we accomplish WHO WE ARE… OUR VISION : To be one with the sports we serve, absolutely indistinguishable from them OUR CORE MISSION : To profitably design, manufacture and bring to market innovative and technical products of high quality, high performance and exemplary durability that are targeted toward our primary customers – climbers, mountaineers and off - piste skiers

3 NASDAQ | BDE BLACK DIAMOND’S OPPORTUNITY Authentic Portfolio of Iconic Lifestyle Brands Industry Leading Product Innovation and Development Capabilities Broad Product, Channel and Geographic Diversification Scalable Global Operating Platform Significant Growth Opportunities Experienced and Incentivized Management Team Efficient Capital Structure Founded: 1977 Target Customers: Backpackers and Mountaineers Awards: Heritage: 1957 Target Customers: Climbers, Mountaineers and Skiers Awards:

4 NASDAQ | BDE HIGHLY FAVORABLE MARKET DYNAMICS (1) Represents current Black Diamond, Inc. target markets; Source: Outdoor Recreation Participation Report 2011, Outdoor Industry Association, SportsScanInfo for OIA Vantage Point (2) Company estimate Outdoor Sector Highlights Large and Growing Global Industry with Numerous Favorable Trends • Health/wellness and environmentalism embodied in active outdoor lifestyle • Penchant for travel and outdoor exploration, particularly among baby - boomers • U.S. outdoor participation has grown 56% since 2006 (1) • Sales of outdoor products in the U.S. reached $7.7 billion for the nine months ended October 30 th , 2011, up 6.3% from same period last year (1) • European market believed to be significantly larger than U.S. (2) Convergence of Function and Fashion Growth and Exposure of Key Retail Partners Numerous Entrepreneurial and Innovative Brands that Would Benefit from Black Diamond, Inc. Platform BDE Represents a Unique “Pure - Play” in the Outdoor Space

5 NASDAQ | BDE OUR CULTURE DEFINES OUR PRODUCTS AND ICONIC BRANDS Our employees are our most discerning customers and demand the most innovative, consistent products Our passion for and intimacy with the sports we serve helps to drive innovation Company of Passionate Users High Performance Products Our brands and products are synonymous with performance, innovation, durability and safety

6 NASDAQ | BDE Marquee Introductions INDUSTRY LEADING PRODUCT INNOVATION AND DEVELOPMENT CAPABILITIES Legacy of redefining the categories in which we enter Strong track record of technical innovation and production development Portfolio of over 70 patents (1) Product development strives to elevate personal performance, safety and comfort Vertically integrated design and development process provides competitive advantage Key technical, highly engineered products manufactured in - house Gridlock ® Factor ® Z - Pole ® Spot Contoured Glove (1) Some patents are pending.

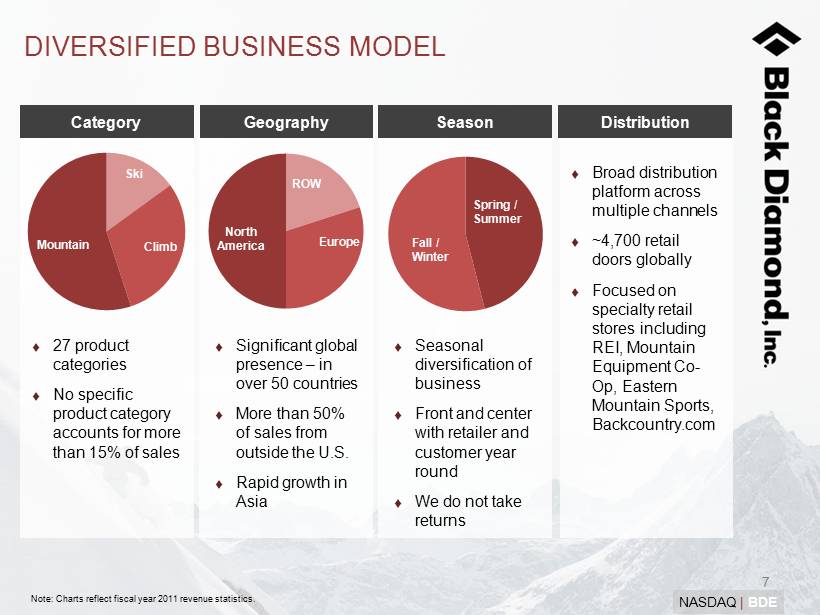

7 NASDAQ | BDE Category Geography Distribution 27 product categories No specific product category accounts for more than 15% of sales Significant global presence – in over 50 countries More than 50% of sales from outside the U.S . Rapid growth in Asia Broad distribution platform across multiple channels ~4,700 retail doors globally Focused on specialty retail stores including REI, Mountain Equipment Co - Op, Eastern Mountain Sports, Backcountry.com Note: Charts reflect fiscal year 2011 revenue statistics. Season Seasonal diversification of business Front and center with retailer and customer year round We do not take returns DIVERSIFIED BUSINESS MODEL Ski Climb Mountain ROW Europe North America Spring / Summer Fall / Winter

8 NASDAQ | BDE SCALABLE GLOBAL OPERATING PLATFORM BASEL, SWITZERLAND • Sales & marketing, distribution • 50+ employees ZHUHAI, CHINA • Manufacturing & distribution • 195+ employees JAPAN • Sales & marketing • 3 employees SALT LAKE CITY, UT • Headquarters, sales & marketing, manufacturing & distribution center • 325+ employees CALEXICO, CA • Production • ~35 employees 40+ International Distributors - Retail stores: Salt Lake City, Tokyo, Seoul Manufacturing / Production Distribution Sales and Marketing

9 NASDAQ | BDE GROWTH OPPORTUNITIES Introduce New Product Technologies Continued double - digit growth driven by future product innovation Grow into New Categories Significant investment in technical outdoor apparel initiative Apparel expected to launch Fall 2013 Pursue Selected Outdoor Acquisitions Highly fragmented industry Opportunity to take brands to next level Service and Grow Existing Retail Accounts Broaden Distribution and Elevate Brand Large European and Asian market opportunity Bring international distribution in - house Direct - to - Consumer and Retail Opportunity to grow with key retail partners including REI, EMS, MEC and Backcountry.com Build existing and new relationships through multiple corporate initiatives

10 NASDAQ | BDE Entrance Cashier Camping Climb Ski Travel & Backcountry Gear Paddle Fitness Cycle Footwear & Accessories Gloves & Mittens LEVERAGE RETAIL SECTOR GROWTH BD Products Command Substantial Floor Space Outdoor specialty retailers have shown considerable growth in recent years • Recreational Equipment, Inc. (REI), our largest customer, has increased its store count by ~80% in the last 6 years (1) • 39,000 sq. ft. REI SoHo opened in December 2011; first NYC location • Awarded REI’s 2011 “Vendor of the Year” award for the camping category We are well poised to capitalize on retail sector growth and increased exposure • Longstanding relationships with key retail partners • Substantial sales floor presence • Visual merchandising initiatives • Acquisitions to extend category reach (1) REI Annual Report for the year ended December 31, 2011.

11 NASDAQ | BDE Current Examples of Innovation Magnetron: Uses the power of magnetic fields to reinvent the locking carabiner Cayenne Heated Glove: Utilizes a built in heater to set exact amount of warmth INTRODUCE NEW PRODUCT TECHNOLOGIES Continue to redefine the categories through which we enter Seek out opportunities that meet a specific technical need of our passionate consumer base Solid pipeline of initiatives across multiple categories Carbon Megawatt: The ultimate backcountry powder ski ReVolt: USB rechargeable headlamp that also runs on AAA alkaline batteries

12 NASDAQ | BDE OUR APPAREL INITIATIVE Targeting $250 million in sales by 2020 Category expected to generate higher gross margin Significant progress with key retailers and suppliers/manufacturers of textiles and technical materials Key retailers from N. America, Japan, China, Europe and Russia expected to visit BD HQ in Sept. 2012 First apparel line launch expected in Fall 2013 & SKU count set • Initiated work on Spring & Fall 2014 collections • Partnering with specialty retail to fill a void in the marketplace • Leverage intimate understanding of fit, performance, style and aesthetics • Rollout strategy: expect six concurrent seasons spanning a three year period Significant Recent Hires Name Position Background Tim Bantle Director of Apparel Bob Jones Director of Direct-To-Consumer Sales Cheryl Knopp Design Lead of Apparel Brian Mecham Director of N.A. Sales Jeff Nash VP of Engineering Saskia Stock Marketing Director of Europe Walter Wilhelm VP of Business Process Sven Mostogl Director of Merchandising, Europe

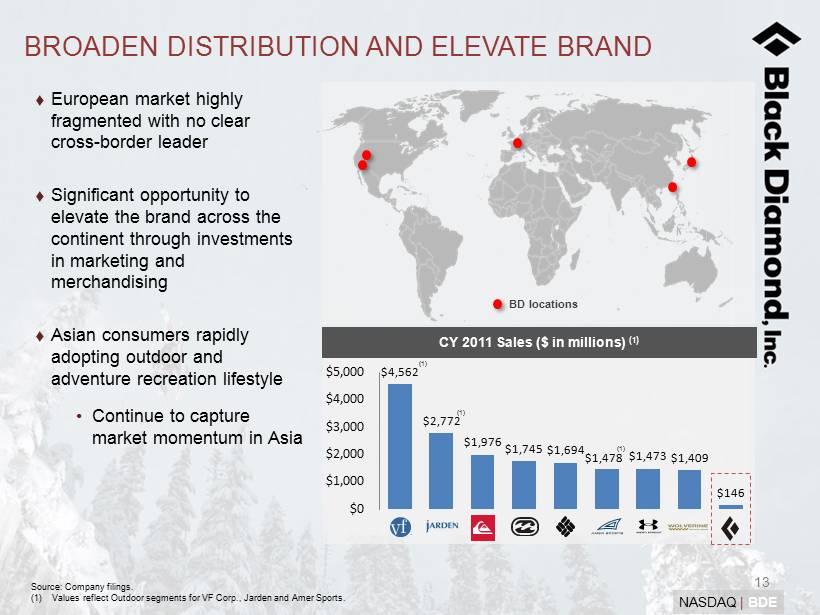

13 NASDAQ | BDE BROADEN DISTRIBUTION AND ELEVATE BRAND European market highly fragmented with no clear cross - border leader Significant opportunity to elevate the brand across the continent through investments in marketing and merchandising Asian consumers rapidly adopting outdoor and adventure recreation lifestyle • Continue to capture market momentum in Asia 2010 Sales by Geography ($ in mm) CY 2011 Sales ($ in millions) ( 1 ) $4,562 $2,772 $1,976 $1,745 $1,694 $1,478 $1,473 $1,409 $146 $0 $1,000 $2,000 $3,000 $4,000 $5,000 (1) (1) (1) BD locations Source: Company filings . (1) Values reflect Outdoor segments for VF Corp., Jarden and Amer Sports.

14 NASDAQ | BDE PURSUE SELECTED OUTDOOR ACQUISITIONS Acquiror of choice • Authentic and iconic brand heritage • Global operating platform with universal application • Targets see us as a partner rather than an acquiror Exploring several near - term opportunities Also pursuing larger, strategic acquisition opportunities Target Tuck - In/Growth Acquisition Parameters Revenues $25 - $50 million Gross margin accretive Highly technical, quality product Concentrated geographic strength Ability to protect IP Strong brand equity/heritage

15 NASDAQ | BDE BLACK DIAMOND TO ACQUIRE POC SWEDEN AB (1) Who is POC? Established: 2004 – Stockholm, Sweden Vision: to be the leading supplier of protection gear for gravity sports athletes and to grow into a global sport lifestyle brand Offering: superior personal protective gear such as: • Helmets • Body Armor • Goggles & Eyewear • Gloves & Apparel User: gravity sports athletes like skiers, snowboarders and cyclists Growth: f iscal 2012 sales increased 35% to $22.5 million (2) (1) On June 7, 2012, Black Diamond entered into a definitive agreement to acquire POC Sweden AB (“POC”). (2) Represents POC’s unaudited total revenues for its fiscal year ended April 30, 2012.

16 NASDAQ | BDE PERSONAL PROTECTION AND PERFORMANCE GEAR FOR GRAVITY SPORTS ATHLETES

17 NASDAQ | BDE POC produces and distributes innovative products to 27 countries Operations in Sweden, Austria, France and U.S.; retail store in Chamonix, France. The POC Lab is renowned for its research and innovation, setting standards for construction, material combinations and engineering • Received the Grand Prize for Active Safety in Volvo ISPO Sports Design Award competition POC PRODUCT INNOVATION AND AWARDS Product: POC Trabec Target Customer: Cyclists Award (2012): Product: POC Fornix Target Customer: Skiers & Snowboarders Awards: Marquee Awards

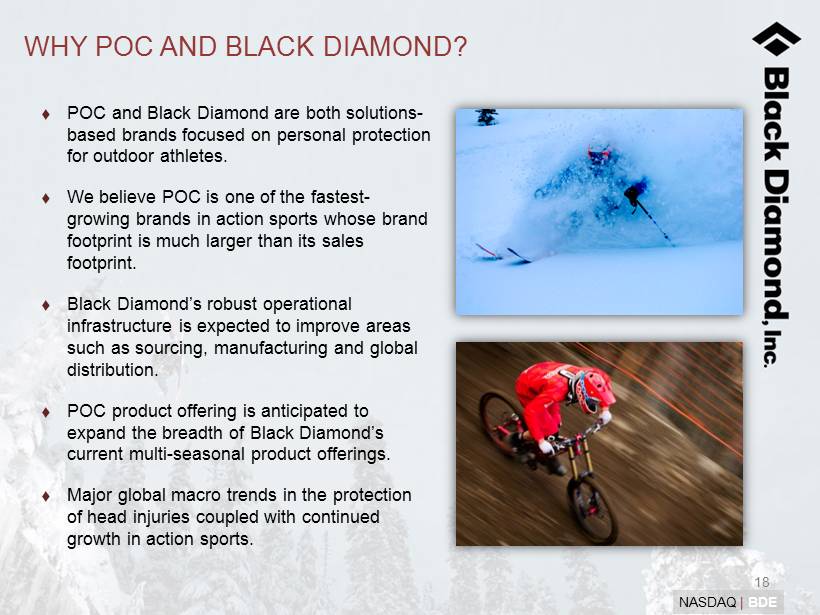

18 NASDAQ | BDE WHY POC AND BLACK DIAMOND? POC and Black Diamond are both solutions - based brands focused on personal protection for outdoor athletes. We believe POC is one of the fastest - growing brands in action sports whose brand footprint is much larger than its sales footprint. Black Diamond’s robust operational infrastructure is expected to improve areas such as sourcing, manufacturing and global distribution. POC product offering is anticipated to expand the breadth of Black Diamond’s current multi - seasonal product offerings. Major global macro trends in the protection of head injuries coupled with continued growth in action sports .

19 NASDAQ | BDE POC TRANSACTION DETAILS Purchase Price: 311 million Swedish kronor or ~$43.5 million cash, subject to closing exchange rates and ~460,000 shares of BDE common stock (the exact number of shares will be determined at closing). Shares to be issued at closing will be subject to a two - year lock - up. Incentive Compensation: estimated to be up to $12.5 million payable to management over a 6.5 year period based upon aggregate POC contribution margin expected from a 30% compounded annual growth of POC’s revenue. Payments offset by gains, if any, imbedded in the vested portion of an employee stock option pool of 500,000 options with exercise prices ranging from $13 to $16 per share. Expected Close: June 2012 POC transaction expected to be accretive to BDE 2013 EPS.

20 NASDAQ | BDE A POWERFUL OUTDOOR EQUIPMENT AND LIFESTYLE PLATFORM One of the most pristine and globally recognized brands in the space Products for climbers, mountaineers and skiers as well as aspirational outdoor enthusiasts Heritage dates back to 1957 Premier technical backpacking and mountaineering products, outdoor - inspired lifestyle packs and accessories Founded in 1977 One of the most innovative, fastest - growing brands in action sports protective gear Product line developed for alpine and free - ride ski, mountain and road bike markets Founded in 2004

21 NASDAQ | BDE $146 $500 $104 $250 $250 2011 2015 2020 BUILDING A $500 MILLION BUSINESS Growth Plan Targets ($ in millions) Over 50% potential organic growth through execution of base business strategy Acquisitions expected to contribute $250 million to top - line sales by 2015 Apparel expected to contribute more than $250 million in sales by 2020 Organic Apparel Acquisitions Incremental

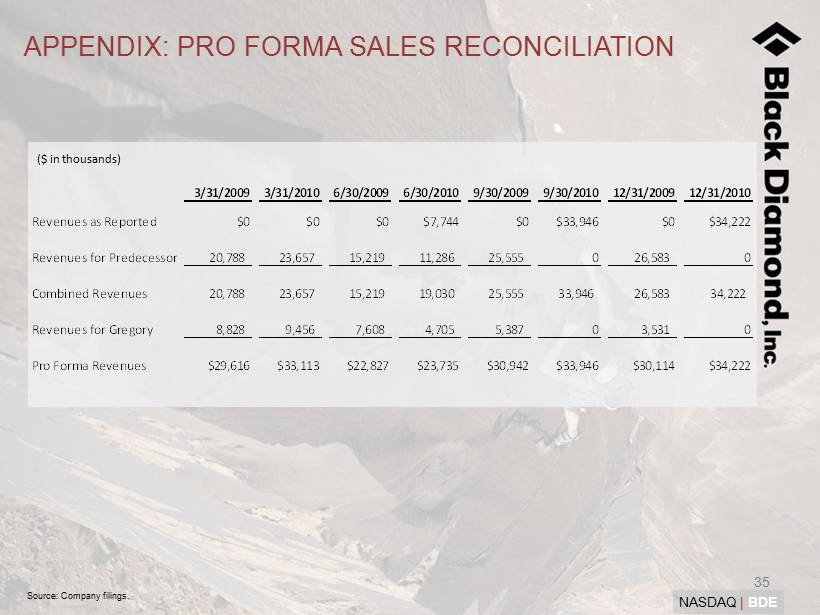

22 NASDAQ | BDE HISTORICAL FINANCIAL PERFORMANCE Adj. EBITDA (2) ($ in millions) Pro Forma Sales (1) ($ in millions) $125.0M $145.8M $153.1M 2010 2011 LTM 3/31/12 (1) See Appendix for a reconciliation of Sales to Pro Forma Sales. (2) See Appendix for a reconciliation of Adjusted EBITDA to net income (loss). (3) Pro forma for the year ended December 31, 2010 assuming the acquisition of Black Diamond Equipment and Gregory Mountain Produ cts by Clarus Corporation had occurred on January 1, 2010. (3) $10.8M $13.6M $15.4M 2010 2011 LTM 3/31/12 (3) Adj. EBITDA Margin 8.7% 9.4% 10.1%

23 NASDAQ | BDE OPERATING MARGINS POISED FOR GROWTH Significant investments in our global operating platform and R&D • Leverage these investments as sales grow Shift of sales mix to higher margin products • Technical apparel • POC Future synergy opportunities • Consolidated supply, logistics, distribution and corporate functions Source: Company filings. (1) Margins exclude stock - based compensation expense. (2) Reflects total company margin. Outdoor segments of VF Corp., Jarden and Amer Sports have EBITDA margins (excluding corporate overhead expenses) of 20.0%, 12.2% and 12.4%, respectively. CY 2011 Adjusted EBITDA Margin (1 ) vs. Select Peers 16.1% 14.7% 14.2% 12.1% 11.5% 11.0% 9.4% 9.4% 9.2% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% (2) (2) (2)

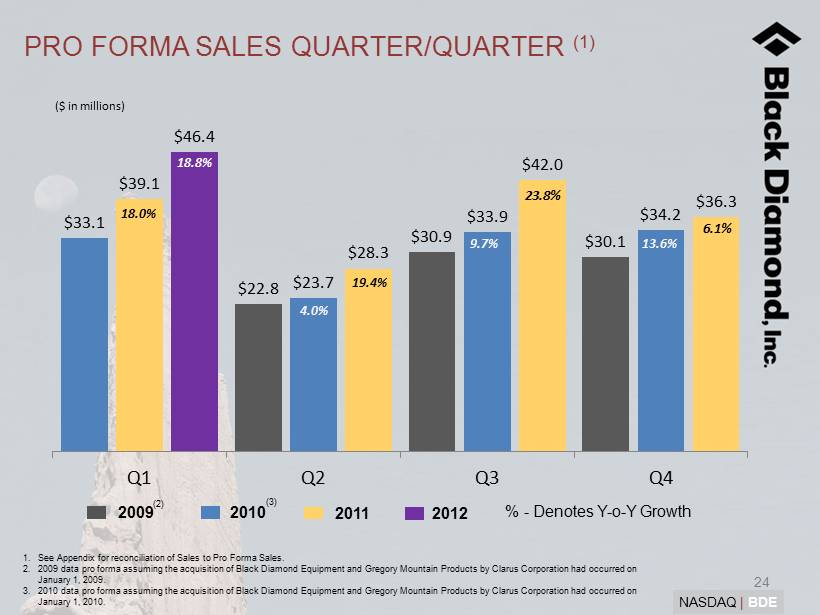

24 NASDAQ | BDE % - Denotes Y - o - Y Growth 1. See Appendix for reconciliation of Sales to Pro Forma Sales. 2. 2009 data pro forma assuming the acquisition of Black Diamond Equipment and Gregory Mountain Products by Clarus Corporation had occurred on January 1, 2009. 3. 2010 data pro forma assuming the acquisition of Black Diamond Equipment and Gregory Mountain Products by Clarus Corporation had occurred on January 1, 2010. PRO FORMA SALES QUARTER/QUARTER (1) $33.1 $22.8 $30.9 $30.1 $39.1 $23.7 $33.9 $34.2 $46.4 $28.3 $42.0 $36.3 Q1 Q2 Q3 Q4 18.8% 2009 2010 2011 (2) (3) 2012 18.0% 4.0% 19.4% 9.7% 23.8% 13.6% 6.1% ($ in millions)

25 NASDAQ | BDE BALANCE SHEET SUPPORTS GROWTH (1) Growth - oriented balance sheet • Revolver capacity of $35.0 million as of 3/31/2012 • On Feb 22 , closed a public offering for 8.9 million shares at $7.50 for net proceeds of $63.4 million NOLs of $217.1 million as of Dec 31, 2011 protect future cash flow $73.7 million deferred net tax assets as of Dec 31, 2011 (1) Does not reflect Black Diamond’s pending acquisition of POC Sweden AB, announced on June 7, 2012. (2) Reflects carrying value; face value of $22.6 million. (3) See Appendix for reconciliation of Adjusted EBITDA to net income (loss ). Capitalization (1) ($ in millions)

26 NASDAQ | BDE NOL SUMMARY Net Operating Losses of $ 217.1 million as of December 31, 2011 $73.7 million deferred net tax asset as of December 31, 2011 $215.5 million of NOL’s do not expire until 2020 and beyond Rights Agreement limiting the number of 5% stockholders NOL Expiration Schedule ($ in millions) $2 $30 $50 $115 $6 $4 $2 $ - $1 $4 $4 $0 $40 $80 $120 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

27 NASDAQ | BDE GUIDANCE AND LONG - TERM TARGETS (1) Total Revenue ~$500 million by 2015 Revenue Growth Comprised of: - Organic Growth $125 million - Acquisitions $250 million Long - Term Targets 2012 Revenue $160 - 165 million - YOY Growth > 10 - 13% 2012 Gross Margins ~ 38.6% 2012 Guidance (1) Does not include any potential revenue associated with the expected acquisition of POC Sweden AB , which Black Diamond announced on June 7, 2012.

28 NASDAQ | BDE KEY TAKEAWAYS Authentic Portfolio of Iconic Lifestyle Brands Industry Leading Product Innovation and Development Capabilities Broad Product, Channel and Geographic Diversification Scalable Global Operating Platform Significant Growth Opportunities Experienced and Incentivized Management Team Efficient Capital Structure POC Embodies the Ideal Acquisition for Black Diamond

29 NASDAQ | BDE NASDAQ | BDE Black Diamond, Inc. 2092 East 3900 South Salt Lake City, UT 84124 Tel 801.278.5552 Company Contact Peter Metcalf, CEO Investor Relations Liolios Group Scott Liolios or Cody Slach Tel 949.574.3860 BDE@Liolios.com

30 NASDAQ | BDE APPENDIX NASDAQ | BDE

31 NASDAQ | BDE NAME & TITLE YEARS AT BDE RELEVANT PRIOR EXPERIENCE Peter Metcalf President and CEO 29 Co - Founded Black Diamond Equipment, Ltd. in 1989 Pioneer Alaskan alpinist Robert Peay CFO, Secretary and Treasurer 15 Public accounting with Arthur Andersen Ryan Gellert President, BD Equipment 10 Led creation of BD Asia & managed first 4 years; Lifetime adventure climber/surfer Billy Kulczycki President, Gregory 1 Former CEO and SVP of Global Sales at Filson Former SVP of Sales & Marketing at Patagonia Christian Jaeggi Head of BD Europe 15 Led creation of BD Europe Former Export Manager of Mammut Mark Ritchie VP, Global Operations 17 Former U.S. Whitewater Team member Operations Visionary Chris Grover VP, Sales, BD Equipment 17 1990’s leader in the creation of indoor climbing in America; American sport climbing pioneer Scott Carlson VP, Acquisitions & Integration 20 Former CFO/CIO of BDEL Former VP of Finance at Skullcandy Adam Chamberlain VP, Marketing, BD Equipment 6 Former Marketing Category Director at Patagonia SVP, International Sales at Patagonia INCENTIVIZED AND EXPERIENCED MANAGEMENT TEAM AND BOARD OF DIRECTORS NAME & TITLE Warren B. Kanders Executive Chairman Robert Schiller Executive Vice Chairman Peter Metcalf President and CEO Philip N. Duff Director Michael A. Henning Director Donald L. House Director Nicholas Sokolow Director Management Team Board of Directors Management Team & Board of Directors Collectively, Beneficially Own Approx. 32% of the Company (1) (1) Per the Company’s Proxy Statement filed with the SEC on April 27 , 2012.

32 NASDAQ | BDE Transaction Value: $44.2 million 2010 Sales: $27.8 million (1) EV / Sales: 1.6x GREGORY MOUNTAIN PRODUCTS CASE STUDY Background & Investment Rationale In May 2010, Black Diamond, Inc. acquired Gregory Mountain Products, Inc. (“GMP”) for $44.2 million in cash and stock GMP was popular in the U.S. and Asia but lacked a European presence GMP was quickly and efficiently incorporated into the BDE platform, achieving European distribution and credibility in less than a year During 2011, BDE recognized $1.4 million in cost savings associated with the integration of GMP Financial Highlights (1) 2010 Gregory sales includes sales of Gregory Mountain Products, inc. for the five months ended May 28, 2010 and sales of Greg ory ™ branded products for the seven months ended December 31, 2010.

33 NASDAQ | BDE ARMOR HOLDINGS CASE STUDY (1) Source : FactSet Research Systems . (2) Represents total consideration to shareholders. Total Gross Transaction Value was approximately $4.2 billion. Background & Overview Industry characteristics • Favorable market trends • Highly fragmented Under the leadership of Warren Kanders and Rob Schiller, Armor completed in excess of 30 acquisitions over the course of 12 years In July of 2007, BAE Systems acquired Armor Holdings for $3.1 billion (2) $78 $97 $157 $221 $292 $305 $365 $980 $1,637 $2,361 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Financial Highlights (1 ) Sales ($ in millions) Market Cap ($ in millions) $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 Oct-99 May-01 Nov-02 Jun-04 Jan-06 Jul-07 Sale to BAE Systems, Inc. for $3.1 billion in July 2007

34 NASDAQ | BDE APPENDIX: ADJUSTED EBITDA RECONCILIATION Source: Company filings . ($ in thousands)

35 NASDAQ | BDE APPENDIX: PRO FORMA SALES RECONCILIATION Source: Company filings . ($ in thousands)